1

Contents

Introduction.................................................................................................................................................................... 3

The Insurance Contract ................................................................................................................................................. 3

Important Information ................................................................................................................................................... 3

Information Provided To Us .......................................................................................................................................... 4

Our Rights Under This Policy ........................................................................................................................................ 4

Cooling Off Provision .................................................................................................................................................... 5

Breach Of Term ............................................................................................................................................................. 5

Terms Not Relevant To The Loss .................................................................................................................................. 5

Pre-Existing Medical Conditions .................................................................................................................................. 6

Sports and Pastimes ...................................................................................................................................................... 7

Coverage Sections ........................................................................................................................................................ 8

Section A – Accidental Bodily Injury ........................................................................................................................ 8

1 What is Covered ................................................................................................................................................. 8

2 Conditions Specific to Section A ...................................................................................................................... 8

3 Exclusions Specific to Section A ....................................................................................................................... 8

Section B – Medical and Associated Expenses ....................................................................................................... 9

1 What is Covered ................................................................................................................................................. 9

2 Conditions Specific to Section B ..................................................................................................................... 10

3 Exclusions Specific to Section B ...................................................................................................................... 10

Section C - Trip Interruption ................................................................................................................................... 11

1 What is Covered ............................................................................................................................................... 11

2 Conditions Specific to Section C .................................................................................................................... 12

3 Exclusions Specific to Section C ..................................................................................................................... 12

Section D - Personal Baggage ............................................................................................................................... 15

1 What is Covered ............................................................................................................................................... 15

2 Conditions Specific to Section D .................................................................................................................... 15

3 Exclusions Specific to Section D ..................................................................................................................... 15

Section E – Money ................................................................................................................................................... 15

1 What is Covered ............................................................................................................................................... 15

2 Conditions Specific to Section E ..................................................................................................................... 16

3 Exclusions Specific to Section E ...................................................................................................................... 16

Section F – Personal Liability .................................................................................................................................. 16

1 What is Covered ............................................................................................................................................... 16

2 Conditions Specific to Section F ..................................................................................................................... 16

3 Exclusions Specific to Section F ...................................................................................................................... 17

Section G – Legal Expenses .................................................................................................................................... 17

1 What is Covered ............................................................................................................................................... 17

2 Conditions Specific to Section G .................................................................................................................... 17

3 Exclusions Specific to Section G ..................................................................................................................... 18

Section H – Winter Sports ....................................................................................................................................... 19

1 What is Covered ............................................................................................................................................... 19

2 Conditions Specific to Section H .................................................................................................................... 20

3 Exclusions Specific to Section H ..................................................................................................................... 20

General Exclusions ...................................................................................................................................................... 21

Key Information ........................................................................................................................................................... 21

General Conditions ..................................................................................................................................................... 22

Key Information ........................................................................................................................................................... 22

1.1 Geographical Area .................................................................................................................................... 22

1.2 Maximum Length of Trips ......................................................................................................................... 22

1.3 Exposure .................................................................................................................................................... 22

1.4 Duplication Of Claims ............................................................................................................................... 22

1.5 Information Disclosed ............................................................................................................................... 22

1.6 Age Limit .................................................................................................................................................... 23

1.7 Compensation ........................................................................................................................................... 23

1.8 Other Insurance ......................................................................................................................................... 23

1.9 Subrogation ............................................................................................................................................... 23

1.10 Interest ................................................................................................................................................... 23

1.11 Loss Mitigation ...................................................................................................................................... 23

1.12 Fraudulent Claims ................................................................................................................................ 23

1.13 Currency ................................................................................................................................................ 23

2

1.14 Cancellation .......................................................................................................................................... 24

1.15 Law And Jurisdiction ............................................................................................................................ 24

1.16 Assignment ........................................................................................................................................... 24

1.17 Contract (Right of Third Parties) Act 1999 .......................................................................................... 24

1.18 Language .............................................................................................................................................. 24

1.19 Entire Agreement ................................................................................................................................. 24

1.20 Severability Clause ............................................................................................................................... 24

1.21 Sanctions ............................................................................................................................................... 24

1.22 End Of Employment ............................................................................................................................. 25

How To Make A Claim ................................................................................................................................................. 26

Things You Must Do When Notifying A Claim .......................................................................................................... 26

Complaints – How To Make A Complaint .................................................................................................................. 27

Financial Services Compensation Scheme ............................................................................................................... 27

Data Protection - Personal Information Notice ......................................................................................................... 28

Definitions .................................................................................................................................................................... 29

3

Introduction

Welcome to this Everest Insurance Police Travel Policy which explains your insurance protection in full.

In this document a number of words or phrases are in bold type. This will give those words or phrases the

special meaning shown in the Definitions Section set out within this Policy, or as set out in a particular Section

of this Policy.

“We”, “our” or “us” is a reference to the insurer, shown in the policy schedule. The “policyholder” is a reference

to the corporate entity or organisation named as a policyholder in the policy schedule. The “insured person”,

“you” or “your” is a reference to a person who meets the criteria specified for an insured person in the policy

schedule.

The Insurance Contract

In return for payment of or agreement to pay the premium shown in the policy schedule by the policyholder

or insured person, we agree to insure the insured person(s) stated on the policy schedule, subject to the

terms, conditions, limitations and endorsement(s) contained in or attached to this insurance Policy.

This document including the policy schedule and any endorsement(s) attached form the Policy. This

document sets out the conditions of the insurance cover provided.

Please read the whole document carefully and keep it in a safe place.

Important Information

It is important that:

• The policyholder checks that the coverage it has requested is included in the policy schedule.

• The policyholder checks that the information it has given to us is accurate – see the “Information

Provided to Us” Section.

• The policyholder and/or insured person notify us via the broker shown in the policy schedule

as soon as practicable of any inaccuracies in the information which the policyholder and/or

insured person have given us.

• The policyholder and insured persons comply with their duties under each Section and under

this Policy as a whole.

4

Information Provided To Us

In deciding to accept this Policy and in setting the terms and premium, we have relied on the information the

policyholder and insured persons have given to us. The policyholder and insured persons must take care

when answering any questions we ask, by answering them honestly and with reasonable care, and by ensuring

that all the information provided to us is accurate and complete.

We will write to the policyholder if we:

• intend to treat the Policy as if it never existed; or

• need to amend the terms of the Policy; or

• will be reducing the amount we will pay on a claim due to inaccurate information.

If the policyholder becomes aware that information given to us is inaccurate, the policyholder must inform us

as soon as practicable.

If an insured person becomes aware that information given to us is inaccurate, the insured person must inform

us as soon as practicable.

Our Rights Under This Policy

If we establish that the policyholder deliberately or recklessly provided us with false or misleading

information, we will treat this policy as if it never existed and decline all claims.

