Dear Clients and Friends,

Houlihan Lokey is pleased to present its inaugural Legal Technology and Services Industry Update.

We have included a sector overview, recent M&A and investment themes, relevant transaction

announcements, a public markets overview, and other insights to help you stay ahead in our dynamic

and constantly evolving industry.

This issue spotlights alternative legal services providers (ALSPs) and some of the key industry trends

and investment themes observed in the sector.

We hope you find this update to be informative and that it serves as a valuable resource to you in

staying abreast of the market. If there is additional content you would find useful for future updates,

please don’t hesitate to call or email us with your suggestions.

We look forward to staying in touch with you.

Regards,

2

Legal Technology and Services Q3 Update

Industry Subsectors Covered

Attorney Workflow

Solutions

Alternative Legal

Services Providers

Enterprise Legal

Management Software

Legal Practice

Management Software

Chin Pandya

Director, BPO and Legal

Services

Los Angeles

310.789.5758

Julian Moore

Managing Director, Joint

Head of Legal Software

London

+44 (0) 20 7907 4219

Charlie Stocks

Managing Director, Joint

Head of Legal Software

New York

Charlie.Stoc[email protected]

917.751.7087

Tom Battersby

Director, BPO and Legal

Services

Manchester

+44 (0) 161 240 6424

3

Houlihan Lokey is the trusted advisor to more top

decision makers than any other independent global

investment bank.

Houlihan Lokey Transactions in the Legal Technology and Services Sector

Market Leader Across Sectors and Geographies

Tombstones included herein represent transactions closed from 2018 forward.

*Selected transactions were executed by Houlihan Lokey professionals while at other firms acquired by Houlihan Lokey

or by professionals from a Houlihan Lokey joint venture company.

2021 Investment Banking Rankings

All Global Technology Transactions

Advisor

Deals

1

Houlihan Lokey

124

2

Goldman Sachs

114

3

JP Morgan

91

4

Morgan Stanley

87

5

William Blair

67

Source: Refinitiv. Excludes accounting firms and brokers.

Houlihan Lokey is the trusted advisor to more top decision-makers than any

other independent global investment bank.

has been acquired by

a portfolio company of

Sellside Advisor

has been acquired by

a portfolio company of

Sellside Advisor

a portfolio company of

has acquired

Buyside Advisor

a portfolio company of

has acquired

Buyside Advisor

has acquired

a portfolio company of

Buyside Advisor

has been acquired by

a portfolio company of

Sellside Advisor

has acquired

a portfolio company of

Buyside Advisor

has been acquired by

Sellside Advisor

has been acquired by

a portfolio company of

Sellside Advisor

has been acquired by

Sellside Advisor*

a subsidiary of

has been acquired by

Sellside Advisor

has been acquired by

Sellside Advisor

has been acquired by

a portfolio company of

Sellside Advisor

a subsidiary of

has been acquired by

a portfolio company of

Sellside Advisor

2021 Investment Banking Rankings

All Global Transactions

Advisor Deals

1 Houlihan Lokey 549

2 Goldman Sachs 511

3 JP Morgan 508

4 Rothschild 437

5 Morgan Stanley 393

Source: Refinitiv. Excludes accounting firms and brokers.

2021 M&A Advisory Rankings

All Global Business Services Transactions

Advisor Deals

1

Houlihan Lokey 80

2

PricewaterhouseCoopers 65

3

KPMG 60

4 K3 Capital Group 45

5

Deloitte 43

Source: Refinitiv.

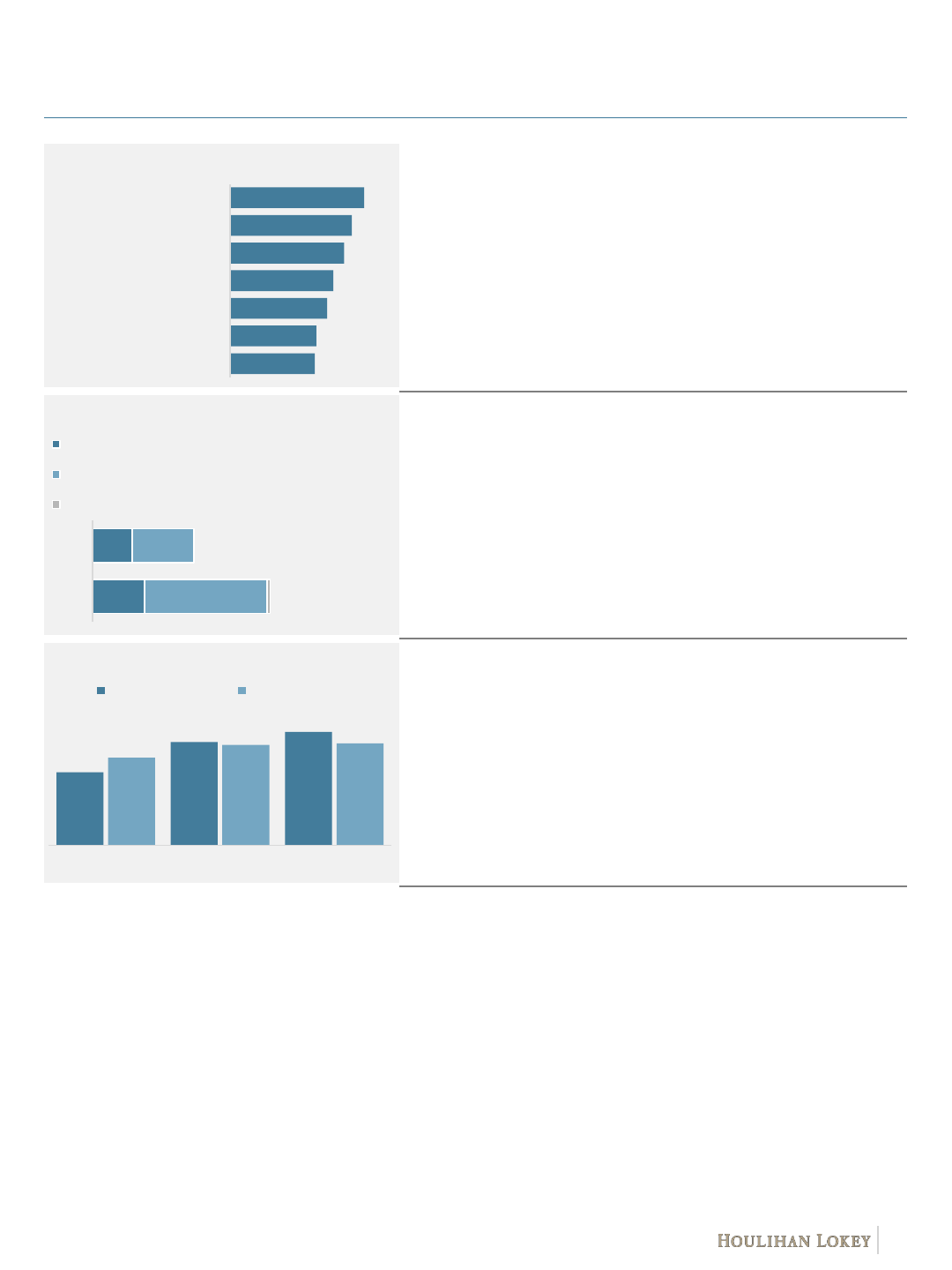

$17.3

$17.6

$18.4

$20.8

$22.2

$23.6

$25.2

2019 2020 2021 2022 2023 2024 2025

Sources: Allied Market Research, Thomson Reuters, Statista, industry research.

4

Overview

The legal technology and services sector, comprising software and/or services providers to law firms

and corporate legal departments offering everything from point solutions to end-to-end capabilities,

will continue to see significant investment and growth driven by a number of broad market trends.

• Legal software market is expected to reach $25.2 billion in 2025, driven by the demand for legal expertise

and the influx of new tech, such as advances in cloud computing, remote work, and machine learning.

• The ALSP market is worth ~$14 billion and has become a growing part of the legal landscape, driven by the

need for more efficiency and speed to handle the growing volume of legal work, combined with tightening

budgets, driving demand for cost-effective alternatives to outside counsel or hiring in-house resources.

At a Glance

CAGR 6.4%

Global Legal Tech Market ($B)

▪ Over 2019–2025, the global legal tech market is

expected to post a 6.4% CAGR to reach $25.2

billion from $17.3 billion.

▪ The sizeable growth in the adoption of legal tech

is driven by the rising opportunities available in the

legal services market, which has allowed for

greater awareness of tech-related solutions for

purposes such as billing and tracking, document

management, and payment processing.

▪ The associated benefits of using software

solutions, such as contract management and

efficient legal data analysis, are further boosting

the demand for legal software solutions.

Legal Technology and Services Subsectors

These solutions will help in-house legal departments manage and optimize legal operations and

workflows, including legal spend and eBilling, matter management, contract management, IP

management, entity management, legal hold, compliance management, and search and reporting.

