FIRST ACCEPTANCE CORPORATION

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 7, 2024

To our Stockholders:

The 2024 annual meeting of stockholders of First Acceptance Corporation will be held Tuesday, May 7, 2024, at

10:00 a.m., Central Time at our corporate headquarters, which is located at 3813 Green Hills Village Drive,

Nashville, Tennessee 37215. Directions to the annual meeting can be obtained by contacting Investor Relations by

email through an information request at https://firstacceptance.com/investor-relations or by phone at 1-800-321-

0899. At the meeting, stockholders will vote on the following matters:

1. Election of the seven directors set forth in this proxy statement to serve until the next annual meeting of

stockholders or until their respective successors are duly elected and qualified;

2. Approval of an increase in the number of shares authorized for issuance pursuant to the First Acceptance

Corporation Employee Stock Purchase Plan;

3. Ratification of the appointment of Crowe LLP as our independent registered public accounting firm for

2024; and

4. Any other matters that may properly come before the meeting and any adjournments or postponements of

the meeting.

Stockholders of record at the close of business on March 13, 2024 are entitled to notice of and to vote at the

meeting.

Your vote is important. Please COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY

CARD as promptly as possible in the enclosed envelope in order that as many shares as possible will be represented.

By Order of the Board of Directors,

Michael J. Bodayle

Secretary

Nashville, Tennessee

March 22, 2024

Important Notice regarding the Availability of Proxy Materials

for the 2024 Annual Meeting of Stockholders to be held on May 7, 2024

First Acceptance Corporation’s Annual Report for the year ended December 31, 2023 Proxy Statement and

Proxy Card are available at

https://firstacceptance.com/investor-relations/proxy-online

1

FIRST ACCEPTANCE CORPORATION

3813 GREEN HILLS VILLAGE DRIVE

NASHVILLE, TENNESSEE 37215

PROXY STATEMENT

The Board of Directors of First Acceptance Corporation (referred to herein as the “Board” or the “Board of

Directors”) is soliciting proxies to be used at the 2024 annual meeting of stockholders. This proxy statement and the

enclosed proxy card will be first mailed to stockholders on or about March 22, 2024.

ABOUT THE MEETING

What Is the Purpose of the Annual Meeting?

At our annual meeting, stockholders will vote on the matters outlined in the proxy statement. In addition, our

management will report on our performance during 2023 and respond to appropriate questions from stockholders.

Who Is Entitled to Vote?

Stockholders of record of our common stock at the close of business on the record date, March 13, 2024, are

entitled to receive notice of the annual meeting and vote the shares of common stock that they held on that date at the

meeting, or any postponement or adjournment of the meeting. Each outstanding share of our common stock entitles

its holder to cast one vote on each matter to be voted upon.

What Constitutes a Quorum?

For purposes of voting on all matters, the presence at the meeting, in person or by proxy, of the holders of a

majority of the shares of common stock outstanding on the record date will constitute a quorum. As of the record

date, 37,980,139 shares of our common stock were outstanding. Proxies received but marked as abstentions will be

included in the calculation of the number of shares considered to be present at the meeting.

How Do I Vote?

If you complete and properly sign the accompanying proxy card and return the card to us, the card will be

voted as you direct. If you are a registered stockholder and attend the meeting, you may deliver your completed proxy

card in person. "Street name" stockholders who wish to vote at the meeting will need to obtain a proxy card from the

institution that holds their shares.

Can I Change My Vote After I Return My Proxy Card?

Yes. You can revoke your proxy at any time before the final vote at the annual meeting in any of three ways:

• by submitting written notice of revocation to the Secretary;

• by submitting another proxy that is later dated and properly signed; or

• by voting in person at the meeting.

2

What Are the Board's Recommendations?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy

card will vote in accordance with the recommendations of the Board of Directors. The Board's recommendations are

set forth below, and a description of each item is included in this proxy statement. In summary, the Board

recommends a vote:

• FOR election of each of the nominated directors;

• FOR approval of an increase in the number of shares authorized for issuance pursuant to the First

Acceptance Corporation Employee Stock Purchase Plan; AND

• FOR the ratification of the appointment of Crowe LLP as our independent registered public

accounting firm.

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as

recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

What Vote Is Required to Approve Each Proposal?

Election of Directors

Each of the director nominees must receive affirmative votes from a plurality of the votes cast to be elected.

This means that the seven nominees receiving the greatest number of votes will be elected as directors. Stockholders

may not cumulate votes in the election of directors.

Approval of Increase in Number of Shares Authorized for Issuance Pursuant to the First Acceptance

Corporation Employee Stock Purchase Plan

The amendment to the First Acceptance Corporation Employee Stock Purchase Plan will be ratified if the

proposal receives the affirmative vote of a majority of the votes cast on the matter. With respect to this proposal, a

properly executed proxy marked “ABSTAIN” will have the same effect as a vote against the proposal. Broker non-

votes will not affect this proposal.

Ratification of Independent Registered Public Accounting Firm

The appointment of Crowe LLP as our independent registered public accounting firm for 2024 will be

ratified if the proposal receives the affirmative vote of a majority of the votes cast on the matter. If this appointment

is not ratified by stockholders, the Audit Committee and the Board may reconsider its recommendation and

appointment, respectively. With respect to this proposal, abstentions will not be counted as votes and will have no

effect on the result of the vote.

Will My Shares Be Voted if I Do Not Sign and Return My Proxy Card?

If you are a registered stockholder and do not sign and return your proxy card, your shares will not be voted

at the annual meeting. We strongly encourage you to vote - every vote is important.

3

PROPOSAL 1 – ELECTION OF DIRECTORS

At the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors

has nominated and recommends to the stockholders, Rhodes R. Bobbitt, Donald J. Edwards, Jeremy B. Ford, Tom

C. Nichols, Lyndon L. Olson, Jr., Kenneth D. Russell and William A. Shipp, Jr. for election to serve as directors

until our next annual meeting of stockholders and until such time as their respective successors are duly elected and

qualified. Each of the director nominees is currently a director and was elected by the stockholders at our 2023

annual meeting of stockholders.

If any of the nominees should become unable to accept election, the persons named in the proxy may vote

for such other person or persons as may be designated by the Board of Directors. Management has no reason to

believe that any of the nominees named above will be unable to serve.

Certain information with respect to the nominees for election as directors is set forth below, including, with

respect to each director nominee, his particular experience, qualifications, attributes, and skills that qualify him to

serve as a director.

Rhodes R. Bobbitt

Director Since: 2004

(Age 78)

Business Experience: From February 1987 until his retirement in June 2004, Mr.

Bobbitt served as Managing Director and Dallas Regional Office Manager of the

Private Client Service Group – Credit Suisse First Boston and its predecessor,

Donaldson, Lufkin & Jenrette. Prior to joining Donaldson, Lufkin & Jenrette,

Mr. Bobbitt was Vice President of Security Sales in the Dallas office of Goldman

Sachs & Co. Mr. Bobbitt has executive experience in finance and investments.

Other Current Board Positions: Hilltop Holdings Inc.

Relationship to Company: Mr. Bobbitt is an Independent Director.

Donald J. Edwards

Director Since: 2002

(Age 58)

Business Experience: Mr. Edwards is the Chief Executive Officer of Flexpoint

Ford, LLC, a Chicago-based private equity firm focused on healthcare and

financial services. Prior to July 2002, Mr. Edwards served as a principal in

GTCR Golder Rauner, a Chicago-based private equity firm, for over eight years

where he was the head of the firm’s healthcare investment effort. Mr. Edwards

has experience in strategic planning, management, finance, and investments.

Other Current Board Positions: GeoVera Holdings.

Relationship to Company: Mr. Edwards is a Director.

4

Tom C. Nichols

Director Since: 2005

(Age 76)

Business Experience: Mr. Nichols is currently the owner and Chief Executive

Officer of Carlile Holdings, Inc., a family investment office. He served as

Chairman and Chief Executive Officer of Carlile Bancshares, Inc. from March

2008 through its April 2017 acquisition by Independent Bancshares, Inc. for

which he served as a director until June 2020. He served as President and a

director of First United Bancorp and Chairman, President and Chief Executive

Officer of State National Bancshares, Fort Worth from October 1996 to March

2008. Mr. Nichols previously served as President of Ford Bank Group and as a

director of United New Mexico Financial Corporation. Mr. Nichols has executive

experience in strategic planning, management, and finance.

Other Current Board Positions: Hilltop Holdings Inc.

Relationship to Company: Mr. Nichols is an Independent Director.

Lyndon L. Olson

Director Since: 2004

(Age 77)

Business Experience: From 2011 until 2015, Mr. Olson served as Chairman of

Hill+Knowlton Strategies, Europe and USA, a global public relations company.

Mr. Olson served as a Senior Advisor to the Chairman of Citigroup, Inc. from

2001 until 2008. Mr. Olson served as United States Ambassador to Sweden from

1998 until 2001. From 1990 to 1998, Mr. Olson served as Chairman and Chief

Executive Officer of Travelers Insurance Group Holdings, Inc., and Associated

Madison Companies, Inc. Prior to joining Travelers, Mr. Olson served as

President of the National Group Corporation and Chief Executive Officer of its

National Group Insurance Company. Mr. Olson has executive experience in

strategic planning, management, insurance regulatory compliance and finance,

with particular emphasis on the insurance industry.

