NBER WORKING PAPER SERIES

DO ENLARGED FISCAL DEFICITS CAUSE INFLATION:

THE HISTORICAL RECORD

Michael D. Bordo

Mickey D. Levy

Working Paper 28195

http://www.nber.org/papers/w28195

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

December 2020

Paper prepared for the IIMR Annual Monetary Conference “The Return of Inflation? Lessons

from History and Analysis of Covid -19 Crisis Policy Response” organized by University of

Buckingham, England, October 28 2020. For helpful comments on an earlier draft we thank:

Michael Boskin, Andy Filardo, Harold James, Owen Humpage, Eric Leeper and Hugh Rockoff.

For valuable research assistance we thank Roiana Reid and Humberto Martinez Beltran. The

views expressed herein are those of the authors and do not necessarily reflect the views of the

National Bureau of Economic Research.

NBER working papers are circulated for discussion and comment purposes. They have not been

peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies

official NBER publications.

© 2020 by Michael D. Bordo and Mickey D. Levy. All rights reserved. Short sections of text, not

to exceed two paragraphs, may be quoted without explicit permission provided that full credit,

including © notice, is given to the source.

Do Enlarged Fiscal Deficits Cause Inflation: The Historical Record

Michael D. Bordo and Mickey D. Levy

NBER Working Paper No. 28195

December 2020

JEL No. E3,E62,N4

ABSTRACT

In this paper we survey the historical record for over two centuries on the connection between

expansionary fiscal policy and inflation. As a backdrop, we briefly lay out several theoretical

approaches to the effects of fiscal deficits on inflation: the earlier Keynesian and monetarist

approaches; and modern approaches incorporating expectations and forward looking behavior:

unpleasant monetarist arithmetic and the fiscal theory of the price level.

We find that the relationship between fiscal deficits and inflation generally holds in wartime

when fiscally stressed governments resorted to the inflation tax. There were two peacetime

episodes in the early twentieth century when bond financed fiscal deficits that were unbacked by

future taxes seem to have greatly contributed to inflation: France in the 1920s and the recovery

from the Great Recession in the 1930s in the U.S. In the post-World War II era a detailed

examination of the Great Inflation in the 1960s and 1970s in the U.S. and the U.K. suggests that

fiscal influences on monetary policy was a key factor. Finally we contrast the experience of the

Great Financial Crisis of 2007-2008, when both expansionary fiscal and monetary policy did not

lead to rising inflation, with the recent pandemic, which may involve the risks of fiscal

dominance and future inflation.

Michael D. Bordo

Department of Economics

Rutgers University

New Jersey Hall

75 Hamilton Street

New Brunswick, NJ 08901

and NBER

Mickey D. Levy

Berenberg Capital Markets LLC

1251 Avenue of the Americas, 53rd Floor

New York, NY 10020

2

Do Enlarged Deficits Cause Inflation? The Historical Record

1. Introduction

The current global Covid -19 pandemic has led to massive government responses across the

world, including lockdowns of normal activities and expansive fiscal and monetary policies to

stabilize their economies and head off financial stresses. In the U.S. and UK and other advanced

nations, expansive fiscal programs raised budget deficits and pushed debt-to-GDP ratios to the

highest levels since World War II or in the preceding two centuries . See figures 1 and 2. Central

banks lowered interest rates to zero, introduced extensive lender of last resort and credit

facilities and engaged in large-scale asset purchases of government bonds. The low interest

rates and central bank purchases of government bonds lowered debt service costs and

facilitated the dramatic fiscal expansions.

In many respects, the initial response combined aspects of the policy response in several

overlapping crisis scenarios in the past: World Wars I and II, the Great Depression, and the

Global Financial Crisis (Bordo, Levin and Levy 2020). These earlier episodes of induced fiscal and

monetary expansion in the 1930s and the World Wars led to rising price levels and inflation. In

this paper we survey the historical record for over two centuries on the connection between

expansionary fiscal policy and inflation and find that fiscal deficits that are financed by

monetary expansion tend to be inflationary. However, some research finds that money finance

is not required for an inflationary outcome.

2

In section 2 we briefly lay out several theoretical approaches to the effects of fiscal deficits on

inflation: the earlier Keynesian and Quantity theoretic approaches; and modern approaches

incorporating expectations and forward looking behavior:unpleasant monetarist arithmetic and

fiscal theory of the price level. In section 3 we survey the historical wartime records,

distinguishing between earlier wars of the eighteenth century including the Napoleonic wars,

and modern wars including the World Wars, Korea and Vietnam. In section 4 we examine the

peacetime episodes in the interwar period of the twentieth century linking fiscal expansion to

2

Earlier surveys by Schwartz (1973) and Capie (1979) cover some of the same ground.

3

inflation. In section 5 we focus on the Great Inflation of the 1960s-1970s in the U.S. and the

U.K. Section 6 covers the recent experience since the 2008-2009 Great Financial Crisis in which

high deficits did not result in inflation and the experience of the pandemic, which may involve

future inflation risks. We conclude in section 7 with some policy lessons, particularly in light of

historically high deficits.

2. Theoretical Perspectives

In the post-World War II era two theories have dominated economists approaches to the link

between fiscal deficits and inflation.

Simple Keynesian models. The prevalent view on the relationship between fiscal deficits and

inflation is based on the post-WWII Keynesian models that posited that any increase in

aggregate demand (consumption expenditures, investment expenditures, government

expenditures less tax receipts and exports less imports) will lead to an increase in nominal

income. The extent to which it leads to a rise in the price level depends on the shape of the

aggregate supply curve. The early Keynesians also argued that monetary policy would be

impotent because the economy was in a liquidity trap so that money does not matter.

Accordingly, fiscal policy is the only tool to influence the economy

3

. The early Keynesians

posited an L-shaped supply curve in which shifts in aggregate demand would result in increase

in real activity until full employment is reached, when expansionary demand would be reflected

in rises in the price level. In the early Phillips curve framework, the supply curve is positively

shaped so that expansionary aggregate demand would lead to both rising prices and output

(Lipsey 1960). Thus, fiscal policy can be inflationary in Keynesian models.

Simple quantity theory of money. Changes in nominal income are generated by changes in the

money supply assuming a stable money demand function that determines the income velocity

of money. Inflation (sustained increases in the price level) requires sustained money growth

(Friedman 1956). Once increases in inflation become expected, higher nominal interest rates

reduce the demand for money such that faster money velocity amplifies the effect of money

3

The early Keynesian models did not explicitly discuss how fiscal deficits would be financed

other than by taxes.

4

supply on prices. Early monetarists also posited that fiscal policy, unless it was money financed,

as during wars when central banks were subservient to the fiscal authorities, would have no

influence on nominal income or price movements (Anderson and Jordan 1965).

Modern approaches. Forward looking behavior and inflationary expectations play a central

role in recent approaches built upon the earlier Keynesian and monetarist approaches. The

heightened importance of inflationary expectations was initiated and reinforced by the Great

Inflation of 1965-1980. Expectations of inflation are reflected in financial markets and affect

real economic activity, and are integral to the inflation process. Adjustments of inflation

expectations operate as constraints on the efficacy of countercyclical fiscal policies and

excessively easy monetary policy.

Fiscal dominance of monetary policy. Fiscal dominance posits that persistent deficits and

mounting debt exert pressures on the central bank to follow inflationary monetary policy.

Sargent and Wallace (1980) “Some Unpleasant Monetarist Arithmetic” extended the

monetarist approach in a dynamic setting with rational expectations and perfect foresight. In

that environment fiscal deficits, even if they are financed by the issuance of government bonds,

ultimately will be accommodated by inflationary increases in high powered money to satisfy the

governments’ long-run consolidated balance sheet.

The Fiscal Theory of the Price Level (FTPL). Sims (2011), Leeper (1991), Cochrane (2019) argue

that if fiscal deficits are persistent and taxes are not raised or expenditures cut in the future

sufficiently to prevent an explosion of national debt, this will lead to a state of fiscal dominance.

Economic agents will perceive the increase in nominal government debt to be an increase in

real wealth. The wealth effect will lead to increased consumption expenditure and to rising

prices that will reduce the real value of the national debt and restore fiscal equilibrium.

According to Jacobson Leeper and Preston (2019) when fiscal policy is active (dominant),

increased government spending induces both the traditional Keynesian multiplier and a more

powerful debt multiplier.