These solutions will help law firms manage and optimize firm operations and workflows,

including practice management software, billing and time management software, and case

management software.

Software, data, and tools for legal professionals will increase efficiency in delivery of legal

services and insights, including contract management, eDiscovery, document management,

verdict and regulatory research, AI and advanced analytics, and IP management.

Enterprise

Legal

Management

Software

Alternative

Legal Service

Providers

Their comprehensive services, traditionally offered by or procured from law firms, include

litigation and investigation support, legal research, document review, eDiscovery, legal process

outsourcing, IP filing and renewals, legal translation, compliance services, legal staffing,

settlements administration, and firm support services.

Legal Practice

Management

Software

Attorney

Workflow

Solutions

Sources: Globalscape, Gartner, Corporate Legal Operations Consortium (CLOC), industry research.

(1) Based on a Gartner study of 117 organizations in the second half of 2020.

5

Common Themes and Value Drivers Across the

Sector

Cloud and AI Adoption Driving Push to Adopt New

Technology

As corporates worldwide move their IT systems away from

on-premise hosted solutions to cost-effective public cloud

deployments, legal departments are shifting their reliance to

new technology.

The demand for integration capabilities, agile work

processes, and composable architecture, coupled with

digital transformation, is driving cloud adoption.

Exponential Growth of Enterprise Data

Increasing enterprise data volume globally is boosting the

demand for streamlined, standardized systems, which help

organizations find, manage, access, store, and secure their

data.

Constantly rising information volume due to regulation,

litigation, or compliance investigations requires software

solutions to govern and scrutinize the data effectively and

increase real-time access.

Increasing Regulatory and Compliance Risk

Compliance spending was projected to remain flat to 2019

levels in 2020 due to widespread disruption of COVID-19

after several years of rapid growth, according to Gartner.

Total compliance spend per 1,000 employees grew more

than 42%, from $114,000 in 2017 to reach $162,000 in

2019.

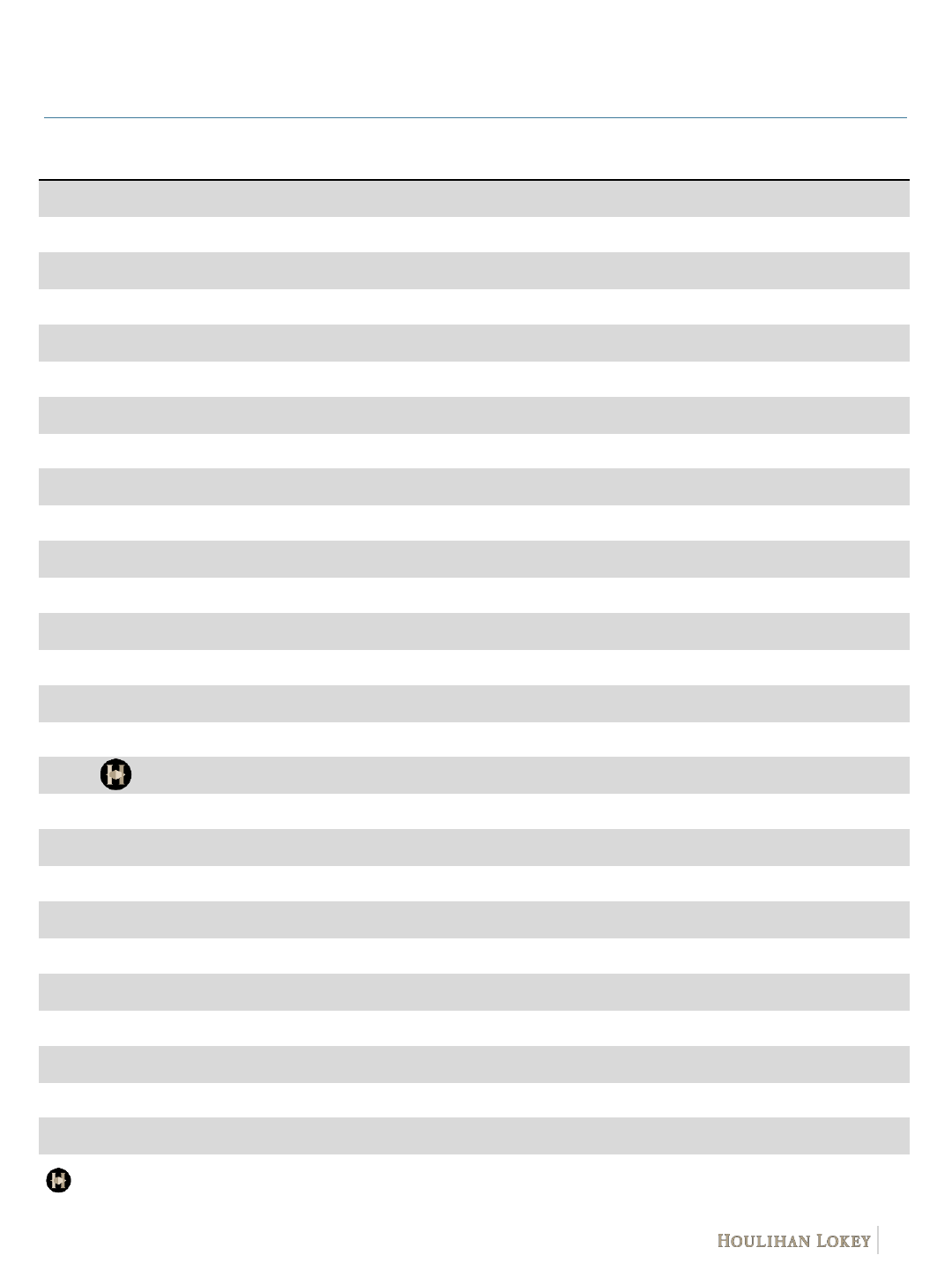

Cloud and Digital Transformation Market ($B)

Global Enterprise Data Volume (Terabytes)

Compliance Spend Per 1,000 Employees ($)

(1)

297

570

221

498

201

407

193

390

89

160

2020

2022

Internally Managed Data Centers

Cloud Repositories

Third-Party Data Centers

Edge and Remote Locations

Other Locations

$19.0

$22.4

$26.5

$31.2

$36.9

$43.6

$13.9

$16.5

$19.5

$23.0

$27.1

$32.0

$69.7

$82.4

$97.3

$114.9

$135.7

$160.2

2020 2021 2022 2023 2024 2025

IaaS PaaS SaaS

$114K

$142K

2017

2019

Sources: GlobalScape, Gartner, CLOC, industry research.

(1) Based on the 2021 CLOC State of the Industry survey report, containing responses from 200 organizations across

more than 22 industries and 21 countries.

