Eliminating

Friction in

Fashion Path

to Purchase

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

2

The content herein is based on the primary survey carried out and consequent data provided by Nielsen India on behalf of Facebook India Online Services

Private Limited (“Primary Data”), which has been relied upon while conducting the secondary survey by [KPMG in India] (“KPMG”). KPMG has also

referred to information from public domain and other secondary sources in conducting secondary survey (“Secondary Data”). KPMG has not verified or

investigated Primary Data or Secondary Data and assumes no responsibility for the veracity, accuracy and completeness of such information and will not

be held liable for it under any circumstances. KPMG accordingly disclaims all responsibility and liability for use of such Primary Data or Secondary Data,

including disclaims any warranty for accuracy, veracity, completeness or non-infringement.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. No one

should act on such information without appropriate professional advice after a thorough examination of the particular situation.

In connection with the report or any part thereof, KPMG does not owe duty of care (whether in contract or in tort or under statute or otherwise) to any

person or party to whom the report is circulated to and KPMG shall not be liable to any party who uses or relies on this report. KPMG thus disclaims all

responsibility or liability for any costs, claims, damages, losses, liabilities, expenses incurred by such third party arising out of or in connection with the

report or any part thereof including for any acts of commission or omission therein, howsoever caused.

Although we have attempted to provide correct and timely information, there can be no guarantee that such information is correct as of the date it is

received or that it will continue to be correct in the future.

Use of companies’ names in the report is only to exemplify the trends in the industry. We maintain our independence from such entities and no bias is

intended towards any of them in the report.

The report may make reference to ‘KPMG Analysis’; this merely indicates that we have (where specified) undertaken certain analytical activities on the

underlying data to arrive at the information presented; we do not accept responsibility for the veracity of the underlying data.

The views and opinions expressed herein are those of the interviewees, survey respondents and do not necessarily represent the views and opinions of

KPMG in India.

This study is commissioned by Facebook. Zero Friction Future is intellectual property of Facebook and cannot be used without prior consent.

By reading this report, the reader of the report shall be deemed to have accepted the terms mentioned hereinabove.

Disclaimers

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

3

Friction

Decoded -

Scope of

Opportunity

Friction Mapping -

Understanding

Friction

Zero Friction

Future -

Reimagining

The Purchase

Journey

* Friction to be explained in the forthcoming chapters

Executive

Summary

01

02

03

Friction Busting -

Increasing

Sales Opportunity

With Mobile

04

05

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

4

Executive summary

Sources:

[1] Apparel and Footwear in India, Euromonitor, February 2018; Apparel Accessories in India, Euromonitor, February 2018

[2] India Internet Opportunity, Kalaari Capital Advisors, May 2017

*Apparel includes – Clothing for men, women, children and sportswear

**Fashion accessories include – Footwear, Apparel accessories, jewelry, watches and bags

#

This number can be achieved by reducing the friction, thus increasing the addressable market opportunity

India has emerged as one of the world’s fastest-

growing fashion markets over the past few years. It

is projected to grow at 15 per cent CAGR till 2022

and become a USD102 billion market* for apparel

and a USD155 billion market**

[1]

for fashion

accessories.

The growing penetration of the internet, social media

and e-commerce is now providing the consumers in

tier 2 and below cities increased access to brands

and products. New operating models such as omni-

channel and assisted e-commerce could further fuel

growth and adoption of online commerce. E-tail

today contributes 2 per cent of total retail

[2]

, and is

expected to capture a larger chunk of both organised

and unorganised retail in near future. In such an

evolving and competitive market, it becomes critical

to understand consumer expectations from media

touch-points during the purchase journey.

In this report, we aim to understand the reasons that

lead to dropouts in the path to purchase of apparel

and fashion accessories, referred to as ‘friction’,

which may lead to potential loss of revenue for the

brands.

With reduced attention span, increased connectivity

and acceptance of new technology, consumers are

demanding everything with limited effort at a click of

a button and any change in the expectation can

cause them to abandon the purchase journey. To

understand the path to purchase and friction at

different stages of the purchase journey, a random

listing study was conducted by Nielsen India on

3,000 respondents to understand the proportion of

the population that falls at each stage of the journey,

and a further deep-dive study was conducted among

1,025 respondents in the fashion category across

varied demographic and socio-economic groups.

KPMG in India also interacted with industry experts

to obtain their perspective on the possible solutions

to eliminate friction and improve conversion rates.

Our research indicates that

• In the apparel category, 19 per cent of

consumers drop out due to friction, and more

than two-thirds of this friction is caused by the

media

• In the fashion accessories category, 22 per cent

of consumers drop out due to friction, and around

two-thirds of this friction is caused by media

• Mobile platforms are expected to influence more

than two-thirds of both apparel and fashion

accessories purchases by 2022

• Facebook is expected to influence more than half

of mobile-influenced purchases for both apparel

and fashion accessories by 2022

• Mobile-enabled purchase journeys of apparel are

14 per cent shorter than offline journeys

• Mobile-enabled purchase journeys of fashion

accessories are 25 per cent shorter than offline

journeys

• Mobile could help apparel brands to tap into

potential sales opportunity of ~USD5 billion

#

by

reducing media friction

• Mobile could help fashion accessory brands to

tap into potential sales opportunity of ~USD9

billion

#

by reducing media friction

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

5

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

6

Consumption in India is undergoing a gradual, yet tectonic shift. Consumer expenditure in India is expected to grow at 12 per cent year-on-year till 2022

[1]

, driving the

consumption of the growing urban population, two-thirds of which lives in 400+ tier 2 and below cities

[2].

Therefore, aspirational demand for branded products from these new

geographies is expected to surge over the next few years. Reaching these consumers through traditional brick-and-mortar route forces the brands to incur heavy capital

investments. Further, with growing access to digital content, consumers today are increasingly updated with the latest fashion trends. Online shopping options and virtual

showrooms are already revolutionising consumers’ shopping journey. In order to tap the emerging opportunities, organisations are deploying unique strategies to penetrate

new markets and differentiate their offerings.

Trends shaping the Indian fashion industry

Rise of content-based commerce

[3]

Emergence of assisted commerce

[3]

Evolving fashion trends of Indian consumers

[4]

Omni-channel for balancing consumers’ expectations

Brands have realised the power of social media and are increasingly leveraging

these platforms that support interactions among users, encourage their

contribution and provide advocacy from influencers. High engagement purchase

categories have found stronger merit in social commerce as it accentuates trust,

referrals and connects with a relatable community.

Micro-targeting by brands through online-only strategy

[3]

Traditional brick-and-mortar brands are adopting digital channels for engaging

with and selling to Indian consumers while defending their competitive

positioning.

Building online brands is helping companies to not only reach a wider

audience, but also test the market before committing to a large-scale

investment.

With similar objectives, established global brands, such as Under Armour,

Bjorn Borg and Replay, are entering India through online-only routes to cater

to their target consumers at minimal investments.

Business models that leverage the existing physical retail network of local

merchants or kiraana stores have emerged to penetrate the 67 per cent of

population that is either not connected to the internet, or have no means to

access aspirational products that do not reach them due to logistical challenges.

Both traditional and internet businesses can adopt such strategies to tap into the

less-penetrated markets of today, and lock these potential consumers to their

brand(s) for tomorrow.

While online platforms allow convenience, information and assortment,

traditional retail allows touch-and-feel and comfort of face-to-face interaction with

brand or store representative.

However, brands — both e-commerce and traditional – have realised the power

of integrating the two channels. Omni-channel is now observed as not only the

means to win consumers, but also the path to higher profitability.

The fashion spectrum in India is evolving where the affluent wants the latest to

keep up with fashion trends, and the masses look for more aspirational

products that offer value for money.

Secondly, the growing propensity of Indian consumers towards fast-fashion is

allowing the brands and retailers to sell their products year-round.

Thirdly, custom-fit apparel have begun gaining popularity again, and premium

brands are targeting niche customers with both made-to-measure and bespoke

fit offerings.

Indian language internet users to drive next wave of growth

India is expected to see a four-fold growth in the number of Indian language e-

tailing users between 2016 (42 million) and 2021 (165 million). By 2021, the

number of Hindi internet users is expected to be more than English users

[3]

.

