Sports and

camping

goods

EU MARKET SURVEY 2005

1

EU MARKET SURVEY 2005

SPORTS AND CAMPING GOODS

Compiled for CBI by:

Fair Trade Solutions

In collaboration with

Searce

April 2005

DISCLAIMER CBI MARKET INFORMATION TOOLS

Although the content of its market information tools has been compiled with the greatest

care, the Centre for the Promotion of Imports from developing countries (CBI) is not able

to guarantee that the information provided is accurate and/or exhaustive, and cannot be

held liable for claims pertaining to use of the information.

In the case of the market publications, neither CBI nor the authors of the publications

accept responsibility for the use which might be made of the information. Furthermore,

the information shall not be construed as legal advice. Original documents should,

therefore, always be consulted where appropriate. The information does not release the

reader from the responsibility of complying with any relevant legislation, regulations,

jurisdiction or changes/updates of same.

In the case of the Internet tools, CBI aims at minimising disruption caused by technical

errors. However, CBI cannot guarantee that its service will not be interrupted or

otherwise affected by technical problems. CBI accepts no responsibility with regard to

problems incurred as a result of using this site or any linked external sites.

The information provided is aimed at assisting the CBI target group, i.e. exporters and

business support organisations (BSOs) in developing countries. It may, therefore, not be

used for re-sale, the provision of consultancy services, redistribution or the building of

databases, on a commercial basis. For utilization of the CBI market information tools by

the CBI target group on a non-commercial basis, the condition applies that CBI is referred

to as the source of the information. All other use is prohibited, unless explicitly approved

in writing by CBI.

Photo courtesy: Searce

2

CONTENTS

REPORT SUMMARY 5

INTRODUCTION

9

PART A: EU MARKET INFORMATION AND ACCESS REQUIREMENTS 11

1 PRODUCT CHARACTERISTICS

12

1.1 Product groups

12

1.2 Customs/Statistical product classification

13

2 INTRODUCTION TO THE EU MARKET

14

3 CONSUMPTION

17

3.1 Market size

17

3.1.1 The EU Sports market

19

3.1.2 Germany

21

3.1.3 France

21

3.1.4 United Kingdom

22

3.1.5 Spain

23

3.1.6 Italy

23

3.1.7 The Netherlands

24

3.1.8 Sweden

24

3.1.9 The 10 new EU countries

25

3.2 Market segmentation

26

3.3 Consumption patterns and trends

36

4 PRODUCTION

38

4.1 EU Production of Sports Goods

38

4.2 Production in the selected countries

39

4.2.1 Germany

39

4.2.2 France

39

4.2.3 United Kingdom

40

4.2.4 Spain

41

4.2.5 Italy

41

4.2.6 The Netherlands

42

4.2.7 Sweden

42

4.2.8 The 10 new EU countries

42

5 IMPORTS

44

5.1 Total imports

44

5.1.1 Total imports by the EU

44

5.1.2 Germany

46

5.1.3 France

47

5.1.4 United Kingdom

48

5.1.5 Spain

49

5.1.6 Italy

50

5.1.7 The Netherlands

51

5.1.8 Sweden

51

5.1.9 The 10 new EU countries

52

5.2 Imports by product group

53

5.2.1 The 10 new EU countries

60

5.3 The role of developing countries

61

5.3.1 The 10 new EU countries

63

3

6 EXPORTS 64

6.1 Total exports by the EU

64

6.2 Exports by the selected countries

65

6.2.1 Germany

65

6.2.2 France

65

6.2.3 United Kingdom

65

6.2.4 Spain

65

6.2.5 Italy

65

6.2.6 The Netherlands

65

6.2.7 Sweden

66

6.2.8 The 10 new EU countries

66

7 TRADE STRUCTURE

67

7.1 EU trade channels

67

7.1.1 Trade channels in the selected countries

71

7.1.2 Germany

71

7.1.3 France

72

7.1.4 United Kingdom

72

7.1.5 Spain

73

7.1.6 Italy

73

7.1.7 The Netherlands

74

7.1.8 Sweden

74

7.1.9 The 10 new countries

75

7.2 Distribution channels for developing country exporters

75

8 PRICES

77

8.1 Price developments

77

8.2 Sources of price information

78

9 EU MARKET ACCESS REQUIREMENTS

79

9.1 Non tariff trade barriers

79

9.1.1 Product legislation

79

9.1.2 Market requirements

80

9.1.3 Occupational health and safety

82

9.1.4 Environmentally sound production

83

9.1.5 Packaging, marking and labelling

84

9.2 Tariffs and quotas

87

PART B: EXPORT MARKETING GUIDELINES: ANALYSIS AND STRATEGY 88

10 EXTERNAL ANALYSIS: MARKET AUDIT 90

10.1 Market developments and Opportunities

90

10.2 Competitive analysis

94

10.3 Sales channel assessment

96

10.4 Logistic requirements

99

10.5 Price structure

100

10.6 Product Profiles

102

11 INTERNAL ANALYSIS: COMPANY AUDIT

104

11.1 Product range and design

104

11.2 Product standards, quality and production capacity

107

11.3 Logistics

108

11.4 Marketing and sales

109

11.5 Financing

111

11.6 Capabilities

111

4

12 DECISION MAKING

112

12.1 SWOT Analysis

112

12.2 Strategic Options & Objectives

113

13 EXPORT MARKETING

114

13.1 Matching products and the product range

114

13.2 Building up a relationship with a suitable trading partner

116

13.3 Pricing and drawing up an offer

118

13.4 Handling the contract

120

13.5 Sales promotion and organisation

122

APPENDICES 125

1 DETAILED HS CODES

126

2 DETAILED IMPORT/EXPORT STATISTICS

128

3 USEFUL ADDRESSES

138

3.1 Standards organisations

138

3.2 Sources of price information

139

3.3 Trade associations

140

3.4 Trade fair organisers

142

3.5 Trade press

143

3.6 Other useful addresses

145

4 LIST OF DEVELOPING COUNTRIES

147

5 USEFUL INTERNET SITES

148

Update of EU Market Survey Sports and Camping Goods (December 2003).

5

REPORT SUMMARY

This survey profiles the EU market for sports and camping goods, which includes all

hardware articles (i.e. equipment and accessories) used for active sports, snow sports,

water sports, fishing, camping and outdoor activities. It emphasises those items which are

relevant to exporters from developing countries and highlights seven selected markets

within the EU.

In Part A, up-to-date market information is given on consumption, production, imports/

exports, trade structure, prices and the major EU market access requirements. As an

exporter, you need this basic information to draw up your Market Entry Strategy (MES) and

Export Marketing Plan (EMP) in order to penetrate the competitive EU market successfully.

To assist you here, CBI has developed Part B, where the Export Marketing Guidelines

provide relevance and a methodology for an external, internal and SWOT analysis. These

analyses are needed for your decision - whether to export or not. Furthermore, essential

guidelines are given on using your marketing tools effectively to build up this export

venture. The appendices at the end of the survey include contact details of trade

associations, trade press and other relevant organisations.

The survey excludes bicycles, motorbikes, cars, boats, caravans, sports bags, sports

clothing and sports footwear. The sports goods, covered in this survey are categorised

into the following product groups:

Product groups

Fitness/gym Rackets

Golf Sports gloves

Snowsports Table tennis

Skates Team/field sport

s

Balls Camping goods

Watersports Fishing tackle

Horse riding

Sports participation

The sports goods market in the selected EU countries (Germany, France, United Kingdom,

Italy, Spain, The Netherlands and Sweden), is closely related to sports participation. Total

participation in these countries averaged 62 percent in 2003, with France having the

largest rate of sports enthusiasts (66%) and southern countries having rates below 60

percent. Regular participation (i.e. at least once a week) averaged 41 percent, or 107

million adults in these countries, with many people being member of one of the 537,157 clubs.

The traditional forms of sport, such as swimming and football still have many participants

in most EU countries. Competitive sports such as badminton, squash and some teamsports

suffered from a shift to individual soft sports (e.g. fitness, jogging, golf) and recreational outdoor

activities (e.g. trekking, climbing). On the other hand, football remains popular and recently

some teamsports have regained the interest of young people of school age via media coverage.

Consumption

Total sports goods retail sales in the EU25 member countries was estimated at € 11,492

million in 2003, of which € 9,700 million (or 84%) was achieved in the seven selected

countries, led by Germany and France. The EU is the second largest market for sports and

camping goods in the world after the USA and is very fragmented due to the wide variety

of sports played. Camping goods and equipment for horse riding are not included in these

figures. In 2003, EU sales of camping goods (excluding rucksacks and seats for camping)

valued € 1,120 million, led by the UK and Germany. EU sales of horse riding equipment

are more difficult to measure, but are estimated to be worth over € 490 million.

Although, like many other major markets, growth levels have stalled or fallen back, rising

participation by women, older people and increasingly middle-aged people have helped

6

protect this market from more serious reversals. In 2004, the EU sports goods market

started to rise again after virtually no change between 2002 and 2003. In the

long run, the sports goods market will be more fragmented and will be stimulated by:

Concern about health and appearance, driving increasing participation levels.

