1

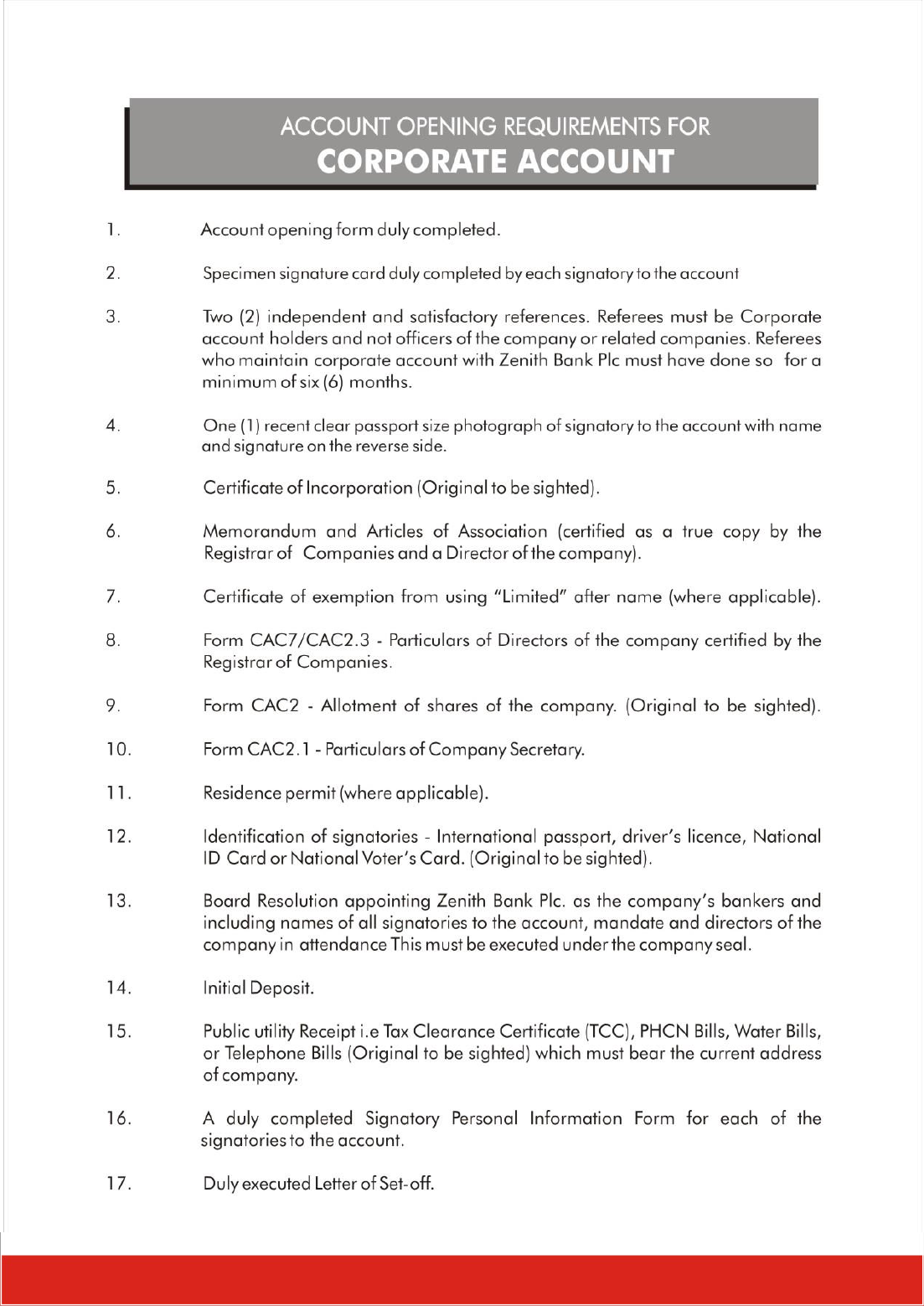

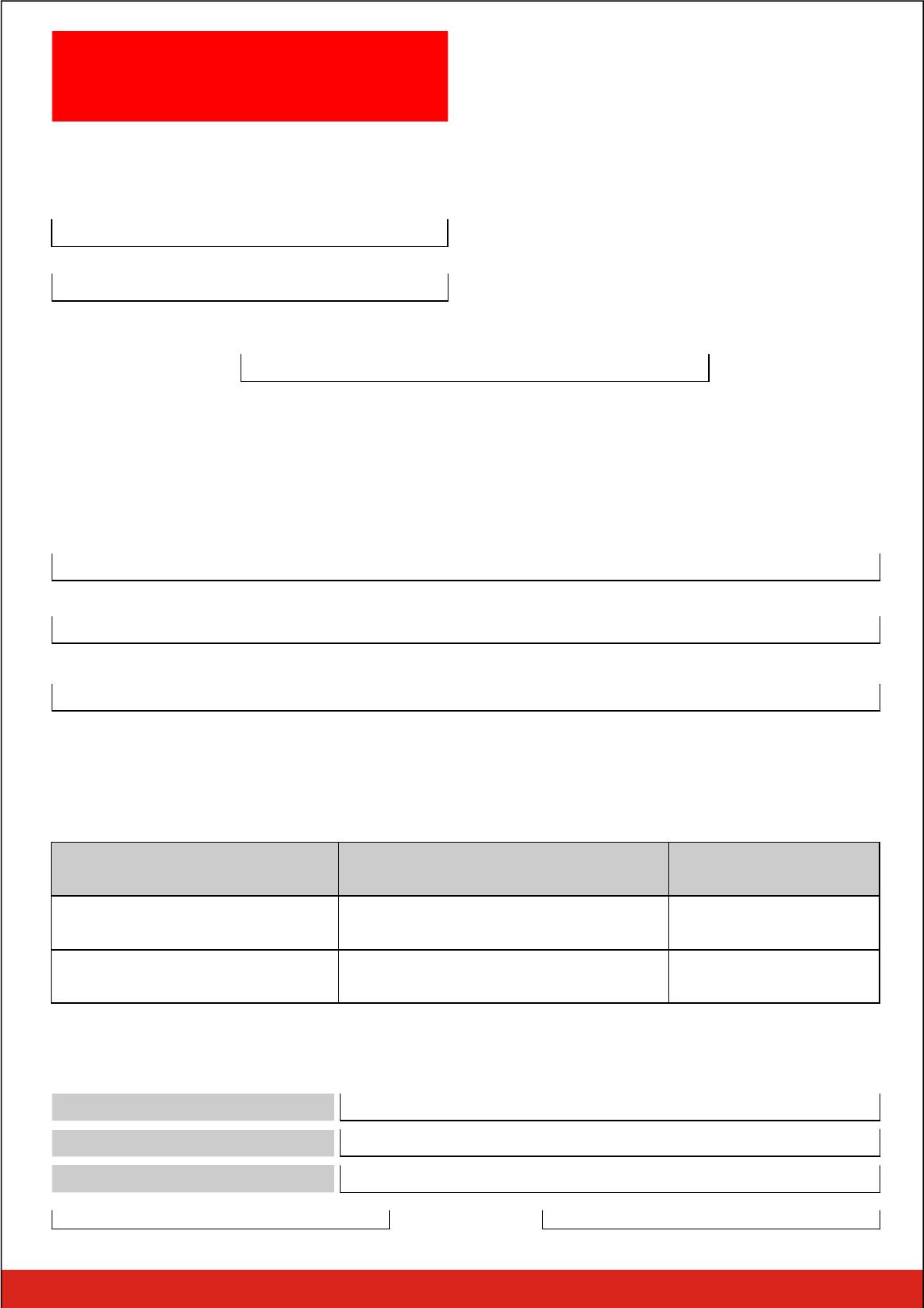

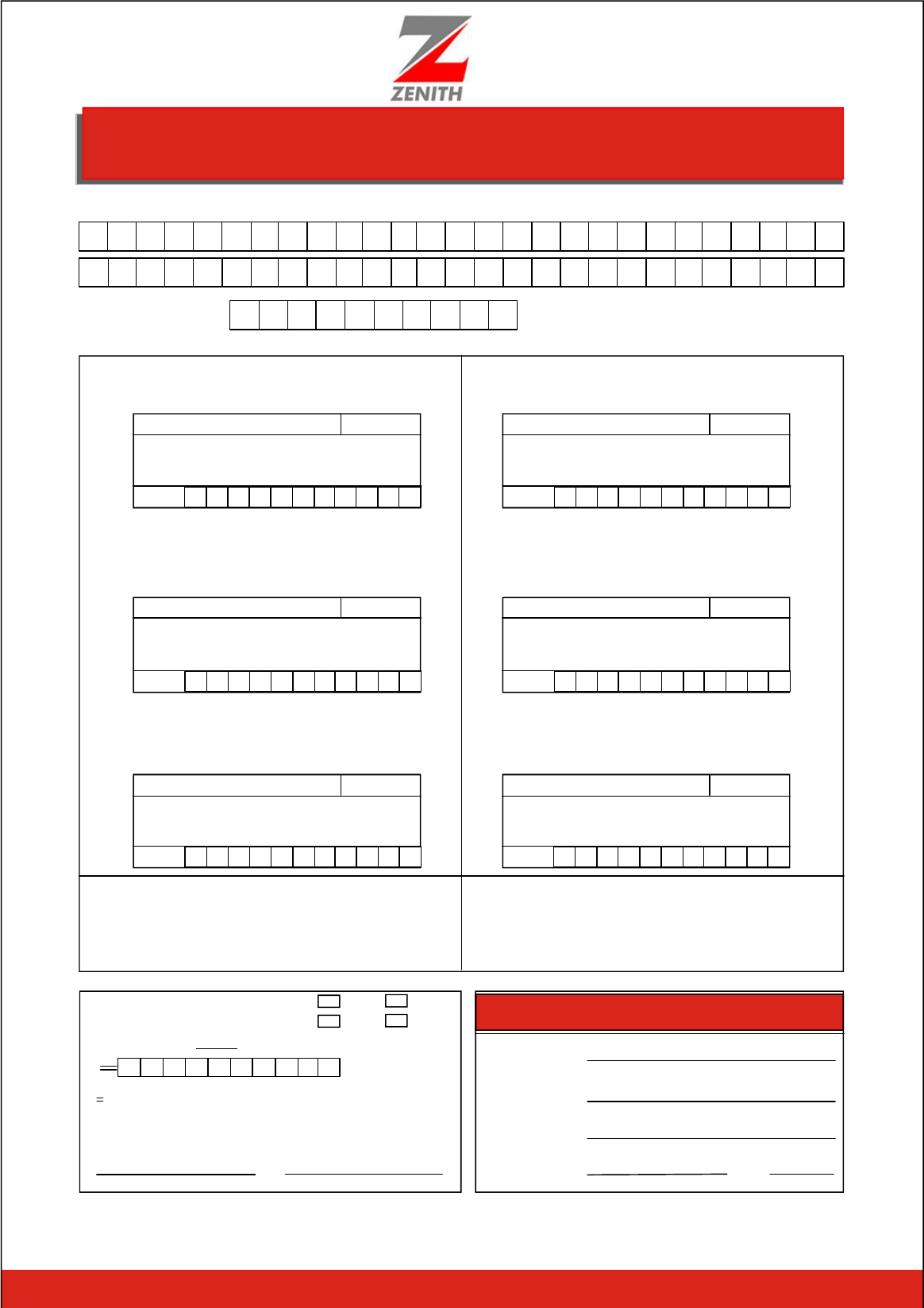

ACCOUNT OPENING FORM — CORPORATE

BRANCH

ACCOUNT No. (for official use only

)

1. COMPANY DETAILS (Please complete in BLOCK LETTERS and tick where necessary).

Company / Business Name

Certificate of Incorporation

/Registration

Number

D D M

M

Y Y Y Y

Sector / Industry

This form should be completed in CAPITAL LETTERS. Characters and marks should be similar in style to the following:

) (

B C A

(Please indicate the business category and type of account to open by ticking the applicable box below)

Category of Business:

2. ANNUAL TURNOVER

Phone Number (1)

Phone Number (2)

CRM No/ Borrower’s

Code

(where applicable)

Email Address

Registered Business

Address

(if different from above)

(a) Below N5M

3. ACCOUNT SERVICE(S) REQUIRED (Please tick applicable option below)

E-mail Alert

(Free)

Transaction Alert Preference(s)

: :

Debit Card Preference(s)

(Fees apply)

:

Others

(Please specify)

Master Card

Electronic Banking Preference(s)

:

EazyMoney

(Mobile Money)

SMS Alert (

Fees apply

)

Visa Card

Corporate - i - bank

(internet

banking)

Statement Delivery

Preference(s)

:

