UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022,

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-32601

____________________________________

LIVE NATION ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

Delaware 20-3247759

(State of Incorporation) (I.R.S. Employer Identification No.)

9348 Civic Center Drive

Beverly Hills, CA 90210

(Address of principal executive offices, including zip code)

(310) 867-7000

(Registrant’s telephone number, including area code)

____________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Trading Symbol(s) Name of Each Exchange on which Registered

Common Stock, $.01 Par Value per Share LYV New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act:

None

_____________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer x Accelerated Filer ¨

Non-accelerated Filer ¨ Smaller Reporting Company

Emerging Growth Company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered accounting

firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

On June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the Common Stock beneficially held by non-affiliates of the registrant was approximately $12.7 billion. (For purposes hereof, directors,

executive officers and 10% or greater stockholders have been deemed affiliates).

On February 16, 2023, there were 231,591,254 outstanding shares of the registrant’s common stock, $0.01 par value per share, including 3,501,153 shares of unvested restricted stock awards and excluding 408,024 shares held in treasury.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Definitive Proxy Statement for the 2023 Annual Meeting of Stockholders, expected to be filed within 120 days of our fiscal year end, are incorporated by reference into Part III.

LIVE NATION ENTERTAINMENT, INC.

INDEX TO FORM 10-K

Page

PART I

ITEM 1. BUSINESS 2

ITEM 1A. RISK FACTORS 13

ITEM 1B. UNRESOLVED STAFF COMMENTS 27

ITEM 2. PROPERTIES 28

ITEM 3. LEGAL PROCEEDINGS 28

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES 29

ITEM 6. SELECTED FINANCIAL DATA 29

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS 30

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK 47

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA 48

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE 96

ITEM 9A. CONTROLS AND PROCEDURES 96

ITEM 9B. OTHER INFORMATION 98

ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS 98

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE 98

ITEM 11. EXECUTIVE COMPENSATION 98

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS 98

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE 98

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES 98

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES 99

ITEM 16. FORM 10-K SUMMARY 106

LIVE NATION ENTERTAINMENT, INC.

GLOSSARY OF KEY TERMS

AOCI Accumulated other comprehensive income (loss)

AOI Adjusted operating income (loss)

APF Ancillary revenue per fan

Company Live Nation Entertainment, Inc. and subsidiaries

FASB Financial Accounting Standards Board

GAAP United States Generally Accepted Accounting Principles

GTV Gross transaction value

Liberty Media Liberty Media Corporation

Live Nation Live Nation Entertainment, Inc. and subsidiaries

LNE Live Nation Entertainment, Inc.

OCESA OCESA Entretenimiento, S.A. de C.V. and certain other related subsidiaries of Corporación Interamericana de Entretenimiento,

S.A.B. de C.V.

SEC United States Securities and Exchange Commission

VIE Variable interest entity

Ticketmaster The ticketing business of the Company

1

PART I

“Live Nation” (which may be referred to as the “Company,” “we,” “us” or “our”) means Live Nation Entertainment, Inc. and its subsidiaries, or one of our segments or subsidiaries, as the context requires.

Special Note About Forward-Looking Statements

Certain statements contained in this Form 10-K (or otherwise made by us or on our behalf from time to time in other reports, filings with the SEC, news releases, conferences, internet postings or otherwise) that are

not statements of historical fact constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended,

notwithstanding that such statements are not specifically identified. Forward-looking statements include, but are not limited to, statements about our financial position, business strategy, competitive position, potential

growth opportunities, potential operating performance improvements, the effects of competition, the effects of future legislation or regulations and plans and objectives of our management for future operations. We have

based our forward-looking statements on our beliefs and assumptions considering the information available to us at the time the statements are made. Use of the words “may,” “should,” “continue,” “plan,” “potential,”

“anticipate,” “believe,” “estimate,” “expect,” “intend,” “outlook,” “could,” “target,” “project,” “seek,” “predict,” or variations of such words and similar expressions are intended to identify forward-looking statements but

are not the exclusive means of identifying such statements.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results to differ materially from those in such statements. Factors that could

cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to, those set forth under Item 1A.—Risk Factors as well as other factors described herein or in our quarterly

and other reports we file with the SEC (collectively, “cautionary statements”). Based upon changing conditions, should any risk or uncertainty that has already materialized, such as, for example, the risks and uncertainties

posed by the global COVID-19 pandemic, worsen in scope, impact or duration, or should one or more of the currently unrealized risks or uncertainties materialize, or should any underlying assumptions prove incorrect,

actual results may vary materially from those described in any forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly

qualified in their entirety by the applicable cautionary statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We do not

intend to update these forward-looking statements, except as required by applicable law.

ITEM 1. BUSINESS

Our Company

We believe that we are the largest live entertainment company in the world, connecting over 670 million fans across all of our concerts and ticketing platforms in 48 countries during 2022.

We believe we are the largest producer of live music concerts in the world, based on total fans that attend Live Nation events as compared to events of other promoters, connecting over 121 million fans to more than

43,600 events for over 7,800 artists in 2022. Live Nation owns, operates, has exclusive booking rights for or has an equity interest for which we have a significant influence in 338 venues globally, including House of

Blues music venues and prestigious locations such as The Fillmore in San Francisco, Brooklyn Bowl , the Hollywood Palladium, the Ziggo Dome in Amsterdam, 3Arena in Ireland, Royal Arena in Copenhagen and

Spark Arena in New Zealand. We believe we are one of the world’s leading artist management companies based on the number of artists represented. Our artist management companies manage music artists and acts across

all music genres. As of December 31, 2022, globally we had over 90 managers providing services to more than 410 artists.

We believe we are the world’s leading live entertainment ticketing sales and marketing company, based on the number of tickets we sell. Ticketmaster provides ticket sales, ticket resale services and marketing and

distribution globally through www.ticketmaster.com and www.livenation.com and our other websites, mobile apps, numerous retail outlets and call centers, selling over 550 million tickets through our systems in 2022.

Ticketmaster serves approximately 9,300 clients worldwide across multiple event categories, providing ticketing services for leading arenas, stadiums, festival and concert promoters, professional sports franchises and

leagues, college sports teams, performing arts venues, museums and theaters.

We believe our global footprint is one of the world’s largest music advertising networks for corporate brands and includes one of the world’s leading ecommerce websites based on a comparison of gross sales of top

internet retailers.

Our principal executive offices are located at 9348 Civic Center Drive, Beverly Hills, California 90210 (telephone: 310-867-7000). Our principal website is www.livenationentertainment.com. Live Nation is listed

on the New York Stock Exchange, trading under the symbol “LYV.”

® ® ®

2

Our Strategy

Our strategy is to grow our global leadership position in live entertainment, promote more shows, sell more tickets and partner with more sponsors, thereby increasing our revenue, earnings and cash flow. We serve

artists, venues and sports teams and leagues to secure content and tickets; we invest in technology to build innovative products which advance our ticketing, digital presence, including mobile platforms, and advertising;

and we are paid by advertisers that want to connect their brands with our passionate fan base.

