RULE 12.285. MANDATORY DISCLOSURE

(a) Application.

(1) Scope. This rule shall apply to all proceedings within the scope

of these rules except proceedings involving adoption, simplified dissolution,

enforcement, contempt, injunctions for domestic or repeat violence, and

uncontested dissolutions when the respondent is served by publication and does

not file an answer. Additionally, no financial affidavit or other documents shall be

required under this rule from a party seeking attorneys' fees, suit money, or costs, if

the basis for the request is solely under section 57.105, Florida Statutes, or any

successor statute. Except for the provisions as to financial affidavits and child

support guidelines worksheets, any portion of this rule may be modified by order

of the court or agreement of the parties.

(2) Original and Duplicate Copies. Unless otherwise agreed by

the parties or ordered by the court, copies of documents required under this rule

may be produced in lieu of originals. Originals, when available, shall be produced

for inspection upon request. Parties shall not be required to serve duplicates of

documents previously served.

(b) Time for Production of Documents.

(1) Temporary Financial Hearings. Any document required

under this rule in any temporary financial relief proceeding shall be served on the

other party for inspection and copying as follows.

(A) The party seeking relief shall serve the required

documents on the other party with the notice of temporary financial hearing, unless

the documents have been served under subdivision (b)(2) of this rule.

(B) The responding party shall serve the required documents

on the party seeking relief on or before 5:00 p.m., 2 business days before the day

of the temporary financial hearing if served by delivery or 7 days before the day of

the temporary financial hearing if served by mail, unless the documents have been

received previously by the party seeking relief under subdivision (b)(2) of this rule.

A responding party shall be given no less than 12 days to serve the documents

required under this rule, unless otherwise ordered by the court. If the 45-day period

for exchange of documents provided for in subdivision (b)(2) of this rule will occur

before the expiration of the 12 days, the provisions of subdivision (b)(2) control.

(2) Initial and Supplemental Proceedings. Any document

required under this rule for any initial or supplemental proceeding shall be served on

the other party for inspection and copying within 45 days of service of the initial

pleading on the respondent.

(c) Disclosure Requirements for Temporary Financial Relief. In any

proceeding for temporary financial relief heard within 45 days of the service of the

initial pleading or within any extension of the time for complying with mandatory

disclosure granted by the court or agreed to by the parties, the following

documents shall be served on the other party:

(1) A financial affidavit in substantial conformity with Florida

Family Law Rules of Procedure Form 12.902(b) if the party's gross annual income

is less than $50,000, or Florida Family Law Rules of Procedure Form 12.902(c) if

the party's gross annual income is equal to or more than $50,000. This requirement

cannot be waived by the parties. The affidavit also must be filed with the court.

(2) All federal and state income tax returns, gift tax returns, and

intangible personal property tax returns filed by the party or on the party's behalf

for the past year. A party may file a transcript of the tax return as provided by

Internal Revenue Service Form 4506 in lieu of his or her individual federal income

tax return for purposes of a temporary hearing.

(3) IRS forms W-2, 1099, and K-1 for the past year, if the income

tax return for that year has not been prepared.

(4) Pay stubs or other evidence of earned income for the 3 months

prior to service of the financial affidavit.

(d) Parties' Disclosure Requirements for Initial or Supplement

Proceedings. A party shall serve the following documents in any proceeding for an

initial or supplemental request for permanent financial relief, including, but not

limited to, a request for child support, alimony, equitable distribution of assets or

debts, or attorneys' fees, suit money, or costs:

(1) A financial affidavit in substantial conformity with Florida

Family Law Rules of Procedure Form 12.902(b) if the party's gross annual income

is less than $50,000, or Florida Family Law Rules of Procedure Form 12.902(c) if

the party's gross annual income is equal to or more than $50,000, which

requirement cannot be waived by the parties. The financial affidavits also must be

filed with the court. A party may request, by using the Standard Family Law

Interrogatories, or the court on its own motion may order, a party whose gross

annual income is less than $50,000 to complete Florida Family Law Rules of

Procedure Form 12.902(c).

(2) All federal and state income tax returns, gift tax returns, and

intangible personal property tax returns filed by the party or on the party's behalf

for the past 3 years.

(3) IRS forms W-2, 1099, and K-1 for the past year, if the income

tax return for that year has not been prepared.

(4) Pay stubs or other evidence of earned income for the 3 months

prior to service of the financial affidavit.

(5) A statement by the producing party identifying the amount and

source of all income received from any source during the 3 months preceding the

service of the financial affidavit required by this rule if not reflected on the pay

stubs produced.

(6) All loan applications and financial statements prepared or used

within the 12 months preceding service of that party's financial affidavit required by

this rule, whether for the purpose of obtaining or attempting to obtain credit or for

any other purpose.

(7) All deeds within the last 3 years, all promissory notes within the

last 12 months, and all present leases, in which the party owns or owned an interest,

whether held in the party's name individually, in the party's name jointly with any

other person or entity, in the party's name as trustee or guardian for any other

person, or in someone else's name on the party's behalf.

(8) All periodic statements from the last 3 months for all checking

accounts, and from the last 12 months for all other accounts (for example, savings

accounts, money market funds, certificates of deposit, etc.), regardless of whether

or not the account has been closed, including those held in the party's name indi-

vidually, in the party's name jointly with any other person or entity, in the party's

name as trustee or guardian for any other person, or in someone else's name on the

party's behalf.

(9) All brokerage account statements in which either party to this

action held within the last 12 months or holds an interest including those held in the

party's name individually, in the party's name jointly with any person or entity, in the

party's name as trustee or guardian for any other person, or in someone else's name

on the party's behalf.

(10) The most recent statement for any profit sharing, retirement,

deferred compensation, or pension plan (for example, IRA, 401(k), 403(b), SEP,

KEOGH, or other similar account) in which the party is a participant or alternate

payee and the summary plan description for any retirement, profit sharing, or

pension plan in which the party is a participant or an alternate payee. (The summary

plan description must be furnished to the party on request by the plan administrator

as required by 29 U.S.C. § 1024(b)(4).)

(11) The declarations page, the last periodic statement, and the

certificate for all life insurance policies insuring the party's life or the life of the

party's spouse, whether group insurance or otherwise, and all current health and

dental insurance cards covering either of the parties and/or their dependent children.

(12) Corporate, partnership, and trust tax returns for the last 3 tax

years if the party has an ownership or interest in a corporation, partnership, or trust

greater than or equal to 30%.

(13) All promissory notes for the last 12 months, all credit card and

charge account statements and other records showing the party's indebtedness as

of the date of the filing of this action and for the last 3 months, and all present lease

agreements, whether owed in the party's name individually, in the party's name

jointly with any other person or entity, in the party's name as trustee or guardian for

any other person, or in someone else's name on the party's behalf.

(14) All written premarital or marital agreements entered into at any

time between the parties to this marriage, whether before or during the marriage.

Additionally, in any modification proceeding, each party shall serve on the

opposing party all written agreements entered into between them at any time since

the order to be modified was entered.

(15) All documents and tangible evidence supporting the producing

party's claim of special equity or nonmarital status of an asset or debt for the time

period from the date of acquisition of the asset or debt to the date of production or

from the date of marriage, if based on premarital acquisition.

(16) Any court orders directing a party to pay or receive spousal or

child support.

(e) Duty to Supplement Disclosure; Amended Financial Affidavit.

(1) Parties have a continuing duty to supplement documents

described in this rule, including financial affidavits, whenever a material change in

their financial status occurs.

(2) If an amended financial affidavit or an amendment to a financial

affidavit is filed, the amending party also shall serve any subsequently discovered

or acquired documents supporting the amendments to the financial affidavit.

(f) Sanctions. Any document to be produced under this rule that is

served on the opposing party fewer than 24 hours before a nonfinal hearing or in

violation of the court's pretrial order shall not be admissible in evidence at that

hearing unless the court finds good cause for the delay. In addition, the court may

impose other sanctions authorized by rule 12.380 as may be equitable under the

circumstances. The court may also impose sanctions upon the offending lawyer in

lieu of imposing sanctions on a party.

(g) Extensions of Time for Complying with Mandatory Disclosure.

By agreement of the parties, the time for complying with mandatory disclosure may

be extended. Either party also may file, at least 5 days before the due date, a motion

to enlarge the time for complying with mandatory disclosure. The court shall grant

the request for good cause shown.