E-mail Post

Collection at branch:

Statement

Frequency

:

Monthly

Quarterly

Bi-Annual Annual

Cheque Book Requisition

:

(Fees apply)

50

leaves

100 leaves

Account Type:

Current Account

Fixed Deposit Account

€ £ $

Domiciliary Account

Jurisdiction of Incorporation /

Registration

Type / Nature of Business

Operating Business

Address 1.

Website (if any)

Tax Identification

Number (TIN)

Special Control Unit against Money Laundering

(SCUML) Registration Number (where applicable)

N500M - Below N5B

Above N5B

(b) Is Your Company Quoted on any Stock Exchange?

Yes

No

(c) If answer to question (b) is Yes, indicate the Stock Exchange and the Stock Symbol………………………………………………………………………...……………..

Purpose of Account

Date of Incorporation /

Registration

Operating Business

Address 2.

Trade Alert

4. CHEQUE CONFIRMATION / THRESHOLD

Please specify minimum amount to be confirmed:

Would you like to pre-confirm your cheques?

Yes

No

If Yes, please note that the minimum cheque confirmation amount allowed by the bank is N500,000.00 in writing and before cheque presentation.

N

:

0

0

Partnership

Limited Liability Company

Sole Proprietorship

MDA’s

Schools

Others

Please specify e.g Clubs, Societies, NGOs,

Trustees, etc.

