Merchant Regulations

International

October 2020

Copyright © 2008-2020 American Express. All rights reserved. This document contains published

confidential and proprietary information of American Express. No disclosure or use of any portion may be

made or reproduced in any form or by any electronic or mechanical means, including without limitation

information storage and retrieval systems, without the express prior written consent of American Express

Travel Related Services Company, Inc.

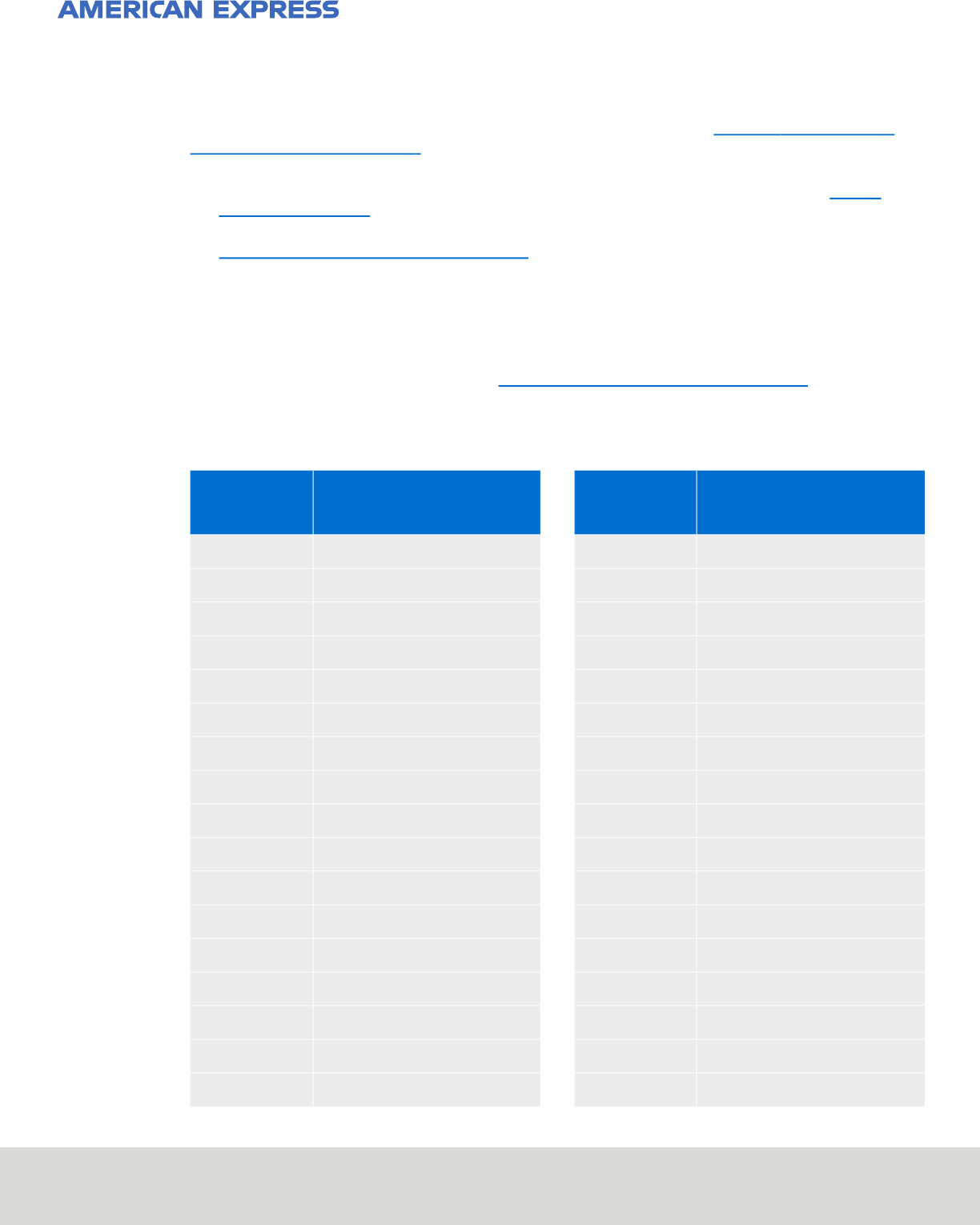

Summary of Changes

Change Icons

Important updates are listed in the Summary of Changes Table and also indicated in the Merchant Regulations with a

change icon. A change icon alongside the title of a section or subsection denotes revised, added, or removed text from

the section or subsection. Changes in the Merchant Regulations are indicated with a change icon as shown here.

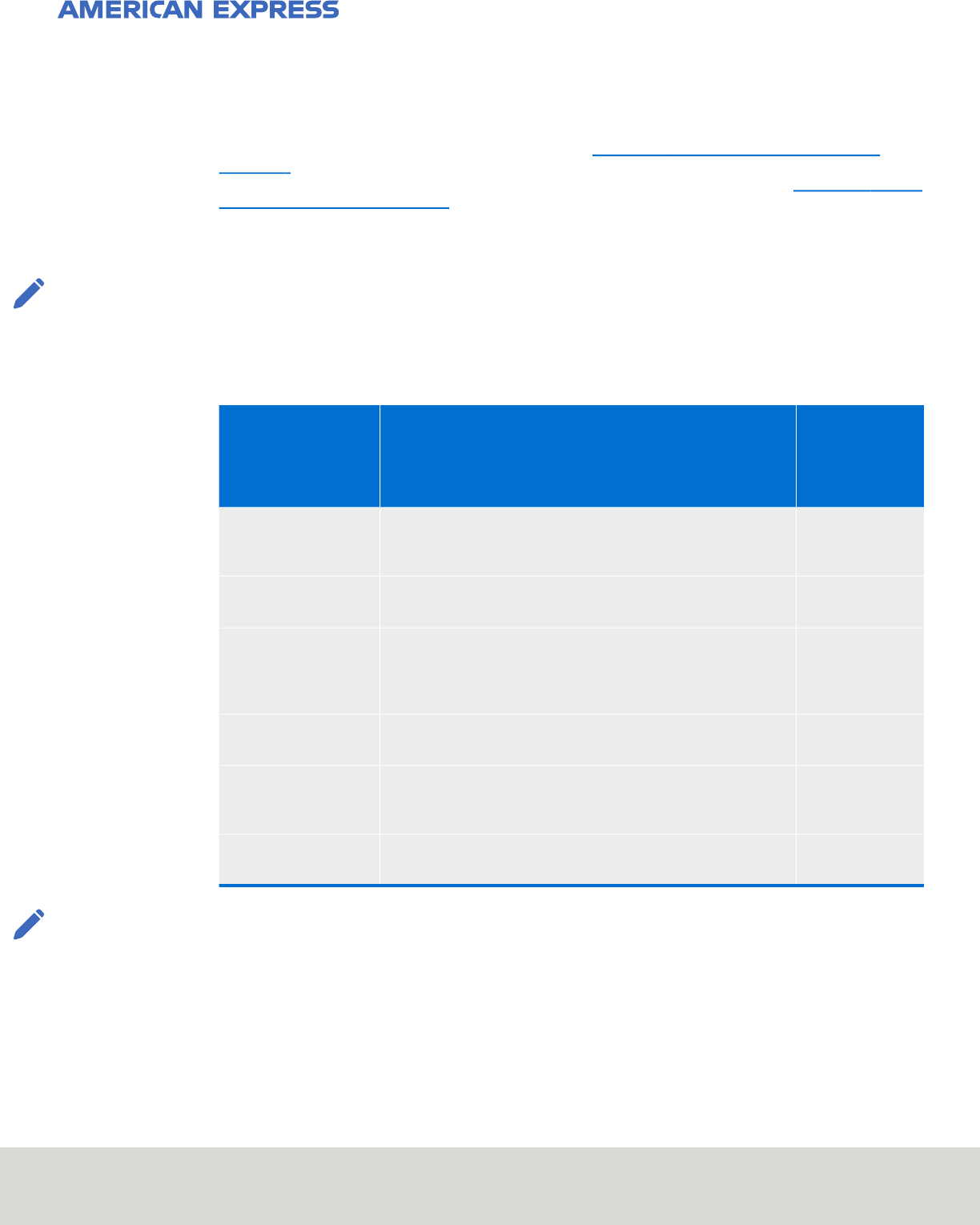

Summary of Changes Table

Important updates are listed in the following table and are also indicated in the Merchant Regulations with a change icon.

Chapter Section/Subsection Description of Change

Chapter 1, "Introduction" Section 1.1, "About the Merchant

Regulations"

Clarified Applicable Law.

Section 1.3, "Compliance with our

Specifications"

Added requirement to comply with Specifications.

Chapter 2, "General Policies" Subsection 2.1.5, "Contactless" Updated reference to Maximum Amount for a

Contactless Transaction.

Section 2.4, "Authorisation" Updated Estimated Authorisation language.

Subsection 2.4.1, "Estimated

Authorisation"

Relocated Estimated Authorisation language.

Section 2.7, "Disputed Charges" Updated the Disputed Charge timeframe.

Subsection 2.7.2, "Fraud Full Recourse

Programme"

Added high risk industries requirement.

Section 2.10, "American Express

SafeKey Programme"

Updated language by removing specific versions of

SafeKey. Updated language applies to all SafeKey

Transactions.

Created two sections for SafeKey Programme with

respective terms.

October 2020

iv

Merchant Regulations – International

Summary of Changes

Chapter 3, "Special

Regulations for Specific

Industries"

Subsection 3.2.1, "Prohibited

Industries"

Added Merchant Category Codes (MCCs) for

clarification.

