1

MLA817 project code:

V.RMH.0079

Prepared By:

J. Green, K. Bryan

Greenleaf Enterprises

Date Published:

PUBLISHED BY

Meat and Livestock Australia Limited

Locked Bag 991

NORTH SYDNEY NSW 2059

Final Report

Collagen Business Case Report

This is an MLA Donor Company funded project.

Meat & Livestock Australia acknowledges the matching funds provided by the Australian

Government and contributions from the Australian Meat Processor Corporation to support the

research and development detailed in this publication.

2

This publication is published by Meat & Livestock Australia Limited ABN 39 081 678 364 (MLA). Care is taken to ensure the accuracy of the

information contained in this publication. However, MLA cannot accept responsibility for the accuracy or completeness of the information or

opinions contained in the publication. You should make your own enquiries before making decisions concerning your interests. Reproduction

in whole or in part of this publication is prohibited without prior written consent of MLA.

3

1 Executive Summary

Collagen is the most abundant source of protein in the human body. It binds cells and tissue

together, and maintains the body’s integrity, shape and strength. However, collagen levels

naturally decline as humans age, which adversely affects humans’ general health and

wellbeing. There has been growth in interest and demand for collagen-based products that

are obtained through various animal sources, including bovine, ovine, porcine, marine and

poultry.

This project evaluates the current state of the market for collagen, and forecasted future

growth for bovine and ovine collagen producers, together with emerging opportunities for

higher value returns from collagen. The global collagen market size has an estimated

valuation of $3.136 billion USD for 2018. The market is expected to experience compounded

annual growth (CAGR) of 5.09% from 2017-2025, resulting in an estimated market size of

$4.150 billion USD in 2025 (QY Research 2018).

Consumer interest in collagen-based products is growing in various applications, including

food and beverage, nutraceutical supplements, cosmetics and medical products. Consumers

are particularly focusing on health and performance nutrition, with the nutraceutical collagen

market forecasted to account for 40.06% of collagen product sales in 2025.

Collagen’s characteristics as a bioavailable bonding material has resulted in growth in both

cosmetic and medical applications. Its most prevalent use among cosmetic consumers is in

skincare products, with this popularity due to its ‘revitalising’ and ‘renewing’ properties.

Advanced medical applications such as tissue regeneration and bone substitutes are

beginning to use collagen; a potential lucrative new frontier for medical collagen is artificial

organs, with research being undertaken into 3D printable organs using biomaterials like

collagen (Breed 2017).

Challenges for Australian companies looking to compete in the red-meat collagen

market

Marine Collagen: Why it is a barrier:

- Higher projected compounded annual growth (CAGR) at 6.33% through to 2025

(bovine forecasted at 4.61%)

- Doesn’t have same speculation regarding safety of consumption (BSE outbreaks

cause uncertainty among many consumers)

How to overcome this barrier:

- Marine collagen extracted at lower yield from raw material collagen extraction (1.2%

yield; bovine collagen extracted at 8-20% yield)- less efficient process

- Lower yield = higher price; marine collagen costs $44539 USD/ metric tonne,

whereas bovine costs $33457/MT. Cost leadership allows bovine collagen to have

big cost advantage in lower-value products (e.g. food)

- Australia has BSE-free status; big selling point for bovine collagen-based products

4

- Focus on medical and nutraceutical applications; BSE-free bovine collagen

commonly used due to being more genetically compatible with humans than marine

Ovine Collagen can only be produced by Holista Colltech in Australia and NZ (2018):

Why this is a barrier:

- Holista Colltech has a patent on production process for ovine collagen- they have

exclusivity to produce ovine collagen in Australia & New Zealand

- Australian ovine is the only disease and prion-free ovine in the world: Holista

basically have a monopoly on the ovine collagen market

How to overcome this barrier:

1. Explore the possibilities of using a different extraction process- can this be used to

circumvent the patent?

2. Invest in Holista Colltech- opportunity to form partnerships: there is excess demand

for ovine collagen- a partner investment may help raise production to meet demand

3. Focus solely on bovine collagen opportunities- access to lucrative value-adding

opportunities for bovine collagen is open; major medical market players using BSE-

free bovine collagen

Counter-acting growing vegan population: Other challenges for red meat collagen

include a growing vegetarian/vegan population who will not consume animal collagen

products; additionally, 3% of the world is allergic to bovine collagen. These problems cannot

inherently be solved; however, the negative impact of these consumers on the market can

be minimised through sustainable production of bovine/ovine herds and raising public

awareness of the benefits of collagen supplements for consumers.

Recommendations for Australian bovine/ovine collagen companies:

There is opportunity for bovine collagen to increase its annual collagen supply by 40,000

tonnes to meet market demand in 2025. Based on a 10% yielding extraction process, this is

equal to 400,000 tonnes of raw bovine product. Should Australia take 12% of this (in

proportion with 2016 bovine export data), the value for secondary bovine product is

forecasted to have nearly doubled by 2025. Below are some points of focus for Australian

producers.

1. Focus on high-value opportunities- the nutraceutical market segment

Countries such as Brazil and China can undercut Australian collagen producers on price due

to factors such as lower cost of labour. Therefore, it is important for Australian companies to

service high value applications. The nutraceutical segment will experience the highest

growth in demand between 2017 and 2025 and is the second highest value per tonne

market segment as well.

5

2. Marketing of BSE-free status

As discussed, Australia’s BSE-free status is a significant competitive advantage and will be a

key selling point of bovine collagen in coming years.

3. Growing demand for Halal/Kosher certified products

Consumers of Muslim and Jewish faith are religiously forbidden to eat porcine-based

products. Therefore, bovine and ovine collagen have a good opportunity to cater to these

consumers by obtaining Halal/Kosher certification. Marine is also able to cater to these

consumers, so BSE-free countries (i.e. Australia) will need to take initiative to service the

growing demand.

6

2 Contents

Executive Summary 2

1 Introduction 7

1.1 Background 7

2 Objectives 8

3 Methodology 8

3.1 Desktop research 8

3.2 Industry consultation 8

4 Global Collagen Market 9

4.1 Definition of Collagen 9

4.2 Global Market Size 9

4.3 Applications for Collagen 10

4.4 Product Trends 11

4.4.1 Food and Beverage Products 13

4.4.2 Nutraceutical Products 13

4.4.3 Cosmetic Products 14

4.4.4 Medical Products 14

4.5 Sources of Collagen 15

4.6 Australian Industry Players 18

4.7 Key Global Market Players 19

5 Results & Discussion 21

5.1 Size of Opportunity in Collagen Market 21

5.2 Competitive Advantage for Australian red-meat collagen value-adding 23

5.2.1 BSE free status- bovine 23

5.2.2 Growing demand for Halal/Kosher products- bovine & ovine 24

5.2.3 Cost Leadership over marine collagen- bovine 24

5.3 Challenges for Australian red-meat collagen growth 25

5.3.1 Importance of accessing high-value opportunities 25

5.3.2 Growing demand for marine collagen products 25

5.3.3 Vegan/Vegetarian population growing 25

5.3.4 Ovine collagen production restricted 25

5.4 Other Relevant Considerations for red-meat value-adding parties 27

5.4.1 Other uses of bovine/ovine hides 27

7

5.4.2 De-valuation of Australian red meat skins 27

6 Summary of Findings 28

7 Bibliography 29

8 Appendices 32

8.1 In-depth overview of global market players 32

8.1.1 Food & beverage market players 32

8.1.2 Nutraceutical market players 32

8.1.3 Cosmetic market players 33

8.1.4 Medical market players 33

8.2 Figures from QY Research 35

8.3 Examples of collagen products by application and their price/kg (Figure 9) 36

8

3 Introduction

3.1 Background

MLA's "High Value Food Frontiers" strategy has an aspiration goal to significantly change

the current paradigm of commodity red meat offer with innovative products and services that

represent a 3-5 value multiplier in value; and that by 2025, 50% of the value will be derived

from these HVFF streams instead of current commodity offers.