N5M- below N20M

N50M - below N500M

N20M - below N50M

1

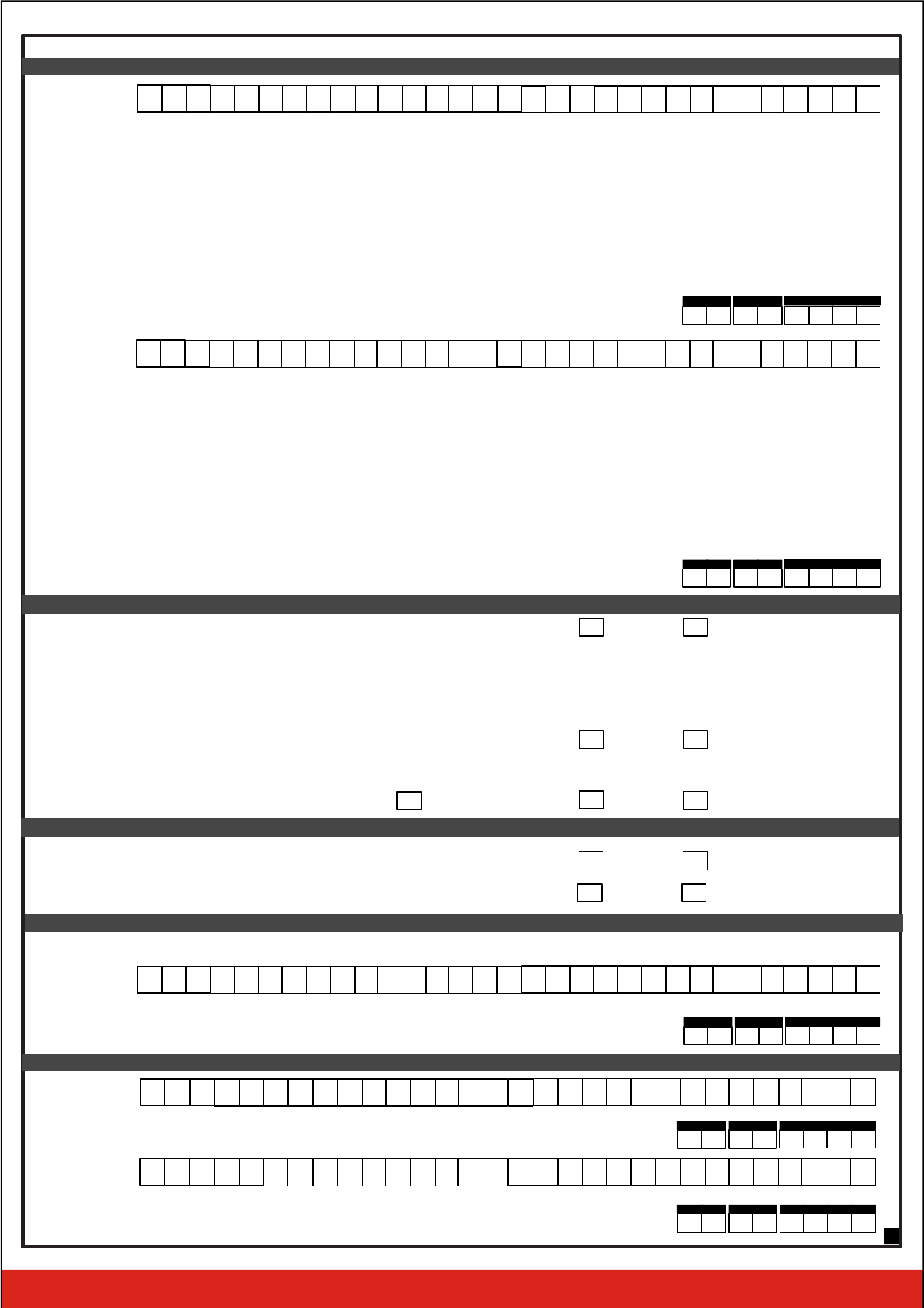

5. BOARD RESOLUTION

FEDERAL REPUBLIC OF NIGERIA

S/N POSITION

1.

2.

3.

4.

NAME

5.

6.

COMPANIES AND ALLIED MATTERS ACT, 2004

(A) LIST OF DIRECTORS PRESENT

IN ATTENDANCE

I __________________________________________________________________________________________ (COMPANY SECRETARY)

BOARD RESOLUTIONS

At the meeting of the Board of Directors of ____________________________________________________________ held on the ___ day of

_______________ 20___ at the Company’s Head Office, the following resolutions were proposed and duly passed:

1

.

2 That the Secretary and a Director of the Company be, and is hereby authorized to certify to the bank names of the present officers of the Company

and other persons authorized to sign for it and the offices respectively held by them, together with the specimen of their signatures and in case of any

change of any holder of any such office or holders of any such offices, the fact(s) of such change and the names of any new officer(s) and the offices

respectively held by them, together with the specimen of their signature(s), and the Bank be and is hereby authorized to honour any instrument signed

by any new officer or officers in respect of whom it has received any such certificate or certificates with the same force and effect as if the said officer

or officers were named in the foregoing resolution in the place of any person(s) with the same title or titles.

3

4.

5. That the Company should open and operate a Current Account with Zenith Bank Plc.

6. That the signatories to the account shall be:

S/N NAME SPECIMEN SIGNATURE

1.

2.

3.

4.

5.

CATEGORY

(B) SIGNATORIES TO THE ACCOUNT

The Mandate of the Company shall be:

We CERTIFY that the Memorandum and Articles of Association of the Company given by us to the Bank are current and up to date.

We FURTHER UNDERTAKE that amendments to the Memorandum and Articles of Association shall be advised to the Bank within fourteen (14) days of such.

We shall indemnify the Bank against any loss, expenses and/or damages it may sustain through our failure to notify or delay in notifying the Bank of any altera-

tion, amendment or addition to the Memorandum and Articles of Association.

We FURTHER CERTIFY that there is no provision in the Memorandum and Articles of Association of the Company limiting the power of the Board of Directors

to pass the foregoing resolutions and that the same are in conformity with the provision of the said Memorandum and Articles of Association.

We CERTIFY that the above is a true and correct extract of the Minutes of the Board Meeting.

Dated at ___________________________________________________ this ________________ day of _________________ 20 ______________________

___________________________________________ _____________________________________

Director Director/Secretary

(COMPANY SEAL)

2

That in addition to any general lien or similar right to which you as a Bank may be entitled by law, you may at anytime without notice to us combine and

or consolidate all or any of the Company’s accounts

,

affiliate, subsidiary or sister company’s accounts (whether or not in the same name) with the

liabilities to you and set off or transfer any sum standing to the credit of any one or more of such accounts or any other credits be it cash, cheques,

valuables, deposits, securities, negotiable instruments or other assets belonging to the Company with you towards satisfaction of any of the Company’s

liabilities to you or any other account or in any other respect, whether such liabilities be actual or contingent, primary or collateral, several or joint.

That any and all withdrawals and borrowing of money and/or other transactions entered into on behalf of the Company with the Bank are hereby ap-

proved, and that the Bank may rely upon the authority conferred by this entire resolution until the receipt by it of a copy of a resolution of this Board

revoking or modifying the same.

That the Bank be promptly notified in writing by the Secretary or any other appropriate officer of the Company of any change in their resolution(s), such

notice to be given to each office of the Bank in which any account of the Company may be maintained, and that until it has actually received such no-

tice and sufficient time shall have elapsed thereafter to permit the Bank in due course and by such means as it may deem appropriate to notify such of

its offices, branches and correspondents as the Bank may deem to be concerned thereby, it is authorized to act in pursuance of these resolutions, and

the Bank shall be indemnified and held harmless from any loss suffered or liability incurred by it in continuing to act pursuant to these resolutions, even

though the resolutions may have been changed; provided that any such change shall not adversely affect the general intendment of this resolution.

