MyFreeTaxes

Self-Employed Tax Guide

For Home-Based

Child Care Businesses

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 2

Table of Contents

INTRODUCTION ............................................................................................................................... 3

PART I: GETTING READY FOR TAX SEASON ................................................................................... 6

PART II: FILING YOUR RETURN ONLINE ........................................................................................ 55

About United Way

United Way brings people together to build strong communities where everyone thrives.

As one of the world's largest privately funded charities, we serve 95% of U.S. communities and

37 countries and territories; our humanitarian aid supports 48 million people every year.

Through United Way, communities tackle tough challenges and work with private, public, and

nonprofit partners to boost education, economic solutions, and

health resources.

United Way is the mission of choice for 1.5 million volunteers, 6.8 million donors, and

45,000 corporate partners in more than 1,100 communities worldwide. Together, we are

building resilient, equitable communities across the globe. Learn more at UnitedWay.org. Follow

us: @UnitedWay and #LiveUnited.

About MyFreeTaxes®

MyFreeTaxes helps people file their federal and state taxes for free while getting the assistance

they need. United Way provides MyFreeTaxes in partnership with the IRS’s Volunteer Income

Tax Assistance (VITA) program to help filers prepare their tax returns on their own or have their

return prepared for them for free.

For millions of Americans, tax refunds and credits are essential to their financial stability and

success. These credits maximize filers’ refunds and provide important opportunities for

individuals and families to build financial stability. For many households, their tax refund may be

the biggest check they receive all year. For entrepreneurs, filing taxes can make or break their

financial bottom line.

Since 2009, MyFreeTaxes has helped more than 1.3 million people file their taxes for free while

claiming over $1 billion in refunds and saving over $260 million in filing fees.

About Civitas Strategies

Founded in 2009 by Gary Romano, Civitas Strategies, is a management consultancy focused on

increasing the impact of mission-driven organizations, both for-profits and nonprofits. The

pandemic of 2020 uncovered countless crippling vulnerabilities for small businesses. As a

result, we shifted our work to focus more intensively on the business basics required for small

businesses to survive and thrive. Our work across the country since then includes business

coaching, technical assistance, and grant administration support to small business owners

which includes sole proprietors and corporations.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 3

Introduction

Small businesses play a critical role in our economy, generating income and wealth that

supports the financial needs of entrepreneurs, employees, and their families. However, the

costs and stress associated with filing business-related taxes limit the positive financial

impacts of self-employment for many entrepreneurs, including home-based child care

providers.

United Way created this guide to help more owners of home-based child care businesses easily

and accurately file their taxes for free. Designed for both full-time and part-time entrepreneurs,

this guide takes you through the steps of getting ready to self-prepare your taxes using online

software.

This guide has two parts.

Part I: Getting Ready for Tax Season focuses on what you need to know about taxes and how to

prepare for tax season.

Part II: Filing Your Return Online offers step-by-step instructions on how to use MyFreeTaxes to

complete your return online.

This guide will help you take each step in your tax-filing journey. The layout is in a simple

question-and-answer format based on the questions frequently posed by other home-based

child care providers. To answer the questions, we drew upon official US Internal Revenue

Service guidance (including their audit guide for child care providers).

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 4

Why Care about your Taxes?

Taxes are an important consideration for any business. Through taxes, we all contribute to our

government at the national, state, and local levels. Paying taxes and following IRS regulations is

important. It’s also important to take advantage of all the deductions and tax credits for which

you are eligible. This will reduce your taxes, maximize your profit, and allow you to continue

investing in your business.

Effective tax preparation can also head off the long-term

cost of an audit. Though only a relatively few people are

audited every year, if you are audited, the cost in time and

money can be great.

The best way to avoid an audit is to keep in mind common

“red flags.” That is, the issues that often lead to an audit. The most common red flags for home-

based child care providers are:

• Not including all your income on your taxes — such as leaving out a 1099 you received

from the Child Care Resource and Referral agency for subsidized care.

• Taking off too many expenses or ones that are really high — like a provider who claimed

$40,000 in cell phone expenses for themselves each year.

• Taking a very large loss on your business or having losses year after year — businesses

will take a loss from time to time (we’ll review that later in this tool) but you want to

avoid having losses that are far more than what you earned. After all, if your business

regularly loses more money than it earns the IRS may be curious about why you continue

to operate it!

• Claiming 100% use of your vehicle. Some of you may have a van or car you use for

transportation for your business — that’s allowed. However, reporting that the vehicle is

only used for work (and never for personal reasons) can draw attention since it is less

common.

As you can see, many red flags can be easily avoided through proper preparation of your taxes.

How to File Your Taxes for Free

MyFreeTaxes helps people file their federal and state taxes for free while getting the assistance

they need. United Way provides MyFreeTaxes in partnership with the IRS’s Volunteer Income

Tax Assistance (VITA) program and is designed to help filers prepare their tax returns on their

own or have their return prepared for them for free.

How does it work?

It’s easy! Head to MyFreeTaxes.com to get started. Once there, use our quick and easy tool to

indicate whether you prefer to prepare your own taxes online or want to have your taxes

prepared for you. After you tell us how you want to file, we’ll ask a few simple questions and

connect you to the free tax filing options for which you are eligible.

PRO TIP Keeping good

records throughout the year

will make tax preparation

easier.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 5

Over 70% of people are eligible for IRS-sponsored free tax filing services such as the Volunteer

Income Tax Assistance (VITA) program, so there’s a good chance you qualify. In the off chance

that you’re not eligible for free tax filing through VITA, we’ll connect you to alternative free tax

filing options so you can still file for free.

Have questions or need support while using one of the tax filing options we recommend? Visit

the MyFreeTaxes Support page to receive assistance from IRS-certified tax specialists via

phone, email, or live chat, or refer to our FAQs and filing guides.

What is the IRS VITA program?

For over 50 years, the IRS Volunteer Income Tax Assistance (VITA) program has provided free

tax preparation services to qualifying individuals. In 2021, tens of thousands of VITA volunteers

at 2,800 VITA sites across the nation prepared nearly one million returns for eligible filers and

generated $1.7 billion in refunds.

Most VITA sites provide services in person, but United Way’s MyFreeTaxes program provides

VITA services virtually, enabling you to file your taxes for free from the convenience of your

laptop, smartphone, or other digital device.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 6

Part 1 Table of Contents

PART I: GETTING READY FOR TAX SEASON ................................................................................... 6

WHAT IS INCLUDED ON MY TAX FORM?.......................................................................................................................... 7

HOW MUCH MONEY DID I MAKE? ............................................................................................................................. 10

Revenue Worksheets ...................................................................................................................................... 11

HOW MUCH MONEY DID I SPEND? ............................................................................................................................ 13

Expense Worksheet ........................................................................................................................................ 14

HOW DO I INCLUDE VEHICLE COSTS? ........................................................................................................................... 16

There are two ways to deduct your vehicle expenses: ..................................................................................... 16

Vehicle Expense Worksheet ............................................................................................................................ 18

Deprecation of Your Vehicle ........................................................................................................................... 18

HOW DO I INCLUDE THE COST OF MY HOME? ............................................................................................................... 19

Indirect Home-Based Business Expenses ......................................................................................................... 23

HOW DO I HANDLE STIMULUS PROGRAM FUNDS? ........................................................................................................... 24

GREAT! I AM READY TO FILE MY TAXES. HOW DO I GET STARTED? ....................................................................................... 26

DECIDE IF YOU WANT TO FILE YOUR OWN TAXES FOR FREE OR IF YOU NEED A PAID TAX PREPARER. .............................................. 26

ONCE MY TAXES ARE COMPLETED, WHAT SHOULD I DO NEXT?............................................................................................ 28

WHAT BUSINESS RESOURCES CAN I ACCESS FOR MORE TRAINING ON TAXES AND OTHER BUSINESS TOPICS? ................................... 28

YEAR-ROUND TAX AND GENERAL BUSINESS RESOURCES .................................................................................................. 29

RESOURCE 1: MILEAGE LOG ...................................................................................................................................... 30

RESOURCE 2: CONFIDENCE IN QUALITY TAX PREP RUBRIC© FOR CHILD CARE PROVIDERS ....................................................... 31

GLOSSARY ...................................................................................................................................................... 31

RESOURCE 3: PAYROLL TAXES (FOR BUSINESSES WITH EMPLOYEES) ..................................................................................... 36

RESOURCE 4: QUARTERLY ESTIMATED TAX PAYMENTS (FOR SELF-EMPLOYED INDIVIDUALS)..................................................... 39

RESOURCE 5: WHAT TO LOOK FOR IN A BUSINESS BANK ACCOUNT? ................................................................................... 42

RESOURCE 6: HOW CAN I CREATE A SIMPLE FINANCIAL SYSTEM FOR MY BUSINESS? .............................................................. 44

RESOURCE 7: WHAT IS DEPRECIATION? ....................................................................................................................... 49

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 7

What is Included on my Tax form?

There are different types of business tax forms. Let’s go over the most common ones.

