2

Oregon Tobacco Laws

Oregon Tobacco Laws

Prepared by

Ilana Kurtzig, Policy Specialist

Tara Weston, Policy Specialist

August 2018

Tobacco Prevention and Education Program

Health Promotion and Chronic Disease Prevention

Oregon Health Authority

800 NE Oregon Street, Suite 730

Portland, OR 97232

(971) 673-0984

http://www.healthoregon.org/morefreshair

3

Suggested Citation

Tobacco Prevention and Education Program. Oregon Tobacco Laws. Portland, Oregon:

Oregon Health Authority, Oregon Public Health Division, 2018.

All material in this report is in the public domain and may be reproduced or copied

without permission; citation as to source, however, is appreciated.

4

Table of Contents

Introduction

7

Preemption Overview

8

I. Access to Tobacco Products and Youth Possession of Tobacco

10

Location of Vending Machines

10

Restriction on Free Distribution of Tobacco and Nicotine Products

10

Possession of Tobacco or Inhalant Delivery Systems by Minors

12

Retailer Regulations

13

Synar Amendment

15

Sale of Tobacco Products or Inhalant Delivery Systems to Persons Under 21

16

Locating Tobacco Products or Inhalant Delivery Systems in Retail Stores

17

Tobacco Seller Licensing

18

Sales of Tobacco through Mail Order or Internet Sales

19

Out-of-State and Internet Sales of Tobacco

20

Prohibition on Sale of Unpackaged Cigarettes

21

II. Cessation

23

Insurance Coverage for Cessation Programs

23

Oregon Health Plan and Cessation Coverage

24

State Funding for Cessation Programs

26

III. Smoke-, Vapor- and Aerosol-free Environments Laws

28

Oregon’s Indoor Clean Air Act

28

Tobacco-Free Schools

35

Tobacco Use in Behavioral Health Outpatient Programs

35

Landlord-Tenant Disclosure of Smoking Policy

36

Tobacco Free In-home Child Day Care

36

Tobacco Free Correctional Facilities

37

Smoke-free Cars for Kids

38

Tobacco Free State Properties Executive Order

38

IV. Tobacco Taxes, Payments, and Distribution

40

Oregon-Specific Tobacco Taxes

40

Ballot Measure 44 Statute

(Use of Tobacco Use Reduction Account-TURA Funds)

48

Tobacco Sold On Tribal Land

49

Tobacco Master Settlement Agreement (TMSA) Financial Provisions

49

Tobacco Enforcement Fund

52

V. Tobacco and Cigarette-Related Product Regulation

55

Reduced-Ignition-Propensity Cigarettes

55

5

Prohibition on the Sale or Distribution of Novelty Lighters

56

Electronic Cigarettes (E-Cigarettes)

58

VI. Miscellaneous

59

Prohibition of Employer Restrictions on Off-Duty Tobacco Use

59

Supersedeas

59

Littering Law

60

VII. Overviews of Laws and Cases

62

Master Settlement Agreement (MSA) and Smokeless

Tobacco Master Settlement Agreement (STMSA)

62

Family Smoking Prevention and Tobacco Control Act

63

Prevent All Cigarette Trafficking Act of 2009 (PACT Act)

63

United States v. Philip Morris USA, Inc.

64

VIII. Laws Comparison Chart

65

6

Oregon Tobacco Laws

7

Introduction

Introduction

This document outlines Oregon laws, federal laws, state agency policies and state and

federal court orders related to tobacco control in Oregon. Federal laws and court

orders are included when they are more stringent than state law.

Format and Content

In subsections I through VI, the laws, policies and court orders have been divided

into six groups based on their content. Laws, policies and orders in these subsections

include a summary and, where practical, full legal citations. In addition, cursory

information about enforcement has been provided.

Subsections VII and VIII are a brief description of state law, federal law, sentinel

federal level court orders and a comparative compilation of those laws and cases.

I. Access to Tobacco Products and Inhalant Delivery Systems (e.g. e-cigarettes)

and Youth Possession of Tobacco and Inhalant Delivery Systems

II. Cessation

III. Smoke-, Vapor- and Aerosol-free Environments Laws

IV. Tobacco Taxes, Payments, and Distribution

V. Tobacco and Cigarette-Related Product Regulation

VI. Miscellaneous

VII. Overview of Laws and Cases

VIII. Laws Comparison Chart

Definitions:

ORS: Oregon Revised Statutes; contains statutes and the Oregon Rules of Civil

Procedure.

OAR: Oregon Administrative Rules; ORS 183.310(9) defines “rule” as “any agency

directive, standard, regulation or statement of general applicability that implements,

interprets or prescribes law or policy, or describes the procedure or practice

requirements of any agency.” The Oregon Administrative Rules are published by the

Oregon Secretary of State.

8

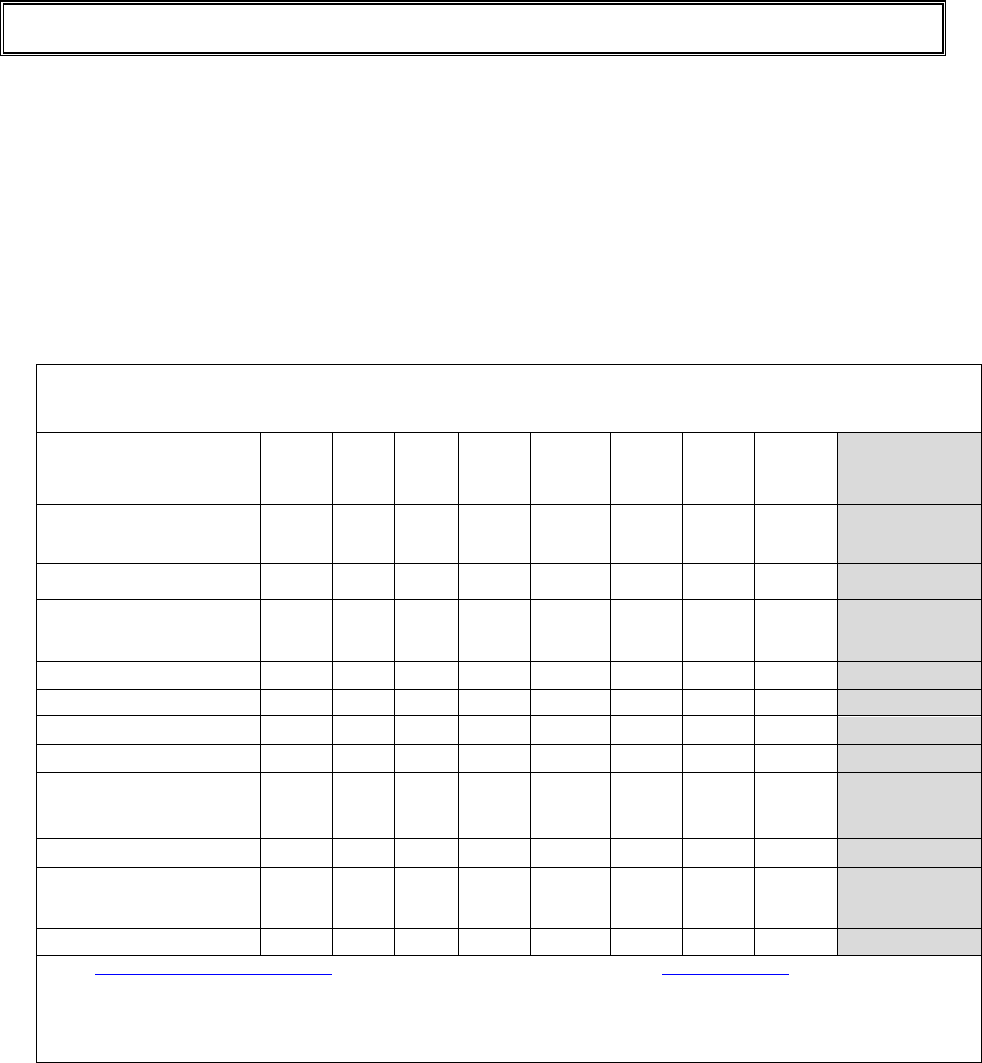

Introduction

This table outlines the dollar amounts of penalties for infractions against different

levels/types of Oregon Law.

Citation

ORS 153.018, 161.615, 161.635

https://www.oregonlegislature.gov/bills_laws/ors/ors153.html

https://www.oregonlegislature.gov/bills_laws/ors/ors161.html

Preemption Overview

The preemption doctrine refers to the idea that a higher authority of law will displace

the law of a lower authority of law when the two authorities come into conflict.

Article VI, paragraph 2, of the U.S. Constitution makes federal law "the supreme law

of the land," notwithstanding the contrary law any state might have. This is

commonly known as the “Supremacy Clause.”

When state law and federal law conflict, federal law displaces, or preempts, state law,

due to the Supremacy Clause of the Constitution. U.S. Const. art. VI., § 2. Preemption

applies regardless of whether the conflicting laws come from legislatures, courts,

administrative agencies, or constitutions. For example, the Voting Rights Act, an act

of Congress, preempts state constitutions, and FDA regulations may preempt state

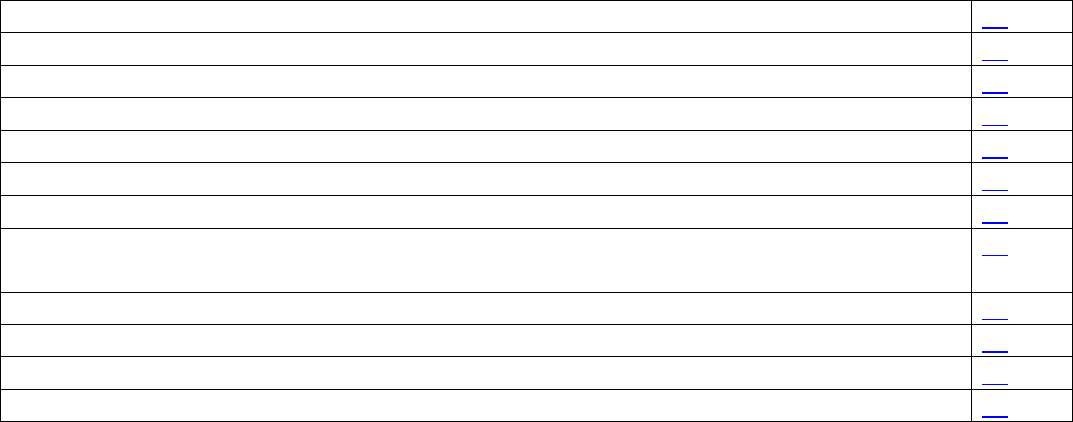

VIOLATION TYPE/CLASS

PENALTY

Class A Misdemeanor

Max. fine: $6,250

Max. prison term: 1 year

Class B Misdemeanor

Max. fine: $2,500

Max. prison term: 6 months

Class C Misdemeanor

Max. fine: $1,250

Max. prison term: 30 days

Unclassified Misdemeanor

As provided in the statute defining the

crime

Class A Violation

Max. fine: $2,000

Class B Violation

Max fine: $1,000

Class C Violation

Max fine: $500

Class D Violation

Max fine: $250

Civil Penalty

Varies based on violation

Unclassified or Specific-Fine Violations

As described in ORS 153.015

9

Introduction

court judgments in cases involving prescription drugs.