In both modern approaches, fiscal deficits are expansionary. In the Sargent and Wallace

framework, fiscal deficits are inflationary because they lead to monetary expansion in the

5

quantity theory tradition. In the FTPL, fiscal deficits are inflationary by themselves in the

tradition of the Keynesian approach.

3. Evidence from History: Wars

In this section, we review some salient episodes in modern economic history of fiscal deficits

associated with inflation in wartime in the eighteenth, nineteenth and twentieth centuries.

4

Three salient episodes stand out in the eighteenth century: the Swedish experience with fiat

money in the Seven Years war, the Continentals in the American Revolution and the Assignats

in the French Revolution.

3.1. Sweden: The Seven Years War

The Riksbank, the earliest central bank, was founded in 1668. It was chartered by and owned by

the Swedish parliament, the Riksdag (Fregert 2018). Its mandate was to be a depository for the

government’s revenues, to provide a safe means of payment and to maintain convertibility of

its notes into specie. It was originally supposed to be independent of the government. After

1720, the Riksbank shifted from being independent of the government to being controlled by it

and becoming a tool for fiscal policy.

In 1745, the expansionist, soft money Hat Party, which was mercantilist and hawkish, took

control of the government from the more conservative Cap Party that favored hard money)

(Eagly 1969). The Riksbank began expanding its notes to finance the war against Russia leading

to a suspension of convertibility. Money financed fiscal deficits burgeoned later in the Seven

Years War with a tripling of the note issue (Fregert and Jonung 1996). This led to significant

inflation and depreciation of the currency by a half of its 1745 value. A return to power of the

Caps in 1765 set in play deflationary policies to restore price stability and resume convertibility

in 1777. This episode is considered the earliest use of fiat money fiscal finance.

3.2. The American Revolutionary War 1775-1781

4

There is a considerable body of research on debasement and seigniorage in the middle ages

and the early modern period not covered here.

6

The War of the American Revolution was an early prominent example of the use of inflationary

finance to pay for the war. In wartime, governments need to finance unusual expenditure by

reallocating resources from peacetime to wartime uses. This requires the use of taxation,

borrowing or the issue of fiat money, sometimes called seigniorage, which is the tax on real

cash balances. Relying on taxes as a source of financing wars in the eighteenth century was

difficult and limited because tax revenues were inelastic. Taxes were derived mainly from

indirect taxes, which were often evaded, while direct taxes were not popular and the

governments were not organized to administer them. Moreover, sufficiently large increases in

taxation to finance the war efforts could reduce labor effort during a time when it is needed

most.

In its many wars of the eighteenth century, the British government, in addition to raising taxes,

began using a policy of tax smoothing, which involved financing wars by the issue of

government debt that would be repaid after the war by continuing war time taxation rates

(Barro 1979,1987). This tax smoothing scheme for financing war may have been an important

reason for Great Britain’s martial success. A key determinant of Great Britain’s ability to issue so

much debt was the efficiency and credibility of its fiscal system (Dickson 1967, Brewer 1989). In

the more costly wars of the subsequent two centuries, debt finance was also supplemented by

the issue of paper money, following the suspension of the specie standard.

5

The American revolutionary government was unable to adopt the British model. The Congress

did not have the power to levy taxes directly and could not raise adequate tax revenue. The

states had the power to tax, but they were unwilling to raise adequate tax revenue in part

because the revolution was fought over the issue of taxation. Moreover, the Congress and the

states found it very difficult to borrow because those colonists who had wealth were unwilling

to lend because of the risk that the British would repudiate the debt were they to win. Foreign

loans were not forthcoming for the same reason until 1780, when France and Spain joined the

war on the Americans side. Thus, the revolutionary government had to resort to the issue of

5

The theory of optimal taxation (Mankiw 1987) posited that an optimal taxation strategy using

a combination of taxes, debt and seigniorage would minimize the marginal excess burden of the

three instruments. This makes the case for some inflationary finance in major wars.

7

paper money—bills of credit. Citizens accepted this practice because it had been widely used by

many of the colonies in the preceding century.

The evidence suggests that over three quarters of government expenditure was financed by fiat

money. The Congress issued bills of credit called continentals. Initially the Congress pledged

that the bills would be retired by state taxes on the assumption that the war would be brief.

This assumption did not hold up, and the bills were issued without the pretext of convertibility.

The states also issued bills and notes.

The issue of paper money to finance the war has been viewed as a tax on real cash balances

(Friedman 1969). Just like any tax, a government with monopoly power can calculate the

revenue-maximizing rate of taxation. Modern studies have estimated the revenue-maximizing

rate of inflation in emerging countries in the late twentieth century that had a history of high

inflation in the twentieth century as between 100-350% per year (Easterly, Mauro and Schmidt-

Hebbel 1995. Rockoff (2016) calculates that the average rate of inflation during the

Revolutionary war was about 22% per year, which suggests that the American revolutionary

government was very conservative in its use of inflationary finance.

3.3. The Assignats in the French Revolution

In the eighteenth century, France was unable to follow the British example of tax smoothing

(Bordo and White 1991). As White (1989, 1995) demonstrates, France’s tax collection was both

inefficient and corrupt. In 1759, in the midst of the Seven Years War, the Crown was forced to

suspend repayment of the principal on a variety of short-term debts. Later, the continuing fiscal

crisis after the war eventually led to a partial bankruptcy in 1770. The government attempted

to restore fiscal balance until the American War of Independence led to large deficits.

Subsequent reforms were unsuccessful (White 1995). By 1787, the Parliament realized that the

Crown would not be able to balance its budget. According to White (1995) the fiscal crisis

precipitated the French Revolution when the Parliament refused to sanction new taxes or

loans.

After the end of the monarchy, the National Assembly chose to seize the lands of the Church

and sell them through auction and use the proceeds to cover the deficit and redeem the

8

unfunded debt. This led to the creation of the assignats, notes backed by the value of the

Church properties. As the Revolution continued, attempts to redeem the assignats ceased and

they were increasingly used to cover the fiscal deficits. Once war broke out in 1792, the

government fully covered the deficits with assignats. The issue of assignats led to increasing

inflation and by 1795 a hyperinflation. The assignats were similar to other schemes in the

eighteenth century to issue note based on the nominal value of land. Rhode Island had a similar

experience. It increased note issuance, which led to inflation that increased the nominal value

of the land. This led to further money issue, eventually leading to hyperinflation.

Modern Wars

Below we discuss the financing of four major wars in the nineteenth and twentieth centuries in

the UK and the US. In all cases, the majority of wartime expenditures was financed by

borrowing and running fiscal deficits. The fiscal deficits were also accommodated to a differing

degree by expansionary monetary policy, leading to inflation and the inflation tax. There were

numerous minor wars that were also funded by taxation that did not involve debt issue or

seigniorage. A major modern exception was the Korean war which the U.S., which was primarily

financed by raising taxes (See Ohanian 1997).

3.4. The Napoleonic Wars: Great Britain

The war against France was initially financed in the traditional eighteenth-century style of tax

smoothing. According to O’ Brien (1967), 90% of wartime expenditure between 1793 and 1798

were covered by borrowing. The massive scale of expenditures required far greater

expenditures, so large deficits persisted for a longer than previous wars, which increased

pressures on government finance (see figure 3).

Britain fought the wars of the eighteenth century on the specie standard but the circumstances

of the late 1790s forced a suspension of payments in February 1797. Pressure on the Bank of

England’s (BoE’s) gold reserves began with a financial crisis at the outbreak of war in 1793. As

the war continued the BoE had increasing difficulty in financing the government’s war demand

(short-term bills) amid demands from commerce and maintaining convertibility. To prevent the

9

perceived collapse of the BoE in the face of both a massive external drain and a run on the

country banks occasioned by fears of a French invasion, the government finally allowed the

bank to suspend specie payments on February 26, 1797.

After the Bank suspended specie payments, the government was again able to sell much of its

short-term debt to the BoE. Historians generally viewed accommodation of both government

and private borrowing as the way in which the bank contributed to war finance (Fetter1965,

Schumpter1938, Silberling 1923 and Viner 1937). Both the BoE’s note issue (figure 4) and the

price level (figure 5) rose considerably during the period.

At the time, there was heated debate between the Bullionists and anti-Bullionists over whether

the inflation was caused by monetary or real forces, but the availability of better data supports

the former view (Bordo and Schwartz 1980,1981). The fact that private borrowers could

discount commercial and government paper freely at the five per cent usury ceiling when the

nominal interest rate was surely higher, reflecting inflation rate up to 10% annually, suggests

that the indirect mechanism originally pointed out by Thornton (1802) was important.