Updated descriptions.

Subsection 3.2.2, "Restricted

Industries"

Added Merchant Category Codes (MCCs) for

clarification.

Subsection 3.5.1, "Onboard Charges" Relocated Estimated Authorisation language.

Subsection 3.7.1, "Authorisation" Relocated Estimated Authorisation language.

Subsection 3.8.2, "Rental" Relocated Estimated Authorisation language.

Section 3.9, "Payment Aggregators" Provided detail on Payment Aggregators' acquiring

requirements.

Section 3.10, "Restaurants" Relocated Estimated Authorisation language.

Section 3.11, "Taxicabs and

Limousines"

Relocated Estimated Authorisation language.

Chapter 4, "Country Specific Policies" Updated Maximum Amount for a Contactless Transaction

with No CVM thresholds for select countries.

Added Mexico-related thresholds and requirements.

Glossary Added/modified definitions (e.g., American Express Card

or Cards, Debit Card, Electronic Commerce Indicator,

Merchant Category Code, Third Party Issuer.)

Appendix A, "Data Security

Operating Policy (DSOP)"

Throughout Appendix Updated Trustwave references to SecureTrust.

Section 1, "Standards for Protection of

Encryption Keys, Cardholder Data, and

Sensitive Authentication Data"

Enhanced language for clarification and ease of

communicating compliance expectation.

Section 3, "Indemnity Obligations for a

Data Incident"

Clarified language regarding the exclusion of Card

Account Numbers for calculation purposes of an

Indemnity claim.

Section 4, "Important Periodic

Validation of Your Systems"

Clarified language for Actions 1, 2, and 4.

Clarified language on the non-validation fee.

Chapter Section/Subsection Description of Change

October 2020

v

Merchant Regulations – International

Summary of Changes

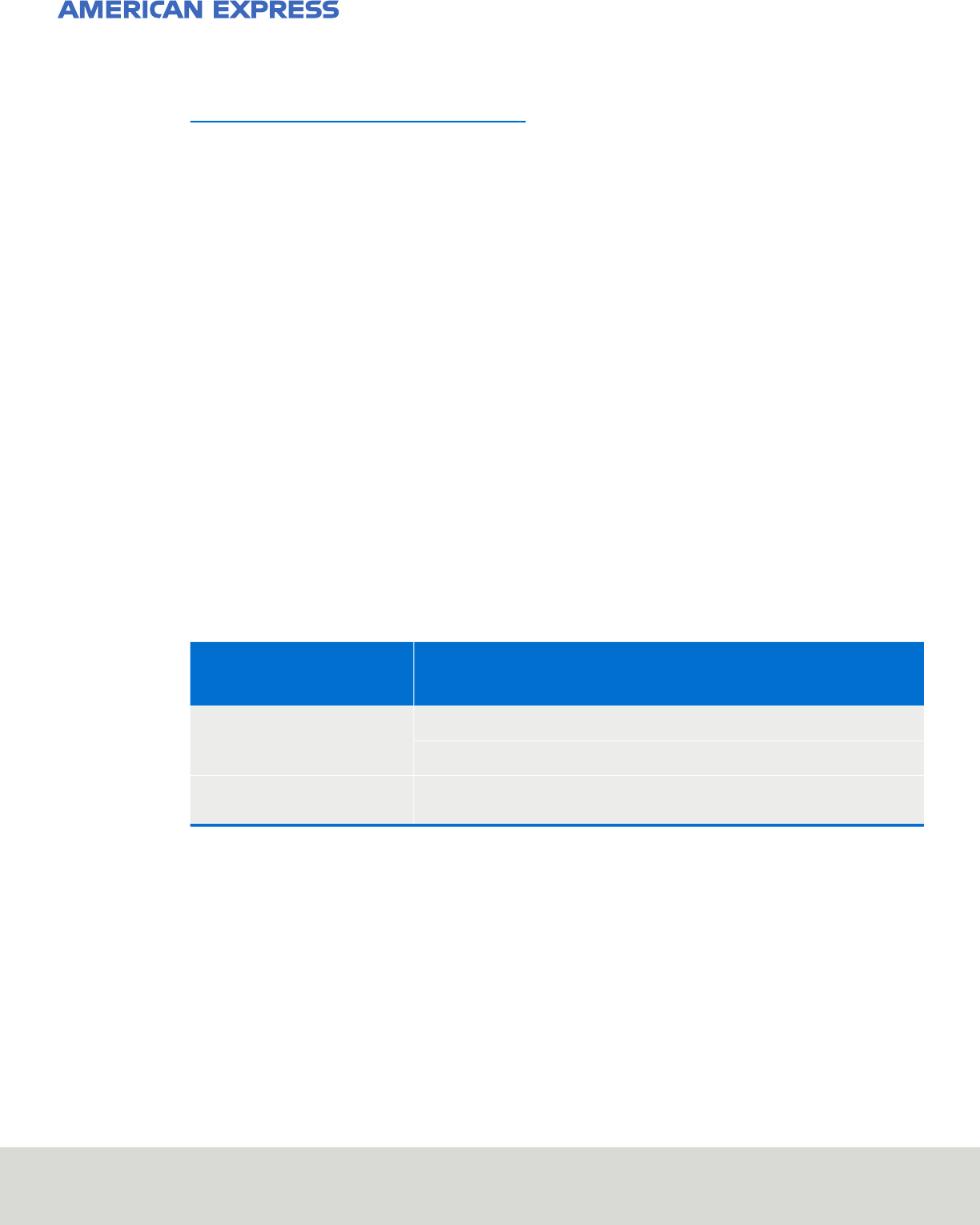

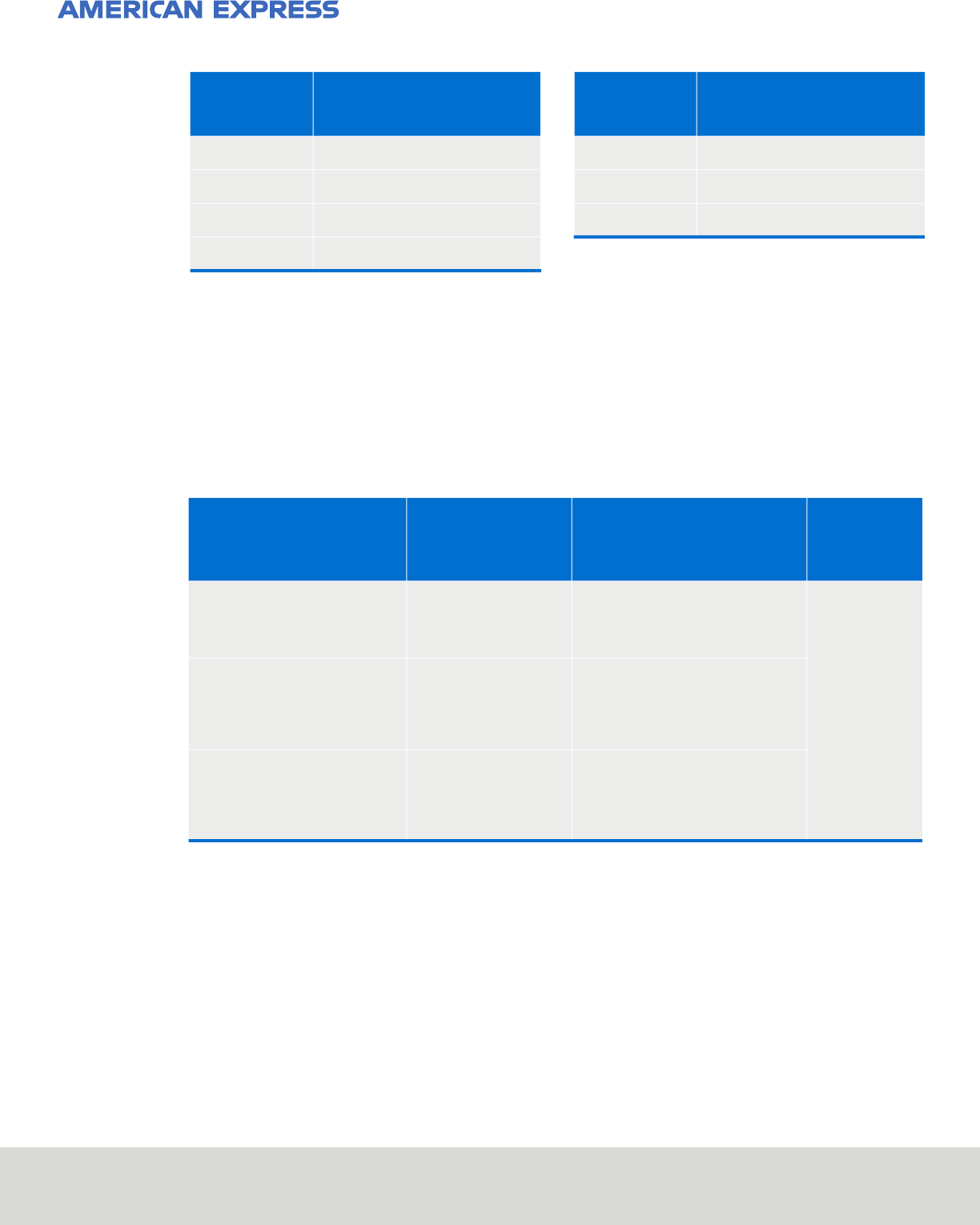

Notification of Future Changes Table

Important updates are described in the following table.