Collagen has traditionally been processed in Australia as a commodity product and

marketed accordingly. However, some overseas companies are developing food, beauty and

sports supplements underpinned by the health benefits of high quality beef derived collagen.

These products are being imported and targeting changing consumer lifestyles and

behaviours to address high value market needs.

This report analyses the consumer trends affecting the market for high value collagen

products and provides recommendations based on these trends and market data. These

recommendations provide insight into potential opportunities for Australian companies

interested in red-meat value-adding opportunities, as well as challenges that will need to be

overcome to become a successful player in the collagen market.

9

4 Objectives

The objectives of this project involved the following:

● Future scenario business model opportunities for collagen supported by data

collection and analysis using excel charts and reports.

● Recommendations on activities that would improve the value of collagen and

resultant positive contribution to the Australian red meat industry.

● Final delivery of a sanitised case study report which describes key lessons learnt,

framework developed and recommendations for MLA to make available on MLA

website.

5 Methodology

5.1 Desktop research

Desktop research was undertaken through Internet searches. Databases such as Mintel

Innova Market Insights Database and University sources were used to enforce previous

findings with organised information on market trends.

Extracts of a report on the global collagen market authored by QY Research (QY Research

2018) was obtained to validate general findings with consistent data that was obtained

through primary research, secondary research and with industry contacts. Figures from

these are displayed throughout the report and are listed in the appendices.

5.2 Industry consultation

Industry research was undertaken by communicating with a range of companies who are

considered market leaders in various capacities within the collagen market. Communication

with industry parties was established through emails and phone call.

In-depth interviews were conducted with two Australian-based companies in particular;

Gelita and Holista Colltech. Greenleaf gratefully acknowledges the time and information that

they contributed to this project.

Communication also occurred between Greenleaf and Freeze Dry Industries, a company

interested in collagen value-adding opportunities and potential commercial applications for

their business within the collagen market.

10

6 Global Collagen Market

6.1 Definition of Collagen

Collagen is the body’s primary structural protein that maintains shape, integrity and strength

of the body. As humans age, their natural collagen production decreases, which adversely

impacts on their wellbeing. As consumers are becoming increasingly focused on health and

wellbeing, the market for products that provide boosts in the body’s collagen levels has

experienced steady growth in recent years, with a focus upon products containing animal-

based collagen. The market for value-added collagen products is expected to experience

continued growth in the years to come.

In the following sections, reference will be made to different ‘types’ of collagen. These refer

to where the collagen was sourced from the animal. 29 types of collagen have been

identified, with over 90% found in Type I and III, and Type II, IV and V, accounting for most

of the rest. Types I – V are in the following:

● Type I: 80% of dermis (skin), tendons, organs, bone

● Type II: Cartilage

● Type III: 15% of dermis (skin), reticulate fibres (e.g. bone marrow)

● Type IV: Base for cell membranes

● Type V: Dermal junction, placental tissue

6.2 Global Market Size

Global market for collagen peptides forecasted at $4.150 billion USD in 2025

According to data from QY Research, the global collagen market size has an estimated

valuation of $3.136 billion USD for 2018. The global collagen market is expected to

experience compounded annual growth (CAGR) of 5.09% from 2017-2025, resulting in an

estimated market size of $4.150 billion USD in 2025 (QY Research 2018).

11

6.3 Applications for Collagen

Table 1 provides an overview of the current annual sales by volume (measured in metric

tonnes; values as of 2017) and the projected future sales by volume (for 2025) for collagen

peptides. It also shows market share by application and expected compounded annual

growth rates for each application (QY Research 2018).

Application

2013

(MT)

2017

(MT)

2025

(MT)

Market

Share in

2025

CAGR

(%)

2017-

2025

Revenue

(million

USD

2017)

$/MT

2017

Food

17,614

21,694

32,399

27.23%

5.14%

692.38

31,916

Nutraceuticals

25,989

32,125

47,665

40.06%

5.06%

1,262.13

39,288

Cosmetics

6,605

8,239

12,374

10.40%

5.22%

306.81

37,238

Medical

9,117

11,183

16,812

14.13%

5.23%

447.26

39,995

Other

5,243

6,751

9,733

8.18%

4.68%

241.79

35,815

Total

64,568

79,993

118,983

100%

5.09%

2,950.38

36,883

Table 1: Statistics for Collagen Market by Application

The market for collagen peptides in nutraceuticals is the largest and is expected to remain

so over the next eight years, with a forecasted 40.06% market share in 2025. Food

applications are the second largest, with a forecasted 27.23% market share. Comparatively,

medical and cosmetic applications for collagen are smaller, with forecasted 2025 market

shares of 14.13% and 10.40% respectively.

Additionally, the $/MT is not as variable as may be expected. Food does have a significantly

lower $/MT, due to the competitive pricing of commodity food products. However, the pricing

for nutraceuticals, cosmetics and medical collagen peptides are all similar. This implies one

of two possibilities:

1. The high-value applications for medical collagen products (worth $ millions per kg)

are a very small proportion of the overall medical collagen market.

2. There is little difference between the grade of raw collagen peptides supplied for

each application, and most of the value-adding happens after raw material collagen

extraction.

It is more likely that the second of the two possibilities is true, as no medical grade collagen-

based products have been found through research that are worth less than $10,000 USD/kg.

Section 8.3 provides examples of medical products and their price/kg.

6.4 Product Trends

The following table (Table 2) provides an overview of consumer trends that are impacting

each application, and the product opportunities that are arising as a result of these trends.

Application

Consumer Trends

Food &

Beverage

- Millennials & young consumers are becoming more adventurous in

consumption of health food & drinks

12

- 70% of consumers are willing to consume unfamiliar food if it has a

health benefit (Mintel 2017)

- Consumers are focusing on natural sources of food- functional

ingredients popular

- ‘You are what you eat’- consumers are consuming more vitamins &

nutrients to feel and look good (Mintel 2017)

Nutraceutical

- Nutraceutical supplements focused on ease of use and functionality

- Rising middle class- higher disposable income = 88% of consumers

willing to pay more for healthy food (Nielsen 2015)

- Food is now a means for managing health & reducing disease

- Millennials taking supplements to maintain good health- 20% take

probiotics for gut health

- 47% of AUS consumers avoid refined sugar

- Functionality highest claim surrounding health food

- 73% of meal replacement drinks aimed at ‘weight & muscle gain’

(Nielsen 2015)

Biggest focus is on natural, healthy functional foods focusing on either:

1. General wellbeing

2. Performance nutrition (e.g. strength)

Cosmetic

- Asian consumers indulging in ‘luxury’ cosmetic goods

- A rising ageing population causing more demand for skincare products

Survey of ten EU states found following about skincare & cosmetics:

- 71% of consumers see them as important day to day

- 80% identify them as important for self esteem

- 82% believe they improve quality of life

In China & South Korea:

- Over 50% of premium buyers have extensive, high end beauty routines

- 63% are ‘very interested’ in high-end luxury products

Medical

Products currently in common usage:

- Tissue engineering and regeneration now common (Silva, et al. 2014)

for variety of applications, like dental, orthopaedic, surgical etc.

- Collagen-based fillers for cosmetic surgery are growing in popularity

- Bone substitutes/fillers available

A potential future medical application for collagen is organ transplants.

Development into this field has already started:

- In 2006, bladders were grown from a collagen-based scaffold and

were implanted into patient’s bodies. (Jain and Bansal 2015)

- Experimentation was undertaken in the same year on rats; their ear

cavities were successfully reconstructed using a collagen scaffold.