If we establish that the policyholder carelessly provided us with false or misleading information, it could

adversely affect this policy and any claim. For example, we may:

a. treat this Policy as if it never existed, refuse to pay all claims and return any premium paid. We

will only do this if we provided the policyholder with insurance cover which we would not

otherwise have offered; or

b. amend the terms of this policy. We may apply these amended terms to a claim as if the terms

were already in place, if the policyholder was careless; or

c. reduce the amount we pay on a claim in proportion to the premium within the policy

schedule, compared to the premium we would have charged the policyholder, should the

information provided have been accurate.

Nothing above shall limit the rights of the policyholder or insured person under any applicable laws

or regulations.

5

Cooling Off Provision

If an insured person is paying to participate under this Policy, the insured person will have a cooling off

period of fourteen (14) days from either:

• the date the insured person receives the Policy; or

• the start of the policy period,

whichever is the later.

The insured person is entitled to revoke their participation under this Policy during the cooling off period

above and in those circumstances, provided a claim has not been made or is not intended to be made by the

insured person, the insured person will be entitled to a full refund of any premium paid.

If an event has occurred that could give rise to a claim under this Policy, then no return premium will be paid.

These rights are in addition to the general rights of cancellation set out in General Condition 1.14.

Breach Of Term

We agree that where there has been a breach of any term (express or implied) which would otherwise

automatically result in us being discharged from any liability hereunder, such breach shall result in any liability

we might have under this Policy being suspended, with such suspension applying from the time the breach

occurred until the time the breach is remedied. This shall mean that we will not have any liability in respect of

any loss occurring, or attributable to something happening, during the period of suspension.

Terms Not Relevant To The Loss

If there is non-compliance with any term (express or implied) hereunder, other than a term that defines the risk

as a whole, and compliance with such a term would tend to reduce the risk of:

• loss of a particular kind;

• loss at a particular location; and/or

• loss at a particular time,

then we agree that we may not rely on the non-compliance to exclude, limit or discharge our liability under this

Policy if the policyholder and/or insured person prove to us that non-compliance with the term could not have

increased the risk of the loss as it actually occurred.

6

Pre-Existing Medical Conditions

This Policy does not provide cover for claims arising from pre-existing medical conditions for:

1. claims made under Section B – Medical and Other Expenses as a result of:

a. your certification as unfit to travel by a medical practitioner;

b. your travel for the purpose of receiving medical treatment, vaccination, medical check-up, care or

advice, regardless of whether or not this is the sole or main purpose of the trip;

c. your travel after receiving a terminal prognosis;

d. your purchase of prescription medicines for a pre-existing medical condition; or

2. claims made under Section C1.1 – Cancellation, Curtailment and Amendment as a result of:

a. your certification as unfit to travel by a medical practitioner;

b. your inclusion on a waiting list the inpatient treatment;

c. your travel for the purpose of receiving medical treatment, vaccination, medical check-up, care or

advice, regardless of whether or not this is the sole or main purpose of the trip;

d. your travel after receiving a terminal prognosis;

e. you, your close relative, your traveling companion or their close relative’s pre-existing medical

condition which we determine could have reasonably been foreseen as likely to give rise to a claim;

or

3. claims made under Section G1.2b Winter Sports Injury and Illness as a result of:

a. an illness you were aware of prior to you travelling for the trip; or

b. travelling against the advice of a medical practitioner.

7

Sports and Pastimes

This Policy may not cover you when you take part in certain sports or pastimes where there is a high risk of

bodily injury.

This Policy provides automatic cover for you whilst participating in the following activities during a trip during

the policy period and operative time:

Abseiling (with a qualified instructor), aerobics, archery (with a qualified supervisor), angling, badminton,

banana boating, baseball, basketball, body boarding, bowls, bungee jumping (with a licenced company) ,

camel/elephant rides (with a qualified guide/instructor), camping, canoeing (up to grade 2, not including sea

canoeing and whilst with a qualified guide/instructor), clay pigeon shooting, cricket, croquet, curling, cycling

(excluding touring, racing and BMX), diving (up to a depth of 30m only), fencing (with a qualified

guide/instructor), fishing (including deep sea fishing and game fishing), football (excluding competitions),

gliding (whilst not piloting and only with a qualified instructor), golf, go karting, gymnastics, handball, hill

walking not involving ropes/guides and under 3,000m, hiking not involving ropes/guides and above 3,000m

(with a qualified guide only), horse riding (excluding racing, eventing and hunting), hot air ballooning (whilst as

a passenger only), ice skating (on a recognised rink only), jet skiing or biking or boating (excluding claims under

the Personal Liability Section hereunder), kayaking (up to grade 3 and not including sea kayaking), motor cycling

(whilst holding a valid licence and wearing appropriate safety gear only), mountain biking (excluding stunts,

racing or extreme terrain), netball, orienteering, paintballing, parascending (over water only), pony trekking,

quad biking (up to 125cc), racquetball, rambling (not including climbing), roller skating, rounders, rowing,

running/jogging (including fell running without climbing but excluding distances longer than a marathon), safari

(provided an organised excursion with a tour operator), sailing/yachting (within fifteen (15) miles from land for

all types and for flotilla sailing this must also be with a qualified guide), scuba diving to a depth of 40m (while

accompanied by a fellow certified diver and provided you hold a recognised diving qualification for the depth),

shooting (excluding hunting), skiing (including on piste and dry slopes but for cross country and off piste with

qualified guide/instructor only), sleigh rides (as a passenger and with a qualified guide), sledding with dogs (as

a passenger only and with a qualified guide), snorkelling, snowboarding (including on piste but for off piste

with qualified guide/instructor only), softball, squash, surfing, swimming (including with dolphins), table tennis,

ten pin bowling, tennis (excluding competitions), tobogganing, volleyball, water polo, water skiing (excluding

jumping), white/black water rafting (up to grade 3 and with a qualified guide), windsurfing (within three (3)

miles from land).

No other sports or pastimes will be covered by this Policy, including organised team sports.

8

Coverage Sections

The benefits listed within Coverage Sections will have a corresponding maximum sum insured stated within the

policy schedule. The sum insured may be limited per insured person, or per claim or otherwise and may be

dependent on the insured person’s age as clearly stated in the policy schedule. The full wording for each

Coverage Section should be reviewed, as there may be limitations to the benefit payable.

Section A – Accidental Bodily Injury

1 What is Covered

We hereby agree with you, to the extent and in the manner herein provided, that if during the policy period

and operative time whilst on a trip you have an accident that results in your bodily injury which, within twelve

(12) months from the date of the accident, solely directly and independently of any other cause results in your

death or you having a disablement listed in the table of benefits for this Section in the policy schedule, we will

pay you or your executors or administrators compensation according to the table.

The maximum we will pay per insured person per benefit, any applicable benefit periods and any applicable

waiting periods for this Section are stated in the policy schedule.

