This report is dedicated to

the amazing

Taxpayer Advocate Service employees

who, for eighteen years,

have tirelessly given of their time and energy

to enable us to submit our Reports to Congress.

As a group of people dedicated to the rights of taxpayers

and to achieving systemic solutions,

they have no peer

&

In memoriam,

to Scott Rutz,

our friend and colleague,

who is truly missed.

This page intentionally left blank.

Taxpayer Advocate Service — Special Report to Congress — Volume Three iii

Table of Contents

Contents

EXECUTIVE SUMMARY OF RECOMMENDATIONS ....................................... v

PREFACE: Introductory Remarks by the National Taxpayer Advocate: Making

the EITC Work for Taxpayers and the Government: Improving Administration and

Protecting Taxpayer Rights ..........................................................vii

I. INTRODUCTION ......................................................................1

Structure of Report.................................................................4

Principles and General Recommendations ............................................4

The IRS Mission Statement: The IRS Must Explicitly Acknowledge Its Role As a Benefits

Administrator.................................................................4

Congress Must Consider Administrability in Furtherance of Other Policy Goals .................7

Congress Must Provide Effective Oversight of the IRS .....................................9

II. RESTRUCTURE THE EITC AS TWO CREDITS: A WORKER CREDIT AND A CHILD

BENEFIT, AND MODERNIZE THE DEFINITION OF A QUALIFYING CHILD ..................10

Present Law and Practice ..........................................................10

Reasons for Change ...............................................................11

Recommendations ................................................................13

Recommendation 1.1: Replace the EITC With a Per-Worker Credit Based on Earned

Income and a Universal Per-Child Benefit ..........................................13

The Worker Credit ........................................................13

The Child Benefit .........................................................16

Recommendation 1.2: Redefine and Modernize the Definition of a Qualifying Child that

Reflects the Experiences of Primary Carers and Their Children..........................17

Paying Out the Child Benefit When There Are Multiple Claims .......................19

Holding Income Tax Returns Until the Vast Majority Have Been Filed ....19

Processing Multiple Claims of the Child Benefit........................21

III. ESTABLISH GREATER IRS OVERSIGHT OF TAX PREPARERS AND TAX PREPARATION

SOFTWARE .........................................................................23

Present Law and Practice ..........................................................23

Reasons for Change ...............................................................26

Paid Preparer Oversight............................................................26

iv

Table of Contents

Table of Contents

Recommendations ................................................................30

Recommendation 2.1: Authorize the Secretary to Establish Standards for Return Preparers........30

Recommendation 2.2: Authorize the Secretary to Establish Standards for Tax Return

Software Providers ............................................................30

Recommendation 2.3: Require Disclosure and Reporting of Fees............................31

IV. ENSURE LOW INCOME TAXPAYERS HAVE DUE PROCESS PROTECTIONS

COMPARABLE TO PROTECTIONS OF OTHER TAXPAYERS BY LIMITING THE USE OF

SUMMARY ASSESSMENT AUTHORITY ................................................32

Present Law and Practice ..........................................................32

Audits and Summary Assessment Authority: A Comparison of Determining Taxpayer

Compliance With the EITC Qualifying Child Residency Requirement ...................34

Pre-Refund Audit (Deficiency Procedures) .......................................34

Summary Assessment Authority (aka “Math Error” Authority) ........................36

Reason for Change ................................................................37

Recommendation 3.1: Limit SAA Use to Appropriate Cases Based on Clear Criteria .............42

Recommendation 3.2: Update and Modernize the SAA Process .............................42

V. ENSURE LOW INCOME TAXPAYERS HAVE DUE PROCESS PROTECTIONS

COMPARABLE TO PROTECTIONS OF OTHER TAXPAYERS: THE BAN UNDER IRC § 32(K) . 44

Present Law and Practice ..........................................................44

Reasons for Change ...............................................................46

Recommendations ................................................................48

Recommendation 3.3: Develop a Structure for Ban Determination That Protects Taxpayer Rights ..48

Recommendation 3.4: Clarify and Improve Court Review of Ban Determinations ..............48

APPENDICES .......................................................................49

EITC Databook....................................................................49

Works Cited ......................................................................75

EITC Literature Review.............................................................82

Published TAS Works on EITC ......................................................93

v

Executive Summary of Recommendations

We are pleased to present this special report on the Earned Income Tax Credit (EITC). The EITC is a refundable tax

credit that provides substantial financial assistance to many low income working families. Research indicates the credit

substantially reduces poverty and encourages many individuals to enter the workforce. While the EITC has historically

had bipartisan support, it has also been criticized for being overly complex, difficult to administer, and prone to high

error rates.

In this report we present proposals to improve the EITC and its administration so that the credit better achieves

policymakers’ objectives (i.e., increasing labor force participation and reducing poverty) while being less burdensome on

both the IRS and taxpayers. Specifically, we recommend the following EITC reforms:

1. Redesign the credit and modernize its eligibility criteria.

Recommendation 1.1: Replace the EITC with a per-worker credit based on earned income and a

universal per-child benefit.

Recommendation 1.2: Redefine and modernize the definition of a qualifying child that reflects the

experiences of primary carers and their children.

2. Establish greater IRS oversight of tax preparation intermediaries such as return preparers and software providers.

Recommendation 2.1: Authorize the Secretary to establish standards for return preparers.

Recommendation 2.2: Authorize the Secretary to establish standards for tax return software

providers.

Recommendation 2.3: Require disclosure and reporting of fees.

3. Ensure EITC compliance procedures are consistent with due process norms and fundamental taxpayer rights.

Recommendation 3.1: Limit summary assessment authority (SAA) use to appropriate cases based on

clear criteria.

Recommendation 3.2: Update and modernize the SAA process.

Recommendation 3.3: Develop a structure for ban determination that protects taxpayer rights.

Recommendation 3.4: Clarify and improve court review of ban determinations.

In providing our specific recommendations related to the EITC, we also identify several general recommendations that

can guide policymakers who seek to use the tax system effectively to deliver social benefits.

General recommendation #1: The IRS must acknowledge its role as a benefits administrator and change its practices

and processes to reflect this role. Congress must also provide additional funding so that the IRS can succeed in this role.

Instead of acting purely as an enforcement agency, the IRS should strive to ensure that low income taxpayers are treated

with respect and fairness and ensure that taxpayers receive the benefits they are eligible for.

General recommendation #2: Congress must consider the administrability of tax provisions, especially family and child-

related provisions, whose eligibility criteria may be difficult if not impossible for the IRS to verify. When a tax provision

is difficult for the IRS to administer, it can be more prone to improper payments, and ultimately subject certain taxpayers

to additional scrutiny. This additional scrutiny can be particularly burdensome for low income taxpayers.

vi

General recommendation #3: Congress should conduct regular oversight hearings of the IRS on a permanent basis.

These hearings would provide an opportunity for the IRS to identify challenges and successes with all the tax laws it

administers. In the case of low income tax benefits, these hearings would provide a forum for Congress to hear directly

from outside experts, including Low Income Taxpayer Clinics, return preparers, and others with particular insights into

the lives and challenges facing low income taxpayers and their families.

Taxpayer Advocate Service — Special Report to Congress — Volume Three vii

Preface

PREFACE: Introductory Remarks by the National Taxpayer Advocate:

Making the EITC Work for Taxpayers and the Government: Improving

Administration and Protecting Taxpayer Rights

In 1975, the year the Earned Income Tax Credit (EITC) was enacted, I “hung out my shingle” as a tax

return preparer for the first time. Thus, the EITC and I have been sisters-in-arms throughout my entire

career in tax. In fact, as a young, newly divorced mother struggling to pay bills, I myself received the

EITC. From both a professional and personal perspective, I have witnessed the significant, positive

impact the EITC can have on people’s lives.

Back in 1975, I certainly did not expect that much of my life’s work would involve the EITC. But as

my work evolved to include legal practice and tax controversy, I saw how vulnerable populations could

lose the much-needed safety net of the EITC merely because they did not understand the IRS’s audit

processes or could not afford to take time off from work during business hours to gather documentation

or sit on the phone trying to get through to the IRS. If they took time off, their pay would be docked.

They might even lose their jobs. So they didn’t respond, the IRS assumed they were not entitled to the

credit, and the taxpayer (and her family) lost out on hundreds or thousands of dollars in much-needed

benefits for which she was, in fact, eligible.

I saw this sequence of events played out time after time after I founded and directed The Community

Tax Law Project, the first independent low income taxpayer clinic (LITC) in the country. I also saw

taxpayers who had no idea what the EITC eligibility criteria were and were completely dependent on a

new breed of return preparers—ones who had no training in tax law but who simply relied on software

and viewed tax preparation as a way to lure vulnerable taxpayers into expensive refund anticipation

loans.

