Non-Financial Report

2019

Deutsche Bank

Contents

3 Letter from the Chairman

of the Management Board

5 Introduction

6 About Deutsche Bank

7 About this report

8 Stakeholder engagement

9 Sustainability ratings and indices

10 Combined separate

non-nancial report

11 Legal basis

14 Culture and integrity

17 Client-related matters

18 Product responsibility

20 Client satisfaction

23 Sustainable nance

31 Organizational matters

32 Anti-nancial crime

37 Data protection

38 Information security

41 Public policy and regulation

44 Employee-related matters

45 Employment and employability

52 Key employee gures

53 Digital transformation

54 Digitization and innovation

57 GRI supplement

58 Approach to sustainability

61 Reputational risk

65 Human rights

67 Climate risk

71 Access and inclusion

72 Tax

73 In-house ecology

78 Corporate social responsibility

84 Art, culture and sports

85 Appendix

86 Reports of the independent auditor

90 GRI and UN GlobalCompact

103 Abbreviations

106 Imprint / publications

Letter from the

Chairman of the

Management Board

Dear Readers,

Sustainability is finally being given the status it deserves in economic life. We experience it in our day-to-day contact with our

clients and we sense it in our dialog with our investors: a bank such as ours is expected to be commercially successful, but

that alone is not enough. Our stakeholders – along with the general public – are focusing increasing attention on non-financial

objectives – and rightly so. Good governance as well as fulfilling our responsibility for the environment and to society as a

whole are essential for a global bank’s success. We see no contradiction between sustainability and profitable returns. Lasting

commercial success is only possible if we do business responsibly. Only then will we secure the necessary acceptance from

the societies in which we operate. That is why we have been committed to the Ten Principles of the United Nations Global

Compact for many years now. In September we signed up to the UN Principles for Responsible Banking as well.

This Non-Financial Report is a key element of our review of our performance in 2019. It delivers additional, valuable, and

above all, comparable information for the dialog and conversations about societal issues, covering an even broader range of

topics than in previous years. As transparent communication about non-financial matters is rapidly gaining importance, we

welcome that corporate reporting requirements are becoming more exacting as a whole.

The year 2019 was marked by our decision to implement the most fundamental transformation of our bank for 20 years. We

are focusing rigorously on our strengths, we have restructured our business units and set ambitious financial targets for the

period until 2022.

We have made a very good start to this transformation, as we detail in our Annual Report, but our transformation does not just

revolve around revenue, cost, and earnings targets. It is also about a fundamentally new way of working. We have therefore

set ourselves four non-financial objectives: we want our clients to always be at the center of what we do; we want to develop

a new form of leadership and become more entrepreneurial; we want to make better use of new technologies, and we aim to

operate more sustainably right across our business. I am convinced that making resolute progress in these areas is the only

way for us to also achieve long-term financial success.

If we want to work differently than we have previously then we must focus on our employees. Only if we offer attractive and

interesting prospects will we be able to continue winning the battle to recruit and retain the most talented people. Although

reducing our workforce is a regrettable but unavoidable part of our transformation, we are conducting this process responsibly.

At the same time, we are investing in our people worldwide, including in their training and continued professional development.

We are translating our support for diversity into action. We are committed to placing more women in leadership positions.

Although the share of women in senior positions has been increasing each year since 2010 and there are lots of support

programs, we are not satisfied with our progress in this area.

With our commitment to lesbian, gay, bisexual, transgender, queer, and intersex (LGBTQI) equality and inclusion, we believe

we are strong advocates for greater openness. Our Human Resources Report provides more detail on diversity at Deutsche

Bank.

We are also continuing to invest in strengthening our control environment, and above all in the area of anti-financial crime. We

have already made considerable progress and will continue resolutely on this path. In 2019, we spent some € 600 million on

protecting Deutsche Bank from non-financial risk, three times more than in 2013. We are beginning to see the benefits of

successfully combining our Anti-Financial Crime, Compliance and Risk functions under a single leadership team which we

announced in July – for example, through better workforce automation and more standardized risk frameworks.

We are also making progress with our digitalization initiatives. To ensure that we implement technology and digital solutions

far more extensively throughout the bank, we have created a Technology, Data and Innovation function that is represented

on the Management Board. With our new technology strategy, we are fundamentally changing the way we develop

technological solutions: we are bringing together businesses and technology experts in agile teams. We no longer rely as

much on external contractors, but are boosting internal hires to ensure that we have in-house expertise. We continue to

simplify our processes and make them more flexible by modernizing our IT infrastructure and preferring cloud solutions, where

these are feasible and make sense. In doing this, we will not make any compromises on data or IT security.

Our efforts over recent years have started paying off: we are regaining trust among our most important external stakeholders,

namely our clients, the regulatory authorities, investors and the media.

The results of this year's in-house People Survey also showed an improvement in internal sentiment. Our employees feel

more committed and rate their working environment more positively, while three out of four support our new strategy.

Another topic that is absolutely central to building trust in our bank is sustainability. We always want to consider the

environmental and social impact of our actions. This is not exclusively about environmental protection and the global climate,

although they are of course included. Our sustainability strategy is shaping our processes more and more markedly – be it

risk management, our own refinancing processes, or just providing the right incentives for our business divisions.

What does sustainability mean for Deutsche Bank in practice?

Sustainability has four dimensions that we are promoting through our Sustainability Council that I chair: we are reducing the

environmental footprint of our own business activities; we are broadening our business policies so that sustainability matters

are given better attention; and we seek to be a thought leader on political and societal matters. And above all we are assisting

our clients in making their own transformation to more sustainable business models – be they companies or investors. This

sustainable finance business is precisely where our focus is currently trained.

We see Deutsche Bank as being strategically well positioned. Our loan book of roughly € 430 billion is a key component in

this respect. Over the next few years we will increase the proportion we set aside for sustainable financing and use this to

structure green bonds and other investment products. In 2019, we were involved in ESG (Environmental, Social, and

Governance) bond issuance and placement for clients that amounted to over € 22 billion, two-and-a-half times as much as in

2018. And this year we plan to issue our first Deutsche Bank green bond and announce specific sustainability targets.

Across all of these activities we are determined to provide very specific and clear details. We are convinced that having a

rigorously prepared and feasible sustainability strategy will enable us to make the most effective contribution to the necessary

transformation of our bank and the economy.

We have traditionally delivered a strong positive impact with our corporate citizenship activities. We are proud to report that in

2019 some 1.6 million people were able to benefit from our initiatives. And last year nearly 19,000 colleagues worldwide

participated in our social projects, acting as mentors for young people or as advisors to social enterprises. In the year that

marks our 150th anniversary we are asking employees to spend at least 150 minutes of their working time – ideally longer –

volunteering for a specific social initiative.

We have made a good start to this anniversary year, and we have a clear sense of where we are going. Our mission is to be

a bank that our clients and investors can trust, a bank to rely on. And we want to be a bank where our employees are proud

and enthusiastic to work.

Best

regards,

Christian Sewing

Chief Executive Officer

Introduction

6 About Deutsche Bank

7 About this report

8 Stakeholder engagement

9 Sustainability ratings and indices

6

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

About Deutsche Bank

About Deutsche Bank

Founded in 1870, Deutsche Bank is Germany’s leading bank, with a strong position in Europe and a significant presence in

the Americas and Asia Pacific. For 150 years, Deutsche Bank has been connecting worlds to help people and businesses get

to where they want to be.