6

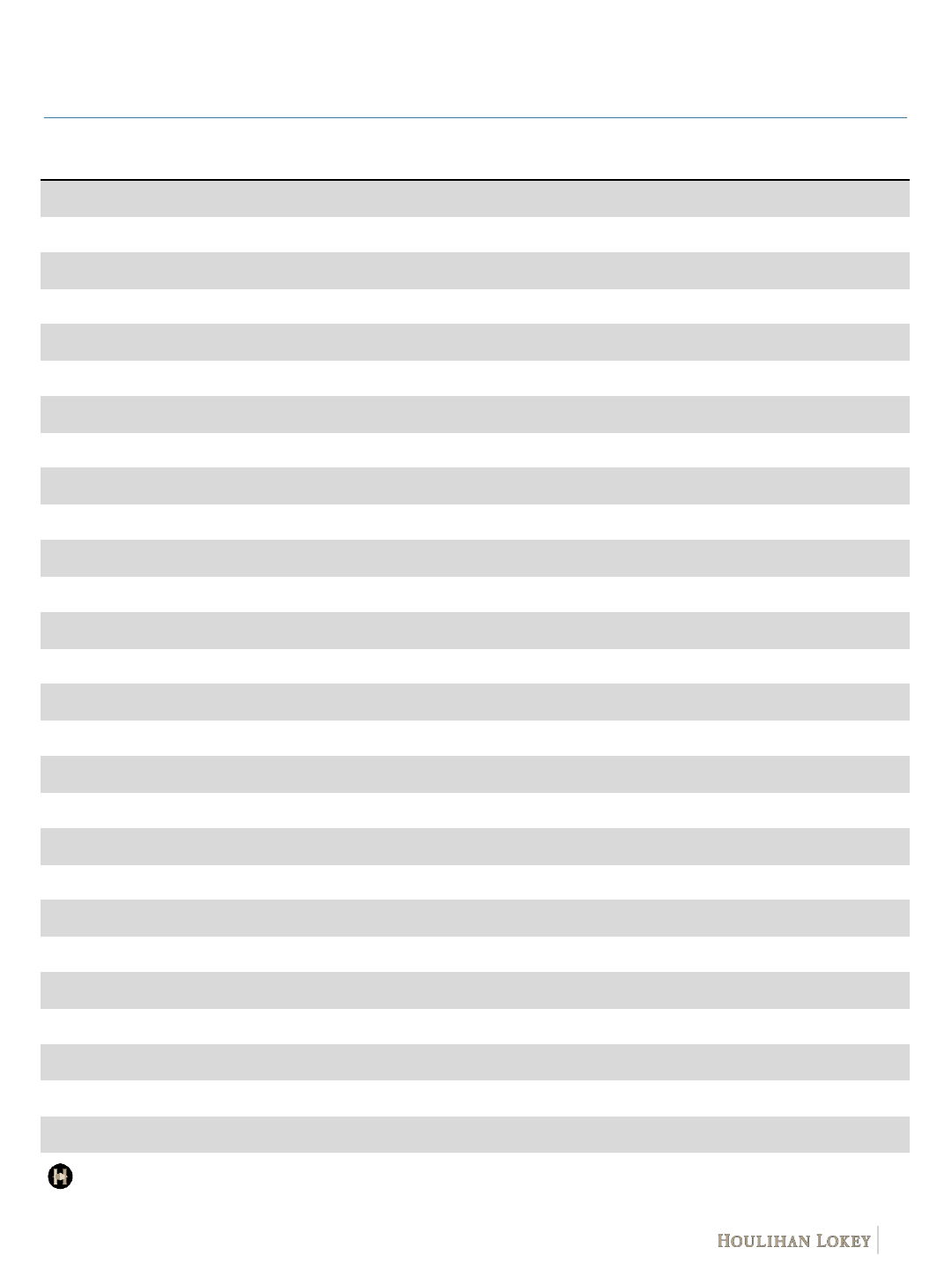

Significant Opportunity for Workflow Automation

Global legal spend remains significantly concentrated in

human labor hours, creating a large opportunity for software

vendors capable of automating manual tasks and increasing

efficiency for corporate clients and law firms.

eSignature, eBilling, contract management, and document

management remain the top four technology areas of

investments by legal departments.

Rise of the Legal Ops Professional

Jobs of legal ops professionals in corporate legal

departments are increasingly taking center stage, driven by

their growing focus on cost management and shift toward

remote work.

This has led to the adoption of a more holistic approach to

IT and software needs in the legal and compliance space, in

addition to coordination and optimization of outside counsel

spend and investments in advanced legal technologies.

Increasing ALSP Adoption as Corporations and Law

Firms Seek to Reduce Costs

Growing access to specialized expertise remains a strong

driver of the adoption of ALSPs both by law firms and

corporations in the U.S.

This adoption is expected to accelerate, owing to the belief

that the outsourcing of certain tasks to ALSPs rather than

assigning them to in-house or external attorneys can better

preserve margins.

55%

56%

63%

67%

74%

79%

87%

Board Management Solution

Legal Analytics and Dashboards

Web Portal/Internal Site

Document Management

Contract Management

eBilling System Management

eSignature

% of Respondents Employing Technology

(1)

13%

17%

20%

40% 1%

2018

2020

Yes, Role Is Served by Lawyer

Yes, Role Is Served by Non-Lawyer

Yes, Role Is Served by a Dedicated Specialist Outside Legal

51%

72%

79%

61%

70%

71%

2016 2018 2020

U.S. Law Firms U.S. Corporations

Departments With Legal Ops Manager

(1)

Use of ALSPs by Law Firms and Corporations

Common Themes and Value Drivers Across the

Sector (cont.)

ALSPs offer a wide range of functional and outsourced support services to law firms and

corporations, including eDiscovery, litigation support, legal process outsourcing, and specialty

legal services.

Source: Industry research.

7

Spotlight: Alternative Legal Services Providers

Breakdown by Subsectors

eDiscovery

eDiscovery allows legal professionals to process, review, tag, and produce electronic

documents—such as emails, files, and databases—with the intent of using them as

evidence in civil or criminal legal cases.

Legal Staffing/Document Review allows companies and legal professionals to recruit

the right professionals and enables organizations to examine the documents related to a

litigation matter to assess their relevancy, responsiveness, and privilege.

Deposition Services is a solution offered by highly trained professionals with the ability

to capture the words spoken during a court or deposition proceeding and convert them

into readable, searchable, and archivable information.

Records Retrieval refers to the process of finding or locating old data, documents, files,

or records—such as legal documents, account records, medical records, or insurance

records.

Litigation

Support

Legal Process Outsourcing refers to the practice wherein a law firm or corporation

outsources flexible lawyering, contract management, compliance, legal software and IT

support, or specialty consultation services on a functional or “captive” basis.

For law firms, LPO refers to internal support functions—such as IT, research, legal ops,

and procurement—to save costs.

For corporates, LPO refers to a third-party alternative to traditional law firms, providing a

fully or partially managed solution for all legal services.

Legal

Process

Outsourcing

Legal Translations involve translation of text from documents such as identity-related

documents, financial documents, official reports, transcripts, filed patents, legal rulings,

and witness statements into the official language of the pertinent jurisdiction.

IP Services and Solutions include a comprehensive suite of solutions such as patent

landscaping, freedom to operate searches, patent filing and translation, patent renewals,

patent licensing, and prosecution.

Legal Settlements/Administration are often driven by regulatory and/or compliance

requirements in regular business activities as well as litigation such as class action, mass

tort, and personal injury.

Specialty

Legal

Services

8

Spotlight: ALSPs (cont.)

13.9

10.7

8.4

201920172015

Global ALSP Market ($B)

Fast-Growing and Evolving ALSP Market…

…Creating a Massive Market Opportunity

Big Four,

10.1%

Independent ALSP,

86.5%

Captive LPOs,

3.46%

2019:

$13.9B

Market Segmentation

(1)

Sources: Alternative Legal Service Providers 2021, industry research.

(1) Big Four includes PwC, Deloitte, KPMG, and EY.

Corporate legal departments are bringing more work in-house due to

rising outside counsel costs and shifting needs for expertise in

specific areas, choosing to work directly with ALSPs.

Widening Gap Between the

Demand and Need for

Outside Counsel

Although the highlighted categories represent a ~$14 billion TAM,

the ALSP landscape includes multiple adjacent categories—such as

records, compliance, and contract management—which would likely

more than triple the overall market size.

Multiple ALSP Categories

Representing a $50+ Billion

Addressable Market

Law firms often struggle to profitably and efficiently compete with

ALSPs, given their cost structure, and hence focus on making their

own investments in technology and infrastructure so as to offset both

pricing pressure from their client base and increasing salaries for

talented attorneys.

Law Firms Invest to Compete

Against ALSPs

Investments in technology and software by ALSPs have automated

workflows, thereby driving efficiency and reducing turnaround times

and costs—a compelling value proposition for law firms and

corporations alike.

Technology Adoption

Despite experiencing record investment and consolidation over the

past five years, the ALSP market remains fragmented, with even the

largest category leaders representing less than half of the overall

market.

Fragmented Market

Landscape Ripe for

Consolidation

9

Spotlight: ALSPs (cont.)

Opportunities for the “Integrated” ALSP Model

Current Model:

Many competitors offer strong expertise in

one “stage” of the litigation lifecycle but

lack the product offerings, expertise, and/or

scale to meet diverse client needs

“Facts” Begin

“Injury” Occurs

Document Requests

Depositions

Pre-Trial Motions

Trial

Appeal

Injury Discovered

Pre-Suit Investigation

Suit Filed

Motion to Dismiss

Gather Documents

Review and Select Documents

Litigation Lifecycle

01

02

03

04

05

06

07

08

09

10

11

12

13

End-to-End Solutions

Discovery Consulting

Managed Review

Data Hosting

Translations

Legal Staffing

Data Collection

Data Processing

Data Analytics

Data Productions

Deposition Preparation

Depositions

Deposition Summaries

Services

Integrated Model:

Long-term, stickier client relationships;

virtuous, compounding cycle of sales and

delivery; direct control and greater share of

contingent spend and resources; and

increasing productivity and efficiency

Sources: Alternative Legal Service Providers 2021, industry research.

10

eDiscovery,

Document Review,

Compliance Solutions

eDiscovery, Contract and

Document Review,

Data Management

Legal Consulting

and eDiscovery

Business

4/17/2018 10/30/2018 5/14/2021 10/19/2021 12/14/2021

Advanced Discovery

provides eDiscovery,

compliance risk assessment,

cybersecurity, legal

operations consulting, data

forensics, paper discovery,

and legal recruiting solutions.

The acquisition enabled

Consilio to offer expert

advisory, data security, and

infrastructure.

DiscoverReady is an

information intelligence

solution provider specializing

in legal, compliance, and

governance.

The acquisition helped

Consilio serve investigation,

litigation, and compliance

matters of all sizes and

complexities across the

globe.

XDD is an international

provider of eDiscovery, data

management, and managed

review services for law firms

and corporations.