Our core businesses surrounding the promotion of live events include ticketing and sponsorship and advertising. We believe our focus on growing these businesses will increase shareholder value as we continue to

enhance our revenue streams and achieve economies of scale with our global platforms. We also continue to strengthen our core operations, further expanding into global markets and optimizing our cost structure. Our

strategy is to grow and innovate through the initiatives listed below.

• Invest in Product Improvements. We will continue to invest in our ticketing platforms and develop innovative products to grow our sales channels, drive increased ticket sales, grow non-service fee revenue streams,

and continue to build our client base. These include technological and digital transformations to improve the experience and transparency for fans, venues, and event organizers as well as the overall quality of

service. In addition, we will continue to invest to eliminate fraud such as our focus on anti-BOT technology and the creation of our Verified Fan service.

• Expand our Concert Platform. We will deliver more shows, grow our fan base and increase our ticket sales by continuing to build our portfolio of concerts globally, expanding our business into additional top global

music markets, and further building our presence in existing markets. Through our strong partnership with artists, agents and managers, we believe we can continue to expand our concert base by delivering strong

and consistent services. In December 2021 we acquired OCESA, one of the most prominent live event businesses globally with a robust business portfolio in ticketing, sponsorship, food and beverage, merchandise,

and venue operations across Mexico and Latin America.

•Grow our Revenue per Show. We will grow our revenue per show across our venues through more effective ticket pricing, broader ticketing distribution and more targeted promotional marketing. We will also grow

our onsite fan monetization by improving ease of purchase including contactless payment and rollout of digital technology, through improved onsite products, merchandising, and enhanced experiences for our fans.

• Sell More Tickets. We are focused on selling tickets through a wide set of sales channels, including mobile and online, and leveraging our fan database. We will continue to enhance our application programming

interface features to reach a broader audience and expand our digital ticketing rollout, strengthening control over distribution for our clients and creating new and unique marketing opportunities. We will grow the

volume of secondary tickets sold through a trusted environment for fan ticket exchanges, allowing our fans to have a dependable, secure destination for secondary ticket acquisition for all events.

• Grow Sponsorship and Advertising Partnerships. We will continue to drive growth in our sponsorship relationships and capture a larger share of the global music sponsorship market by further monetizing our fan

base and portfolio of brands. We will focus on expanding existing partnerships and developing new corporate sponsor partners to provide them with targeted strategic programs, accessing the fans attending our

shows each year. We will continue to develop and to scale new products in order to drive onsite and digital revenue.

Our Strengths

We believe we have unique resources that are unmatched in the live entertainment industry.

• Fans. During 2022, we connected over 670 million fans to their favorite live event. Our database of fans and their interests provides us with the means to efficiently communicate to them on shows they are likely to

be interested in.

• Artists. We have extensive relationships with artists ranging from those just beginning their careers to established superstars. In 2022, we promoted shows or tours for over 7,800 artists globally. In addition, through

our artist management companies, we managed more than 410 artists in 2022.

• Digital Platforms and Ticketing. We own and operate various branded websites, both in the United States and abroad, which are customized to reflect services offered in each jurisdiction. Our primary commercial

websites, www.livenation.com and www.ticketmaster.com, together with our other branded ticketing websites, are designed to promote ticket sales for live events. We also have both Live Nation and Ticketmaster

mobile apps that our fans can use to access event information and buy tickets.

3

• Distribution Network. We believe that our global distribution network of promoters, venues and festivals provides us with a strong position in the live concert industry. We believe we have one of the largest global

networks of live entertainment businesses in the world, with offices in 44 countries worldwide. In addition, we own, lease, operate, have exclusive booking rights for, or have an equity interest in 338 venues and

have operations located across 48 countries as of the end of 2022, making us, we believe, the second largest operator of music venues in the world. We also believe that we are one of the largest music festival

producers in the world with 147 festivals globally in 2022. In addition, we believe that our global ticketing distribution network—which includes one of the largest ecommerce sites and related apps along with

approximately 9,300 clients worldwide in 2022 — makes us the largest ticketing network in the world.

• Sponsors. We monetize our physical and digital assets through long-term sponsorship agreements and advertising. We employ a sales force of approximately 600 people that worked with approximately 1,200

sponsors during 2022, through a combination of strategic partnerships, local venue-related deals, national agreements and digital campaigns, both in North America and internationally. Our sponsors include some of

the most well-recognized national and global brands across diverse sectors including consumer, financials and leisure including Citibank, O , American Express, Cisco, Hilton, Red Bull and Anheuser Busch (each

of these brands is a registered trademark of the sponsor).

Our Industry

We operate in the following main industries within the live entertainment business: live music events, music venue operations, the provision of management and other services to artists and athletes, ticketing

services and sponsorship and advertising sales.

The live music industry includes concert promotion and/or production of music events or tours. Typically, to initiate live music events or tours, booking agents contract with artists to represent them for defined

periods. Booking agents then work with promoters, who will contract with them or with artists directly, to arrange events. Promoters earn revenue primarily from the sale of tickets. Artists are paid by the promoter under

one of several different formulas, which may include fixed guarantees and/or a percentage of ticket sales or event profits. In addition, promoters may also reimburse artists for certain costs of production, such as sound and

lights. Under guaranteed payment formulas, promoters assume the risks of unprofitable events. Promoters may renegotiate lower guarantees or cancel events because of insufficient ticket sales in order to reduce their

losses. Promoters can also reduce the risk of losses by entering into global or national touring agreements with artists and including the right to offset lower performing shows against higher performing shows on the tour in

the determination of overall artist fees. Artist managers primarily provide services to music artists to manage their careers. The artist manager negotiates on behalf of the artist and is paid a fee, generally as a percentage of

the artist’s earnings.

Our strategy is to provide minimum revenue guarantees to artists, which generates the vast majority of their total income. We believe the artist-fan connection is the source of nearly all commercial value and as a

result, our artists receive the majority of all ticketing revenue. For music tours, four to eight months typically elapse between initially booking artists and the first performances. Artists, in conjunction with promoters,

managers and booking agents, set ticket prices and advertising plans. Promoters market events, sell tickets, rent or otherwise provide venues and arrange for local production services, such as stages and equipment.

Venue operators typically contract with promoters to have their venues rented for specific events on specific dates and receive fixed fees or percentages of ticket sales as rental income. In addition, venue operators

provide services such as concessions, parking, security, ushering and ticket scanning at the gate, and receive some or all of the revenue from concessions, merchandise, parking and premium seating.

Ticketing services generally refers to the sale of tickets primarily through online and mobile channels, but also include sales through phone, outlet and box office channels. Ticketing companies will contract with

venues and/or promoters to sell tickets to events over a period of time, generally three to five years. The ticketing company generally gets paid a fixed fee per ticket sold or a percentage of the total ticket service charges.

The ticketing company receives the cash for the ticket sales and related service charges at the time the ticket is sold and periodically remits these receipts to the venue and/or promoter after deducting its fee. Venues will

often also sell tickets through a local box office at the venue using the ticketing company’s technology. The ticketing company will generally not earn a fee on these box office tickets.

