GETTING STARTED

Credit reports and military service

This tool will help you get, review, improve, and protect your

credit history.

As a servicemember, having a strong credit history means having greater

opportunities during your military career. Financial readiness involves requesting and

reviewing your credit reports, taking steps to improve your credit including disputing

errors on your credit reports, and protecting your credit history.

Negative information in your credit reports may keep you from getting promotions,

higher security clearances, or special duty assignments.

What to do

•

Enroll in free electronic credit monitoring services. Equifax, Experian, and

TransUnion—are providing free electronic credit monitoring services to active duty

servicemembers and members of the National Guard.

• Get free copies of your credit reports. You can get them on the internet, by

telephone, or by mail. If you get your reports on the internet, be sure you’re

accessing them from a safe and secure device and location.

• Review your credit reports. Read through each credit report carefully, using the

checklist as a guide for what errors to look for.

• Improve your credit reports. This can include disputing errors you find in your

credit reports. If you find any mistakes on your credit reports, you should dispute

them. Use the “Disputing errors on your credit reports” tool in the toolkit for even

more information. You may also opt for a strategy or combination of strategies to

improve your credit reports that work for you.

• Protect your credit history. There is a range of specific things you can do to

limit access to your credit reports. This can help you prevent identity theft and

financial fraud.

1

Understanding Credit reports and

military service

1. Read each step in the checklist below.

2. Follow each step as it applies to you.

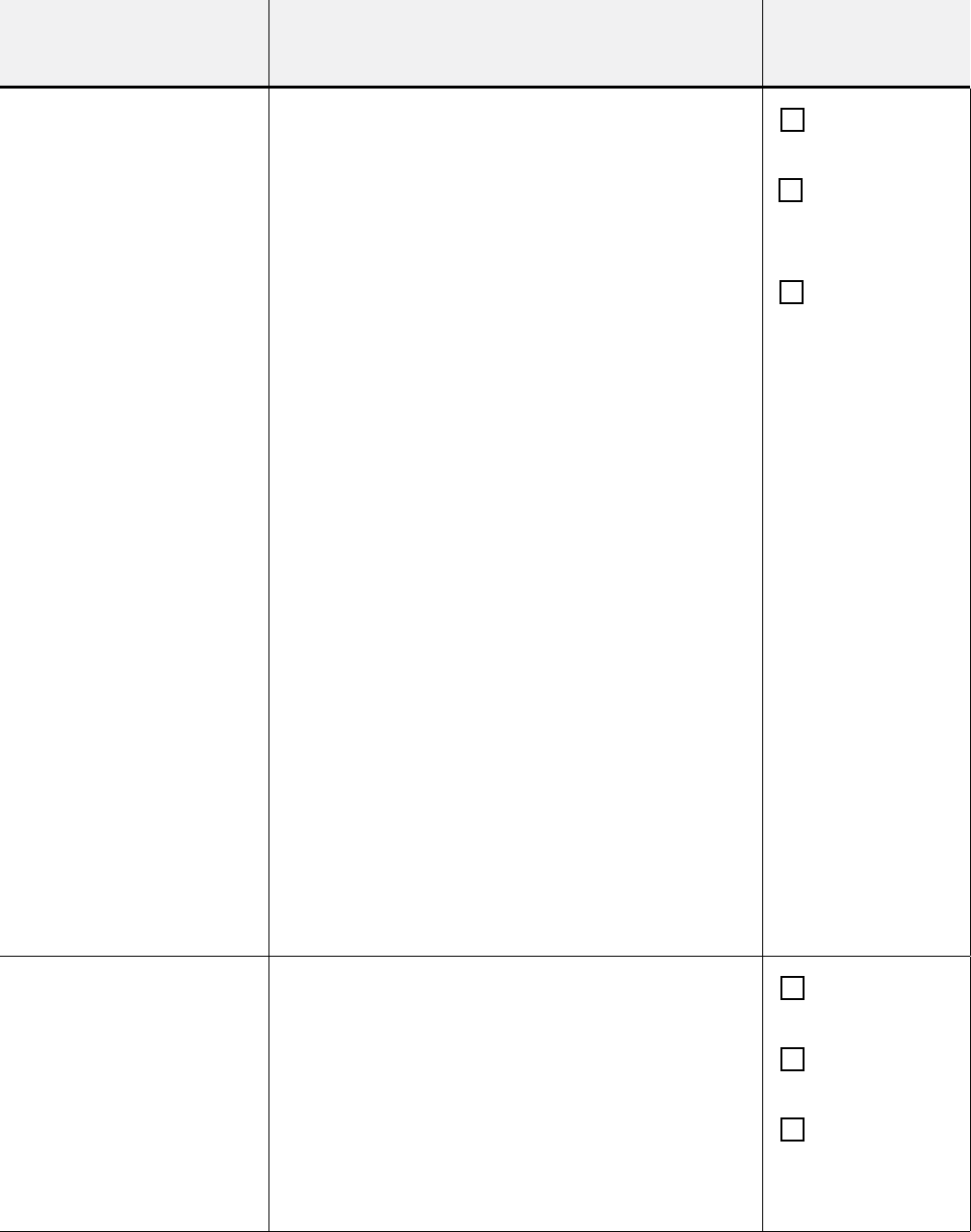

Monitor your credit

Step to take Additional steps or information

Check when

complete

Active

duty

servicemembers,

reservists on active

duty, and members of

the National Guard can

enroll in free electronic

credit monitoring

services.

