As of August 2024

AUTO INSURANCE

A COMPARISON GUIDE TO RATES

A Comparison Guide

to Automobile Insurance Rates

in Maryland

Table of Contents

How to Shop for Auto Insurance

2

What Factors Impact Rates

2

How to Use This Guide

3

About Financing Insurance 3

Notes to Rate Tables

3

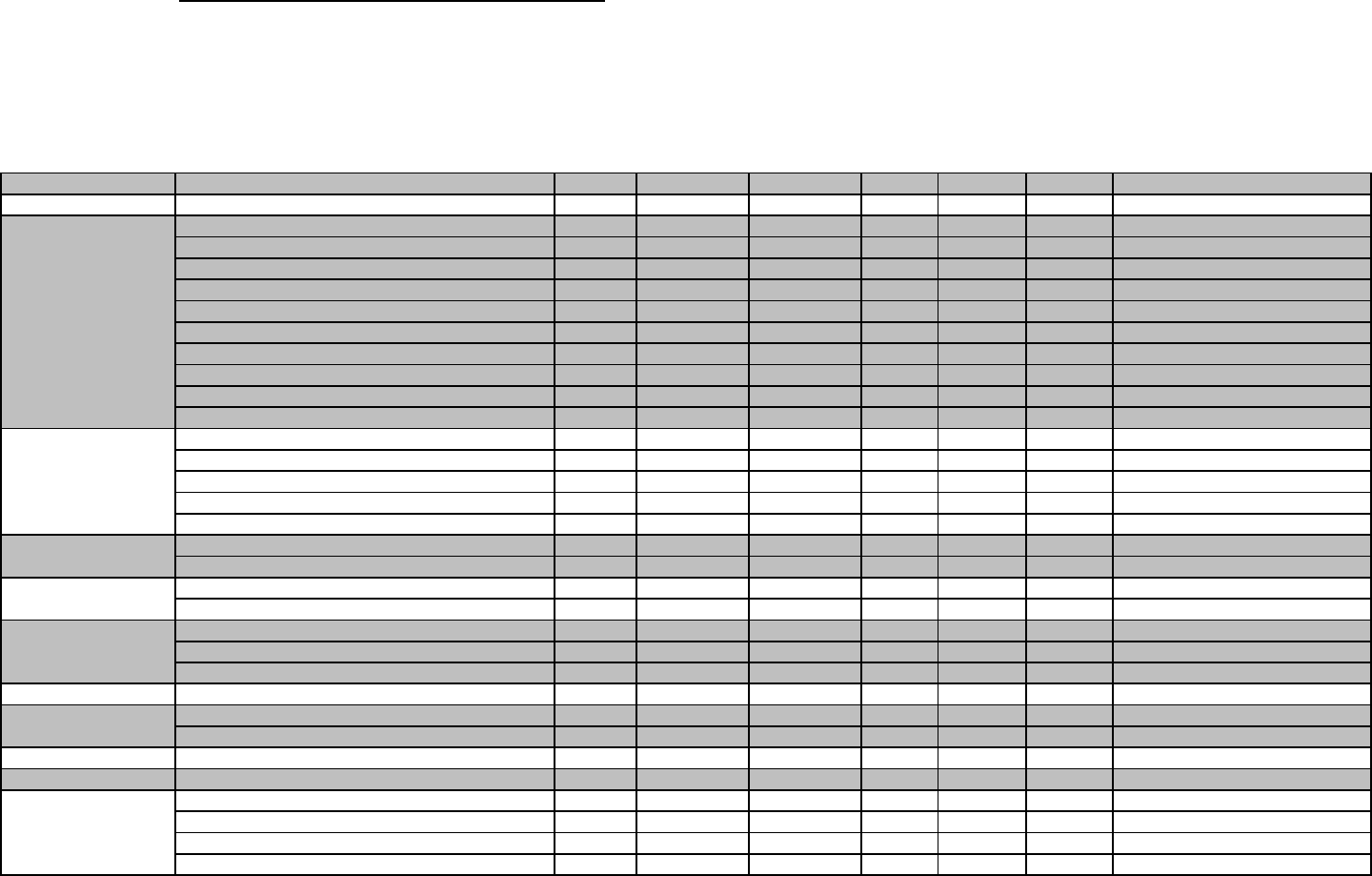

Rate Tables

Western Maryland, Washington D.C.

13

Suburbs, and Southern Maryland

Greater Baltimore Suburban

101

189

233

235

243

Eastern Shore (w/o Cecil)

Insurer Phone Numbers and Websites

Coverages Offered by Insurers

How to File a Complaint

Rapid Response Program

243

1

Comparison Worksheet

9

Scenario Descriptions 4

1

How to Shop for Auto Insurance

Comparison shopping is the key to getting the most for your insurance

dollar. The best time to shop for insurance is before you purchase a car,

trade in a vehicle, add drivers or when your policy is up for renewal. Here

are some basic tips to follow when shopping for insurance:

Before buying a new car, determine your insurance costs. High-

performance vehicles usually come with higher insurance costs.

Know what insurance coverage you are buying. Before you begin

calling to request price quotes, familiarize yourself with the insurance

coverage you are buying. It is important to know which coverages Maryland

law requires you to purchase and what optional coverages you may purchase.

Seek unbiased information. In addition to referring to this auto insurance

rate guide, you also may seek information from consumer groups, consumer

publications (i.e. Consumer Reports) and the Internet.

Do comparison-shopping. Contact several insurers or insurance

producers (also known as agents or brokers). Also, ask your relatives and

friends for recommendations. In addition, some banks, employers and

special interest groups offer insurance directly to their members.

Ask for price quotes. In order to make an “apples-to-apples” price

comparison, you must provide the same information to each insurer or

insurance producer. The following information is normally requested:

make/model/year of vehicle, number of average annual miles, region in

which you live, coverages and limits desired and driving record (accidents or

violations).

Ask about deductibles. A deductible is the amount you agree to be

responsible for in the event of damage to your vehicle (i.e. accident, fire or

vandalism). If you select a high deductible, you pay more out of your own

pocket for any damage or loss; however, your premium should be lower.

Ask for discounts. Again, to help keep rates down, ask what discounts the

insurer offers (i.e. security devices, safety devices, good-driving record,

defensive-driving courses, good student, etc.).

Protect yourself from insurance fraud. Once you have selected the

insurer, contact the Maryland Insurance Administration at,

www.insurance.maryland.gov, or via phone to verify that the insurer/insurance

producer is licensed to sell insurance in Maryland. It is illegal for unlicensed

insurers and insurance producers to sell insurance in Maryland.

What Factors Impact Rates?

When applying for auto insurance, insurers evaluate your risk and the

likelihood you will file a claim. This is referred to as underwriting a risk.

Once your level of risk has been determined, the insurer will group you with

policyholders who have similar risk characteristics. Then, the insurer will

assign a rate based on the claims history for your risk group. The most

common factors that impact rates are:

Driving record. If your driving record is less than perfect, you will be

considered a higher risk and will pay a higher premium.

Geographic area. The number of claims filed by policyholders in your

area will also affect the rates charged by insurers.

Gender and age. Statistics show that males and young adults have a higher

incidence of accidents and claims. Therefore, your gender and age will

determine your rate.

Marital status. Married individuals have a lower incidence of accidents and

claims so they generally pay lower premiums than single people.

Prior insurance coverage. Any time period(s) that you did not carry auto

insurance will affect your premium.

Annual mileage. Insurers will calculate your premium based on the

average distance you drive on an annual basis.

Make and model of car. Premiums are also based on your car’s

make/model and value.

Credit history. Some, but not all, insurers use your credit history (good or

bad) as a factor in determining your premium.

For more detailed information about shopping for auto insurance,

please refer to the Maryland Insurance Administration’s A Consumer

Guide to Auto Insurance. It is available on our website,

www.insurance.maryland.gov or it may be requested by calling

410-468-2000 or 800-492-6116.

2

2

How to Use This Guide

This guide lists those companies writing the greatest number of insurance policies in

Maryland. Individuals may not qualify for coverage in all insurers. Affiliated insurers

have different underwriting standards. Within a group of insurers (i.e. State Farm or

Allstate), consumers are placed in the affiliated insurer based on their risk level.

To obtain a sample premium in your area, use the included charts as follows:

• Refer to the region you wish to compare (i.e. Western Maryland,

Washington D.C. Suburbs, Southern Maryland, Greater Baltimore Suburban

Area, or Eastern Shore (w/o Cecil)

• Choose a scenario that most closely reflects your household makeup.

• Determine which zip code is closest to where you live.

• Compare the insurers and rates provided for that scenario in that

zip code

Rates shown in this guide are total annual premiums for 22 scenarios and do not

account for other variables such as discounts you may qualify for or other vehicles and

age brackets. This data is provided by the insurers and is subject to change.

About Financing Insurance

Not everyone can afford to pay their insurance premiums upfront. Therefore, many

insurers offer installment plans. In addition, your premium may also be financed by a

premium finance company, which finances premiums in exchange for a consumer’s

agreement to pay interest and service fees.

The minimum coverages and coverage limits required

by Maryland law are:

Liability coverages of $30,000 for bodily injury per person or $60,000

per accident, and $15,000 for property damage (a.k.a. 30/60/15);

Comprehensive and Collision coverages are optional.

*PIP may be limited (See Definitions), which will result in a lower

premium. If you meet certain conditions, the Maryland Auto Insurance

Fund and some insurers will allow you to fully reject PIP. Ask your insurer

or insurance producer to learn more.

Notes to Rate Tables

:

RATES AND AVAILABILITY ARE SUBJECT

TO CHANGE BY THE INSURERS.

* Indicates those insurers which consider credit scores in determining premiums.

N/A = Insurers that do not have rates available based on criteria in the scenario, such as

an at-fault accident.

Maryland Automobile Insurance Fund:

MAIF generally offers the state mandatory minimum liability limits of

$30,000/$60,000/$15,000. MAIF does offer limits of $100,000/$300,000/ $100,000,

for which rates are provided. However, MAIF does not provide the limits in Scenarios

16, 18 and 22.