(h) Objections to Mandatory Automatic Disclosure. Objections to the

mandatory automatic disclosure required by this rule shall be served in writing at

least 5 days prior to the due date for the disclosure or the objections shall be

deemed waived. The filing of a timely objection, with a notice of hearing on the

objection, automatically stays mandatory disclosure for those matters within the

scope of the objection. For good cause shown, the court may extend the time for

the filing of an objection or permit the filing of an otherwise untimely objection. The

court shall impose sanctions for the filing of meritless or frivolous objections.

(i) Certificate of Compliance. All parties subject to automatic

mandatory disclosure shall file with the court a certificate of compliance, Florida

Family Law Rules of Procedure Form 12.932, identifying with particularity the

documents which have been delivered and certifying the date of service of the

financial affidavit and documents by that party. Except for the financial affidavit

and child support guidelines worksheet, no documents produced under this rule

shall be filed in the court file without a court order.

(j) Child Support Guidelines Worksheet. If the case involves child

support, the parties shall file with the court at or prior to a hearing to establish or

modify child support a Child Support Guidelines Worksheet in substantial

conformity with Florida Family Law Rules of Procedure Form 12.902(e). This

requirement cannot be waived by the parties.

(k) Place of Production.

(1) Unless otherwise agreed by the parties or ordered by the court,

all production required by this rule shall take place in the county where the action is

pending and in the office of the attorney for the party receiving production. Unless

otherwise agreed by the parties or ordered by the court, if a party does not have an

attorney or if the attorney does not have an office in the county where the action is

pending, production shall take place in the county where the action is pending at a

place designated in writing by the party receiving production, served at least 5 days

before the due date for production.

(2) If venue is contested, on motion by a party the court shall

designate the place where production will occur pending determination of the venue

issue.

(l) Failure of Defaulted Party to Comply. Nothing in this rule shall be

deemed to preclude the entry of a final judgment when a party in default has failed

to comply with this rule.

Commentary

1995 Adoption. This rule creates a procedure for automatic financial

disclosure in family law cases. By requiring production at an early stage in the

proceedings, it is hoped that the expense of litigation will be minimized. See Dralus

v. Dralus, 627 So.2d 505 (Fla. 2d DCA 1993); Wrona v. Wrona, 592 So.2d 694

(Fla. 2d DCA 1991); and Katz v. Katz, 505 So.2d 25 (Fla. 4th DCA 1987). A

limited number of requirements have been placed upon parties making and

spending less than $50,000 annually unless otherwise ordered by the court. In cases

where the income or expenses of a party are equal to or exceed $50,000 annually,

the requirements are much greater. Except for the provisions as to financial

affidavits, other than as set forth in subdivision (k), any portion of this rule may be

modified by agreement of the parties or by order of the court. For instance, upon

the request of any party or on the court's own motion, the court may order that the

parties to the proceeding comply with some or all of the automatic mandatory

disclosure provisions of this rule even though the parties do not meet the income

requirements set forth in subdivision (d). Additionally, the court may, on the motion

of a party or on its own motion, limit the disclosure requirements in this rule should

it find good cause for doing so.

Committee Notes

1997 Amendment. Except for the form of financial affidavit used,

mandatory disclosure is made the same for all parties subject to the rule, regardless

of income. The amount of information required to be disclosed is increased for

parties in the under-$50,000 category and decreased for parties in the $50,000-or-

over category. The standard family law interrogatories are no longer mandatory,

and their answers are designed to be supplemental and not duplicative of

information contained in the financial affidavits.

1998 Amendment. If one party has not provided necessary financial

information for the other party to complete a child support guidelines worksheet, a

good faith estimate should be made.

Instructions for Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (9/00)

IN THE CIRCUIT COURT OF THE JUDICIAL CIRCUIT,

IN AND FOR COUNTY, FLORIDA

Case No.:

Division:

,

Petitioner,

and

,

Respondent.

FAMILY LAW FINANCIAL AFFIDAVIT (SHORT FORM)

(Under $50,000 Individual Gross Annual Income)

I, {full legal name} , being sworn, certify that the following

information is true:

My Occupation:

Employed by:

Business Address:

Pay rate: $ ( ) every week ( ) every other week ( ) twice a month ( ) monthly ( ) other:

9 Check here if unemployed and explain on a separate sheet your efforts to find employment.

SECTION I. PRESENT MONTHLY GROSS INCOME:

All amounts must be MONTHLY. See the instructions with this form to figure out money amounts for anything that is NOT

paid monthly. Attach more paper, if needed. Items included under “other” should be listed separately with separate dollar

amounts.

1. Monthly gross salary or wages

2.

Monthly bonuses, commissions, allowances, overtime, tips, and similar

payments

3.

Monthly business income from sources such as self-employment,

partnerships, close corporations, and/or independent contracts (gross receipts

minus ordinary and necessary expenses required to produce income) (9

Attach sheet itemizing such income and expenses.)

4. Monthly disability benefits/SSI

5.

Monthly Workers’ Compensation

6. Monthly Unemployment Compensation

7.

Monthly pension, retirement, or annuity payments

8. Monthly Social Security benefits

9.

Monthly alimony actually received

9a. From this case: $

9b. From other case(s): Add 9a and 9b

10.

Monthly interest and dividends

11. Monthly rental income (gross receipts minus ordinary and necessary expenses

required to produce income) (9 Attach sheet itemizing such income and

expense items.)

12.

Monthly income from royalties, trusts, or estates

13. Monthly reimbursed expenses and in-kind payments to the extent that they

reduce personal living expenses

1. $

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (9/00)

14.

Monthly gains derived from dealing in property (not including nonrecurring

gains)

15. Any other income of a recurring nature (list source)

16.

14.

15.

16.

17. PRESENT MONTHLY GROSS INCOME (Add lines 1–16)

TOTAL: 17. $

PRESENT MONTHLY DEDUCTIONS:

18.

Monthly federal, state, and local income tax (corrected for filing status and

allowable dependents and income tax liabilities)

a. Filing Status ____________

b. Number of dependents claimed _______

19. Monthly FICA or self-employment taxes

20. Monthly Medicare payments

21.

Monthly mandatory union dues

22. Monthly mandatory retirement payments

23.

Monthly health insurance payments (including dental insurance), excluding

portion paid for any minor children of this relationship

24. Monthly court-ordered child support actually paid for children from another

relationship

25. Monthly court-ordered alimony actually paid

25a. from this case: $

25b. from other case(s): Add 25a and 25b

18.

$

19.

20.

21.

22.

23.

24.

25.

26. TOTAL DEDUCTIONS ALLOWABLE UNDER SECTION 61.30,

FLORIDA STATUTES (Add lines 18 through 25) TOTAL: 26. $

PRESENT NET MONTHLY INCOME (Subtract line 26 from line 17) 27. $

SECTION II. AVERAGE MONTHLY EXPENSES

A. HOUSEHOLD:

Mortgage or rent $

Property taxes $

Utilities

$

Telephone $

Food

$

Meals outside home

$

Maintenance/Repairs $

Other:

$

B. AUTOMOBILE

Gasoline

$

Repairs $

Insurance $

C. CHILD(REN)’S EXPENSES

Day care

$

Lunch money

$

Clothing $

Grooming

$

Gifts for holidays

$

Medical/dental (uninsured)

$

Other:

$

D. INSURANCE

Medical/dental

$

Child(ren)’s medical/dental

$

Life $

Other: $

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (9/00)

E. OTHER EXPENSES NOT LISTED ABOVE

Clothing $

Medical/Dental (uninsured)

$

Grooming $

Entertainment $

Gifts

$

Religious organizations $

Miscellaneous $

Other:

$

$

$

$

$

$

$

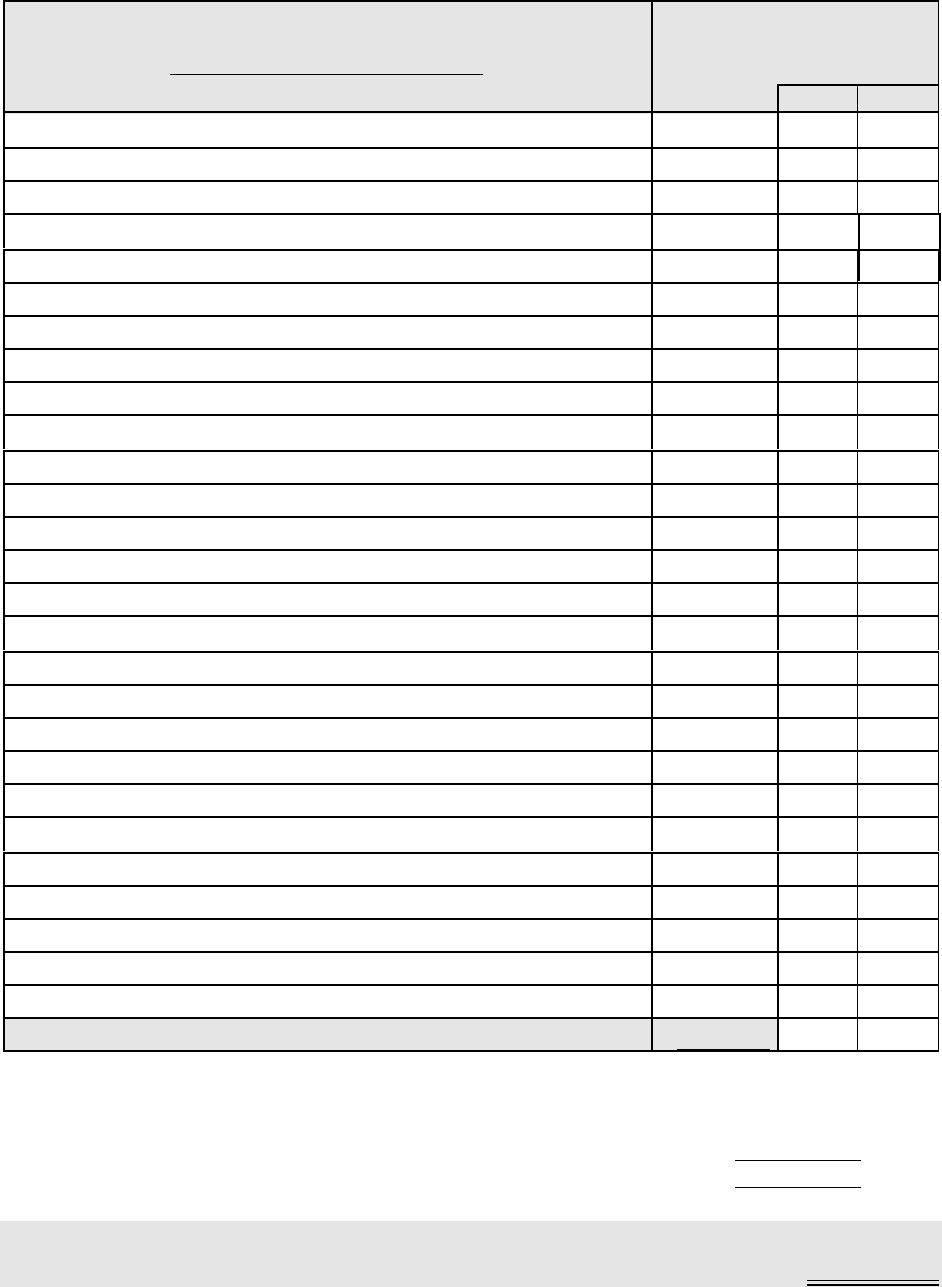

F. PAYMENTS TO CREDITORS

MONTHLY

CREDITOR: PAYMENT

$

$

$

$

$

$

$

$

$

$

$

28. TOTAL MONTHLY EXPENSES (add ALL monthly amounts in

A through F above) 28. $

SUMMARY

29. TOTAL PRESENT MONTHLY NET INCOME

(from line 27 of SECTION I. INCOME)

30. TOTAL MONTHLY EXPENSES (from line 28 above)

31. SURPLUS (If line 29 is more than line 30, subtract line 30 from line 29.

This is the amount of your surplus. Enter that amount here.)

32. (DEFICIT) (If line 30 is more than line 29, subtract line 29 from line 30.

This is the amount of your deficit. Enter that amount here.)

29. $

30. $

31. $

32. ($ )

SECTION III. ASSETS AND LIABILITIES

Use the nonmarital column only if this is a petition for dissolution of marriage and you believe an item is

“nonmarital,” meaning it belongs to only one of you and should not be divided. You should indicate to whom you believe

the item(s) or debt belongs. (Typically, you will only use this column if property/debt was owned/owed by one spouse before

the marriage. See the “General Information for Self-Represented Litigants” found at the beginning of these forms and

section 61.075(1), Florida Statutes, for definitions of “marital” and “nonmarital” assets and liabilities.)

A. ASSETS:

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (9/00)

DESCRIPTION OF ITEM(S). List a description of each separate item owned by you

(and/or your spouse, if this is a petition for dissolution of marriage).

DO NOT LIST ACCOUNT NUMBERS. / the box next to any asset(s) which you

are requesting the judge award to you.

Current Fair

Market Value

Nonmarital

(/ correct column)

husband wife

9 Cash (on hand) $

9 Cash (in banks or credit unions)

9 Stocks, Bonds, Notes

9 Real estate: (Home)

9 (Other)

9 Automobiles

9 Other personal property

9 Retirement plans (Profit Sharing, Pension, IRA, 401(k)s, etc.)

9 Other

9

9

9

9

9

9

9 / here if additional pages are attached.

Total Assets (add column B) $

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (9/00)

B. LIABILITIES:

DESCRIPTION OF ITEM(S). List a description of each separate debt owed by you

(and/or your spouse, if this is a petition for dissolution of marriage).

DO NOT LIST ACCOUNT NUMBERS

/ the box next to any debt(s) for which you believe you should be responsible.

Current

Amount

Owed

Nonmarital

(/ correct column)

husband wife

9 Mortgages on real estate $

9

9

9

9 Auto loans

9

9

9 Charge/credit card accounts

9

9

9

9 Other

9

9

9 / here if additional pages are attached.

Total Debts (add column B) $

C. CONTINGENT ASSETS AND LIABILITIES:

INSTRUCTIONS: If you have any POSSIBLE assets (income potential, accrued vacation or sick leave, bonus, inheritance,

etc.) or POSSIBLE liabilities (possible lawsuits, future unpaid taxes, contingent tax liabilities, debts assumed by another), you

must list them here.

Contingent Assets

/ the box next to any contingent asset(s) which you are requesting the judge

award to you.

Possible Value

Nonmarital

(/ correct column)

husband wife

9 $

9

Total Contingent Assets $

Contingent Liabilities

/ the box next to any contingent debt(s) for which you believe you should be

responsible.

Possible

Amount Owed

Nonmarital

(/ correct column)

husband wife

9 $

9

Total Contingent Liabilities $

SECTION IV. CHILD SUPPORT GUIDELINES WORKSHEET

(O” Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet, MUST be filed

with the court at or prior to a hearing to establish or modify child support. This requirement cannot be waived by the

parties.)

[ / one only]

A Child Support Guidelines Worksheet IS or WILL BE filed in this case. This case involves the

Florida Family Law Rules of Procedure Form 12.902(b), Family Law Financial Affidavit (Short Form) (9/00)

establishment or modification of child support.

A Child Support Guidelines Worksheet IS NOT being filed in this case. The establishment or

modification of child support is not an issue in this case.

I certify that a copy of this document was [ / one only] ( ) mailed ( ) faxed and mailed ( ) hand delivered

to the person(s) listed below on {date} .

Other party or his/her attorney:

Name:

Address:

City, State, Zip:

Fax Number:

I understand that I am swearing or affirming under oath to the truthfulness of the claims made in this

affidavit and that the punishment for knowingly making a false statement includes fines and/or imprisonment.

Dated:

Signature of Party

Printed Name:

Address:

City, State, Zip:

Telephone Number:

Fax Number:

STATE OF FLORIDA

COUNTY OF

Sworn to or affirmed and signed before me on by .

NOTARY PUBLIC or DEPUTY CLERK

[Print, type, or stamp commissioned name of notary or deputy

clerk.]