A sole proprietor or self-employed individual is both the owner

and the only employee. Income for a sole proprietorship is

reported on a Schedule C as part of your personal 1040 tax

return. If you have more than one business activity, you will need

more than one Schedule C. For example, a home-based childcare

provider who also drove for Uber needs to produce a Schedule C

for her childcare business and also a separate one for her Uber

driving.

A Limited Liability Company is a business structure that offers

protections from some liabilities and has tax flexibility. At the

time of creation and typically once a year, the LLC owner can

declare how they will be taxed. LLCs with a single owner can use

the same process as a sole proprietor, but they can also choose

to use an S-Corporation or C-Corporation process or, if there is

more than one owner, a partnership (all are described below).

An S-Corporation is a small business type where any profit is

“transferred” directly to your personal tax return (so you don’t pay

corporate taxes on it). An S-corporation uses a Form 1120S

(income tax return for S corporation) and will show the “pass

through” income to the owner on a Schedule K-1 (individual

owner shares).

A C-Corporation is often called a “regular” corporation. The C-

corporation uses Form 1120 (corporation income tax return) and

will have profit taxed as a corporation before you can claim it as

personal income (and it gets taxed again). Likely few home-based

providers will benefit from their business being taxed this way.

A partnership is formed between one or more business owners

who share the costs and the profit from the business.

Partnerships use a Form 1065 to report their earnings.

Though this guide focuses on Sole Proprietors/Self-Employed

Individuals who submit a Schedule C, there are three parts of

business tax forms that they all have in common:

• You first report your revenue (all the money you received

from your business);

• You show all your expenses (the things you paid for to

keep your business running); and

EIN vs. SSN

In the early stages of running a

sole proprietorship, most

business owners usually use

their own social security

number as the tax

identification number for the

business. This is a quick and

simple way to get your

business up and running

without having to do any

additional paperwork.

However, you can also get an

Employer Identification

Number (EIN) from the IRS.

This number functions like a

social security number for

your business. It is an

identification number issued

by the IRS specifically for your

business.

The advantage of an EIN is

that it will limit the number of

documents with your social

security number on it, which

can help you to keep your

personal identification number

safe and prevent it from being

misused. Sole proprietors

must get an EIN if they wish to

hire employees, and if you

want to open a business bank

account with most banks.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 8

• Finally, you calculate the amount that. If it is positive, you made a profit; if negative, then

a loss.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 9

Schedule C

Let’s take a closer look at

the Schedule C to show

where the different

sections are for reporting

data on your business.

Your tax software will

enter these numbers

based on your

submissions, but it can

be helpful to know your

way around this

important document.

Part I is where your sales

are totaled, and your cost

of goods sold is reported

so you can see your

gross profit.

Part II is where your

business expenses are

reported. There are over

a dozen categories to

help you stay organized,

such as advertising, car

and truck expenses, legal

and professional

services, rent, travel and

meal expenses, and other

costs.

This last section is where

your net profit is

calculated (Line31) by

subtracting your total

expenses (from Part II)

from the total revenue (in

Part I).

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 10

How Much Money Did I Make?

The first section of your taxes is all about revenue, that is,

how much money you made. Getting this information

may be easy if you have an accounting system. If not, no

worries, you can use the revenue worksheet below to

calculate it.

Start by gathering your records. You are likely to have

three types of records for revenue:

1099 forms — these are evidence that another business

paid you for services. Many home-based child care

businesses will receive a 1099-NEC for subsidy care payments and for participation in the Child

and Adult Care Food Program (CACFP). You will also receive a 1099-K if you received more than

$600 in business payments from apps like Square, Zelle, or PayPal.

Bank records — showing additional funds you may have received from other sources.

Your own documents — such as year-end or weekly receipts that show parents paid for care

.

Then fill out the revenue worksheets. Include each 1099 and revenue for each child you serve.

Also list other income, such as grants, that may not already be accounted for on a 1099.

If you received reimbursement for food costs through the Child and Adult Care Food Program,

you can report all the reimbursements under the income section of Part I of the Schedule C

using the 1099 you received. You can then deduct your food expenses in full in the next section.

PRO TIP You must include

your CACFP reimbursement

as income. However, you can

still deduct your food costs as

expenses. This will help

ensure your CACFP

reimbursements do not

increase your taxes.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 11

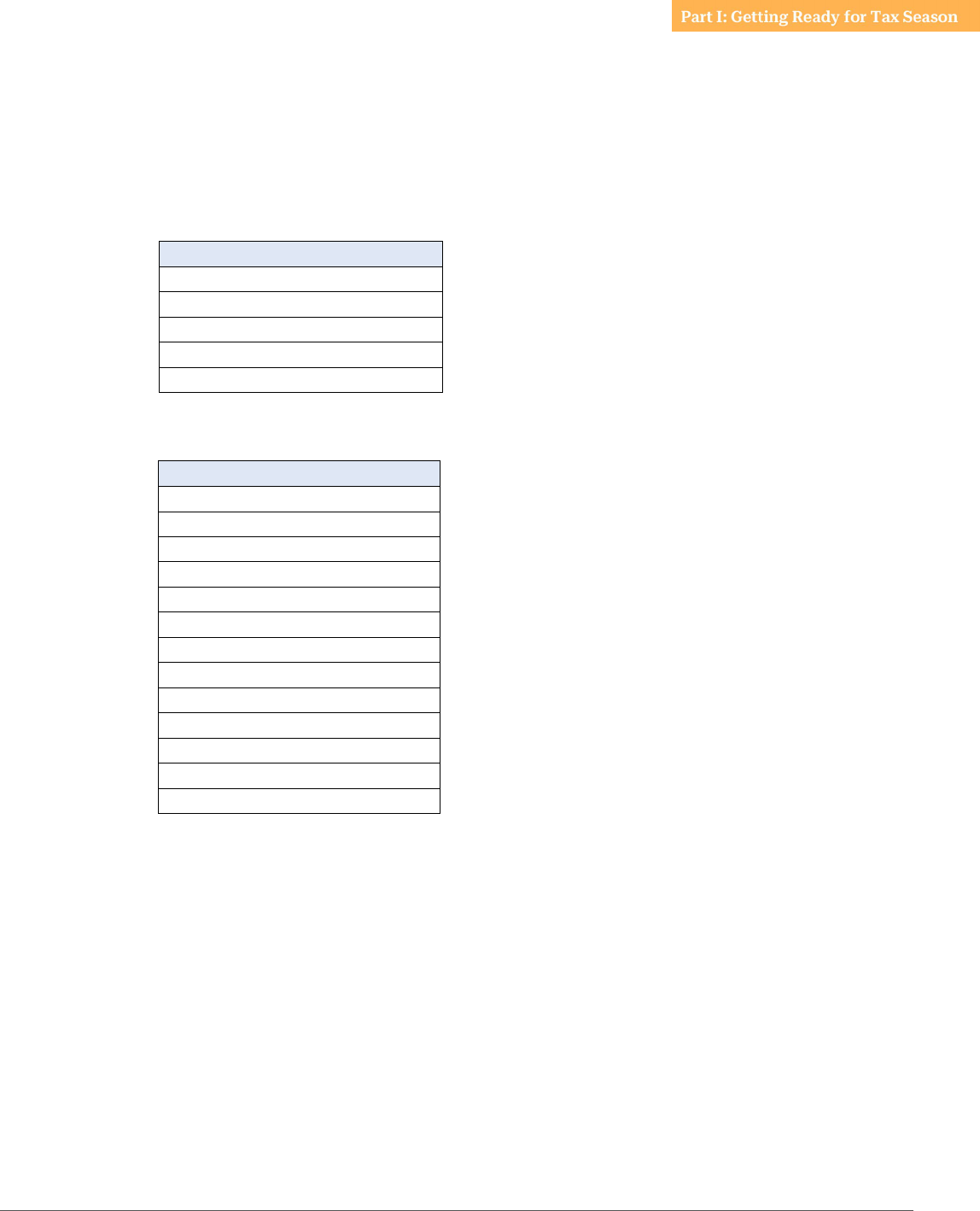

Revenue Worksheets

Click the to access the digital version of this worksheet you can download and use.

1099 INCOME

1099 Payer Name Amount

Total (add all of the 1099s)

PARENT PAYMENTS & FEES (INCLUDING CASH)

Parent Total Amount Paid

Total (add all of the parent payments)

OTHER INCOME (SUCH AS GRANTS NOT ASSOCIATED WITH A 1099)

Payer Name Purpose Amount

Total (add all of them together)

TOTAL REVENUE

Total Payment Amount

Total 1099 Payments

Total Parent Payments

Total Other Payments

Total Revenue (add them all up)

PRO TIP Make sure all your

revenue records match.

That is, the amount sale

receipt to a customer

should be the same amount

they paid per your bank

records and is the amount

you report to the IRS.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 12

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 13

How Much Money Did I Spend?

Now that you have your business income, you need to collect

your expenses, i.e., what you spent money on for your

business in 2022

.

You will need records of your costs, ideally

receipts showing payment for expenses, but in most cases

you can also use canceled checks, invoices, or credit card and

bank records. It is critical that any proof of an expense show:

• That you paid the expense.

• The amount you paid.

• The date you paid it.

• A description of the item purchased, or service

received.