Effective

Date

Current Language New Language

April 2021 N/A - New Section

2.3.1.1 Introductory Offers

a. If you offer Cardmembers an option to make

Recurring Billing Charges that include an

Introductory Offer, you must comply with all

requirements set forth in this Subsection 2.3.1,

"Recurring Billing", in addition to the following

requirements:

i. Clearly and conspicuously disclose all material

terms of the Introductory Offer to the

Cardmember, including a simple and

expeditious cancellation process that allows the

Cardmember to cancel before submitting the

first Recurring Billing Charge;

ii. Obtain the Cardmember’s express consent to

accept the terms and conditions of the

Introductory Offer;

iii. Send the Cardmember a confirmation

notification in writing upon enrolment in the

Introductory Offer; and

iv. Send the Cardmember a reminder notification

in writing before submitting the first Recurring

Billing Charge, that allows the Cardmember a

reasonable amount of time to cancel.

April 2021

Chapter 4, "Country Specific Policies" Chapter 4, "Country Specific Policies"

Country EMV Requirement Country EMV Requirement

Mexico Chip Only Country Mexico Chip and PIN Country

Table of Contents

Summary of Changes Table . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .iii

Notification of Future Changes Table . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . v

1 Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

1.1 About the Merchant Regulations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

1.2 Changes in the Merchant Regulations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

1.3 Compliance with our Specifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

1.4 Compliance with our Data Security Operating Policy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

2 General Policies. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

2.1 In-Person Charges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

2.1.1 Chip Cards. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

2.1.2 Non-Chip Cards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

2.1.3 Obtaining Cardmember Signature. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

2.1.4 No CVM Programme. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

2.1.5 Contactless . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

2.1.5.1 Merchant-Presented Quick Response (MPQR) . . . . . . . . . . . . . . . . . 6

2.1.6 Unattended Terminals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

2.2 Card Not Present Charges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

2.2.1 Digital Orders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

2.3 Other Charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

2.3.1 Recurring Billing. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

2.3.1.1 Recurring Billing – European Economic Area . . . . . . . . . . . . . . . . . . . 9

2.3.2 Delayed Delivery Charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

2.3.3 Advance Payment Charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

2.3.4 Aggregated Charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

2.3.5 No Show Charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

2.4 Authorisation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

2.4.1 Estimated Authorisation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

2.5 Charge or Credit Records . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

2.5.1 Submitting Charges and Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

2.5.1.1 Submitting Charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

2.5.1.1.1 Submitting Charges – European Economic Area . . . . . . . 14

2.5.1.2 Submitting Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

October 2020

vii

Merchant Regulations – International

Table of Contents

2.5.1.3 Submitting Charges and Credits – Electronically . . . . . . . . . . . . . . 15

2.5.1.4 Submitting Charges and Credits – Paper . . . . . . . . . . . . . . . . . . . . . 15

2.5.1.5 Submission Errors and Adjustments . . . . . . . . . . . . . . . . . . . . . . . . . 15

2.6 Retaining Charge and Credit Records. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

2.7 Disputed Charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

2.7.1 Disputed Charges – European Economic Area. . . . . . . . . . . . . . . . . . . . . . . . . . . 16

2.7.2 Fraud Full Recourse Programme . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

2.8 Fraud Prevention Tools . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

2.9 Strong Customer Authentication. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

2.10 American Express SafeKey Programme . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

2.10.1 American Express SafeKey Fraud Liability Shift. . . . . . . . . . . . . . . . . . . . . . . . . . 18

3 Special Regulations for Specific Industries . . . . . . . . . . . . . . . . . . . . . . .19

3.1 Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20

3.2 Prohibited or Restricted Industries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20

3.2.1 Prohibited Industries. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20

3.2.2 Restricted Industries. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20

3.3 Airline Merchants. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

3.3.1 Affiliate Carriers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .23

3.3.2 Charge Records . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

3.3.3 Extended Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

3.3.4 In-Flight Charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .23

3.3.5 Private Charter Charges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

3.3.6 Submitting Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .24

3.4 Charitable Donations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .24

3.5 Cruise Lines. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .24

3.5.1 Onboard Charges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .24

3.5.2 Charge Records . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .25

3.6 Insurance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

3.7 Lodging . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .26

3.7.1 Authorisation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .26

3.7.2 Periodic Charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .26

3.8 Motor Vehicles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .26

3.8.1 Parking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .26

3.8.2 Rental . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .26

3.8.3 Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .28

3.9 Payment Aggregators. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .28

3.10 Travel Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .28

October 2020

viii

Merchant Regulations – International

Table of Contents

4 Country Specific Policies. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Glossary. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Appendix A: Data Security Operating Policy (DSOP) . . . . . . . . . . . . . . . . 42

October 2020

2

Merchant Regulations – International

Introduction :: About the Merchant Regulations

1.1 About the Merchant Regulations

a. The Merchant Regulations set forth the operational policies and procedures governing your acceptance of

the American Express® Card. In the event of any conflict between the Merchant Regulations and Applicable

Law, the requirements of law govern. The Merchant Regulations contain global policies that apply to your

Establishments and country-specific policies that apply to your Establishments located in the specific

country listed. In the event of any conflict between the global policies and country-specific policies, the

requirements of the country-specific policies take precedence. In order to ensure that these policies and

procedures are kept up to date, we will periodically update them as set out in these Merchant Regulations.

1.2 Changes in the Merchant Regulations

a. We reserve the right to change the Merchant Regulations (including by adding new terms or deleting or

modifying existing terms) by providing the Merchant Regulations in electronic form at

www.americanexpress.com/InternationalRegs

or its successor website (as made available by us). Any

future changes to the Merchant Regulations are set out in the Notification of Future Changes section of the

Merchant Regulations at the beginning of the document. Revised versions of the Merchant Regulations will

be published twice per year, in April and October, and the revised versions will be available on the website

referred to above. In exceptional circumstances, it may be necessary to make changes to the Merchant

Regulations outside of this cycle. If this is the case, we will notify you of any changes in accordance with your

Agreement.

1.3 Compliance with our Specifications

a. You must comply with our Technical Specifications and other documents required to support Authorisation,

Submission, Communication, and Connectivity as found at www.americanexpress.com/merchantspecs

,

which may change from time to time. The American Express Network publishes the Technical Specifications

twice a year, in April and October. Technical changes to implement or support, as well as any certification

requirements and/or compliance dates, will be communicated six (6) months prior to publication in a Notice

of Specification Changes (NOSC). Technical Bulletins may also be used to communicate changes occurring

outside of the April and October publication schedule.

1.4 Compliance with our Data Security Operating Policy

a. You must comply with our Data Security Operating Policy, as set forth in Appendix A, "Data Security

Operating Policy (DSOP)". You agree to be bound by and accept all provisions in that policy (as changed from

time to time) as if fully set out herein and as a condition to your agreement to accept the Card. Under that

policy you have additional (i) indemnity obligations if you suffer a data incident and (ii) obligations based on

your Transaction volume, including providing to us documentation validating your compliance with the PCI

DSS. Your data security procedures for the Card shall be no less protective than for other payment products

you accept.

October 2020

4

Merchant Regulations – International

General Policies :: In-Person Charges

2.1 In-Person Charges

a. For all In-Person Charges the Card must be presented and you must:

i. not accept a Card that is visibly altered or mutilated, or presented by anyone other than the

Cardmember, and, if a Transaction is declined, you must notify the Cardmember immediately;

ii. follow the Card acceptance steps outlined below in Subsection 2.1.1, "

Chip Cards" through

Subsection 2.1.6, "

Unattended Terminals" as applicable; and

iii. obtain an Authorisation.

2.1.1 Chip Cards

a. For Chip and personal identification number (PIN) Countries and Chip Only Countries, as indicated in

Chapter 4, "

Country Specific Policies", you must ensure that your POS Systems accepts Chip Cards, and

follow the procedures below.

i. When presented with a Chip Card, the Card must be inserted into the reader of the POS System (unless

the Charge is processed through Contactless Technology, in which case you must follow the steps

outlined in Subsection 2.1.5, "

Contactless" ).

ii. If you are in a Chip and PIN Country, the POS System must capture Chip Card Data and the POS System

should advise the Cardmember to enter the PIN (a “Chip and PIN Transaction”) or any other Cardholder

Verification Method (CVM), excluding Cardmember signature. Upon such advice, your Establishment

must ensure that the Cardmember completes the applicable CVM when prompted by the POS System.

In a Chip Only Country, the POS System may also advise for the Cardmember to enter a CVM. In a Chip

Only Country, if you choose to obtain a Cardmember signature, see Subsection 2.1.3, "

Obtaining

Cardmember Signature".

iii. If the Establishment is unable to complete a Chip Card Transaction due to a technical problem, the POS

System should show an error message and either decline the Transaction or direct the Establishment to

capture full magnetic stripe data by following the procedure for non-Chip Card Transactions (See

Subsection 2.1.2, "

Non-Chip Cards").

iv. If your Establishment swipes a Chip Card through, or manually keys a Charge into, the POS System

when no technical problem exists, the issuer may decline the Transaction and, if it does not, we may

have Chargeback rights for fraudulent In-Person Charges.

v. In addition to Subsection 2.1.1. (iv)

, you will be liable for any losses that we may suffer and we will have

Chargeback rights for fraudulent In-Person Charges, and/or we may terminate the agreement, if:

a. the POS System has not been upgraded to accept Chip Cards; or

b. you and your Processing Agent do not have the ability to capture and send Chip Card Data; or

c. we have not certified the POS System to accept Chip Transactions or Chip and PIN Transactions as

indicated under EMV®

1

Requirements, as specified in Chapter 4, "Country Specific Policies".

vi. In all cases, you will be liable for fraudulent Charges arising from a failure to comply with our Card

acceptance procedures.