New sporting activities e.g, board sports, extreme forms of snow and

watersports, Nordic walking

The ongoing increase in the number of retail outlets selling sports goods.

Production

In 2003, there were 3,200 production companies in the selected countries, the majority

of which produce specialised and high quality sports goods, each country having its own

speciality. Production in the EU25 valued around € 3.51 billion and is controlled by a large

number of small EU manufacturers, especially in Italy and Spain. Italy is major producer

of ski boots, in-line skates, skis and watersports equipment, while fitness, camping and

watersports equipment were sizeable categories in Spanish production. Fitness equipment

is the main category in Germany, skis in France, whilst in the United Kingdom golf is the

largest category.

According to the WFSGI (World Sports Federation), around 80 percent of most sports

goods is outsourced in Asia, led by China and Taiwan. With rising standards of living and

labour costs in Asia, EU suppliers are also looking for other developing countries, e.g.

North Africa with cheaper production costs. More co-operation between the selected

countries and Eastern Europe is expected, as many of these countries are themselves now

part of the EU.

Imports

The EU is one of the leading importers of sports goods in the world, and in 2003 accounted

for 909 thousand tonnes with a value of € 5,219 million. Total EU15 imports increased by

27 percent in volume and 7 percent in value. The 10 new EU countries accounted for a

further € 303 million of imports. The United Kingdom is the largest EU importer,

accounting for 19% of total EU volume imports: 172 thousand tonnes, with a value of

€ 964 million. The UK is followed by Germany (18% of EU imports) and France (16%).

Product groups

In 2003, fitness and team/field sports together accounted for 57 percent by volume (34%

by value) of the EU15 total. In terms of value, other sizeable product groups were

equipment for golf, snowsports, camping goods, fishing tackle, balls, watersports, skates

and horse riding equipment, most of which are of relevance to exporters from developing

countries. Between 2001 and 2003, equipment for team/field, balls, golf, fitness,

camping goods and fishing tackle grew more than other groups.

Main supplying countries

Intra-EU supplying countries: In 2003, 40 percent of EU imports by value came from

other EU countries with Germany representing 15 percent of intra-EU sports goods supplies

followed by France (15%) and Italy (14%).

Extra-EU supplying countries: The greater part, or 60 percent of EU imports, came

from non-EU sources, of which 27 percent came from China. In 2003, EU imports from

China were € 1,409 million, or 424 thousand tonnes. The huge investments in technical

and design expertise from EU manufacturers in China and improving communications

have stimulated this expansion. The international focus continues to be on China, who

are hosting the Olympic Games in 2008. The role of China in the supply of sports goods

will continue to grow. Taiwan (fitness), South Korea (fishing tackle), USA (golf and fitness),

Romania (skates) and other Eastern European countries are sizeable non-EU suppliers.

Developing countries

Next to China, suppliers from developing countries include Pakistan (balls and gloves),

Thailand (skates and watersports) and India (saddlery). Between 2001 and 2003, the

7

volume of imports from developing countries to the EU rose by 41 percent from 342 to

483 thousand tonnes, valued at € 1,833 million in 2003. The largest increases were in the

supplies (by volume) from China (+44%), Pakistan (+46%), India (+37%), Vietnam (+72%),

Philippines (+54%), Brazil (+100%), South Africa (+46%) and Turkey, while less was

imported from Indonesia and Morocco.

Trade channels

Large manufacturers have their own distribution networks and sometimes sell direct to

consumers by their concept stores or via factory outlets. The big brand manufacturers,

such as Nike and Adidas, use exclusive importers (and own stores) in each country, which

are engaged in sales and service. The actual distribution is controlled by their distribution

centres in Belgium, The Netherlands and Germany.

The majority of sports goods continue to be supplied from manufacturers through

importers/buying groups or through large retailers to consumers. In 2003, two-thirds of

total retail sales of sports goods in the selected countries was achieved by 26,000

specialist outlets, most of which were linked to one buying group. The two major groups,

Intersport (focus on 'expertise in sports') or Sport 2000 (focus on 'sports and lifestyle')

together represented over 30 percent in the EU. In the 1990s, many small family-owned

sports shops were forced to join, buying in large volumes in order to obtain similar

discounts to sports chains. Chain stores and specialist stores connected to a buying group

are prevalent in middle and northern EU countries, while smaller specialists’ shops are typical

in Italy and Spain. A further 10,000 outlets sell sports goods in the 10 new EU countries.

The share of chain stores (multiples, megastores or category killers), grew to an average

share of 24 percent of EU sports retail sales in 2003 and are expected to rise further. They

are dominant in France (Décathlon, Go Sport), UK (JJB, JD Sports, Blacks), Netherlands and

Sweden. The sports specialist retailers are particularly strong in Italy and The Netherlands

and were less significant in Germany and Spain, where department stores (Karstadt and El

Corte Inglés) were important sports goods retailers. Other non-specialists such as

hypermarkets (e.g. Carréfour, Metro) and discounters (e.g. Aldi) continue to expand their

ranges. In the UK, sales by mail order companies was 9 percent of UK sports retail sales.

Opportunities for exporters in developing countries

The sports equipment market is clearly a global market, and customers are prepared to

source the right items from anywhere in the world. Sometimes smaller suppliers are best

placed to meet specific requirements. The sustained demand for equipment for fitness

(weights, dumbbells, in-home trainers), horse riding, golf, new boarding and gliding activities

will offer opportunities for equipment and accessories. Here, most exporters concentrate

on the (OEM or ODM) production of outsourced equipment for EU manufacturers.

Alternatively, exporters could also consider supplying sports goods direct to EU importers.

In general, exporters must look for opportunities in areas in which they are strong, i.e.

labour intensive sports goods, which are not too complex to manufacture and where brands

still are of minor importance, such as:

Fitness Æ Simple in-home training equipment, small exercise equipment and martial

arts equipment.

Teamsports Æ Balls: footballs (normal - promotional or special balls e.g. for calcetto or

futsal), street basketballs, coloured beach volleyballs, rugby balls, waterpolo-

balls or medicine balls.

Æ Gloves, protective equipment (e.g. head or mouth guards, knee/ankle pads),

bats, sticks other team/field equipment (e.g. nets, goals, dome markers, disc

cones, starting blocks).

Golf Æ Balls (also for promotional purposes), bags, putting mats, exercise sets,

nets and golf carts.

Watersports Æ Swimming caps, headbands, spectacles, goggles, skimming boards, beach

mats, accessories, belts and wallets.

Camping Æ Tents, mattresses, lanterns, knives, compasses, money belts, picnic mats,

ropes.

Horse riding Æ Saddles, harnesses, whips, stirrups.

8

Other opportunities can be found in specific niche markets e.g. in the ethnic minority

population or in young people with a disability, who sometimes need special or modified

sports equipment. Women also often require equipment which differs from equipment

specifically designed for men.

Threats and difficulties for exporters:

Î The sports article should be well finished, made precisely according to importers'

specifications, and meet quality standards of the demanding EU market, where strict

safety standards are also required.

Î Production capacity, keen pricing and fast delivery are needed to establish reliable

relationships with importers or other buyers. Good communication (e-mail and

personal contact) and flexibility are vital.

Î The exporter must comply with International Codes of Conduct, meaning that the

use of child labour is not allowed. Potential buyers and auditors from the World

Federation of Sporting Goods Industry (WFSGI) may wish to inspect.

Further market research

This EU Market Survey serves as a basis for further market research: after you have

read the survey it is important to further research your target markets, sales channels

and potential customers in order to properly carry out your external analysis, and to

know how to keep control of your marketing tools.

Market research depends on secondary data (data that has already been compiled and

published) and primary data (information that you collect yourself). An example of

secondary data is this EU Market Survey. Primary data is needed when secondary data

is not sufficient for your needs as, for example, when you are researching which type of

consumer might be interested in your sports goods.

Sources of information include (statistical) databanks, newspapers and magazines,

market reports, (annual) reports from trade associations, along with shops in target

countries, products or catalogues from your competitors, and conversations with

suppliers, specialists, colleagues and even competitors. After you have collected your

information you should analyse it.

In order to assess the attractiveness of a market, you should use a Research Action

Plan and develop a classification or score system. Detailed information on market

research can be found in CBI’s manual ‘Your guide to Market Research’.

9

INTRODUCTION

This CBI survey consists of two parts: EU Market Information and Market Access

Requirements (Part A), and Export Marketing Guidelines (Part B).