The Mileage Log at the end of this tool can be used to track the information above.

To collect your expenses, begin by collecting all your receipts. Next, go month by month in your

records for 2022 to:

• Review your credit card bills.

• Check app-based system payments (such as Venmo, Zelle, PayPal, and Square Cash).

• Look at your bank statements and checks.

With your accumulated expenses you can now fill out the expense worksheet.

The worksheet

uses the expense categories for a Schedule C that are most relevant to home-based child care

providers, but they can also be used for any corporate or partnership tax return as well

.

The full amount of home expenses that are directly related to

your business can be included in the expense worksheet. The

IRS defines a direct expense as one that is “incurred

exclusively for the business and provide no personal benefit.”

Some examples of direct expenses in your home are: fixing

the bathroom used by the children, getting a new carpet for

the play area, and light bulbs for fixtures in a play area.

Indirect costs associated with your home, such as

homeowner’s insurance or your electric costs will be covered

under the section on the business use of your home below

.

You should hold onto all proof of payment through the tax season and at least four years after.

It’s great to have paper copies as well as electronic ones, even if that is just snapping a picture

of each with your phone.

PRO TIP The IRS

understands you may not

have a receipt for every

expense, so look closely at

one or more documents

that show the information

they need: That you paid the

expense; the amount you

paid; the date you paid it,

and a description of the

item purchased, or service

received.

PRO TIP Each year, create

a folder for each of the

expense categories above.

Throughout the year, place

receipts in the correct folder

and update your expense

sheet.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 14

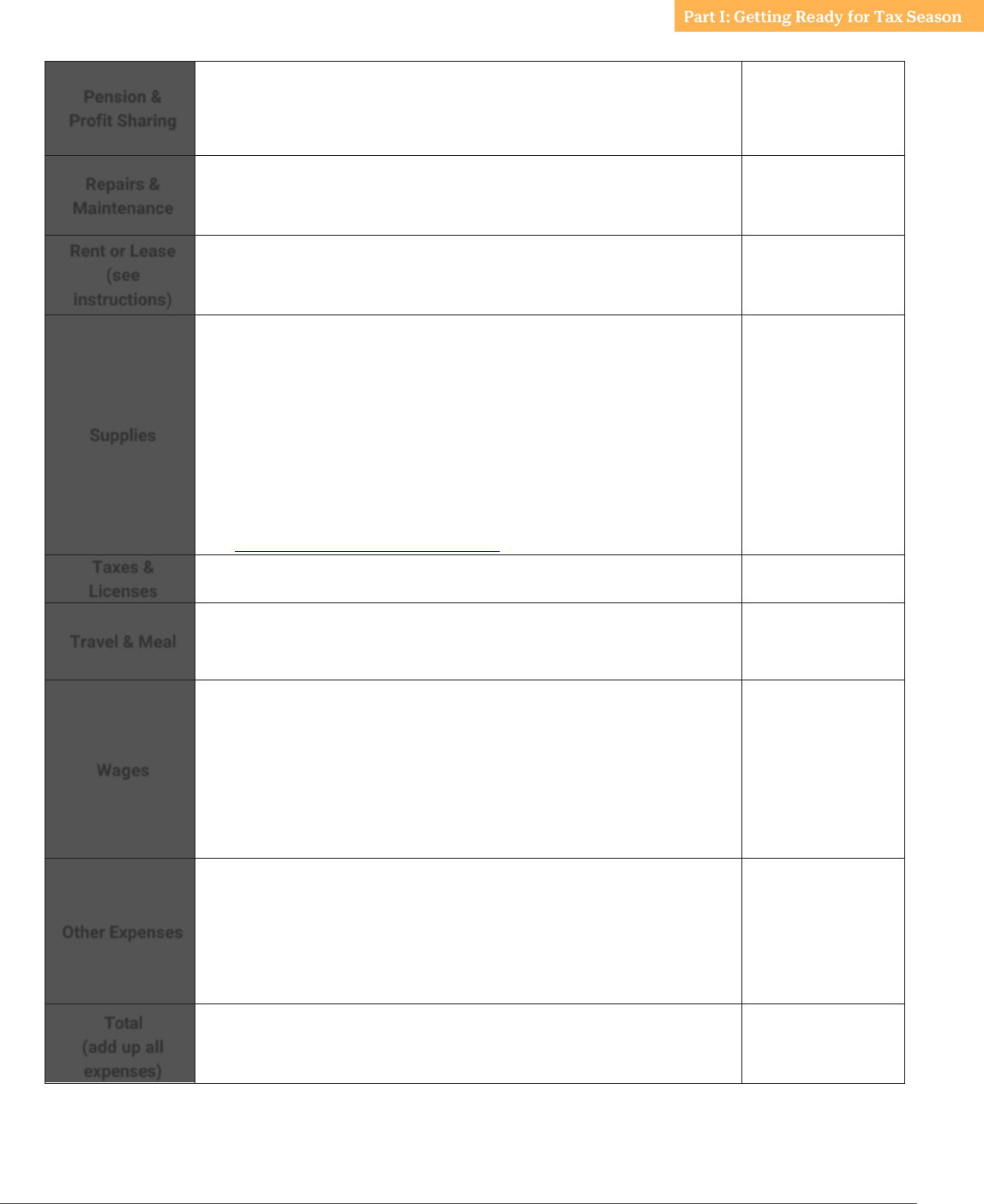

Expense Worksheet

Click the link to access the digital version of this worksheet you can download and use.

CATEGORY DESCRIPTION TOTAL EXPENSES

Advertising

Costs to promote your business including online and print ad costs,

brochures, mailers, and flyers.

Car & Truck

Expenses related to use of your vehicle for your business. You will

most likely use the total mileage calculation in the Mileage Log

resource in this document.

Contract Labor

This is for any contractors you use (workers you pay using a 1099).

If you paid a contractor $600 or more in a year, you will need to

send them a 1099 form to document the expense.

Employee

Benefit

Programs

Do you have a company health or accident insurance program? This

includes programs associated with your business (not your

personal expense) like group-term life insurance and dependent

care assistance programs.

Insurance

(other than

health)

Include your general liability insurance and workers compensation

insurance if you have employees. Don't include your health

insurance (that will be later in this table) or homeowner’s insurance

(that will be in the section on deducting the business use of your

home).

Interest Paid

Includes interest you paid directly related to your business (we’ll talk

about mortgage interest later in the section on the business use of

your home). Deductible interest can include interest on business

credit cards (not personal ones) and business loans such as the

Economic Injury Disaster Loan or an SBA 7a loan.

Legal Fees &

Professional

Services

Should include any fees paid to a lawyer, accountant, or tax preparer

as well as membership fees for professional associations like the

National Association of Family Care or the National Association for

the Education of Young Children.

Office

Expenses

All office supplies, postage, cleaning supplies and personal

protective equipment, apps and software that cost less than $200

(those that are more than $200 will be under Other Expenses). Also

add in larger purchases, like computers, telephones, copiers, and

furniture that cost less than $2,500.

If any single purchase of equipment or furniture is more than $2,500

you will need to consult current depreciation rules in the What is

Depreciation? resource. In 2022, there are special depreciation rules

that will allow businesses to elect to deduct the full cost of these

higher-cost equipment. Most online tax software, including those

available through MyFreeTaxes, will walk you through using these

elections.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 15

Pension &

Profit Sharing

Do you have a company retirement program? If so, include the

employer contributions you made for the benefit of your employees

to a pension, profit-sharing, or annuity plan (including SEP, SIMPLE,

and SARSEP plans).

Repairs &

Maintenance

Includes any repairs and maintenance of the space or equipment

you use. For example, if you need a plumber to fix the bathroom

used only by the children or if you need your work computer fixed.

Rent or Lease

(see

instructions)

For equipment rent or lease only. Costs for renting your home will

be included in the section on deducting the business use of your

home.

Supplies

Includes items you use with the children (such as art supplies),

diapers and wipes, toys, and food for snacks and meals that you

serve your children. For meals, you can use the actual expenses or

can use a standard meal and snack rate set by the IRS. The

standard rate for 2022 in all states other than AK and HI is:

breakfast $1.40; lunch $2.63; dinner $2.63; and snack $0.78. For AK,

the rates are: breakfast $2.23; lunch $4.26; dinner $4.26; and snack

$1.27. For HI, the rates are: breakfast $1.63; lunch $3.08; dinner

$3.08; and snack $0.91.

Note that this applies to home-based child care only and is equal to

the Tier 1 CACFP reimbursement rates.

Taxes &

Licenses

Such as a business registration fee or fee for licensure.

Travel & Meal

For you as part of your business, such as going to a conference or

an off-site meeting. Food for the children in your care should be in

Supplies.

Wages

For all of your business’s W-2 employees (not contractors).

Note that paying yourself is not included as wages here. You are

allowed to take an owner’s draw or salary from your self-

employment. However, paying yourself is not deductible, so you will

not report that as an expense on your tax return. The IRS considers

all income that you receive from your business as a self-employed

individual as your pay, as noted in Part I, Revenue, of the Schedule

C.

Other Expenses

Covers anything else that is deductible but not listed, the most

common will be software or apps that cost more than $200

(otherwise they can be listed as an office expense).