2 Conditions Specific to Section A

In addition to the General Conditions set out later in this wording, the following conditions apply to this Section:

1. Benefit shall not be payable under more than one (1) of Items A1-A9 of the policy schedule in respect

of the consequences of one (1) accident for the same insured person.

2. We shall not make any further payments during the policy period for an insured person once

payment has been made for such insured person under one (1) of Items A1-A9 of the policy schedule.

3. If a claim is to be made for any one (1) of A2-A9 of the policy schedule in respect of the consequences

of one (1) accident for an insured person, then we shall not be liable for any claim for permanent

partial disablement (A10(a)-A10(k) of the policy schedule) for the same accident for that insured

person.

4. If Item A1 of the policy schedule is covered and the insured person has not died as a result of an

accident, we will only pay a benefit from A2-A8 of the policy schedule after at least thirteen (13)

consecutive weeks from the date of the accident.

5. Item A9 of the policy schedule will only be payable after fifty-two (52) consecutive weeks of

disablement following an accident.

6. Benefits for permanent partial disablement shall be calculated by multiplying the stated percentage

shown in the table for the corresponding disablement under A10(a)-A10(k) by the monetary limit for

permanent partial disablement.

7. Item A10(k) of the policy schedule includes any permanent disability which is not covered by any of

the items A1-A9 or A10(a)-A10(j). It shall be assessed by us by considering the severity of disablement

alongside the percentages for other disablements stated in the policy schedule and shall be a

maximum of 100% and minimum of 0%. The insured person’s occupation will not be considered under

this assessment.

8. If more than one (1) of Items A10(a)-A10(k) of the policy schedule shall occur in respect of the

consequences of one (1) accident for the same insured person, the percentages shown will be added

together but in no instance shall we be liable to pay more than 100% in total.

9. Payments under Items A11 and/or A12 of the policy schedule will be paid at four (4) weekly intervals

in arrears after expiry of the corresponding waiting period.

10. Payments under Items A11 and A12 of the policy schedule shall be limited to the corresponding

benefit period shown in the policy schedule.

11. Payment under Items A11 and A12 of the policy schedule shall be limited to a maximum percentage

of the insured person’s normal weekly wage as stated in the policy schedule. It is your duty to inform

us if any claim payment exceeds this percentage and if so, payments will be proportionately reduced

until the limits are no longer exceeded.

3 Exclusions Specific to Section A

In addition to the General Exclusions set out later in this wording, we will not be liable under this Section for

any claim arising out of, based upon or attributable to:

1. illness;

2. any gradually operating cause; and

3. any naturally occurring condition or degenerative process.

9

Section B – Medical and Associated Expenses

1 What is Covered

We hereby agree with you, to the extent and in the manner herein provided:

1.1 - Overseas Medical Expenses

To reimburse you for the necessary and reasonable emergency medical expenses and emergency dental

expenses (for the relief of pain and suffering only, sublimited in the policy schedule) incurred overseas solely

and directly as a result of you sustaining a bodily injury or illness during the operative time and period of

insurance whilst on a trip.

The maximum we will pay per insured person per claim and any applicable excess per claim for this Section

are stated in the policy schedule.

1.2 - Emergency Medical Evacuation

To pay for the costs of your evacuation when arranged by us utilizing the means we believe to be most

appropriate at our sole discretion, if in our opinion it is medically appropriate to move you from one (1)

overseas location to another overseas location of our choosing for medical treatment following bodily injury

or illness during the operative time and period of insurance whilst on a trip.

The maximum we will pay per insured person per claim is stated in the policy schedule.

1.3 - Repatriation

To pay for the costs of repatriation of you and your personal belongings when arranged by us utilizing the

means we believe to be most appropriate at our sole discretion, if in our opinion it is medically appropriate to

move you and your personal belongings to your country of residence from a location overseas for medical

treatment following bodily injury or illness during the operative time and period of insurance whilst on a

trip.

The maximum we will pay per insured person per claim is stated in the policy schedule.

1.4 – Compassionate Visit and Emergency Travel Expenses

That if you are an inpatient in a hospital as a result of sustaining a bodily injury or illness during the operative

time and period of insurance whilst on a trip, we will pay the reasonable and necessary scheduled

transportation expenses and accommodation expenses incurred by you as a result and we will pay for two (2)

of your close relatives resident in your country of residence or traveling companions to visit you from your

country of residence or remain with you, if on the advice of a qualified medical practitioner and as agreed in

advance by us they are advised to do so.

The reasonable and necessary expenses incurred under this Section shall be limited to scheduled

transportation expenses and hotel accommodation expenses.

The maximum we will pay per insured person per claim is stated in the policy schedule.

1.5 – Continuing Medical Expenses

To reimburse you for reasonable medical expenses incurred whilst you are an inpatient in a hospital in your

country of residence immediately following repatriation from an overseas trip during the operative time and

period of insurance as provided by us under Section B1.3, should we consider it necessary and appropriate

to ensure that you are not medically compromised.

The maximum we will pay per insured person per claim is stated in the policy schedule.

1.6 –In-Hospital Cash

To pay the daily benefit stated in the policy schedule for each continuous and complete twenty-four (24) hour

period for which you are confined by a medical practitioner to a hospital as an inpatient due to bodily injury

or illness you suffered whilst on a trip during the operative time and policy period.

The maximum number of complete days we will pay per insured person per claim and the maximum per

insured person per day are stated in the policy schedule.

1.7 – Funeral Expenses

That in the event of your death as a direct result of bodily injury or illness you sustained whilst on an overseas

trip during the operative time and policy period, we will indemnify your estate for either:

10

a. the reasonable costs incurred for a funeral outside of your country of residence; or

b. the costs to repatriate your mortal remains and personal belongings to your country of residence.

The maximum we will pay per insured person per claim is stated in the policy schedule.

1.8 – Overseas Coma Benefit

To pay the additional daily amount stated in the policy schedule for each continuous and complete twenty-

four (24) hour period for which you are in a continuous comatose state due to a bodily injury you suffered

whilst on an overseas trip during the operative time and policy period.

The maximum number of complete days we will pay per insured person per claim and the maximum per

insured person per day are stated in the policy schedule.

1.9 – Country of Residence Transportation Expenses

That following a valid claim under Section B1.1, if you are subsequently treated in hospital in your country of

residence as an outpatient during the policy period as a direct result, we will reimburse you for any reasonable

transportation expenses to get you to and from your normal place of work or your home and hospital.

The maximum number of consecutive weeks we will pay per insured person per claim, the maximum amount

per insured person per day and the maximum total amount per insured person per claim is stated in the policy

schedule.