Other Current Board Positions: Scott & White Health Plan.

Relationship to Company: Mr. Olson is an Independent Director.

Jeremy B. Ford

Director Since: 2011

(Age 49)

Chairman of the Board of

Directors

Business Experience: Mr. Ford is the Chairman of the Board of Directors. He

currently serves as a director, President and Chief Executive Officer of Hilltop

Holdings Inc. (“Hilltop”), a financial holding company that owns PlainsCapital

Bank, PrimeLending (mortgage lender), and HilltopSecurities (investment bank).

Prior to joining Hilltop, he worked for Ford Financial Fund, L.P., a private equity

fund, and for Diamond A-Ford Corporation, a family limited partnership. Mr.

Ford has extensive experience in operating a public company, as well as mergers

and acquisitions.

Other Current Board Positions: Hilltop Holdings Inc.

Relationship to Company: Jeremy B. Ford is the son of Gerald J. Ford, the

Company’s former Chairman of the Board of Directors who controls

approximately 57% of our outstanding common stock.

5

Kenneth D. Russell

Director Since: 2014

(Age 75)

President and Chief

Executive Officer

Business Experience: Since November 2021, Mr. Russell had served as a Special

Advisor to the Company. Upon the death of Larry Willeford in October 2022, he has

served as President and Chief Executive Officer. He previously served as the

Company's Chief Executive Officer from October 2019 through November 2021. Mr.

Russell previously served as both the Company's Interim President and Chief

Executive Officer from October 2016 until October 2019. From June 2015 to October

2016, Mr. Russell served as President, Chief Executive Officer and a director of

Mechanics Bank, an affiliate of Gerald J. Ford. Mr. Russell is a former member of the

managing board of directors for KPMG Deutsche Treuhand-Gesellschaft

Aktiengesellschaft (KPMG DTG). Prior to joining KPMG DTG, Mr. Russell was the

lead financial services partner in the US KPMG LLP's Department of Professional

Practice in New York. Prior to joining the Department of Professional Practice at

KPMG in 1993, Mr. Russell spent 20 years in KPMG's Dallas office and had

engagement responsibilities for several significant regional banking, thrift and other

financial services clients.

Other Current Board Positions:

Hilltop Holdings Inc. and Mechanics Bank

Relationship to Company: Mr. Russell is the Interim President and Chief Executive

Officer of the Company in addition to being a Director.

William A. Shipp, Jr.

Director Since: 2004

(Age 71)

Business Experience: Mr. Shipp has been a principal of W.A. Shipp, Jr. & Co., a

business and financial advisory firm, since July 1995 and has served as

Treasurer/Secretary of the Jack C. Massey Foundation since July 1999, as a

Director of the Foundation since April 2015, and as President since November

2016. From December 1983 to June 1995, Mr. Shipp served as Vice President of

Massey Investment Company, the family office of Jack C. Massey. Prior to

joining Massey Investment Company, Mr. Shipp worked for more than eight

years in various audit and tax capacities for Ernst & Young LLP. Mr. Shipp is a

certified public accountant with the CGMA designation and has experience in

accounting, finance, and investments.

Other Current Board Positions: Jack C. Massey Foundation.

Relationship to Company: Mr. Shipp is an Independent Director.

Required Vote; Recommendation of the Board

The affirmative vote of a plurality of the votes cast by the stockholders entitled to vote at the meeting is

required for the election of directors. Abstentions will be counted in determining whether there is a quorum but will

not be voted with respect to the proposal. Stockholders may not cumulate votes in the election of directors.

The Board of Directors unanimously recommends that you vote FOR each of the nominees identified

above.

6

PROPOSAL 2 – APPROVAL OF THE AMENDMENT TO THE FIRST ACCEPTANCE CORORATION

EMPLOYEE STOCK PURCHASE PLAN

The Company believes that broad-based ownership of equity interests in the Company by its employees

provides a substantial motivation for superior performance by more closely aligning the economic interests of those

employees with the overall performance of the Company and the interests of the stockholders of the Company. In

order to encourage ownership of the Company's common stock by its employees, the Board of Directors and

stockholders of the Company previously approved the First Acceptance Corporation Employee Stock Purchase Plan,

as amended, which we will refer to as the "plan." The Company proposes to amend the plan to increase the number

of shares of common stock authorized for issuance under the plan from 1,00,000 to 1,300,000, to allow for future

shares to be issued. The Board of Directors has reviewed the plan and determined that, in order to encourage

continued participation in the plan by the Company’s employees, the stockholders should approve this amendment.

Required Vote; Recommendation of the Board

Approval of this proposal requires the affirmative vote of a majority of the shares represented in person or by proxy

and entitled to vote on the matter. A properly executed proxy marked "ABSTAIN" with respect to this proposal will

have the same effect as a vote against the proposal. Broker non-votes will not affect this proposal. However, as

discussed elsewhere in this proxy statement, both abstentions and broker non-votes will factor into the determination

of the existence of a quorum.

The Board of Directors recommends that you vote FOR approval of the amendment to the First Acceptance

Corporation Employee Stock Purchase Plan.

PROPOSAL 3 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Crowe LLP (“Crowe”) to serve as our independent registered public

accounting firm for the current year, and the stockholders are requested to ratify this appointment. This will be

Crowe’s fifth year as our independent registered public accounting firm. A representative of Crowe is expected to be

present at the annual meeting, will have an opportunity to make a statement if he or she so desires and is expected to

be available to respond to appropriate questions. Stockholders should recognize that the ratification of the

appointment of Crowe does not preclude the Audit Committee from subsequently determining to change our

independent registered public accounting firm if the Audit Committee determines such action to be in the best

interests of the Company and its stockholders.

Required Vote; Recommendation of the Board

The appointment of Crowe LLP as our independent registered public accounting firm for 2024 will be

ratified if this proposal receives the affirmative vote of a majority of the votes cast on the matter. With respect to this

proposal, abstentions will not be counted as votes cast and will have no effect on the result of the vote.

The Board of Directors recommends that you vote FOR the ratification of the appointment of Crowe

LLP as the Company's independent registered public accounting firm.

OTHER MATTERS

As of the date of this proxy statement, we know of no business that will be presented for consideration at the annual

meeting other than the items referred to above. If any other matter is properly brought before the meeting for action

by stockholders, proxies in the enclosed form returned to us will be voted in accordance with the recommendation of

the Board of Directors or, in the absence of such a recommendation, in accordance with the judgment of the proxy

holder.

7

ADDITIONAL INFORMATION

Stockholder Proposals for the 2025 Annual Meeting. To be eligible for inclusion in our proxy statement for the

2025 Annual Meeting of Stockholders, we must receive any stockholder proposals no later than December 8, 2024.

Requests in this regard should be addressed to:

Investor Relations

First Acceptance Corporation

3813 Green Hills Village Drive

Nashville, Tennessee 37215

1-800-321-0899

FIRST ACCEPTANCE CORPORATION

ANNUAL INFORMATION AND DISCLOSURE STATEMENT

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

Table of Contents

Part A – General Company Information .................................................................................................................................................... 3

Part B – Share Structure ............................................................................................................................................................................. 4

Part C – Business Information ................................................................................................................................................................... 6

Part D – Management Structure and Financial Information .................................................................................................................... 12

Part E – Issuance History ......................................................................................................................................................................... 19

Part F – Exhibits ...................................................................................................................................................................................... 19

3

Part A – General Company Information

Item 1. The Exact Name of The Issuer

First Acceptance Corporation

Item 2. The Address of The Issuer’s Principal Executive Offices

Principal Executive Offices: First Acceptance Corporation

3813 Green Hills Village Drive

Nashville, TN 37215

Telephone: 615-844-2800

Web: www.firstacceptance.com

Investor Relations: Michael J. Bodayle

Vice President, Secretary & Treasurer

First Acceptance Corporation

3813 Green Hills Village Drive

Nashville, TN 37215

Email: mbodayle@firstacceptance.com

Item 3. The Jurisdiction and Date of the Issuer’s Incorporation

First Acceptance Corporation was incorporated in the state of Delaware in 1996.

4

Part B – Share Structure

Item 4. The Exact Title and Class of Securities Outstanding

Class: Common Stock

CUSIP: 318457108

Trading Symbol: FACO

Item 5. Par or Stated Value and Description of the Security

A. Par or Stated Value

The Company’s outstanding securities consists solely of common stock, par value $0.01 per share.

B. Common Stock or Preferred Stock

Common Stock

Stockholders of the Company are entitled to dividends if declared by the Board of Directors. Each share of our common stock entitles

the holder thereof to one vote on all matters submitted to a vote of the stockholders. Our common stock is not subject to redemption or

future calls or assessment by First Acceptance Corporation. Holders of common stock do not have preemptive rights, or rights to convert

their common stock into other securities. In the event of a liquidation, dissolution or winding up of the affairs of First Acceptance

Corporation, holders of our common stock have the right to a ratable portion of the assets remaining after the payment of all liabilities.

All outstanding shares of our common stock are fully paid and nonassessable.