2.1.2 Non-Chip Cards

a. For In-Person Charges where the Card is not a Chip Card, or in non-Chip Countries, the POS System will

provide instructions for you to swipe, and you must swipe the Card through the POS System (unless the

Charge is processed through Contactless Technology, in which case you must follow the steps outlined in

Subsection 2.1.5, "

Contactless"). You must:

i. ensure that the Card is being used within any valid dates shown on its face;

ii. ensure that the account number on the face of the Card matches the account number on its back and

there is a Card Identification Number (CID);

iii. verify that the signature panel of the Card is signed, where applicable, and is the same name as the

name on its face (except for Prepaid Cards that show no name on their face);

1. EMV® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere.

The EMV trademark is owned by EMVCo, LLC. section 2.1.1.A.V.C.

October 2020

5

Merchant Regulations – International

General Policies :: In-Person Charges

iv. verify that the Cardmember's name and signature, if obtained, on the Charge Record matches the name

and signature on the Card, or for a Prepaid Card that shows no name on its face, that the signature on

the back of such Prepaid Card matches the signature on the Charge Record, if obtained; and

v. verify that the Card account number and expiration date printed on the Charge Record matches the

Card account number and expiration date on the Card.

b. You may obtain the Cardmember's signature on the Charge Record. If you choose to obtain a Cardmember

signature, or are required to do so by law, see Subsection 2.1.3, "

Obtaining Cardmember Signature".

c. If your POS System fails then, in addition, you must seek a voice Authorisation (See Section 2.4,

"Authorisation").

d. If the magnetic stripe is unreadable, the Charge may be keyed into the POS System manually and you must

obtain an imprint of the Card to verify that the Card was present. A pencil rubbing or photocopy of the Card

is not considered to be a valid imprint. If you do not take a manual imprint where required, and make it

available to us on request, we will have Chargeback rights for such Charge.

2.1.3 Obtaining Cardmember Signature

a. Obtaining Cardmember signature on In-Person Charges is optional to complete a Charge Record, and at

your discretion, unless required by Applicable Law.

b. If you choose to obtain a Cardmember signature on a manual imprint, printed, or electronic In-Person

Charge, you must:

i. obtain signature on the Charge Record; and

ii. if possible, verify that the name indicated by the signature is the same as the name on the Card; and

iii. verify that the signature on the Charge Record matches the signature on the Card; except in the case of

Prepaid Cards that may not include a signature.

c. You must still obtain the Cardmember’s signature for all Transactions that are made pursuant to an

American Express instalment payment plan or as communicated to you from time to time that you need to

do so.

2.1.4 No CVM Programme

a. Save as expressly set out elsewhere, Transactions conducted within the European Economic Area (EEA) will

not qualify for the No CVM Programme unless it is a Contactless Transaction at an Expresspay enabled POS

System. If your Establishment is located outside the EEA, you may choose not to request a CVM from

Cardmembers where:

i. the Charge amount equals or is less than the value provided in the Maximum Amount for a Contact

Transaction without a CVM column indicated in Chapter 4, "

Country Specific Policies";

ii. the Charge submission includes the appropriate indicator to reflect the Card and the Cardmember were

present at the POS System; and

iii. the Charge includes a valid Authorisation approval.

b. Under the No CVM Programme, we will not exercise Chargeback for such Charges based solely on the failure

to obtain the Cardmember's CVM. Nonetheless, you are required to comply with our request for written

response to a Disputed Charge related to fraud for not capturing a CVM. Even if an Establishment and a

Charge qualify under the No CVM Programme, we have the right to Chargeback for reasons unrelated to the

Establishment's failure to obtain a CVM from the Cardmember at the POS System. The No CVM Programme

does not apply to Disputed Charges involving customer service or goods and services disputes. If we receive

disproportionate numbers of Disputed Charges under the No CVM Programme, you must work with us to

reduce the number of disputes. If such efforts fail, we may exercise our Chargeback rights and/or modify or

terminate your participation in the No CVM Programme.

c. You may only participate in the No CVM Programme if we classify you in an industry that accepts In-Person

Charges, except in the following instances:

i. Your Establishment does not conduct In-Person Charges (i.e., Internet, mail order, telephone order);

ii. We consider your Establishment to be high risk;

iii. Your Establishment is placed in the Fraud Full Recourse Programme; or

October 2020

6

Merchant Regulations – International

General Policies :: In-Person Charges

iv. We deem, in our sole discretion, your Establishment is ineligible for any other reason.

2.1.5 Contactless

a. When presented with a Chip Card or Mobile Device to be read via Contactless Technology and the Charge is

equal or less than the applicable Maximum Amount for a Contactless Transaction with No CVM set out in

Chapter 4, "

Country Specific Policies", you must:

i. capture the Charge Data using the Contactless reader; and

ii. obtain Authorisation;

b. If the Charge amount is over the Maximum Amount for a Contactless Transaction with No CVM, if you are

unable to complete a Contactless Transaction, or if prompted by your POS System, you will need to follow

the process set out in Subsection 2.1.1, "

Chip Cards".

c. For Digital Wallet Contactless-initiated Transactions, a Consumer Device Cardmember Verification Method

(CDCVM) is permitted if the Mobile Device and the POS System are capable of performing CDCVM. For

these Charges, you must create a Charge Record as described in Section 2.5, "

Charge or Credit Records",

including an indicator that the Transaction is a Digital Wallet Contactless-initiated Transaction. To ensure

proper POS System acceptance for Digital Wallet Contactless-initiated Transactions, you should comply with

the most current American Express Contactless-enabled POS System requirements.

d. We will not exercise missing imprint, counterfeit, lost, stolen, or non-received fraud Chargebacks for

Contactless or Digital Wallet Contactless-initiated Transactions if the Establishment successfully verifies the

Cardmember and meets all of the criteria and requirements listed above. This does not apply to Disputed

Charges involving dispute reasons other than fraud (e.g., it does not apply to goods or services disputes).

Nonetheless, you are required to comply with our request for written response to a Disputed Charge related

to fraud for Contactless or Digital Wallet Contactless-initiated Transactions.

e. If you have the ability to process Consumer-Presented Quick Response Code (CPQR) Transactions, you

must:

i. clearly inform the Cardmember that they can pay for the purchase by generating a QR Code;

ii. use a scanning device easily accessible to the Cardmember, but placed in such a manner that there is no

possibility that the Cardmember’s device is triggered due to proximity; and

iii. if the presented QR Code fails to be scanned, request:

a. the QR Code be re-presented;

b. an alternative payment method be used; or

iv. obtain an Authorisation.

2.1.5.1 Merchant-Presented Quick Response (MPQR)

a. If you have the ability to process MPQR Transactions, you must:

i. have the Cardmember use their Mobile device to scan the MPQR code;

ii. display the Quick Response (QR) code, which can be dynamic or static, for scanning by the

Cardmember;

iii. ensure the MPQR Code is not altered or tampered with;

iv. receive a notification that the Transaction has been approved and check the Transaction amount is

correct before providing the goods or services. If you do not receive the notification, you should contact

us to confirm the status of the MPQR Transaction;

v. contact us or decline the Transaction if you are suspicious of the Cardmember or receive notification

from us to do so;

vi. retain records of MPQR Transactions. These can be in the form of a notification from us, an invoice, or

other documentation of the Transaction; and

vii. obtain an Authorisation.

October 2020

7

Merchant Regulations – International

General Policies :: Card Not Present Charges

2.1.6 Unattended Terminals

a. We will accept Charges for purchases at your unattended POS Systems (e.g., Customer Activated Terminals

(CATs) or payment kiosks) subject to the Charge Records requirements in Section 2.5, "

Charge or Credit

Records", and the following additional requirements. You must:

i. include in all requests for Authorisation the full magnetic stripe stream or Chip Card Data;

ii. ensure the Charge complies with the Specifications, including flagging all requests for Authorisation and

all Charge submissions with a CAT indicator, where technically feasible;

iii. follow any additional Authorisation procedures that we may provide to you if you accept the Card at an

unattended POS System that is part of, or attached to, a fuel dispenser; and

iv. ensure that the unattended POS System notifies the Cardmember if the Transaction is declined, where

technically feasible.

b. In Chip and PIN Countries, as indicated in Chapter 4, "

Country Specific Policies", if an unattended POS

System is not configured for Chip and PIN Transactions then you may still accept the Card and the provisions

of Subsection 2.1.1, "

Chip Cards" will not apply in relation to completing the applicable CVM. However, if you

do so, you will be liable for any losses and we will have Chargeback rights for fraudulent In-Person Charges

made with lost, stolen and non-received Chip Cards.

c. In Chip Only Countries, as indicated in Chapter 4, "

Country Specific Policies", if an unattended POS System

is not configured for Chip Card Transactions you may still accept the Card. However, if you do so, you will be

liable for any losses and we will have Chargeback rights for fraudulent In-Person Charges made with

counterfeit Chip Cards.