Personally known

Produced identification

Type of identification produced

IF A NONLAWYER HELPED YOU FILL OUT THIS FORM, HE/SHE MUST FILL IN THE BLANKS BELOW: [ N

fill in all blanks]

I, {full legal name and trade name of nonlawyer} ,

a nonlawyer, located at {street} , {city} ,

{state} , {phone} , helped {name} ,

who is the [ / one only] petitioner or respondent, fill out this form.

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

IN THE CIRCUIT COURT OF THE JUDICIAL CIRCUIT,

IN AND FOR COUNTY, FLORIDA

Case No.:

Division:

,

Petitioner,

and

,

Respondent.

FAMILY LAW FINANCIAL AFFIDAVIT

($50,000 or more Individual Gross Annual Income)

I, {full legal name}

, being sworn, certify that the following information is true:

SECTION I. INCOME

1.

Date of Birth:

2. Social Security Number:

32. My occupation is:

43.

I am currently

[ / all that apply]

a. Unemployed

Describe your efforts to find employment, how soon you expect to be employed, and the pay you

expect to receive:

b. Employed by:

Address:

City, State, Zip code:

Telephone Number:

Pay rate: $ ( ) every week ( ) every other week ( ) twice a month ( )

monthly

( ) other:

If you are expecting to become unemployed or change jobs soon, describe the change you expect and

why and how it will affect your income:

9 Check here if you currently have more than one job. List the information above for the second

job(s) on a separate sheet and attach it to this affidavit.

c. Retired. Date of retirement:

Employer from whom retired:

Address:

City, State, Zip code: Telephone Number:

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

LAST YEAR’S GROSS INCOME:

Your Income Other Party’s Income (if known)

YEAR $ $

PRESENT MONTHLY GROSS INCOME:

All amounts must be MONTHLY. See the instructions with this form to figure out money amounts for anything that is NOT paid

monthly. Attach more paper, if needed. Items included under “other” should be listed separately with separate dollar amounts.

1. Monthly gross salary or wages

2.

Monthly bonuses, commissions, allowances, overtime, tips, and similar

payments

3.

Monthly business income from sources such as self-employment,

partnerships, close corporations, and/or independent contracts (Gross

receipts minus ordinary and necessary expenses required to produce

income.)

(9 Attach sheet itemizing such income and expenses.)

4.

Monthly disability benefits/SSI

5. Monthly Workers’ Compensation

6. Monthly Unemployment Compensation

7.

Monthly pension, retirement, or annuity payments

8.

Monthly Social Security benefits

9.

Monthly alimony actually received

9a. From this case: $

9b. From other case(s): Add 9a and 9b

10.

Monthly interest and dividends

11.

Monthly rental income (gross receipts minus ordinary and necessary

expenses required to produce income) (9 Attach sheet itemizing such

income and expense items.)

12. Monthly income from royalties, trusts, or estates

13.

Monthly reimbursed expenses and in-kind payments to the extent that they

reduce personal living expenses (9 Attach sheet itemizing each item and

amount.)

14. Monthly gains derived from dealing in property (not including nonrecurring

gains)

Any other income of a recurring nature (identify source)

15.

16.

1. $

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17. PRESENT MONTHLY GROSS INCOME (Add lines 1–16) TOTAL:

17. $

PRESENT MONTHLY DEDUCTIONS:

All amounts must be MONTHLY. See the instructions with this form to figure out money amounts for anything that is NOT paid

monthly.

18. Monthly federal, state, and local income tax (corrected for filing status and

allowable dependents and income tax liabilities)

a. Filing Status

b. Number of dependents claimed

19. Monthly FICA or self-employment taxes

20. Monthly Medicare payments

21.

Monthly mandatory union dues

22.

Monthly mandatory retirement payments

18.

$

19.

20.

21.

22.

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

23. Monthly health insurance payments (including dental insurance), excluding

portion paid for any minor children of this relationship

24.

Monthly court-ordered child support actually paid for children from another

relationship

25. Monthly court-ordered alimony actually paid

25a. from this case: $

25b. from other case(s): Add 25a and 25b

23.

24.

25.

26. TOTAL DEDUCTIONS ALLOWABLE UNDER SECTION 61.30,

FLORIDA STATUTES (Add lines 18 through 25)

TOTAL: 26. $

27. PRESENT NET MONTHLY INCOME (Subtract line 26 from line 17)

27. $

SECTION II. AVERAGE MONTHLY EXPENSES

Proposed/Estimated Expenses. If this is a dissolution of marriage case and your expenses as listed below

do not reflect what you actually pay currently, you should write “estimate” next to each amount that is

estimated.

HOUSEHOLD:

1.

Monthly mortgage or rent payments

2.

Monthly property taxes (if not included in mortgage)

3. Monthly insurance on residence (if not included in mortgage)

4. Monthly condominium maintenance fees and homeowner’s association fees

5. Monthly electricity

6.

Monthly water, garbage, and sewer

7.

Monthly telephone

8.

Monthly fuel oil or natural gas

9. Monthly repairs and maintenance

10. Monthly lawn care

11. Monthly pool maintenance

12.

Monthly pest control

13.

Monthly misc. household

14.

Monthly food and home supplies

15. Monthly meals outside home

16. Monthly cable t.v.

17. Monthly alarm service contract

18.

Monthly service contracts on appliances

19.

Monthly maid service

Other:

20.

21.

22.

23.

24.

1.

$

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25. SUBTOTAL (add lines 1 through 24) 25. $

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

AUTOMOBILE:

26. Monthly gasoline and oil

27. Monthly repairs

28.

Monthly auto tags and emission testing

29.

Monthly insurance

30.

Monthly payments (lease or financing)

31. Monthly rental/replacements

32. Monthly alternative transportation (bus, rail, car pool, etc.)

33.

Monthly tolls and parking

34. Other:

26.

$

27.

28.

29.

30.

31.

32.

33.

34.

35. SUBTOTAL (add lines 26 through 34) 35. $

MONTHLY EXPENSES FOR CHILDREN COMMON TO BOTH

PARTIES:

36. Monthly nursery, babysitting, or day care

37. Monthly school tuition

38.

Monthly school supplies, books, and fees

39. Monthly after school activities

40.

Monthly lunch money

41. Monthly private lessons or tutoring

42. Monthly allowances

43.

Monthly clothing and uniforms

44. Monthly entertainment (movies, parties, etc.)

45.

Monthly health insurance

46. Monthly medical, dental, prescriptions (nonreimbursed only)

47. Monthly psychiatric/psychological/counselor

48.

Monthly orthodontic

49. Monthly vitamins

50.

Monthly beauty parlor/barber shop

51. Monthly nonprescription medication

52. Monthly cosmetics, toiletries, and sundries

53.

Monthly gifts from child(ren) to others (other children, relatives, teachers,

etc.)

54.

Monthly camp or summer activities

55. Monthly clubs (Boy/Girl Scouts, etc.)

56. Monthly access expenses (for nonresidential parent)

57.

Monthly miscellaneous

36. $

37.

38.

39.

40.

41.

42.

43.

44.

45.

46.

47.

48.

49.

50.

51.

52.

53.

54.

55.

56.

57.

58. SUBTOTAL (add lines 36 through 57) 58. $

MONTHLY EXPENSES FOR CHILD(REN) FROM ANOTHER

RELATIONSHIP: (other than court-ordered child support)

59.

60.

61.

62.

59.

$

60.

61.

62.

63. SUBTOTAL (add lines 59 through 62) 63. $

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

MONTHLY INSURANCE:

64.

Health insurance, excluding portion paid for any minor child(ren) of this

relationship

65.

Life insurance

66. Dental insurance

Other:

67.

68.

64. $

65.

66.

67.

68.

69. SUBTOTAL (add lines 64 through 68) 69. $

OTHER MONTHLY EXPENSES NOT LISTED ABOVE:

70. Monthly dry cleaning and laundry

71. Monthly clothing

72.

Monthly medical, dental, and prescription (unreimbursed only)

73.

Monthly psychiatric, psychological, or counselor (unreimbursed only)

74. Monthly non-prescription medications, cosmetics, toiletries, and sundries

75. Monthly grooming

76.

Monthly gifts

77.

Monthly pet expenses

78. Monthly club dues and membership

79. Monthly sports and hobbies

80.

Monthly entertainment

81.

Monthly periodicals/books/tapes/CD’s

82. Monthly vacations

83. Monthly religious organizations

84.