I found this heartbreaking because what I saw, almost every day of my working life, first at the LITC

and later as the National Taxpayer Advocate, was the substantial, life-supporting difference the EITC

made in the lives of tens of millions of taxpayers. Yes, the EITC is a complicated statute. Yes, the EITC

is undermined by overclaims—both inadvertent and fraudulent. And yes, the EITC requires the IRS

to play a different role than merely revenue collector. But it is important to keep in mind that the EITC is

a low-cost, effective, and efficient method of delivering tens of billions of dollars in assistance to families and

individuals who are working in low-paying jobs.

As the National Taxpayer Advocate, I have spent much of the last 18 years thinking about how to

improve the administration of the EITC. How should the IRS change its approach and processes?

How should the IRS and others increase the participation rate? And how can the IRS minimize

noncompliance while respecting taxpayer rights and not deterring participation by eligible taxpayers?

I have attempted to seek answers and make recommendations with respect to these questions. I and

Taxpayer Advocate Service (TAS) employees have conducted research studies, served on Treasury

and IRS taskforces, conducted training sessions for IRS and TAS employees, and made scores of

administrative and legislative recommendations about the EITC.

1

1

In fact, in my first Annual Report as National Taxpayer Advocate, I proposed an overhaul of the six definitions of a child

in the family status provisions of the Internal Revenue Code (IRC) —dependency exemption, head of household status,

child and dependent care credit, child tax credit, earned income tax credit, and the definition of “not married” under

IRC § 7703(b). National Taxpayer Advocate 2001 Annual Report to Congress 76-127. In 2004, Congress incorporated

significant portions of my recommendation into the Uniform Definition of a Qualifying Child, Pub. L. No. 108-311, although

there is still much more work to be done in this area. See National Taxpayer Advocate 2016 Annual Report to Congress

325 - 357.

viii

Preface

Preface

It is fitting, then, in my last Report to Congress before I retire as National Taxpayer Advocate on July 31,

2019, that we should publish this extraordinary document, Making the EITC Work for Taxpayers and the

Government: Improving Administration and Protecting Taxpayer Rights. This report, with its discussions,

analyses, and recommendations, will serve as a reference for future work. The EITC Databook and

Literature Review in the appendices provide valuable information for future tax administration studies.

But this report is not just a research document. It is a call to action. As we show throughout this report,

the way the EITC is structured and the way the IRS is administering it often harms the very taxpayers it

is intended to serve. We have made specific, common sense recommendations to mitigate that harm and

reform the administration of the EITC. All our recommendations are actionable and supported by data

and research.

Finally, what is so remarkable about this report is that it is the result of a unique and collaborative

effort between academia and the executive and legislative branches of the federal government. The

stars aligned in March 2019, when TAS was able to bring on Professor Leslie Book of the Villanova

University School of Law as a Professor-in-Residence, and Margot Crandall-Hollick on detail from the

Congressional Research Service. Les and Margot led a small and dedicated team of TAS employees that

included attorney advisors, research and technical analysts, and a Local Taxpayer Advocate. Several

team members had represented taxpayers in EITC audits and Tax Court cases during their earlier

careers as LITC attorneys; thus, they brought to this project their “real world” experience with EITC

administration. The team conducted extensive interviews with internal and external stakeholders, and

it compiled and reviewed reams of documents, studies, and data about the EITC, as well as other benefit

programs and tax credits of other countries.

The bottom line is that this report reflects intimate knowledge of the EITC from many different

perspectives. I am enormously proud of—and grateful to—the team that prepared it, and I am

hopeful that it will lead to a serious conversation about how to advance the twin goals of increasing the

participation rate of eligible taxpayers and reducing overclaims by ineligible taxpayers. This conversation

needs to be framed by the fundamental realization that the IRS is no longer just a tax collector but is

also a benefits administrator. Unless the IRS embraces that role and organizes itself accordingly, we

will continue to have problems with the EITC, and vulnerable taxpayers will continue to be denied the

assistance they dearly need.

Respectfully submitted,

Nina E. Olson

National Taxpayer Advocate

30 June 2019

Taxpayer Advocate Service — Special Report to Congress — Volume Three 1

Introduction

Restructure the

EITC As Two Credits

Establish Greater

IRS Oversight

Limit Summary

Assessment Authority

Ensure Comparable

Protections

Appendices

Introduction

2

The Earned Income Tax Credit (EITC) is a refundable credit for low and moderate income working

families. In tax year (TY) 2017, 26.2 million workers and families received about $64.5 billion in

EITC.

3

Decades of research indicate that the EITC is an effective tool in reducing poverty, encouraging

work, and improving health and education outcomes among low income Americans.

4

Despite these

positive outcomes, relatively high participation rates

5

and low direct administrative costs,

6

the credit has

been plagued by a stubbornly high rate of improper payments.

7

Improper payments increase the cost

of the program, making it and similar low income refundable tax credits subject to intense scrutiny.

Improper payments also lead the IRS to audit a disproportionately high share of low income taxpayers.

8

In fiscal year (FY) 2018, 43 percent of all individual returns selected for audit included an EITC claim

and 37 percent of all audited individual returns were selected because they included an EITC claim.

9

This

is despite the fact that EITC returns account for approximately 18 percent of all individual returns filed

2

The principal authors of this report are Leslie Book, Margot Crandall-Hollick, Laura Baek, Susan Morgenstern, Amy Ibbotson,

Jeff Wilson, Zachary Bend, and Katrina Leifeld. The authors would like to thank Jill MacNabb, Eric Lopresti, and Francis

Cappelletti for their assistance in drafting this report. This report would not have been possible without Nina Olson’s

leadership and determination. During her 18-year tenure as National Taxpayer Advocate, Nina Olson has championed the

rights of all taxpayers, especially the most vulnerable. Nowhere is this dedication more apparent than in her work on the

Earned Income Tax Credit (EITC). Nina Olson has written extensively on the issues discussed in this report. Many of the

ideas and recommendations in this report directly reflect those past writings.

3

IRS, Compliance Data Warehouse (CDW), Individual Returns Transaction File (IRTF), tax year (TY) 2017 returns processed

through cycle 13 of 2019 (May 2019).

4

For an excellent summary of the research surrounding the effects of the EITC, see Austin Nichols & Jesse Rothstein, The

Earned Income Tax Credit, in Economics of mEans-TEsTEd TransfEr Programs in ThE UniTEd sTaTEs (2016), https://www.nber.org/

chapters/c13484.pdf. For summaries of specific aspects of the EITC, see pages 180-181 (impact on poverty); pages 187-

198 (impact on labor); pages 181-182 (impact on health outcomes); and pages 185-187 (impact on education outcomes).

5

Id. at 174-176 (looking at take up rates for taxpayers at different positions on the EITC schedule and favorably comparing

EITC take up to other transfer programs).

6

The IRS estimates costs for administering the EITC are less than one percent of benefits delivered; administrative costs for

non-tax benefits programs can range as high as 37 percent of program expenditures. See Appendix 1, EITC Databook. As

discussed below, other data shows that administrative costs for non-tax benefits programs as a percent of total program

costs may be even higher.

7

Since 2010, EITC estimated improper payment rates have fluctuated between a low of 22.8 percent in 2012 and a high

of 27.2 percent in 2014. National Taxpayer Advocate 2018 Annual Report to Congress 91, 95 (Most Serious Problem:

Improper Earned Income Tax Credit Payments: Measures the IRS Takes to Reduce Improper Earned Income Tax Credit

Payments Are Not Sufficiently Proactive and May Unnecessarily Burden Taxpayers).

8

IRS, 2018 Data Book, table 9a (May 2019).

9

Id.

2

Appendices

Ensure Comparable

Protections

Limit Summary

Assessment Authority

Establish Greater

IRS Oversight

Restructure the

EITC As Two Credits

Introduction

Earned Income Tax Credit — Introduction

in calendar year 2017.

10

While EITC misreporting represents a small portion of the tax gap

11

there has

been a persistent emphasis on reducing the EITC improper payment rate.

12

As a result of that scrutiny and a narrow internal view of how the IRS considers its responsibilities,

all too often the IRS takes an enforcement-oriented approach to administering the EITC, leading to

relatively high audit rates for low income taxpayers. This approach can deter or altogether block eligible

taxpayers from claiming the credit, prevent ineligible taxpayers from understanding what they did

wrong, and squander opportunities to educate taxpayers to encourage future voluntary tax compliance.

13

The enforcement-oriented approach is problematic because the population of taxpayers who rely on the

EITC often share a common set of characteristics, such as limited education and high transiency, which

create challenges for taxpayer compliance.

14

All of this unduly burdens some of the most vulnerable

populations—kids and families struggling to make ends meet. And it has subjected the IRS to criticism

for unfair audit coverage of low income taxpayers at the expense of other taxpayers.

15

Yet, in spite of these challenges, Congress continues to view refundable credits for the working poor

as a desirable way to help low income working Americans. Congress has proposed various bills to

expand the EITC and related family credits like the Child Tax Credit to boost wages, increase labor

force participation, reduce poverty, and support families.

16

Given these competing forces of wanting

to provide more social benefits through the tax code while also reducing existing administrative and

compliance challenges, this report provides policymakers a framework to achieve both goals.