6

The British experience in the first modern world war with inflationary finance set the stage for

war finance in later wars in the nineteenth and twentieth centuries. However, its contribution

was modest accounting for less than 10% of the fiscal deficit (Bordo and White 1991 Table 3).

3.5. The US Civil War 1861-1865

Unlike the American Revolutionary War, the Federal (Union) Government had access to capital

markets and financed most of its Civil War expenditures by borrowing (62%), then taxes (21%)

and lastly seigniorage (13%) (Friedman and Schwartz 1963). The ratio of debt-to-GDP increased

from negligible to 35%, far less than during the Revolutionary War (Hall and Sargent 2020).

Within a year after hostilities began, the Federal Government found it increasingly difficult to

obtain favorable terms for its bonds and following the suspension of specie payments in

December 1861 began in February 1862 the issue of fiat money, greenbacks that were non-

6

More recently Antipa and Chamley (2017) have challenged the Bullionist/monetarist

explanation arguing that according to the fiscal theory of the price level it was announcements

of unbacked (by future taxes) fiscal policy not the Bank of England’s note issue that drove

movements in the price level.

10

interest-bearing notes denominated in dollars and declared to be legal tender. These notes

were issued on the presumption that they would be convertible into specie but the date and

provisions for convertibility were not clearly stated. The total amount of greenbacks created

was $450 million. The greenbacks were supplemented by national bank notes issued by the

newly created (1863) national banking system. The average inflation rate in the Union was 25%

per year. Once hostilities ceased, efforts began to reverse the debt build up through running

primary budget surpluses to retire the greenbacks. However, it took until 1879 to restore price

stability and reduce most of the accumulated debt.

7

3.6. World War I 1914-1918

The unprecedented scale and duration of World War I led all of the belligerents to engage in

massive fiscal expansion. The UK’s debt-to-GDP ratio peaked at 140%, France close to 200% and

the US, which joined the war 3 years later, 35%, similar to the Civil War. The U.S.’s bond finance

accounted for the lion’s share of the financing, followed by taxes and then seigniorage, with a

5% share (Friedman and Schwartz 1963). For all nations, the central bank acted as an engine of

inflation by following low interest pegs to aid the fiscal authorities. The Federal Reserve

discounted member bank bills, secured by government obligations at a fixed discount rate

below the market rate of interest. This policy generated a 10% per year growth in the M2

money supply and 12% inflation. In the UK, inflation ran at 25% per year. After the war the US,

UK and many other countries aimed to restore the gold standard by monetary contraction and

fiscal retrenchment according to the tax smoothing framework (Ahamed 1986, Bordo and

Bayoumi 2000). This led to a serious recession in 1920-21. Countries success in returning to a

gold standard depended on the extent of their monetary and fiscal expansion during the war

and the underlying political economy (Eichengreen 1992, Bordo and Hautcoeur 2007)

3.7. World War II 1939-1945

7

In the Confederacy (the Southern states), with much more limited access to the capital

markets and a smaller tax base, 60% of the war was financed by the issue of paper money. This

led to a hyperinflation. Confederate money and debt were declared worthless after the union

victory in April 1865 (Lerner 1956).

11

World War II was financed in a similar manner. In the U.S, government spending increased to

32% of GDP, financed by taxes (42%), bond issuance (34%) and the inflation tax (24%)

(Friedman and Schwartz, 1963). The ratio of gross debt to GDP rose to 120%. The patterns were

similar in the UK.

During the war, the U.S.’s fiscal spending was accommodated by the Federal Reserve, which

gave up its independence to the Treasury, implementing a low interest rate peg (3/8% on short-

term Treasuries and 2 1/ 2% on long-term Treasuries) to minimize the costs of debt issuance

(Humpage 2016). The inflationary consequences of this policy were somewhat mitigated by

wage and price controls. Reflecting these controls, WPI inflation was 9% per year 1939-1945

and 4.5% per year during 1941-1945.

At the end of the war, policy makers feared a repeat of the deflation and recession that

followed World War I, reflecting tight monetary policies to maintain adherence to the gold

standard. It was widely agreed that it was the government’s role to manage aggregate demand

(Stein 1994). They ignored the pent -up consumer spending demand and surge in business

investment that began once hostilities ceased and rationing ended. Consequently, the

accommodative low interest peg policy was continued, which fueled rapid inflation once price

controls were removed (WPI inflation averaged 11.5% per annum 1945-1948). In comparison to

the preceding big wars, the post-World War II era was not characterized by the deflation that

led to a return to gold convertibility, nor did the advanced countries shift to tight fiscal policies

as under the tax smoothing framework. The big debt build ups were gradually reduced by a

combination of inflation, rapid growth and financial repression (Grossman 1990, Aizenman and

Marion 2010, Reinhart and Srbancia 2015)

4. Peacetime Episodes of Fiscal Expansion and High inflation

In this section we consider several examples where expansionary fiscal policy was associated

with inflation in peace time: the high inflation in France in the 1920s; the recovery from the

Great Contraction in the US in the 1930s; the Great Inflation in the US 1965-1979 and the Great

Inflation in the UK 1965 to 1980.

12

4.1. France in the 1920s

Most of the defeated powers after World War I faced hyperinflations that collapsed their

economies, tax bases and fiscal systems and generated extreme political dysfunction

(Eichengreen1992). France stood out as a major victor from the war, but experienced high

inflation associated with fiscal instability. France’s fiscal experience in the 1920s is a good

example of fiscal dominance that has resonance for the recent Fiscal Theory of the Price Level

(Leeper and Walker 2011).

A contrast between Great Britain, which followed a policy of active monetary policy and passive

fiscal policy, helps make the case (Bordo and Hautcoeur 2007).

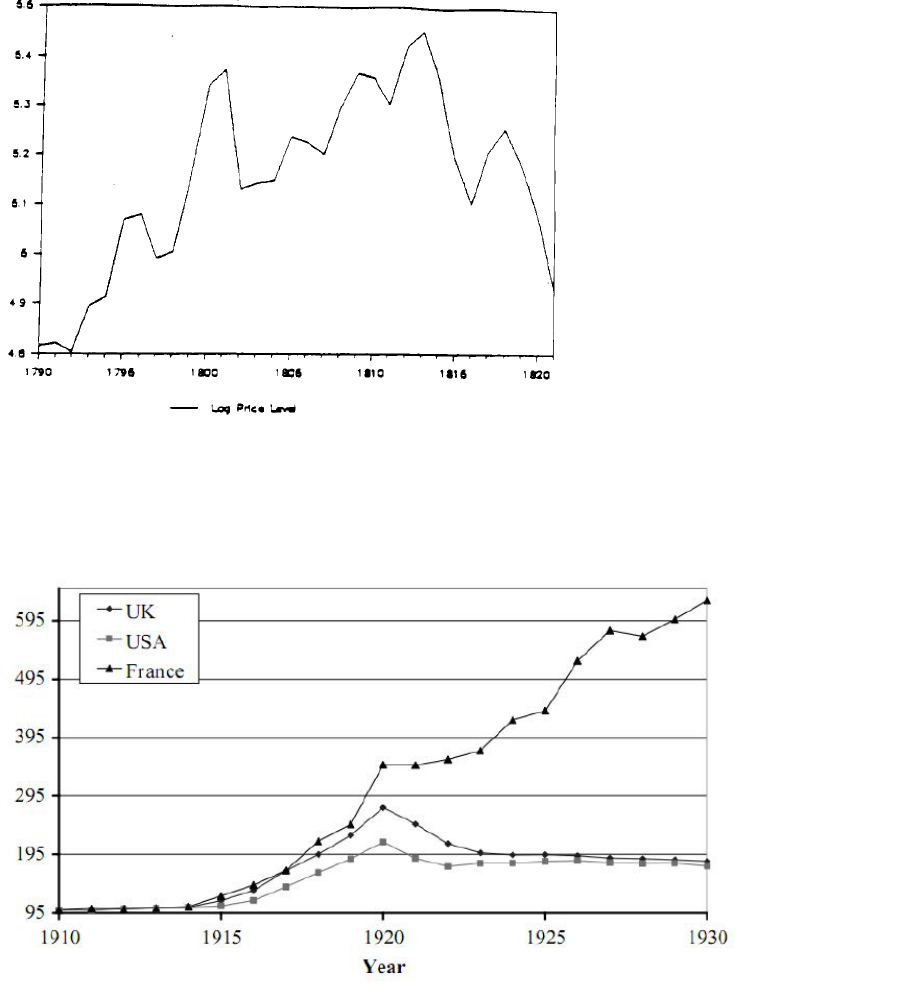

Both countries emerged from World War I with more than a doubled price level (figure 6), a

high ratio of debt-to-GDP (figure 7), large fiscal deficits (figure 8) and a devalued exchange rate

(figure 9). France was in worse shape than Britain in all dimensions but not by much. The key

difference between the two countries was their fiscal and monetary stances after the war.