Definitions

Full PIP covers you and members of your family residing with you who

may be injured in a motor vehicle accident, anyone else injured while in your

vehicle, and pedestrians injured by your vehicle.

Limited PIP eliminates coverage for you, your family members 16 years of

age or older that reside with you, and any listed drivers on the policy.

Anyone else injured while in your vehicle and pedestrians injured by your

vehicle will continue to be covered. Limited PIP premiums are typically

40% of Full PIP premiums. You must sign a waiver form to obtain Limited PIP.

Rejection of PIP - If you meet certain conditions, the Maryland Automobile

Insurance Fund and some insurance companies will allow you to reject PIP.

Uninsured Motorist (UM) protects you if a hit-and-run driver or someone

without insurance causes damage to your property or injures you or your

passenger(s).

Comprehensive coverage pays for damage to your car resulting from

causes other than an accident, such as vandalism or theft.

Collision coverage pays to repair your vehicle or what your vehicle was

worth right before an accident occurred (if your insurer determines the car is

totaled), regardless of who caused the accident.

Personal Injury Protection (PIP*) coverage of $2,500; and

Uninsured Motorist (UM) coverages of $30,000 bodily injury per

person or $60,000 per accident, and $15,000 for property damage

(a.k.a. 30/60/15).

3

SCENARIO DESCRIPTIONS

Scenario 1:

Young Single Male, Age 19. Rents an apartment.

Drives a 2014 Honda Accord EX-L 6 CYL 4DR

Drives 20 miles each day total for work. Drives 15,000 miles annually.

No accidents or violations in past three years. No credit history (where

applicable). No companion policy discount.

Liability $30,000/$60,000/$15,000

Full PIP $2,500

UM $30,000/$60,000/$15,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 2:

Young Single Female, Age 19. Rents an apartment.

Drives a 2008 Toyota Camry SE Sedan 4DR

Drives 20 miles each day total for work. Drives 15,000 miles annually.

No accidents or violations in past three years. No credit history (where

applicable).No companion policy discount.

Liability $30,000/$60,000/$15,000

Full PIP $2,500

UM $30,000/$60,000/$15,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 3:

Young Single Male, Age 23. Rents an apartment.

Drives a 2012 Honda CR-V EX AWD

Drives 15 miles each day total for work. Drives 15,000 miles annually.

No accidents or violations in past three years. No credit history (where

applicable). No companion policy discount.

Liability $30,000/$60,000/$15,000

Full PIP $2,500

UM $30,000/$60,000/$15,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 4:

Young Single Female, Age 23. Rents an apartment.

Drives a 2012 Jeep Liberty

Drives 15 miles each day total for work. Drives 15,000 miles annually.

Speeding ticket 19 months ago for driving 10 miles over the speed limit.

No credit history (where applicable). No companion policy discount.

Liability $30,000/$60,000/$15,000

Full PIP $2,500

UM $30,000/$60,000/$15,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 5:

Single Male, Age 30. Homeowner.

Drives a 2015 Toyota RAV4 Limited AWD

Drives 25 miles each day total for work. Drives 25,000 miles annually.

No accidents or violations in past 3 years. No credit history (where

applicable). Receives companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 6:

Single Female, Age 30. Homeowner.

Drives a 2016 Nissan Altima 6 CYL 3.5L

Drives 15 miles each day total for work. Drives 15,000 miles annually.

No accidents or violations in past 3 years. Best credit history (where

applicable). Receives companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

4

Scenario 7:

Single Male, Age 40. Homeowner.

Drives a 2015 Nissan Sentra SL

Drives 50 miles each day total for work. Drives 25,000 miles annually.

No accidents or violations in past 3 years. No credit history (where

applicable). Receives companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 8:

Single Female, Age 40. Homeowner.

Drives a 2016 Toyota Prius C Hatchback 4DR

Drives 40 miles each day total for work. Drives 15,000 miles annually.

No accidents or violations in past 3 years. Best credit history (where

applicable). Receives companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 9:

Single Male, Age 50. Homeowner.

Drives 2017 Ford F-250 XLT 4x4 4DR Crew Cab Gas 164 WB

Drives 60 miles each day total for work. Drives 25,000 miles annually.

Second vehicle – 2012 Honda CR-V EX AWD

For pleasure use only – Drives 3,000 miles annually. Garage kept.

No accidents or violations in past 3 years. Best credit history (where

applicable). Receives companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 10:

Single Male, Age 50. Renter.

Drives 2016 Ford F-150 XLT 4x4 4DR Crew Cab Gas 145 WB

Drives 60 miles each day total for work. Drives 25,000 miles annually.

No accidents or violations in past 3 years. Best credit history (where

applicable). Receives companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 11:

Single Female, Age 50. Renter.

Drives 2014 Hyundai Elantra 4DR SE WB

Drives 60 miles each day total for work. Drives 20,000 miles annually.

No accidents or violations in past 3 years. No credit history (where

applicable). No companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 12:

Single Male, Age 65. Homeowner (retired).

Drives a 2012 Ford Escape XLS UTL 4x2 4DR

Drives 5,000 miles annually – pleasure use.

No accidents or violations in past 3 years. Best credit history (where

applicable). Receives companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

5

Scenario 13:

Single Male, Age 65. Renter (retired).

Drives a 2014 Honda Accord EX-L 6CYL 4DR

Drives 5,000 miles annually – pleasure use.

No accidents or violations in past 3 years. Best credit history (where

applicable). Receives companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 14:

Single Female, Age 65. Homeowner (retired).

Drives a 2017 Toyota Camry Hybrid LE

Drives 5,000 miles annually – pleasure use.

No accidents or violations in past 3 years. Best credit history (where

applicable). No companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 15:

Single Female, Age 65. Renter (retired).

Drives a 2015 Honda Accord Coupe LX 2.4L/4CYL

Drives 5,000 miles annually – pleasure use.

No accidents or violations in past 3 years. Best credit history (where

applicable). No companion policy discount.

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 16:

Family Rate -- Premiums include coverage for two vehicles and two

drivers, with a multi-car discount and a companion homeowners

discount (where available).

Married Male, Age 26.

Drives a 2008 Toyota Tundra Double Cab 4X2

Drives 20 miles each day total for work. Drives 20,000 miles

annually.

No accidents or violations in past 3 years. Best credit history (where

applicable).

Liability $250,000/$500,000 /$100,000

Full PIP $2,500

UM $250,000/$500,000 /$100,000

Comprehensive $250 deductible

Collision $500 deductible

Married Female, Age 24.

Drives a 2014 Dodge Grand Caravan SE

Does not work. Drives 5,000 miles annually.

No accidents or violations in past 3 years. Best credit history (where

applicable).

Liability $250,000/$500,000 /$100,000

Full PIP $2,500

UM $250,000/$500,000 /$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 17:

Family Rate -- Premiums include coverage for two vehicles and two

drivers, with a multi-car discount and a companion renters discount

(where available).

Married Male, Age 29.

Drives a 2011 Chevrolet Silverado 1500 PKP 4x2 2DR Regular Cab

Drives 40 miles each day total for work. Drives 15,000 miles

annually.

No accidents or violations in past 3 years. No credit history (where

applicable).

Liability $30,000/$60,000 /$15,000

Full PIP $2,500

UM $30,000/$60,000 /$15,000

Comprehensive $250 deductible

Collision $500 deductible

6

Scenario 17 (Cont.):

Married Female, Age 29.

Drives a 2014 Dodge Grand Caravan SRT

Works part-time. Drives 5,000 miles annually.

No accidents or violations in past 3 years. No credit history (where

applicable).

Liability $ $30,000/$60,000 /$15,000

Full PIP $2,500

UM $30,000/$60,000 /$15,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 18:

Family Rate -- Premiums include coverage for two vehicles and two

drivers, with a multi-car discount and a companion homeowners

discount (where available).

Married Male, Age 35.

Drives a 2010 Dodge Dakota Crew Cab PKP 4x4 4DR

Drives 45 miles each day total for work. Drives 35,000 miles

annually.

No accidents or violations in past 3 years. Best credit history (where

applicable).

Liability $250,000/$500,000 /$100,000

Full PIP $2,500

UM $250,000/$500,000 /$100,000

Comprehensive $250 deductible

Collision $500 deductible

Married Female, Age 32.

Drives a 2017 Nissan Rogue SL 4DR SUV AWD 2.5L 4CYL

Drives 20 miles each day total for work. Drives 15,000 miles

annually.

No accidents or violations in past 3 years. Best credit history (where

applicable).

Liability $ 250,000/$500,000 /$100,000

Full PIP $2,500

UM $250,000/$500,000 /$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 19:

Family Rate -- Premiums include coverage for two vehicles and three

drivers, with a multi-car discount and a companion homeowners

discount (where available).

Married Male, Age 44.

Drives a 2016 Mercedes E350

Drives 60 miles each day total for work. Drives 35,000 miles

annually.

No accidents or violations in past 3 years. Best credit history (where

applicable).

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Married Female, Age 44.

Drives a 2016 Honda Accord EX-L 6 CYL 4DR Honda Sensing

Drives 15,000 miles annually.

No accidents or violations in past 3 years. Best credit history (where

applicable).

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Young Single Male, Age 17.

Does not have his own vehicle – he is an occasional driver of the

vehicles. Speeding ticket 6 months ago – 10 miles over the speed

limit.

Scenario 20:

Family Rate -- Premiums include coverage for two vehicles and three

drivers, with a multi-car discount and a companion homeowners

discount (where available).

Married Male, Age 44.

Drives a 2012 Jeep Grand Cherokee 4WD

7

Scenario 20 (Cont.):

Drives 60 miles each day total for work. Drives 35,000 miles

annually.

No accidents or violations in past 3 years. Worst credit history

(where applicable).

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Married Female, Age 44.