- 2010- approximately 500,000 Americans benefit from a transplant

annually

- 2010- Approximately 108,000 US citizens waiting for suitable

transplants; many will die (U.S. Department of Health & Human

Services 2013)

13

Technology is rapidly advancing in the field of tissue regeneration, with

scientists now able to 3D print stem cells from cellulose that multiply into a

material very similar to human cartilage tissue (CBS News 2017). They are

now looking to compounds more biologically compatible with the human body

for:

- Development of 3D-printable tissue and organs that can be safely

merged into the body.

This may be an exciting and lucrative new frontier for medical-grade collagen.

Table 2: Consumer Trends for Collagen by Application

The following sections provide examples of value-added collagen products for each

applications and the relevant consumer trends that they service.

6.4.1 Food and Beverage Products

Figure 1: Examples of Collagen-Based Food & Beverage Products

Figure 1 illustrates food and beverage products that are advertised as containing collagen.

Commonly known examples include collagen jelly and gummy products, as well as sausage

and burger casings. However, collagen beverages have begun to become mainstream

products, particularly in Asia. As seen in the far-right image, the collagen-based beverages

are marketed in a similar fashion to health and cosmetic collagen supplements, with key

words including ‘anti-ageing’, ‘radiance’ and ‘vitality’.

14

6.4.2 Nutraceutical Products

Figure 2: Examples of Collagen-Based Nutraceutical Supplements

The products in Figure 2 have a variety of health purposes and benefits. Some, such as

Optimum Nutrition’s Creatine powder, support muscular strength and endurance, or use

slow and fast release proteins to stimulate muscle growth. They also include multivitamins

for diet supplementation.

These products are examples of nutritional supplements that are targeted at providing

consumers with healthy nutritional supplements that have a particular purpose and give a

specific benefit. Some of these benefits include enhanced muscle growth, improved gut

health, natural boosts in energy levels and increased strength.

6.4.3 Cosmetic Products

15

Figure 3: Examples of Collagen-Based Cosmetic Products

The products in Figure 3 are examples of collagen-based products that are commercially

sold for cosmetic use. Skincare products include anti-wrinkle creams, face creams and anti-

ageing formulas. Other cosmetic applications include hair and nail health products, marketed

as products that ‘revitalise’ and ‘replenish’ your skin, with the focus on natural, youthful

radiance.

6.4.4 Medical Products

Figure 4: Examples of Collagen-Based Medical Products

The products in Figure 4 are examples of other collagen-based medical products. Products

such as these fulfil a wide array of applications; the above products provide only a snapshot

16

of the possible medical solutions collagen may be able to service in future. Medical products

sourced from collagen function for different purposes. These purposes include the natural

regeneration of tissue for both dental and surgical purposes, fillers for cosmetic surgery and

bone substitutes for increasing the structural integrity of bones.

Table 3 provides a more detailed overview of medical products/devices that commonly use

collagen as an active ingredient.

Medical Devices

Surgical or Medical Application

Product Types

Aesthetic Surgery

Dermal Fillers

Dental Surgery

Bone substitutes and haemostatic sponges

General Surgery

Haemostatic sponges

Orthopaedic Surgery

Bone substitutes, matrixes for cartilage engineering

Vascular Surgery

Coating solutions for vascular prostheses

Visceral Surgery

Prosthetic coatings and anti-adhesion film

Haemodialysis

Compressive haemostatic sponges

Burns and dermal reconstruction

Bi-layered dermal regeneration matrixes

Table 3: Medical devices that use collagen

Collagen is usually used in these products due to its bio-compatibility with human cells, that

enable faster regeneration of tissue and other bio-structures.

6.5 Sources of Collagen

Table 4 provides an overview of the market for each source of collagen. These figures are

values for the collagen peptides used in value-added products, not the value-added collagen

products themselves (QY Research 2018).

Source

Volume

Sales

(MT)

2017

Volume

Sales

(MT)

2025

CAGR

2017-

2025

Sales

Share

2017

Sales

Share

2025

Revenue

2018

(million $

USD)

Revenue

Share

2018

Bovine

34,053

48,819

4.61%

42.57%

41.03%

1,186.91

37.85%

Porcine

17,230

23,951

4.20%

21.54%

20.13%

568.81

18.14%

Marine

24,502

40,038

6.33%

30.63%

33.65%

1,200.24

38.28%

Others

4,208

6,175

4.91%

5.26%

5.19%

179.62

5.73%

Total

79,993

118,983

5.09%

(Average)

100%

100%

3,135.58

100%

Table 4: Statistics for Collagen Market by Source

All the collagen sources discussed share the following 2 characteristics:

1. Most abundant types are Type I and Type III collagen

2. They are rich in glycine and proline: Glycine promotes lean muscle building, prevents

ulcers & diabetes, and is an anti-inflammatory. Proline simulates collagen synthesis

and prevents cell damage (Patiry, n.d.).

17

The following section provides the benefits and negatives of each collagen source.

Bovine:

● High processing yields

● Most widely used- plenty of raw materials

● Comparatively inexpensive to marine collagen

● Able to be Halal/Kosher certified

● Negative consumer perception due to BSE (see section 5.2.1 for analysis of

Australian status)

● Culturally sensitive to those who identify as Hindu, Sikh or Buddhist (Holista Colltech

Limited 2010)

● Nearly 3% of the global population is allergic to the usage of bovine collagen

Bovine is primarily obtained from the skin and bone of the cow. Use of the collagen is also

impacted by the cow’s development stages; for example, foetal bovine dermis is used for

skin and wound healing and tendon reinforcement (QY Research 2018). Depending on the

quality of bovine hides, the yield from the processing of the hide is 8% to 20%.

Bovine collagen currently has the largest market share by volume sales with 48,819 MT of

sales, which equals a sales share of 42.57%. This is expected to decrease to 41.03% in

2025, due to large sales growth of marine collagen.

Porcine

● Cheapest collagen source

● Doesn’t suffer from same speculation regarding safety as bovine

● Culturally sensitive- forbidden for those of Jewish or Islamic faith

Porcine collagen is mostly known for its skin benefits (Further Food, 2018); however, as

seen in Figure 9, under section 4.7, it is used in a wide range of applications. Market share

(by sales volume) for porcine collagen is expected to decrease from 21.54% to 20.13%

between 2017 and 2025, with an anticipated sales volume of 23,951 MT in 2025.

Marine

● Highly bioavailable

● Considered as safe for all applications

● More expensive than other sources of collagen- low processing yields (1.2%- 12g of

collagen per 1kg of raw materials processed)

● Non-mammalian- not considered as genetically similar, which may adversely affect

usage in medical applications

Marine collagen is expected to experience high growth over the next 7-8 years, with a

forecasted CAGR of 6.33%. This will result in the sales share of marine collagen increasing

from 30.63% in 2017 to 33.65% in 2025. This is likely attributable to a more favourable

consumer perception of the safety of marine collagen over bovine collagen.

18

Ovine

● Not restricted by disease or cultural sensitivity- can be Halal certified

● Highly bioavailable

● Australia = the only disease/prion-free sheep producer in the world

● Holista Colltech (Australian company) has patented rights for production process-

they have the exclusive right to produce ovine collagen in Australia and New

Zealand. However, this also presents opportunities for investment and partnerships

to take advantage of Australia’s status as the world’s sole disease-free sheep

producer (further developed in section 5.3.3)

The production levels of ovine collagen in volume terms have been very small, with Holista

Colltech the only company in the world currently involved in ovine collagen production.

However, due to the benefits Australian ovine collagen provides, demand has outsourced

Holista’s supply. They have rejected orders that they cannot realistically meet and are

providing food-grade collagen to China for a purchase price worth nearly 3x what Chinese

manufacturers can buy locally.