Citation

U.S. Const. art. VI., § 2.

“This Constitution, and the laws of the United States which shall be made in

pursuance thereof; and all treaties made, or which shall be made, under the authority

of the United States, shall be the supreme law of the land; and the judges in every

state shall be bound thereby, anything in the Constitution or laws of any State to the

contrary notwithstanding.”

Oregon state law preempts local jurisdictions on:

Regulating vending machines that dispense tobacco products or inhalant

delivery systems

• ORS 167.775 Local regulation of vending machines. Cities and counties by

ordinance or resolution may not regulate vending machines that dispense

tobacco products or inhalant delivery systems and that are in any manner

accessible to persons under 21 years of age. [Formerly 167.404]

Increasing taxes on cigarettes and other tobacco products

• ORS 323.030 Tax imposed; rate; exclusiveness; only one distribution

taxed.

(2) The taxes imposed by ORS 323.005 to 323.482 are in lieu of all other state,

county or municipal taxes on the sale or use of cigarettes.

• ORS 323.640 Tax on distributors in lieu of all other state, county or

municipal taxes on sale or use of tobacco. (1) The taxes imposed by ORS

323.505 are in lieu of all other state, county or municipal taxes on the sale or

use of tobacco products.

• (2) Any tobacco product with respect to which a tax has once been imposed

under ORS 323.505 shall not be subject upon a subsequent distribution to the

taxes imposed by ORS 323.505. [1985 c.816 §44a]

10

I. Access to Tobacco and

Youth Possession of Tobacco

I. Access to Tobacco and Youth Possession of Tobacco

Location of Vending Machines

State

Oregon law prohibits vending machines that supply tobacco products or inhalant

delivery systems from being in any place except an Oregon Liquor Control

Commission-licensed establishment that is off limits to persons under 21. Selling

tobacco from vending machines in any other location is a Class B violation. Local

jurisdictions are preempted from passing stronger laws.

Enforcement

Law enforcement authorities

Citation

ORS 167.780 Sale or dispensing of tobacco products or inhalant delivery

systems by vending machines.

(1) As used in this section and ORS 167.775, “vending machine” means a device

that, upon the insertion of tokens, money or another form of payment, dispenses

tobacco products or inhalant delivery systems.

(2) A person may not sell or dispense tobacco products or inhalant delivery

systems from a vending machine, except in an establishment where the premises are

permanently and entirely off-limits to persons under 21 years of age as required by

rules adopted by the Oregon Liquor Control Commission.

(3) A person who violates this section commits a Class B violation. Each day that

the person commits the violation constitutes a separate offense. [Formerly 167.402]

Note: 167.747 to 167.785 were enacted into law by the Legislative Assembly but

were not added to or made a part of ORS chapter 167 or any series therein by

legislative action. See Preface to Oregon Revised Statutes for further explanation.

https://www.oregonlegislature.gov/bills_laws/ors/ors167.html

Restriction on Free Distribution of Tobacco and Nicotine Products

Federal

The federal Family Smoking Prevention and Tobacco Control Act (2009) prohibits all

tobacco sampling except the distribution of free samples of smokeless tobacco in

qualified adult-only facilities.

Tobacco Control Act, Section 102 – Prohibition Against Free Samples

11

I. Access to Tobacco and

Youth Possession of Tobacco

(21 CFR 1140.16(d)). This restriction prohibits the distribution of free samples of

newly deemed tobacco products (e.g. e-cigarettes, hookah), as required by section 102

of the Tobacco Control Act.

Enforcement

U.S. Food and Drug Administration

Consumers can call FDA at 1-877-CTP-1373, option 4, send an email to:

CTPCompliance@FDA.hhs.gov

or complete an online form

(https://www.accessdata.fda.gov/scripts/ptvr/index.cfm) to report a violation.

ORS 180.486 Prohibited conduct; penalty.

(1) A person may not:

(a) Sell, offer for sale or possess for sale in this state smokeless tobacco

products of a tobacco product manufacturer that is not included in the directory

developed under ORS 180.477;

(b) Sell, offer for sale or possess for sale in this state smokeless tobacco

products of a tobacco product manufacturer that the person acquired at a time when

the tobacco product manufacturer was not included in the directory developed under

ORS 180.477;

(c) Possess in this state for sale in another jurisdiction smokeless tobacco

products of a tobacco product manufacturer that the person acquired at a time when

the tobacco product manufacturer was not included in the directory developed under

ORS 180.477 and was not in compliance with the Smokeless Tobacco Master

Settlement Agreement qualifying statute in the other jurisdiction or with statutes that

supplement the qualifying statute in that jurisdiction; or

(d) Distribute, in this state, free samples of smokeless tobacco products:

(A) To persons under 21 years of age; or

(B) In any area, unless access by persons under 21 years of age to that area is

prohibited.

(2) A person who sells, offers for sale, distributes, acquires, holds, owns,

possesses, transports, imports or causes to be imported smokeless tobacco products

that the person knows or should know are intended for sale or distribution in

violation of subsection (1) of this section commits a Class A misdemeanor. [2009

c.717 §13]

ORS 180.468 Definitions.

As used in ORS 180.465 to 180.494:

(6) “Smokeless tobacco products” has the meaning given that term in ORS 323.810.

12

I. Access to Tobacco and

Youth Possession of Tobacco

https://www.oregonlegislature.gov/bills_laws/ors/ors180.html

ORS 323.810 Definitions.

As used in ORS 323.810 to 323.816:

(7) “Smokeless tobacco products” means moist snuff, as defined in ORS 323.500, or

chewing tobacco, as defined in section 5702 of the Internal Revenue Code.

ORS 323.500 Definitions.

As used in ORS 323.500 to 323.645, unless the context otherwise requires:

(9) “Moist snuff” means:

(a) Any finely cut, ground or powdered tobacco that is not intended to be smoked

or placed in a nasal cavity; or

(b) Any other product containing tobacco that is intended or expected to be

consumed without being combusted.

https://www.oregonlegislature.gov/bills_laws/ors/ors323.html

Possession of Tobacco or Inhalant Delivery Systems by Minors

State

Oregon law prohibits a person under the age of 18 from possessing tobacco products

or inhalant delivery systems.

Enforcement

City, county or state law enforcement authorities

Citation

ORS 167.785 Possession of tobacco products or inhalant delivery systems by

person under 18 years of age; penalty.

(1) It is unlawful for a person under 18 years of age to possess tobacco products or

inhalant delivery systems.

(2) A person who violates this section commits a Class D violation. [Formerly

167.400]

https://www.oregonlegislature.gov/bills_laws/ors/ors167.html

ORS 431A.175 Definitions.

(a)(A) “Inhalant delivery system” means:

13

I. Access to Tobacco and

Youth Possession of Tobacco

(i) A device that can be used to deliver nicotine or cannabinoids in the form of

a vapor or aerosol to a person inhaling from the device; or

(ii) A component of a device described in this subparagraph or a substance in

any form sold for the purpose of being vaporized or aerosolized by a device described

in this subparagraph, whether the component or substance is sold separately or is not

sold separately.

(B) “Inhalant delivery system” does not include:

(i) Any product that has been approved by the United States Food and Drug

Administration for sale as a tobacco cessation product or for any other therapeutic

purpose, if the product is marketed and sold solely for the approved purpose; and

(ii) Tobacco products.

(b) “Tobacco products” means:

(A) Bidis, cigars, cheroots, stogies, periques, granulated, plug cut, crimp cut,

ready rubbed and other smoking tobacco, snuff, snuff flour, cavendish, plug and twist

tobacco, fine-cut and other chewing tobaccos, shorts, refuse scraps, clippings, cuttings

and sweepings of tobacco and other forms of tobacco, prepared in a manner that

makes the tobacco suitable for chewing or smoking in a pipe or otherwise, or for both

chewing and smoking;

(B) Cigarettes as defined in ORS 323.010 (1); or

(C) A device that:

(i) Can be used to deliver tobacco products to a person using the device; and

(ii) Has not been approved by the United States Food and Drug Administration

for sale as a tobacco cessation product or for any other therapeutic purpose, if the

product is marketed and sold solely for the approved purpose

https://www.oregonlegislature.gov/bills_laws/ors/ors431a.html

Retailer Regulations

State

Oregon law requires retailers to post a notice informing the public that selling tobacco

products and inhalant delivery systems to individuals under 21 is prohibited. Oregon

law also prohibits the sale of inhalant delivery systems packaged in a manner attractive

to minors.

Enforcement

Oregon Health Authority

Citation

14

I. Access to Tobacco and

Youth Possession of Tobacco

ORS 431A.175 Unlawful activities; notice; rules

(2) It is unlawful:

(a) To violate ORS 167.750.

(b) To fail as a retailer of tobacco products to post a notice substantially similar to

the notice described in subsection (3) of this section in a location that is clearly visible

to the seller and the purchaser of the tobacco products.