The merger was expected to

allow the combined company

to operate as a global

technology-enabled service

provider and eDiscovery

leader.

Adecco Group’s D4 and EQ

is the legal consulting and

eDiscovery (“legal solutions”)

business of Special Counsel.

The acquisition milestone

significantly bolsters

Consilio’s document review,

legal process outsourcing,

and cyber incident response

capabilities.

Legility operates as a global

legal services provider.

The acquisition was

estimated to enhance

Consilio’s resources with a

deepened breadth of new

talent in managed review,

flexible legal talent,

enterprise legal solutions,

eDiscovery, and investigation

and litigation support to

corporations and law firms.

eDiscovery,

Risk Management,

Document Review

eDiscovery, Enterprise

Legal Services

Litigation Support

Outsourcing Services,

Record Retrieval

Medical Record Retrieval

Service System

Court Reporting,

Legal Video Services

5/11/2021 9/15/2021 12/21/2021 2/22/2022 6/1/2022

Imber specializes in workers’

compensation matters and

serves a large group of law

firms, third-party

administrators, insurance

companies, and corporations.

The acquisition allowed

Lexitas to broaden its reach

nationally in the outsourced

litigation services market.

Benchmark is a premier

resource for court reporters,

litigation support, and legal

video services.

This acquisition deepened

Lexitas’ presence in the

highly attractive Midwest

market, further strengthening

its national presence and

strategic growth plan.

TaylorMorse is a premier

resource for medical record

retrieval.

This acquisition was

expected to enhance Lexitas'

commitment for growth in the

West Coast market and

expand its reach in civil

litigation in California.

Strehlow, headquartered in

Newtown, Pennsylvania, is a

premium provider of court

reporting and legal video

services.

This acquisition was

estimated to allow Lexitas to

expand the depth and quality

of its service offerings in the

greater Philadelphia market.

Yorkson Legal is a legal

talent outsourcing services

provider in the U.S.

This acquisition is estimated

to allow Lexitas to increase

its service offerings to law

firms and corporate legal

departments nationwide.

Workers’-Compensation-

Related Outsourced

Litigation Support Services

Legal Staffing,

Legal Compliance

Sources: Company website, press release, industry research.

Spotlight: ALSPs (cont.)

The ALSP sector continues to experience record levels of investment and M&A activity as

providers seek to add scale, new clients and geographies, and capability sets to differentiate

themselves in the market.

Common M&A Themes and Value Drivers—Rapid Consolidation

Common M&A Themes and Value Drivers—The One-Stop-Shop Model

has been acquired by

a portfolio company of

Sellside Advisor

has acquired

a portfolio company of

Buyside Advisor

11

Select ALSP M&A Transactions

Sources: S&P Capital IQ, press releases.

(1) An enterprise legal management software company specializing in intellectual property.

eDiscovery

Litigation

Support

Legal

Process

Outsourcing

Specialty

Legal

Services

The transactions below represent a select list of relevant deals across the ALSP sector that

highlight some of the themes driving investment and consolidation in the industry.

Acquirer Target Subsector

Announced

Date

Houlihan Lokey

Deals

eDiscovery Nov-21 –

eDiscovery Jul-21

eDiscovery Apr-21

eDiscovery Aug-20 –

Compliance Oct-20

Legal Staffing/Review Mar-20 –

Records Retrieval Feb-20

Records Retrieval Jan-20 –

Deposition Services/

Records Retrieval

Nov-19 –

Deposition Services Aug-18 –

LPO Dec-21 –

LPO Jun-21 –

LPO Aug-20 –

LPO Sept-18 –

Legal Translations Apr-22 –

Legal Settlements/

Administration

Dec-21 –

IP Jun-21

IP Apr-21

Legal Translations Mar-21

IP Mar-21 –

IP Oct-20 –

(1)

Deals advised by Houlihan Lokey

(1)

(1)

(1)

(1)

12

Public Markets Overview

Legal Technology and Services

TEV/2022E EBITDA

TEV/2022E Revenue

40.9x

26.2x

NM

NM

15.2x

NM

31.0x

12.6x

19.8x

9.3x

33.9x

16.6x

20.6x

13.5x

NM

23.0x

8.1

NM

33.0x

10.0x

16.2x

8.2x

23.3x

15.9x

2021 2022E

3.5x

8.4x

7.4x

5.7x

6.5x

3.8x

6.6x

3.7x

6.0x

1.7x

8.5x

5.0x

2.9x

5.6x

5.5x

4.5x

4.5x

3.2x

5.0x

3.5x

6.1x

1.8x

8.1x

5.0x

2021 2022E

Revenue growth, EBITDA, and other projections are based on S&P Capital IQ consensus estimate

data points as of 30 June 2022.

13

Public Markets Overview

Legal Technology and Services (cont.)

Valuations Are Correlated to Future Revenue Growth

(1)

Publicly Traded Legal Technology and Services Providers

R² = 0.4855

0.0x

5.0x

10.0x

15.0x

20.0x

25.0x

30.0x

35.0x

40.0x

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0%

TEV/2022E EBITDA

2022/2023E Revenue Growth

The legal technology and services sector continues to enjoy robust growth, which is a major driver

of valuations.

Valuation is also driven by business models, with SaaS businesses driving the highest multiples,

followed by subscription content business and tech-enabled services. This is similar to most other

information verticals.

($ in millions, except per-share prices) Market Data

As of 6/30/22 % of 52- Total 2022E TEV/ 2022E

Company Name

Stock

Price

Week

High

Equity

Value

Enterprise

Value

Revenue

Gross

Margin

EBITDA

EBITDA

Margin

FCF

Conversion

(2)

Net Debt

Net Debt/

EBITDA

2022E

EBITDA

2022E

Revenue

Cellebrite DI Ltd. $5.10 86.3% $965.9 $851.2 $292.0 81.6% $41.3 14.1% 79.8% ($181.1) N/M 20.6x 2.9x

Clarivate Plc 13.86 50.0% 9,321.5 15,698.6 2,792.8 67.5% 1,162.1 41.6% 85.7% 5,428.2 4.7x 13.5x 5.6x

CS Disco, Inc. 18.04 26.0% 1,057.8 840.8 152.2 72.2% (46.0) (30.2%) N/M (194.1) 4.2x NM 5.5x

DocuSign, Inc. 57.38 18.2% 11,472.8 11,224.8 2,472.5 80.3% 488.5 19.8% 82.4% (647.3) N/M 23.0x 4.5x

Dye & Durham Limited 16.89 43.1% 1,167.6 1,932.2 425.4 NA 238.6 56.1% 99.7% NA N/M 8.1x 4.5x

Intapp, Inc. 14.64 35.8% 910.9 922.1 291.0 NA (8.1) (2.8%) N/M NA N/M NM 3.2x

Magnet Forensics Inc. 13.41 26.2% 547.8 461.5 92.5 92.6% 14.0 15.1% 77.5% (130.2) N/M 33.0x 5.0x

Open Text Corporation 37.84 68.5% 10,130.0 12,711.9 3,599.2 NA 1,271.2 35.3% 93.4% NA N/M 10.0x 3.5x

RELX PLC 27.05 90.0% 51,843.2 59,198.4 9,713.9 64.3% 3,645.1 37.5% 86.9% 6,825.0 1.9x 16.2x 6.1x

RWS Holdings plc 4.18 50.5% 1,628.6 1,641.3 900.5 NA 200.1 22.2% 78.4% NA N/M 8.2x 1.8x

Thomson Reuters Corporation 104.18 85.7% 50,607.4 53,963.7 6,676.9 35.6% 2,313.4 34.6% 77.2% 2,903.8 1.3x 23.3x 8.1x

Wolters Kluwer N.V. 96.76 87.9% 24,662.4 26,890.1 5,319.5 70.0% 1,692.1 31.8% 81.2% 2,153.3 1.3x 15.9x 5.1x

Median $1,686.5 71.1% $363.6 27.0% 81.8% $1,011.5 1.9x 16.1x 4.8x

Mean $2,727.4 70.5% $917.7 22.9% 84.2% $2,019.7 2.7x 17.2x 4.7x

Revenue growth, EBITDA, and other projections are based on S&P Capital IQ consensus estimate data points as of 30 June 2022..

(1) CS Disco and Intapp are not a part of the analysis due to negative EV/2022E EBITDA values.

(2) FCF Conversion defined as (EBITDA – CapEx)/EBITDA.

14

Legal Technology and Services Transactions

Source: S&P Capital IQ.

Deals advised by Houlihan Lokey

Announced

Date

Acquirer Target Target

Description

Enterprise Legal Management Software

Jun-22

Shanghai Yunqi Investment

Management Co., Ltd.