The provisions of First Acceptance Corporation’s articles of incorporation and bylaws that are summarized below may have an anti-

takeover effect and may delay, defer or prevent a tender offer or takeover attempt that a stockholder might consider to be in such

stockholder's best interests, including those attempts that might result in a premium over the market price for the shares held by

stockholders:

• the requirement that only stockholders owning at least one-third of the outstanding shares of our common stock may call a

special stockholders’ meeting; and

• the requirement that stockholders owning at least two-thirds of the outstanding shares of our common stock must approve

any amendment to our certificate of incorporation provisions concerning the ability to call special stockholders’ meetings.

Under our certificate of incorporation, we may issue shares of preferred stock on terms that are unfavorable to the holders of our

common stock. The issuance of shares of preferred stock could also prevent or inhibit a third party from acquiring us. The existence of

these provisions could depress the price of our common stock, could delay or prevent a takeover attempt or could prevent attempts to

replace or remove incumbent management.

Item 6. The Number of Shares or Total Amount of the Securities Outstanding for Each Class of Securities Authorized

Common Shares

December 31, 2023

December 31, 2022

Number of Shares Authorized

75,000,000

75,000,000

Number of Shares Outstanding

38,264,718

37,867,980

Freely Tradeable Shares (Public Float)

10,711,656

10,144,257

Total Number of Stockholders of Record

237

235

Preferred Shares

December 31, 2023

December 31, 2022

Number of Shares Authorized

10,000,000

10,000,000

Number of Shares Outstanding

—

—

Freely Tradeable Shares (Public Float)

—

—

Total Number of Stockholders of Record

—

—

The Company has more than 50 beneficial stockholders of record owning at least 100 shares.

5

Item 7. The Name and Address of the Transfer Agent

Computershare is registered as a transfer agent under the Exchange Act.

Shawn P. Sharp, Assistant Vice President and Relationship Manager

Computershare – Client Services

1325 Remington Blvd.

Bolingbrook, IL 60490

502-551-9319

Shawn.Sharp@computershare.com

6

Part C – Business Information

Item 8. The Nature of the Issuer’s Business

A. Business Development (During the Last Three Years)

1. The form of organization of the issuer.

We are a Delaware corporation.

2. The year that the issuer (or any predecessor) was organized.

We were organized in 1996.

3. The issuer’s fiscal year end date.

Our fiscal year end date is December 31.

4. Whether the issuer (or any predecessor) has been in bankruptcy, receivership or any similar proceeding.

We have not been in any bankruptcy, receivership, or any similar proceeding.

5. Any material reclassification, merger, consolidation, or purchase or sale of a significant amount of assets.

We have not had any reclassification, merger, consolidation, or purchase or sale of a significant amount of assets other than

the sale of our insurance agency operations effective December 1, 2023, as detailed in Part F, Item 18, Number 7, and

discussed throughout this document.

6. Any default of the terms of any note, loan, lease, or other indebtedness or financing arrangement requiring the issuer

to make payments.

We have not had any default of the terms of any note, loan, lease, or other indebtedness or financing arrangement.

7. Any change of control.

We have not had a change in control.

8. Any increase of 10% or more of the same class of outstanding equity securities.

There has not been an increase of 10% or more in any class of outstanding equity securities.

9. Any past, pending or anticipated stock split, stock dividend, recapitalization, merger, acquisition, spin-off, or

reorganization.

We do not have any past, pending or anticipated stock split, stock dividend, recapitalization, merger, acquisition, spin-off, or

reorganization.

10. Any delisting of the issuer’s securities by any securities exchange or deletion from the OTC Bulletin Board.

Effective April 9, 2018, we voluntarily terminated our listing with the New York Stock Exchange and began trading on the

OTCQX Marketplace.

11. Any current, past, pending or threatened legal proceedings or administrative actions either by or against the issuer

that could have a material effect on the issuer’s business, financial condition, or operations and any current, past or

pending trading suspensions by a securities regulator. State the names of the principal parties, the nature and current

status of the matters, and the amounts involved.

Please see the section entitled “Litigation” in Note 14 of our consolidated financial statements which are attached to this

report.

7

B. Business of Issuer

1. The issuer’s primary and secondary SIC codes.

Our primary SIC Code is 6331.

2. If the issuer has never conducted operations, is in the development stage, or is currently conducting operations.

We are currently conducting operations.

3. Whether the issuer has at any time been a “shell company.”

We are not, and never have been, a shell company.

4. The names of any parent, subsidiary, or affiliate of the issuer, and its business purpose, its method of operation, its

ownership, and whether it is included in the financial statements attached to this disclosure statement.

First Acceptance Corporation owns and operates three insurance company subsidiaries: First Acceptance Insurance Company,

Inc. (“FAIC”), First Acceptance Insurance Company of Georgia, Inc. (“FAIC-GA) and First Acceptance Insurance Company

of Tennessee, Inc. (“FAIC-TN”) and had one wholly-owned insurance agency subsidiary: Acceptance Insurance Agency of

Tennessee, Inc. (“AITN”), which was sold effective December 1, 2023. We also have other subsidiaries that individually and

collectively are not material. These entities are all included in the consolidated financial statements attached to this disclosure

statement.

We also own an unconsolidated subsidiary trust, First Acceptance Statutory Trust I (“FAST I”) that in June 2007 issued

debentures to outside investors on behalf of First Acceptance Corporation.

5. The effect of existing or probable governmental regulations on the business.

Insurance Company Regulation. Our insurance company subsidiaries are regulated by governmental agencies in the states in

which we conduct business and by various federal statutes and regulations. These state regulations vary by jurisdiction but,

among other matters, usually involve:

• regulating premium rates and forms;

• setting minimum solvency standards;

• setting capital and surplus requirements;

• licensing companies, agents and, in some states, claims adjusters;

• setting requirements for and limiting the types and amounts of investments;

• establishing requirements for the filing of annual statements and other financial reports;

• conducting periodic statutory examinations of the affairs of insurance companies;

• requiring prior approval of changes in control and of certain transactions with affiliates;

• limiting the amount of dividends that may be paid without prior regulatory approval; and

• setting standards for advertising and other market conduct activities.

Required Licensing. We operate under licenses issued by various state insurance authorities. Such licenses may be of perpetual

duration or periodically renewable, provided we continue to meet applicable regulatory requirements. The licenses govern,

among other things, the types of insurance coverages and products that may be offered in the licensing state. Such licenses are

typically issued only after an appropriate application is filed and prescribed criteria are met. All our licenses are in good

standing.

As required by our current operations, we hold managing general agency licenses in Texas and Florida. In addition, business

that was written through other third-party insurance carriers required our agency operations to hold agency or broker licenses

8

in those states. To expand into a new state or offer a new line of insurance or other new product, we must apply for and obtain

the appropriate licenses.

Insurance Holding Company Regulation. We operate as an insurance holding company system and are subject to regulation in

the jurisdictions in which our insurance company subsidiaries conduct business. These regulations require that each insurance

company in the holding company system register with the insurance department of its state of domicile and furnish information

concerning the operations of companies in the holding company system which may materially affect the operations,

management or financial condition of the insurers in the holding company domiciled in that state. We have three insurance

company subsidiaries that are organized and domiciled under the insurance statutes of Texas, Georgia and Tennessee. The

insurance laws in each of these states similarly provide that all transactions among members of a holding company system be

done at arm’s length and shown to be fair and reasonable to the regulated insurer. Transactions between insurance company

subsidiaries and their parents and affiliates typically must be disclosed to the state regulators, and any material or extraordinary

transaction requires prior approval of the applicable state insurance regulator. A change of control of a domestic insurer or of

any controlling person requires the prior approval of the state insurance regulator. In general, any person who acquires 10% or

more of the outstanding voting securities of the insurer or its parent company is deemed by statute to have acquired control of

the domestic insurer.

Restrictions on Paying Dividends. We may in the future rely on dividends from our insurance company subsidiaries to meet

corporate cash requirements. State insurance regulatory authorities require insurance companies to maintain specified levels of

statutory capital and surplus. The amount of an insurer’s capital and surplus following payment of any dividends must be

reasonable in relation to the insurer’s outstanding liabilities and adequate to meet its financial needs. Prior approval from state

insurance regulatory authorities is generally required in order for an insurance company to declare and pay extraordinary

dividends. The payment of ordinary dividends is limited by the amount of capital and surplus available to the insurer, as

determined in accordance with state statutory accounting practices and other applicable limitations. State insurance regulatory

authorities that have jurisdiction over the payment of dividends by our insurance company subsidiaries may in the future adopt

statutory provisions more restrictive than those currently in effect. See Note 15 to our consolidated financial statements for a

discussion of the current ability of our insurance company subsidiaries to pay dividends.

Regulation of Rates and Policy Forms. Most states in which our insurance company subsidiaries operate have insurance laws

that require insurance companies to file premium rate schedules and policy or coverage forms for review and approval. In many

cases, such rates and policy forms must be approved prior to use. State insurance regulators have broad discretion in judging

whether an insurer’s rates are adequate, not excessive and not unfairly discriminatory. Generally, property and casualty insurers

are unable to implement rate increases until they show that the costs associated with providing such coverage have increased.