This is where you will also include accessibility and financing

expenses such as screen readers, online service fees, bank and

merchant fees, and credit card processing fees.

Total

(add up all

expenses)

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 16

How do I Include Vehicle Costs?

Many home-based child care providers use their own car or van to conduct their business. This

could be as simple as the personal car you also use to purchase supplies for your business, or a

van you purchased to transport children to and from school as part of your child care business.

Vehicle costs can add up, so keeping records of costs and knowing how to deduct them is

important.

There are two ways to deduct your vehicle expenses:

> The Standard Mileage Rate provides a simple cost per mile that is used to calculate your

deduction.

> The Actual Expense method uses all the costs of your car.

Here are the pros and cons of each option:

Pros/Cons

Standard Mileage Rate

Regular (Actual Cost) Method

Pros

Easy to do

Fewer records to collect

and keep

Only need to track miles

driven for business

purposes

May result in a higher deduction,

especially if you use your car for

work a great deal.

Cons

Limited to a set rate per

mile.

Takes time to collect all the

expenses and you need to hold

onto the receipts.

Must log miles driven for business

and personal purposes.

Regardless of the method you use, you need a simple log recording the number of miles you

drove your car for related to business purposes. The log should include:

• The date.

• The distance you traveled.

• Where you went.

• The purpose (business or personal) as specifically as possible.

An example Mileage Log can be found in the resource section of this guide. There are also apps

such a Mile IQ and Everlance which can automatically track your trips and make them easier to

log. The costs of these apps can also be deducted under Other Expenses.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 17

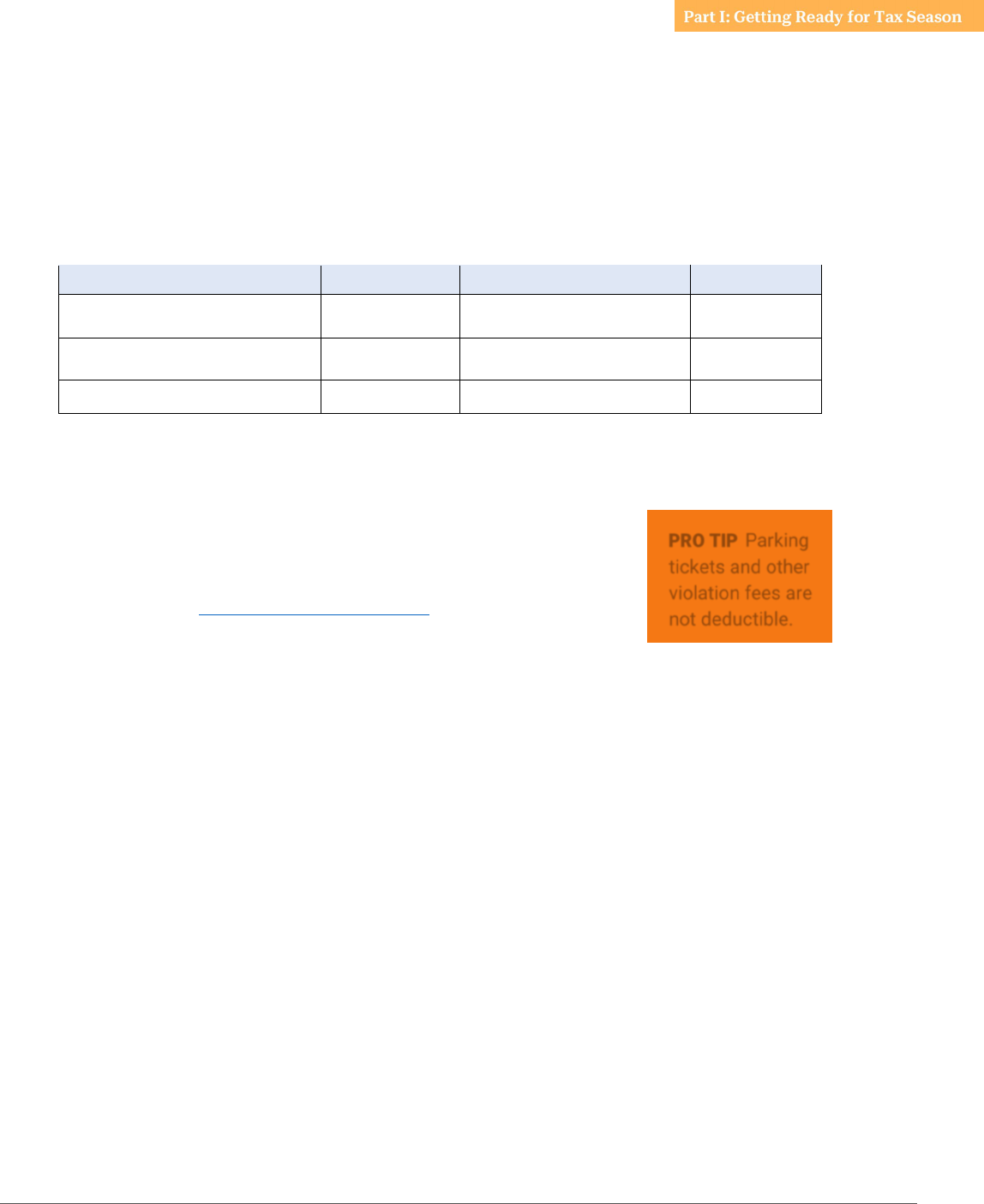

If you use the Standard Rate, you take the total miles you drove in the year and multiply it by the

IRS rate. In 2022, there are two rates. From January 1, 2022 to June 30, 2022, the rate is 58.5

cents per mile. Due to increased gas prices, the rate increased. From July 1, 2022 to December

31, 2022, the rate is 62.5 cents a mile.

For example, if you logged 150 business miles from January 1 to June 30, 2022 and 340

business miles from July 1 to December 31, 2022, your deduction would be:

Time

Miles

Rate

Deduction

January 1 to June 30, 2022

150

58.5 cents a mile

$87.75

July 1 to December 31, 2022

340

62.5 cents a mile

$212.50

TOTAL DEDUCTION

$300.25

Keep in mind, when you use the standard mileage rate, you can still deduct parking fees and

tolls accumulated as you are working.

If you use your car a lot for your work, you may want to use the

Actual Expense method. It requires more record keeping but could

result in a larger deduction. With the actual expense method, you will

collect receipts or other proof of payments for all expenses related

to your car. The Vehicle Expense Worksheet included below can

help you collect the total amount of your actual vehicle expenses.

If you have a dedicated work vehicle, all expenses will be business expenses.

If you use your vehicle for work and personal expenses, you will need to multiply the total of

your actual expenses by the percentage of miles driven for work. To determine this, you take

your mileage log and divide the miles driven for work by the total miles driven in the year. You

then multiply your total expenses by this percentage.

Here’s an example: A home-based child care provider logged 3,000 miles for business-related

purposes. Overall, she drove her car for work and personal reasons for 10,000 miles over the

year. She had $6,000 in actual car expenses. First, the provider will divide their miles driven for

work, 3,000, by the total miles driven, 10,000, to come up with 0.30 or 30%. She will then multiply

her total vehicle expenses of $6,000 by 30% to determine her business use of vehicle deduction,

which would be $1,800.