1.10 – Search and Rescue Expenses

To pay for the necessary and reasonable costs incurred if whilst on an overseas trip you are reported as missing

and it becomes necessary for the rescue or police authorities to instigate a search and rescue operation where:

a. it is known or believed that you may have suffered bodily injury or illness; or

b. local weather or safety conditions are such that it becomes necessary to do so in order to prevent you

from suffering bodily injury or illness.

The maximum we will pay per insured person per claim is stated in the policy schedule.

We will only pay a claim under this benefit provided:

a. The Emergency Medical Assistance Service must be informed immediately or as soon as reasonably

possible of any potential Search and Rescue Expenses claim.

b. You must comply at all times with local safety advice and adhere to recommendations prevalent at the

time of the trip, or the excursion/activity whilst on a trip.

c. You must not knowingly endanger either your own life or the life of any other insured person or

engage in activities where your experience or skill levels fall below those reasonably required for you

to participate in such activities.

d. We will only pay your proportion of any search and rescue operation.

e. We will only pay up to the point where you are recovered by a search and rescue operation or at the

time when the search and rescue authorities advise that continuing the search is no longer viable.

2 Conditions Specific to Section B

In addition to the General Conditions set out later in this wording, the following conditions apply to this Section:

1. The Emergency Assistance Provider must be contacted by you or a person acting on your behalf for

approval prior to incurring any expenses under this Section, except in the event that this is not possible

for reasons beyond your control due to an emergency situation. In that instance, the Emergency

Assistance Provider must be contacted as soon as reasonably practicable and we shall at our sole

discretion only reimburse those expenses that we would have provided under the same circumstances.

2. Expenses under Section B1.5 shall only be payable for a bodily injury that was sustained or for an

illness that first manifested itself whilst you were overseas and where repatriation was directed by us

or the Emergency Assistance Provider.

3. If you are traveling to an EU country or Switzerland or the UK and have either a European Health

Insurance Card (EHIC) or a UK Global Health Insurance Card (GHIC), you are advised to take this with

you whilst traveling. As a result, you may be entitled to receive treatment in the EU, Switzerland or UK

without paying an excess.

4. You shall reimburse us for any costs that are made in good faith under this Section by the Emergency

Assistance Provider to any person who is not insured under this Section.

3 Exclusions Specific to Section B

In addition to the General Exclusions set out later in this wording, we will not be liable under this Section for

any claim arising out of, based upon or attributable to:

11

1. pre-existing medical conditions detailed in the Pre-Existing Medical Conditions Section;

2. normal costs of pregnancy unless there have been medical complications resulting from a bodily

injury or illness whilst on a trip;

3. a) expenses incurred under Section B (excluding B1.5) more than twelve (12) months after the date the

need for treatment for your bodily injury or illness first arises;

b) expenses incurred under Sections B1.1 and B1.4 after we deem that you are fit to travel to your

country of residence;

c) expenses incurred under Section B1.5 more than three (3) months after you are repatriated to your

country of residence;

4. treatment that we believe could have been delayed until your return to your country of residence;

5. private health treatment or single rooms unless specifically approved by the Emergency Assistance

Provider;

6. medical expenses incurred whilst on a trip inside your country of residence; and

7. repeat prescription medications.

Section C - Trip Interruption

1 What is Covered

We hereby agree with you, to the extent and in the manner herein provided:

1.1 – Cancellation, Curtailment and Amendment

That for a trip scheduled to take place during the operative time and policy period, if you are forced to cancel

such trip before departure or curtail or amend such trip following departure due to any one (1) of the Listed

Reasons detailed below, we will reimburse you for the corresponding reasonable and necessary expenses

detailed in the following table:

Expense

Curtailment

following

departure

Amendment

following

departure

Cancellation

before

departure

Irrecoverable transportation and accommodation

expenses which have been paid for or are legally

required to be paid for under a contract and must be

cancelled.

Yes

No

Yes

Additional transport and accommodation

expenses to return you to your country of

residence.

Yes

No

No

Additional transport and accommodation

expenses to allow you to complete your original

trip.

No

Yes

No

Non-refundable deposits which have been paid for

or are legally required to be paid for under a contract

and must be cancelled.

Yes

Yes

Yes

Listed Reasons

a) death, serious injury, sudden illness, complications in pregnancy or compulsory medical quarantine of:

i. you;

ii. your traveling companion or their close relative; or

iii. your close relative;

provided cancellation, curtailment or alteration of the trip is confirmed as medically necessary by a

medical practitioner;

b) your unemployment provided that the unemployment qualifies for payment under any unemployment

act in your country of residence;

c) your being summoned to jury service or to be a witness in a court, compulsory quarantine, military

service, medical service, subpoena or exigency of duty;

d) major damage to your home causing it to become inhabitable or burglary or attempted burglary to

your home resulting in police requesting your presence, within fourteen (14) days immediately prior

to the planned trip or occurring during your trip;

e) adverse weather conditions, strike, riot or civil commotion resulting in scheduled public transport

services being cancelled or curtailed;

f) a natural catastrophe resulting in the Foreign and Commonwealth Office recommending against all

but essential travel to the trip destination or the government of the country of trip destination declaring

12

a state of emergency;

For amendment of a trip following departure only, the above Listed Reasons are extended to include natural

catastrophe (other than as described in Listed Reason f above), avalanche, explosion, fire, landslide and

quarantine, if an accommodation provider or local or national authority have deemed it necessary for you to

leave a pre-booked and prepaid accommodation, written confirmation of this is provided to us and where costs

cannot be claimed back from a service provider. This extension is sub-limited in the policy schedule as

Amendment due to Catastrophe.

The maximum we will pay per claim per insured person and any applicable excess are stated in the policy

schedule.

1.2 – Delay

a. Reimbursement – To reimburse you for irrecoverable payments paid or contracted to be paid for travel

and accommodation and non-refundable deposits in the event that you cancel your trip that was scheduled to

take place during the operative time and period of insurance after a delay to your outward or homeward

scheduled pre-booked public conveyance of at least twenty-four (24) consecutive hours as a direct result of an

exceptional circumstance.

The maximum we will pay per claim per insured person and any applicable excess is stated in the policy

schedule.

b. Monetary Benefit – To pay to you an amount for each completed consecutive twelve (12) hour period

your outward or homeward pre-booked scheduled conveyance due to take place during the operative time

and period of insurance is delayed due to an exceptional circumstance.

The maximum we will pay per complete twelve (12) hour period per insured person and per claim per insured

person is stated in the policy schedule.

1.3 – Missed Departure

To reimburse you for the reasonable and necessary additional transport and accommodation expenses to

reach the final destination of your trip scheduled to take place during the operative time and policy period,

if you arrive late at the initial departure point of the trip as shown on your itinerary due to:

a) your scheduled public transport being delayed;

b) the car you are travelling in being involved in an accident or breaking down; or

c) the car you are travelling in being delayed due to exceptional and unforeseen traffic flow congestion

and you can support this with documentary evidence.