Drives a 2015 Toyotoa Camry

Does not work. Drives 5,000 miles annually.

No accidents or violations in past 3 years. Best credit history (where

applicable).

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Young Single Male, Age 17.

Does not have his own vehicle – he is an occasional driver of the

vehicles. Speeding ticket 6 months ago – 10 miles over the speed

limit.

Scenario 21:

Family Rate -- Premiums include coverage for two vehicles and two

drivers, with a multi-car discount and a companion renters discount

(where available).

Married Male, Age 50.

Drives a 2017 Toyota Avalon Hybrid XLE

Drives 60 miles each day total for work. Drives 35,000 miles

annually.

One at fault accident 15 months ago with claim paid in excess of

$10,000. Best credit history (where applicable).

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Married Female, Age 50.

Drives a 2008 Toyota Camry SE Sedan 4DR

Does not work. Drives 5,000 miles annually.

No accidents or violations in past 3 years. Best credit history (where

applicable).

Liability $100,000/$300,000/$100,000

Full PIP $2,500

UM $100,000/$300,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Scenario 22:

Family Rate -- Premiums include coverage for two vehicles and

two drivers, with a multi-car discount and a companion

homeowners discount (where available).

Married Male, Age 65.

Drives a 2015 Jeep Grand Cherokee Altitude 4x4

Drives 20 miles each day total for work. Drives 20,000 miles

annually.

No accidents or violations in past 3 years. Best credit history (where

applicable).

Liability $250,000/$500,000/$100,000

Full PIP $2,500

UM $250,000/$500,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

Married Female, Age 65.

Drives a 2016 Lexus

Does not work. Drives 5,000 miles annually.

No accidents or violations in past 3 years. Best credit history (where

applicable).

Liability $250,000/$500,000/$100,000

Full PIP $2,500

UM $250,000/$500,000/$100,000

Comprehensive $250 deductible

Collision $500 deductible

8

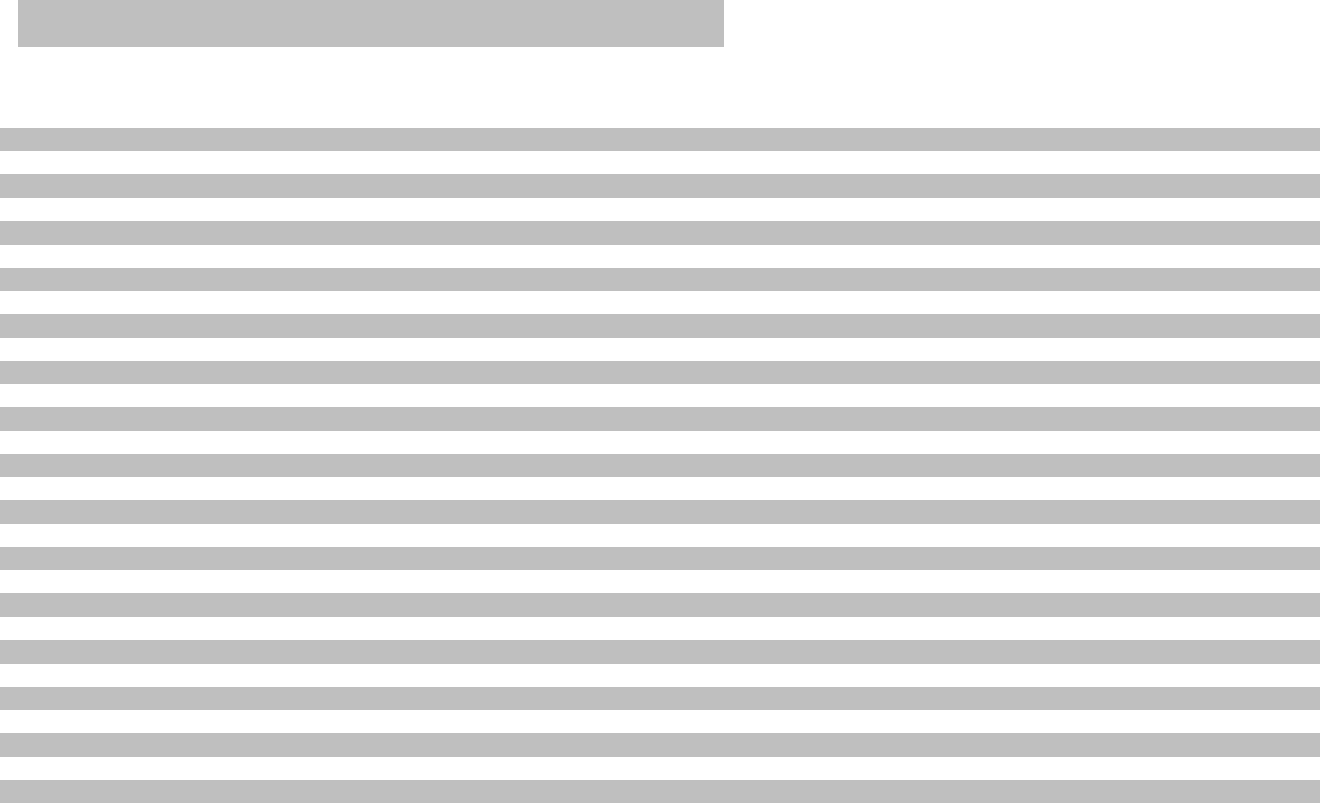

Shopping for Automobile Insurance

Insurer/Policy Comparison Worksheet

If you are shopping for automobile insurance, you may use this worksheet to help gather information about insurers and the

automobile insurance policies they sell. You may call an insurance producer or the insurer for a rate quote.

Insurer Name

Telephone number

Financing rating

Insurer licensed (Yes/No)

Discounts offered

Annual premium

List all vehicles and drivers

9

COVERAGE LIMITS

COVERAGE LIMITS COMPARISON (Coverages vary by policy. Make sure you get the coverage you need!)

Limits (30/60/15 is the minimum

required by law):

Premium:

Limits ($2,500 is the minimum required

by law, unless waived):

Premium

— Full Coverage:

Premium — Waived Coverage:

Limits:

Premium:

Limits:

Premium:

Deductible:

LIABILITY

PERSONAL INJURY

PROTECTION (PIP)

COLLISION

UNINSURED/

UNDERINSURED

MOTORIST

COVERAGE

Premium - Rejected PIP, if available:

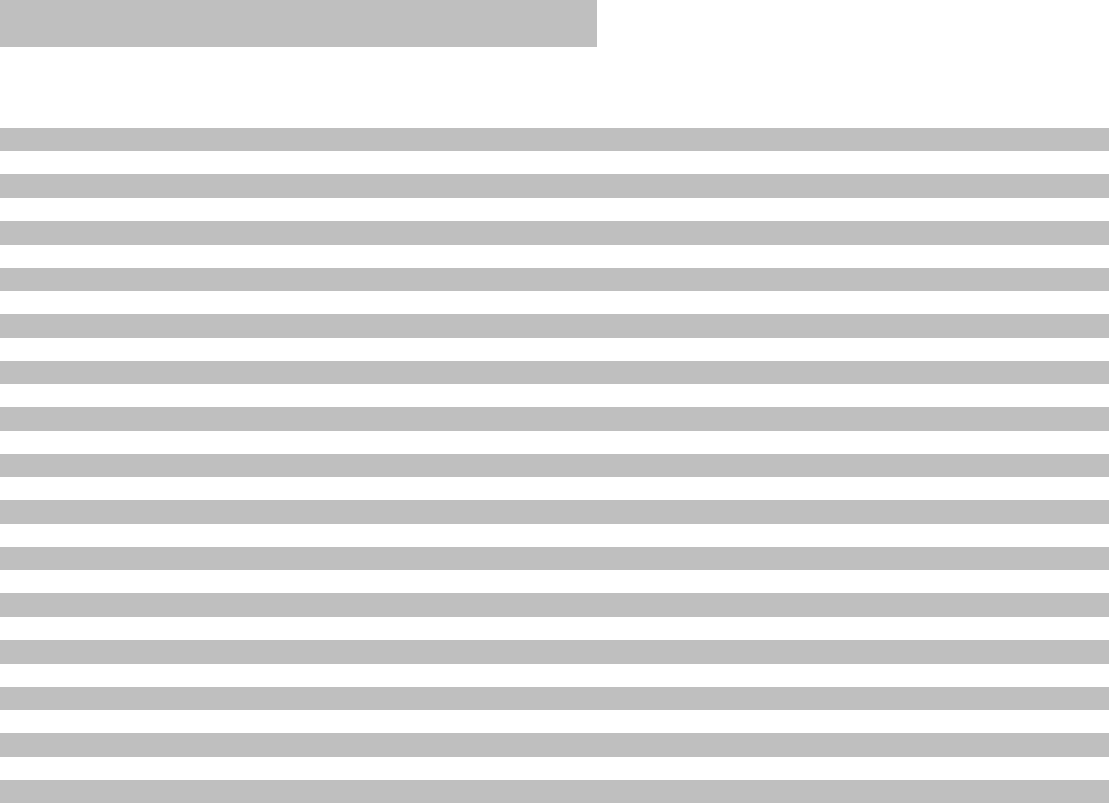

10

Limits:

Premium:

Deductible:

Limits:

Premium:

Limit per disablement:

Maximum number of day:

Premium:

Limits:

Maximum number of days:

Premium:

COMPREHENSIVE

(OTHER THAN COLLISION)

MEDICAL

PAYMENTS

RENTAL

REIMBURSEMENT

TOWING AND LABOR

11

COVERAGE COMPARISON

COVERAGE COMPARISON (Coverages vary by policy. Make sure you get the coverage you need!)

Does the policy cover:

• Family and other household residents?

• People who drive my car with my

permission?

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Does this policy provide liability coverage if:

• I drive someone else’s car?

• I am driving a rental car?

• I drive out the United States?

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Does the policy cover:

• Family and other household residents

who drive my car:

• People who drive my car with my

permission?