Ticketing resale services generally refers to the sale of tickets by a holder who originally obtained the tickets from a venue or other entity, or a ticketing services provider selling on behalf of a venue or other entity.

Resale tickets are also referred to as secondary tickets. Generally, the ticket resale company is paid a service charge when the ticket is resold and the ticket value is paid to the holder.

2

4

The sponsorship and advertising industry within the live entertainment business involves the sale of international, national, regional and local advertising and promotional programs to a variety of companies to

advertise or promote their brand, product or service. These sponsorships typically include venue naming rights, onsite venue signage, online advertisements and exclusive partner rights in various categories such as credit

card, beverage, travel and telecommunications, and may include event pre-sales and onsite product activation.

Our Business

Our reportable segments are Concerts, Ticketing and Sponsorship & Advertising.

Concerts. Our Concerts segment principally involves the global promotion of live music events in our owned or operated venues and in rented third-party venues, the operation and management of music venues, the

production of music festivals across the world, the creation of associated content and the provision of management and other services to artists. Including intersegment revenue, our Concerts business generated $13.5

billion, or 80.9%, of our total revenue during 2022. We promoted more than 43,600 live music and other events in 2022. While our Concerts segment traditionally operates year-round, we experience higher revenue during

the second and third quarters due to the seasonal nature of shows at our outdoor amphitheaters and festivals, which primarily occur from May through October.

As a promoter, we earn revenue primarily from the sale of tickets and pay artists under one of several formulas, including a fixed guaranteed amount and/or a percentage of ticket sales or event profits. For each event

we promote, we either use a venue we own or operate, or rent a third-party venue. Revenue is generally impacted by the number of events, volume of ticket sales and ticket prices. Event costs such as artist fees and

production expenses are included in direct operating expenses and are typically substantial in relation to the revenue. As a result, significant increases or decreases in promotion revenue do not typically result in

comparable changes to operating income.

As a venue operator, we generate revenue primarily from the sale of concessions, parking, premium seating, rental income and ticket rebates or service charges earned on tickets sold through our internal ticketing

operations or by third parties under ticketing agreements. In our amphitheaters, the sale of concessions is outsourced and we receive a share of the net revenue from the concessionaire, which is recorded in revenue with

limited associated direct operating expenses. Revenue generated from venue operations typically has a higher margin than promotion revenue and therefore typically has a more direct relationship to changes in operating

income.

As a festival promoter, we typically book artists, secure festival sites, provide for third-party production services, sell tickets and advertise events to attract fans. We also provide or arrange for third parties to provide

operational services as needed such as concessions, merchandising and security. We earn revenue from the sale of tickets and typically pay artists a fixed guaranteed amount. We also earn revenue from the sale of

concessions, camping fees and service charges earned on tickets sold. For each event, we either use a festival site we own or rent a third-party festival site. Revenue is generally impacted by the number of events, volume

of ticket sales and ticket prices. Event costs such as artist fees and production expenses are included in direct operating expenses and are typically substantial in relation to the revenue. Since the artist fees are typically

fixed guarantees for these events, significant increases or decreases in festival promotion revenue will generally result in comparable changes to operating income.

Ticketing. Our Ticketing segment is primarily an agency business that sells tickets for events on behalf of its clients and retains a portion of the service charge as its fee. We sell tickets for our events and also for

third-party clients across multiple live event categories, providing ticketing services for leading arenas, stadiums, amphitheaters, music clubs, concert promoters, professional sports franchises and leagues, college sports

teams, performing arts venues, museums and theaters. We sell tickets through mobile apps, websites and ticket outlets. During 2022, we sold 56%, 42% and 2% of primary tickets through these channels, respectively. Our

Ticketing segment also manages our online activities including enhancements to our websites and product offerings. Including intersegment revenue, our Ticketing business generated $2.2 billion, or 13.4%, of our total

revenue during 2022, which excludes the face value of tickets sold and is net of the fees paid to our ticketing clients. Through all of our ticketing services, we sold approximately 281 million tickets in 2022 on which we

were paid fees for our services. In addition, approximately 270 million tickets were sold using our Ticketmaster systems, including through season seat packages, our venue clients’ box offices, and other channels through

which we did not receive a fee. Our ticketing sales are impacted by fluctuations in the availability of events for sale to the public, which may vary depending upon event scheduling by our clients. As ticket sales increase,

related ticketing operating income generally increases as well.

5

We sell tickets on behalf of our clients through our ticketing platforms across the world. We generally enter into written agreements with individual clients to provide primary ticketing services for specified multi-

year periods, typically ranging from three to five years. Pursuant to these agreements, clients generally determine and then tell us what tickets will be available for sale, when such tickets will go on sale to the public and

what the ticket price will be, sometimes with our guidance and recommendations. Agreements with venue clients in North America and Australia generally grant us exclusive rights to sell tickets for all events presented at

the relevant venue for which tickets are made available to the general public. Agreements with promoter clients in other international markets generally grant us the right to an allocation of tickets for events presented by a

given promoter at any venue, unless that venue is already covered by an existing exclusive agreement with our ticketing business or another ticketing service provider. Similarly, in such international markets we have

venue agreements which provide Ticketmaster an allocation of tickets for all events at those venues. While we generally have the right to sell a substantial portion of our clients’ tickets, venue and promoter clients often

sell and distribute a portion of their tickets in-house through their box office and season ticket programs. In addition, under many written agreements between promoters and our clients, and generally subject to

Ticketmaster approval, the client may allocate certain tickets for artist, promoter, agent and venue use and do not make those tickets available for sale by us. Due to these and other permitted third-party ticket distribution

channels, we do not always sell all of our clients’ tickets, even at venues where we are the exclusive primary ticketing service provider, and the amount of tickets that we sell varies from client to client and from event to

event, and also varies as to any given client from year to year.

We currently offer ticket resale services, sometimes referred to as secondary ticketing, principally through our integrated inventory platform, league/team platforms and other platforms internationally. We enter into

arrangements with the holders of tickets previously distributed by a venue or other source to post those tickets for sale at a purchase price equal to a new sales price, determined by the ticket holder, plus a service fee to the

buyer. The seller in this circumstance receives the new sales price less a seller service fee.

Sponsorship & Advertising. Our Sponsorship & Advertising segment employs a sales force that creates and maintains relationships with sponsors through a combination of strategic, international, national and local

opportunities that allow businesses to reach customers through our concert, festival, venue and ticketing assets, including advertising on our websites. We work with our corporate clients to help create marketing programs

that support their business goals and connect their brands directly with fans and artists. We also develop, book and produce custom events or programs for our clients’ specific brands, which are typically presented

exclusively to the clients’ consumers. These custom events can involve live music events with talent and media, using both online and traditional outlets. Including intersegment revenue, our Sponsorship & Advertising

business generated $968.1 million, or 5.8%, of our total revenue during 2022. We typically experience higher revenue in the second and third quarters as a large portion of sponsorships are usually associated with our

outdoor venues and festivals, which are primarily used in or occur from May through October.