10

IRS, 2018 Data Book, table 9a (May 2019).

11

The most recent estimate of the gross tax gap, based on data for TYs 2008-2010, is $458 billion. Of that amount, $264

billion, or 58 percent, is attributable to income misreporting by individual taxpayers. IRS Pub. 1415, Federal Tax Compliance

Research: Tax Gap Estimates for Tax Year 2008-2010 1 (May 2016). The EITC represents approximately six percent of the

gross tax gap and ten percent of the tax gap attributable to income misreporting by individuals. Department of the Treasury,

Agency Financial Report Fiscal Year 2018 146 (2018). National Taxpayer Advocate 2018 Annual Report to Congress 98

(Most Serious Problem: Improper Earned Income Tax Credit Payments: Measures the IRS Takes to Reduce Improper Earned

Income Tax Credit Payments Are Not Sufficiently Proactive and May Unnecessarily Burden Taxpayers). The largest component

of the tax gap attributable to individual income misreporting is business income misreporting, which amounts to $125

billion, or approximately 47 percent of the tax gap attributable to income misreporting. For further discussion on the relative

significance of the EITC and the underreporting tax gap, see National Taxpayer Advocate 2018 Annual Report to Congress

98-100.

12

See, e.g., Treasury Inspector General for Tax Administration (TIGTA), Ref. No. 2018-40-032, The Internal Revenue Service

is Not in Compliance With Improper Payment Requirements (Apr. 2018). Money is fungible and in theory one more dollar

improperly claimed as a credit has an equal impact budgetarily as one fewer dollar collected in taxes. What accounts for

the additional scrutiny on low income taxpayers? Professor Larry Zelenak explains that an underpayment of tax allows the

taxpayer to keep more of his or her pretax income, and that there is a persistent sense that the government’s right to tax

pretax income “was dubious to begin with.” Larry Zelenak, The Myth of Pretax Income 101 Mich. L. Rev. 2261, 2263-2264

(2003).

13

National Taxpayer Advocate 2018 Annual Report to Congress 91-104 (Most Serious Problem: Improper Earned Income

Tax Credit Payments: Measures the IRS Takes to Reduce Improper Earned Income Tax Credit Payments Are Not Sufficiently

Proactive and May Unnecessarily Burden Taxpayers); National Taxpayer Advocate 2017 Annual Report to Congress 141-

150 (Most Serious Problem: Earned Income Tax Credit: The IRS Continues to Make Progress to Improve Its Administration

of the EITC, But It Has Not Adequately Incorporated Research Findings That Show Positive Impacts of Taxpayer Education on

Compliance).

14

National Taxpayer Advocate 2015 Annual Report to Congress 235-239 (Introduction: The IRS Can Do More to Improve Its

Administration of the Earned Income Tax Credit and Increase Future Compliance Without Unduly Burdening Taxpayers and

Undermining Taxpayer Rights).

15

Paul Kiel, It’s Getting Worse: The IRS Now Audits Poor Americans at About the Same Rate as the Top 1%, Pro PUblica

(May 30, 2019), https://www.propublica.org/article/irs-now-audits-poor-americans-at-about-the-same-rate-as-the-top-1-

percent.

16

Isabel Sawhill & Christopher Pulliam, Lots of plans to boost tax credits: which is best?, brookings insT. (Jan. 15, 2019),

https://www.brookings.edu/research/lots-of-plans-to-boost-tax-credits-which-is-best/.