One Contract Cloud

Develops contract management software offering contract templates, drafting,

approval, signing, and changes solutions

Jun-22 Intapp Billstream (Wilson Allen)

Provider of billing automation solution intended to help businesses automate their

billing process

May-22

Tiger Global; Avatar Growth Capital;

Sequoia Capital; Partners Group

Sirion Labs Private Ltd.

Provides SaaS-based enterprise post-signature contract management solutions

such as contract repository and automated invoice reconciliation

May-22 LexisNexis Parley Pro

Provides contract lifecycle management (CLM) solution such as contract request,

drafting, negotiation, signature, and post-signature management

Mar-22 Main Capital Partners BV Blika Solutions AB

Develops tax and legal management SaaS software solutions such as entity

management, contract management, document generator, and filing tracker

Mar-22 G Squared; G2VP, LLC LinkSquares, Inc.

Provider of AI-powered contract and legal document analytics tool offering crisis

management, contract review, and compliance solutions

Mar-22

Eurazeo SE; Cathay Capital Private

Equity; Sagard Holdings

DiliTrust SAS

Provides SaaS-based software solutions such as contract management, legal

entities management, and centralized management of legal areas

Feb-22

Empire Technologies Risk

Management Group

Palmeiro & Platt Law Firm

Acquired cybersecurity and data protection practice of Palmeiro & Platt law firm

Feb-22

Red Dot Capital; Vintage Ventures;

Shasta Ventures; Aleph Venture

Anecdotes A.I Ltd.

Develops a SaaS enterprise-class compliance platform offering data evidence

collection solutions to automate evidence collection

Feb-22 MLM 2 and Warburg Pincus Minesoft

Provider of global patent search software and information services

Feb-22 team.blue Iubenda

Offers products and services such as a privacy and cookie policy generator, cookie

solution, consent solution, and internal privacy management

Feb-22 Lexly AB LegalHero

Provides online legal advisory platform where companies can create cases and

receive legal advice online from a curated selection of legal experts

Jan-22 Alt Legal Towergate

Provides intellectual property monitoring, reporting, and data feed services to law

firms and organizations

Jan-22 SAP SE (XTRA:SAP) Icertis, Inc.

Develops a cloud-based contract management platform that manages sellside,

buyside, and corporate enterprise contracts

Jan-22 Vista Equity Partners Management BigTime Software, Inc.

Develops cloud-based platform offering time-tracking, billing, resource

management, and project management for professional services firms

Jan-22 Mitratech Quovant

Operates as a legal-spend management software that provides analytics,

engagement visibility, and managed services to legal professionals

Jan-22

Eight Roads; Union Square;

Seedcamp Investments; Point Nine

Juro Online Ltd.

Develops a SaaS-based contract management software that helps legal and

business users agree and manage contracts in one unified workspace

Jan-22 Onit SecureDocs

Provides cloud-based business software that helps companies store and share

critical business documents

Dec-21

Golub Capital; Meritech Capital;

StepStone; Signal Peak

Filevine, Inc.

Provides case management, lead management, document management, contract

management, business analytics, and eSignatures solutions

Dec-21 Mitratech Continuity

Provides regulatory technology services to automate compliance management for

banks, credit unions, and financial institutions

Dec-21 LexisNexis Closd

Provides legal project management solutions such as automated workflow

management, secure document sharing, data rooms, and electronic closing

Dec-21 Mitratech

Integrum Management

Systems

Provides integrated management services solutions in health and safety, risk,

quality, environmental, training, document, and compliance

Dec-21 Arteria AI H4

Operates as a provider of a contract lifecycle management platform offering digital

repository, online collaboration, and contract migration solutions

Nov-21 MyCase, Inc. Woodpecker (U.S.)

Provides an AI-enabled tool to automate legal document drafting through automated

population of data, document generation, and custom templates

Nov-21 Gemspring Capital LLC AINS, Inc.

Provides case management, human capital management, contract lifecycle

management, and governance, risk, and compliance solutions

Nov-21 Plum Ventures; Blue Lake Capital One Contract Cloud

Develops contract management software offering contract template, contract drafting,

contract approval, contract signing, and contract changes solutions

Announced

Date

Acquirer

Target Target

Description

Nov-21 Smarsh

Micro Focus International

DigitalSafe Business

Offers compliance, data surveillance, social media governance, and compliance

review to meet all SEC, FINRA, IIROC, GDPR, and other regulatory requirements

Nov-21

TPG; HIG Growth Partners; Capital G; Menlo

Ventures; Andreessen Horowitz; K9 Ventures

Everlaw

Provides cloud-based eDiscovery software offering early case assessment, legal

holds, trial preparation, data privacy, and matter management solutions

Nov-21 Entreda, Inc. Privva, Inc.

Develops and offers cloud-based vendor risk assessment platform to law firms,

academic institutions, and healthcare technology companies

Oct-21 Scanmarket A/S Symfact AG

Provides enterprise compliance management solutions such as contract

management, risk management, legal entity management, and IP management

Oct-21 VR Ventures Management GmbH ContractHero GmbH

Develops a SaaS-based contract management software, offering a central digital

contract filing system to archive digital contracts, and lease management software

Oct-21 Cellebrite Digital Clues

Operates as an omnichannel digital intelligence platform that offers open-source

intelligence tools such as ProBot, ProFound, and Profiler

Sep-21 Onit BusyLamp

Operates as a legal spend and matter management platform that offers legal advice,

automated budget notifications, reports, and legal analytical services

Sep-21

Noro-Moseley Partners; TDF Ventures;

Osage Venture Partners

Malbec Solutions, Inc.

Offers contract management and quote management solutions such as contract

redlining, negotiation, review, repository, and eSignature execution

Sep-21 Mitratech Alyne

Provides risk management software that offers cybersecurity, risk management, and

compliance capability services

Sep-21 Recurring Capital Partners Hanzo

Provides in-house control over dynamic and collaborative data sources to corporate

legal and compliance teams

Sep-21 Onit Bodhala

Operates as a legal spend management platform that gathers data around attorneys’

performance, experience, and referrals with counsel options

Aug-21 BlackRock Morae Global Corporation

Provides digital and business transformation solutions such as discovery services,

document management, legal hold, and compliance services for the legal industry

Aug-21

Insight Venture Management, LLC;

AirTree Ventures Pty. Ltd.

LawVu Ltd.

Provides software offering matter, contract, spend, knowledge and document

management, and analytics and reporting solutions

Jul-21 Ipro Tech, LLC ZyLAB, Inc.

Provider of legal discovery platform covering legal hold, collection and processing,

legal discovery workflow, and legal data analytics solutions

Jun-21 Litify, Inc. LegalStratus

Provides enterprise legal management system offering legal matters management

and financial and analytics to lawyers and legal professionals

Jun-21

Picus Capital Management; Kalaari

Capital Advisors; Arka Venture Labs

Simplicontract

Technologies Private Ltd.

Develops a contract management platform covering the lifecycle from request to

renewal and all types of contracts

Jun-21 Corsearch Incopro

Operates as an online IP and brand protection software provider that helps brand

owners with actionable intelligence related to IP and copyright infringements

Jun-21

Sorenson Capital; Xerox Holdings; Catalyst

Investors; Bottomline Technologies; MassMutual

Ventures; First Ascent Ventures; BGV

Management

LinkSquares, Inc.

Provider of AI-powered contract and legal document analytics tool offering crisis

management, contract review, contract storage, and compliance solutions

Jun-21 Nordic Eye Venture Capital ContractZen

Provides governance software for advanced contract management, board meeting

management, entity management, eSignature, and virtual data management

May-21

Future Energy Ventures; British

Business Investments; NextLaw Labs

Libryo Ltd.

Develops regulatory compliance management software

May-21 Mitratech Contract Room, Inc.

Provides an enterprise cloud-based negotiation and contract management platform

May-21 Mitratech AdvanceLaw

Specializes in identifying lawyers and law firms through its in-house legal teams

May-21

Shasta Ventures Management, LLC;

AirTree Ventures Pty. Ltd.

LawVu Ltd.

Provides software offering matter, contract, spend, knowledge and document

management, and analytics and reporting solutions

May-21 Anaqua SeeUnity

Developer of content integration, sync, and migration software products catering to

various types of business applications

May-21 Intapp Repstor

Provides data management SaaS and offers backup and recovery, cloud archiving,

disaster recovery, and data migration

Apr-21 Thomas Bravo Proofpoint

Operates as a cybersecurity and compliance company offering email security and

protection, threat protection, cloud security, and compliance and archiving

Apr-21

OMERS Private Equity; G Squared; M12; One

Peak Partners; Altos Ventures Management;

Rembrandt Partners

PandaDoc, Inc.

Provides document workflow automation platform that enables users to create sales

documents, employ quoting, get eSignatures, and automate workflow

15

Legal Technology and Services Transactions (cont.)

Source: S&P Capital IQ.