E-tailers could realise their next big growth-wave by targeting these vernacular

language internet users by creating local content and engaging with them in

the language of their choice.

Sources:

[1] Economies and Consumers Annual Data, Euromonitor, July 2018

[2] India Internet Opportunity, Kalaari Capital Advisory, May 2017

[3] #India Trends 2018: Trends Shaping Digital India, KPMG-YourStory-NASSCOM-Kalaari Report, May 2018

[4] Seven consumption trends that will define the future of Indian apparel industry, Wazir Advisors, 2016

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

7

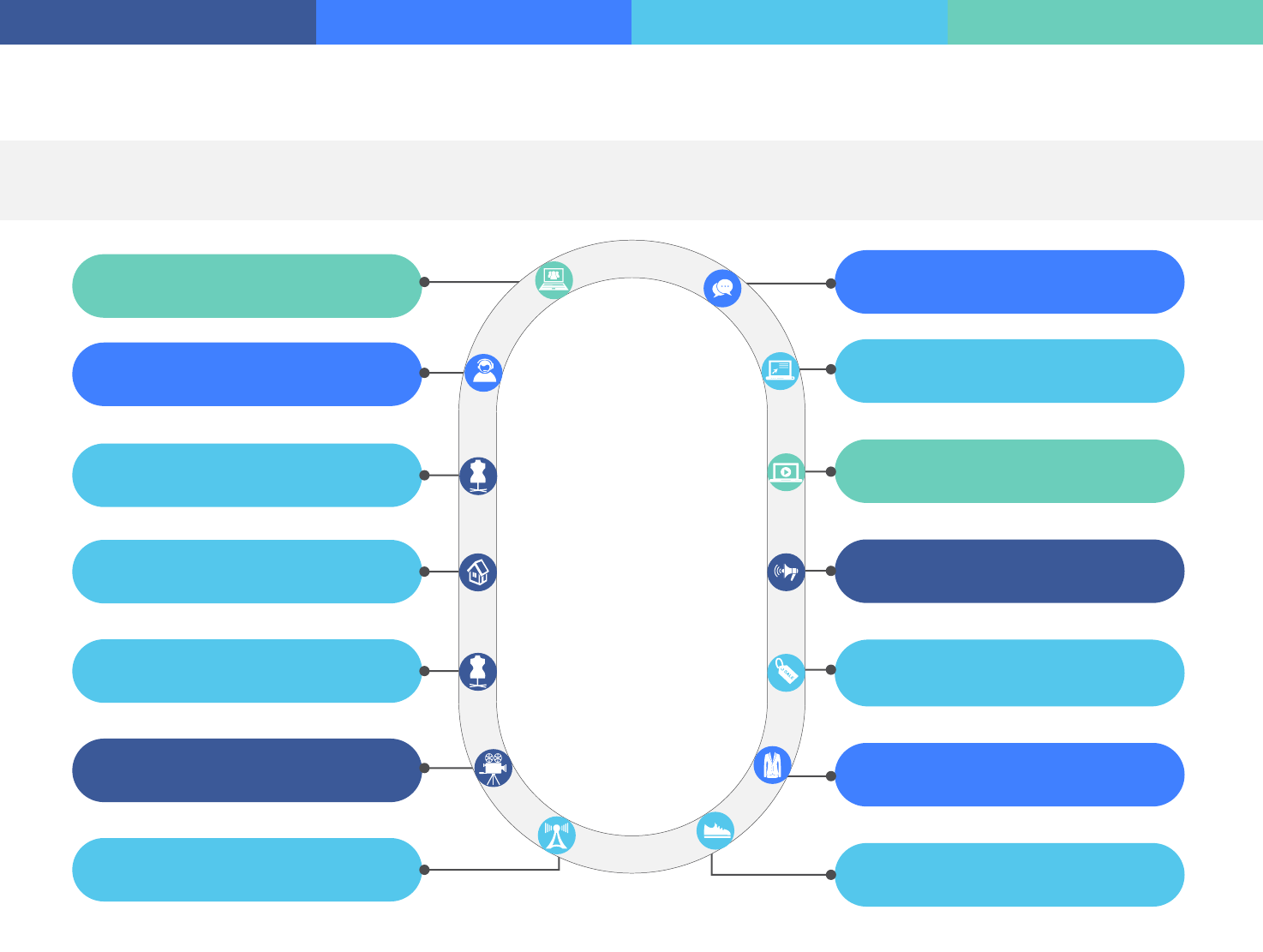

Understanding the varied dimensions of today’s fashion consumer

My attention

My motivation

My connection

My watch

My wallet

Motivational

characteristics

that drive behaviours

and expectations

How consumers balance

constraints of time and

how they change across

life events

The ways consumers

direct their attention

and focus

How consumers connect

to devices, information

and each other

How consumers adjust

their share of wallet

across life events

Understanding the fashion consumer through 5Mys framework

Source:

Me, my life, my wallet report, KPMG International, 2017

• Brand community events

and support

• Word of mouth online via

fashion blogs

• On-demand availability

of apparel/fashion

accessories (rent/custom

made)

• Referrals from friends

and family

• Peer reviews and

suggestions

• Aspirational vs. functional

apparel/fashion

accessories – ones for

‘my need’ and for ‘my

wallet’

• Off-season sale/discount

• Bundled offers on fashion

accessories and apparel

• Rental options for luxury

apparel or fashion

accessories

• Channel specific

discounts

• Targeted communication

• Relevant information

• Channel and media of

choice

• Customised offers

and(or) payment modes

• Popular trends or fashion

fads

• Customised season-

specific offers

• Occasion-based needs,

e.g., festivals, weddings,

celebrations

• Fashion as a status

symbol

• Celebrity endorsements

• Seasonal preferences e.g.

linen clothes during

summers

• Functional purchases

such as sportswear, gym-

wear, etc.

• Emotion based purchase

e.g. eco-friendly or

organically made clothes

• Fast access to new

designs and styles

• Innovative models such

as ‘Buy Online, Pickup In

Store’

• Home pick-up in case of

replacement and delivery

• Eliminating wait time

using virtual changing

rooms

• Content for consumer

stickiness with brand(s)

