FEDERAL

EMPLOYEES

HEALTH BENEFITS

PROGRAM

Additional Monitoring

Mechanisms and

Fraud Risk

Assessment Needed

to Better Ensure

Member Eligibility

Report to Congressional Requesters

December 2022

GAO-23-105222

United States Government Accountability Office

United States Government Accountability Office

Highlights of GAO-23-105222, a report to

congressional requesters

December 2022

FEDERAL EMPLOYEES HEALTH BENEFITS

PROGRAM

Additional Monitoring Mechanisms and Fraud Risk

A

ssessment Needed to Better Ensure Member

Eligibility

What GAO Found

The Office of Personnel Management (OPM) is responsible for administering the

Federal Employees Health Benefits (FEHB) program. OPM has taken steps to

enable a process for employing offices and FEHB carriers to identify and remove

ineligible FEHB members. For example, OPM amended its regulations in

January 2018 so that employing offices and FEHB carriers may—but are not

required to—request proof of family member eligibility at any time for existing

participants. OPM also issued new requirements in 2021 for employing offices

and FEHB carriers to verify family member eligibility for certain types of new

enrollments.

However, OPM does not plan to establish a monitoring mechanism to identify

and remove ineligible family members who already have FEHB coverage.

Without such a monitoring mechanism, ineligible family members may remain

covered and related improper payments may continue to accrue over time. OPM

has estimated these related improper payments could cost the program up to

approximately $1 billion per year.

OPM performs an annual fraud risk assessment of the FEHB program but has

not included ineligible members as a fraud risk to the program. In fiscal year

2020, OPM conducted a fraud risk assessment and documented a fraud risk

profile for the FEHB program. OPM determined the program was at a low risk of

fraud overall. However, OPM’s fraud risk assessment and profile did not include

fraud risks associated with ineligible members in the program.

OPM acknowledged in discussions with GAO that not verifying eligibility for

current members carries a risk of fraud and improper payments. OPM’s Office of

the Inspector General has also documented instances of fraud and improper

payments associated with ineligible members in the FEHB program. For

example, a federal employee fraudulently covered two individuals purported to be

his wife and stepchild in the FEHB program. The individuals were ineligible and

remained on FEHB health insurance for about 12 years. The FEHB program paid

claims totaling more than $100,000 on behalf of these ineligible individuals.

Until OPM assesses the likelihood and impact from the fraud risk of ineligible

FEHB members and documents that assessment, it cannot support its

determination that the program is at a low risk of fraud. As a result, the program

may remain vulnerable to the fraud risk associated with ineligible members.

View

GAO-23-105222. For more information,

contact

Seto J. Bagdoyan at (202) 512-6722

or

Why GAO Did This Study

FEHB is

the largest employer-

sponso

red health care program in the

country

. It provides health insurance

benefits to more than 8

million federal

employees

, family members, and

other

s at a cost of about $59 billion in

fiscal year

2021. Until 2021,

employing

offices were

not required to review

eligibility documentation to verify family

member eligibility

. This left the

program vulnerable to fraud and

improper payments associated with

ineligible family members

.

This report identifies

, among other

things,

the extent to which (1) OPM

has implemented control activities to

identify and remove ineligible

family

members

with FEHB coverage and (2)

OPM’s fraud risk assessment

for the

FEHB program

includes fraud risks

related to ineligible

FEHB members.

GAO analyzed

OPM documentation

and

interviewed OPM officials as well

as

officials from a nonprobability

sample of

five federal employing

offices

, selected to obtain views from

offices of

different workforce sizes.

GAO also interviewed

officials from

five

FEHB insurance car

riers representing

approximately 8

7 percent of FEHB

enrollment at the time of GAO’s

review

.

T

he interview information is illustrative

but

not generalizable.

What GAO Recommends

GAO

is making four recommendations

to OPM

, including that it implement a

monitoring mechanism

to identify and

remove ineligible family members from

the FEHB program

and assess and

document

the likelihood and impact of

fraud risks associated with ineligible

FEHB

members. OPM generally

agreed with our recommendations.

Page i GAO-23-105222 Federal Employees Health Benefits Program

Letter 1

Background 4

OPM has Implemented Preventative Controls But Cannot

Reasonably Ensure Ineligible Family Members are Not Covered

in FEHB Enrollments 10

OPM Relies on Limited Efforts to Identify and Remove Ineligible

Family Members with FEHB Coverage 14

OPM’s Fraud Risk Assessment does not Include Fraud Risks

Related to Ineligible Members in FEHB 20

Conclusions 21

Recommendations for Executive Action 22

Agency Comments and Evaluation 23

Appendix I Objectives, Scope, and Methodology 25

Appendix II Comments from the Office of Personnel Management 28

Appendix III GAO Contact and Staff Acknowledgments 31

Figures

Figure 1: The Four Components of the Fraud Risk Framework and

Selected Leading Practices 9

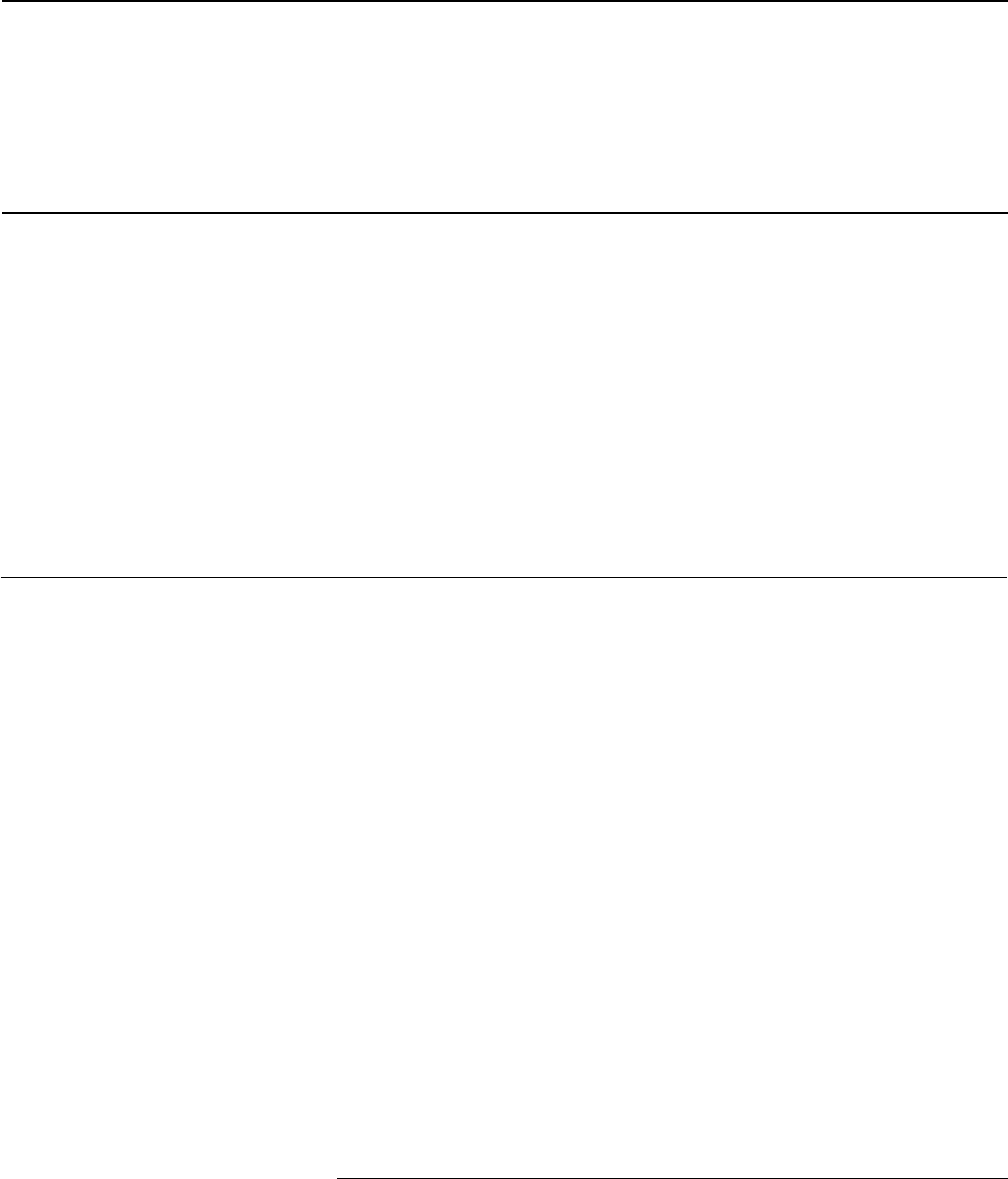

Figure 2: Examples of States that have performed or announced a

Dependent Eligibility Verification Audit (DEVA) for a State

Health Insurance Program (1992 - 2022) 17

Contents

Page ii GAO-23-105222 Federal Employees Health Benefits Program

Abbreviations

DEVA Dependent Eligibility Verification Audit

FEHB Federal Employees Health Benefits

GEMS Government-wide Enrollment and Member Support

OIG Office of Inspector General

OMB Office of Management and Budget

OPM Office of Personnel Management

QLE Qualifying Life Event

This is a work of the U.S. government and is not subject to copyright protection in the

United States. The published product may be reproduced and distributed in its entirety

without further permission from GAO. However, because this work may contain

copyrighted images or other material, permission from the copyright holder may be

necessary if you wish to reproduce this material separately.

