Deutsche Bank A.Ş.

Annual Report 2022

Annual Report

2022

Deutsche Bank A.Ş.

Annual Report 2022

Message from the Chairman and the CEO

Dear Shareholders,

We look back on a year that was marked by geopolitical escalations, high inflation, supply chain

disruptions, energy price and growth concerns, along with increasing global uncertainties.

In 2022, domestic growth was strong in H1 but started to slow in Q3 on the back of the slowdown in

loan growth and weakening external demand. Thanks to record high tourism revenues and fiscal

support later in the year, 2022 growth should be slightly above 5% - ahead of most peers, yet also

noticeably lower than the 11.4% recorded in 2021. The first half of the year was once again marked by

high FX volatility, with the lira reaching new all-time lows. Reasons were mostly the unconventional

monetary policy approach and subdued portfolio flows. As from Q3, the lira was mostly stable, driven

by FX-interventions, macro-prudential measures, strong tourism revenues and bilateral inflows.

In what was a challenging year for Turkish markets, Deutsche Bank A.Ş. operated profitably once more

and recorded a materially improved net income of TRY 848million. With its robust capital levels, our

bank remains well positioned for further growth in our financing as well as risk and capital market

intermediation activities for public and private sector corporate and institutional clients.

Throughout 2022, we also continued to remain committed to our social responsibilities. In order to

strengthen the fabric of our society and to help enhance the environment in which we operate, our staff

participated in various activities organized or initiated by our Corporate Social Responsibility

volunteers.

Going into 2023, Türkiye - like many other countries - is facing important external and domestic

challenges. Global financial tightening continues, as central banks fight persistent underlying price

pressures. Global growth is expected to slow noticeably, with potentially mild recessions in Europe and

the USA, impacting Turkish exports. In addition, the war in Ukraine goes into its second year, and

weighs on global risk sentiment. On the domestic front, we expect demand to remain relatively robust

at the start of the year, due to the minimum wage increase and accommodative fiscal & monetary

policies. However, still elevated (yet falling) inflation pressures as well as weaker external demand

should limit upside surprises to domestic demand. In addition, a less competitive currency (in real

terms), will further weigh on exports. This said, the reopening of China in combination with lower gas

prices, surprisingly resilient domestic demand, and the reduced risk of a hard landing in Europe would

seem conducive for Turkish production and exports. We expect that fiscal and credit stimulus measures

to likely support domestic demand this year.

Deutsche Bank A.Ş.

Annual Report 2022

On the negative side, the tragic earthquakes early February, have – beyond the immediate human

tragedy – complicated the situation for the government. The impacted region accounts for some 10%

of GDP – with a strong focus on industrial production and the textile industry, leading to negative

implications on the overall output for Türkiye. The impact of the earthquakes is still difficult to put into

numbers, but it is reasonable to expect the direct impact at well above USD 50bn. This said, given

Türkiye’s strong fiscal position, we expect a relatively quick rebuilding process. All in all, we expect a

direct negative impact of minus 0.3%-0.5% on the economy, with further risks in case of a decline in

tourism later this year. Overall, we currently see annual GDP growth falling to 2.7% in 2023.

Headline inflation reached a 24-year record level and averaged 72% last year. Despite a decline in price

pressure in December and January, underlying inflationist tendencies have remained strong due to the

minimum wage hike in January (55%), the retirement reform and pronounced services inflation (at all-

time highs). For the rest of the year, we expect headline inflation to fall, but most likely much more

gradually than initially expected. We forecast levels below 50% by mid-year and 40% by year-end. Main

drivers in H1 are base effects, slowing food inflation and a stable currency. Our forecasts for H2 remain

still uncertain considering the potential impact of any potential currency volatility and potential

measures announced post the 2023 national elections.

After cutting its policy rate by 500bps to 9% last year, the easing cycle was supposed to be over.

However, on the back of the devastating earthquakes the CBT delivered another 50bps cut at its

February meeting to support the economy. The interest rate outlook remains uncertain. Though the

CBT has indicated that the current rate level is adequate, the path depends on various domestic

developments including the extent of economic slowdown ahead of the elections and its impact

resulting on inflation, and the timing of the election itself. We would not rule out further rate cuts ahead

of the election. In addition, we expect the CBT to continue to implement targeted macro-prudential

measures and actively use FX-interventions to keep the lira stable.

Though inflation is on a decelerating path from recent peaks, we would argue that inflation remains

structural in Türkiye, and reaching levels sustainably below 30% remains difficult to achieve for the

time being. Following supply chain disruptions due to the earthquakes, inflation risks are in fact now

higher than before. Although the CBT has made it clear that there will be no reversal of the current

monetary policy framework any time soon, we would not rule out monetary policy tightening in H2-23,

i.e. post elections, as the current monetary policy mix looks unsustainable in the medium term.

A critical topic for Turkish local markets in 2023 will be whether the CBT will keep interest rates at

current low levels and whether it will let the currency adjust after becoming very expensive in real terms.

Questions should also arise around the FX-protected lira deposit scheme and whether the tool will be

extended into 2024. Although the FX-protected lira deposit scheme has significantly reduced concerns

Deutsche Bank A.Ş.

Annual Report 2022

around financial stability, we continue to see risks for lira depreciation in light of extremely loose

monetary and fiscal policies coupled with structural inflationary pressures.

Notwithstanding the overall economic and geopolitical backdrop, our bank and our staff will continue

to focus on sustainable growth, innovation and the ongoing development of our service and product

offering to clients. As employer, corporate citizen and member of the Deutsche Bank Group, we shall

maintain highest standards in terms of governance, risk management, compliance and business ethics,

and continue to deliver value to our stakeholders

Istanbul, 3 March, 2023

With our best regards,

Frank Helmut Krings Orhan Özalp

Chairman of the Board of Directors CEO, Board Member

Deutsche Bank A.Ş.

Annual Report 2022

1. Introduction

History of Deutsche Bank A.Ş.

Established as Türk Merchant Bank A.Ş. in 1987.

Renamed as Bankers Trust A.Ş. in 1997.

Continued operations as Deutsche Bank A.Ş. as of 2000 following Deutsche Bank’s acquisition of

Bankers Trust.

Having provided corporate ban services under an investment banking license until 2004, Deutsche

Bank A.Ş. applied to the Banking Regulation and Supervision Agency (BRSA) for permission to

accept deposits in an attempt to expand its product range.

Obtained permission to accept deposits in October 2004.

Added corporate cash management and custody and settlement services to its product portfolio in

2005.

The Bank acquired Securities Services portfolio of T. Garanti Bankası A.Ş. in 2007

Received factoring and forfeiting licenses in February 2012, in accordance with the decision taken

by the Banking Regulation and Supervision Agency.

Upon the application made to the Capital Markets Board in accordance with the newly introduced

capital markets legislation, the Bank was granted license to provide dealing on own account, limited

custody and general custody services on 5.11.2015.

The Bank has no branches other than Head Office.

The Trade Registry Number of the Bank is 244378.

The Central Registration System Number (MERSIS) of the Bank is: 0-8760-0487-2200015

Bank’s web address: www.db.com.tr

Bank’s E-mail address: tr.muhaberat@db.com

Bank’s Head Office address: Ferko Signature Esentepe Mahallesi, Büyükdere Cd. No: 175/ 149

34394 Şişli/İstanbul

Tel: +90 212 317 0100

Fax: +90 212 317 0105

Electronic Notification Address (National Electronic Notification System) is 25999-32177-21566

Bank’s Registered Electronic Mail (KEP) is db.iletisi[email protected]

Deutsche Bank A.Ş.

