?

2023 Robo-Advisor Landscape

Our take on the digital advice industry and the best options for

individual investors.

Executive Summary

The growth and refinement of the robo-advisor industry over the past 15 years have provided investors,

especially those of modest means, with access to diversified, professionally managed portfolios. Given

their low required account balances, modest costs, and ease of use, robo-advisors are a compelling

option for young investors who have less complicated financial situations. But choosing the right one

can be a challenge. This industry landscape report evaluates 18 leading robo-advisors while providing

data on up to 20. It focuses on the features and benefits that are most likely to help investors reach their

financial goals: fees, quality of investment advice, financial planning tools, and other factors.

Our

research found broad similarities among major retail-oriented U.S. digital advice providers in

investor engagement and advice delivery. Nearly all use questionnaires to gather information on client

goals, time horizons, and risk tolerance and then feed that data into advice engines that recommend one

of several portfolio options, typically consisting of low-cost, passively managed funds.

Pro

viders differ more in how much additional financial planning they offer. Most focus on digital

investment management and add some basic features. The top providers, however, offer comprehensive

tools, ranging from online-only counsel to on-demand access to human financial advisors.

Cost i

s another key differentiator. The median advisory fee among robo-advisors surveyed was 0.25% of

assets per year—much cheaper than traditional financial advisors' typical 1.00% levy. But specific fee

levels and how they are charged vary. The optimal fee structure depends on how much money clients

invest and whether they want basic investment advice or more-comprehensive financial planning.

Of th

e 18 robo-advisors evaluated, Vanguard Digital Advisor and Fidelity Go ranked first and second,

respectively, thanks to their low costs, nuanced asset-allocation approaches, broad range of financial

planning tools, and transparency. Though they made some improvements, Titan Invest and several bank-

affiliated providers were still the least attractive because of higher costs, poor transparency, or limited

financial planning tools.

Key

Takeaways

× Despite its growth potential, the digital advice industry still accounts for a small percentage of

investable assets in the United States.

× Dedicated digital advice firms often struggle to reach profitable scale, while the large brokerage firms

and wealth managers that acquire them often struggle to integrate their digital advice capabilities.