There is also sufficient opportunity for value-adding raw ovine collagen; when fully refined as

medical-grade collagen, 10kg has a retail value of $5.4 million USD.

Poultry

● Generally regarded as safe

● Variable supply- affects the consistency of production (Holista Colltech Limited 2010)

● Possible transmission of avian influenza- may negatively affect consumer perception

Poultry-sourced collagen likely accounts for a significant part of the ‘other’ source of

collagen. It is chiefly processed from chicken feet. However, variable supply and difficulty in

processing/extracting poultry collagen prevents its ability to provide consistent supply to

manufacturers and will probably inhibit the growth/scalability of poultry collagen in future.

This is reflected in an absence of forecasted growth of market share; other sources of

collagen dropped from 5.26% to 5.19% of sales share from 2017 to 2025.

19

6.6 Australian Industry Players

Current gelatine or collagen production in Australia, from beef or sheep, is undertaken by

Gelita (Beaudesert, Qld), Devro (Bathurst, NSW), Sonac (Maryborough, Victoria) and Holista

Colltech (Perth, WA), amongst others.

Gelita: a world leader in gelatine and collagen production. At their Queensland facility they

process hairy cattle hides to make edible gelatine, with 60% to the confectionary industry

and the remainder to jelly crystal and dairy applications. Their production goal for 2019 is to

produce 4000 tonnes of gelatin.

Devro: involved in the manufacture, import and sale of collagen, fibrous and other food

casings. Their administration is situated in Kelso, NSW. Their products include edible

casings and films, which are used in the packaging of processed meats (sausages), and

non-edible casings and plastics, which are used as protective packaging for processed

meats (IBISWorld 2017)

Holista Colltech: as of 2017, they were the only company in the world producing sheep-

based (ovine) collagen. Their patent grants them exclusivity to extract collagen from sheep

skin in Australia and New Zealand. Additionally, should companies outside Australia seek to

copy their patented process, they would not have the same disease-free and prion-free

benefits that Holista have. They produce an estimated 48 tonne/annum of food-grade

collagen and 24 tonne/annum of cosmetic-grade collagen, from lamb and sheep hides. They

are (as of 2017) the only company in the world producing ovine (sheep collagen) and have

patented rights to their collagen extraction process.

Based on communication with major market players, the general belief is that while there is

currently enough bovine raw material supply to sustain production as it stands in 2018,

significant growth in demand for increased output may result in shortages in the necessary

bovine raw material from Australian suppliers.

20

6.7 Key Global Market Players

The companies listed in Table 5 are global leaders in their relevant collagen applications.

Certain Australian market leaders have been excluded from the table, as they are evaluated

in section 4.6 (i.e. Gelita). An in-depth overview of these companies and their scope of

operations is provided in the Appendices (section 7.1).

Company

Base Country of

Operation

Relevant Application

Source of

Collagen

Key Products

JBS- NovaProm

Brazil

Food & Beverage, Cosmetic,

Nutraceuticals, Other

Bovine

Collagen peptides for use in food, cosmetics and

health products

Rousselot B.V.

EU, South & North

America, Asia

Food & Beverage, Medical

Bovine,

Porcine

Gelatin & Collagen peptides

PB Leiner/ PB

Gelatins

Whole World

(Large EU)

Food & Beverage,

Nutraceutical

Bovine,

Porcine

Collagen peptides

Ewald Gelatine

GMBH

Germany

Food & Beverage

Bovine

Leaf, powder & Halal gelatine

Certified

Nutraceuticals Inc.

USA

Nutraceutical

Marine

Collagen general health supplements

Vital Proteins LLC

USA

Nutraceutical

Bovine,

Marine

Collagen peptide nutrition supplements & beauty

shakes

Company

Base Country of

Operation

Relevant Application

Source of

Collagen

Key Products

Nitta Gelatin

Asia, North

America

Food & Beverage,

Nutraceutical, Health, Other

Bovine, porcine,

marine

Gelatin and collagen peptides

Nippi Inc.

Japan

Nutraceutical, Food, Medical,

Cosmetic

Bovine, porcine,

marine, poultry

Gelatin, collagen peptides, casings, cosmetics and

PVC foams

ProPlenish

Australia

Cosmetic

Marine

Edible collagen cosmetic powders

Gold Collagen

United Kingdom

Cosmetic

Marine

Collagen beauty supplements

Collagen

Solutions PLC

United Kingdom

Medical

Bovine

Medical collagen biomaterials & devices

Collagen

Matrix

USA

Medical

Porcine, Bovine

Collagen medical devices- spinal, dental etc.

Geistlich

Pharma

Switzerland/

Australia

Medical

Bovine

Natural bone substitutes & tissue regeneration

Medtronic

PLC

Ireland/USA

Medical

Porcine

Collagen repair patch

Advanced

Biomatrix

USA

Medical

Bovine

Collagen powders & solutions

Table 5: Overview of Key Collagen Market Players

21

7 Results & Discussion

7.1 Size of Opportunity in Collagen Market

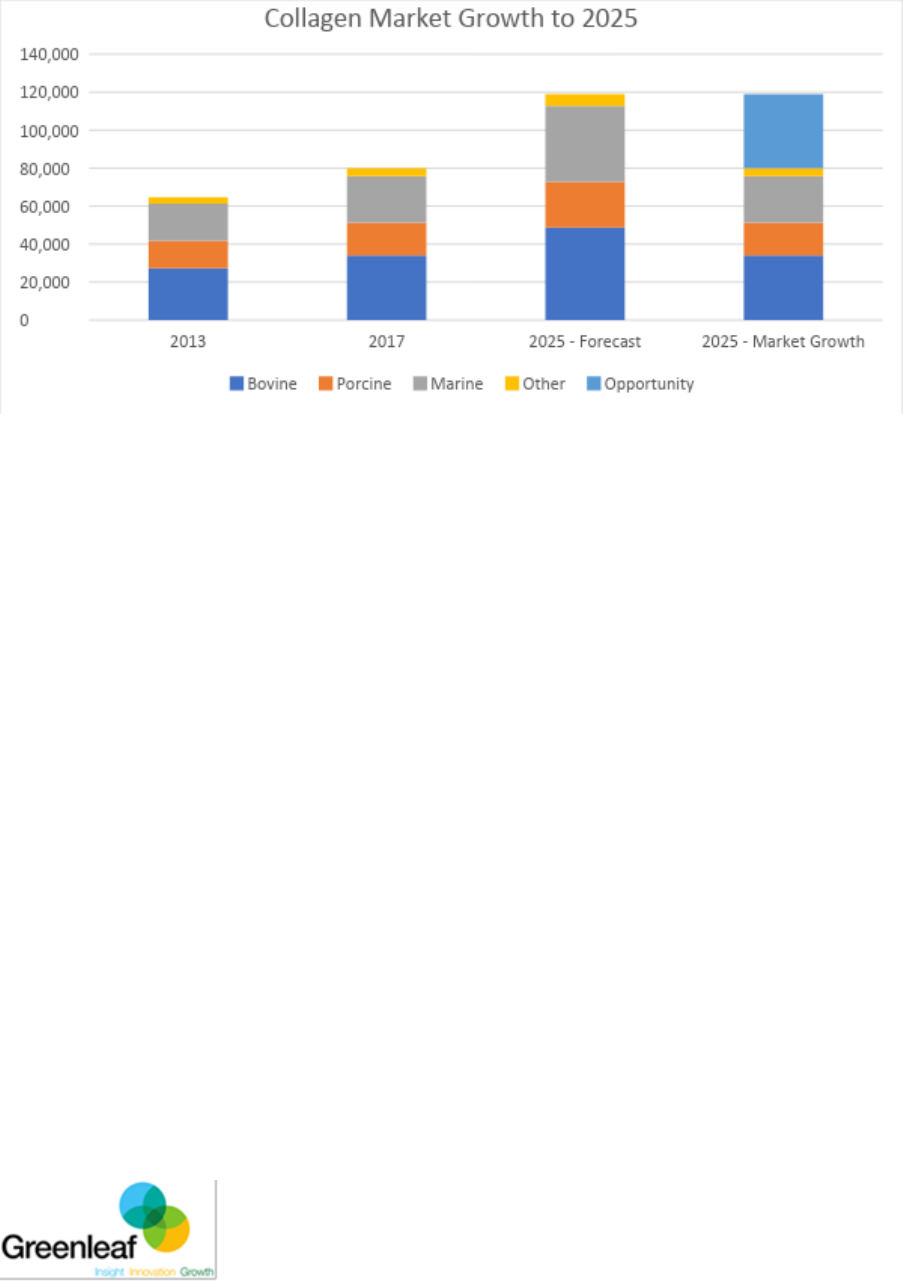

Figure 5: Collagen market growth by volume (MT) to 2025

Figure 5 compares the total volume (MT) of collagen the market needs to meet demand in