PRO TIP Parking

tickets and other

violation fees are

not deductible.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 18

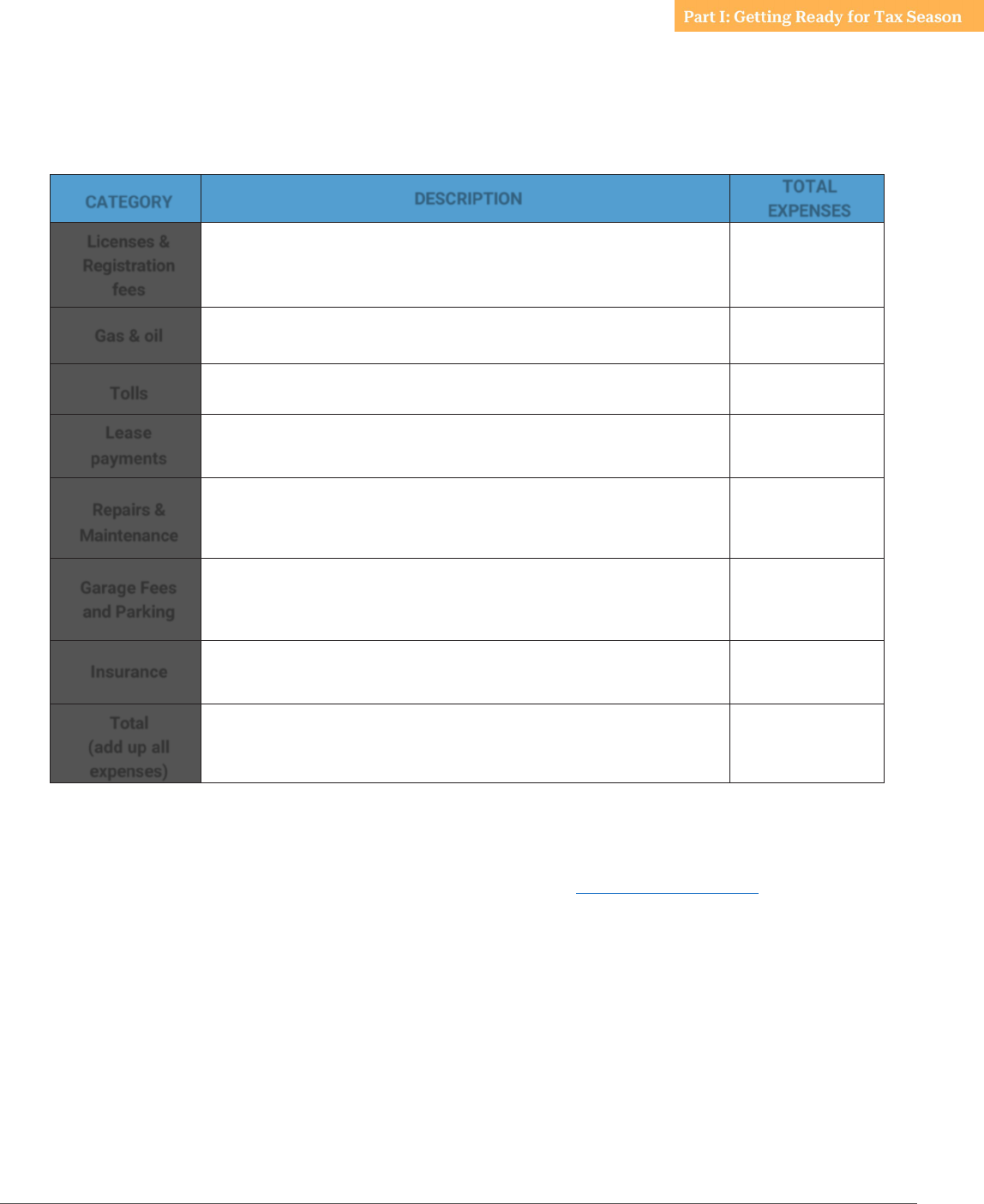

Here is a worksheet that you can use to log your actual vehicle expenses, which will help you

complete this portion of your Schedule C.

Vehicle Expense Worksheet

CATEGORY

DESCRIPTION

TOTAL

EXPENSES

Licenses &

Registration

fees

The cost of getting and renewing a license, inspections, and

registration costs.

Gas & oil

The costs of gas or diesel fuel, as well as oil and oil changes for

the car. This can also include charging costs for electric vehicles.

Tolls

Payments for accessing toll roads, highways, and bridges.

Lease

payments

Payments for a leased vehicle used for work.

Repairs &

Maintenance

For the vehicle including preventative “checkups.”

Garage Fees

and Parking

To keep the vehicle on a regular basis (like an off-street parking

garage in a city) or temporarily (such as airport parking while you

wait to pick up a ride).

Insurance

For the vehicle even if not required by your state.

Total

(add up all

expenses)

Deprecation of Your Vehicle

Another consideration if you are using the Actual Expense method is depreciation. If you use a

vehicle for your work 50% or more of the time, you may want to also deduct part of the overall

wear and tear on the car. You can learn more about this in the What is Depreciation? resource.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 19

How do I Include the Cost of My Home?

As a home-based child care provider, if you are licensed and regularly use your home for your

business, you can deduct the cost of your home and other related expenses

.

To prepare for claiming these deductions on your return, whether you rent or own your home,

there are two steps you need to take: 1) determining the space and time used for care and 2)

determining the allowable expenses related to providing care in your home

.

Let’s go through each one and know there is a table to record your answer below:

Step 1: Calculating the space and time use of your home

There are two elements that determine how much of your home expenses can be deducted:

(1) the space regularly used for care and (2) the amount of time it is used on average.

Calculating space and time for the percentage of your home expenses that are deductible is

done by multiplying the percentage of space used in your home by the time it is used.

We are going to go through the calculation here, but there is also a spreadsheet you can use to

make it even easier.

Space

Typically, space is measured in the square feet of your home that is used for care and the total

square footage of your home. Exclusive use is space that is only used for child care and has no

personal use. Regular use space includes areas that may be used all day for care (such as a

play area) but also ones that are regularly used for only part of the day. To give an idea of an

area that is only used part of the day, the IRS guide to auditing child care providers uses the

example of a provider with three children who each nap in different rooms at quiet time (so they

can rest better).

Though the other rooms are just used at nap time, it is a regular use and can be included in your

calculation. As a rule of thumb “regular use” means you use the space two or more times per

week.

You then take the space used in your home for care and divide it by the total square footage of

your home to get a percentage:

Space used for care ÷ total square footage of your home x 100 = percentage of

your home that you use for child care

For example: a provider uses 500 square feet of her 1,100 square foot home

regularly for care. If she divides 500 by 1,100, she gets .454. By multiplying 0.454

by 100, she calculates that 45.4% of her home is used regularly for care.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 20

Time

Time is the total number of hours you used your facility on average. This includes not only the

time that you are caring for children, but also the time you used the space for cleaning, cooking,

and preparing for the care of children. You can also include the time when your business was

closed but you were preparing to open.

DESCRIPTION EXAMPLE YOUR HOME

Square feet exclusively used for care.

Exclusive use areas are only used for childcare business purposes

and no personal purposes whatsoever. If no exclusive use, enter 0.

0

Square feet regularly used for care

Regular use areas are shared for both personal and child care

business purposes.

500

Total square feet of your home.

Include square footage of your basement, garage, porch, and deck in

addition to the interior of your home. Do not count patios or yard

space, even outdoor play areas.

1

,

1

00

Exclusively used space percentage.

Divide spaced used exclusively by the total square feet in your home

for a percentage.

0%

Regularly used space percentage.

Divide spaced used regularly by the total square feet in your home for

a percentage.

45.4%

Total time, in hours, spent a year for care.

This can include activities such as bookkeeping and paying bills,

planning lessons/activities, purchasing supplies online,

communicating with families, any online trainings, and cleaning.

Keep track of these other non-direct childcare tasks for your

records. The best way to figure out your total time is to multiply the

average number of hours you work each week and multiply it by the

number of weeks you provide care during the year. Exclude any

days you were closed and did not perform any business activities.

2,890

Total hours in a year.

8,760

8,760

Divide the time spent for care by the total number of hours in a year

to create a percentage.

32.9%

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 21

For example, let’s say your business is open and providing care for children 10 hours a day.

During the hours that you are closed, you clean and set up for two hours a day. Combined, this

would give you 12 hours a day that you were using your facility. Then, let’s say you were closed

for four weeks but did 10 hours of work in this time to maintain the space and prepare for re-

opening. Your total hours would be:

Calculation

To calculate how much of your home expenses you can deduct, multiply the Space of your

home you use for your business by the Time you use your home for the business. Then multiply

the result by the costs of your home.

In our examples above, the provider is using 45.4% of her home (Space) for care that is provided

32.9% (Time) of the year. If she multiplies 45.4% times 32.9% she gets 14.9% (0.454 x 0.329 =

0.149). So, she can deduct 14.9% of her home expenses.

We also have a spreadsheet that can make these calculations easier.

Multiply your regularly used space percentage by the time

percentage.

If you have no exclusively used space, this is your Time-Space

Percentage. You’ll use this percentage to deduct your business use of

home expenses for your in-home child care services.

45.4% *

32.9% =

14.9%

If you have exclusively used spaces: Add to your regularly used

Time-Space Percentage to your exclusively used space percentage.

If you don’t have exclusively used spaces, skip this step.

It will be: Space percentage (%) of exclusive use area + (regular use

space percentage (%) * time percentage (%)).

This will weigh your exclusively use areas higher in your Time-Space

Percentage. This is your Time-Space Percentage. You’ll use this

percentage to deduct your business use of home expenses for your

in-home child care services.

N/A in

example

12 hours a day x 5 days a week x 48 weeks +10 hours when you were closed = 2,890

hours

You can create a percentage of the business use of your home by dividing your total

hours used for care by 8,760 (the total hours in a year).

For example, our provider above uses her home for care 2,890 hours a year. When you

divide 2,890 by 8,760 you find that her home is used for business 0.329 or 32.9% of

the time.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 22

Step 2: Collecting allowable expenses for your home

The full amount of expenses that are for your home and directly related to

your business can go under your expenses under the applicable Schedule C

line (as we mentioned under the section on expenses).

Now you want to focus on collecting indirect expenses related to your

home, such as electricity usage, which is partially for your business, but

also partially for your own use.

The table below includes many of the indirect home-based business expenses you can collect

by looking at your receipts, bank accounts, credit care bills, checks, invoices, and app pay

services (like Zelle and Venmo).