Credit monitoring services can alert consumers

to mistakes or problems with their credit

reports that might stem from the unauthorized

use of their personal information to obtain

credit.

Equifax

(8 0 0) 685 -1111

equifax.com/

personal/

military-credit-

monitoring/

Experian

(888) 397-3742

experian.com/

lp/military.html

TransUnion

(800) 916-8800

transunion.com/

active-duty-

military-credit-

center

Equifax

Experian

TransUnion

Visit annualcreditreport.

com to get a copy of

each credit report.

You are entitled to one free credit report every

12 months from each of the three nationwide

credit reporting companies. If you were

affected by the Equifax data breech, you can

get access to extra reports too as noted here:

consumerfinance.gov/equifax-settlement.

Be ready to answer the security questions you

will be asked. If you are unable to answer them,

you will have to order your reports by phone or

mail.

You can order all three at a time, but it’s a

better practice to order a different one every

four months.

Equifax

Experian

TransUnion

3

Step to take Additional steps or information

Check when

complete

Order your free credit

reports by phone or

by mail if you can't get

them online.

Call: (877) 322-8228 or download and

print this form: annualcreditreport.com/

manualRequestForm.action

Complete it and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Equifax

Experian

TransUnion

Get a free copy of your

credit score by visiting

your local Personal

Financial Counselor

(PFC).

PFCs are part of the Military Financial

Readiness Management Program. In

addition to providing a free credit score,

PFCs also conduct classes, seminars,

one-on-one counseling and educate

servicemembers and their families about

consumer rights to help them achieve

financial stability. You can locate your

nearest Financial Counselor by contacting

Military One Source at 800-342-9647 or

visiting militaryonesource.mil.

Yes, a I have met

with a PFC and

received a copy

of my credit score

No, I need to

contact a PFC

Review your credit reports

Step to take Additional information Check when complete

I need to file a

dispute.

Review:

Your name including spelling

Social Security number

Telephone numbers

Addresses

Employment history

Yes, all information

is correct

No, something is

wrong. I need to

file a dispute.

4

Step to take Additional information Check when complete

Is the public

record information

correct?

Check for bankruptcies

Check for possible tax liens and court

judgments

Yes, all information

is correct

No, something

is wrong. Follow

steps for filing a

dispute to get it

corrected

Review collection

agency account

information.

Review:

Ac

count information—did the original

account belong to you?

Status of each account

Yes, all information

is correct

No, something

is wrong. Follow

steps for filing a

dispute to get it

corrected

Review the

credit account

information.

Review:

Account information—do all the accounts

belong to you?

The status of each account—open versus

closed, paid on time, missed payments,

current balances

Yes, all information

is correct

No, something

is wrong. Follow

steps for filing a

dispute to get it

corrected

Review the

inquiries made to

your file.

There are two types of inquiries:

• Hard inquiries—often after you have applied

for credit or an apartment.

• Soft inquiries—a business has reviewed your

credit to see if you may be eligible for a

promotional offer. When you, an employer,

or insurance company check your credit

reports, these are also considered soft

inquiries.

• Hard inquiries affect your credit scores

slightly. Soft inquiries do not.

Yes, all information

is correct

No, something is

wrong. I need to

file a dispute.

5

Improve your credit reports

Step to take Additional steps or information

Check when

complete

Dispute mistakes

on your credit

report.

You can call, complete an online dispute form, or send

a letter explaining the mistakes. If sending a letter, you

may also have to complete a dispute form. See this link

for further help: consumerfinance.gov/ask-cfpb/how-

do-i-dispute-an-error-on-my-credit-report-en-314/

Dispute forms are available on the credit reporting

company websites. If submitting evidence; like receipts,

cleared checks, bank or credit card statements, or

screenshots of electronic payments; make sure you

send copies—not original documents.

Equifax

(8 0 0) 685 -1111

equifax.com/

personal/

disputes

Equifax

Information

Services, LLC

P.O. Box 740256

Atlanta, GA

30348

Experian

(888) 397-3742

experian.com/

dis

putes

Experian

P.O. Box 4500

Allen, TX 75013

TransUnion

(800)

916-8800

transunion.com

/

disputes

TransUnion

Consumer

Solutions

P.O. Box 2000

Chester, PA

19016

Dispute sent

to:

Equifax

on __/__/__

Experian

on __/__/__

TransUnion

on __/__/__

Credit

reporting

companies

have 30 days

to respond to

your dispute.

6

Step to take Additional steps or information

Check when

complete

Dispute the

mistakes with

the information

furnisher.