2.2 Card Not Present Charges

a. For Card Not Present Charges, you must:

i. create a Charge Record as described in Section 2.5, "

Charge or Credit Records", including an indicator

that the Transaction is Card Not Present and a designation of "mail order," "telephone order," "Digital

Order," "fax order" or "Signature on File," as applicable, on the signature line or the appropriate

electronic descriptor on the Charge Record;

ii. obtain the Cardmember's name as it appears on the Card, the Card account number or Token and

expiry date, the Cardmember's billing address, and the delivery address;

iii. obtain Authorisation;

iv. if the order is to be shipped or delivered more than seven (7) days after the original Authorisation, obtain

a new Authorisation before shipping or delivering the order; and

v. immediately notify the Cardmember if the Transaction is declined.

b. If the goods are to be collected by the Cardmember, the Card must be presented by the Cardmember upon

collection and you should treat the Transaction as an In-Person Charge and comply with the provisions

provided in Section 2.1, "

In-Person Charges".

c. For Card Not Present Charges where goods are to be collected from a designated store you must establish a

process to ensure that the goods are collected by the Cardmember who placed the order, or by an

authorised third party designated by the Cardmember at the time of placing the order.

d. If you wish to accept orders for goods or services where the card is not physically presented to you, then you

do so at your own risk. We have Chargeback rights for any Card Not Present Charge that the Cardmember

denies making or authorising. This excludes Transactions that qualify for the AESK Programme. We will not

exercise our Chargeback rights for Card Not Present Charges based solely upon a Cardmember claim that

he or she did not receive the disputed goods if you have verified with us that the address to which the goods

were shipped is the Cardmember's billing address and obtained a receipt signed by an authorised signer

verifying the delivery of the goods to such address.

October 2020

8

Merchant Regulations – International

General Policies :: Card Not Present Charges

2.2.1 Digital Orders

a. We will accept Charges for Digital Orders subject to the requirements above in this Section 2.2, "Card Not

Present Charges" and the following additional requirements. You must:

i. send Charge Data concerning any Digital Order via the internet, email, intranet, extranet, or other digital

network or any other electronic mail medium only to the Cardmember who made the Digital Order, your

Processor or us, in accordance with Appendix A, "

Data Security Operating Policy (DSOP)";

ii. submit all Charges for Digital Orders electronically;

iii. use any separate Establishment Numbers that we provide you for Digital Orders in all your requests for

Authorisation and submissions of Charges for Digital Orders;

iv. ensure your websites that permit Cardmembers to make Digital Orders are identified by extended

validation certificates or by other similar authentication methods in order to restrict the use of

fraudulent websites;

v. employ appropriate controls to separate payment related processes from your online shop to enable the

Cardmember to determine whether they are communicating with you or us; and

vi. provide us with at least one (1) month's prior written notice of any change in your website address.

b. We reserve the right not to accept Digital Orders immediately if any event or series of events occurs which in

our opinion may affect your ability to comply with your obligations under the Agreement or to any

Cardmember.

c. We may dispense with the notice period, as set out in the Agreement, and immediately notify you of

additional requirements, including our encryption software requirements and security guidelines, in order to

protect the security of Digital Orders and/or Cardmember Information and/or to prevent fraud.

d. We will not be liable for fraudulent Digital Orders. We will have the right to Chargeback for Charges

transacted over the Internet, even if you have received an Authorisation approval code and have complied

with all other provisions of this Agreement. Additionally, if a Disputed Charge arises involving a Card Not

Present Charge that is a Digital Delivery Transaction, we will exercise our Chargeback rights for the full

amount of the Charge.

e. You must ensure that your website or applicable digital medium notifies the Cardmember if the Transaction

is declined for Authorisation.

f. For Digital Wallet Application-initiated Transactions, you will (i) certify for Digital Wallet Application-initiated

Transactions with your Processor, terminal provider, or if you have a direct link to us, your American Express

representative and (ii) follow Card Not Present Charge requirements set forth in this Section 2.2, "

Card Not

Present Charges". If applicable, a CDCVM is permitted if the Mobile Device is capable of performing CDCVM.

For these Charges, you must create a Charge Record as described in Section 2.5, "

Charge or Credit

Records". For these Charges to qualify as a Digital Wallet Application-initiated Transaction, you must include

an indicator that the Transaction is a Digital Wallet Application-initiated Transaction on the Charge Record.

We will not exercise a missing imprint fraud Chargeback for Digital Wallet Application-initiated Transactions

if the Establishment meets all off the criteria and requirements set out in this paragraph. The preceding

sentence does not apply to Disputed Charges involving dispute reasons other than fraud (e.g., it does not

apply to goods or services disputes).

g. In circumstances where you accept Charges for Digital Orders that are verified by the American Express

SafeKey Programme, we may offer the Cardmember the option to pay for their purchase with points. This

does not impact the relationship between you and us and does not change either party's rights or obligations

under this Agreement. However, if you prefer that we do not offer this functionality to Cardmembers using

your digital platform then please write to us using the correspondence address for your country found in

your Agreement.

h. For Digital Wallet Application-initiated Transactions that are also Recurring Billing Charges, you must follow

the process set out in Subsection 2.3.1, "

Recurring Billing". The Charge Record should include indicators that

the Charge is a Recurring Billing Charge and not a Digital Wallet Application-initiated Transaction.

October 2020

9

Merchant Regulations – International

General Policies :: Other Charges

2.3 Other Charges

2.3.1 Recurring Billing

a. Before submitting your first Recurring Billing Charge you must:

i. clearly and conspicuously disclose all material terms of the offer including, if applicable, the fact that

Recurring Billing Charges will continue until the option is cancelled by the Cardmember;

ii. disclose details of your cancellation/refund policy, and obtain the Cardmember's consent to bill their

Card and the Recurring Billing Charges terms before submitting the first Recurring Billing Charge;

iii. obtain the Cardmember's name, the Card number, the Cardmember's signature (if applicable), Card

expiry date, the Cardmember's billing address, and a statement confirming consent:

a. for you to charge their Card for the same or different amounts at specified or different times; and

b. that the Cardmember can withdraw such consent at any time.

iv. comply with any instructions of which we may reasonably notify you; and

v. notify the Cardmember that they are able to discontinue Recurring Billing Charges at any time and

provide contact details for cancelling Recurring Billing Charges.

b. The method you use to secure the Cardmember's consent must contain a disclosure that you may receive

updated Card account information from the financial institution issuing the Cardmember's Card. You must

retain evidence of such consent for two (2) years from the date you submit the last Recurring Billing Charge.

c. In addition to our other Chargeback rights, we may exercise Chargeback for any Charge that does not meet

the requirements set forth in this Subsection 2.3.1, "

Recurring Billing". We may exercise our Chargeback

rights for any Charge of which you have notified the Cardmember and to which the Cardmember does not

consent.

d. Before submitting any Recurring Billing Charge you must:

i. obtain Authorisation; and

ii. create a Charge Record including indicators that the Transaction is a Recurring Billing Charge.

e. Before submitting any "Signature on File" Charge you must:

i. obtain Authorisation; and

ii. create a Charge Record with the words "Signature on File" and the appropriate electronic descriptor.

f. The cancellation of a Card constitutes immediate cancellation of that Cardmember's consent for Recurring

Billing Charges. We need not notify you of such cancellation, nor will we have any liability to you arising from

such cancellation. You must discontinue the Recurring Billing Charges immediately if requested to do so by a

Cardmember directly, or through us or the financial institution issuing the Cardmember's Card. If a Card

account is cancelled, or if a Cardmember directly (or through us or the Card issuer) withdraws consent to

Recurring Billing Charges, you are responsible for arranging another form of payment (as applicable) with

the Cardmember (or former Cardmember).

g. If the Agreement is terminated for any reason, then you shall at your own cost notify all Cardmembers for

whom you have submitted Recurring Billing Charges of the date when you will no longer be accepting the

Card. At our option you will continue to accept the Card for up to ninety (90) days after any termination

takes effect.

2.3.1.1 Recurring Billing – European Economic Area

a. If you are located in the EEA, and in relation to a Card issued in the EEA, if you submit a Recurring Billing

Charge for an amount which was not specified in full when the Cardmember provided consent to Recurring

Billing Charges and you do not obtain the Cardmember's consent specifically in relation to the full exact

amount of such Charge, we will have Chargeback rights for the full amount of the Charge for a period of one

hundred and twenty (120) days from submission of the applicable Charge, and thereafter for any disputed

portion of such Charge (up to and including the full amount). If the Cardmember consents to an adjusted

Charge amount, we may exercise our Chargeback rights accordingly. Nothing in this paragraph will prejudice

our Chargeback rights generally in relation to Recurring Billing Charges.

October 2020

10

Merchant Regulations – International

General Policies :: Other Charges

b. If notification is required prior to each varying Recurring Billing charge, you must notify the Cardmember of

the amount and date of each Recurring Billing Charge:

i. at least ten (10) days before submitting each Charge; and

ii. whenever the amount of the Charge exceeds a maximum Recurring Billing Charge amount specified by

the Cardmember.

c. You will permit us to establish a hyperlink from our website to your website (including its home page,

payment page or its automatic/recurring billing page) and list your customer service contact information.

2.3.2 Delayed Delivery Charges

a. You may accept the Card for Delayed Delivery Charges. For a Delayed Delivery Charge, you must:

i. clearly disclose your intent and obtain written consent from the Cardmember to perform a Delayed

Delivery Charge before you request an Authorisation;

ii. obtain a separate Authorisation for each of the two (2) Delayed Delivery Charges on their respective

Charge dates;

iii. clearly indicate on each Charge Record that the Charge is either for the "deposit" or for the "balance" of

the Delayed Delivery Charge;

iv. submit the Charge Record for the balance of the purchase only after the goods have been shipped or

provided or services rendered;

v. submit each Charge Record within our submission timeframes, and any in case, within seven (7) days of

the Charge being incurred. The Charge will be deemed "incurred":

a. for the deposit: on the date the Cardmember agreed to pay the deposit for the purchase

b. for the balance: on the date the goods are shipped or provided or services are rendered

vi. submit and obtain Authorisation for each part of a Delayed Delivery Charge under the same

Establishment Number; and

vii. treat deposits on the Card no differently than you treat deposits on all Other Payment Products.