PRO TIP Make sure

you have records of

indirect expenses

for your home, just

like your other

expenses.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 23

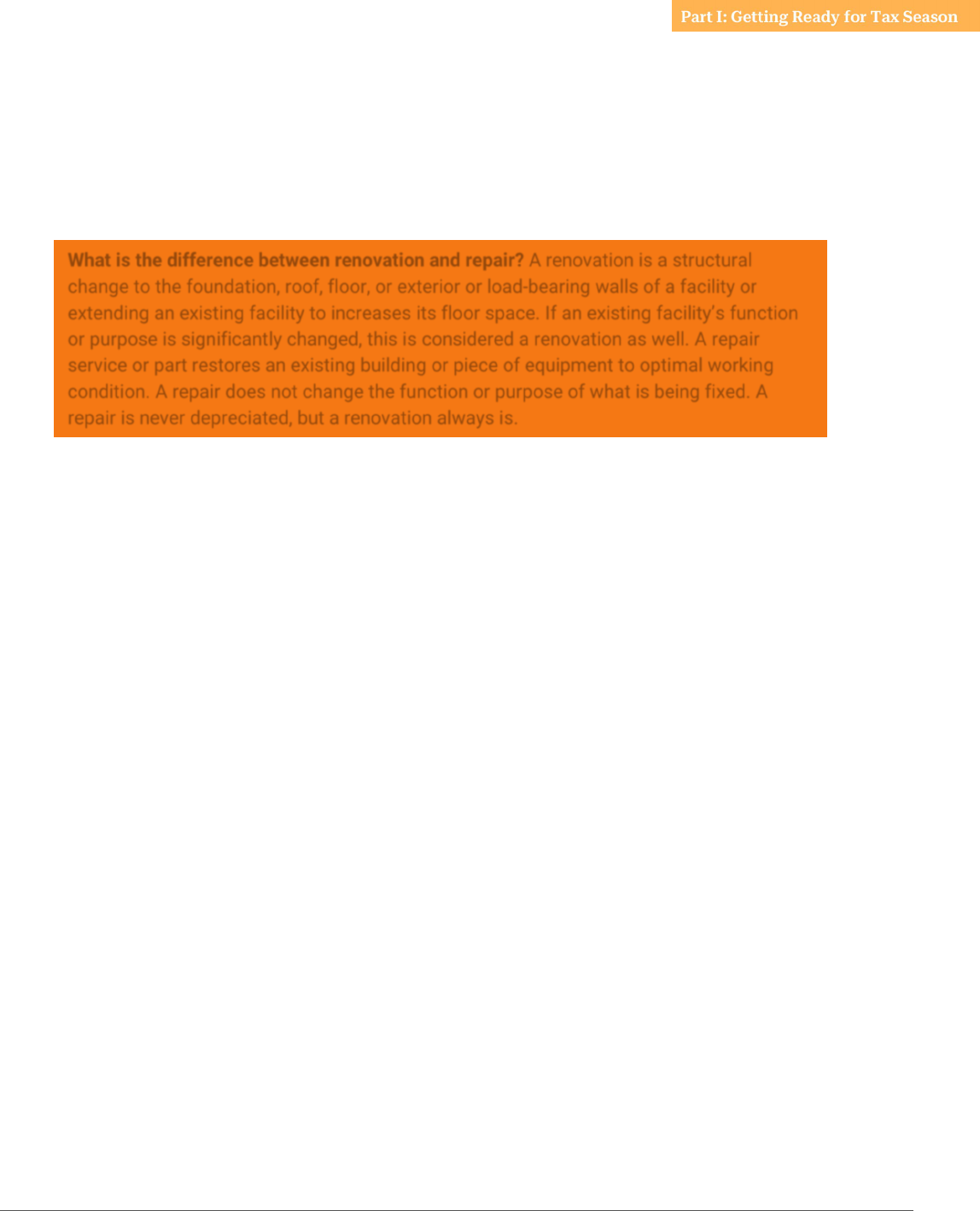

Indirect Home-Based Business Expenses (subject to time-space percentage)

Click the link to access the digital version of this worksheet you can download and use.

INDIRECT EXPENSE

NOTES TOTAL AMOUNT

DEDUCTIBLE

AMOUNT

(TOTAL AMOUNT X

BUSINESS USE %)

Rent

The full amount you paid

over the year.

Mortgage Interest &

Mortgage Insurance

Payments

Not mortgage principal

Real Estate Property Taxes

Electricity

Gas

Oil

Water

Home Phone, Internet, &

Cable

Common Area Repairs

Such as repairing the front

steps of your home if they

are used by clients when

they stop by to meet with

you.

Cleaning & Lawn Care

Services

Homeowner’s or Renter’s

Insurance

Other

Total

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 24

How do I handle stimulus program funds?

Many home-based child care providers benefited from federal and state stimulus programs in

2022. The funding programs do have different tax implications, so it is helpful to review some of

the most common ones.

Stabilization Grants

Many state and local governments used stimulus funding to provide one-time grants to

providers, often referred to as “stabilization grants” for personal protective equipment or other

needs. Typically, you will receive a Form 1099-NEC displaying the income received. Even if you

do not receive a Form 1099-NEC, this revenue should be noted as income for your business

(and will be treated as any other source of income). Many business purchases that you made

with grant funds will be subject to usual tax deduction guidelines.

Each state administers its own stabilization grant on its own terms and timeline. To find

Stabilization Grant Applications for your State or Territory, visit the Child Care Technical

Assistance Network.

Additional Subsidy Funding

Many home-based childcare providers received additional subsidy funds (for example, based on

pre-COVID enrollment or at a higher rate). This helped to make up for gaps in revenue due to

drastic decreases in enrollment. These funds need to be recorded as revenue for your business

and are likely already included in a 1099-NEC you received from the Child Care Resource and

Referral agency or other entity that paid you.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 25

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 26

Great! I am ready to file my taxes. How do I get started?

Decide if you want to file your own taxes for free or if you need a paid tax preparer.

Part II: Filing Your Return Online will help you use MyFreeTaxes to prepare your return for free

using online software. This is a great option for people who want

to avoid paying tax preparation costs or surprise fees. Head to

MyFreeTaxes.com to get started.

However, if your tax situation is especially complicated and you

choose to use professional tax preparation services, it is

important to find a service that is right for you. Here are some

things to consider if you make the choice to pay for tax

preparation service

.

Make sure your tax preparation service is qualified.

All tax preparers should have an IRS Preparer Tax Identification

Number (PTIN). Paid tax preparers are required to register with

the IRS so be sure to ask for this in advance as they are not

allowed to prepare your tax return without one. You can use this

IRS directory to verify a preparer’s PTINs and credentials.

Ask if your tax preparer has any professional credentials. Enrolled

agents (licensed by the IRS), certified public accountants, or

attorneys all work as tax preparers. Other qualified preparers may

be participants in the Annual Filing Season Program,

bookkeepers, or certified financial planners.

You can search for qualified tax preparers in your area on the IRS

Directory of Federal Tax Return Preparers.

Look at your tax preparation service’s history and experience.

Experience counts when looking for a qualified tax preparation service. In addition to checking

for length of previous experience, make sure your tax preparation service has knowledge that is

relevant to your specific circumstances. Ask if your tax preparer is part of any professional

organizations or takes any continuing education classes to keep up to date. Make sure your tax

preparer knows your state and local tax requirements in addition to federal return requirements.

Evaluate your tax preparation service’s costs.

It is important to properly evaluate the cost of your paid tax preparation options, as many paid

tax preparation services may cost more than you realize. Here is some information that can

help you ensure you don’t pay more than you intend.

Approximately how much might it cost to use paid tax preparation options?

• If you have a typical home-based child care business and choose to use paid online

software to file your return, you may pay $60-$250 depending on the features you

choose (e.g., audit protection).

PRO TIP Around half of

all individual tax returns

are filed without the use

of a professional tax

preparer. If you’re

comfortable using email

and online banking

services, we think there

is a good chance you can

comfortably prepare your

own return for free using

MyFreeTaxes. Head to

MyFreeTaxes.com to get

started and consult the

MyFreeTaxes Self-

Employed Tax Guide for

in-depth help completing

your return using free

online software.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 27

• If you have a typical home-based child care business and choose to hire a paid tax

preparer to file your return for you, you may pay on average $400 for the Form 1040 and

Schedule C. This amount increases if you add itemized deductions and any other forms,

such as quarterly estimated tax forms.

Remember, the entry cost is just the cost to file your forms, and the price may be higher if you

elect to add on additional services and features.

Do not leave your original tax documents with the tax preparer.

Have the preparer scan or photocopy your documents if they need to work on your return while

you are not there. You want to avoid leaving your important original tax documents with a

preparer as you may have trouble getting them back. You may need your original documents

later if you need to amend or resubmit your return or if you get audited.

Get a copy of your completed return as soon as it has been submitted.

You should keep a copy of your completed return for your own records. You may need a copy of

your tax return to prove your income when applying for a loan or other financial product, and the

easiest time to obtain a copy of your return is immediately after your preparer completes it.

Other questions to ask:

• Is my tax preparer available after tax season?

• Do they have a clear, upfront fee schedule?

• Do they know how to deal with an audit?

• Exactly how much time do they require to prepare and deliver a tax return?

• How do you get a copy of your tax return?

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 28

Once my taxes are completed, what should I do next?

First, make sure that you get written confirmation that your state

and federal taxes were submitted, either from your online tax

software or from your tax preparer if you used one.