The speed at which an insurer can change rates in response to competition or increasing costs depends, in part, on the method

by which the applicable state’s rating laws are administered. There are three basic rate administration systems: (i) the insurer

must file and obtain regulatory approval of the new rate before using it; (ii) the insurer may file the new rate and begin using

the new rate during regulatory review; or (iii) the insurer may begin using the new rate and file it in a specified period of time

for regulatory review. Under all three rating systems, the state insurance regulators have the authority to disapprove the rate

subsequent to its filing. Thus, insurers who begin using new rates before the rates are approved may be required to issue

premium refunds or credits to policyholders if the new rates are ultimately deemed excessive and disapproved by the applicable

state insurance authorities.

Investment Regulation. Our insurance company subsidiaries are subject to state laws and regulations that require diversification

of their investment portfolios and limitations on the amount of investments in certain categories. Failure to comply with these

laws and regulations would cause non-conforming investments to be treated as non-admitted assets for purposes of measuring

statutory surplus and, in some instances, would require divestiture. If a non-conforming asset is treated as a non-admitted asset,

it would lower the affected subsidiary’s surplus and thus, its ability to write additional premiums and pay dividends.

Restrictions on Cancellation, Non-Renewal or Withdrawal. Many states have laws and regulations that limit an insurer’s ability

to exit a market. For example, certain states limit an automobile insurer’s ability to cancel or not renew policies. Some states

prohibit an insurer from withdrawing one or more lines of business from the state, except pursuant to a plan approved by the

state insurance department. The state insurance department may disapprove a plan that may lead to market disruption. Laws

and regulations that limit cancellations and non-renewals and that subject business withdrawals to prior approval requirements

may restrict an insurer’s ability to exit unprofitable markets.

Privacy Regulations. The Gramm-Leach-Bliley Act protects consumers from the unauthorized dissemination of certain

nonpublic personal information. In addition, most states have implemented additional regulations to address privacy issues.

These laws and regulations apply to all financial institutions, including insurance companies, and require us to maintain

9

appropriate procedures for managing and protecting certain nonpublic personal information of our customers and to fully

disclose our privacy practices to our customers. We may also be exposed to future privacy laws and regulations, which could

impose additional costs and impact our results of operations or financial condition.

Licensing of Our Employee-Agents and Claims Adjusters. Prior to the sale of AITN, all our employees who sold, solicited or

negotiated insurance were licensed, as required, by the state in which they worked, for the applicable line or lines of insurance

they offer. In certain states in which we operate, our insurance claims adjusters are also required to be licensed and are subject

to annual continuing education requirements.

Unfair Claims Practices. Generally, insurance companies, adjusting companies and individual claims adjusters are prohibited

by state statutes from engaging in unfair claims practices which could indicate a general business practice. We set business

conduct policies and conduct regular training to ensure that our employee-adjusters and other claims personnel are aware of

these prohibitions, and we require them to conduct their activities in compliance with these statutes.

Financial Reporting. We are required to file quarterly and annual financial reports with states utilizing statutory accounting

practices that are different from U.S. generally accepted accounting principles, which generally reflect our insurance company

subsidiaries on a going concern basis. The statutory accounting practices used by state regulators, in keeping with the intent to

assure policyholder protection, are generally based on a liquidation concept. For statutory financial information on our

insurance company subsidiaries, see Note 15 to our consolidated financial statements which are attached to this report.

Periodic Financial and Market Conduct Examinations. The state insurance departments that have jurisdiction over our

insurance company subsidiaries conduct on-site visits and examinations of the insurers’ affairs, especially as to their financial

condition, ability to fulfill their obligations to policyholders, market conduct, claims practices and compliance with other laws

and applicable regulations. Generally, these examinations are conducted every five years. If circumstances dictate, regulators

are authorized to conduct special or target examinations of insurers, insurance agencies and insurance adjusting companies to

address particular concerns or issues. The results of these examinations can give rise to regulatory orders requiring remedial,

injunctive, or other corrective action on the part of the company that is the subject of the examination. Our three insurance

companies have been examined for financial condition through December 31, 2020 by their respective states of domicile. FAIC

has been the subject of various limited scope market conduct examinations.

Risk-Based Capital. In order to enhance the regulation of insurer solvency, the National Association of Insurance

Commissioners, or “NAIC,” has adopted a formula and model law to implement risk-based capital, or “RBC,” requirements

designed to assess the minimum amount of statutory capital that an insurance company needs to support its overall business

operations and to ensure that it has an acceptably low expectation of becoming financially impaired. RBC is used to set capital

requirements based on the size and degree of risk taken by the insurer and considering various risk factors such as asset risk,

credit risk, underwriting risk, interest rate risk and other relevant business risks. The NAIC model law provides for increasing

levels of regulatory intervention as the ratio of an insurer’s total adjusted capital decreases relative to its RBC, culminating

with mandatory control of the operations of the insurer by the domiciliary insurance department at the so-called mandatory

control level. This calculation is performed on a calendar year basis, and at December 31, 2023, each of our insurance

companies maintained an RBC level that was in excess of an amount that would require any corrective actions on their part.

6. An estimate of the amount spent during each of the last two fiscal years on research and development activities, and, if

applicable, the extent to which the cost of such activities is borne directly by customers.

We have not spent any material amounts during the last two fiscal years on research and development activities.

7. Costs and effects of compliance with environmental laws (federal, state, and local).

Based on our environmental assessments, we believe that any compliance costs associated with environmental laws and

regulations or any remediation of affected properties are not material, and that any future compliance costs would not have a

material adverse effect on our business, financial position, results of operations, or cash flows.

8. The number of total employees and number of full-time employees.

At December 31, 2023, the Company had 633 full time employees.

10

Item 9. The Nature of Products or Services Offered

A. Principal products or services, and their markets.

Our core business involved offering automobile insurance policies categorized as “non-standard” to individuals based primarily

on their inability or unwillingness to obtain insurance coverage from standard carriers due to various factors, including their

payment history or need for monthly payment plans, failure to maintain continuous insurance coverage or driving record. We

believed that a majority of our customers seek non-standard insurance due to flexible payment terms and positive customer

service experience, including dependable and direct interaction through our retail locations. These policies were written both

through our insurance companies and third-party carriers.

Our employee-agents primarily sold non-standard personal automobile insurance products that were underwritten by us and

through third-party carriers for which we received a commission. We also offered a variety of additional commissionable

products, and, in most states, our employee-agents also sold (and continue to sell) an insurance product providing personal

property and liability coverage for renters that were underwritten by us. Through December 1, 2023, our 288 retail locations,

were also able to complete the entire sales process over the phone via our call center or through the internet via our consumer-

based website or mobile platform. On a limited basis, we also sold our products through selected retail locations owned and

operated by independent agents.

On December 1, 2023, the Company sold AITN, the Company’s retail sales agency operations subsidiary, which maintained

retail locations in 13 states, and whose operations generated revenue from selling non-standard personal automobile insurance

products and related products in 15 states. Following this transaction, we operate solely through independent agents. We are

also licensed as an insurance company in 11 states where we do not conduct any underwriting operations.

Our employee-agents primarily sold non-standard personal automobile insurance products that were underwritten by us and

through third-party carriers for which we received a commission. We also offered a variety of additional commissionable

products, and, in most states, our employee-agents also sold (and continue to sell) an insurance product providing personal

property and liability coverage for renters that were underwritten by us. Through December 1, 2023, our 288 retail locations,

were also able to complete the entire sales process over the phone via our call center or through the internet via our consumer-

based website or mobile platform. On a limited basis, we also sold our products through selected retail locations owned and

operated by independent agents.

As an insurance company, we are a servicer and underwriter of non-standard personal automobile insurance.

We offer customers automobile insurance with low down payments, competitive monthly payments and a high level of personal

service. This strategy makes it easier for our customers to obtain automobile insurance, which is legally mandated in the states

in which we currently operate. Currently, our policy life expectancy is lower than that of standard personal automobile insurance

providers due to the payment patterns of our customers. However, we accept customers seeking insurance who have previously

terminated coverage provided by us without imposing any additional requirements on such customers. Our business model and

systems allow us to issue policies efficiently and, when necessary, cancel them to minimize the potential for credit loss while

adhering to regulatory cancellation notice requirements.

In addition to a low-down payment and competitive monthly rates, we offered customers valuable face-to-face contact and

speed of service as many of our customers preferred not to purchase a new automobile insurance policy over the phone or

through the internet. The majority of our customers made their payments through our retail locations. For many of our

customers, our employee-agents were not only the face of the Company, but also the preferred interface for buying insurance.

B. Distribution methods of the products or services.

Following the December 1, 2023 sale of our insurance agency operations, we now solely distribute our products through

independent agents.

C. Status of any publicly announced new product or service.

We have not publicly announced any new product or service.

11

D. Competitive business conditions, the issuer’s competitive position in the industry, and methods of competition.

The non-standard personal automobile insurance business is highly competitive. Our primary competition comes not only from

national companies or their subsidiaries, but also from non-standard insurers and independent agents that operate only in

specific regions or states. We compete against other insurance companies and independent agents that market insurance on

behalf of a number of insurers. We compete with these other insurers on factors such as initial down payment, availability of

monthly payment plans, price, customer service and claims service.

E. Sources and availability of raw materials and the names of principal suppliers.

We do not use raw materials.

F. Dependence on one or a few major customers.

For the year ended December 31, 2023, 25% of insurance company operating revenues resulted from insurance policies

produced by a single independent agent who is engaged in a technology driven method of delivering insurance through an

app that is commonly referred to as “Insurtech.” In 2024, it is anticipated that the buyer of AITN will produce the majority

of insurance company operating revenues.

