Inflation Dynamics in

Bulgaria: The Role of

Policies

Anh Dinh Minh Nguyen, Hajime Takizawa, and Iglika Vassileva

WP/23/212

IMF Working Papers describe research in

progress by the author(s) and are published to

elicit comments and to encourage debate.

The views expressed in IMF Working Papers are

those of the author(s) and do not necessarily

represent the views of the IMF, its Executive Board,

or IMF management.

2023

SEP

* The authors would like to thank Jean-François Dauphin for the suggestions and support to this project. They are grateful for useful

comments from Chikako Baba, Isabela Ferreira Duarte, Sebastian Weber, Genet Zinabou, Borja Gracia, the Bulgarian National

Bank, the Bulgarian Ministry of Finance, participants to an EUR Seminar. They also thank Sabiha Subah Mohona, Tina Kang, and

Hannah P Jung for excellent support.

© 2023 International Monetary Fund WP/23/212

IMF Working Paper

European Department

Inflation Dynamics in Bulgaria: The Role of Policies

Prepared by Anh Dinh Minh Nguyen, Hajime Takizawa, and Iglika Vassileva

Authorized for distribution by Jean-François Dauphin

September 2023

IMF Working Papers describe research in progress by the author(s) and are published to elicit

comments and to encourage debate. The views expressed in IMF Working Papers are those of the

author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

ABSTRACT: This paper analyses inflation dynamics in Bulgaria using different complementary econometrics

technics. We find that common factors play a large role in the EU’s inflation variation but impact individual

countries differently due to country-specific factors. Greater weight of energy and food in Bulgaria’s CPI basket

amplifies the impact of shocks on headline inflation. Furthermore, second-round effects in Bulgaria are likely

pronounced, associated with a higher inflation persistence compared to the EU countries. Recent ECB

monetary tightening has been insufficient for Bulgaria and its transmission is weak. Fiscal policy supported the

recovery from the COVID crisis but added to inflation.

RECOMMENDED CITATION: Anh Dinh Minh Nguyen, Hajime Takizawa and Iglika Vassileva 2023. “Inflation

Dynamics in Bulgaria: The Role of Policies”, IMF Working Paper No. 2023/212.

JEL Classification Numbers:

E31, E62, E52

Keywords:

Inflation; Monetary policy; Fiscal policy; ECB interest rates; Phillips

curve; Principal Component Analysis; VARl Sign restrictions.

Author’s E-Mail Address:

WORKING PAPERS

Inflation Dynamics in Bulgaria:

The Role of Policies

Prepared by Anh Dinh Minh Nguyen, Hajime Takizawa, and

Iglika Vassileva

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

2

Contents

I. INTRODUCTION ______________________________________________________________________________ 4

II. SELECTED LITERATURE REVIEW _____________________________________________________________ 5

III. RECENT INFLATION DEVELOPMENTS IN BULGARIA _______________________________________ 6

IV. CONTRIBUTING FACTORS ___________________________________________________________________ 8

V. ROLE OF POLICIES ___________________________________________________________________________ 15

VI. CONCLUSION _______________________________________________________________________________ 23

REFERENCES _____________________________________________________________________________________ 28

FIGURES

1. Inflation in EU Countries ___________________________________________________________________________________ 6

2. Maastricht Criterion on Inflation ___________________________________________________________________________ 6

3. Global Food and Energy Prices _____________________________________________________________________________ 7

4. Producer and Consumer Prices in Bulgaria _________________________________________________________________ 7

5. Contribution to Annual HICP Inflation by Commodity Groups in Bulgaria and EU _________________________ 7

6. Inflation in Unprocessed and Processed Food and Core Inflation in Bulgaria and EU ______________________ 8

7. Histogram of the Bilateral Correlations of the National Inflation Rates in the EU. _________________________ 9

8. Decomposition of Headline and Core Inflation in Bulgaria by Common and Country-Specific ___________ 10

9. Factor Loadings in the First Principal Component for Headline and Core Inflation _______________________ 11

9. Factor Loadings in the First Principal Component for Headline and Core Inflation _______________________ 11

10. Bulgaria: Decomposition of GDP Deflator _______________________________________________________________ 11

11. Bulgaria: Core inflation (exc. Taxes) and _________________________________________________________________ 12

12. Difference Between ECB Policy Rate and Taylor Rule-Implied Interest Rate _____________________________ 15

13. ECB Policy Rate and Costs of Funding ___________________________________________________________________ 16

14. Bulgaria: Banking Sector Liquidity and Interest Rates on Household Deposits __________________________ 16

15. Interest Rates on Loans to Nonfinancial Corporations ___________________________________________________ 17

16. Bank Interest Rate on New Mortgages __________________________________________________________________ 17

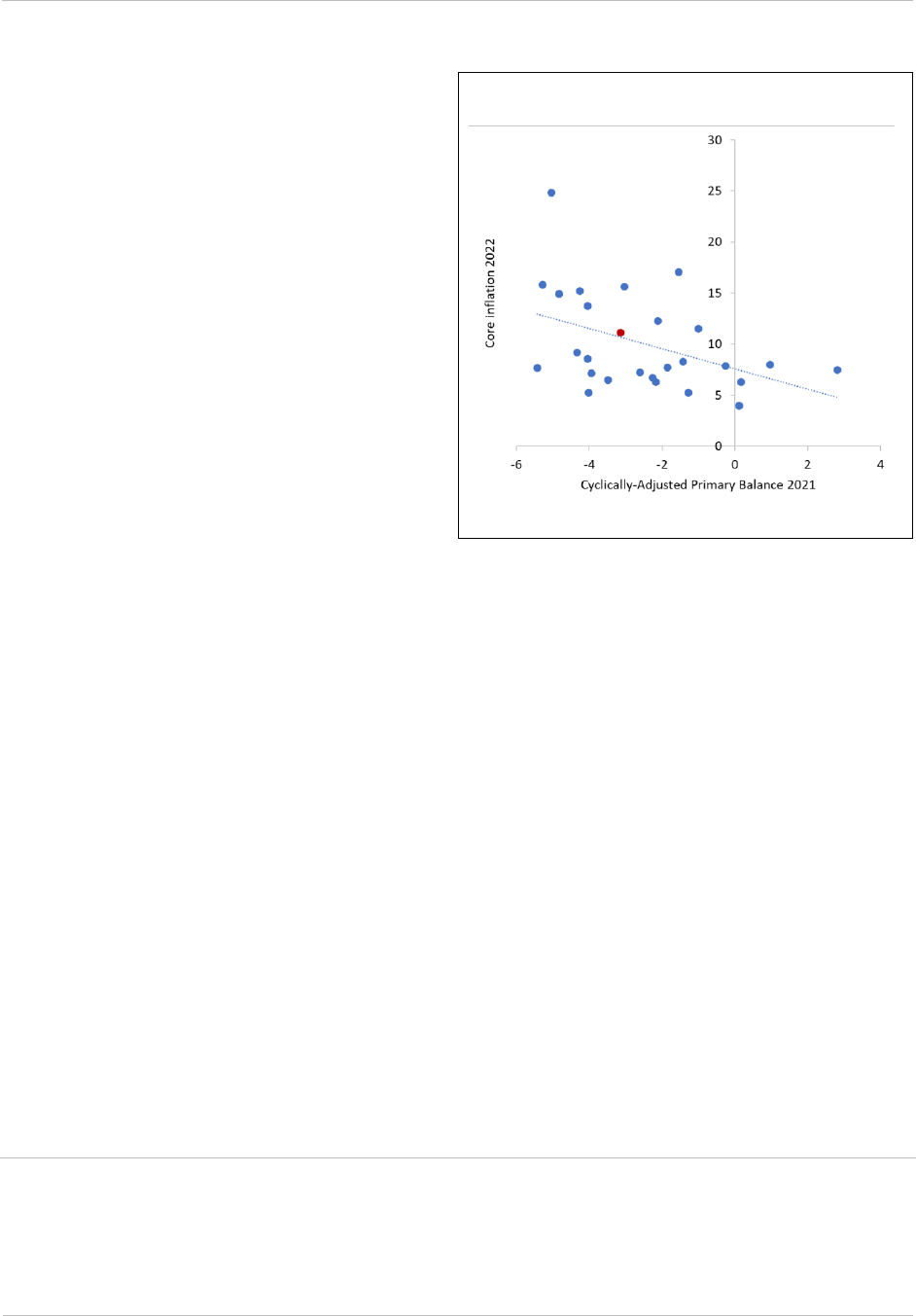

17. Fiscal Stance in 2021 and Inflation in 2022 in EU Countries _____________________________________________ 18

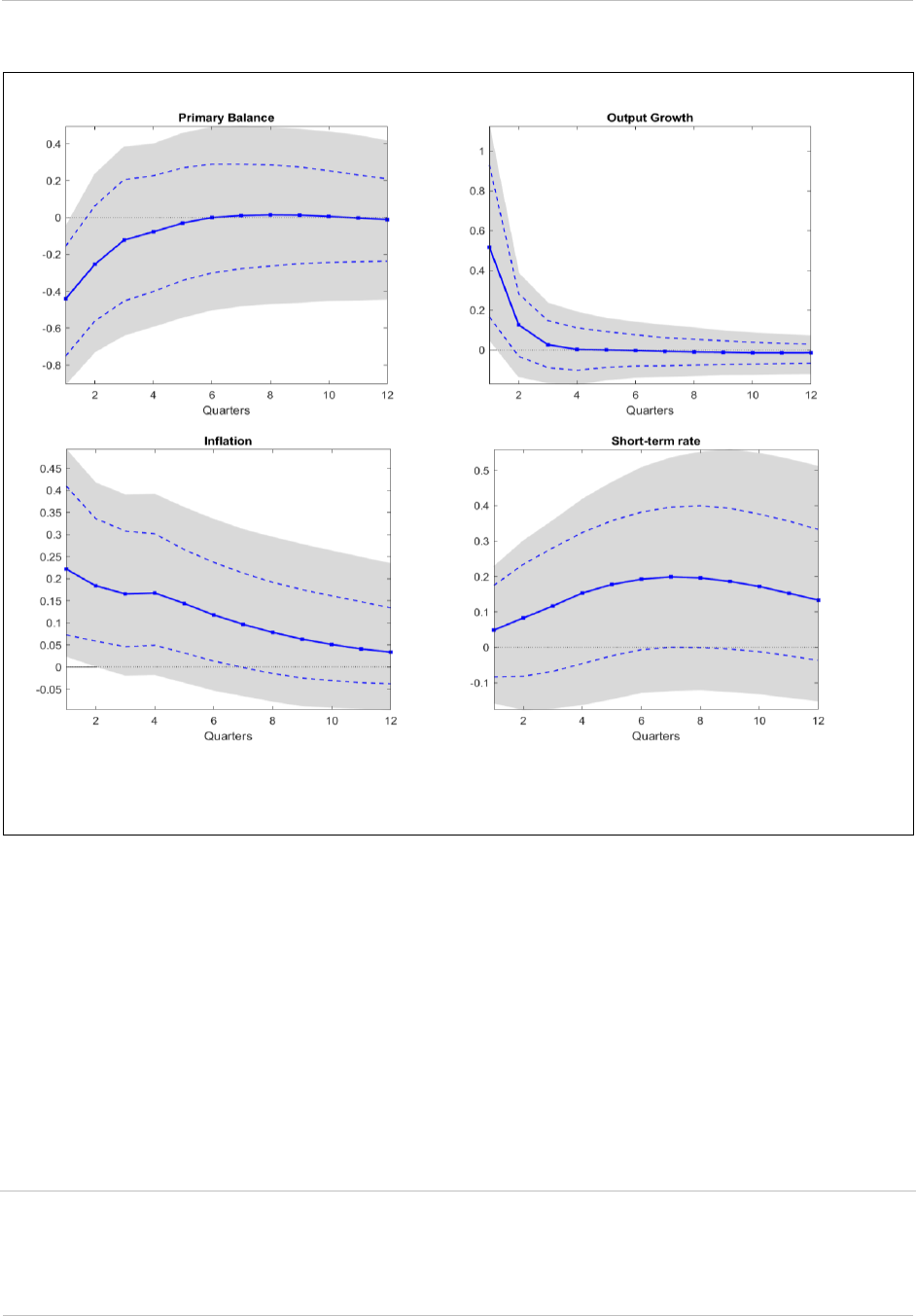

18. Impulse Response to a One-Standard-Deviation Expansionary Fiscal Shock ____________________________ 19

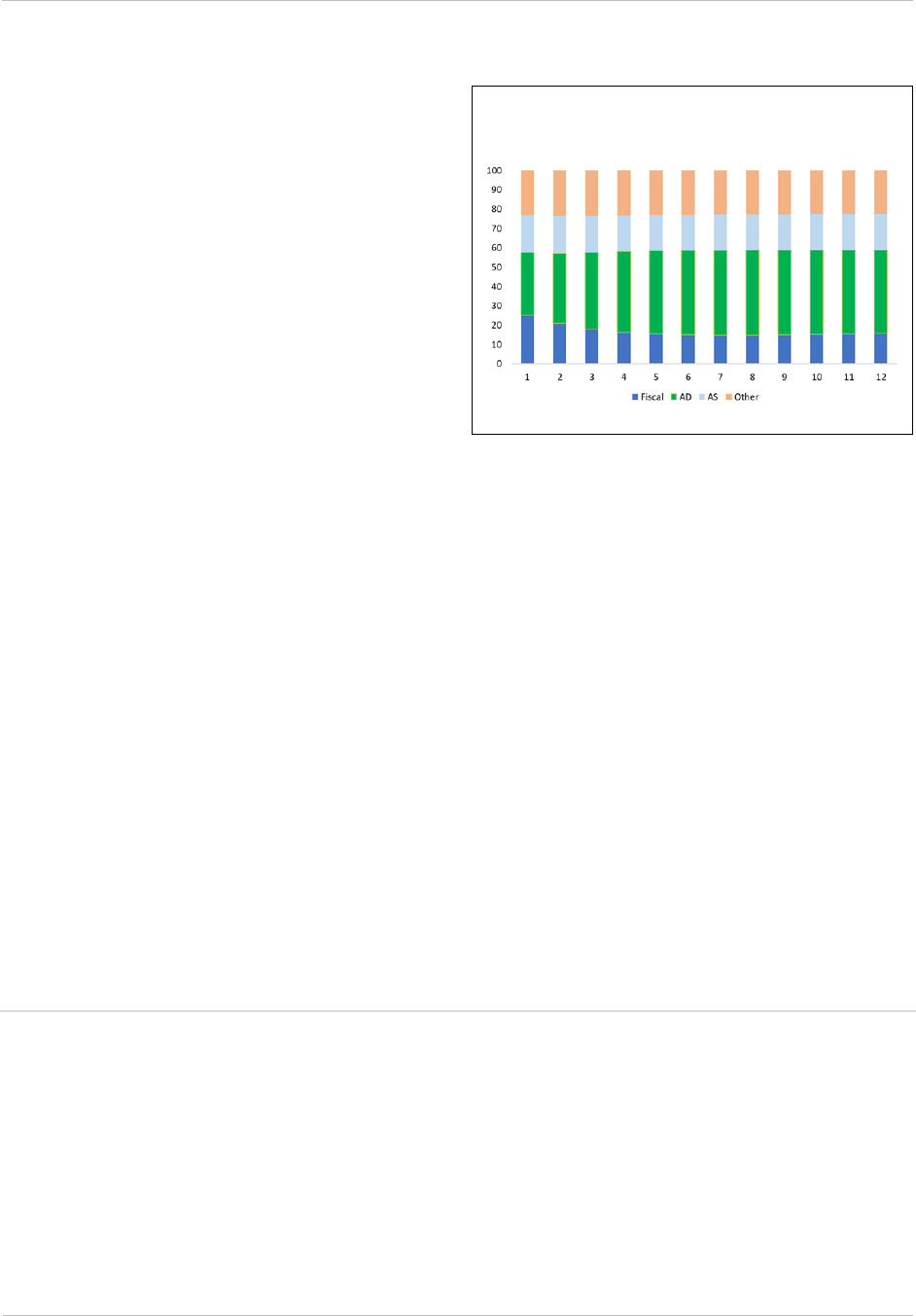

19. Forecast Errors Variance Decomposition of Inflation ____________________________________________________ 20

20. A Decomposition of Recent Output Growth and Inflation Dynamics ____________________________________ 21

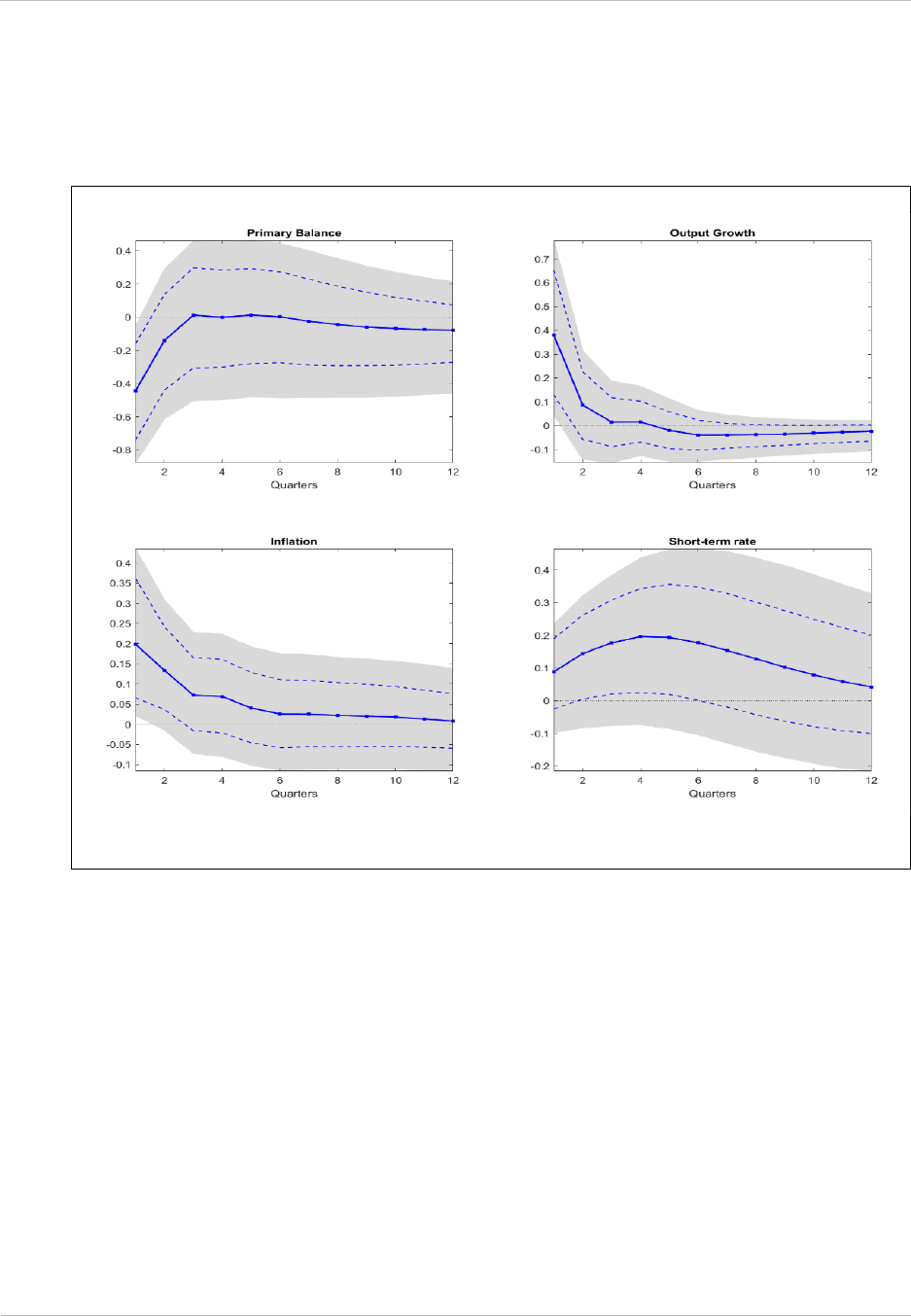

21. A Decomposition of Inflation Dynamics in an Extended Model _________________________________________ 22

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

3

TABLES

1. Decomposition of the Contribution of Major Product Groups to Inflation in Bulgaria and EU in July 2023 8

2. Estimated Phillips Curve ___________________________________________________________________________________ 14

3. Taylor Rule Parameters ____________________________________________________________________________________ 16

REFERENCES _______________________________________________________________________________________________ 28

ANNEXES

I. Phillips Curve Estimates- Extension ________________________________________________________________________ 24

II. VAR Model ________________________________________________________________________________________________ 25

III. Sensitivity Analyses _______________________________________________________________________________________ 26

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

4

I. Introduction

“Inflation is always and everywhere a monetary phenomenon”

Milton Friedman, 1963

“Persistent inflation is always and everywhere a fiscal phenomenon”

Thomas Sargent, 2013

Inflation in Bulgaria peaked above 15 percent in 2022, marking its highest level since 2000 and has

been relatively persistent, fading away only gradually over subsequent periods. The sudden rise in

inflation after being low and stable for long was not limited to Bulgaria. It affected many countries around the

globe, both advanced economies and emerging markets. Against this global backdrop, this paper explores the

drivers and characteristics of recent inflation dynamics in Bulgaria. Questions include: (1) are there country-

specific factors given the seemingly global nature of inflation? (2) how persistent is the inflation dynamics in

Bulgaria? and (3) did policy contribute to the recent surge in inflation, as inspired by the quotes of Friedman

and Sargent? Addressing these questions would help inform policies for managing inflationary risks, a

particularly important issue for Bulgaria given its ambition to join the euro area in the near term.

To explore these questions, we use a variety of complementary econometrics technics. First, building on

a stylized discussion on inflation in Bulgaria and the EU, we use a principal component analysis to shed light on

the potential interplay between common and country-specific factors affecting inflation dynamics. Second, the

study delves deeper into identifying potential inflation drivers by estimating Phillips curves for Europe as a

whole and Bulgaria individually. This is complemented with a breakdown of changes in GDP deflator into unit

profits and unit labor costs based on a GDP accounting identity. Third, to assess the role of macroeconomic

policies, we develop a measure to capture the loosening/tightening of the ECB’s monetary policy stance for

Bulgaria building on the literature. We then estimate a structural VAR model, which explicitly identifies fiscal

and monetary policy shocks and quantifies their contributions to inflation in Bulgaria. The use of a variety of

methods intends to test the robustness of our findings.

Several important findings emerge from the analysis. With respect the first question, we find evidence that,

although common factors explain a large share of inflation variations in the EU, they translate to inflation in

individual countries with varying degrees, reflecting the role of country-specific factors. Greater weights of

energy and food in Bulgaria’s HICP basket amplifies the impact of shocks on headline inflation. The increase in

core inflation in Bulgaria was more pronounced than in the EU. GDP accounting identity indicates a quick pass-

through of supply shocks at the beginning of the inflation surge, followed by an increasing role of the labor