Our purpose

What inspired the founders of this bank still drives us now: we are here to enable economic growth and societal progress by

generating positive impact for our clients, our people, our investors, and our communities.

Our values

We expect all of our employees to apply our corporate values: integrity, sustainable performance, client centricity, innovation,

discipline, and partnership. Our Code of Conduct articulates what our bank stands for and what we want our overall culture to

be. We want to foster an environment that is open and diverse, where staff opinions and “speaking up” are valued and our

employees’ and the bank’s success is built on respect, collaboration, and teamwork.

Our business

Deutsche Bank provides commercial and investment banking, retail banking, transaction banking, and asset and wealth

management products and services to corporations, governments, institutional investors, small and medium-sized businesses,

and private individuals.

Our strategy

In July 2019, Deutsche Bank announced a fundamental transformation and a profound restructuring of its businesses. The

bank now consists of four strong, client-centered businesses. Alongside our Investment Bank, Private Bank (including Wealth

Management), and Asset Management, we established a fourth division, the Corporate Bank, which comprises the former

Transaction Bank and German commercial banking business. As part of the restructuring process, we are withdrawing from

businesses in areas where we do not have a leading position and are allocating capital to businesses that show higher

earnings and growth. To this end, we have reorganized assets from non-strategic businesses into a separate unit, called the

Capital Release Unit. We will only refer to this unit if there is a direct link to the respective topic in this report.

The changes do not only affect our business model; we will also strive to change the way our employees work. Our declared

goal is to transform Deutsche Bank into an organization that is inspired by our clients and continuously designed by our

employees. We are therefore focusing on four levers that will help us to achieve our ambitions: client centricity,

entrepreneurship, technology-led, and sustainability.

7

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

About this report

About this report

GRI 102-49/52

This Non-Financial Report 2019, covering developments from January 1, 2019 to December 31, 2019, communicates

Deutsche Bank’s group-wide management approaches for a determined set of non-financial topics, major activities, and

progress made in 2019, as well as describes our governance, policies, and structures.

The reporting content complies with § 315c (1) of the German Commercial Code (Handelsgesetzbuch, HGB) in conjunction

with § 289c (2) HGB and is aligned to the Global Reporting Initiative (GRI). In this respect, this report has been compiled in

accordance with the GRI Sustainability Reporting Standards: Core option. It also serves as our Communication on Progress

for the UN Global Compact (see GRI index and UN Global Compact). All information contained in this report is subject to

independent assurance (see “Reports of the independent auditor”). References to information outside the Deutsche Bank

Group Management Report do not form part of the Non-Financial Report and the independent assurance.

While we merged the legal entities Deutsche Postbank AG (Postbank) and Deutsche Bank Privat- und Geschäftskunden AG

into DB Privat- und Firmenkundenbank AG in the previous reporting year, the integration process has not yet been fully

completed. As a result, some Postbank-related content is still presented separately in this report, while other information is no

longer explicitly disclosed for Postbank. Irrespective of the merger of the legal entity, Postbank continues to be present in the

market as a key brand of our Private Bank.

Deutsche Bank AG’s approach to non-financial topics is in line with the group-wide principles. As the parent company,

Deutsche Bank AG’s approach to sustainability includes our affiliated entities.

This Non-Financial Report 2019 is also available in German. The report is disclosed annually. The next report will be published

in March 2021.

8

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Stakeholder engagement

Stakeholder engagement

GRI 102-12/21/40/42/43/44, G4 DMA

We value an ongoing dialog with our stakeholders, helping us to understand the expectations and concerns of various groups,

and to recognize the positive and potentially negative impact of our business activities. We have clearly defined responsibilities

for each stakeholder group, and use various formats, including bilateral conversations with individuals or groups, as well as

exchanges in the context of meetings, events, forums or working groups. We also regularly release publications on a range

of topics and communicate via digital platforms.

The table below lists a cross-section of exemplary stakeholder engagements by Deutsche Bank:

Stakeholder group

Channels/ formats

Examples in 2019

Clients

In

-person meetings and calls

Interviews and surveys

Conferences and events

Publications

Online communications and social

media

Hotlines

• Surveying clients in Germany via online banking and

self

-service devices, conducting client interviews with

the aim of improving the service quality and client

experience (see "Client satisfaction");

• Conducting more than 200 advisor and

client events

in order to increase ESG awareness, hosting several

ESG

-related events, including the ESG Engagement

Conference with a focus on green bonds in New York

or the Next Generation Innovation Summit on ESG

investments in San Francisco (see "Sustai

nable

finance"); and

• Publishing articles in client magazines as well as

structured investment and market assessments (Chief

Investment Officer View, CIO View) on ESG topics

(see "Sustainable finance").

Investors

In person meetings and calls

Conferences

and events

Annual General Meeting

Online communications

Publications

• Organizing the Annual General Meeting, attended by

around 3,900 shareholders;

• Providing information about the Annual General

Meeting on an dedicated website;

• Regularly excha

nging with shareholders on the

bank’s strategy and financial results as well as further

topics;

• Conducting an Investors’ Day for analysts and

investors;

• Publishing presentations, financial reports, and

results on the Investor Relations website; and

• T

ransmission of investor events on the Investor

Relations website.

Employees

Employee surveys

Employee meetings

Networks

E

-mails and newsletters

Publications

Online communications and social media

Hotlines

• Conducting the annual employee survey, the

quarterly surveys on feedback culture, and life

-cycle

surveys on joining the bank, settling in, changing jobs

or leaving the bank;

• Regularly communicating on employee

-related, non-

financial and sustainability/ESG

-related topics on the

internal website; a

nd

• Hosting global hackathons, e.g. “Banking on

Sustainability”, engaging more than 1,100 participants

worldwide.

Society

Meetings

Conferences and events

Memberships and partnerships

Participation in consultations

Publications

Online communications and

social media

Hotlines

• Participation in the Value Balancing Alliance (VBA)

as a founding member, working collaboratively on the

development of a standardized Impact Measurement

and Valuation (IMV) model (see “ESG approach“);

• Membership of the Sustainab

le Finance Advisory

Council, inaugurated by the German federal

government to support the development of a national

and sustainable finance strategy; and

• Giving colleagues several weeks off to implement or

advance development projects in emerging markets as

part of our Corporate Community Partnership (CCP)

program, since 2018. In 2019, a panel discussion in

Frankfurt am Main marked the end of our three

-year

collaboration with the Gesellschaft für Internationale

Zusammenarbeit (GIZ), whose aim was to build

up

and professionalize the banking sector in Myanmar.

9

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Sustainability ratings and indices

Sustainability ratings and indices

In recent years, we have observed a growing demand from stakeholders for ESG information. This trend reflects the growing

importance of ESG/sustainability ratings. At Deutsche Bank we consider sustainability ratings, on the one hand, as a valuable

instrument for internal benchmarking and, on the other hand, as a common basis to adjust our ESG approach. The market for

ESG ratings is not a regulated market with a high number of market participants. Therefore, the bank’s focus is on agencies

identified as relevant with regard to their importance for the bank’s investors and customers, significance for the bank’s

sustainability performance, and methodology transparency.