Morningstar Manager

Research

2

2 June 2023

C

ontents

1

Executive Summary

1

Key Takeaways

2

Introduction

6

Results

24

Industry History and Trends

2

8 Pricing

3

1 Risk-Tolerance Questionnaires

3

2 Portfolio Construction

3

9 Financial Planning Services

43

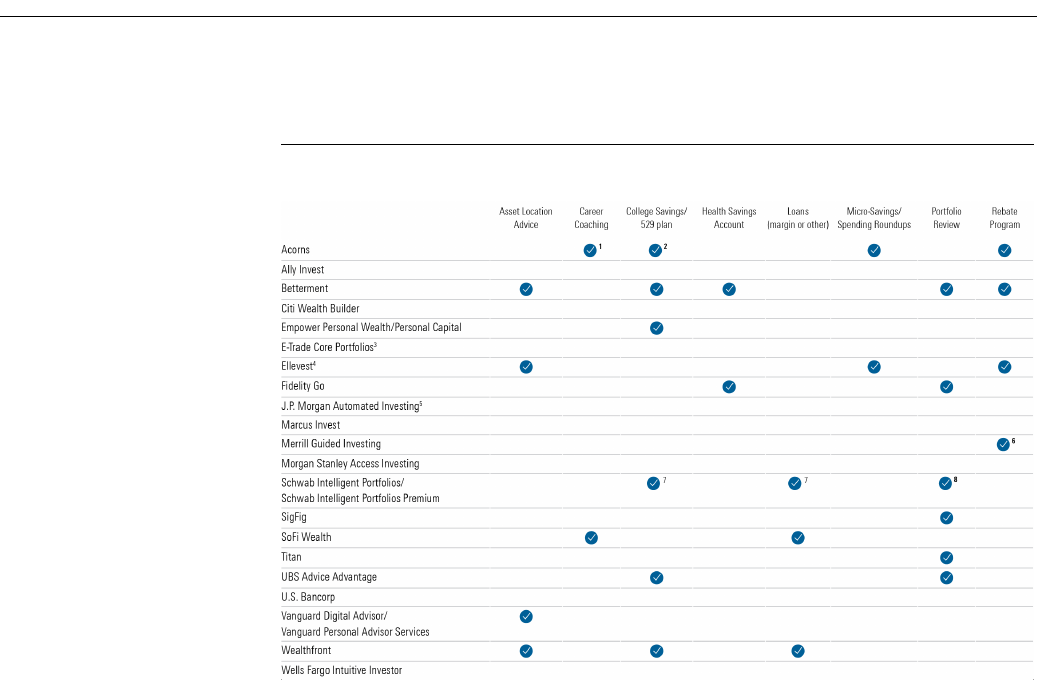

Features and Benefits

44

Robo-Advisors vs. Traditional Advisors

4

6 Conclusion

47 Appendix

Amy

C. Arnott, CFA

Alec Lucas, Ph.D.

Daniel Culloton

Drew Carter

Gabriel Denis

David Kathman

, CFA, Ph.D.

Elizabeth Templeton

Lan Anh Tran

Connor

Gallagher

Important Disclosure

The conduct of Morningstar’s analysts is governed

by Code of Ethics/Code of Conduct Policy, Personal

Security Trading Policy (or an equivalent of),

and Investment Research Policy. For information

regarding conflicts of int

erest, please visit:

http://global.morningstar.com/equitydisclosures

Corrections and Clarifications

Corrections

issued July 6, 2023.

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 2 of 51

× The typical robo-advisor playbook includes portfolios composed of passively managed, low-cost

exchange-traded funds with a range of risk levels. But asset-allocation ranges vary, and several

providers have added active or quasi-active strategies.

× The lines between robo-advisors and traditional financial advice continue to blur, as firms such as Ally

Invest, Merrill Lynch, and J.P. Morgan have added hybrid offerings that blend automated advice with

access to a human advisor.

× Vanguard and Fidelity Go stood out as the best options, although we also assigned above-average

scores to Schwab Intelligent Portfolios, Betterment, and Wealthfront.

× Titan Invest, E-Trade Core Portfolios, Merrill Guided Investing, UBS Advice Advantage, and Ally Invest

scored poorly because of higher costs, limited planning features, and/or a lack of transparency.

Int

roduction

The robo-advisor industry is more than a quarter century in the making, but it remains a story of

untapped potential, both for digital advice providers and the investors who stand to benefit. Indeed,

industrywide assets of around $740 billion as of early 2022

1

made up only a small fraction of the $31.4

trillion U.S. retail market, which Cerulli Associates defines as investors with $100,000 to $5 million of

financial assets. Meanwhile, even as access to low-cost portfolios diversified by asset class and region

has become the norm, leading robo-advisor providers have only recently added basic features, such as

nonretirement goal planning, and services like tax-loss harvesting aren’t standard yet.

As ro

bo-advisors compete for new business by adding investing and planning capabilities, it can be hard

to discern which ones are advancing or failing behind industry changes. Varied pricing models and often

poor transparency into underlying investments, where conflicts of interest and risks can lurk, complicate

matters further.

Thi

s paper surveys the industry landscape and assesses 18 major robo-advisor providers. Vanguard and

Fidelity received the two highest scores. We consider three others to be above average, and some

competitors aren't far behind. Several offerings, though, warrant caution, because of above-average

costs and/or transparency issues.

Defin

ition

The birth of robo-advisors reflects the confluence of many trends, including the growth of the internet,

the surge in popularity of ETFs and other low-cost investment options, and the decline of defined-benefit

pension plans. At the risk of oversimplifying, though, robo-advisors are the offspring of the marriage

between Modern Portfolio Theory and advanced computing power. In fact, Nobel laureate William

Sharpe, one of the fathers of the capital asset pricing model, founded in 1996 what would emerge as the

first robo-advisor, Financial Engines. Initially an online advice provider whose recommendations

investors had to implement on their own, the firm became a robo-advisor once it launched computer-

based discretionary asset management.