Page 1 GAO-23-105222 Federal Employees Health Benefits Program

441 G St. N.W.

Washington, DC 20548

December 9, 2022

The Honorable Ron Johnson

Ranking Member

Permanent Subcommittee on Investigations

Committee on Homeland Security and Governmental Affairs

United States Senate

The Honorable Rick Scott

United States Senate

The Federal Employees Health Benefits (FEHB) program is the largest

employer-sponsored health care program in the country and provides

health insurance benefits to federal employees, retired federal

employees, other eligible individuals, and their eligible family members. In

fiscal year 2021, FEHB provided health insurance benefits to more than

8.2 million individuals at a cost of approximately $59 billion. FEHB-eligible

federal employees and retirees are entitled to enroll themselves and

cover eligible family members in a health insurance plan offered under

the program. The Office of Personnel Management (OPM) administers

the FEHB program by publishing regulations and guidance and

contracting with qualified health insurance carriers, among other

responsibilities. Health insurance carriers that provide FEHB coverage

contract with OPM to offer certain health benefits to all individuals who

enrolled in their participating health plans. Employing offices and FEHB

health insurance carriers bear responsibility for enrolling federal

employees and adding coverage for eligible family members.

1

Since the program’s inception in 1960, OPM has delegated responsibility

to employing offices to make eligibility determinations for enrollees and

covered family members. OPM did not require employing offices to review

supporting documentation to verify family member eligibility during new-

1

Under 5 C.F.R. § 890.101, an employing office is the office of a federal agency to which

jurisdiction and responsibility for employee health benefits actions have been delegated by

OPM. For retirees, the employing office will tentatively determine if an individual is eligible

to continue enrollment at the time of retirement. OPM’s Office of Retirement Programs is

responsible for reviewing the retirement and health benefits documents and making a final

determination of eligibility to continue the FEHB enrollment into retirement.

Letter

Page 2 GAO-23-105222 Federal Employees Health Benefits Program

hire enrollment or certain qualifying life events (QLE) until 2021.

2

Not

doing so left the FEHB program vulnerable to improper payments caused

by inadvertent errors or fraud and abuse associated with ineligible family

members who should not be covered under FEHB. In October 2020,

OPM’s Office of the Inspector General (OIG) reported that OPM lacked

sufficient controls to prevent ineligible family members from being

covered in the FEHB program and recommended that OPM implement an

eligibility verification process for family members to participate in the

program.

3

You asked us to review OPM’s efforts to prevent, detect, and remove

ineligible family members from the FEHB program. This report identifies

the extent to which (1) OPM has implemented control activities to prevent

ineligible family members from being covered in FEHB enrollments; (2)

OPM has implemented control activities to identify and remove ineligible

family members with FEHB coverage; and (3) OPM’s fraud risk

assessment for the FEHB program includes risks related to ineligible

FEHB members.

4

To identify the extent to which OPM has implemented control activities to

(1) prevent ineligible family members from being covered in FEHB

enrollments and (2) identify and remove ineligible family members with

FEHB coverage, we interviewed officials from OPM, five employing

offices, and five FEHB health insurance carriers. To obtain views from

offices of differing employee size, for our interviews with five employing

offices we randomly selected one employing office each from two cabinet-

level departments, one employing office of a large independent federal

agency, one employing office of a medium independent federal agency,

2

As described in greater detail below, QLEs include a change in family status that results

in an increase or decrease in the number of eligible family members, such as marriage,

divorce, and the birth or adoption of a child.

3

OPM partially concurred with this recommendation. We describe actions OPM has taken

since the OIG’s October 2020 report—including issuing new guidance in April 2021—in

greater detail later in this report. Office of Personnel Management, Office of the Inspector

General, Audit of the U.S. Office of Personnel Management’s Administration of Federal

Employee Insurance Programs, (Washington, D.C.: October 2020).

4

In this report, we use the term “members” to refer to federal employees, retired federal

employees, other eligible individuals, and their eligible family members with health

insurance coverage in the FEHB program.

Page 3 GAO-23-105222 Federal Employees Health Benefits Program

and one employing office of a small independent federal agency, as

defined by OPM’s list of federal agencies.

5

For our interviews with FEHB health insurance carriers, we selected a

nonprobability sample of five FEHB carriers that had at least 1 percent of

total FEHB employee and retiree enrollment as of October 2021.

Combined, the five carriers we interviewed represented approximately 87

percent of FEHB employee and annuitant enrollment at the time of our

selection.

6

While the statements from the selected employing offices and

health insurance carriers we spoke with are not generalizable to their

entire populations, they provide specific information about their FEHB

responsibilities and operations. We also reviewed relevant

documentation, such as OPM regulations, FEHB guidance and

instructions for employing offices and health insurance carriers, and

OPM’s FEHB handbook.

For our second objective, we also reviewed relevant documentation,

including final audit reports on dependent eligibility verification audits

(DEVA) performed on behalf of states to prevent, identify, and remove

ineligible family members covered under state health benefit programs.

7

As part of this work, we interviewed three of the six vendors that

contracted with these state health benefit programs to conduct the

DEVAs we reviewed.

For our first and second objectives, we assessed the extent to which

OPM’s responses and documents aligned with principles in Standards for

Internal Control in the Federal Government, specifically the principles

5

OPM maintains a publicly available list of federal agencies and employment numbers on

its website that we used to select employing offices. OPM defines large independent

agencies as those having more than 1,000 employees, medium independent agencies as

those having between 100 and 999 employees, and small independent agencies as those

having less than 100 employees.

6

This percentage does not include family member coverage.

7

A dependent eligibility verification audit (DEVA) is an audit designed to verify the

eligibility of enrollees’ dependents, such as spouses and children. Typically, the entity

conducting the DEVA requests that enrollees provide marriage certificates, birth

certificates, or other documents to demonstrate eligibility.

Page 4 GAO-23-105222 Federal Employees Health Benefits Program

related to designing and developing monitoring mechanisms and

remediating internal control deficiencies.

8

To identify the extent to which OPM’s fraud risk assessment includes

fraud risks related to ineligible FEHB members, we analyzed additional

OPM documentation, such as the agency’s fraud risk assessment, and

interviewed OPM officials. We assessed the extent to which this

information aligned with relevant leading practices in GAO’s Framework

for Managing Fraud Risks in Federal Programs (Fraud Risk Framework),

specifically the leading practices related to identifying and assessing risks

to determine the program’s fraud risk profile.

9

For more information about

our objectives, scope, and methodology, see appendix I.

We conducted this performance audit from May 2021 to December 2022

in accordance with generally accepted government auditing standards.

Those standards require that we plan and perform the audit to obtain

sufficient, appropriate evidence to provide a reasonable basis for our

findings and conclusions based on our audit objectives. We believe that

the evidence obtained provides a reasonable basis for our findings and

conclusions based on our audit objectives.

Although there has been some minor fluctuation in the number of FEHB

members over time, total program coverage has remained around 8

million members since 2000. In the 2021 plan year, the FEHB program

covered approximately 8.2 million individuals, including 2.2 million federal

employees, 1.9 million retirees, and an estimated 4.1 million family

members.