2017 and 2025. The light blue section in 2025- Market Growth represents the opportunity for

bovine collagen to increase the volume of supply to the collagen market. This represents

approximately 40,000 tonnes of collagen. Based on the collagen extraction process for

bovine collagen having a yield efficiency of 10%, this means there is opportunity for bovine

collagen equal to 400,000 tonnes of raw bovine product (e.g. hides) in 2025.

The value opportunity for Australian bovine collagen to cater to market demand is explained

in the analysis of Figure 6.

22

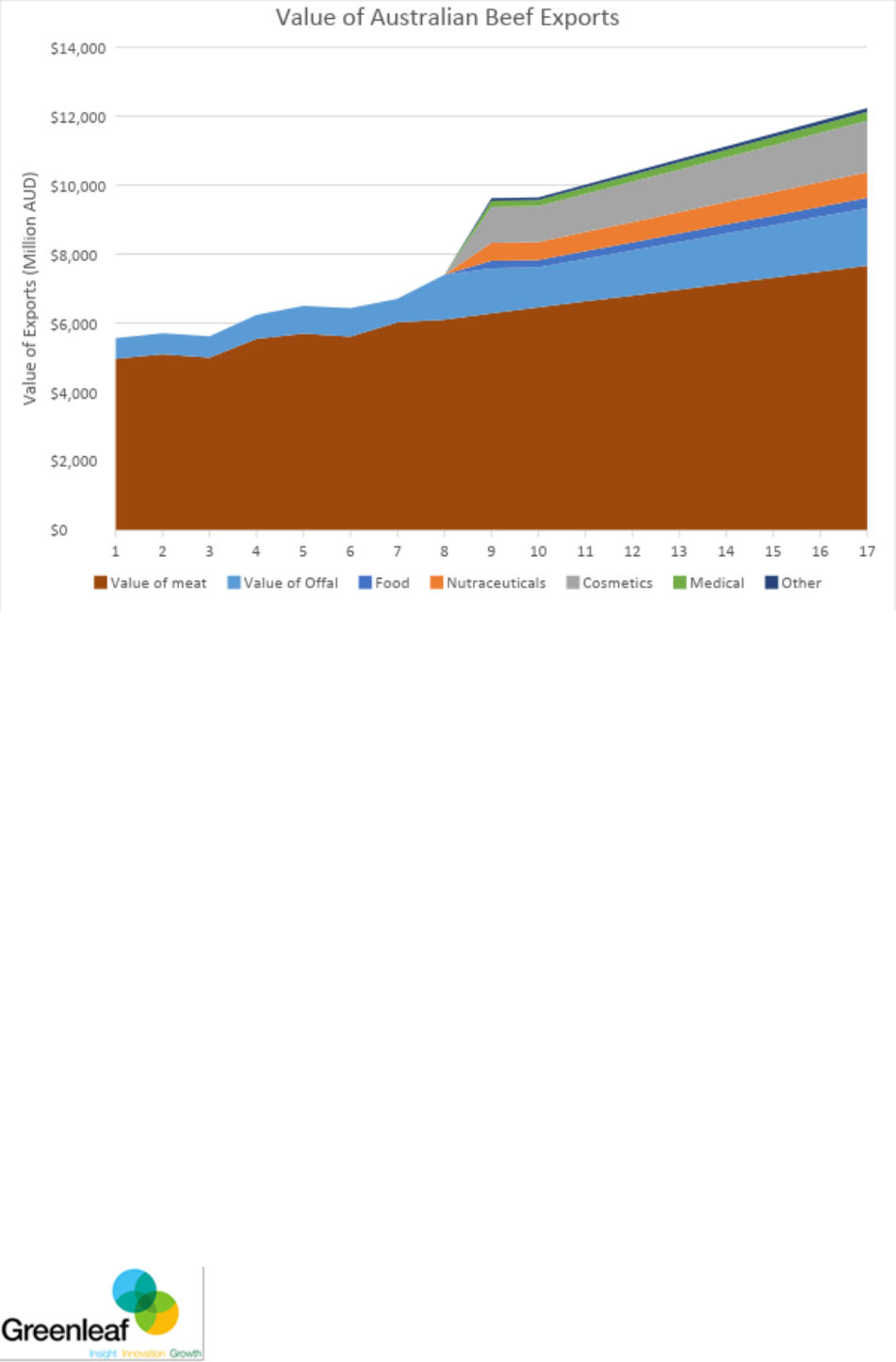

Figure 6: Value Increase for Australian Beef Exports due to bovine collagen production

Figure 6 represents the growth in value Australia will derive from meeting the growing

market demand for the relevant collagen products. This is assuming Australia accounts for

12% of bovine collagen products (in proportion with 2016 bovine export figures)- the volume

of collagen is distributed evenly across collagen market segments.

Figure 6 shows that the value for secondary products (offal, bones, hides) has nearly

doubled between 2017 and 2025. It should also be noted that should Australia leverage the

access we have to marketing and technology in a way that emphasises the benefits of using

Australian bovine collagen (as discussed in the following sections), the realised value

multiplier could be much higher (as Australia will account for a higher proportion of collagen

supply than 12%).

23

Figure 7: Collagen market segment growth by volume (MT) and value (USD/MT) to 2025

The trend lines in Figure 7 represent the value (USD) per tonne for collagen by segment.

Value increase for collagen to 2025 is minimal. The primary increase in market value for

collagen is the increase in volume. This increase is largely due to an increase in demand for

food and nutraceutical collagen sales. Nutraceutical collagen yields a substantially higher

sale price per tonne than food collagen; as the market segment with the highest demand and

the second highest $/MT, this should be an area of focus for collagen producers.

7.2 Competitive Advantage for Australian red-meat collagen value-adding

7.2.1 BSE free status- bovine

The recent outbreak of BSE cases among cattle has resulted in consumer uncertainty

regarding the safety of consuming bovine-sourced collagen. This has led to a decrease in its

usage in various collagen applications, substituted chiefly by marine collagen. Therefore, it is

logical to assume that this provides BSE-free countries (such as Australia) with a competitive

advantage for supplying bovine collagen, as their no-risk-of-BSE classification enables them

to assure consumers that their products are 100% disease free.

24

However, while advertising products as BSE-free may be somewhat useful as a marketing

tool to influence consumers, it does not actually have any tangible advantage. The OIE

Terrestrial Animal Health Code (which is the global standard for animal health and product

trading) states that there is no need for veterinary authorities to utilise any BSE related

conditions for ‘gelatine and collagen prepared exclusively from hides and skins’. This is

because there is a negligible risk of disease transmission through products sourced from

hides or skins. As hides and skin are classified as Type I and III collagen, the most abundant

collagen sources used, the BSE-status of countries manufacturing most bovine collagen

products is actually of little relevance.