In 2019, Deutsche Bank responded, inter alia, to CDP Climate Change, ISS-oekom Corporate Rating, RobecoSAM Corporate

Sustainability Assessment, Sustainalytics, Vigeo Eiris, FTSE Russel, and MSCI ESG Research. Selected

results are outlined

in the table below:

Selected sustainability ratings

1

Dec 31, 2019

Dec 31, 2018

Dec 31, 2017

CDP Climate Score (on a scale from A to D-)

C

C

n/a

2

ISS-oekom (on a scale from A+ to D−)

C/Prime

3

C/Prime

C/Prime

MSCI ESG Research (on a scale from AAA to CCC)

4

BBB

BBB

BBB

RobecoSAM (on a scale from 0 to 100)

48

5

54

69

Sustainalytics (on a scale from 0 to 100)

61

6

62

66

1

Industry classification according to Global Industry Classification Standard (GICS).

2

No scoring in 2017 due to re-evaluation of our climate risks and opportunities in light of TCFD recommendations.

3

Sector average: D+; maximum in sector: C+.

4

Intangible Value Assessment (IVA) Rating.

5

Sector average: 35; maximum in sector: 83.

6

Deutsche Bank ranking in sector: 140 out of 353.

Based on sustainability ratings, Deutsche Bank continues to be listed in the FTSE4Good Index (World, Eurozone) and MSCI

Sustainability Index. Our final score, particularly in RobecoSAM’s assessment that defines the composition of the Dow Jones

Sustainability Indices (DJSI), was largely impacted by controversies stemming from litigations and conduct-related issues.

Consequently, Deutsche Bank stocks, have no longer been listed in the DJSI since September 2019. We have been interacting

with the rating agency to better understand how to balance these adverse effects in order to pursue our objective to be listed

in the major sustainability indices.

Combined separate

non-nancial report

11 Legal basis

14 Culture and integrity

17 Client-related matters

31 Organizational matters

44 Employee-related matters

53 Digital transformation

11

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Legal basis

Legal basis

GRI 102-49/50/54

The following combined separate non-financial report includes non-financial information in accordance with the requirements

of §§ 315b and 315c in connection with §§ 289b to 289e of the German Commercial Code (Handelsgesetzbuch, HGB) and

formally belongs to the Management Report of Deutsche Bank. As a framework, the GRI Sustainability Reporting Standards

were used.

Materiality and risk assessment process

GRI 102-15/21/29/31/44/46, 103-1

To ensure we focus management attention and non-financial reporting on those topics that are relevant in an ever-changing

global environment, we continued our materiality assessment of non-financial topics. We adopted a two-dimensional approach

that considered the impact of Deutsche Bank’s business activities on the respective topics, and the impacts of these topics on

Deutsche Bank. This also included that expectations of stakeholders and topics addressed by peers were taken into account.

We executed an evidence-based approach to uncover the material topics. We set clear thresholds for topics to be considered

and always view them in a Deutsche Bank context. Just as in previous years, some of the non-financial topics identified are

more mature and well regulated, while others are rather emerging topics still requiring further evaluation. The assessment is

conducted from the group perspective and equally applies to Deutsche Bank AG, the parent company.

Throughout the year, we conducted desk research to identify potentially material non-financial topics. We checked for changes

in global societal trends, the global sustainability agenda, and regulatory adjustments, as well as key environmental, social,

and governance topics (risks and opportunities) impacting Deutsche Bank.

In 2019, we surveyed the opinions of 272 internal senior management representatives regarding the relevance of non-financial

topics for Deutsche Bank. Furthermore, we held a group discussion with ten internal subject matter experts. The results of

both stakeholder engagements were merged with the results of our desk research.

To ensure we report in accordance with § 315c (2) in conjunction with § 289c (3) of the German Commercial Code

(Handelsgesetzbuch, HGB) we complemented our assessment of the impact of Deutsche Bank’s activities on a non-financial

topic and of the importance of a non-financial topic to stakeholders by an analysis of whether a non-financial topic is relevant

to understand Deutsche Bank’s development, performance, or position. The results of all three assessment steps were

combined in a materiality matrix which was the basis for our validating meeting with the Non-Financial Report Steering Group.

In accordance with § 315c (1) in conjunction with § 289c (3) no. 3 and 4 HGB, Deutsche Bank also evaluates all potential

significant risks that are very likely to have or will have a severely negative impact on material non-financial topics with respect

to its own business activities and business relations, as well as its products and services. No such risks were identified.

12

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Legal basis

Materiality results for 2019

GRI 102-44/47/48, 103-1

Compared to the previous year, sustainable finance and climate risk gained in importance. We also included the topics of

access and inclusion as well as digital transformation in our materiality matrix. Digital activities which were part of other

chapters of the Non-Financial Report in previous years are presented in a separate chapter in this Non-Financial Report 2019

to provide for the increasing importance of this topic.

Moreover, we merged the topics of diversity, attracting talents and employee development into the topic cluster Employment

and employability. This is to ensure that all material details linked to our human resources work are covered. The business

integrity topic cluster has been renamed Culture and integrity.

The materiality matrix reflects the requirement in § 315b (2) in conjunction with § 289c (3) HGB to assess (a) the relevance of

a non-financial topic to understand Deutsche Bank’s development, performance, or position, which also includes the relevance

of a non-financial topic to stakeholders (x-axis) and (b) the relevance of Deutsche Bank’s business activities on the non-

financial topic (y-axis).

The topics in the top right quadrant of the matrix are the ones that in accordance with § 315c (2) HGB, are both necessary to

understand Deutsche Bank’s development, performance, or position and the impact of Deutsche Bank’s activities on the topic.

These topics are part of this section “Combined separate non-financial report” and are formally part of the Deutsche Bank

Group Management Report.

Further information on non-financial topics not in the top right quadrant of the matrix is disclosed in the section “Additional

information according to GRI”.

As human-rights-related matters and in-house ecology do not fulfill the materiality criteria of § 315c (2) in conjunction with

§ 289c (3) HGB, we continue to disclose relevant information, such as our management approach, and results relating to

these matters in the section “Additional information according to GRI”.

13

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Legal basis

Report limits and further information

This report is a supplement to the Annual Report of Deutsche Bank. A description of the business model of Deutsche Bank in

accordance with § 315c (1) in conjunction with § 289c (1) HGB is part of this Non-Financial Report and can be found in the

Deutsche Bank Group Management Report. In addition to the information in this report, information on our key economic data

is disclosed in our Annual Report. For the parent company, please refer to the

Deutsche Bank AG Annual Financial Statements

and Management Report.

Deutsche Bank’s system for data generation and aggregation of greenhouse gas (GHG) emissions is based on the

GHG Protocol and ISO 14064.

In addition to our annual reporting, we strive for transparency throughout the year by providing additional information to

sustainability rating organizations (see “Sustainability ratings and indices” in this report) and by publishing information on our

corporate responsibility website

.

Material topic index

Reported topics

Chapter

Access and inclusion

Access and inclusion

Anti-financial crime

1

Anti-financial crime

Climate risks

Climate risks

Culture and integrity

1

Culture and integrity

Data protection

1

Data protection

Digital transformation

1

Digitization and innovation

Employment and employability

1

Employment and employability

ES Due diligence

Reputational risk

Human rights

Human rights

Information security

1

Information security

In-house ecology

In-house ecology

Product responsibility

1

Product responsibility

Public policy and regulation

1

Public policy and regulation

Social responsibility

Corporate social responsibility

Sustainable finance

1

Sustainable finance

Tax

Tax

1

Material in accordance with HGB.

14

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Culture and integrity

Culture and integrity

GRI 103-1

Integrity is the basis of everything we do. Without it, we cannot thrive as a business. Deutsche Bank expects its employees to

operate to the highest standards of integrity and conduct. Without this, we can neither build trust and protect our reputation,

nor serve our clients and stakeholders.