Wallet-shareMind-share Time-share

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

8

Friction Decoded -

Scope of Opportunity

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

9

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

10

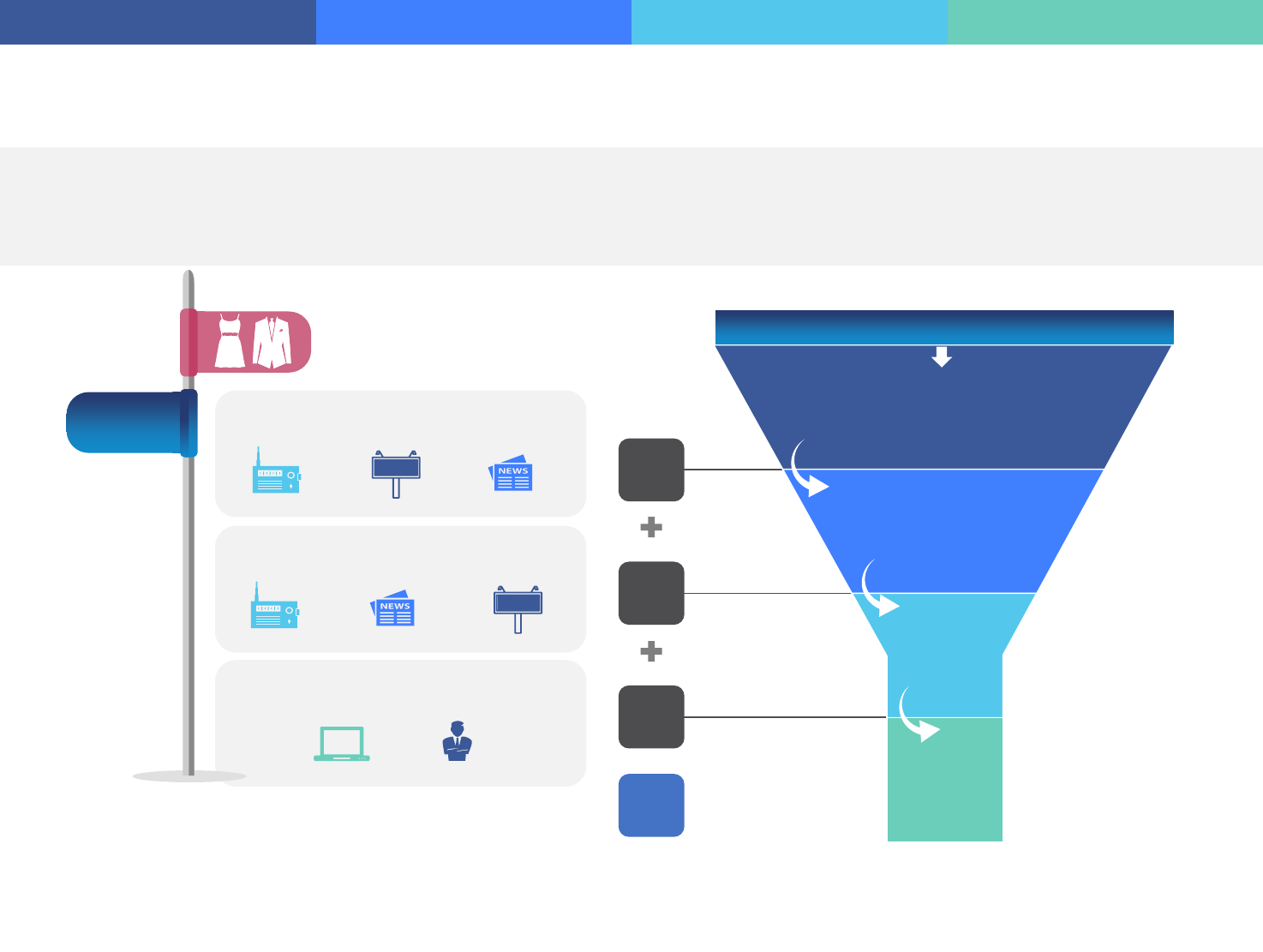

Understanding and defining friction

The traditional path to purchase is undergoing transformation

with the advent of technology, smartphones and digital

assistants, and is expected to be replaced by personalised

journeys.

Today’s consumer expects and demands convenience, speed,

automation and simplicity that weren’t possible a few years

ago. Any unnecessary additional effort, incremental step or

inconvenience that leads the consumers to abandon their

purchase journey is defined as ‘friction’.

Friction may occur offline or online, and includes subjecting

consumers to unnecessarily wait, queue, click, type, tap, add

information or fill in forms. On their journey, they may also have

to load, buffer, switch channels/windows or hold for service. It

can hinder efficiency, impact consumer experience and in turn,

the consumer purchase journey. Any friction that is primarily

caused by a media touch-point is defined as ‘Media friction’.

Research shows that consumer pain points that lead to friction

can occur across three main stages of the consumer journey:

awareness, consideration and intent as listed below.

Businesses may be offering friction unknowingly, hindering

efficiency and in turn, the consumer journey.

• Awareness Friction: Every touchpoint or missing

touchpoint that requires the consumers to make any effort

to discover a brand

• Consideration Friction:: Every touchpoint or missing

touchpoint that requires the consumers to make any effort

to consider a brand

• Intent Friction:: Every touchpoint or missing touchpoint

that requires the consumers to make any effort to purchase

a brand

Awareness

Consideration

Intent

Purchase

Discovering the

product and identifying

the need

Gathering information and

decision-making

parameters to narrow the

consideration set

Displaying realistic intention to

purchase and understanding the

purchase process

Completing the transaction

Buyer

Post

Purchase

Consideration

friction

Intent friction

First time purchaser

of a fashion product

Repeat purchaser of

a fashion product

Potential buyer

Path-to-purchase (P2P)

Awareness

friction

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

11

Awareness

Consideration

Intent

Purchase

Post

Purchase

Discover models,

brands and

categories

Research trends on

social media, vlogs,

blogs, magazines,

etc.

Compare styles/brands

on different portals or

websites

Seek

opinions

Visit

showroom

Seek expert

views

Visit brand

website/e-

commerce

portal or

app

Check for payment

options

Make a

purchase

Recommend/

review

Contact

customer

service/

customer care

for exchange or

replacement

• The ad content does not appeal to the consumer, or a potentially ‘good’ ad

content displayed at a time that caused ‘inconvenience’ to the consumer

• The consumer is targeted with an ad that is not relevant to him/her

• Ad content is not appealing in terms of design/colour/graphics or offer

negative reviews or coverage about the item or brand in media and(or)

other channels

• Desired brand or style is out-of-stock at the beginning of the purchase

journey itself

• The prospects learns about hidden terms and conditions on offers

communicated in advertisements

An apparel/fashion accessories buyer’s friction areas

Fashion needs identified –

Utilitarian (Use based) or

Hedonic (Pleasure/Status)