G. Patents, trademarks, licenses, franchises, concessions, royalty agreements or labor contracts, including their duration.

The Company maintains trademarks related to our trade names and logos. We do not have any patents, franchises, concessions,

royalty agreements, or labor contracts. See Item 8 B.5. for information regarding our required licenses.

H. The need for any government approval of principal products or services and the status of any requested government

approvals.

Insurance products are required to be reviewed and approved by insurance regulators in the various states in which we conduct

business. Variations on certain products may occur on a state-by-state basis based on the laws or regulations of a given state.

From time-to-time, we do seek to add new products and modify existing products, but the Company is not currently awaiting

any approval that materially impacts our ability to conduct business.

Item 10. The Nature and Extent of the Issuer’s Facilities

We lease office space in two separate facilities (a total of approximately 80,000 square feet) in Nashville, Tennessee for our corporate

office and customer service, claims, and data center. We also lease office space for a regional claims office in Tampa, Florida. Through

December 1, 2023. our 288 retail locations were all leased and were typically located in storefronts in retail shopping centers.

12

Part D – Management Structure and Financial Information

Item 11. The Name of the Chief Executive Officer, Members of the Board of Directors, as well as Control Persons

A. Officers and Directors

Kenneth D. Russell

President and Chief Executive Officer and Director Since 2014

(Age 75)

Business Experience: Since November 2021, Mr. Russell had served as a

Special Advisor to the Company. Upon the death of Larry Willeford in October

2022, he has served as President and Chief Executive Officer. He previously

served as the Company's Chief Executive Officer from October 2019 through

November 2021. Mr. Russell previously served as both the Company's Interim

President and Chief Executive Officer from October 2016 until October 2019.

From June 2015 to October 2016, Mr. Russell served as President, Chief

Executive Officer and a director of Mechanics Bank, an affiliate of Gerald J.

Ford. Mr. Russell is a former member of the managing board of directors for

KPMG Deutsche Treuhand-Gesellschaft Aktiengesellschaft (KPMG DTG). Prior

to joining KPMG DTG, Mr. Russell was the lead financial services partner in the

US KPMG LLP's Department of Professional Practice in New York. Prior to

joining the Department of Professional Practice at KPMG in 1993, Mr. Russell

spent 20 years in KPMG's Dallas office and had engagement responsibilities for

several significant regional banking, thrift, and other financial services clients.

Other Current Board Positions: Hilltop Holdings Inc. and Mechanics Bank

Relationship to Company: Mr. Russell is the President and Chief Executive

Officer of the Company.

Brian Dickman

Executive Vice President and Chief Financial Officer

(Age 50)

Business Experience: Mr. Dickman has been the Company’s Executive Vice

President and Chief Financial Officer since December 2019. From 2011 to 2019,

Mr. Dickman was Director – Financial Analysis and Strategy for Direct General

Insurance.

Other Current Board Positions: None

Relationship to Company: Mr. Dickman is the Executive Vice President and

Chief Financial Officer of the Company.

Rhodes R. Bobbitt

Director Since: 2004

(Age 78)

Business Experience: From February 1987 until his retirement in June 2004, Mr.

Bobbitt served as Managing Director and Dallas Regional Office Manager of the

Private Client Service Group – Credit Suisse First Boston and its predecessor,

Donaldson, Lufkin & Jenrette. Prior to joining Donaldson, Lufkin & Jenrette,

Mr. Bobbitt was Vice President of Security Sales in the Dallas office of Goldman

Sachs & Co. Mr. Bobbitt has executive experience in finance and investments.

Other Current Board Positions: Hilltop Holdings Inc.

Relationship to Company: Mr. Bobbitt is an Independent Director.

13

Donald J. Edwards

Director Since: 2002

(Age 58)

Business Experience: Mr. Edwards is the Chief Executive Officer of Flexpoint

Ford, LLC, a Chicago-based private equity firm focused on healthcare and

financial services. Prior to July 2002, Mr. Edwards served as a principal in

GTCR Golder Rauner, a Chicago-based private equity firm, for over eight years

where he was the head of the firm’s healthcare investment effort. Mr. Edwards

has experience in strategic planning, management, finance, and investments.

Other Current Board Positions: GeoVera Holdings.

Relationship to Company: Mr. Edwards is a Director.

Gerald J. Ford

Principal Shareholder

(Age 79)

Business Experience: Gerald J. Ford is the Chairman of the Board of Hilltop

Holdings Inc. and the Co-Managing Partner of Ford Financial Fund II, L.P. and

Ford Financial Fund III. LP., private equity funds. He was Chairman of the

Board of Directors and a director of the Company until 2011.

Other Current Board Positions: Hilltop Holdings Inc., and Mechanics Bank.

Relationship to Company: Gerald J. Ford controls approximately 57% of our

outstanding common stock and is the father of Jeremy B. Ford, the Chairman of

our Board of Directors.

Jeremy B. Ford

Director Since: 2011

(Age 49)

Chairman of the Board of

Directors

Business Experience: Mr. Ford is the Chairman of the Board of Directors. He

currently serves as a director, President, and Chief Executive Officer of Hilltop

Holdings Inc. (“Hilltop”), a financial holding company that owns PlainsCapital

Bank, PrimeLending (mortgage lender), and HilltopSecurities. Prior to joining

Hilltop, he worked for Ford Financial Fund, L.P., a private equity fund, and for

Diamond A-Ford Corporation, a family limited partnership. Mr. Ford has

extensive experience in operating a public company, as well as mergers and

acquisitions.

Other Current Board Positions: Hilltop Holdings Inc.

Relationship to Company: Jeremy B. Ford is the Chairman of the Board of

Directors. He also is the son of Gerald J. Ford who controls approximately 57%

of our outstanding common stock.

14

Tom C. Nichols

Director Since: 2005

(Age 76)

Business Experience: Mr. Nichols is currently the owner and Chief Executive

Officer of Carlile Holdings, Inc., a family investment office. He served as

Chairman and Chief Executive Officer of Carlile Bancshares, Inc. from March

2008 through its April 2017 acquisition by Independent Bancshares, Inc. for

which he served as a director. He served as President and a director of First

United Bancorp and Chairman, President and Chief Executive Officer of State

National Bancshares, Fort Worth from October 1996 to March 2008. Mr. Nichols

previously served as President of Ford Bank Group and as a director of United

New Mexico Financial Corporation. Mr. Nichols has executive experience in

strategic planning, management, and finance.

Other Current Board Positions: Hilltop Holdings, Inc.

Relationship to Company: Mr. Nichols is an Independent Director.

Lyndon L. Olson

Director Since: 2004

(Age 77)

Business Experience: From 2011 until 2015, Mr. Olson served as Chairman of

Hill+Knowlton Strategies, Europe and USA, a global public relations company.

Mr. Olson served as a Senior Advisor to the Chairman of Citigroup, Inc. from

2001 until 2008. Mr. Olson served as United States Ambassador to Sweden from

1998 until 2001. From 1990 to 1998, Mr. Olson served as Chairman and Chief

Executive Officer of Travelers Insurance Group Holdings, Inc. and Associated

Madison Companies, Inc. Prior to joining Travelers, Mr. Olson served as

President of the National Group Corporation and Chief Executive Officer of its

National Group Insurance Company. Mr. Olson has executive experience in

strategic planning, management, insurance regulatory compliance and finance,

with particular emphasis on the insurance industry.

Other Current Board Positions: Scott & White Health Plan.

Relationship to Company: Mr. Olson is an Independent Director.

William A. Shipp, Jr.

Director Since: 2004

(Age 71)

Business Experience: Mr. Shipp has been a principal of W.A. Shipp, Jr. & Co., a

business and financial advisory firm, since July 1995 and has served as

Treasurer/Secretary of the Jack C. Massey Foundation since July 1999, as a

Director of the Foundation since April 2015, and as President since November

2016. From December 1983 to June 1995, Mr. Shipp served as Vice President of

Massey Investment Company, the family office of Jack C Massey. Prior to

joining Massey Investment Company, Mr. Shipp worked for more than eight

years in various audit and tax capacities for Ernst & Young LLP. Mr. Shipp is a

certified public accountant with the CGMA designation and has experience in

accounting, finance, and investments.

Other Current Board Positions: Jack C. Massey Foundation.

Relationship to Company: Mr. Shipp is an Independent Director.

The business address of our directors and executive officers is 3813 Green Hills Village Drive, Nashville, TN 37215. The address of

Gerald J. Ford is 6565 Hillcrest Avenue, Suite 600, Dallas, TX 75205.