Monthly bank charges/credit card fees

85. Monthly education expenses

Other: (include any usual and customary expenses not otherwise mentioned in

the items listed above)

86.

87.

88.

89.

70. $

71.

72.

73.

74.

75.

76.

77.

78.

79.

80.

81.

82.

83.

84.

85.

86.

87.

88.

89.

90. SUBTOTAL (add lines 70 through 89) 90.

$

MONTHLY PAYMENTS TO CREDITORS: (only when payments are currently made by you on

outstanding balances) DO NOT LIST ACCOUNT NUMBERS

NAME OF CREDITOR(s):

91.

92.

93.

94.

95.

96.

97.

98.

99.

100.

101.

91. $

92.

93.

94.

95.

96.

97.

98.

99.

100.

101.

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

102.

103.

102.

103.

104. SUBTOTAL (add lines 91 through 103) 104. $

105. TOTAL MONTHLY EXPENSES:

(add lines 25, 35, 58, 63, 69, 90, and 104 of Section II, Expenses) 105. $

SUMMARY

106.

TOTAL PRESENT MONTHLY NET INCOME

(from line 27 of SECTION I. INCOME)

106. $

107.

TOTAL MONTHLY EXPENSES (from line 105 above)

108.

SURPLUS (If line 106 is more than line 107, subtract line 107 from

line 106. This is the amount of your surplus. Enter that amount here.)

107. $

108. $

109.

(DEFICIT) (If line 107 is more than line 106, subtract line 106 from

line 107. This is the amount of your deficit. Enter that amount here.) 109. ($ )

SECTION III. ASSETS AND LIABILITIES

A. ASSETS (This is where you list what you OWN.)

INSTRUCTIONS:

STEP 1: In column A, list a description of each separate item owned by you (and/or your spouse, if this is a petition for dissolution

of marriage). Blank spaces are provided if you need to list more than one of an item.

STEP 2: If this is a petition for dissolution of marriage, check the box in Column A next to any item that you are requesting the

judge award to you.

STEP 3: In column B, write what you believe to be the current fair market value of all items listed.

STEP 4: Use column C only if this is a petition for dissolution of marriage and you believe an item is “nonmarital,”

meaning it belongs to only one of you and should not be divided. You should indicate to whom you believe the item belongs.

(Typically, you will only use Column C if property was owned by one spouse before the marriage. See the “General Information

for Self-Represented Litigants” found at the beginning of these forms and section 61.075(1), Florida Statutes, for definitions of

“marital” and “nonmarital” assets and liabilities.)

A

ASSETS: DESCRIPTION OF ITEM(S)

DO NOT LIST ACCOUNT NUMBERS

/ the box next to any asset(s) which you are requesting the judge award to you.

B

Current Fair

Market Value

C

Nonmarital

(/ correct column)

husband wife

9 Cash (on hand)

$

9 Cash (in banks or credit unions)

9

9 Stocks/Bonds

9

9

9 Notes (money owed to you in writing)

A

ASSETS: DESCRIPTION OF ITEM(S)

DO NOT LIST ACCOUNT NUMBERS

/ the box next to any asset(s) which you are requesting the judge award to you.

B

Current Fair

Market Value

C

Nonmarital

(/ correct column)

husband wife

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

9

9

9 Money owed to you (not evidenced by a note)

9

9

9 Real estate: (Home)

9 (Other)

9

9

9

9

9

9 Business interests

9

9

9

9

9 Automobiles

9

9

9

9 Boats

9

9

9 Other vehicles

9

9

9 Retirement plans (Profit Sharing, Pension, IRA, 401(k)s, etc.)

9

9

9

9 Furniture & furnishings in home

9

9 Furniture & furnishings elsewhere

9

9 Collectibles

A

ASSETS: DESCRIPTION OF ITEM(S)

DO NOT LIST ACCOUNT NUMBERS

/ the box next to any asset(s) which you are requesting the judge award to you.

B

Current Fair

Market Value

C

Nonmarital

(/ correct column)

husband wife

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

9

9 Jewelry

9

9 Life insurance (cash surrender value)

9

9

9 Sporting and entertainment (T.V., stereo, etc.) equipment

9

9

9

9

9 Other assets

9

9

9

9

9

9

9

Total Assets (add column B) $

B. LIABILITIES/DEBTS (This is where you list what you OWE.)

INSTRUCTIONS:

STEP 1: In column A, list a description of each separate debt owed by you (and/or your spouse, if this is a petition for dissolution

of marriage). Blank spaces are provided if you need to list more than one of an item.

STEP 2: If this is a petition for dissolution of marriage, check the box in Column A next to any debt(s) for which you believe you

should be responsible.

STEP 3: In column B, write what you believe to be the current amount owed for all items listed.

STEP 4: Use column C only if this is a petition for dissolution of marriage and you believe an item is “nonmarital,”

meaning the debt belongs to only one of you and should not be divided. You should indicate to whom you believe the debt

belongs. (Typically, you will only use Column C if the debt was owed by one spouse before the marriage. See the “General

Information for Self-Represented Litigants” found at the beginning of these forms and section 61.075(1), Florida Statutes, for

definitions of “marital” and “nonmarital” assets and liabilities.)

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

A

LIABILITIES: DESCRIPTION OF ITEM(S)

DO NOT LIST ACCOUNT NUMBERS

/ the box next to any debt(s) for which you believe you should be responsible.

B

Current

Amount

Owed

C

Nonmarital

(/ correct column)

husband wife

9 Mortgages on real estate: (Home) $

9

9

9

9 Charge/credit card accounts

9

9

9

9

9

9 Auto loan

9 Auto loan

9 Bank/Credit Union loans

9

9

9

9 Money you owe (not evidenced by a note)

9

9 Judgments

9

9 Other

9

9

9

9

9

9

Total Debts (add column B) $

C. NET WORTH (excluding contingent assets and liabilities)

Total Assets (enter total of Column B in Asset Table; Section A) $

Total Liabilities (enter total of Column B in Liabilities Table; Section B) $

TOTAL NET WORTH (Total Assets minus Total Liabilities)

(excluding contingent assets and liabilities) $

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

D. CONTINGENT ASSETS AND LIABILITIES

INSTRUCTIONS:

If you have any POSSIBLE assets (income potential, accrued vacation or sick leave, bonus, inheritance, etc.) or POSSIBLE

liabilities (possible lawsuits, future unpaid taxes, contingent tax liabilities, debts assumed by another), you must list them here.

A

Contingent Assets

/the box next to any contingent asset(s) which you are requesting the judge

award to you.

B

Possible Value

C

Nonmarital

(/ correct column)

husband wife

9 $

9

9

9

9

Total Contingent Assets

$

A

Contingent Liabilities

/the box next to any contingent debt(s) for which you believe you should be

responsible.

B

Possible

Amount Owed

C

Nonmarital

(/ correct column)

husband wife

9 $

9

9

9

9

Total Contingent Liabilities

$

E. Has there been any agreement between you and the other party that one of you will take responsibility

for a debt and will hold the other party harmless from that debt? ( ) yes ( ) no

If yes, explain:

F. CHILD SUPPORT GUIDELINES WORKSHEET. O” Florida Family Law Rules of Procedure

Form 12.902(e), Child Support Guidelines Worksheet, MUST be filed with the court at or prior to a hearing

to establish or modify child support. This requirement cannot be waived by the parties.

[ / one only]

A Child Support Guidelines Worksheet IS or WILL BE filed in this case. This case involves

the establishment or modification of child support.

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

A Child Support Guidelines Worksheet IS NOT being filed in this case. The establishment

or modification of child support is not an issue in this case.

I certify that a copy of this financial affidavit was: ( ) mailed, ( ) faxed and mailed, or ( ) hand

delivered to the person(s) listed below on {date} .

Other party or his/her attorney:

Name:

Address:

City, State, Zip:

Fax Number:

I understand that I am swearing or affirming under oath to the truthfulness of the claims

made in this affidavit and that the punishment for knowingly making a false statement includes fines

and/or imprisonment.

Dated:

Signature of Party

Printed Name:

Address:

City, State, Zip:

Telephone Number:

Fax Number:

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (9/00)

STATE OF FLORIDA

COUNTY OF

Sworn to or affirmed and signed before me on by .

NOTARY PUBLIC or DEPUTY CLERK

[Print, type, or stamp commissioned name of

notary or deputy clerk .]