10

For that plan year, OPM had 87 contracts with health

insurance carriers to provide health care coverage for FEHB members.

8

GAO, Standards for Internal Control in the Federal Government, GAO-14-704G

(Washington, D.C.: September 2014).

9

We selected leading practices from the Fraud Risk Framework’s second component that

are most relevant to this objective based on our review of OPM documents and

discussions with OPM staff. GAO, A Framework for Managing Fraud Risks in Federal

Programs, GAO-15-593SP (Washington, D.C.: July 28, 2015). More information on the

Fraud Risk Framework and its leading practices, which are organized into four

components, appears below.

10

A plan year is the 12-month period of benefits coverage under a group health plan. The

FEHB plan year begins on the first day of the first pay period that begins on or after

January 1.

Background

FEHB Program

Page 5 GAO-23-105222 Federal Employees Health Benefits Program

These health insurance carriers offer plans in which eligible individuals

may enroll to receive health care coverage for themselves and eligible

family members. According to OPM data for the 2021 plan year, federal

employees and retirees had the option to enroll in 276 different FEHB

plans. Approximately 66 percent of FEHB enrollees were enrolled in plans

offered by one health insurance carrier.

The FEHB program operates under a diffuse administrative structure.

OPM is responsible for administering the FEHB program. In doing so,

OPM relies on over 160 government employing offices—and 87 contracts

with health insurance carriers—to enroll and verify the eligibility of FEHB

members. There may be one employing office per agency, multiple

employing offices per agency, or multiple agencies could have one

employing office.

Eligible individuals have three opportunities to enroll in FEHB coverage:

• New-hire enrollment: New federal employees who are eligible for

FEHB coverage may enroll themselves and add coverage for eligible

family members in any available plan, option, and type of enrollment

within 60 days after becoming eligible.

• Open season: Eligible individuals can enroll in FEHB coverage,

change plans, and add family members to their plan during the annual

open season, which runs from the Monday of the second full

workweek in November through the Monday of the second full

workweek in December unless modified by OPM for a specific year.

• QLEs: Eligible individuals may enroll in FEHB coverage, change

plans, or add family members to their current plan within a specific

timeframe of experiencing a QLE.

11

QLEs include, but are not limited

to, a change in family status that results in an increase or decrease in

the number of eligible family members, such as a marriage, divorce,

and the birth or adoption of a child. Outside of new-hire and open

season enrollment, new enrollment or changes to FEHB coverage can

be made only in connection with QLEs.

Three types of FEHB enrollments are available:

• A “Self Only” enrollment only provides FEHB benefits for the enrollee.

11

A QLE is a term defined by OPM to describe events deemed acceptable by the Internal

Revenue Service that may allow premium conversion participants to change their

participation election for premium conversion outside of an Open Season.

FEHB Enrollment

Page 6 GAO-23-105222 Federal Employees Health Benefits Program

• A “Self Plus One” enrollment provides benefits for the enrollee and

one eligible family member.

• A “Self and Family” enrollment provides benefits for the enrollee and

all eligible family members.

Family members eligible for coverage under an employee’s “Self Plus

One” or “Self and Family” enrollment include spouses, children under the

age of 26 (including biological children, stepchildren, adopted children,

and foster children), and a child of any age who is incapable of self-

support.

12

Both the federal government and enrollees, through their contributions

toward health insurance premiums, contribute to the FEHB program.

Generally, as set by statute, the government pays 72 percent of the

average premium across all FEHB plans—but no more than 75 percent of

any particular plan’s premium—while enrollees pay the balance.

13

In fiscal

year 2021, the FEHB program had a combined annual premium value

paid by the government and enrollees of approximately $59 billion.

Premiums vary by plan option and depend on whether the enrollment is

for “Self Only,” “Self Plus One,” or “Self and Family” coverage. Premiums

are intended to cover members’ health care costs (including claims),

plans’ administrative expenses, reserve accounts specified by law, plan

profits, and OPM’s administrative costs.

Improper payments are payments that should not have been made or

were made in the incorrect amount—i.e., an overpayment or

underpayment—under a statutory, contractual, administrative, or other

legally applicable requirement.

14

Improper payments can be a result of

mismanagement, errors, or fraud and abuse. Within the FEHB program,

improper payments include payments for premiums or claims for ineligible

12

A stepchild includes the child of an enrollee’s spouse even after the enrollee’s divorce

from the spouse or death of the spouse, so long as the child continues to live with the

enrollee in a regular parent-child relationship. A child incapable of self-support due to a

mental or physical disability is eligible to be covered under a federal employee’s FEHB

plan if the disabling condition began before the age of 26.

13

5 U.S.C. § 8906(b).

14

Also included are any payment to an ineligible recipient, any payment for an ineligible

good or service, any duplicate payment, any payment for a good or service not received

(except for such payments where authorized by law), and any payment that does not

account for credit for applicable discounts. 31 U.S.C. § 3351(4).

FEHB Premiums and

Funding

Improper Payments

Page 7 GAO-23-105222 Federal Employees Health Benefits Program

members, including family members, according to OPM officials. OPM is

currently unable to identify or estimate how many ineligible family

members receive benefits from the FEHB program or the total cost to the

program of those improper payments and did not report an improper

payment estimate for fiscal year 2021. According to OPM’s OIG, the high

costs of improper payments without accurate accounting of improper

payment rates in the FEHB program is a persistent top management

challenge.

15

In July 2022, OPM officials told us they were updating their method for

estimating the agency’s improper payments and exploring how to define

improper payments in the FEHB program for the purposes of reporting

improper payments to the Office of Management and Budget’s (OMB)

www.paymentaccuracy.gov website. OPM officials told us this work was

in response to a 2020 OPM OIG report that determined OPM’s current

improper payment methodology could result in a substantial

underreporting of estimated improper payments in a given fiscal year. For

example, OPM did not include an estimate of improper payments

associated with ineligible members in the estimate of improper payments

it had previously reported to OMB. Instead, OPM’s calculation reported an

improper payment rate that was based in part on judgmentally selected

samples of claims the OIG audited each year at a small percentage of

FEHB carriers, leaving a large amount of claims not considered for

OPM’s improper payment rate.

16

Fraud and fraud risk are distinct concepts. Fraud—obtaining something of

value through willful misrepresentation—is challenging to detect because

of its deceptive nature. Fraud risk—a function of likelihood and impact—

exists when people have an opportunity to engage in fraudulent activity,

have an incentive or are under pressure to commit fraud, or are able to

rationalize committing fraud. When fraud risks can be identified and

mitigated, fraud may be less likely to occur. Although the occurrence of

15

Office of Personnel Management, Office of the Inspector General, Office of Audits, Final

Report: The U.S. Office of Personnel Management’s Top Management Challenges for

Fiscal Year 2022 (Washington, D.C.: October 13, 2021).

16

For more information, see Office of Personnel Management, Office of the Inspector

General, Audit of the U.S. Office of Personnel Management’s Federal Employees Health

Benefits Program and Retirement Services Improper Payments Rate Methodologies

(Washington, D.C.: April 2020).

Fraud Risk Management

Page 8 GAO-23-105222 Federal Employees Health Benefits Program

fraud indicates there is a fraud risk, a fraud risk can exist even if actual

fraud has not yet occurred or been identified.

Managers of federal programs maintain the primary responsibility for

fraud risk management. The objective of fraud risk management is to

ensure program integrity by continuously and strategically mitigating both

the likelihood and effects of fraud. Effectively managing fraud risk helps to

ensure that federal programs’ services fulfill their intended purpose—that

funds are spent effectively and assets are safeguarded.

In July 2015, we issued the Fraud Risk Framework, which provides a

comprehensive set of key components and leading practices that serves

as a guide for agency managers to use when developing efforts to

combat fraud in a strategic, risk-based way.

17

Additionally, the Fraud

Reduction and Data Analytics Act of 2015 required that OMB establish

guidelines for federal agencies to create controls to identify and assess

fraud risks and to design and implement anti-fraud control activities.

18

The

act also required that OMB incorporate the leading practices from the

Fraud Risk Framework in its guidelines. The Payment Integrity

Information Act of 2019, which repealed the Fraud Reduction and Data

Analytics Act of 2015, requires these guidelines to remain in effect,

subject to modification by OMB as necessary and in consultation with

GAO.