Date

To: ZENITH BANK PLC

LETTER OF SET-OFF

In consideration of your providing us financial and/or banking accommoda-

tion and other facilities, we agree that in addition to any general lien or

similar right which you as a bank be entitled by law, you may at any time

and without notice to us combine or consolidate all or any of our accounts,

affiliate, subsidiary or sister company’s accounts (whether or not in the same name)

with the liabilities to you and set-off or transfer any sums standing to the

credit of any one or more of such accounts in or towards satisfaction of any

of our liabilities to you on any account or in any other respect whether such

liabilities be actual or contingent, primary or collateral and several or joint

Dated this day of 20

The common seal of the company is hereunto affixed in the presence of:

Director Director/Secretary

(Company Seal)

3

6. ACCOUNT SIGNATORY’S DETAILS

Date

D D M M Y Y Y Y

Signature

PHOTO

Nationality (for non-Nigerians)

Means of Identification

(Driver’s Licence, International Passport, National ID

or Voter’s Card)

Nearest Bus Stop/ Landmark

ID Number

ID Issue Date

D D M M

Y Y Y Y

ID Expiry Date

D D M M

Y Y Y Y

Bank Verification/Biometric ID

number:

Other Names

Date of

D D M M Y Y Y Y

F

M

Surname

:

First Name

Mother’s maiden name

Gender:

Title:

(Mr., Mrs., Dr,. Chief etc)

Birth

Occupation

Status / Job Title :

Residential Address:

Street Name

House Number

City/ Town

L.G.A

State

Phone Number (1)

Phone Number (2)

E-mail Address

Date

D D M M Y Y Y Y

Signature

PHOTO

Nationality (for non-Nigerians)

Means of Identification

(Driver’s Licence, International Passport, National ID

or Voter’s Card)

Nearest Bus Stop/ Landmark

ID Number

ID Issue Date

D D M M

Y Y Y Y

ID Expiry Date

D D M M

Y Y Y Y

Bank Verification/Biometric ID

number:

Other Names

Date of

D D M M Y Y Y Y

F

M

Surname

:

First Name

Mother’s maiden name

Gender:

Title:

(Mr., Mrs., Dr,. Chief etc)

Birth

Occupation

Status / Job Title :

Residential Address:

Street Name

House Number

City/ Town

L.G.A

State

Phone Number (1)

Phone Number (2)

E-mail Address

4

“CAUTION”

IT IS DANGEROUS TO INTRODUCE A PERSON

WHO IS NOT WELL-KNOWN TO YOU

The Manager,

ZENITH BANK PLC

PROSPECTIVE ACCOUNT NAME

We understand that the above-named Company has applied to open a Current Account with you.

We have known the above named Company for ………………(period) and we comment on their

means and reputation as follows:

Dear Sir,

We also confirm that the applicant is an entity to whom the usual banking facilities may be ex-

tended.

We maintain current account(s) with:

NAME OF BANK/BRANCH

BANKER’S ADDRESS

ACCOUNT NUMBER

1

.

2

.

The above information is provided in confidence.

Yours faithfully,

REFEREE’S ACCOUNT NAME

REFEREE’S ADDRESS

REFEREE’S PHONE NUMBER

Authorised Signatory Authorised Signatory

……………..…..20.….....

“CAUTION”

IT IS DANGEROUS TO INTRODUCE A PERSON

WHO IS NOT WELL-KNOWN TO YOU

The Manager,

ZENITH BANK PLC

PROSPECTIVE ACCOUNT NAME

We understand that the above-named Company has applied to open a Current Account with you.

We have known the above named Company for ………………(period and we comment on their

means and reputation as follows:

Dear Sir,

We also confirm that the applicant is an entity to whom the usual banking facilities may be ex-

tended.

We maintain current account(s) with:

NAME OF BANK/BRANCH

BANKER’S ADDRESS

ACCOUNT NUMBER

1.

2.

The above information is provided in confidence.

Yours faithfully,

REFEREE’S ACCOUNT NAME

REFEREE’S ADDRESS

REFEREE’S PHONE NUMBER

Authorised Signatory Authorised Signatory

……………..…..20.….....

Date

D D M M Y Y Y Y

Signature

Nearest Bus Stop/ Landmark

Occupation

Status / Job Title :

Residential Address:

Street Name

House Number

City/ Town

L.G.A

State

Phone Number (1)

Phone Number (2)

E-mail Address

7A. DETAILS OF THE DIRECTORS/EXECUTIVES/TRUSTEES/PROMOTERS/EXECUTORS/ADMINISTRATORS/PRINCIPAL OFFICERS

Date

D D M M Y Y Y Y

Signature

Nearest Bus Stop/ Landmark

Occupation

Status / Job Title :

Residential Address:

Street Name

House Number

City/ Town

L.G.A

State

Phone Number (1)

Phone Number (2)

E-mail Address

Nationality (for non-Nigerians)

Means of Identification

(Driver’s Licence, International Passport, National ID

or Voter’s Card)

ID Number

ID Issue Date

D D M M Y Y Y Y

ID Expiry Date

D D M M

Y Y Y Y

Bank Verification/Biometric ID

number:

Other Names

Date of

D D M M Y Y Y Y

F

M

Surname

:

First Name

Mother’s maiden name

Gender:

Title:

(Mr., Mrs., Dr,. Chief etc)

Birth

Other Names

Date of

D D M M Y Y Y Y

F

M

Surname

:

First Name

Mother’s maiden name

Gender:

Title:

(Mr., Mrs., Dr,. Chief etc)

Birth

Nationality (for non-Nigerians)

Means of Identification

(Driver’s Licence, International Passport, National ID

or Voter’s Card)

ID Number

ID Issue Date

D D M M Y Y Y Y

ID Expiry Date

D D M M

Y Y Y Y

Bank Verification/Biometric ID

number:

5

II. CONTACT DETAILS

I. PERSONAL INFORMATION

7B. DETAILS OF A SOLE PROPRIETOR

8. ADDITIONAL DETAILS

Name of

Parent/Affiliated

Company

Country of

Incorporation

of Parent/

Affiliated

Company

III. MEANS OF IDENTIFICATION

IV. DETAILS OF NEXT OF KIN

Residence Permit

Number

Nationality

(for non-Nigerians)

D D M M Y Y Y Y

Surname

F

M

Gender:

Title

(Mr, Mrs, Dr,.Chief, etc)

First Name

Other Names

Mother’s maiden

name

Date of Birth

Marital

Status:

Place of Birth

Others

Single

Married

D D M M

Y Y Y Y

Permit Issue

Date

D D M M Y Y Y Y

Permit

Expiry Date

Local Govt.

Area

State

of Origin

Tax ID. No.

(TIN)

Religion

(optional)

Purpose of

Account

Nearest Bus

Residential Address:

Street Name

House Number

State

City/ Town

L.G.A

Stop/Landmark

E-mail Address

Phone Number 1

Phone

Number 2

* People in peculiar circumstances: Artisans, Petty Traders,

Students who may not have prescribed IDs

ID Number

ID Issue Date

D D M M

Y Y Y Y

ID Expiry Date

D D M M

Y Y Y Y

Bank Verification

Number (BVN)

*Others

National ID Card

National Driver’s License

International Passport

INEC Voter’s Card

(Please specify)

Contact Details

Surname

:

Title

(Mr, Mrs, Dr,.Chief, etc)

First Name

Other

Names

D D M M

Y Y Y Y

F

M

Gender:

Relationship

Date of

Birth

Nearest Bus

State

Street Name

House Number

Stop/Landmark

Phone Number1

Phone

Number 2

E-mail Address

L.G.A

City/Town

6

S/N NAME AND ADDRESS OF

BANK/BRANCH

ACCOUNT NAME ACCOUNT NUMBER STATUS:

ACTIVE/DORMANT

1.

2.

3.

4.

5.