Personally known

Produced identification

Type of identification produced

IF A NONLAWYER HELPED YOU FILL OUT THIS FORM, HE/SHE MUST FILL IN THE

BLANKS BELOW: [ N fill in all blanks]

I, {full legal name and trade name of nonlawyer} ,

a nonlawyer, located at {street}

, {city} ,

{state}

, {phone} , helped {name} ,

who is the [ / one only] petitioner or respondent, fill out this form.

Florida Supreme Court Approved Family Law Form 12.902(d), Uniform Child Custody Jurisdiction Act (UCCJA) Affidavit (9/00)

IN THE CIRCUIT COURT OF THE JUDICIAL CIRCUIT,

IN AND FOR COUNTY, FLORIDA

Case No.:

Division:

,

Petitioner,

and

,

Respondent.

UNIFORM CHILD CUSTODY JURISDICTION ACT (UCCJA) AFFIDAVIT

I, {full legal name} , being sworn, certify that the following

statements are true:

1.

The number of minor child(ren) subject to this proceeding is . The name, social security

number, place of birth, birth date, and sex of each child; the present address, periods of residence, and places

where each child has lived within the past five (5) years; and the name, present address, and relationship

to the child of each person with whom the child has lived during that time are:

THE FOLLOWING INFORMATION IS TRUE ABOUT CHILD # 1 :

Child’s Full Legal Name:

S.S. #

Place of Birth: Date of Birth: Sex:

Child’s Residence for the past 5 years:

Dates

(From/To)

Address (including city and

state) where child lived

Name and present address of

person child lived with

Relationship

to child

/present*

/

/

/

/

/

* If you are the petitioner in an injunction for protection against domestic violence case and you have filed Petitioner’s

Request for Confidential Filing of Address, O” Florida Supreme Court Approved Family Law Form 12.980(i), you

should write “confidential” in any space on this form that would require you to enter the address where you are

currently living.

THE FOLLOWING INFORMATION IS TRUE ABOUT CHILD # :

(Make as many copies of page 2 as necessary.)

Florida Supreme Court Approved Family Law Form 12.902(d), Uniform Child Custody Jurisdiction Act (UCCJA) Affidavit (9/00)

Child’s Full Legal Name: S.S. #

Place of Birth: Date of Birth: Sex:

Child’s Residence for the past 5 years:

Dates

(From/To)

Address (including city and

state) where child lived

Name and present address of

person child lived with

Relationship

to child

/present

/

/

/

/

/

THE FOLLOWING INFORMATION IS TRUE ABOUT CHILD # :

Child’s Full Legal Name: S.S. #

Place of Birth:

Date of Birth: Sex:

Child’s Residence for the past 5 years:

Dates

(From/To)

Address (including city and

state) where child lived

Name and present address of

person child lived with

Relationship

to child

/present

/

/

/

/

/

Florida Supreme Court Approved Family Law Form 12.902(d), Uniform Child Custody Jurisdiction Act (UCCJA) Affidavit (9/00)

A completed Notice of Social Security Number, Florida Supreme Court Approved Family Law Form 12.901(j)

has been filed in this action.

2.

Participation in custody proceeding(s):

[ / one only]

I HAVE NOT participated as a party, witness, or in any capacity in any other litigation or custody

proceeding in this or any other state, concerning custody of a child subject to this proceeding.

I HAVE participated as a party, witness, or in any capacity in any other litigation or custody

proceeding in this or another state, concerning custody of a child subject to this proceeding. Explain:

a. Name of each child:

b. Type of proceeding:

c. Court and state:

d. Date of court order or judgment (if any):

3. Information about custody proceeding(s):

[ / one only]

I HAVE NO INFORMATION of any custody proceeding pending in a court of this or any other

state concerning a child subject to this proceeding.

I HAVE THE FOLLOWING INFORMATION concerning a custody proceeding pending in a court

of this or another state concerning a child subject to this proceeding, other than set out in item 2.

Explain:

a. Name of each child:

b. Type of proceeding:

c. Court and state:

d. Date of court order or judgment (if any):

4.

Persons not a party to this proceeding:

[ / one only]

I DO NOT KNOW OF ANY PERSON not a party to this proceeding who has physical custody or

claims to have custody or visitation rights with respect to any child subject to this proceeding.

I KNOW THAT THE FOLLOWING NAMED PERSON(S) not a party to this proceeding has

(have) physical custody or claim(s) to have custody or visitation rights with respect to any child

subject to this proceeding:

a. Name and address of person:

( ) has physical custody ( ) claims custody rights ( ) claims visitation rights.

Name of each child:

b. Name and address of person:

( ) has physical custody ( ) claims custody rights ( ) claims visitation rights.

Name of each child:

c. Name and address of person:

( ) has physical custody ( ) claims custody rights ( ) claims visitation rights.

Name of each child:

5.

Knowledge of prior child support proceedings:

[ / one only]

Florida Supreme Court Approved Family Law Form 12.902(d), Uniform Child Custody Jurisdiction Act (UCCJA) Affidavit (9/00)

The child(ren) described in this affidavit are NOT subject to existing child support order(s) in this or

any state or territory.

The child(ren) described in this affidavit are subject to the following existing child support order(s):

a. Name of each child:

b. Type of proceeding:

c. Court and address:

d. Date of court order/judgment (if any):

e. Amount of child support paid and by whom:

6.

I acknowledge that I have a continuing duty to advise this Court of any custody, visitation,

child support, or guardianship proceeding (including dissolution of marriage, separate

maintenance, child neglect, or dependency) concerning the child(ren) in this state or any

other state about which information is obtained during this proceeding.

I certify that a copy of this document was [ / one only] ( ) mailed ( ) faxed and mailed ( ) hand

delivered to the person(s) listed below on {date} .

Other party or his/her attorney:

Name:

Address:

City, State, Zip:

Fax Number:

I understand that I am swearing or affirming under oath to the truthfulness of the claims

made in this affidavit and that the punishment for knowingly making a false statement includes fines

and/or imprisonment.

Dated:

Signature of Party

Printed Name:

Address:

City, State, Zip:

Telephone Number:

Fax Number:

Florida Supreme Court Approved Family Law Form 12.902(d), Uniform Child Custody Jurisdiction Act (UCCJA) Affidavit (9/00)

STATE OF FLORIDA

COUNTY OF

Sworn to or affirmed and signed before me on by .

NOTARY PUBLIC or DEPUTY CLERK

[Print, type, or stamp commissioned name of notary or

clerk.]

Personally known

Produced identification

Type of identification produced

IF A NONLAWYER HELPED YOU FILL OUT THIS FORM, HE/SHE MUST FILL IN THE

BLANKS BELOW: [ N fill in all blanks]

I, {full legal name and trade name of nonlawyer} ,

a nonlawyer, located at {street}

, {city} ,

{state}

, {phone} , helped {name} ,

who is the [ / one only] petitioner or respondent, fill out this form.

Instructions for Florida Supreme Court Approved Family Law Form 12.902(j), Notice of Social Security Number (9/00)

INSTRUCTIONS FOR FLORIDA SUPREME COURT APPROVED FAMILY LAW FORM

12.902(j),

NOTICE OF SOCIAL SECURITY NUMBER

When should this form be used?

This form must be completed and filed by each party in all paternity, child support, and dissolution of

marriage cases, regardless of whether the case involves a minor child(ren) and/or property.

This form should be typed or printed in black ink. After completing this form, you should filedeliver the

original withto the clerk of the circuit court in the county where your case was filed and keep a copy for

your records. The original will be placed in a separate depository with limited access or a confidential file

maintained for notices of social security number.

What should I do next?

A copy of this form must be mailed or hand delivered to the other party in your case, if it is not served on

him or her with your initial papers.

Where can I look for more information?

Before proceeding, you should read “General Information for Self-Represented Litigants” found

at the beginning of these forms. The words that are in “bold underline” in these instructions are defined

there. For further information, see sections 61.052 and 61.13, Florida Statutes.

Special notes...

If this is a domestic violence case and you want to keep your address confidential for safety

reasons, do not enter the address, telephone, and fax information at the bottom of this form.

Instead, file Petitioner’s Request for Confidential Filing of Address, O’ Florida Supreme Court

Approved Family Law Form 12.980(i).