market dynamics more recently (similar to the finds of Blanchard and Bernanke (2023) for the US). With

respect to the second question, estimation of Phillips curves suggests that second-round effect in Bulgaria

might be stronger than in the EU, as indicated by a greater persistence of core inflation and a higher

contribution of economic slack. In relation to the third question, our analysis suggests that recent ECB

monetary tightening has been insufficient for Bulgaria and its transmission is weak. While fiscal policy in

Bulgaria played an important role in supporting the recovery from the COVID-19 pandemic, our analysis finds

that made a non-negligible contribution to inflation as well.

The rest of this paper is organized as follows. Section II offers a brief selected review of the literature.

Section III provides an overview on the recent inflation developments in Bulgaria. Section IV analyzes the

inflation dynamics using principal component analysis and the Phillips curve. Section V focuses on the role of

monetary and fiscal policies in recent inflation surges. Section VI concludes.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

5

II. Selected literature review

An increasing number of papers have studied the recent global inflation surge. For advanced and

emerging European economies, IMF (2022) analyze the drivers of inflation by estimating Phillips curves, which

relate inflation to its past and expected future values, economic slack, and foreign price developments. The

study documents a large role of food and energy price in inflation in Europe. It also highlights the role of

pandemic- and war-related forces, such as rising shortages in input markets as reflected by the labor market

tightness and supply bottlenecks. Our paper is related to this work and estimates a similar specification of the

Phillips curve for Bulgaria.

Several studies have highlighted the synchronized inflation surge across many countries, driven by

both supply and demand shocks. Gopinath (2022) documents several factors that appear at play. It points

out the significant size of the global fiscal and monetary stimulus, and the speed at which they were deployed.

It notes that the stimulus was heavily channeled into goods, causing key sectors to bump against capacity

constraints and that potential employment likely declined, adding to other supply-related bottlenecks. The

author argues the likelihood of steepening of the Phillips curve in advanced economies, a point that possibly

applies also to emerging markets as discussed in our analysis based on Bulgarian data. Cascaldi-Garcia, Orak,

and Saijid (2023) analyze selected advanced economies and show that the rise in core inflation has been

highly synchronized, with increases in inflation dominated by the common component relative to idiosyncratic

movements. In line with Gopinath (2022), they document that the strong demand for goods and lockdown-

induced supply bottlenecks for inputs and industrial goods resulted largely contributed to core inflation.

Stimulus packages supported the recovery from the COVID, but likely contributed to inflation.

De Soyres, Santacreu, and Young (2023) argue that generous fiscal support was associated with an increase

in the demand for consumption goods during the pandemic, but industrial production did not adjust quickly

enough to meet the sharp increase in demand. The imbalance between supply and demand across countries

contributed to high inflation. Meanwhile, IMF (2023) empirically finds the positive impact of an increase in

government expenditure on inflation by applying VAR models for advanced economies. It also shows that the

inflationary effect of expansionary fiscal policy is larger when monetary policy accommodates fiscal

expansions. Motivated by these studies, this paper contributes to the literature with an analysis on the role of

policies from the perspective of an emerging market economy.

Our paper aims at adding insights to the drivers of inflation to the existing literature about Bulgaria.

This literature finds that inflation dynamics in Bulgaria is characterized by strong persistence, high sensitivity to

external supply-side shocks, and relatively low responsiveness to ECB monetary policy. Kasabov et al. (2017)

estimate a Phillips curve for the Bulgarian economy using a state-space model, including output, inflation, and

unemployment. The study finds that core inflation in Bulgaria is highly persistent and significantly affected by

supply-side shocks. Price changes were not found to be very sensitive to the economic cycle, mainly due to

one-off country-specific factors that were in place during the analyzed period. Nenova et al. (2019) provide an

in-depth estimate of the transmission channels of ECB’s monetary policy to economic activity and inflation,

using a large macro-econometric model calibrated to the Bulgarian economy. With respect to inflation, Nenova

et al. (2019) find that the impact of ECB monetary policy tightening on consumer price dynamics in Bulgaria is

relatively weak, while the effect on the real variables is much more pronounced. The World Bank (2023)

analyzes key factors behind inflation in the EU using a Bayesian structural VAR. For Bulgaria, they find that the

deviation from its long-term average since 2021 was due to foreign and domestic demand, domestic supply,

and exchange rate. Different from these studies, we quantify explicitly the role of fiscal and monetary policies to

recent inflation dynamics in Bulgaria.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

6

III. Recent Inflation Developments in Bulgaria

Inflation in Bulgaria gained momentum through mid-2022, quickly reaching double-digit levels. HICP

inflation soared to 15.6 percent year-on-year (y-o-y) in September 2022, reaching levels only comparable to the

price increases observed before the Great Financial Crisis in late 2008. Since Q4 2022, inflation decelerated

and was 7.5 percent y-o-y in June 2023. Though recent consumer price increases in Bulgaria are largely in line

with CESEE countries and were only the 10

th

largest in the EU (Figure 1), relative price developments led to

growing divergence with best performers in Europe (Figure 2).

Figure 1. Inflation in EU Countries (Percent, y-o-y)

Figure 2. Maastricht Criterion on Inflation

(Percent)

Strong external supply-side shocks first affected import and producer prices, then headline inflation

and, eventually, core consumer prices. Price pressures resulting from supply chain disruptions in the

aftermath of the COVID-19 and, on the demand side, a strong post pandemic recovery in 2021 were

exacerbated in 2022 by the soaring international commodity prices caused by Russia’s war in Ukraine (Figure

3). As a result, both import prices and domestic producer prices increased significantly. Import prices inflation

peaked at 22 percent in the second quarter of 2022 while domestic producer price index (PPI) inflation soared

to almost 80 percent in September 2022. This almost immediately led to the high headline HICP inflation

(Figure 4). Food and energy price increases quickly spread to the rest of commodity groups in the consumer

basket. Core inflation followed headline HICP inflation with lags and has remained elevated despite the recent

deceleration of headline inflation.

