This guide will lead you through the steps to connue your

insurance aer leaving acve employment and explain which

included forms you must complete.

Your member status

Years of service you need to continue

insurance at retirement

•

When you leave acve employment, you are

given a member status based on your vesng

right with a state funded rerement system or

your years of employment service. There are

four member status categories:

• Vested – You have worked long enough to

keep insurance benets and you contributed

to a rerement system, but you are not ready

to draw your rerement benets.

• Non-vested – You have worked long enough

to keep insurance benets, but you did

not contribute to a rerement system that

parcipates with the Employees Group

Insurance Division, or you withdrew your

contribuons from your rerement system.

• Reree – You have worked long enough to

leave acve employment, keep insurance

benets and draw your rerement benets.

• Defer – You have worked long enough to

qualify as a vested, non-vested or reree

member, but you elect to transfer your

health, dental or vision insurance to your

spouse’s current insurance through EGID.

If you leave acve employment, lose coverage

because of reduced hours or your employment

is terminated for reasons other than gross

misconduct, you can connue health, dental and

vision coverage for up to 18 months under the

Consolidated Omnibus Budget Reconciliaon Act.

Coverage connued under COBRA is temporary.

You are encouraged to retain your insurance

benets in a vested, non-vested, reree or defer

status if you meet the qualicaons.

• Teachers' Retirement System (TRS) – Ten

years minimum of creditable service.

• Oklahoma Public Employees Retirement

System (OPERS) – Eight years minimum of

creditable service.

• Oklahoma Law Enforcement Retirement

System (OLERS) – Eight years minimum of

creditable service.

• Oklahoma Pathfinders Plan – Five years

minimum of creditable service.

• Other or no retirement system – Employment

years may qualify as creditable service to

continue insurance. Contact EGID Member

Services for specific information.

Plan premiums

Refer to the premium rate charts in this guide.

Premium payment opons

• Rerement check deducon – Your monthly

premium for the previous month's coverage is

automacally withheld from your rerement

check. When selecng this opon, the

premium withheld is for the previous month's

coverage.

• Direct bill – You are directly billed for your

monthly premium due by the 20th of each

month.

• Automac dra – Your monthly premium

is automacally draed from your checking

account on or around the 20th of each month.

To elect this opon, select the direct bill

opon on the Applicaon for Reree/Vested/

Non-Vested/Defer Insurance Coverage (Page

A2) and provide EGID an Electronic Fund

Transfer Authorizaon and a voided check.

This form (Page D1-D2) is available on the

EGID website or by contacng member

services.

2

Retirement system contribution to your

monthly insurance premium

Your rerement system may contribute toward

your health insurance premium.

• TRS contributes between $100 to $105

monthly.

• OPERS contributes $105 monthly.

• OLERS contributes $105 monthly.

• Pathnders does not contribute.

The premiums listed in this guide do not reect

any rerement system contribuon.

When you leave

active employment

Keep all the coverage you think you will need

in rerement. You can drop or reduce benets

later, but you cannot add health, dental or life

insurance aer you leave acve employment.

Rerement is not a qualifying event that allows

you to make plan changes unless you or your

covered dependent is Medicare eligible. All

covered dependents must enroll in the same

plan. For example, if you are enrolled in an MAPD

plan, your pre-Medicare dependents must enroll

in the HMO opon of that plan. If you move

out of your health plan’s service area, you are

allowed to change health plans within 30 days of

your move.

EGID Administrave Rule 260:50-3-13 (h)

states that you must return to work for an EGID

parcipang employer for three years to qualify

to retain benets not elected upon ceasing

current employment.

If your employer oers these benets through

EGID, the following rules apply:

Health and dental insurance – You can add,

keep, drop or defer coverage within 30 days of

leaving acve employment.

Vision insurance – You can add, keep, drop or

defer coverage within 30 days of leaving acve

employment or during the annual Opon Period.

Once you leave acve employment, vision

insurance is the only benet that can be added

during the annual Opon Period.

Life insurance – You can keep, reduce or drop

life coverage you have in place at the me

you leave acve employment. You must make

the elecon within 30 days of leaving acve

employment. You cannot add or increase life

insurance at rerement. Life insurance cannot

be deferred and must be kept in your rerement

account.

Life insurance must be kept in $5,000 units.

Refer to the premium charts included in this

guide.

Life insurance connued at rerement does not

include Accidental Death and Dismemberment

benets.

If you connue life insurance coverage when you

leave acve employment, it is very important

to keep your beneciary informaon current. If

you are unsure of your beneciary designaons,

please complete the Beneciary Designaon

Form (Page E1). Instrucons are on the back of

the form.

HealthChoice must pay life benets to the

beneciaries listed on the most recent beneciary

designaon. If there is no signed beneciary

designaon, benets are paid to the estate.

Coverage for your dependents

You can add, keep or drop health, dental and

vision coverage for your spouse and other

eligible dependents at rerement; however,

dependent life insurance must be in eect

before you leave acve employment. Dependent

coverage must be with the same carrier as the

member.

3

You can exclude your spouse from health, dental

and vision coverage and cover your other eligible

dependents. Your spouse must sign the Spouse

Exclusion Cercaon secon of the Applicaon

for Reree/Vested/Non-Vested/Defer Insurance

Coverage (Page A2).

If you add or keep coverage for your dependent

children, including disabled dependents, you

must cover all your eligible dependents up to

age 26.

You can exclude dependents from coverage

if they have other group coverage or are

eligible for Indian Health Services or military

health benets. You can also exclude eligible

dependents who do not reside with you, are

married or are not nancially dependent on you.

Aer rerement, you cannot add dependents

to any coverage except vision, unless one of the

following qualifying events occurs:

• Birth of a child.

• Your spouse or eligible dependents lose other

group coverage.

• You marry.

• You adopt or gain legal guardianship of a child

under age 26.

You must add your spouse and any eligible

dependents within 30 days of the qualifying

event.

Dependent life insurance

You can keep dependent life insurance in eect

at rerement but cannot add or increase it later.

It must be kept in $500 units and each covered

dependent pays a separate, individual premium.

• For your spouse – The amount you keep for

your spouse can be dierent from the amount

you keep for your covered dependents.

• For your dependents – The amount you

keep must be the same for each covered

dependent.

Surviving Dependents

In the event of your death, your surviving

dependents may connue their insurance

coverage. A surviving spouse can connue their

insurance benets, including Dependent Life,

as long as the premiums are paid. The spouse

will be moved to their own account and pay the

primary member rate.

Surviving dependent children can also connue

coverage, including Dependent Life, unl age 26.

A leer will be sent by EGID to your surviving

dependents advising them of their opons.

Dependents have 60 days to nofy EGID that

they wish to connue insurance coverage.

If you decide to work past age 65

If you decide to work past age 65, you may

contact Social Security to delay your enrollment

in Medicare Part B. Your employer insurance

will be primary payer while working. Since all

insurance oered through EGID is creditable

coverage, you will not be assessed a penalty

once employer insurance ends.

When you turn age 65 after you leave

active employment

If you are close to age 65 and are not receiving

Social Security benets, you need to enroll in

Medicare Part A and Part B.

To enroll, contact Social Security at least three

months before you turn age 65. By enrolling

early, you avoid any delay in the start of your

Medicare coverage.

COBRA

To comply with federal guidelines, a COBRA

packet will be mailed to you when you leave

employment. Do NOT complete this packet if

you are elecng to connue your insurance

coverage as a Former Employee

4

The Enrollment Process

If you are not yet

eligible for Medicare

To connue your insurance

You must complete the Applicaon for Reree/

Vested/Non-Vested/Defer Insurance Coverage

(Page A1) and return it to EGID.

To defer (transfer) your coverage to your

spouse’s plan

If your spouse works and is currently enrolled

in coverage through EGID, you can transfer

your health, dental and vision coverage to your

spouse’s coverage as a dependent.

Life insurance cannot be deferred and must be

kept in your rerement account.

To transfer your coverage to your spouse’s plan:

• Mark Defer on the Applicaon for Reree/

Vested/Non-Vested/Defer Insurance Coverage

(Page A1-A2) and return it to EGID.

• Your spouse must contact their employer to

add you to their coverage as a dependent.

• Any rerement system contribuon paid

toward your health insurance premium will

not be paid during the deferral period.

As long as your former employer group connues

to parcipate with EGID, you can transfer your

coverage back to your own EGID account at any

me by compleng the Applicaon for Reree/

Vested/Non-Vested/Defer Insurance Coverage.

If you are eligible for Medicare

About Medicare

Medicare is the federal health insurance

program for people age 65 or older, people

under age 65 with certain disabilies and those

with end-stage renal disease or amyotrophic

lateral sclerosis.