9. DETAILS OF ACCOUNTS HELD WITH OTHER BANKS BY THE PROSPECTIVE COMPANY/PARTNERSHIP/SOLE PROPRIETOR

7

We hereby authorize the Bank to debit our account with the applicable charges for the legal search conducted on our account at the Corporate Affairs Commission or

the relevant agency/ authority.

Authorized Signature of the Customer/ Representative & Date Authorized Signature of the Customer/ Representative & Date

10. AUTHORITY TO DEBIT FOR SEARCH FEE

11. DECLARATION

We hereby apply for the opening of a current with ZENITH BANK PLC. We understand that the information provided here in is the basis for opening the account and

hereby certify that the information is correct.

We further undertake to indemnify the Bank for any loss suffered as a result of any false information or error in the information provided to the Bank. “ In Witness whereof ,

the common seal of..............................................................................................................................................................................................................................................

( Name of Company)

is hereby affixed this………………..…………………………………...................... …………... day of 20..........................................................................................................

Director (Name and Signature) Director/Secretary (Name and Signature)

(Company Seal)

12. TERMS AND CONDITIONS

ZENITH BANK PLC BANKING TERMS AND CONDITIONS

You should read these terms and conditions carefully. You will be bound by them

once you sign an application form and so you should make sure that you read them

before that. You should retain a copy it for future reference.

I/We (“Customer”) hereby confirm and agree to the following terms and conditions

in relation to all banking and other financial transactions between me/us and Zenith

Bank Plc (“the Bank”). I/We further agree that where the services to be provided by

the Bank are not regulated by the terms and conditions contained herein, they shall

be regulated by customary banking practices in Nigeria.

1. ACCOUNT OPENING

1.1 Opening of an account with us is subject to certain restrictions. For example,

you must be at least 18 years of age to open a current account with us and we will

require you to place a minimum deposit with us.

Exceptions may however be created for special accounts for certain categories

below 18 years.

1.2 We reserve the right to decline your account application or accept your money

if you are unable to provide us with any of the information we require or for any

other reason. We are not obliged to inform you of the reason why your application

was declined and we will not enter into any correspondence in these circum-

stances.

2. E-BANKING SERVICES

2.1 Before you can be availed the bank’s E-banking Services, you must have any

one or a combination of the following:

(a) An account with the bank

(b) A pass code, access code, username, password or Token authenticators.

(c) A Personal Identification Number “PIN”

(d) An E-mail address

(e) GSM Number

2.2 We may issue you with Personal Identification Numbers (PINs) or other security

information (for example details that allow you to access your accounts through our

Internet Banking Service). You must not disclose your security information to

anyone else and you must take reasonable steps to keep it secure. For example

you should not choose obvious codes or passwords, write down the information in

a way that is recognisable or let another person overhear or observe its use.

2.3 You understand that your Pass code, Access code/Password/E-mail is used to

give instruction to the bank and accordingly undertake:

(a) That under no circumstance shall the Pass code, Access Code / Password be

disclosed to anybody.

(b) Not to write the Pass code, Access Code / Password in an open place in order

to avoid a third party coming across same.

(c) To instruct and authorize the bank to comply with any instruction given to the

bank through the use of the service.

(d) Once the bank is instructed by means of the customer’s Pass code.

(e) To immediately change your Pass code, Access code if becomes known or you

suspect that it has become known to

someone else.

(f) To exempt the bank from any form of liability whatsoever for complying with any

or all instruction(s) given by means of your Pass code, Access code if by any

means the Pass code, Access code becomes known to a third party.

(g) Where you notify the bank of your intention to change your Pass code, Access

code arising from loss of memory of same or that it has come to the notice of a

third party, the bank shall, with your consent, delete same and thereafter allow you

to enter a new Pass code or Access code PROVIDED that the bank shall not be

responsible for any loss that occurs between the period of such loss of memory of

the Pass code, Access code or knowledge of a third party and the time the report is

lodged with the bank.

(h) Once your Pass code/Access code is given, it shall be sufficient confirmation of

the authenticity of the instruction given.

(i) You shall be responsible for any instruction given by means of your Pass code/

Access code. Accordingly, the bank shall

not be responsible for any fraudulent, duplicate or erroneous instruction given by

means of your Pass code/Access code.

2.4 Customer’s responsibilities

(a) You undertake to be absolutely responsible for safe-guarding your username,

access code, Pass code, PIN and password and under no c i r c u m-

stance shall you disclose any or all of these to any person.

(b) The bank is expressly exempted from any liability arising from unauthorized

access to your account and/or date as contained in the bank’s records via the

service, which arises as a result of your inability and/or otherwise to safeguard

your PIN Pass code/Access code and/or password and/or failure to log

out of the system completely by allowing on screen display to this account

information.

(c) The bank is further relieved of any liability as regards breach of duty of secrecy

arising out of your inability to scrupulously observe and implement the provisions

of clause 2.3 above, and/or instances of breach of such duty by hackers and other

unauthorized access to your account via the service.

2.5 Under no circumstance will the bank be liable for any damages, including

without limitation direct or indirect, special, incidental or consequential damages,

loses or expenses arising in connection with this service or use thereof or inability

to use by any party, or in connection with any failure of performance, error,

omission, interruption, defect, delay on operation, transmission, computer virus or

line or system failure even if the bank or its representatives therefore are advised to

the possibility of such damages, losses or hyperlink to other internet resources are

at your risk.

2.6 Copyright in the cards and other proprietary information relating to the service

including the screens displaying the pages and in the information and material

therein and agreement is owned by the bank.

2.7 The bank shall not be responsible for any electronic virus or viruses that you

may encounter in the course of making use of this service.

2.8 The bank makes no warranty that:

(a) The e-banking service will meet your requirements;

(b) The e-banking service will be uninterrupted, timely, secure, or error free;

(c) The results that may be obtained from the use of the service will be accurate or

reliable;

(d) The quality of any products, services, information or other material purchased

or obtained from the use of the service will be accurate or reliable;

(e) The quality of any products, services, information or other material purchased or

obtained from the service will meet your expectations; and

(f) Any errors in the technology will be corrected

3. LIABILITY FOR REFUNDS

3.1 Generally, if you tell us without undue delay and at least no later than 6 months

after a payment is taken from your account, that a payment from your account was

not authorised by you, we will carry out an investigation and, as soon as we are

reasonably satisfied that you did not authorise the payment, we will refund the

amount deducted and will return your account to the position it would have been in

if the unauthorised payment had not taken place.

3.2 However, you will be liable for:

(a) All payments made from your account where you have acted fraudulently; and

(b) All payments on your account(s) that take place before you inform us that a

payment instrument has been lost or any of your security information

has become known to someone else, if the payment was made because you

deliberately, negligently or very carelessly failed to keep your payment instrument

safe or your secret information secret. After you have informed us you will not have

any further liability for unauthorized payments, unless Condition (a) applies.

3.3 We will not be liable to you for any losses you suffer or costs you incur

because:

(a) We do not act on an instruction for any reason specified in this agreement;

(b) The details contained in the instruction were not correct; or

(c) We cannot carry out our responsibilities under this agreement as a result of

anything that we cannot reasonably control. This may include, among other things,

any machine, electronic device, hardware or software failing to work or being down

for a period, industrial disputes and complete or partial closure of any payment

system.

3.4 Unless Conditions 3.2 or 3.3 apply, or a different level of liability is imposed by

law, we will be liable to you for any loss, injury or damage caused to you as a result

of any failure or delay in carrying out your payment instruction, but we will not be

liable to you in any circumstances for: loss of business, loss of goodwill, loss of

opportunity, loss of profit; or any loss to you that we could not reasonably have

anticipated when you gave us an instruction under this agreement.