France had a higher debt ratio, more short-term debt and a big monetary overhang. France had

extensive destruction of its physical capital stock but also a faster growth rate than Britain.

The UK was able to manage a successful stabilization and resumption to the gold standard at

the original parity beginning in 1919 and culminating in April 1925. France delayed policy

stabilization, going back to gold in December 1926 with an 80% depreciation in the franc. More

importantly, France had 6 years of rapidly rising prices. This was consistent with the FTPL model

of Leeper and Walker (2011), Cochrane (2019), as the rise in the price level reduced the real

value of the national debt. Fiscal balance was retired in 1926 by a political compromise

between the left and the right that involved rising taxes and reducing government expenditure.

France’s fiscal problems in the 1920s are well known (Eichengreen 1992). First, like Britain,

France financed World War I with a combination of taxes, debt and seigniorage, but it raised

taxes by less and relied more on debt financing (see figures 7 and 8). In both France and the UK,

the central banks absorbed Treasury bills and pegged short-term interest rates.

Second, France did not have the same political commitment to stabilization as the British, for

three reasons: a) reparations –the belief that German reparations would pay for reconstruction;

13

b) a political struggle between the left and the right over who would cover the fiscal deficit

once it became apparent that the Germans would not pay (the left wanted to impose a capital

levy and the right wanted to raise excise and other taxes); and c) the French had monetized

more of their short-term debt than did the British and consequently had a larger monetary

overhang, requiring more deflation to get back to the pre-war parity. Moreover, the

government had to repay its short-term debt to the Banque de France, which in turn would

raise the deficit and the debt.

The political tug of war continued for seven years with several changes of government and

many finance ministers. Instead of raising taxes and cutting expenditures sufficiently to balance

the budget, the government kept issuing short-term bills that were difficult to sell and roll over,

and consequently were absorbed by the (passive) Banque de France. This led to inflation and a

depreciating exchange rate.

The political impasse was finally broken in July 1926 when a revolt by left-wing deputies in

Parliament led to an invitation to Raymond Poincare (center right) to take over the government

and to rule by decree. He raised taxes, cut expenditures and was able to borrow dollars from JP

Morgan and Lazards and use the funds to conduct a bear squeeze on speculators selling the

franc short. This stabilized the franc, which was then pegged to gold at a greatly depreciated

rate.

8

4.2. The Recovery from the Great Contraction in the US 1933-1936

Friedman and Schwartz (1963) and Meltzer (2005) attribute the Great Contraction in the U.S.

from 1929-1933 when output and prices each fell by a third to a collapse of the money supply

brought upon by a policy failure of the Federal Reserve. The contraction ended in March 1933.

Friedman and Schwartz attribute the subsequent recovery to the bank holiday that ended the

fourth banking panic, as well as President Franklin Delano Roosevelt’s decision to leave the gold

8

Bordo and Hautcoeur (2007) simulate a model of the French economy in the 1920s and show

that it was impossible for France to engineer a British style stabilization and resumption. This is

because following the British route of consolidating debt and deflation would have increased

French debt unsustainable levels. This suggests that France had to have a huge increase in the

price level and a major devaluation to achieve fiscal equilibrium.

14

standard and devaluing the US dollar by close to 40%. They argued that recovery was fueled by

an increase in the monetary gold stock, reflecting FDR’s gold purchase policy following the

advice of George Warren, and the profits from the currency devaluation that greatly expanded

the monetary gold stock and gold inflows from Europe, which accompanied capital flight from a

growing political uncertainty. This view was empirically supported by Romer (1992).

Recently the Friedman and Schwartz position has been challenged by Eggertson (2008) who

posited that it was a fiscal/monetary regime change brought about by FDR‘s abandoning the

gold standard that led to a rise in inflationary expectations.

9

Jacobson, Leeper and Preston (2019) argue that the reflation can be explained by unbacked

fiscal expansion after the US left the gold standard. They argue based on the FTPL that

adherence to the gold standard meant that any fiscal expansion had to be fully backed by

future taxes. Once the gold standard constraint was removed, the Treasury could run unbacked

fiscal deficits. Then according to the FTPL this would lead to a rise in nominal debt which in turn

would lead to an increase in household expenditure and by a wealth effect would raise the

price level. Consistent with Meltzer (2005), they emphasize that the Fed was not following

active monetary policy. Hence, similar to the French case in the 1920s, inflation could be

attributed to an active fiscal and passive money regime.

The evidence is based on a large increase in emergency expenditure measures (New Deal

programs including the WPA, AAA and CCC) that were not ( perceived by the public to be)

backed by future taxes. This allowed gross nominal debt to rise by 40% in 7 years. The increase

in nominal debt raised wealth and nominal aggregate demand. This evidence combined with

the results from vector auto regression analysis (VARS) lead them to conclude that fiscal

expansion explained the 1930s reflation.

5. The Great Inflation 1965 to 1982

9

Also see Jalil and Rua (2017), who also attribute the recovery to a change in inflationary

expectations.

15

We focus on two recent important episodes of peacetime inflation associated with fiscal

expansion in the U.S. and the U.K.

5.1 The Great inflation in the U.S. 1965-1979

Following the Federal Reserve –Treasury Accord of February 1951 that released the Fed’s policy

making from the Treasury’s fiscal needs, the Fed was led by Chairman William McChesney

Martin, a fiscal conservative, consistent with the conservative fiscal policies of the Eisenhower

Administration (Meltzer 2010, Stein 1994).

The underlying ideology of macroeconomic policy changed from classical orthodoxy to

Keynesianism in the 1960s, as the Kennedy and Johnson administrations placed the highest

priority on increasing US growth and reducing unemployment using aggregate demand

management policies and relying on the Phillips Curve as their guideline.

Council of Economic Advisors Chairman Walter Heller and then Arthur Okun perceived that the

welfare costs of inflation were lower than the costs of unemployment. The Keynesians also

believed that fiscal policy was a more potent tool of demand management than monetary

policy, and both monetary policy and fiscal policies should be used to fine-tune the business

cycle (Stein 1994).

The confluence of activist fiscal policies and the persistence of deficits accommodated by

monetary ease dominated the inflationary environment of 1965-1980. The story was similar in

the UK. In addition, both in the US and UK, policymakers believed that inflation was caused by

cost-push factors rather than easy money and favored incomes policies—wage and price

controls to combat inflation.

The 1964 Kennedy tax cut increased the fiscal deficit (See figure 10), and the Fed began

accommodating fiscal policy through its even keel operations (Meltzer 2010, Humpage 2015)

10

.

Martin attached considerable importance to cooperating with the administration and his

10

“Even keel” refers to the Fed’s policy of holding interest rates steady during Treasury funding

operations. Beginning in the 1960s the Fed increasingly held rates below what its policy

instincts suggested as the Treasury kept increasing its funding operations. Humpage and

Meltzer’s calculations suggest that even keel may have explained up to half of the Fed’s

monetary expansion.

16

concept of central bank independence was “independent within the government”. As a

consequence, money growth began increasing along with fiscal deficits (see figure 11).

Inflation had been modest through 1965 and then accelerated with the buildup in government

expenditures for the Vietnam War and President Lyndon Baines Johnson’s Great Society

programs (figure 12) and monetary accommodation. In 1966-1967, the Fed’s monetary

tightening led to the Credit Crunch and mini-recession when rising rates surpassed the

regulation Q ceiling rate on time deposits and led to a decline in mortgage finance. In response,

Congress and particularly LBJ placed extreme pressure on the Fed to maintain monetary ease,

and the Fed refrained from raising rates as deficit spending on the Vietnam War and domestic

programs boosted aggregate demand. LBJ’s verbal attack on Martin on a visit to his Texas

ranch following the FOMC’s decision to raise the discount rate by 50 basis points in late 1965

was identified by Meltzer and others as an experience that significantly weakened Martin’s

anti-inflation resolve (Meltzer 2010). Inflation increased and so did inflationary expectations

and bond yields. The Fed did not begin serious tightening monetary policy until after LBJ

announced that he would not seek re-election for President in March 1968. By then, inflation

had risen to 4% from its 1.25% average during 1960-1965.