Remember, a person who is NOT an attorney is called a nonlawyer. If a nonlawyer helps you fill out these

forms, that person must give you a copy of a Disclosure from Nonlawyer, O‘ Florida Family Law Rules

of Procedure Form 12.900(a), before he or she helps you. A nonlawyer helping you fill out these forms also

must put his or her name, address, and telephone number on the bottom of the last page of every form he

or she helps you complete.

Florida Supreme Court Approved Family Law Form 12.902(j), Notice of Social Security Number (9/00)

IN THE CIRCUIT COURT OF THE JUDICIAL CIRCUIT,

IN AND FOR COUNTY, FLORIDA

Case No.:

Division:

,

Petitioner,

and

,

Respondent.

NOTICE OF SOCIAL SECURITY NUMBER

I, {full legal name} ,

certify that my social security number is , as required in section

61.052(7), sections 61.13(9) or (10), section 742.031(3), sections 742.032(1)–(3), and/or sections

742.10(1)–(2), Florida Statutes. My date of birth is .

[/ one only]

1. This notice is being filed in a dissolution of marriage case in which the parties have no minor

children in common.

2. This notice is being filed in a paternity or child support case, or in a dissolution of marriage in

which the parties have minor children in common. The minor child(ren)'s name(s), date(s) of

birth, and social security number(s) is/are:

Name Birth date Social Security Number

{Attach additional pages if necessary.}

Disclosure of social security numbers shall be limited to the purpose of administration of the Title IV-D

program for child support enforcement.

I understand that I am swearing or affirming under oath to the truthfulness of the claims made in

this notice and that the punishment for knowingly making a false statement includes fines and/or

imprisonment.

Dated:

Signature

Printed Name:

Address:

City, State, Zip:

Florida Supreme Court Approved Family Law Form 12.902(j), Notice of Social Security Number (9/00)

Telephone Number:

Fax Number:

STATE OF FLORIDA

COUNTY OF ________

Sworn to or affirmed and signed before me on

by .

NOTARY PUBLIC or DEPUTY CLERK

[Print, type, or stamp commissioned name of notary or clerk]

Personally known

Produced identification

Type of identification produced

NOTICE TO CLERK OF COURT: This form is to be maintained in a confidential file or maintained in a

separate depository with access limited to Title IV-D agencies, the parties or their attorneys of record, the

court, any child support enforcement agent, and the attorney for the minor child. This notice is not to be

placed in the court file.

NOTICE TO THIRD PARTIES RECEIVING THIS NOTICE; The information contained in this notice

is not be disclosed to other entities. This information is provided for purposes of support enforcement only.

IF A NONLAWYER HELPED YOU FILL OUT THIS FORM, HE/SHE MUST FILL IN THE

BLANKS BELOW: [ N fill in all blanks]

I, {full legal name and trade name of nonlawyer} ,

a nonlawyer, located at {street}

, {city} ,

{state}

, {phone} , helped {name} ,

who is the [ / one only] petitioner or respondent, fill out this form.

Instructions for Florida Family Law Rules of Procedure Form 12.930(a), Notice of Service of Standard Family Law Interrogatories

(9/00)

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULES OF PROCEDURE FORM 12.930(a),

NOTICE OF SERVICE OF STANDARD FAMILY LAW INTERROGATORIES

When should this form be used?

You should use this form to tell the court that you are asking the other party in your case to answer certain

standard questions in writing. These questions are called interrogatories, and they must relate to your case.

The standard family law interrogatories are designed to supplement the information provided in the Financial

Affidavit, O” Florida Family Law Rules of Procedure Form 12.902(b) or (c). You should carefully read the

standard interrogatory forms, O” Florida Family Law Rules of Procedure Form 12.930(b) and (c), to

determine which questions, if any, the other party needs to answer in order to provide you with information

not covered by the financial affidavit forms.

This form should be typed or printed in black ink. You must indicate whether you are sending the

interrogatories for original and enforcement proceedings or the interrogatories for modification proceedings.

You must also indicate which questions you are asking the other party to answer. After completing this form

you should file the original with the clerk of the circuit court in the county where your case was filed and

keep a copy for your records.

What should I do next?

A copy of this form, along with two copies of the appropriate interrogatories, O” Florida Family Law Rules

of Procedure Form 12.930(b) or (c), must be mailed or hand delivered to the other party in your case.

You may want to inform the other party of the following information:

As a general rule, within 30 days after service of interrogatories, the other party must answer the questions

in writing and mail (have postmarked) the answers to you. His or her answers may be written on as many

separate sheets of paper as necessary. He or she should number each page and indicate which question(s)

he or she is answering, and be sure to make a copy for him/herself. All answers to these questions are made

under oath or affirmation as to their truthfulness. Each question must be answered separately and as

completely as the available information permits.The original of the answers to the interrogatories is to be

provided to the requesting party. Do not file the original or a copy with the clerk of the circuit court except

as provided in Florida Rule of Civil Procedure 1.340(e).

The other party may object to a question by writing the legal reason for the objection in the space provided.

He or she may also ask the court for a protective order granting him or her permission not to answer certain

questions and protecting him or her from annoyance, embarrassment, apprehension, or undue burden or

expense. If the other party fails to either answer or object to the questions within 30 days, he or she

may be subject to court sanctions.

Where can I look for more information?

Before proceeding, you should read “General Information for Self-Represented Litigants” found

at the beginning of these forms. For further information, see rules 12.280, 12.285, 12.340, and 12.380,

Florida Family Law Rules of Procedure, and rules 1.280, 1.340, and 1.380, Florida Rules of Civil Procedure.

Instructions for Florida Family Law Rules of Procedure Form 12.930(a), Notice of Service of Standard Family Law Interrogatories

(9/00)

Special notes...

Remember, a person who is NOT an attorney is called a nonlawyer. If a nonlawyer helps you fill out these

forms, that person must give you a copy of Disclosure from Nonlawyer, O” Florida Family Law Rules

of Procedure Form 12.900(a), before he or she helps you. A nonlawyer helping you fill out these forms also

must put his or her name, address, and telephone number on the bottom of the last page of every form he

or she helps you complete.

Instructions for Florida Family Law Rules of Procedure Form 12.930(b), Standard Family Law Interrogatories for Original

Enforcement Proceedings (1/01)

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULES OF PROCEDURE FORM 12.930(b),

STANDARD FAMILY LAW INTERROGATORIES FOR ORIGINAL OR ENFORCEMENT

PROCEEDINGS

When should this form be used?

This form should be used to ask the other party in your case to answer certain standard questions in writing.

These questions are called interrogatories, and they must relate to your case. If the other party fails to

answer the questions, you may ask the judge to order the other party to answer the questions. (You cannot

ask these questions before the petition has been filed.)

The questions in this form should be used in original proceedings or enforcement proceedings and are

meant to supplement the information provided in the Financial Affidavit, O” Florida Family Law Rules of

Procedure Form 12.902(b) or (c). You should read all of the questions in this form to determine which

questions, if any, the other party needs to answer in order to provide you with information not covered in the

financial affidavit forms. If there are questions to which you already know the answer, you may choose not

to ask them.

This form should be typed or printed in black ink. You must complete the box at the beginning of this form

to indicate which questions you are requesting that the other party answer. You should send 2 copies of this

form and the Notice of Service of Standard Family Law Interrogatories, O” Florida Family Law Rules

of Procedure Form 12.930(a), to the other party. You should also keep a copy for your records. You do not

needshould not to file this form with the clerk of the circuit court. However, you must file the Notice of

Service of Standard Family Law Interrogatories, O” Florida Family Law Rules of Procedure Form

12.930(a), to tell the court that you have sent this form to the other party.

Where can I look for more information?

Before proceeding, you should read “General Information for Self-Represented Litigants” found

at the beginning of these forms. For further information, see the instructions for Notice of Service of

Standard Family Law Interrogatories, O” Florida Family Law Rules of Procedure Form 12.930(a), rules

12.280, 12.285, 12.340, and 12.380, Florida Family Law Rules of Procedure, and rules 1.280, 1.340, and 1.380,

Florida Rules of Civil Procedure.

Special notes...

In addition to the standard questions in this form, you may ask up to 10 additional questions. You should type

or print legibly your additional questions on a separate sheet of paper and attach it to this form. If you want

to ask more than 10 additional questions, you will need to get permission from the judge.