3.5 If we receive notice of a court order or a court judgment against you (or, if you

have a joint account, any other account holder), we may refuse to allow withdraw-

als or transfers from your account until the legal process comes to an end. Any

court order or court judgment will not prevent us from using any right of set-off we

may have (using money which we hold for you, or which is due to you, to pay

closure on a shorter notice.

10.5 We may choose not to close your account and to end this agreement until you

have returned any unused cheques. You must repay any money you owe us.

10.6 When your account is closed it is your responsibility to cancel any direct

payments to or from your account. Where someone attempts to make a payment

into an account which has been closed, we will take reasonable steps to return the

payment to the sender.

10.7 All parties to a joint account must request the closure of the account before we

act on any instructions for the disposal of the funds in the account.

10.8 If you no longer require the account and wish to end this agreement, please

tell us by writing to your domicile branch office or any of our branch offices and

return any unused cheques to us.

10.9 Before any funds are returned to you, identification requirements may still

need to be satisfied. Any funds returned will be remitted either to the account from

which they were sent or to an account held in your name or by a manager’s cheque

in your name. No other third party remittances will be permitted.

11. DORMANT ACCOUNTS

11.1 We consider that an account is dormant if no activity (other than interest and

charges) has taken place on it for a continuous period of 6 months. To reopen

same you must submit fresh identification and Know Your Customer (KYC)

documents.

11.2 When an account becomes dormant we may write to you to ascertain if the

account is still required and to obtain written confirmation from you of your mailing

address. If we receive no response from you, for security reasons, we may close

the account and hold the funds in a suspense account pending instructions from

you.

12. HANDLING OF PERSONAL INFORMATION

12.1 We will retain information about you after the closure of your account, if the

banking relationship has terminated, or if your application is declined or abandoned,

for as long as permitted for legal, regulatory, fraud prevention and legitimate

business purposes.

12.2 Where you provide personal and financial information relating to others (e.g.

dependants or joint account holders) for the purpose of opening or administering

your account, you confirm that you have their consent or are otherwise entitled to

provide this information to us and for us to use it in accordance with these terms

and conditions.

12.3 If we are asked to respond to a banker’s reference, we will make sure that we

have your written permission before we give it.

12.4 We may share information with persons acting as our agents who have agreed

to keep your personal information strictly confidential..

13. ADDITIONAL TERMS AND CONDITIONS FOR FIXED TERM DEPOSITS

13.1 In order to open any of the fixed term products that we offer, you will need to

make a minimum deposit, which will be advised to you at the time that you wish to

make the deposit.

13.2 You will not be able to add further funds to your initial deposit once the term

and interest rate have been fixed.

13.3 However further deposits can be used to open additional fixed term deposits.

The rate applicable to the new deposit will be that available on the day that the new

deposit is made.

13.4 We will pay net interest (interest with tax deducted) on the maturity date of

your deposit if your deposit is for a period of one year or less. If your deposit is for a

period greater than one year, interest will be paid annually on the anniversary of

your deposit.

13.5 Before your deposit comes to an end (matures), we need to know what you

want to do when it does mature.

You can:

(a) Give us renewal instructions when you make your initial deposit;

(b) Contact us in writing with your instructions before close of business on the

business day before your deposit is due to mature; or

(c) Set up an automatic rollover so that, until you tell us otherwise, we will renew

your deposit for the same term at the interest rate that applies each time it matures.

13.6 It is your responsibility to advise us in good time of your instructions upon

maturity of the deposit.

13.7 No cheque book or statement will be issued on your fixed term account but

you can contact us at any time if you would like details of your deposit. We will

provide you with a confirmation of the deposit amount, interest rate and maturity

date when you place the deposit.

13.8 There is no cancellation period for fixed term deposit.

13.9 We will only make changes to the terms and conditions applying to a fixed

term deposit if it is necessary or appropriate to do so to meet legal, financial or

regulatory requirements or to set out our duties and responsibilities under them. We

will give you at least 30 days' advance personal notice of a change of this kind,

unless we are required to make the change sooner due to those legal or regulatory

requirements

14. OTHER GENERAL TERMS

14.1 The agreement between you and us is in English and is governed by the laws

of the Federal Republic of Nigeria. The courts of Nigeria may deal with any claim,

dispute or difference arising from this agreement.

14.2 No-one else apart from you will have any rights or be able to enforce these

terms and conditions.

15. CHANGES TO TERMS AND CONDITIONS

15.1 We may, at our discretion, change these terms and conditions (including our

charges and interest rates) and introduce changes to and charges for our services

at any time. How much notice we will give will depend on the kind of change we are

making.

15.2 Some of these conditions are based on expected regulatory requirements that

have not been published or finalized yet. If any of these conditions turn out to be

inconsistent with a regulatory requirement we will treat that condition as if it were

consistent. We will make any changes to the conditions to reflect the requirement

when they are next reprinted.

16. CONTACTS

16.1 We may contact you by post, telephone or e-mail (which in these terms and

conditions includes the internet and any form of electronic message made by any

type of electronic device) using the latest address, telephone number or electronic

mail address you have given us.

16.2 You may telephone us during normal business hours to request information

about your account. We reserve the right not to disclose any information until we

are satisfied that you have been satisfactorily identified.

16.3 We may record or monitor telephone calls and monitor electronic communica-

tions (including emails) between us so that we can check instructions and make

sure that we are meeting out service standards.

16.4 The address that you provide to us or, in the case of a joint account, either of

you gives us, when you open an account will be the one to which all communica-

tions will be sent.

16.5 You are responsible for advising us as soon as possible of any changes to

your name, telephone number, usual residential address (and appropriate updated

address verification) and email address and ensuring that all information held about

you is up to date. You must do this by writing to your account domicile office.

16.6 If you do not inform us promptly of a change to your details, the security of

your information could be put at risk as we will continue to send information to you

at the last known address we have for you.

16.7 If you do not tell us about a change of address and, as a result, post is

returned to us, we may restrict access to your account until we receive satisfactory

proof of your new address.

debts you owe us) or enforcing any other ‘security interest’ (a right over something

which we can take if debts are not paid). You are responsible for an amount which

represents a reasonable assessment of any losses, costs or expenses we have as a

direct result of any dispute or legal action with yourself of someone else involving

your account (including, without limitation, where we require legal advice because we

are or may become concerned or involved in a dispute by reason of our relationship

with you).

3.6 You undertake to ensure that your account is sufficiently funded before you issue

your cheque in favour of a third party and that you shall take all necessary steps to

confirm these cheques through your relationship manager to ensure the instruments

are duly processed.

3.7 You are informed that issuance of Dud Cheques constitutes a criminal offence

under the Nigerian Law and we are obligated by virtue of Central Bank of Nigeria’s

directive contained in circular no. FPR/DIR/CIR/GEN/03/005 to submit details of

customers who issue cheques on insufficiently funded accounts to the CBN for

investigation and prosecution in line with the provisions of the Dishonored Cheques

(offences) Act LFN 2007.

4. CLAIMS

4.1 If another person makes a claim for any of the funds in your account (for example,

if someone takes legal action to recover funds they believe belong to them), or if we

know or believe that there is a dispute involving someone else who owns or controls

funds in the account, we may:

(a) Put a hold on your account and refuse to pay out any funds until we are satisfied

that the dispute has ended

(b) Send the funds to the person who we have good reason to believe is legally

entitled to them;

(c) Continue to rely on the current records we hold about you; apply for a court order;

or take any other action we feel is necessary to protect us.