(c) To fail as a retailer of inhalant delivery systems to post a notice in a location

that is clearly visible to the seller and the purchaser of the inhalant delivery systems

that it is unlawful to sell inhalant delivery systems to persons under 21 years of age.

The Oregon Health Authority shall adopt by rule the content of the notice required

under this paragraph.

(d) To distribute, sell or allow to be sold an inhalant delivery system if the inhalant

delivery system is not labeled in accordance with rules adopted by the authority.

(e) To distribute, sell or allow to be sold an inhalant delivery system if the inhalant

delivery system is not packaged in child-resistant safety packaging, as required by the

authority by rule.

(f) To distribute, sell or allow to be sold an inhalant delivery system if the inhalant

delivery system is packaged in a manner that is attractive to minors, as determined by

the authority by rule

(3) The notice required by subsection (2)(b) of this section must be substantially as

follows:

__________________________________________________________________

NOTICE

The sale of tobacco in any form to persons under 21 years of age is prohibited by law.

Any person who sells, or allows to be sold, tobacco to a person under 21 years of age

is in violation of Oregon law.

https://www.oregonlegislature.gov/bills_laws/ors/ors167.html

ORS 167.770 Display of sign; penalty.

(1) A person who sells tobacco products or inhalant delivery systems shall display a

sign clearly stating that the sale of the tobacco products or inhalant delivery systems

to persons under 21 years of age is prohibited by law.

(2) Failure to display a sign required by this section is a Class A violation. [2017 c.701

§3]

15

I. Access to Tobacco and

Youth Possession of Tobacco

ORS 431.A.178 Civil penalty for violation of ORS 431A.175.

(1) The Oregon Health Authority may impose a civil penalty for each violation of

ORS 431A.175 A civil penalty imposed under this section may not be less than $250

or more than $1,000.

(2) (a)Amounts collected under subsection (1) of this section shall be deposited in

the Oregon Health Authority Fund established under ORS 413.101. Except as

provided in paragraph (b) of this subsection, moneys deposited in the fund under this

subsection are continuously appropriated to the authority for carrying out the duties,

functions and powers of the authority under ORS 431A.175 and 431A.183.

(b) At the end of each biennium, the authority shall transfer the unobligated moneys

collected under subsection (1) of this section remaining in the fund to the Tobacco

Use Reduction Account established under ORS 431A.153. [Formerly 431.845]

https://www.oregonlegislature.gov/bills_laws/ors/ors431A.html

Synar Amendment

Federal

(PL 102-321 sec. 1926)STATE LAW REGARDING SALE OF TOBACCO PRODUCTS TO

INDIVIDUALS UNDER AGE OF 18

(1) IN GENERAL- Subject to paragraph (2), for fiscal year 1994 and subsequent

fiscal years, the Secretary may make a grant under section 1921 only if the State

involved has in effect a law providing that it is unlawful for any manufacturer, retailer,

or distributor of tobacco products to sell or distribute any such product to any

individual under the age of 18.

Applies to all states and the District of Columbia, Puerto Rico, the U.S. Virgin

Islands, and six Pacific jurisdictions

Enforcement

Substance Abuse and Mental Health Services Administration (SAMHSA)

(c) NONCOMPLIANCE OF STATE- Before making a grant under section 1921 to a

State for the first applicable fiscal year or any subsequent fiscal year,

the Secretary shall make a determination of whether the State has maintained

compliance with subsections (a) and (b). If, after notice to the State and

an opportunity for a hearing, the Secretary determines that the State is

not in compliance with such subsections, the Secretary shall reduce the

amount of the allotment under such section for the State for the fiscal

year involved by an amount equal to:

(1) in the case of the first applicable fiscal year, 10 percent of the

16

I. Access to Tobacco and

Youth Possession of Tobacco

amount determined under section 1933 for the State for the fiscal year;

(2) in the case of the first fiscal year following such applicable fiscal

year, 20 percent of the amount determined under section 1933 for the State

for the fiscal year;

(3) in the case of the second such fiscal year, 30 percent of the amount

determined under section 1933 for the State for the fiscal year; and

(4) in the case of the third such fiscal year or any subsequent fiscal

year, 40 percent of the amount determined under section 1933 for the State

for the fiscal year.

Sale of Tobacco Products or Inhalant Delivery Systems to Persons Under 21

State

Oregon law prohibits selling or distributing tobacco products, which includes devices

that can be used to deliver tobacco, or inhalant delivery systems to individuals under

the age of 21.

Enforcement

City, county and state law enforcement authorities

431A.183 Random inspections of sellers of tobacco and inhalant delivery

systems; rules. (1) The Oregon Health Authority shall:

(a) Coordinate with law enforcement agencies to conduct random, unannounced

inspections of wholesalers and retailers of tobacco products or inhalant delivery

systems to ensure compliance with the laws of this state designed to discourage the

use of tobacco products and inhalant delivery systems by persons under 21 years of

age, including ORS 167.750, 167.755, 167.760, 167.765, 167.775, 167.780 and

431A.175; and

(b) Submit a report describing:

(A) The activities carried out to enforce the laws listed in paragraph (a) of this

subsection during the previous fiscal year;

(B) The extent of success achieved in reducing the availability of tobacco products

and inhalant delivery systems to persons under 21 years of age; and

(C) The strategies to be utilized for enforcing the laws listed in paragraph (a) of

this subsection during the year following the report.

(2) The authority shall adopt rules for conducting random inspections of

establishments that distribute or sell tobacco products or inhalant delivery systems.

(3) The Oregon Liquor Control Commission, pursuant to an agreement or

otherwise, may assist the authority with the authority’s duties under subsection (1)(a)

of this section and the enforcement of ORS 431A.175. [Formerly 431.853; 2017 c.701

17

I. Access to Tobacco and

Youth Possession of Tobacco

§11]

https://www.oregonlegislature.gov/bills_laws/ors/ors431A.html

Citation

ORS 167.755 Selling tobacco products or inhalant delivery systems to person

under 21 years of age; penalties.

(1) A person commits the offense of selling tobacco products or inhalant delivery

systems to a person under 21 years of age upon the occurrence of one of the

following:

(a) The person knowingly distributes or sells, or allows to be sold, to a person

under 21 years of age, tobacco products;

(b) The person knowingly distributes or sells, or allows to be sold, to a person

under 21 years of age, an inhalant delivery system;

(c) If the person is a manager or other person who supervises the retail sale of

tobacco products or inhalant delivery systems, the person is acting within the course

and scope of the person’s employment and the person has supervisory authority over

a person who violates paragraph (a) or (b) of this subsection; or

(d) If the person is an owner of a business that sells tobacco products or inhalant

delivery systems at retail, a violation of paragraph (a) or (b) of this subsection occurs

at the business.

(2)(a) Violation of subsection (1)(a) or (b) of this section is a specific fine violation

punishable by a fine not to exceed $50.

(b) Violation of subsection (1)(c) of this section is a specific fine violation

punishable by a fine not to exceed:

(A) $250 for the first or second violation; or

(B) $500 for the third or subsequent violation.

(c) Violation of subsection (1)(d) of this section is a specific fine violation

punishable by a fine not to exceed:

(A) $500 for the first or second violation; or

(B) $1,000 for the third or subsequent violation. [2017 c.701 §2]

Locating Tobacco Products or Inhalant Delivery Systems in Retail Stores

State

Under Oregon law, retail store owners may not place tobacco products or inhalant

delivery systems in a location where customers can access the product without the

assistance of an employee, unless the store is always off limits to individuals under 21

years of age. Violation of this section is a Class B violation. Each day that the person

commits the violation constitutes a separate offense.

18

I. Access to Tobacco and

Youth Possession of Tobacco

Enforcement

City, county and state law enforcement authorities

Citation

ORS 167.765 Retail store location of tobacco products or inhalant delivery

systems; penalty.

(1) A person having authority over the location of tobacco products or inhalant

delivery systems in a retail store may not locate the tobacco products or inhalant

delivery systems in a location in the store where the tobacco products or inhalant

delivery systems are accessible by store customers without assistance by a store

employee.

(2) Violation of this section is a Class B violation. Each day of violation constitutes

a separate offense.

(3) This section does not apply to a person if the location at which the tobacco

products or inhalant delivery systems are sold is a store or other establishment that

prohibits persons under 21 years of age from entering the store or establishment.

[Formerly 167.407]

https://www.oregonlegislature.gov/bills_laws/ors/ors167.html

Tobacco Seller Licensing

State

In Oregon, tobacco distributors must obtain licenses in order to distribute tobacco

products. Typically, distributors sell tobacco to retailers, who then sell to the public.

Retailers, such as individual stores, are not* required to have licenses to sell tobacco

products. *Some local jurisdictions in Oregon require retailers of tobacco products

and inhalant delivery systems to obtain licenses in order to sell these products.

Enforcement

Oregon Department of Revenue

Citation

OAR 150-323-0360 When Tobacco Product Distributor's License Required

A distributor's license is required for each place of business at which a person

engages in the distribution of cigarettes as defined in ORS 323.500. A tobacco

product distributor's license is required for any person distributing tobacco products

in Oregon, including:

19

I. Access to Tobacco and

Youth Possession of Tobacco

(1) Bringing or causing to be brought, into this state, tobacco products for sale,

storage, use or consumption;

(2) Making, manufacturing, or fabricating tobacco products in this state for

sale, storage, use or consumption in this state;

(3) Shipping or transporting tobacco products to retail dealers in this state, to

be sold, stored, used or consumed by those retail dealers in this state;

(4) Storing untaxed tobacco products in this state that are intended to be for

sale, use or consumption in this state; or

(5) Selling untaxed tobacco products in this state

https://secure.sos.state.or.us/oard/viewSingleRule.action?ruleVrsnRsn=21777

Sales of Tobacco through Mail Order or Internet Sales

Federal

Pursuant to the Prevent All Cigarette Trafficking Act of 2009, federal law prohibits

the sale of untaxed tobacco products through the Internet or by mail order and makes

tobacco products ineligible to be sent via mail (with few exceptions). Internet- and

mail-order sellers may not deliver their merchandise through the U.S. Postal Service,

but may continue to use private common carriers and other delivery services. They

must also verify the age of customers both at the time of purchase and at the point of

delivery.