2.3.3 Advance Payment Charges

a. Advance Payment Charge procedures are available for custom orders (e.g., orders for goods to be

manufactured to a customer's specifications), entertainment / ticketing (e.g., sporting events, concerts,

season tickets), tuition, room and board, and other mandatory fees (e.g., library fees) of higher educational

institutions, airline tickets, vehicle rentals, rail tickets, cruise line tickets, lodging, and travel-related services

(e.g., tours, guided expeditions).

b. If you offer Cardmembers the option, or require them to make Advance Payment Charges, you must:

i. state your full cancellation and refund policies, clearly disclose your intent and obtain written consent

from the Cardmember to bill the Card for an Advance Payment Charge before you request an

Authorisation. The Cardmember's consent must include:

a. his or her agreement to all the terms of the sale (including price and any cancellation and refund

policies); and

b. a detailed description and the expected delivery date of the goods and/or services to be provided

(including, if applicable, expected arrival and departure dates);

ii. obtain Authorisation; and

iii. complete a Charge Record.

c. If the Advance Payment Charge is a Card Not Present Charge, you must also:

i. ensure that the Charge Record contains the words "Advance Payment"; and

ii. within twenty-four (24) hours of the Charge being incurred, provide the Cardmember written

confirmation (e.g., email or facsimile) of the Advance Payment Charge, the amount, the confirmation

number (if applicable), a detailed description and expected delivery date of the goods and/or services to

be provided (including expected arrival and departure dates, if applicable) and details of your

cancellation/refund policy.

October 2020

11

Merchant Regulations – International

General Policies :: Other Charges

d. If you cannot deliver goods and/or services (e.g., because custom-ordered merchandise cannot be fulfilled),

and if alternate arrangements cannot be made, you must immediately issue a Credit for the full amount of

the Advance Payment Charge which relates to the goods or services which cannot be delivered or fulfilled.

e. In addition to our other Chargeback rights, we may exercise Chargeback for any Advance Payment Charge

that is a Disputed Charge or portion thereof if, in our sole discretion, the dispute cannot be resolved in your

favour based upon unambiguous terms contained in the terms of sale to which you obtained the

Cardmember's written consent.

2.3.4 Aggregated Charges

a. This Subsection 2.3.4, "Aggregated Charges" applies only to Transactions processed by your Establishments

conducting business over the internet. You may process Aggregated Charges provided the following criteria

are met:

i. you clearly disclose your intent and obtain consent from the Cardmember that their purchases or

refunds (or both) on the Card may be aggregated and combined with other purchases or refunds (or

both) before you request an Authorisation;

ii. each individual purchase or refund (or both) that comprises the Aggregated Charge must be incurred

under the same Establishment Number and on the same Card;

iii. obtain Authorisation of no more than the applicable limit shown in Chapter 4, "

Country Specific

Policies" (or Local Currency equivalent) or such other amount as notified to you;

iv. create a Charge Record for the full amount of the Aggregated Charge;

v. the amount of the Aggregated Charge must not exceed the applicable limit set forth in Chapter 4,

"Country Specific Policies" (or such other amount as notified to you) or the amount for which you

obtained Authorisation, whichever is lower;

vi. submit each Charge Record within our submission timeframe. A Charge will be deemed "incurred" on

the date of the first purchase or refund (or both) that comprises the Aggregated Charge; and

vii. provide the Cardmember with an email containing:

a. the date, amount, and description of each individual purchase or refund (or both) that comprises

the Aggregated Charge, and

b. the date and the amount of the Aggregated Charge.

2.3.5 No Show Charges

a. If we classify you in one of the following industries, you may process No Show Charges provided that the

criteria set out below are met:

lodging,

trailer park/campground, or

vehicle, aircraft, bicycle, boat, equipment, motor home, or motorcycle rentals.

b. The amount of any No Show Charge must not exceed:

i. the cost of the stay in the case of a lodging reservation; or

ii. the equivalent of one (1) day's rental in the case of other reservations.

c. If the Cardmember made a reservation with you and failed to show, you may process a No Show Charge if:

i. the Cardmember has guaranteed the reservation with their Card;

ii. you have recorded the Card number, its expiry date and the Cardmember's billing address;

iii. at the time of accepting the reservation you provided the Cardmember with the applicable daily rate and

a reservation number or confirmation code;

iv. you held the accommodation/vehicle for the Cardmember until the published check-out/return time

the day following the first day of the reservation and you did not make the accommodation/vehicle

available to any other customers; and

v. you have a documented "No Show" policy, which reflects common practice in your industry and is in

accordance with the prevailing law, which policy has been advised to the Cardmember at the time they

made the reservation.

October 2020

12

Merchant Regulations – International

General Policies :: Authorisation

d. You must obtain an Authorisation for any No Show Charges prior to submitting them. If the Cardmember

does not honour their reservation, you must include in the Charge Record an indicator that the Charge is a

"No Show Charge".

e. Prepaid Cards may not be used to guarantee reservations.

2.4 Authorisation

a. You must obtain Authorisation for all Charges according to our Specifications, except for Charges under any

applicable Floor Limit for Card Present Charges. Every Authorisation request must include the full Card

account number or Token and be for the full amount of the Charge. You may create multiple Charge Records

for a single purchase placed on different Cards, if you obtain full Authorisation on each Card.

b. We will have Chargeback rights for any Charge for which Authorisation is not properly obtained, or for which

Authorisation was refused, or for which no approval code number was given or properly recorded.

Authorisation does not guarantee that we will accept the Charge without exercising our Chargeback rights,

nor is it a guarantee that the person making the Charge is the Cardmember or that you will be paid. You must

not seek Authorisation on behalf of a third party.

c. Authorisation approvals are valid for seven (7) days after the original Authorisation date. Establishments

must obtain a new Authorisation approval if you submit a Charge to us more than seven (7) days from the

original Authorisation date, except as otherwise indicated by us. For Charges for goods or services shipped

or provided more than seven (7) days after an order is placed, you must obtain Authorisation of the Charge

at the time the order is placed, and again at the time you ship or provide the goods or services to the

Cardmember.

d. If your POS System is unable to connect to our computer authorisation system for Authorisation or we ask

you to do so (i.e., a referral), you must obtain Authorisation for all Charges by calling us at our Authorisation

telephone number. We reserve the right to charge you a fee for each Charge for which you request

Authorisation by telephone, unless such failure to obtain Authorisation electronically is due to the

unavailability or inoperability of our computer authorisation system, or unless prohibited by law.

e. If you are located outside of the EEA, we may assign you a Floor Limit. In the event that any one Charge or

series of Charges made on the same day by any one Cardmember at your Establishment is equal to or

greater than the Floor Limit established by us, you must, before accepting the Charge, request Authorisation

by calling us at our Authorisation telephone number. We reserve the right to change your Floor Limit at any

time, and will give you notice of the change and the effective date.

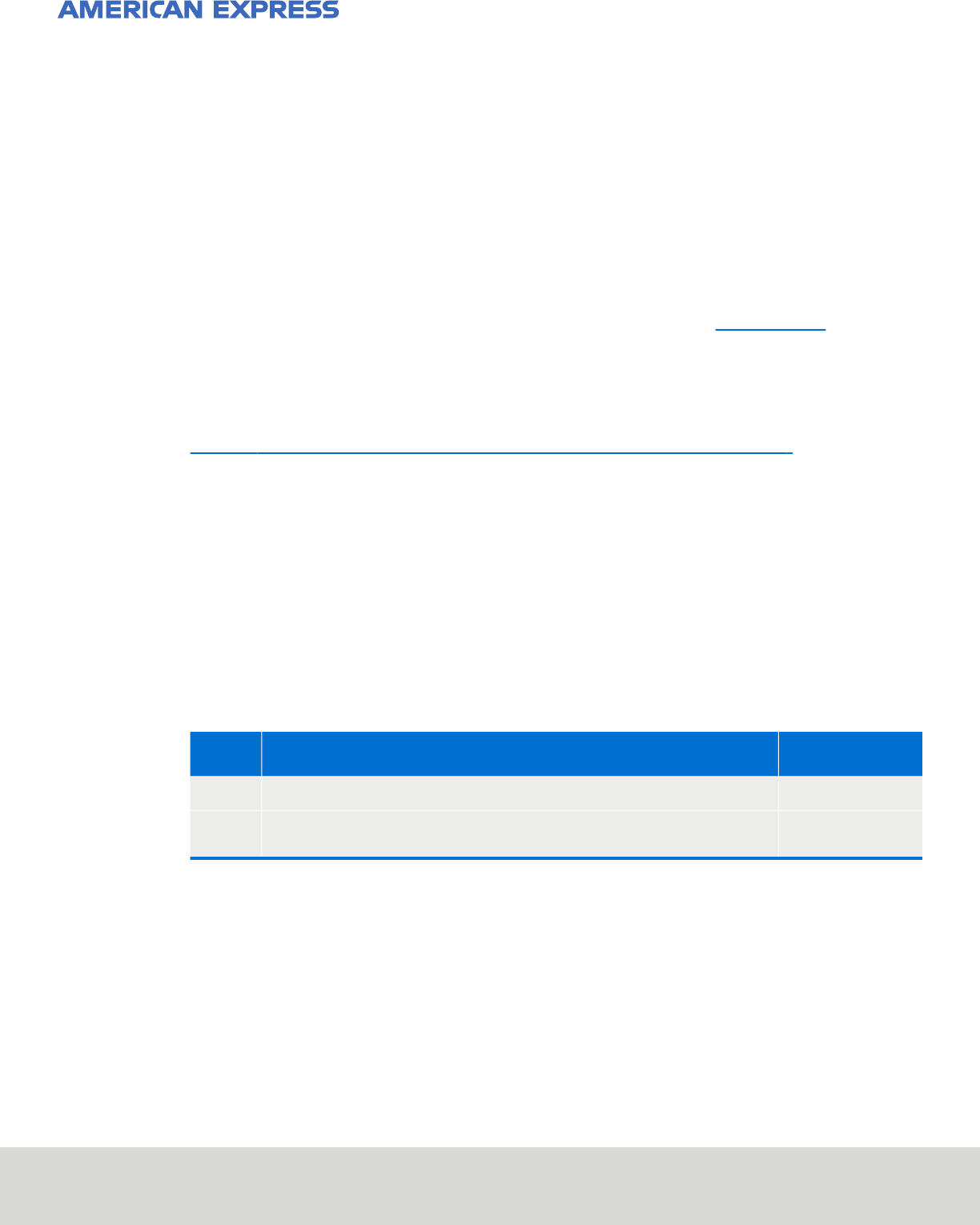

2.4.1 Estimated Authorisation

a. You may only obtain an Estimated Authorisation in the industries listed below. You must obtain the

Cardmember's consent to such estimated amount prior to requesting the Authorisation.

b. You must submit the corresponding Charge as soon as you become aware of the full amount to be charged.