-5

0

5

10

15

20

25

30

Jan-21 Jun-21 Nov-21 Apr-22 Sep-22 Feb-23 Jul-23

Sources: Eurostat, staff calculations

Bulgaria

-2

0

2

4

6

8

10

12

14

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Difference b/n Bulgaria and best 3 euro countries

Rolling 12-month HICP inflation of best 3 euro area countries

Bulgaria

Threshold of 1.5 percentage points

Sources: Eurostat, staff calculations

* Assuming no outliers in the calculation of the 3 top performers.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

7

Figure 3. Global Food and Energy Prices

(Index, July 1, 2019 = 100)

Figure 4. Producer and Consumer Prices in

Bulgaria (Percent, y-o-y)

Source: Bloomerber Finance L. P.

Sources: Eurostat and IMF staff calculations.

Food and energy prices had the highest contribution to HICP inflation in both Bulgaria and the EU but

to varying degrees. Following the outbreak of Russia’s war in Ukraine, energy prices inflation soared to

around 41 percent in the EU and 37.5 percent in Bulgaria in June 2022, but then quickly subsided as

alternative sources of energy supplies were secured. It has been contributing negatively to the headline

inflation since April 2023 (Figure 5). Food prices increased more gradually and peaked at 22 percent in

Bulgaria (November 2022) and almost 17 percent in the EU (March 2023). Reflecting the higher increase and

the much larger weight of food in the consumer basket in Bulgaria than in the EU, the contribution of food

prices to headline inflation was much more pronounced in Bulgaria, reaching 6.4 ppt, while in the EU its

contribution reached only 3.7 ppt. Meanwhile, the contribution of energy products to headline inflation was

similar in the two regions, as a lower share in consumer spending in the EU was offset by a lower increase in

energy prices in Bulgaria. The latter reflected the fact that on the one hand, household electricity and central

heating prices are regulated, and, on the other hand, generous energy subsidies were extended to the

businesses. Also, reduced VAT and excise duties rates were introduced for a number of energy goods.

Figure 5. Contribution to Annual HICP Inflation by Commodity Groups in Bulgaria and EU

Sources: Eurostat and IMF staff calculations.

0

500

1000

1500

2000

2500

3000

0

50

100

150

200

250

300

Jul-19 Jun-20 May-21 Apr-22 Mar-23

Brent oil

Wheat

Aluminum

Natural gas (rhs)

Source: Bloomberg Finance L.P.

-20

-10

0

10

20

30

40

50

60

70

80

90

-2

0

2

4

6

8

10

12

14

16

18

2018

2019

2020

2021

2022

2023

Headline inflation

Core inflation

Domestic PPI (rhs)

Sources: Eurostat, staff calculations

-2

0

2

4

6

8

10

12

14

16

2018

2019

2020

2021

2022

2023

Bulgaria

Core inflation

Energy

Food

HICP, y/y

Sources: Eurostat, staff calculations

-2

0

2

4

6

8

10

12

14

16

2018

2019

2020

2021

2022

2023

EU

Core inflation

Energy

Food

HICP, y/y

Sources: Eurostat, staff calculations

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

8

Table 1. Decomposition of the Contribution of Major Product Groups to Inflation in Bulgaria and EU

in July 2023.

Bulgaria

EU

Bulgaria

Bulgaria

EU

Bulgaria

EU

Bulgaria

EU

Annual change, y/y percent

12.4

11.6

-9.4

-4.4

9.9

6.2

Weight in the consumer basket

29.0

21.5

13.0

10.8

57.9

67.7

Contribution

3.6

2.5

-1.2

-0.5

5.7

4.1

Sources: Eurostat and IMF staff calculations.

The impact of the international food price shock on consumer prices was much stronger in Bulgaria

than in the EU. Though the pattern of the impact and subsequent deceleration appears similar in the two

regions, unprocessed food prices in Bulgaria increased faster and higher than the EU with a larger impact on

processed food (Figure 6).

Figure 6. Inflation in Unprocessed and Processed Food and Core Inflation in Bulgaria and EU

(Percent, y-o-y).

Sources: Eurostat, and IMF staff calculations.

The increase in core inflation in Bulgaria was also more pronounced than in the EU. Core inflation in

Bulgaria was almost twice as high as in the EU at end-2022 (11.1 percent y-o-y compared to 6.2 percent y-o-y).

Furthermore, the pass-through of the external price shocks to the remaining commodity groups was more

broad-based—by end-2022, double-digit inflation was recorded in around 65 percent of the HICP commodity

groups (at 4-digit level) in Bulgaria, compared to 35 percent in the EU on average.

IV. Contributing Factors

The more pronounced inflation surge in Bulgaria raises questions about its drivers. This section applies

the principal component analysis and the well-known Philips curve approach to examine the interplay between

common and country-specific factors and the extent of the second-round effect.

-2

0

2

4

6

8

10

12

14

16

2018

2019

2020

2021

2022

2023

Bulgaria

Core inflation

Energy

Food

HICP, y/y

Sources: Eurostat, staff calculations

-2

0

2

4

6

8

10

12

14

16

2018

2019

2020

2021

2022

2023

EU

Core inflation

Energy

Food

HICP, y/y

Sources: Eurostat, staff calculations

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

9

Principal Component Analysis

Multiple studies document an increasing co-movement of national inflation rates. Attinasi and Balatti

(2021), for example, attribute it to common shocks (mainly changes in commodity prices), more wide-spread

application of inflation-targeting and structural changes (related to the applied wage and price setting

mechanisms). This seems to be especially valid for lower frequency datasets, covering advanced economies

including periods of high fluctuations in commodity prices.

1

The bilateral correlations between inflation rates in the EU helps evaluate the extent of their co-

movements. The average of bilateral correlation between each of the EU27 countries, based on q-o-q

seasonally adjusted annualized national inflation rates from 2007 onwards is 0.71 and is even higher at 0.76 if

the sample is limited to only EU member CESEE countries (Figure 7). The coefficient is slightly lower for core

inflation rates, but it remains relatively high at 0.60 for the EU as a whole.

Figure 7. Histogram of the Bilateral Correlations of the National Inflation Rates in the EU.

Sources: Eurostat, and IMF staff calculations.

A principal component approach shows that EU national inflation series display strong communality.

Over two thirds of the variance in inflation in the EU member states can be explained by a single principal

component.

2

The first principal component explains close to 73 percent of the variance in the headline inflation

and around 66 percent of the variance in the core inflation. This high level of synchronization in the consumer

price developments across EU countries can be attributed to several factors, including common shocks,

openness and trade integration within the EU, and likely similar policy responses to shocks.

1

These observations can be intuitively explained by the fact that many of the advanced economies belong to the EU and therefore

operate in a more coordinated political framework and are often subject to similar external shocks.

2

The validity of the PCA was verified using a dynamic factor model with a single AR(4) factor and an idiosyncratic component for

each inflation time series estimated as an AR(1). The results were very similar.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

10

Figure 8. Decomposition of Headline and Core Inflation in Bulgaria by Common and Country-Specific

Components

(Percent, seasonally adjusted annualized q-o-q).

Headline Inflation

Core Inflation

Sources: Eurostat, and IMF staff calculations.

A decomposition of the HICP headline and core inflation rates in Bulgaria shows that they have

generally been in line with the other EU countries. Historically, the country-specific (idiosyncratic)

component was positive in 2007 and 2008, as Bulgaria entered the GFC-induced recession only in 2009. It

became negative in 2011–14 reflecting a more sluggish recovery from the crisis than in other EU countries. The

surge of the headline and core inflation rates since 2021—the period characterized by supply-side shocks and

policy responses that affected countries across the EU—is estimated to be driven by the single principal

component. The idiosyncratic component of both headline and core inflation has been negative. The negative

contribution of the country-specific component to inflation in Bulgaria might be at least partly attributed to the

fact that the increase in the energy prices in Bulgaria was much more limited compared to other countries, as

noted above.

Bulgaria, together with the majority of CESEE countries, is more sensitive to global inflation

fluctuations than its EU counterparts. The sensitivity is measured through the factor loadings for the first

principal component. As shown in Figure (9), these differences are even more striking for core inflation. In the

case of Bulgaria, specifically, the factor loading for the core inflation is even higher than for headline. The

estimated factor loadings are generally in line with the standard deviation of the inflation series by countries,

where much higher values are observed in the Baltic countries, Hungary, Czech Republic and Bulgaria and

price developments have the lowest variability in France, Finland, Malta and Sweden. Such differences in

factor loadings indicate that country-specific factors matter in the transmission and propagation of the same

common shock.

3

3

This could be partly due to the high energy intensity and market inefficiencies in Bulgaria. For example, the Bulgarian economy is

almost four times less energy efficient than the EU on average while OECD (2021) notes low competition in product markets in

Bulgaria due to regulatory barriers, both of which could amplify the impact of external shocks on inflation. We find that factor

loadings in CESEE countries display high correlations with the share of food and energy in the consumer baskets in the EU

countries (correlations above 0.70 for both headline and core inflation). They also exhibit an inverse relationship with the size of the

economy (-0.38 with headline inflation and -0.47 with core inflation). Trade openness does not seem to be a significant factor.

-7

-2

3

8

13

18

23

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Idiosyncratic component

Common component

Bulgaria

Headline inflation

Sources: Eurostat, staff calculations

-7

-2

3

8

13

18

23

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Idiosyncratic component

Common component

Bulgaria

Core inflation

Sources: Eurostat, staff calculations

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

11

Figure 9. Factor Loadings in the First Principal Component for Headline and Core Inflation

Headline Inflation

Core Inflation

Source: IMF staff estimates.