Enforcement

The U.S. Bureau of Alcohol, Tobacco, Firearms and Explosives for the most part,

with the U.S. Postal Service in charge of the non-mailable matter section of PACT.

State

Oregon law prohibits the delivery sale of tobacco products to underage individuals.

Delivery sellers must obtain signed written certifications that their customers meet the

minimum age, as well as a copy of each customer’s valid, government-issued

identification showing age or date of birth, prior to shipping any tobacco products.

Sellers may only accept payment issued in the name of the prospective purchaser (i.e.,

a debit/credit card or personal check issued in that individual’s name) for each sale,

and must use a shipping method that requires a signature and photo identification

from the customer or another non-minor individual residing at the same address. All

delivery sellers must obtain a distributor’s license prior to making delivery sales.

Enforcement

20

I. Access to Tobacco and

Youth Possession of Tobacco

Oregon Department of Justice

Citation

ORS 323.703 Delivery sales to persons under legal minimum purchase age

prohibited. A person may not make a delivery sale of tobacco to a person who is

under the legal minimum purchase age. [2003 c.804 §74]

ORS 323.706 Requirements for persons accepting delivery sale purchase

orders.

A person accepting a purchase order for a delivery sale, prior to the first mailing,

shipment or other delivery of tobacco to a consumer, shall comply with:

(1) The age verification requirements set forth in ORS 323.709;

(2) The distributor license requirements set forth in ORS 323.712;

(3) The disclosure requirements set forth in ORS 323.715;

(4) The mailing or shipping requirements set forth in ORS 323.718;

(5) The reporting requirements set forth in ORS 323.721; and

(6) All other laws of this state applicable to sales of tobacco that occur entirely

within Oregon, including but not limited to ORS 323.005 to 323.482, 323.500 to

323.645, 323.806 and 323.816. [2003 c.804 §75; 2009 c.717 §23]

https://www.oregonlegislature.gov/bills_laws/ors/ors323.html

Out-of-State and Internet Sales of Tobacco

State

Out-of-state and internet sellers of tobacco products to Oregon consumers are

subject to the same regulation as sellers located in Oregon. Internet sellers are also

subject to federal and state laws governing delivery sales.

ORS 180.440 Prohibited conduct; penalty.

(1) A person may not:

(a) Affix a stamp to a package or other container of cigarettes of a tobacco

product manufacturer or brand family that is not included in the directory developed

under ORS 180.425;

(b) Sell, offer for sale or possess for sale cigarettes of a tobacco product

manufacturer or brand family that the person acquired at a time when the tobacco

product manufacturer or brand family was not included in the directory developed

under ORS 180.425; or

(c) Possess in this state for sale in another jurisdiction cigarettes of a tobacco

21

I. Access to Tobacco and

Youth Possession of Tobacco

product manufacturer or brand family that the person acquired at a time when the

tobacco product manufacturer or brand family was not included in the directory

developed under ORS 180.425 and was not in compliance with the Master Settlement

Agreement qualifying statute in the other jurisdiction or with statutes that supplement

the qualifying statute in that jurisdiction.

(2) A person who sells, offers for sale, distributes, acquires, holds, owns,

possesses, transports, imports or causes to be imported cigarettes that the person

knows or should know are intended for sale or distribution in violation of subsection

(1) of this section commits a Class A misdemeanor. [2003 c.801 §11; 2009 c.70 §1]

https://www.oregonlegislature.gov/bills_laws/ors/ors180.html

Prohibition on Sale of Unpackaged Cigarettes

Federal

The Tobacco Control Act prohibits the sale of cigarette packages containing fewer

than 20 cigarettes, including single cigarettes, known as “loosies”.

Enforcement

Food and Drug Administration

State

It is illegal to sell cigarettes that are not in a sealed package. A violation of this law can

result in a civil penalty.

Enforcement

Oregon Health Authority

Citation

ORS 431A.175 Unlawful activities; notice; rules.

(2) It is unlawful:

(g) To distribute, sell or allow to be sold cigarettes in any form other than a

sealed package.

ORS 431A.178 Civil penalty for violation of ORS 431A.175.

(1) The Oregon Health Authority may impose a civil penalty for each violation of

ORS 431A.175. A civil penalty imposed under this section may not be less than $250

or more than $1,000.

(2)(a) Amounts collected under subsection (1) of this section shall be deposited in

22

I. Access to Tobacco and

Youth Possession of Tobacco

the Oregon Health Authority Fund established under ORS 413.101. Except as

provided in paragraph (b) of this subsection, moneys deposited in the fund under this

subsection are continuously appropriated to the authority for carrying out the duties,

functions and powers of the authority under ORS 431A.175 and 431A.183

(b) At the end of each biennium, the authority shall transfer the unobligated moneys

collected under subsection (1) of this section remaining in the fund to the Tobacco

Use Reduction Account established under ORS 431A.153. [Formerly 431.845]

https://www.oregonlegislature.gov/bills_laws/ors/ors431a.html

23

II. Cessation

II. Cessation

Insurance Coverage for Cessation Programs

State

Oregon law requires that “health benefit plans” purchased after January 1, 2010,

provide at least $500 in payment, coverage or reimbursement for tobacco-use-

cessation programs. Health benefit plans do not include Medicaid, Medicare, disability

income, short-term health insurance, insurance for students or other non-traditional

health insurance plans. Nevertheless, some of these programs, such as Medicaid, do

provide cessation coverage.

Enforcement

Oregon Insurance Board

Citation

ORS 743A.170 Tobacco use cessation programs.

(1) A health benefit plan as defined in ORS 743B.005 must provide payment,

coverage or reimbursement of at least $500 for a tobacco use cessation program for a

person enrolled in the plan who is 15 years of age or older.

(2) As used in this section, “tobacco use cessation program” means a program

recommended by a physician that follows the United States Public Health Service

guidelines for tobacco use cessation. “Tobacco use cessation program” includes

education and medical treatment components designed to assist a person in ceasing

the use of tobacco products.

(3) This section is exempt from ORS 743A.001. [2009 c.503 §2]

https://www.oregonlegislature.gov/bills_laws/ors/ors743A.html

ORS 743B.005 Definitions.

For purposes of ORS 743.004, 743.007, 743.022, 743.535, 743B.003 to 743B.127 and

743B.128:

(16)(a) “Health benefit plan” means any:

(A) Hospital expense, medical expense or hospital or medical expense policy or

certificate;

(B) Subscriber contract of a health care service contractor as defined in ORS

750.005; or

(C) Plan provided by a multiple employer welfare arrangement or by another

benefit arrangement defined in the federal Employee Retirement Income Security Act

of 1974, as amended, to the extent that the plan is subject to state regulation.

(b) “Health benefit plan” does not include:

24

II. Cessation

(A) Coverage for accident only, specific disease or condition only, credit or

disability income;

(B) Coverage of Medicare services pursuant to contracts with the federal

government;

(C) Medicare supplement insurance policies;

(D) Coverage of TRICARE services pursuant to contracts with the federal

government;

(E) Benefits delivered through a flexible spending arrangement established

pursuant to section 125 of the Internal Revenue Code of 1986, as amended, when the

benefits are provided in addition to a group health benefit plan;

(F) Separately offered long term care insurance, including, but not limited to,

coverage of nursing home care, home health care and community-based care;

(G) Independent, noncoordinated, hospital-only indemnity insurance or other

fixed indemnity insurance;

(H) Short term health insurance policies that are in effect for periods of three

months or less, including the term of a renewal of the policy;

(I) Dental only coverage;

(J) Vision only coverage;

(K) Stop-loss coverage that meets the requirements of ORS 742.065;

(L) Coverage issued as a supplement to liability insurance;

(M) Insurance arising out of a workers’ compensation or similar law;

(N) Automobile medical payment insurance or insurance under which benefits

are payable with or without regard to fault and that is statutorily required to be

contained in any liability insurance policy or equivalent self-insurance; or

(O) Any employee welfare benefit plan that is exempt from state regulation

because of the federal Employee Retirement Income Security Act of 1974, as

amended.

(c) For purposes of this subsection, renewal of a short-term health insurance

policy includes the issuance of a new short-term health insurance policy by an insurer

to a policyholder within 60 days after the expiration of a policy previously issued by

the insurer to the policyholder.

https://www.oregonlegislature.gov/bills_laws/ors/ors743b.html

Oregon Health Plan and Cessation Coverage

Federal

In 2014, the US Affordable Care Act (ACA) required non-grandfathered health

insurance plans to cover without cost sharing tobacco cessation services

recommended in the US Preventive Services Task Force guidelines. This includes

screening for tobacco use, and coverage for at least two cessation attempts per year.

25

II. Cessation

Four counseling sessions (at least 10 minutes each) and FDA-approved cessation

medications should be offered for each cessation attempt. The Oregon rules

pertaining to tobacco cessation described here are aligned with this national

requirement.

State

The Oregon Health Plan covers basic, intensive, and telephonic tobacco-cessation

treatment. Basic treatment includes a brief conversation to discuss the patient’s

concerns and provide support to help the patient stop smoking. Intensive tobacco

cessation treatment includes up to ten treatment sessions every three-month period,

access to tobacco cessation products (such as nicotine patches and oral medications),

and group counseling. Telephone calls by a trained counselor may be conducted in

place of in-person encounters. The Tobacco Use Disorder code is the principal

diagnosis code when a patient participates in a tobacco cessation program.

Enforcement

Oregon Department of Human Services

Citation

OAR 410-130-0190 Tobacco Cessation

(1) Tobacco treatment interventions may include one or more of these services:

basic, intensive, and telephone calls.

(2) Basic tobacco cessation treatment includes the following services:

(a) Ask — systematically identify all tobacco users — usually done at each visit;

(b) Advise — strongly urge all tobacco users to quit using;

(c) Assess — the tobacco user’s willingness to attempt to quit using tobacco

within 30 days;

(d) Assist — with brief behavioral counseling, treatment materials and the

recommendation/prescription of tobacco cessation therapy products (e.g., nicotine

patches, oral medications intended for tobacco cessation treatment and gum);

(e) Arrange — follow-up support and/or referral to more intensive treatments,

if needed.