The maximum we will pay per insured person per claim and any excess is stated in the policy schedule.

1.4 – Hijack and Kidnap

To pay you an amount for each complete twenty-four (24) hour period that you are detained as a result of a

hijack or kidnap occurring during the operative time and period of insurance whilst on an overseas trip after

the initial twenty-four (24) hour detained period for which there will be no payment by us. For the avoidance of

doubt, we will not pay for your initial twenty-four (24) hour period of detainment.

The maximum we will pay per twenty-four (24) hour period per insured person and per claim per insured

person are stated in the policy schedule.

2 Conditions Specific to Section C

In addition to the General Conditions set out later in this wording, the following conditions apply to this Section:

1. You will only be reimbursed once for the same outgoing cost under either Section C1.1 or C1.2,

whichever reimburses the higher amount.

2. You will only be reimbursed once for the same delay under either Section C1.2a or C1.2b.

3. You must allow sufficient time for the transport you are travelling in to arrive and deliver you to the

scheduled point of departure so that you can check-in according to your itinerary to claim under

Section C1.2 and C1.3.

4. You must comply with the terms of contract of the travel agent, tour operator or provider of transport.

3 Exclusions Specific to Section C

In addition to the General Exclusions set out later in this wording, we will not be liable under this Section for

any claim arising out of, based upon or attributable to:

For Section C1.1:

13

1. costs which have been paid for or incurred on behalf of a person other than an insured person, the

cost of which is to be borne by you;

2. refusal or disinclination to travel or change travel plans;

3. your or an insured person’s financial circumstances;

4. your redundancy, resignation or termination of employment within thirty (30) days immediately prior

to a planned trip or during your trip;

5. costs due to the service of any means of transport being temporarily or permanently suspended on the

recommendation or orders of the Government or any Public Authority or manufacturer in any country,

except for when the airspace in your country of residence from where you are scheduled to depart

from or the port or airport that you are due to travel from or through is closed due to a natural

catastrophe for at least twenty-four (24) hours prior to the date and time of departure as stated on the

ticket or itinerary, subject to you proving these costs are unable to be refunded from the provider;

6. financial failure or omission or neglect of any provider or its agent of transport or accommodation;

7. strike, labour dispute or failure of a means of transport except

a. after a delay to departure of at least twenty-four (24) hours of a pre-booked transport, and

b. only if the delay is due to a strike or industrial action which did not exist or the possibility of

which did not exist and for which no advanced warning had been given prior to the date on

which the transport was booked;

8. food and beverages;

9. pre-existing medical conditions detailed in the Pre-Existing Medical Conditions Section;

10. failing to check in according to the itinerary unless the failure was due to strike or industrial action;

11. regulations made by any Government or public authority;

12. claims arising from your failure to provide appropriate travel documents or visas;

13. compensation for any air miles or holiday points used to pay for the trip in part or in full; and

14. a) Coronavirus disease (COVID-19);

b) Severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2);

c) any mutation or variation of a) or b) or disease caused by a) or b);

d) any measures taken by any governmental, public or other authority or any other person for the

prevention, suppression, mitigation, cleaning or removal of any virus or disease referred to in a), b), or

c) listed herein; or

e) any fear or threat of a), b), c) or d) listed in herein.

This exclusion does not apply to any claim for cancellation of a trip before departure as a direct result

of:

i. you being positively diagnosed with a), b), or c) herein which directly results in:

A. an official requirement for you to undertake compulsory quarantine or self-isolation, or

B. you being certified by a medical practitioner as being unable to travel due to

symptoms resulting therefrom;

ii. your close relative with whom you reside at your home being positively diagnosed with a),

b), or c) herein which directly results in an official requirement for you to undertake

compulsory quarantine or self-isolation.

For Section C1.2

1. costs due to the service of any means of transport being temporarily or permanently suspended on the

recommendation or orders of the Government or any Public Authority or manufacturer in any country,

except for when the airspace in your country of residence from where you are scheduled to depart

from or the port or airport that you are due to travel from or through is closed for at least twenty-four

(24) hours prior to the date and time of departure as stated on the ticket or itinerary, subject to you

proving these costs are unable to be refunded from the provider;

2. any loss from the time you failed to take the first alternative reasonable travel during a delay period;

3. your failure to obtain written confirmation from the carriers or their agents of the number of hours

delay and the reason for such delay;

4. failing to check in accordance with the time indicated by the conveyance; and

5. strike labour dispute or industrial action which existed or the possibility of which existed and for which

advance warning had been given prior to the date on which the trip was booked.

For Section C1.3

1. you not doing everything possible, as determined by us, to get to the departure point of your trip at

the time specified by the transport provider.

For Section C1.4

1. if you have ever had any insurance similar to that under Section C1.4 excluded or cancelled or declined

by any insurance provider in the past.

14

15

Section D - Personal Baggage

1 What is Covered

We hereby agree with you, to the extent and in the manner herein provided, that if during your trip during the

operative time and period of insurance:

a) your personal baggage is lost, stolen or damaged, we will at our sole discretion either replace or

repair or reimburse the cost for the loss of, theft of or damage to your personal baggage.

b) your personal baggage is delayed, we will reimburse the cost of reasonable and necessary essential

items purchased by you during your trip after a delay to your personal baggage of a minimum of

twenty-four (24) consecutive hours from the time you arrive at your outbound trip destination.

c) your keys to your home or vehicle are lost, we will reimburse the cost (including parts and labour) of

replacing the relevant locks or keys. We will not arrange for replacement to be carried out.

The maximum we will pay overall for this Section D per claim per insured person, per Sub-Section per claim

per insured person, per single item, pair or set (sub-limited for valuables) and any applicable excess are stated

in the policy schedule.

2 Conditions Specific to Section D

In addition to the General Conditions set out later in this wording, the following conditions apply to this Section:

1. Any costs payable under Section D1b will be subtracted from a subsequent payment under Section

D1a where a delay becomes a permanent loss.

2. You must retain any damaged personal baggage in respect of which a claim is made under this

Section and we shall be entitled to keep and salvage such damaged property if we pay the claim

made.

3. You must take every possible step and reasonable precaution to ensure your personal baggage is

kept safe, properly packaged, carried and secured during the trip.