19

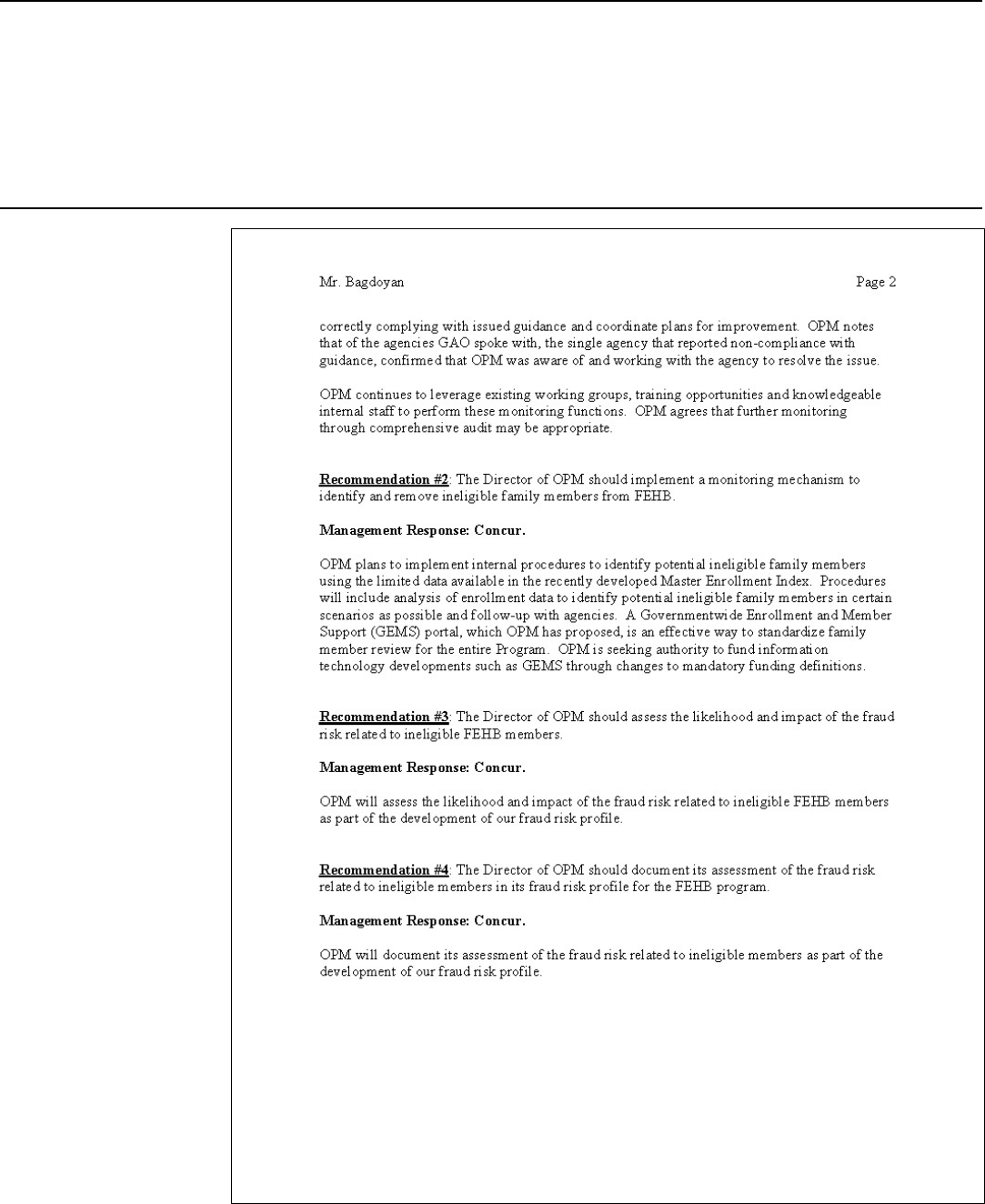

As figure 1 shows, the Fraud Risk Framework describes leading

practices within four components: commit, assess, design and implement,

and evaluate and adapt.

17

GAO-15-593SP.

18

Pub. L. No. 114-186, 130 Stat. 546 (2016).

19

Pub. L. No. 116-117, § 2(a), 134 Stat. 113, 131 - 132 (2020), codified at 31 U.S.C. §

3357.

Page 9 GAO-23-105222 Federal Employees Health Benefits Program

Figure 1: The Four Components of the Fraud Risk Framework and Selected Leading Practices

If implemented appropriately, these leading practices can help ensure

that federal program managers and their stakeholders are able to meet

their responsibilities for managing fraud risks. Specifically, the second

component—assess—calls for program managers to plan regular fraud

risk assessments and assess risks to determine a fraud risk profile.

Specific leading practices associated with these concepts include

• identifying the range of inherent fraud risks affecting the program,

20

20

Inherent fraud risk is the risk to an entity prior to considering management’s response to

the risk.

Page 10 GAO-23-105222 Federal Employees Health Benefits Program

• assessing the likelihood and impact of inherent fraud risks, and

• documenting these risks in a fraud risk profile.

As discussed in the Fraud Risk Framework, managers who effectively

assess fraud risks attempt to fully consider the fraud risks facing their

program, analyze the potential likelihood and impact of fraud schemes,

and then ultimately document prioritized fraud risks. The fraud risk profile

documents the key findings and conclusions from the fraud risk

assessment. The profile is an essential piece of an overall antifraud

strategy and can inform the specific antifraud control activities that

managers design and implement.

OPM recently implemented control activities designed to prevent ineligible

family members from being covered in the FEHB program. As mentioned,

from the FEHB program’s inception in 1960, OPM has delegated

responsibility to employing offices to make family member eligibility

determinations, but did not require employing offices to review

documentation to verify family member eligibility during new hire, QLE, or

open season enrollments.

21

However, beginning in 2018, OPM put in

place a new regulation and guidance that establish requirements and

21

During our review, each of the five selected employing offices we spoke with told us they

did not verify family member eligibility during new-hire enrollments prior to OPM’s April

2021 guidance, which required them to begin doing so, as described in greater detail

below.

OPM Has

Implemented

Preventative Controls

but Cannot

Reasonably Ensure

Ineligible Family

Members Are Not

Covered in FEHB

Enrollments

OPM Recently

Implemented Preventative

Controls

Page 11 GAO-23-105222 Federal Employees Health Benefits Program

control activities designed to prevent ineligible family members from being

covered in the FEHB program. Specifically:

• Amended regulations. In 2018, OPM published amended

regulations stating that proof of family member eligibility must be

provided to the FEHB health insurance carrier, employing office, or

OPM upon request. These regulations also establish a process for the

removal of individuals who are not found to be eligible.

22

Pursuant to

these regulations, employing offices and FEHB carriers may—but are

not required to— request proof of family member eligibility at any time

for existing participants.

• Guidance to employing offices. In April 2021, OPM issued guidance

to federal employing offices that required them to begin verifying

family member eligibility for new-hire and QLE enrollments by July

2021.

23

However, this guidance does not require employing offices to

verify family member eligibility during the annual open season, as

described in greater detail below.

24

Employing offices remained

responsible for processing all changes in enrollment that affect

premium withholdings, such as changes from “Self Plus One” to “Self

and Family.”

• Guidance to FEHB carriers. Also in April 2021, OPM issued

guidance to the FEHB carriers that requires them to obtain proof of

family member eligibility when adding family members to an existing

“Self and Family” plan.

25

For example, if an employee wants to add a

child to an existing “Self and Family” plan, the FEHB carrier must

obtain proof of the child’s eligibility—such as a birth certificate—before

adding the child to the “Self and Family” plan.

OPM’s 2021 guidance to employing offices and carriers also outlines

what documents may be used as proof of eligibility. For example, a

government-issued marriage certificate may be used as proof of

22

83 Fed. Reg. 3059 (Jan. 23, 2018).

23

Office of Personnel Management, Family Member Eligibility Verification for Federal

Employees Health Benefits Program Coverage, Benefits Administration Letter 21-202

(April 15, 2021).