(3) When providing basic treatment, include a brief discussion to address client

concerns and provide the support, encouragement, and counseling needed to assist

with tobacco cessation efforts. These brief interventions, less than 6 minutes,

generally are provided during a visit for other conditions, and additional billing is not

appropriate.

(4) Intensive tobacco cessation treatment is on the Health Services Commission's

Prioritized List of Health Services and is covered if a documented quit date has been

established. This treatment is limited to ten sessions every three months. Treatment is

26

II. Cessation

reserved for those clients who are not able to quit using tobacco with the basic

intervention measures.

(5) Intensive tobacco cessation treatment includes the following services:

(a) Multiple treatment encounters (up to ten in a 3-month period);

(b) Behavioral and tobacco cessation therapy products (e.g., nicotine patches,

oral medications intended for tobacco cessation treatment and gum);

(c) Individual or group counseling, six minutes or greater.

(6) Telephone calls: the Division may reimburse a telephone call intended as a

replacement for face-to-face contact with clients who are in intensive treatment as it is

considered a reasonable adjunct to, or replacement for, scheduled counseling sessions:

(a) The call must last six to ten minutes and provides support and follow-up

counseling;

(b) The call must be conducted by the provider or other trained staff under the

direction or supervision of the provider;

(c) Enter proper documentation of the service in the client's chart.

(7) Diagnosis Code ICD-10-CM (F17.200-F17.299; Nicotine Dependence):

(a) Use as the principal diagnosis code when the client is enrolled in a tobacco

cessation program or if the primary purpose of the visit is for tobacco cessation

services;

(b) Use as a secondary diagnosis code when the primary purpose of this visit is

not for tobacco cessation or when the tobacco use is confirmed during the visit.

(8) Billing Information: Coordinated care organizations and managed care plans

may have tobacco cessation services and programs. This rule does not limit or

prescribe services a Prepaid Health Plan provides to clients receiving OHP benefits.

http://arcweb.sos.state.or.us/pages/rules/oars_400/oar_410/410_130.html

State Funding for Cessation Programs

State

Oregon law states that a portion of Oregon’s Master Settlement Agreement (MSA)

funds may be used to pay for tobacco cessation programs, but MSA funds have never

been allocated for this purpose.

Citation

ORS 431A.150 Smoking cessation program reimbursement; rules.

(1) The Oregon Health Authority shall develop a program to reimburse smoking

cessation program providers for services provided to residents of this state who are

not insured for smoking cessation costs.

(2) The authority shall adopt rules for the program established under subsection

(1) of this section that include but are not limited to criteria for provider and

27

II. Cessation

participant eligibility and other program specifications. The rules shall establish a

maximum reimbursement limit for each participant.

(3) Costs for smoking cessation programs funded under subsection (1) of this

section are eligible for reimbursement from funds received by the State of Oregon

from tobacco products manufacturers under the Master Settlement Agreement of

1998. [Formerly 431.831]

https://www.oregonlegislature.gov/bills_laws/ors/ors431a.html

28

III. Smoke, Vapor and Aerosol-free Environments

Laws

III. Smoke-, Vapor- and Aerosol-free Environments Laws

Oregon’s Indoor Clean Air Act

State

The Oregon Indoor Clean Air Act (ICAA) prohibits smoking, vaporizing or

aerosolizing in most public places and places of employment. Additionally, smoking,

vaporizing or aerosolizing is not permitted within ten feet of any entrance, exit,

window that opens or air-intake vent. Exceptions to these restrictions include

smoking in certified smoke shops, certified cigar bars and up to 25 percent of

motel/hotel rooms; and smoking of non-commercial tobacco for American Indian

ceremonial purposes. All public places and workplaces affected by the law must post

appropriate signs.

The ICAA is a complaint-driven law; OHA may respond to complaints, inspect public

places and issue citations and penalties for violating the law.

Enforcement

Oregon Health Authority and Local Public Health Authorities (LPHAs) (delegated)

Citation

OREGON INDOOR CLEAN AIR ACT

ORS 433.835 Definitions.

As used in ORS 433.835 to 433.875:

(1) “Cigar bar” means a business that:

(a) Has on-site sales of cigars as defined in ORS 323.500;

(b) Has a humidor on the premises;

(c) Allows the smoking of cigars on the premises but prohibits the smoking

aerosolizing or vaporizing of other inhalants on the premises;

(d) Has been issued and operates under a full on-premises sales license issued

under ORS 471.175;

(e) Prohibits persons under 21 years of age from entering the premises and

posts notice of the prohibition;

(f) Does not offer video lottery games as authorized under ORS 461.217;

(g) Has a maximum seating capacity of 40 persons;

(h) Has a ventilation system that exhausts smoke from the business and is

designed and terminated in accordance with the state building code standards for

the occupancy classifications in use; and

(i) Requires all employees to read and sign a document that explains the

dangers of exposure to secondhand smoke.

29

III. Smoke, Vapor and Aerosol-free Environments

Laws

(2) “Enclosed area” means the entirety of the space between a floor and a ceiling

that is enclosed on three or more sides by permanent or temporary walls or windows,

exclusive of doors or passageways, that extend from the floor to the ceiling.

(3) “Inhalant” means nicotine, a cannabinoid or any other substance that:

(a) Is in a form that allows the nicotine, cannabinoid or substance to be

delivered into a person’s respiratory system;

(b) Is inhaled for the purpose of delivering the nicotine, cannabinoid or other

substance into a person’s respiratory system; and

(c)(A) Is not approved by, or emitted by a device approved by, the United States

Food and Drug Administration for a therapeutic purpose; or

(B) If approved by, or emitted by a device approved by, the United States Food

and Drug Administration for a therapeutic purpose, is not marketed and sold solely

for that purpose.

(4)(a) “Place of employment” means an enclosed area under the control of a public

or private employer, including work areas, employee lounges, vehicles that are

operated in the course of an employer’s business that are not operated exclusively by

one employee, rest rooms, conference rooms, classrooms, cafeterias, hallways,

meeting rooms, elevators and stairways.

(b) “Place of employment” does not include a private residence unless it is used

as a child care facility as defined in ORS 657A.250 or a facility providing adult day

care as defined in ORS 410.490.

(5) “Public place” means an enclosed area open to the public.

(6) “Smoke shop” means a business that is certified with the Oregon Health

Authority as a smoke shop pursuant to the rules adopted under ORS 433.847.

(7) “Smoking instrument” means any cigar, cigarette, pipe or other instrument

used to smoke tobacco, marijuana or any other inhalant. [1981 c.384 §2; 2001 c.990

§1; 2007 c.602 §1; 2009 c.595 §684; 2011 c.601 §1; 2015 c.158 §14; 2017 c.21 §108;

2017 c.732 §1]

ORS 433.840 Policy.

The people of Oregon find that because exposure to secondhand smoke, certain

exhaled small particulate matter or other exhaled toxins is known to cause cancer and

other chronic diseases such as heart disease, asthma and bronchitis, it is necessary to

reduce exposure to such smoke, matter or toxins by prohibiting the smoking,

aerosolizing or vaporizing of inhalants in all public places and places of employment.

[1981 c.384 §1; 2007 c.602 §2; 2015 c.158 §15]

ORS 433.845 Prohibition on aerosolizing, smoking or vaporizing in public

30

III. Smoke, Vapor and Aerosol-free Environments

Laws

place or place of employment.

(1) A person may not smoke, aerosolize or vaporize an inhalant or carry a lighted

smoking instrument in a public place or place of employment except as provided in

ORS 433.850.

(2) A person may not smoke, aerosolize or vaporize an inhalant or carry a lighted

smoking instrument within 10 feet of the following parts of public places or places of

employment:

(a) Entrances;

(b) Exits;

(c) Windows that open; and

(d) Ventilation intakes that serve an enclosed area.

(3) A person may not smoke, aerosolize or vaporize an inhalant or carry a lighted

smoking instrument in a room during the time that jurors are required to use the

room. [1981 c.384 §3; 1985 c.752 §1; 2007 c.602 §3; 2015 c.158 §16]

ORS 433.847 Smoke shop certification; rules.

(1) The Oregon Health Authority shall adopt rules establishing a certification

system for smoke shops. In adopting such rules, the authority shall prohibit the

smoking, aerosolizing or vaporizing of inhalants that are not tobacco products in

smoke shops.

(2) The authority shall issue a smoke shop certification to a business that:

(a)(A) Is primarily engaged in the sale, for off-premises consumption or use, of

tobacco products and smoking instruments used to smoke tobacco products, with

at least 75 percent of the gross revenues of the business resulting from such sales;

(B) Prohibits persons under 21 years of age from entering the premises;

(C) Does not offer video lottery games as authorized under ORS 461.217,

social gaming or betting on the premises;

(D) Does not sell or offer food or beverages and does not sell, offer or

allow on-premises consumption of alcoholic beverages;

(E) Is a stand-alone business with no other businesses or residential

property attached to the premises;

(F) Has a maximum seating capacity of four persons; and

(G) Allows smoking only for the purpose of sampling tobacco products for

making retail purchase decisions;

(b) On December 31, 2008:

(A) Met the requirements of paragraph (a)(A) to (D) of this subsection; and

(B)(i) Was a stand-alone business with no other businesses or residential

property attached; or

31

III. Smoke, Vapor and Aerosol-free Environments

Laws

(ii)Had a ventilation system that exhausted smoke from the business and

was designed and terminated in accordance with the state building code standards

for the occupancy classification in use; or

(c)(A) Was certified as a smoke shop under ORS 433.835, as in effect

immediately before June 30, 2011, by the authority on or before December 31,

2012; and

(B) Allows smoking of cigarettes only if at least 75 percent of the gross

revenues of the business results from the sale of cigarettes.

(3) A smoke shop certified under subsection (2)(b) of this section must renew the

smoke shop certification every five years by demonstrating to the satisfaction of the

authority that the smoke shop:

(a)(A) Meets the requirements of subsection (2)(a)(A) to (D) of this section; and

(B)(i) Is a stand-alone business with no other businesses or residential

property attached; or

(ii) Has a ventilation system that exhausts smoke from the business and is

designed and terminated in accordance with the state building code standards for

the occupancy classification in use; and

(b) Allows smoking of cigarettes only if at least 75 percent of the gross

revenues of the business results from the sale of cigarettes.