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Does this policy provide physical damage

coverage if:

• I drive someone else’s car?

• I am driving a rental car?

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Does the policy cover damage to:

• A rental car?

Yes No Yes No Yes No

Does the policy cover physical damage for:

• Replacement vehicles?

• Temporary substitute vehicles?

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

PHYSICAL DAMAGE

LIABILITY

12

August 2024

Maryland Insurance Administration 1-800

-492-6116 www.insurance.maryland.gov

Scenario 1: Young Single Male, Age 19

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Agency Insurance Co. 4805 5636 6705 5615 5531 6448

* AIG Property Casualty Co. 4751 4912 4912 4751 3294 3593

* Allstate Indemnity Co. 8402 10131 11375 8309 10312 11794

American Family Connect P & C Ins. Co. 5056 5228 6272 5228 5482 6740

American National Property & Casualty Co. 5342 5792 7532 5338 5872 6952

American States Preferred Insurance Co. 5708 6482 6800 5548 6881 7393

* Amica Mutual Insurance Co. 5871 7651 7651 5871 6957 6715

* Amica Property and Casualty Insurance Co. 7478 9744 9744 7478 8873 8556

Berkley Insurance Co. 5342 6147 6324 5493 4690 5082

* Branch Insurance Exchange 3341 3669 4531 3636 3955 4296

* Brethren Mutual 3693 4231 5030 3694 3973 4821

* Chubb National Insurance Co. 6129 7687 9326 6129 8033 10044

Cincinnati Casualty Co. 4302 4527 6366 4562 5246 5653

Cincinnati Insurance Co. 5058 5548 5485 4692 5481 5700

* Clearcover Insurance Co. 13455 14527 17376 13455 12038 14823

* CSAA General Insurance Co. 5247 6380 7707 6468 6887 7713

* Cumberland Insurance Co. Inc. 4991 6250 6264 4991 6374 6655

* Dairyland Insurance Co. 8283 11465 16776 8123 12976 15775

Elephant Insurance Co. 7786 9639 12220 7786 10032 11299

*

Encompass Home and Auto Insurance Compa

4981 7195 8255 4981 9162 8645

Erie Insurance Exchange 3582 3744 4817 3582 4317 4883

Farmers Casualty Insurance Co. 7305 10693 10595 9216 10098 10935

Farmers Direct P & C Insurance Co. 6982 8214 8356 6982 8588 7494

Farmers Group Property & Casualty Ins. Co. 8500 10620 14916 9646 10578 11636

Farmers Insurance Exchange 5324 6182 7390 5362 6132 7400

* Foremost Insurance Co. 14245 16208 19219 16693 15659 18183

Garrison Property & Casualty Ins. Co. 4514 5476 6042 4656 5206 5969

* GEICO Secure Co. 3668 3450 4123 3668 3605 3962

Hartford Casualty Insurance Co. 7640 10238 8424 4980 7600 8282

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

13

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 1: Young Single Male, Age 19

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Horace Mann Insurance Co. 3962 4297 5287 3962 4245 4539

Horace Mann Property & Casualty Ins. Co. 3509 4086 5770 3509 4862 4862

* Integon Indemnity 9668 10059 13072 10260 9836 11574

* Integon Preferred Insurance Co 8021 8990 11378 8231 8941 11072

Liberty Mutual Insurance Co. 11521 13743 15070 11657 13765 14643

Liberty Mutual Personal Insurance Co. 10463 12460 13658 10583 12482 13270

Maryland Auto Insurance Fund 6180 6293 6544 6180 6096 5265

* MGA Insurance Company, Inc. 10220 12351 16873 11484 12360 15050

* Mutual Benefit Insurance Co. 8327 10178 12390 9156 10008 11567

* Nationwide Property & Casualty Co. 7595 8658 11358 7901 9869 11785

* NGAC 20411 20761 23965 20411 20888 25873

* NJM Insurance Co. 4038 5238 6183 4038 5295 6220

Noblr Insurance Exchange 4069 4430 5526 4595 4565 5016

Old Dominion Insurance Co. 8228 9024 10828 8250 10080 11568

Penn National Insurance Co. 7856 9703 10639 7830 10093 10203

Privilege Underwriters Reciprocal Exch. 8784 9161 9161 8784 6140 8558

* Progressive Select Insurance Co. 3228 3761 4444 3823 3687 4275

* Progressive Specialty Insurance Co. 4559 5531 6641 5185 5515 6512

Root Insurance Co. 3672 4376 5548 3994 4546 5460

* Selective Ins. Co. of South Carolina 7168 7568 9191 7714 7809 8773

Southern Insurance Co. of VA 3350 3335 5007 3029 4681 5046

Teachers Insurance Co. 3733 4254 6080 3733 5000 5000

* Travelers Property Casualty Insurance Co. 5163 6575 8145 5833 7849 9234

United Services Automobile Association 3178 3787 4323 3251 3774 4335

* Unitrin Safeguard Insurance Co. 6742 9561 10820 6771 10480 12010

USAA Casualty Insurance Co. 3199 3410 4216 3391 3806 4373

USAA General Indemnity Co. 4022 4735 5415 4189 4615 5356

* Vault Recipricol Exchange 5500 7759 7759 7570 5196 5347

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

14

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 1: Young Single Male, Age 19

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

20744 20783 20659

21740

Insurer Prince George's Prince George's Saint Mary's Washington

Agency Insurance Co. 7330 7801 6517 5195

* AIG Property Casualty Co. 6344 4215 4912 2325

* Allstate Indemnity Co. 12270 12547 9969 8384

American Family Connect P & C Ins. Co. 7812 8018 4942 5228

American National Property & Casualty Co. 7848 8062 5852 5268

American States Preferred Insurance Co. 8405 9261 6525 5792

* Amica Mutual Insurance Co. 8729 9573 7651 5871

* Amica Property and Casualty Insurance Co. 11123 12202 9744 7478

Berkley Insurance Co. 7704 7375 5857 3465

* Branch Insurance Exchange 5358 5592 4507 3622

* Brethren Mutual 5615 5590 3890 3777

* Chubb National Insurance Co. 9906 11195 7335 6821

Cincinnati Casualty Co. 6835 6711 5021 4281

Cincinnati Insurance Co. 7060 9592 5414 4442

* Clearcover Insurance Co. 19228 18805 13125 12092

* CSAA General Insurance Co. 9928 9551 5916 5121

* Cumberland Insurance Co. Inc. 8579 13270 5909 4991

* Dairyland Insurance Co. 16837 20703 11826 10265

Elephant Insurance Co. 11963 12965 8456 8939

*

Encompass Home and Auto Insurance Compa

10937 12115 8255 4424

Erie Insurance Exchange 6154 6154 3744 3563

Farmers Casualty Insurance Co. 12589 10941 10693 7305

Farmers Direct P & C Insurance Co. 11132 12224 8266 6982

Farmers Group Property & Casualty Ins. Co. 12408 14096 10620 8500

Farmers Insurance Exchange 8452 9192 6124 5058

* Foremost Insurance Co. 20392 21752 18365 15063

Garrison Property & Casualty Ins. Co. 6645 7068 5260 4661

* GEICO Secure Co. 4641 4766 3450 3384

Hartford Casualty Insurance Co. 10320 11036 7282 6362

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

15

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 1: Young Single Male, Age 19

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

20744 20783 20659

21740

Insurer Prince George's Prince George's Saint Mary's Washington

Horace Mann Insurance Co. 5905 5905 4297 3784

Horace Mann Property & Casualty Ins. Co. 7178 7178 4086 3883

* Integon Indemnity 12254 13894 11061 9209

* Integon Preferred Insurance Co 11585 12725 9481 8304

Liberty Mutual Insurance Co. 16257 17559 14109 12619

Liberty Mutual Personal Insurance Co. 14724 15896 12793 11449

Maryland Auto Insurance Fund 6817 6532 6436 6180

* MGA Insurance Company, Inc. 17282 19499 13551 11643

* Mutual Benefit Insurance Co. 14364 13816 10178 8995

* Nationwide Property & Casualty Co. 12363 12674 7892 7582

* NGAC 26039 30845 21707 20157

* NJM Insurance Co. 6093 6602 5204 4038

Noblr Insurance Exchange 6407 6488 5580 4282

Old Dominion Insurance Co. 13694 14958 9364 7606

Penn National Insurance Co. 12652 13167 9642 8139

Privilege Underwriters Reciprocal Exch. 9572 9572 9161 3988

* Progressive Select Insurance Co. 4855 5172 4314 3505

* Progressive Specialty Insurance Co. 7344 7922 6530 5065

Root Insurance Co. 9210 5016 4554 4370

* Selective Ins. Co. of South Carolina 10054 10271 7013 7440

Southern Insurance Co. of VA 5081 5559 3846 3354

Teachers Insurance Co. 7627 7627 4254 4284

* Travelers Property Casualty Insurance Co. 8981 10461 7447 6094

United Services Automobile Association 5130 5484 3819 3515

* Unitrin Safeguard Insurance Co. 13281 14518 9749 7579

USAA Casualty Insurance Co. 5154 5288 3664 3194

USAA General Indemnity Co. 6234 6290 4759 4219

* Vault Recipricol Exchange 9317 9317 7759 3259

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

16

August 2024

Maryland Insurance Administration 1-800

-492-6116 www.insurance.maryland.gov

Scenario 2: Young Single Female, Age 19

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Agency Insurance Co. 3400 4160 5000 3847 4211 4917

