Citizens Property Insurance Corporation

Overview

Christine Ashburn

Chief – Communications, Legislative and External Affairs

• A state-created, not-for-profit, tax-exempt government entity whose public purpose is to

provide property insurance coverage to those unable to find coverage in the voluntary

admitted market or if coverage in the voluntary admitted market is more than 15% higher

than coverage with Citizens

• Created from the merger of the Florida Windstorm Underwriting Association (FWUA) and the

Florida Residential Property and Casualty Joint Underwriting Association (FRPCJUA)

• FWUA: created in 1972 as insurer of last resort to provide wind-only coverage in

Monroe County. The wind-only territories of the FWUA were expanded over time to

include most coastal regions

• FRPCJUA created in 1992 following Hurricane Andrew as an insurer of last resort for

areas of the state not covered by the FWUA

• Governed by a nine member board of Governors, three of whom are appointed by the

Governor and two of whom are each appointed by the Chief Financial Officer, Senate

President and Speaker of the House

• Operate pursuant to a plan of operation which is reviewed and approved by the Financial

Services Commission

• Subject to regulation by the Florida Office of Insurance Regulation (OIR), Operational Reviews

by the Auditor General and OIR Market Conduct Examiners, and external audits

• Citizens also has a robust Office of Internal Audit and an Inspector General

Page 2

Overview

When Citizens was created, each of the predecessor organizations had slightly different coverage

offerings and outstanding indebtedness, requiring the premium associated with each to remain

aligned.

Each of the following three accounts are separate are statutory accounts and have separate

calculations of surplus, plan-year deficit and assessment bases. Assets in one account many not

be comingled or used to fund losses in another account. The three accounts are listed below with

the types of policies written in each.

Personal Lines Account (PLA)

• Personal Residential Multiperil policies, including homeowners, dwelling fire, mobile home,

tenants and condominium unit owners, These policies tend to be located further inland or in

non-coastal areas of the state

Coastal Account (Formerly High Risk Account)

• Wind-only and multiperil policies for personal residential, commercial residential and

commercial nonresidential risks located in eligible coastal high risk areas

Commercial Lines Account (CLA)

• Commercial Residential Multiperil policies, including condominium associations, apartment

buildings and homeowners association policies

• Commercial Nonresidential Multiperil policies located outside of the coastal (HRA) eligible

areas

Page 3

Overview

• Under Florida law, Citizens may write a new insurance policy only for property that meets one

of the following eligibility criteria:

• Coverage is not available from a Florida-authorized insurance company

• Premiums for coverage from Florida-authorized insurance companies are more than

15 percent higher than the premiums for comparable coverage from Citizens

• In 2013 the legislature created a Property Insurance Clearinghouse to help identify private-

market insurance options for consumers who believe Citizens might be their only choice for

property insurance and to ensure that only customers who are eligible obtain coverage from

Citizens

• Citizens' Depopulation Program, authorized by Florida law, matches Citizens policyholders

with insurance companies interested in removing their policy from Citizens and providing

private-market coverage for their policy. All companies assuming policies from Citizens have

been approved by the Office of Insurance Regulation (OIR)