Code of Conduct

GRI 102-16/17, 404-2

The Code of Conduct

(the Code) articulates the bank’s key values and the standards of conduct to which employees should

adhere. The Code seeks to foster an open and diverse environment in which employees understand what the bank expects

of them. This includes, among other things, acting ethically, responsibilities as a manager, risk awareness, protection of

confidential information, identification and management of conflicts of interest, financial crime prevention and detection, fair

and free markets, treating clients fairly. Also included is an expectation that employees have a responsibility to speak up and

challenge poor practices and behaviors, especially where actions or failures to act are inconsistent with the Code. Employees

are actively encouraged to escalate, without fear of retaliation, any potential misconduct, inappropriate behavior, or any serious

potential conduct risk to their supervisors, Compliance, Legal, or Human Resources, in line with the Code and other bank

policies and procedures (including the Whistleblowing Policy). Additionally, employees can also report concerns or suspicions,

including anonymously, using the Integrity Hotline. In 2019, the bank introduced a new permanent Report a Concern button

on the bank’s intranet. The information provided here helps employees to identify the right channel to report a concern and

gives them the relevant contact details.

As the Code articulates the bank’s key values and standards of conduct, internal and external employees were required to

complete an e-learning course specifically focused on the Code and the bank’s values. That training was launched in late

2018 and continued in 2019. By the end of 2019, more than 68,000 employees had enrolled in the training, with a completion

rate of 99.9 %. Employees in scope for Compliance Attestation must attest, among other things, to their understanding of the

Code on an annual basis. The Compliance Attestation completion rate was 100.0 % of internal employees and 90.4 % of

external employees.

Failure to adhere to the Code and the bank’s policies and procedures can result in referrals to Human Resources as a part of

the bank’s disciplinary processes.

Culture, Integrity, and Conduct program

GRI 102-16/18/20/26, 103-2/3, 412-2, G4 DMA

Objectives and governance

Deutsche Bank also drives culture and ethical conduct through its Culture, Integrity, and Conduct (CIC) program. The objective

of the program is to reinforce the bank’s values, as articulated in the Code of Conduct, and desired outcomes, and to deliver

enhanced conduct and integrity across all geographies, businesses, and infrastructure functions within Deutsche Bank.

The Management Board and CEO have overall responsibility for achieving the desired cultural outcomes. Each Management

Board member is accountable for culture in their respective business division or infrastructure function. The culture-related

initiatives to support the CIC objectives are developed and implemented in the individual business division and infrastructure

function culture plans.

The CIC Committee oversees the implementation and management of the CIC program. The Committee establishes group-

wide CIC initiatives and drives the CIC topics and messages that are to be embedded in business division and infrastructure

function culture plans.

15

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Culture and integrity

This formal Management Board committee is chaired by the Chief Risk Officer and the Senior Group Director responsible for

Legal and Regulatory Affairs. This committee comprises representatives from each business division, infrastructure function,

and region who are nominated by the respective Management Board member. Group-wide coordination of conduct and

integrity-related initiatives is supported by the CIC Operating Forum (CIC OpFo), which reports to the CIC Committee.

The CIC Committee reports to the Integrity Committee of the Supervisory Board at the Integrity Committee’s request. The

chairs of the CIC OpFo updated members of the Group Management Committee (GMC) on the CIC agenda and progress of

various CIC initiatives in the fourth quarter of 2019 and will continue to do so periodically. The GMC is designed to more

closely link the Management Board to the divisions and comprises Management Board members as well as leaders of the

business divisions.

2019 CIC focus values and mandatory initiatives

GRI 102-44

In 2019, the CIC Committee focused on three of the bank’s six values, with a special emphasis on the value integrity:

– Integrity: Focus on enhancing positive conduct and reducing misconduct, ethical decision-making, and a ”speak-up” culture;

– Discipline: Focus on individual accountability and fiscal responsibility; and

– Client Centricity: Focus on treating clients fairly as a top priority for client-facing employees, and the creation of products

that provide value to clients.

In the context of the specific emphasis on integrity in the year under review, the CIC Committee identified three group-wide

mandatory initiatives that were incorporated into the 2019 CIC Book of Work as well as in the annual business division and

infrastructure function culture plans:

– Speak Up: Encouraging employees to speak up if they see something that feels wrong;

– Listen- Up: Educating managers on how to listen to concerns and respond when people raise issues to them, and to create

an environment conducive to speaking up; and

– Gray areas in ethical decision-making: Fostering a culture where structured conversations can be held on potential gray

areas in ethical decision-making as part of creating a Speak Up and Listen Up environment.

The group-wide focus values and mandatory initiatives are incorporated into:

– CIC Book of Work: A set of centrally led initiatives focused on group-wide frameworks and processes (e.g. reviewing HR

employee life cycle processes), training, and campaigns (e.g. Be on the Right Side Speak Up Campaign); and

– Annual business division and infrastructure function culture plans: Annual culture plans of each business division and

infrastructure function tailored to their specific needs and incorporating the global topics and messaging to better embed

the CIC objectives.

16

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Culture and integrity

Key CIC initiatives in 2019

GRI 102-16

The key initiatives implemented in 2019 included:

– An integrated Conduct and Speak Up awareness campaign and training program was launched in July 2018 and continued

through 2019. The integrated campaign promoted a culture where employees could feel comfortable to express their

concerns, including those that might be conduct-related, with no fear of reprisal or retaliation. A robust Speak Up culture –

focusing on being on the “right side” – is intended to increase employee awareness and responsibility. Such a culture

should also increase the likelihood that problems will be identified at an early stage before they can become more serious.

The campaign also focused on educating managers on how to encourage speaking up, and how to listen to and respond

when people raise issues to them. April 2019 saw the launch of the Speak Up Navigator to guide employees through

Speak-Up and Listen Up training resources. The results of the People Survey showed a clear link between the impact of

managers and employees giving and receiving feedback, mutual appreciation and attendance rates for team meetings on

commitment to the bank, enablement and confidence to speak up. Appreciation is particularly critical in helping people

voice their concerns and take the right actions in line with the bank’s values, beliefs and principles. Five questions focused

on the Speak Up culture were included in our 2019 People Survey. The results for each of these questions showed an

improvement on the previous year’s results. For further details about the 2019 People Survey, please refer to the 2019

Human Resources Report;

– The Whistleblowing Policy, which was revised in 2019, sets forth the framework for employees to report concerns or

suspicions regarding possible violations of laws, rules or regulations, or possible violations of internal policies or

procedures, including the bank’s Code of Conduct. Any reports received are reviewed to establish their nature, content,

and priority. If necessary, an internal investigation of the incident will be initiated. This may result in a number of outcomes,

for example disciplinary actions against employees or changes to the relevant processes. One of the channels employees

can use to report such concerns or suspicions is the bank’s Integrity Hotline which can also be used on an anonymous

basis. An important feature of the Whistleblowing Policy is that retaliation of any kind is prohibited against employees who

make a report internally or externally to any regulatory, investigatory or other agency or authority, or to self-regulatory

agencies;