* AIG Property Casualty Co. 4267 4409 4409 4267 2961 3261

* Allstate Indemnity Co. 6592 8240 9204 6479 8590 9822

American Family Connect P & C Ins. Co. 3730 3880 4698 3812 4140 5162

American National Property & Casualty Co. 5210 5762 7492 5076 5960 7088

American States Preferred Insurance Co. 4916 5746 6068 4691 6264 6805

* Amica Mutual Insurance Co. 5944 7733 7733 5944 7087 6843

* Amica Property and Casualty Insurance Co. 7534 9832 9832 7534 9001 8690

Berkley Insurance Co. 3342 3894 4055 3398 3003 3308

* Branch Insurance Exchange 3260 3627 4456 3466 4009 4360

* Brethren Mutual 2667 3169 3771 2566 3068 3870

* Chubb National Insurance Co. 5146 6571 7965 5146 7096 8872

Cincinnati Casualty Co. 3585 3794 5355 3676 4526 4956

Cincinnati Insurance Co. 4499 5106 5028 4047 5091 5327

* Clearcover Insurance Co. 9502 11121 13028 9502 9423 11785

* CSAA General Insurance Co. 4706 5733 7002 5723 6160 6893

* Cumberland Insurance Co. Inc. 4066 5163 5163 4066 5344 5557

* Dairyland Insurance Co. 5456 8076 12203 5114 9419 11942

Elephant Insurance Co. 5473 6804 8563 5473 6978 7807

*

Encompass Home and Auto Insurance Compa

5155 7501 8623 5155 9686 9098

Erie Insurance Exchange 2668 2858 3682 2668 3308 3758

Farmers Casualty Insurance Co. 5474 7958 7909 6729 7510 8350

Farmers Direct P & C Insurance Co. 4762 5784 5816 4762 6030 5256

Farmers Group Property & Casualty Ins. Co. 5948 7372 10956 6476 7438 8752

Farmers Insurance Exchange 4876 5880 6988 4902 5980 7278

* Foremost Insurance Co. 8153 9694 11714 9058 9714 11463

Garrison Property & Casualty Ins. Co. 4273 5179 5757 4401 4978 5748

* GEICO Secure Co. 2858 3046 3750 2858 3340 3747

Hartford Casualty Insurance Co. 5714 7528 6244 3732 5766 6332

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

17

August 2024

Maryland Insurance Administration 1-800

-492-6116 www.insurance.maryland.gov

Scenario 2: Young Single Female, Age 19

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Horace Mann Insurance Co. 2499 2874 3521 2499 2894 3162

Horace Mann Property & Casualty Ins. Co. 2376 2985 4102 2376 3454 3454

* Integon Indemnity 8133 8670 11478 8595 8951 10608

* Integon Preferred Insurance Co 6662 7856 10175 6753 8272 10493

Liberty Mutual Insurance Co. 8724 11128 12409 8570 11258 12093

Liberty Mutual Personal Insurance Co. 7947 10108 11261 7803 10223 10976

Maryland Auto Insurance Fund 4906 4981 5203 4906 4831 4232

* MGA Insurance Company, Inc. 5429 7192 10000 6061 7366 9514

* Mutual Benefit Insurance Co. 6367 7797 9590 6722 8024 9319

* Nationwide Property & Casualty Co. 6589 7908 10916 6687 9307 11018

* NGAC 14057 14594 16761 14057 14726 18365

* NJM Insurance Co. 3653 4872 5652 3653 4991 5868

Noblr Insurance Exchange 2825 3136 3886 3059 3423 3750

Old Dominion Insurance Co. 6206 7092 8482 6228 8118 9410

Penn National Insurance Co. 6982 8774 9669 6968 9195 9781

Privilege Underwriters Reciprocal Exch. 5831 6120 6120 5831 4059 5860

* Progressive Select Insurance Co. 2649 3229 3856 2991 3279 3819

* Progressive Specialty Insurance Co. 3546 4471 5411 3902 4585 5419

Root Insurance Co. 3532 4368 5626 3710 4662 5700

* Selective Ins. Co. of South Carolina 4890 5265 6403 4946 5626 6481

Southern Insurance Co. of VA 3201 3270 4931 2787 4672 5019

Teachers Insurance Co. 2480 3070 4259 2480 3505 3505

* Travelers Property Casualty Insurance Co. 4371 5706 7074 4921 6964 8175

United Services Automobile Association 2577 3070 3502 2643 3099 3569

* Unitrin Safeguard Insurance Co. 4707 6803 7713 4713 7573 8724

USAA Casualty Insurance Co. 2961 3164 3936 3134 3581 4114

USAA General Indemnity Co. 3902 4597 5329 4049 4528 5295

* Vault Recipricol Exchange 3191 4514 4514 4372 3006 3155

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

18

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 2: Young Single Female, Age 19

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

20744 20783 20659

21740

Insurer Prince George's Prince George's Saint Mary's Washington

Agency Insurance Co. 5532 5977 4846 3827

* AIG Property Casualty Co. 5744 3812 4409 2120

* Allstate Indemnity Co. 10035 10595 7998 6647

American Family Connect P & C Ins. Co. 5886 6074 3670 3862

American National Property & Casualty Co. 7870 8284 5774 5208

American States Preferred Insurance Co. 7504 8408 5804 5025

* Amica Mutual Insurance Co. 8867 10028 7733 5944

* Amica Property and Casualty Insurance Co. 11303 12743 9832 7534

Berkley Insurance Co. 4884 4698 3707 2234

* Branch Insurance Exchange 5349 5706 4409 3625

* Brethren Mutual 4429 4533 2953 2764

* Chubb National Insurance Co. 8470 9677 6242 5814

Cincinnati Casualty Co. 5794 5882 4205 3612

Cincinnati Insurance Co. 6425 8529 4823 3940

* Clearcover Insurance Co. 14659 14424 9781 9063

* CSAA General Insurance Co. 8764 8435 5333 4558

* Cumberland Insurance Co. Inc. 7176 11228 4872 4066

* Dairyland Insurance Co. 12280 16200 8282 7216

Elephant Insurance Co. 8428 9098 5924 6201

*

Encompass Home and Auto Insurance Compa

11460 12768 8623 4626

Erie Insurance Exchange 4753 4753 2858 2694

Farmers Casualty Insurance Co. 10215 8434 7958 5474

Farmers Direct P & C Insurance Co. 8076 8580 5588 4762

Farmers Group Property & Casualty Ins. Co. 8860 10278 7372 5948

Farmers Insurance Exchange 8054 8946 5756 4750

* Foremost Insurance Co. 12659 13926 11186 8989

Garrison Property & Casualty Ins. Co. 6457 6844 5006 4393

* GEICO Secure Co. 4260 4613 3046 2919

Hartford Casualty Insurance Co. 7748 8442 5376 4794

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

19

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 2: Young Single Female, Age 19

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

20744 20783 20659

21740

Insurer Prince George's Prince George's Saint Mary's Washington

Horace Mann Insurance Co. 4014 4014 2874 2462

Horace Mann Property & Casualty Ins. Co. 5072 5072 2985 2605

* Integon Indemnity 10833 12859 9646 8022

* Integon Preferred Insurance Co 10478 12078 8246 7308

Liberty Mutual Insurance Co. 13419 14647 11325 10086

Liberty Mutual Personal Insurance Co. 12167 13278 10285 9172

Maryland Auto Insurance Fund 5434 5198 5113 4906

* MGA Insurance Company, Inc. 10473 13000 7974 6712

* Mutual Benefit Insurance Co. 11247 11024 7797 7025

* Nationwide Property & Casualty Co. 11685 12204 7129 6908

* NGAC 18347 21912 15401 13896

* NJM Insurance Co. 5663 6323 4834 3653

Noblr Insurance Exchange 4640 4917 3902 3129

Old Dominion Insurance Co. 10784 12074 7350 5796

Penn National Insurance Co. 11471 12008 8732 7293

Privilege Underwriters Reciprocal Exch. 6447 6447 6120 2795

* Progressive Select Insurance Co. 4267 4634 3745 3001

* Progressive Specialty Insurance Co. 6049 6619 5300 4092

Root Insurance Co. 6372 6742 4630 4128

* Selective Ins. Co. of South Carolina 7118 7380 4926 5149

Southern Insurance Co. of VA 5044 5508 3770 3238

Teachers Insurance Co. 5373 5373 3070 2839

* Travelers Property Casualty Insurance Co. 7834 9332 6450 5258

United Services Automobile Association 4182 4492 3066 2842

* Unitrin Safeguard Insurance Co. 9619 10736 6878 5342

USAA Casualty Insurance Co. 4835 4985 3393 2973

USAA General Indemnity Co. 6149 6200 4616 4063

* Vault Recipricol Exchange 5440 5440 4514 1973

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

20

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 3: Single Male, Age 23

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Agency Insurance Co. 2027 2406 2857 2415 2359 2746

* AIG Property Casualty Co. 3541 3706 3706 3541 2460 2722

* Allstate Indemnity Co. 3680 4483 4950 3639 4532 5155

American Family Connect P & C Ins. Co. 2404 2504 3002 2456 2602 3264

American National Property & Casualty Co. 2872 3120 4048 2854 3170 3750

American States Preferred Insurance Co. 2932 3278 3379 2895 3320 3522

* Amica Mutual Insurance Co. 2203 2811 2811 2203 2559 2481

* Amica Property and Casualty Insurance Co. 3368 4325 4325 3368 4010 3880

Berkley Insurance Co. 2728 3122 3211 2793 2438 2626

* Branch Insurance Exchange 1803 1991 2446 1960 2155 2327

* Brethren Mutual 2137 2455 2878 2098 2284 2806

* Chubb National Insurance Co. 3413 4328 5227 3413 4573 5709

Cincinnati Casualty Co. 2451 2591 3627 2617 2958 3196

Cincinnati Insurance Co. 2467 2744 2712 2269 2712 2832

* Clearcover Insurance Co. 4768 5348 6388 4768 4488 5599

* CSAA General Insurance Co. 2217 2752 3196 2661 2818 3134

* Cumberland Insurance Co. Inc. 2480 3152 3160 2480 3221 3362

* Dairyland Insurance Co. 5033 7193 10653 4980 8145 10087

Elephant Insurance Co. 4968 6071 7682 4968 6274 7046

*

Encompass Home and Auto Insurance Compa

2364 3340 3819 2364 4198 3954

Erie Insurance Exchange 2095 2261 2932 2095 2649 3021

Farmers Casualty Insurance Co. 4130 6103 6102 5226 5680 6326

Farmers Direct P & C Insurance Co. 3844 4544 4580 3844 4722 4140

Farmers Group Property & Casualty Ins. Co. 4952 6072 9042 5710 6000 6964

Farmers Insurance Exchange 3452 3928 4760 3476 3972 4686

* Foremost Insurance Co. 7226 8449 10149 8568 8234 9707

Garrison Property & Casualty Ins. Co. 2489 2997 3323 2528 2821 3256

* GEICO Secure Co. 1890 1877 2269 1890 1987 2207

Hartford Casualty Insurance Co. 5392 7162 5986 3542 5388 5838

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

21

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 3: Single Male, Age 23

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Horace Mann Insurance Co. 1928 2153 2627 1928 2130 2302