Check for fit and size

variations

• Opinion of peers differ from the prospect’s perception

• Limited community or influencer view on the selected item

• Showroom of the shortlisted brand is not in vicinity of the prospect

• The required size/colour is not available in the store/portal

• Sales representative is not able to assist the prospect

• The apparel’s look and feel does not match expectations from

advertisements across media channels

• Consumers not sure how the apparel or fashion accessories fit them, since

catalogue displays only attractive models

• Consumer travels long distance at the cost of his/her daily schedule to

visit the store

• No arrangement for alteration of the product

• Sales representative fails to provide information to the consumer for

size/colour/material

• Experience at the showroom was not pleasant or up to the consumer’s

expectations

• Competing brand provided a better offer

• Preferred payment options are not available

• Product delivered differs from what was displayed on the online catalogue

Decoding a fashion buyer’s journey and friction across purchase stages

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

12

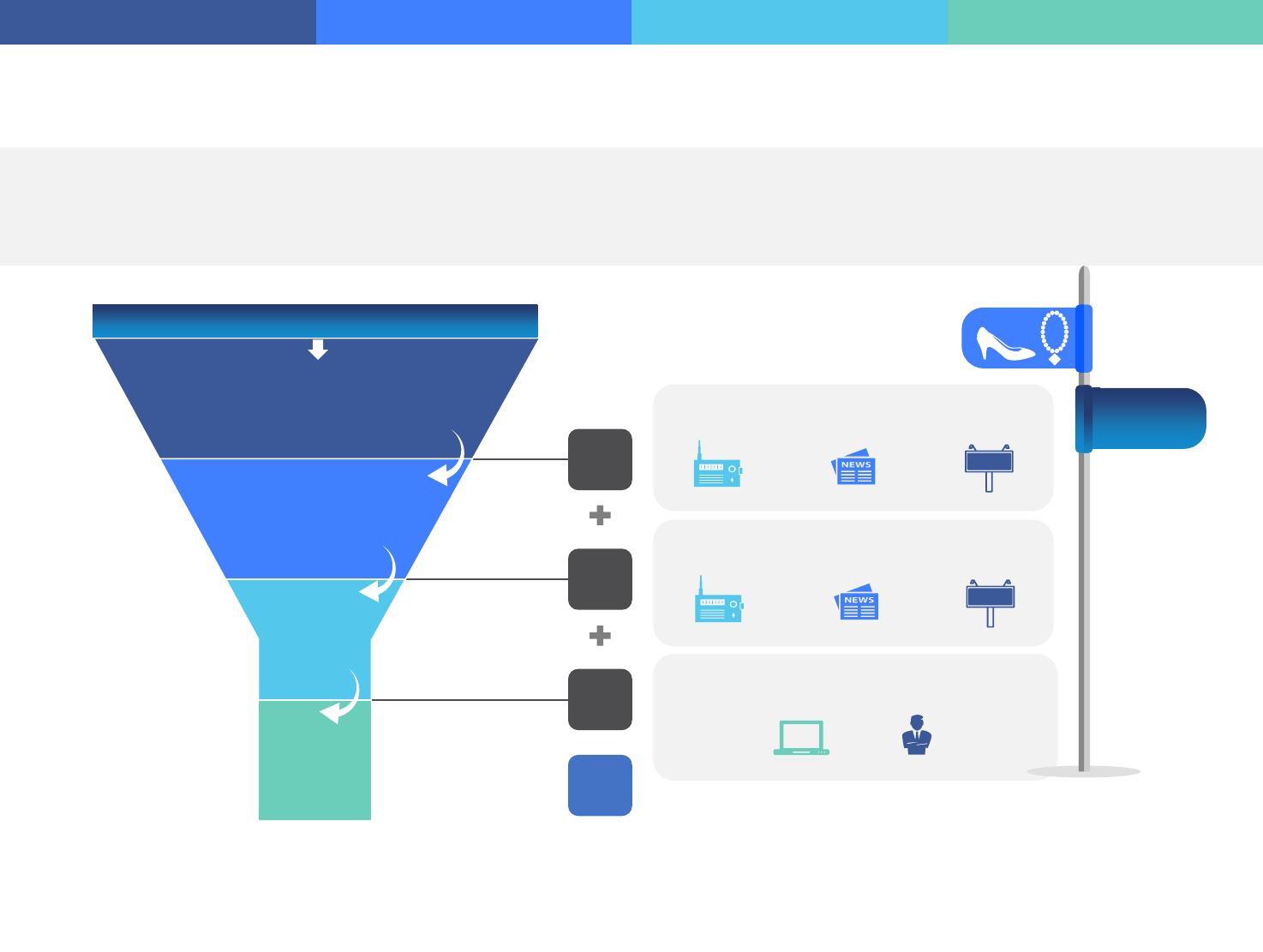

Media friction accounts for more than two-thirds of total friction in the

apparel purchase journey

• 'Deep Dive is only among 86 per cent of the population who are Aware Decision

Makers for Apparel and Accessories categories each

• At intent stage, only retail store and online touch-points were evaluated in media

mix to calculate friction

• Apparel Buyers – Aware Decision Makers who have purchased or tried to purchase a

clothing apparel in the last 3 months

• Apparel Considerers – Aware Decision Makers who have considered purchase of a clothing

apparel in the last 3 months but have yet not purchased

• Apparel Aware Non-considerers – Aware Decision Makers who have not considered

purchase of a clothing apparel in the last 3 months

In a highly penetrated apparel market, nearly one out of five buyers abandon the purchase during some stage of the purchase journey. Such dropout could be on account

of unavailability of desired product, hidden charges, compulsory registration, stock-out or any other dissatisfaction caused by media touch-point(s).

More than a two-thirds of friction loss is driven by dissatisfaction with media touch-point(s) across the purchase journey. Friction is observed the most at the final stage of

the journey, where highest media friction is experienced. Despite heavy focus of leading e-commerce platforms on bottom of the pyramid oriented marketing campaigns

[1]

,

media friction remains highest (8 per cent) at intent stage.

Source:

[1] How e-commerce companies make you spend more, YourStory, April 2017

3%

10%

19%

Media

friction

2%

8%

2%

12%

Total

friction

Consumers who are unaware of the category, or are

not primary decision makers/influencers

Awareness

friction

Aware decision

makers & influencers

Consideration

Intent

86%

77%

Purchase

Consideration

friction

Intent

friction

80%

67%

Total population – 100%

=

=

14%

Base = 547

Apparel

6%

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

13

• 'Deep Dive is only among 86 per cent of the population who are Aware Decision Makers

for Apparel and Accessories categories each

• At intent stage, only retail store and online touch-points were evaluated in media mix to

calculate friction

• Accessories Buyers – Aware Decision Makers who have purchased or tried to purchase a

male and(or) female fashion accessories in the last 3 months

• Accessories Considerers – Aware Decision Makers who have considered purchase of a

male and(or) female fashion accessories in the last 3 months but have yet not purchased

• Accessories Aware Non-considerers – Aware Decision Makers who have not considered

purchase of a male and(or) female fashion accessories in the last 3 months

Base = 478

Fashion accessories is a high-engagement category, where consumers seek to evaluate how watches, jewelry or footwear look or fit in terms of size, and style or design.

Despite this, nearly half of the total friction loss is observed at the intent stage, where consumers evaluate last minute offers and prices. Also, campaigns by the brands

targeted at creating awareness at top of the funnel drive consumers towards the brand at the point of sale. Further, contribution of media to friction is 80 per cent at intent

stage and nearly half at the top of the funnel. Brand building content and advocacy can plug friction at top of the funnel, while improved efficiency in media and point of sale

is needed to close the larger gap of intent stage friction.

Media friction accounts for 60 per cent of total friction in the fashion

accessories purchase journey

4%

8%

10%

Media

friction

3%

8%

2%

22% 13%

Total

friction

Consumers who are unaware of the category, or

are not primary decision makers

Awareness

friction

Consideration

Intent

Purchase

Consideration

friction

Intent

friction

78%

74%

64%

Total population – 100%

=

=

14%

Accessories

Aware decision

makers & influencers

86%

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

14

Apparel

Mobile could help apparel brands to tap into potential sales opportunity

of approximately USD5 billion by reducing media friction

Media friction can impact marketing ROI and significantly hit a brand’s bottom line. The loss of even a single prospect can add to revenue loss, more so in case of luxury or

high-end fashion market. Each and every sale counts, and according to this study mobile has the potential to reduce media friction by 3 percentage points, creating a sales

opportunity of about USD5 billion between apparel brands

[1][2]

. Based on this study, currently, nearly half of apparel purchases are influenced by mobile, and by 2022, nearly

two out of three apparel purchases would be influenced by mobile. In addition, the reduction in media friction could accelerate the growth in fashion e-commerce. Hence, it

becomes imperative for marketers to strengthen their media mix by enhancing marketing activities on mobile.

Media friction

observed in

purchase journey

12%

Estimated media

friction in

purchase journey

~9%

By reducing media friction with mobile, apparel brands can tap into a

~USD5 billion* opportunity

Note: Potential opportunity estimated by KPMG India is based on the potential reduction in consumer dropout. Modelling for reduction in

dropouts is based on the potential friction reduction, which may get impacted due to the usage of mobile-based media.

*This number can be achieved by reducing the friction, thus increasing the addressable market opportunity

Source:

[1] Apparel and Footwear in India, Euromonitor, February 2018

[2] KPMG in India's analysis, 2018 based on data obtained from multiple industry reports and primary survey conducted by Nielsen, 2018

2017

2022

e

Enhancing mobile in

media mix

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

15

Accessories

Mobile could help accessories brands tap into potential sales

opportunity of approximately USD9 billion by reducing media friction

Mobile has the ability to reduce media friction, and by enhancing mobile in the media mix, brands can improve the conversion rate. Mobile not only helps add additional

revenue, but also enhances the customer experience leading to more satisfied consumers. In case of fashion accessories, mobile can reduce media friction by nearly 4

percentage points, creating a sales opportunity of about USD9 billion between the fashion accessories brands

[1][2]

. Currently, more than half of fashion accessories

purchases are influenced by mobile, and by 2022, more than 70 per cent of such purchases would be influenced by mobile.

Media friction

observed in

purchase journey

13%

Estimated media

friction in

purchase journey

~9%

Note: Potential opportunity estimated by KPMG India is based on the potential reduction in consumer dropout. Modelling for

reduction in dropouts is based on the potential friction reduction, which may get impacted due to the usage of mobile-based media.

*This number can be achieved by reducing the friction, thus increasing the addressable market opportunity

Source:

[1] Apparel and Footwear in India, Euromonitor, February 2018; Apparel Accessories in India, Euromonitor, February 2018

[2] KPMG in India's analysis, 2018 based on data obtained from multiple industry reports and primary survey conducted by

Nielsen, 2018

2017

2022

e

By reducing media friction with mobile, fashion accessories brands can tap into a