1 https://www.theroboreport.com/data/aum-statistics/

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 3 of 51

Such algorithmic asset management is what separates robo-advisors from do-it-yourself trading

platforms and advice providers, on the one hand, and higher touch, personalized wealth management,

on the other. Morningstar's Michael Wong defines robo-advisors as platforms that offer automated,

semitailored strategic asset-allocation investment portfolios directly to retail customers.

2

Additional

services and financial planning tools are common, as is some access to human advisors, the "robo' or

"robot" moniker notwithstanding.

Exhibit 1

Robo-Advisors Fill Niche Between Discount Brokers and Traditional Wealth Management

Source: Morningstar. Wealth tiers are based on research from Cerulli Associates.

Scope

This research focuses on U.S.-based robo-advisors and digital wealth managers, most of which include

access to human advisors, that are widely available to individual investors, and it excludes those limited

to retirement assets. While it gives information on up to 20 providers, it assesses only 18. We didn’t

assess Ellevest because Morningstar has an ownership stake in the company. We also omitted J.P.

Morgan Automated Investing, which uses some funds that track Morningstar indexes. We did, however,

assess Betterment. Although Betterment's sustainability-focused portfolios include three ETFs tracking

Morningstar indexes, those funds claimed a small fraction of the firm's total assets as of Dec. 31, 2022.

This year we added three robo-advisors: Citi Wealth Builder, Empower Personal Wealth, and U.S.

Bancorp Automated Investor. Three robo-advisors from our 2022 study are not in this one: Capital One

sold its robo-advisor business in April 2022; BlackRock sold its direct-to-consumer FutureAdvisor

business to Ritholtz Wealth Management in February 2023; and Morgan Stanley has essentially

2 Wong, M.W. 2015. “Hungry Robo-Advisors Are Eyeing Wealth Management Assets? We Believe Wealth Management Moats Can Repel the Fiber-

Clad Legion.” P. 2.

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 4 of 51

replaced its Access Investing with the E-Trade Core Portfolios service, which Morgan Stanley picked up

when it bought the online broker in 2020.

Our

18 assessments draw on a combination of regulatory filings and online information, along with

additional insights from robo-advisor survey responses, follow-up interviews, and product

demonstrations. Acorns, Citi Wealth Builder, Empower Personal Wealth, Marcus Invest, and UBS Advice

Advantage each declined our survey request or did not grant an interview, but we proceeded with

publicly available information, albeit with some adjustments for insufficient data (detailed below).

Meth

odology

We based our assessments on the factors most likely to help investors succeed. Our methodology draws

on the Morningstar Medalist Rating and other evaluations, such as our 529 college savings plan and

health savings account research as well as our Best Interest Scorecard methodology,

2

but it is tailored to

robo-advisors.

Our

assessments prioritized low, transparent fees; a robust risk-tolerance questionnaire; logical mapping

to portfolios; sound portfolio diversification that steers clear of questionable asset classes and

investment tactics; and a broad range of planning-related features.

We s

cored robo-advisors on a five-point scale in four categories: total price (30% weighting); the process

used to select investments, construct portfolios, and match portfolios with investors (30%); the provider

organization behind the digital platform (20%); and breadth of services (20%). We summed each

weighted component to arrive at an overall score, which we then used to rank the robo-advisors. Robo-

advisors with scores between 5.0 and 4.5 earned High assessments; from 4.4 to 3.5 were Above

Average, 3.4 to 2.5 Average, 2.4 to 1.5 Below Average, and 1.4 or below Low.