Annual Report 2022

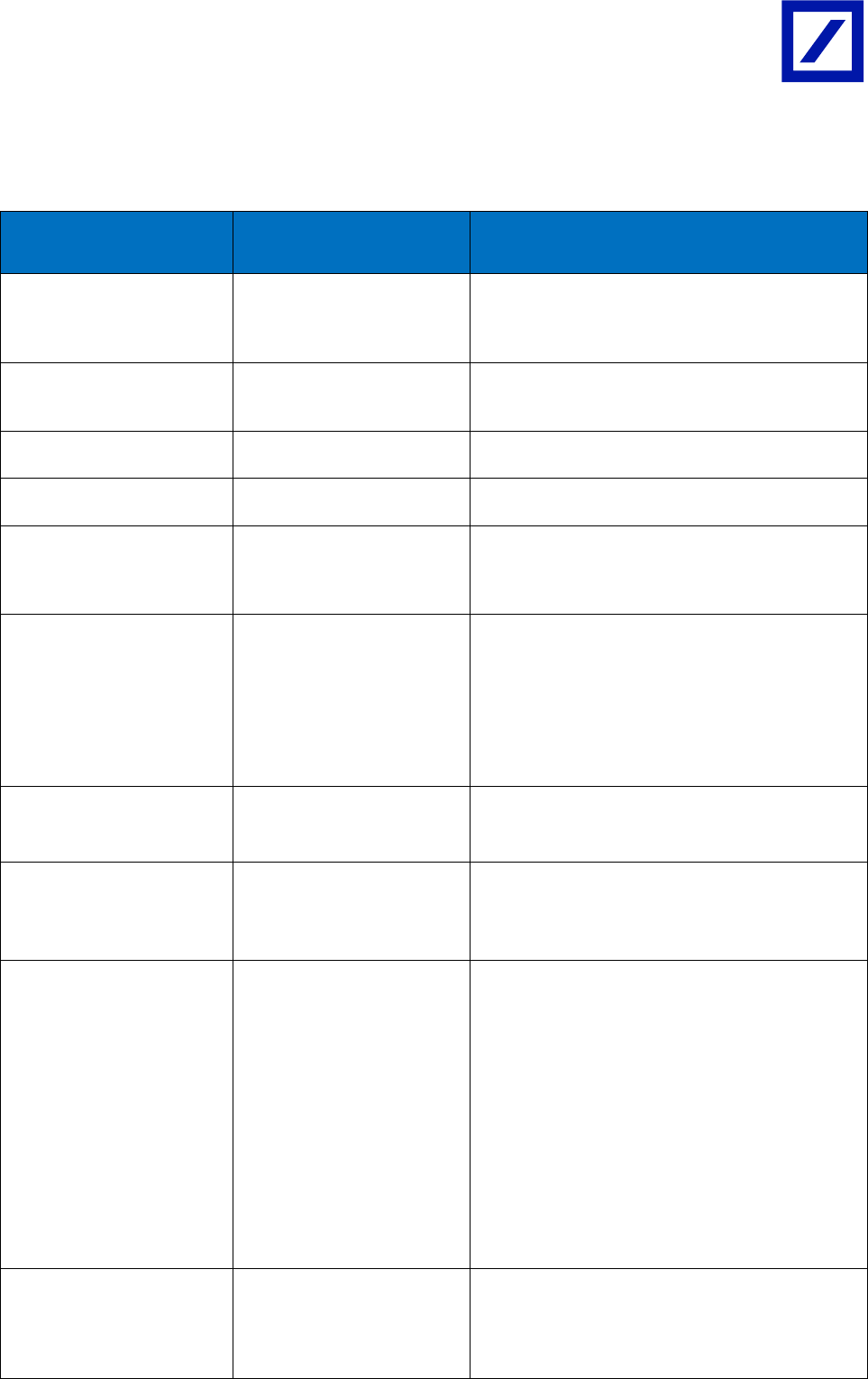

Financial Highlights

December 31, 2022

Summary Financial Highlights

(TRY 000)

2022

Cash and Cash Equivalents

3,054,805

Financial Assets at Fair Value Through Profit and Loss

2,427,140

Loans (Net)

3,914,826

Total Assets

11,406,223

Deposits

2,188,686

Funds Borrowed

5,897,204

Shareholders’ Equity

1,819,516

Interest Income

1,093,216

Net Trading Income/Loss

652,842

Net Operating Profit

1,131,040

Financial Ratios

(TRY 000)

2022

Capital Adequacy Ratio

29.11

Shareholders’ Equity/Assets

15.95

Off-Balance Sheet Items

(TRY 000)

2022

Guarantees and Warranties

825,281

Commitments

3,914,080

Derivative Financial Instruments

43,493,521

Items Held in Custody

9,815,222

Deutsche Bank A.Ş.

Annual Report 2022

Amendments to the Articles of Association

No amendments were made to the Articles of Association of Deutsche Bank A.Ş. during 2022.

Extraordinary General Assembly Meeting in 2022

No Extraordinary General Assembly Meetings were held during 2022. Ordinary General Assembly

Meeting of Deutsche Bank A.Ş. was held on March 31, 2022

Shareholder Structure, Changes during the Year,

Qualified Shares and Management Shares

All shareholders of Deutsche Bank A.Ş. are Deutsche Bank Group companies. The Bank holds no

privileged shares.

The most recent shareholder structure is presented in the table below.

Chairman and Members of the Board of Directors, Members of the Audit Committee and CEO do

not own any shares in the Bank.

The Bank did not acquire its own shares.

Shareholder Number of Shares Share Capital (TL) Share (%)

Deutsche Bank AG 1,349,999,730 134,999,973 99.99

Süddeutsche Vermögensverwaltung GmbH 68 6.8 <1

DB Industrial Holdings GmbH 68 6.8 <1

Deutsche Holdings (Luxembourg) S. á r. l. 67 6.7 <1

DB Capital Markets (Deutschland) GmbH 67 6.7 <1

Total 1,350,000,000 135,000,000 100

Deutsche Bank A.Ş.

Annual Report 2022

Equity Investments

The Bank does not have any equity investments, either directly or indirectly.

Deutsche Bank A.Ş. within the Banking Industry

Operating in Türkiye since 1987, leveraging the strong global banking network of its parent company

Deutsche Bank AG, Deutsche Bank A.Ş. is primarily focused on investment banking and corporate

banking. Offering its investment and corporate banking services with a workforce of 122 employees,

Deutsche Bank A.Ş. is the Istanbul based subsidiary of Deutsche Bank Group, which has

approximately 84,930 employees and EUR 1,337 billion in total assets (as of 31st December 2022)

throughout the world. Deutsche Bank A.Ş. does not have any branches in Türkiye other than Head

Office. Deutsche Bank A.Ş. targets the highest levels of quality in all product and service segments

in which it is active, and strives to be one of the prime relationship bank of each client.

In 2022, the Bank continued to take an active part in the bonds and foreign currency vs. Turkish lira

transactions. Having started to provide custody services as of 2005, Deutsche Bank A.Ş. has become

an extremely reputable bank, preferred by foreign investors for its custody services. The bank has a

30% market share among all the custodian banks that keep custody of securities portfolios of foreign

institutional investors in accordance with Central Bank’s and Central Securities Depository of

Türkiye, MKK’s records.

The bank mediates cash management circulation in domestic and international trade and provides

services and consultancy to clients in Türkiye in the fields of short and medium term trade financing

and risk management via its specialist teams. Besides conventional foreign trade products, the bank

has become a reliable partner in its clients’ banking transactions by providing customized solutions in

terms of trade financing products and corporate cash management.

The bank continues to work actively in preparation of major foreign company acquisition financing

packages of Turkish groups.

Deutsche Bank A.Ş. aims to provide services in line with the priorities and requirements of its local and

multinational customer segment, so as to develop strategic and longstanding relations with its

prominent customers. In doing so, it takes advantage of Deutsche Bank’s global know-how and

maximizes the coordination within different product groups, thus providing the most effective solutions

through exclusively designed financing techniques and banking services for its clients.

Bank’s target for 2023 will be to reinforce its reputation as a reliable and permanent business partner

by establishing longstanding relations with its clients.

Deutsche Bank A.Ş.

Annual Report 2022

Research and Development

After many years of providing corporate banking services in Türkiye under an investment banking

license, Deutsche Bank A.Ş. began offering commercial banking services in October 2004 after

having been granted a deposit taking license. Deutsche Bank A.Ş. continuously seeks to enhance the

quality and diversity of the services it provides. The Bank has been developing systems and products

to ensure the highest level of quality and diversity of its products in line with its expanding businesses.

Having started as an extension of its main business line in 2006, Custody Services were structured

to ensure compliance with the new capital markets legislation. The Bank was granted the license to

provide Dealing on Own Account, Limited Custody and General Custody services on 5.11.2015.

Combining its local experience with its main shareholder Deutsche Bank AG’s global network,

expertise and know-how in the areas of public offerings, block sales and derivative products,

Deutsche Bank A.Ş. continues to provide capital markets and treasury solutions. In 2022, the Bank

focused on capital markets instruments (in lieu of risk controlling) service management and capacity

expansion, and gained successful results. In 2022, the Bank completed its system development and

new processes to execute forward FX transactions at Borsa Istanbul Futures and Options Market and

became an active member of the market

The Bank, in line with its strategies, will continue delivering against digitalization stock exchange

products and capacity optimization in 2023.

Operations in 2022

Deutsche Bank A.Ş. Management believes that Türkiye, which has long stood out among emerging

economies, offers tremendous potential for growth and investment in the years ahead.

Corresponding to this perspective, the Bank is continuing its expansion into Türkiye with a primary

focus on investment banking and corporate banking.

The organization of Deutsche Bank A.Ş. is composed of Investment Bank, Corporate Bank Support

Functions and Internal Systems.

Deutsche Bank A.Ş.

Annual Report 2022

Investment Bank

Fixed Income Securities and Currencies

Fixed Income Securities and Currencies unit conducts the structuring and sales transactions of debt and

money market instruments. It executes trading of debt securities such as government bonds and treasury

bills, as well as foreign exchange spot and derivatives. Moreover, it assists in pricing of spot and derivative

currency transactions of financial institutions, insurance companies and corporations. It provides support

to related divisions regarding foreign exchange and interest rate risk management solutions offered to

the clients in line with their risk management policies.

Structured Treasury and Lending Solutions

Structured Treasury and Financing Solutions offers clients, Deutsche Bank’s market-leading expertise in

Capital Markets and Emerging Markets.