~USD9 billion* opportunity

Enhancing mobile in

media mix

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

16

Friction Mapping -

Understanding

Friction

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

17

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

18

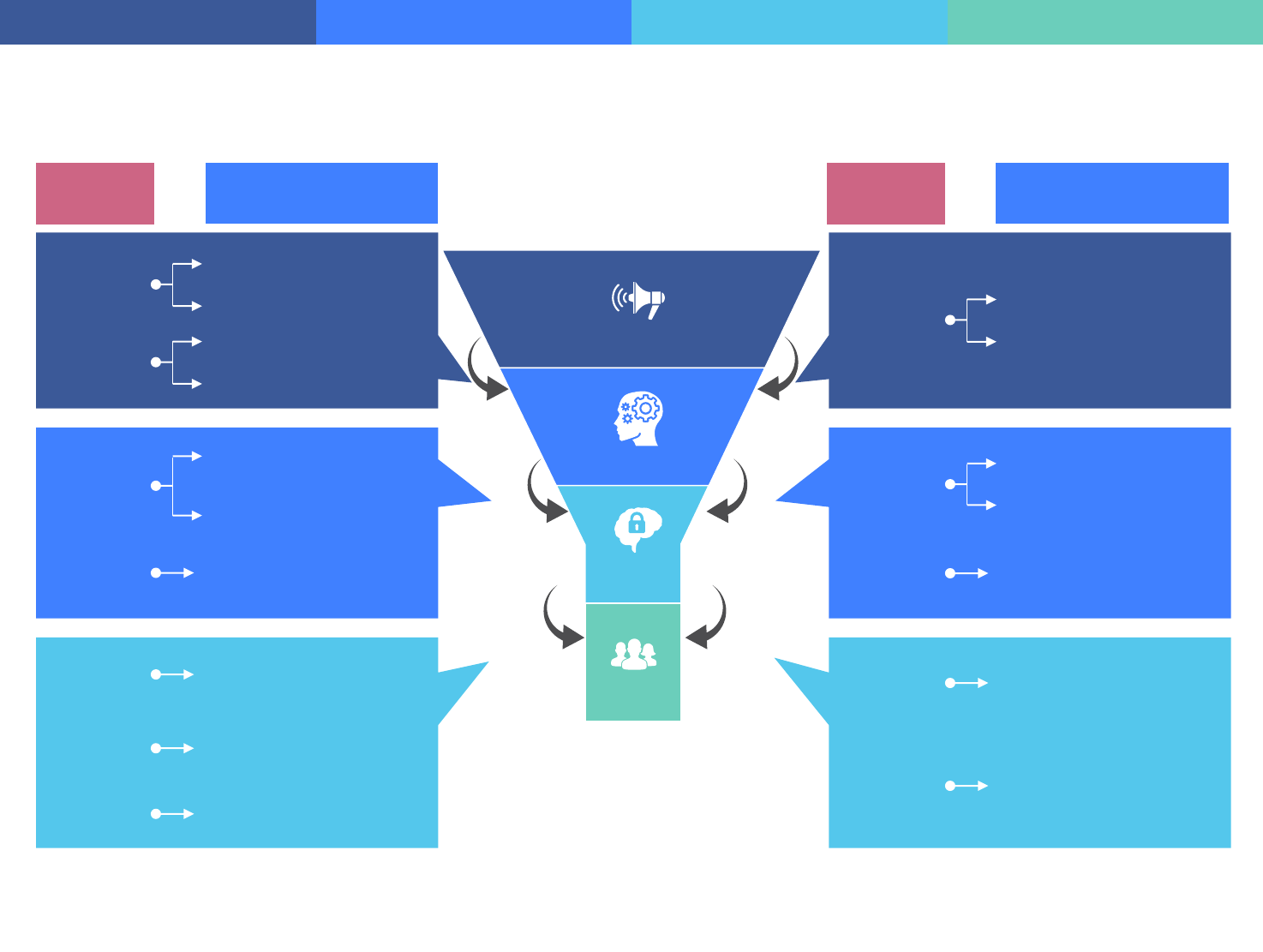

Consumers expect more information and clarity on next steps at the top of the funnel, where traditional media such as print, outdoor and radio are relatively less efficient.

Further, two-thirds of media-led friction occurs at intent stage of the purchase journey. While consumers are most comfortable in physical browsing and trial of apparel at

stores, the survey revealed that nearly one-third of the consumers at retail stores found a better product, brand, or price elsewhere. A similar behaviour was observed for e-

commerce portals, where the proportion of consumers facing friction shows an increasing trend from one in five at the awareness stage, to nearly one-third at intent stage.

This indicates that while e-commerce platforms provide relevant information, they lack the ability to drive the final transaction efficiently.

Base = 547

Apparel Buyers – Aware Decision Makers who have purchased or tried to purchase a clothing

apparel in the last 3 months

Apparel Considerers – Aware Decision Makers who have considered purchase of a clothing

apparel in the last 3 months but have yet not purchased

Apparel Aware Non-considerers – Aware Decision Makers who have not considered

purchase of a clothing apparel in the last 3 months

Note: * At intent stage, only retail store and online touch-points were evaluated in the research to eliminate default

attribution to top-of-mind channels

** Online includes top five media touch points accessed by respondents at respective stage of the journey

Top 3 friction-causing media at Awareness stage

Top 3 friction-causing media at Consideration stage

Top friction-causing media at Intent stage*

Outdoor PrintRadio

PrintRadio

Online** Retail Store

Media

friction

2%

8%

2%

12%

Consideration

Intent

86%

77%

Purchase

Consideration

friction

Intent

friction

80%

67%

Total population – 100%

Awareness

friction

Aware decision

makers/influencers

=

86%

74%

70%

90%

89%

Outdoor

85%

74%

57%

Apparel

More than 8 out of 10 people face friction on print, outdoor and radio at

the top of the apparel purchase funnel

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

19

Base = 478

Static media touch points such as print, radio and outdoor offer the highest friction at the top of the funnel. Although these media touch-points are best suited for creating

‘brand awareness and recall’ among the target consumers, they are less suited for providing further information to the consumers. Online channels, on the other hand,

perform better as source of more information or as point of sale. Not only can online platforms attract attention of consumers through contextualised and targeted

communication, but can also provide detailed product information with convenience of home delivery. However, in terms of transactions, only 20 per cent of buyers reported

using e-commerce for purchase of fashion accessories, indicating an opportunity for the brands to further leverage digital channels for improving their reach among target

consumers.

Accessories Buyers – Aware Decision Makers who have purchased or tried to purchase

a male and(or) female fashion accessories in the last 3 months

Accessories Considerers – Aware Decision Makers who have considered purchase of a

male and(or) female fashion accessories in the last 3 months but have yet not

purchased

Accessories Aware Non-considerers – Aware Decision Makers who have not considered

purchase of a male and(or) female fashion accessories in the last 3 months

Note: * At intent stage, only retail store and online touch-points were evaluated in the research to eliminate default

attribution to top-of-mind channels

** Online includes top five media touch points accessed by respondents at respective stage of the journey

Media

friction

3%

8%

2%

13%

Consideration

Intent

86%

74%

Purchase

Consideration

friction

Intent

friction

78%

64%

Total population – 100%

Awareness

friction

Aware decision

makers/influencers

=

Top 3 friction-causing media at Awareness stage

Top 3 friction-causing media at Consideration stage

Top friction-causing media at Intent stage*

PrintRadio

PrintRadio

Online** Retail Store

72%

64%

93%

92%

Outdoor

72%

67%

47%

Outdoor

57%

Accessories

Print, outdoor and radio cause dissatisfaction to nearly 7 out of 10

people in fashion accessories purchase funnel

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

20

Both genders display different drivers for entering the purchase funnel. Men seek clear next steps after watching an advertisement. On the other

hand, women are more susceptible to ignoring ads if they fail to either capture their attention or provide relevant information. As the prospects move

ahead in the purchase journey, offer communication and better ‘value for money deals’ become important decision-making parameters for both

genders. At the intent stage, consumers lack trust with point of sale on account of product authenticity, delivery and payment. However, consumers

are much more likely to switch brand/sales channel at retail stores, as they are significantly more likely to find better price, product or fit elsewhere.