• Medicare Part A pays for hospitalizaon

services.

• Medicare Part B pays for doctor and

outpaent medical services. Call Social

Security for informaon on your Part B

premiums. Refer to Contact Informaon at

the back of this guide.

• Medicare Part D pays for prescripon drug

coverage. All the plans oered through EGID

provide Part D coverage. This means the

plans all meet the benet guidelines set by

Medicare for creditable prescripon drug

coverage.

Your enrollment in Medicare is handled in one

of two ways:

• Automac enrollment (depending on your

individual circumstances).

• Applicaon for enrollment. You should apply

three months prior to turning 65 to avoid a

possible delay in the start of your coverage.

Contact Social Security for more informaon.

5

To connue your insurance and enroll in a

Medicare supplement or MAPD plan

There are two forms you must complete to

connue your health coverage:

• The Applicaon for Reree/Vested/Non-

Vested/Defer Insurance Coverage (Page A1).

• You must also complete the form associated

with the plan you are enrolling in – the

Applicaon for Medicare Supplement With

Prescripon Drug Plan or the Applicaon

for Medicare Advantage Prescripon Drug

(MAPD) Plan.

Refer to Page 9 for the available Medicare plans.

To enroll in a Medicare supplement plan

A Medicare supplement plan helps pay for

some of the remaining out-of-pocket costs

that original Medicare doesn’t pay, such as

copayments, coinsurance and deducbles. A

Medicare supplement plan is in addion to

original Medicare. To parcipate in a Medicare

supplement plan, you must be entled to

benets under Medicare Part A. EGID has three

Medicare supplement plans. BCBSOK-BlueSecure

requires Part B enrollment to parcipate in

their plan. HealthChoice SilverScript High and

Low Opon Medicare Supplement plans do not

require you to be enrolled in Part B, but pay

benets as if you are.

To enroll in a Medicare supplement plan,

complete and return the Applicaon for Medicare

Supplement With Prescripon Drug Plan (Page

B1). You must provide your Medicare ID number

to coordinate your benets with Medicare.

To enroll in a Medicare Advantage

Prescripon Drug plan

MAPD plans contract with Medicare to provide

benets for Medicare Part A and Part B covered

services, as well as Part D prescripon drug

benets.

You must be enrolled in Medicare Part A and Part

B to be eligible for enrollment. When you enroll

in an MAPD plan, the plan replaces Medicare as

your primary insurer.

To be eligible to enroll in an MAPD HMO, you

must also live in the plan’s approved ZIP code

service area. You can receive services only within

the plan’s network.

To be eligible to enroll in an MAPD PPO, you

may live anywhere in the United States. You can

receive services anywhere in the U.S. as long as

the provider is a Medicare eligible provider and

accepts the plan’s payment terms and condions.

To enroll in an MAPD plan, you must complete

and return the Applicaon for Medicare

Advantage Prescripon Drug (MAPD) Plan

(Page C1). Be sure to provide your Medicare ID

number on your applicaon.

Enrollment deadline

If you are not eligible for Medicare

EGID Administrave Rules allows 30 days from

the day your acve insurance ends to elect to

begin or connue your insurance.

Failure to add, keep or defer coverage within

30 days of your acve coverage ending cancels

eligibility in the plans oered through EGID.

If you are eligible for Medicare

It is important that your applicaon is received

at least 30 days prior to the day you leave acve

employment. This gives EGID enough me to

process applicaons and resolve problems before

coverage is eecve. It also prevents delays in

enrolling in a Part D prescripon drug plan.

If your applicaon is not received prior to your

employment terminaon, you may be enrolled in

a HealthChoice Medicare supplement plan that

includes creditable prescripon drug benets, but

not Part D prescripon drug benets, unl the

rst of the following month. This is to prevent you

from having a break in coverage. Be aware the

premium for this temporary plan is higher.

6

Plan ID cards

Confirmation statement

If you enroll in a Medicare plan through EGID, a

new ID card will be issued. Do not destroy your

current cards unl you receive your new ones.

If you move outside

your plan’s service area

If you are not eligible for Medicare

If you are enrolled in an HMO plan and move

outside your plan’s ZIP code service area, you

must nofy EGID in wring of your new address.

To connue your health coverage, you will need

to select a new plan that is in your service area.

If you are eligible for Medicare

If you are enrolled in an MAPD HMO plan and

move outside your plan’s ZIP code service

area, you must contact EGID to disenroll. To

change your coverage to a plan including Part D

prescripon drug benets, you must complete

an Applicaon for Medicare Supplement With

Prescripon Drug Plan or an Applicaon for

Medicare Advantage Prescripon Drug (MAPD)

Plan.

Address information

It is important to keep your mailing and email

addresses current, or you risk delaying claims

processing or missing important communicaons.

Medicare requires that you report any change in

your home address to your insurance plan.

Contact EGID Member Services for a Change of

Address form, or submit a wrien request to:

EGID

P.O. Box 11137

Oklahoma City, OK 73136-9998

You can email your signed form to

[email protected]. Verbal requests for

address changes are not accepted.

When you enroll as a former employee or make

changes to your coverage, EGID mails you a

conrmaon statement which lists the coverage

you are enrolled in, the eecve date of your

coverage and the premium amounts.

Check it carefully. If incorrect, immediately

contact EGID Member Services. Correcons

must be submied to EGID within 60 days of

the elecon. Correcons reported aer 60 days

are eecve the rst of the month following

nocaon. Refer to Contact Informaon at the

back of this guide.

Option Period

Aer you leave acve employment, EGID mails

your Opon Period materials directly to you.

To make plan changes, complete your Opon

Period form and return it directly to EGID. Keep a

copy of your form for your records. EGID will mail

you a conrmaon statement.

If you have no plan changes, do not return

your form. You will not receive a conrmaon

statement.

7

Monthly Premiums for Former Employees

and Surviving Dependents

Plan Year Jan. 1-Dec. 31, 2024

O°ce of Management

& Enterprise Services

HEALTH PLANS MEMBER SPOUSE CHILD CHILDREN

Blue Cross Blue Shield of Oklahoma – BlueLincs HMO

$ 600.78 $ 825.98 $ 556.90 $ 1299.08

CommunityCare HMO

$ 650.06 $ 762.16 $ 326.98 $ 554.88

GlobalHealth HMO

$ 979.42 $ 1445.72 $ 559.30 $ 913.38

HealthChoice High and High Alternative

$ 679.62 $ 796.80 $ 341.86 $ 580.10

HealthChoice Basic and Basic Alternative

$ 543.08 $ 637.32 $ 280.06 $ 473.72

HealthChoice High Deductible Health Plan (HDHP) $ 473.68 $ 556.24 $ 244.66 $ 413.06

BCBSOK – BlueCare Dental High Plan

$ 35.08 $ 35.08 $ 28.44 $ 72.52

DENTAL PLANS MEMBER SPOUSE CHILD CHILDREN

BCBSOK – BlueCare Dental Low Plan

$ 23.84 $ 23.84 $ 20.60 $ 50.40

Cigna Prepaid High (K1I09)

$ 13.56 $ 10.98 $ 8.40 $ 14.44

Cigna Prepaid Low (OKIV9)

$ 10.48 $ 6.80 $ 4.62 $ 10.42

Delta Dental PPO

$ 39.70 $ 39.70 $ 34.54 $ 87.30

Delta Dental PPO – Choice

$ 17.88 $ 40.50 $ 40.80 $ 99.02

HealthChoice Dental

$ 48.58 $ 48.58 $ 39.28 $ 100.74

MetLife High Classic MAC

$ 50.90 $ 50.90 $ 43.62 $ 107.98

MetLife Low Classic MAC

$ 28.90 $ 28.90 $ 24.78 $ 60.94

Sun Life Preferred Active PPO

$ 34.98 $ 34.80 $ 26.12 $ 70.14

Primary Vision Care Services (PVCS)

$ 10.40 $ 9.28 $ 9.20 $ 11.50

VISION PLANS MEMBER SPOUSE CHILD CHILDREN

Superior Vision

$ 7.40 $ 7.34 $ 6.96 $ 14.30

Vision Care Direct

$ 15.48 $ 10.96 $ 10.96 $ 24.48

VSP (Vision Service Plan)

$ 8.62 $ 5.66 $ 5.58 $ 12.22

LIFE PLAN FOR PRE-MEDICARE RETIREES/VESTED MEMBERS

From $5,000 to $40,000 $3.12 Per $1,000 unit

AGE-RATED SUPPLEMENTAL LIFE – Cost per $1,000 unit for $41,000 and up

<30

–

$0.06

45-49

–

$0.14

65-69

–

$0.74

30-34

–

$0.06

50-54

–

$0.26

70-74

–

$1.28

35-39

–

$0.06

55-59

–

$0.40

75+

–

$1.96

40-44

–

$0.08

60-64

–

$0.46

Spouse

Child (live birth to age 26)

$ 6,000 of coverage

$ 3,000 of coverage

$ 10,000 of coverage

$ 5,000 of coverage

$ 20,000 of coverage

$ 10,000 of coverage

DEPENDENT LIFE

$1.56 per $500 unit, per dependent

MONTHLY LIFE INSURANCE PREMIUMS FOR SURVIVING DEPENDENTS

Surviving Dependents of Current Employees Low Option $2.60 Standard Option $4.32 Premier Option $11.26

Surviving Dependents of Former Employees $1.56 per $500 unit, per dependent

These rates do not reect any retirement system contribution.