Note: The red line is the average of factor loading to the first common component across all countries in the sample.

GDP Deflator Inflation and Phillips Curve

A GDP accounting identity and estimated

Phillips curves help shed light on factors

behind the inflation dynamics in Bulgaria.

Using the income side of GDP, changes in the

GDP deflator can be decomposed into changes in

unit profit, unit labor cost and unit tax. The

breakdown thus provides insights into the roles of

profits and wages behind general price

developments. Meanwhile, estimation of Phillips

curves serves to enhance our understandings on

the role of labor market slack, the persistence of

inflation, and other inflation drivers.

The inflation surge was initially accompanied

by an increase in unit profits in Bulgaria. Unit

profits did not play a large role to the change in

GDP deflator prior to 2021, a period characterized by a relatively stable GDP deflator inflation (Figure 10).

However, the change of unit profits rose in 2021 and the first half of 2022. Bulgaria’s economy recovered

robustly from the COVID-19 crisis amid supply constraints in 2021 and was subsequently hit by an energy price

shock in 2022, which drove input costs higher. Firms might have been able to pass on higher input costs

Figure 10. Bulgaria: Decomposition of GDP Deflator

(Year-on-year percent change; percentage points)

-5

0

5

10

15

20

2015 2016 2017 2018 2019 2020 2021 2022

Unit tax

Unit labor cost

Unit profit

GDP Deflator (y/y percent)

Sources: Eurostat; and IMF staff calculations.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

12

promptly as the supply side shocks hit the economy. The high contribution of unit profit likely reflects the pass-

through of these higher input costs.

4

Unit labor costs contributed significantly to the

increase in GDP deflator in 2022. Unlike unit

profits, the contribution of unit labor costs remained

muted in 2021 when the economy started

recovering and Bulgaria’s employment support

scheme was still in place. However, the

contribution of unit labor costs rose significantly in

2022, as wage increases outpaced productivity

growth, particularly in the private sector. The initial

smaller contribution of unit labor costs suggest that

it takes time for wages to adjust to shocks. The

lagged adjustment could potentially reflect factors

such as labor market frictions and gradual

adjustments of inflation expectations.

While common factors, including exogenous shocks, have likely contributed to the initial surge of

inflation, the second round-effect was also at play. Exogenous shocks could push up inflation, but they do

not necessarily lead to sustained inflation. Data suggest that the labor market has gradually tightened and the

inverse relationship between core inflation and unemployment rate might have steepened in the current

episode of inflation surge (Figure 11), which is consistent with the increase in unit labor cost shown in Figure

10. Furthermore, it supports the argument of Gopinath (2022) but from an emerging market economy

perspective. This suggests that the high inflation that initially was caused by exogenous shocks might have

given a momentum for inflation dynamics. For example, the tightening labor market might have provided

workers with greater powers to negotiate wage increases than in the past, as headline inflation surged.

Phillips curve estimation suggests significant persistence of core inflation and an important role of

short-term inflation expectation in Bulgaria. Phillips curves are estimated to examine the impact of typical

drivers of inflation on core inflation for European, Advanced European (AE) and Emerging European (EE)

economies as well as Bulgaria over 2000Q1–2022Q4, using a similar specification as in IMF (2022) to facilitate

the comparison. In particular, core inflation is regressed over lagged core inflation, one-year ahead inflation

expectations based on consensus forecasts, unemployment gap (deviation from the Hodrick-Prescott —HP—

filtered unemployment rate) and a lagged proxy of external price pressure (i.e., combined changes in foreign

producer price indices and exchange rates), together with measures of food and energy prices (IMF 2022).

While estimating in a panel framework has the advantage of utilizing both information on cross sections and

over time, estimating at individual level is useful from a country-specific perspective. However, the later could

4

The increase in unit profits does not necessarily mean that profit margins have also increased. Scope for future disinflation is more

limited if there was little increase in profit margins.

Figure 11. Bulgaria: Core inflation (exc. Taxes) and

Unemployment

(Year-on-year percent change; percent)

-2

0

2

4

6

8

10

12

3.5 4.5 5.5 6.5 7.5 8.5 9.5 10.5

Core inflation exc. taxes

Unemployment rate

2011 - H1 2021

H1 2021 -

Sources: Eurostat, staff claculations.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

13

be subject to a larger amount of estimate uncertainty from a smaller sample size.

5

The analysis yields important

findings (Table 2):

6

▪ Past core inflation level is a very important driver of the current level of core inflation in Bulgaria, even after

controlling for inflation expectation. The estimated coefficient is much larger than those for European, EE

and AE economies, indicating more persistent inflation dynamics (Column 4, Table 2). The persistence of

inflation dynamics is also a robust feature in the extensions of the Phillips curve presented in Annex I.

▪ Short-term inflation expectation is also found to matter for the level of core inflation in Bulgaria. It is possible

that the measured expectation reflects factors that drive near-term inflation such as exogenous shocks.

Estimation of a separate specification replacing one-year ahead inflation expectation with three-year ahead

inflation expectation shows that the estimated coefficient is much smaller and not statistically significant for

Bulgaria. It is also smaller than the estimated coefficients for other country groups. The role of medium-term

inflation expectation in inflation dynamics appears smaller for Bulgaria, which is not surprising given the

stability of medium-term (three-year) inflation expectation around 2.5 percent in recent inflation surges.

7

▪ The coefficient for the unemployment gap is statistically significant.

8

An alternative specification including a

dummy variable for mid-2021 onward interacting with the unemployment gap suggests a steepening of the

Phillips curve since mid-2021 (Columns 5–6, Table 2). However, estimated coefficients for both employment

gap and the interaction term are not statistically significant.

▪ Coefficients for external price pressures and energy prices have expected signs but are not statistically

significant. However, food prices are statistically significant, providing some signs of the second-round effect.

5

Having said that, our baseline specification spans more than 20 years of quarterly data (more than 80 observations), which is not

too small from a time-series perspective.

6

We conduct additional sensitivity analyses in Annex I: i) controlling for the time and fixed effects in panel estimation, ii) allowing for

two cross-dummies with unemployment gap: the 2007Q1–2008Q2 period and the post-2021Q2 period; iii) restricting the sum of the

sum of coefficients on past and expected inflation rates to be 1; and iv) an alternative measure of unemployment gap. We obtain

similar findings with these extensions.

7

Here, we are using the three-year inflation expectation from Consensus Economics. But the results would likely depend on the

specific measures of expectations, such as from professionals’, households’, and firms’ expectations. Divergence between these

measures could lead to different results.

8

The result is robust when an HP-filter based output gap is used instead of the unemployment gap.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

14

Table 2. Estimated Phillips Curve

Sources: IMF staff estimates, see also IMF (2022).

Notes: Estimates in columns (1) to (3) are from a panel regression with country fixed effects: European economies (EUR),

Advanced European (AE), and Emerging European (EE) economies. Estimates in columns (4), (5), and (6) for BGR are from

an OLS regression. Time notation: t-1 indicates information at time t-1, similarly for t-2, t-3, and t-4. The core HICP is the

HICP excluding energy, food, alcohol, and tobacco.

Strong persistence of core inflation suggests that inflation expectation in Bulgaria might be largely backward-

looking.

9

The steepening of the Phillips curve suggests that the shrinking slack could have played a greater role

than previously in the inflation dynamics at the time inflation surged.

9

Bulgaria has maintained a long-running currency board with the euro, which historically supported Bulgaria’s conservative fiscal

management and helped disinflation. Persistence of core HICP inflation and the limited role of medium-term inflation expectation

might in part owe to the period of high inflation prior to the Great Financial Crisis in the sample.

(1) (2) (3) (4) (5) (6)

VARIABLES EUR EE AE BGR BGR BGR

Unemployment gap -0.258*** -0.567*** -0.106 -0.384* -0.377 -0.222

(0.052) (0.150) (0.068) (0.222) (0.227) (0.271)

Dummy variable for post-2021Q3 x unemployment_gap -3.306 -5.442

(3.845) (4.162)

Lag of core HICP inflation 0.341*** 0.435*** 0.238* 0.676*** 0.678*** 0.826***

(0.107) (0.112) (0.138) (0.077) (0.075) (0.126)

Inflation expectations, 1 year ahead 0.607*** 0.475*** 1.011*** 0.276*** 0.268***

(0.142) (0.153) (0.218) (0.083) (0.080)

External price pressure (t-1) 0.028*** 0.047*** 0.013* 0.020 0.018

(0.009) (0.017) (0.007) (0.020) (0.021)

Export share-weighted food price inflation 0.096*** 0.145*** 0.059*** 0.054** 0.054**

(0.024) (0.045) (0.013) (0.027) (0.027)

Export share-weighted food price inflation (t-1) 0.055*** 0.045** 0.053*** 0.014 0.003

(0.016) (0.022) (0.013) (0.037) (0.038)

Export share-weighted food price inflation (t-2) 0.027 -0.011 0.054*** 0.003 -0.013

(0.018) (0.031) (0.014) (0.035) (0.035)

Export share-weighted food price inflation (t-3) 0.060*** 0.062* 0.060*** 0.064* 0.051

(0.017) (0.033) (0.011) (0.036) (0.035)

Export share-weighted food price inflation (t-4) 0.022 0.029 0.021 -0.002 -0.008

(0.017) (0.026) (0.019) (0.036) (0.035)

Export share-weighted energy price inflation 0.029*** 0.037* 0.036*** 0.010 -0.003

(0.010) (0.020) (0.011) (0.042) (0.042)

Export share-weighted energy price inflation (t-1) -0.022 -0.002 -0.034 -0.000 0.002

(0.019) (0.023) (0.028) (0.050) (0.051)

Inflation expectations, 3 years ahead 0.095

(0.093)

Observations 2,552 530 2,022 88 88 62

R-squared 0.734 0.832 0.479 0.855 0.857 0.825

Country FE Yes Yes Yes No No No

Time FE No No No No No No

Robust standard errors in parentheses.