15

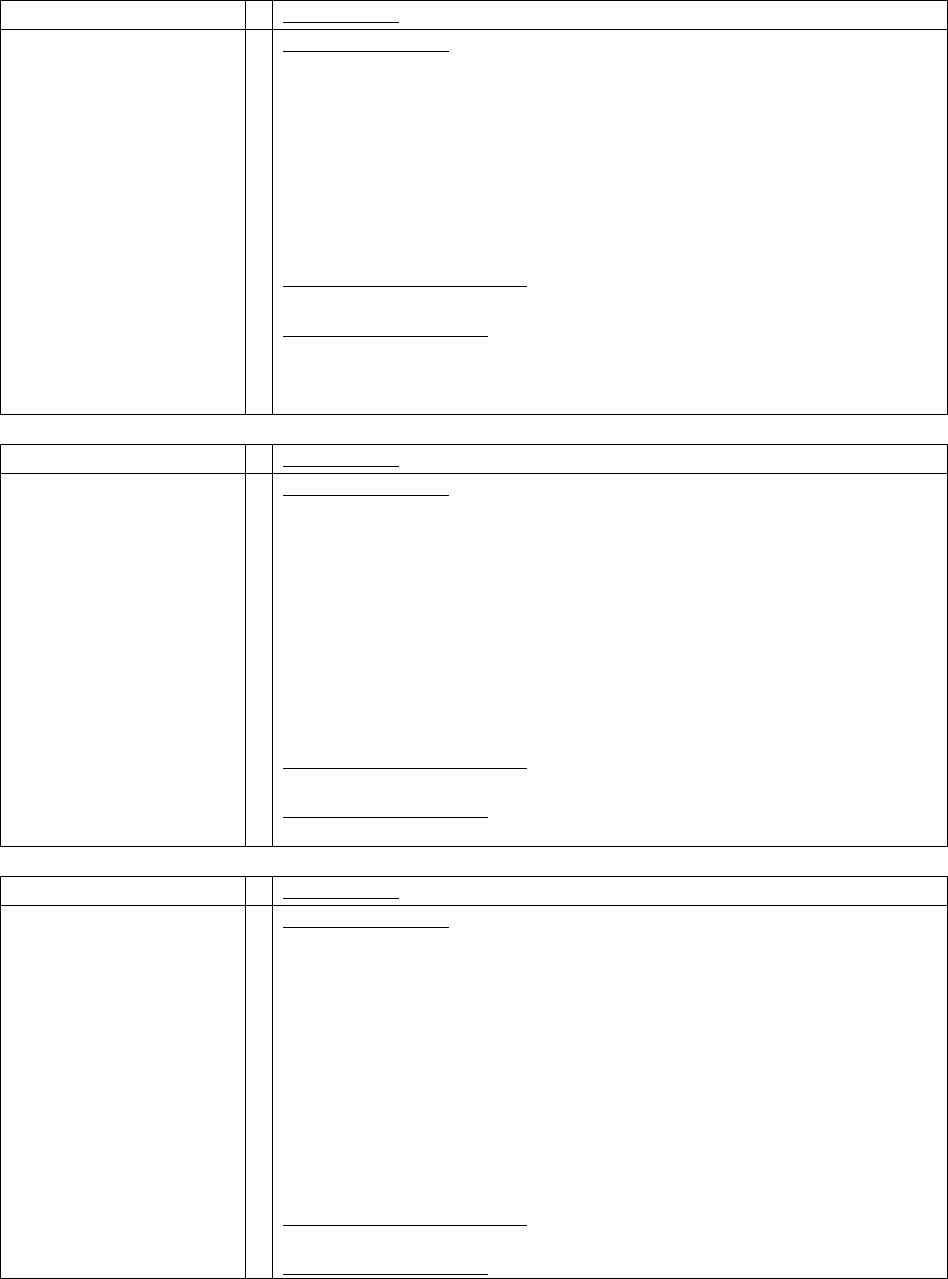

2023 Compensation of Executive Officers

The following table summarizes information with respect to the compensation paid to our executive officers in 2023.

Stock

Awards

Name and Principal Position

Salary ($)

Bonus ($)

($) (1)

Total ($)

Kenneth D. Russell

(2)

400,000

35,000

582,820

1,071,820

Interim President and Chief Executive

Officer

Brian Dickman

(3)

302,713

147,850

385,380

835,943

Executive Vice President and

Chief Financial Officer

(1) Represents the aggregate grant date fair value of restricted stock units granted computed in accordance with FASB ASC 718. Aggregate compensation

expense is equal to the grant date fair value based on the closing stock price on the date of grant.

(2) Mr. Russell also serves in various capacities for affiliates of Gerald J, Ford, our principal stockholder. The salary amounts represent reimbursements by the

Company to Mr. Russell’s current employer, Diamond-A Administration Company, at an annual rate of $400,000.

(3) Mr. Dickman’s current annual salary is $305,000.

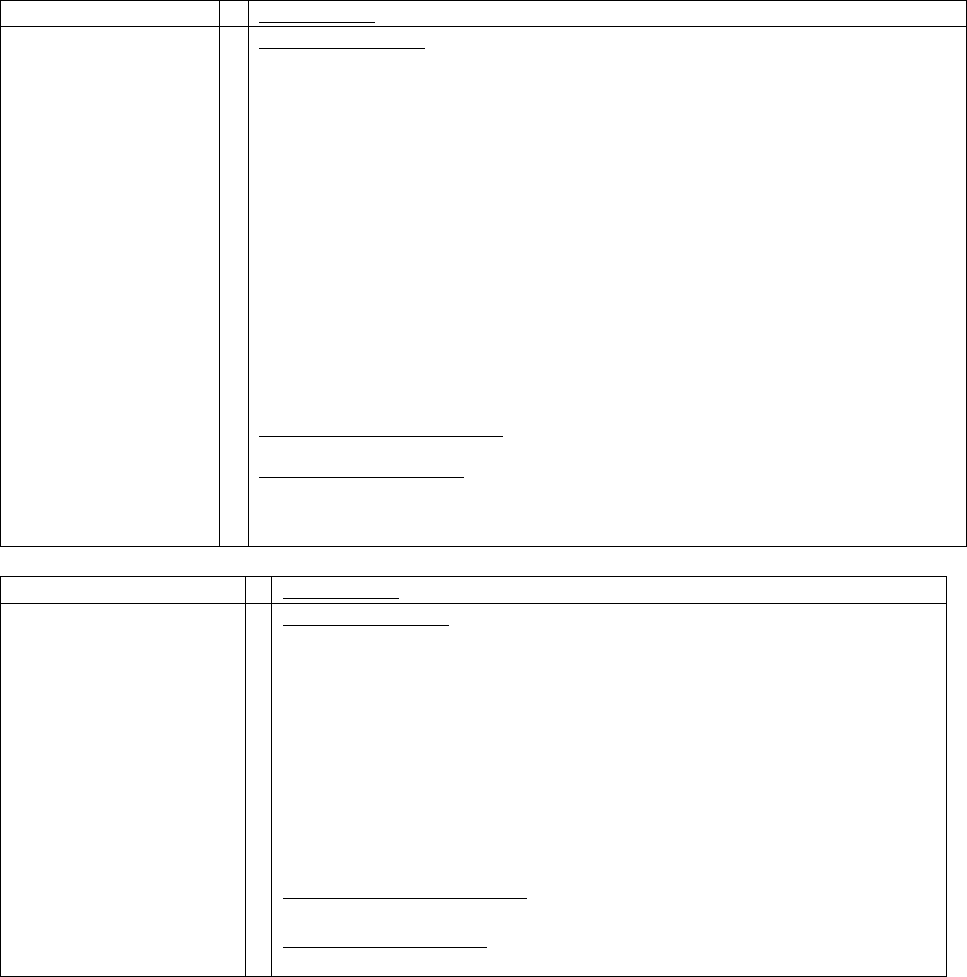

2023 Director Compensation

Each director receives an annual retainer of $20,000, payable in equal, quarterly installments. The Chairman of the Audit

Committee of the Board of Directors receives an additional annual retainer of $5,000, payable in equal, quarterly installments.

Directors also receive a fee of $2,000 for each Board of Directors meeting attended and $1,000 for each Board committee meeting

attended. In addition, directors receive an award pursuant to the Amended and Restated First Acceptance Corporation 2002 Long

Term Incentive Plan of 1,000 shares of common stock on the date of each annual meeting of our stockholders.

The following table summarizes information with respect to the compensation paid to the members of our Board in 2023.

Fees Earned

or Paid in

Stock

Name

Cash ($)

Awards ($) (1)

Total ($)

William A. Shipp, Jr.

41,000

810

41,810

Rhodes R. Bobbitt

37,000

810

37,810

Kenneth D. Russell

36,000

810

36,810

Tom C. Nichols

33,000

810

33,810

Jeremy B. Ford

33,000

810

33,810

Lyndon L. Olson, Jr.

30,000

810

30,810

Donald J. Edwards

30,000

810

30,810

(1) Represents the proportionate amount of the total value of stock awards to directors recognized as an expense during 2023 for financial accounting purposes

under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 718-20, Compensation – Stock Compensation,

disregarding for this purpose estimated forfeitures relating to service-based vesting conditions. Compensation expense is equal to the grant date fair value of

the stock awards using the closing price for the Company’s common stock on the New York Stock Exchange on the date of grant ($0.81).