Taxpayer Advocate Service — Special Report to Congress — Volume Three 3

Introduction

Restructure the

EITC As Two Credits

Establish Greater

IRS Oversight

Limit Summary

Assessment Authority

Ensure Comparable

Protections

Appendices

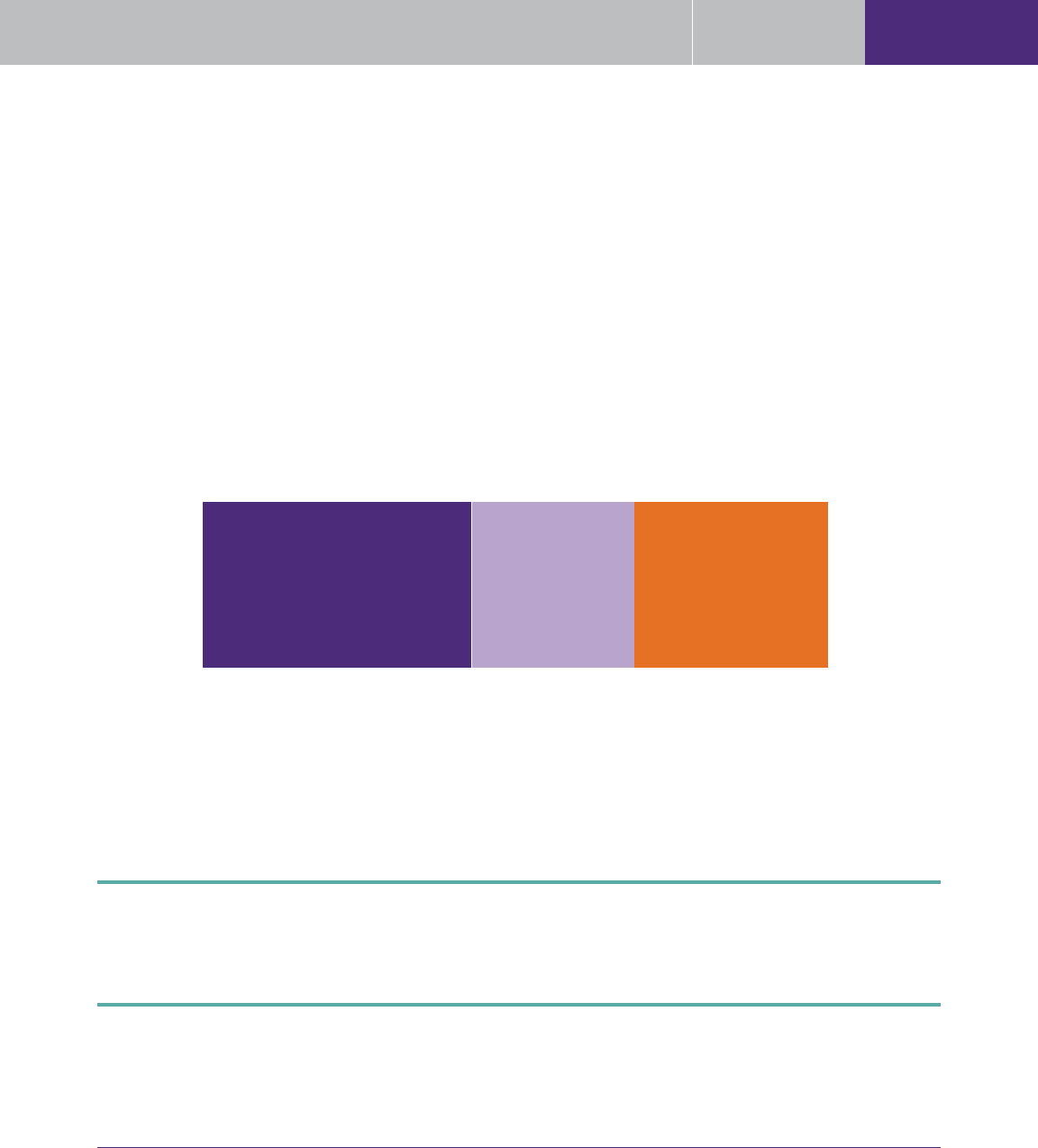

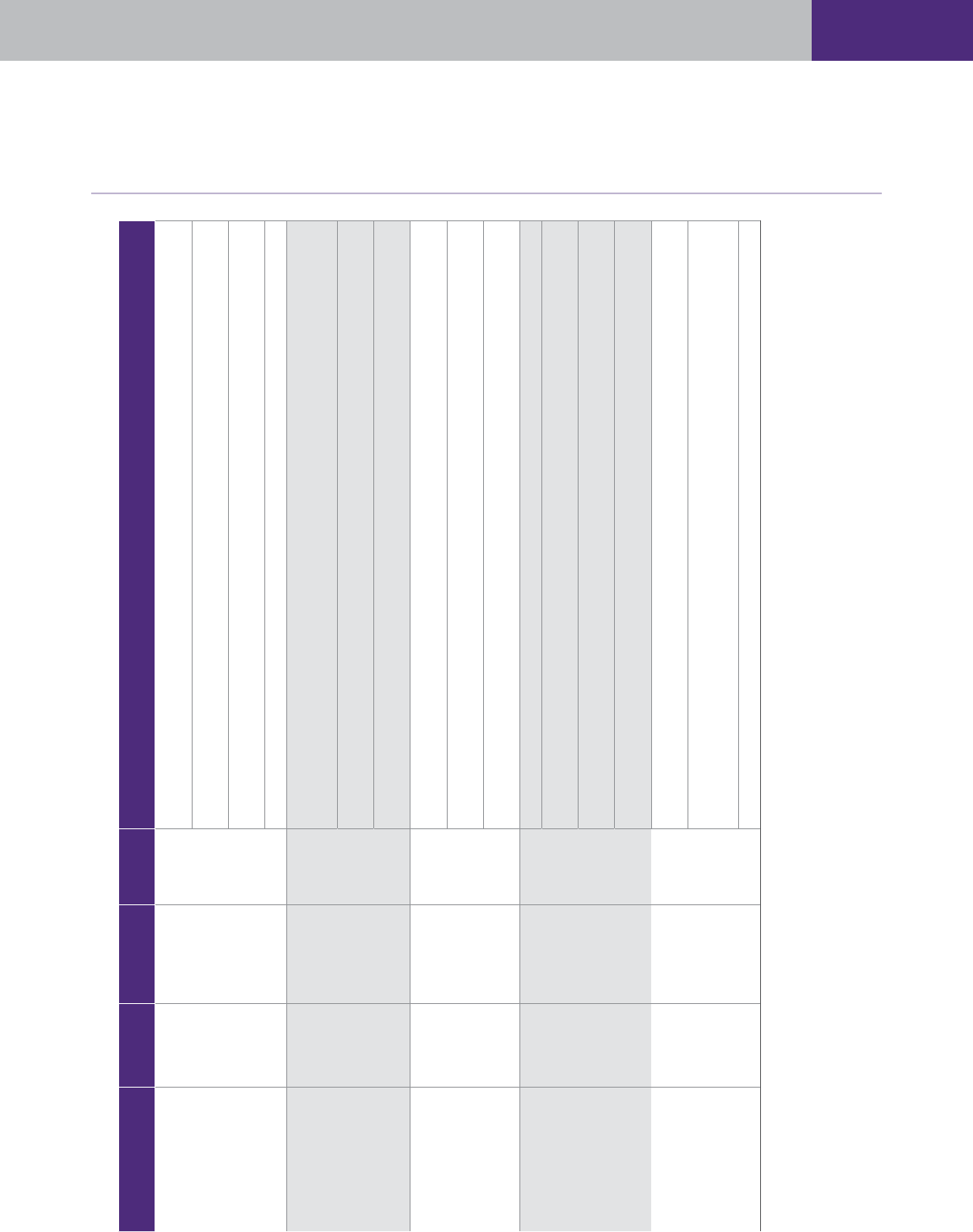

FIGURE 1, EITC Participation Rates and Program Costs Compared to Other Benefits

Programs

17

Placing the EITC in the tax system has many benefits relative to other programs including fewer direct

administrative costs, higher participation rates, and less stigma for recipients. The absence of upfront

eligibility screening associated with other programs contributes to less direct administrative costs for

the IRS but also generally means that there are higher error rates, both intentional and unintentional.

As this figure shows, however, the EITC’s combined costs, taking into account errors and administrative

cost, is similar to many other programs. (See the EITC Databook appendix for additional data). And

recent research shows that the behavioral responses to the EITC—including how it reduces public

assistance to households and increases taxes that those households pay—suggests that the true

costs of the EITC are lower than many have thought.

18

Medicaid

68%

EITC Participation Rates Compared to Other Means-Tested Programs

EITC Overhead Costs and Improper Payments Compared to Other Means-Tested Programs

Overhead Costs Improper Payments EITC Overhead Costs EITC Improper Payments

CHIP

93%

School

Lunch

85%

SNAP

85%

EITC

78%

SSI

58%

WIC

55%

TANF

28%

HUD

32%

TANF

9%

10%

SSI

9%

8%

Medicaid

10%

13%

SNAP

7%

7%

School

Lunch

10%

10%

CHIP

7%

18%

HUD

7%

4%

WIC

37%

4%

EITC

25%

1%

17

See Appendix 1, EITC Databook Figure A.9, infra.

18

Jacob Bastian & Maggie Jones, Do EITC Expansions Pay For Themselves? Effects on Tax Revenue and Public Assistance

Spending (2019).

4

Appendices

Ensure Comparable

Protections

Limit Summary

Assessment Authority

Establish Greater

IRS Oversight

Restructure the

EITC As Two Credits

Introduction

Earned Income Tax Credit — Introduction

STRUCTURE OF REPORT

This report proposes three major areas of reforms to the EITC that can improve the credit’s

administrability and efficacy, reduce taxpayer burden, and reduce erroneous payments. These proposals

include:

Redesigning the credit and modernizing its eligibility criteria;

Establishing greater IRS oversight of tax preparation intermediaries such as return preparers and

software providers; and

Ensuring EITC compliance procedures are consistent with due process norms and fundamental

taxpayer rights.

Each proposal includes a discussion of the current practice or law, reasons for change, and specific

reform recommendations. In presenting these proposals, we are mindful of the significant research and

background relating to the EITC in general and the specific issues we discuss. For readers interested

in further detail, the appendices provide additional data relating to the EITC, summaries of the

significant work that the Taxpayer Advocate Service (TAS) has done on the EITC, including prior Most

Serious Problems, Legislative Recommendations, and research studies, as well as a Literature Review of

important EITC studies and articles.

These proposals and their associated recommendations are not intended to be exhaustive, nor address

every policy goal. Instead, they are meant to guide policymakers interested in modifying the EITC or

other refundable credits (or developing new ones) so that their proposals are effective at achieving their

objectives. By considering our proposals in light of the foundational principles, the report also provides

a framework for improving the administration of tax benefits more broadly.

PRINCIPLES AND GENERAL RECOMMENDATIONS

Underlying the proposals and specific recommendations in this report are three foundational principles

and more general recommendations that we believe should inform policymakers as they consider using

the tax system to deliver social benefits in the form of refundable credits.

The IRS Mission Statement: The IRS Must Explicitly Acknowledge Its Role As a Benefits

Administrator

How the IRS publicly identifies its role and mission matters. It matters in terms of how employees view

their role in interacting with taxpayers, it matters in terms of what type of employee the IRS hires, and

it matters in terms of how the IRS dedicates resources to particular responsibilities. In the Internal

Revenue Service Restructuring and Reform Act of 1998 (RRA 98), Congress directed the IRS to restate

its mission statement with an emphasis on taxpayer service.

19

The IRS soon adopted the following

mission statement: “Provide America’s taxpayers top quality service by helping them understand and

meet their tax responsibilities and by applying the tax law with integrity and fairness to all.”

20

In 2009,

without any public notice or discussion, the IRS changed the statement to read “Provide America’s

taxpayers top quality service by helping them understand and meet their tax responsibilities and enforce

the tax law with integrity and fairness to all.”

21

19

Pub. L. No. 105-206, § 1002, 112 Stat. 685 (1998).

20

https://www.irs.gov/pub/irs-news/ir-98-59.pdf.

21

IRM 1.1.1.2, IRS Mission (June 2, 2015).

Taxpayer Advocate Service — Special Report to Congress — Volume Three 5

Introduction

Restructure the

EITC As Two Credits

Establish Greater

IRS Oversight

Limit Summary

Assessment Authority

Ensure Comparable

Protections

Appendices

The EITC has grown in importance since its inception in 1975 and has grown significantly since RRA

98.

22

Despite this growth in the EITC and other credits, the current mission statement fails to recognize

the IRS’s dual lines of business—revenue collector and benefits administrator. If an agency views its

primary mission as enforcing the tax laws and fails to even identify its role in delivering benefits, it will

design its procedures and apply its resources with a focus that will likely not meet Congress’s desire

that the IRS “restate its mission to place a greater emphasis on serving the public and meeting taxpayer

needs.”

23

The IRS mission statement sends a clear message about the IRS’s priorities. The IRS has continued to

employ an approach to administering the EITC that is primarily based on enforcement. To successfully

meet the needs of the low and moderate income taxpayers that benefit from the EITC, the IRS should

hire employees whose education, skills, and background are suited for the work of delivering benefits.

24

That could include, for example, employees with skills that are drawn from social work. By explicitly

stating the IRS’s benefits administration role as a separate agency mission in the context of service

and non-coercive compliance, the IRS would be required to align its procedures, goals, and measures

with those of other agencies serving similar situations. That would in turn build taxpayer trust and

confidence, leading to improved compliance and an environment that reflects the essential dignity of all

taxpayers.

One example of the IRS’s failure as a benefits administrator is the agency’s continued refusal to reform

EITC audits so that one IRS employee is assigned to work the audit if the taxpayer calls or writes the

IRS in response to an IRS audit notice.

25

Family matters are inherently personal and private. A single

IRS employee can gain familiarity with the taxpayer’s issues and be able to suggest alternate sources

of documentation given that familiarity, as well as reassure the taxpayer who may be anxious about

sharing personal information. The employee may also play a key role if the taxpayer is not entitled to

the EITC and help educate the taxpayer so he or she understands how the rules apply to their specific

circumstances.