*** p<0.01, ** p<0.05, * p<0.1

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

15

V. Role of Policies

The persistent core inflation in Bulgaria suggests the importance of controlling aggregate demand and

preventing inflation from becoming entrenched. The rest of the paper discusses the roles of and constraints

on policies.

Monetary Policy

The currency board arrangement means that ECB monetary policy could directly influence monetary

conditions in Bulgaria. There is limited scope for independent monetary policy in Bulgaria as the Bulgarian

National Bank (BNB) does not set a policy interest rate under the currency board. ECB monetary policy could

affect monetary conditions and deposit and interest rates in Bulgaria, which in turn could result in changes in

demand and inflation. ECB monetary policy could also affect inflation via changes in Bulgaria’s external

demand, effective exchange rate vis-à-vis non-euro area countries and import prices, and capital flows (BNB,

2019 and 2023).

ECB’s monetary policy was more

accommodative than implied by an

illustrative Taylor rule for Bulgaria in

recent years. A Taylor-rule implied policy

interest rate can be derived based on

parameters from a range of existing studies

for the euro area (Table 3) and the output gap

and inflation in Bulgaria. We take the average

over the parameters. The output gap is

derived from applying the Hodrick-Prescott

(HP) filter to seasonally-adjusted quarterly

GDP for 2000Q1–2022Q4. The difference

between the actual ECB deposit rate and the

Taylor rule-based interest rate is then

calculated. This difference measures the

extent of deviation of ECB’s policy rate from

the rule-based estimated interest rate for Bulgaria, as an indicator of the loose or tight stance under the

Bulgaria’s currency board arrangement. The result suggests that ECB’s policy rate was too accommodative for

Bulgaria in 2021–22 and remains so as of mid-2023 (Figure 12).

10

10

The Taylor rule parameters used in the calculation apply to the euro area. The neutral interest rate for Bulgaria is likely to be

higher than the one for the euro area given its development level. The estimated Taylor rule-based interest rate therefore is likely to

be lower than the one that applies to Bulgaria.

Figure 12. Difference Between ECB Policy Rate and

Taylor Rule-Implied Interest Rate

(Percentage points)

Sources: ECB IMF WEO; and IMF staff calculations.

-4

-3

-2

-1

0

1

2

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Bulgaria

Sources: ECB, IMF WEO, staff calculations

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

16

Table 3. Taylor Rule Parameters

Sources: IMF staff calculations based on cited references.

Figure 13. ECB Policy Rate and Costs of Funding

(Percent)

Figure 14. Bulgaria: Banking Sector Liquidity and

Interest Rates on Household Deposits (Percent)

Source: ECB.

Sources: ECB; BNB; and IMF staff calculations.

Transmission of ECB’s tightening monetary policy to Bulgaria’s economy appears weak. External

funding costs for banks in Bulgaria are on the rise: EURIBOR has increased in line with ECB policy rates since

the ECB started raising policy rates in July 2022 (Figure 13). However, interest rates on deposits, the main

source of funding for banks, have remained low. Indeed, interest rates on retail deposits barely increased

despite the increase in ECB policy rates. This likely reflects abundant liquidity in Bulgaria’s banking sector

(Figure 14). Increases in interest rates on loans also have been slow. Interest rate on new loans to non-

financial corporations (NFCs) in Bulgaria has not increased as much as in the euro area (Figure 15). The

difference between Bulgaria and the euro area is even more pronounced for the interest rate on new mortgage

loans to households. The rate has hardly increased in Bulgaria while the rate in the euro area has jumped and

now exceeds the rate in Bulgaria for the first time in 15 years (Figure 16). In an environment of low funding

costs, strong competition in the banking sector for credit market share has underpinned the slow transmission

of the ECB’s monetary policy. The quantitative impact of the ECB monetary policy on inflation is discussed in

the next sub-section along with the role of fiscal policy.

Inflation Output gap

Inflation

change

Output gap

change

Interest rate

(-1)

Output

growth

NAWM II (Coenen and others, 2019) 0.19 0.01 0.04 0.40 0.93

EAGLE model 0.22 0.87 0.01

Dieppe and others (2011) 0.38 0.13 0.75

European Commission Model (2019) 0.24 0.04 0.85

Smets and Wouters (2002) 0.12 0.01 0.22 0.17 0.93

Cardani and others (2022) 0.21 0.01 0.91

Gerali and others (2010) 0.46 0.77 0.08

Mean 0.26 0.04 0.13 0.29 0.86

Std 0.12 0.05 0.13 0.16 0.07

coef of variation 0.45 1.28 0.98 0.57 0.09

Max 0.46 0.13 0.22 0.40 0.93

Min 0.12 0.01 0.04 0.17 0.75

-1

0

1

2

3

4

5

6

2007 2009 2011 2013 2015 2017 2019 2021 2023

ECB: Interest rate for

deposit facility

3-Month EURIBOR Rate

Source: ECB.

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

0

1

2

3

4

5

6

7

8

9

2007 2009 2011 2013 2015 2017 2019 2021 2023

Interest rates on new

household deposits with

maturity of 1 year or less

Bank-held private deposits-

to-loans to the private sector

(right scale)

Sources: ECB; BNB; and Fund staff calculations.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

17

While scope for independent monetary policy is limited, the BNB has several tools to tighten monetary

conditions in Bulgaria. The BNB sets the rate of minimum required reserves (MRR) maintained by banks.

The main purpose of MRR is to maintain precautionary liquidity buffers in the banking system as the BNB has a

limited ability to function as a lender of last resort under the currency board arrangement. Because the rate of

MRR affects the amount of liquidity in the banking sector, the BNB can use it as a monetary policy tool. Since

minimum reserves are not renumerated, a higher MRR rate increases banks’ funding costs and is therefore

expected to exert an upward pressure on banks’ lending interest rate, thereby discouraging bank lending.

Faced with weak transmission of ECB’s monetary policy tightening and continuing robust credit growth amid

high inflation, the BNB recently increased MRR from 5 percent (liabilities to nonresidents) and 10 percent

(residents) to 12 percent (for both) in two steps in June and July 2023. Another tool for the BNB to influence the

monetary condition is the interest rate on excess reserves maintained by banks. Renumerating excess

reserves at a rate that is higher than the one on alternative liquid assets would encourage banks to maintain

excess liquidity at the BNB. However, the BNB historically did not renumerate excess reserves as costs for

BNB could potentially increase substantially.

Figure 15. Interest Rates on Loans to

Nonfinancial Corporations

(Percent)

Figure 16. Bank Interest Rate on New Mortgages

to Households

(Percent)

Fiscal Policy

In addition to monetary policy, fiscal policy appears to have played an important role in the recent

inflation surge. A simple observation across EU countries (Figure 17) indicates that countries with large

cyclically-adjusted primary deficit in 2021 are associated with higher core inflation in 2022. While this provides

a useful illustration, there are several caveats of using CAPB because it is unobserved, and its estimates may

include non-policy-related movements that could be corelated with other developments affecting output. For

example, a boom in the stock market both raises cyclically-adjusted tax revenues by increasing capital gains

realizations and is likely to reflect other developments that will raise output in the future (Romer and Romer,

2010). For this reason, the literature has been proposing to use structural identification to analyze the impact of

a fiscal shock. One of the popular approaches is to use a VAR model, which we follow in this analysis.

0

2

4

6

8

10

12

2007 2009 2011 2013 2015 2017 2019 2021 2023

Bulgaria Euro area

Sources: ECB and BNB.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

18

Structural fiscal shocks are identified via sign

restrictions in a VAR framework. Specifically, the

VAR model has four variables: real GDP growth (i.e.,

log difference of real GDP), core inflation (i.e.,

excluding energy and unprocessed food), a measure

of short-term interest rate, and the primary fiscal

balance in percent of GDP in the previous quarter

(see model details in Annex II).

11

Although the model

is parsimonious, it includes important variables of

interest: the first three variables are to capture the

behavior of the macroeconomy, and the last variable

is to capture the behavior of fiscal policy over time

(see also, Bianchi and Melosi, 2017, for a similar

setup). The baseline model includes four lags, but

the results are also robust with different lag

structures. The model is estimated with quarterly

data over the period 2004Q1–2022Q4. It is well-

known that there is an endogeneity between fiscal

variables and macro-variables such as GDP and inflation. On the one hand, changes in GDP affects fiscal

variables, for instance via automatic stabilizers. On the other hand, changes in tax and government expenditure

cause changes in GDP and inflation via the fiscal multiplier effect. To identify fiscal shocks, we apply the sign

restrictions approach as discussed in, just to name a few, Canova and De Nicolo (2002), Uhlig (2005) and

Rubio-Ramirez et al. (2010). Specifically, the fiscal shock is identified by the restrictions that tightening fiscal

policy raises primary balance, but lower GDP growth or inflation.

12

Note that the sign restrictions apply only on

the contemporaneous effects: there is no magnitude restrictions or any other restrictions beyond the

contemporaneous effects.

11

Our results are nearly identical if we scale by the contemporaneous or previous quarter GDP. Also, primary balance is moving-

averaged over four quarters.

12

Fiscal policy can affect inflation dynamics via different channels. For instance, in line with Smets and Wouters (2007),

expansionary fiscal policy increases aggregate demand, therefore raising output and inflation. Meanwhile, Bianchi and Melosi

(2022) emphasize the inflation expectations channel. We do not distinguish these channels and let the data speak about the

“general equilibrium” effect on inflation. We consider the impact over the sample on average, but these could be state dependent

depending on labor market and supply-chains conditions facing the economy, among other factors.