4951

8

Monthly Premiums for

Medicare Eligible Members

Plan Year Jan. 1-Dec. 31, 2024

O°ce of Management

& Enterprise Services

MEDICARE SUPPLEMENT PLANS

BCBSOK – BlueSecure

SM

$ 466.02 per covered person

HealthChoice SilverScript High Option Medicare Supplement

$ 437.00 per covered person

HealthChoice SilverScript Low Option Medicare Supplement

$ 356.06 per covered person

MEDICARE ADVANTAGE PRESCRIPTION DRUG (MAPD) PLANS

BCBSOK – MAPD

$ 238.40 per covered person

CommunityCare Senior Health Plan

$ 215.64 per covered person

Generations by GlobalHealth

$ 199.00 per covered person

Humana MAPD PPO

$ 192.92 per covered person

DENTAL PLANS MEMBER SPOUSE CHILD CHILDREN

BCBSOK – BlueCare Dental High Plan

$ 35.08 $ 35.08 $ 28.44 $ 72.52

BCBSOK – BlueCare Dental Low Plan

$ 23.84 $ 23.84 $ 20.60 $ 50.40

Cigna Prepaid High (K1I09)

$ 13.56 $ 10.98 $ 8.40 $ 14.44

Cigna Prepaid Low (OKIV9)

$ 10.48 $ 6.80 $ 4.62 $ 10.42

Delta Dental PPO

$ 39.70 $ 39.70 $ 34.54 $ 87.30

Delta Dental PPO – Choice

$ 17.88 $ 40.50 $ 40.80 $ 99.02

HealthChoice Dental

$ 48.58 $ 48.58 $ 39.28 $ 100.74

MetLife High Classic MAC

$ 50.90 $ 50.90 $ 43.62 $ 107.98

MetLife Low Classic MAC

$ 28.90 $ 28.90 $ 24.78 $ 60.94

Sun Life Preferred Active PPO

$ 34.98 $ 34.80 $ 26.12 $ 70.14

Primary Vision Care Services (PVCS)

$ 10.40 $ 9.28 $ 9.20 $ 11.50

VISION PLANS MEMBER SPOUSE CHILD CHILDREN

Superior Vision

$ 7.40 $ 7.34 $ 6.96 $ 14.30

Vision Care Direct

$ 15.48 $ 10.96 $ 10.96 $ 24.48

VSP (Vision Service Plan)

$ 8.62 $ 5.66 $ 5.58 $ 12.22

LIFE PLAN

From $5,000 to $40,000 $3.12 Per $1,000 unit

AGE-RATED SUPPLEMENTAL LIFE – Cost per $1,000 unit for $41,000 and up

<30

–

$0.06 30-34

–

$0.06 35-39

–

$0.06 40-44

–

$0.08

45-49

–

$0.14 50-54

–

$0.26 55-59

–

$0.40 60-64

–

$0.46

65-69

–

$0.74 70-74

–

$1.28 75+

–

$1.96

DEPENDENT LIFE

$1.56 per $500 unit, per dependent

These rates do not reect any contribution from your retirement system.

4952

9

10

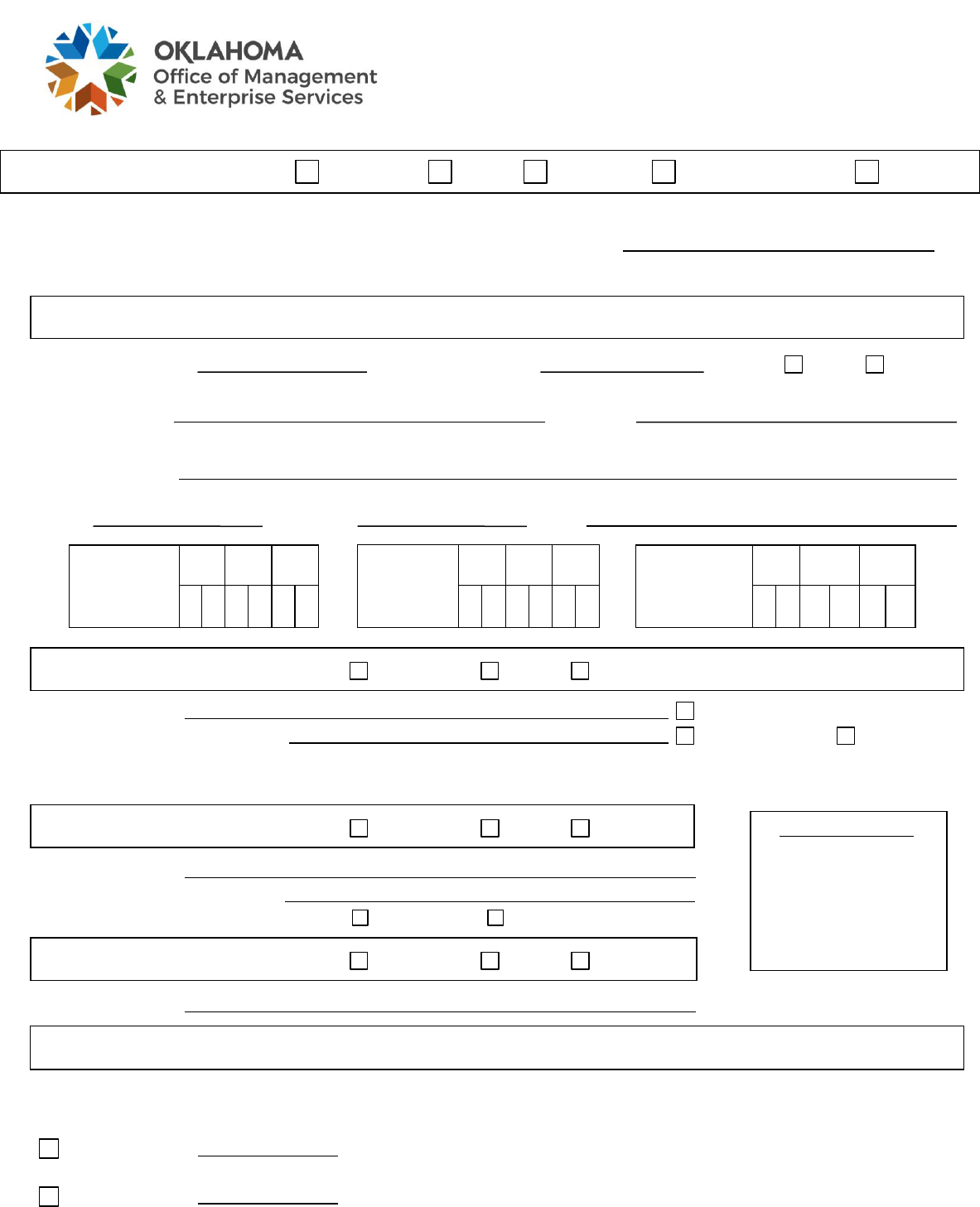

*FORMER*

Employees Group Insurance Division

APPLICATION FOR RETIREE/VESTED

NON-VESTED/DEFER INSURANCE COVERAGE

RETIREMENT SYSTEM OPERS TRS OLERS PATHFINDER OTHER

My member status will be Retiree Vested Non-vested Defer (See instructions on page 3.)

For defer only: Spouse’s Social Security number or member ID number

Cancel my deferment and reinstate my retiree/vested/non-vested insurance coverage.

MEMBER INFORMATION

SSN or member ID Member’s birth date Gender Male Female

Member’s name Employer

First M.I. Last

Mailing address

Street City State ZIP code

Phone Alt. phone Email

Last date of

employee

insurance

coverage

Mo.

Day

Yr.

Vested/

non-vested

Mo.