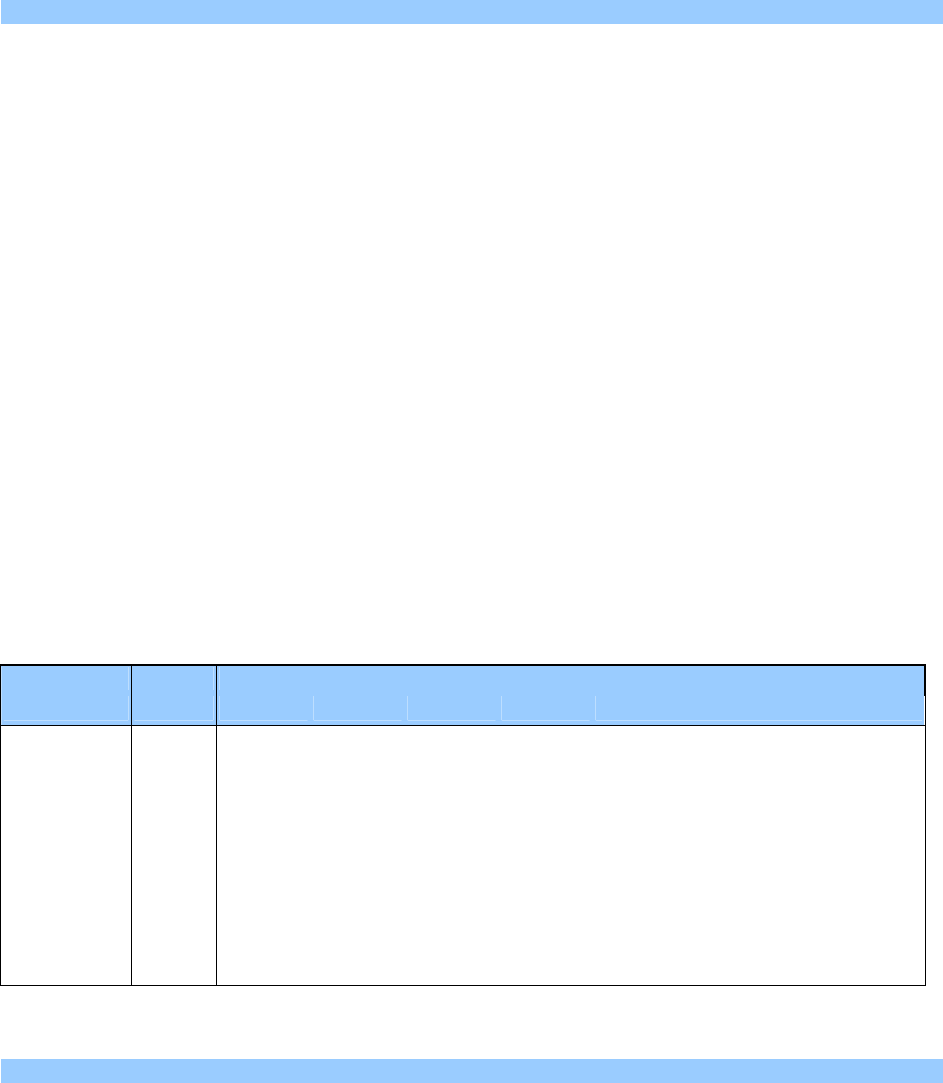

Market Survey

Part A

EU Market Information and Market Access Requirements

EU Market Information (Chapters 1-8)

Product characteristics

Introduction to the EU market

Consumption and production

Imports and exports

Trade structure

Prices

EU Market Access Requirements

(Chapter 9)

Quality and grading standards

Environmental, social and health & safety

issues

Packaging, marking and labelling

Tariffs and quotas

Part B

Export Marketing Guidelines: Analysis and Strategy

External Analysis (market audit)

(Chapter 10)

Opportunities & Threats

Internal Analysis (company audit)

(Chapter 11)

Strengths & Weaknesses

Decision Making

(Chapter 12)

SWOT and situation analysis:

Target markets and segments

Positioning and improving competitiveness

Suitable trade channels and business partners

Critical conditions and success factors (others than mentioned)

Strategic options & objectives

Export Marketing

(Chapter 13)

Matching products and product range

Building up a trade relationship

Drawing up an offer

Handling the contract

Sales promotion

Chapters 1 to 8 of Part A profile the EU market for Sports and Camping Goods. The

emphasis of the survey lies on those products which are of importance to exporters from

developing countries. The major national markets within the EU for those products are

10

highlighted. Furthermore, statistical market information on consumption, production and

trade, and information on trade structure and opportunities for exporters is provided.

Chapter 9 subsequently describes the requirements which have to be fulfilled in order to

gain access to this market. It is furthermore of vital importance that exporters comply with

the requirements of the EU market in terms of product quality, packaging, labelling and

social, health & safety and environmental standards.

After having read Part A, it is important for an exporter to analyse target markets, sales

channels and potential customers in order to formulate export marketing and product

strategies. Part B therefore aims to assist (potential) exporters from developing countries

in their export decision- making process.

After having assessed the external (Chapter 10) and internal environment (Chapter 11),

the (potential) exporter should be able to determine whether interesting export markets

exist for his company. In fact, by matching external opportunities and internal capabilities,

the exporter should be able to identify suitable target countries, market segments and

target product(s) within these countries, and possible trade channels to export the

selected products (Chapter 12).

Chapter 13 subsequently describes the marketing tools which can be of assistance in

successfully achieving the identified export objectives.

The survey is interesting for both new exporters as well as exporters already engaged in

exporting (to the EU market). Part B is especially interesting for more experienced

organisations exporting to the EU for the first time and exporters looking for new EU

markets, sales channels or customers.

New exporters are advised to read this publication together with the CBI’s Export

Planner, a guide that shows systematically how to set up export activities and the

interactive tool on the CBI website “Export Marketing Plan”.

11

PART A

EU MARKET INFORMATION AND

EU MARKET ACCESS REQUIREMENTS

12

1 PRODUCT CHARACTERISTICS

1.1 Product groups

The products covered in this survey are hardware articles used for active sports (individual

and team sports), snow sports, water sports, fishing, horse riding, camping and outdoor

activities (e.g. trekking, climbing). Larger items of equipment usually bought by

institutions (e.g. sports schools), such as fitness equipment, are also included, although

many of the figures available only show sales to consumers. All these hardware articles,

mostly referred to as sports goods, are categorised into the following groups:

Product groups Sports goods/equipment

Fitness/gym - exercise bikes, treadmills, steppers, elliptical trainers, free

weights, dumbbells;

Racket sports - tennis, badminton and squash rackets;

Table tennis - bats, balls, nets, tables;

Balls - leather/non-leather, inflatable/non-inflatable; tennis, football,

hockey, cricket, volleyball, basketball etc.;

Team/field sports - equipment and accessories for cricket, polo and most other team

sports such as hockey sticks, baseball or cricket bats, equipment

for basketball (nets and stands), handball, volleyball, rugby etc;

Skates - ice skates, roller skates, in-line skates, skateboards, kickboards,

wakeboards, carveboards;

Golf - clubs, balls, accessories, carriage (trolley, carts and bags);

Snowsports - skis, bindings, boots and accessories;

Watersports - sailboards, waterskis, surfboards, diving, snorkelling, spectacles,

swimming caps etc.;

Sports gloves

- gloves used for baseball, cricket, ice hockey and other sports;

Camping goods - tents, airbeds, mattresses, sleeping bags, camping accessories,

climbing equipment, other equipment for recreational outdoor

activities (cooking gear, lanterns etc.);

Fishing tackle - rods, hooks, reels, nets.

Horse riding - saddlery and animal harnesses and accessories such as leads,

knee pads.

Team/field sports include a variety of small to very large items of equipment (e.g. nets for

volleyball, stands for basketball, goals for hockey, football etc.) for team sports, which are

played indoors as well as outdoors. This should not be confused with outdoor equipment,

such as hiking or climbing equipment, which are meant for recreational outdoor activities

and not for outdoor sports. Consequently, in this survey and in trade statistics, this type

of outdoor equipment falls into the category of camping goods.

Bicycles, motorbikes, cars, motor boats, sailing boats, yachts, caravans, campers, sports

bags, sports clothing and sports footwear are not covered in this survey. In some cases,

reference is made to sports clothing and sports footwear, which were two fast growing

sectors in the sports market in the 1990s. As sportswear is increasingly used as

leisurewear, most specialist sports stores in EU countries emphasise sports clothing and

footwear in their product range. This has been at the expense of the sales of sports

equipment. Detailed information on sports clothing can be found in the Market Survey

'Outerwear', whereas information on sports footwear is given in the Market Survey

'Footwear'.

Definition of sports participation

The COMPASS project was undertaken by the EU sports federations in 2000 to create a

uniform platform for monitoring sports participation in EU countries, since methodologies to

measure participation varied from country to country. Compass defines sports as follows:

13

'Sports' are all forms of physical activity which, through casual or organised participation,

aim at expressing or improving physical fitness and mental well-being, forming social

relationships or obtaining results in competition at all levels.

The total sports participation of each country is broadly defined and includes all regular

and occasional participants aged 6 years or older. Regular sports participation refers in

most countries to adults (over 16 years) and excludes walking.

Regular: Played 60 or more times in a year and refers to club members and to

people practising sports for competition at a regular and high frequency.

Occasional: Played less than 60 times in a year (i.e. less than once a week).