We believe that we have a unique opportunity to connect the music fan to corporate sponsors and therefore seek to optimize this relationship through strategic sponsorship programs. We continue to also pursue the

sale of national and local sponsorships, both domestically and internationally, and placement of advertising, including signage, online advertising and promotional programs. Many of our venues have naming rights

sponsorship programs. We believe national and international sponsorships allow us to maximize our network of venues and festivals and to arrange multi-venue or multi-festival branding opportunities for advertisers. Our

local and venue-focused sponsorships include venue signage, promotional programs, onsite activation, hospitality and tickets, and are derived from a variety of client companies across various industry categories.

Live Nation Venue Details

In the live entertainment industry, venue types generally consist of:

•Stadiums—Stadiums are multi-purpose facilities, often housing local sports teams. Stadiums typically have 30,000 or more seats. Although they are the largest venues available for live music, they are not

specifically designed for live music.

•Amphitheaters—Amphitheaters are generally outdoor venues with between 5,000 and 30,000 seats that are used primarily in the summer season. We believe they are popular because they are designed specifically

for concert events, with premium seat packages and better lines of sight and acoustics.

•Arenas—Arenas are indoor venues that are used as multi-purpose facilities, often housing local sports teams. Arenas typically have between 5,000 and 20,000 seats. Because they are indoors, they are able to offer

amenities that other similar-sized outdoor venues cannot, such as luxury suites and premium club memberships. As a result, we believe they are popular for higher-priced concerts aimed at audiences willing to pay

for these amenities.

6

•Theaters—Theaters are indoor venues that are built primarily for music events, but may include theatrical performances. These venues typically have a capacity of between 1,000 and 6,500. Theaters represent less

risk to concert promoters because they have lower fixed costs associated with hosting a concert and may provide a more appropriately-sized venue for developing artists and more artists in general. Because these

venues have a smaller capacity than an amphitheater or arena, they do not offer as much economic upside on a per show basis. Theaters can also be used year-round.

•Clubs—Clubs are indoor venues that are built primarily for music events, but may also include comedy clubs. These venues typically have a capacity of less than 1,000 and often without full fixed seating. Because

of their small size, they do not offer as much economic upside, but they also represent less risk to a concert promoter because they have lower fixed costs associated with hosting a concert and also may provide a

more appropriately-sized venue for developing artists. Clubs can also be used year-round.

•Restaurants & Music Halls—Restaurants & Music Halls are indoor venues that offer customers an integrated live music, entertainment and dining experience. This category includes our House of Blues and

Brooklyn Bowl venues whose live music halls are specially designed to provide optimum acoustics and typically can accommodate between 1,000 to 2,000 guests. A full-service restaurant and bar is located

adjacent to the live music hall. We believe that the strength of the brand and the quality of the food, service and unique atmosphere in our restaurants attract customers to these venues independently from a live

music event and generate a significant amount of repeat business from local customers.

•Festival Sites—Festival sites are outdoor locations used primarily in the summer season to stage large single-day or multi-day concert events featuring several artists on multiple stages. Depending on the location,

festival site capacities can range from 10,000 to over 100,000 fans per day. We believe they are popular because of the value provided to the fan by packaging several artists together for an event. While festival sites

only host a few events each year, they can provide higher operating income because we are able to generate income from many different services provided at the event.

• Other Venues—Other venues includes restaurants, exhibition and convention halls that typically are not used for live music events.

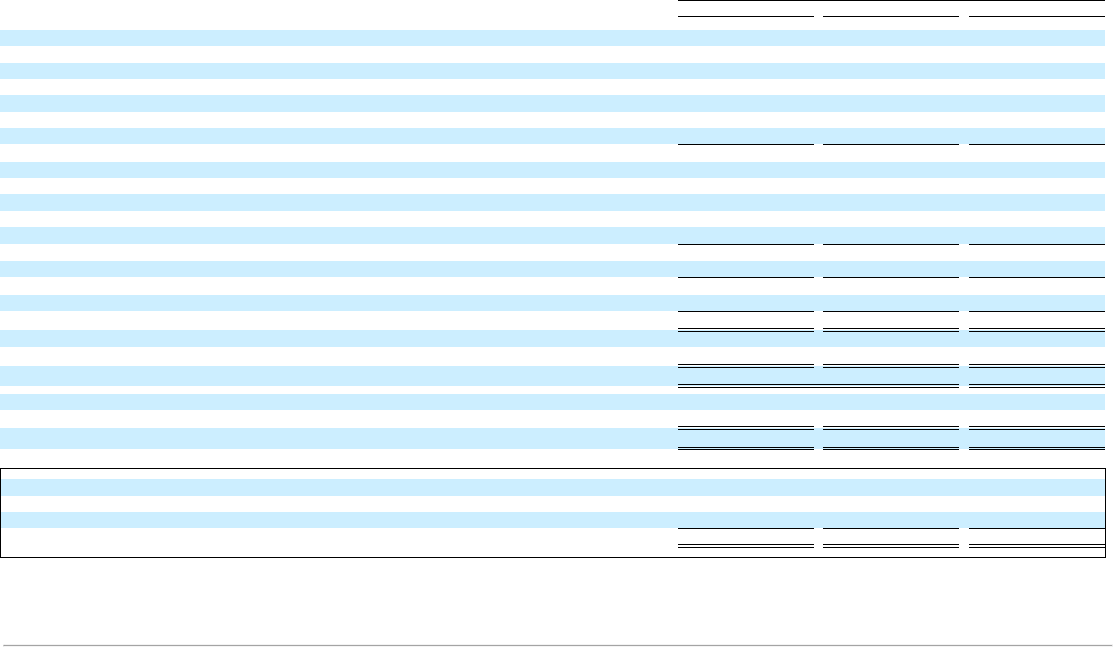

The following table summarizes the number of venues by type that we owned, leased, operated, had exclusive booking rights for or had an equity interest over which we had a significant influence as of

December 31, 2022:

Venue Type Capacity Owned Leased Operated

Exclusive

Booking

Rights

Equity

Interest Total

Stadium More than 30,000 — — 1 — — 1

Amphitheater 5,000 - 30,000 10 39 1 16 — 66

Arena 5,000 - 20,000 2 13 2 5 1 23

Theater 1,000 - 6,500 9 66 10 24 2 111

Club Less than 1,000 5 43 1 14 — 63

Restaurants & Music Halls 1,000 - 2,000 2 16 — — — 18

Festival Sites Varies 2 — 38 — — 40

Other Venues Varies — 11 — 2 3 16

Total venues in operation 30 188 53 61 6 338

Venues currently under construction — 4 — — 2 6

Venues not currently in operation 3 1 — 4 2 10

Total venues in operation by location:

North America 21 137 14 60 6 238

International 9 51 39 1 — 100

__________

Operated festival sites includes multi-year agreements providing us the right to use public or private land for a defined period of time leading up to and continuing after the festival. We may enter into multiple

agreements for a single festival site or use the same site for multiple festivals. We have aggregated the agreements for each festival site and reported them as one festival site.

®

®

(1)

(1)

7

Competition

Competition in the live entertainment industry is intense. We believe that we compete primarily on the basis of our ability to deliver quality music events, sell tickets and provide enhanced fan and artist experiences.