Deals advised by Houlihan Lokey

Announced

Date

Acquirer

Target Target

Description

Mar-21

HenQ Capital Partners B.V.; Kima

Ventures SAS

Leeway SAS

Develops contract management software offering contract monitoring, visibility and

control, and contract collaboration to in-house legal departments

Mar-21 Ironclad, Inc. PactSafe, Inc.

Provides contract management and eSignature solutions for large and

small businesses

Mar-21

Parkwalk Advisors Ltd.; Perivoli

Innovations

Legislate Technologies

Ltd.

Provides software platform offering contract management, create agreement,

automated insights, and contract lifecycle management solutions

Mar-21 Silver Lake Relativity

Provider of eDiscovery and enterprise legal software solutions such as early case

management, data privacy, legal holds, and patent search

Mar-21 Ontario Teachers Mitratech

Provides web-based enterprise legal management solutions such as matter

management, spend management, eBilling, legal hold, and contract management

Feb-21

Meritech Capital; Headline; Greycroft;

Premji Invest; B Capital Group; PSP

Growth

Icertis, Inc.

Develops a cloud-based contract management platform that manages sellside,

buyside, and corporate enterprise contracts

Feb-21 Anaqua Quantify IP

Provider of intellectual property (IP) cost estimation software that gathers IP cost data

and combines them into its product line

Feb-21 RLDatix Ltd. Ecteon, Inc.

Provides contract management services, including strategic planning,

implementation, training, and support services

Jan-21 Peak Capital BV Precisely AB

Operates as a legal tech company that develops cloud-based automation software

for contract management

Jan-21 BOND Ironclad

Provides contract lifecycle management platform to handle all contract types—legal,

sales, finance, HR, marketing, and procurement

Jan-21 Questel doeLEGAL, Inc.

Operates as an enterprise legal management and eDiscovery legal technology

company

Jan-21 Relativity VerQu

Operates as a data management software company that helps organizations

migrate and capture communication data for record retention and compliance

Legal Practice Management Software

Jun-22

Wolters Kluwer Legal, Tax &

Regulatory Europe

Level Programs S.L.

Designs, develops, and provides legal practice management software solutions to

lawyers, solicitors, advisors, company, or administration legal departments

Jun-22 Anaqua Practice Insight

Provider of business intelligence software that offers timezone handling, auto activity

tagging, and automated timekeeping for law professionals

Jun-22 AffiniPay, LLC MyCase, Inc.

Develops legal practice management software solutions such as client

communications, tracking billing cycles, case management, and lead management

Jun-22 Surepoint Technologies Coyote Analytics LLC

Develops and operates a legal software that offers financial management solutions

to law firms

May-22 MyCase, Inc. Docketwise

Provides immigration software platform and case management solutions, which

includes case tracking, workflows, two-way text messaging, and billing

May-22 Magnet Forensics Comae Technologies

Operates as a cybersecurity company that specializes in cloud-based memory

analysis used to recover evidence from the volatile memory of devices

Apr-22 Resurgens Technology Partners i-Sight Software

Develops and provides web-based case management solutions for incidents and

investigations

Apr-22 LegalTech, LLC LollyLaw

Provides legal practice management software solutions for immigration law or

related areas

Mar-22 Clio Proof Technology

Developer of a mobile application to deliver time-sensitive legal documents, real-

time tracking, and electronic proof-of-service

Feb-22 Surepoint Technologies Cole Valley Software

Offers contact-ease cloud, CRM lookup, financial system integration, outlook

integration, and implementation services

Feb-22 Softplan SAJ ADV Sistemas Ltda.

Provides legal software for integrated management, specially developed for law

firms, departments, and public bodies

Feb-22 BigHand Ltd. Iridium Technology LLC

Develops a platform that offers business intelligence (BI), financial analytics, and

timekeeping solutions for legal and professional services firms

Jan-22 Litera Corp. Prosperoware

Developer of privacy and regulatory compliance platform to ensure compliance and

drive real business value for the digitized legal industry

Jan-22 Litera Corp. Lynch Marks

Developer of shipping management software that specializes in shipping, invoice

processing, and package tracking

16

Legal Technology and Services Transactions (cont.)

Source: S&P Capital IQ.

Deals advised by Houlihan Lokey

Announced

Date

Acquirer

Target Target

Description

Dec-21 B. Riley Securities, Inc. Exela Technologies, Inc.

Provides transaction processing solutions, enterprise information management,

document management, and digital business process services

Nov-21 MyCase, Inc. Soluno

Offers workflow-based productivity software enabling law firms to move from

underinvested legacy desktop accounting systems to cloud-based software

Nov-21 MyCase, Inc. CASEpeer

Provides case management software that offers features like leads and conversions,

tasks, calendaring, settlement negotiations, and litigation tracking

Oct-21 Francisco Partners Management, LP LegalTech, LLC

Designs and develops a suite of legal software such as law practice management

software, time tracking and billing software, and an online payments platform

Oct-21 Francisco Partners Paradigm

Provider of practice management software and integrated payments to the legal

industry

Sep-21 Clio Lawyaw

Provider of legal document automation platform designed to enable legal

professionals to streamline the document-intensive part of their work

Aug-21 Clio CalendarRules

Specializes in creating calendar events based on court deadlines and offers other

features such as date calculator, docket calculator, and docket research

Aug-21

CMIA Capital Partners; Wavemaker

Partners; M Venture Partners

Tessaract Technologies

Private Ltd.

Provides workflow automation platform offering business management, law practice

management, insurance software, and accounting practice management

Aug-21 Mainsail Management Company, LLC Centerbase, Inc.

Develops and offers practice management software for law firms, focusing on

document management, timekeeping, and business development

Aug-21 Litera Corp. Concep Ltd.

Provider of digital marketing software that offers customer relationship management

(CRM) integration, email marketing surveys, and content automation

Aug-21 Litera Corp. Kira Systems

Provider of AI-driven contract analytics software that enables users to reduce the time

spent on document review and identifies and extracts provisions and data points

Jul-21 AbacusNext Zola Suite

Provides fully integrated legal practice platform that offers matter management,

document automation, time and billing, and settlement management

Jul-21 ProfitSolv Tabs3

Provides software products for law firms and legal professionals, ranging from

billing to practice management, check writing to general ledger, and trust accounting

Jul-21 Litera Corp. Objective Manager

Provider of strategic planning, performance management, and talent engagement

software primarily for law firms

Jul-21 Dye & Durham

GlobalX Information

Services

Provides cloud-based software solutions, including business regulatory information,

practice management software, electronic contracts, and legal support services

Jun-21 Access UK Ltd. Select Legal Systems Ltd.

Provides legal software solutions such as practice management, case management,

document management, and litigation cost management

Jun-21

Aquiline Capital Partners LLC;

ParkerGale, LLC

Surepoint Technologies

Provides financial, time management, and practice management software to law

firms

May-21 Sandline Discovery 24legal

Provides consultation, implementation, and management of document management

platforms as well as law firm management platforms like CLIO PMS

May-21 Warburg Pincus NetDocuments

Provides cloud-based content services and productivity platform for law firms,

corporate legal teams, and compliance departments

Apr-21

OMERS Private Equity; T. Rowe Price

Associates, Inc.

Themis Solutions Inc.

Develops legal practice management and client intake software solutions such as

billing, case management, contact management, and document management

Apr-21

CDPQ; Neuberger Berman; Viking Global

Investors; Atreides Management

Druva

Provides protection and management software solutions for cloud data

Apr-21 Litera Corp. Clocktimizer

Provider of business intelligence software that specializes in providing insights that

enable law firms to improve their pricing, control budget, and scope

Apr-21

T. Rowe Price Associates; OMERS

Growth Equity

Clio

Provides legal practice management, document automation, client intake, and CRM

software solutions

Mar-21 Kroll Redscan

Provides services and digital products related to valuation, governance, risk, and

transparency

Mar-21 Thomas H. Lee AbacusNext

Provider of practice management software for legal, accounting, and compliance

firms

Feb-21 Litera Corp. DocsCorp

Provider of hybrid SaaS-based software solutions such as redaction, document

filing, metadata removal, document processing, and PDF manipulation

Feb-21 Opus2 International Bar Squared

Provides chambers management software that streamlines and automates billing to

improve cash flow

17

Legal Technology and Services Transactions (cont.)

Source: S&P Capital IQ.

Deals advised by Houlihan Lokey

Announced

Date

Acquirer

Target Target

Description

Feb-21

70Ventures; Iron Wolf Capital, UAB;

Corvus Ventures; Next Road Ventures

Amberlo Ltd.

Provides law practice management software to manage legal billing, contacts,

matters, case, documents, legal calendar, rates, and trust accounting for law firms

Jan-21 Litera Corp.