Also, make sure you have your own hard copy of your filed tax

return and all documents included in your filing. It’s good to have

a copy for your records and, you never know when you might

need a copy quickly.

While several of the online tax programs allow you to login at any

time and print or download a copy of your return, tax preparers

may or may not be easy to reach outside of tax season. In

addition to the hard copy of all the documents in your tax return,

it is recommended to have electronic copies as well. Digital

copies could be made by scanning hard copies and converting

them to PDF files, or taking photos of the documents with your phone, and saving the files on a

secure device.

Finally, make sure all the original documents submitted to your tax preparer are returned to you.

Keep all receipts, proof of payments, 1099s, and all other tax-related documentation for at least

four years.

How can my business benefit from filing my taxes?

Taxes are often associated with confusing and overwhelming

forms, anxiety about future audits, and fears of a large tax bill. But

tax season can also be an opportunity for small business owners

to save money, prevent future issues, and provide the

documentation you need to grow your business, like a business

loan.

When you are self-employed, you do not have paystubs to show a bank when you are seeking a

loan. Giving them your bank records will also not be sufficient. What most lenders look for are

financial statements to show your business’s income and your tax returns to show your

personal income history. Often, lenders will use Line 31 (Net Income) on your tax return to prove

your income for a mortgage or business loan.

What business resources can I access for more training on taxes and other business

topics?

America’s SBDC represents America’s nationwide network of Small Business Development

Centers (SBDCs) – the most comprehensive small business assistance network in the United

States and its territories. Sponsored by the US Small Business Administration (SBA), they

provide management assistance to small business owners in the form of one-on-one

counseling, training seminars, assistance with SBA loans, and technical assistance.

PRO TIP You can use

the IRS Get Transcript

Tool to access your tax

records online. Here,

you can see your prior

year adjusted gross

income (AGI) and get

all transcript types such

as a Tax Return

Transcript and a Wage

& Income Transcript.

PRO TIP You can use

Google Drive to store

your tax return and

related documents

digitally!

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 29

Small business owners and aspiring entrepreneurs can go to their local SBDCs for FREE face-to-

face business consulting and at-cost training on a variety of topics. There are nearly 1,000 local

centers available to provide no-cost business consulting and low-cost training to new and

existing businesses. SBDCs help local businesses start, grow, and thrive.

You may also call 211 to get connected to additional resources and services that can help you,

your family, and your business.

Year-Round Tax and General Business Resources

Now that you’ve filed your tax return this year, consider changes you might make to help the

process go even smoother next year! The following pages include additional resources that may

help you learn more about certain tax topics and business practices that can improve your

business operations and your tax filing experience.

Resource 1: Mileage Log

Resource 2: Confidence in Quality Tax Prep Rubric

©

for Child Care Providers

Resource 3: Payroll Taxes (for businesses with employees)

Resource 4: Quarterly Estimated Tax Payments (for self-employed individuals)

Resource 5: What to look for in a business bank account?

Resource 6: How can I create a simple financial system for my business?

Resource 7: What is depreciation?

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 30

Resource 1: Mileage Log

Click to access the digital version of this worksheet.

DATE

DISTANCE

LOCATION

PURPOSE

e.g. 11/2/2022

e.g. 5.5

miles

e.g Burbank Wal-Mart

e.g. Picking up supplies

TOTAL DISTANCE

(ADD UP ALL YOUR ENTRIES)

MULTIPLY BY THE IRS PER MILE RATE TOTAL EXPENSE AMOUNT

0

.

585

(1/1 through 6/30/2022)

0.625

(7/1 through 12/31/2022)

The IRS standard mileage rates for 2022 are available here:

https://www.irs.gov/newsroom/irs-increases-mileage-rate-for-remainder-of-2022

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 31

Resource 2: Confidence in Quality Tax Prep Rubric© for Child Care Providers

Luminary Evaluation Group created the Confidence in Quality Tax Prep Rubric

©

for Child Care

Providers so that a provider or partner can evaluate if their federal tax returns are consistent

with best practices for their program type. This rubric was informed by an analysis of a set of

child care provider tax returns. It can be used widely, especially by organizations who offer

business technical assistance to childcare providers, to ensure they are applying these

practices. Providers can also use this rubric with their paid preparer to guide tax preparation or

feel empowered to submit their own returns and save several hundred dollars on fees

.

The

rubric can also be used to retroactively review past submitted tax returns.

Through this opportunity for the assessment of past taxes, providers can search for errors and

amend returns for up to three years, receiving back money they overpaid in already submitted

returns. This rubric has been created under a Creative Commons CC BY-NC license allowing use

and adaption with attribution and for non-commercial purposes

.

There are several different terms that are associated with the tax return process

.

To help make

this process more understandable, we have created a glossary which includes some of those

that are most common

.

Disclaimer: The information in this rubric does not constitute tax advice. Individuals should always

seek professional advice or actual guidance from the Internal Revenue Service (IRS) if they have

any questions regarding their tax returns.

GLOSSARY

Money coming into your business

Revenue/Income is the total income your business makes by selling goods or delivering a

service. This will be reflected on Line 7.

Net Profit, also known as Taxable Income, is how much money is left after all your business

costs are deducted from your revenue. This will be reflected on Line 31 as a positive dollar

amount. Profit = revenue minus expenses

.

Money going out/costs to conduct your business

A loss is when your costs to conduct business exceeds the income that you had come in. This

is the opposite of profit, reflected on Line 31 as a negative dollar amount

.

Expenses refer to any amount of money that you spend on anything within your business. The

IRS categorizes allowable expenses on lines 8 through 27a.

Depreciation is a way to allocate the costs of a fixed asset over the period in which the asset is

useable to the business. You record the full transaction when the asset is bought, but the value

of the asset is gradually reduced by subtracting a portion of that value as a depreciation

expense each year. Noteworthy things that depreciate are vehicles, homes or other buildings,

furniture, and equipment. Businesses will enter their depreciation expenses on Line 13.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 32

Money you owe as a result of doing business

Tax liability for sole proprietors is the amount of tax they are required to pay

.

In their case,

92.35% of their net profit is first subject to a self-employment tax of 15.3%. Then, the remaining

profit is taxed as income, at their individual tax rate. As you see, the lower your profit, the lower

your tax liability will be.

Money the government owes your business

Deductions can help reduce your tax liability.

You can deduct certain expenses which will

subtract the cost of the expenses from your taxable income

.

Allowable expenses are already

categorized on Lines 8 through 26. However you may have other expenses that do not fit into

those categories. Those other expenses should go on Line 27a. The result of using deductions

is to lower your tax liability (the amount of taxes you owe).

A Refund is owed to you if you paid the IRS more than you owed during the prior year. For

example, if your quarterly estimated tax payments paid during the year add up to more than you

owe when you file your tax return, then the IRS will owe you a refund The difference will come

back to you in the form of cash paid via direct deposit or check.

An inspection of your tax records

If the IRS issues an audit, they are investigating whether the financial information reported on

your taxes accurately reflects your financial records and is reported according to tax laws.

Some tax filing mistakes increase the likelihood that the IRS will select your return for review. If

your return is selected for review (audited), you will be asked to provide documentation

supporting the information you recorded on your tax return.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 33

Confidence in Quality Tax Prep Rubric

©

A 2022 Form 1040 Schedule C Tax Form Rubric

LINE ENTRIES

COMMONLY

USED FOR

SMALL

BUSINESSES?

NOTES

Gross receipts (Line 1) Required

Enter all revenue earned for the year and should include all

parent fees paid, subsidy revenue, and food program

payments you received.

Cost of goods sold

(Line 4)

No

Use of this Line could trigger an audit alert since it would be

extremely uncommon (if ever used) in childcare.

Gross profit (Line 5)

Required

This will usually be equal to Line 1.

Advertising (Line 8)

Yes

Enter all expenses for ads, flyers, business cards, and

promotional materials.

Car and truck

expenses (Line 9)

Yes, use

caution

Providers can deduct the actual expenses of operating their

car for business (gas, oil, repairs, insurance, license plates,

tolls, parking, etc.) by calculating the percentage of time that

the vehicle is used for business.

Alternatively, they can perform the Standard Mileage rate

calculation: multiply the number of business miles driven by

58.5 cents for 1/1-6/30 and 62.5 cents for 7/1-12/31 then add

to this amount your business portion of car loan interest and

parking fees and tolls. You must be able to document how you

came to the total entered.

Commissions and fees

(Line 10)

No

Providers using this expense are encouraged to seek

professional advice.

Contract labor

(Line 11)

Yes, use

caution

Enter all payments made to 1099 contractors. Providers should

be mindful not to misclassify employees as contractors. For

more information on classifying workers, see When Is Someone

a Contractor or Employee?

Depletion (Line 12)

No

Providers using this expense are encouraged to seek

professional advice.

Depreciation (Line 13)

Yes, use

caution

Depreciation must be applied only for business use of certain

property. Providers using this expense are encouraged to

consider seeking professional advice. Review What is

Depreciation? to learn more about Depreciation.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 34

Employee benefit

programs (Line 14)

Yes, use

caution

If you offer employee benefits, enter amounts paid for

employee benefits (i.e., health plans, supplemental insurance,

life insurance).