Day

Yr.

Retirement

Insurance

Mo.

Day

Yr.

insurance

effective date

0

1

effective

date

0

1

MEMBER HEALTH PLAN Add/keep Drop Defer

Health plan name Check if Medicare-eligible*

Primary physician (HMO only) Current patient New patient

* If you and/or your dependents are eligible for Medicare, an additional application must be completed. Please

contact EGID Member Services to request an application.

For EGID Use Only

MEMBER DENTAL PLAN Add/keep Drop Defer

Dental plan name

Primary dentist (Prepaid only)

Current patient New patient

MEMBER VISION PLAN Add/keep Drop Defer

Vision plan name

MEMBER LIFE INSURANCE

You can keep a minimum of $5,000 up to the total amount of your current life insurance. You cannot enroll in more life insurance than you

currently have. You must keep life insurance on yourself to be able to keep life insurance on your dependents. You cannot increase life

insurance after this election. Life insurance cannot be deferred and must be carried as a primary retiree/vested member.

I elect to keep $ ($5,000 to $40,000 in $5,000 units) of member life insurance at a

flat rate per $1,000 of coverage.

I elect to keep $ (amount above $40,000 in $5,000 units) of additional life insurance.

Revised 12/29/2021

A1

DEPENDENT INFORMATION

NOTE: If you and/or your dependents are eligible for Medicare, an additional application must be completed.

Please contact EGID Member Services to request an application. You cannot add dependent life if you do not

already have it. The dependent life amount must be the same for each child, though the amount for your spouse

can be different.

SPOUSE

Name Check if Medicare-eligible.

Add/keep Drop SSN Date of birth Male Female

Health Primary physician (HMO only) New patient Current patient

Dental Primary dentist (Prepaid only) New patient Current patient

Vision

Dep. life I elect to keep $ (in $500 units) of dependent life insurance.

Does your spouse currently have coverage through OMES EGID? Yes No

(If yes, list name and Social Security number above.)

CHILD

Name Check if Medicare-eligible.

Add/keep Drop SSN Date of birth Male Female

Health Primary physician (HMO only) New patient Current patient

Dental Primary dentist (Prepaid only) New patient Current patient

Vision

Dep. life I elect to keep $ (in $500 units) of dependent life insurance.

CERTIFICATION SIGNATURES

I authorize EGID to deduct the amount of my premiums from my retirement check according to Administrative

Rule 260:50-3-5. (You must verify with your retirement system that your retirement check will cover your

premiums.)

I request EGID direct bill me for my monthly premiums at the mailing address on this form.

Spouse must sign if being excluded from health, dental and/or vision or if they are a common-law spouse.

Spouse exclusion certification: I certify that I am aware I am being excluded from health, dental and/or vision

coverage as indicated on this form. I am also aware that I cannot be added to coverage at a later date except

within 30 days of the loss of other coverage. (Required only if children are covered and spouse is not.)

Common-law spouse certification: I certify the person listed as my spouse and I have an actual and mutual

agreement between ourselves to be married; that this is a permanent relationship; that our relationship is

exclusive, as proven by our cohabitation as spouses; and that we do hereby hold ourselves out publicly as

married. I am aware this relationship can be dissolved only by legal divorce.

Spouse signature

Date

I understand that no coverage, except vision, can be added at a later date.

Member signature Date

A2

Revised 12/29/2021

Retirement information can be found at oklahoma.gov/omes.

You can carry health, dental, vision and life insurance on yourself and your dependents.

The health, dental and life coverage you take into retiree/vested/non-vested status is the only coverage you can have

with EGID through your retirement years. If you do not keep coverage now, you cannot add it later. Plan changes can

be made during the annual Option Period.

If you are insuring one dependent, you must insure all eligible dependents (for any given coverage) unless they are

covered by other insurance or Indian or military benefits. Children who have Indian or military benefits or other

insurance may be required to show proof of coverage.

Following your retirement, dependents can be added only within 30 days of one of the following events: birth,

adoption or guardianship, marriage or loss of other group insurance.

DEFER INSTRUCTIONS: If your spouse has separate coverage through EGID at the time you terminate

employment, you can transfer your individual health, dental and/or vision coverage to dependent coverage under

your spouse’s coverage. Your spouse must contact their employer to add you as a dependent. You must elect to

transfer coverage within 30 days of your termination of employment. Any 30-day break in coverage voids your

eligibility to keep coverage in the future. Life insurance cannot be deferred and must be carried as a primary

retiree/vested/non-vested member. When you are ready to return to retiree/vested/non-vested status, you must again

complete this form and mark the box on Page 1 of your form to cancel your deferment.

THINGS TO CONSIDER AS A RETIREE WHEN YOU BECOME MEDICARE-ELIGIBLE

IMPORTANT: If you are under age 65 and eligible for Medicare, you must notify EGID and provide your

Medicare number as it appears on your Medicare card. Medicare supplement coverage is effective the date you

become eligible for Medicare or the first day of the month following notification of your Medicare eligibility,

whichever is later.

When you turn age 65, you have the option to enroll in either a Medicare supplement with prescription drug plan or a

Medicare Advantage prescription drug plan.

BCBSOK-BlueSecure and all MAPD plans offered through EGID require you to have both Medicare Part A

and Medicare Part B.

If you are eligible and do not enroll in Medicare Part B, there are two Medicare supplement plans available to you:

HealthChoice SilverScript High Option Medicare Supplement Plan and HealthChoice SilverScript Low Option

Medicare Supplement Plan. All medical benefits under these plans are paid as if you are enrolled in both Medicare

Part A and Part B. If you are not enrolled in Medicare Part B, your plan will estimate Medicare’s benefits and

provide supplemental coverage as if Medicare is the primary carrier. This means HealthChoice pays secondary and

you are responsible for the primary share of the claim.

For information concerning HMO, MAPD, Medicare supplement, dental or vision plans, contact their customer

service numbers.

For information regarding enrollment, or to obtain an application for a Medicare supplement plan or

MAPD plan, call 405-717-8780 or toll-free 800-752-9475 or TTY 711 or contact:

OMES Employees Group Insurance Division

P.O. Box 11137

Oklahoma City, OK 73136-9998

Revised 12/29/2021

A3

14

Who can use this form? People with Medicare who want to join a Medicare prescription drug plan.

To join a plan, you must:

• Be a United States citizen or be lawfully present in the U.S.

• Live in the plan’s service area.

Important:

To join a HealthChoice SilverScript Medicare supplement with prescription drug plan, you must have either, or

both:

• Medicare Part A (hospital insurance).

• Medicare Part B (medical insurance).

To join the BCBSOK Medicare supplement with prescription drug plan, you must have both:

• Medicare Part A (hospital insurance) and Medicare Part B (medical insurance).

When do I use this form?

You can join a plan:

• Between Oct. 15-Dec. 7 each year (for coverage starting Jan. 1).

• Within three months of first getting Medicare.

• In certain situations where you’re allowed to join or switch plans. Visit Medicare.gov to learn more about

when you can sign up for a plan.

What do I need to complete this form?

• Your Medicare Number (the number on your red, white and blue Medicare card).

• Your permanent address and phone number.

Reminder:

• If you want to join a plan during fall open enrollment (Oct. 15-Dec. 7), the plan must have your

completed form by Dec. 7.

What happens next?

Send your completed and signed form to:

OMES EGID

P.O. Box 11137

Oklahoma City, OK 73136-9998

Once they process your request to join, they’ll contact you.

How do I get help with this form?

Call EGID Member Services at 405-717-8780 or toll-free 800-752-9475 Monday-Friday, 8 a.m. to 4:30 p.m.

Central time to see if you are eligible to enroll. TTY users call 711. Or, call Medicare at 800-MEDICARE (800-

633-4227). TTY users call 877-486-2048. En español: Llame a EGID al 800-752-9475/TTY 711 o a Medicare

gratis al 800-633-4227 y oprima el 2 para asistencia en español y un representante estara disponible para

asistirle.

Individuals experiencing homelessness

If you want to join a plan but have no permanent residence, a post office box, an address of a shelter or clinic,

or the address where you receive mail (e.g., Social Security checks) may be considered your permanent

residence address.