In this survey, the lists of sports or activities, which are considered important in each of the

selected countries, are contained within the following major categories:

Individual activities - golf, racket sports, skiing, athletics, darts, pétanque, martial arts

Fitness activities - aerobics, dance, fitness, weight/working out, taebo, spinning, running

Team sports - football, cricket, rugby, basketball, hockey, volleyball, polo

Watersports - swimming, surfing, waterskiing, scuba diving, canoeing, rowing

Outdoor activities - hiking (over 3 km), rambling, climbing, horse riding, fishing.

In France the term gliding sports ('sports de glisse') is often used and refers to various

kinds of new sensational sliding activities, popular among younger people. In some

countries they are referred to as extreme sports. These activities can be:

On snow, e.g. snowboarding, carving, parabolic skiing, curling.

On water, e.g. sailing, (wind, kite or body) surfing, waterskiing, rafting.

On the street, e.g. in-line skating, roller skating, skateboarding, kick- or carveboarding.

In the air, e.g. delta flying, parachute jumping or paragliding.

1.2 Customs/statistical product classification

The classification system used for both Customs and statistical purposes in EU member

countries is the Harmonised Commodity Description and Coding System (HS), which is

used worldwide. The EU has a set of its own internal codes, referred to here as

PRODCOM, which broadly mirror the HS codes. Table 1.1, from Eurostat, gives a list of

the main codes for sports and camping goods. The more detailed HS code groups

covered in this survey are given in Appendix 1. The major groups are given below:

HS Code Product group PRODCOM Code

9506 Sports equipment 3640

95061 Snowsports 3640113

95062 Watersports 3640120, 351212

95063 Golf 3640143

95064 Table tennis 3640145

95065 Rackets 3640146

95066 Balls (all types) 3640148

95067 Skates 3640115

950691 Fitness/gym 3640130

950699 Team/field sports 3640149

420321 Gloves for exercise sports 3640141

4201 Saddlery for horse riding 1920110

6306 Camping goods (inc outdoor equipment) 17402

63062 Tents 1740223

63064 Airbeds 1740227

630699 Miscellaneous camping goods (inc in 1740227)

94043 Sleeping bags 1740243

9507 Fishing tackle (rods, hooks and reels) 3640153/55

14

2 INTRODUCTION TO THE EU MARKET

The European Union (EU) is the current name for the former European Community. Since

January 1, 1995 the EU has consisted of 15 member states. Ten new countries joined the

European Union in 2004. They are the Czech Republic, Estonia, Slovakia, Cyprus, Latvia,

Lithuania, Malta, Slovenia, Poland and Hungary. Negotiations are in progress with a

number of other candidate member states to join in 2007. In this survey, the EU will

sometimes be referred to as the EU25, sometimes the former EU15, depending on the

context. Specific reference is also made to the “10 new EU countries”.

Population and economy

In 2003, the EU25 population totalled 458 million, which is over 3 times the Japanese

and 1.7 times the US population. The population of the selected EU markets in this

survey represents 328 million people with over 130 million households. The EU has an

ageing population structure with the proportion of 45+ olds rapidly increasing, especially

in Spain, Italy and Germany. The densely populated areas in the EU are located in The

Netherlands, Belgium, the Northwest of Germany, the Southwest of England and in

northern Italy.

Table 2.1 Population and GDP of selected and new EU countries, 2003

Countries Population Age 15-64 GDP (€)

million

%

estimation 2003

S

elected EU

countries

Germany 82.4 67.0 24,407

France 62.4 65.1 24,318

UK 60.3 66.3 24,495

Italy 58.1 66.9 23,699

Spain 40.3 68.0 19,455

The Netherlands 16.3 67.8 25,291

Sweden 9.0 65.2 23,717

New EU countries

Poland 38.6 70.0 9,727

Czech Republic 10.2 70.9 13,884

Hungary 10.0 69.0 12,292

Slovakia 5.4 70.8 11,761

Lithuania 3.6 68.4 9,904

Latvia 2.3 69.2 8,931

Slovenia 2.0 70.6 16,183

Estonia 1.3 67.5 10,877

Cyprus 0.8 67.4 14,149

Malta 0.4 68.5 6,263

Currencies €, UK £, SKr, DKr, CZK, EEK, SKK, CYP, LVL,

LTL, MTL, SIT, PLN, HUF

Exchange (2003) € 1 = US$ 1.13

Source: The World Factbook 2004, Insee

Within Western Europe – covering 15 EU member countries, Iceland, Liechtenstein,

Norway and Switzerland – more than 20 million enterprises are active. Small and

medium-sized enterprises (SMEs) accounted for the lion’s share. In 2003, the

average turnover per enterprise of SMEs and large enterprises amounted to € 600

thousand and € 260 million respectively.

15

EU harmonisation

The most important aspect of the process of unification (of the former EC countries),

which affects trade, is the harmonisation of rules in the EU countries. As the unification

allows free movement of capital, goods, services and people, the internal borders have

been removed. Goods produced or imported into one member state can be moved

around between the other member states without restrictions. A precondition for this free

movement is uniformity in the rules and regulations concerning locally produced or

imported products. Although the European Union is already a fact, not all the regulations

have yet been harmonised. Work is in progress in the fields of environmental pollution,

health, safety, quality and education. For more information about harmonisation of the

regulations visit AccessGuide, CBI’s database on European non-tariff trade barriers at

http://www.cbi.nl/accessguide

Monetary unit: Euro

On January 1, 1999, the Euro (€) became the legal currency within twelve EU member

states: Austria, Belgium, Finland, France, Germany, Italy, Ireland, Luxembourg, The

Netherlands, Spain and Portugal. Greece became the 12th member state to adopt the

Euro on January 1, 2001. In 2002, circulation of euro coins and banknotes replaced

national currency in these countries. Denmark, United Kingdom and Sweden have

decided not to participate in the Euro, at least for the time being.

The most recent Eurostat trade statistics quoted in this survey are from the year 2003.

In this market survey, the € is the basic currency unit used to indicate value. For more

general information on the EU market, please refer to the CBI’s manual Exporting to the

European Union.

Trade Statistics

Trade figures quoted in this survey must be interpreted and used with extreme caution.

The collection of data regarding trade flows has become more difficult since the

establishment of the single market on January 1, 1993. Until that date, trade was

registered by means of compulsory customs procedures at border crossings. Since the

removal of the intra-EU borders, this is no longer the case.

Statistical bodies such as Eurostat cannot now depend on the automatic generation of

trade figures. In the case of intra-EU trade, statistical reporting is only compulsory for

exporting and importing firms whose trade exceeds a certain annual value. The threshold

varies considerably from country to country, but it is typically about € 100,000. As a

consequence, although figures for trade between the EU and the rest of the world are

accurately represented, trade within the EU is generally underestimated.

Furthermore, the information used in this market survey is obtained from a variety of

different sources, e.g. national sports trade associations or trade press, using different

definitions. Therefore, extreme care must be taken in the qualitative use and

interpretation of quantitative data, both in the summary and throughout the text, as also

in comparisons of different EU countries with regard to market approach, distribution

structure, etc.