(4) A smoke shop certified under subsection (2)(c) of this section must renew the

smoke shop certification every five years by demonstrating to the satisfaction of the

authority that the smoke shop:

(a) Meets the requirements of ORS 433.835, as in effect immediately before

June 30, 2011; and

(b) Allows smoking of cigarettes only if at least 75 percent of the gross

revenues of the business results from the sale of cigarettes.

(5) The owner of a smoke shop certified under subsection (2)(b) or (c) of this

section may transfer the certification with ownership of the smoke shop in

accordance with rules adopted by the authority.

(6) A smoke shop certified under subsection (2)(b) of this section may continue to

be certified in a new location under subsection (2)(b) of this section if:

(a)(A) The new location occupies no more than 3,500 square feet; or

(B) If the old location occupied more than 3,500 square feet, the new

location occupies no more than 110 percent of the space occupied by the old

location; and

(b) The smoke shop as operated in the new location:

(A) Meets the requirements of subsection (2)(a)(A) to (D) of this section;

(B)(i) Is a stand-alone business with no other businesses or residential

32

III. Smoke, Vapor and Aerosol-free Environments

Laws

property attached; or

(ii) Has a ventilation system that exhausts smoke from the business and is

designed and terminated in accordance with the state building code standards for

the occupancy classification in use; and

(C) Allows smoking of cigarettes only if at least 75 percent of the gross

revenues of the business results from the sale of cigarettes.

(7) A smoke shop certified under subsection (2)(c) of this section may continue to

be certified in a new location under subsection (2)(c) of this section if:

(a)(A) The new location occupies no more than 3,500 square feet; or

(B)If the old location occupied more than 3,500 square feet, the new location

occupies no more than 110 percent of the space occupied by the old location; and

(b) The smoke shop as operated in the new location:

(A) Meets the requirements of ORS 433.835, as in effect immediately before

June 30, 2011; and

(B) Allows smoking of cigarettes only if at least 75 percent of the gross

revenues of the business results from the sale of cigarettes.

(8) Rules adopted under this section must provide that, in order to obtain a smoke

shop certification, a business must agree to allow the authority to make unannounced

inspections of the business to determine compliance with ORS

433.835 to 433.875(Short title). [2011 c.601 §3; 2015 c.51 §1; 2015 c.158 §17; 2017

c.701 §12]

ORS 433.850 Prohibition on aerosolizing, smoking or vaporizing in place of

employment; exceptions; posting signs.

(1) An employer:

(a) Shall provide for employees a place of employment that is free of all smoke,

aerosols and vapors containing inhalants; and

(b) May not allow employees to smoke, aerosolize or vaporize inhalants at the

place of employment.

(2) Notwithstanding subsection (1) of this section:

(a) The owner or person in charge of a hotel or motel may designate up to 25

percent of the sleeping rooms of the hotel or motel as rooms in which smoking,

aerosolizing or vaporizing of inhalants is permitted.

(b) Smoking of noncommercial tobacco products for ceremonial purposes is

permitted in spaces designated for traditional ceremonies in accordance with the

American Indian Religious Freedom Act, 42 U.S.C. 1996.

(c) The smoking of tobacco products is permitted in a smoke shop.

(d) The smoking of cigars is permitted in a cigar bar that generated on-site retail

33

III. Smoke, Vapor and Aerosol-free Environments

Laws

sales of cigars of at least $5,000 for the calendar year ending December 31, 2006.

(e) A performer may smoke or carry a lighted smoking instrument that does

not contain tobacco or marijuana, and may aerosolize or vaporize a substance that

does not contain nicotine or a cannabinoid, while performing in a scripted stage,

motion picture or television production if:

(A) The production is produced by an organization whose primary

purpose is producing scripted productions; and

(B) The act of smoking, aerosolizing or vaporizing is an integral part of

the production.

(f) The medical use of marijuana is permitted in the place of employment of a

licensee of a professional licensing board as described in ORS 475B.919.

(3) An employer, except in those places described in subsection (2) of this section,

shall post signs that provide notice of the provisions of ORS 433.835 to 433.875.

[1981 c.384 §§4,5; 2001 c.104 §161; 2001 c.990 §2; 2007 c.602 §4; 2011 c.234 §1; 2015

c.158 §18; 2017 c.21 §109]

ORS 433.855 Duties of Oregon Health Authority; civil penalties; rules;

limitations; compliance checks.

(1) The Oregon Health Authority, in accordance with the provisions of ORS

chapter 183:

(a) Shall adopt rules necessary to implement the provisions of ORS 433.835 to

433.875;

(b) Is responsible for ensuring compliance with ORS 433.835 to 433.875 and

rules adopted under ORS 433.835 to 433.875; and

(c) May impose a civil penalty not to exceed $500 per day for each violation of

ORS 433.845 or 433.850 or a rule adopted under ORS 433.835 to 433.875.

Penalties imposed under this paragraph must be collected in the manner provided

in ORS 441.705 to 441.745. All monies recovered under this paragraph shall be

paid into the State Treasury and credited to:

(A) The Tobacco Use Reduction Account established under ORS 431A.153, if the

violation concerns nicotine; or

(B) The Oregon Health Authority Fund established under ORS 413.101, if the

violation concerns an inhalant other than nicotine.

(2) In carrying out its duties under this section, the Oregon Health Authority is not

authorized to require any changes in ventilation or barriers in any public place or place

of employment. This subsection does not limit the power of the authority to enforce

the requirements of any other provision of law.

(3) In public places which the authority regularly inspects, the authority shall check

34

III. Smoke, Vapor and Aerosol-free Environments

Laws

for compliance with the provisions of ORS 433.835 to 433.875. In other public places

and places of employment, the authority shall respond to complaints, notifying the

proprietor or person in charge of the requirements of ORS 433.835 to 433.875. If

repeated complaints are received, authority may take appropriate action to ensure

compliance.

(4) When a county has assumed responsibility of the duties and responsibilities

under ORS 446.425 and 448.100, or contracted with the authority under ORS

190.110, the county is responsible for enforcing the provisions of ORS 433.835 to

433.875 and has the same enforcement power as the authority.

[1981 c.384 §6; 1991

c.734 §21; 2001 c.104 §162; 2001 c.990 §6; 2003 c.309 §6; 2007 c.445 §36; 2007 c.602 §5;

2009 c.595 §686; 2011 c.597 §84a; 2015 c.158 §19]

ORS 433.860 Enforcement.

The Oregon Health Authority or local public health authority, as defined in ORS

431.003, may institute an action in the circuit court of the county where the violation

occurred to enjoin repeated violations of ORS 433.850. [1981 c.384 §7; 2009 c.595

§687; 2015 c.736 §84]

ORS 433.870 Regulation in addition to other aerosolizing, smoking or

vaporizing regulations.

ORS 433.835 to 433.875 and rules adopted under ORS 433.835 to 433.875 are in

addition to and not in lieu of any other law regulating the smoking, aerosolizing or

vaporizing of inhalants. [1981 c.384 §11; 2001 c.104 §164; 2001 c.990 §5; 2007 c.602

§6; 2015 c.158 §20]

ORS 433.990 Penalties.

(5) Violation of ORS 433.850 is a Class A violation. Fines imposed against a single

employer under this subsection may not exceed $4,000 in any 30-day period.

[1973 c.779 §46; 1979 c.492 §6; 1979 c.828 §13; subsection (5) enacted as 1981 c.384

§10; 1987 c.320 §232; 1987 c.600 §16; 1999 c.1051 §182; 2001 c.104 §166; 2001 c.636

§5; 2001 c.990 §7; 2007 c.445 §30; 2007 c.602 §7; 2009 c.595 §688; 2011 c.597 §8]

https://www.oregonlegislature.gov/bills_laws/ors/ors433.html

35

III. Smoke, Vapor and Aerosol-free Environments

Laws

Tobacco-Free Schools

State

State law forbids the use of tobacco products anywhere on school property or at

school-sponsored events, including during non-school hours. This restriction includes

all vehicles and facilities that are used by a school.

Enforcement

Oregon Department of Education and school districts

Citation

OAR 581-021-0110 Tobacco-Free Schools

(1) For the purpose of this rule "tobacco" is defined to include any lighted or

unlighted cigarette, cigar, pipe, bidi, clove cigarette, and any other smoking product,

and spit tobacco, also known as smokeless, dip, chew, and snuff, in any form.

(2) No student, staff member, or school visitor is permitted to smoke, inhale, dip,

or chew or sell tobacco at any time, including non-school hours

(a) In any building, facility, or vehicle owned, leased, rented, or chartered by the

school district, school, or public charter school; or

(b) On school grounds, athletic grounds, or parking lots.

(3) No student is permitted to possess a tobacco product:

(a) In any building, facility, or vehicle owned, leased, rented, or chartered by the

school district, school, or public charter school; or

(b) On school grounds, athletic grounds, or parking lots.

(4) By January 1, 2006, school districts must establish policies and procedures to

implement and enforce this rule for students, staff and visitors.

(5) For purposes of this rule, the term "school district" includes the Oregon

School for the Deaf (OSD) and the Oregon School for the Blind (OSB). The Oregon

School for the Deaf and the Oregon School for the Blind must establish, in

cooperation with the Oregon Department of Education, policies and procedures to

implement and enforce this rule for students, staff and visitors by June 30, 2006.

http://arcweb.sos.state.or.us/pages/rules/oars_500/oar_581/581_021.html

Tobacco Use in Behavioral Health Outpatient Programs

State

Outpatient programs may not allow tobacco use on program grounds.

Enforcement

Oregon Health Authority, Health Systems Division

36

III. Smoke, Vapor and Aerosol-free Environments

Laws

Citation

OAR 309-019-0205 Building Requirements in Behavioral Health Programs

(6) Outpatient programs may not allow tobacco use in program facilities and on

program grounds.

https://secure.sos.state.or.us/oard/displayDivisionRules.action?selectedDivision=1016

Landlord-Tenant Disclosure of Smoking Policy

State

State law requires that rental agreements entered on or after January 1, 2010 include a

disclosure of the smoking policy for the premises on which the rental unit is located.