16

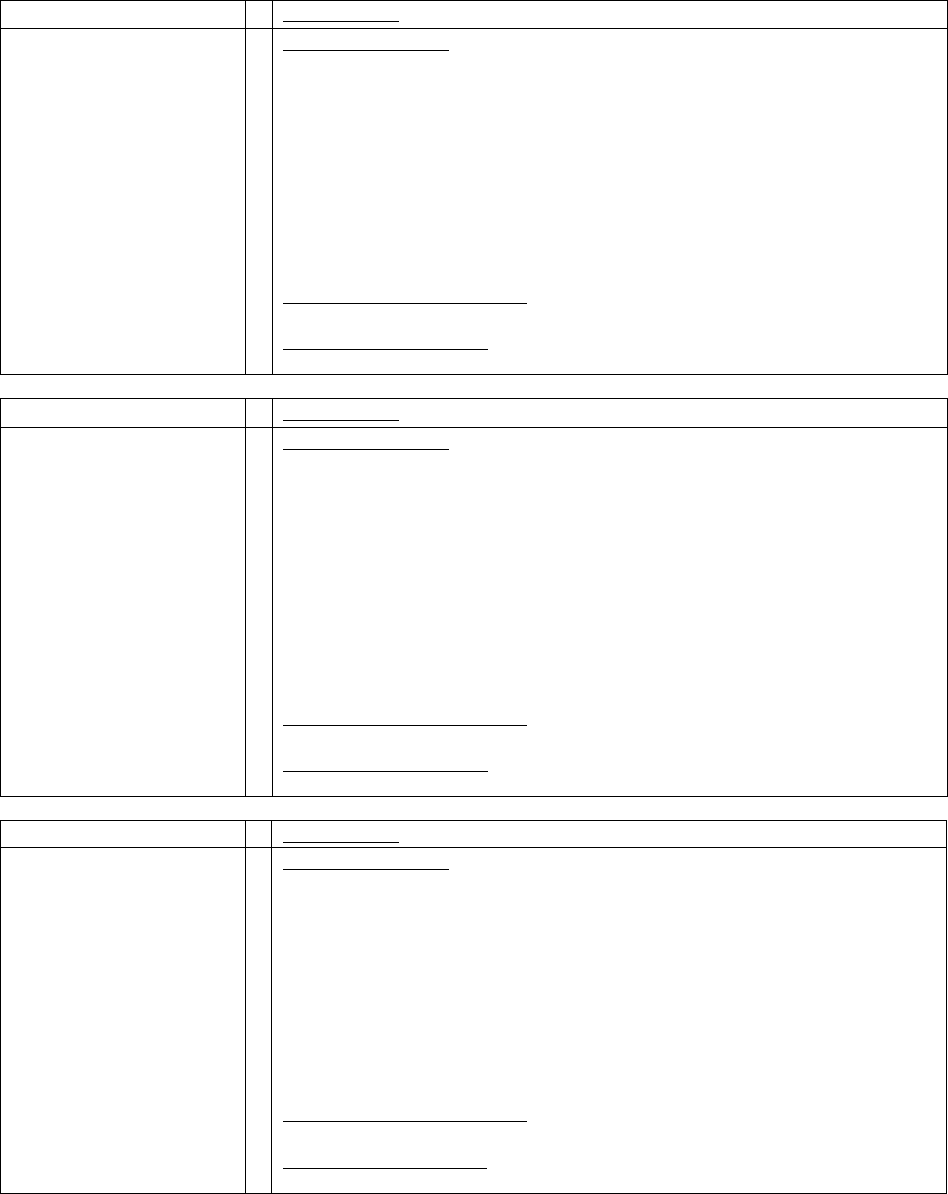

Beneficial Ownership of Directors and Officers

The following table shows the amount of our common stock beneficially owned as of December 31, 2023 by our current

directors and our named executive officers.

Outstanding

Percent of

Name

Shares (1)

Class

Jeremy B. Ford

2,806,552

(2)

7.3%

Kenneth D. Russell

1,082,919

2.8%

Rhodes R. Bobbitt

876,240

2.3%

Donald J. Edwards

537,666

1.4%

Tom C. Nichols

123,000

*

Lyndon L. Olson, Jr.

68,000

*

William A. Shipp, Jr.

44,501

*

Brian Dickman

24,676

*

* Represents less than 1% of our outstanding common stock.

(1) The number of shares shown includes shares that are individually or jointly owned, as well as shares over which the individual has either

sole or shared investment or voting authority.

(2) Excludes shares beneficially owned by Hunter’s Glen (See Beneficial Ownership of Control Persons table.). Mr. Jeremy B. Ford is the

beneficiary of a trust that owns approximately 46% of Hunter’s Glen. Mr. Jeremy B. Ford disclaims beneficial ownership of the shares

owned by Hunter’s Glen, except to the extent of his pecuniary interest therein.

B. Legal/Disciplinary History

In the last five years, none of our officers, directors or control persons have been the subject of any of the following:

1. A conviction in a criminal proceeding or named as a defendant in a pending criminal proceeding (excluding traffic

violations and other minor offenses);

2. The entry of an order, judgment, or decree, not subsequently reversed, suspended, or vacated, by a court of competent

jurisdiction that permanently or temporarily enjoined, barred, suspended or otherwise limited such person’s involvement

in any type of business, securities, commodities, or banking activities;

3. A finding or judgment by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission,

the Commodity Futures Trading Commission, or a state securities regulator of a violation of federal or state securities or

commodities law, which finding, or judgment has not been reversed, suspended, or vacated; or

4. The entry of an order by a self-regulatory organization that permanently or temporarily barred, suspended, or otherwise

limited such person’s involvement in any type of business or security activities.

C. Disclosure of Family Relationships

Jeremy B. Ford, Chairman of the Board, is the son of Gerald J. Ford, the Company’s former Chairman of the Board of Directors

who controls approximately 57% of our outstanding common stock.

D. Disclosure of Related Party Transactions

The Company also operates under standard agreements for Treasury and Custodial Services with a bank indirectly owned 24%

by Gerald J. Ford. The fees under these agreements for the year ended December 31, 2023 were $141 thousand.

E. Disclosure of Conflicts of Interest

There are no conflicts of interest with regards to our executive officers and directors.

17

Item 12. Financial Information for the Issuer’s Most Recent Fiscal Period

Our audited consolidated financial statements for the year ended December 31, 2023, were filed separately through the OTC

Disclosure and News Service, are available at www.otcmarkets.com and incorporated herein by reference.

Item 13. Similar Financial Information for Such Part of the Two Preceding Fiscal Years as the Issuer or its Predecessor Has

Been in Existence

Our audited consolidated financial statements for the year ended December 31, 2023, are incorporated herein by reference

and available through the OTC Disclosure and News Service, or at www.otcmarkets.com. Prior to April 9, 2018, the

Company traded on the New York Stock Exchange. The Annual Report on Form 10-K for the year ended December 31, 2017

was previously filed by the Company with the Securities and Exchange Commission and is incorporated herein by reference.

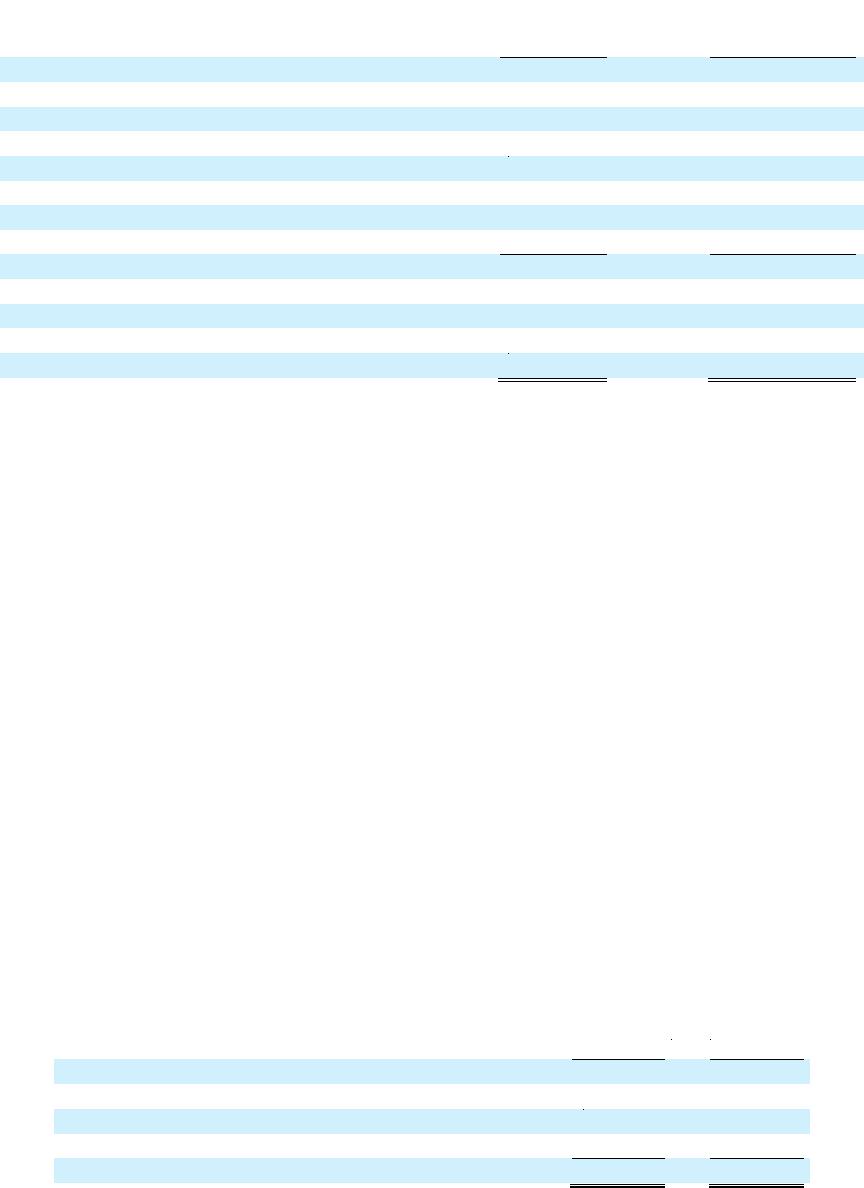

Item 14. Beneficial Owners

Beneficial Ownership of Control Persons

Amount and

Nature of

Beneficial

Percent of

Name and Address of Beneficial Owner

Ownership

Class (1)

Gerald J. Ford (2)

6565 Hillcrest Avenue, Suite 600

Dallas, Texas 75205

21,851,599

57.1%

Jeremy B. Ford

3813 Green Hills Village Drive

Nashville, Tennessee 37215

2,806,552

7.3%

(1) Based on 38,264,718 shares of common stock outstanding on December 31, 2023.