16

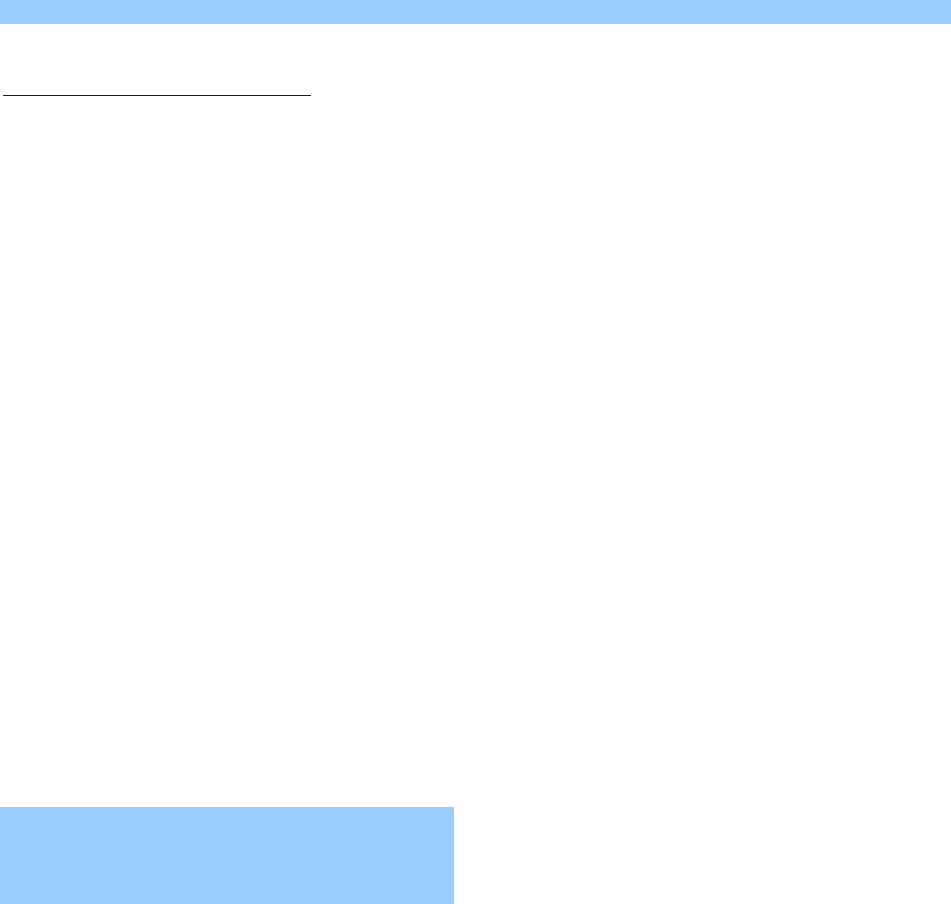

Table 2.2 Exchange rates of EU25 currencies in US$, 1998-2005

Country Currenc

y

1999 2000 2001 2002 2003 Feb 05

EU € 1.063 0.920 0.900 0.946 1.125 1.297

Denmark Dkr 0.14 0.12 0.12 0.13 0.15 0.17

Sweden Skr 0.12 0.10 0.10 0.10 0.12 0.14

UK GB£ 1.61 1.52 1.44 1.50 1.63 1.88

Poland PLN 0.25 0.23 0.24 0.24 0.26 0.33

Estonia EEK 0.07 0.06 0.06 0.06 0.07 0.08

Czech Rep CZK 0.03 0.03 0.03 0.03 0.04 0.04

Hungary HUF 0.004 0.004 0.003 0.004 0.004 0.005

Slovakia SKK 0.02 0.02 0.02 0.02 0.03 0.03

Lithuania LTL 0.25 0.25 0.25 0.27 0.32 0.38

Latvia LVL 1.72 1.64 1.59 1.61 1.75 1.85

Slovenia SIT 0.006 0.005 0.004 0.004 0.005 0.005

Cyprus CYP 1.85 1.61 1.56 1.64 1.92 2.22

Malta MTL 2.5 2.3 2.2 2.3 2.6 3.0

Source: http://www.xe.com

The Selected Markets

This survey profiles the EU market for “Sports and Camping Goods” in which seven

selected markets within the EU are highlighted. The countries selected for this survey

are Germany, France, The United Kingdom, Italy, Spain, The Netherlands and Sweden,

which are the largest consumers of sports goods in the European Union. In 2003, they

accounted for over 84 percent of total EU25 purchases of sports goods, with Germany

and France both taking a large share of over 20 percent each. The United Kingdom is the

largest consumer of golf and fitness equipment, while France and Italy sets worldwide

trends in snow sports and racket sports. Developing countries supplied 35 percent in value

and 53 percent in volume of sports and camping goods to the EU in 2003, most of which

were to these seven countries.

All seven selected countries within the EU have a high proportion of people who are

active in sports. The emphasis on sports participation is less on competitive team sports

and more on leisure and individual sports. With more leisure time, people tend to

exercise or undertake outdoor activities in order to stay fit. Demographic changes mean

that by the year 2020, the proportion of 45+ olds in most countries is expected to be

more than 40 percent of their total population. Besides outdoor activities, fitness and

golf are continuing to gain in popularity as well.

As far as the 10 new EU countries are concerned, the countries of Eastern Europe have

a history of considerable state support for sport. Hence there is a well established

market for a wide range of different sports equipment. Many of these countries also

have established production facilities for sports equipment eg fitness equipment in

Hungary.

17

3 CONSUMPTION

3.1 Market size

Sports participation

The use of sports equipment is closely related to participation in various kinds of sports.

Over 60 percent of the population in the selected EU countries, representing over 200

million people, participate in some form of sporting activity. Germany had the largest

number of sports participants (i.e. 50 million), which can be mainly attributed to its large

population size. France had the highest rate of sports enthusiasts (52% of the French

population), compared to Italy and Spain, which had the lowest rates as is shown in Figure

3.1. These total rates include regular (at least once a week) and occasional (less than once

a week) participation by people of all ages.

Regular participation in the selected countries was lower with an average rate of 41

percent, representing 107 million adults (16 years or older) doing a sporting activity at

least once a week. Many of these people were member of one of the 537,000 sports

clubs in the seven countries. In this case, France and the United Kingdom had the

highest rates of regular participants (see table in figure 3.1).

These figures are in contrast to a Eurobarometer poll published in 2004 which highlighted

the fact that Northern Europeans tend to do more sport and exercise than their southern

counterparts, as the following table indicates:

Table 3.1 % of EU population practising sport at least once a week

0

10

20

30

40

50

60

70

Swed Holland UK EU15 Germ Spain France Italy

% pop.

Source: Eurobarometer, 2004

18

Link between health and exercise

The health lobby and medical profession in the EU have been active in all countries in

promoting the benefits of maintaining fitness levels and an active lifestyle. The least

physically active are in southern EU countries where more people tend to smoke.

However, in northern EU countries, middle-aged people in particular have tended to stop

smoking but, perhaps as a substitute, have started to eat more. To compensate they do

some form of fitness or exercise. Italians have become more health aware as well. While

smoking is still a major public health concern, it is predicted that the number of people

who are significantly overweight, particularly children, may well be the greatest public

health concern in the future. This is already a major issue in the USA.

Individuals rather than teams

Sports are done on a competitive, individual or recreational basis. People in most

northern countries prefer to participate in individual (sports) activities, which demand

less in terms of time or commitment. Participation in most sports – with some notable

exceptions, have either declined or reached a plateau, with more consumers devoting

their time to general fitness – swimming, walking or working out in a gym – rather than

involving themselves in organised competitive sport.

Here, many sports clubs have suffered, lacking staff who do not want to commit time to

these voluntary activities. Consolidation seems inevitable, with more clubs (e.g. swimming,

tennis, basketball, handball and other team sports) closing down or merging with another

club. However, consumers also seek out the sociability and relaxing environment of health

clubs where they carry out their individual fitness activities in the company of others.

Major sports undertaken in selected EU countries

The traditional forms of sport, such as swimming and football still have large numbers of

participants in most EU countries (see table 3.2). Competitive sports such as badminton,

squash and some of the teamsports have suffered from a shift to individual less

competitive sports and recreational activities such as golf and jogging. Note cycling is very

popular in many EU countries, particularly France, Netherlands, Spain, Italy, but it has

been excluded from this table as sales of cycles and cycling accessories are not included

in this survey.

Fitness has been popular in all northern EU countries and is increasingly recognised by

young and older people in all selected countries. In southern EU countries, outdoor

activities e.g. climbing and wintersports, remain popular. People find these activities

sociable. Doing things with friends and family remains important in southern EU

countries.

Table 3.2 Top sports in the selected EU markets in 2003, by club membership

and participation

Country Sports

Germany

Gym, football, tennis, riding, fishing, table tennis, swimming,

keep fit, walking

France Football, tennis, judo, riding, basketball, swimming, walking,

jogging, camping, keep fit, fishing.

United Kingdom Gym, football, golf, tennis, fishing, walking/trekking,

swimming, jogging.

Spain Football, swimming, basketball, golf, jogging, fitness,

hunting/riding, judo, fishing

Italy Football, swimming, wintersports, tennis, fitness, watersports,

volleyball, basketball, fishing, judo

Netherlands Football, swimming, fitness, tennis, jogging,

rollerblading/skating, fishing

Sweden

Football, skiing, gymnastics, floorball, athletics, riding, fishing

Source: TGI, Stat. Bundesamt, INSEE, ISTAT, Inébase, CBS, Stat Sweden

19

Participation by gender

Men in most countries are strongly represented in regular participation (especially in

team sports), although the number of women participating either occasionally or

regularly in sporting activities continues to increase (see table 3.3). Fitness, aerobics,

dancing, running, swimming, gymnastics, volleyball, skating and horse riding were the

most popular activities among women in all selected EU countries. In northern EU countries,

contrary to some of the trends in male competitive sports, women’s football is becoming

popular. This has in part been stimulated by the intense media coverage which football

receives on a regular basis. Women are also taking up golf in large numbers. Sweden has

the highest proportion of sportswomen among the selected countries.

Table 3.3 Women's sports participation in the selected countries

2003 Total Participation Regular Participation

million ratio

women / men

million ratio

women / men

Germany

23.0

46%

10.5

40%

France

19.3

47%

11.5

44%

UK

17.1

43%

11.0

40%

Italy

14.5

44%

5.7

38%

Spain

10.0

42%

3.6

36%

Netherlands 4.7 47% 2.3 40%

Sweden

3.0

49%

1.5

50%

Source: TGI, National Statistics of the selected countries

Participation by age

An increasing proportion of the older population are taking up sporting activities, particularly

in Sweden, Germany and the United Kingdom. This is seen as one explanation for increasing

life expectancy. The sports in question tend to be fitness related or “softer” sports such as

golf. The younger age groups in most countries continue to participate

more in football, (street) basketball, volleyball (Italy and Spain) or other team sports.

Young people are interested in new individual activities, all of which are strongly related

to lifestyle in terms of clothing, brands, celebrities and music, such as:

Adventurous outdoor activities (e.g. rafting, climbing, delta flying, parachute jumping,

paragliding, diving, surfing)

Alternative snowsports (carving/snowboarding, curling, skeleton)

Extreme sports (skateboarding, cross skating, wake or carveboarding) and street

sports.