We believe that our primary strengths include:

•the quality of service delivered to our artists, fans, ticketing clients and corporate sponsors;

•our track record and reputation in promoting and producing live music events and tours both domestically and internationally;

•our artist relationships;

•our global footprint;

•the quality of our ticketing software and services;

•our ecommerce site and its extensive database;

•our diverse distribution platform of venues;

•the scope, effectiveness and expertise of our advertising and sponsorship programs; and

•our financial stability.

Although we believe that our products and services currently compete favorably with respect to such factors, we cannot provide any assurance that we can maintain our competitive position against current and

potential competitors, especially those with significantly greater brand recognition, or greater financial, marketing, technical and other resources.

In the markets in which we promote music concerts, we face competition from other promoters and venue operators. We believe that barriers to entry into the promotion services business are low and that certain

local promoters are increasingly expanding the geographic scope of their operations.

Some of our competitors in the live music promotion industry are Anschutz Entertainment Group, or AEG, Another Planet Entertainment, CTS Eventim, Jam Productions, Ltd., I.M.P., Outback Presents and TEG

Dainty in addition to numerous smaller regional companies and various casinos and venues in North America, Europe, Asia and Australia. AEG operates under a number of different names including AEG Presents,

Concerts West, Frontier Touring, Goldenvoice and Messina Touring Group. Some of our competitors in the live music industry have a stronger presence in certain markets, have access to other sports and entertainment

venues and may have greater financial resources in those markets, which may enable them to gain a greater competitive advantage in relation to us.

In markets where we own or operate a venue, we compete with other venues to serve artists likely to perform in that general region. Consequently, touring artists have various alternatives to our venues when

scheduling tours. Our main competitors in venue management include ASM Global, Madison Square Garden Entertainment Corp., The Nederlander Organization and Bowery Presents, in addition to numerous smaller

regional companies in North America, Europe, Australia and New Zealand. Some of our competitors in venue management may have more attractive or a greater number of venues in certain markets, and may have

greater financial resources in those markets.

The ticketing services industry includes the sale of tickets primarily through online and mobile channels, but also through telephone and ticket outlets. The transition to online and mobile ticket purchases has made it

easier for technology-based companies to offer primary ticketing services and standalone, automated ticketing systems that enable venues to perform their own ticketing services or utilize self-ticketing systems. In the

online environment, we compete with other websites, online event sites and ticketing companies to provide event information, sell tickets and provide other online services such as fan clubs and artist websites.

We experience competition from other national, regional and local primary ticketing service providers to secure new venues and to reach fans for events. Resale, or secondary, ticketing services have created more

aggressive buying of primary tickets whereby certain brokers are using automated internet “bot” technology to attempt to buy the best tickets when they go on sale, notwithstanding federal and state prohibitions. We

actively develop and apply methods to mitigate the impact of these bots, however, the bot technology constantly evolves and changes. The internet allows fans and other ticket resellers to reach a vastly larger audience

through the aggregation of inventory on resale websites and marketplaces, and provides consumers with more convenient access to tickets for a larger number and greater variety of events.

8

We also face significant and increasing competition from companies that sell self-ticketing systems, as well as from venues that choose to integrate self-ticketing systems into their existing operations or acquire

primary ticketing service providers. Our competitors include primary ticketing companies such as Tickets.com, AXS, Paciolan, Inc., CTS Eventim AG, Eventbrite, eTix, SeatGeek, Ticketek, See Tickets and Dice;

secondary ticketing companies such as StubHub, Vivid Seats, Viagogo and SeatGeek; and many others, including large technology and ecommerce companies that we understand have recently entered or could enter these

markets.

Our main competitors at the local market level for sponsorships and advertising dollars include local sports teams, which often offer state-of-the-art venues, strong brand association and attractive local media

packages, as well as festivals, theme parks and other local events. On the national level, our competitors include the major sports leagues that sell sponsorships combined with significant national media packages.

Government Regulations

We are subject to federal, state and local laws, both domestically and internationally, governing matters such as:

•privacy and the protection of personal or sensitive information;

•compliance with the United States Foreign Corrupt Practices Act, the United Kingdom Bribery Act 2010 and similar regulations in other countries;

•primary ticketing and ticket resale services;

•construction, renovation and operation of our venues;

•licensing, permitting and zoning, including noise ordinances;

•human health, safety, security and sanitation requirements;

•the service of food and alcoholic beverages;

•working conditions, labor, minimum wage and hour, citizenship and employment laws;

•compliance with the Americans with Disabilities Act of 1990 (“ADA”), the United Kingdom’s Disability Discrimination Act of 1995 (“DDA”) and similar regulations in other countries;

•hazardous and non-hazardous waste and other environmental protection laws;

•sales and other taxes and withholding of taxes;

•marketing activities via the telephone and online; and

•historic landmark rules.

We believe that we are materially in compliance with these laws.

We are required to comply with federal, state and international laws regarding privacy and the storing, sharing, use, disclosure and protection of personally identifiable information and user data, an area that is

increasingly subject to legislation and regulations in numerous jurisdictions around the world, including the European Union’s GDPR (as defined and discussed below in Item 1A.—Risk Factors) and the California

Consumer Protection Act.

We are required to comply with the laws of the countries in which we operate and also the United States Foreign Corrupt Practices Act and the United Kingdom Bribery Act 2010 regarding anti-bribery regulations.

These regulations make it illegal for us to pay, promise to pay or receive money or anything of value to, or from, any government or foreign public official for the purpose of directly or indirectly obtaining or retaining

business. This ban on illegal payments and bribes also applies to agents or intermediaries who use funds for purposes prohibited by the statute.

From time to time, federal, state, local and international authorities and/or consumers commence investigations, inquiries or litigation with respect to our compliance with applicable consumer protection, advertising,

unfair business practice, antitrust (and similar or related laws) and other laws, particularly as related to primary ticketing and ticket resale services.

The regulations relating to our food service operations in our venues are many and complex. A variety of regulations at various governmental levels relating to the handling, preparation and serving of food, the

cleanliness of food production facilities and the hygiene of food-handling personnel are enforced primarily at the local public health department level.

9

We also must comply with applicable licensing laws, as well as state and local service laws, commonly called dram shop statutes. Dram shop statutes generally prohibit serving alcoholic beverages to certain persons

such as an individual who is intoxicated or a minor. If we violate dram shop laws, we may be liable to third parties for the acts of the customer. Although we generally hire outside vendors to provide these services at our

larger operated venues and regularly sponsor training programs designed to minimize the likelihood of such a situation, we cannot guarantee that intoxicated or minor customers will not be served or that liability for their

acts will not be imposed on us.

We are also required to comply with the ADA, the DDA and certain state statutes and local ordinances that, among other things, require that places of public accommodation, including our websites as well as

existing and newly constructed venues, be accessible to customers with disabilities. The ADA and the DDA require that venues be constructed to permit persons with disabilities full use of a live entertainment venue. The

ADA and the DDA may also require that certain modifications be made to existing venues to make them accessible to customers and employees who are disabled. In order to comply with the ADA, the DDA and other

similar ordinances, we may face substantial capital expenditures in the future.