The Unit provides financial solutions in coordination with global and local Treasury, Capital

Markets and Corporate Banking teams of Deutsche Bank.

The Unit offers Turkish companies, operating both in Türkiye and abroad, access to Deutsche

Bank’s global platform.

The Unit provides local knowledge and access of Deutsche Bank in Türkiye to global clients thus

contributes to development of Turkish capital markets.

The Unit also develops solutions based on market opportunities and needs in all financial

products including currency, fixed income securities, long-term funding and structured products.

Corporate Bank

The Corporate Bank consists of five units providing services to corporate and financial institutions; which

are Securities Services, Trade Finance, Cash Management and Trade Finance Financial Institutions,

Corporate Cash Management and Corporate Coverage.

Securities Services: With its Securities Services Unit, established by a highly competent and experienced

team in 2005, Deutsche Bank A.Ş. has become an extremely reputable bank, preferred by foreign

investors for its custody services. As of 2022

The Bank maintained its 30% market share among all

custodian banks that keep custody of securities portfolios of foreign institutional investors in 2022.

In 2022, Deutsche Bank A.Ş. continued to provide qualified and specialist services to its current

customers. Having received the general license for custody in accordance with the Capital Markets Law

in 2015, the Bank has maintained its successful custody and intermediary services by providing the best

solutions for its non-resident clients even during the most volatile times of the markets.

Deutsche Bank A.Ş.

Annual Report 2022

Deutsche Bank A.Ş. Securities Services confirmed their ‘TOP RATED’ status, first granted in 2009, by

receiving positive remarks from their clients and repeatedly scoring high points in the annual customer

poll conducted by the Global Custodian magazine in 2022, as in previous years. In this way, it has asserted

its first class quality of client services.

In 2023, Deutsche Bank A.Ş. plans to increase its market share and develop its position in the market for

clearing and custody activities through new products to be included in its already wide product range.

Trade Finance: Trade Finance unit intermediates domestic and international trade. The team, expert in

trade services and finance, has been serving its clients for short and medium term trade financing and risk

management. Deutsche Bank A.Ş. offers value added solutions based on 153 years of experience in 46

countries of Deutsche Bank AG, its main shareholder, to its clients. In addition to traditional trade services

and products, the Bank has become a reliable partner in providing tailor made solutions to meet its clients’

trade finance needs.

In Corporate Banking, enhancing the efficiency of resources, managing liquidity and risks, and, for this

purpose, setting the necessary targets and attaining them gain more and more importance with each

passing day. As Deutsche Bank A.Ş., the Bank contribute to efficient management of our clients’ working

capital and the Bank pay its best efforts to meet their demands with innovative solutions.

Although the competition is becoming fiercer, particularly in corporate banking as a result of rising interest

to Türkiye, Deutsche Bank A.Ş. Trade Finance Business Unit develops suitable products which meet the

needs of changing conditions and business models for more productive activities, as a result of which, the

Bank has gradually strengthened its market share.

Financial Institutions Cash Management and Trade Finance: As one of the leading global banks in the field

of Cash Management, Deutsche Bank continues to provide services as one of the solution partners and

main correspondents for Turkish banks. Enjoying this position to provide cash management solutions to

banks, the unit performs US Dollar money transfers through Deutsche Bank Trust Company Americas,

New York; Euro transfers through Deutsche Bank AG, Frankfurt Branch and Sterling transfers through

Deutsche Bank AG, London Branch. Services provided by the unit include Dollar and Euro based

commercial and treasury money transfers, liquidity management and sales and support services for

related products. While supporting clients with local, regional and global cash management solutions, the

unit aims to provide the most efficient and the best services through its extensive global branch network.

Having been providing its clients with foreign trade services in 46 countries and 67 locations Deutsche

Bank AG offers solutions for foreign trade products and trade financing through its experience,

knowledge and wide variety of products in order to maximize the level of its clients’ efficiency in foreign

trade transactions.

Through difficult times in financial markets and the global economy, the Bank has maintained

uninterrupted and consistent support for Financial Institutions. Thus, it aims to always be the most reliable

Deutsche Bank A.Ş.

Annual Report 2022

and preferred business partner of Turkish banks by continuing to share its Cash Management and Foreign

Trade products with clients, as well as by providing innovative solutions and global experience.

Corporate Cash Management: Corporates operating globally have to cope with economic complexity,

shifting regulatory landscapes, as well as unfamiliar markets and currencies. To thrive, the treasury of

tomorrow needs to have greater transparency over cash flows and payments, digital capabilities and the

ability to marry flexibility with control.

Our cash management corporate experts provide a wide range of world-class solutions that can help

clients improve liquidity and cash flow and optimize their treasury and payment businesses.

We also offer a complete range of services to handle the complexities of global, regional and domestic

cash management, including global payments, collections, liquidity management, and information and

reporting services.

Global Corporate Coverage: The builds strategic and longstanding relationships with corporate clients

that are incorporated in Türkiye but operate with a global outreach to provide services in line with their

requirements and priorities. In doing so, Global Corporate Coverage takes advantage of Deutsche Bank’s

global know-how and maximizes the coordination within different product groups, thus providing the

most effective solutions through exclusively designed financing techniques and banking services for its

clients. Global Corporate Coverage works in coordination with its partners in Financial Solutions Group,

Risk Management and Financial Institutions Cash Management and Trade Finance.

Local Corporate Coverage: Thanks to the synergy created by Deutsche Bank AG’s network and global

footprint, our unit serves global companies operating in Türkiye with the highest international banking

experience, provides consultancy for Cash Management, Treasury Management and Trade Financing

and offers solutions. Our goal here is to contribute to our clients’ working capital management. With the

local expertise and experience of Deutsche Bank AG and our global branch network, we bring unique

solutions to our corporate clients. Our goal is to maintain being a reliable partner in the banking processes

of our customers by providing custom solutions as well as traditional products.

Deutsche Bank A.Ş.

Annual Report 2022

Support Functions and Internal Systems

Finance, Treasury, Legal and Data Protection, Human Resources, Credit Allocation, Technology,

Operations and Chief Information Security Office are included under Support Functions; whereas,

Compliance and Anti-Financial Crimes, Internal Control, Internal Audit and Risk Management are

included under Internal Systems.

Support Functions

Finance: The Finance Unit examines the Bank’s financial position through its daily and monthly reports

and informs the management on the results. In order to adequately assess the performance of profit

centres, the unit prepares the financial statements for these units on a daily and monthly basis. The unit

is in charge of providing the information flow for the Bank’s audit by the independent auditor and

regulatory bodies. The Finance Unit generates new projects for Executive Management reporting and

internal control systems and supports other related projects, prepares the Bank’s financial statements

and related disclosures in the required format and submits them to regulatory and supervisory bodies

such as the Banking Regulation and Supervision Agency, Central Bank of Türkiye, Undersecretaries of

Treasury, Capital Markets Board and The Banks Association of Türkiye.

Treasury: Treasury unit is mainly responsible for managing asset and liability, capital, liquidity and

publishing transfer pricing of the Bank in accordance with strategy and risk appetite of bank while

complying with internal and regulatory requirements.

Treasury’s key responsibilities are to make sure that there is enough liquidity in the bank at any given point

in time, that there is capital available when needed and that funds can be raised as and when necessary,

all at a reasonable cost whilst balancing the needs of business growth and regulatory demands. Treasury’s

role extends to business steering through the effective transfer pricing of these liquidity and capital

resources to the businesses. Treasury’s fiduciary mandate, which encompasses the Bank’s funding pools,

asset and liability management (ALM) and fiduciary buffer management, supports businesses in

delivering on their strategic targets.

Legal and Data Protection: The Unit provides legal consultancy services to the business and support

service divisions of Deutsche Bank A.Ş. sets the legal framework regarding protection of personal data in

order to ensure that personal data protection activities are executed in accordance with the applicable

laws and performs Corporate Secretariat functions. It reviews the compliance of contracts to which the

Bank is a party, as well as transactions and texts prepared by other divisions of the Bank with the

applicable laws, and expresses its opinions with respect to legal implications to the divisions. The Unit is

responsible for examining the Bank’s new projects and recently developed products from a legal point of

view, and where necessary, for offering legally compliance alternatives. The Unit also serves as the

secretariat to General Assembly, Board of Directors, Audit Committee, Credit Committee, Assets and

Deutsche Bank A.Ş.

Annual Report 2022

Liabilities Committee, Executive Council, Operating Council, Information Security Committee,

Information Systems Strategy and Steering Committee, Information Systems Continuity Committee and

Data Sharing Committee meetings. The Unit represents the Bank in lawsuits to which the Bank is a party

or appoints 3rd party law firms for this purpose.

In 2023, the Unit aims to continue providing legal consultancy services related to the finance sector and

issues concerning the Bank, to provide legal support for potential projects, and to conduct the necessary

studies in order for the Bank to be in compliance with the amended legislation.