5%

11%

4%

Male

Female

Prospect does not know

what to do next after

watching ads

Prospect finds too little

information from ads

Offer communication is not

clear

Prospect does not find

requisite information

Prospect found a better

price/option elsewhere

Lack of trust at point of sale

5%

10%

3%

Prospect found a better

price/option elsewhere

Lack of trust at point of sale

Prospect finds too little

information from ads

Prospect did not pay

enough attention to ads

Offer communication is not

clear

Prospect does not trust the

medium as source of

information

Note: * At intent stage, only retail store and online touch-points were evaluated in the research to eliminate

default attribution to top-of-mind channels

18%

Media friction (%)

Media friction (%)

Media friction (%)

Media friction (%)

Media friction (%)

Media friction (%)

17%

25% 22%

17%

37%

37%

17% 17%

=

20%

=

18%

Aware decision makers/

influencers

Consideration

Intent

Purchase

Total population – 100%

Consideration

friction

Intent friction

84%

79%

76%

66%

Awareness

friction

Consideration

friction

Intent friction

88%

83%

79%

68%

Awareness

friction

28%

‘Value for money’ and ‘credible information’ at point of sale are

common asks for both men and women

Legend

Outdoor Print Television Digital Medium*

Media with highest contribution to top two friction points

Retail store

Radio

Apparel

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

21

Consideration

friction

Intent friction

Awareness

friction

Consideration

friction

Intent friction

Awareness

friction

Note: * At intent stage, only retail store and online touch-points were evaluated

in the research to eliminate default attribution to top-of-mind channels

8%

4%

4%

7%

12%

4%

A similar proportion of target population of men and women commences purchase journey of fashion accessories. Primary reasons for abandoning the

purchase are same for men and women. However, women are more sensitive to price of the product and trust at the point of sale. Men, on the other hand,

are more likely to ignore an advertisement at top of the funnel, but seek lucrative offers and detailed information for evaluating their shortlisted products.

Further, the tendency of consumers to switch to another product or brand is significantly higher at offline stores. Of the total, 41 per cent men and 33 per

cent women are likely to find an option of the product elsewhere when buying at retail stores. On the other hand, brand or product loyalty is observed to be

higher at online stores among both genders.

Prospect finds too little

information from ads

Prospect did not pay attention to

the ads

Offer communication is not clear

Prospect does not find requisite

information

Prospect found a better

price/option elsewhere

Lack of trust at point of sale

Prospect found a better

price/option elsewhere

Lack of trust at point of sale

Prospect does not know what to

do next after watching ads

Prospect finds too little

information from ads

Offer communication is not

clear

Prospect does not find

requisite information

11% 19%

24% 22% 16%

11%

16%

23%

20%

Media friction (%)

Media friction (%)

Media friction (%)

Media friction (%)

Media friction (%)

Media friction (%)

=

16%

=

23%

Aware decision makers/

influencers

Consideration

Intent

Purchase

Total population – 100%

84%

77%

73%

61%

88%

80%

76%

72%

19% 35%

27%

Women are more sensitive to the price of product and lack trust at

point of sale

Legend

Outdoor Print Television Digital Medium*

Media with highest contribution to top two friction points

Retail store

Radio

Male

Female

Accessories

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

22

Although e-commerce advertising is often targeted towards younger age groups, similar number of potential consumers across older age groups also enter and

complete the purchase journey. Unlike younger consumers, 35-49 year-olds are more sensitive to inaccurate targeting of ads, or lack of clear call-to-action.

However, younger age group of 18-24 year olds has a higher propensity to drop out at the intent stage.

Consumers from all age groups display discontent for lack of options to compare, lack of attractive offers and expectation mismatch at point of sale. This

creates an opportunity for e-commerce players to deploy a full-funnel marketing strategy by addressing such friction points. Brand’s marketing communication

strategy implemented in tandem with e-commerce strategy, could capture leads at top of the funnel and facilitate their movement through the purchase funnel.

Note: * At intent stage, only retail store and online touch-points were evaluated in the research to

eliminate default attribution to top-of-mind channels

Friction points

for 35-49 years

Prospect finds too little

information from ads

Prospect does not know what

to do next after watching ads;

and prospect did not pay

attention to the ads

Prospect does not trust the

medium as source of

information

Prospect does not find

requisite information

Prospect found a better

price/option elsewhere

Prospect found it difficult to

express interest/buy

instantly

Friction points

for 25-34 years

Prospect does not know what to

do next after watching ads

Prospect did not pay enough

attention to ads

Offer communication is

not clear

Prospect does not trust

the medium as source of

information

Prospect found a better

price/option elsewhere

Lack of trust at point of sale

Friction points

for 18-24 years

Prospect finds too little

information from ads

Prospect does not know what

to do next after watching ads;

and prospect did not pay

attention to the ads

Offer communication is not

clear

Prospect does not find

requisite information

Lack of trust at point of sale

Prospect found a better

price/option elsewhere

21% 40% 20% 20%

28% 23% 44% 35% 29%36%

14% 21%

24%

Consideration

Intent

88%

84%

80%

Purchase

68%

86%

79%

76%

67%

18–24 years

3%

9%

25–34 years 35–49 years

Aware decision

makers/influencers

84%

81%

77%

68%

4%

3%

9%

Total population

100%

Total population

100%

Total population

100%

4%

4%

12%

= =

16% 19%20%

7%

Media friction (%)

22% 24%

40%

Legend

Outdoor Print Television Digital Medium*

Media with highest contribution to top two friction points

Retail store

Radio

Apparel

All age groups seek product assortment with attractive offers and

assured authenticity

Media friction (%)

Media friction (%)

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

23

Highest friction in fashion accessories purchase across all age groups is observed at the top of the funnel. The age group of 35-49 years distinctly show

dissatisfaction with print advertisements in terms of gathering information or understanding next steps in the purchase journey. This age group also

seeks more assistance in decision making, and is less likely than younger age groups to abandon the purchase at the bottom of the funnel. The age

group of 18-24 years abandon the purchase at the awareness stage itself, because the advertisement fails to both capture their attention and provide

call-to-action. Further, all age groups demand competitive pricing and assurance of quality from the sales channel they purchase from.

Friction points

for 35-49 years

Prospect does not know

what to do next after

watching ads

Prospect finds too little

information from ads

Prospect does not find

requisite information

No expert advice/answers

available

Prospect found a better

price/option elsewhere

Lack of trust at point of

sale

Friction points

for 25-34 years

Prospect finds too little

information from ads

Prospect does not know what

to do next after watching ads

Offer communication is

not clear

No expert advice/answers

available

Prospect found a better

price/option elsewhere

Lack of trust at point of sale

Friction points

for 18-24 years

Prospect does not know what

to do next after watching ads

Prospect did not pay enough

attention to the ads

Prospect does not find

requisite information

Offer communication is

not clear

Prospect found a better

price/option elsewhere

Lack of trust at point of sale;

and it was difficult express

interest or buy instantly

Note: * At intent stage, only retail store and online touch-points were evaluated in the research to eliminate default

attribution to top-of-mind channels

27% 11% 29% 22% 41% 17%

9% 26% 33% 20%

19% 25% 15%

Consideration

Intent

89%

80%

76%

Purchase

72%

86%

77%

73%

68%

18–24 years

4%

5%

25–34 years 35–49 years

Aware decision

makers/influencers

84%

78%

74%

71%

4%

6%

3%

Total population

100%

Total population

100%

Total population

100%

9%

4%

4%

= =

13% 18%17%

9%

Media friction (%)

29%20%

Accessories

Across age groups, more than 1 in 3 consumers shopping at retail

stores are likely to change their accessories purchase decision

Media friction (%)

Media friction (%)

Legend

Outdoor Print Television Digital Medium*

Media with highest contribution to top two friction points

Retail store

Radio

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

24

Both NCCS A and NCCS B* consumers display comparable tendency to enter and complete the apparel purchase journey. However, more than three-fourths

of prospects abandon the purchase at either the awareness or intent stage.

Further, the spending patterns evolve from need or utility based for NCCS B consumers, to hedonic for NCCS A consumers. At the top of the funnel, NCCS B

consumers tend to ignore advertisements that do not resonate with their needs. Further, although e-commerce advertisements are more often focused on

NCCS A consumers, NCCS B consumers are 34 per cent more likely to purchase apparel online than NCCS A consumers, thereby offering an additional

source of growth to e-commerce players. While network robustness could improve gradually, innovative solutions such as an offline shopping mode on e-

commerce apps and assisted e-commerce could curb a significant portion of final-stage friction loss arising due to weak internet connectivity.