Horace Mann Property & Casualty Ins. Co. 1776 2152 2976 1776 2492 2492

* Integon Indemnity 3553 3809 4977 3807 3908 4616

* Integon Preferred Insurance Co 3723 4324 5556 3824 4446 5588

Liberty Mutual Insurance Co. 7647 9244 10198 7714 9188 9818

Liberty Mutual Personal Insurance Co. 6976 8414 9273 7036 8363 8929

Maryland Auto Insurance Fund 4313 4395 4606 4313 4241 3712

* MGA Insurance Company, Inc. 4395 5409 7386 5056 5365 6602

* Mutual Benefit Insurance Co. 3010 3674 4491 3262 3696 4278

* Nationwide Property & Casualty Co. 3596 4115 5388 3770 4609 5444

* NGAC 7572 7764 9000 7572 7749 9619

* NJM Insurance Co. 1377 1746 1991 1377 1771 2012

Noblr Insurance Exchange 1759 1918 2402 1987 2000 2192

Old Dominion Insurance Co. 3796 4246 5096 3818 4776 5534

Penn National Insurance Co. 4449 5545 6077 4439 5745 6116

Privilege Underwriters Reciprocal Exch. 4248 4446 4446 4248 2965 4209

* Progressive Select Insurance Co. 1778 2087 2449 2119 2045 2359

* Progressive Specialty Insurance Co. 2399 2955 3546 2757 2955 3489

Root Insurance Co. 2640 3114 3856 2858 3222 3816

* Selective Ins. Co. of South Carolina 3604 3816 4564 3942 3857 4340

Southern Insurance Co. of VA 2195 2195 3178 2140 2860 3094

Teachers Insurance Co. 1857 2212 3101 1857 2537 2537

* Travelers Property Casualty Insurance Co. 2565 3278 4033 2948 3863 4515

United Services Automobile Association 1626 1950 2219 1664 1910 2190

* Unitrin Safeguard Insurance Co. 3429 4802 5481 3458 5138 5930

USAA Casualty Insurance Co. 1773 1914 2342 1865 2062 2365

USAA General Indemnity Co. 2227 2636 3021 2301 2530 2952

* Vault Recipricol Exchange 2649 3735 3735 3626 2496 2610

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

22

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 3: Single Male, Age 23

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

20744 20783 20659

21740

Insurer Prince George's Prince George's Saint Mary's Washington

Agency Insurance Co. 3130 3321 2787 2220

* AIG Property Casualty Co. 4639 3203 3706 1774

* Allstate Indemnity Co. 5392 5549 4395 3676

American Family Connect P & C Ins. Co. 3744 3834 2368 2466

American National Property & Casualty Co. 4226 4362 3148 2832

American States Preferred Insurance Co. 4052 4487 3274 2960

* Amica Mutual Insurance Co. 3197 3601 2811 2203

* Amica Property and Casualty Insurance Co. 4993 5620 4325 3368

Berkley Insurance Co. 3881 3716 2973 1820

* Branch Insurance Exchange 2876 3025 2426 1978

* Brethren Mutual 3253 3271 2275 2176

* Chubb National Insurance Co. 5600 6316 4132 3806

Cincinnati Casualty Co. 3896 3823 2872 2436

Cincinnati Insurance Co. 3456 4641 2646 2163

* Clearcover Insurance Co. 7157 7043 4781 4421

* CSAA General Insurance Co. 3990 3846 2523 2216

* Cumberland Insurance Co. Inc. 4364 6815 2982 2480

* Dairyland Insurance Co. 10685 13496 7427 6386

Elephant Insurance Co. 7556 8160 5355 5642

*

Encompass Home and Auto Insurance Compa

5028 5581 3819 2133

Erie Insurance Exchange 3800 3800 2261 2146

Farmers Casualty Insurance Co. 7634 6373 6103 4130

Farmers Direct P & C Insurance Co. 6284 6766 4500 3844

Farmers Group Property & Casualty Ins. Co. 7310 8540 6072 4952

Farmers Insurance Exchange 5426 5788 3936 3272

* Foremost Insurance Co. 10915 11835 9708 7870

Garrison Property & Casualty Ins. Co. 3741 3939 2938 2558

* GEICO Secure Co. 2559 2688 1877 1816

Hartford Casualty Insurance Co. 7234 7784 5120 4530

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

23

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 3: Single Male, Age 23

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

20744 20783 20659

21740

Insurer Prince George's Prince George's Saint Mary's Washington

Horace Mann Insurance Co. 2967 2967 2153 1866

Horace Mann Property & Casualty Ins. Co. 3655 3655 2152 1954

* Integon Indemnity 4853 5637 4207 3464

* Integon Preferred Insurance Co 5701 6434 4567 3997

Liberty Mutual Insurance Co. 10961 11856 9484 8415

Liberty Mutual Personal Insurance Co. 9958 10764 8629 7669

Maryland Auto Insurance Fund 4818 4576 4518 4313

* MGA Insurance Company, Inc. 7578 8656 5966 5055

* Mutual Benefit Insurance Co. 5265 5092 3674 3275

* Nationwide Property & Casualty Co. 5838 6007 3779 3581

* NGAC 9826 11469 8133 7459

* NJM Insurance Co. 1977 2126 1736 1377

Noblr Insurance Exchange 2751 2844 2403 1871

Old Dominion Insurance Co. 6520 7134 4450 3542

Penn National Insurance Co. 7248 7588 5539 4621

Privilege Underwriters Reciprocal Exch. 4666 4666 4446 1998

* Progressive Select Insurance Co. 2674 2836 2398 1948

* Progressive Specialty Insurance Co. 3939 4245 3502 2704

Root Insurance Co. 4280 4428 3274 2958

* Selective Ins. Co. of South Carolina 5021 5106 3548 3703

Southern Insurance Co. of VA 3152 3402 2527 2162

Teachers Insurance Co. 3861 3861 2212 2130

* Travelers Property Casualty Insurance Co. 4412 5166 3708 3006

United Services Automobile Association 2614 2798 1975 1799

* Unitrin Safeguard Insurance Co. 6756 7355 4920 3776

USAA Casualty Insurance Co. 2836 2919 2047 1770

USAA General Indemnity Co. 3501 3536 2647 2331

* Vault Recipricol Exchange 4502 4502 3735 1630

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

24

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 4: Single Female, Age 23

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Agency Insurance Co. 2393 2925 3500 2722 2960 3441

* AIG Property Casualty Co. 4192 4436 4436 4192 2869 3337

* Allstate Indemnity Co. 4004 4882 5380 3953 5006 5622

American Family Connect P & C Ins. Co. 2956 3080 3712 3032 3240 4060

American National Property & Casualty Co. 4100 4582 5906 3848 4834 5734

American States Preferred Insurance Co. 3106 3586 3709 2995 3754 4007

* Amica Mutual Insurance Co. 2763 3527 3527 2763 3271 3177

* Amica Property and Casualty Insurance Co. 3517 4488 4488 3517 4169 4045

Berkley Insurance Co. 4449 5148 5336 4516 4017 4393

* Branch Insurance Exchange 2489 2780 3400 2629 3091 3335

* Brethren Mutual 2939 3406 4005 2807 3260 4030

* Chubb National Insurance Co. 4520 5828 7055 4520 6323 7909

Cincinnati Casualty Co. 3620 3835 5375 3779 4481 4872

Cincinnati Insurance Co. 4531 5260 5180 4022 5204 5490

* Clearcover Insurance Co. 5768 6602 7883 5768 5516 6963

* CSAA General Insurance Co. 4015 4991 5959 4846 5189 5799

* Cumberland Insurance Co. Inc. 2301 2935 2944 2301 2991 3130

* Dairyland Insurance Co. 5097 7347 10860 4971 8408 10433

Elephant Insurance Co. 4118 5019 6335 4118 5135 5746

*

Encompass Home and Auto Insurance Compa

3187 4531 5204 3187 5743 5397

Erie Insurance Exchange 2723 3039 3993 2723 3602 4147

Farmers Casualty Insurance Co. 4662 6783 6713 5754 6378 7069

Farmers Direct P & C Insurance Co. 4134 4982 5034 4134 5192 4552

Farmers Group Property & Casualty Ins. Co. 5768 7140 10536 6402 7160 8364

Farmers Insurance Exchange 5910 7138 8252 5944 7098 8606

* Foremost Insurance Co. 5655 6625 7933 6591 6477 7613

Garrison Property & Casualty Ins. Co. 3459 4189 4672 3552 4076 4724

* GEICO Secure Co. 2929 3034 3705 2929 3279 3669

Hartford Casualty Insurance Co. 5974 7888 6648 3924 6034 6514

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

25

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 4: Single Female, Age 23

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Horace Mann Insurance Co. 2243 2494 3046 2243 2445 2648