Figure 17. Fiscal Stance in 2021 and Inflation in

2022 in EU Countries

Source: WEO database.

Notes: The red circled point is Bulgaria.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

19

Figure 18. Impulse Response to a One-Standard-Deviation Expansionary Fiscal Shock

Sources: IMF staff estimates.

Notes: Blue solid line: median response; dash blue line: 68 percent credible intervals; shaded area: 90 percent credible intervals.

The impulse response of primary balance is in percentage points of GDP and those of output growth, inflation and short-term rate

in percentage points.

Identifying other shocks may help identify the shocks of interest.

13

We therefore identify two other shocks:

aggregate demand and aggregate supply shocks. A negative aggregate demand shock would lower GDP

growth and inflation, while reducing the primary balance (for instance, because of the automatic stabilizers).

Meanwhile, the aggregate supply is identified because it has different signs on GDP growth and inflation.

14

Note that, aggregate demand and supply shocks can comprise both global and domestic shocks.

15

13

As motivated by Paustian (2007).

14

Similar identifications are applied in IMF (2023) in the context of a Bayesian Panel VAR.

15

For a VAR system of n endogenous variables, following Gambetti and Musso (2017) who identify n − 1, and leave one of the

reduced-form residual shock unidentified to act as a buffer and capture the effects of omitted variables and other shocks which are

different from three identified shocks.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

20

A one-standard-deviation unexpected

expansionary fiscal policy shock raises both

output growth and inflation. As shown in Figure 18,

the shock reduces the primary balance by 0.45 percent

of GDP while increasing annual output growth by

0.5 percent, implying a fiscal multiplier of 1, which is in

the range of multipliers documented in the literature.

Meanwhile, annual inflation increases by

0.2 percentage points, with the effects only fading

away gradually, which is in line with the persistence of

core inflation identified in the Phillips curve estimation.

Given the increase in output growth and inflation,

interest rate goes up, but the response is weak and

with large bounds, mostly reflecting the fact that

Bulgaria has a currency board in which the Bulgarian lev is fixed to the euro and monetary conditions in

Bulgaria follow those in the euro area.

16

In addition, the analysis on the forecast error variance decomposition

confirms the relevance of fiscal shocks to inflation dynamics in Bulgaria. Specifically, on average, fiscal policy

shocks explain about 15–25 percent of inflation variation, with a larger explanatory power in the short term

(Figure 19).

Fiscal policy played an important role in supporting the recovery from the COVID-19 pandemic. As

shown in Figure 20.A, the model attributed the significant drop in output growth in 2020 mainly to non-fiscal

shocks, particularly aggregate demand and supply, which is in line with the interpretation that the COVID-19

pandemic shocks constituted a mix of both (del Rio-Chanona et al., 2020). The negative contribution of fiscal

policy to output indicates that the size of fiscal support in 2020 could be relatively smaller compared to the

severity of the COVID-19 shock hitting the economy.

17

This could be explained partly by challenges in

accurately gauging the shock’s impact and the corresponding policy response in real-time, especially

considering potential implementation lags. Such assessments become clear with the benefits of hindsight.

However, in 2021, fiscal support, beyond the endogenous response to aggregate demand, is estimated to have

contributed 2.8 percentage points to output growth, almost 40 percent of total output growth.

18

In addition, it

added about 1 percentage point of growth in 2022.

16

The results are similar when using the pre-COVID sample, 2004Q1–2019Q4, as shown in Annex III.1, therefore indicating the

stability of the model parameters.

17

The relationship between primary balance (PB), cyclically adjusted primary balance (CAPB), and output gap (OG) can be

represented as: , where is the change in primary balance, is the change in cyclically adjusted

primary balance, is the change in output gap, and is the budget balance semi-elasticity with respect to output gap. From 2019

to 2020, primary balance (on a cash-basis) declines by 2 percent of GDP (from -0.4 percent to -2.4 percent of GDP). Assuming

consistent with Price et al. (2015)’s average estimate for OECD countries, if the output gap fell by more than 4 percentage points

between 2019 and 2020, then the change of CAPB would be positive, indicating a tightening direction. While output gap estimates

can vary considerably, some measures suggest a decline of more than 4 percentage points between 2019 and 2020. For example,

BNB (2022) estimates that output gap was near 3 percent in 2019 but then shifted into the negative, falling below -2 percent in 2020

due to the shocks. Similarly, AMECO’s data indicates that output gap went from 1.3 in 2019 to -4.7 percent in 2020 (i.e., falling by 6

pp). The IMF’s estimate (based on WEO July 2023 vintage) also shows a large decline in the output gap, moving from 2.5 percent in

2019 to -3.9 percent in 2020 (i.e., falling by 6.4 pp).

18

This is the total effect including the lagged effect of fiscal shocks before 2021 and the one in 2021.

Figure 19. Forecast Errors Variance

Decomposition of Inflation

Source: IMF staff estimate.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

21

Figure 20. A Decomposition of Recent Output Growth and Inflation Dynamics

A. Output growth

B. Inflation

Sources: IMF staff estimates.

Notes: The annual number is the sum of decomposition over quarters.

Fiscal support, while supporting recovery, also contributed to inflation, as observed in other countries.

Specifically, fiscal shocks explain about 1.2 percentage points of inflation in 2021 and about 3 percentage

points of inflation in 2022 (Figure 20.B). As shown in the impulse response function analysis, the impact of

fiscal policy on output growth fades away quickly, but its impact on inflation is persistent. This means that there

is an influence of the negative impact in 2020 carrying over into 2021. The significant impact in 2022 is due to

the lagged effect of previous fiscal supports, particularly those that were implemented at the end of 2021

resulting in a significant and positive impact in 2022 (associated with high persistence of inflation dynamics in

Bulgaria), together with looser-than-warranted policies in 2022 in the context of a strong recovery. Excluding

the pre-determined factors, i.e., deterministic contributions and initial conditions likely reflecting long-term (or

structural) factors and thus not explained by model-based structural shocks, our results confirm that non-fiscal

shocks (particularly aggregate demand and supply) are the main contributor to inflation in Bulgaria.

19

The

negative contribution in 2021 can be explained partly by the persistent effect of the negative demand shock in

2020 combined with the supply-side improvement in 2021, which pushed output up while lowering price. In

2022, these non-fiscal shocks, on average, explain more than 40 percent of core inflation, consistent with the

view that external factors, including supply-chain constraints and the energy crisis in Europe amidst the

recovery of demand from the COVID-19 pandemic, pushed global inflation.

A variety of sensitivity analyses confirms the inflationary effect of fiscal shocks in 2022. First, instead of

using the primary balance as in the baseline, we consider four alterative fiscal variables: the primary balance

that excludes grant, the cyclically-adjusted primary balance excluding grant, the overall balance in cash, and

the overall balance in accrual.

20

As shown in Annex III.2, these additional exercises obtain similar results. If

anything, the contribution of fiscal policy to inflation is slightly larger when using the overall balance in accrual.

Such a larger effect is not surprising given that the accrual-based deficit has been larger than cash-based one

19

The pre-determined factor is sample-dependent; its value being greater than 2 percent (ECB’s inflation target) partly reflects the

on-going convergence path of inflation in Bulgaria.

20

The cyclically-adjusted primary balance excluding grant is obtained by excluding the business cycles fluctuations (i.e., HP-filtered

output gap) from the primary balance excluding grant.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

22

in recent years. Second, in addition to the interbank rate money market overnight interest rate in the baseline,

the study also considers the short-term interest rate, the rate of less-than-one-year deposits, and the

government bond yield for newly issued bonds with maturity over a year.

21

The first measure captures short-

term dynamics of interest rates as in the baseline, the second one reflects the short-to-medium term, and the

last one covers the influences of medium-to-long term dimension, including the potential effect of forward

guidance and quantitative easing. The results (Annex III.3) once again corroborate the contribution of fiscal

policy on inflation, particularly in 2022.

Extending the framework to control explicitly

the EA monetary policy, we confirm that its

stance appears too loose for Bulgaria and,

thus, contributed to inflation in 2022. We

include into the baseline VAR model a measure of

EA’s monetary policy stance, which is constructed

as the interest rate gap between the actual ECB

interest rate and the Taylor-rule based rate. The

model therefore has five variables. We add the

baseline identification restrictions with a sign

restriction to identify the EA monetary policy

shock. Specifically, a positive monetary policy

shock would increase the ECB Taylor gap (which

means that tightening would make the gap more

positive or less negative), while putting an upward

pressure on Bulgaria’s short rate, lower inflation

and output growth. Again, note that the restriction

is contemporaneous only, and we also assume that contemporaneously the impact on Bulgaria short-term

interest rate would be larger in absolute term than the impact on inflation and output growth, reflecting the

quicker transmission via financial linkages due to the banking network and the fact that Bulgaria has a currency

board.

22

In this extension, the impact of fiscal policy on inflation remains robust, although with a slightly smaller

contribution of 2.5 percentage points in 2022 (Figure 21). As above, this result remains robust with different

measures of interest rates. Not surprisingly, we also find that too-loose stance of ECB monetary policy also

contributed to inflation in Bulgaria in 2022, by about 1 percentage point, therefore providing an empirical

support to the discussion about the role of the monetary policy in the previous section.

21

The short-term interest rate is from OECD, which is the rate at which short-term borrowings are affected between financial

institutions or the rate at which short-term government paper is issued or traded in the market. The rate of less-than-one-year

deposits is the average rates of new business on time deposits of over 1 day up to 1 year for households and non-financial

corporations; the quarterly rate is the average of monthly rates in the same quarter, with the source of data from Bulgarian National

Bank. The government bond yield is from IMF and Haver.