26

Such education is particularly important since the population eligible to claim the

22

See Austin Nichols & Jesse Rothstein, The Earned Income Tax Credit, in Economics of mEans-TEsTEd TransfEr Programs in ThE

UniTEd sTaTEs (2016), https://www.nber.org/chapters/c13484.pdf.

23

Pub. L. No. 105-206, § 1002 112 Stat. 685 (1998).

24

National Taxpayer Advocate 2016 Annual Report to Congress 1, 15-16 (Special Focus: IRS Future State: The National

Taxpayer Advocate’s Vision for a Taxpayer-Centric 21st Century Tax Administration).

25

See National Taxpayer Advocate 2014 Annual Report to Congress 134-144 (Most Serious Problem: Correspondence

Examination: The IRS Has Overlooked the Congressional Mandate to Assign a Specific Employee to Correspondence

Examination Cases, Thereby Harming Taxpayers).

26

See National Taxpayer Advocate 2015 Annual Report to Congress 248, 252-253 (Most Serious Problem: Earned Income

Tax Credit (EITC): The IRS is Not Adequately Using the EITC Examination Process as an Educational Tool and is not Auditing

Returns With the Greatest Indirect Potential for Improving EITC Compliance). TAS has conducted research that has focused

on educating EITC taxpayers in a manner tailored to their specific circumstances and the results reflected a statistically

significant improvement in compliance for taxpayers who broke relationship and residency Dependent Database (DDb)

rules. The DDb is a rule-based system incorporating data from within the IRS and information from external sources such

as the Department of Health and Human Services and the Social Security Administration. TIGTA, Ref. No. 2018-40-024,

Some Tax Returns Selected for Fraud Screening Did Not Have Refunds Held and Required Notifications Were Not Always Sent

to Taxpayers 1 (Mar. 27, 2018). For more on the TAS research studies, which tested whether sending educational letters

to taxpayers who erroneously claimed EITC in a previous tax year improved future compliance, see National Taxpayer

Advocate 2017 Annual Report to Congress vol. 2 14-40 (Research Study: Study of Subsequent Filing Behavior of Taxpayers

Who Claimed Earned Income Tax Credits (EITC) Apparently In Error and Were Not Audited But Were Sent an Educational Letter

From the Taxpayer Advocate Service, Part 2: Validation of Prior Findings and the Effect of an Extra Help Phone Number and a

Reminder of Childless-Worker EITC); National Taxpayer Advocate 2016 Annual Report to Congress vol. 2 32-52 (Research

Study: Study of Subsequent Filing Behavior of Taxpayers Who Claimed Earned Income Tax Credits (EITC) Apparently in Error and

Were Sent an Educational Letter From the National Taxpayer Advocate).

6

Appendices

Ensure Comparable

Protections

Limit Summary

Assessment Authority

Establish Greater

IRS Oversight

Restructure the

EITC As Two Credits

Introduction

Earned Income Tax Credit — Introduction

EITC is constantly churning, with approximately one-third of the eligible population changing every

year.

27

Assigning a single IRS employee would also likely increase the percentage of audited EITC taxpayers

that fully engage with the IRS during an audit. Almost all EITC audits are correspondence audits

(i.e., conducted via the mail). For FY 2018, less than a third (31 percent) of EITC claimants who were

audited had a complete interaction with the IRS that led to some resolution of their EITC claim, as

illustrated in Figure 2.

FIGURE 2

28

EITC Claimants’ Audit Interactions With the IRS in FY 2018

43% never responded

to an audit notice

26% started

responding but then

stopped and did not

petition the Tax Court

31% had a

comple

te interaction

with the IRS

In contrast, in FY 2018, 43 percent of audited EITC claimants were denied the credit because they never

responded to the audit notice (i.e., the “non-response rate” was 43 percent); while 26 percent responded

to some IRS notices, but the EITC was denied because the taxpayer stopped responding and did not

petition the Tax Court or sign an agreement with the IRS (i.e., the “default assessment rate” was 26

percent).

29

Personal engagement between EITC claimants and IRS employees helps to build trust in

27

IRS, EITC Fast Facts, https://www.eitc.irs.gov/partner-toolkit/basic-marketing-communication-materials/eitc-fast-facts/eitc-

fast-facts (last visited May 17, 2019).

28

IRS, CDW, Audit Information Management System (AIMS) Closed Case Database for EITC audits closed in FY 2018 (May

2019).

29

For comparison, among the field and office audits of non-EITC returns that were closed in FY 2018, the non-response rate

was five percent and the default assessment rate (the taxpayer stopped responding) was ten percent. (Because virtually

all audits of EITC returns are correspondence audits, it is not possible to compare these statistics to field and office audits

of EITC returns.) These statistics do not include correspondence audits on non-EITC returns. IRS, CDW, AIMS Closed Case

Database for EITC audits closed in FY 2018 (May 2019).

For fiscal year 2018, less than a third (31 percent) of EITC claimants who were audited

had a complete interaction with the IRS that led to some resolution of their EITC claim,

as illustrated in Figure 2.

Taxpayer Advocate Service — Special Report to Congress — Volume Three 7

Introduction

Restructure the

EITC As Two Credits

Establish Greater

IRS Oversight

Limit Summary

Assessment Authority

Ensure Comparable

Protections

Appendices

the tax system. An impersonal correspondence-based process without the personal engagement with a

specific IRS employee will likely negatively affect taxpayers’ perception of the agency.

30

General recommendation #1: The IRS must acknowledge its role as a benefits

administrator and change its practices and processes to reflect this role. Congress must

also provide additional funding so that the IRS can succeed in this role. Instead of acting

purely as an enforcement agency, the IRS should strive to ensure that low income taxpayers

are treated with respect and fairness and ensure that taxpayers receive the benefits they are

eligible for.

Congress Must Consider Administrability in Furtherance of Other Policy Goals

While the IRS must embrace its role as a benefits administrator, Congress should directly consider issues

of administrability when it enacts or amends provisions like the EITC. Policymakers understandably

focus on other aspects of a proposal—how many people will the policy lift out of poverty, how will the

policy affect decisions about working, how will it affect children—and too often gloss over whether

the IRS can administer the provision so that it achieves its intended goals. If a tax provision cannot

be effectively administered by the IRS, it can dampen or lessen the provision’s effectiveness, increase

taxpayer burden, cost the federal government money, and subject the benefit (and its recipients) to

increased scrutiny. For example, when the IRS is unable to verify or authenticate data relating to EITC

eligibility, or the EITC’s complexity means that taxpayers and preparers cannot understand how the law

applies,

31

it makes the EITC more vulnerable to opposition and increases pressure on the IRS to audit

EITC claimants. That then leads to a cycle where the IRS is criticized for disproportionately auditing

low income taxpayers

32

while still being unable to reduce stubbornly high improper payment rates.

33

30

One TAS Research study found that “taxpayers who experienced a correspondence audit report relatively low perceived

levels of procedural, informational, interpersonal, and distributive justice.” For more information, see National Taxpayer

Advocate 2017 Annual Report to Congress vol. 2 148, 167 (Research Study: Audits, Identity Theft Investigations, and

Taxpayer Attitudes: Evidence from a National Survey).

31

Government Accountability Office (GAO), Refundable Tax Credits: Comprehensive Compliance Strategy and Expanded Use

of Data Could Strengthen IRS’s Efforts to Address Noncompliance 21 (2016) (“[T]he complexity of eligibility requirements,

besides being a major driver of noncompliance and complicating IRS’s ability to administer these credits, are also a major

source of taxpayer burden.”), https://www.gao.gov/assets/680/677548.pdf.

32

See, e.g., Paul Kiel & Hannah Fresques, Where in the U.S. Are You Most Likely to Be Audited By the IRS, Pro PUblica, (Apr. 1,

2019), https://projects.propublica.org/graphics/eitc-audit.

33

See, e.g., Kyle Pomerlau, Earned Income Tax Credit Still Plagued with High Error Rate, Ta x foUndaTion (May 14, 2014),

https://taxfoundation.org/earned-income-tax-credit-still-plagued-high-error-rate (suggesting that wage subsidies in the tax

code may be predisposed to high error rates that may make any reform efforts “futile”).

If a tax provision cannot be effectively administered by the IRS, it can dampen

or lessen the provision’s effectiveness, increase taxpayer burden, cost the federal

government money, and subject the benefit (and its recipients) to increased scrutiny.

8

Appendices

Ensure Comparable

Protections

Limit Summary

Assessment Authority

Establish Greater

IRS Oversight

Restructure the

EITC As Two Credits

Introduction

Earned Income Tax Credit — Introduction

EITC ComplExITy and FamIly lIFE

Many observers have noted that the EITC is a complex provision. The combination of family complexity and

strict eligibility requirements contributes to many families struggling to determine eligibility. Consider three

family scenarios from a 2016 Government Accountability Office (GAO) report

34

that includes examples of

complications that can arise when applying EITC Eligibility Rules:

Scenario 1:

A woman separated from and stopped living with her husband in January of last year, but they are still

married. She has custody of their children. She is likely eligible for the EITC because she can file using the

head of household status.