Meltzer (2010 chapter 4) summarized Fed policy during this early stage of the Great Inflation as

prioritizing unemployment over inflation, reflecting both ideology—the adoption of Keynesian

doctrine--and political pressures to avoid rising unemployment. The tug and pull between the

ideologies led to alternating periods of expansionary monetary policy (and fiscal policy)

followed by tightening and then back again. The monetary expansion would generate lower

unemployment and higher inflation with a lag, followed by Fed tightening aimed at reducing

inflation. The subsequent rise in unemployment led to political pressure that would encourage

the Fed to abandon its tightening. Meltzer believed these actions convinced the public that the

Fed did not attach high priority to inflation, which became more and more persistent as

inflationary expectations became embedded in the public conscience.

11

The persistence of

inflationary expectations and the failure of the Fed to address it became a critical theme of the

1970s.

11

For further explanations of the Great Inflation see Bordo and Orphanides 2013.

17

Richard Nixon campaigned for President on a fiscally conservative platform of rolling back the

expansionary aggregate demand policies and the liberal agenda of the preceding Democratic

administrations. Although Nixon was influenced by the views of Milton Friedman and posited a

greater role for free markets, monetary gradualism to reduce inflation, and full employment

balanced budgets, his real focus was foreign policy and not economics, and he did not follow his

platform on either fiscal or monetary policy. Nixon appointed Arthur Burns, who had been a

close advisor since 1960 and a student and friend of Milton Friedman, as Chairman of the Fed.

Burns was viewed as an advocate of sound money but not monetary rules (Meltzer 2010, Wells

1994). In fact, his views on inflation were eclectic, and tilted toward incomes policies—wage

and price controls—as a way to combat inflation.

When Burns became Fed Chair in February 1970, inflation was high and the economy was in

recession generated by tight monetary policy and the 1968 “Vietnam War tax surcharge”.

Worried about budget deficits, the Nixon Administration did not rollback the Johnson

surcharge, adding to the recession and rising unemployment in 1970. Although inflation

remained above 6%, Burns was reticent to tighten monetary policy and instead began formally

advocating wage and price controls, arguing that the key determinant of inflation was cost-push

pressure by big labor unions and large firms with considerable market power.

12

Nixon pressured the Fed to lower interest rates aggressively (from 8% to 4.9% by year-end

1970). Inflation receded to 3.5% by year-end, but inflationary expectations did not fall

commensurately. The U.S. was facing mounting international financial tensions stemming from

an erosion of credibility of its monetary system and inflation that was contributing to pressures

on U.S. gold reserves. In August 1971, with full support of Burns, Nixon cancelled the direct

international convertibility of the US dollar into gold, effectively abandoning the Bretton Woods

system, and imposed wage and price controls (Bordo 2018).

Burns purposely pursued easy monetary policy during Nixon’s 1972 Presidential election

campaign, upholding his promise to Nixon on the day that he was installed as Chairman “You

12

See Shultz (2018) who unearthed a letter from Burns to Nixon dated June 22 1971 when he

explicitly advocated wage price controls.

18

see to it: no recession” (Wells 1994 page 42).

13

During 1972, as the economy recovered strongly

from recession, the Fed was purposely slow to raise rates, so money supply accelerated sharply.

This spurred aggregate demand in 1973 while the wage and price controls constrained

measured inflation, generating strong real growth. The wage and price controls generated

widespread economic distortions, undercutting productivity and the government’s credibility.

(Stein 1994).

The Arab oil embargo and surge in oil prices beginning in November 1973 generated a deep

recession and higher inflation, and greatly exacerbated the distortions imposed by the wage

and price controls. The Fed lowered rates, accommodating the negative oil price shock. When

the price controls were actually lifted in April 1974, inflation soared over 11% by year-end. This

depressed real incomes, exacerbating and extending the recession through early 1975 and

lifting the unemployment rate above 10%.

In response to concerns about high unemployment and poor economic performance, the Fed

lowered rates aggressively from 12% in Fall 1974 to 5.2% at year-end 1975 and 4.7% in early

1977. The Fed’s monetary base—bank reserves plus currency—and the broader monetary

aggregates accelerated throughout the decade.

Despite the modest fiscal policy responses to the deep 1973-1975, persistent deficits emerged

in the 1970s, a new peacetime characteristic of government finances. Longer-run projections of

significant increases of spending on entitlement programs and persistent budget deficits

received significant attention.

The second half of the 1970s involved high and rising inflation that stemmed from easy

monetary policy by the Burns-led Fed, and various non-monetary strategies by the Carter

Administration to corral inflation that were based on the belief that inflation derived from cost-

push pressures (Greenspan, Kahn, Kosters and Daly 1978). Inflationary expectations became

13

Nixon also said about Burns, “I respect his independence. However, I hope that

independently he will conclude that my views are the ones that should be followed’ (Wells

1994 page 42)

19

embedded in financial and economic behavior. This culminated in a loss of global confidence in

the US dollar and a currency crisis in late 1978.

As inflation rose, the Fed and the Carter Administration did not want to tighten monetary policy

because the costs of reducing inflation were perceived to be too high (Burns 1978). Congress

pushed for lower unemployment and enacted the Full Employment Act of 1978 that amended

the Employment Act of 1946, mandating the goals of 4% unemployment with inflation not over

4%. It also instructed the government to take reasonable means to balance the budget and

achieve a balance in trade. The Congressional debate was driven largely by the frameworks

provided by activist Keynesianism and the Phillips Curve, without regard to the monetary

sources of inflation. This legislation had little immediate impact on monetary or fiscal policies

during the remainder of the 1970s.

In the four years 1976-1979, nominal GDP rose at an average annual rate of 11.75%. Real

economic growth held up through 1978, as inflationary expectations were slow to rise to reflect

the situation, but the higher inflation eroded the underlying fundamentals. It reduced real

purchasing power and raised real taxes by pushing taxpayers into progressively higher tax

brackets, reducing real disposable incomes. The higher inflation also increased the cost of

capital and harmed businesses. (Feldstein 1983).

The rising inflation and the unwillingness of the Fed to tighten monetary policy and reduce

inflation, along with the persistence of budget deficits, eroded confidence and the

government’s credibility. In February 1978, President Carter announced that he would not

reappoint Burns as Fed Chairman and subsequently replaced him with G. William Miller, who

maintained an accommodative monetary policy until Volcker became Chair in August 1979.

The Carter Administration favored wage and price controls to control inflation, and in October

1978, imposed a wage-price guidelines program that assigned voluntary limits of 7% increase

on wages and 5.75% increases on prices and an array of government sanctions. These sanctions

were monitored by the Council on Wage and Price Stability, which had been established by the

Nixon Administration to manage the failed wage and price controls of 1971.

Carter’s wage-price guideline programs only reinforced the government’s lack of a credible anti-

inflation policy and accentuated the falling US dollar. Facing crisis, the Carter administration

20

proffered a massive scheme to offset the dollar collapse that would involve a sharp increase in

interest rates, coordinated intervention to prop up the dollar supported by an international

pool of reserves including funds from West Germany, Switzerland and Japan, and the pledge to

issue foreign currency-denominated US government debt, so-called Carter bonds (Bordo,

Humpage and Schwartz 2015).

This rescue package stabilized the US dollar and financial markets. However, economic

performance was deteriorating and a second oil price shock that resulted from a sharp decline

in Iranian oil production doubled oil prices and slowed real GDP to fractional growth in 1979.

Stagflation--the combination of high inflation and poor real economic performance with rising

unemployment—had enveloped the economy. The high inflation and rising unemployment

were inconsistent with a downward-sloping Phillips Curve. Policymakers were faced with poor

economic performance and policies that required remedy.

Volcker’s aggressive disinflation monetary policy. The biggest concern facing policymakers was

that reducing inflation would harm the economy and raise unemployment. Many, including

Alan Greenspan, Chairman of the Council of Economic Advisors under President Ford,

advocated a more gradual monetary tightening while Paul Volcker argued that aggressive

tightening was required to reduce inflationary expectations. He made clear those intentions to

President Carter who nominated him to become Fed Chairman and in his confirmation hearings

before the Senate (Volcker 1979). In October 1979, when inflation was nearly 12%, the Volcker-

led Fed began its aggressive anti-inflation monetary tightening.