This requirement does not apply to rental agreements in which the owner of a

manufactured home or floating home is renting space in a park or moorage because

such situations straddle the line between ownership and rental.

Enforcement

Private legal action

Citation

ORS 479.305 Smoking policy disclosure.

(1) Except as provided in subsection (2) of this section, the rental agreement for a

dwelling unit regulated under ORS chapter 90 must include a disclosure of the

smoking policy for the premises on which the dwelling unit is located. The disclosure

must state whether smoking is prohibited on the premises, allowed on the entire

premises or allowed in limited areas on the premises. If the smoking policy allows

smoking in limited areas on the premises, the disclosure must identify the areas on the

premises where smoking is allowed.

(2) This section does not apply to a rental agreement subject to ORS 90.505 to

90.850 for space in a facility as defined in ORS 90.100. [2009 c.127 §2]

https://www.oregonlegislature.gov/bills_laws/ors/ors479.html

Tobacco Free In-home Child Day Care

State

Many daycare environments are workplaces and therefore fall under the Oregon

Indoor Clean Air Act as environments that are required to be smokefree.

Additionally, registered in-home child day care provider homes and cars are required

to be tobacco free during the time that clients or children are present.

37

III. Smoke, Vapor and Aerosol-free Environments

Laws

Enforcement

Oregon Child Care Division

Citation

Registered Family Child Care Homes

OAR 414-205-0100 Health

(2) The home must be a healthy environment for children.

(a) No person shall smoke or carry any lighted smoking instrument, including an e-

cigarette or vaporizer in the family child care home or within ten feet of any entrance,

exit, or window that opens or any ventilation intake that serves an enclosed area,

during child care hours or when child care children are present. No person shall

smoke, carry any lighted smoking instrument, including an e-cigarette, or vaporizer or

use smokeless tobacco in motor vehicles while child care children are passengers.

http://arcweb.sos.state.or.us/pages/rules/oars_400/oar_414/414_205.html

Tobacco Free Correctional Facilities

State

Inmates in State of Oregon correctional facilities are not allowed to possess tobacco

or smoking paraphernalia.

Enforcement

Oregon Department of Corrections

Citation

OAR 291-105-0015 Rules of Misconduct

(e) 1.11 Contraband II: An inmate commits Contraband II if he/she possesses

contraband other than that listed in Contraband I (OAR 291-105-0015(d)(A)–(G) and

Contraband III (291-105-0015(f) and it creates a threat to the safety, security or

orderly operation of the facility, including but not limited to:

(A) 1.11.01 Tobacco or smoking paraphernalia, unauthorized medication, items of

barter (such as jewelry or canteen items not purchased by the inmate), checks, money

under $10, or unauthorized sexually explicit material.

http://arcweb.sos.state.or.us/pages/rules/oars_200/oar_291/291_105.html

38

III. Smoke, Vapor and Aerosol-free Environments

Laws

Smoke Free Cars for Kids

State

Smoking, aerosolizing or vaporizing in a motor vehicle with a minor under the age of

18 present is a secondary traffic violation. Individuals can be fined for smoking,

aerosolizing or vaporizing in a vehicle when youth are present.

Enforcement

Oregon State Police

Citation

ORS 811.193 Smoking, aerosolizing or vaporizing in motor vehicle when child

is present; penalty.

(1)(a) A person commits the offense of smoking, aerosolizing or vaporizing in a

motor vehicle if the person smokes or uses an inhalant delivery system in a motor

vehicle while a person under 18 years of age is in the motor vehicle.

(b) As used in this subsection:

(A) “Smokes” means to inhale, exhale, burn or carry a lighted cigarette, cigar,

pipe, weed, plant, regulated narcotic or other combustible substance; and

(B) “Uses an inhalant delivery system” means to use an inhalant delivery

system, as defined in ORS 431A.175, in a manner that creates an aerosol or

vapor.

(2) Notwithstanding ORS 810.410, a police officer may enforce this section only if the

police officer has already stopped and detained the driver operating the motor vehicle

for a separate traffic violation or other offense.

(3) Smoking, aerosolizing or vaporizing in a motor vehicle is a:

(a) Class D traffic violation for a first offense.

(b) Class C traffic violation for a second or subsequent offense. [2013 c.361 §2;

2015 c.158 §12]

https://www.oregonlegislature.gov/bills_laws/ors/ors811.html

Tobacco Free State Properties Executive Order

In August 2012, Governor John Kitzhaber signed the Tobacco-free State Properties

Executive Order. The Order required all state agencies to implement tobacco-free

campus policies.

Enforcement

40

IV. Tobacco Taxes, Payments, and Distribution

IV. Tobacco Taxes, Payments and Distribution

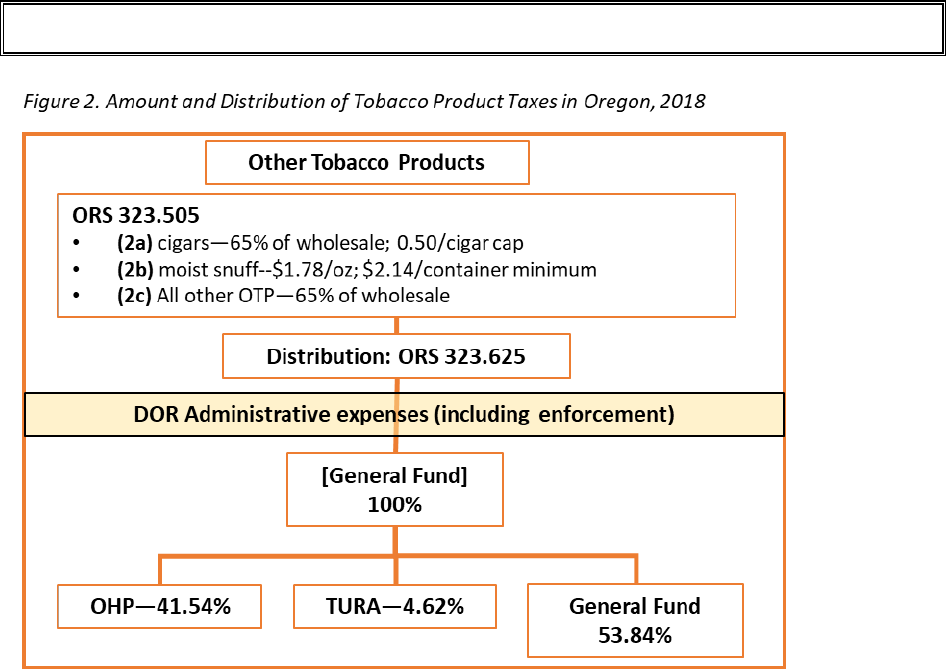

Oregon-Specific Tobacco Taxes

Oregon tax code defines and taxes four types of tobacco products:

1. Cigarettes

2. Cigars

3. Moist snuff

4. Other Tobacco Products

In 2015, the legislature defined inhalant delivery systems (including e-cigarettes) as

tobacco products for the purposes of the Indoor Clean Air Act (ICAA), but not for

taxation.

Historically, legislators and advocates focused primarily on cigarette taxes because of

the significant public health burden cigarettes place on people in Oregon and because

of the potential tax revenue. Legislators have paid less attention to other tobacco

products (OTP).

Cigarettes

In Oregon, distributors pay the excise taxes on cigarettes. by purchasing tax stamps

from the Oregon Department of Revenue (DOR) and applying them to unstamped

packs of cigarettes purchased from manufacturers or importers.

The Oregon legislature passed the first tobacco excise tax in 1966—a $.04/pack tax

on cigarettes. The legislature distributed he revenue from this tax to counties to

reduce property taxes (50%), and to city and county general funds (25% each).

Between 1971 and 1989, the legislature increased this tax three times, resulting in a

$.28/pack tax on cigarettes in 1989. Since 1989, the legislature has passed multiple

tobacco tax bills, but instead of simply directing the revenue to counties to reduce

property taxes, the legislature, with input from various health system and public health

organizations, began directing portions of the tobacco tax revenue to support

treatment and prevention efforts.

Since 1989, the legislature has adjusted cigarette taxes five times:

• 1993—Temporary (2 year) $.10/pack tax on cigarettes with all additional

revenue going to the Oregon Health Plan. Strongly supported by Oregon

Association of Hospitals and Health Systems.

o $.28/pack + $.10/pack = $.38/pack

o Of the additional $.10/pack:

75.57% went to State General Fund

7.14% each to

41

IV. Tobacco Taxes, Payments, and Distribution

• Counties

• Cities

• ODOT (elderly and disabled transportation via Special

Transportation Fund (STF))

o This temporary tax was renewed each biennium until 2003.

• 1996—BM 44 was put on the ballot by health systems affiliates and the

American Cancer Society. It passed, raising the cigarette tax by $.30/pack. All

additional revenue was directed to the Oregon Health Plan (OHP), including

10% for the creation of the Tobacco Prevention and Education Program

(TPEP) in 1997 via establishment of Tobacco Use Reduction Account.

o $.28/pack + $.10/pack + $.30/pack = $.68/pack

o Of the permanent $.58/pack tax:

89.65% goes to the State General Fund, of which

• 51.92% goes to OHP

• 5.77% goes to Tobacco Use Reduction Account (TURA)

o ORS 431A.153

• The rest, 42.31%, remains in the General Fund

3.45% each to:

• Counties

• Cities

• ODOT-STF

o Currently enshrined in Oregon Tax Law as ORS 323.030 (1)

• 2002—BM 20 passed, adding $.60/pack on to existing taxes

o $.28/pack + $.10/pack + $.30/pack + $.60/pack = $1.28/pack

Distribution of the additional $.60/pack tax:

• 18.64% for State General Fund

• 72.66% for OHP

• 2.9% for TURA/TPEP

• 1.93% each to Cities, Counties, and ODOT-STF

o Currently enshrined in Oregon Tax Law as ORS 323.031

• 2004—The temporary $.10/pack tax enacted in 1993 sun-setted on Dec 31,

1993

o BM 30, which proposed to continue the 1993 temporary tax, did not

pass.

o $1.28/pack - $.10/pack = $1.18/pack

• 2013—The Oregon legislature passed HB 3601, which raised the cigarette tax

rate $.13/pack on 1/1/14, then another $.01/pack on 1/1/16 and another

$.01/pack on 1/1/18.