However … If the couple separated in November, she is likely NOT eligible for the EITC because she was

not living apart from her husband for the last six months of the year and therefore cannot claim the head of

household filing status.

Scenario 2:

An 18-year-old woman and her daughter moved home to her parents’ house in November of last year. She is

likely eligible for the EITC because she was supporting herself and her child.

However … If she always lived at her parents’ house, she is likely NOT eligible

35

for the EITC because she

was a dependent of her parents for the full tax year and therefore cannot claim the EITC on her own behalf.

Scenario 3:

A young man lives with and supports his girlfriend and her two kids. He and the mom used to be married,

got divorced, and are now back together. He is likely eligible for the EITC because the children are his

stepchildren and therefore meet the relationship requirement.

However … If he and the mom were never married, he is likely NOT eligible for the EITC because the

children are not related to him.

Whether Congress redesigns the credit entirely or only modernizes certain eligibility criteria to reflect

the reality of Americans’ lives, the changes should reflect the changing dynamics of the American family

while ensuring appropriate administrative tools are available to the IRS.

By understanding the dynamics of the EITC population, Congress can design an expanded, more

inclusive EITC that furthers its original goal of supporting low income working taxpayers and their

families. In so doing, Congress will reaffirm the IRS’s dual roles as revenue collector and benefits

administrator, and explicitly affirm taxpayer rights as a guiding principle for tax administration.

36

34

GAO, Refundable Tax Credits: Comprehensive Compliance Strategy and Expanded Use of Data Could Strengthen IRS’s Efforts to

Address Noncompliance 21 (2016).

35

Crucially, these are stylized examples of the likely eligibility of the taxpayer given the limited information provided. The

actual eligibility of a taxpayer in this situation may differ, especially in light of additional information not provided in these

examples. For example, in scenario 2, if the 18-year old woman was paying rent to her parents, buying her own food, and

generally supporting herself and her child, she likely would qualify for the credit. The applicability of general rules to very

specific circumstances highlights some of the complexity in administering family and child related tax benefits like the EITC.

36

We note that this foundational principle is consistent with Congress’ directive in The IRS Reform and Restructuring Act

of 1998 (RRA 98) that IRS front-line technical experts should advise Congress about the administrability of pending tax

legislation. Pub. L. No. 105-206, § 4021, 112 Stat. 685 (1998). This has not been followed. See National Taxpayer

Advocate 2014 Annual Report to Congress 108-111 (Most Serious Problem: Complexity: The IRS Has No Process to Ensure

Front-Line Technical Experts Discuss Legislation with the Tax Writing Committees, as Requested by Congress).

Taxpayer Advocate Service — Special Report to Congress — Volume Three 9

Introduction

Restructure the

EITC As Two Credits

Establish Greater

IRS Oversight

Limit Summary

Assessment Authority

Ensure Comparable

Protections

Appendices

When Congress considers legislation with tax administration in mind, the legislation is likely to be

simpler and less burdensome.

General recommendation #2: Congress must consider the administrability of tax

provisions, especially family and child related provisions, whose eligibility criteria may be

difficult if not impossible for the IRS to verify. When a tax provision is difficult for the

IRS to administer, it can be more prone to improper payments, and ultimately subject

certain taxpayers to additional scrutiny. This additional scrutiny can be particularly

burdensome for low income taxpayers.

Congress Must Provide Effective Oversight of the IRS

The IRS has faced significant budget constraints in recent years.

37

As the National Taxpayer Advocate

has stated before, however, the support that the IRS needs is not just financial.

38

The IRS needs an

engaged Congress that provides appropriate oversight over IRS policies and initiatives. That oversight

will lead to greater transparency and public trust in the tax system. It will provide Congress with

information on how legislation is meeting the goals that Congress has identified and the challenges that

both the IRS and taxpayers face.

We note that there is precedent for this type of legislative engagement. As part of the agency’s

reorganization mandated by RRA 98, Congress held joint annual meetings, over five years, to review the

IRS strategic plan.

39

The hearing participants included three members (two from the majority and one

from the minority) from each of the congressional committees with jurisdiction over the IRS: Senate

Finance, Appropriations, and Government Affairs, and House Ways and Means, Appropriations, and

Government Reform and Oversight.

General recommendation #3: Congress should conduct regular oversight hearings of the

IRS on a permanent basis.

40

These hearings would provide an opportunity for the IRS

to identify challenges and successes with all the tax laws that the IRS administers. In the

case of low income tax benefits, these hearings would provide a forum for Congress to hear

directly from outside experts, including Low Income Taxpayer Clinics, return preparers,

and others with particular insights into the lives and challenges facing low income

taxpayers and their families.

With these principles and general recommendations in mind, we now turn to the EITC reform

proposals and specific recommendations.

37

In inflation-adjusted dollars, the IRS budget has declined from $12.1 billion in 2010 to $10.1 billion in 2018. Department

of the Treasury, FY 2012 Budget in Brief 1 (Feb. 2012), https://home.treasury.gov/about/budget-performance/budget-in-

breif/Documents/FY2012_BIB_Complete_508.pdf. Department of the Treasury, FY 2020 Budget in Brief 1 (March 2019),

https://home.treasury.gov/system/files/266/FY2020BIB.pdf.

38

National Taxpayer Advocate 2016 Annual Report to Congress 6-11 (Special Focus: IRS Future State: The National Taxpayer

Advocate’s Vision for a Taxpayer-Centric 21st Century Tax Administration).

39

Pub. L. No. 105-206, § 4001, enacting Internal Revenue Code (IRC) § 8021(f), & § 4002, amending IRC § 8022, 112 Stat.

685, 783-84 (1998).

40

This oversight would include issues beyond refundable credits (like the IRS modernization progress), but the EITC is a

particularly important provision that could benefit from systematic Congressional review and information and suggestions

from the IRS and external stakeholders.

10

Appendices

Ensure Comparable

Protections

Limit Summary

Assessment Authority

Establish Greater

IRS Oversight

Restructure the

EITC As Two Credits

Introduction

Earned Income Tax Credit — Restructure the EITC As Two Credits

Restructure the EITC As Two Credits: A Worker Credit and a Child Benefit,

and Modernize the Definition of a Qualifying Child

PRESENT LAW AND PRACTICE

Eligibility for the EITC and the amount of EITC a taxpayer is entitled to are based on a variety of

factors including the presence and number of qualifying children, the taxpayer’s earned income, adjusted

gross income (AGI), investment income, and marital status.

41

There are eight different EITC formulas as illustrated in Figure 3 (see EITC Databook appendix for the

TY 2018 credit parameters), although all follow the same general structure: the EITC increases in value

over a range of earned income (between $0 and the “earned income amount”), reaches its maximum

level (when earned income is between the “earned income amount” and the “phase out amount

threshold”), and then begins to phase out to zero (when earned income (or AGI, whichever is greater)

exceeds the “phase out amount threshold”). The income level at which the credit begins to phase out

is higher for married couples than unmarried recipients (this is often referred to as “marriage penalty

relief”).

FIGURE 3

42

Earned Income Credit Amount

EITC Amounts by Earned Income, Marital Status,

and Qualifying Children for Tax Year 2018

Earned Income

$60,000

$40,000

$6,500

$3,250

$6,431

$5,716

$3,461

$519

$20,000

Single, 1 child

Married, 1 child

Single, 2 children

Married, 2 children

Single, 3 children

Married, 3 children

Single, no children

Married, no children

41

See IRC § 32. For a comprehensive list of EITC eligibility requirements and how to calculate the credit, see Gene Falk &

Margot Crandall-Hollick, Cong. Research Serv., R43805, The Earned Income Tax Credit (EITC): An Overview (2018). See

also National Taxpayer Advocate 2016 Annual Report to Congress 325, 330-331 (Legislative Recommendation: Tax Reform:

Restructure the Earned Income Tax Credit and Related Family Status Provisions to Improve Compliance and Minimize Taxpayer

Burden).

42

See IRC § 32 and IRS Revenue Procedure 2018-18. EITC phases out based on the taxpayer’s earned income or adjusted

gross income whichever is greater.

Taxpayer Advocate Service — Special Report to Congress — Volume Three 11

Introduction

Restructure the

EITC As Two Credits

Establish Greater

IRS Oversight

Limit Summary

Assessment Authority

Ensure Comparable

Protections

Appendices

The size of the credit varies substantially depending on the number of qualifying children the taxpayer

has, as illustrated in Figure 3. An individual must meet three primary requirements to be a “qualifying

child.” First, the individual must have a specific relationship to the tax filer (son, daughter, adopted

child, step child, foster child,

brother, sister, half-brother, half-sister, step brother, step sister, or

descendent of such a relative such as a grandchild, niece, or nephew). Second, the individual must share

a residence with the taxpayer for more than half the year in the United States. Third, the individual

must be under the age of 19 (or age 24, if a full-time student) or be permanently and totally disabled.