Page 4

Eligibility

Page 5

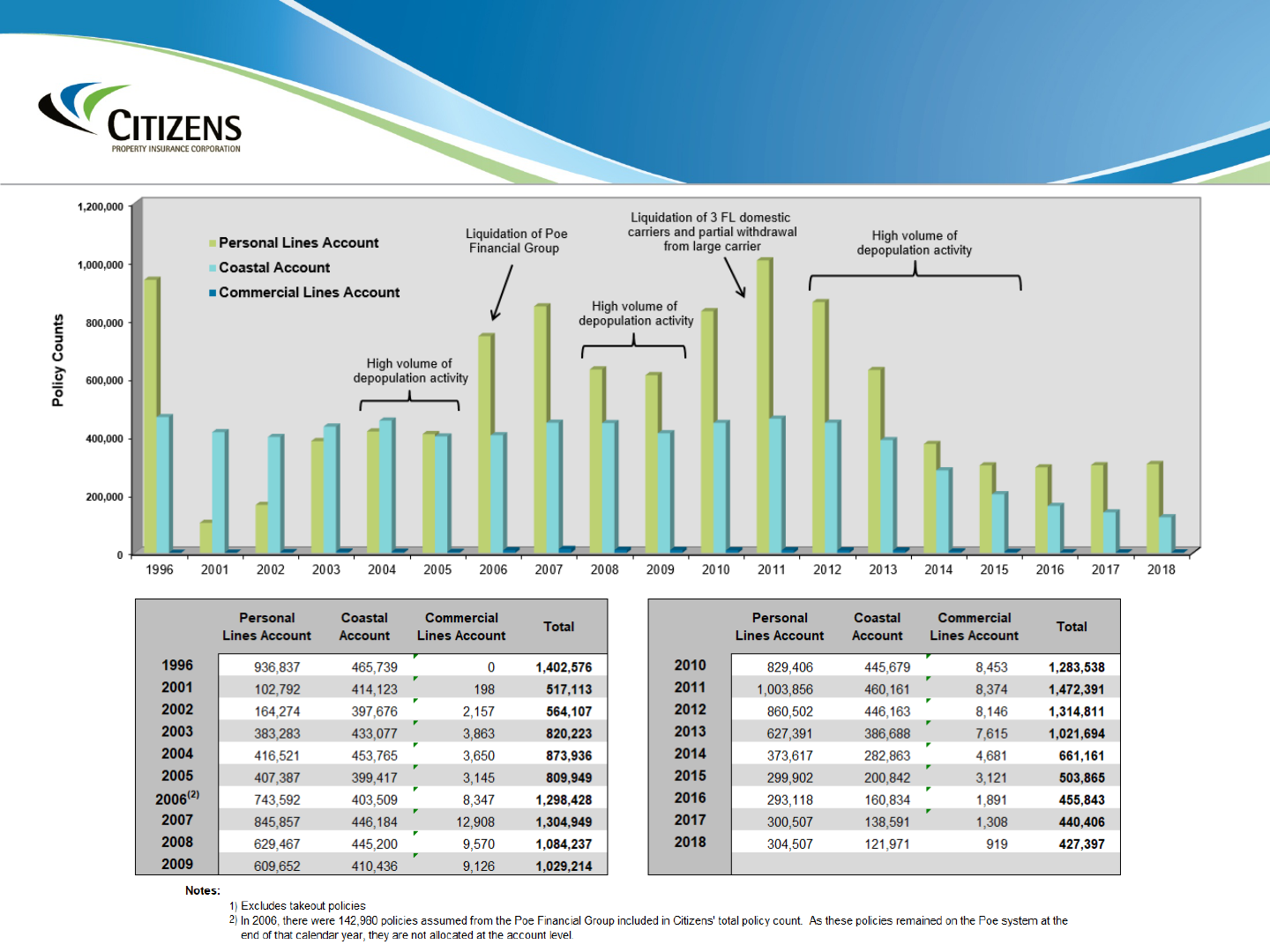

Policies In Force

Page 6

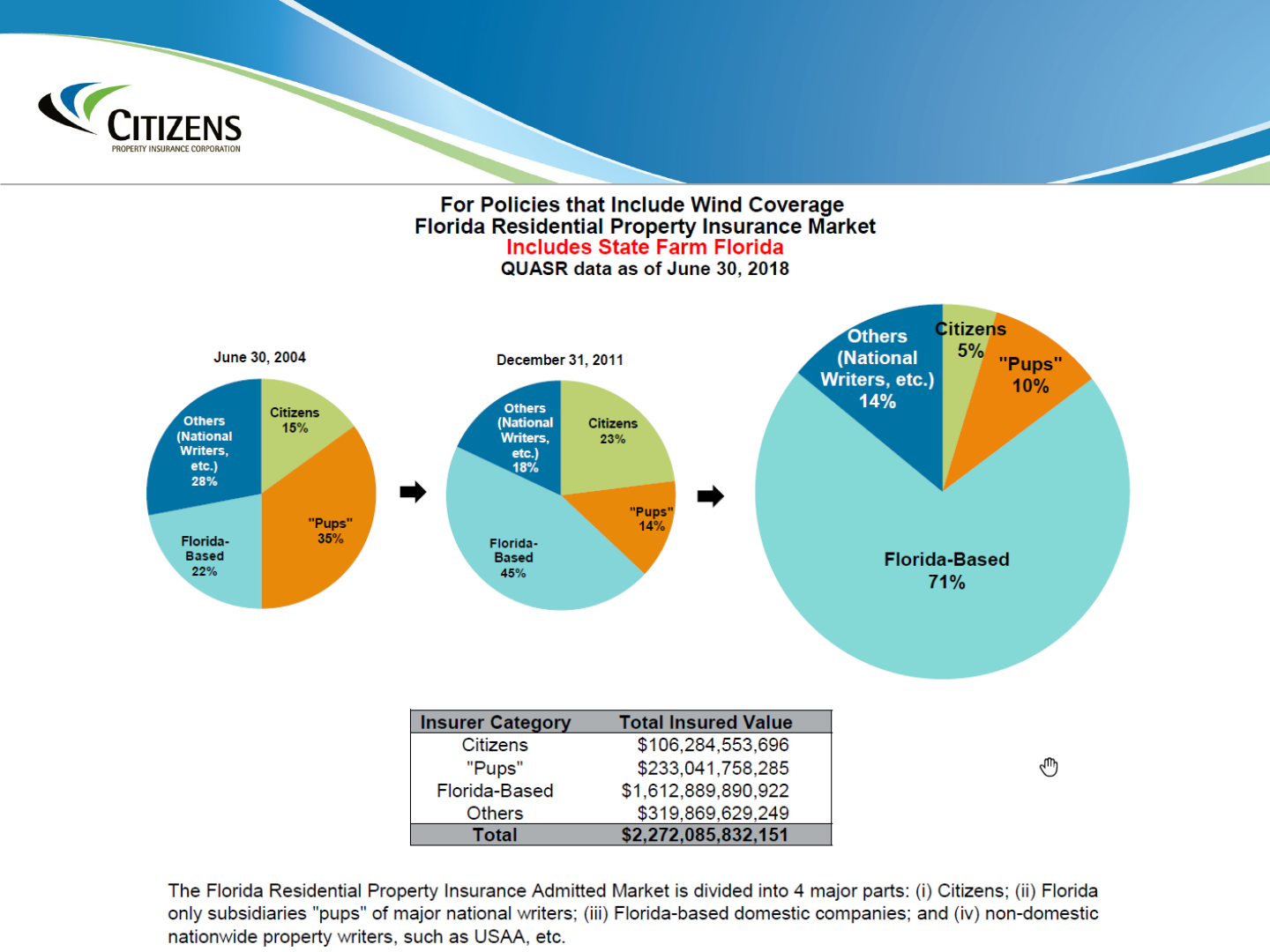

Market Share

Citizens has at its disposal both the traditional resources available to all property and

casualty companies that conduct business in the state as well as assessment powers

granted to Citizens by law.

Page 7

Financial Resources

Traditional Financial Resources

• Insurance Premiums

• Investment Income

• Operating Surplus from Prior Years

• Florida Hurricane Catastrophe Fund Reimbursements

• Traditional Reinsurance and Capital Markets Risk

Transfer

Unique Financial Resources

• Citizens’ Policyholder Surcharges

• Regular Assessments (Coastal only)

• Emergency Assessments

• Pre-event liquidity resources (debt issuances and lines of

credit which, if drawn upon, must be repaid)

Page 8

Assessments

Page 9

Assessments

• The 2005 Emergency

Assessment was

terminated for policies

issued or renewed

beginning on July 1,

2015

• Currently, no

assessments are being

levied by Citizens

Page 10

Financial Summary (in billions)

YTD

Q3-2018

2017 2016 Book of Business

Nov-2018

Change

Last Mth

Change

Last Yr

Surplus

1

100-YR PML

2

Claims-Paying Capacity

3

Total Cash and Invested Assets

$6.4

$4.9

$11.7

$9.5

$6.4

$5.2

$11.9

$10.1

$7.4

$6.0

$15.8

$12.1

Total Premium Inforce

Average Premium - PLA

Average Premium - Coastal

Average Premium - CLA

$866M

$1,711

$2,552

$16,435

-0.2%

0%

0%

-1%

-0.6%

6.3%

0.2%

3.7%

1

Accumulated Surplus is determined in accordance with Statutory Accounting Principles (SAP).

2

As of Q4-2014, Single-event occurrence Probable Maximum Loss ("PML“) includes demand surge, excludes storm surge, and does not include LAE.