Despite this, companies involved heavily in production of collagen sourced from bovines

believed that BSE-free was a big selling point, particularly to Asian countries. This was due

to consumers finding greater security in their knowledge that the collagen contained in their

product was sourced from a disease-free country. Thus, Australian- based companies

should seek to market their BSE-free status when selling bovine collagen or BSE-free

collagen products.

7.2.2 Growing demand for Halal/Kosher products- bovine & ovine

Porcine products are forbidden for consumption by people of Islamic and Jewish religion. As

a result, demand is expected to rise heavily for bovine/ovine products that are kosher and

halal-certified.

Marine collagen will also threaten to steal this growth- however, bovine and ovine producers

can use to their advantage the more cost-effective and higher yielding extraction processes

they have access to. This will enable them to compete effectively in the halal/kosher market

through cost leadership.

7.2.3 Cost Leadership over marine collagen- bovine

Table 6 in section 8.2 shows the $/MT based on the collagen source. The 2018 $/MT for

bovine collagen is $33,457 USD, whereas marine is $45,539 USD. This is likely due to

bovine collagen having a higher-yielding extraction process than marine (8-20% compared

to 1.2%); greater efficiency allows bovine collagen processors to charge a more competitive

price. While this is not likely to be an influencing factor for high-value multiplier products in

medical applications, for low-value commodity products in food applications this is a serious

competitive advantage for bovine collagen producers.

25

7.3 Challenges for Australian red-meat collagen growth

7.3.1 Importance of accessing high-value opportunities

For commodity items such as gelatin, there is heavy competition from countries such as

China and South American countries such as Brazil, who can undercut Australia on price.

This is due to factors such as lower costs in labour and raw materials. Therefore, it is

critical for Australian companies to look beyond low-value commodity goods and to

higher-value opportunities that are emerging within the global collagen market.

7.3.2 Growing demand for marine collagen products

Market statistics for marine collagen are provided in Figure 7. It can be seen that marine

collagen has the highest expected CAGR to 2025, at 6.33%. This will provide the marine

collagen market with an approximate 3% gain in volume sales share at the expense of

bovine and porcine collagen. Additionally, as it is more expensive than bovine collagen, it will

have a higher share of revenue, obtaining 38.28% of revenue share in 2018 compared to

37.85% for bovine collagen.

Thus, marine collagen is a serious competitor for bovine collagen, largely due to its higher

bioavailability and perceived higher sustainability. It also does not have the same consumer

misgivings regarding its safety for human consumption and is thus considered a safer

collagen source than bovine collagen.

As mentioned in section 5.2.3, one of the key points of difference for bovine collagen is the

cheaper price per metric tonne, and the more effective extraction processes. Additionally, for

medical purposes, key market players such as Collagen Solutions PLC and Advanced

Biomatrix use BSE-free collagen. This is likely due to bovine collagen having closer genetic

similarity to humans than marine collagen.

7.3.3 Vegan/Vegetarian population growing

Another industry growth inhibitor is the increasingly popular vegetarian/vegan trend. As

collagen can be naturally produced, consuming collagen growth stimulants such as silica,

vitamins and soy are collagen alternatives that vegetarians and vegans may take so they

don’t have to consume bovine collagen sources (Lam-Feist 2017).

The negative impact of these consumers on the red-meat collagen market can be minimised

through sustainable production of bovine/ovine herds and raising public awareness of the

benefits of collagen supplements for consumers.

7.3.4 Ovine collagen production restricted

As mentioned previously, Holista Colltech has a patent on the production process for ovine

collagen, that grants them exclusivity to produce this in Australia and New Zealand.

Additionally, countries that wish to produce ovine collagen outside Australia/New Zealand

26

will not have access to the same disease-free and prion-free benefits that Holista do. With

these factors in play, three viable options with regards to ovine collagen are:

1. Focus solely on bovine collagen opportunities

The market for bovine collagen is large and developed, with bovine collagen being widely

used across most applications for collagen. Access to lucrative value-adding opportunities

for bovine collagen is open, with much of the medical segment opting to use BSE-free

bovine collagen over other sources (see Table 5 for examples of major market players who

are using bovine collagen). As Australian bovine has BSE-free status, it presents a

competitive advantage over countries that do not have this status (as discussed in section

5.2.1). Therefore, Australian bovine collagen is likely to continue as a competitive collagen

source in coming years.

2. Explore the possibilities of using a different extraction process

There is some ambiguity regarding Holista Colltech’s patent (based on Greenleaf’s

research). In contact with Holista Colltech, their patent was described as providing them with

a process that was not allowed to be copied. It may be possible that if a process sufficiently

different to theirs is developed, ovine collagen can be extracted from Australian sheep by

other companies. Should this option be of interest, further research into the coverage of the

patent and other methods of extraction would be necessary.

3. Invest in Holista Colltech- opportunities to form partnerships

Holista Colltech currently uses a mid-scale production plant to cater for orders from collagen

value-adding companies. They are not currently producing at their 72 tonne/annum

production target. There is much higher demand than they are able to cater for- an order of

280 tonnes per annum (from China) was rejected due to their factory not being able to meet

this level of production sustainably (Williamson 2017).

Holista have registered interest in investment and partnership opportunities. As there is

unmet demand for ovine collagen, and Australian ovine collagen has exclusive disease-free

benefits, this may be a valuable opportunity for companies looking to value-add collagen to

source or create high-value ovine collagen-based products.

27

7.4 Other Relevant Considerations for red-meat value-adding parties

7.4.1 Other uses of bovine/ovine hides

Most of the bovine/ovine collagen used in value-added products is obtained from the hide of

the animals. Therefore, for collagen extraction to be worthwhile for red meat processors, the

price obtained for the hide must exceed the value they can obtain from using them for

alternative applications such as leather.

7.4.2 De-valuation of Australian red meat skins

Recent de-valuation in the price paid for bovine/ovine skins means that value-adding

processes like collagen extraction are becoming more important for the consideration of red

meat processors. If greater value can be obtained from skins through collagen extraction

than through selling the hides, then red meat processors should explore the equipment they

need to facilitate the extraction process and determine how worthwhile/profitable an

investment this would be. When extracting collagen, raw materials (hides) account for

approximately 82.26% of the cost of extraction (QY Research 2018), as seen in Figure 8.

Figure 8: Cost of Manufacture for Collagen Peptides

28

8 Summary of Findings

For Australian companies, it is important to use the BSE-free status of Australian bovine as a

selling point for bovine collagen and value added bovine collagen products. This status will

be particularly useful in the medical space and will provide a competitive advantage across

all applications. Additionally, Halal/Kosher certification will be of benefit for bovine collagen

producers and value-added products, as this will allow them to cater to the growing demand

for such products from Muslim and Jewish consumers.

The growth in popularity of marine collagen is a source of competition for bovine collagen,

particularly in nutraceutical and cosmetic applications. However, BSE-free bovine collagen

will find competitive advantage in its more efficient, higher-yielding extraction processes,

which enable it to be sold at a cheaper price per tonne than marine collagen. Countries like

Brazil have lower costs than Australia, so Australian producers should be aware that cost

leadership may not be a particularly sustainable strategy and should rather focus on high

quality BSE-free collagen opportunities in high value applications (i.e. nutraceutical,

medical). As nutraceutical collagen also has both the highest market demand and forecasted

growth to 2025, it is recommended that Australian collagen producers focus on the

nutraceutical collagen segment in the coming years.

Opportunities for ovine collagen production and value-added opportunities is limited by

Holista Colltech’s patent, which is currently preventing supply from meeting demand.

However, this presents a business proposition for interested companies to seek partnerships

and investment opportunities with Holista to scale up production and access new high value

opportunities for Australian ovine collagen.