43

REASONS FOR CHANGE

The current credit design may not be the most effective means of increasing labor force participation and

reducing poverty among all low income taxpayers. The current credit is also complicated for taxpayers

to comply with, difficult for the IRS to administer, and is associated with a high improper payment rate,

especially among taxpayers with qualifying children.

44

When the credit was first enacted, its purpose was to encourage work and reduce dependence on cash

welfare among single mothers.

45

Economic research has consistently shown that the credit has been

effective at increasing the labor force participation of this population.

46

Of note, when the EITC was

originally created, a credit for childless workers did not exist.

During the 1990s, Congress enacted the EITC for workers without qualifying children, often referred

to as the “childless EITC.” The main rationale for the childless EITC was to offset a gasoline tax

increase.

47

The credit was and remains small in comparison to the credit for those with children. In

2018, an individual without any qualifying children working full time at a minimum wage job would

receive an EITC of about $60.

48

Research indicates that while the EITC has had a significant impact on

reducing poverty among recipients with children, it has little poverty reduction impact among childless

43

The individual must also have a Social Security number that is valid for employment. IRC §§ 32(c)(3)(D), (m).

44

An improper payment is defined as “any payment that should not have been made or that was made in an incorrect amount

(including overpayments and underpayments) under statutory, contractual, administrative, or other legally applicable

requirements” and ‘‘any payment to an ineligible recipient.” Improper Payments Elimination and Recovery Act of 2010, Pub.

L. No. 111–204, § 2(e), 124 Stat. 2224 (2010) amending Improper Payments Information Act of 2002, Pub. L. No. 107-

300, 116 Stat. 2350 (2002) (striking § 2(f) and adding (f)(2)). The IRS estimates that for FY 2018, 25 percent of the total

EITC program payments were improper. Department of the Treasury, Agency Financial Report Fiscal Year 2018 42-43 (2018).

45

Margot Crandall-Hollick, Cong. Research Serv., R44825, The Earned Income Tax Credit (EITC): A Brief Legislative History 7

(2018).

46

Nada Eissa & Hilary Hoynes, Behavioral Responses to Taxes: Lessons from the EITC and Labor Supply, 20 Tax Pol’y & Econ. 73

(2006). For a review, see Margot Crandall-Hollick & Joseph Hughes, Cong. Research Serv., R44057, The Earned Income Tax

Credit (EITC): An Economic Analysis (2018).

47

See Margot Crandall-Hollick, Cong. Research Serv., R44825, The Earned Income Tax Credit (EITC): A Brief Legislative History

7 (2018).

48

This assumes a federal minimum wage of $7.25 received by a worker who works 40 hours per week for 50 weeks per year

equaling an annual pre-tax earned income of $14,500.

12

Appendices

Ensure Comparable

Protections

Limit Summary

Assessment Authority

Establish Greater

IRS Oversight

Restructure the

EITC As Two Credits

Introduction

Earned Income Tax Credit — Restructure the EITC As Two Credits

individuals.

49

And given the relatively small benefit (and lower participation rate)

50

it is unlikely to have

any labor supply increasing effect among low income childless adults.

Concerns about the size and limited effect on poverty and labor force participation of the childless

EITC have become more relevant in light of research showing decreased labor force participation of

some childless adults and stagnant wage growth among many workers, especially the poorest workers.

51

Indeed, a recent proposal by Leonard Burman to create a substantially larger and near universal per-

worker EITC is partially conceived as a way to encourage work and mitigate wage stagnation for both

low and middle income workers.

52

In addition, TAS, the IRS, and other organizations have repeatedly documented how the EITC’s

complex structure burdens taxpayers and is difficult for the IRS to administer.

53

Much of the

complexity, administrative issues difficulty, and taxpayer burden associated with the credit center around

the qualifying child rules.

First, the IRS cannot independently verify that a child meets all the current EITC qualifying child

rules, especially the residency requirement, during filing season. There is no national, authoritative, and

timely database that indicates where and with whom a child lives during a calendar year for the purposes

of administering this tax benefit, making accurate verification of this requirement difficult. Nor do we

believe U.S. taxpayers would tolerate the government creating such a database. Failure of a taxpayer

49

Chuck Marr et al., Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty 6 (2016),

https://www.cbpp.org/research/federal-tax/strengthening-the-eitc-for-childless-workers-would-promote-work-and-reduce.

In addition, analysis by the Congressional Research Service indicates that the EITC reduces the proportion of unmarried

childless workers in poverty from 19.9 percent to 19.6 percent (a 1.5 percent reduction). In comparison, the EITC reduces

the proportion of unmarried households with three children in poverty from 40.5 percent to 32.3 percent (a 20.2 percent

reduction). Margot Crandall-Hollick & Joseph Hughes, Cong. Research Serv., R44057, The Earned Income Tax Credit (EITC):

An Economic Analysis (2018).

50

For TY 2016, an estimated 65 percent of eligible childless workers claimed the EITC, compared to an estimated 86 percent

participation for those with one child, 85 percent participation for those with two children, and 82 percent participation for

those with three children. For more information, see the EITC Databook appendix, infra.

51

See Figure 4 in Chuck Marr et al., Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty 6

(2016), https://www.cbpp.org/research/federal-tax/strengthening-the-eitc-for-childless-workers-would-promote-work-and-

reduce; Isabel V. Sawhill & Christopher Pulliam, Lots of plans to boost tax credits: which is best?, brookings insT. (Jan. 15,

2019), https://www.brookings.edu/research/lots-of-plans-to-boost-tax-credits-which-is-best/. See also, Dylan Matthews,

Senate Democrats have coalesced around a big plan to expand tax credits, Vox (April 10, 2019), https://www.vox.com/future-

perfect/2019/4/10/18302183/tax-cut-democrats-earned-income-tax-credit-child-allowance; Peter S. Goodman & Jonathan

Soble, Global Economy’s Stubborn Reality: Plenty of Work, Not Enough Pay, n.y. TimEs, Oct. 7, 2017, https://www.nytimes.

com/2017/10/07/business/unemployment-wages-economy.html; Jay Shambaugh et. al., Thirteen Facts about Wage Growth

(2017); Matthew Desmond, Americans Want to Believe Jobs Are the Solution to Poverty. They’re Not, n.y. TimEs, Sept. 11,

2018, https://www.nytimes.com/2018/09/11/magazine/americans-jobs-poverty-homeless.html.

52

Leonard E. Burman, A Universal EITC: Sharing the Gains from Economic Growth, Encouraging Work, and Supporting Families

(2019).

53

See National Taxpayer Advocate 2016 Annual Report to Congress 325-340 (Legislative Recommendation: Tax Reform:

Restructure the Earned Income Tax Credit and Related Family Status Provisions to Improve Compliance and Minimize Taxpayer

Burden); National Taxpayer Advocate Fiscal Year 2017 Objectives Report to Congress 113-118 (Area of Focus: Earned

Income Tax Credit Reform Could Reduce the EITC Improper Payment Rate Without Reducing Participation by Eligible Taxpayers);

Margot Crandall-Hollick, Cong. Research Serv., R43873, The Earned Income Tax Credit (EITC): Administrative and Compliance

Challenges (2018); IRS Pub. 5162, Compliance Estimates for the Earned Income Tax Credit Claimed on 2006-2008 Returns

(Aug. 2014); Jason J. Fichtner, William G. Gale & Jeff Trinca, Tax Administration: Compliance, Complexity, and Capacity

(2019); Elaine Maag, Simplicity: Considerations in Designing a Unified Child Credit, 63 naT’l Tax J. 765 (2010). In addition, in

its most recent Annual Financial Report, the Treasury Department stated “Treasury and IRS analyses, as well as audits by

the Government Accountability Office (GAO) and Treasury Inspector General for Tax Administration (TIGTA), have consistently

found that payment errors for EITC and other tax credit programs are largely attributable to the statutory design and

complexity of the credits within the tax system, and not rooted in internal control weaknesses, financial management or

financial reporting deficiencies.” Department of the Treasury, Agency Financial Report Fiscal Year 2018 150 (2018).

Taxpayer Advocate Service — Special Report to Congress — Volume Three 13

Introduction

Restructure the

EITC As Two Credits

Establish Greater

IRS Oversight

Limit Summary

Assessment Authority

Ensure Comparable

Protections

Appendices

to meet the residency requirement results in the greatest amount of erroneous claims of the credit in

dollar terms.

54

It is also difficult for the IRS to verify that children meet the relationship requirement.

While the IRS does have data on a child’s age and data that links him or her to at least one biological

parent, the IRS does not have data that links the child to other family members (like aunts, siblings, or

grandparents).

Second, the qualifying child rules often do not reflect the real-life connections between children

and adults in low income families. A 2016 study by the Tax Policy Center found that the number

of households made up of “traditional families” (married parents with only biological children) have

declined while alternative family types, such as families led by a single parent or cohabitating parents,

have increased.

55

Only 51.6 percent of children living in families with income at or below 200 percent of

the federal poverty level (FPL) were in families headed by married couples. Low income children were

more likely to live with either a single parent, in a multigenerational household, a cohabiting household,

or in a family with at least one non-biological child in comparison to their higher income peers.