24

Open season is an annual opportunity for FEHB members to make enrollment changes

to their FEHB coverage.

25

Office of Personnel Management, Family Member Eligibility Verification for Federal

Employees Health Benefits Program Coverage, Federal Employees Health Benefits

Program Carrier Letter 2021-06 (April 15, 2021).

Page 12 GAO-23-105222 Federal Employees Health Benefits Program

marriage, and a government-issued birth certificate may be used to add

coverage to a biological child under the age of 26. Proof of eligibility is

also required for other FEHB family members such as common-law

spouses, adopted children, foster children, and children over the age of

26 who are incapable of self-support because of a mental or physical

disability.

OPM’s 2021 guidance to employing offices also discusses the process for

an employing office to request proof of family member eligibility and the

actions the employing office must take based on an employee’s

response. Specifically, if an employing office determines that eligibility

documents are insufficient, it must provide the employee with a written

notice of its initial decision, with an explanation of the decision, and

provide notice of the right to a reconsideration of the employing office’s

initial decision.

According to OPM’s 2021 guidance and OPM officials, employing offices

may—but are not required to—verify family member eligibility during the

FEHB open season. Similarly, FEHB health insurance carriers are not

required to verify family member eligibility during open season. Officials

from OPM told us that verifying eligibility during the approximately 4 to 5

week open season was currently not feasible because of the high number

of enrollment transactions that occur during the period.

We recognize the challenge of verifying eligibility during open season.

However, we also note that beyond not verifying family members’

eligibility during open season, OPM has not required employing offices or

carriers to verify eligibility since the program’s inception in 1960,

emphasizing the need for a monitoring mechanism to identify and remove

ineligible members from the FEHB program, as we discuss later in this

report.

Since OPM’s April 2021 guidance was put into effect, OPM has not

designed or implemented monitoring mechanisms to ensure employing

offices and insurance carriers are complying with the guidance’s

requirements to verify the eligibility of family members for new-hire and

QLE enrollments. OPM officials told us they do not have the funding

necessary to perform monitoring of employing offices or carriers and have

no plans to conduct this monitoring in the future.

Standards for Internal Control in the Federal Government states that

management should establish and operate monitoring activities to monitor

OPM Cannot Reasonably

Ensure Employing Offices

and Carriers are

Preventing Ineligible

Family Members from

Being Covered in FEHB

Page 13 GAO-23-105222 Federal Employees Health Benefits Program

the internal control system and evaluate the results.

26

Without monitoring

employing offices and insurance carriers’ implementation of its new

guidance, OPM cannot have reasonable assurance that employing offices

and carriers are implementing control activities to prevent FEHB coverage

of ineligible family members.

We found that not all employing offices are implementing such control

activities. Specifically, our interviews with five employing offices found

that one employing office within a cabinet-level department was not

reviewing family member eligibility for all new-hire or QLE enrollments as

OPM’s guidance requires. Officials from this employing office cited the

large number of transactions and technology issues as challenges to

complying with OPM’s guidance. Officials from this employing office told

us that OPM was aware of their noncompliance and that they were

working toward complying with the OPM requirements in the future.

Officials from the other four employing offices we interviewed stated that

they were following the eligibility verification requirements for new-hire

and QLE coverage outlined in OPM guidance. Officials from each of the

carriers we met with told us that they verified family member eligibility

when an individual was added to existing “Self and Family” enrollments,

as required by the 2021 carrier letter.

However, as with employing offices, OPM does not conduct monitoring to

verify that the health insurance carriers are properly and consistently

verifying individuals’ eligibility. While the example of employing office

noncompliance we identified is not generalizable to all employing offices,

it nonetheless highlights how OPM monitoring could help ensure all

offices and carriers implement required control activities for preventing

ineligible family members from being covered in the FEHB program.

Without monitoring the population of FEHB employing offices and carriers

responsible for verifying family members’ FEHB eligibility during a new

hire or QLE, OPM cannot be certain of how many employing offices and

carriers are not meeting OPM’s eligibility verification requirements

because of information technology or staffing limitations, high transaction

volume, or other reasons. Unless OPM establishes a mechanism to

monitor employing offices and carriers to ensure they are implementing

requirements to verify family members’ eligibility, the FEHB program may

26

GAO-14-704G

Page 14 GAO-23-105222 Federal Employees Health Benefits Program

continue to be vulnerable to improper payments resulting from ineligible

family member participation in FEHB.

OPM’s amended regulations and guidance establish a process for

removing ineligible family members from the FEHB program, and OPM

relies on limited efforts by employing offices and FEHB health insurance

carriers to identify and remove ineligible family members. However, OPM

officials told us the agency itself does not monitor—and does not plan to

begin regularly monitoring—family members who already have FEHB

coverage to identify and remove those who are ineligible from the

program. As described previously in this report, in January 2018, OPM

published amended regulations that require enrollees to submit proof of

family member eligibility to employing offices or carriers upon request.

These regulations also provide a process for removing ineligible family

members from the FEHB program. OPM has also issued guidance to

employing offices that details the process for removing ineligible family

members from the FEHB program.

27

Pursuant to these regulations and

the OPM guidance, employing offices and FEHB carriers may—but are

not required to—request proof of family member eligibility at any time for

existing participants.

Officials from the five selected employing offices we spoke with told us

that they perform limited activities to identify and remove ineligible family

members from the FEHB program. Specifically, officials from each of

these five selected employing offices told us they do not regularly perform

any ongoing monitoring or eligibility verification for currently participating

family members. Instead, these officials noted that they might discover

ineligible family members when employees make coverage changes that

reveal ineligible family members who are currently covered or when

notified by an employee. For example, if an employee tries to enroll a new

spouse, the employing office might discover that the employee never

removed their ex-spouse from their plan; in this way, the employing office

would discover the ineligible family member at the time of the coverage

change. During this review, officials from OPM and some of the

employing offices we spoke with acknowledged that relying on tips or

enrollment changes to discover ineligible family members creates a risk

that family members will continue to be covered even after they are

27

Office of Personnel Management, Removal of Ineligible Family Members from

Enrollments, Benefits Administration Letter 20-203 (Nov. 5 2020).

OPM Relies on

Limited Efforts to

Identify and Remove

Ineligible Family

Members with FEHB

Coverage

Page 15 GAO-23-105222 Federal Employees Health Benefits Program

ineligible, resulting in improper payment vulnerabilities in the FEHB

program.

28

Similarly, officials from each of the five FEHB insurance carriers we spoke

with told us they perform limited activities to identify and remove ineligible

family members from the FEHB program. For example, officials from each

of the five carriers told us they perform regular monitoring to identify

family members who become ineligible when they turn 26 years old. At

the same time, officials from each of the five carriers told us they do not

monitor members for ineligibility due to divorce, stating they rely on

enrollees to inform them about their divorces. These responses from the

employing offices and carriers are not generalizable to their respective

universes. However, they highlight control weaknesses that could

heighten the risk that ineligible members remain in the FEHB program

undetected. As described below, the potential costs associated with this

risk are considerable.

OPM does not have a precise estimate of how many ineligible members

exist and at what cost to the program. OPM officials told us they

recognize ineligible individuals may be covered in FEHB, and information

from OPM indicates the cost savings from performing a DEVA for all

existing family members to be in the estimated range of $360 million to

about $1 billion.

29

According to OPM officials, these estimated cost

savings would generally be an avoidance of future claims costs as

opposed to current return of actual dollars. As mentioned, FEHB

28

Officials from OPM and some employment offices we spoke with noted that employees

may retain ex-spouses on their plans out of confusion, rather than as an act of fraud. For

example, employees may receive a court order to continue health insurance coverage for

their ex-spouse as part of their divorce. Employees might incorrectly interpret the court

order to indicate that they are allowed to keep their ex-spouse covered in the FEHB

program as a dependent. However, OPM officials stated this is not permitted, even with a

court order.

29

As previously mentioned, a DEVA is an audit designed to verify the eligibility of currently

covered dependents, such as spouses and children. Typically the entity conducting the

DEVA requests that enrollees provide marriage certificates, birth certificates, or other

documents to demonstrate eligibility. GAO did not independently verify the accuracy of

OPM’s estimate. OPM notes this estimate has limitations, including that it did not take into

account the cost of the audit and that the cost data averages derived from this estimate

are from one health care provider and may not represent cost data averages for the entire

FEHB program. These limitations may result in an underestimate or overestimate of cost

savings. OPM’s OIG estimates the cost of ineligibles at between $250 million and $3

billion annually. OPM has stated it believes the OPM OIG’s estimate is too high, in part

because of the cost of certain family members. GAO did not independently verify the

accuracy of the OIG estimate.