3 Exclusions Specific to Section D

In addition to the General Exclusions set out later in this wording, we will not be liable under this Section for

any claim arising out of, based upon or attributable to:

1. loss of money;

2. damage caused in replacing locks;

3. loss or theft if the incident is not reported within forty-eight (48) hours of discovery to the most

appropriate of any of the following and for which a written report is not obtained: the local police or

other appropriate authority, hotel, airline or tour operator;

4. confiscation or detention or destruction or damage by customs or any other authority, or any property

which is contraband or which is or has been illegally transported or traded;

5. theft or attempted theft from an unattended vehicle, unless stored out of sight in a locked boot or

compartment and there is evidence that the vehicle has been broken into;

6. electrical or mechanical breakdown;

7. moth, vermin, wear and tear (except where wear and tear to the fastening of an item to a carrier or

container causes loss or damage to the item) or gradual deterioration, or atmospheric or climatic

conditions or damage sustained due to any process or while actually being cleaned or worked upon

or resulting from these processes;

8. loss, damage or theft of any land, sea or air or other motorised conveyance and/or its accessories;

9. pressure in an aircraft cargo hold;

10. damage to brittle items unless sustained as a result of an accident in a conveyance; and

11. personal baggage sent as freight or under a bill of lading.

Section E – Money

1 What is Covered

We hereby agree with you, to the extent and in the manner herein provided, that if during your trip during the

operative time and period of insurance:

a) your money is lost or stolen whilst in your custody and control, we will indemnify you for this loss. This

is extended to include loss or theft of money in your custody and control within the forty-eight (48)

hours immediately prior to or following the trip if the money was obtained for the purpose of the trip.

16

b) you suffer financial loss as a result of your payment card being lost or stolen during the trip and

subsequently used without your authorisation by any person other than your close relative or your

traveling companion, we will indemnify you for such loss.

c) your travel documents, driving licence, visa or passport that are required for the trip are lost or

damaged, we will reimburse the reasonable and necessary costs (including for additional travel and

accommodation) of obtaining official permanent or temporary replacements. This is extended to

include theft of such documents if they are stolen within the seven (7) days immediately prior to the

departure date of the trip.

d) your rental vehicle rented under a licensed rental vehicle agreement from a licensed rental vehicle

company is lost, stolen or damaged, we will reimburse you for any excess or deductible you become

legally liable to pay under a rental vehicle insurance policy as a result. We will only reimburse under

this Policy for one (1) claim per period of insurance for all insured persons.

The maximum we will pay overall for this Section E per claim per insured person, per Sub-Section and any

applicable excess are stated in the policy schedule. Additionally, Section E1a is sub-limited in respect of cash.

2 Conditions Specific to Section E

In addition to the General Conditions set out later in this wording, the following conditions apply to this Section:

1. You must take every possible step and reasonable precaution to ensure your money is kept safe,

properly packaged, carried and secured during the trip.

2. You must comply with the terms and conditions of the payment card issuer.

3 Exclusions Specific to Section E

In addition to the General Exclusions set out later in this wording, we will not be liable under this Section for

any claim arising out of, based upon or attributable to:

1. loss or theft if the incident is not reported to police or another appropriate authority within seventy-

two (72) hours of discovery and for which a written report is not obtained;

2. fraudulent use of payment cards if you have not complied with the terms and conditions under which

the card was issued;

3. theft or attempted theft of money from an unattended vehicle, unless stored out of sight in a locked

boot or compartment and there is evidence that the vehicle has been broken into;

4. fraudulent use of credit cards, charge cards or banker’s cards where this is covered by a guarantee

given by the issuing bank or company to you;

5. monetary shortfall due to error, omission, delay, exchange transaction or depreciation in value;

6. deliberate loss or damage to a rental vehicle by you;

7. rental vehicle wear and tear, gradual deterioration, mechanical or electrical failure; and

8. rental vehicle damage or loss that existed prior to the commencement of the rental period.

Section F – Personal Liability

1 What is Covered

We hereby agree with you, to the extent and in the manner herein provided, that if during your trip during the

operative time and policy period you cause the accidental bodily injury or accidental death of any other

person or loss or damage to the other person’s property, we will:

a) pay for compensatory damages you become legally liable to pay as a result; and

b) reimburse the reasonable and necessary legal costs and expenses for settling and defending a claim

made against you as a result.

The maximum we will pay per claim per insured person is stated in the policy schedule.

2 Conditions Specific to Section F

In addition to the General Conditions set out later in this wording, the following conditions apply to this Section:

1. No offer or promise of payment or admission of any liability or fault or negotiation must be made to

any party without our prior written approval.

2. Legal costs and expenses incurred by you will only be reimbursed should they have been agreed by

us.

3. You or your representatives must not become involved in any litigation without our prior written

approval.

4. You must give us immediate notice of any inquest, impending prosecution, fatal enquiry and event

that might give rise to a claim under this Section.

17

5. We must be provided with all documents relating to a claim or potential claim, including but not limited

to every writ, summons, letter, claim and process, under this Section immediately upon receipt of such

documents by you.

6. We must be provided with all reasonable assistance required by us by you and your legal

representatives.

7. Should we so choose, we shall have the right to act in your name and take over the defence and/or

settlement of any claim. This shall extend to include, at our own expense, any prosecution or claim for

indemnity or damages against any other person.

8. Should we so choose, at any time we may pay you the amount shown for this Section in the policy

schedule (minus any sums already paid as compensation) or an amount that is lesser for which the

claim or a series of claims can be settled. Following this, we shall not be under any further liability in

respect of the claim or series of claims, except for any costs or expenses incurred prior to the date of

such payment.

9. If your liability in respect of a claim or series of claims exceeds the amount shown for this benefit in the

policy schedule, the amount of our liability for the claim or series of claims shall be reduced in the

same proportion to the difference between the amount shown for this benefit in the policy schedule

and the total amount you will settle in relation to the claim or series of claims.

3 Exclusions Specific to Section F

In addition to the General Exclusions set out later in this wording, we will not be liable under this Section for

any claim arising out of, based upon or attributable to:

1. the insured person’s family;

2. ownership, custody, or use of any motor vehicle or mechanically propelled vehicle, aircraft, watercraft,

firearms, land or buildings, or animals;

3. the conduct of a business, profession or trade, including you providing professional advice or services

or employment;

4. punitive, aggravated or exemplary damages;

5. any wilful, unlawful, or malicious act;

6. material property belonging to or held in trust by you or your family or your employee or agent except

for your temporary accommodation whilst on a trip;

7. your participation in terrorist activity;

8. the transmission of a communicable disease or virus; and

9. any liability agreed by you unless such liability would have attached to you in the absence of that

agreement.

Section G – Legal Expenses

1 What is Covered

We hereby agree with you, to the extent and in the manner herein provided, that if during your trip during the

operative time and policy period a third party causes accidental bodily injury to you or your accidental

death, we will pay for your legal expenses incurred or legal expenses incurred on behalf of you in pursuit of

a civil claim for damages or compensation against the third party.

The maximum we will pay from a single original event or circumstance for all legal expenses reasonably and

necessarily incurred is stated in the policy schedule.

2 Conditions Specific to Section G

In addition to the General Conditions set out later in this wording, the following conditions apply to this Section:

1. You must report any original event or circumstance that is likely to give rise to a claim under this Section

to us as soon as practicably possible and in any event no less than six (6) months after you knew or

ought to have known about the event or circumstance. In respect of an appeal or defence of an appeal

this must be reported to us at least ten (10) working days prior to the deadline for the appeal.