Rev. August 2023 MSP

B1

*MCENRL*

Employees Group Insurance Division

APPLICATION FOR MEDICARE SUPPLEMENT

WITH PRESCRIPTION DRUG PLAN

Member information

Member name (First MI Last) Member ID

Date of birth

Male Female

Member SSN

Permanent address (P.O. Box not allowed) City State ZIP code

Mailing address (if different from above) City State ZIP code

Phone Alternate phone Email

Dependent information (only if enrolling in Medicare)

Dependent name (First MI Last)

Date of birth

Male Female

Dependent SSN

Your Medicare information (required to process your application)

Name on Medicare card:

Medicare number: - -

Part A effective date:

Part B effective date:

To participate in the BCBSOK Medicare supplement plan, you must be enrolled in both Medicare Part A (hospital) and Part B

(medical) and continue to pay your monthly Part B premium. To participate in the HealthChoice Medicare supplement plans,

you must be entitled to benefits under Medicare Part A. You are not required to be in enrolled in Part B, but the plan pays

Answer these important questions

benefits as if you are. To maximize your benefits, you need to be enrolled in Medicare Part B.

1. In which Medicare supplement with Medicare Part D prescription drug plan do you want to enroll?

HealthChoice SilverScript Medicare Supplement Plan

High Low

BCBSOK – BlueSecure

2. Some individuals may have other drug coverage through private insurance, TRICARE, federal employee

health benefits, VA benefits or state pharmaceutical assistance programs. Will you have other

prescription drug coverage in addition to your coverage through OMES Employees Group Insurance

Division?

Name of other coverage ID# Group#

No

Yes

3.

Typically, you can enroll in a Medicare prescription drug plan only during the annual enrollment period

from Oct. 15 through Dec. 7. Additionally, there are exceptions that may allow you to enroll in a Medicare

prescription drug plan outside of the Annual Enrollment Period. (Refer to statements on Page 2.)

I am enrolling during an Annual Enrollment Period (Option Period).

B2

Read the following statements and check the box if the statement applies to you. By checking any of the

following boxes, you are certifying that, to the best of your knowledge, you are eligible for an enrollment

period. If we later determine that this information is incorrect, you may be disenrolled.

I am new to Medicare.

I recently moved outside of the service area of my current plan. I moved on (insert date):

I recently was released from incarceration. I was released on (insert date):

I recently returned to the U.S. after living permanently outside of the U.S.

I returned to the U.S. on (insert date):

I recently obtained lawful presence status in the U.S. I got this status on (insert date):

I recently had a change in my Medicaid (newly got Medicaid, had a change in level of Medicaid assistance or lost

Medicaid) on (insert date):

I recently had a change in my Extra Help paying for Medicare prescription drug coverage (newly got Extra Help, had a

change in level of Extra Help or lost Extra Help) on (insert date):

I have both Medicare and Medicaid or I get Extra Help paying for my Medicare prescription drug coverage, but I haven’t

had a change.

I live in or recently moved out of a long-term care facility (for example, a nursing home or other long-term care facility).

I moved/will move into/out of the facility on (insert date):

I recently left a PACE program on (insert date):

I recently involuntarily lost my creditable prescription drug coverage (as good as Medicare’s). I lost my drug coverage on

(insert date):

I am leaving employer or union coverage on (insert date):

I belong to a pharmacy assistance program provided by my state.

I was enrolled in a plan by Medicare (or my state), and I want to choose a different plan. My enrollment in that plan

started on (insert date):

I was affected by an emergency or major disaster (as declared by the Federal Emergency Management Agency (FEMA) or

by a federal, state or local government entity. One of the other statements here applied to me, but I was unable to make

my enrollment request because of the disaster.

My plan is ending its contract with Medicare, or Medicare is ending its contract with my plan.

None of these statements apply to me. Call EGID at 405-717-8780 or toll-free 800-752-9475 Monday-Friday, 8 a.m. to

4:30 p.m. Central time to see if you are eligible to enroll. TTY users call 711.

Answering these questions is your choice. You cannot be denied coverage if you don’t

answer.

4. Are you Hispanic, Latino/a, or Spanish origin? Select all that apply.

No, not of Hispanic, Latino/a, or Spanish origin Yes, Mexican, Mexican American, Chicano/a

Yes, Puerto Rican Yes, Cuban

Yes, another Hispanic, Latino/a, or Spanish origin

I choose not to answer.

5. What’s your race?

American Indian or Alaska Native Asian Indian Black or African American

Chinese Filipino Guamanian or Chamorro

Japanese Korean Native Hawaiian

Other Asian Other Pacific Islander Samoan

Vietnamese White

I choose not to answer.

B3

–

–

Signatures Important: Read and sign below

• I must keep Part A or Part B to stay in the plans offered by EGID.

• By joining this Medicare supplement with prescription drug plan, I acknowledge that the Medicare supplement with

prescription drug plans offered by EGID will release my information to Medicare, who may use it to track beneficiary

enrollment, for payment and other purposes applicable to federal statutes that authorize the collection of this information

(see Privacy Act Statement below).

• Your response to this form is voluntary. However, failure to respond may affect enrollment.

• The information on this enrollment form is correct to the best of my knowledge. I understand that if I intentionally provide

false information on this form, I will be disenrolled from the plan.

• I understand that people with Medicare are generally not covered under Medicare while out of the country, except for

limited coverage near the U.S. border.

• I understand that my signature (or the signature of the person legally authorized to act on my behalf) on this application

means I have read and understand the contents of this application. If signed by an authorized representative (as described

above), this signature certifies that:

1) This person is authorized under state law to complete this enrollment.

2) Documentation of this authority is available upon request by Medicare.

Member signature Date

Dependent signature (only if dependent is enrolling in Medicare) Date

If you are the authorized representative, you must sign above and provide this information:

Name Phone

Address

Relationship to enrollee

Mail or fax the form to Attn: Member Accounts

Mail: OMES EGID

Fax: 405-717-8939

P.O. Box 11137

Oklahoma City, OK 73136-9998

2024 monthly premium information does not reflect any retirement system contribution

MEDICARE SUPPLEMENT WITH PRESCRIPTION DRUG PLANS

BCBSOK – BlueSecure $466.02 per covered person

HealthChoice SilverScript High Option Medicare Supplement $437.00 per covered person

HealthChoice SilverScript Low Option Medicare Supplement

Privacy Act Statement

$356.06 per covered person

The Centers for Medicare & Medicaid Services (CMS) collects information from Medicare plans to track beneficiary enrollment in Medicare

Advantage (MA) Plans, improve care, and for the payment of Medicare benefits. Sections 1860D-1 of the Social Security Act and 42 CFR §§

423.30 and 423.32 authorize the collection of this information. CMS may use, disclose and exchange enrollment data from Medicare beneficiaries

as specified in the System of Records Notice (SORN) “Medicare Advantage Prescription Drug (MARx)”, System No. 09-70-0588. Your response

to this form is voluntary. However, failure to respond may affect enrollment in the plan.

If you have questions, call EGID Member Services at

405-717-8780 or toll-free 800-752-9475. TTY users call 711.

B4

Who can use this form? People with Medicare who want to join a Medicare Advantage prescription drug plan.

To join a plan, you must:

• Be a United States citizen or be lawfully present in the U.S.

• Live in the plan’s service area.

Important:

To join a Medicare prescription drug plan, you must also have both:

• Medicare Part A (hospital insurance).

• Medicare Part B (medical insurance).

When do I use this form?

You can join a plan:

• Between Oct. 15-Dec. 7 each year (for coverage starting Jan. 1).

• Within three months of first getting Medicare.

• In certain situations where you’re allowed to join or switch plans. Visit Medicare.gov to learn more about

when you can sign up for a plan.

What do I need to complete this form?

• Your Medicare Number (the number on your red, white and blue Medicare card).

• Your permanent address and phone number.

Reminder:

• If you want to join a plan during fall open enrollment (Oct. 15-Dec. 7), the plan must have your

completed form by Dec. 7.

What happens next?

Send your completed and signed form to:

OMES EGID

P.O. Box 11137

Oklahoma City, OK 73136-9998

Once they process your request to join, they’ll contact you.

How do I get help with this form?

Call EGID Member Services at 405-717-8780 or toll-free 800-752-9475 Monday-Friday, 8 a.m. to 4:30 p.m.

Central time to see if you are eligible to enroll. TTY users call 711. Or, call Medicare at 800-MEDICARE (800-

633-4227). TTY users can call 877-486-2048. En español: Llame a EGID al 800-752-9475/TTY 711 o a

Medicare gratis al 800-633-4227 y oprima el 2 para asistencia en español y un representante estara disponible

para asistirle.

Individuals experiencing homelessness

If you want to join a plan but have no permanent residence, a post office box, an address of a shelter or clinic,

or the address where you receive mail (e.g., Social Security checks) may be considered your permanent

residence address.