Page 16 GAO-23-105222 Federal Employees Health Benefits Program

premiums paid by the government and enrollees are intended to cover

members’ health care costs (including claims), plans’ administrative

expenses, and other costs. Thus, these estimates would represent

savings to the federal government and enrollees who pay FEHB

premiums.

OPM officials told us that in 2014 they explored performing a DEVA for

the FEHB program as a monitoring control activity. However, OPM

subsequently decided not to pursue a DEVA, citing the need to establish

regulations providing it the authority to remove any ineligible family

members identified by such an audit, among other issues. After

publishing amended regulations in 2018 (as described above), OPM

explored auditing a sample of members for continued eligibility. However,

OPM ultimately did not pursue a request for funding to complete this

work, which was never initiated due to competing priorities, according to

OPM officials.

During our review, OPM officials told us they believed performing a one-

time audit of all FEHB members was not feasible given the size and

scope of the FEHB program population. We recognize the challenge of

performing a one-time audit of all FEHB members given the size and

scope of the FEHB program population. However, we also note that

DEVAs may be structured with different scopes and methodologies, such

as auditing samples of the population over several years, rather than

attempting to audit the entire population all at once. For example, during

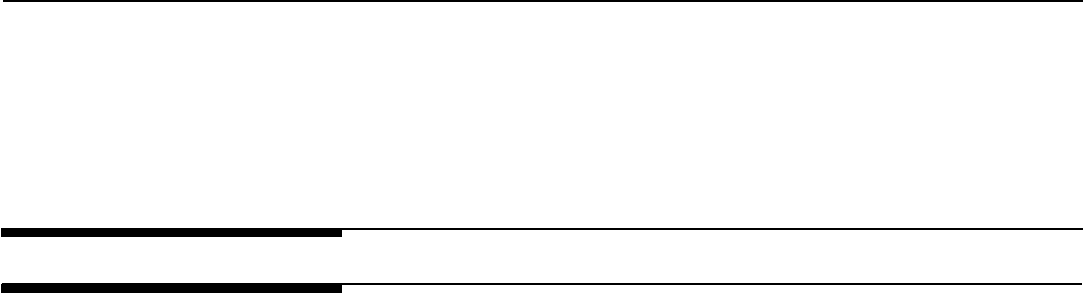

our review we identified 25 states that have conducted or announced

plans to conduct a DEVA for their respective state healthcare insurance

programs (see fig. 2 below).

30

30

Additional states may have monitored or announced plans to monitor dependent

eligibility in their state health program that are not included in this review. Additional

information on our methodology for reviewing these DEVAs appears in appendix I.

Page 17 GAO-23-105222 Federal Employees Health Benefits Program

Figure 2: Examples of States That Have Performed or Announced a Dependent Eligibility Verification Audit (DEVA) for a State

Health Insurance Program (1992–2022)

Note: Additional states may have monitored or announced plans to monitor dependent eligibility in

their state health program that are not included in this review. Additional information on our

methodology for reviewing these DEVAs appears in appendix I.

These state DEVAs used varying scopes and methodologies to verify

family member eligibility. Some states performed one-time audits of the

entire member population, while other states audited samples of the

population over several years. For example:

• In 2018, Florida’s State Group Health Insurance Program contracted

with a third party audit vendor that conducted a DEVA requesting

Page 18 GAO-23-105222 Federal Employees Health Benefits Program

verification for all participating dependents. The audit identified 3

percent of the dependent population as ineligible for coverage. Based

on a detailed claims analysis, the annual cost avoidance to the State

Group Health Insurance Program was estimated at $20.4 million.

• In 2015, the California Public Employees’ Retirement System

conducted an audit. The system requires all employees to reverify

dependents every 3 years based on the dependent’s birth month.

After its audit, the California retirement system removed 2.6 percent of

dependents because of ineligibility and estimated it saved nearly $122

million.

• In 2020, the Kansas State Employee Health Plan contracted with a

third party audit vendor that conducted a DEVA using two sample

groups. According to the final report, the DEVA included (1) a

statistically valid sample of 200 employees with dependents, and (2) a

targeted sample of 200 employees with dependents who had medical

or prescription drug claims during the audit period. The Kansas State

Employee Health Plan found that of the 400 employees sampled, 348

(87 percent), provided documentation of their dependents’ eligibility.

31

We asked OPM officials whether they were pursuing funding for a DEVA

with a different scope, such as auditing samples of the population over

several years—similar to some state DEVAs we reviewed—rather than

attempting to audit the entire population all at once. In response, the

officials told us they did not plan to pursue funding for a DEVA—whether

on a one-time basis or a smaller, sample basis—due to alternative

funding priorities. Specifically, OPM officials told us they were focusing

instead on developing and pursuing funding for the Government-wide

Enrollment and Member Support (GEMS) program to centralize the

enrollment process, rather than establishing mechanisms to monitor

current member eligibility. OPM officials told us they believe focusing on

acquiring GEMS is a better use of funds, which would allow for a

centralized enrollment process and OPM oversight of eligibility

verification.

However, we reviewed documentation related to OPM’s plans for GEMS

and found no evidence that this project would establish a monitoring

31

Employees who did not verify their dependents’ eligibility either did not respond or failed

to submit sufficient paperwork. The names of the employees with dependents not verified

were provided to State Employee Health Plan Membership Services for review. The

findings report we reviewed did not include information on cost savings stemming from

this DEVA.

Page 19 GAO-23-105222 Federal Employees Health Benefits Program

mechanism as called for by the Standards for Internal Control in the

Federal Government. We also found no indication it would identify

ineligible family members for removal from the FEHB program. Further,

as of March 2022 OPM had not established a date for completing the

development of GEMS and was in the process of determining how to fund

the project. This raises questions as to when OPM will begin and finish its

work on GEMS.

As previously mentioned, Standards for Internal Control in the Federal

Government states that management should establish and operate

activities to monitor the internal control system and evaluate the results.

32

In doing so, management should monitor the internal control system

through ongoing monitoring and separate evaluations, such as audits.

These standards note that audits and other evaluations may be

performed by internal auditors, external auditors, or other external

reviewers. Many of the states we identified as having conducted or

announced plans to conduct a DEVA for their state health insurance

program performed this work through external auditors or other external

reviewers, indicating this approach might also be an option for OPM.

Standards for Internal Control in the Federal Government also states that

management should remediate identified internal control deficiencies on a

timely basis. As mentioned, OPM recognizes that ineligible family

members may be covered in the FEHB program. Further, the risk posed

by ineligible family members—and the corresponding need to put in place

a monitoring mechanism to identify and remove ineligible family

members—is heightened by the fact that OPM does not require

employing offices and carriers to verify family member’s eligibility during

open season. Previously, OPM did not require employing offices or

carriers to verify family member eligibility since the program’s inception.

For example, as discussed above, each of the five selected employing

offices we spoke with told us they did not verify eligibility for family

members of new hires prior to the OPM requirement to do so in 2021.

The longer OPM delays its efforts to establish a monitoring mechanism to

identify and remove ineligible members from FEHB, the more ineligible

members and related improper payments in the program may continue to

accrue, costing the program millions, or up to approximately one billion

dollars per year according to OPM’s own estimate. Further, these

ineligible members could file insurance claims, leading to potentially

32

GAO-14-704G

Page 20 GAO-23-105222 Federal Employees Health Benefits Program

higher premium costs for the federal government and FEHB enrollees in

future years.

As part of managing fraud risks, the Fraud Risk Framework calls on

federal managers to plan regular fraud risk assessments that are tailored

to the program and assess risks to determine the program’s fraud risk

profile.

33

Specific leading practices associated with these concepts

include

• identifying the range of inherent fraud risks affecting the program;

• assessing the likelihood and impact of inherent fraud risks; and

• documenting these risks in the fraud risk profile.