Through April 1980, the Fed raised interest rates from 11.5% to 17.6% and slowed money

growth. Concerned with inflation and excessive use of credit, President Carter tried to restore

discipline through credit controls on consumers and technical tax policy adjustments that would

raise government tax receipts. Carter’s actions backfired, as many consumers believed that he

had put a ban on credit card purchases, which generated a deep recession in the second

quarter of 1980.

21

The Fed backed away from its monetary tightening, lowering interest rates to 9% in July 1980.

When economic growth resumed, the Fed more than doubled rates to 19% by early 1981,

generating a marked deceleration in money growth. The Fed maintained its restrictive

monetary policy through June 1982.

President Reagan entered office in January 1981, and the Economic Recovery Tax Act of 1981

dramatically lowered taxes while government spending was increased, nearly exclusively for

defense. Recession persisted through year-end 1982, in response to the restrictive monetary

policy and adjustment to lower inflation. Inflation receded below 9% by December 1981 and to

3.8% by December 1982. Inflationary expectations adjusted to the new monetary regime while

the fiscal policies set the stage for stronger growth. The US dollar strengthened dramatically.

Even as the real economy rebounded, with robust real GDP growth averaging 6% in 1983-1984,

inflation remained below 4%, its lowest sustained rate since 1967.

Volcker’s strategy hinged critically on the Fed’s credibility to impose a persistent monetary

policy that would achieve low inflation (Bordo, Erceg and Levin 2017). Critics and public outcries

were loud, but the Volcker-led Fed persisted. The Fed received full support from President

Reagan.

Volcker’s successful disinflationary monetary policy ushered in the Great Moderation, a

sustained period of moderate inflation, economic expansion and prosperity. The lessons

learned from Volcker’s policies are historic.

5.2 Monetary and Fiscal Policy Interactions in the Great Inflation in the UK 1965 to 1980

The inflation performance of the UK was considerably worse than the G10 average. Inflation

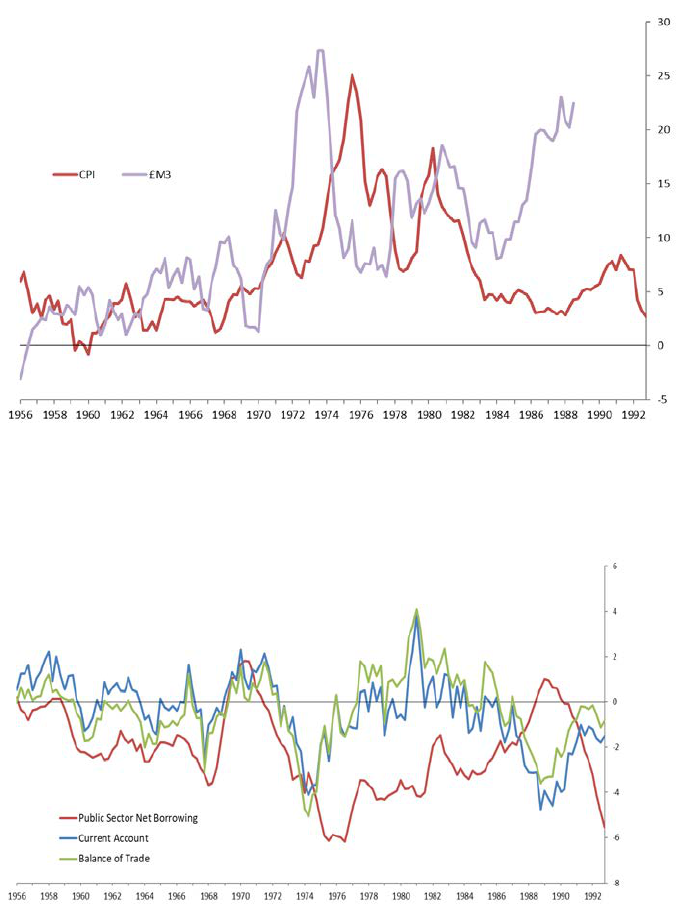

peaked in 1980 at 25% versus the US at 13.5%. Bordo, Bush and Thomas (2020) argue that the

UK experience can best be characterized as one of fiscal dominance under which fiscal deficits

by the Treasury (referred to as the Public Sector Borrowing Requirement, PSBR) was

accommodated by the Bank of England (which at the time was not independent from the

Treasury).

22

Two deep fundamentals that underlay the UK experience were: first adherence to the pegged

(adjustable) exchange rates (and the capital controls) of the Bretton Woods System (Bordo

1993). Under the BWS once the UK declared current account convertibility in December 1958,

financial (monetary and fiscal) policy was constrained by the pegged exchange rate and the

state of the balance of payments. The expansionary fiscal/monetary policy leading to a rise in

nominal income (referred to as Go policy) would lead to a balance of payments (current

account) deficit reflecting an increased demand for imports, a decline in international reserves

and often a speculative attack on the pound (a currency crisis). The crisis would then be

resolved by a rescue by the IMF, G10 leading to a policy of contractionary fiscal/monetary

policy (Stop policy). This would continue until nominal income had contracted sufficiently to

remove the deficit and replenish international reserves (see figure 13).

A second fundamental was that the real growth of the UK economy and the growth of

productivity were lower than its trading partners. These factors contributed to overvalued

nominal and real exchange rates, which in the presence of the peg led speculative attacks and

currency crises. These forces led to contractionary effects on the British economy and created

reasons for fiscal and monetary policies to offset them.

A final important factor was the role of the trade unions who strongly resisted downward wage

movements and made it difficult for the monetary authorities to follow tight financial policies.

This helped create a ratchet in the inflation rate.

5.3. Active Fiscal and Passive Monetary Policy in the 1960s

The UK Treasury generally followed expansionary policies in this period. It ran persistent and

rising deficits that were mostly accommodated by expansionary Bank of England policies. There

were a number of justifications for these policies. The first was the belief in the efficacy of

Keynesian aggregate demand management policies to offset business cycle fluctuations and to

maintain full employment. Keynesian thinking dominated the Treasury, the Bank and the

government as a whole. Related to this was the Phillips curve tradeoff that a reduction in the

unemployment rate could be accomplished at the expense of higher inflation. Second, it was

23

believed that expansionary aggregate demand policies would not only reduce the output gap

but would also raise the long-run growth rate and even reduce the inflation rate. This view

associated with the work of Nicholas Kaldor (1966) posited that expansionary fiscal policy

would raise investment and in turn the growth of technical change and the capital stock. The

rise in growth in turn associated with increasing returns to scale in industry would both raise

real wages and reduce inflation. Empirical estimates and forecasts of the British growth rate in

the 60s by the National Institute of Economic and Social Research (NIESR) justified this “Going

for Growth Strategy” Estimates of potential annual growth rates of 6%, were way above the

historical trend growth rate of 2.5 %. A final important rationale for expansionary fiscal policy

was to improve the living standards of labor. The idea had several strands that were accepted

by both the Conservatives and Labour parties. First was the power of the trade unions who

continually pushed for higher wages and for redistribution from capital to labor. Second was

the fear of social unrest should living standards decline, as was perceived to have been the case

in the interwar period. This there was a postwar consensus for full employment and for

sustained real growth.

A serious problem with these views is that they conflated aggregate demand with aggregate

supply. British policy makers continued to believe that aggregate demand policy could stimulate

the economy and also increase the underlying growth rate.

The BWS period from the late 1950s until the breakdown of Bretton Woods can be

characterized by Go-Stop policy (Dow 1964). To maintain full employment and raise growth

rates, successive government of both parties pursued expansionary fiscal policy (increasing

government expenditure and reduced taxes (see figure 14) which in turn were accommodated

by expansionary monetary policy. These expansions, which lasted 2-3 years, always ended

when the economy hit the balance of payments constraint. On several occasions (1959, 1961,

1964, 1967) this led to a speculative attack on the Bank’s international reserves and a currency

crisis (see Bordo, MacDonald and Oliver 2009), which required rescue loans from the IMF, G10,

BIS and the Federal Reserve. Once reserves were restored, pressure increased on the

government to fiscally expand and the economy would transit again into the Go phase. During

the Go phase not only would the economy recover but prices would rise and as the 60s

24

progressed inflation became a growing problem. Moreover, as inflation increased so did

inflationary expectations. This meant that after each successive stop period the underlying

inflation rate would be reduced but not entirely. This led to an upward ratchet in the inflation

rate as the monetary authorities renewed expansionary policy.