Foundation Software

Group

Provider of software for large law firms that includes integrated applications for

experience management, expertise location, and client management

Attorney Workflow Solutions

Jun-22 Anaqua WiseTime

Provides enterprise-grade autonomous timekeeping solution for legal

Jun-22 Syntheia Motionize

Offers a Word Add-In that improves access to knowledge and provides drafting

guidance to transactional lawyers

Mar-22 Thomson Reuters ThoughtTrace

Provides a document understanding and contract analysis platform that allows users

to read, organize, and manage the document workflow

Mar-22

David Marroso; Esq.; Dr. Andrew

Langroudi; Gregory Mazares

ModeOne Technologies

Develops SaaS tool to help litigation services providers automate the remote

collection and analysis of mobile data stored on smartphones

Feb-22 DISCO

Hold360 and Request360

from Congruity 360

Provides legal workflow products and regulatory and alert solutions

Feb-22 Law Business Research Ltd.

Worldwide Legal

Research

Offers information services to the international legal community, which includes

international corporations, government agency individuals, and law firms

Jan-22 Aderant/Roper American Legal Net

Provides court forms, eFiling, calendaring, and docketing solutions to legal firms

Dec-21

Clifford Chance; Ventech; Latham &

Watkins; Forefront Venture Partners

Reynen Court Inc.

Operates a platform to support law firms to deploy legal tech tools, such as contract

analysis, discovery, and practice management

Dec-21 Karnov Group AB

Thomson Reuters' and

Wolters Kluwer's Assets

Carved out legal information-based businesses of both Thomson Reuters in Spain

and Wolters Kluwer in Spain and France

Dec-21 G Squared; UiPath Ventures airSlate Inc.

Designs and develops a workflow automation platform that offers no-code workflow

automation, eSignature, and document management solutions

Nov-21 Brightflag Joinder

Provides system of record that helps legal professionals securely track activities,

collaborate with colleagues, and store work assets

Oct-21

Sterling National Bank and Bigfoot

Capital

Nextpoint

Provides cloud-based technology that automates litigation workflows for all matters

from eDiscovery to trial

Oct-21 iCONECT

Ayfie Inspector AI Code

Base from Ayfie Group

Provides search and text analytics solutions through its text analytics engine to detect

personally identifiable information and power security practice workflows

Aug-21 TWC Tech Holdings Cellebrite

Provides digital intelligence platform and solutions that transform how customers

collect, review, analyze, and manage data in legally sanctioned investigations

Aug-21 CloudNine ESI Analyst

Provides metadata analysis tools that provide intelligent link analysis, data

visualization, reporting, and review of multiple disparate forms of modern data

Aug-21 Law Business Research Ltd. Docket Navigator

Provider of patent litigation database that maintains a database of trademark,

copyright, antitrust litigation activities, and patent infringement investigations

Jun-21 The Riverside Company CloudLex, Inc.

Operates a cloud-based legal platform for trial lawyers offering proactive matter

management, calendaring, document management and storage, and conflict check

Jun-21 Crest Rock Management Company LP CloudNine

Develops cloud-based eDiscovery platform that offers preservation and collection,

legal hold notification, data ingestion, and early data assessment solutions

May-21 DocuSign Clause

Operates as a smart agreement provider that helps automate tasks such as sending

notifications, updates of contract status, and compliance checks

May-21 Filevine Outlaw

Provides end-to-end contract platform that reinvents the entire process, from legal

authoring to document generation to negotiation to signing

Apr-21 Toppan SmashDocs

Provides web-based document collaboration tool that allows users to create, review,

and negotiate documents

Mar-21

Astorg Asset Management; Five

Arrows Managers

Opus 2 International

Provides integrated software and services used in legal disputes, including court

reporting and real-time transcription, as well as virtual hearing services

Jan-21 K1 Investment Management Reveal Data Corp.

Provider of AI-powered eDiscovery platform offering processing, early case

assessment, review, and infrastructure solutions

Jan-21 K1 Investment Management Brainspace

Provider of visual analytics for eDiscovery and investigations

18

Legal Technology and Services Transactions (cont.)

Source: S&P Capital IQ.

Deals advised by Houlihan Lokey

Announced

Date

Acquirer

Target Target

Description

Jan-21

General Catalyst; Morgan Stanley

Private Equity; Highsage Ventures

airSlate Inc.

Designs and develops a workflow automation platform that offers no-code workflow

automation, eSignature, and document management solutions

Jan-21 Fastcase, Inc. Casemaker

Provider of legal research information such as federal supreme, circuit, district and

bankruptcy court decisions, case laws, practice guides, and coursebooks

Alternative Legal Services Providers

Jun-22 Lexitas Yorkson Legal, Inc.

Operates as a legal staffing and recruiting firm that provides quality attorneys,

paralegals, compliance professionals, and litigation support staff

May-22 Esquire Deposition Solutions, LLC TSG Reporting, Inc.

Provides court reporting, legal video technology, virtual and remote services, exhibit

services, and transcription services

May-22 ArcherHall, LLC Forensic Pursuit, LLC

Provider of digital forensics, eDiscovery, and expert witness services to law firms,

corporations, and eDiscovery companies

Apr-22 BIG Language Solutions Lawlinguists

Operates as a legal translation network created by lawyers, offering legal translation

services in more than 100 different language combinations

Apr-22 ArcherHall

Cooper Discovery

Solutions

Provides digital forensics and eDiscovery consulting services to the legal

community

Mar-22 Questel Markify

Provides search and watch services such as pro search screening, comprehensive

word mark searching, and trademark search

Mar-22 Veritext Legal Solutions

Michael Musetta &

Associates, Inc.

Provides unprecedented service, court reporting, and video conferencing services

Mar-22 U.S. Legal Support, Inc.

Baton Rouge Court

Reporters, LLC

Provides court reporting and related litigation support services

Mar-22 Epiq Systems Fireman & Company

Offers legal process outsourcing, litigation support, and document management

services

Mar-22

Empire Technologies Risk

Management Group

L2 Services

Operates as a full-service litigation support service provider, offering solutions

related to legal discovery core tasks of collection, processing, and review

Feb-22 ArcherHall, LLC One Source Discovery

Provider of digital forensics and eDiscovery consulting services to the legal

community

Feb-22 J.S. Held, LLC Capital Forensics, Inc.

Provides data analytics, litigation support and arbitration tools, fraud and forensic

investigations, and regulatory and risk management services

Dec-21 Lexitas TaylorMorse, Ltd.

Specializes in medical record retrieval and claims and legal document management

Dec-21

Empire Technologies Risk

Management Group

GoldMind

Offers services such as data acquisition and forensics, eDiscovery, data breach

support, big data analytics, language services, and professional staffing

Dec-21 Consilio LLC Legility, LLC

Provides consulting, technology, managed solutions, and legal talent engagement

services to corporations and law firms

Dec-21

Sedgwick Claims Management

Services, Inc.

JND Legal Administration

Co.

Provides class-action administration services, eDiscovery software and professional

services, government services, healthcare solutions, and legal notice offerings

Dec-21 Epiq Systems Simplex Legal

Offers interim support for in-house teams and corporations, legal technology

consulting, and technology-enabled legal services for high-volume legal mandates

Nov-21 J.P. Morgan Modus

Operates as a partner for law firms, corporations, and government agencies offering

eDiscovery and information governance solutions

Nov-21 Driven, Inc. Innovative Discovery, LLC

Provides service, guidance, and consultation around information lifecycle and

eDiscovery to law firms, corporations, and government agencies

Oct-21 Nextpoint WarRoom

Provides cloud-based deposition transcript repository to litigators

Sep-21 Lexitas

Benchmark Reporting

Agency, Inc.

Offers court reporting and national court reporting, litigation support, video

conferencing, and video streaming services to the legal industry

Sep-21 Consilio LLC Special Counsel, Inc.

Provider of legal consulting, attorney recruiting, legal talent, legal technology, and

eDiscovery solutions

Sep-21 Magnet Forensics DME Forensics

Operates as a video and multimedia evidence solution company offering data

recovery, DVR causality analysis, witness consulting, and digital evidence solutions

Sep-21 Nuix Topos Labs, Inc.

Develops natural language processing (NLP) software that helps computer systems

better understand text and spoken words

19

Deals advised by Houlihan Lokey

Legal Technology and Services Transactions (cont.)

Source: S&P Capital IQ.

Announced

Date

Acquirer

Target Target

Description

Sep-21 UnitedLex Corp. Blackstone Discovery Inc.

Provides litigation support, collection and analysis, data processing, eDiscovery, and

database hosted solutions for law firms and corporations

Aug-21 Frontline Managed Services LogicForce Consulting

Provides IT services and solutions for the legal profession, ranging from network

administration and desktop support to practice management

Aug-21 IMS Consulting & Expert Services, LLC Litigation Insights, Inc.

Operates as a trial-consulting and visual-communication fields firm offering mock

trials, witness preparation and jury selection services, and trial graphics services

Aug-21 Magna Legal Services

O'Brien & Levine Court

Reporting Services, Inc.