Sinc

e information about the risk levels, asset mixes, and underlying funds is essential for consumers to

make an informed decision before signing up, we assigned each offer that fell short a Quality of

Investments/Portfolio Construction score of 1 out of 5. This year, we penalized Citi Wealth Builder and

UBS Advice Advantage for insufficient disclosure, whereas in our 2022 study, we penalized two other

offers.

2 https://assets.contentstack.io/v3/assets/blt4eb669caa7dc65b2/bltb38f56957e3f90f1/best-interest-scorecard-methodology.pdf

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 5 of 51

Exhibit

2 Morningstar's Robo-Advisor Assessment Criteria

Source: Morningstar. Data as of May 31, 2023.

Key assumptions and questions related to each of the four categories include:

Price (30%)

× Assumption:

× All else being equal, lower fees are better, but we also looked for transparency and pricing

models that align with investors' interests.

× Questions:

× What is the total annual cost (including underlying fund expense ratios) for an account with

a $15,000 balance, assuming no market fluctuations, and how does that cost change at

smaller and larger asset levels?

× Aside from asset-based fees, how does the platform make money off of client assets and/or

the client relationship?

× What role, if any, do fee waivers play?

Quality of Investments/Portfolio Construction (30%)

× Assumption:

× A seasoned team with strong resources selects investments and constructs portfolios that

emphasize client results over sales of questionable proprietary products that do not align

with investors' interests.

× Questions:

× Who is in charge, and what are their qualifications?

× Does the team select quality investments across a range of proven asset classes to build and

maintain portfolios with sensible allocations?

× How does the platform collect client-specific information on risk tolerance and other factors,

and how does that information influence portfolio construction?

× What drives investment changes?

Provider (20%)

× Assumption:

× The organization behind the robo-advisor is aligned with clients while demonstrating a

thoughtful approach, long-term commitment, and a track record of doing right by investors.

× Questions:

× Are topnotch investment research leaders in charge of the platform?

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 6 of 51

× Does the platform stand on its own, or is it integrated into the firm's broader suite of

offerings?

× Are there potential conflicts between the ultimate owners of the firm and its clients?

Brea

dth of Services (20%)

× Assumption:

× Tools and services support holistic financial planning for varied investing goals.

× Questions:

× What is the breadth of investing and planning features available on the platform?

× Does the program include key features, such as account aggregation, tax-loss harvesting,

and planning for multiple goals?

× Do tools and services consider investors' total assets and tax situation?

× Do investors have access to humans, especially qualified financial professionals?

Resul

ts: Vanguard Tops the List Again

Vanguard Digital Advisor, and its premium sibling Vanguard Personal Advisor Services, once again

received the only High overall assessment, while Fidelity Go, Schwab Intelligent Portfolios, Betterment,

and Wealthfront repeated with Above Average assessments. Meanwhile, only Titan received a Low

assessment.

Des

pite the similarities of this year's results to those of 2022, there are important differences. SigFig

dropped to Average from Above Average as the one-time pioneer fell behind best-in-class rivals. The

overall scores among the Above Average robo-advisors also shifted. Betterment dropped from second to

a fourth-place tie with Wealthfront, partly driven by our concerns around Betterment’s expanded lineup

of portfolio options, including risky cryptocurrency-focused portfolios.

Vanguard is now the only robo-advisor to receive a High mark in three of our four categories after

multiple enhancements boosted its Quality of Investments/Portfolio Construction and Breadth of

Services scores to High from Above Average. Vanguard added ESG options, active equity and fixed-

income funds, and a municipal-bond strategy, which helped the former grade, and introduced tax-loss

harvesting to all its advice clients to lift the latter. Vanguard also improved the tax efficiency of its

onboarding process for clients who are new to the advice program. If those clients have embedded

capital gains in one or more of up to 90 Vanguard strategies, they no longer must sell those holdings.

Instead, Vanguard uses a completion methodology to round out their portfolio exposures.

Schwa

b Intelligent Portfolios, meanwhile, maintained its High Breadth of Service score. Schwab offered

tax-loss harvesting before Vanguard, and its overall suite of capabilities still compares favorably.