Rev. August 2023 MAPD

C1

*MAPDEN*

Employees Group Insurance Division

APPLICATION FOR MEDICARE ADVANTAGE

PRESCRIPTION DRUG (MAPD) PLAN

Member information

Member name (First MI Last) Member ID

Date of birth

Male Female

Member SSN

Permanent address (P.O. Box not allowed) City State ZIP code

Mailing address (if different from above) City State ZIP code

Phone Alternate phone Email

Dependent information (only if enrolling in Medicare)

Dependent name (First MI Last)

Date of birth

Male Female

Dependent SSN

Your Medicare information (required to process your application)

Name on Medicare card:

Medicare number: - -

Part A effective date:

Part B effective date:

You must have Medicare Part A and Part B to join an MAPD plan.

Answer these important questions

1. In which MAPD plan do you want to enroll?

BCBSOK – MAPD Generations by GlobalHealth

CommunityCare Senior Health Plan Humana MAPD PPO

2.

Some individuals may have other drug coverage through private insurance, TRICARE, federal employee

health benefits, VA benefits or state pharmaceutical assistance programs. Will you have other

prescription drug coverage in addition to your coverage through OMES Employees Group Insurance

Division?

Name of other coverage ID# Group#

No

Yes

3.

Typically, you can enroll in a Medicare prescription drug plan only during the annual enrollment period

from Oct. 15 through Dec. 7 each year. Additionally, there are exceptions that may allow you to enroll in a

Medicare prescription drug plan outside of the Annual Enrollment Period. (Refer to statements on Page 2.)

I am enrolling during an Annual Enrollment Period (Option Period).

C2

Read the following statements and check the box if the statement applies to you. By checking any of the

following boxes, you are certifying that, to the best of your knowledge, you are eligible for an enrollment

period. If we later determine that this information is incorrect, you may be disenrolled.

I am new to Medicare.

I recently moved outside of the service area of my current plan. I moved on (insert date):

I recently was released from incarceration. I was released on (insert date):

I recently returned to the U.S. after living permanently outside of the U.S.

I returned to the U.S. on (insert date):

I recently obtained lawful presence status in the U.S. I got this status on (insert date):

I recently had a change in my Medicaid (newly got Medicaid, had a change in level of Medicaid assistance or lost

Medicaid) on (insert date):

I recently had a change in my Extra Help paying for Medicare prescription drug coverage (newly got Extra Help, had a

change in level of Extra Help or lost Extra Help) on (insert date):

I have both Medicare and Medicaid or I get Extra Help paying for my Medicare prescription drug coverage, but I haven’t

had a change.

I live in or recently moved out of a long-term care facility (for example, a nursing home or other long-term care facility).

I moved/will move into/out of the facility on (insert date):

I recently left a PACE program on (insert date):

I recently involuntarily lost my creditable prescription drug coverage (as good as Medicare’s). I lost my drug coverage on

(insert date):

I am leaving employer or union coverage on (insert date):

I belong to a pharmacy assistance program provided by my state.

I was enrolled in a plan by Medicare (or my state), and I want to choose a different plan. My enrollment in that plan

started on (insert date):

I was affected by an emergency or major disaster (as declared by the Federal Emergency Management Agency (FEMA) or

by a federal, state or local government entity. One of the other statements here applied to me, but I was unable to make

my enrollment request because of the disaster.

My plan is ending its contract with Medicare, or Medicare is ending its contract with my plan.

None of these statements apply to me. Call EGID at 405-717-8780 or toll-free 800-752-9475 Monday-Friday, 8 a.m. to

4:30 p.m. Central time to see if you are eligible to enroll. TTY users call 711.

Answering these questions is your choice. You cannot be denied coverage if you don’t

answer.

4. Are you Hispanic, Latino/a, or Spanish origin? Select all that apply.

No, not of Hispanic, Latino/a, or Spanish origin Yes, Mexican, Mexican American, Chicano/a

Yes, Puerto Rican Yes, Cuban

Yes, another Hispanic, Latino/a, or Spanish origin

I choose not to answer.

5. What’s your race?

American Indian or Alaska Native Asian Indian Black or African American

Chinese Filipino Guamanian or Chamorro

Japanese Korean Native Hawaiian

Other Asian Other Pacific Islander Samoan

Vietnamese White

I choose not to answer.

6. Would you prefer that the MAPD plan send you information in a language other than English or in

another format?

Yes No

C3

–

–

Primary care physician selection

As an MAPD plan member with CommunityCare Senior Health Plan or Generations by GlobalHealth, you must choose a PCP

who will coordinate your health care. You can obtain a list of the plan’s network physicians by contacting the plan or visiting

their website.

Physician name (First Last) Are you a current patient of this physician?

Yes

No

Signatures Important: Read and sign below

• I must keep both Part A and Part B to stay in the plans offered by EGID.

• By joining this Medicare Advantage plan, I acknowledge the Medicare Advantage prescription drug plans offered by EGID

will release my information to Medicare, who may use it to track beneficiary enrollment, for payment and other purposes

applicable to federal statutes that authorize the collection of this information (see Privacy Act Statement below).

• Your response to this form is voluntary. However, failure to respond may affect enrollment.

• The information on this enrollment form is correct to the best of my knowledge. I understand that if I intentionally provide

false information on this form, I will be disenrolled from the plan.

• I understand that people with Medicare are generally not covered under Medicare while out of the country, except for

limited coverage near the U.S. border.

• I understand that when my MAPD coverage through EGID begins, I must get all of my medical and prescription drug

benefits from that plan. Benefits and services provided by my plan and contained in my evidence of coverage document

(also known as a member contract or subscriber agreement) will be covered. Neither Medicare nor my plan will pay for

benefit or services that are not covered.

• I understand that my signature (or the signature of the person legally authorized to act on my behalf) on this application

means I have read and understand the contents of this application. If signed by an authorized representative (as described

above), this signature certifies that:

1) This person is authorized under state law to complete this enrollment.

2) Documentation of this authority is available upon request by Medicare.

Member signature

Date

Dependent signature (only if dependent is enrolling in Medicare) Date

If you are the authorized representative, you must sign above and provide this information

Name Phone

Address

Relationship to enrollee

Mail or fax the form to Attn: Member Accounts

Mail: OMES EGID Fax: 405-717-8939

P.O. Box 11137

Oklahoma City, OK 73136-9998

2024 monthly premium information does not reflect any retirement system contribution

MEDICARE ADVANTAGE PRESCRIPTION DRUG (MAPD) PLANS

BCBSOK – MAPD $238.40 per covered person

CommunityCare Senior Health Plan $215.64 per covered person

Generations by GlobalHealth $199.00 per covered person

Humana MAPD PPO $192.92 per covered person

Privacy Act Statement

The Centers for Medicare & Medicaid Services (CMS) collects information from Medicare plans to track beneficiary enrollment in Medicare

Advantage (MA) Plans, improve care, and for the payment of Medicare benefits. Sections 1860D-1 of the Social Security Act and 42 CFR §§

423.30 and 423.32 authorize the collection of this information. CMS may use, disclose and exchange enrollment data from Medicare beneficiaries

as specified in the System of Records Notice (SORN) “Medicare Advantage Prescription Drug (MARx)”, System No. 09-70-0588. Your response

to this form is voluntary. However, failure to respond may affect enrollment in the plan.

If you have questions, call EGID Member Services at

405-717-8780 or toll-free 800-752-9475. TTY users call 711.

C4

Re: Automatic Bank Withdrawal for Insurance Premium

The Office of Management and Enterprise Services Employees Group Insurance

Division is pleased to offer you a convenient way to pay your monthly insurance

premiums. Through a program established by the Office of the State Treasurer, upon

your authorization, EGID will automatically draft your bank account for your monthly

insurance premiums.

If you wish to participate, your bank account will be debited on the 20th of each month,

and you will not need to mail a check for your insurance premium. There is no charge

for this service.

Once you are enrolled in this process, you will no longer receive a monthly bill from us.

EGID will notify you of any change in the monthly debit amount. This process will

continue as long as you have insurance through EGID, until you notify us in writing that

you no longer wish to participate, or until a debit does not clear your bank.

We encourage you to take advantage of direct debiting by completing the enclosed

authorization form. A confirmation will be sent to you showing the amount that will be

debited every month along with the month in which this process will begin.

The authorization form must be received in our office by the 10th of the month to

be effective for the current month’s premium. Forms received after the 10th will

be effective the following month. Premiums are required to be paid in full prior to

enrolling in direct debiting.

If you have any questions, call EGID Member Services at 405-717-8780 or 800-752-

9475. TTY users call 711.

D1

Revised 01/14/2022

This authorization form must be received in our office by the 10th of the month to be

effective for the current month’s premium. Forms received after the 10th will be effective

the following month. Premiums are required to be paid in full prior to enrolling in direct

debiting.