(2) Includes 19,019,653 shares owned through Hunter's Glen/Ford Ltd. ("Hunter's Glen") and 2,268,218 shares owned through Turtle Creek

Revocable Trust ("Turtle Creek Trust"). Because Mr. Ford is one of two general partners of Hunter's Glen and the sole stockholder of Ford

Diamond Corporation, a Texas corporation and the other general partner of Hunter's Glen, Mr. Ford is considered the beneficial owner of

the shares that Hunter's Glen owns. Since Mr. Ford is trustee of Turtle Creek Trust, Mr. Ford is considered the beneficial owner of the

shares that Turtle Creek Trust owns.

We are not aware of any additional beneficial stockholders owning 5% or more of our Common Stock. It is possible that there are one

or more additional beneficial holders of a significant percentage of our Common Stock, however the federal securities laws do not

require a beneficial stockholder of 5% or more of our Common Stock to disclose that information publicly or to the Company. The

table above is based on the best information available to the Company.

18

Item 15. The Name, Address, Telephone Number, and Email Address of Each of the Following Outside Providers that Advise

the Issuer on Matters Relating to Operations, Business Development and Disclosure

Our securities counsel is:

Corey G. Prestidge

Hilltop Holdings Inc.

6565 Hillcrest Avenue

Dallas, TX 75205

(214) 855-2177

Our auditor is:

Crowe LLP

720 Cool Springs Boulevard

Suite 600

Franklin, TN 37067

(615) 360-5500

Preparation of our consolidated financial statements is the responsibility of the Company. Crowe LLP is responsible for

conducting an audit of the consolidated financial statements in accordance with auditing standards generally accepted in the

United States of America, with the objective of expressing an opinion as to whether the presentation of the consolidated

financial statements conforms with accounting principles generally accepted in the United States of America (GAAP). Crowe

LLP has confirmed to us that the firm is licensed to practice public accounting in the states in which we conduct our business.

Crowe LLP is registered with the PCAOB.

Item 16. Management’s Discussion and Analysis or Plan of Operation

A. Plan of Operation

This item is not applicable as we have had revenue in each of the last two fiscal years.

B. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our Management’s Discussion and Analysis of Financial Condition and Results of Operation for each of the last two fiscal

years are incorporated by reference to our Annual Report filed separately through the OTC Disclosure and News Service,

available at www.otcmarkets.com.

C. Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

19

Part E – Issuance History

Item 17. List of Securities Offerings and Shares Issued for Services in the Past Two Years

We have had no securities offerings or shares issued for services during the past two fiscal years, or since December 31, 2023.

Part F – Exhibits

Item 18. Material Contracts

1. Amended and Restated First Acceptance Corporation 2002 Long Term Incentive Plan, was filed as Exhibit 10.1 of the

Company’s Current Report on Form 8-K dated November 23, 2009 and is incorporated herein by reference.

2. Second Amended and Restated First Acceptance Corporation Employee Stock Purchase Plan, was filed in the Company’s

Report on Form 10-K dated December 31, 2017 as Exhibit 10.4 and is incorporated herein by reference.

3. Form of Indemnification Agreement between the Company and each of the Company’s directors and executive officers, was

filed in the Company’s Report on Form 10-K dated December 31, 2012 as Exhibit 10.6 and is incorporated herein by

reference.

4. Junior Subordinated Indenture, dated June 15, 2007, between First Acceptance Corporation and Wilmington Trust Company,

was filed as Exhibit 99.2 in the Company’s June 18, 2007 Report on Form 8-K and is incorporated herein by reference.

5. Guarantee Agreement, dated June 15, 2007, between First Acceptance Corporation and Wilmington Trust Company, was

filed as Exhibit 99.3 in the Company’s June 18, 2007 Report on Form 8-K and is incorporated herein by reference.

6. Amended and Restated Trust Agreement, dated June 15, 2007, among First Acceptance Corporation, Wilmington Trust

Company and the Administrative Trustees Named Therein, was filed as Exhibit 99.4 in the Company’s June 18, 2007 Report

on Form 8-K and is incorporated herein by reference.

7. On December 1, 2023, the Company entered into a Securities Purchase Agreement with Alliant Insurance Services

(“Alliant”) to sell 100% of its issued and outstanding shares of capital stock of its wholly-owned subsidiary, Acceptance

Insurance Agency of Tennessee, Inc., for net cash consideration of up to $120 million which included $55 million paid at

closing and $20 million held in escrow which will be released monthly from March 2024 through December 2024. The

Company is eligible to receive additional contingent consideration of $15 million (held in escrow), $10 million, and $20

million on December 1, 2024, 2025 and 2026, respectively, based upon achievement of certain annual premium production

targets. The agreement provides that the Company would receive its additional contingent consideration in its entirety should

the buyer fail to submit applications within the applicable underwriting guidelines of the Insurance Companies, provided that

the Company has not breached any of its agreements with the buyer. The agreement also provides that any contingent

consideration payments to the Company would be used to maintain $100 million of capital and surplus in the Insurance

Companies. The Company also on this date entered into a Producer Agreement with certain insurance agency affiliates of

Alliant to operate as independent agents of the Company with terms effective through December 31, 2026.

Item 19. Articles of Incorporation and Bylaws

The Articles of Incorporation, as Restated in 2004, were filed as Exhibit 3.1 to the Company’s Report on Form 8-K dated May 3, 2004

and incorporated herein by reference. The Bylaws as Amended and Restated November 7, 2007, were filed as Exhibit 3.2 to the

Company’s Report on Form 8-K dated November 7, 2007 and are incorporated herein by reference.

Item 20. Purchases of Equity Securities by the Issuer and Affiliated Purchasers

In 2023, the Company repurchased 55,594 shares from employees to cover payroll withholding taxes in connection with the vesting of

restricted stock units.

20

Item 21. Issuer’s Certifications

I, Kenneth D. Russell, Chief Executive Officer, certify that:

1. I have reviewed this annual disclosure statement of First Acceptance Corporation;

2. Based on my knowledge, this disclosure statement does not contain any untrue statement of a material fact or omit to state a

material fact necessary to make the statements made, in light of the circumstances under which such statements were made,

not misleading with respect to the period covered by this disclosure statement; and

3. Based on my knowledge, the financial statements, and other financial information includes or incorporated by reference in

this disclosure statement, fairly present in all material respects the financial condition, results of operations and cash flows of

the issuer as of, and for, the periods presented in this disclosure statement.

Date: March 5, 2024

/s/ Kenneth D. Russell

Kenneth D. Russell

Chief Executive Officer

I, Brian Dickman, Executive Vice President and Chief Financial Officer, certify that:

1. I have reviewed this annual disclosure statement of First Acceptance Corporation;

2. Based on my knowledge, this disclosure statement does not contain any untrue statement of a material fact or omit to state a

material fact necessary to make the statements made, in light of the circumstances under which such statements were made,

not misleading with respect to the period covered by this disclosure statement; and

3. Based on my knowledge, the financial statements, and other financial information includes or incorporated by reference in

this disclosure statement, fairly present in all material respects the financial condition, results of operations and cash flows of

the issuer as of, and for, the periods presented in this disclosure statement.

Date: March 5, 2024

/s/ Brian Dickman

Brian Dickman

Executive Vice President and Chief Financial Officer

[

This page intentionally left blank]

FIRST ACCEPTANCE CORPORATION

2023 ANNUAL REPORT

FIRST ACCEPTANCE CORPORATION

TABLE OF CONTENTS

Our Marketplace ........................................................................................................................................................................................ 3

Stock Market Information .......................................................................................................................................................................... 3

Selected Financial Data .............................................................................................................................................................................. 4

Consolidated Financial Statements:

Consolidated Balance Sheets ................................................................................................................................................................ 5

Consolidated Statements of Operations ................................................................................................................................................ 6

Consolidated Statements of Stockholders’ Equity ................................................................................................................................ 7

Consolidated Statements of Cash Flows ............................................................................................................................................... 8

Notes to Consolidated Financial Statements ........................................................................................................................................ 9

Report of Independent Auditors ............................................................................................................................................................... 30

Management’s Discussion and Analysis of Financial Condition and Results of Operations ................................................................... 33

Risk Factors ............................................................................................................................................................................................. 45

3

Our Marketplace