Vangua

rd remained the only robo-advisor with a High Price assessment. At as little as 0.20% per year for

advisory and underlying fund fees, Vanguard Digital Advisor isn’t the cheapest entry-level offering; but it

offers new investors the most value for its cost. Similarly, Vanguard Personal Advisor Services' starting

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 7 of 51

advisory fee of 0.30%, while not the lowest for those with more-complicated needs or preferences, is still

cheap for a higher-end service combining automated features with human financial advisors.

A

lthough Schwab Intelligent Portfolios and SoFi Wealth appear to be bargains, concerns about each

kept their Price assessments at Above Average and Average, respectively. Schwab Intelligent Portfolios

charges no advisory fee for accounts with at least $5,000 but allocates a significant portion of client

assets to in-house cash accounts. That drags on returns in up markets while generating revenue for

Schwab, which receives the spread (or difference) between the revenue it earns on asset balances and

the yield it pays investors.

SoFi Wealth will be hard-pressed to maintain its current pricing, and it suffers from other weaknesses.

SoFi charges no advisory fee and has waived the expense ratios for its two proprietary funds that

together make up nearly two thirds of each portfolio's equity allocation. The service, part of what SoFi

calls its "Financial Services Productivity Loop" strategy, seems as much designed for making money

through cross-selling as for serving investment needs. Meanwhile, its two SoFi ETFs track growth

benchmarks, which could backfire if value stocks take an extended turn leading the market.

N

o robo-advisor received a perfect score, including Vanguard. Its Provider mark dropped to Above

Average from High because of a dubious partnership. Invest for Amex by Vanguard, launched in April

2022, offers Vanguard's digital financial planning to some U.S. American Express cardholders but

charges a gross advisory fee 30 basis points higher than Vanguard Digital Advisor's. The program also

levies additional fees that are contrary to Vanguard's reputation for keeping investors' costs low.

Th

e lowest-scoring robo-advisors were not all bad, either. For example, Titan, which ranked last with

Low scores in three of four categories, reduced its pricing and added more diversified portfolio building

blocks in the form of stock and bond ETF portfolios. These modest improvements are steps in the right

direction.

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 8 of 51

Exhibit

3 Morningstar's Robo-Advisor Assessments

Source: Morningstar. Data as of May 31, 2023.

1 High and Above Average Price scores indicate more modest and thus attractive

fees, while Low and Below Average signify the opposite.

2 E

-Trade Core Portfolios licenses certain services from Morningstar, including fund fact sheets and a risk-tolerance questionnaire.

X Insufficient portfolio data resulted in a score of 1.

To fa

cilitate further comparison between the robo-advisor offers we evaluated, we provide a brief

overview of each, arranged alphabetically below.

Acorns | Average

Acorns doesn't quite live up to the hype.

The c

ompany boasts prominent board members and investors, including stars Jennifer Lopez, Alex

Rodriguez, and Ashton Kutcher as well as finance authorities Richard Thaler, Shlomo Benartzi, and Harry

Markowitz. It stands out for its focus on micro-savings, with features that help investors round up

spending on everyday purchases to build an investment balance. It also offers an "Earn Program" that

provides rebates on purchases made through select companies. With no investment minimum and a

straightforward investment approach, it's easily accessible for beginning investors.

However, its subscription-based pricing model is pricey given its target audience. The company had

offered a $1 per month Lite option, but its cheapest subscription tier now charges $3 per month, or $36

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 9 of 51

per year. That translates into 24 basis points for a $15,000 account but is steep (3.27%) relative to its

average account size of about $1,100.