– While we are fully aware that culture is difficult to measure, we report a number of metrics from various group-wide sources

to evaluate progress against our culture objectives in the Culture and Conduct Metrics Dashboards. The Dashboards are

produced at a group, divisional, and regional level and reported quarterly to the CIC Committee. The metrics are aligned

to the bank’s values and include, for example, data on investigation processes, disciplinary and consequence management

processes, gender diversity, the number of employee hours attributed to corporate social responsibility, and client

satisfaction, as well as escalations through whistleblowing channels. The metrics also incorporate results from the bank’s

annual People Survey, which can provide a more in-depth view of employees’ engagement with the bank’s values. Some

of the culture metrics are included in the Management Board balanced scorecard. In 2019, as part of our continued efforts

to enhance the Culture and Conduct Metrics Dashboards, we undertook a review of the existing suite of culture and conduct

metrics. This included looking across the industry to identify best practices and any gaps in our metrics compared to other

firms. Based on the industry review, our Culture and Conduct Metrics Dashboards report metrics in line with common

industry practice;

– The Market Conduct and Integrity Classroom training program launched in 2018 was completed in 2019. More than 4,000

primarily front office employees were trained in small class-room settings; employees not able to attend in person received

an online version of the classroom training. Since its launch, the training reached a completion rate of 99.6 % by the end

of 2019. The training consisted of two video scenarios designed to explore good conduct and inappropriate behaviors in

connection with securities and investment-banking-related businesses. The scenarios were intended to create some gray

areas, in which the learners could explore and discuss the facts about appropriate and inappropriate behaviors. They also

gave them the chance to learn how to make decisions, exercise judgment, reach out for help in resolving gray areas, and

escalate where necessary. A total of 99 % of the attendees strongly agreed or agreed that the course objectives had been

met; and

– Targeted communications to business divisions and infrastructure functions on culture and conduct topics were delivered

across the bank. This included embedding key messages in senior management communications, articles, and video

interviews on the dbnetwork homepage, as well as in town hall meetings.

While the emphasis of many of the initiatives was on integrity, there were a number of business division and infrastructure

function culture plans initiatives focused on the values client centricity and discipline, including:

– Redesigning the client on-boarding process to increase speed, improve the client user experience and promote behavioral

change across the bank;

– Creating client value metrics on client satisfaction; and

– Improving the speed of decision-making through clearer accountability.

Client-related matters

18 Product responsibility

20 Client satisfaction

23 Sustainable nance

18

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Product responsibility

Product responsibility

GRI 102-16/42, FS4

Product responsibility at Deutsche Bank is defined by the principles of our Code of Conduct, which lay down the guidelines to

ensure that all our business divisions – Corporate Bank (CB), Investment Bank (IB), Private Bank (PB), and

Asset Management (AM) – behave responsibly and with integrity towards clients. As these business divisions are responsible

for implementing the Code of Conduct, they are accountable for treating clients fairly at every stage – from the development

to the sale of our products and services. Specific control functions support the business divisions in living out their

responsibility. Processes and controls set up as a result of legislation and regulations, for example MiFID II, help us to

recognize relevant topics in good time and define action areas, including market screenings of products to identify those that

best fit our specific client needs. The bank’s internal guidelines address these topics and regulate important aspects of them.

For further details on product governance please refer to our Annual Report 2019 - Risk and capital overview - Risk

governance as well as Operational risk management - Operational risk type frameworks.

In view of the differing profiles of our client groups, our business divisions enjoy varying degrees of freedom in implementing

these guidelines. Their interpretation is determined, for example, by a specific client group’s touch points with the bank, the

need for client protection, or how much a client group knows about financial transactions. In order to ensure we are acting

with integrity in a client-centric manner, we regularly train all employees involved in client relationships. The topics we pay

particular attention to include a responsible attitude towards new products and dealing with new product-related requirements,

advising clients responsibly, helping clients to avoid becoming heavily indebted, and knowing how to deal with conflicts of

interest.

Product design and approval

GRI 102-11/15, 103-1/2/3, 417-1, G4 DMA

A group-wide New Product Approval (NPA) and Systematic Product Review (SPR) process defines the design and approval

of new products and services. Regional or divisional NPA councils also express their opinions on new products and material

developments affecting existing products, such as new risk factors or businesses. We also systematically review our products

throughout their life cycles to ensure they remain fit for purpose and consistent with the needs, characteristics, and objectives

of the respective client groups. Additionally, any features causing concern, such as a potential reputational impact on the bank

from environmental or social issues, are referred to the relevant management approval committees, such as our Regional

Reputational Risk Committees or, ultimately, the Group Reputational Risk Committee.

Our investment activities are based on a process designed to ensure decisions are taken in our clients’ best interests. To

provide products and advice that match our clients’ specific needs in a given market environment, our analysis of market

conditions is conducted separately from sales planning. For current and prospective clients, this process provides

transparency on the bank’s views on specific investment topics, asset classes, and market events. In our AM and PB, for

example, this investment process leads to the formulation of structured investment and market assessments by the Chief

Investment Officer (CIO Views), which draw on the expertise of senior employees and are used to inform both our portfolio

managers and our client advisors. In order to take into account the different cultural, and regional backgrounds of our clients

in client portfolios, we adapt our CIO Views to regional conditions.

Product and advisory principles

GRI 102-16

Minimum standards for our product lines commit us to offering ethically justifiable and transparent products and services based

on processes and principles designed to ensure compliance with legal and regulatory requirements. For example, our

guidelines on product oversight governance require frequent monitoring as to whether specific products have only been sold

to the appropriate client group. Moreover, we strive to offer clients responsible and foresighted advice that fulfills their needs

and reveals the respective benefits and risks. To ensure the suitability and appropriateness of our products, we assess a

variety of parameters, including the complexity of a product, a client’s knowledge of and experience with a product, and a

client’s regulatory classification and investment objectives. Then we select the product that matches the desired client demand.

19

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Product responsibility

Our basic principles require us not to sell any product or service if it becomes obvious that a client does not need the product,

cannot afford it in the mid-term, and has not understood it, or that a product does not meet the client’s risk profile. Furthermore,

our products must be designed in such a way that their potential returns exceed the cost of investing in the product.

The principles we apply also state that our products should be beneficial to the individual but not have detrimental side effects

on society at large. This rules out products or investments that, for example, involve the manufacturing or sale of nuclear

weapons, cluster munitions, and landmines, promote or use child labor, violate human rights, or in any way support drug

trafficking or money laundering.

In our Investment Advisory business, we advise on and offer both Deutsche Bank and third-party products, which enables us

to only provide products that best fit specific client needs. Our Product Guidelines for Investment and Insurance Products also

define products that are not to be advised to clients, such as investments in contracts for difference (CFDs). Furthermore, we

do not launch new products based on momentum strategies in soft commodities.

Prevention of excessive indebtedness

GRI 102-11

In granting loans, particularly to private clients, we strive to protect them from over-indebtedness. Therefore, each loan

application must be accompanied by an obligatory analysis of the client’s personal situation. A loan engagement will only be

set up if sufficient financial leeway is left after the deduction of interest and repayment amounts. The stated aim is to protect

clients against over-indebtedness and, in particular, loss of property. We fully reflected these requirements in our loan

processes and regularly train our sales employees in this respect.

For non-performing loans the bank deploys a series of measures to mitigate hardship. In cases of late or nonpayment, we

contact our clients at an early stage. In the event of a financial emergency due to unemployment, illness, or insolvency, for

example, or in other justified exceptional cases, our PB Germany Deutsche Bank brand business has a separate hardship

process and employs individualized strategies to provide the necessary financial solutions, for example moratorium of

payments or reduced repayment rates.