4%

10%

4%

Prospect finds too little information

from ads

Prospect does not know what to

do next after watching ads

Offer communication is not clear

Prospect does not find requisite

information

Prospect found a better

price/option elsewhere

Lack of trust at point of sale

7%

8%

5%

Lack of trust at point of sale

Connectivity issue impacting

experience

Prospect did not pay enough

attention to ads

Prospect does not know what to do

next after watching ads

Prospect does not find requisite

information

Offer communication is not clear

Note: At intent stage, only retail store and online touch-points were evaluated in the research to eliminate

default attribution to top-of-mind channels

*NCCS- New Consumer Classification System

30%

Media friction (%)

Media friction (%)

28% 30% 19%

21%

32%

28%

19%

14%

21%

=

18%

=

20%

Aware decision makers/

influencers

Consideration

Intent

Purchase

Total population – 100%

Consideration

friction

Intent friction

87%

80%

75%

67%

Awareness

friction

Consideration

friction

Intent friction

85%

81%

77%

67%

Awareness

friction

Media friction (%)

Media friction (%)

31%

Apparel

Legend

Outdoor Print Television Digital Medium*

Media with highest contribution to top two friction points

Retail store

Radio

Media friction (%)

Media friction (%)

Poor connectivity and lack of trust at point of sale inhibit mobile-driven

purchase journeys of NCCS B consumers

NCCS A NCCS B

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

25

7%

4%

3%

10%

4%

5%

NCCS B* consumers are more likely to abandon purchase of fashion accessories after entering the purchase funnel as compared to NCCS A

consumers, and half as likely as NCCS A consumers to transact online. More than half of friction loss among NCCS B consumers occurs at the

awareness stage itself. Performance of digital medium could be further enhanced by targeting NCCS B consumers with the relevant content. Further,

at consideration stage, this consumer segment is more sensitive to price offers and lacks trust in the information shared by traditional media.

Prospect does not know what to

do next after watching ads

Prospect finds too little

information from ads

Prospect does not find requisite

information

Offer communication is not clear

Prospect found a better

price/option elsewhere

Lack of trust at point of sale

Prospect found a better

price/option elsewhere

Lack of trust at point of sale

Prospect does not know what to

do next after watching ads

Prospect finds too little

information from ads

Offer communication is not clear

Prospect does not trust the

medium as source of

information

Note: At intent stage, only retail store and online touch-points were evaluated in

the research to eliminate default attribution to top-of-mind channels

*NCCS- New Consumer Classification System

Media friction (%)

Media friction (%)

Media friction (%)

Media friction (%)

Media friction (%)

Media friction (%)

19% 23% 17%

18%

50%

36%

19%

20%

20%

=

14%

=

19%

Aware decision makers/

influencers

Consideration

Intent

Purchase

Total population – 100%

Consideration

friction

Intent friction

87%

77%

72%

68%

Awareness

friction

Consideration

friction

Intent friction

85%

78%

75%

71%

Awareness

friction

27%

21%

Accessories

Legend

Outdoor Print Television Digital Medium*

Media with highest contribution to top two friction points

Retail store

Radio

Lack of contextualised content and clear call-to-action mechanism are

key asks for NCCS B consumers

NCCS A NCCS B

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

26

At the awareness stage, the objective of advertising campaigns is to make the brand visible and stand out from the crowd. Traditional print media placements,

store displays, extravagant photo-shoots and images of celebrities wearing the brand collections have been conventionally used by fashion brands to create

consumer awareness. However, new age digital platforms have emerged as a preferred source for building consumer awareness and communication.

Fashion and retail brands are leveraging social platforms to successfully create a community following. By way of highly efficient tools such as sequential

advertisements and analytics based micro-targeting, digital platforms outscore traditional media at the top of the funnel in capturing the attention of

consumers, and driving them towards the point of sale.

Awareness

Consideration

Intent

Purchase

Top friction points Television Print Outdoor Radio

Retail

store/outlet

Online*

Prospect finds too little

information from ads

Prospect does not

know what to do next

after watching ads

Prospect did not pay

enough attention to

ads

Offer communication

is not clearly

mentioned

Payment

schemes/options

available are not

enlisted

29%

28%

28%

22%

16%

27%

12%

9%

2%

3%

21%

29%

12%

10%

9%

9%

14%

29%

8%

4%

5%

36%

32%

19%

5%

4%

2%

7%

4%

5%

5%

9%

12%

11%

7%

Percentage of respondents experiencing the mentioned

friction in respective media touchpoints

%

Media with lowest friction for the given friction point Media with highest friction for the given friction point

Medium causing high friction

Apparel: Awareness friction

* Online includes top five media touch points accessed by respondents at respective stage of the journey

New age digital platforms emerging as the preferred source for

consumer awareness and communication

Apparel

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

27

While traditional mediums, such as print and radio, lag in meeting consumers’ expectations at the top of the funnel, fashion accessories brands and retailers

are increasingly leveraging digital platforms for deploying their full-funnel strategies. Xeric brand of watches has leveraged social media to bootstrap the

brand awareness for its vintage inspired watches and raised more than USD2 million by leveraging the power of social media and crowdfunding

[1]

. Today,

people do not have to rely on traditional advertising mediums to stay abreast with fashion trends, but prefer digital mediums to seek information. Fashion

accessories brand, Kate Spade allows its customers to ‘seamlessly explore, tap and shop the product’— going from inspiration to information to purchase in

just a few steps. Shoppable (also called interactive or e-commerce) technology allows viewers to click prompts on the screen to save items for viewing later

or to head straight to a link to buy the item. Social media oriented marketers who have already uploaded their product catalogues on that platform can easily

plug them into the ‘shoppable technology.’

[2]

Awareness

Consideration

Intent

Purchase

Top friction points Television Print Outdoor Radio

Retail

store/outlet

Online*

Prospect does not

know what to do next

after watching ads

Prospect finds too little

information from ads

Prospect did not pay

enough attention to

the ads

Payment

schemes/options

available are not

enlisted

Offer communication is

not clearly mentioned

27%

26%

22%

17%

15%

13%

20%

5%

3%

2%

31%

21%

13%

7%

8%

12%

9%

13%

7%

8%

26%

6%

24%

9%

18%

0%

3%

1%

2%

3%

Percentage of respondents experiencing the mentioned

friction in respective media touchpoints

%

Media with lowest friction for the given friction point Media with highest friction for the given friction point

Medium causing high friction

Accessories: Awareness friction

0%

5%

8%

4%

6%

[1] How a Vintage-Inspired Watch Brand Used Crowdfunding and Social Media to Raise Millions, Adweek.com, April 2017

[2] Retailers Can Now Make Instagram Posts Much More Shoppable, Adweek.com, May 2017

* Online includes top five media touch points accessed by respondents at respective stage of the journey

Innovative applications of digital platforms augment consumer

experience with brands at the top of the funnel

Accessories

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

28

Awareness

Consideration

Intent

Purchase

Fashion brands, which traditionally used print extensively, are gradually moving towards digital. Leading global brands such as Gucci, Louis Vuitton and others

have spent 60 per cent more on online ads in 2016 as compared to 2013.

[1]

Tailor-made and in-vogue product suggestions, purchase discounts, offers and

incremental services that are suitable to meet consumer’s lifestyle, comfort and requirement could significantly aid brands in converting the acquired lead into a

potential buyer at this stage. Digital channels are uniquely equipped to, first identify prospects that have moved to the consideration stage by analysing their

digital footprints, and then provide immersive and sequential content to assist them in the purchase journey. Virtual product trials and technology based tools for

accurate body measurements have already become a commercial reality and could further break barriers to evaluating and buying apparel online.

Awareness

Consideration

Intent

Purchase

Top friction points Television Print Outdoor Radio

Retail

store/outlet

Online*

Offer communication

is not clear

Prospect does not

find it easy to

browse/find

information required

Prospect does not

trust the medium as

source of information

Not able to get

credible/clear advice

Prospect does not

get all the required

information

27%

27%

22%

20%

16%

14%

2%

8%

26%

3%

53%

6%

17%

16%

6%

28%

11%

37%

12%

11%

22%

17%

31%

9%

2%

3%

3%

3%

1%

5%

8%

9%

12%

6%

10%

Percentage of respondents experiencing the mentioned

friction in respective media touchpoints

%

Media with lowest friction for the given friction point Media with highest friction for the given friction point

Medium causing high friction

Apparel: Consideration friction

[1] ”Fashion Ads, a Last Bastion of Print, Are Going Digital”-Matthew Dalton, WSJ.com, June 2017

* Online includes top five media touch points accessed by respondents at respective stage of the journey

Digital helps drive brand visibility and stickiness

Apparel

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

29

Fashion-related products remain the number one category for online sales globally, and the numbers continue to grow. While the e-commerce industry

allocates more than two-thirds of its marketing budget to television, print, radio and outdoor

[1]

, these mediums scored significantly less in meeting consumers’

expectations at this stage. On the other hand, creative usage of digital technology is becoming more evident in the retail and online fashion market. Leading

fashion accessories brands in India have tried to eliminate the need for visiting a retail store by deploying Virtual Reality (VR), which allows users to interact

with high resolution 3D catalogue of products and see how they look from every angle. Such adoption of technologies has rewarded e-tailers with lower

perception of ‘touch and feel friction’ on an online portal than in offline touch-points. Digital content supported by such technologies could make the evaluation

process of fashion accessories more interactive and engaging for consumers.