3.1.1 The EU Sports Market

The total European Sporting Goods Market in the selected EU countries – taking into

account all three sectors (clothing, footwear and equipment) was € 37,000 million in

2003, of which € 9,700 million related to sports and camping goods equipment in the

selected countries. Although sales in 2003 were marginally lower than 2002, mainly due

to continuing falls in Germany, 2004 is forecast to be a better year. Greater sales of

winter sports equipment, team/field, fitness and golf products are driving this growth.

The figures have been adjusted from previous surveys so that the figure for sports goods

includes all categories including fishing tackle, but not camping goods or saddlery items

for horse riding. Those figures are shown separately. Some countries also include cycling

in their figures for sporting goods. For consistency, these figures have also been excluded.

As is shown in figure 3.2, Germany, despite its falls in recent years, is still the largest

market, worth € 2,475 million in 2003. France is close behind on € 2,380 million, 4.8

percent higher than 2003. The figures shown are best estimates based on the available

sources. Between 2001 and 2003, with the exception of Germany and The Netherlands,

20

the consumption of sports goods still rose in other countries, especially in the United

Kingdom and Italy with growth rates of 9.2 percent and 5.9 percent respectively.

The EU market for sports goods is more fragmented than the other major world markets.

Total retail sales of sporting goods equipment in the EU15 member countries was

estimated at € 10,970 million in 2003, of which € 9,700 million (or 88%) was achieved

in the seven selected countries. Over 40 percent of this was from Germany and France.

The EU is the second largest market for sports goods in the world following the USA. A

further € 522 million of sporting goods were sold in the 10 new EU countries, the two

major markets being Poland and the Czech Republic.

The average consumption per capita on sports goods in the EU15 in 2003 was € 29, which

was higher in Sweden, France and Germany as is shown in figure 3.2. Consumption levels

in the 10 new EU countries was significantly lower at € 7 per capita. However, growth rates

here, albeit slowing in the last couple of years, are still much higher than in the EU15.

Between 2001 and 2003, consumption in the selected countries increased by just 1 percent.

Although growth rates have reduced in the review period, consumer expenditure has

continued to be stimulated in most countries by rising levels of participation in sports

generally, by women, older people and increasingly middle-aged people. The outdoor market

was strong. Fitness products continued to grow everywhere, particularly in Italy. A wider

range of outlets are now selling sporting equipment, but perhaps most significantly,

growth is driven by the media and celebrity endorsement of various sports, particularly

new, more fashionable sports. Many commentators are speculating that media coverage

for some sports, particularly football, is reaching saturation point. However, opportunities

still exist in many other sports eg basketball, for growth via more media coverage.

21

3.1.2 Germany

Germany is the largest EU market for sports goods. In 2003, German retail sales were

€ 2,475 million, representing 22 percent of the EU25 market. German households spent

€ 30 per capita on sports goods, just above the EU15 average.

As is shown in figure 3.3, sales of sports goods decreased between 2001 and 2003. This

was mainly because of the economic recession in Germany which affected all sectors, and

was more prolonged than for other EU countries. The main sectors are fitness, golf and

outdoor sporting activities. New snowsports such as carve skiing and snowboarding are

also popular.

There are clear regional differences in sports participation, partly due to sports culture

and disposable income. The former East Germans do not spend money on sports and are more

active in e.g. swimming, athletics and table tennis.

The market performance is also poor due to increased sales of cheap equipment by discounters

(Aldi, Tchibo). On the other hand, in-home fitness, golf, snowsports and outdoor equipment

remain popular by the more affluent Germans. Technical innovations and (new) material, with

a view to achieving more comfort in playing, especially for older consumers taking up sports

later in life, is the principal route for new product development in Germany.

3.1.3 France

France has a high level of participation in sport within the selected EU countries and is the

second largest market for sports goods in the EU with retail sales in 2003 valued at € 2,380

million, representing 21 percent of the EU25 market.

22

The French per capita expenditure of € 38 was second highest after Sweden (see figure

3.2). Cycling is the most popular sporting activity in France. As the country offers mountains,

coasts and a favourable climate, people enjoy many kinds of water, snow, street and

outdoor (gliding) activities, often referred to as ‘sports de glisse’.

As is shown in figure 3.4, sales of sports goods in 2003 rose by 5 percent since 2001.

The popularity of outdoor activities, in-line skating, snowboarding, fitness, golf,

watersports (canoeing, surfing, sailing) and horse riding combined to provide a good

market performance. Sales of tennis rackets declined due to falling demand. In 2003,

equipment for snowsports, fitness and outdoor activities formed the largest segments in

the French sports goods market. Young French sports enthusiasts are switching to more

extreme and energetic sports. In general, serious sports consumers prefer performance

and quality, and are concerned about how a product has been made (e.g. environmentally

sound, no child labour), rather than choosing the lowest price.

3.1.4 United Kingdom

The United Kingdom was the third largest EU market for sports goods. In 2003, UK retail

sales were € 1,710 million, 15 percent of the EU25 market. The per capita expenditure was

slightly below its major competitors, but the overall performance was better, the market

being 9 percent above its position in 2001. The UK sports goods market is highly

fragmented, as there are many sports in the UK such as snooker, darts and cricket, all

requiring their own specific equipment and accessories. Unlike other EU countries, sports

participation levels have ceased to increase. Sports such as swimming, racket sports,

snooker, darts, bowls and some team sports (cricket, hockey) have become less popular.

Golf is still the most popular sport in the UK, representing approximately 30 percent of

the market in 2003. The other key activity, walking, has recovered much more quickly

than expected from the Foot and Mouth disease outbreak in 2001.

Young people are interested in 'fashionable' extreme sports such as abseiling or

snowboarding, and street sports such as skating. As is shown in figure 3.5, sales of

sports goods in the UK have not been affected by recession as much as their European

counterparts. Future growth is expected to be slower. A growing demand is forecast for

equipment for golf, in-home fitness, football, and outdoor activities. Fishing is one of the

most popular pastimes in the UK and continues to be an important market.

23

3.1.5 Spain

In 2003, Spanish retail sales of sports goods was € 1,070 million, representing 9 percent

of the EU25 market. Per capita consumption was € 27, just below the EU15 average of

€ 29. The sports goods market grew by 4 percent between 2001 and 2003.

Sports participation by Spanish people is on the increase due to a growing concern about

health. This has stimulated sports goods sales. The International Olympic Committee

commented in early 2005 of the significant progress of sport in Spain as Madrid hopes to

host the 2012 Olympics.

Football continues to be the most popular sport, but fitness and aerobic activities are

increasing at a fast rate. Fitness equipment represented one third of the market (see fig

3.6) of all sports goods sold in Spain. Basketball enjoys high participation. Volleyballs and

balls for other teamsports such as rugby and polo will increase in demand. Swimming has

high participation levels, but is gradually declining as Spaniards have become interested

in individual and recreational activities, especially climbing, fitness, outdoor activities and

golf. Other sports which have seen increases are fishing and street sports, while tennis

and surfing has declined.

3.1.6 Italy

Italy is a large market for sportswear, but a smaller

market for sports goods. In 2003 Italian sports goods

sales were valued at € 1,260 million. Compared to the

other EU markets, Italian households are the lowest

spenders on sports goods, with a per capita expenditure

of € 22 in 2003.

The sports goods market in Italy has grown faster than

other European markets in recent years because of

new sports and a growing popularity for recreational

activities, undertaken not only by young people, but

also by middle-aged and older people.

Between 2001 and 2003, sales of sports goods

increased by 6 percent from € 1,190 to € 1,260 million

(see figure 3.7). Team/field equipment represented

over one third of the market, followed by snowsports

and skating. The market for fitness equipment is also

healthy, as is the market for watersports.

A recent survey by AC Nielsen for Assosport indicated that the number of people playing

tennis had fallen by 40 percent since 1997. Skiing and horse riding, both traditionally

24

strong Italian sports, had also fallen. The indoor personal regime activities of dance and

martial arts - both of which increased their number of practitioners by 45 percent over

the same time frame - were major winners. Trekking and hill walking saw numbers of

adherents boosted 35 percent, while muscle development was also a favoured exercise,

with 31 percent more people taking part.

Football is still the most popular sport. A large number of the newcomers to sport were

women and also men over 40. A significant number had apparently been won over to

some form of physical exercise, including swimming, aqua-gym activities, bodybuilding

and aerobics.

3.1.7 Netherlands

The Netherlands is the sixth largest market for

sports goods in the EU. In 2003, retail sales were

valued at € 405 million, representing 3.5 percent of

the EU25 market. Consumption per capita of € 25 is

below the EU15 average.

More than half of all athletes are members of one or

several of the approximately 30,000 clubs, football

and tennis clubs being the most popular. Roughly 1.5

million people opt for a different form of organisation.

They hike, jog, swim, cycle, ride mountain bikes or

motocross, either by themselves or in small groups.