Operates as a litigation consulting and support company providing records retrieval,

depositions, video, language services, graphics, jury consulting, and trial solutions

Aug-21 Morae Global Adaptive Solutions

Provides advisory, compliance, contract lifecycle management, document

management, and legal management services to law firms

Aug-21 Cobra Legal Solutions Digital Discovery

Operates as a digital forensics and data collection company offering upstream

evidence collection, forensic investigations, and cyber incident response services

Jul-21 TransPerfect Semantix

Provides translation and interpretation services

Jul-21 Array Gnoêsis Group

Provides solutions to litigation problems, staffing needs, and document reviews to

corporate legal department and law firm clients

Jul-21 Frontline Managed Services Glasser Tech

Offers specialized software and hardware support, network design, training and

support, cloud services, backup, and disaster recovery to law organizations

Jul-21 Frontline Managed Services

Invoice Preparation

Services

Provider of eBilling services intended to help law firms by preparing invoices that

meet clients' billing and litigation management guidelines

Jul-21 Lighthouse H5, Inc.

Provides advanced search, review, and data analytics products and services

Jun-21 Veritext Legal Solutions CitiCourt, LLC

Provides court reporting, videography, and litigation support solutions and services

Jun-21 EagleTree Capital, LP Integreon, Inc.

Provides litigation, cyber incident response, contracts and compliance, creative, and

legal administrative services

May-21 Relativity Text IQ

Operates as a B2B technology company that uses AI to manage and mitigate risks in

enterprise data

May-21 Anaqua Actio IP

Provider of intellectual property management services such as patent cooperation

treaty filing, trademark search and filing, patent validation, and renewals

May-21 Lexitas Imber Court Reporters

Provides court reporting services, including conference rooms, interpretation, legal

videography, virtual office, online repository, and teleconferencing services

May-21 Gimmal Sherpa Software

Operates as an enterprise data governance and eDiscovery solutions provider

May-21 Veritext Legal Solutions Brown & Jones Reporting

Provides court reporting services, including real-time reporting, videoconferencing,

videography, and computerized litigation support services

Apr-21 Xact Data Discovery (XDD) Paralaw

Operates as a legal outsourcing company providing managed review staffing,

eDiscovery, and contracts management services to law firms and corporations

Apr-21 Xact Data Discovery (XDD) Lexolution LLC

Provider of temporary contract attorney staffing and managed review services for law

firms and corporations

Apr-21

Stone Point Capital LLC; Aquiline

Capital Partners LLC

Consilio LLC

Provider of eDiscovery, document review, risk management, and legal consulting

services

Apr-21 Consilio LLC Xact Data Discovery (XDD)

Provider of eDiscovery, data management, and managed review services for law

firms and corporations

Apr-21 Xact Data Discovery (XDD) Zeledon-Castillo, LLC

Provides core eDiscovery services

Apr-21 Blue Sage Capital Cobra Legal Solutions

Provides legal services, including eDiscovery technology services, eDiscovery

managed review, contracts management, and legal research

Apr-21 Magna Legal Services Kim Tindall & Associates

Offers legal services including court reporting, legal videography, records retrieval,

process service, and trial presentation

Apr-21 Astorg Asset Management Corsearch

Provides brand risk and performance solutions such as IP clearance, brand

protection, and anti-piracy

Mar-21 Questel

Morningside Translations,

LLC

Specializes in patent translation and foreign filing solutions as well as legal, life

sciences, and corporate compliance language services

20

Legal Technology and Services Transactions (cont.)

Source: S&P Capital IQ.

Deals advised by Houlihan Lokey

Announced

Date

Acquirer

Target Target

Description

Mar-21 Lexitas

Confidential

Communications Int'l

Offers full-service litigation support services, including records retrieval, court

reporting, and process serving

Mar-21 Oaktree Capital System One

Provides specialized workforce solutions and integrated services to utilities, telecom,

industrial, government, legal, life sciences, marketing, and IT end market

Mar-21 Questel Novum IP

Operates as an IP solutions provider comprising PAVIS, a global IP management

service provider, and Novagraaf, an IP consulting group

Mar-21 HBR Consulting Keno Kozie Associates

Provides IT consulting, systems integration, advanced application integration,

managed services, and security and risk management services to law firms

Feb-21 First Legal Redpoint Technologies

Operates as an eDiscovery and litigation technology firm offering advanced data

collection and processing, document review, and production and trial services

Feb-21 Veritext Legal Solutions Atkinson-Baker, Inc.

Operates as a court-reporting agency offering court reporting and conferencing

services, transcription and transcript, and exhibit services

Feb-21 UBEO, LLC

Rainmaker Document

Technologies, Inc.

Provides full-service litigation support technology solutions, from electronic and

paper discovery to digital printing

Feb-21 Esquire Honorable Reporting

Provides court-reporting solutions to law firms as well as servicing the Miami,

Broward, and West Palm Beach court systems

Feb-21 Veristar LLC Planet Data Solutions, Inc.

Provider of contract analysis solutions and eDiscovery services

Jan-21 Morae Global Trinogy Systems Pty Ltd.

Offers information management and software solutions, including right-to-know

processing, general counsel, electronic document, and paperless legal systems

Jan-21 ArcherHall, LLC eDiscovery Inc.

Provider of digital forensics and eDiscovery consulting services

21

Legal Technology and Services Transactions (cont.)

Source: S&P Capital IQ.

Deals advised by Houlihan Lokey

22

Disclaimer

© 2022 Houlihan Lokey. All rights reserved. This material may not be reproduced in any format by any

means or redistributed without the prior written consent of Houlihan Lokey.

Houlihan Lokey is a trade name for Houlihan Lokey, Inc., and its subsidiaries and affiliates, which include

the following licensed (or, in the case of Singapore, exempt) entities: in (i) the United States: Houlihan

Lokey Capital, Inc., and Houlihan Lokey Advisors, LLC, each an SEC-registered broker-dealer and member

of FINRA (www.finra.org) and SIPC (www.sipc.org) (investment banking services); (ii) Europe: Houlihan

Lokey EMEA, LLP, Houlihan Lokey (Corporate Finance) Limited, and Houlihan Lokey UK Limited,

authorized and regulated by the U.K. Financial Conduct Authority; Houlihan Lokey (Europe) GmbH,

authorized and regulated by the German Federal Financial Supervisory Authority (Bundesanstalt für

Finanzdienstleistungsaufsicht); (iii) the United Arab Emirates, Dubai International Financial Centre (Dubai):

Houlihan Lokey (MEA Financial Advisory) Limited, regulated by the Dubai Financial Services Authority for

the provision of advising on financial products, arranging deals in investments, and arranging credit and

advising on credit to professional clients only; (iv) Singapore: Houlihan Lokey (Singapore) Private Limited

and Houlihan Lokey Advisers Singapore Private Limited, each an “exempt corporate finance adviser” able

to provide exempt corporate finance advisory services to accredited investors only; (v) Hong Kong SAR:

Houlihan Lokey (China) Limited, licensed in Hong Kong by the Securities and Futures Commission to

conduct Type 1, 4, and 6 regulated activities to professional investors only; (vi) India: Houlihan Lokey

Advisory (India) Private Limited, registered as an investment adviser with the Securities and Exchange

Board of India (registration number INA000001217); and (vii) Australia: Houlihan Lokey (Australia) Pty

Limited (ABN 74 601 825 227), a company incorporated in Australia and licensed by the Australian

Securities and Investments Commission (AFSL number 474953) in respect of financial services provided to

wholesale clients only. In the United Kingdom, European Economic Area (EEA), Dubai, Singapore, Hong

Kong, India, and Australia, this communication is directed to intended recipients, including actual or

potential professional clients (UK, EEA, and Dubai), accredited investors (Singapore), professional

investors (Hong Kong), and wholesale clients (Australia), respectively. Other persons, such as retail clients,

are NOT the intended recipients of our communications or services and should not act upon this

communication.

Houlihan Lokey gathers its data from sources it considers reliable; however, it does not guarantee the

accuracy or completeness of the information provided within this presentation. The material presented

reflects information known to the authors at the time this presentation was written, and this information is

subject to change. Houlihan Lokey makes no representations or warranties, expressed or implied,

regarding the accuracy of this material. The views expressed in this material accurately reflect the personal

views of the authors regarding the subject securities and issuers and do not necessarily coincide with those

of Houlihan Lokey. Officers, directors, and partners in the Houlihan Lokey group of companies may have

positions in the securities of the companies discussed. This presentation does not constitute advice or a

recommendation, offer, or solicitation with respect to the securities of any company discussed herein, is not

intended to provide information upon which to base an investment decision, and should not be construed

as such. Houlihan Lokey or its affiliates may from time to time provide investment banking or related

services to these companies. Like all Houlihan Lokey employees, the authors of this presentation receive

compensation that is affected by overall firm profitability.

23

CORPORATE FINANCE

FINANCIAL RESTRUCTURING

FINANCIAL AND VALUATION ADVISORY

HL.com