Human Resources: Human Resources Unit acts in accordance with the principle that its employees are

Bank’s most valuable assets, draws its strength from the employees, and provides equal opportunities

with innovative human resources applications supporting and improving the employees. In addition to a

fair wage structure, which aims to increase loyalty of the employees towards the Bank and to meet their

needs under challenging conditions of competition, HR also provides conditions that will enable the

employees to establish their work-life balance. In order to keep the organizational structure dynamic, the

unit provides an efficient communication and motivation environment where the employees are able to

use their creativity and to express their opinions, and adopts a transparent management policy that

accommodates and embraces different opinions and knowledge. Human Resources Unit supports

professional and personal development of the employees, reinforces their connection with the Bank and

therefore plays a strategic role in attaining the Bank’s targets with ease. The unit manages the relevant

structures and processes in accordance with the policies and procedures stipulated in the Laws and

regulations. Possible impacts of legislation amendments to current practices are discussed at the

Executive Council and the Operating Council. Furthermore, issues that concern the Bank as a whole,

personnel policies and social organizations, etc. are, discussed in Executive Council where necessary and

put into effect by Chief Executive Officer, Chief Operating Officer and Human Resources. Promotion

proposals up to the level of Managing Director, based on Executive Council’s review are approved by the

Board of Directors, and announced to all employees.

Credit Allocation: Credit Allocation Unit is responsible for reviewing loan applications received from

business units for the existing or new credit clients, assessment of their financial statements, accurate

and proper reflection of the financial analyses to the credit packages and, subsequent to finalization of

these processes, presentation of the credit packages to the appropriate credit authority (CEO, Credit

Committee or Board of Directors) in co-operation with the business units. The Unit will, if deemed

necessary, be further responsible from paying visits to clients, conducting reviews to see whether there

are any excesses in the credit limits assigned, evaluation of possible NPLs with Legal and Data Protection

and Risk Management units and, if applicable, presentation of these credits to the appropriate authorities.

Operations Unit: Carrying out all banking transactions in accordance with the regulatory requirements

Bank company standards and accepted high quality control and work flow practices followed by the

banking sector. In order to achieve this goal in the best conditions; creates and implements simple, easy-

to-understand and transparent workflows. Follows technology, legislation, relevant standard

changes and market practices and works one-to-one with the relevant teams in line with the needs.

Deutsche Bank A.Ş.

Annual Report 2022

In addition to its daily operational activities, Operations also carries out activities in projects aimed at

compliance with legislation, risk management and offering different products to customers.

Investment Banking Operations Unit; is responsible for the efficient, accurate, profitable and risk-free

clearing and settlement of bank transactions for corporate and government clients. Investment Banking

Operations support Global market and Treasury units by aiming to run processes smoothly, create

improvement and increase efficiency

Information Technology Unit: Employing the applicable legislation and standards established by both the

main partner and the Bank, knowledge, risk approach and innovation culture; the Unit establishes,

develops and operates technological structure of the Bank.

The Unit is responsible of governance and execution of the procedural structure in harmony with the

required standards to ensure the integrity and continuity of Information Systems, which are vital for the

operations of the Bank, to establish efficient controls on the same and to manage investments and

projects that are in compliance with both business targets and applicable regulations.

In order to provide continuity of the technological structure, both data centres and subsequent user areas

have been structured to operate with real time synchronization.

Chief Information Security Office: the Unit responsible for the Bank’s security matters. CSO

implements technology and physical security protection measures in accordance with the DB AG

Group’s Security Strategy and Risk Appetite. CISO develops and drives the global implementation

and operationalization of our group-wide information security strategy and ensures that the Bank’s

people and assets are appropriately protected.

To protect the Bank’s information and systems, a multi-layered approach is taken to build information

security controls, including data, devices, and applications. End-to-end protection is delivered while

providing concrete security to detect, prevent, respond, and recover from cyber threats. This

approach is a key tool of the Bank’s technology infrastructure and Deutsche Bank Group Information

Security Strategy to increase security and stability of the technology platforms.

In addition to prevention methods and controls like threat intelligence, data leakage prevention,

vulnerability management, business continuity management and continuous staff awareness

programs, prioritizing detection, backed up by a robust response process is an important facet of

Deutsche Bank Group Information Security Strategy. Global Cyber Intelligence and Response

Centres are set up to provide 24/7 coverage across different time zones (“follow the sun” model),

thus improving the Bank’s capability to detect threats and respond to information security incidents.

Deutsche Bank A.Ş.

Annual Report 2022

Internal Systems

Compliance and Anti-Financial Crimes (AFC) Unit: Compliance and AFC is responsible for advising

the business on and overseeing adherence of the business to applicable laws and regulations mainly

the Banking Law No: 5411 Capital Markets Low No: 6362 Law No: 5549 on Prevention of Laundering

Proceeds of Crime, Law No. 6415 on the Prevention of the Financing of Terrorism and Law no. 7262

on Prevention of Financing of Proliferation of Mass Destruction Weapons rules, regulations, and

ethical standards and also assessing the appropriateness and effectiveness of the control

environment. Compliance Unit acts as a coordinator within the Bank to avoid gaps in the Bank’s

internal control landscape to counteract risks that may result from failure to comply with material

rules and regulations.

The unit provides recommendations about maintaining the necessary compliance and cooperation in

relations with the supervisory and regulatory institutions determined by laws and regulations. The

unit also undertakes the responsibility to assess and advise on the Compliance related risks to the

Board of Directors, Executive Management and business units, in compliance with the related

legislation.

AFC is responsible for ensuring compliance with obligations on prevention of laundering proceeds of

crime proliferation of mass destruction weapons and terrorism financing, as set out in Law No 5549,

Law No 6415 and Law No 7262, setting strategies, internal controls and measures, functioning rules

and responsibilities to reduce risk by evaluation of clients, processes and services on a risk-based

approach, and increasing employee awareness on these topics. Responsibilities include conducting

the required monitoring and research as well as preparing necessary reports regarding Bank’s

businesses and transactions of Bank’s clients.

Internal Control: Responsible for execution of internal control activities, in order to provide

reasonable assurance on effectiveness, adequacy and compliance of internal control systems,

especially the financial and operational systems established within Deutsche Bank A.Ş. The Unit

performs the activities in accordance with the policy approved by the Board of Directors. The Bank

established the control points based on segregation of duties principle. Through this structure, it is

assured that the second level control activities within internal control system are performed

independently and objectively from functional units with the principle of the segregation of duties.

The internal control activities are designed according to risk types and levels that emerge based on

the characteristics and content of the Bank’s activities.

Internal Audit: The Internal Audit Unit monitors the internal control structure at all Deutsche Bank

A.Ş. units regularly and independently on behalf of the Board of Directors. Internal Audit evaluates

the units’ transactions and practices on the basis of targets, their compliance with internal/external

regulations and their performance within the framework of risk analysis, and focuses on assisting the

Board of Directors regarding the effectiveness of the corporate management.

Deutsche Bank A.Ş.

Annual Report 2022

Internal Audit checks that the Bank’s ethical standards have been fully implemented by the business

units. In addition to monitoring the compliance with internal and external regulations, Internal Audit

also conducts dynamic and effective monitoring of the working environment at all business and

support units through a risk-based approach.

Risk Management: The Risk Management Unit is responsible for Bank-wide implementation of the

standards “regarding the risk-return structure of the Bank’s cash flows and monitoring, controlling

and, when necessary, modifying the nature and level of the operations” that were devised and put

into effect by the Board of Directors within the framework of the BRSA regulations. On the other

hand, coordinating and assessment of the ICAAP Process, reporting and presenting its results are

among the significant responsibilities of the Risk Management Unit.

The Risk Management Unit is responsible from understanding risks and conducting sufficient

evaluations before entering a transaction, setting risk management policies and practice methods

based on risk management strategies, ensuring the application and adaptation of risk management

policies and practice methods. Maintaining quantified risks within limits and reporting the risk

measurements and risk monitoring results to the Board of Directors or to the Audit Committee and

senior management, on a regular and timely basis are also included among the responsibilities of the

Unit.

Deutsche Bank A.Ş.

Annual Report 2022

2. Management and Corporate Governance

Board of Directors

Frank Helmut Krings

Chairman of the Board of Directors (Since 2019), Member of the Audit Committee,

Chairman of the Compensation Committee

Frank Krings serves as Non-Executive Director on the statutory boards of various European financial

institutions and organizations within and outside the European Union. In the Grand Duchy of

Luxembourg, he is a Member of the Supervisory Board, the Risk Committee, and the Nomination

Committee of Deutsche Bank Luxembourg S.A.; he is also an elected member of the plenary

assembly of the Luxembourg Chamber of Commerce and a Member of its Audit Committee. In the

Swiss Confederation, he is a Member of the Board of Directors, the Audit Committee, and the Credit

Committee of Deutsche Bank (Schweiz) AG, Geneva. In France, he is a Member of the Board of

Directors of the Franco-German Chamber of Commerce and Industry, Paris.