From time to time, governmental bodies have proposed legislation that could affect our business. For example, some legislatures have proposed laws in the past that would impose potential liability on us and other

promoters and producers of live music events for entertainment taxes and for incidents that occur at our events, particularly relating to drugs and alcohol. Some jurisdictions have also proposed legislation that would

restrict ticketing methods or mandate ticket inventory disclosure.

In addition, we and our venues are subject to extensive environmental laws and regulations relating to the use, storage, disposal, emission and release of hazardous and non-hazardous substances, as well as zoning

and noise level restrictions which may affect, among other things, the hours of operations of and the type of events we can produce at our venues.

Our People and Culture

Bringing more than 43,600 events to life and connecting over 670 million fans across all of our concerts and ticketing platforms, as we did in 2022, is a massive undertaking, made possible by our thousands of

employees spread across 48 countries. Our teams come together every day to grow our business, and we recognize our people are the key to our success—whether they’re putting on a show at one of our venues, selling

tickets, working with our brand partners or supporting our businesses in a myriad of other ways.

Taking Care of Our Own

Our core value with our employees is “taking care of our own,” which means our top priority is making sure that every employee can rely on us to go above just providing standard compensation and benefits by

offering assistance for a range of planned and unplanned situations. We also ensure that our employees have direct access to senior executives to raise concerns and share ideas. Our programs are structured under eight core

pillars, designed to support key life moments:

•Taking Care of Yourself: To enhance overall happiness and wellness, we offer flexible vacation time, free ticket perks and in-house meditation sessions, crisis support and crowdfunding networks, and more.

•Taking Care of Your Health: Beyond a full suite of medical, dental and vision benefits, we provide access to virtual doctor’s appointments.

•Taking Care of Your Mental Health: In 2022, we doubled down on our mental well-being offerings for staff – free virtual mental health coaching or therapy sessions, group support sessions, 24/7 counselor

support line, and both in-person or virtual meditation and yoga sessions.

•Taking Care of Your Family: We provide assistance with fertility needs such as egg-freezing, egg-donation and IVF, as well as adoption or surrogacy, primary caregiver leave for new parents, sick leave to care

for loved ones, and leave for bereavement or end-of-life care.

•Taking Care of Your Career: We offer many different career advancement opportunities including leadership workshops for mid-career employees, recognition for successful patent applications, live and on-

demand training and tuition reimbursement to further an ongoing education.

•Taking Care of Your Wealth: To support long-term financial goals, we traditionally provide 401(k) or pension matching, a stock reimbursement program, and student loan repayment assistance.

•Taking Care of Our Own: During life’s most difficult moments, we offer employees financial support to help them through a variety of crises, including unexpected deaths, natural disasters, and escaping

domestic violence. To this end, in March 2020, in partnership with House of Blues Music Forward Foundation, we announced Crew Nation, a global relief fund offering financial support to live music crews to

which we have donated over $10 million.

10

•Taking Care of Others: In order to empower our employees to get involved in causes that are meaningful to them, we provide paid time off for them to volunteer in their local communities.

Diversity, Inclusion and Belonging

We are continually striving towards our goal of being as diverse as the fans and artists that we serve, with an aim to uplift people across race, ethnicity, gender, sexual orientation, disability, and other

underrepresented groups. Programs key to this mission include:

•Promotion and Pay: Ongoing reviews of positions and compensation with the goal of ensuring that all employees across Live Nation are paid appropriately and provided with promotion opportunities, regardless

of individual demographics.

•Employee Resource Groups: Our seven employee-led groups with executive leaders as sponsors provide programs that focus on empowering underrepresented groups within our employee base through career

development, networking, talent development, advocacy, non-profit support and community outreach.

•Diversity Goals: We remain committed to reaching the ambitious goals we set to strengthen the company’s diversity from the top down. Our efforts thus far have resulted in both hiring and promoting diverse

talent into a number of key leadership roles and in increasing overall representation across the business.

•Live Nation Women Fund: An early-stage investment fund we have created focused on female-led live music businesses.

•Industry Engagement: In 2022, we further demonstrated our commitment to diversity and inclusion by joining the efforts of “Diversify The Stage” and signing their pledge to provide greater access to equitable

opportunities for underrepresented groups in live music, events, and touring industries.

Our efforts around diversity, equity, and inclusion have also gained us recognition on Forbes’ Best Employers for Diversity list (2019, 2021-22), Forbes’ America’s Best Employers for Women (2022), Forbes’ Best

Employers for New Grads (2022), and Newsweek’s Americas Greatest Workplaces for Diversity List (2023). We have also received a score of 100% on Human Rights Campaign Foundation’s Corporate Equality Index

(2019-22), earning us a Best Places to Work for LGBTQ+ Equality designation.

Human Capital

Our compensation philosophy is focused on attracting and retaining talented individuals who contribute to our values and help lead our dynamic and innovative environment. To determine market-competitive pay

for our employees, we use a combination of entertainment and technology industry benchmarks.

We are committed to encouraging and rewarding pay-for-performance that is aligned with business objectives in the best interest of our shareholders for long-term growth and profitability. We further strive to

reward individual achievements and contributions that are both aligned with and supportive of our short- and long-term goals and core business values. We believe that our efforts in these areas are working and

contributing to the overall success of the Company, as evidenced by accolades such as obtaining a Great Place to Work® certification (2017-19, 2022), placing fourth on Indeed's list of the World's 50 Best

Workplaces (2019), placing on Forbes’ America’s Best Large Employers List (2022), placing third on Fast Company’s Most Innovative Companies list for the music sector (2019), and placing on Fortune’s World’s Most

Admired Companies List (2021).

As of December 31, 2022, we had approximately 12,800 full-time employees. During regular operational times, our staffing needs vary significantly throughout the year. Therefore, we also employ seasonal and

part-time employees, primarily for our live music venues and festivals. At the end of 2022, we employed approximately 15,500 seasonal and part-time employees and during peak seasonal periods, particularly in the

summer months, we employed as many as 29,000 seasonal and part-time employees in 2022.

11

Labor Relations

The stagehands at some of our venues and other employees are subject to collective bargaining agreements. Our union agreements typically have a term of three years and thus regularly expire and require

negotiation in the course of our business. We believe that we have good relationships with our employees and other unionized labor involved in our events, and there have been no related significant work stoppages in the

past three years. Upon the expiration of any of our collective bargaining agreements, however, we may be unable to renegotiate on terms favorable to us, and our business operations at one or more of our facilities may be

interrupted as a result of labor disputes or difficulties and delays in the process of renegotiating our collective bargaining agreements. In addition, our business operations at one or more of our facilities may also be

interrupted as a result of labor disputes by outside unions attempting to unionize a venue even though we do not have unionized labor at that venue currently. A work stoppage at one or more of our owned or operated

venues or at our promoted events could have a material adverse effect on our business, results of operations and financial condition. We cannot predict the effect that a potential work stoppage will have on our results of

operations.

Information About Our Executive Officers

Set forth below are the names, ages and current positions of our executive officers and other significant employees as of February 16, 2023.