Communications and marketing

GRI 103-1/2/3, 417-1, G4 DMA

We are dedicated to marketing our products and services responsibly and to providing information our clients can trust. All

information contained in marketing material as well as product information, must be transparent, clear, fair, accurate, and not

misleading. All our client communications – irrespective of format, medium, or audience – must meet the minimum standards

and requirements set out in our internal policies, such as our Business Communications Policy. While advertising our products

and services, we do not guarantee a particular outcome or result.

Conflicts of interest

GRI 102-25

Conflicts of interest are inherent in all business activities and can arise in conjunction with employee trading, outside business

interests, transactions performed by deal teams, or family and close personal relationships. Failure to recognize and

appropriately manage conflicts of interest can result in inappropriate or adverse consequences for clients, the bank, and

employees. Our employees are required to notify their supervisor and/or Compliance if they identify such a conflict. Every

business division has implemented a conflict-of-interest framework to identify actual and potential conflicts, mitigate them, or

manage them fairly and appropriately for all involved parties. Senior managers are required to sponsor systems and controls

to document, track, manage, and mitigate any conflicts of interest and regularly review their effectiveness. The bank’s Business

Selection and Conflicts Office is an independent control function responsible for group-wide oversight of management activities

relating to conflicts of interest and reports at least once a year to the Management Board.

20

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Client satisfaction

Client satisfaction

GRI 102-42/44

As loyal and satisfied clients are vital for our ongoing success, we work to improve our products and services and to ensure

compliance with the legal requirements for such advice. We apply business-division-specific approaches to assess client

satisfaction, including client satisfaction surveys, test purchases, mystery shopping

1

, and third-party assessments. We

integrate client feedback into quality assurance and optimization measures. The results are communicated internally to

relevant internal stakeholders, for example senior management. Based on the respective feedback, steps for improvement

are formulated and, where appropriate, incorporated.

In our Investment Bank (IB) we employ broker reviews as an approach to ensure client satisfaction. This dialog puts us in a

position to take educated decisions on proposed changes by key stakeholders. In 2019, our Corporate Bank (CB) and IB

teams jointly engaged in our Voice of the Client process, which covers our global corporate client activities across coverage

and sales/implementation, as well as service activities. We used the feedback from key decision makers and service recipients

to create client-specific action plans and initiate product developments. In 2019, 81 % of our clients stated they were mainly

or fully satisfied with how we dealt with their feedback.

Client surveys, interviews, and test purchases are key tools for measuring client satisfaction and loyalty in our Private Bank

(PB) Germany and Private & Commercial Business International. Overall, the level of satisfaction in 2019 changed little from

2018. However, our clients’ feedback revealed, for example, some room for improvement in our advisory processes. Our sales

employees get in touch with dissatisfied clients to discuss the reason for their dissatisfaction.

In 2019, we received responses on the degree of satisfaction with PB Germany, Deutsche Bank brand business, from around

170,000 clients in Germany via self-service devices and online banking. We use mystery shopping to check that our advisory

processes meet our clients’ needs. In 2019, an independent market research institute conducted interviews with around

8,000 clients. This gave us feedback on their satisfaction with our advice. Additionally, a total of 1,993 test purchases took

place in Germany. In our Private & Commercial Business International, 328 test purchases were conducted in 2019. The

results have been integrated into our branches’ sales management processes.

Client satisfaction index Private Bank (excl. Wealth Management, WM)

In

%

(unless stated otherwise)

Dec 31, 2019

Dec 31, 2018

Dec 31, 2017

Client satisfaction Private Bank Germany (excl. WM), Deutsche Bank brand

1

Index Private Bank Germany (excl. WM), Deutsche Bank brand

69.4

68.2

70.2

With our services

70.3

69.3

71.5

With our advice

70.5

69.2

71.4

With actively offered products and services

65.0

63.7

65.6

Willingness to recommend Deutsche Bank

71.5

70.6

72.3

Number of clients taking part in the survey

171,053

192,207

237,095

Client satisfaction Private & Commercial Business International

2

Index Private & Commercial Business International

78.4

79.5

77.4

Willingness to recommend Deutsche Bank

84.9

76.5

75.5

Number of clients taking part in the survey

19,200

20,510

24,272

1

Comparative values for prior years 2017 and 2018 have been restated to reflect the transition of commercial clients from our PB to our CB division in Germany.

2

The figures for Private & Commercial Business International include numbers for Spain and Italy and are based on country-specific survey methods with different scales. The

results have been converted to a uniform scale of 0-100 %.

Mystery Shopping index Private Bank (excl. WM)

In

%

(unless stated otherwise)

Dec 31, 2019

Dec 31, 2018

Dec 31, 2017

Private Bank Germany (excl. WM), Deutsche Bank brand

1

Mystery Shopping Index

82.6

81.1

78.5

Private & Commercial Business International

2

Mystery Shopping Index

84.7

79.8

74.5

Private Bank Germany (excl. WM), Postbank brand

Mystery Shopping Index

67.2

67.0

68.8

1

Comparative values for prior years 2017 and 2018 have been restated to reflect the transition of commercial clients from our PB to our CB division in Germany.

2

In 2019, Private & Commercial Business International conducted test purchases in Spain, while Belgium, India, and Italy did not participate in the mystery shopping program.

Therefore, the Mystery Shopping Index for 2019 consists only of results from Spain. The index value for 2018 contains test purchases from Poland, Portugal, and Spain. The

figures for Private & Commercial Business International are based on country-specific survey methods with different scales. The results have been converted to a uniform

scale of 0 – 100 %.

1

Mystery shopping is only used in our Private Bank.

21

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Client satisfaction

Postbank, which remains present in the market as a key brand, measures not only the degree of satisfaction with its services

as a whole but also the willingness to recommend its services as well as other detailed aspects of the client-bank relationship

(including client satisfaction with central service processes and client contact points). In 2019, overall client satisfaction was

lower than the previous year. The various reasons included the closure of branches, pricing measures, availability problems,

and some changes in the online banking application, for example a modified security process. In 2019, Postbank conducted

2,048 test purchases. Its Mystery Shopping index rating was essentially flat in comparison to 2018 despite the impact of strikes

and the conversion of the online banking access to the two-factor authentication process.

Various measures were initiated to improve the client experience and quality of advice, such as the ongoing development of

sales software. Additionally, Postbank uses the self-developed online tool Competence Quiz to improve the quality of sales

and advice. The tool offers sales employees the possibility to test and expand in a playful manner their client-related knowledge

about products, processes, and regulations based on relevant and up-to-date customer use cases. In 2019, Postbank

employees used the online Competence Quiz more than 100,000 times.

In 2019, Wealth Management (WM) in Germany continued using its Net Promoter Scores (NPS) and Client Satisfaction Survey

for the majority of eligible clients

2

. In 2019, the NPS in Germany was 75 %. In 2019, we started working on a Voice of the

Client survey in collaboration with Scorpio Partnership. This client survey is scheduled to be piloted in the Americas region in

Q1/2020 before a broader rollout takes place later in the year. Ongoing measures to enhance client satisfaction include

process improvements, such as the optimization of client onboarding within Global Markets and the digitization of the client

onboarding process.