3

Claims Paying Capacity consists of (1) 2018 Q3 Statutory Surplus, (2) risk transfer for 2018-19 hurricane season (including FHCF coverage), and (3) par

value of pre-event bonds. Please note that this figure shows resources on a combined basis. However, resources are specific to each account and may

not be used to fund needs in another account

Financial Overview

• While Citizens continues to have a healthy financial position, the PLA has had net losses

each year since 2015:

• Oct 2018 (unaudited): ($64,465,000)

• 2017 (audited): ($555,475,000)*

• 2016 (audited): ($35,017,000)

• 2015 (audited): ($21,489,000)

*Due to Hurricane Irma losses

Page 11

Public Summary of Citizens Assessment Reduction Efforts Over Time

Notes:

1. Storm Risk is as measured by 1-in-100 year probable maximum loss (PML) plus estimated loss adjustment expenses using the Florida Hurricane Catastrophe Fund (FHCF) account

allocation where PLA and CLA are combined. PLA/CLA combined PMLs are added to the Coastal PMLs to be consistent for surplus distribution. In general, the PMLs presented are

as projected at the beginning of storm season; with the exception of 2017 which is as of August 31, 2017.

2. Surplus and Assessments are as projected at beginning of storm season. Not all PLA/CLA surplus is needed to fund storm risk in 2014. In 2015 - 2018, not all surplus in PLA/CLA and

the Coastal Account is needed to fund storm risk. Remaining surplus is available to fund a second event.

3. Florida Hurricane Catastrophe Fund (FHCF) is as projected at beginning of storm season; with the exception of 2017 and 2018 which are Citizens' initial data submission to the FHCF.

4. Depopulation PMLs are not included in storm risk totals and are presented as year end totals; with the exception of 2018, which is as of May 31, 2018. PMLs from 2011-2014 use a

weighted average of 1/3 Standard Sea Surface Temperature (SSST) and 2/3 Warm Sea Surface Temperature (WSST). 2015 - 2018 PMLs reflect only SSST event catalog.

Storm Risk: 1 in 100 year PML

Hurricane Michael Claims

Statistics

Claims Summary Total Commercial Personal

New Claims 3,360 59 3,301

Closed Claims 2,442 39 2,403

% Closed 73% 66% 73%

Indemnity Paid $89,927,150 $7,664,979 $76,262,171

Expense Paid $1,972,680 $82,299 $1,890,381

Total Incurred $96,309,324 $7,852,144 $88,457,179

% Submitted by Self 79% 54% 79%

% Submitted by Rep 1% 12% 1%

% Submitted by Other 20% 34% 20%

% Storm Surge 5% 15% 5%

% AOB 1% 7% 1%

*As of 1-2-19

12

• Prior to 2007, rates were required to be non-competitive with the private market

• Rates for personal and commercial residential policies were frozen by statute from January 1,

2007 through December 31, 2009.

• Rates are now required to be actuarily sound, but not to exceed 10% increase annually per

policy, excluding the Florida Hurricane Catastrophe Fund Rapid Cash Build-Up Factor

• Citizens Board makes annual recommended rate changes to the Office of Insurance Regulation

(OIR) and they establish rates for Citizens.

• Citizens current average actuarial rate indication for multiperil homeowners is 25.2% with a

capped indication of 8.5%

• Actuarial rate need for homeowners multiperil policies ranges among House districts from