Name Age Position

Michael Rapino 57 President, Chief Executive Officer and Director

Jacqueline Beato 39 Chief Operating Officer–U.S. Concerts

Joe Berchtold 58 President and Chief Financial Officer

Brian Capo 56 Senior Vice President–Chief Accounting Officer

Liz Dyer 37 Senior Vice President–Human Resources

Johnel Evans 48 Global Vice President–Diversity and Inclusion

Arthur Fogel 69 Chairman–Global Music and President–Global Touring

Kaitlyn Henrich 32 Senior Vice President–Corporate Communications and Social Impact

John Hopmans 64 Executive Vice President–Mergers and Acquisitions and Strategic Finance

Bob Roux 65 President–U.S. Concerts

Michael Rowles 57 General Counsel and Secretary

Russell Wallach 57 President–Sponsorship and Advertising

Mark Yovich 48 President–Ticketmaster

Michael Rapino is our President and Chief Executive Officer and has served in this capacity since August 2005. He has also served on our board of directors since December 2005. Mr. Rapino has worked for us or

our predecessors since 1999.

Jacqueline Beato is our Chief Operating Officer of our U.S. Concerts division and has served in this capacity since February 2022. Prior to that, Ms. Beato served as Executive Vice President of Operations starting

in August 2020 and Senior Vice President of Investor Relations since joining us in July 2019. Ms. Beato was Senior Vice President of Finance and Treasurer of Caesars Entertainment prior to joining Live Nation.

Joe Berchtold is our President and Chief Financial Officer. He has served as President since December 2017 and Chief Financial Officer since July 2021. Prior to that, Mr. Berchtold served as our Chief Operating

Officer since joining us in April 2011.

Brian Capo is our Senior Vice President and Chief Accounting Officer and has served in this capacity since joining us in December 2007.

Liz Dyer is our Senior Vice President of Human Resources and has served in this capacity since September 2020. Prior to that, Ms. Dyer served in various human resources roles since joining us in April 2016.

Johnel Evans is our Global Vice President of Diversity and Inclusion and has served in this capacity since joining us in June 2021. Prior to that, Ms. Evans was the Vice President, Inclusion Diversity & Engagement

at Becton Dickinson and Company from September 2018 to June 2021 and Vice President, Human Resources of Becton Dickinson and Company’s Vascular Access Division from November 2015 to September 2018.

12

Arthur Fogel is the Chairman of our Global Music group and President of our Global Touring division and has served in these capacities since 2005. Mr. Fogel has worked for us or our predecessors since 1999.

Kaitlyn Henrich is our Senior Vice President of Corporate Communications and Social Impact and has served in this capacity since January 2022. Prior to that, Ms. Henrich served in various corporate

communications roles since joining us in January 2016.

John Hopmans is our Executive Vice President of Mergers and Acquisitions and Strategic Finance and has served in this capacity since joining us in April 2008.

Bob Roux is President of our U.S. Concerts division and has served in this capacity since October 2010. Mr. Roux has worked for us or our predecessors since 1990.

Michael Rowles is our General Counsel and has served in this capacity since joining us in March 2006 and as our Secretary since May 2007.

Russell Wallach is President of our Sponsorship and Advertising division and has served in this capacity since July 2006. Mr. Wallach has worked for us or our predecessors since 1996.

Mark Yovich is President of Ticketmaster and has served in this capacity since December 2020. Prior to that, Mr. Yovich served as President of Ticketmaster’s International division since November 2011.

Mr. Yovich has worked for us or our predecessors since 2000.

Available Information

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any materials we have filed with the SEC at the SEC’s Public Reference

Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Our filings with the SEC are also available to the

public through the SEC’s website at www.sec.gov.

You can find more information about us online at our investor relations website located at www.investors.livenationentertainment.com. Our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, our

Current Reports on Form 8-K and any amendments to those reports are available free of charge on our website as soon as reasonably practicable after we electronically file such material with the SEC. The information

posted on or accessible through our website is not incorporated into this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

You should carefully consider each of the following risks and all of the other information set forth in this Annual Report. The following risks relate principally to our business and operations, our leverage and our

common stock. If any of the risks and uncertainties develop into actual events, this could have a material adverse effect on our business, financial condition or results of operations. In that case, the trading price of our

common stock could decline.

Risks Relating to Our Business and the Live Events and Ticketing Industries

Our business is highly sensitive to public tastes and is dependent on our ability to secure popular artists and other live music events, and we and our ticketing clients may be unable to anticipate or respond to changes

in consumer preferences, which may result in decreased demand for our services.

Our business is highly sensitive to rapidly changing public tastes and is dependent on the availability of popular artists and events. Our live entertainment business depends in part on our ability to anticipate the tastes

of consumers and to offer events that appeal to them. Since we rely on unrelated parties to create and perform at live music events, any unwillingness to tour or lack of availability of popular artists could limit our ability to

generate revenue. In particular, there are a limited number of artists that can headline a major North American or global tour or who can sell out larger venues, including many of our amphitheaters. If those artists do not

choose to tour, or if we are unable to secure the rights to their future tours, then our concerts business would be adversely affected. Our artist management business could be adversely affected if the artists it represents do

not tour or perform as frequently as anticipated, or if such tours or performances are not as widely attended by fans as anticipated due to changing tastes, general economic conditions or otherwise. Our ticketing business

relies on third parties to create and perform live entertainment, sporting and leisure events and to price tickets to such events. Accordingly, our ticketing business’ success depends, in part, upon the ability of these third

parties to correctly anticipate public demand for particular events, as well as the availability of popular artists, entertainers and teams.

13

In addition, our live entertainment business typically books our live music tours four to eight months in advance of the beginning of the tour and often agrees to pay an artist a fixed guaranteed amount prior to our

receiving any revenue. Therefore, if the public is not receptive to the tour, or we or an artist cancel the tour, we may incur a loss for the tour depending on the amount of the fixed guarantee or incurred costs relative to any

revenue earned, as well as revenue we could have earned at booked venues. We have cancellation insurance policies in place to cover a portion of our losses if an artist cancels a tour but such policies may not be sufficient

and are subject to deductibles. Furthermore, consumer preferences change from time to time, and our failure to anticipate, identify or react to these changes could result in reduced demand for our services, which would

adversely affect our business, financial condition and results of operations.

Our business depends on relationships between key promoters, executives, agents, managers, artists and clients and any adverse changes in these relationships could adversely affect our business, financial

condition and results of operations.

The live music business is uniquely dependent upon personal relationships, as promoters and executives within live music companies such as ours leverage their existing network of relationships with artists, agents

and managers in order to secure the rights to the live music tours and events which are critical to our success. Due to the importance of those industry contacts to our business, the loss of any of our promoters, officers or

other key personnel could adversely affect our business. Similarly, the artist management business is dependent upon the highly personalized relationship between a manager and an artist, and the loss of a manager may

also result in a loss of the artist represented by the manager, which could adversely affect our business. Although we have entered into long-term agreements with many of those individuals described above to protect our

interests in those relationships, we can give no assurance that all or any of these key employees or managers will remain with us or will retain their associations with key business contacts, including music artists, as some

agreements between a manager and an artist are not for a fixed period of time and are instead terminable at will.