Awareness

Consideration

Intent

Purchase

Top friction points Television Print Outdoor Radio

Retail

store/outlet

Online*

Prospect does not

find it easy to

browse/find

information required

Offer communication

is not clear

Not able to get

credible/clear advice

Prospect does not

trust the medium as

source of information

Unable to touch and

feel the product

28%

27%

23%

21%

2%

13%

25%

5%

5%

12%

32%

27%

20%

14%

10%

27%

9%

29%

15%

8%

20%

13%

30%

8%

3%

6%

1%

2%

2%

5%

5%

4%

10%

6%

Percentage of respondents experiencing the mentioned

friction in respective media touchpoints

%

Media with lowest friction for the given friction point Media with highest friction for the given friction point

Medium causing high friction

Accessories: Consideration friction

[1] Digital Advertising in India 2018, Dentsu Aegis Network

* Online includes top five media touch points accessed by respondents at respective stage of the journey

17%

Virtual trials have broken the barrier of touch-and-feel for e-tailing

platforms

Accessories

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

30

Online brands have leveraged digital technology to match their relevance with the traditional retail stores. For instance, Virtusize allows online shoppers to go

through different outfits and compare the size and fitting of a garment they are looking to purchase with their favourite wardrobe outfits they already own. This

comparison helps them in selecting the ideal fit.

[1]

. However, customers still experience friction while concluding purchase on the online mediums. The inability

to ensure that the product displayed in catalogue is how it actually looks, and apprehension around delivery and return of the product, lead to lack of trust with

online point of sale. Further, more than one-fourth of e-commerce users face friction while completing online payments.

Traditional retail stores may continue to stay relevant and score higher on parameters of trust, touch-and-feel and impulse purchases. However, an optimised

omni-channel play, with multiple payment solutions could integrate the two channels and address each others’ friction areas to provide a uniform experience to

consumers.

% Percentage of respondents experiencing the mentioned friction in respective media touchpoints

[1] ‘How it works’, Vitusize.com, June 2018

* Online includes top five media touch points accessed by respondents at respective stage of the journey

Awareness

Consideration

Intent

Purchase

Top friction points Retail store/outlet Online*

Prospect did not find the preferred

payment option

Prospect found a better price/option

elsewhere

Lack of trust at point of sale

The right size was no longer available

Payment failed and prospect did not

try again

30%

25%

22%

Apparel: Intent friction

32%

2%

7%

12%

23%

12%

21%

33%

0%

37%

18%

21%

Note: At intent stage, only retail store and online touch-points were evaluated in media mix to calculate friction

Online platforms provide product information and comparisons, but

cause friction at the point of sale

Apparel

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

31

At retail stores, consumers are more likely to be influenced by a competing brand or product. Especially in multi-brand outlets, where products from various

brands are on display, it is more convenient for consumers to compare prices, features and fit of products. On the other hand, it is more likely that a

consumer accesses an online channel with a predetermined set of brands or products. Therefore, stickiness of a consumer with a brand is significantly

higher on online portals.

However, online point of sales still offers friction on account of convenience of payment, touch and feel of product and credibility of information. Localisation

of payment web-pages and offering multiple and easy payment solutions could address such concerns significantly. Further, e-tailers have already seen

proven results from VR-based platforms providing a virtual experience of the product and prompt chat-bot based system for customer connect, targeted at

addressing bottom-of-the-funnel friction.

% Percentage of respondents experiencing the mentioned friction in respective media touchpoints

Note: At intent stage, only retail store and online touch-points were evaluated in media mix to calculate friction

* Online includes top five media touch points accessed by respondents at respective stage of the journey

Awareness

Consideration

Intent

Purchase

Top friction points Retail store/outlet Online*

Prospect found a better price/option

elsewhere

Prospect did not get the preferred

payment option

Lack of trust at point of sale

Unable to touch and feel the product

The same price was no longer available

or the offer had expired

34%

26%

19%

18%

28%

Accessories: Intent friction

43%

5%

6%

9%

14%

17%

22%

15%

16%

18%

Online observes higher stickiness of consumers towards brand or

product at bottom of the funnel

Accessories

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

32

Accessories

Apparel

Lack of immediate availability and touch-and-feel of size, colour, fit and design of product(s) are the key barriers to online fashion commerce today. E-tailers are increasingly

adopting consumer-friendly technology solutions and are integrating digital technology to their physical assets to either replicate, or complement the offline consumer

experience. They, however, are still solving the ‘returns management’ part of the e-commerce puzzle. Omni-channel has offered one of the solutions where consumers

could access physical touch-points of e-tailers for both returning and experiencing the products. Both offline and online brands today are increasingly exploring omni-

channel strategies to offer the best of both channels to the consumers.

Further, advocacy is a major aspect of apparel and fashion accessories. Consumers display their fashion purchases and are more vocal about their product experience.

Consumers who shop online are more likely to speak about the purchase and give reviews about the product quality or experience with the portal. In a category where

brand or channel loyalty is low, fashion brands could create communities around their differentiated brand identities to engage with potentially loyal customers.

47%

33%

23%

Spoke about the

purchase on social

media

Recommended the

purchase to friends,

family members on

social media or chat

apps

Wrote reviews for the

product online

Purchase channel preference Post purchase activities

38%

29%

Wrote reviews for the

product online

40%

Spoke about the products

purchased on social

media

Recommended the

purchase to friends,

family members on social

media or chat apps

Convenience of door

step delivery

78%

Anytime

purchase

67%

Easy access to multiple

brands/products

42%

What

lacks in

offline?

Immediate availability

of product

55%

Ability to see, touch

and try merchandise

39%

Ability to easily return

items

34%

What

lacks in

online?

Anytime purchase

Convenience of door

step delivery

Easy access to multiple

brands/products

81%

63%

51%

What

lacks in

offline?

Immediate availability of

product

Ability to easily return

items

Ability to see, touch

and try merchandise

59%

44%

41%

What

lacks in

online?

E-tailers and traditional players are adopting strategies to offer the best

of both channels to their target consumers

Purchase channel preference Post purchase activities

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

33

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

34

Friction Busting -

Increasing Sales

Opportunity With

Mobile

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

35

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

36

By 2022, mobile internet users in India are expected to rise to 677 million from 420 million users in 2017

[1]

. Nearly 65 per cent of apparel purchases in 2022 are expected to

be mobile-influenced, while nearly one out of three purchases is expected to be Facebook-influenced, each growing nearly three times. This growth is expected to be driven

on the back of organic penetration of internet, social media and digital technologies over the next five years. Brands, therefore, have a USD66 billion opportunity to re-look

at their marketing strategies and adapt to the fast-evolving mobile-first internet economy of India. Further, a mobile-enabled apparel purchase journey is shortened by at

least five days (14 per cent) as compared to a pure offline journey.

Mobile-enabled journeys are 14 per cent shorter. By 2022, mobile is

expected to influence ~2 in 3 apparel purchases, half of which are

expected to be driven by Facebook

Mobile influence

2.6x

USD66

billion

2017 2022

e

[2][3]

USD26

billion

47%

44%

58%

49%

62%

59%

73%

65%

Average

influence

Awareness

Consideration

Intent

Sales

opportunity

within

category

Facebook influence

2.7x

USD35

billion

2017 2022

e

[2][3]

USD13

billion

21%

24%

27%

24%

31%

35%

38%

34%

Average

influence

Awareness

Consideration

Intent

Sales

opportunity

within

category

Purchase journey in days

38 days

33 days

Offline

purchase

Mobile-enabled

purchase

Sources:

[1] [2] Internet users to touch 420 million by June 2017: IAMAI