Consistent with these leading practices, OPM performs an annual fraud

risk assessment and has documented a fraud risk profile for the FEHB

program that includes inherent fraud risks affecting the program, as well

as the likelihood and impact of those inherent fraud risks. For example, in

fiscal year 2020, OPM conducted a fraud risk assessment and

subsequently documented a fraud risk profile for the FEHB program.

OPM’s fiscal year 2020 fraud risk profile identified three inherent fraud

risks facing the FEHB program, all of which relate to fraud by providers.

The specific risks identified are: (1) providers billing for tests or services

not covered or not performed; (2) providers overbilling for services

performed; and (3) providers falsifying a patient’s diagnosis. Based on

this fraud risk assessment and profile, OPM determined that the FEHB

program’s overall fraud risk was low.

However, OPM’s fiscal year 2020 fraud risk assessment and profile did

not include ineligible members as an inherent fraud risk. OPM’s OIG has

noted that identifying ineligible family members is often difficult and that

fraud, waste, and abuse can occur over years before being discovered.

Moreover, OPM’s OIG has documented cases of fraud associated with

ineligible members in the FEHB program, further underscoring the need

for OPM to assess the risk of fraud in the program such members pose

and ensure it has antifraud controls to mitigate this risk. Some examples

of fraud involving ineligible FEHB members from OIG reports are noted

below:

33

GAO-15-593SP

OPM’s Fraud Risk

Assessment Does

Not Include Fraud

Risks Related to

Ineligible Members in

FEHB

Page 21 GAO-23-105222 Federal Employees Health Benefits Program

• An FEHB program enrollee submitted altered official court documents

when removing an ex-spouse and adding a new spouse to the

enrollee’s FEHB insurance plan. The altered document indicated that

the enrollee divorced their ex-spouse in January 2017 when in fact

they had divorced in April 1993. The FEHB program paid more than

$150,000 in claims on behalf of the ex-spouse over the 14 years of

ineligible coverage. In June 2019, the enrollee pleaded guilty to

making false statements.

• A federal employee fraudulently covered two individuals purported to

be the employee’s wife and stepchild in the FEHB program. The

individuals were ineligible and remained on FEHB health insurance

from January 2005 to January 2017. The FEHB program paid claims

totaling more than $100,000 on behalf of the ineligible individuals. The

employee pleaded guilty and was sentenced to 24 months of

supervised release.

• A federal employee added multiple ineligible individuals as family

members to an FEHB program health insurance plan. The FEHB

program paid more than $12,000 for services provided to these

ineligible individuals. In February 2018, the employee and a

codefendant were indicted for making false statements relating to

health care matters, as well as aiding and abetting the same. In July

2018, the employee pleaded guilty, and in April 2019 was sentenced

to 3 years of probation and ordered to pay more than $12,000 in

restitution.

The OPM OIG’s work demonstrating fraud in the FEHB program, and

OPM’s acknowledgement that not verifying eligibility for current members

carries fraud risk, indicates that OPM has identified ineligible members as

an inherent fraud risk. However, when asked, OPM officials could not

explain to us why OPM’s fraud risk profile did not include an assessment

of the likelihood and impact of ineligible FEHB members. Until OPM

assesses the likelihood and impact of the fraud risk of ineligible FEHB

members and documents its assessment in a fraud risk profile, it cannot

support its determination that the FEHB program is at a low risk of fraud,

and the FEHB program may remain vulnerable to the fraud risk

associated with ineligible members.

The FEHB program is the largest employer-sponsored group health

insurance program in the country, providing coverage for over 8.2 million

members at a cost of approximately $59 billion in fiscal year 2021. OPM

has the overall responsibility for administering the FEHB program and for

ensuring only eligible family members receive coverage. However, the

Conclusions

Page 22 GAO-23-105222 Federal Employees Health Benefits Program

size of the program and diffuse administrative structure make that task

challenging, and pose risks for potential fraud, as OPM relies on over 160

employing offices and multiple insurance carriers to ensure eligibility

requirements are enforced for millions of federal employees, retirees, and

their family members.

In 2021, OPM began requiring that employing offices and insurance

carriers verify family members’ eligibility for new-hire and QLE

transactions—an important step in mitigating improper payments,

including those resulting from fraud, in the FEHB program. However,

OPM cannot reasonably ensure that employing offices and insurance

carriers are verifying family members’ eligibility as required. Unless OPM

establishes a mechanism to monitor employing offices and carriers to

ensure that such verification occurs, the FEHB program may continue to

be vulnerable to improper payments resulting from ineligible family

members’ participation in FEHB.

Further, OPM recognizes ineligible individuals are likely participating in

FEHB. However, it does not have a monitoring mechanism in place to

identify and remove ineligible members from the program. Without such a

mechanism in place, the more ineligible participants and related improper

payments in the program may continue to accrue, costing the program

millions.

OPM performs an annual fraud risk assessment of the FEHB program.

However, it has not assessed fraud risks associated with ineligible

members in a manner consistent with leading practices. OPM recognizes

that the size and scope of the program, and the lack of monitoring for

dependent eligibility for current members, carries a risk for improper

payments and fraud. However, OPM has not assessed the likelihood and

impact associated with coverage of ineligible family members in the

FEHB fraud risk assessment and profile. Until OPM assesses the

likelihood and impact of ineligible FEHB members and documents its

assessment in a fraud risk profile, it cannot support its determination that

the FEHB program is at low risk of fraud. As a result, the FEHB program

may remain vulnerable to the fraud risk associated with ineligible

members.

We are making the following four recommendations to OPM:

The Director of OPM should implement a monitoring mechanism to

ensure employing offices and carriers are verifying family member

eligibility as required by OPM’s 2021 guidance. (Recommendation 1)

Recommendations for

Executive Action

Page 23 GAO-23-105222 Federal Employees Health Benefits Program

The Director of OPM should implement a monitoring mechanism to

identify and remove ineligible family members from the FEHB program.

(Recommendation 2)

The Director of OPM should assess the likelihood and impact of the fraud

risk related to ineligible FEHB members. (Recommendation 3)

The Director of OPM should document its assessment of the fraud risk

related to ineligible members in its fraud risk profile for the FEHB

program. (Recommendation 4)

We provided a draft of this report to OPM for review and comment. In its

written comments, reproduced in appendix II, OPM concurred with three

of the four recommendations and partially concurred with one

recommendation. OPM also provided technical comments, which we

incorporated as appropriate.

OPM partially concurred with our first recommendation to implement a

monitoring mechanism to ensure employing offices and FEHB carriers

are verifying family member eligibility as required by OPM’s 2021

guidance. In its comments, OPM identified steps it has taken to ensure

that its 2021 guidance is consistently followed. This included surveying

agencies and carriers related to verification practices and providing

training. At the same time, OPM agreed that further monitoring through

comprehensive audit may be appropriate. The steps described in OPM’s

comments are positive actions to help ensure compliance. However, as

OPM acknowledged, it may need to take additional action to implement a

monitoring mechanism to ensure employing offices and FEHB carriers

are verifying family member eligibility going forward. As such, we believe

this recommendation is still warranted.

If you or your staff have any questions about this report, please contact

Offices of Congressional Relations and Public Affairs may be found on

the last page of this report. GAO staff who made key contributions to this

report are listed in appendix III.

Agency Comments

and Evaluation

Page 24 GAO-23-105222 Federal Employees Health Benefits Program

As agreed with your offices, unless you publicly announce the contents of

this report earlier, we plan no further distribution until 30 days from the

report date. At that time, we will send copies to the appropriate

congressional committee and the Director of OPM. In addition, the report

will be available at no charge on the GAO website at

https://www.gao.gov.

Seto J. Bagdoyan

Director, Audit Services

Forensic Audits and Investigative Service

Appendix I: Objectives, Scope, and

Methodology

Page 25 GAO-23-105222 Federal Employees Health Benefits Program

This report discusses the extent to which (1) the Office of Personnel

Management (OPM) has implemented control activities to prevent

ineligible family members from being covered in Federal Employees

Health Benefits (FEHB) program enrollments; (2) OPM has implemented

control activities to identify and remove ineligible family members with

FEHB coverage; and (3) OPM’s fraud risk assessment for the FEHB

program includes fraud risks related to ineligible FEHB members.