22

For instance, to make it concrete, if it raises the short rate by 0.2 percentage points, then the impact on inflation and output growth

would be smaller than “0.2”. This assumption appears to be reasonable particularly at quarterly frequency. In addition, this reflects

the potential lagged effect of monetary policy.

Figure 21. A Decomposition of Inflation Dynamics

in an Extended Model

Notes: IMF staff estimate.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

23

VI. Conclusion

This paper applied a suite of models to study the characteristics and drivers of recent inflation

dynamics in Bulgaria. First, the principal component analysis examined potential influences of country-

specific factors in the global phenomenon of inflation. Second, the estimation of a Phillips curve was used to

identify important drivers of inflation in Bulgaria and the persistence of inflation. Third, the estimated structural

VAR models aimed to evaluate the role of policies in the recent inflation surge, controlling for other factors.

Important findings and policy implications emerge. Our analysis confirms the important role played by

external factors, such as supply-chain constraints, commodity and food price shocks, synchronized significant

policy supports, to inflation dynamics in Bulgaria. It also shows that these factors translate to inflation of

individual countries with varying degrees, reflecting the role of country-specific factors. Greater weight of

energy and food in Bulgaria’s CPI basket amplifies the impact of shocks on headline inflation. We document

that the second-round effect seems stronger in Bulgaria, as indicated by a greater persistence of core inflation

than in EU and an increasing role of the economic slack in recent inflation. Regarding the role of

macroeconomic policies, ECB monetary tightening seems to have been insufficient for taming inflation in

Bulgaria, which is further aggravated by a weak transmission at present given significant liquidity and strong

competition in the banking sector. Fiscal policy, while supporting a fast recovery, likely also contributed to the

inflation surge. These findings point to the importance of fiscal policy as well as liquidity management in

managing inflation risks in Bulgaria, considering the currency board arrangement.

There are several potential avenues for future research. First, it would be interesting to apply different

identifications, such as narrative approach, to identify fiscal shocks and compare with our findings based on

sign restrictions. Second, one could study the nonlinearity in the relation between changes in policies and

inflation dynamics, for instance depending on the business cycles (boom vs. bust). Third, it would be interesting

to quantify if different types of ECB monetary shocks as discussed in Altavilla et al., (2019), such as changes in

short term rate, changes in forward guidance, or changes in quantitative easing, would have different

implications to inflation dynamics in Bulgaria.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

24

Annex I. Phillips Curve Estimates- Extension

We conduct the following extensions for the Phillips Curve estimates and present results in Table A.1:

1) Control for both time and fixed effects in the panel estimation (columns 1 to 3 for European economies

(EUR), Advanced European (AE), and Emerging European (EE) economies, respectively);

2) Allow for two cross-dummies: i) 2007Q1–2008Q4 and unemployment gap; and ii) post-2021Q2 and

unemployment gap (column 4);

3) Consider the cross dummy for periods with high inflation (above 7 percent) and unemployment gap

(column 5);

4) Restrict that the sum of coefficients on past and expected inflation rates to be equal to one (column 6);

and

5) Use an alternative measure of unemployment gap: deviation from average five-year unemployment

rate (i.e., average over 20 previous quarters t-1 to t-20, column 7).

Table A.1. Estimated Phillips Curve

Sources: IMF staff estimates.

Notes: Estimates in columns (1) to (3) are from a panel regression with country time and fixed effects: European

economies (EUR), Advanced European (AE), and Emerging European (EE) economies. Estimates in columns (4), (5),

(6), and (7) for BGR are from an OLS regression. Time notation: t-1 indicates information at time t-1, similarly for t-

2, t-3, and t-4.

VARIABLES (1) (2) (3) (4) (5) (6) (7)

EUR EE AE BGR BGR BGR BGR

Unemployment gap -0.272*** -0.425** -0.122 -0.368 -0.391 -0.379* -0.283***

(0.055) (0.168) (0.084) (0.246) (0.249) (0.227) (0.103)

Dummy variable for post-2021Q3 x unemployment_gap -3.364 -1.236

(4.126) (0.798)

Dummy variable for high inflation x unemployment_gap 0.024

(0.496)

Dummy variable for 2007Q1-2008Q4 x unemployment_gap -0.044

(0.674)

Lag of core HICP inflation 0.290*** 0.422*** 0.175 0.676*** 0.675*** 0.677*** 0.620***

(0.100) (0.107) (0.120) (0.082) (0.076) (0.075) (0.096)

Inflation expectations, 1 year ahead 0.562*** 0.391*** 1.066*** 0.267*** 0.277*** 0.323*** 0.192**

(0.129) (0.129) (0.235) (0.080) (0.086) (0.075) (0.084)

External price pressure (t-1) 0.005 0.010 0.005 0.018 0.020 0.024 0.008

(0.007) (0.020) (0.008) (0.021) (0.020) (0.020) (0.021)

Export share-weighted food price inflation 0.209*** 0.373*** 0.075** 0.054* 0.054* 0.053* 0.017

(0.054) (0.079) (0.029) (0.027) (0.028) (0.027) (0.034)

Export share-weighted food price inflation (t-1) 0.152*** 0.221* 0.063* 0.003 0.014 0.010 -0.024

(0.056) (0.125) (0.038) (0.039) (0.037) (0.035) (0.046)

Export share-weighted food price inflation (t-2) -0.018 -0.081 0.119*** -0.013 0.004 -0.003 -0.016

(0.039) (0.052) (0.025) (0.036) (0.036) (0.034) (0.032)

Export share-weighted food price inflation (t-3) 0.062 0.070 0.084*** 0.051 0.063* 0.057 0.015

(0.039) (0.047) (0.031) (0.035) (0.036) (0.036) (0.031)

Export share-weighted food price inflation (t-4) 0.003 0.003 0.024 -0.008 -0.002 -0.007 0.042

(0.034) (0.044) (0.041) (0.035) (0.036) (0.034) (0.034)

Export share-weighted energy price inflation -0.010 -0.259** 0.039 -0.003 0.010 0.011 0.015

(0.030) (0.129) (0.032) (0.042) (0.043) (0.042) (0.039)

Export share-weighted energy price inflation (t-1) -0.030 -0.160 -0.071 0.002 0.000 -0.006 0.038

Observations 2,552 530 2,022 88 88 88 72

R-squared 0.774 0.891 0.549 0.857 0.855 0.872

Country FE Yes Yes Yes No No No No

Time FE Yes Yes Yes No No No No

Robust standard errors in parentheses

*** p<0.01, ** p<0.05, * p<0.1

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

25

Annex II. VAR Model

To quantify the role of policies, we follow the literature and use a VAR model as follows:

,

where

is the vector of four endogenous variables for the country in analysis: real GDP growth (i.e., log

difference of real GDP), core inflation (i.e., excluding energy and unprocessed food), a measure of short-term

interest rate, and the primary fiscal balance in percent of GDP. For other notations: is the lag length;

represent deterministic terms;

is a matrix of parameters corresponding the lag-l of

;

is a

matrix of parameters, capturing the contemporaneous relationships between the endogenous variables; and

is a vector of orthogonal structural shocks with a Gaussian distribution of mean zero and identity

covariance matrix.

The reduced-form representation implied by the structural model (1) is:

where

,

and

. Gibbs Sampling is used to draw the posterior distribution of VAR

coefficients using the Normal-Wishart prior. There are 40,000 draws, out of which the first 32,000 are for

burning. It is known that the reduced-form estimation does not provide enough information to identify even one

column of

, so additional restrictions/information are needed to identify the shock of interest. To overcome

this, we apply sign restrictions to identify a fiscal shock as discussed in the main text.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

26

Annex III. Sensitivity Analyses

1. Impulse responses with the pre-COVID sample (excluding 2020–22)

Figure A.1. Impulse Response to a Fiscal Shock

Sources: IMF staff estimates.

Notes: The fiscal shock is one-standard-deviation expansionary shock.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

27

2. Different indicators of fiscal variables

Figure A.2. Contribution of Fiscal Policy to Inflation in 2022

Sources: IMF staff estimates.

Notes: The annual number is the sum of decomposition over quarters.

3. Different interest rates measures

Figure A.3. Contribution of Fiscal Policy to Inflation

Sources: IMF staff estimates.

Notes: The annual number is the sum of decomposition over quarters.

IMF WORKING PAPERS

Inflation Dynamics in Bulgaria: The Role of Policies

INTERNATIONAL MONETARY FUND

28

References

Altavilla, C., Brugnolini, L., Gürkaynak, R.S., Motto, R. and Ragusa, G., 2019, “Measuring Euro Area Monetary

Policy,” Journal of Monetary Economics, 108, pp.162–179.

Attinasi G. and M. Balatti, 2021, “Globalisation and Its Implications for Inflation in Advanced Economies,” ECB

Economic Bulletin, Issue 4/2021, https://www.ecb.europa.eu/pub/economic-

bulletin/articles/2021/html/ecb.ebart202104_01~ae13f7fe4c.en.html

Bernanke, B. and Blanchard, O., 2023, What Caused the US Pandemic-era Inflation? Hutchins Center Working

Papers.

Bianchi, F. and Melosi, L., 2017, “Escaping the Great Recession,” American Economic Review, 107(4),

pp.1030-1058.

Bulgarian National Bank, 2022, Quarterly Economic Review 1/2022,

https://www.bnb.bg/bnbweb/groups/public/documents/bnb_publication/pub_ec_r_2022_01_en.pdf

Bulgarian National Bank, 2023, “Transmission of the ECB Monetary Policy to Interest Rates in Bulgaria.

Assessment of Potential Effects of the Increase in Minimum Required Reserve Rate on Key Macroeconomic