Another 1.5 million people maintain their fitness and

health through weekly visits to a gym. A lot of sporting

and leisure activities take place in unorganised

associations. Skiing and skating are popular activities

of this type and also, among younger people, surfing,

skateboarding, snowboarding and rock-climbing. However, in the past few years, both

the number of hours per week in which people engage in sports and the amount of

physical activity engaged in during leisure time have fallen.

Equipment for team sports, fitness, in-line skating and watersports formed the largest

categories. Golf is reported to be a fast growing sport in The Netherlands. As is shown in

figure 3.8, sales of sports goods fell by one percent between 2001 and 2003, mainly

because of the recession which has affected much of mainland Europe.

3.1.8 Sweden

In relation to its low population, Sweden is a large

market for sporting goods. Valued at € 400 million in

2003, with a per capita expenditure of € 41, the

Swedes are an outdoor nation who participate in a

wide range of sporting activities.

Virtually half of the entire market relates to golf

products. Golf is a popular sport in Sweden, but

football is the largest participation sport. Ice hockey

is popular, as is “Bandy”, a team game using sticks

which is similar to hockey. Floorball is also popular.

Outdoor pursuits are particularly popular. Hence,

sports such as fishing and horse riding have many

followers in Sweden.

The fitness boom around Europe

has also been shared in Sweden and fitness equipment

is a large market. As you would expect, wintersports,

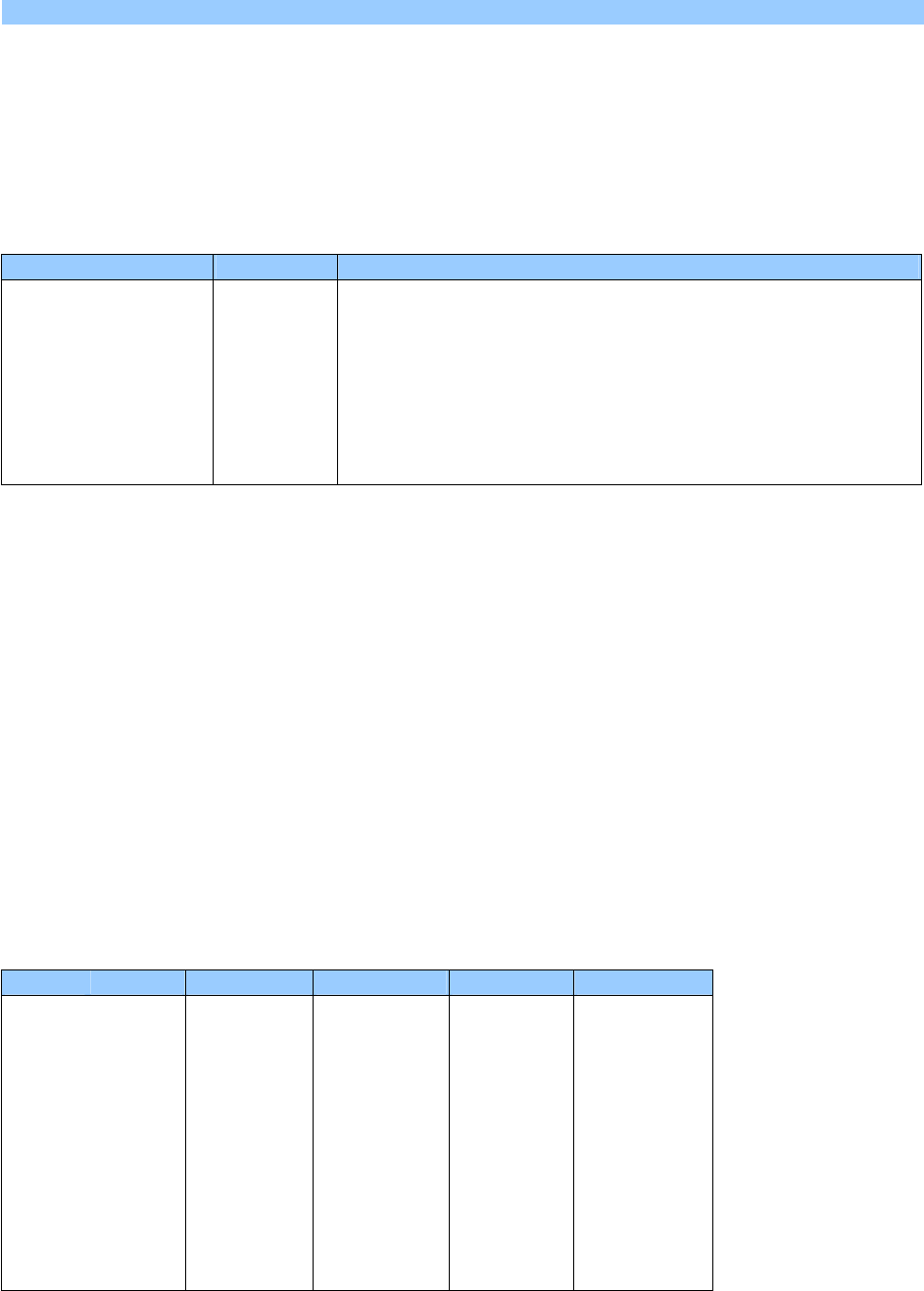

particularly skiing and skating, have many followers.

The Swedish sports goods market has grown by 4 percent between 2001 and 2003. It is

forecast to continue to grow at similar rates in the near future.

25

3.1.9 The 10 new EU Countries

The 10 new EU countries differ from the EU15 in two key aspects. Firstly, consumers spend

significantly less on sports equipment in these countries than the rest of the EU. This in

itself presents opportunities for developing country exporters, as there are still significant

growth opportunities in markets where many of the consumers already are interested in or

participate in a variety of sports, without spending much on equipment. The other aspect

is that a number of the new EU countries are used as production centres for some multi-

national sports goods companies. This presents a challenge to developing country exporters,

where some commentators are observing production moving closer to home markets.

Table 3.4 Consumption of sports goods in the 10 new EU Countries, value in € million

2003 2004* Population

(millions)

Consumption

per capita €

Czech Republic

200

214

10.2

20

Poland 150 161 38.6 4

Hungary 40 43 10.0 4

Slovakia 50 54 5.4 9

Slovenia 30 33 2.0 15

Lithuania 20 22 3.6 6

Latvia 15 16 2.3 7

Estonia 8 9 1.3 6

Cyprus 6 6 0.8 8

Malta 3 3 0.4 8

Total 522 561 74.6 7

*Estimate

Source: Sporting Goods Intelligence, Trade Estimates

Total sales in 2003 were € 522 million, representing just 4.5 percent of EU25 sales (see

table 3.4). The Czech Republic (€ 200 million) and Poland (€ 150 million) were the most

significant markets in terms of size. However, per capita rates were high in the Czech

Republic, but very low in Poland. Individual product group sales are difficult to estimate,

but according to apparent consumption figures from Eurostat, the largest product groups

were fitness, team/field, fishing, balls and skating. To give some specific examples:

- the Hungarian market for sports and fitness equipment has entered a new phase where

participation in sports and fitness activities is growing widely. New sports are becoming

popular such as golf, skiing and tennis. Consequently consumers are seeking more and

better quality equipment. Hungary has a large number of fitness centres and spas, as well

as traditional state supported sports clubs, which constitute a market for professional

quality exercise equipment.

- In Poland, the market for sporting goods is divided into two major segments: the brand

market and the general sporting products market. Recently, demand has moved toward

more expensive, better quality articles. It created a market for specialty sporting goods

stores, with well-trained sales staff. Less expensive equipment is sold through

supermarket chains.

- Czechs have a history of participating in organized mass sports such as hiking, skiing,

canoeing, and cycling; various collective ball sports, such as football, volleyball, basketball

and handball; and gymnastics. Nowadays, many hikers, bikers, canoeists, and skiers are

not organized. 1 million Czechs spend weekends down-hill and cross-country skiing every

winter. The number of registered skiers has remained stable at 30,000. While the numbers

of registered athletes in most traditional sports have dropped during the past four years,

a variety of new sports has been attracting new members. Aerobics, fitness, floorball,

snowboarding and skateboarding; or sports that were considered bourgeois during the

Communist regime, such as golf and horse riding, have flourished. The sports that have

experienced the biggest membership drop are traditional team ball sports with the

exception of football.

26

3.2 Market segmentation

Wintersport equipment, fitness, golf articles, team/field equipment, skates, and camping

goods form the largest categories within the sports goods market. Some products such as

motorized fitness equipment require high investments in R&D or in complex manufacturing

systems. These products will not be covered in this section. On the other hand, developing

countries dominate the supply of more simple equipment for fitness (e.g. small trainers, mats,

dumbbells), team/field sports, balls, gloves and camping goods. Many of these sports goods

are OEM or ODM (Original Designed Manufacturing) supplies to EU manufacturers.

For each sports, relevant to exporters, an EU overview in terms of participants, clubs and

major brands are described. A breakdown of equipment within some of these sports will

be illustrated in one sample country. It should be noted here that these breakdowns may

differ from country to country.