You may want to inform the other party of the following information: As a general rule, within 30 days

after service of interrogatories, the other party must answer the questions in writing and mail (have

postmarked) the answers to you. His or her answers shall be written in the blank space provided after each

separately numbered interrogatory. If sufficient space is not provided, the answering party may attach

additional papers with the answers and refer to them in the space provided in the interrogatories. He or she

should be sure to make a copy for him/herself. All answers to these questions are made under oath or

affirmation as to their truthfulness. Each question must be answered separately and as completely as the

Instructions for Florida Family Law Rules of Procedure Form 12.930(b), Standard Family Law Interrogatories for Original

Enforcement Proceedings (1/01)

available information permits. The original of the anwers to the interrogatories is to be provided to the

requesting party. Do not file the original or a copy with the clerk of the circuit court except as provided in

Florida Rule of Civil Procedure 1.340(c). The other party may object to a question by writing the legal reason

for the objection in the space provided. He or she may also ask the court for a protective order granting him

or her permission not to answer certain questions and protecting him or her from annoyance, embarrassment,

apprehension, or undue burden or expense. If the other party fails to either answer or object to the questions

within 30 days, he or she may be subject to court sanctions.

Remember, a person who is NOT an attorney is called a nonlawyer. If a nonlawyer helps you fill out these

forms, that person must give you a copy of Disclosure from Nonlawyer, O” Florida Family Law Rules

of Procedure Form 12.900(a), before he or she helps you. A nonlawyer helping you fill out these forms also

must put his or her name, address, and telephone number on the bottom of the last page of every form he

or she helps you complete.

Instructions for Florida Family Law Rules of Procedure Form 12.930(c), Standard Family Law Interrogatories for Modification

Proceedings (1/01)

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULES OF PROCEDURE FORM 12.930(c),

STANDARD FAMILY LAW INTERROGATORIES FOR MODIFICATION PROCEEDINGS

When should this form be used?

This form should be used to ask the other party in your case to answer certain standard questions in writing.

These questions are called interrogatories, and they must relate to your case. If the other party fails to

answer the questions, you may ask the judge to order the other party to answer the questions. (You cannot

ask these questions before the petition has been filed.)

The questions in this form should be used in modification proceedings and are meant to supplement the

information provided in the Financial Affidavits, O” Florida Family Law Rules of Procedure Form

12.902(b) or (c). You should read all of the questions in this form to determine which questions, if any, the

other party needs to answer in order to provide you with information not covered in the financial affidavit

forms. If there are questions to which you already know the answer, you may choose not to ask them.

This form should be typed or printed in black ink. You must complete the box at the beginning of this form

to indicate which questions you are requesting that the other party answer. You should send two copies of

this form and the Notice of Service of Standard Family Law Interrogatories, O” Florida Family Law

Rules of Procedure Form 12.930(a), to the other party. You should also keep a copy for your records. You

do not need toshould not file this form with the clerk of the circuit court. However, you must file the

Notice of Service of Standard Family Law Interrogatories, O” Florida Family Law Rules of Procedure

Form 12.930(a), to tell the court that you have sent this form to the other party.

Where can I look for more information?

Before proceeding, you should read “General Information for Self-Represented Litigants” found

at the beginning of these forms. For further information, see the instructions for Notice of Service of

Standard Family Law Interrogatories, O” Florida Family Law Rules of Procedure Form 12.930(a), rules

12.280, 12.285, 12.340, and 12.380, Florida Family Law Rules of Procedure and rules 1.280, 1.340, and 1.380,

Florida Rules of Civil Procedure.

Special notes...

In addition to the standard questions in this form, you may ask up to 10 additional questions. You should type

or print your additional questions on a separate sheet of paper and attach it to this form. If you want to ask

more than 10 additional questions, you will need to get permission from the judge.

You may want to inform the other party of the following information: As a general rule, within 30 days

after service of interrogatories, the other party must answer the questions in writing and mail (have

postmarked) the answers to you. His or her answers shall be written in the blank space provided after each

separately numbered interrogatory. If sufficient space is not provided, the answering party may attach

additional papers with the answers and refer to them in the space provided in the interrogatories. He or she

should be sure to make a copy for him/herself. All answers to these questions are made under oath or

affirmation as to their truthfulness. Each question must be answered separately and as completely as the

available information permits.The original of the answers to the interrogatories is to be provided to the

requesting party. Do not file the original or a copy with the clerk of the circuit court except as provided in

Florida Rule of Civil Procedure 1.340(e). The other party may object to a question by writing the legal reason

for the objection in the space provided. He or she may also ask the court for a protective order granting him

or her permission not to answer certain questions and protecting him or her from annoyance, embarrassment,

apprehension, or undue burden or expense. If the other party fails to either answer or object to the questions

Instructions for Florida Family Law Rules of Procedure Form 12.930(c), Standard Family Law Interrogatories for Modification

Proceedings (1/01)

within 30 days, he or she may be subject to court sanctions.

Remember, a person who is NOT an attorney is called a nonlawyer. If a nonlawyer helps you fill out these

forms, that person must give you a copy of Disclosure from Nonlawyer, O” Florida Family Law Rules

of Procedure Form 12.900(a), before he or she helps you. A nonlawyer helping you fill out these forms also

must put his or her name, address, and telephone number on the bottom of the last page of every form he

or she helps you complete.

Instructions for Florida Family Law Rules of Procedure Form 12.932, Certificate of Compliance with Mandatory Disclosure (9/00)

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULES OF PROCEDURE FORM 12.932,

CERTIFICATE OF COMPLIANCE WITH MANDATORY DISCLOSURE

When should this form be used?

Mandatory disclosure requires each party in a dissolution of marriage case to provide the other party

with certain financial information and documents. These documents must be provided by mail or hand

delivery to the other party within 45 days of service of the petition for dissolution of marriage or

supplemental petition for modification on the respondent. The mandatory disclosure rule applies to all

original and supplemental dissolution of marriage cases, except simplified dissolution of marriage cases and

cases where the respondent is served by constructive service and does not answer. You should use this

form to notify the court and the other party that you have complied with the mandatory disclosure rule.

Each party must provide the other party with the documents listed in section 2 of this form if the

relief being sought is permanent regardless of whether it is an initial or supplemental proceeding.

Of the documents listed on this form, the financial affidavit and child support guidelines worksheet isare

the only documents that must be filed with the court and sent to the other party; all other documents should

be sent to the other party but not filed with the court. If your individual gross annual income is under $50,000,

you should complete the Family Law Financial Affidavit (Short Form), O” Florida Family Law Rules of

Procedure Form 12.902(b). If your individual gross annual income is $50,000 or more, you should complete

the Family Law Financial Affidavit, O” Florida Family Law Rules of Procedure Form12.902(c).

In addition, there are separate mandatory disclosure requirements that apply to temporary financial

hearings, which are listed in section 1 of this form. The party seeking temporary financial relief must serve

these documents on the other party with the notice of temporary financial hearing. The responding party must

either deliver the required documents to the party seeking temporary financial relief on or before 5:00 p.m.,

2 business days before the hearing on temporary financial relief, or mail (postmark) them to the party seeking

temporary financial relief 7 days before the hearing on temporary financial relief. Any documents that have

already been served under the requirements for temporary or initial proceedings, do not need to be re-served

again in the same proceeding. If a supplemental petition is filed, seeking modification, then the mandatory

disclosure requirements begin again.

This form should be typed or printed in black ink. After completing this form, you should file the original with

the clerk of the circuit court in the county where your case is filed and keep a copy for your records. A

copy of this form must be mailed or hand delivered to any other party in your case.

What should I do next?

After you have provided the other party all of the financial information and documents and have filed this form

certifying that you have complied with this rule, you are under a continuing duty to promptly give the other

Instructions for Florida Family Law Rules of Procedure Form 12.932, Certificate of Compliance with Mandatory Disclosure (9/00)

party any information or documents that change your financial status or that make the information already

provided inaccurate. You should not file with the clerk any of the documents listed in the certificate of

compliance other than the financial affidavit and child support guidelines worksheet. Refer to the instructions

regarding the petition in your case to determine how you should proceed after filing this form.

Where can I look for more information?

Before proceeding, you should read “General Information for Self-Represented Litigants” found