1

As part of this work, we determined that internal controls were significant

to our first and second objectives. Specifically, the monitoring component

of internal control—along with the related principles that (1) management

should establish and operate monitoring activities to monitor the internal

control system and evaluate the results, and (2) management should

remediate identified internal control deficiencies—as outlined in

Standards for Internal Control in the Federal Government, were

significant to our first and second objectives.

2

To assess relevant control

activities in both objectives, we reviewed federal regulations and OPM

guidance. We also interviewed officials and reviewed relevant

documentation from OPM, OPM’s Office of the Inspector General (OIG),

federal employing offices, FEHB health insurance carriers, and others, as

described in greater detail below.

For our first two objectives, we conducted interviews with officials from

OPM, five employing offices, and five FEHB health insurance carriers. To

obtain views from offices of differing employee size, for our interviews

with five employing offices we randomly selected one employing office

each within two cabinet level departments, one employing office of a large

independent federal agency, one employing office of a medium

independent federal agency, and one employing office of a small

independent federal agency, as defined by OPM’s list of federal

1

In this report, we use the term “members” to refer to federal employees, retired federal

employees, other eligible individuals, and their eligible family members with health

coverage in the FEHB program.

2

GAO, Standards for Internal Control in the Federal Government, GAO-14-704G

(Washington, D.C.: September 2014).

Appendix I: Objectives, Scope, and

Methodology

Appendix I: Objectives, Scope, and

Methodology

Page 26 GAO-23-105222 Federal Employees Health Benefits Program

agencies.

3

For our interviews with FEHB health insurance carriers, we

selected a non-probability sample of five FEHB carriers that had at least 1

percent of total FEHB employee and retiree enrollment as of October

2021. The five carriers we interviewed represented a combined total of

approximately 87 percent of FEHB employee and annuitant enrollment at

the time of our selection.

4

While the statements from the selected

employing offices and carriers we spoke with are not generalizable to

their entire populations, they provided specific information about their

FEHB responsibilities and operations. We also reviewed relevant

documentation, such as OPM regulations, FEHB guidance and

instructions for employing offices and health insurance carriers, and

OPM’s FEHB handbook.

For our second objective, we reviewed additional documentation,

including final audit reports on dependent eligibility verification audits

(DEVAs) performed by states as a control activity to identify and remove

ineligible family members covered under state health benefit programs.

5

To identify examples of states that have performed or announced DEVAs,

we sent out an inquiry to the National Association of State Auditors

requesting information on this topic. We also performed web searches

and reviewed state auditor websites for all 50 states. However, additional

states may have monitored or announced plans to monitor dependent

eligibility in their state health programs that are not included in this review

because, for example, these states did not provide us information on

those efforts or it was not published on the internet or State Auditor

websites.

As part of this work, we also interviewed three of the six vendors we

identified that contracted with these state health benefit programs to

conduct the DEVAs we reviewed. We attempted to meet with all six

3

OPM maintains a publicly available list of federal agencies and employment numbers on

its website that we used to select employing offices. OPM defines large independent

agencies as those having more than 1,000 employees, medium independent agencies as

those having between 100 and 999 employees, and small independent agencies as those

having less than 100 employees.

4

This percentage does not include family member enrollment.

5

A dependent eligibility verification audit (DEVA) is an audit designed to verify the

eligibility of enrollees’ dependents, such as spouses and children. Typically, the entity

conducting the DEVA requests that enrollees provide marriage certificates, birth

certificates, or other documents to demonstrate eligibility.

Appendix I: Objectives, Scope, and

Methodology

Page 27 GAO-23-105222 Federal Employees Health Benefits Program

vendors we identified as having conducted DEVAs, but three either

declined or did not respond to our request for a meeting. For our first and

second objectives, we also assessed the extent to which OPM’s

responses and documents aligned with principles in Standards for

Internal Control in the Federal Government –specifically those principles

related to designing and developing monitoring mechanisms and

remediating internal control deficiencies.

6

For our third objective, we analyzed OPM’s fraud risk assessment and

interviewed agency officials. We assessed the extent to which OPM’s

fraud risk assessment for the FEHB program aligned with relevant leading

practices in GAO’s A Framework for Managing Fraud Risks in Federal

Programs - specifically those leading practices related to identifying and

assessing risks to determine the program’s fraud risk profile.

7

We conducted this performance audit from May 2021 to December 2022

in accordance with generally accepted government auditing standards.

Those standards require that we plan and perform the audit to obtain

sufficient, appropriate evidence to provide a reasonable basis for our

findings and conclusions based on our audit objectives. We believe that

the evidence obtained provides a reasonable basis for our findings and

conclusions based on our audit objectives.

6

GAO, Standards for Internal Control in the Federal Government, GAO-14-704G

(Washington, D.C.: September 2014).

7

We selected leading practices from the Fraud Risk Framework’s second component that

are most relevant to this objective based on our review of OPM documents and

discussions with OPM staff. GAO, A Framework for Managing Fraud Risks in Federal

Programs, GAO-15-593SP

(Washington, D.C.: July 2015).

Appendix II: Comments from the Office of

Personnel Management

Page 28 GAO-23-105222 Federal Employees Health Benefits Program

Appendix II: Comments from the Office of

Personnel Management

Appendix II: Comments from the Office of

Personnel Management

Page 29 GAO-23-105222 Federal Employees Health Benefits Program

Appendix II: Comments from the Office of

Personnel Management

Page 30 GAO-23-105222 Federal Employees Health Benefits Program

Appendix III: GAO Contact and Staff

Acknowledgments

Page 31 GAO-23-105222 Federal Employees Health Benefits Program

In addition to the contact named above, Jonathon Oldmixon (Assistant

Director), Scott Clayton (Analyst in Charge), Daniel Silva, and Kaitlyn

Brown made key contributions to this report. Other contributors include

James Murphy and Andrew Stavisky.

Appendix III: GAO Contact and Staff

Acknowledgments

GAO Contact

Staff

Acknowledgments

(105222)

The Government Accountability Office, the audit, evaluation, and investigative

arm of Congress, exists to support Congress in meeting its constitutional

responsibilities and to help improve the performance and accountability of the

federal government for the American people. GAO examines the use of public

funds; evaluates federal programs and policies; and provides analyses,

recommendations, and other assistance to help Congress make informed

oversight, policy, and funding decisions. GAO’s commitment to good government

is reflected in its core values of accountability, integrity, and reliability.

The fastest and easiest way to obtain copies of GAO documents at no cost is

through our website. Each weekday afternoon, GAO posts on its website newly

released reports, testimony, and correspondence. You can also subscribe to

GAO’s email updates to receive notification of newly posted products.

The price of each GAO publication reflects GAO’s actual cost of production and

distribution and depends on the number of pages in the publication and whether

the publication is printed in color or black and white. Pricing and ordering

information is posted on GAO’s website, https://www.gao.gov/ordering.htm.

Place orders by calling (202) 512-6000, toll free (866) 801-7077, or

TDD (202) 512-2537.

Orders may be paid for using American Express, Discover Card, MasterCard,

Visa, check, or money order. Call for additional information.

Connect with GAO on Facebook, Flickr, Twitter, and YouTube.

Subscribe to our RSS Feeds or Email Updates. Listen to our Podcasts.

Visit GAO on the web at https://www.gao.gov.

Contact FraudNet:

Website:

https://www.gao.gov/about/what-gao-does/fraudnet

Automated answering system: (800) 424-5454 or (202) 512-7700

A. Nicole Clowers, Managing Director, ClowersA@gao.gov, (202) 512-4400, U.S.

Government Accountability Office, 441 G Street NW, Room 7125, Washington,

DC 20548

Chuck Young, Managing Director, young[email protected], (202) 512-4800

U.S. Government Accountability Office, 441 G Street NW, Room 7149

Washington, DC 20548

Stephen J. Sanford, Managing Director, [email protected], (202) 512-4707

U.S. Government Accountability Office, 441 G Street NW, Room 7814,

Washington, DC 20548

GAO’s Mission

Obtaining Copies of

GAO Reports and

Testimony

Order by Phone

Connect with GAO

To Report Fraud,

Waste, and Abuse in

Federal Programs

Congressional

Relations

Public Affairs

Strategic Planning and

External Liaison

Please Print on Recycled Paper.