-3.5% to 56%

Page 13

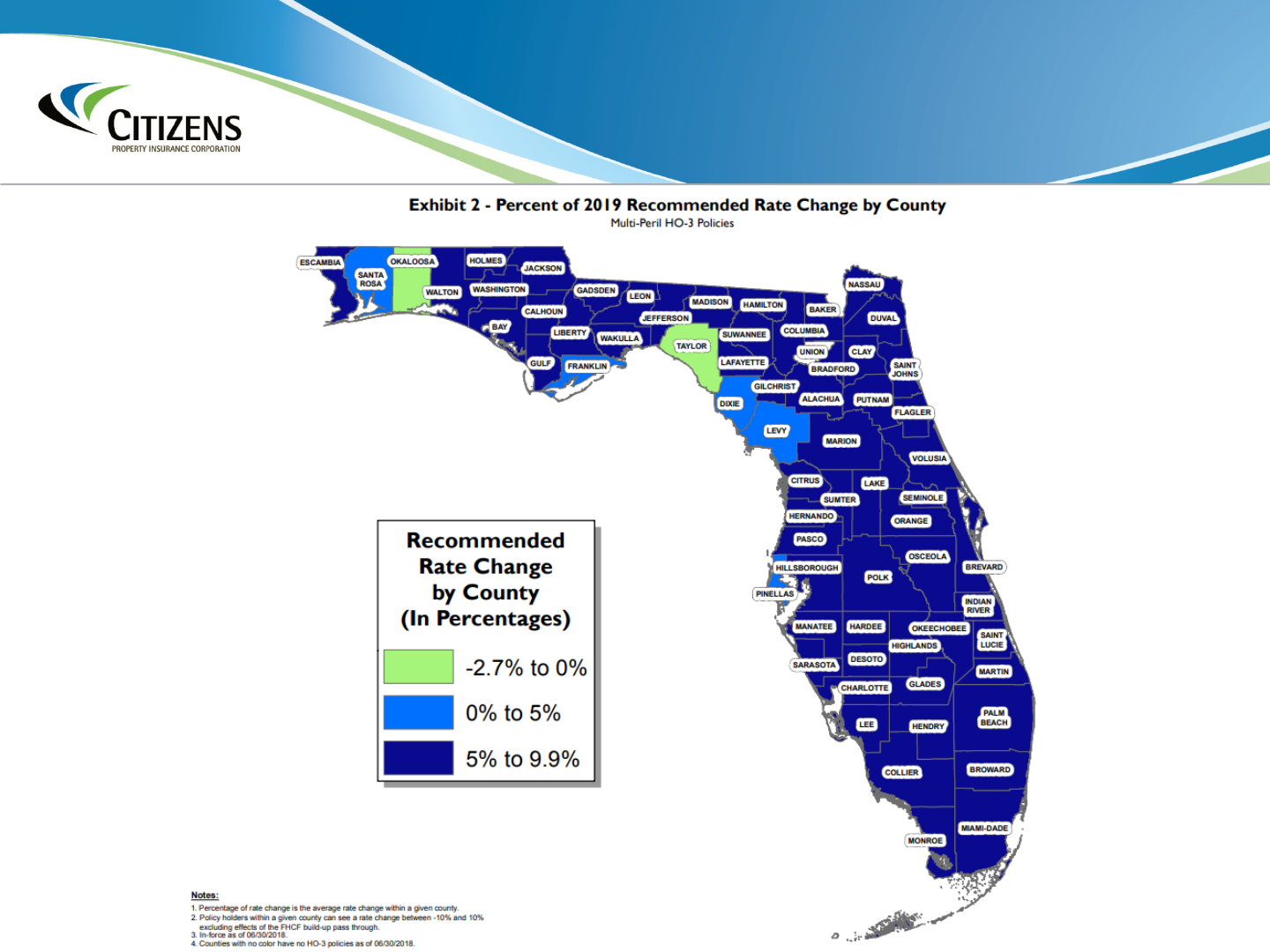

Rates

Page 14

Homeowners Multiperil Rates

Page 15

Homeowners Wind-Only Rates

Page 16

Litigation

Available for Non-Weather Water Losses for Citizens’ HO-3 and DP-3 Policies

• Voluntary program offered at time of loss for water losses caused by accidental discharge or overflow of water or

steam from a plumbing, heating, air conditioning, automatic fire protective sprinkler system or household

appliance

• Emergency Water Removal Services

• No deductible

• No cost to policyholder even if loss is not covered by Citizens

• If the policyholder agrees to participate, Citizens provides a Citizens-approved contractor(s) to provide

water removal and drying services to protect insured structures from further damage

• Managed Repair Contractor Network Program

• Provides permanent repair services for covered damage

• Policyholder works with licensed and insured contractors within the network

• All contractors’ claim related work is guaranteed for three years

2018 Policy Changes

• Effective for HO-3 and dwelling DP-3 new business and renewals August 1, 2018

• $10,000 Sublimit for Coverages A and B if Managed Repair Contractor Network not used

• Requires all claimants other than insured, their agent, representative or a public adjuster representing claimant

to:

• Provide documentation supporting the right to make a claim

• Provide documentation detailing the scope and amount of loss

• Participate in appraisal or alternative dispute resolution

Page 17

Managed Repair Program