2. Our consent to pay any legal expenses must firstly be obtained in writing before they are incurred, or

this shall entitle us to withdraw cover under this Section and recover any legal expenses we have paid.

3. In the first instance, we will appoint a legal representative. If, however, there are reasonable

circumstances for this not to be appropriate, such as a conflict of interest, you may nominate a legal

representative by sending us their name and address. If we do not approve of the legal

representative that has been chosen, you may choose an alternative. If there is still a disagreement

regarding the nomination of the legal representative, we will ask the president of a relevant national

law society to choose a suitable individual, the choice of whom all parties must abide by.

4. You and your representatives and the legal representative must fully cooperate with us, keep us fully

18

informed at all times and pass on any information we require in regard to any third party claim or

legal proceedings under this Section of the Policy. You must also cooperate fully with the legal

representative. We are entitled to have access to and be provided by the legal representative on

request, any information or documentation or advice relating to any third party claim or legal

proceedings under this Section of the Policy.

5. Our decision to allow the commencement and the continuation of legal proceedings will take into

account the opinion of the legal representative and our own counsel. Consent will be given if:

a) the collective legal opinion of the legal representative and our own counsel is that there is a

continuing reasonable prospect of success (more than 50%) for pursuing the legal proceedings;

and

b) the cost in pursuing a third party claim is likely to be less than the amount of damages or

compensation that you are likely to receive; and

c) it is reasonable for legal expenses to be paid by us.

6. If the opinion of the legal representative, you and/or our own counsel differ, we may at our own cost

obtain an opinion from a qualified barrister to be mutually selected, or if agreement upon selection

cannot be reached, to be chosen by the president of a relevant national law society. This opinion will

determine whether we give our consent to the commencement and continuation of legal

proceedings.

7. If we do not give our consent to the commencement of legal proceedings, then we will only pay for

the reasonable costs in obtaining the initial opinion of the legal representative upon the merits of

pursuing a third party claim for damages or compensation. If we do not give our consent for the

continuation of legal proceedings and as such we withdraw our consent, then we will only pay for the

costs incurred under this Section up until the date that consent to continue is withdrawn by us.

8. If the opinion of the legal representative, you and/or our own counsel is that there is a reasonable

prospect of success but the cost of pursuing a third party claim is likely to be more than the amount

of damages or compensation that you are likely to receive, the maximum we will pay is the anticipated

amount of damages or compensation or the applicable limit of indemnity stated on the policy

schedule, whichever is the lesser amount. This shall be payable at our sole discretion.

9. All claims including any appeal against a judgment resulting from the same original cause, event, or

circumstances, will be regarded as one claim.

10. We may at our discretion assume control, in your name, of any third party claims or legal

proceedings under this Section at any time.

11. If you settle or withdraw a third party claim without our prior written agreement, cover under this

Section will end and we will be entitled to recover any legal expenses we have incurred from you.

12. If you refuse to accept a reasonable offer or payment into court to settle a third party claim against

our and the legal representative’s recommendation, then we may refuse to pay any further benefit

under this Section.

13. No agreement to settle on the basis of both parties paying their own costs is to be made without our

prior written agreement.

14. If the legal representative is dismissed without our prior written agreement, cover under this Section

will end and we will be entitled to recover any legal expenses we have incurred from you.

15. If following any successful claim or legal proceedings an award of costs is made in the favour of you

or those acting on your behalf, any legal expenses paid by us will be reimbursed by you or those

acting on your behalf to us to the extent of the full amount of such costs awarded.

16. Apart from the decision of appointing a legal representative, or the commencement or continuation

of legal proceedings, if there is any dispute between you and us in respect of acceptance, control,

handling or refusal of any claim under this Section, this will be referred to a single arbitrator. The

arbitrator will be a solicitor or barrister agreed by you and us, or if there is a dispute as to the choice,

one who is chosen by the president of a relevant national law society. The arbitrator’s decision shall be

final and binding on all parties, including the apportionment of costs.

17. Third parties do not have any right to enforce the terms of this Section, including under The Contracts

(Rights of Third Parties) Act 1999.

3 Exclusions Specific to Section G

In addition to the General Exclusions set out later in this wording, we will not be liable under this Section for

any claim arising out of, based upon or attributable to:

1. the defending of any civil claim or legal proceedings made or brought against you, including any

counterclaims made against you in connection with any third party claim;

2. illness;

3. death or bodily injury that occurs gradually or is not caused by an accident, including deep vein

thrombosis (DVT) or its symptoms in relation to air travel;

4. when you do not keep to the terms, conditions and exclusions under this Section;

5. when there is more specific insurance under another policy that you hold or where there is no

19

possibility of recovery under another insurance policy because that insurer has refused the claim;

6. fines or other penalties imposed by a court of criminal jurisdiction or other authority;

7. any criminal act deliberately or intentionally committed by you;

8. your driving a motor vehicle without a valid licence and/or insurance;

9. pursuing any claim against any travel agent, tour operator, insurer or their agents;

10. clinical negligence;

11. an application for judicial review;

12. any claim or circumstance notified more than six (6) months after the event from which the cause of

action arose or where you have failed to notify us of the event giving rise to a third party claim within

a reasonable time and we believe this failure has prejudiced our position;

13. legal expenses incurred by you making a claim against the policyholder, your employer, us, your

close relative, any other person covered under this Policy, or any organisation or person involved in

arranging this Policy;

14. legal expenses incurred before we have given our consent;

15. legal expenses chargeable by the legal representatives under contingency fee arrangements; and

16. slander or libel.

Section H – Winter Sports

1 What is Covered

We hereby agree with you, to the extent and in the manner herein provided:

1.1 – Winter Sports Equipment

That if winter sports equipment you are using on a trip during the policy period and operative time is lost,

stolen or damaged by accident, we will reimburse you for:

a) Winter Sports Equipment Owned by You

The lower amount of replacement or repair for winter sports equipment owned by you. This will be

payable only after making an allowance for wear, tear and loss of value using the following scale:

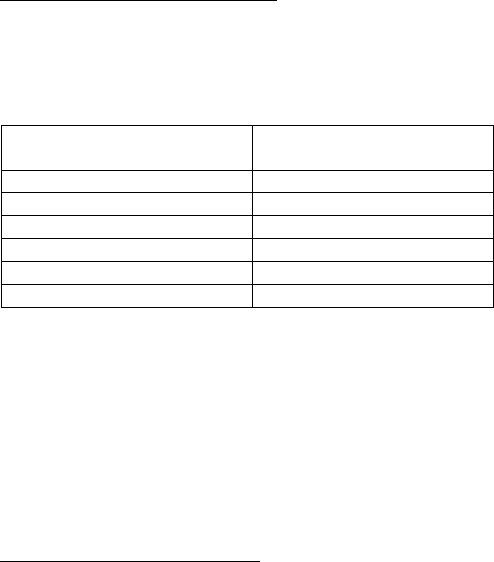

Equipment age (years)

Deduction from the price

you paid

0-1

10%

1-2

20%

2-3

40%

3-4

50%

4-5

80%

5+

100% (nothing payable)

b) Winter Sports Equipment Hired by You

The lower amount of replacement or repair for winter sports equipment hired by you.

c) Replacement Winter Sports Equipment Hire

The hire of winter sports equipment for the rest of your trip, following a valid claim under Section

H1.1b only.

d) Lift Pass

The cost of a replacement lift pass but only in respect of loss or theft.