56

Refundable credits intended to support low income working families should be designed to benefit their

target population.

RECOMMENDATIONS

Recommendation 1.1: Replace the EITC With a Per-Worker Credit Based on Earned

Income and a Universal Per-Child Benefit

TAS recommends restructuring the EITC into (1) a refundable worker credit based on each individual

worker’s earned income irrespective of the presence of a qualifying child, and (2) a refundable child

benefit that would reflect the costs of caring for a child. This child benefit would also replace the child

tax credit and the dependent exemption which is scheduled to be reinstated beginning in 2026.

57

TAS

has proposed a similar restructuring of the EITC and other child and family related tax benefits in the

past.

58

The Worker Credit

Much like the current EITC, the worker credit would be structured to phase-in as a percentage of earned

income, reach a plateau, and then phase out.

59

Unlike the current EITC, however, the benefit would

be uniform for each worker at a given income level and not vary depending on the number of children

the worker has or, if the worker is married, the couple’s combined income. This structure would target

the benefit to the lowest income taxpayers and help ensure that workers in low-wage jobs receive enough

54

IRS, Pub. 5162, Compliance Estimates for the Earned Income Tax Credit Claimed on 2006-2008 Returns (Aug. 2014).

55

Elaine Maag, H. Elizabeth Peters & Sarah Edelstein, Increasing Family Complexity and Volatility: The Difficulty in Determining

Child Tax Benefits 10 (2016). See also National Taxpayer Advocate 2016 Annual Report to Congress 334 (Legislative

Recommendation: Tax Reform: Restructure the Earned Income Tax Credit and Related Family Status Provisions to Improve

Compliance and Minimize Taxpayer Burden).

56

Id.

57

Under § 11041 of Pub. L. No. 115-97, personal exemptions equal $0 for TYs 2018-2025.

58

See National Taxpayer Advocate 2016 Annual Report to Congress 325-340 (Legislative Recommendation: Tax Reform:

Restructure the Earned Income Tax Credit and Related Family Status Provisions to Improve Compliance and Minimize Taxpayer

Burden).

59

For examples on how to structure a per-worker credit, see Elaine Maag, Investing in Work by Reforming the Earned Income

Tax Credit (2015).

14

Appendices

Ensure Comparable

Protections

Limit Summary

Assessment Authority

Establish Greater

IRS Oversight

Restructure the

EITC As Two Credits

Introduction

Earned Income Tax Credit — Restructure the EITC As Two Credits

money to meet their basic needs.

60

In order to prevent wealthy taxpayers with relatively low levels of

earned income from claiming the credit, the credit could phase out based on AGI (a broader measure of

income that includes unearned income like capitals gains, dividends, rents and royalties) and/or retain

the EITC provision that denies the credit to taxpayers with excessive investment income.

61

The exact

parameters could be adjusted to meet policymakers’ distributional, anti-poverty, and budgetary goals.

62

Several proposals have already been put forth that expand the EITC for childless workers, providing a

framework for how to design a worker credit.

63

Since the credit would be based on earned income and not on the presence of qualifying children,

the dollar amounts of improper payments of the worker credit would likely fall in comparison to

current EITC improper payments. Most EITC recipients have at least some Form W-2, Wage and Tax

Statement, wage income, and errors associated with this type of income are relatively small in dollar

terms. In TY 2017, about 15 percent of EITC recipients had both self-employment and W-2 income,

while about 11 percent had only self-employment income (see the EITC Databook appendix for

additional data).

64

In addition, as a result of changes made by the Protecting Americans from Tax Hikes (PATH) Act, the

IRS has more timely data it can use to detect and prevent any overclaims of the worker credit based

on W-2 income.

65

The PATH Act requires employers to submit W-2s (and information returns for

nonemployee compensation like Form 1099-MISC, Miscellaneous Income) by January 31 and requires

the IRS to hold refunds until February 15 if the taxpayer claims EITC or the refundable portion of

the child tax credit. These legislative changes were made in part to prevent “refund fraud related to

fabricated wages and withholdings.”

66

Data indicate that more Forms W-2, Wage and Tax Statement,

were submitted to the IRS earlier in the 2019 filing season compared with the 2018 filing season.

67

The

IRS received 219 million Forms W-2 as of February 4, 2019, compared with 101 million for the same

60

Some experts caution that without a minimum wage, employers would reduce and capture the benefit of an increased EITC.

See Austin Nichols & Jesse Rothstein, The Earned Income Tax Credit, in Economics of mEans-TEsTEd TransfEr Programs in ThE

UniTEd sTaTEs Vol. 1 137 (Robert A. Moffitt ed., 2016). Therefore, many proposals couple an increased childless EITC or

worker credit with an increased minimum wage. See Isabel V. Sawhill & Quentin Karpilow, Raising the Minimum Wage and

Redesigning the EITC, brookings insT. (Jan. 30, 2014), https://www.brookings.edu/research/raising-the-minimum-wage-and-

redesigning-the-eitc/.

61

IRC § 32(i).

62

For more information about how changing different parameters of the credit can affects taxpayers, see Elaine Maag, Donald

Marron & Erin Hoffer, Redesigning the EITC: Issues in Design, Eligibility, Delivery, and Administration (2019).

63

See, e.g., Leonard E. Burman, A Universal EITC: Sharing the Gains from Economic Growth, Encouraging Work, and Supporting

Families (2019). For a summary of other recent proposals to modify the EITC and child tax credit, see Isabel V. Sawhill &

Christopher Pulliam, Lots of plans to boost tax credits: which is best?, brookings insT. (Jan. 15, 2019), https://www.brookings.

edu/research/lots-of-plans-to-boost-tax-credits-which-is-best/.

64

IRS, CDW, IRTF and Information Returns Master File (IRMF), TY 2017 returns processed through cycle 13 of 2019 (May

2019).

65

See Pub. L. No. 114-113, Division Q, Title II, § 201 (a) and (b), 129 Stat. 2242, 3076 (2015) codified at IRC §§ 6071(c)

and 6402 (m).

66

IRS, New Federal Tax Law May Affect Some Refunds Filed in Early 2017; IRS to Share Details Widely with Taxpayers Starting

This Summer, https://www.irs.gov/tax-professionals/new-federal-tax-law-may-affect-some-refunds-filed-in-early-2017 (last

visited June 10, 2018).

67

For more information about the 2019 Filing Season, see National Taxpayer Advocate FY 2020 Objectives Report to Congress

(Review of the 2019 Filing Season), supra.

Taxpayer Advocate Service — Special Report to Congress — Volume Three 15

Introduction

Restructure the

EITC As Two Credits

Establish Greater

IRS Oversight

Limit Summary

Assessment Authority

Ensure Comparable

Protections

Appendices

period last filing season—an increase of about 117 percent.

68

Assuming payouts of the worker credit

were also held till February 15, this additional data would minimize improper payments of the credit

associated with W-2 income, although improper payments associated with self-employment income

would still exist.

The 2006-2008 EITC Compliance Study indicates that income reporting errors account for

approximately one-quarter of credit dollars erroneously claimed, with most of those errors attributed

to self-employment income.

69

While manipulation of self-employment income to maximize the credit

could still occur, it would likely be relatively small in dollar terms in comparison to the tax gap that

results from misreporting of self-employment income, as illustrated in Figure 4.

FIGURE 4

70

Comparison of the Tax Gap and EITC Overclaim Estimates

Attributable to Misreported Self-Employment Income

EITC Overclaims Tax Gap

$65 Billion Per Year

Self-Employment Tax

$125 Billion Per Year

Individual Income Tax

Underreporting of

self-employment income

costs the federal

government an estimated

$190 billion a year:

$65 billion in unpaid

self-employment taxes and

$125 billion in unpaid

individual income taxes

Misreporting of

self-employment income

resulted in $3.2 to 3.8 billion

of EITC overclaims

According to IRS data, the cost of the misreporting of self-employment income in terms of EITC

overclaims is between $3.2 and $3.8 billion per year while the foregone tax revenue attributable to

underreporting of self-employment income costs is approximately $190 billion per year, nearly fifty

times more.

In addition, by making the benefit per worker, the total amount of the credit would no longer fall when

taxpayers married, as often happens currently (because their combined incomes exceed the phase out

amount threshold). This would eliminate the main driver of the marriage penalty among low income

68

IRS Identity Theft (IDT) and Integrity Verification Operations (IVO) Modeling Analysis - MAIN Performance Report, slide 10 (Feb.

6, 2019). See IRC § 6402(m), which prevents the IRS from issuing certain refunds before Feb. 15 each year. The increase

in timely received Form W-2 data, in conjunction with two other changes, likely resulted in more returns being released

earlier in the process this year compared to last year. One change is the newly adopted systemic release feature which

allows returns to be released back into normal processing systemically rather than waiting for an IRS employee to manually

release the refund. The other is the availability of third-party documentation daily rather than weekly.

69