A key belief in the 1960s and 1970s in the UK and later the US was that inflation was not caused

by expansionary aggregate demand, especially by expansion in the money supply as was argued

by Milton Friedman and the monetarists. Rather, it was caused by cost-push forces—the

increasing power of trade unions to raise wages and the increasing power of industry to push

prices up to keep up with the rise in wages, leading to a wage price spiral (DeCeccio and Nelson

2013).

The solution to the cost-push problem was to impose incomes policies: wage price guidelines,

and later wage price controls. It was not understood that wage price controls would only make

the problem worse by creating suppressed inflation, which distorted the real economy. As

Milton Friedman once stated “suppressed inflation was like filing a kettle with water, putting it

on the stove and turning on the burner and ten putting a brick on top of the kettle.”

The Go stop policies of the 1960s turned into a hyper-Go phase after the collapse of the BWS in

1971-72. Now the imperative to “Go for Growth” was no longer hobbled by the balance of

payments constraint and so Go fiscal policy accommodated by expansionary monetary policy

went into overdrive. The best example of this was the Barber boom of 1971 to 1973. In 1973,

the monetary authorities attempted to reduce the accelerating inflation by raising interest

rates and the Treasury reducing government expenditures. But it was short-lived.

The boom ended with the first oil price shock in late 1973, which led to a downturn in the real

economy. However, the oil price shock was accommodated in 1974 by expansionary financial

policies and the Go phase returned. The policies to raise aggregate demand to offset the

decline in real income associated with a change in the relative price of oil led to a decline in the

exchange rate, declining international reserves and increasing inflation.

The Go Phase of inflation led to a massive run up in prices to 25% per year by 1975 and a severe

drop in the exchange rate. This led to a new sterling crisis in 1976 precipitating an IMF mission

that urged the monetary authorities to reduce domestic credit and the budget deficit (Roberts

25

2017). This external intervention was the catalyst that led officials in the BOE to pay more

attention to the behavior of the monetary aggregates and the monetarist views of Friedman,

Brunner and Meltzer that inflation was a monetary phenomenon that could only be contained

by monetary contraction.

The Great inflation continued through the 1970s, reaching a peak in 1980 of 18% as a result of

the end of exchange control and a surge of bank credit expansion (James 2020 page 83). As in

the U.S , the Great Inflation ended consequent upon a major regime change in 1979-1980

when Margaret Thatcher came to power and applied the monetarist medicine. Led by Alan

Walters, her special advisor, the Treasury put in an ambitious plan to both reduce fiscal deficits

by cutting expenditures and raising taxes and by having the Bank adopt the monetarist recipe

of monetary targeting of broad money (sterling M3) and significantly reducing money growth

(See figures 13 and 15).

The strategy, similar to that followed by Paul Volcker in the U.S., was very successful in reducing

both inflation and inflation expectations considerably by 1983 and ending the Great Inflation in

the UK. As in the US, the disinflation was accompanied by a decline in real GDP and a rise in

unemployment.

6. Recent Episodes

The Great Financial Crisis (GFC) of 2008-2009 and the pandemic of 2020 are two modern

episodes of surges in deficit spending that illustrate the linkages between deficits and inflation.

Both involved high budget deficit spending and easy monetary policies. This section reviews

the policies around the GFC and identifies the important factors why the spike in deficit

spending and the Fed’s unconventional monetary easing did not generate higher inflation. It

then analyzes the differences in macroeconomic responses to the pandemic, which may raise

the risks of higher inflation. The section concludes with a brief discussion about how the

government’s rising debt may impinge on the Fed’s monetary policy and a possible rising risk of

fiscal dominance.

6.1. The Great Financial Crisis 2007-2008

26

In the years preceding the GFC, there were persistent deficits and inflation rose above the Fed’s

2% objective. President George W. Bush campaigned as a fiscal conservative but cut taxes in

response to the recession of 2001 and the 9/11 attacks and increased spending.

Early in the expansion, from 2002- 2004, the Greenspan-led Fed was excessively concerned

with the possibility of deflation, and maintained easy monetary policy, keeping its policy rate

below the rate of inflation. This facilitated the environment for the debt-financed boom in

housing (Taylor 2007). Inflation and inflationary expectations rose and the US dollar

depreciated.

The Fed’s gradual but persistent policy rate increases contributed to a reversal in the debt-

finance booming housing market beginning in spring 2006. This depressed expectations and

generated sizable losses in mortgage-backed debt securities and complex derivatives. A shift

toward risk aversion damaged short-term funding markets in fall 2007, requiring a liquidity

infusion by the Fed, and mounting financial stresses followed.

Fiscal and Monetary Responses to the GFC. Besides the Fed aggressively lowering its interest

rates from 5.5% in October 2007 to 1% in November 2008, the government was slow to

respond to the increasing signs of financial stresses. Dysfunctional financial markets and severe

risk aversion in late 2008 finally elicited coordinated responses from the Treasury, Federal

Reserve and Congress.

Congress enacted the Emergency Economic Stabilization Act of 2008 that authorized financing

of the Treasury’s Troubled Asset Relief Program (TARP) that provided $700 billion, or 4.8% of

GDP, of capital infusions into the largest banks through purchases of toxic assets.

The Fed initiated its first round of quantitative easing (QEI) in November 2008, primarily

purchases of mortgage-backed securities (MBS) aimed at the dysfunctional mortgage market.

Fed Chairman Bernanke emphasized that QEI was “credit policy” because it focused on MBS,

and stated that the Fed would unwind its purchases “on a timely basis” in order to reduce

inflation risks (Bernanke 2008)

This was followed by the Economic Recovery and Jobs Act (ERJA), a fiscal stimulus package of

$780 billion in deficit spending that was signed into law by President Obama in January 2009.

The combined government spending and emergency loans of ARJA and TARP, approximately

27

10.3% of GDP, is far less than spending increases during major wars, but was the largest

peacetime spending since the Great Depression of the 1930s.

The Fed initiated QEII in March 2009, which involved more purchases of MBS and also

Treasuries. This was followed by a Fed maturity extension program, so-called Operation Twist,

of selling short-term Treasuries and buy longer-term Treasuries, which lengthened the duration

of its portfolio holdings in an effort reduce bond yields. It was largely considered ineffective,

having little sustained impact on bond yields (Ehlers 2011).

In 2012, amid moderate economic growth but a lingering high unemployment rate, the Fed

initiated QEIII, open-ended asset purchases of Treasuries and MBS. QEIII continued through

October 2014, raising the Fed’s balance sheet to $4.5 trillion from its average of $900 billion

balance prior to the GFC. The Fed anchored interest rates to zero until the end of 2015.

Inflation concerns following the financial crisis. Even in the initial stages of recovery from the

deep recession, when the unemployment rate hovered around 10 percent, there were

concerns that the surge in money supply stemming from the Fed’s unconventional QEs

ballooning balance sheet and sustained zero interest rates would lead to higher inflation. At the

same time, soaring deficits were a worry. Government debt rose to 91% percent of GDP, the

highest since World War II (figure 15), and the Congressional Budget Office forecast significant

further in rises in in its long-run projections (CBO 2010), reflecting the aging population and

higher costs of Medicare and Medicaid.

Why didn’t inflation rise? In the decade of sustained economic expansion that followed the

GFC, inflation remained low and fears of rising inflation dissipated. By decade-end, with the

unemployment rate at a 50-year low, the Fed expressed concern that inflation was too low

(Powell 2019). Numerous factors may explain the constrained inflation. The primary reason why

inflation stayed low is that the unprecedented monetary easing, including the Fed’s massive

balance sheet and sustained zero interest rates, and the record deficit spending, did not

stimulate any sustained acceleration in aggregate demand (Levy 2017). This constrained excess

demand and product pricing and wages.

28

The monetary base (MB)—bank reserves plus currency--grew over 100% in response to the

Fed’s QEI and 25% with QEII and QEIII, but M2 growth picked up only modestly and temporarily

in response to QEI and then decelerated significantly (figure 16). In effect, the Fed’s QEs

increased the supply of bank reserves, but banks increased their demand for reserves rather

than providing credit to the economy. There was little if any influence on broader money

growth, credit lending or aggregate demand. Thus, the money multiplier (M2/MB), the

relationship between the Fed’s high-powered money and broader money supply, collapsed

(figure 17). At the same time, money velocity (NGDP/M2) receded as the demand for money

rose as an adjustment to lower interest rates

14

. The economic responses to the 2009 fiscal

stimulus was also modest. Some observers attributed the lackluster response to the poor

structure of the fiscal initiatives within the ARJA (Feldstein 2011).