For any amount of the Charge that exceeds the amount for which you obtained an Authorisation, you must

obtain the Cardmember's consent.

c. If the final amount of the Charge is:

i. no greater than the amount for which you obtained Authorisation plus the applicable Estimated

Authorisation percentage listed below of that amount, no further Authorisation is necessary; or

ii. greater than the amount for which you obtained Authorisation by more than the applicable Estimated

Authorisation percentage listed in the table below of that amount, you must obtain a new Authorisation.

If you fail to obtain such Authorisation, or your request for such Authorisation is declined, we will have

Chargeback rights for the amount in excess of the original Authorisation amount plus the applicable

Estimated Authorisation percentage of that amount. For the avoidance of doubt, we will have

Chargeback rights for the final amount of the Charge for reasons other than the failure to obtain an

approved Authorisation.

October 2020

13

Merchant Regulations – International

General Policies :: Charge or Credit Records

2.5 Charge or Credit Records

a. For every Charge or Credit, you must create an electronically reproducible Charge Record or Credit Record at

the time of purchase that complies with the Specifications or in a form approved by us containing the

following information:

i. full Card number or Token for Charge Records;

ii. the expiry date of the Card;

iii. the date the Charge or Credit was incurred;

iv. your Establishment's name, address and Establishment Number;

v. the amount of the Charge or Credit, including applicable taxes;

vi. for Charge Records, a description of the goods and services purchased;

vii. for Charge Records, the Authorisation approval code number; and

viii. all other information as required from time to time by us or Applicable Law.

b. On copies of Charge Records delivered to Cardmembers, you must truncate the Card number and you must

not print the Card's expiry date nor the CID. Truncated Card Number digits must be masked with

replacement characters such as "x," " *," or "#," and not blank spaces or numbers;

c. You may create multiple Charge Records for a single purchase placed on different Cards, but you must not

create multiple Charge Records for a single purchase to the same Card, by dividing the purchase into more

than one Charge, except in the case of a Delayed Delivery Charge or where we have authorised you to do so

for Charges above a certain value.

d. For Corporate Purchasing Card (CPC) Charges, you must comply with our Charge Record requirements

above. In addition, you are required to capture additional Card Data on the Charge Record, and Transmission

Data on the Transmissions, according to our Specifications, including:

i. CPC reference information (e.g., purchase order number);

ii. the CPC Client Account information;

iii. the purchase price of the goods with the actual amount of taxes charged shown separately, where taxes

are applicable;

e. You must process CPC Charges under your CPC Establishment Number.

Industry

Estimated Authorisation

Percentage

Cruise Lines (Section 3.5.1) 15%

Grocery (Card Not Present) 15%

Lodging (Section 3.7.1) 15%

Rentals (Section 3.8.2) 15%

Restaurants 20%

Retail (Card Not Present) 15%

Taxicabs and Limousines 20%

October 2020

14

Merchant Regulations – International

General Policies :: Charge or Credit Records

2.5.1 Submitting Charges and Credits

a. Establishments must submit Transactions, whether electronic or paper, in Local Currency, or in the case of

an Establishment that we have approved for processing on the American Express multi-currency platform, in

accordance with the Agreement, unless American Express otherwise agrees in writing or unless required by

Applicable Law. Any currency conversions made by American Express pursuant to the Agreement shall be

made as of the date of processing the Transaction by American Express or at such other date as American

Express may provide notice. Unless a specific rate is required by Applicable Law, American Express will use

conversion rates based on interbank rates that American Express selects from customary industry sources

on the business day prior to the processing date.

b. If, after the effective date of the Agreement, an Establishment wishes to permit customers to make

purchases or payments in a currency not listed in the Specifications and not previously agreed to by

American Express as an eligible currency on the American Express multi-currency platform, you shall

immediately notify American Express in writing; and you shall, after written notice from American Express of

our agreement to your submission of Charges in that currency, submit Charges in that currency. If American

Express does not agree to your submission of Charges in a currency not listed in the Specifications, you must

not submit Charges in such currency.

c. In all cases, submission and payment of Transactions will be subject to immediate review and amendment in

the event that Applicable Law, regional volatility, or other unforeseen events inhibit the settlement operation

for either party.

2.5.1.1 Submitting Charges

a. You must submit all Charges to us within seven (7) days of the date they are incurred, provided that you must

wait to submit Charges until you have shipped the goods or provided the services to the Cardmember, after

which you have seven (7) days to submit such Charges.

b. The deposit element of a Delayed Delivery Charge and any Advance Payment Charges may be submitted

before the goods are shipped or services provided. See Subsection 2.3.2, "

Delayed Delivery Charges" and

Subsection 2.3.3, "

Advance Payment Charges".

2.5.1.1.1 Submitting Charges – European Economic Area

a. If you are located in the EEA, you must not submit Charges where the full exact amount is not specified when

the Cardmember consents to the Transaction. Without prejudice to our Chargeback rights generally, if you

do so, and the Card is issued in the EEA, we will have Chargeback rights for the full amount of the Charge for

a period of one hundred and twenty (120) days from the date of submission of the Charge, and thereafter for

any disputed portion of the Charge (up to and including the full amount). If the Cardmember consents to an

adjusted Charge amount, we may exercise our Chargeback rights accordingly. A Cardmember may provide

consent, e.g., by completing a valid CVM, excluding Cardmember signature, in the course of your following

the procedures set out for an In-Person Charge in Section 2.1, "

In-Person Charges".

2.5.1.2 Submitting Credits

a. You must create a Credit Record for every Credit and submit Credits to us within seven (7) days of

determining that a Credit is due. You must not issue a Credit when there is no corresponding Charge.

Establishments must submit the Credit under the Establishment Number where the Credit originated. You

must submit a Credit only for the value of the corresponding Charge, excluding the Merchant Service Fee. We

will deduct the full amount of the Credit from our payment to you (or, if you have signed a direct debit

mandate, debit your Account), but if we cannot, then you must pay us promptly upon receipt of our

notification. If you issue a Credit, we will not refund the Discount or any other fees or assessments previously

applied on the corresponding Charge and may charge you a fee for processing the Credit. You must submit

all Charges and Credits under the Establishment Number of the Establishment where the Charge or Credit

originated. A credit shall be issued in the currency in which the original Charge was submitted to us.

b. You must issue Credits to the Card account used to make the original purchase, unless it was made with a

Prepaid Card that is no longer available for the Cardmember's use, or unless the Credit is for a gift that is

being returned by someone other than the Cardmember that made the original purchase, in which case you

may apply your refund policy. Charges and Credits will be deemed accepted on a given business day if

processed by us before our deadline for processing Charges and Credits for that day at the relevant location.

October 2020

15

Merchant Regulations – International

General Policies :: Charge or Credit Records

c. You must not give cash refunds to Cardmembers for goods or services they purchase on the Card, unless

required by law. You must disclose your refund policy to Cardmembers at the time of purchase and in

compliance with Applicable Law.

2.5.1.3 Submitting Charges and Credits – Electronically

a. If you have an electronic POS System, you must submit Charges and Credits electronically over

communication links (Transmissions). Transmissions must comply with the Specifications. We need not

accept any non-compliant Transmissions or Charge Data. You must place additional, less, or reformatted

information on Transmissions within thirty (30) days written notice from us. Even if you transmit Charge

Data electronically, you must still complete and retain Charge Records and Credit Records.

b. If you upgrade your system for Chip Card acceptance for Other Payment Products, you agree to comply with

Specifications that we provide to you to enable Chip Card acceptance.

c. You must ensure your POS System meets all relevant mandates and certification requirements as required

and in accordance with the compliance dates notified to you by American Express, including but not limited

to:

POS Systems need to be American Express Chip/American Express Integrated Circuit Card Payment

Specifications (AEIPS) compliant

Contactless reader POS Systems need to be American Express Expresspay compliant

d. American Express may choose to notify you in writing or via its Merchant Specifications Website

(www.americanexpress.com/merchantspecs

) or its successor website.

e. With our prior approval, you may retain, at your expense, a Processor which (together with any of your other

Covered Parties) you must ensure cooperates with us to enable your Card acceptance. You, and not

American Express, are responsible and liable for any problems, errors, omissions, delays, or expenses

caused by your Processor including in relation to the handling of confidential Cardmember Information; and

for any fees that your Processor charges us or our Affiliates, or that we or our Affiliates incur as a result of

your Processor's system for transmitting requests for Authorisations and Charge Data to us or our Affiliates;

and your Processor's compliance with the Specifications. You must ensure that your Processor has

sufficient resources and security controls to comply with all standards, including but not limited to technical

standards, guidelines or rules including to prevent internet fraud and protect the personal data of the

Cardmember, including data related to Transactions, under Applicable Law. We may bill you for any fees

charged by your Processor or deduct them from our payments to you. You must notify us promptly if you

change your Processor and provide us, on request, with all relevant information about your Processor.

f. Notwithstanding the foregoing, if commercially reasonable and not prohibited by any of your other

agreements, you will work with us to configure your Card Authorisation, submission, and POS System

equipment or systems to communicate directly with our systems for Authorisations and submissions of

Charge Data.