Employees Group Insurance Division

ELECTRONIC FUND TRANSFER

AUTHORIZATION

Member name

SSN or member ID

Member’s financial institution

I hereby authorize the Office of the State Treasurer to initiate debit entries for the

checking account at the financial institution indicated above for amounts due to the

Office of Management and Enterprise Services Employees Group Insurance Division.

This authority is to remain in full force and effect until one of the following occurs:

• EGID has received notification from the insured of his or her desire to stop

participating in automatic bank withdrawals. The notice must be made at least

one week before the debit date.

• The Office of the State Treasurer is unable to debit the account for any month

because of a closed account, insufficient funds or any other reason.

Signature Date

Attach a voided check here. Deposit slips will not be accepted.

ATTACH CHECK HERE

Please mail this completed form to:

EGID MEMBER ACCOUNTS

P.O. BOX 11137

OKLAHOMA CITY, OK 73136 9998

-

D2

__________________________________________ ______________________

*BENEFI*

Employees Group Insurance Division

Beneficiary Designation Form

Please read the instructions carefully and complete this form in ink.

SSN or Member ID: __________________ Member Name: _____________________________________

First MI Last

Address: ___________________________________________________________________________

New Address Street City State ZIP

Phone: (____) ___________________________ Alt Phone: (____) ________________________

Important*: Please ensure the “Share Percentage” section in both Primary Beneficiary(ies) and Contingent Beneficiary(ies)

add up to 100 percent. Payment will be made in equal shares to all surviving beneficiaries unless otherwise indicated.

P

RIMARY BENEFICIARY(IES)

Primary Beneficiary’s Name and Address

SSN

Phone #

Relationship

Date of Birth

Share

Percentage

100%

CONTINGENT BENEFICIARY(IES)

Proceeds are paid to the contingent beneficiary(ies) identified below only if there is no surviving primary beneficiary(ies).

Contingent Beneficiary’s Name and Address

SSN

Phone #

Relationship

Date of Birth

Share

Percentage

100%

I have named the above beneficiary(ies) to receive my life insurance benefits from HealthChoice. I

understand this form replaces and cancels all prior beneficiary designations and will become effective

only when it is received by EGID.

Member Signature - original signature required Date

Mail this form to OMES EGID at P.O. Box 11137, Oklahoma City, OK 73136-9998

E1

Instructions for Completing the Beneficiary Designation Form

This beneficiary form applies to the HealthChoice Life Insurance Plan offered through the Office of Management

and Enterprise Services Employees Group Insurance Division. If you are retired, it does not affect the beneficiaries

for any death benefit you may have through your retirement system.

The beneficiary designations you make on this form replace and cancel all prior life insurance beneficiary

designations with EGID. Your designations do not become effective until this form is signed and received by

EGID. Do not alter this form or attach additional pages.

It is very important that you provide the full legal name, address, relationship, date of birth and Social

Security number of each beneficiary you designate. This information is essential in ensuring that your named

beneficiaries can be located and receive your intended benefit amount. The Beneficiary Designation Form has

three parts: Member Information, Primary and Contingent Beneficiary Designation and Signature. Please print

clearly in ink.

Employer Name – Provide the name of your employer. This information is not required of a former

employee/retiree.

Member Information – Provide your name, SSN or Member ID and address.

Primary Beneficiary Designation – You can designate one or more primary beneficiaries. All primary

beneficiaries share equally, unless you note otherwise. In the event that multiple primary beneficiaries are

named and a primary beneficiary dies before or simultaneously with you, the remaining primary

beneficiary(ies) will be entitled to equal share of the deceased beneficiary’s designated benefit amount.

Contingent Beneficiary Designation – You can designate one or more contingent beneficiaries.

Contingent beneficiaries receive benefits only in the event all primary beneficiaries die before or

simultaneously with you. All contingent beneficiaries share equally, unless you note otherwise on your form.

In the event that multiple contingent beneficiaries are named and a contingent beneficiary dies before or

simultaneously with you, the remaining contingent beneficiary(ies) will be entitled to equal share of the

deceased beneficiary’s designated benefit amount.

Signature – You must sign and date your form.

Special Beneficiary Designations

Sometimes members wish to make a special designation for trusts, minors or institutions. If you wish to make a

special designation, please read the following information carefully.

Designating a trust as beneficiary – To designate a trust as beneficiary, provide the actual name of the

trust and the date the trust was created in the space provided.

Designating a minor as beneficiary – A minor can be named your beneficiary; however, it is often difficult

and costly for a minor to receive payment, especially if the amount exceeds $10,000. Before you designate a

minor as your beneficiary, you should consult an attorney or professional financial advisor.

Designating an institution as beneficiary – To designate an institution (church, charity, funeral home, etc.)

as your beneficiary, provide the full name of the institution and list the address in the space provided.

After you complete and sign the Beneficiary Designation Form, mail it to:

Office of Management and Enterprise Services

Employees Group Insurance Division

P.O. Box 11137, Oklahoma City, OK 73136-9998

Remember to keep a copy of your completed form for your records.

E2

State of Oklahoma

Office of Management and Enterprise Services

Privacy Notice

Revised October 2023

This notice describes how medical information about you may be used and disclosed and

how you can get access to this information. Please review this notice carefully.

For questions or complaints regarding privacy concerns with OMES, please contact:

OMES HIPAA Privacy Officer

P.O. Box 11137, Oklahoma City, OK 73136

405-717-8780 or toll-free 800-752-9475

TTY 711

oklahoma.gov/omes

Why is the notice of privacy practices important?

This notice provides important information about the practices of OMES pertaining to the way it

gathers, uses, discloses and manages your Protected Health Information and also describes how

you can access this information. PHI is health information that can be linked to a particular person by

certain identifiers including, but not limited to, names, Social Security numbers, addresses and birth

dates.

Oklahoma privacy laws and the federal Health Insurance Portability and Accountability Act of 1996

(HIPAA) protect the privacy of an individual’s health information. Please note, in general the laws

and regulations of HIPAA do not apply to the Health Choice Disability Plan and HealthChoice Life

Insurance Plan. For HIPAA purposes, OMES has designated itself as a hybrid entity. This means

that HIPAA only applies to areas of OMES operations involving health care and not to all lines of

service offered by OMES. This notice applies to the privacy practices of the following OMES

divisions and positions that may share or access your PHI as needed for treatment, payment and

health care operations:

• Employees Group Insurance Division (EGID).

• General Counsel Legal.

• Information Services as it applies to maintenance and storage of PHI.

• The Director of Public Affairs and Grants Management and the Legislative Liaison.

OMES is committed to protecting the privacy and security of your PHI as used within the

components listed above.

27

4997

Your information. Your rights. Our responsibilities.

Your rights

When it comes to your health information, you have certain rights. This section explains your

rights and some of our responsibilities to help you.

Get an electronic or paper copy of your health and claims records.

• You can ask to see or get an electronic copy of your medical record and other health

information we have about you. Ask us how to do this using the contact information at the

beginning of this notice.

• We will provide a copy or a summary of your health and claims records, usually within 30 days

of your request. We may charge a reasonable, cost-based fee.

Ask us to correct health and claims records.

• You can ask us to correct your health and claims records if you think they are incorrect or

incomplete. Ask us how to do this using the contact information at the beginning of this

notice.

• We may decline your request but will explain the reasons in writing within 60 days.

Request confidential communications.

• You can ask us to contact you in a specific manner; e.g., home or office phone, or to send

mail to an alternate address.

• We will consider all reasonable requests.

o If declining would put you in danger, tell us and we will automatically approve your

request.

Ask us to limit what we use or share.

• You can ask us not to use or share certain health information for treatment, payment or our

operations.

o We are not required to approve your request and may decline if it would affect your

care.

Get a list of those with whom we’ve shared information.

• You can ask for an accounting of the times we’ve shared your health information for six

years prior to the date you ask, who we shared it with and why.

• We will include all the disclosures except for those about treatment, payment andhealth care

operations, and certain other disclosures (such as any you asked us to make).

• We will provide one free accounting per year but will charge a reasonable fee if you request

an additional accounting within 12 months.

Get a copy of this privacy notice.

You can ask for a paper copy of this notice at any time, even if you have agreed to receive the

notice electronically. We will promptly provide you with a paper copy.

28

Choose someone to act for you.

• If you have named a medical power of attorney, or if someone is your legal guardian,

that person can exercise your rights and make decisions about your health information.

• We will verify the person has this authority and can act for you before any action is

taken.

File a complaint if you feel your rights are violated.