Since 2008, an external service provider has been commissioned to conduct client satisfaction surveys with the aim of

improving service quality and the client experience in our AM. The annual client satisfaction survey among AM clients focuses

on perceived service quality, professionalism, and service process transparency. Clients and advisors can rate their

satisfaction on topics, such as staff friendliness, response rate, professional competence, comprehensibility, solution

orientation, and sales-specific questions. The degree of advisor satisfaction with, for example, recommended solutions,

professional competence, and friendliness was again evaluated, and we regard the fact that advisors stated they were “likely

to recommend our telephone services to colleagues” as proof of customer loyalty. For AM’s U.S. insurance and institutional

business, an annual client satisfaction survey is conducted with a focus on investment performance and other areas of

improvement, such as relationship management, innovation, and overall satisfaction. The intention here is to embed client

feedback into AM’s senior management sessions and U.S. Fund Board meetings. Regular surveys covering knowledge,

sincerity, problem-solving, and overall client satisfaction are also conducted on a monthly basis by a third-party vendor who

services the direct retail client base in the U.S.

2

Eligible clients are those who meet each of the following criteria: the client is German speaking; the client has an email address registered with Wealth Management and; the

client has positively acknowledged an opt-in email.

22

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Client satisfaction

Complaint management

GRI 102-15/17/31/44, 418-1

We have a defined set of core values for dealing with complaints fairly, impartially, and without undue delay. How we address

complaints is governed by the Group Policy on Minimum Requirements for Handling and Recording of Complaints, which

applies to all our businesses and complies with the EU Guidelines on Complaints Processing for Securities Trading (ESMA)

and Banking (EBA) and their interpretation by the Federal Financial Supervisory Authority (Bundesanstalt für

Finanzdienstleistungsaufsicht, BaFin). Our business divisions are responsible for developing and implementing procedures

incorporating the objectives and minimum requirements set out in the Group Policy. We strive to anticipate and avoid potential

complaints before they arise or solve them, whenever possible, during the initial client contact. To achieve this, a robust and

consistent client complaint handling and reporting process helps to facilitate the improvement of client satisfaction by

identifying and remedying poor client outcomes. This enables us to learn from mistakes and thus reduce their incidence and

any related costs, as well as to enhance risk transparency and improve management information. Clients who are dissatisfied

with a product, service, or decision can contact the bank in any local branch, by e-mail, online, by calling our client service

center, or through authorized third parties. We immediately acknowledge receipt of complaints and work to resolve them

quickly and transparently by regularly training our complaint managers. Client complaints are reported to the bank’s senior

management and Compliance function and are subject to periodic review. Complaint metrics also feed into our Non-Financial

Risk Report oversight reporting. We screen new complaints for recurring noticeable problems. Management information

provides an oversight of the type of complaints (clustered by group-wide non-financial risk-type taxonomy), materiality,

severity, and time to closure.

In 2019, we continued our efforts to comply with a consistent complaint-handling framework. As we realign our businesses

into the newly established CB and IB, our focus continues to be on integrating the complaint-handling processes. These

processes are regularly enhanced, while staff training ensures consistent capturing and reporting of complaints, as well as

improved oversight and governance. As a result, the number of complaints handled by IB was over 40 % lower in 2019 than

in 2018. The focus here was on transaction processing.

In our PB, the number of client complaints rose sharply in 2019. Despite a decline in the Private & Commercial Business

International, triggered by the discontinuation of the private client business in Portugal and Poland, the overall number

increased due to complaints related to PB Germany, Postbank brand business. This was particularly due to the deactivation

of the mobile TAN procedure in the course of the Payment Services Directive 2 (PSD2) implementation. In our PB, we

participate in all applicable dispute resolution schemes run by national ombudsmen, which offer a free, fair and easily

accessible service to consumers who prefer to resolve a dispute not directly with the bank.

For complaints from WM clients, our complaint indicator revealed that there were fewer complaints in 2019 than in 2018. A

Global Product Governance Forum (GPGF) reviews quarterly the output of product life cycle analysis and management

processes, including product-related client complaints, and in particular global trends.

In 2019, AM observed an increase in complaints. This is almost exclusively due to a delay in the distribution of tax filings and

declaration of profits in Germany and Luxembourg respectively. We have taken an important governance measure by initiating

a globally responsible complaint management function, assumed within the Divisional Control Office of AM. This function

coordinates complaints across regions and business areas. In this capacity, this function also reports to regulatory bodies.

Furthermore, complaint filing, logging, and reporting have been centralized in a new system known as Salesforce. The relevant

employees were trained for both measures in 2019.

23

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Sustainable finance

Sustainable finance

GRI 102-15/43

In 2019, the public debate about the urgent need to transition to a sustainable and low-carbon economy and the discussion

about the role the financial sector plays in this – above all, the call for sustainable finance – gained a new level of importance

worldwide. Climate protection was also a major topic of discussion with politicians and supervisory authorities. When

Deutsche Bank signed the Paris Pledge for Action in 2015, we demonstrated our commitment to contribute to the goals of the

Paris Agreement. This commitment continues unabated.

As a global financial intermediary, we have a role to play in facilitating the transition of economies towards sustainable and

low-carbon growth. In this context, we understand sustainable finance to be business activities that support this transition by

directing financial flows towards more sustainable and climate-friendly solutions. We use our market expertise, products, and

solutions to drive our customers' transformation towards this direction. Our increased focus in this field was reflected in the

results of our 2019 materiality assessment (see “Legal basis“). Sustainable finance also includes questioning our involvement

in certain business areas, such as the financing of new coal-fired power plants.

The transition to a more sustainable and low-carbon economy and the physical effects of climate change will also lead to risks.

Our approach to managing climate risk and a summary of the steps we are taking to enhance our framework in alignment with

the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are outlined in the GRI supplement of this

report (see “Climate risk“). It contains a summary of how Deutsche Bank manages exposures to carbon-intensive industries,

risks from commodity price volatility, and physical risks to infrastructure, employees, and key processes.

We offer a range of sustainable finance solutions geared towards our clients’ specific needs. In doing so, we can play to our

strength as a universal bank. For our commercial and corporate clients, we create individual lending offerings to advance their

own business transformation to low carbon models. Our Investment Bank (IB) assists companies and governments in gaining

access to sustainable financing on the capital markets. In our Asset Management (AM), we are focusing on mainstreaming

ESG by integrating ESG aspects into our investment strategies, as well as the respective product portfolio and services. We

are continuously growing the number of sustainable investment products available for institutional and private investors. Some

of our offerings seek to directly or indirectly contribute to the Sustainable Development Goals (SDGs) of the United Nations

Global Agenda 2030.

Governance

GRI 102-12/16/18, 103-2/3

Our group-wide Sustainability Council is mandated by the Management Board to drive the integration of sustainability

throughout the bank (see “Approach to sustainability“). In 2019, the focus was on developing the bank’s approach to

sustainable finance. The discussions focused on, among other things, the establishment of a consistent group-wide definition

of sustainable finance for our lending and capital market activities. To support these discussions, the bank joined the pilot

project led by the United Nations Environment Programme Finance Initiative (UNEP FI) and the European Banking Federation

(EBF) to draw up guidance on the voluntary application of the EU taxonomy to core banking products. Furthermore, we focused

on assessing the bank’s opportunities across various business lines and initiated steps to set targets for sustainable finance,

which we expect to adopt in 2020.

We address sustainable finance opportunities through divisional ESG governance structures to ensure that we generate

appropriate answers to client demands, and to continually expand our ESG product portfolio and services. International

standards, such as the UN Global Compact and the OECD Guidelines for Multinational Corporations, are examples of the

guiding principles for our business. In 2019, Deutsche Bank committed itself to the newly established Principles for

Responsible Banking. Furthermore, we are governed by several internal policies, such as our publicly available Environmental

and Social Policy Framework, and the Responsible Investment (RI) Statement, ESG Integration Policy for Active Investment

Management, and ESG Engagement Policy that are specific to our AM. We regularly review our policies and procedures.