The success of our ticketing business depends, in significant part, on our ability to maintain and renew relationships with existing clients and to establish new client relationships. We anticipate that, for the

foreseeable future, the substantial majority of our Ticketing segment revenue will be derived from both online and mobile sales of tickets. We also expect that revenue from primary ticketing services, which consists

primarily of our portion of per ticket convenience charges and per order service fees, will continue to comprise the substantial majority of our Ticketing segment revenue. We cannot provide assurances that we will be able

to maintain existing client contracts, or enter into or maintain new client contracts, on acceptable terms, if at all, and the failure to do so could have a material adverse effect on our business, financial condition and results

of operations.

Another important component of our success is our ability to maintain existing and to build new relationships with third-party distribution channels, advertisers, sponsors and service providers. Any adverse change

in these relationships, including the inability of these parties to fulfill their obligations to our businesses for any reason, could adversely affect our business, financial condition and results of operations.

We face intense competition in the live music and ticketing industries, and we may not be able to maintain or increase our current revenue, which could adversely affect our business, financial condition and results

of operations.

Our businesses are in highly competitive industries, and we may not be able to maintain or increase our current revenue due to such competition. The live music industry competes with other forms of entertainment

for consumers’ discretionary spending and within this industry we compete with other venues to book artists, and, in the markets in which we promote music concerts, we face competition from other promoters and venue

operators. Our competitors compete with us for key employees who have relationships with popular music artists and who have a history of being able to book such artists for concerts and tours. These competitors may

engage in more extensive development efforts, undertake more far-reaching marketing campaigns, adopt more aggressive pricing policies and make more attractive offers to existing and potential artists. Due to increasing

artist influence and competition to attract and maintain artist clients, we may enter into agreements on terms that are less favorable to us, which could negatively impact our financial results. Our competitors may develop

services, advertising options or music venues that are equal or superior to those we provide or that achieve greater market acceptance and brand recognition than we achieve. Within the live music industry, our artist

management business also competes with numerous other artist management companies and individual managers in the United States alone, both to discover new and emerging artists and to represent established artists.

Across the live music industry, it is possible that new competitors may emerge and rapidly acquire significant market share.

14

Our ticketing business faces significant competition from other national, regional and local primary ticketing service providers to secure new and retain existing clients on a continuous basis. Additionally, we face

significant and increasing challenges from companies that sell self-ticketing systems and from clients who choose to self-ticket, through the integration of such systems into their existing operations or the acquisition of

primary ticket services providers or by increasing sales through venue box offices and season and subscription sales. We also face competition in the resale of tickets from resale marketplaces and from other ticket

resellers with online distribution capabilities. The advent of new technology, particularly as it relates to online ticketing, has amplified this competition. The intense competition that we face in the ticketing industry could

cause the volume of our ticketing services business to decline. As we are also a content provider and venue operator we may face direct competition with our prospective or current primary ticketing clients, who primarily

include live event content providers. This direct competition with our prospective or current primary ticketing clients could result in a decline in the number of ticketing clients we have and a decline in the volume of our

ticketing business, which could adversely affect our business, financial condition and results of operations.

In the secondary ticket sales market, we have restrictions on our business that are not faced by our competitors, imposed as a result of agreements entered into with the Federal Trade Commission (“FTC”), the

Attorneys General of several individual states, and various international governing bodies. These restrictions include: a requirement to clearly and conspicuously disclose on any primary ticketing website where a link or

redirect to a resale website owned or controlled by us is posted, that the link is directing the user to a resale website and that ticket prices often exceed the ticket’s original price; and a requirement to make certain clear and

conspicuous disclosures and in certain instances disclose when a ticket being offered for resale is not “in-hand” as well as a requirement to monitor and enforce the compliance of third parties offering tickets on our

websites with such disclosure requirements. There are certain state laws that now ban such speculative ticket listings, and the New York Attorney General has in the past brought lawsuits against resale companies for these

practices.

Other variables related to the competitive environment that could adversely affect our financial performance by, among other things, leading to decreases in overall revenue, the number of sponsors, event

attendance, ticket prices and fees or profit margins include:

•an increased level of competition for advertising dollars, which may lead to lower sponsorships as we attempt to retain advertisers or which may cause us to lose advertisers to our competitors offering better programs

that we are unable or unwilling to match;

•unfavorable fluctuations in operating costs, including increased guarantees to artists, which we may be unwilling or unable to pass through to our customers via higher ticket prices;

•inability or unwillingness to fund the significant up-front cash requirements associated with our touring and ticketing businesses due to insufficient cash on hand or capacity under our senior secured credit facility,

which could result in the loss of key tours to competitors or the inability to secure and retain ticketing clients;

•competitors’ offerings that may include more favorable terms than we do in order to obtain agreements for new venues or ticketing arrangements or to obtain events for the venues they operate;

•technological changes and innovations that we are unable to adopt or are late in adopting that offer more attractive entertainment alternatives than we or other live entertainment providers currently offer, which may

lead to a reduction in attendance at live events, a loss of ticket sales or lower ticket fees; and

•other entertainment options available to our audiences that we do not offer.

Our success depends, in significant part, on entertainment, sporting and leisure events and economic and other factors adversely affecting such events could have a material adverse effect on our business, financial

condition and results of operations.

A decline in attendance at or reduction in the number of live entertainment, sporting and leisure events may have an adverse effect on our revenue and operating income. In addition, during periods of economic

slowdown and recession, many consumers have historically reduced their discretionary spending and advertisers have reduced their advertising expenditures. The impact of economic slowdowns on our business is difficult

to predict, but they may result in reductions in ticket sales, sponsorship opportunities and our ability to generate revenue. The risks associated with our businesses may become more acute in periods of a slowing economy

or recession, which may be accompanied by a decrease in attendance at live entertainment, sporting and leisure events. Many of the factors affecting the number and availability of live entertainment, sporting and leisure

events are beyond our control. For instance, certain sports leagues have experienced labor disputes leading to threatened or actual player lockouts. Any such lockouts that result in shortened or canceled seasons would

adversely impact our business to the extent that we provide ticketing services to the affected teams both due to the loss of games and ticketing opportunities as well as the possibility of decreased attendance following such

a lockout due to adverse fan reaction.

15

Our business depends on discretionary consumer and corporate spending. Many factors related to corporate spending and discretionary consumer spending, including economic conditions affecting disposable

consumer income such as unemployment levels, fuel prices, interest rates, changes in tax rates and tax laws that impact companies or individuals, and inflation can significantly impact our operating results. Business

conditions, as well as various industry conditions, including corporate marketing and promotional spending and interest levels, can also significantly impact our operating results. These factors can affect attendance at our

events, premium seat sales, sponsorship, advertising and hospitality spending, concession and merchandise sales, as well as the financial results of sponsors of our venues, events and the industry. Negative factors such as

challenging economic conditions and public concerns over terrorism and security incidents, particularly when combined, can impact corporate and consumer spending, and one negative factor can impact our results more

than another. There can be no assurance that consumer and corporate spending will not be adversely impacted by current economic conditions, or by any future deterioration in economic conditions, thereby possibly

impacting our operating results and growth.