Overall, there are a range of value-adding opportunities for red meat collagen producers that

will multiply the value obtained from the raw material sources of collagen. It is recommended

that companies involved in the Australian red meat industry explore ways to seize the

opportunities discussed in this report, through involvement in the value-adding of collagen to

service current and future demand for collagen-based products.

29

9 Bibliography

Advanced BioMatrix. n.d. https://www.advancedbiomatrix.com/collagen-type-i/purecol-type-i-

bovine-collagen-lyophilized-15mg/ (accessed May 28, 2018).

Bloomberg L.P. Company Overview of Nippi, Incorporated. 2018.

https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=881153

(accessed May 23, 2018).

CBS News. Scientists hit milestone in 3D printing of cartilage. 5 May 2017.

https://www.cbsnews.com/news/scientists-hit-milestone-in-successful-3d-printing-of-

cartilage/ (accessed June 12, 2018).

Certified Nutraceuticals. Healthy Living through Innovative Technology. 2018.

http://certifiednutra.com/products-telos95.php (accessed May 28, 2018).

Covidien. Covidien Collagen Repair Patch. 2009.

http://www.medtronic.com/content/dam/covidien/library/us/en/product/sports-

surgery/collagen-repair-patch-faqs.pdf (accessed May 31, 2018).

delicious. Why vegan is the fastest growing food movement in the world. 28 May 2017.

https://www.delicious.com.au/food-files/article/why-vegan-fastest-growing-food-

movement-world/pGyK8ZIL (accessed June 21, 2018).

Ewald Gelatine. Quality, Safety and Innovation. 2018. https://www.ewaldgelatine.de/english/

(accessed May 29, 2018).

Further Food. What are the types of collagen? 2018. https://www.furtherfood.com/what-are-

the-types-of-collagen/ (accessed June 6, 2018).

Gold Collagen. Products. 2018. http://www.gold-collagen.com/uk/products (accessed June

3, 2018).

Hardman & Co. Collagen Solutions plc (COS.L) Initiation. 2014.

http://ir.collagensolutions.com/pdf/research/Hardman_Research_24Sept2014.pdf

(accessed May 23, 2018).

Holista Colltech. Different Sources of Collagen. 4 June 2018.

http://www.holistaco.com/index.php?option=com_content&view=article&id=392

(accessed June 11, 2018).

Holista Colltech Limited. OviColl. 2010. http://ovicoll.com/about.php (accessed June 7,

2018).

IBISWorld. Devro Pty Limited- Profile Company Report Australia. 31 December 2017.

https://www.ibisworld.com.au/australian-company-research-

reports/manufacturing/devro-pty-limited-company.html (accessed June 20, 2018).

30

iHerb. Neocell, Super Collagen, Type 1 & 3, 7 oz (198 g). 2018.

https://au.iherb.com/pr/Neocell-Super-Collagen-Type-1-3-7-oz-198-g/6074 (accessed

June 20, 2018).

Jain, Aditya, and Ramta Bansal. Applications of regenerative medicine in organ

transplantation. September 2015.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4517320/ (accessed June 11, 2018).

Lam-Feist, Monica. “A Vegetarian's Guide to COllagen and Healthy Bones.” AlgaeCal. 20

July 2017. https://www.algaecal.com/expert-insights/vegetarians-guide-protein-

collagen-healthy-bones/ (accessed May 25, 2018).

MarketsandMarkets Research Private Ltd. Collagen & Gelatin Market for Regenerative

Medicine (by Source (Bovine, Porcine, Marine), Application (Wound Care,

Orthopedic, Cardiovascular)), Value and Volume Analysis - Global Forecast to 2022.

2017. https://www.marketsandmarkets.com/Market-Reports/collagen-gelatin-

regenerative-medicine-market-

95663122.html?gclid=Cj0KCQjwuMrXBRC_ARIsALWZrIhlwIML9Ir4RifcXMyBqm_3M

1G895wB8YDirTW-m2OiHh6xVb-pw9MaAhOXEALw_wcB (accessed May 10,

2018).

Mintel. Collagen finds mainstream appeal in smoothie offerings. 21 August 2017.

http://reports.mintel.com/display/850695/?highlight (accessed June 6, 2018).

Nielsen. “We are What we Eat.” Nielsen Global Health and Wellness Survey. January 2015.

https://www.nielsen.com/content/dam/nielsenglobal/eu/nielseninsights/pdfs/Nielsen%

20Global%20Health%20and%20Wellness%20Report%20-%20January%202015.pdf

(accessed May 28, 2018).

Nitta Gelatin. Unlocking the Potential of Gelatin & Collagen for Over a Century. 9 March

2018. http://nitta-gelatin.com/ (accessed May 25, 2018).

NovaProm. Collagen & Food Ingredients. 2018. http://www.novaprom.com.br/en/ (accessed

May 25, 2018).

Patiry, Megan. Bovine Collagen VS Marine Collagen. n.d.

https://blog.paleohacks.com/bovine-collagen-vs-marine-collagen/# (accessed June 6,

2018).

ProPlenish. ProPlenish Shop. 2018. https://www.proplenish.com.au/product/anti-ageing-

facemask/ (accessed May 31, 2018).

QY Research. Global Collagen Peptide Market Research Report. Commercial , QY

Research, 2018.

Rousselot. Reaching Further Together. 2018. https://www.rousselot.com/ (accessed May 28,

2018).

31

Roy Morgan. The slow but steady rise of vegetarianism in Australia. 15 August 2016.

http://www.roymorgan.com/findings/vegetarianisms-slow-but-steady-rise-in-australia-

201608151105 (accessed June 21, 2018).

Silva, Tiago, Joana Moreira-Silva, Ana Marques, Alberta Domingues, Yves Bayon, and Rui

Reis. Marine Origin Collagens and Its Potential Applications. 5 December 2014.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4278207/ (accessed May 11, 2018).

Tessenderlo Group. Solugel. 2017. http://www.gelatin.com/en/Pages/SOLUGEL.aspx

(accessed June 21, 2018).

U.S. Department of Health & Human Services. Regenerative Medicine. 29 March 2013.

https://report.nih.gov/nihfactsheets/ViewFactSheet.aspx?csid=62 (accessed May 15,

2018).

Vital Proteins. Our Story. 2018. https://www.vitalproteins.com/pages/our-story (accessed

June 21, 2018).

Williamson, Rachel. “An ASX-listed company wants to do what with my collagen?”

Stockhead. 21 August 2017. https://stockhead.com.au/health/an-asx-listed-company-

wants-to-do-what-with-my-collagen/ (accessed May 25, 2018).

10 Appendices

10.1 In-depth overview of global market players

10.1.1 Food & beverage market players

Company: JBS NovaProm

Primary Country: Brazil

Key Applications: Food & Beverage, Cosmetic, Medical, Other

Source: Bovine

Description: NovaProm is a business division of the JBS Group

Company: Rousselot B.V.

Primary Country: EU, South & North America, Asia

Key Applications: Food & Beverage, Medical

Source: Bovine, Porcine

Description: They are a leading producer of gelatin and collagen peptides. (Rousselot

2018).

Company: PB Leiner/PB Gelatins

Primary Country: Whole World (Large EU)

Key Applications: Food & Beverage, Nutraceutical

Source: Bovine, Porcine

Description: They provide easily digestible, quick absorption collagen peptides.

(Tessenderlo Group 2017).

32

Company: Ewald Gelatine GMBH

Primary Country: Germany

Key Applications: Food & Beverage

Source: Bovine

Description: They provide a range of qualities of leaf gelatine, powder gelatine, Halal

gelatine and organic gelatine. Users of their products include hotels, restaurants, patisseries,

bakeries and households (Ewald Gelatine 2018).

10.1.2 Nutraceutical market players

Company: Certified Nutraceuticals Inc.