4.2 If we have acted reasonably, we will not be liable to you for taking any of the

above steps.

5. JOINT ACCOUNTS

5.1 If you are opening an account with another person, we will ask for a specimen

signature from all parties to the account.

5.2 Joint accounts are operated on the basis of the authority set out in a mandate

which we will ask you to complete. Each of you can take or use everything in the joint

account. All of you are together and individually responsible for any money owed to

us on the joint account. We may demand repayment from all of you, any of you, and

any combination of joint account holders for any money owing on the account. In legal

terms this means that each joint account holder will have joint and several liability.

This is generally true even if only one of you puts all the money into the joint account

or if only one of you takes all the money out and spends it.

6. OVERDRAFTS AND OTHER LOANS

6.1 This agreement deals with borrowing through an overdraft. Additional terms and

conditions apply to borrowing by other means such as a loan. The form of borrowing

and any security required will be agreed between you and us.

6.2 We may cancel any standing orders and direct debits from your account if your

account becomes overdrawn.

6.3 When borrowing is agreed, the interest rate and all other fees and charges

payable will be shown in a letter to you that sets out the terms and conditions of the

facility.

6.4 Unless we have agreed other terms with you in writing, overdrafts will always be

repayable on demand.

6.5 You will have to pay all costs and fees incurred or charged by us in connection

with the negotiation, preparation, investigation, administration, supervision or

enforcement of your borrowing. These will include expenses, fees (e.g. legal, security

and valuation fees), stamp duty, taxes and other charges. These costs and fees will

be debited to your account.

6.6 We reserve the right to decline a request from you to borrow.

7. SET-OFF

7.1 If any accounts you hold with us are in credit, we may use them to repay any

amounts you owe us including but not limited to sums due on any other accounts you

hold with us either in the same name(s) or in the case of corporate accounts, its

affiliate, subsidiary or sister company’s accounts (whether or not in the same name),

even if the accounts are in different currencies.

7.2 Where any of you also has an account with us in your sole name, and that

account has a credit balance, we can set-off these monies against any money owing

to us on the joint account even if the accounts are in different currencies.

8.0 BANK CHARGES

8.1 We will levy charges for the operation of the account in accordance with our

Standard Tariff. We reserve the right to levy any reasonable charges for additional

services in relation to managing your account in addition to those stated in the

Standard Tariff or for providing you with more frequent information regarding the

operation of your account.

8.2 We may take any charges or interest you owe us from any account you hold with

us.

8.3 We may vary these charges from time to time in accordance with Condition 14.

9. STATEMENTS

9.1 We will make a statement available each month there are payments on the

account and we will provide a statement on paper or any other durable medium at a

frequency agreed with you. This will be sent to the last known recorded address that

we hold and will contain details of all transactions through the account since the

previous statement issued to you.

9.2 There may be a charge if more frequent statements are requested.

9.3 Even if the account has not been used for some time, we will continue to send out

statements unless previous statements have been returned. Please check carefully

all transactions on the statement(s) and advise us as soon as possible of any

discrepancies without undue delay but in any event no later than 12 months after the

date of any discrepant transaction. If we need to investigate a transaction on your

account, you should co-operate with us and the police, if we need to involve them.

We may disclose information about you or your account to the police or other third

parties if we think it will help us prevent or recover losses.

9.4 Your statement balance will show credits when we receive them even if they

include cheques and other items which are not "cleared" and we may refuse to allow

you to draw against these items.

9.5 If you do not receive a statement on your account that you would normally expect

to receive please let us know as soon as you can.

9.6 If you have a joint account, we will send a statement to each of you (to different

addresses if you wish) unless you ask us not to.

10. ACCOUNT CLOSURE

10.1 This agreement will continue until you or we cancel or end it.

10.2 We reserve the right to close the account and to end this agreement if we, at our

absolute discretion, consider that it has not been operated in a manner satisfactory to

us, or if we believe that you have contravened any of these terms and conditions.

10.3 We may take action to close your account without notice and to end this

agreement immediately in exceptional circumstances such as if we reasonably

believe that:

(a) You are not eligible for an account;

(b) You have given us any false information at any time;

(c) You, or someone else, are using the account illegally or for criminal activity;

(d) It is inappropriate for a person authorized to give instructions on your account to

operate it;

(e) Your behaviour means that it is inappropriate for us to maintain your account;

(f) You have not met our reasonable conditions and requests relating to identification

and the provision of information about yourself and the activity (past, present or

future) on any account or proposed account;

(g) By maintaining your account we might break a law, regulation, code or other duty

which applies to us;

(h) By maintaining your account we may damage our reputation; or

(i) You are or have been in serious or persistent breach of these terms and conditions

or any additional conditions which apply to an account.

10.4 We would normally give you one weeks’ notice to close the account and to end

this agreement unless there are circumstances (such as the above) that justify

8

D

. CUSTOMER INTRODUCED BY:

Name

Date

D D M M Y Y Y Y

Signature ………………………………………………………………………………………………………………..

Date

D D M M Y Y Y Y

Signature:…………………………………………………………………………………………………………………..

Name of Unit/

Branch Head

I hereby confirm the existence of the prospective customer’s Business office/company address at……………………………………………………………………………...

………………………………………………………………………………………………………………………………………………………………………………………………...

………………………………………………………………………………………………………………………………………………………………………………………………...

A. ADDRESS VERIFICATION/VISITATION DETAILS:

Name of RSM

I hereby confirm the existence of the Business office/company address at………………………………………………………………………………………………………….

………………………………………………………………………………………………………………………………………………………………………………………………...

……………………………………………………………………………………………………………………………………………………………………………………………….

………………………………………………………………………………………………………………………………………………………………………………………………..

………………………………………………………………………………………………………………………………………………………………………………………………...

COMMENT (S)

(Address description and Findings)

Date

D D M M

Y Y Y Y

Signature:…………………………………………………………………………………………………………………..

………………………………………………………………………………………………………………………………………………………………………………………………..

………………………………………………………………………………………………………………………………………………………………………………………………...

COMMENT (S)

(Address description and Findings)

ii If the answer to (i) above is

YES

,

state other documents obtained in line with the Bank’s policy on socially/financially disadvantaged customer In

compliance with Regulation 77 (4) of AML/CFT Regulation 2013

…………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………..

Iv If answer to question (iii) above is

YES

, identify the customer risk category:

B. AUTHENTICATION FOR FINANCIAL INCLUSION:

i. Is any director/signatory to the account socially or financially disadvan-

taged?

NO

YES

iii. Does the customer enjoy tiered KYC requirements?

NO

YES

HIGH RISK

MEDIUM RISK

LOW RISK

C. AUTHENTICATION FOR POLITICALLY / FINANCIALLY EXPOSED PERSONS:

i. Is the Applicant a Politically Exposed Person?

NO

YES

I hereby introduce the customer to the bank. I also confirm the financial inclusion and political/financial exposure status as indicated above

ii. Is the Applicant a Financially Exposed Person?

NO

YES

FOR BANK USE ONLY

9

E. DEFERRAL/WAIVER OF DOCUMENT (IF ANY)

Date

D D M M

Y Y Y Y

Signature ………………………………………………………………………………………………………………..

Date

D D M M Y Y Y Y

Signature ………………………………………………………………………………………………………………..