Even with the massive Fed response to the financial crisis, nominal GDP averaged just 3.8

percent during 2010-2013. This resulted in 2 percent real growth and 1.8 percent inflation.

Subsequently, during the four years following the Fed’s QEIII and sustained zero interest rates,

nominal GDP growth did not accelerate, averaging 4 percent (Levy 2018). Over the decade,

from 2010-2019, nominal GDP averaged 4 percent, with 2.25 percent real growth and 1.75

percent inflation.

The Fed’s easy monetary policy may not have generated stronger economic activity because of

a combination of risk averse behavior by banks and the non-financial sector and changes in

some of the Fed’s operating procedures and regulations that may have created bottlenecks in

the monetary transmission channels (Jordan 2016 and Nelson 2020). The Fed began paying

interest on excess reserves in October 2008, which reduced the cost of holding reserves and

deterred lending (Ireland 2020). It changed from managing the effective funds rate through a

14

See Anderson, Bordo and Duca (2017) who compare the drop in velocity in the 1930s with

the GFC. Velocity recovered after World War II reflecting a reduction in uncertainty, financial

innovation and rising interest rates, whereas in the aftermath of the GFC it did not snap back

for close to a decade after the crisis ended. Their model of the long-run behavior of M2 velocity

finds that raised levels of uncertainty (seen in measures of the liquidity premium) associated

with the Dodd Frank Act of 2010 is a key determinant of the slow bounce back in velocity.

29

corridor system to a floor system, which dramatically changed the conduct of short-term

funding markets and expanded the Fed’s role. Following the GFC, risk averse banks--

particularly big banks that faced the Fed’s stress tests and intense credit reviews--tightened

credit standards and constrained credit. According to Federal Reserve data collected from

commercial banks, bank commercial and industrial (C&I) loans fell significantly from Sept 2008

through Dec 2010 and did not regain prior levels until late 2014, while consumer loans fell even

more, not regaining their prior peak until Q1 2016 (Federal Reserve 2020).

The weak aggregate demand growth fell shy of expectations laid out by Fed Chair Bernanke and

forecasts by the Fed’s FRB-US macroeconomic model, which projected strong growth and

higher inflation (Bernanke 2012). Although asset prices were pumped up and risk-taking

flourished there was little pickup in growth of M2 or nominal GDP (Levy 2017). The moderate

economic growth that did occur lowered unemployment but constrained inflation. Inflationary

expectations receded, reinforced by the non-acceleration of wages.

The low inflation became an increasing concern for the Fed which worried that if sustained it

could lead to a downward spiral in inflationary expectations, which with the zero lower bound

on interest rates would constrain the Fed’s ability to fight a future economic downturn.

However up to then stable low inflation had been associated with sustained economic

expansion, and inflationary expectations had remained fairly closely anchored to 2%. During

the decade, inflation in the UK, Europe, Japan and other advanced nations remained low, and

global central banks expressed the same concerns as the Fed about low inflation.

6.2. The Pandemic of 2020.

On the eve of the pandemic, the Fed’s balance sheet was enlarged and its policy rate was low,

and budget deficits were high and government debt was projected to rise sharply. The

pandemic and mandated government shutdown generated a deep economic contraction, with

real GDP plunging 9% in the second quarter 2020, the fastest in history. In March, risk

premiums and volitility spiked in financial markets as the stock market fell dramatically, yield

spreads of corporate bonds and other debt instruments soared and the U.S. treasury market

30

became temporarily dysfunctional. The government responded with unprecedented monetary

and fiscal stimulus.

Fiscal initiatives, which included the CARES Act, involved approximately $3 trillion in new deficit

spending, or 13% of GDP. The Fed promptly lowered its policy rate to zero, purchased over $2

trillion of Treasury securities and MBS, provided short-term liquidity and purchased corporate

and municipal bonds and made direct loans to businesses. In less than two months, the Fed had

increased its balance sheet from $4.5 trillion to $7 trillion.

The government’s responses were similar in certain ways to wartime in magnitude and

initiatives that harnessed and redirected private sector resources to combat the pandemic.

Unlike many wars, taxes were not increased, so all of the increases in government spending

were debt-financed.

The contractionary economy and insufficient aggregate demand temporarily eased inflation

(Levy 2020), but some have argued that there may be risks of higher long-run inflation

(Goodhart 2020).

In striking contrast to monetary policy during and following the GFC, both the monetary base

and M2 have surged (Levy 2020). During March-May 2020, while the Fed’s QE and increase in

supply of bank reserves increased the monetary base 51%, and its year-over-year rise through

September was 50.2%. M2 rose 20.2% during March-September, lifting its year-over-year rise

to 24%. Risk averse businesses drew down unused lines of credit from their banks and left

them as deposits counted in M2, also generating a surge of C and I loans (figure 18). This

business risk aversion partially reversed over the summer. Household saving and bank deposits

soared, reflecting the “forced” consumer saving by the pandemic and government shutdowns

and the sizable portion of the government’s generous income support fiscal policy that was

saved.

The aggressive monetary and fiscal actions appeared to have supported the economic recovery

in the third quarter of 2020 (Edelberg and Sheiner 2020 and Powell 2020). The simultaneous

surges in bank deposits and the rate of personal saving (refected in a drop in the income

velocity of money of several monetary aggregates) suggest that a significant amount of

31

deferred consumer purchasing power remains at the end of 2020, and may be spent as the risks

and fears of the pandemic abate, boosting aggregate demand (figure 19).

The Fed’s new strategic framework. In response to its fears of low inflation and the zero lower

bound, the Fed adopted a new strategy that explicitly favors higher inflation and views higher

inflationary expectations as an important aspect of achieving its new objective (Powell 2020

and Clarida 2020). This strategy involves an asymmetric flexible average inflation targeting

(FAIT) that involves a makeup strategy of higher inflation following a period of sub-2% inflation

and employment mandate of “maximum inclusive employment”, that emphasizes “shortfalls”

rather than “deviations” from the maximum (Powell 2020). This reinterpretation of its dual

mandate and the Fed’s signal that it would not tighten preemptively in response to higher

anticipated inflation it has been argued may pose risks of higher inflation (Levy and Plosser

2020 ).

Under this monetary regime, any future reduction in productivity and potential growth could

add to inflation pressures. The economic environment of the 1970s provides a warning. Then,

stagflation resulted from sustained monetary ease and double-digit growth of aggregate

demand while tax and regulatory policies distorted economic behavior and constrained

potential growth.

Risks of fiscal dominance and influences on monetary policy. Some have argued that the

rising fiscal deficits and debt since the Covid 19 pandemic began in March 2020 may possibly

impinge on monetary policy in the future. Sustained deficits may raise the risk of fiscal

dominance, as we have seen in the past (Sims 2020). This could occur along several dimensions.

First, the massive deficits and Treasury bond issuance contributed to financial instability in

March 2020 that led the Fed to come to the rescue. The jump in Treasury bond issuance in mid-

March 2020 associated with a spike in the government’s cash flow deficit, combined with

abrupt selling of treasuries, squeezed the balance sheets of the primary dealers in treasuries

and resulted in illiquidity and dysfunction in the treasury market (Duffie 2020). The Fed

intervened, purchasing over $1.5 trillion of Treasuries in a six week period and easing capital

32

requirements of primary dealers. Some argue that persistent high deficits and Treasury bond

issuance may raise the risks of future problems. Boskin (2020) and others expressed concern

that without support from the Fed the domestic and foreign demand for Treasuries ultimately

may become inelastic, and a curtailment of demand may drive up yields.

Second, although there is no evidence or any indication that the Fed has taken into

consideration the impacts of its policies on government finances, the increased sensitivity of

debt service costs to interest rates (CBO 2020) highlights the importance of Fed policies.

At its June 2020 FOMC meeting the Fed signalled that it would anchor its policy rate to 0%

through 2023 and that it would continue purchasing Treasuries and MBS. The Fed has been

aware that its policies are widely considered a factor that has kept bond yields low, and it is

careful to avoid policy changes that may jar financial markets (Federal Reserve 2020).

Third, the Fed’s independence from the fiscal authorities may also be jeopardized by Congress’s

ability to tap the Fed’s massive asset holdings or the net profits it remits to the Treasury to