Primary Country: USA

Key Applications: Nutraceutical

Source: Marine

Description: They specialise in quality collagen nutritional ingredients for cardiovascular,

joint, skin, eye health and anti-aging support (Certified Nutraceuticals 2018).

Company: Vital Proteins LLC

Primary Country: USA

Key Applications: Nutraceutical

Source: Bovine (Australia, New Zealand), Marine (Hawaii)

Description: They promote health, fitness and natural beauty through sustainably-sourced

nutrition products. They sell collagen peptide dietary supplements, beauty shakes and

protein powders (Vital Proteins 2018).

Company: Nitta Gelatin

Primary Country: Asia, North America

Key Applications: Nutraceutical, Food and Beverage, Health, Other

Source: Bovine, Porcine, Marine

Description: Nitta Gelatin supply high quality gelatin and collagen peptides. (Nitta Gelatin

2018).

Company: Nippi Inc.

Primary Country: Japan

Key Applications: Nutraceutical, Food, Medical, Cosmetic

Source: Bovine, Porcine, Marine, Poultry

Description: They manufacture gelatin, collagen peptides, casings, cosmetics and PVC

foams. (Bloomberg L.P. 2018).\

10.1.3 Cosmetic market players

Company: Gold Collagen

Primary Country: United Kingdom

Key Applications: Cosmetic

Source: Marine

Description: Gold Collagen provide clinically tested beauty supplements, mainly for

skincare purposes, as well as the promotion of healthy hair and nails (Gold Collagen 2018).

33

Company: ProPlenish

Primary Country: Australia

Key Applications: Cosmetic

Source: Marine

Description: ProPlenish is an Australian brand that was the first to provide edible marine

collagen products to the Australian market. Many of their products are provided in a powder

form that are dissolvable, and are marketed as ‘reinvigorating your skin, hair and nails’. They

also provide other cosmetic products like anti-ageing facemasks, which are to be used in

conjunction with their collagen oral supplements. (ProPlenish, 2018)

10.1.4 Medical market players

Company: Collagen Solutions PLC

Primary Country: United Kingdom

Key Applications: Medical

Source: Bovine (Australia, New Zealand)

Description: Collagen Solutions create biodegradable/bio resorbable devices, and supply

medical collagen biomaterials for research purposes, medical devices and regenerative

medicine. Their goal (as of 2014) was to move from acting a supplier of purified, functional

collagen that was valued at $500-$1,000 per gram to developing and supplying medical

devices that contained the same collagen, but were valued at prices upwards of $1,000 per

gram (Hardman & Co, 2014).

Company: Collagen Matrix

Primary Country: USA

Key Applications: Medical

Source: Porcine, Bovine

Description: Collagen Matrix offers collagen and mineral based medical devices that

support the body’s natural regenerative ability. They provide clinical application solutions for

dental, spinal, orthopaedic, dural repair and nerve repair.

Company: Geistlich Pharma

Primary Country: Switzerland/Australia

Key Applications: Medical

Source: Bovine

Description: Geistlich are market leaders in natural bone substitutes for regenerative

dentistry. Some of the products they sell include Bone Substitutes, Membranes for tissue

regeneration and matrices for soft-tissue regeneration and tissue grafts.

Company: Medtronic PLC

Primary Country: Ireland/USA

Key Applications: Medical

Source: Porcine

Description: Their collagen repair patch is a trusted, reliable soft tissue reinforcement

material. Over 250,000 of these patches have been implanted in medical procedures since

34

1998. It is derived from pig dermis and is used for tissue repair across many surgical

disciplines (Covidien, 2009).

Company: Advanced Biomatrix

Primary Country: USA

Key Applications: Medical

Source: Bovine

Description: Advanced Biomatrix is an industry leader in 3D applications for tissue culture,

cell assay, and cell proliferation. They sell a wide range of medical solutions and powders

(not all collagen-based). They are an industry leader in the science of 3D applications for

tissue culture and cell proliferation.

10.2 Figures from QY Research

Source

2013

2014

2015

2016

2017

2018 (E)

Bovine

32,502

32,617

32,636

33,107

33,365

33,457

Porcine

30,215

30,613

30,243

30,910

31,252

31,564

Marine

44,265

44,531

44,081

44,918

45,261

45,539

Others

38,695

38,909

38,672

39,349

39,625

39,796

Average

35,883

36,224

35,906

36,572

36,883

37,166

Table 6: Global Collagen Peptide Price (USD/MT) by source

Application

2013

2014

2015

2016

2017

2018 (E)

Food

17,614

18,615

19,251

20,604

21,694

23,049

Nutraceuticals

25,989

27,792

29,213

30,925

32,125

34,034

Cosmetics

6,605

7,118

7,502

7,967

8,239

8,563

Medical

9,117

9,645

10,360

10,766

11,183

11,811

Others

5,243

5,673

6,019

6,418

6,751

6,910

Total

64,568

68,842

72,345

76,681

79,993

84,367

Table 7: Global Collagen Peptide Sales (MT) by Application (2013-18)

Revenue

2013

2014

2015

2016

2017

2018 (E)

Bovine

890.88

951.46

974.58

1077.66

1136.19

1186.91

Porcine

434.51

470.81

483.09

513.86

538.49

568.81

Marine

864.58

933.78

995.30

1052.94

1108.98

1200.24

Others

126.92

137.68

144.64

159.92

166.73

179.62

Total

2316.89

2493.73

2597.62

2804.38

2950.38

3135.58

Table 8: Global Collagen Peptide Revenue (million USD) by Source

35

10.3 Examples of collagen products by application and their price/kg (Figure

9)

Company

Product

Application

Collagen-related

ingredients

How it is obtained

Advanced

Biomatrix

PureCol

Lyophilized

Medical- prepares thin layers

for culturing cells

Bovine collagen

(Type I)

Isolated from bovine

hide- >99.9% purity

PureCol EZ Gel

(5mg/mL = 0.5%)

Medical- Improve gel

consistency for cell cultures

Bovine Collagen

Bovine Collagen

Solution

Medical- provides structure for

connective tissue

Bovine Collagen

(Type V)

Isolated from

placenta- final purity

of >95%

Bovine Collagen

Lyophilized Fibrous

Powder

Medical- prepared into tissue

scaffolds, foams, putties etc.

Bovine Collagen

(Type I)

Extracted from

bovine flexor

tendon- >96% purity

Beauty &

Go

Skin Detox

Bioactive Beauty

Drink

Beverage/Health- Skin purifying

drink with antioxidants

Collagen Peptides

Bioactive Collagen

Shot

Beverage/Cosmetic- Firms skin

and smooths wrinkles

Collagen

Ewald

Gelatine

Gelatine Powder

Food- prepared into jellies and

mousse

Porcine Collagen

Extracted from pig

hide

Leaf Gelatine

Sheets

Food- prepared into jellies and

soups

Porcine Collagen

Extracted form pig

hide

Gelatin

Health

Joint Care

Health- Joint Mobility &

Cartilage Formation

Bovine Collagen

Soft Skin

Cosmetic- Wrinkle reduction &

smoother skin

Bovine Collagen

Pet Care Collagen

Health- General mobility and

wellbeing

Collagen peptides

Gold

Collagen

Gold Collagen

Hairlift

Cosmetic- Healthy hair growth

Marine Collagen

Pure Gold

Collagen

Cosmetic- Hair, skin & nail

health

Marine Collagen

Nature’s

Way

Beauty Collagen

Powder

Cosmetic- Healthy, smooth skin

Collagen (Type I &

III)

Collagen Bone

Broth

Health- Joint & Gut Health

Bone Broth &

Hydrolysed Collagen

The Beauty

Chef

Collagen Inner

Beauty Boost

Health- Probiotic Elixir

(VEGAN Alternative)

Does not actually

contain collagen