Approved by

Requested by

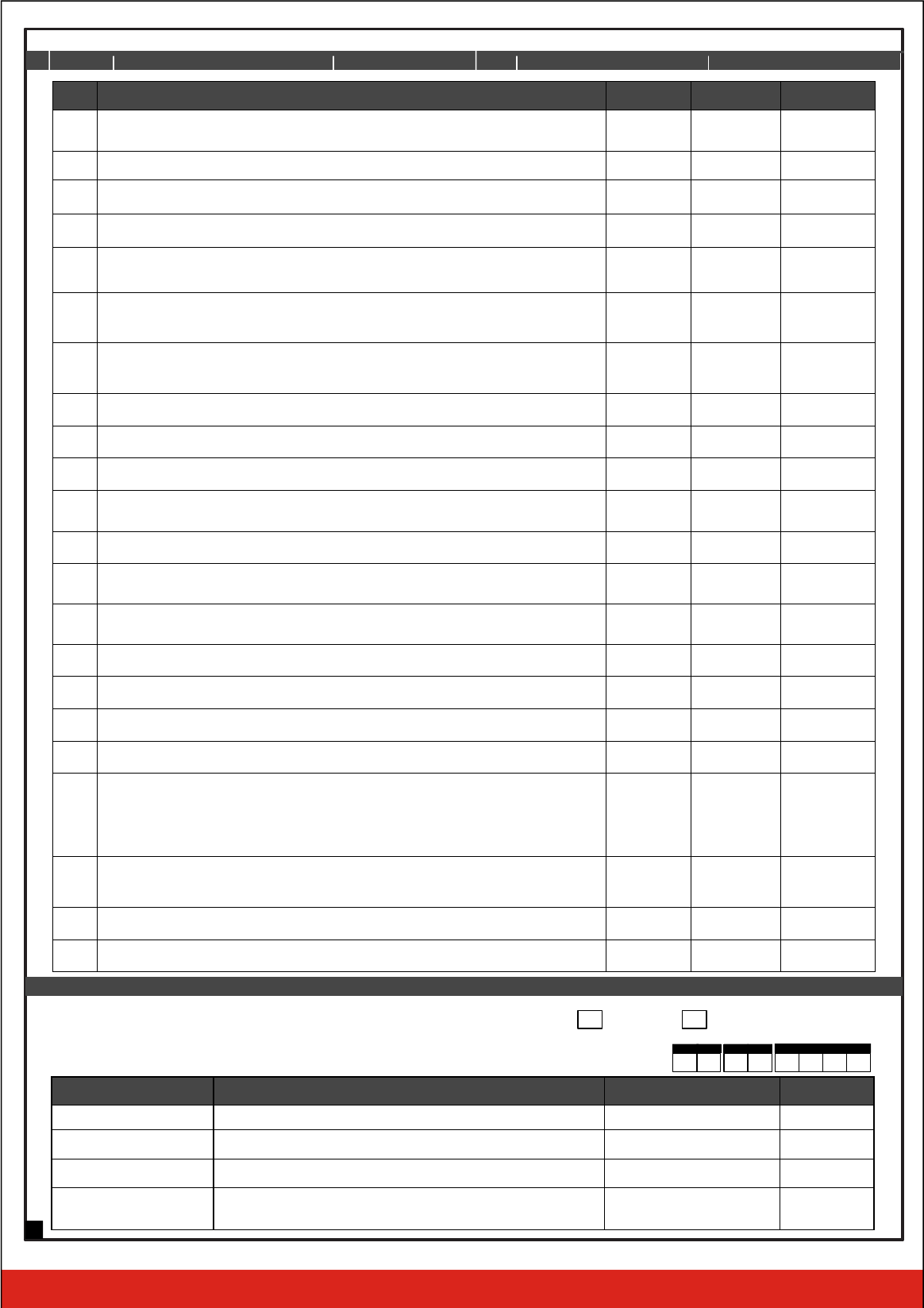

F. REQUIREMENT CHECKLIST

FOR BANK USE ONLY

S/N DOCUMENTS REQUIRED CHECKED DEFERRED WAIVED

1. Account opening form duly completed

2. Specimen signature card duly completed

3. Copy of CAC Certificate of Registration

4. Board Resolution

5. Copy of Memorandum and Article of Association

(Certified as true copy by the Registrar of Companies)

6. Form CO7—Particulars of Directors

(Certified as true copy by the Registrar of Companies and Certification by a Notary public for Foreign

Companies)

7. Form CO2—Allotment of Shares

(Certified as true copy by the Registrar of Companies and Certification by a Notary public for Foreign

Companies)

8. Partnership Deed (Where applicable)

9. Approval Letter (for Government Agency)

10. Act/Gazette (for Government Agency where applicable)

11. Two (2) Passport sized photographs of each signatory to the account with name written

on the reverse side

12. Residence permit (for Non-Nigerians)

13. Evidence of Registration with Nigerian Investment Promotion Council (NIPC)

(where applicable)

14. Evidence of Registration with Special control Unit against Money Laundering (SCUML)

(where applicable)

15. Search Report

16. Power of Attorney (where applicable)

17. Proof of Company address

18. Business Premises Visitation certificate

19. Proof of Identity of all signatories and Directors/Officers whose names appear on the

account opening form/document

(Preferred Identity card are International Passport, National Identity Card, National

Driver’s License and Valid Nigerian INEC Voter’s card)

20. Proof of Address of all signatories and Directors/Officers whose names appear on the

account opening form/document Utility bill

(Certified true copy is acceptable if original is held)

21. Two Completed satisfactory Reference forms

22. Others (Please specify)

Customer Service Officer

Head of Operations

Branch Head

APPROVALS NAME SIGNATURE DATE

Group/Zonal Head

(Where applicable)

G. AUTHENTICATION FOR KYC WATCH-LIST COMPLIANCE

i.

Is the applicant on the KYC Watch-list

?

NO

YES

Date

D D M M Y Y Y Y

Name and Signature CSO :………………………………………………………………………………………………..

10

DATE

REMARK

CSU OFFICER

APPROVAL

RSM

FOR BANK USE

MANDATE

COMPANY STAMP SPECIMEN

(If required for mandate)

1.

4.

2.

5.

6.

3.

NAME OF SIGNATORY:…………………….

………………………………………………….

CATEGORY

SPECIMEN SIGNATURE

NAME OF SIGNATORY:…………………….

………………………………………………….

CATEGORY

SPECIMEN SIGNATURE

NAME OF SIGNATORY:…………………….

………………………………………………….

CATEGORY

SPECIMEN SIGNATURE

NAME OF SIGNATORY:…………………….

………………………………………………….

CATEGORY

SPECIMEN SIGNATURE

NAME OF SIGNATORY:…………………….

………………………………………………….

CATEGORY

SPECIMEN SIGNATURE

NAME OF SIGNATORY:…………………….

………………………………………………….

CATEGORY

SPECIMEN SIGNATURE

· PLEASE TICK AS APPROPRIATE

COMPANY STAMP REQUIRED

If YES, please specify minimum amount to be confirmed

CHEQUE CONFIRMATION REQUIRED ?

YES

NO

YES

NO

Please note that the minimum cheque confirmation amount allowed by the bank is

N500,000.00 in writing and before cheque presentation.

N

:

0

0

NAME OF ACCOUNT

ACCOUNT NUMBER

Mobile

Phone No.:

Mobile

Phone No.:

Mobile

Phone No.:

Mobile

Phone No.:

Mobile

Phone No.:

Mobile

Phone No.:

Mandate specified by Account holder(s)

Signature

Signature

ZENITH BANK PLC

MANDATE FOR CORPORATE ACCOUNT