2.5.1.4 Submitting Charges and Credits – Paper

a. If, due to extraordinary circumstances, you are required to submit Charges and Credits on paper, you must

submit Charges and Credits in accordance with our instructions. We are not obliged to agree to paper

submissions and we reserve the right to charge a fee for Charges and Credits submitted on paper. Such fee

will be notified to you in advance.

2.5.1.5 Submission Errors and Adjustments

a. In the event that American Express’ reconciliation of Charges indicates an error (e.g., incorrect calculations,

inclusion of another party’s charge forms, inclusion of invalid Card Numbers), the following procedures will

apply:

i. The adjustment will be calculated in the currency in which the Charges were submitted.

ii. If monies are to due American Express, American Express shall, upon presentation to you or the

Establishment, as applicable, of appropriate documentation substantiating the amount due, deduct

such amount from the payment due to the relevant Establishment, in American Express’ discretion, for

such submission.

iii. Establishments must notify American Express in writing of any error or omission in respect of the

Discount or other fees or payments for Transactions or Chargebacks within ninety (90) days of the date

October 2020

16

Merchant Regulations – International

General Policies :: Retaining Charge and Credit Records

of the statement containing such claimed error or omission, or American Express will consider the

statement to be conclusively settled as complete and correct in respect of such amounts. In the event

monies are due to you or the Establishment, as applicable, American Express shall add the appropriate

amount to payment due for said submission.

2.6 Retaining Charge and Credit Records

a. You must retain the original Charge Record or Credit Record (as applicable) and all documents and data

evidencing the Transaction, including evidence of the Cardmember's consent to it, or reproducible records

thereof, for the full Record Retention Period as defined in Chapter 4, "

Country Specific Policies", from the

later of the date you submitted the corresponding Charge or Credit to us or the date you fully delivered the

goods or services to the Cardmember, or for a different retention period as required by law. If we send you a

request, you must provide a copy of the Charge Record or Credit Record and other supporting documents

and data to us within the Response Timeframe from the date of our request.

2.7 Disputed Charges

a. With respect to a Disputed Charge, unless otherwise indicated by us:

i. we have Chargeback rights, prior to contacting you, if we determine we have sufficient information to

substantiate the Cardmember's claim and resolve the Disputed Charge in their favour; or

ii. we will contact you prior to exercising our Chargeback rights giving you the opportunity to provide a

written response to the dispute.

b. The paragraph above does not apply to Charges subject to the Fraud Full Recourse Programme.

c. We will provide twenty (20) days after the date we contact you or the Chargeback to provide to us a written

response containing the information we request, including the full Card account number, or in the case of

Chargeback, seeking a Chargeback reversal. We have Chargeback rights (or our previous decision to

exercise our Chargeback rights will remain in effect) for the amount of the Disputed Charge if, by the end of

the Response Timeframe, you have not either provided the Cardmember with a full refund or provided us

with the information requested.

d. If we determine, based upon the information provided by you and the Cardmember, to resolve the Disputed

Charge in the Cardmember's favour, or the Cardmember is entitled to withhold payment by law, we will have

Chargeback rights for that Disputed Charge, or our previous exercise of our Chargeback rights will remain in

effect. If we resolve the Disputed Charge in your favour, we will take no further action (if we have not

previously exercised our Chargeback rights) or we will reverse our previous exercise of our Chargeback

rights.

e. The foregoing does not affect procedures under any special Chargeback programmes (such as Fraud Full

Recourse Programme) that apply to you and under which you do not receive inquiries or notices regarding

certain types of Charges prior to our final exercise of our Chargeback rights.

f. If we exercise our Chargeback rights with respect to a Disputed Charge that would have been avoided had

our Card acceptance procedures been followed (an Avoidable Chargeback), we may charge you a fee which

we will notify to you. We will provide you with a list of Avoidable Chargebacks upon request.

g. In the event of a Chargeback, we will not refund the Discount or any other fees or assessments, or we will

otherwise recoup such amounts from you, unless stated otherwise to you by us.

2.7.1 Disputed Charges – European Economic Area

a. If a Disputed Charge relates to a Card issued in the EEA and involves a claim that the Cardmember was not

advised of the full exact amount of the Charge at the time the Cardmember consented to the Transaction, we

reserve the right to reduce the response period to five (5) days from the date on which we contacted you

requesting a written response.

October 2020

17

Merchant Regulations – International

General Policies :: Fraud Prevention Tools

2.7.2 Fraud Full Recourse Programme

a. In all countries in which we operate the Fraud Full Recourse Programme (see Chapter 4, "Country Specific

Policies"), we may put you onto a Fraud Full Recourse Programme for all Charges, if:

i. you engage or participate in fraudulent, deceptive, or unfair business practices, illegal activities, or

permit (or fail to take reasonable steps to prevent) prohibited uses of the Card; or

ii. an Establishment experiences a disproportionately high number or amount of Disputed Charges or

fraud relative to your prior history or industry standards; or

iii. you are in an industry we consider high risk.

b. In countries where Fraud Full Recourse applies (see Chapter 4, "

Country Specific Policies"), we may place

you in a Fraud Full Recourse Programme under which:

i. we may exercise our Chargeback rights without contacting you where a Cardmember disputes a Charge

for actual or alleged fraud; and

ii. you will have no right to request a reversal of our decision to exercise our Chargeback rights.

c. We will have these rights even if we had notice of such defect at the time of payment, you have received an

Authorisation and have complied with all other provisions of the Agreement.

d. We may place you in this programme upon signing, or at any time during the term of the Agreement upon

notice to you.

e. For the avoidance of doubt, if you have been placed on the Fraud Full Recourse Programme, the programme

will apply to all fraud related Cardmember disputes, including disputed Transactions that precede the

application date of the programme to you by up to one (1) year.

2.8 Fraud Prevention Tools

a. As available, you should use our Automated Address Verification (AAV), Address Verification Service (AVS),

Enhanced Authorisation, and CID services (or any other similar fraud prevention tools that we may make

available to you from time to time). These are methods to help you mitigate the risk of fraud but are not

guarantees that a Charge will not be subject to Chargeback. You must be certified for AAV, AVS, and

Enhanced Authorisation in order to use these fraud prevention tools. We may suspend, terminate, amend or

prevent access to the fraud prevent tools at any time, with or without notice to you. We will not be liable and

will have no obligation to you in the event we suspend, terminate, amend, or prevent access to the fraud

prevention tools.

2.9 Strong Customer Authentication

a. If you have Establishments in the EEA, those Establishments must support solutions allowing us to perform

Strong Customer Authentication of the Cardmember for Charges made by Digital Orders. If you fail to allow

us to perform Strong Customer Authentication, Charges made by Digital Orders may be declined.

b. If your Establishments in the EEA accept Charges made by Digital Orders, they should participate in our

American Express SafeKey Programme.

2.10 American Express SafeKey Programme

a. The American Express SafeKey Programme (“SafeKey Programme”) enables Merchants to verify

Cardmembers during the online Authentication process in order to help reduce the likelihood of American

Express Card fraud.

b. The SafeKey Programme does not eliminate online fraud, especially where no authentication occurs. You

must continue to employ other reasonable fraud mitigation practices and continue to perform fraud

screening to mitigate fraud.

c. American Express offers different versions of the SafeKey Programme, supporting different types of

Transactions. Your Establishments must use the version of SafeKey that supports the types of Transactions

you process. For additional information about the American Express SafeKey Programme, please refer to the

relevant SafeKey Implementation Guide, SafeKey Protocol Guide, and Technical Specifications which are

available at www.americanexpress.com/merchantspecs

.

October 2020

18

Merchant Regulations – International

General Policies :: American Express SafeKey Programme

d. To participate in the SafeKey Programme, your Establishments must:

i. complete the required SafeKey technical integration with your SafeKey service provider;

ii. comply with the relevant SafeKey Implementation Guide and the SafeKey Protocol Guide, as may be

updated from time to time, which are available at www.americanexpress.com/merchantspecs

;

iii. provide complete and accurate data for SafeKey Charges, as specified in the relevant SafeKey

Implementation Guide and the SafeKey Protocol Guide and Specifications; and

iv. comply with the SafeKey branding requirements detailed in the American Express SafeKey Logo

Guidelines, available at www.americanexpress.com/merchantspecs

.

e. We may suspend, terminate, amend, or prevent access to the SafeKey Programme at any time, with or

without notice to you. We shall not be liable and shall have no obligation to you in the event we suspend,

terminate, amend, or prevent access to the SafeKey Programme. If you do not agree with the modified or

current SafeKey Programme, you must cease participation.

2.10.1 American Express SafeKey Fraud Liability Shift