The maximum we will pay per complete twenty-four (24) hour period per insured person for equipment hire,

per claim per insured person and any applicable excess is stated in the policy schedule.

1.2 – Bodily Injury and Illness

That if you suffer illness or bodily injury and as a direct result you are certified by a medical practitioner as

being unable to take part in your pre-booked winter sports activities, we will:

a) Non-Refundable Costs Reimbursement

Reimburse you for the non-refundable costs of ski school lessons, winter sports equipment hire and lift

passes, if these were hired for use on a trip scheduled to take place during the policy period and

operative time.

b) Compensatory Daily Benefit

Pay you a daily amount per complete twenty-four (24) hour period that you are certified as being

unable to take part, if your illness or bodily injury occurred whilst you were on a trip during the policy

period and operative time.

The maximum we will pay per complete twenty-four (24) hour period per insured person and/or per insured

20

person per claim are stated in the policy schedule.

1.3 – Interruption

a) Avalanche

That if whilst on a trip during the operative time and policy period you are unavoidably delayed from

arriving at or leaving a pre-booked resort due to an avalanche, we will reimburse you for the

reasonable and necessary additional transport and accommodation expenses incurred as a result.

b) Resort Closure

That if whilst on a trip during the operative time and policy period there is not enough snow, too

much snow or high winds resulting in all ski lifts and ski schools at your pre-booked resort being closed,

we will either:

i. reimburse you for the reasonable additional costs you pay to travel to another resort; or

ii. pay you a daily amount per complete twenty-four (24) hour period that the resort is closed if

there is no other resort available,

whichever is the lesser amount.

The maximum we will pay per complete twenty-four (24) hour period per insured person and/or per insured

person per claim are stated in the policy schedule.

2 Conditions Specific to Section H

In addition to the General Conditions set out later in this wording, the following conditions apply to this Section:

1. You must make a reasonable effort to keep your winter sports equipment safe and secure.

2. If your winter sports equipment is lost or stolen you must take all reasonable steps to get it back.

3. If your winter sports equipment is lost or damaged by a transport provider, authority or

accommodation provider you must report the details of the loss or damage to them in writing within

their timeframe limits (where applicable) and get written confirmation from them in return.

4. If your winter sports equipment is lost or stolen you must report the details of the theft to police within

twenty-four (24) hours and get written confirmation from them in return.

3 Exclusions Specific to Section H

In addition to the General Exclusions set out later in this wording, we will not be liable under this Section for

any claim arising out of, based upon or based upon or attributable to:

1. your deliberate or malicious damage to or carelessness or neglect of winter sports equipment resulting

in it being lost or damaged;

2. loss or theft or damage of winter sports equipment when it is stored in a motorised vehicle;

3. damage to winter sports equipment from moth and vermin, or any process of cleaning, restoring or

repairing; and

4. any claims under Section H1.3b for resort closure if the winter sport you had pre-booked to take part

in during your trip is not affected by the closure of ski lifts or ski schools, including but not limited to

cross country skiing.

21

General Exclusions

This Policy does not cover claims in any way caused or contributed to by:

1. pre-existing medical conditions detailed in the Section Pre-Existing Medical Conditions;

2. whilst on a trip acting in a way which goes against the advice of a medical practitioner;

3. an event or circumstance of which you were aware of or could reasonably be expected to be aware of

at the time this Policy was purchased or your travel was booked (whichever occurs last) and which

could reasonably be expected to lead to you making a claim under this Policy under Sections C1.1,

C1.2, C1.3 and H1.2a;

4. sports or pastimes not listed within the Sports and Pastimes Section;

5. winter sports unless the Winter Sports Section is included as shown in the policy schedule;

6. winter sports after the insured person has been travelling on winter sports holidays for more than thirty

(30) days (not necessarily consecutively) during the policy period;

7. war in an insured person’s country of residence or secondment, including losses in relation to or to

control, prevent or suppress such war, unless an insured person is already on a trip when such war is

declared;

8. the insured person piloting or crewing any aircraft;

9. the insured person being a full-time member of the military or armed forces, or a member of any

reserve forces called out for permanent duties;

10. any trip connected with the business of the policyholder;

11. voluntary work;

12. terrorist activity when you are taking an active part therein;

13. the refusal, failure or inability of any person, company or organisation including any carrier or service

provider to provide services, facilities or accommodation by reason of their own financial default or

the financial default of any person, company or organisation with whom or with which they have

business dealings;

14. your suicide or attempted suicide or intentional self-injury, except under Section B1.3 for repatriation

of mortal remains following suicide;

15. you deliberately exposing yourself to exceptional danger, except in an attempt to save human life;

16. your own criminal or intentional illegal act, including violating the laws or regulations of a country that

is being visited or acting in violation or contravention of any government or government authority,

regulation or prohibition of the country in which you are travelling;

17. being under the influence of alcohol or drugs, other than those prescribed by a medical practitioner

but not for the treatment of drug addiction;

18. pregnancy, childbirth or any medical complications resulting therefrom if you are, or would have been,

pregnant for thirty-five (35) weeks or longer at any point during a trip;

19. claims arising as the consequence of a loss, for example loss of earnings due to an accident;

20. any claims resulting from travel to any country or region where the Foreign Commonwealth and

Development Office or other similar regulatory body in your country of residence has issued warnings

against all but essential travel to;

21. any excess amount or waiting period, the cost of which is to be borne by you; and

22. claims for which you do not provide us with evidence that we reasonably require.

Key Information

The following general exclusions apply to the whole of this Policy. In addition to these General Exclusions,

there are additional exclusions which apply within the Policy.

22

General Conditions

1.1 Geographical Area

You will be covered for trips limited to the Geographical Area stated in the policy schedule.

1.2 Maximum Length of Trips

The maximum length of an overseas trip and/or a trip within your country of residence is shown in the policy

schedule.

1.3 Exposure

This wording covers claims arising out of death and bodily injury caused by exposure to the elements as a

result of an accident covered under this wording.

1.4 Duplication Of Claims

If a loss is covered under more than one Section of this Policy we will provide cover under the Section that