42

IV. Tobacco Taxes, Payments, and Distribution

o Currently (2018), the cigarette tax is:

$1.18 + $.13/pack + $.01/pack + $.01/pack = $1.33/pack

o All 100% of the additional tax goes to OHP-Mental Health

o HB 3601 also adjusted the distribution of the $.60/pack tax in ORS

323.030 (2).

o The additional $.15/pack tax is currently enshrined in Oregon Law as

ORS 323.030 (4)

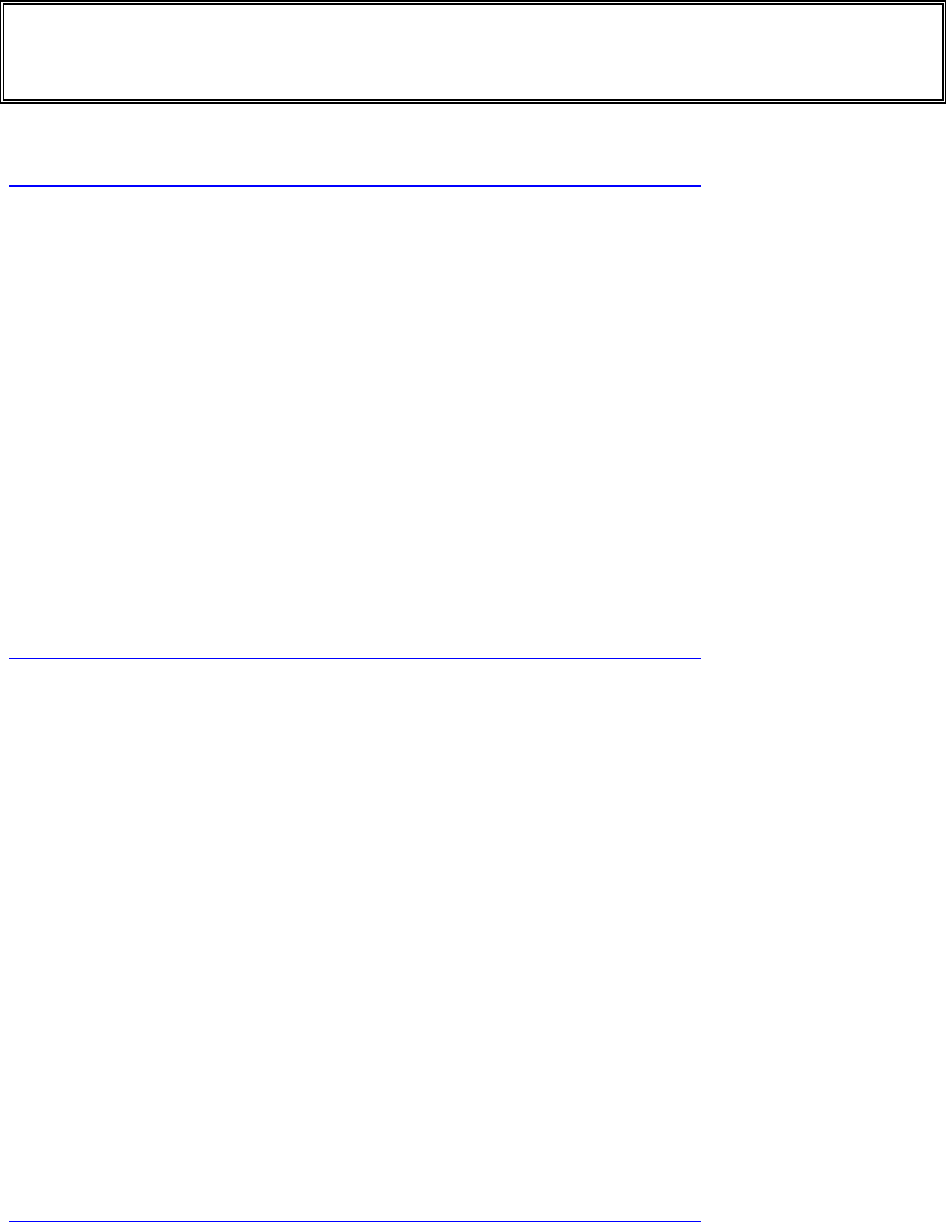

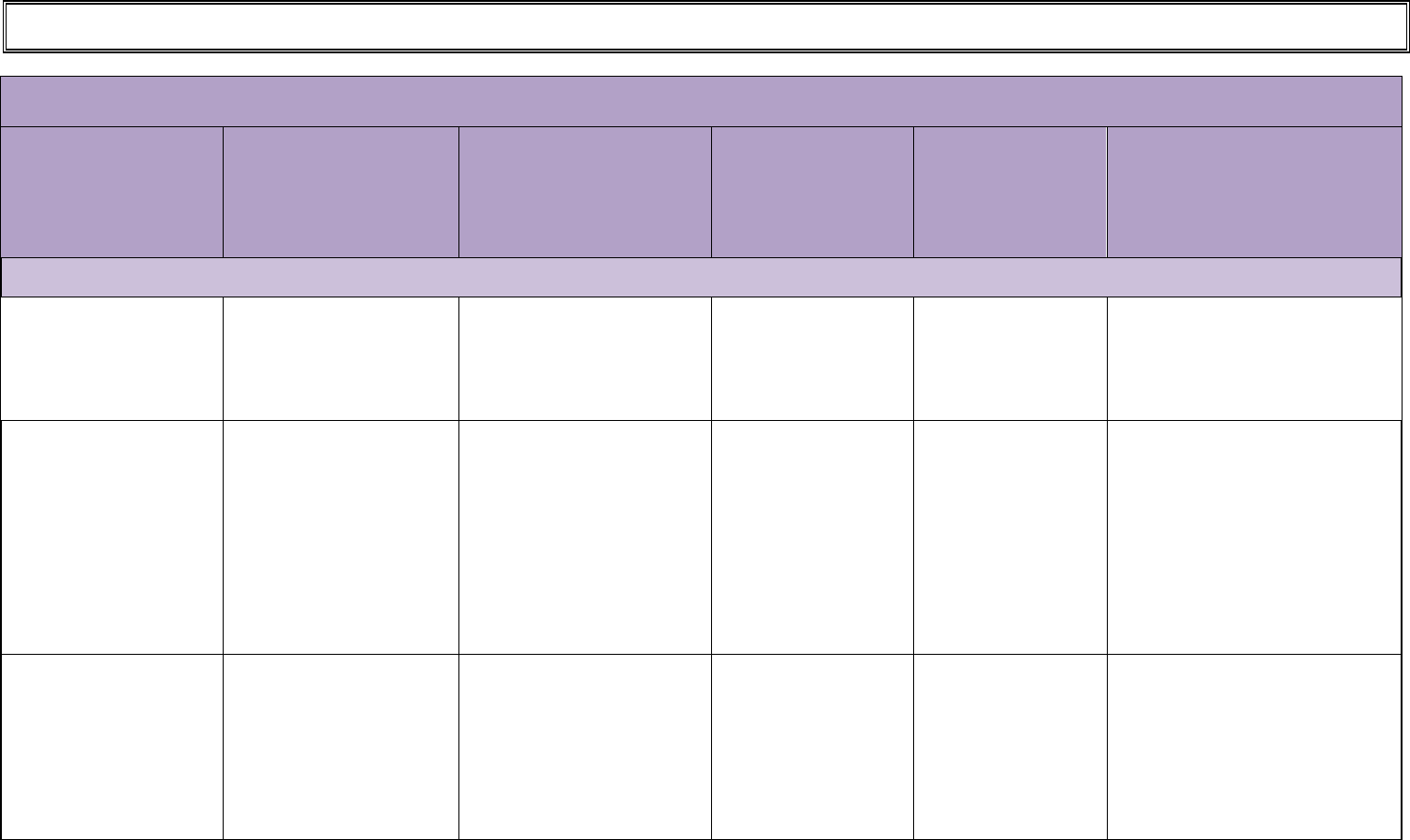

Table 1 below summaries the current distributions of Oregon’s cigarette taxes. Figure

1 on the following page contains a diagram of the distributions for cigarette taxes.

Table 1 – Current (2018) distribution of existing cigarette taxes.

Percent of

individual

tax

Percent of all

cigarette taxes

Dollars per

pack

ORS 323.030 (1)

General Fund

37.93

16.54

0.2200

Oregon Health Plan

46.55

20.30

0.2700

Tobacco Use Reduction Account

5.17

2.26

0.0300

Cities

3.45

1.50

0.0200

Counties

3.45

1.50

0.0200

Department of Transportation

3.45

1.50

0.0200

Total

100.00

0.5800

ORS 323.030 (4)

Oregon Health Plan (mental health)

100.00

11.28

0.150*

Total

100.00

0.15

OR 323.031 (2)

Oregon Health Plan

97.90

44.17

0.5874

Cities

0.47

0.21

0.0028

Counties

0.47

0.21

0.0028

Department of Transportation

0.47

0.21

0.0028

Tobacco Use Reduction Account

0.70

0.32

0.0042

Total

100.00

0.6000

Grand total

100

1.3300

*This is the tax amount that will be in place in 2018. Currently (2017), it is $.14.

43

IV. Tobacco Taxes, Payments, and Distribution

44

IV. Tobacco Taxes, Payments, and Distribution

Enforcement

Department of Revenue

Citations

ORS 323.030 Tax imposed; rate; exclusiveness; only one distribution taxed.

(1) Every distributor shall pay a tax upon distributions of cigarettes at the rate of

29 mills for the distribution of each cigarette in this state.

(2) The taxes imposed by ORS 323.005 to 323.482 are in lieu of all other state,

county or municipal taxes on the sale or use of cigarettes.

(3) Any cigarette with respect to which a tax has been prepaid under ORS 323.068