• You can file a complaint if you feel we have violated your rights by contacting us using

the information at the beginning of this notice.

• You may also file a complaint with the U.S. Department of Health and Human Services

Office for Civil Rights by sending a letter to 200 Independence Ave., S.W., Washington,

D.C. 20201, calling 1-877-696-6775, or visiting

hhs.gov/ocr/privacy/hipaa/complaints/.

• We will not retaliate against you for filing a complaint.

Your choices

For certain health information, you can tell us your choices about what we share. If you

have a clear preference for how we share your information in the situations described below, talk

to us. Tell us what you want us to do, and we will follow your instructions.

In these cases, you have both the right and choice to tell us to:

• Share information with your family, close friends, or others involved in payment for your

care.

• Share information in a disaster relief situation.

• Contact you for fundraising efforts.

If you are not able to tell us your preference (e.g., if you are unconscious), we may share your

information if we believe it is in your best interest. We may also share your information when needed

to lessen a serious and imminent health or safety threat.

In these cases, we never share your information unless you give us written permission:

• Marketing purposes.

• Sale of your information.

• Most sharing of psychotherapy notes.

Our uses and disclosures

How do we typically use or share your health information?

Your PHI is used and disclosed by OMES employees and other entities under contract with OMES

according to HIPAA Privacy Rules and the “minimum necessary” standard, which releases only the

minimum necessary health information to achieve the intended purpose or to carry out a desired

function within OMES.

29

We typically use or share your health information in the following ways:

Help manage the health care treatment you receive.

• We can use your health information and share it with professionals who are treating you.

Example: A doctor sends us information about your diagnosis and treatment plan so we can

arrange additional services.

Run our organization.

• We can use and disclose your information to run our organization and contact you when

necessary.

• We are not allowed to use genetic information to decide whether we will give you coverage

and the price of that coverage. This does not apply to long term careplans.

Examples: We use health information about you to develop better services for you, provide customer

service, resolve member grievances, member advocacy, conduct activities to improve member

health and reduce costs, assist in the coordination and continuity of health care, and to set premium

rates.

Pay for your health services.

• We can use and disclose your health information as we pay for your eligible health services.

Example: We share information about you with your dental plan to coordinate payment for your

dental work.

Administer your plan.

• We may disclose summarized health information to your health plan sponsor for

plan administration.

Example: Your employer contracts with us to provide a health plan, and we provide the

employer with certain statistics to explain the premiums we charge.

How else can we use or share your health information?

We are allowed or required to share your information in other ways – usually in ways that contribute

to the public good, such as public health and research. We must comply with the law to share your

information for these purposes. For more information, refer to

hhs.gov/ocr/privacy/hipaa/understanding/consumers/index.html.

Help with public health and safety issues.

We can share your health information for certain situations such as:

• Preventing disease.

• Helping with product recalls.

• Reporting adverse reactions to medications.

• Reporting suspected abuse, neglect or domestic violence.

• Preventing or reducing a serious threat to anyone’s health or safety.

30

Do research.

We can use or share your information for health research, as permitted by law.

Comply with the law.

We will share information about you if state or federal laws require it, including with the Department

of Health and Human Services if it wants to ensure we are complying with federal privacy laws.

Respond to organ and tissue donation requests.

We can share health information about you with organ procurement organizations.

Work with a medical examiner or funeral director.

We can share health information with a coroner, medical examiner or funeral director when an

individual dies.

Address workers’ compensation, law enforcement and other government requests.

We can use or share health information about you:

• For workers’ compensation claims.

• For law enforcement purposes or with a law enforcement official.

• With health oversight agencies for activities authorized by law.

• For special government functions such as military, national security, and presidential

protective services.

Respond to lawsuits and legal actions.

We can share health information about you in response to a court or administrative order or in

response to a subpoena.

Our responsibilities

When it comes to your health information, we have specific obligations such as:

• We are required by law to maintain the privacy and security of your Protected Health

Information.

• We will let you know promptly if a breach occurs that may have compromised the privacy or

security of your PHI.

• Wemust follow the duties and privacy practices described in this notice and give you a copy

of it.

• We will not use or share your PHI other than as described here unless you notify us in writing

that wecan. You may change your mind at any time but must let us know in writing if you do.

For more information, refer to

hhs.gov/ocr/privacy/hipaa/understanding/consumers/noticepp.html.

Changes to the terms of this notice.

We can change the terms of this notice, and the changes will apply to all information we have about

you. The new notice will be available upon request, on our website, and we will deliver a copy to

you. You may also subscribe online to receive notice of changes to this page via email or text

message.

31

Contact Informaon

Health plans

BCBS – BlueLincs

855-609-5684

bcbsok.com/state

CommunityCare

918-594-5242 or 800-777-4890

TDD/TTY 800-722-0353

state.ccok.com

GlobalHealth Inc.

405-280-5600 or 877-280-5600

TTY 711

GlobalHealth.com/Oklahoma/mystateplan

HealthChoice

Medical

800-323-4314

TTY 711

HealthChoiceOK.com

Pharmacy

877-720-9375

TTY 711

Caremark.com

Health Plans – Medicare

Supplement Plans

BCBSOK Member Services

833-418-0443

TTY 711

bcbsok.com/reree-medicare-state

HealthChoice

Medical

800-323-4314

TTY 711

HealthChoiceOK.com

Pharmacy

866-275-5253

TTY 711

Caremark.com

Health Plans – MAPD Plans

BCBSOK Member Services

833-418-0443

TTY 711

bcbsok.com/retiree-medicare-state

CommunityCare Senior Health Plan

918-594-5323 or 800-642-8065

TDD/TTY 800-722-0353

stateshp.ccok.com

Generations by GlobalHealth

Prospective Members:

844-322-8322

Current Members:

405-280-5555 or 844-280-5555

TTY 711

GlobalHealth.com/Oklahoma/osr

Humana Group Medicare Customer Care

Identify yourself as a retiree with the State of

Oklahoma/EGID when calling as a prospective

member.

866-396-8810

TTY 711

7 a.m. to 8 p.m. CT

your.humana.com/ok-medicare

Dental Plans

BCBS – BlueCare

855-609-5684

Bcbsok.com/state/dental

Cigna Prepaid Dental

800-244-6224

Hearing-impaired relay 800-654-5988

view.ceros.com/cigna/ok-ins-benets

Delta Dental

405-607-2100 or 800-522-0188

DeltaDentalOK.org/client/OK

32

405-521-2387 or 877-738-6365

ok.gov/trs

Oklahoma Law Enforcement

Retirement System

405-522-4931 or 877-213-0856

olers.state.ok.us

Contact Informaon

HealthChoice

Customer Care 800-323-4314

TTY 711

HealthChoiceOK.com

MetLife

855-676-9443

metlife.com/Oklahoma

Sun Life

800-442-7742

onboard.sunlifeconnect.com

Life Plans

HealthChoice

Customer Care 800-323-4314

TTY 711

HealthChoiceOK.com

Vision plans

Primary Vision Care Services (PVCS)

888-357-6912

TDD 800-722-0353

pvcs-usa.com/okstate

Superior Vision

800-507-3800

TDD 916-852-2382

superiorvision.com/stateofoklahoma/benets

Vision Care Direct

855-918-2020

TTY 711

okstate.vision

VSP

800-877-7195

TDD 800-428-4833

stateofok.vspforme.com

Other important numbers

Employees Group Insurance Division

405-717-8780 or 800-752-9475

TTY 711

Oklahoma.gov/omes

Social Security Administraon

800-772-1213

TTY 800-325-0778

SSA.gov

Medicare

800-633-4227

TTY 877-486-2048

Medicare.gov

Oklahoma Public Employees

Rerement System

405-858-6737 or 800-733-9008

opers.ok.gov

Oklahoma Teachers’

Rerement System

405-521-2387 or 877-738-6365

ok.gov/trs

Oklahoma Law Enforcement

Rerement System

405-522-4931 or 877-213-0856

olers.state.ok.us

33

Forms you must complete to continue

benefits when you leave active employment

INSURANCE

FORMS

IF YOU ARE A

PRE-MEDICARE

MEMBER

IF YOU ARE A

MEMBER ENROLLING

IN A MEDICARE

SUPPLEMENT PLAN

IF YOU ARE

A MEMBER

ENROLLING IN A

MEDICARE ADVANTAGE

PRESCRIPTION DRUG

(MAPD) PLAN

Application for

Retiree/Vested/Non-

Vested/Defer Insurance

Coverage

(Page A1)

Yes Yes

Application for Medicare

Supplement With

Prescription Drug Plan

(Page B1)

No

Yes