Claire Coustar

Member of the Board of Directors, Deputy Chairperson

Claire Coustar is Managing Director, Global Head of ESG for FIC and Head of CEEMEA Client

Coverage. Claire joined Deutsche Bank in 2003, and during her tenor she has held various positions

across structuring, sales, and trading; including Head of Emerging Market Structuring Prior to

Deutsche Bank Claire held various positions in London office of a foreign bank, including Commodity

Derivative, European Securitization and Latin America Structured Products groups. Coustar was

appointed as a member of the Board of Directors of Deutsche Bank A.Ş. in February 2018. Claire

holds a Bachelor of Science degree from Babson College with major in Finance, Economics and

International Business and a Non-Executive Director Diploma from the Financial Times. Claire sits on

the Fixed Income & Currencies Executive Committee of Deutsche Bank AG. Claire represents

Deutsche Bank on GFANZ and the Net Zero Banking Alliance and is a member of the Group

Sustainability Steering Committee. Claire sits on the Fixed Income & Currencies Executive

Committee of Deutsche Bank and is Vice-chair of the Board of Directors of Deutsche Bank Türkiye.

Deutsche Bank A.Ş.

Annual Report 2022

Jorge Andrés Otero Letelier

Member of the Board of Directors, Deputy Chairperson

Born in 1969, Jorge Andrés Otero Letelier holds a Bachelor’s Degree in Finance from the University

of Santiago, Chile and a Master in Business Administration from New York University. Mr. Otero has

more than 20 years of experience in banking, including 15 years where he held managerial positions

with Deutsche Bank in New York, London and Singapore covering Emerging Markets.

He is currently

based in London as the Head of Credit for Emerging Markets, International Institutional and

Corporate Credits and the Illiquid Financing businesses. Mr. Otero previously served in the

Supervisory Board of OOO Deutsche Bank in Moscow and the Management Board of Deutsche Bank

Mexico S.A.

Orhan Özalp

Member of the Board of Directors, Chief Country Officer, Chief Executive Officer,

Chairman of the Credit Committee

Orhan is the Chief Country Officer of Türkiye, CEO of Deutsche Bank A.S and also heads the Central

Eastern Europe, Balkans, Türkiye and Israel coverage teams at Deutsche Bank. He joined Deutsche

Bank in 2006 and held various positions in Financial Institutions Coverage, Structured Product

Origination and Sales, FICC and Equity Derivatives Sales. Orhan later became a Managing Director

in Institutional Coverage and appointed as CEO of Deutsche Bank A.Ş. in January 2019. He holds BA

degrees in Economics and Business Management from Koc University.

Mark Michael Bailham

Member of the Board of Directors, Member of the Audit Committee, Member of the Compensation

Committee

Born in 1963, Mark Michael Bailham holds a Bachelor’s Degree in BSc Economics from University

College London. Mr. Bailham is the Head of EMEA AFC and Compliance, Global Head of Central

Compliance and Global Head of AFC and Compliance Risk Assessments, Deutsche Bank, London.

He has more than 30 years of experience in Compliance and AFC matters, including country, regional

as well as global issues, all products both retail, commercial and investment banking for global retail

and commercial banks, investment banks and asset management companies. Mr. Bailham joined

Deutsche Bank AG in 2014 and has been involved in. He has been working as a Member of Board of

Directors at Deutsche Bank A.Ş. since August 2020. Mr. Bailham is also a member of the Supervisory

Board of OOO Deutsche Bank in Moscow

Deutsche Bank A.Ş.

Annual Report 2022

Michael Christoph Maria Dietz *

Member of the Board of Directors

Michael Dietz is Deutsche Bank’s Global Head of Trade Finance Flow business Over the time of his

career at Deutsche Bank Michael covered various senior positions in Corporate Coverage functions

across Germany, Switzerland as well as the United States of America. Prior to joining the current role,

Michael has developed the EMEA Coverage for Commodity Traders as well as Swiss Corporates for

Deutsche Bank in Zurich. Michael has a degree in Mechanical Engineering and Economics at

Darmstadt University, Germany. He is a certified Dodd- Frank Securities Trader. He was appointed

as a member of the Board of Directors of Deutsche Bank A.Ş. in February 2019.

*

Resigned from his duties at the Bank on 15.08.2022 and replaced by Kornelis Jan Hoving as Board

Member.

Kornelis Jan Hoving

Member of the Board of Directors, Member of the Audit Committee

Appointed in July 2020, Kees Hoving is the Co-Chief Executive Officer (CEO) for Deutsche Bank in

the Middle East and Africa (MEA), Head of Corporate Bank MEA and Head of Corporate Coverage

MEA based in Dubai, United Arab Emirates. Hoving joined Deutsche Bank in 2010 as Head of

Corporate Transaction Banking in Germany based in Frankfurt. In 2013, he moved to the Netherlands

as Head of the Corporate Bank business and acted as CEO of Deutsche Bank Nederland NV.

Subsequently in 2014, Hoving was appointed Head of Global Transaction Banking responsible for

Europe, Middle East and Africa (ex. Germany) based in Frankfurt. In 2016, he returned to the

Netherlands as the Chief Country Officer (CCO). Before joining Deutsche Bank, Hoving had 14 years

of international banking experience working for RBS, Bank of America, JPMorgan and ING in London,

Frankfurt, Moscow and Amsterdam. A Dutch national, Kees Hoving holds a Master of Science degree

in Economics from Erasmus University Rotterdam and a Bachelor of Business Administration from

Nyenrode University, both in the Netherlands. He also holds the Certificate of Corporate Governance

from INSEAD.

Hamit Sedat Eratalar

Member of the Board of Directors, Chairman of the Audit Committee, Member of the Compensation

Committee, Member of the Credit Committee

Born in 1952, Mr. Eratalar is a graduate of Ankara University, Department of Economics and Public

Finance. He worked as a partner at Arthur Andersen between 1981 and 2001. Serving as a founding

partner at Eratalar Management Consulting since 2001, Mr. Eratalar has been working as a Member

of Board of Directors at Deutsche Bank A.Ş. since August 2001 and worked as a Board Member

responsible from Internal Systems between 2006 - 2019. Eratalar assumed the role of Chairman of

the Audit Committee in May, 2019.

Deutsche Bank A.Ş.

Annual Report 2022

Salah Mohd I Al-Jaidah

Member of the Board of Directors

Salah Jaidah joined Deutsche Bank in 2011 as Chief Country Officer for Qatar and Chairman of DB

MENA Prior to joining Deutsche Bank, he held the positions of General Manager and Chief Executive

Officer of various banks in Qatar. Jaidah has a Bachelor of Business from Texas Christian University

and has completed an Advanced Management Programme at Oxford Business School.

Özge Kutay

Member of the Board of Directors, CFO and COO, Member of the Credit Committee

Born in 1970, Ms. Kutay is a graduate of the Faculty of Business Administration at Istanbul University.

Starting her career at an independent audit firm in 1993 and worked at financial control unit of a local

bank, Ms. Kutay has 29 years of experience in banking and business administration. Having been

employed by Deutsche Bank A.Ş. since 1998, she served as an Assistant General Manager between

2001 and 2012 before being appointed as a member of the Board of Directors in October 2012.

None of the members of the Board of Directors is involved in transactions with the Bank either in their

own capacity or on behalf of third persons or engaged in operations considered under the prohibition

of competition.

Senior Management

Orhan Özalp, Member of the Board of Directors, CEO

Member of the Board of Directors, Chief Country Officer, Chief Executive Officer,

Chairman of the Credit Committee

Orhan is the Chief Country Officer of Türkiye, CEO of Deutsche Bank A.S and also heads the Central

Eastern Europe, Balkans, Türkiye and Israel coverage teams at Deutsche Bank. He joined Deutsche

Bank in 2006 and held various positions in Financial Institutions Coverage, Structured Product

Origination and Sales, FICC and Equity Derivatives Sales. Orhan later became a Managing Director

in Institutional Coverage and appointed as CEO of Deutsche Bank A.Ş. in January 2019. He holds BA

degrees in Economics and Business Management from Koc University.

Özge Kutay, Member of the Board of Directors responsible of Financial Reporting and AFC, Chief Operating

Officer

Born in 1970, Ms. Kutay is a graduate of the Faculty of Business Administration at Istanbul University.

Starting her career at an independent audit firm in 1993 and worked at financial control unit of a local

bank, Ms. Kutay has 29 years of experience in banking and business administration. Having been

employed by Deutsche Bank A.Ş. since 1998, she served as an Assistant General Manager between

2001 and 2012 before being appointed as a member of the Board of Directors in October 2012.

Deutsche Bank A.Ş.

Annual Report 2022

Esra Özakdağ, Director, Corporate Bank, Financial Instutions, Cash Management and Trade Finance

Born in 1983, Mrs. Özakdağ has a Bachelor’s Degree in Economics and International Relations from

Connecticut College and an Executive MBA degree from Boğazici University. Having served in the

banking sector since 2006, Esra Özakdağ joined Deutsche Bank in 2012. Özakdağ works as a

manager in Corporate Bank Cash Management and Trade Finance, FI.

Feyza Aktaş, Director- Corporate Bank, Local Corporate Coverage & Corporate Cash Management

Born in 1972, Ms. Aktaş graduated from the Marmara University with a degree from the Department

of International Relations. Serving in the corporate banking sector since 1995 mainly in the

international banks, Ms. Aktaş joined Deutsche Bank A.Ş. in 2007. In addition to the management of

our Local Corporate Coverage Unit since 2012, she has also been assigned as the manager of Cash

Management Unit in 2019.