Call or send a letter to the creditor or business that

provided the incorrect information. Be sure to send

copies of evidence or proof of payment. Never send

original documents.

Use these

strategies to

improve your

credit history

File disputes if there are mistakes

Pa

y your bills on time and as agreed

Use only 30% of your available credit limit on revolving credit accounts

(e.g. credit cards)

Pay off tax liens or judgements

Use a credit building strategy:

• Get a credit building loan from a bank or credit union

• Get a secured credit card if you are unable to qualify for a

conventional credit card. Use only 30% of your credit limit

Keep old accounts open

Resist applying for new credit cards

If you have debts that existed before you went on active military duty,

request an interest rate reduction to 6%. This is your right under the

Servicemembers Civil Relief Act (SCRA).

If you have debts you cannot pay, get help from your military branch

relief society. (See the handout in this guide in Module 4 called Military

relief societies.)

If you are unable to stay current with your bills and debt, get help:

• Visit a personal financial counselor at your closest military

installation

• Visit a nonprofit in the community that helps people with their

finances

• Contact your local/state Department of Veterans’ Affairs: nasdva.us/

Links.aspx

Get and review your credit reports at least once every 12 months

7

Protect your credit history

Step to take Additional steps or information

Check when

complete

Place an initial fraud

alert

• Use this if you are concerned you may

become the victim of identity theft or fraud

• Requires creditors or businesses to verify

your identity before opening a new account,

issuing an additional card, or increasing the

credit limit on an existing account based on

a consumer’s request

• Place with one nationwide credit reporting

company, and it must notify the other two

• Free and stays in place for 12 months

Initial fraud

alert placed

Place an active duty

military alert

• Use this if you are concerned you may

become the victim of identity theft or fraud,

and you are an active duty servicemember

who is deployed or stationed overseas

• Requires creditors or businesses to verify

your identity before opening an account,

issuing an additional credit card on an

existing account, or increasing the credit

limit on your existing account

• Place with one nationwide credit reporting

company, and it must notify the other two

• Free and stays in place for 12 months, but

can be renewed for the length of your

deployment

Active duty

military alert

placed

8

Step to take Additional steps or information

Check when

complete

Place an Extended

Fraud Alert

• Use this if you have been the victim of

identity theft

• Requires creditors or businesses to verify

your identity before opening an account,

issuing an additional credit card on an

existing account, or increasing the credit

limit on your existing account

• Place with one nationwide credit reporting

company, and it must notify the other two

• Free and stays in place for seven years

• Must provide proof of identity theft and a

copy of an identity theft report, which you

can create at IdentityTheft.gov

Extended

fraud alert

placed

9

Step to take Additional steps or information

Check when

complete

Place a credit freeze • Use this if you want more protection than a

fraud alert provides

• Prevents access to your credit reports by

almost anyone (including you); this keeps

new credit accounts from being opened,

and stops new accounts for other services

such a mobile phones or utilities

• If you request a credit freeze, the credit

reporting company must implement it

within one business day of your request if

made by telephone or electronically.

• Upon your request, a credit freeze must be

lifted for free and be removed no later than

one hour after you make the request by

telephone or electronically

• Federal law protects credit records and

identity theft for persons under age 16 and

incapacitated persons or persons for whom

a guardian has been appointed. Persons

with authority to act for these consumers

can request a credit freeze

• Must establish a freeze with each credit

reporting company unlike fraud alerts

• Free and stays in place until you lift it

Equifax credit

freeze placed

Experian

credit freeze

placed

TransUnion

credit freeze

placed

Get, review, dispute

errors on, and improve

credit reports

• This is the most important step in

defending your credit history over the long-

term.

• Get and review your credit reports from

each credit reporting company at least

once every 12 months

Equifax on

__/__/__

Experian on

__/__/__

TransUnion

on __/__/__

10

11

DISCLAIMER

The Consumer Financial Protection Bureau prepared the tools included in the Your

Money, Your Goals: Focus on Military Communities companion guide as a resource

for the public. This material is provided for educational and information purposes

only. It is not a replacement for the guidance or advice of an accountant, certified

financial advisor, or otherwise qualified professional. The CFPB is not responsible for

the advice or actions of the individuals or entities from which you received the CFPB

educational materials. The CFPB’s educational efforts are limited to the materials that

CFPB has prepared.

The tools may ask you to provide sensitive information. The CFPB does not collect

this information and is not responsible for how your information may be used if you

provide it to others. The CFPB recommends that you do not include names, account

numbers, or other sensitive information and that users follow their organization’s

policies regarding personal information.

This guide includes links or references to third-party resources or content that

consumers may find helpful. The Bureau does not control or guarantee the accuracy

of this outside information. The inclusion of links or references to third-party sites

does not necessarily reflect the Bureau’s endorsement of the third-party, the views

expressed on the outside site, or products or services offered on the outside site. The

Bureau has not vetted these third-parties, their content, or any products or services

they may offer. There may be other possible entities or resources that are not listed

that may also serve your needs.