24

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Sustainable finance

Training and awareness

GRI 102-21/43, 103-1, 404-2, G4 DMA

To develop and complement our in-house competences, we collaborate with industry experts and external service providers.

We also invest in ESG research, engage with our stakeholders, and participate in a variety of initiatives to foster sustainable

finance. In our Private Bank Germany, we conducted more than 200 advisor and client events in the year under review in

order to increase ESG awareness. To further develop our capabilities in Wealth Management (WM), we built up a network of

ESG Ambassadors in each region to serve as first points of contact on ESG-related financial matters. The European

Federation of Financial Analysts Societies (EFFAS) was also engaged to roll out a Web-based Certified Environmental Social

Governance Analyst (CESGA) training course for all our 4,000 WM employees worldwide. In-person training sessions were

conducted in Europe and the U.S. In AM, we continued our regular training for investment professionals across AM in Active,

Passive, and Alternatives on the assessment of ESG risks and opportunities in order to support ESG integration across the

entire investment platform. In 2019, we continued the engagement of AM investment professionals towards environmental

and social issues in Active and ran mandatory internal training sessions for Active investment experts. This included offering

the optional EFFAS ESG Certification Program. In 2019, a total of 36 current and permanent employees across AM registered

for the exam and have become certified ESG analysts. At the end of 2019, AM counted a total of 123 CESGA-certified

employees.

Deutsche Bank also recognizes its responsibility as a convener for multi-stakeholder engagements towards sustainable

financing. As such, our Corporate Bank (CB) and Investment Bank (IB) hosted various events on the key topic of green bonds

and sustainable finance in 2019, for example an ESG Engagement Conference in Frankfurt am Main co-hosted by the Green

and Sustainable Finance Cluster Germany and the International Capital Market Association (ICMA), the Next Generation

Innovation Summit held in San Francisco in November, and an ESG engagement conference in New York focusing on green

bonds. We also co-initiated the Conscious Capitalism European Conference in Berlin. To increase education and client

discussions in WM, the September 2019 issue of our German client magazine WERTE was dedicated to sustainability topics.

Moreover, our outreach included key client events, such as dedicated ESG-themed sessions at Wealth with Responsibility in

Germany, as well as smaller-scale ESG-focused client events in Milan and Napa Valley in October. We are also working to

improve our clients’ understanding of ESG-based investment approaches and ESG-related market developments. In 2019,

we continued publishing CIO Insights on ESG topics, including “The E in ESG”, which took an in-depth look at the

environmental aspect of ESG, and “The S in ESG”, which highlighted the importance of social sustainability.

25

Deutsche Bank

Combined separate non-financial report

Non-Financial Report 2019

Sustainable finance

Lending and advisory

GRI 102-16, 201-2, 404-2, G4 DMA, FS8

ESG and green bonds

In our IB division, a dedicated debt capital market product team helps our clients around the world to achieve their sustainability

strategies and to make environmental and social contributions while meeting their financing needs. We advise clients

holistically on broader sustainable finance aspects as well as on how to successfully issue ESG bonds, including all the

strategic and operational preparation required. In 2019, we partnered with a number of global clients in supporting them with

their ESG bond transactions and helped them to raise more than € 22 billion funding in various instruments, such as green,

social, sustainability, and sustainability-linked bonds. Besides advancing the ESG bond market, these transactions were of

high strategic importance to Deutsche Bank’s issuers. For example, we helped the Italian utility company Enel to introduce a

new format known as sustainability-linked bond, which was the first-ever public bond format to attach contractual

consequences to the fulfilling of certain pre-defined sustainability key performance indicators. We also provided support to

Assicurazioni Generali in issuing the first green-subordinated benchmark transaction by a financial institution in Europe, to

Standard Chartered in issuing their inaugural sustainability bond, and to the Republic of Indonesia in issuing their second

green sukuk bond. These exemplary transactions illustrate how Deutsche Bank drives the development of sustainable finance,

and how we facilitate the flow of capital into sustainable projects in alignment with the SDGs set by the United Nations.

Renewable energy

Our IB became involved in financing renewable energy projects in the mid-2000s when projects reached industrial scale. In

2019, we arranged full or partial project finance totaling around € 2.5 billion for renewable energy projects generating over

2,200 megawatts.

Corporate loans

The European corporate loan market saw green or ESG incentives become a regular component of refinancing transactions

in 2019, although the total volume remained relatively small. Sustainability-linked loans are being issued by companies

irrespective of their size, industry, or sustainability score and highlight an issuer’s commitment to its sustainability targets. This

trend is being supported by the Sustainability Linked Loan Principles issued by the Loan Markets Association in March 2019.

In 2019, Deutsche Bank acted as coordinator for eight sustainability-linked loans. Five of these closed in December 2019,

including the German companies Continental, LANXESS, and Zeppelin, the U.K. company NEPI Rockcastle, as well as the

U.S. company Crown, where Deutsche Bank led the first leveraged sustainability-linked loan agreement in the U.S. market.

Overall, Deutsche Bank has participated in over 20 sustainability-linked loans with a total deal volume of more than € 50 billion

in 2019.

Infrastructure development

In 2019, our CB arranged or participated in more than € 3.4 billion of financing for infrastructure projects with strong

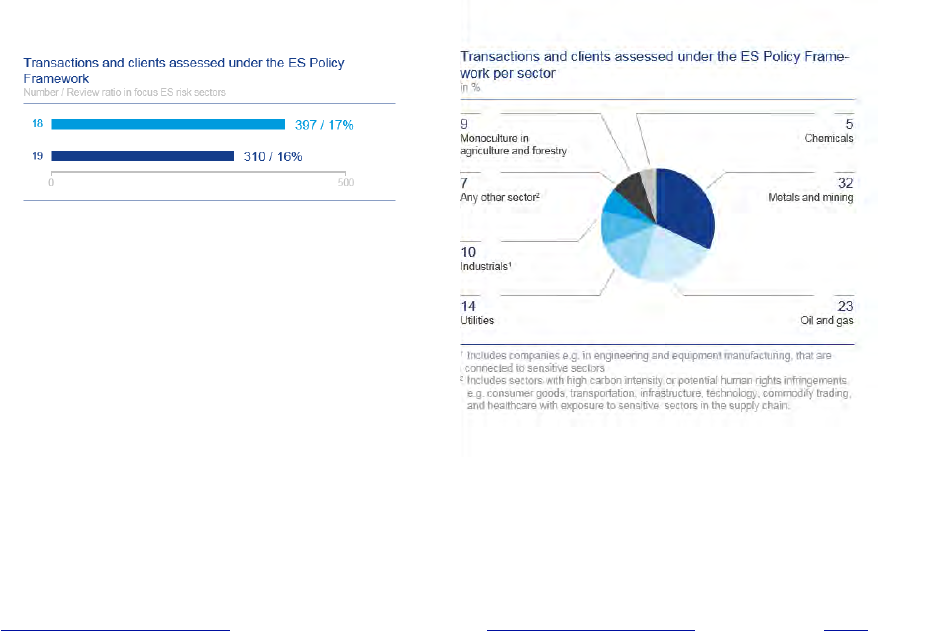

developmental credentials and a positive contribution to the development of local communities in sectors like education,