Kaan Kantarcıoğlu, Director, Compliance and Anti Financial Crime

Born in 1970, Kaan Kantarcıoğlu graduated from Boğaziçi University, Department of Political

Science and International Relations. Since 1993, Kantarcıoğlu worked in various roles within

banking and Turkish capital markets sectors and joined Deutsche Bank Group in 2004. Kantarcıoğlu

was appointed as Head of Compliance and Anti Financial Crime and Compliance Officer of

Deutsche Bank A.Ş. on March 15, 2017. At the same time, VP responsible from Internal Control,

appointed to perform internal control activities of the Bank, administratively reports to Kantarcıoğlu.

Nesrin Akyüz, Director, Finance

Born in 1975, Nesrin Akyüz graduated from the Middle East Technical University with a degree from

the Department of Business Administration. Starting her career in an independent audit firm and

having gained auditing experience in various banks since 1997, Akyüz joined Deutsche Bank A.Ş. in

2006.

Pınar Şengün, Director, Corporate Bank, Securities Services

Born in 1972, Ms. Şengün is a graduate of the Faculty of Economics at Istanbul University and holds

a master’s degree from the International Relations Department at Istanbul University. Ms. Şengün

has 28 years of experience in banking and capital markets. Having been employed by Deutsche Bank

A.Ş. since 2005, she served as the Head of Sales and Relationship Manager for international clients

between 2005 and 2020 before being appointed as the Head of Securities Services Türkiye in 2021.

Senem Ertuncay Kuzu, Director, Corporate Bank

Born in 1976, Ertuncay Kuzu has a Bachelor’s Degree in Economics from Middle East Technical

University. Have been working in the banking sector since 1998, Ertuncay Kuzu has joined

Deutsche Bank A.Ş. in 2007. Ertuncay Kuzu is Head of Corporate Banking Coverage division since

2016. Within 2020 Local Corporate Coverage relationship management has been added under her

responsibility; within 2021 she was appointed as Head of Corporate Bank.

Deutsche Bank A.Ş.

Annual Report 2022

Sevla Gonca, Director, Investment Bank – Structured Lending Solutions

Born in 1984, Sevla Gonca holds an undergraduate degree in Finance and International Business

from The George Washington University and a MBA from the Said Business School of Oxford

University. She has held various Global Markets Sales positions at international banks since 2005. In

2018 she has joined Deutsche Bank A.Ş. Investment Banking team.

Ümit Yılmazcan, Director, Investment Bank, Fixed Income and Currencies

Born in 1978, Ümit Yılmazcan received a Bachelor’s Degree of Science in Mechanical Engineering

from Bogazici University, and a MBA from Koc University. Joining DB Group in 2004, Mr. Yılmazcan

held different positions in equity derivatives and initiated many key projects DB Group and Turkish

Capital Markets. Mr. Yılmazcan is serving as a Director in Fixed Income and Currencies Department

since 2020.

Abdullah Kaçmaz, Vice President, Internal Audit

Born in 1980, Kaçmaz graduated from Istanbul University, Department of Economics. Kaçmaz

started his banking career in 2002 and joined Deutsche Bank A.Ş. in 2011. Kaçmaz holds CIA

(Certified Internal Auditor), CISA (Certified Information Systems Auditor), CRMA (Certification in

Risk Management Assurance) and CRISC (Certified in Risk and Information Systems Control)

certificates. Kaçmaz was appointed as Head of Internal Audit of Deutsche Bank A.Ş. on November

17, 2014.

Ali Berge Dikmen, Vice President, Investment Bank, Structured Treasury Solutions

Born in 1987, Berge Dikmen graduated from Robert College and Galatasaray University with a

degree in Economics. He holds a Masters in Management degree from Fuqua Business School of

Duke University. He has started working for Deutsche Bank A.Ş. in 2012 upon graduating from Duke,

and has held various positions in Global Markets Sales desk. He has been serving as a Vice President

in Investment Bank since 2018.

Can Göğüş, Vice President, Credit Allocation

Born in 1971, Göğüş holds a Bachelor’s Degree of Science degree in Mechanical Engineering from

Tennessee Technological University and an MBA from Carnegie Mellon University. Göğüş started his

professional career in 1996 and has been working in corporate client coverage & credit fields of the

banking sector since 2002. Göğüş joined Deutsche Bank A.Ş. in 2017.

Esra Kumru Besim, Vice President, Risk Management

Born in 1973, Kumru Besim graduated from Sankt Georg Austrian College and Istanbul University,

Faculty of Business Administration (English). After completing a certificate program in University of

California, Berkeley, Besim started her banking career in 1998 in Financial Control and Planning

departments of various banks and joined Deutsche Bank A.Ş.’s Finance Unit in 2006. After

establishing Internal Control under the Compliance and Internal Control Unit in 2011, she was

appointed as the Vice President responsible from Risk Management in April 2015

Deutsche Bank A.Ş.

Annual Report 2022

Mehmet Çağlayan, Vice President, Technology

Born in 1977, Mehmet Çağlayan holds a Bachelor’s Degree from Yıldız Technical University,

Mathematical Engineering and a Graduate Degree from Marmara University, Institute of Banking and

Insurance. Çağlayan started his career in 1997 in Retail Banking Product Development Unit of

Information Technologies Department. Having joined Deutsche Bank A.Ş. in 2001, Mehmet Çağlayan

is the manager in charge of Information Technologies.

Merdan Yılmaz, Vice President, Operations

Born in 1968, Merdan Yılmaz graduated from İstanbul University, Faculty of Political Sciences and

Department of Public Administration. Merdan Yılmaz actively participated in many new banking

initiatives; he worked in the Operations Unit during the establishment phase of Personal Banking in

a foreign bank, in Investment Banking Mid Office during the process of establishment of another

foreign bank office and as Project Management and Business Development Manager. He joined

Deutsche Bank A.Ş. in 2005 as the Manager responsible from Investment Banking and Corporate

Banking Operations

Nazım Aslan, Vice President, Treasury

Born in 1980, Aslan holds an undergraduate degree in Economics from Boğaziçi University and a

master’s degree in Money, Capital Markets and Financial Institution from İstanbul University. Aslan

started his professional career in 2005 and has been working in Treasury field of the banking sector

since 2008. Aslan joined Deutsche Bank A.Ş. in 2017.

Mehmet Nihat Fırat, Vice President, Human Resources

Mehmet Nihat Fırat, born in 1971, holds a master’s degree from Bahçeşehir University. 15 years, out

of Fırat’s total experience since 1998 in various companies, is in banking sector. He manages the

Human Resources Unit at Deutsche Bank Türkiye since July 2019.

Nihat Erhan Aykut, Vice President, Investment Bank, Fixed Income and Currencies

Born in 1985, Nihat Erhan Aykut graduated from Robert College and received a Bachelor’s Degree

of Economics from Yıldız Technical University and he has attended to master degree of Business

Administration in Yıldız Technical University. Mr. Aykut joined Deutsche Bank A.Ş. in 2020, serving

as a Vice President in Fixed Income and Currencies Department. Prior to joining Deutsche Bank A.Ş.,

Mr. Aykut held different positions in Investment Banking in various international banks.

Deutsche Bank A.Ş.

Annual Report 2022

Özge Sanioğlu, Vice President, Legal and Data Protection

Born in 1980, Mrs. Sanioğlu graduated from İstanbul University, Faculty of Law. Sanioğlu has 20

years of professional experience, 16 of which were in the banking sector. Mrs. Sanioğlu has been with

Deutsche Bank A.Ş. since July 2012.

Sitare DevrimTulumbacı, Vice President, Trade Finance

Born in 1974, Tulumbacı has a Bachelor’s degree from Istanbul Technical University, Department of

Environmental Engineering. Started her career as Environmental Engineer in 1996, Tulumbacı

started to work in the banking sector in Trade Finance Operations and Advisory units in 2000 and

joined Deutsche Bank A.Ş. as Head of Trade Finance Operations in 2012. Having total 20 years’ of

experience in banking, Tulumbacı is working as the Head of Trade Finance Advisory & Services Unit

as of September 2019 and as Head of Trade Flow Unit as of September 2020.

Ümit Rüstem Tok, Vice President, Technology

Born in 1979, Ümit Rüstem Tok graduated from Girne American University, Computer Engineering

Department. Tok has assumed several roles and positions in Deutsche Bank A.Ş.’s Information

Technologies Unit since 2006 and became the Manager responsible from Information Technologies

Operations in 2017.

Barbaros Utku Yıldız, Assistant Vice President, Chief Security Office

Born in 1979, Barbaros Utku Yıldız received a Bachelor’s degree from Kocaeli University Industrial

Engineering and a Master’s degree in Business Administration (MBA) from University of North

Alabama. Starting his career as an engineer, Mr. Yıldız held different positions in Internal Audit,

Internal Control and Compliance units in mainly banking and finance industries starting from 2005.