This is not a typical expense for home-based providers.

Providers using this expense are encouraged to seek

professional advice.

Insurance (other than

health) (Line 15)

Yes

Enter amounts paid for liability insurance and any other

business-related insurance.

Mortgage Interest

(Line 16a)

Yes

Enter amounts paid in mortgage interest on an owned

business property. For home- based providers this is likely a

part of their time/space calculation already.

Other interest

(Line 16b)

No

This refers to other interest such as credit card interest.

Providers using this expense are encouraged to seek

professional advice.

Legal and professional

services (Line 17)

Yes

Enter amounts paid for legal and other services such as

accounting, consulting, tax prep, etc.

Office expense

(Line 18)

Yes

Enter amounts paid for office supplies and postage.

Pension and profit

sharing

(Line 19)

No

This must be a company sponsored program (i.e., not the

providers’ personal or spouse’s retirement plan).

Providers using this expense are encouraged to seek

professional advice.

Vehicle Rent or lease

(Line 20a)

Yes

Enter the business portion of your vehicle rental or lease cost.

For a company car, this would be 100% of costs.

For use of personal vehicle for business-related purposes,

enter business related costs only.

Other business

property rent or lease

(Line 20b)

Yes

Enter the amounts paid for renting business property.

For home-based providers, this is likely included in their

time/space calculation already.

Repairs and

maintenance

(Line 21)

Yes

Enter amounts for repairs and maintenance made in the child

care facility.

Home-based providers should include repairs made to spaces

used for child care. If the repair is of a common area, that

would be captured in the time/space calculation.

Supplies (Line 22) Yes

Enter the amounts for materials and supplies (i.e. –

classroom supplies, learning materials, toys, diapers and

wipes, cleaning supplies, etc.)

Taxes and Licenses

(Line 23)

Yes

Enter the amounts for license fees.

MyFreeTaxes Self-Employed Tax Guide: For Home-Based Child Care Businesses | © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved. 35

Travel (Line 24a) Yes

Enter amounts for lodging and transportation associated with

business travel (i.e., conference attendance).

Deductible meals

(Line 24b)

Yes, use

caution

Enter the amounts for your meals while on business travel or

business-related meetings.

Note that this Line should not be used to claim food expenses

for children’s meals. Those expenses can go on Line 27a,

Other expenses.

Utilities (Line 25) Yes

Enter amounts paid for utilities for the child care facility.

For home-based providers, this is likely included in their

time/space calculation already.

Wages (Line 26)

Yes, use

caution

Enter the total salaries and wages for the year for W-2

employees and yourself (if you pay yourself through payroll).

For more information on paying yourself, see Paying Yourself:

A Guide for Sole Proprietors

.

Other expenses

(Line 27a)

Yes

Enter amounts for all other expenses that do not fall into the

above categories (i.e., professional development expenses,

membership fees, special events for the children, children’s

food expenses, etc.).

# of expenses claimed

This number should never be zero. There will always be

expenses to claim for your small business.

Total expenses (Line

28)

This is the sum of all claimed Schedule C expenses.

Business Use of Home

(Line 30)

Home-based providers operating from their primary residence

should always claim the business use of home deduction.

This applies to expenses that have a shared personal and

business use. If a provider has an expense that is 100%

business use, that expense should be fully claimed on the

applicable expense line.

Business use of home does not typically apply to center-

based programs.

Time/space

percentage (%)

To calculate time/space, view this worksheet.

Time/Space ($)

(Line 30)

Amount calculated from worksheet.

Net profit or loss

(Line 31)

This is your revenue minus expenses.

MyFreeTaxes Self-Employed Tax Guide: For Family Child Care Providers

| © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved.

36

Resource 3: Payroll Taxes (for businesses with employees)

Learn how to understand your payroll tax obligations as an employer.

What are Payroll Taxes?

Payroll taxes are taxes that employees and employers must pay on wages, salaries, and tips.

The employee pays their portion of these taxes through a payroll deduction and the employer

pays the rest directly to the IRS. Typically, the employer will report payroll taxes using Form 941,

Employer’s Quarterly Federal Tax Return.

There are different types of payroll taxes:

1. Federal income tax

2. Social Security and Medicare (also known as FICA)

3. Federal Unemployment (also known as FUTA)

How much are Payroll Taxes and when are they due?

Some payroll taxes are a fixed percentage of wages, and some are dependent on the

employee’s tax bracket. There are also various due dates for these taxes. Here is a helpful chart

that describes the tax, the amount, who is responsible for paying it, and when it’s due:

Tax Type

Amount

Due Date

Responsible Party

Federal income tax

Varies, based on

individual withholding

status.

Withheld from

each paycheck

issued; paid to the

IRS from employer

monthly if you

reported $50,000

or less in taxes

July 1 – June 30 of

the previous tax

year and semi-

weekly (twice a

week) if total taxes

reported were

more than $50,000.

Employee, but

employer must

withhold based on

W-4 received.

FICA

Social Security – 12.4%

Employer and

employee each pay

6.2%

Medicare – 2.9%

Employer and

employee each pay

1.45%

FUTA

6% on the first $7,000 in

wages paid per

employee, each year.

Quarterly

Employer

MyFreeTaxes Self-Employed Tax Guide: For Family Child Care Providers

| © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved.

37

What forms must be completed?

• Form W-4 – completed by employee to let the employer know how much payroll tax to

withhold. The amount withheld will be calculated based on their marital status, number

of dependents, and any additional withholding they may choose. This is completed once

an employee is hired, prior to their first paycheck and can be updated by the employee if

their tax situation changes.

• Form W-2- you must file Forms W-2 to report wages paid to employees. This must be

issued by January 31 to any employee with wages withheld during the previous tax year.

• Form 941 – used to report income taxes, Social Security tax, or Medicare tax withheld

from employee's paychecks and can be used to pay the employer's portion of Social

Security or Medicare tax. This is due quarterly by the last day of the month that follows

the end of the quarter:

Quarter

Months in the Quarter

Form 941 Due Date

1

January, February, March

April 30

2

April, May, June

July 31

3

July, August, September

October 31

4

October, November, December

January 31

• Form 940 – used to report any FUTA tax. The due date for filing the Form 940 is January

31.

What about part-time workers?

Part-time workers and workers hired for short periods of time are treated the same as full-time

employees for federal income tax withholding and social security, Medicare, and FUTA tax

purposes.

What about family employees?

One of the advantages of operating your own business is hiring family members. However,

employment tax requirements for family employees may vary from those that apply to other

employees. View the Family Help resource to learn about the tax requirements for family

employees.

For more information, review IRS Publication 15, Employer’s Tax Guide.

How to determine if someone is an employee or 1099 contractor?

Employees and contractors are treated very differently under federal and state law. Contractors

are considered independent business people. They pay their own employment taxes and the

employer usually has fewer legal obligations to the individual, such as providing paid time off.

Employees, on the other hand, come with greater costs, like employment taxes and benefits.

There are rules that determine if a person should be considered an employee or a contractor

and there can be harsh fines if you misclassify an employee as a contractor.

In determining if you have a contractor or employee, you should look at the three essential

elements of the definition of employment: service, wages, and direction and control.

MyFreeTaxes Self-Employed Tax Guide: For Family Child Care Providers

| © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved.

38

In determining if you have a contractor or employee you should look at the three essential

elements of the definition of employment: service, wages, and direction and control.

1. Service (Type of Relationship)– Does the person

work on a project-by-project basis (like a

contractor)? Does the person work for other

businesses or just for you?

2. Wages (Financial)— How is the person paid? For

example, is the person paid every week for a set

number of hours (which indicates an employee), or

does the work vary (like a contractor)? Do they have regular expenses that are

reimbursed (like an employee)?

3. Direction (Behavioral) — How much control do you have over their day-to-day work?

For example, do you set the requirements around their work hours, the equipment or

tools to be used, or the training needed? (If yes, then this person is likely an

employee.)

For more guidance, run through the IRS list of 20 factors that indicate if someone is a contractor

or an employee.

Disclaimer: The information contained here has been prepared by Civitas Strategies Early Start and is not intended to constitute legal, tax, or

financial advice. The Civitas Strategies Early Start team has used reasonable efforts in collecting, preparing, and providing this information,

but does not guarantee its accuracy, completeness, adequacy, or currency. The publication and distribution of this information is not

intended to create, and receipt does not constitute, an attorney-client or any other advisory relationship. Reproduction of this information is

expressly prohibited.

PRO TIP Don't use Forms

1099 to report wages and

other compensation you

paid to employees; report

these on Form W-2.

MyFreeTaxes Self-Employed Tax Guide: For Family Child Care Providers

| © 2022 United Way Worldwide and Civitas Strategies, LLC. All rights reserved.

39

Resource 4: Quarterly Estimated Tax Payments (For Self-Employed Individuals)

What are quarterly estimated taxes?

Quarterly estimated taxes are estimated self-

employment (SE) tax payments you may need to make

to the IRS four times a year. Self-employment taxes are

taxes that freelancers, independent contractors, and

other business owners pay towards Medicare and

Social Security. W-2 employees have these taxes taken