Fitness/Gym

30 percent of all fitness equipment in the world is sold in Europe. The people worldwide

who are members of a club exceed 60 million. Fitness and body-building continue to

take an increasing share of sporting activity in Europe, partly because of their fashionable

image and partly because they can be undertaken at times to suit the participant.

The main reasons for taking it up were to stay healthy, relax and improve one’s figure or

physique. In 2003, women accounted for more than half of all fitness participants in all

selected EU countries. Keep fit exercise, aerobics, yoga and, more recently, self-defence

activities such as taebo and martial arts (karate, taekwondo) have become popular among

women. Power yoga, which works by boosting body shape and wellness is a trend from the

USA. The contents of a power yoga kit are items which developing country exporters may

feel equipped to produce. It consists of a bag, mat, strap and yoga block.

Major activities undertaken by men are body-building, working out, weight training and

martial arts. Over 100,000 people in Spain are members of a judo club. A further 60,000

were in a karate club. There has also been a large increase in the number of participants in

the 40+ age group. Since fitness is increasingly recommended by doctors and

physiotherapists, especially for overweight people, the number of both men and women

participating is expected to continue to increase in the coming years. In addition, demand

by certain ethnic minorities in most selected countries is growing as well.

In 2003, the number of registered participants in the selected EU countries was over 20

million people (see table 3.5). Note, these figures only relate to those who are members

of commercial clubs. So, for example in the UK, there are a further 2,400 fitness facilities

in the public sector, accounting for a further 2.5 million members. Those who participate

in fitness activities on a regular (weekly) basis do so in fitness centres and clubs. There

has been a growing number of frequent participants, who have become more educated

and enthusiastic, increasing the demand for fitness and training equipment for in-home use.

Exercises at home can be done cheaply and quickly, without spending time going to the

gym. However, there are indications this increase is levelling off.

Table 3.5 Fitness clubs and value of equipment in € million, 2003

Commercial

Clubs

Participants

registered

Sales € million

Germany

6,500

5,600,000

400

France

2,500 3,500,000 400

United Kingdom

2,000 3,600,000 350

Italy

6,000 3,000,000 180

Spain

3,500 2,000,000 120

Netherlands

1,700 1,500,000 70

Sweden

1,000 900,000 60

Total

23,200 20,100,000 1,580

Source; SAZ, International Health, Racket & Sportsclub Association, Eurostat, Trade estimates (2004)

27

The estimated value of the fitness equipment market in the selected countries is € 1,580

million. This includes both home fitness and equipment in gyms and clubs. Germany,

France and United Kingdom are the largest EU markets for fitness equipment, as is shown

in table 3.5. 25 percent of French people who participate in sport engage in fitness activity.

The German fitness equipment market reached in 2003 a total value of € 400 million, of

which perhaps € 260 million was for in-home use. Some sports clubs are now open 24

hours a day, responding to demand from busy people who want to find time to stay fit.

The German market overall has been static compared with the previous year. There has

been significant price pressure in the market. Any volume gains have been at the expense

of heavy price discounting, as retailers such as Aldi have started selling the higher value

items alongside the smaller, portable items. Cycle shops have also started to sell exercise

equipment. Internet sales are also hitting specialist retailers hard.

Elliptical trainers accounted for 25 percent of all fitness equipment sold in Germany in

2003 (see fig 3.10) and along with the treadmills and steppers were the fastest growing

segments. Within these segments, electronically controlled equipment requires top quality

after sales service, as well as extremely knowledgeable sales staff. Market leaders for

larger items are Kettler (Kettler, HKS, Metro), Bremshey (Tunturi, UNO) and Aicon (Proform,

Healthrider, Weider, Weslo). Other well-known brands include Unifit, Life Fitness,

Technogym, Icon Fitness, Lifestyle and Reebok. Consumers spend on average € 1,500

for such equipment.

Within the more simple types of treadmills and trainers, there is a growing demand for back

boards, belly exercisers (e.g. benches or hoops), biceps trainers or smaller home multi gyms.

These portable items are relatively cheap and are often purchased on impulse. However,

consumers are looking for higher quality home fitness equipment which approaches the

quality found in studios.

Free weights are another large segment in the German fitness market (16%). There is an

increased demand from women, who are convinced that long-term slimming is achieved by

the regular use of dumbbells. The segment 'other equipment' includes many items, ranging

from AB Toners, rollers, exercise mats, resistance equipment (e.g. small hand, thigh

exercisers), jumping ropes, trampolines and fitness/martial arts related accessories (e.g.

protective equipment, punch bags, flexabands). Within most of these segments, brands

are still of minor importance.

A combination of a slow EU economy and a greater emphasis on fitness at all ages has

produced an upsurge in high-fitness, low-cost sports, meaning running and walking.

Nordic Walking has been developed as a new form of fitness training by Finnish

sporting manufacturer, Exel, in co-operation with sports analysts and medical

28

professionals. This recent phenomenon is rapidly becoming one of Europe’s main outdoor

activities, with an estimated 3.5 million people doing it regularly, urged on by some 3,000

instructors. The sport is defined as ‘hiking with special poles’ and provides gentle and

easily-controllable exercise, so it presents a promising way of responding to the needs of

beginners (or people with a stronger build) who view the sport as an ideal way to enter a

new world of fitness, wellness and body shaping.

Nordic Walking has been the most high profile “new sport" for the last couple of years. A

new “Nordic Treadmill” also enables people to practice it at home. Enthusiasts claim that

it uses more of the body’s muscles than cycling, swimming or running, increasing energy

consumption and allowing more calories to be burned. The arms take more of the strain,

making it popular with elderly enthusiasts. Other claims are that it can strengthen bones,

combat the effects of osteoporosis, reduce neck and shoulder tension and alleviate

symptoms of repetitive strain injury.

Team/field sports

Football is the most popular teamsport, well exceeding not only other teamsports but all

other sports. In 2003, there were an estimated 128,000 clubs in the selected countries

with a total number of 15 million members (see table 3.6). This will not include the large

number of people who play on a less formal basis. For example, in the UK, 7 million

adults and 5 million children play football regularly. The figure stated for Spain significantly

understates the number of people who actually play. Football has grown in popularity in all

selected countries in the past few years, largely driven by very heavy television coverage.

The number of women playing football in Europe is increasing significantly. Sweden and

Germany have had the most successful women’s teams. The next big European tournament

is in England in summer 2005, and the next Women’s World Cup is in 2007. Women’s

football in Spain is growing rapidly.

Table 3.6 Football participation in the selected countries, 2003

Clubs Registered Participants

Germany

26,239

6,273,921

France

19,073 2,146,752

United Kingdom

42,000 2,000,000

Italy

18,577 1,050,000

Spain

16,683 671,581

Netherlands

3,000 1,050,000

Sweden

3,307 1,951,789*

Total 128,879 15,144,043

*Swedish figure is number of participants, not all of whom will be registered

Source: French & Swedish FAs, Keynote, National Statistics Offices (2004)

Major brands of leather footballs are Mitre, Nike, Umbro, Patrick, Adidas, Puma, Donnay

and Hummel. The Mitre top range includes a 'Fluo Flare' ball for improved visibility. The

2006 World Cup will be held in Germany. This tournament always generates increased

interest in football, both in terms of watching it, playing it and purchasing equipment.

Germany will naturally benefit the most, but a surge in interest will also be seen across

all selected EU markets due to its proximity. This is in addition to the major European

football tournament, held every four years. The next tournament takes place in 2008.

The venue will be shared between Austria and Switzerland.

Most leather footballs are produced under licence by the major brands in Asia. Manually

stitched balls mainly come from Pakistan (Sialkot) and India. This is also the major source

of fair trade footballs. Each year, approximately 40 million footballs are sold around the

world. However in 2001, only 1.6 million of these balls carried one of the official FIFA quality

labels. The principal purpose of this is to denote high quality and consistency. But they are

also the indication of footballs made without child labour, as all manufacturers granted a

licence to bear a FIFA quality label are contractually obliged to reject all child labour.

29

Approximately 75 percent of the world's hand-stitched footballs are made in Sialkot,

Pakistan. A smaller proportion is also made in India. In 1997, FIFA signed an agreement

aimed at preventing child exploitation. This agreement was also signed by the Sialkot

Chamber of Commerce and Industry, ILO and UNICEF. Representatives of WFSGI and

other child welfare organisations also attended the signing ceremony in Atlanta.

Machine stitched leather footballs, which are lower quality than manually stitched balls,

mainly come from China. Many of these balls are used for promotional purposes e.g. use

during company games, as a give away item etc. As mentioned earlier, football is

strongly influenced by media coverage and during or before high-profile football matches,

the sales of replica kits, footballs with special logos, gadgets and other sales promotion

articles for fans increase enormously. For similar purposes, moulded (synthetic or PVC)

or plastic balls are also being used. Most of these balls are sold at the cheaper end of

the market e.g. in supermarkets, garages etc.

FIFA, the world football body (http://www.fifa.com) recognises the importance of football

in society and is also heavily involved in promoting disabled sport, and is also involved in

a number of high profile social campaigns, such as anti-racism.

Teamsports