Mr. Yıldız was awarded the CIA (Certified Internal Auditor) certificate in 2011, and also holds the

COSO Internal Control and ISO 27001 Lead Auditor certificates. Participated in projects about

personal data protection and information security management system implementation throughout

his professional career, Mr. Yıldız has been working as Chief Information Security Officer (CISO) in

Deutsche Bank A.Ş. since September 2020.

Buse Özerbek, Assistant Vice President, Investment Bank Operations

Born in 1986, Buse Ozerbek graduated from Dokuz Eylul University, Faculty of Economics and

Administrative Sciences. Ozerbek has joined Deutsche Bank A.Ş. in 2011 and has over 11 years of

experience in Operations. Ozerbek was appointed as Head of Investment Banking Operations in

2021.

Deutsche Bank A.Ş.

Annual Report 2022

Filiz Yalçın, Assistant Vice President, Internal Control

Born in 1980, Filiz Yalçın has undergraduate degree in Bilkent Üniversitesi, Department of Economics

and masters degree in Bournemouth University, Department of Information Systems Management.

She has started her business career in 2002. Yalçın has started working in audit and control areas in

2006 and she has certification on Risk Management (CRMA) and COBIT 5. Yalçın has been working

as Internal Control responsible in Deutsche Bank A.Ş. since October, 2017.

Independent Auditor

During the Ordinary General Assembly of the Bank held on March 31, 2022, it was resolved with

unanimous vote to select Güney Bağımsız Denetim ve Serbest Muhasebeci Mali Müavirlik A.Ş. as the

Independent Auditor for a period of 1 year.

Committees and Councils

Audit Committee

H. Sedat Eratalar, Chairperson

Frank H. Krings, Member

Mark Michael Bailham, Member

Kornelis Jan Hoving

The Audit Committee was established on October 31, 2006, pursuant to the Board of Directors Resolution

no. 48/6. The Audit Committee convened 13 times during the 2022 fiscal year.

Credit Committee

Orhan Özalp, Chairperson

H. Sedat Eratalar, Member

Özge Kutay, Member

The Credit Committee was established to allocate credits under the authority delegated to the committee

by the Board of Directors’ decision no. 84 dated December 13, 2010. The Committee takes loan decisions

within the limits determined for itself, and by determining the allocation conditions. The Credit Committee

convenes weekly or when deemed necessary.

Compensation Committee

Frank Helmut Krings, Chairperson

H. Sedat Eratalar, Member

Mark Michael Bailham, Member

Deutsche Bank A.Ş.

Annual Report 2022

Deutsche Bank A.Ş. Board of Directors is, in addition to the application fields of Global Compensation

Policy - Deutsche Bank Group, also required to approve, regularly review and apply appropriate Policies

regarding Compensation of Senior Managers of the Internal Systems Units, Variable Compensation and

its Principles, as stipulated in the Guideline on Good Remuneration Practices in Banks (Guideline), publicly

announced by the Banking Regulation and Supervision Agency (BRSA). Board of Directors of Deutsche

Bank A.Ş. performs the responsibilities indicated by means of a Compensation Committee to be made up

of at least three members.

Compensation Committee convenes at least twice annually and reviews compliance of the Compensation

Policy with the local legislation and global applications and issues a report to the Board of Directors. This

review also includes whether or not compensation processes and applications of Deutsche Bank A.Ş. are

compatible with the risk appetite, strategy and long-term goals of the Bank and whether or not they are

in contradiction with the provisions of the BRSA’s Guideline. Head of Human Resources Unit of Deutsche

Bank A.Ş. attends Compensation Committee meetings to provide the necessary explanations on

performance or compensation and to share his/her opinions. Minutes of the Compensation Committee

are kept by the Head of Human Resources at the Human Resources Office.

Executive Council (EXCO)

Orhan Özalp, Chairperson

Özge Kutay, Vice Chairperson, Member

Pınar Şengün, Member

Nesrin Akyüz, Member

Feyza Aktaş, Member

Esra Özakdağ, Member

Senem Ertuncay, Member

Sitare Devrim Tulumbacı, Member

Sevla Gonca, Member

Ümit Yılmazcan, Member

Ali Berge Dikmen, Member

The Executive Council meets once a month for a number of purposes including Deutsche Bank’s global

strategies to be followed in Türkiye, generating ideas for the mutual development of coordination and new

business ideas among the executive units established in Türkiye, in addition to exploring cross- selling

opportunities, coordination with the infrastructure units and assessing any risks regarding the reputation

of Deutsche Bank’s franchise.

Operating Council (OPCO)

Özge Kutay, Chairperson

Nesrin Akyüz Vice Chairperson, Member

Kaan Kantarcıoğlu, Member

Mehmet Nihat Fırat, Member

Deutsche Bank A.Ş.

Annual Report 2022

Özge Sanioğlu, Member

Kumru Besim, Member

Utku Yıldız, Member

Merdan Yılmaz, Member

Nazım Aslan, Member

Mehmet Çağlayan, Member

Ümit Rüstem Tok, Member

Buse Özerbek, Member

The Operating Council convenes once in every month. The Council is a platform where all Operations,

Support and Control Units discuss the developments, changes and problems regarding the operations of

the Bank, provide solutions and organize the effective utilization and allocation of resources.

Assets and Liabilities Committee (ALCO)

Orhan Özalp, Chairperson

Nazım Aslan, Vice-chairperson, Member

Özge Kutay, Member

Senem Ertuncay, Member

Carsten Anders, Member

Nesrin Akyüz, Member

Kumru Besim, Member

Hakan Birinci, Member

Erhan Aykut, Member

The ALCO is responsible from analysing the Bank’s future capital requirements by overseeing the

structure of the Bank’s assets and liabilities, and evaluating risk-bearing assets, liquidity and market risk.

The ALCO convenes quarterly under the presidency of the Bank’s CEO.

Information Systems Strategy and Steering Committee

IS Strategy and Steering Committee is, on behalf of the Board of Directors, responsible from supervising

Information Systems investments to see whether they are in line with the IS strategy plan, monitoring

Information Systems targets to see whether they are in line with the business targets of the bank, regularly

and directly reporting to the Board of Directors on these matters, reviewing the IS strategy plan at least

annually, making the necessary revisions on it, if required, and presenting it to the Board for approval and

from monitoring activities of the IS Steering Committee. The Committee is also liable from prioritization

of IS investments and projects, monitoring the on-going IS projects, resolving resource disputes between

projects, providing guidance to ensure that IS architecture and IS projects are aligned with the regulations

Deutsche Bank A.Ş.

Annual Report 2022

and monitoring service levels of IS services. The Committee convenes twice a year and presents a report

to the Board of Directors.

Orhan Özalp, Chairperson

Özge Kutay, Vice-Chairperson

Mehmet Çağlayan, Member

Ümit RüstemTok, Member

Merdan Yılmaz, Member

Nesrin Akyüz, Member

Mehmet Nihat Fırat, Member

Senem Ertuncay, Member

Ümit Yılmazcan, Member

Kaan Kantarcıoğlu, Member

Özge Sanioğlu, Member

Kumru Besim, Member

Information Security Committee

The ultimate responsibility for ensuring data security in the Bank rests with the Board of Directors. Board

of Directors is liable to show determination in bringing the precautions taken for information systems to

the desired level and to allocate necessary resources for these activities. As a requirement of this

responsibility, Board of Directors builds and establishes an information security management system,

execution of which it is liable to supervise. Information security policy, procedures and process

documentation, governing the execution of information security management system on a bank-wide

manner, are issued. Issuance of the information security policy and application of it are undertaken by the

Information Security Committee on behalf of the Board of Directors. Furthermore, it is under the

responsibility of this Committee to conduct regular threat and risk assessment works and activities in

correlation with information assets, monitor and report security breach events and incidents, monitor

current security vulnerabilities affecting information assets and to take the required actions and to assume

works and activities to increase information security awareness. The Committee convenes twice a year

and presents a report to the Board of Directors.

Özge Kutay, Chairperson

Utku Yıldız, Vice-Chairperson

Mehmet Çağlayan, Member

Ümit Rüstem Tok, Member

Merdan Yılmaz, Member

Nesrin Akyüz, Member

Mehmet Nihat Fırat, Member

Senem Ertuncay, Member

Ümit Yılmazcan, Member

Deutsche Bank A.Ş.

Annual Report 2022

Kaan Kantarcıoğlu, Member

Özge Sanioğlu, Member

Kumru Besim, Member

Information Systems Continuity Committee

IS Continuity Committee, established under the IS continuity management process, which is a part of

business continuity management and plan, in order to ensure continuity of IS services used in providing

banking activities, is responsible from building and ensuring application of the Information Systems

continuity management process and IS Continuity Plan, and after due consideration of all factors relating

to events, announcing that there is a crisis, deciding whether the IS continuity plan will be launched and

ensuring coordination of other recovery, continuity and response teams. The Committee convenes once

a year and presents a report to the Board of Directors.