Horace Mann Property & Casualty Ins. Co. 2040 2473 3426 2040 2859 2859

* Integon Indemnity 4305 4629 6109 4600 4793 5653

* Integon Preferred Insurance Co 4617 5475 7110 4697 5780 7310

Liberty Mutual Insurance Co. 7723 9466 10489 7705 9491 10160

Liberty Mutual Personal Insurance Co. 7044 8613 9533 7027 8633 9238

Maryland Auto Insurance Fund 3706 3741 3939 3706 3636 3233

* MGA Insurance Company, Inc. 3669 4734 6520 4153 4797 6074

* Mutual Benefit Insurance Co. 2881 3525 4315 3161 3515 4082

* Nationwide Property & Casualty Co. 5239 6227 8453 5295 7340 8593

* NGAC 8522 8922 10252 8522 8982 11231

* NJM Insurance Co. 2378 3165 3611 2378 3243 3719

Noblr Insurance Exchange 2611 2899 3618 3017 2969 3210

Old Dominion Insurance Co. 5662 6510 7786 5684 7480 8684

Penn National Insurance Co. 5738 7289 8030 5733 7605 8083

Privilege Underwriters Reciprocal Exch. 5360 5646 5646 5360 3711 5380

* Progressive Select Insurance Co. 2138 2596 3081 2426 2624 3043

* Progressive Specialty Insurance Co. 2869 3606 4345 3187 3686 4337

Root Insurance Co. 3078 3746 4744 3284 3950 4766

* Selective Ins. Co. of South Carolina 5550 5928 7114 5795 6189 7034

Southern Insurance Co. of VA 3020 3147 4600 2786 4233 4554

Teachers Insurance Co. 2145 2558 3593 2145 2928 2928

* Travelers Property Casualty Insurance Co. 3045 3951 4877 3499 4721 5522

United Services Automobile Association 2021 2418 2754 2080 2461 2829

* Unitrin Safeguard Insurance Co. 5353 7685 8665 5374 8510 9756

USAA Casualty Insurance Co. 2258 2441 3018 2391 2759 3165

USAA General Indemnity Co. 3054 3624 4202 3173 3593 4205

* Vault Recipricol Exchange 2839 4015 4015 3891 2677 2804

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

26

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 4: Single Female, Age 23

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

20744 20783 20659

21740

Insurer Prince George's Prince George's Saint Mary's Washington

Agency Insurance Co. 3873 4161 3404 2692

* AIG Property Casualty Co. 5523 3897 4436 2148

* Allstate Indemnity Co. 5805 5978 4808 3998

American Family Connect P & C Ins. Co. 4662 4800 2908 3050

American National Property & Casualty Co. 6224 6658 4546 4128

American States Preferred Insurance Co. 4423 4974 3594 3169

* Amica Mutual Insurance Co. 4084 4548 3527 2763

* Amica Property and Casualty Insurance Co. 5200 5791 4488 3517

Berkley Insurance Co. 6488 6222 4866 2969

* Branch Insurance Exchange 4056 4344 3359 2790

* Brethren Mutual 4606 4646 3181 3022

* Chubb National Insurance Co. 7544 8579 5548 5103

Cincinnati Casualty Co. 5788 5794 4244 3628

Cincinnati Insurance Co. 6482 8462 4893 3949

* Clearcover Insurance Co. 8880 8767 5851 5406

* CSAA General Insurance Co. 7426 7147 4593 3954

* Cumberland Insurance Co. Inc. 4082 6401 2778 2301

* Dairyland Insurance Co. 10913 13923 7552 6522

Elephant Insurance Co. 6272 6751 4420 4627

*

Encompass Home and Auto Insurance Compa

6858 7614 5204 2866

Erie Insurance Exchange 5201 5201 3039 2875

Farmers Casualty Insurance Co. 8597 7155 6783 4662

Farmers Direct P & C Insurance Co. 6934 7414 4860 4134

Farmers Group Property & Casualty Ins. Co. 8638 10040 7140 5768

Farmers Insurance Exchange 9512 10562 6982 5772

* Foremost Insurance Co. 8534 9212 7640 6136

Garrison Property & Casualty Ins. Co. 5311 5611 4099 3560

* GEICO Secure Co. 4208 4506 3034 2918

Hartford Casualty Insurance Co. 8024 8718 5646 5058

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

27

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 4: Single Female, Age 23

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

20744 20783 20659

21740

Insurer Prince George's Prince George's Saint Mary's Washington

Horace Mann Insurance Co. 3442 3442 2494 2160

Horace Mann Property & Casualty Ins. Co. 4200 4200 2473 2254

* Integon Indemnity 5878 6904 5145 4242

* Integon Preferred Insurance Co 7298 8384 5760 5091

Liberty Mutual Insurance Co. 11331 12331 9672 8640

Liberty Mutual Personal Insurance Co. 10289 11192 8798 7869

Maryland Auto Insurance Fund 4138 3951 3868 3706

* MGA Insurance Company, Inc. 6778 8161 5237 4412

* Mutual Benefit Insurance Co. 5080 4884 3525 3137

* Nationwide Property & Casualty Co. 9120 9462 5655 5493

* NGAC 11255 13395 9451 8419

* NJM Insurance Co. 3537 3904 3149 2378

Noblr Insurance Exchange 4141 4235 3631 2801

Old Dominion Insurance Co. 9974 11144 6756 5298

Penn National Insurance Co. 9524 10069 7290 6012

Privilege Underwriters Reciprocal Exch. 5916 5916 5646 2535

* Progressive Select Insurance Co. 3403 3667 3012 2408

* Progressive Specialty Insurance Co. 4854 5271 4276 3297

Root Insurance Co. 5324 5594 3960 3542

* Selective Ins. Co. of South Carolina 7869 8049 5538 5761

Southern Insurance Co. of VA 4600 4953 3623 3025

Teachers Insurance Co. 4454 4454 2558 2469

* Travelers Property Casualty Insurance Co. 5356 6353 4472 3612

United Services Automobile Association 3271 3523 2414 2237

* Unitrin Safeguard Insurance Co. 10764 11925 7773 6052

USAA Casualty Insurance Co. 3690 3815 2605 2280

USAA General Indemnity Co. 4851 4895 3636 3189

* Vault Recipricol Exchange 4828 4828 4015 1751

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

28

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 5: Single Male, Age 30

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Agency Insurance Co. 1759 2061 2442 2181 1984 2300

* AIG Property Casualty Co. 3111 3250 3250 3111 2191 2407

* Allstate Indemnity Co. 2296 2759 2967 2272 2702 3090

American Family Connect P & C Ins. Co. 1642 1722 2044 1692 1720 2194

American National Property & Casualty Co. 2650 2864 3742 2688 2872 3412

American States Preferred Insurance Co. 2710 3030 3126 2718 2944 3203

* Amica Mutual Insurance Co. 1672 2122 2122 1672 1909 1831

* Amica Property and Casualty Insurance Co. 2208 2793 2793 2208 2526 2424

Berkley Insurance Co. 2274 2603 2682 2329 2021 2190

* Branch Insurance Exchange 1149 1263 1562 1266 1359 1473

* Brethren Mutual 2178 2505 2885 2144 2249 2847

* Chubb National Insurance Co. 3007 3764 4533 3005 3845 4797

Cincinnati Casualty Co. 2598 2746 3822 2883 2995 3194

Cincinnati Insurance Co. 2791 3063 3041 2638 2978 3104

* Clearcover Insurance Co. 6953 7743 9307 6953 6306 8030

* CSAA General Insurance Co. 1376 1726 1962 1653 1741 1933

* Cumberland Insurance Co. Inc. 1459 1832 1843 1459 1818 1923

* Dairyland Insurance Co. 5836 8634 13231 5717 9808 12541

Elephant Insurance Co. 5629 6966 8839 5629 7108 7978

*

Encompass Home and Auto Insurance Compa

1427 1935 2173 1427 2324 2204

Erie Insurance Exchange 1962 2114 2751 1962 2453 2795

Farmers Casualty Insurance Co. 2902 4275 4276 3680 3946 4381

Farmers Direct P & C Insurance Co. 3176 3724 3770 3176 3860 3422

Farmers Group Property & Casualty Ins. Co. 3464 4264 6260 4036 4166 4808

Farmers Insurance Exchange 1862 2068 2502 1876 1996 2356

* Foremost Insurance Co. 3709 4223 5033 4483 4037 4728

Garrison Property & Casualty Ins. Co. 2059 2471 2776 2101 2375 2749

* GEICO Secure Co. 2168 2063 2526 2168 2108 2378

Hartford Casualty Insurance Co. 6456 8668 7208 4246 6338 6922

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

29

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 5: Single Male, Age 30

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Horace Mann Insurance Co. 1539 1671 2014 1539 1596 1721