Özge Kutay, Chairperson

Mehmet Çağlayan, Vice-Chairperson

Utku Yıldız, Member

Ümit Rüstem Tok, Member

Merdan Yılmaz, Member

Nesrin Akyüz, Member

Mehmet Nihat Fırat, Member

Senem Ertuncay, Member

Ümit Yılmazcan, Member

Kaan Kantarcıoğlu, Member

Özge Sanioğlu, Member

Kumru Besim, Member

Data Sharing Committee

Data Sharing Committee serves as main governance body to review requests for transfer of client data

and/or banking secret data out of DB A.Ş. Coordinating procedures around sharing of confidential client

data and banking secret data and assessing the suitability of incoming client data and banking secret data

sharing requests are among the main responsibilities of the Committee. The Committee convenes once a

month.

Özge Kutay, Chairperson

Kaan Kantarcıoğlu, Vice-Chairperson

Utku Yıldız, Member

Özge Sanioğlu, Member

Filiz Yalçın, Member

Deutsche Bank A.Ş.

Annual Report 2022

Participation of Board Members and Committee Members in Meetings

The Board of Directors meets once in every two months in accordance with the Bank’s Articles of

Association and governing legislation to oversee matters related to the Bank and to make decisions

(within the scope of its duties and responsibilities). When deemed necessary, the Chairman of the Board

of Directors may also calls for meetings. During 2022, members participated in Board meetings regularly,

conforming to the criteria for a quorum to convene and to make decisions.

The Audit Committee meets at least once a month. During 2022, members participated in Audit

Committee meetings regularly, conforming to the criteria for a quorum to convene and make decisions.

Transactions conducted by Members of the Board of Directors with the Bank

Pursuant to the permission granted by the Bank’s General Assembly, none of the members of the Board

of Directors is involved in transactions with the Bank either in their own capacity or on behalf of third

parties or engaged in operations considered under the prohibition of competition.

Financial Benefits provided to Senior Executives

Total benefits provided to senior executives such as Chairman of the Board of Directors, members of the

Board, the CEO, the Assistant General Managers and supervisors of the units amounted to TRY 83,345

thousands. Furthermore, expenses such as transportation and accommodation of senior executives

amounted to TRY 1,068 thousands.

Information on Dividend Distribution Policy

The Bank has adopted as its dividend distribution policy to distribute all of its profit available for

distribution to its shareholders by receiving the necessary BRSA approval, provided that there are no

unfavorable conditions prevalent in the national and/or global economic conditions and Deutsche Bank’s

total equity adequacy ratio is at the target level. The allocation and the distribution of the net profit are

decided at the Deutsche Bank A.Ş. shareholders’ Annual General Assembly.

Banking Regulation and Supervision Agency’s (BRSA) permission is sought for dividend distribution.

BRSA, with a letter sent to the Banks’ Association of Türkiye, stated that taking into account that the

ongoing economic instability and recession expectations around the world, the prudent policy maintained

so far to ensure that shareholders’ equity structure of banks is robust should be pursued further; In this

respect, it will be beneficial if the profit to be earned in 2022 and the profit and reserves that were despite

earned before 2022 were not distributed but kept in the shareholders’ equity will not be distributed in a

way that will require cash outflow but retained as reserves; however, possible requests to distribute

dividends will be assessed considering the prudent policy and conditions unique to banks such as capital

adequacy ratio. Dividend distribution shown below will be presented to the approval of the General

Assembly of the Bank according to the permission which was received from BRSA.

Deutsche Bank A.Ş.

Annual Report 2022

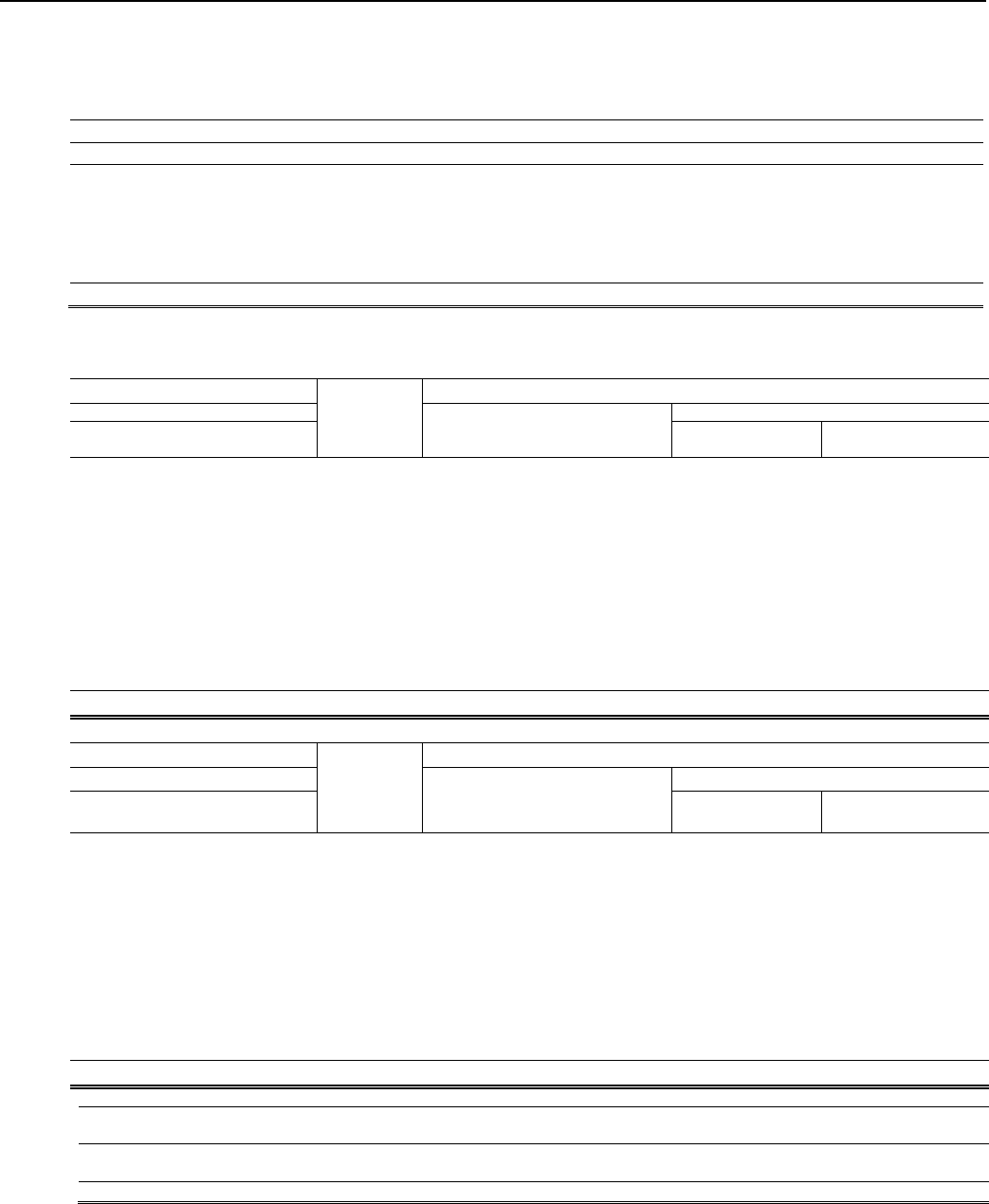

Dividend Distribution Table for 2022 (TRY Thousands)

2022 Dividend Distribution TRY k

Net Profit of the Period 848.117

1

st

Legal Reserves based on Article 519 of the Turkish Commercial Code 42.406

1

st

Dividend to Shareholders 23.500

2

nd

Dividend to Shareholders 61.312

2

nd

Legal Reserves over paid and distributed amounts 6.131

Amounts allocated to Extraordinary Reserves 714.768

Dividend Ratio Table

Dividend Amount

Total Corresponding

Total Distributed to Share

Distributed Dividend / Net With a Nominal

Group Dividend Distributable DividendValue of TRY 0.1

Cash Bonus Ratio of

(TRY) (TRY) the Period (%)Amount (TRY) Ratio (%)

GROSS - 84.811.700 - 10,00 0,02 18,05

NET - 80.571.114 - 9,50 0,02 17,14

During the Annual General Assembly of the Bank to be held on March 31, 2023, it will be presented to the

approval of the shareholders that out of the net profit for the period that ended on December 31, 2022 in

the amount of TRY 848.117 thousands, TRY 84.812 thousands will be distributed as dividend, TRY

48.537 thousands will be set aside as legal reserves and TRY 714.768 thousands will be allocated to

Extraordinary Reserves.

Deutsche Bank A.Ş.

Annual Report 2022

Human Resources Policy

Recruitment: Employing the right persons with the right qualifications, who will apply Bank’s strategy,

adopt and appropriate Deutsche Bank’s corporate culture, at the right positions is the basic principle

underlying the recruitment policy. Managers, who are responsible from execution of their unit’s activities

in line with the applicable legislation, should have sufficient expertise in their unit’s area of activity and

employees of each unit should have the qualifications their duties, authorities and responsibilities require.

It is essential that recruitment processes and applications be based on objective criteria and executed in

accordance with the principle of equal opportunity.

Open positions are published at Deutsche Bank’s career portal and intra-group requests and group