Horace Mann Property & Casualty Ins. Co. 1765 2115 2893 1765 2414 2414

* Integon Indemnity 3936 4238 5532 4224 4402 5270

* Integon Preferred Insurance Co 2836 3255 4149 2942 3245 4084

Liberty Mutual Insurance Co. 5096 6174 6806 5153 6009 6452

Liberty Mutual Personal Insurance Co. 4676 5650 6221 4732 5503 5898

Maryland Auto Insurance Fund 4534 4633 4932 4534 4465 4031

MGA Insurance Company, Inc. n/a n/a n/a n/a n/a n/a

* Mutual Benefit Insurance Co. 1788 2190 2682 1981 2144 2513

* Nationwide Property & Casualty Co. 2323 2586 3275 2465 2819 3328

* NGAC 9635 9973 11497 9635 9967 12436

* NJM Insurance Co. 1068 1350 1509 1068 1360 1535

Noblr Insurance Exchange 1727 1859 2304 1941 1912 2132

Old Dominion Insurance Co. 2528 2808 3388 2550 3130 3632

Penn National Insurance Co. 2430 3038 3317 2425 3125 3354

Privilege Underwriters Reciprocal Exch. 4894 5121 5121 4894 3432 4822

* Progressive Select Insurance Co. 1296 1475 1716 1615 1413 1612

* Progressive Specialty Insurance Co. 1796 2144 2552 2161 2108 2452

Root Insurance Co. 2888 3424 4298 3202 3538 4262

* Selective Ins. Co. of South Carolina 3445 3664 4343 3792 3648 4235

Southern Insurance Co. of VA 2261 2285 3308 2180 2990 3234

Teachers Insurance Co. 1863 2192 3056 1863 2483 2483

* Travelers Property Casualty Insurance Co. 2390 3247 4041 2874 3739 4468

United Services Automobile Association 1422 1688 1938 1458 1700 1954

* Unitrin Safeguard Insurance Co. 1645 2234 2546 1667 2336 2704

USAA Casualty Insurance Co. 1585 1702 2107 1667 1881 2157

USAA General Indemnity Co. 1830 2153 2494 1887 2092 2467

* Vault Recipricol Exchange 2331 3266 3266 3174 2205 2281

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

30

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 5: Single Male, Age 30

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

20744 20783 20659

21740

Insurer Prince George's Prince George's Saint Mary's Washington

Agency Insurance Co. 2667 2796 2366 1904

* AIG Property Casualty Co. 4076 2837 3250 1608

* Allstate Indemnity Co. 3468 3534 2699 2284

American Family Connect P & C Ins. Co. 2570 2626 1624 1670

American National Property & Casualty Co. 3916 4014 2902 2602

American States Preferred Insurance Co. 3805 4251 3003 2701

* Amica Mutual Insurance Co. 2327 2641 2122 1672

* Amica Property and Casualty Insurance Co. 3075 3484 2793 2208

Berkley Insurance Co. 3216 3089 2487 1533

* Branch Insurance Exchange 1845 1933 1544 1254

* Brethren Mutual 3328 3351 2322 2189

* Chubb National Insurance Co. 4901 5450 3609 3289

Cincinnati Casualty Co. 4072 3865 3037 2555

Cincinnati Insurance Co. 3849 5279 3006 2459

* Clearcover Insurance Co. 10562 10354 6907 6376

* CSAA General Insurance Co. 2478 2387 1571 1394

* Cumberland Insurance Co. Inc. 2535 4008 1740 1459

* Dairyland Insurance Co. 13247 17342 8964 7681

Elephant Insurance Co. 8565 9226 6124 6365

*

Encompass Home and Auto Insurance Compa

2816 3059 2173 1284

Erie Insurance Exchange 3581 3581 2114 2000

Farmers Casualty Insurance Co. 5227 4453 4275 2902

Farmers Direct P & C Insurance Co. 5130 5570 3732 3176

Farmers Group Property & Casualty Ins. Co. 5184 6066 4264 3464

Farmers Insurance Exchange 2852 2992 2098 1722

* Foremost Insurance Co. 5347 5726 4800 3942

Garrison Property & Casualty Ins. Co. 3137 3298 2411 2115

* GEICO Secure Co. 2869 2968 2063 1993

Hartford Casualty Insurance Co. 8912 9454 6198 5430

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

31

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 5: Single Male, Age 30

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

20744 20783 20659

21740

Insurer Prince George's Prince George's Saint Mary's Washington

Horace Mann Insurance Co. 2262 2262 1671 1461

Horace Mann Property & Casualty Ins. Co. 3554 3554 2115 1946

* Integon Indemnity 5574 6532 4657 3831

* Integon Preferred Insurance Co 4264 4757 3445 2989

Liberty Mutual Insurance Co. 7246 7821 6355 5566

Liberty Mutual Personal Insurance Co. 6614 7133 5810 5102

Maryland Auto Insurance Fund 5251 4905 4828 4534

MGA Insurance Company, Inc. n/a n/a n/a n/a

* Mutual Benefit Insurance Co. 3185 3039 2190 1920

* Nationwide Property & Casualty Co. 3611 3720 2410 2237

* NGAC 12647 14929 10450 9505

* NJM Insurance Co. 1530 1642 1339 1068

Noblr Insurance Exchange 2716 2776 2341 1802

Old Dominion Insurance Co. 4360 4726 2952 2362

Penn National Insurance Co. 3993 4197 3042 2524

Privilege Underwriters Reciprocal Exch. 5350 5350 5121 2311

* Progressive Select Insurance Co. 1860 1935 1659 1386

* Progressive Specialty Insurance Co. 2808 2983 2480 1982

Root Insurance Co. 4840 5016 3624 3244

* Selective Ins. Co. of South Carolina 4919 5018 3409 3515

Southern Insurance Co. of VA 3292 3546 2628 2233

Teachers Insurance Co. 3783 3783 2192 2137

* Travelers Property Casualty Insurance Co. 4402 5169 3760 2915

United Services Automobile Association 2292 2464 1695 1566

* Unitrin Safeguard Insurance Co. 3197 3502 2298 1775

USAA Casualty Insurance Co. 2565 2640 1816 1590

USAA General Indemnity Co. 2918 2941 2158 1905

* Vault Recipricol Exchange 3888 3888 3266 1435

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

32

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 6: Single Female, Age 30

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

Insurer Allegany Calvert Charles Garrett Montgomery Montgomery

Agency Insurance Co. 1459 1706 2038 1807 1645 1908

* AIG Property Casualty Co. 2829 2923 2923 2829 1990 2158

* Allstate Indemnity Co. 1885 2208 2374 1869 2175 2458

American Family Connect P & C Ins. Co. 1606 1672 1970 1692 1664 2070

American National Property & Casualty Co. 1798 1976 2580 1810 1994 2386

American States Preferred Insurance Co. 1830 2027 2093 1845 1957 2139

* Amica Mutual Insurance Co. 1878 2363 2363 1878 2116 2025

* Amica Property and Casualty Insurance Co. 2430 3058 3058 2430 2746 2625

Berkley Insurance Co. 1313 1497 1546 1345 1170 1267

* Branch Insurance Exchange 1097 1197 1493 1239 1260 1370

* Brethren Mutual 1549 1793 2093 1546 1637 2086

* Chubb National Insurance Co. 2042 2532 3034 2042 2554 3167

Cincinnati Casualty Co. 1600 1675 2350 1778 1843 1957

Cincinnati Insurance Co. 1628 1756 1748 1562 1704 1770

* Clearcover Insurance Co. 1523 1630 1946 1523 1367 1697

* CSAA General Insurance Co. 1120 1392 1557 1344 1406 1558

* Cumberland Insurance Co. Inc. 1200 1483 1494 1200 1451 1544

* Dairyland Insurance Co. 6149 9092 13889 6091 10278 13117

Elephant Insurance Co. 3805 4573 5820 3805 4712 5282

*

Encompass Home and Auto Insurance Compa

1273 1704 1890 1273 1927 1854

Erie Insurance Exchange 1236 1275 1635 1236 1443 1623

* Farmers Casualty Insurance Co. 1909 2788 2769 2399 2574 2834

* Farmers Direct P & C Insurance Co. 2078 2430 2468 2078 2516 2244

* Farmers Group Property & Casualty Ins. Co. 2414 2978 4350 2860 2894 3324

* Farmers Insurance Exchange 1750 2024 2394 1760 2022 2414

* Foremost Insurance Co. 2715 3076 3652 3356 2923 3405

Garrison Property & Casualty Ins. Co. 1833 2204 2445 1882 2085 2388

* GEICO Secure Co. 1676 1561 1906 1676 1578 1782

Hartford Casualty Insurance Co. 3044 4108 3376 2078 2972 3274

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

33

August 2024

Maryland Insurance Administration 1-80

0-492-6116 www.insurance.maryland.gov

Scenario 6: Single Female, Age 30

Western Maryland, D.C. suburbs, and Southern Maryland

Rates Effective as of 8/1/2024

21502 20657 20603 21550 20878 20906

* Horace Mann Insurance Co. 1233 1313 1579 1233 1245 1336

* Horace Mann Property & Casualty Ins. Co. 1370 1600 2192 1370 1835 1835

* Integon Indemnity 2634 2818 3651 2814 2920 3485

* Integon Preferred Insurance Co 2265 2554 3227 2366 2493 3111

Liberty Mutual Insurance Co. 3400 3895 4227 3478 3761 3985

Liberty Mutual Personal Insurance Co. 3153 3600 3897 3222 3478 3681

Maryland Auto Insurance Fund 5149 5220 5527 5149 5076 4511

MGA Insurance Company, Inc. n/a n/a n/a n/a n/a n/a

* Mutual Benefit Insurance Co. 1165 1424 1736 1285 1390 1619

* Nationwide Property & Casualty Co. 2335 2594 3310 2492 2829 3369

* NGAC 2504 2622 3004 2504 2626 3268

* NJM Insurance Co. 864 1060 1185 864 1059 1195

Noblr Insurance Exchange 1068 1170 1481 1244 1196 1293

Old Dominion Insurance Co. 1674 1860 2246 1696 2082 2404

* Penn National Insurance Co. 7145 2144 2327 1739 2190 2364

Privilege Underwriters Reciprocal Exch. 2748 2851 2851 2748 1922 2668

* Progressive Select Insurance Co. 1029 1171 1369 1271 1131 1288

* Progressive Specialty Insurance Co. 1456 1732 2076 1758 1701 1983

* Root Insurance Co. 2232 2626 3302 2518 2700 3272

* Selective Ins. Co. of South Carolina 2195 2329 2777 2438 2313 2694

Southern Insurance Co. of VA 1476 1475 2137 1415 1943 2103

* Teachers Insurance Co. 1460 1674 2339 1460 1907 1907

* Travelers Property Casualty Insurance Co. 1668 2206 2724 2006 2499 2962

United Services Automobile Association 1190 1402 1602 1215 1400 1601

* Unitrin Safeguard Insurance Co. 1151 1563 1793 1164 1648 1917

USAA Casualty Insurance Co. 1387 1475 1813 1460 1615 1849

USAA General Indemnity Co. 1646 1913 2198 1700 1856 2161

* Vault Recipricol Exchange 1835 2542 2542 2499 1734 1765

* Indicates those insurers that consider credit scores in determining premiums. Refer to "Notes to Rate Tables"

n/a = Insurers that do not have rates available based on the criteria in the scenario, such as an at-fault accident.

34

August 2024