Acor

ns lacks some key features. It offers automatic rebalancing but no tax-loss harvesting and few if any

planning-related features. Acorns' "Early" program includes Uniform Transfers to Minors Act/Uniform

Gifts to Minors Act accounts, which are suboptimal for at least two reasons: They're not tax-advantaged,

and account owners have full access to the funds when they reach the age of 21 in most states (18 in a

few). Acorns defaults these accounts into the Aggressive portfolio, which is also less than ideal for kids

approaching college age. Its approach to emergency savings is suboptimal, as well. Customers can set

up an emergency fund, which is a non-interest-bearing demand deposit. With other cash options now

yielding 5% or more, it’s unclear why anyone would find this option appealing.

Acor

ns offers a small number of portfolios corresponding to different risk levels (five Core portfolios and

four Socially Responsible Investing portfolios). Asset allocation is straightforward, and the quality of the

underlying investments (mainly from iShares, Vanguard, J.P. Morgan, and Goldman Sachs) is above

average. However, investors can now opt into a bitcoin ETF with up to 5% of portfolio assets or directly

invest in stocks with up to 50% of their assets.

The ma

nagement team seems heavy on tech and venture capital types and light on investment research.

Seth Wunder started as chief investment officer in October 2021 after working as a hedge fund

manager, but his record is largely unknown. CEO Noah Kerner also has retooled the firm's growth plans

after a scuttled 2022 IPO via a special-purpose acquisition company merger; for instance, in April 2023, it

bought U.K.-based child and teen banking startup GoHenry.

Ally I

nvest | Below Average

Ally Invest still has some attractive features for Ally Financial banking customers, but it has otherwise

ceded ground to rivals and now merits a Below Average assessment.

The

April 2016 acquisition of TradeKing paved the way for its May 2017 rebranding as Ally Invest.

Mitesh Patel, who had worked at Ally from 2009 to 2014, then rejoined in May 2018 to develop the

service. He works with an investment committee whose members participate in portfolio development.

Betw

een mid-2018 and late 2019, Patel and his team added investment options and some planning

capabilities while lowering the service's minimum investment to $100 from $2,500. Ally's current suite of

32 portfolios relies on inexpensive Vanguard and iShares ETFs and comes in two basic types: Market

Focused (2% cash allocation) for a 0.30% annual advisory fee and Cash Enhanced (30% cash allocation),

which has no advisory fee. Each type has a core, tax-optimized, and ESG version. All three versions have

five different allocations based on one's risk profile (conservative, moderate, moderate growth, growth,

and aggressive growth). There is also an income version of each type.

The portfolios include domestic market-cap tilts and varied regional exposures. For example, the Market

Focused Core Aggressive portfolio's 93% equity stake is divided among U.S. large-cap (33%), mid-cap

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 10 of 51

(17%), and small-cap (6%) stocks as well as non-U.S. developed (30%) and emerging (7%) markets. A

tiered rebalancing approach is distinctive: The thresholds are smaller for asset classes with single-digit

allocations and larger for those with double-digit allocations, though Ally does not disclose those

thresholds.

In May 2022, Ally launched a wealth management service. It includes access to a human advisor

alongside the digital advisor for a tiered fee: 0.85% for a household’s first $250,000 in assets, 0.80% for

its next $750,000, and 0.75% for assets exceeding $1 million. Those fees, however, are high compared

with the premium offers of best-in-class rivals such as Betterment, Fidelity, and Vanguard.

Ally has other weaknesses. It hasn’t added capabilities like its competitors have. Features that have

become common, such as aggregation of outside accounts, multiple goal planning, and tax-loss

harvesting, are not available. Moreover, Ally defaults clients into the Cash Enhanced portfolios, whose

30% cash allocation may earn a competitive rate relative to other high-yield savings accounts but will

struggle to keep up with inflation and likely cause investors to miss longer-term gains available from

greater market exposure.

Bett

erment/Betterment Premium | Above Average

Betterment's broad range of services and value set it apart, but investors would be better served sticking

to its core offering and avoiding its gimmicky extras like cryptocurrency.

Bette

rment offers a lot for its below-average price tag. It charges a 0.25% asset-based, annual fee for

automated portfolio management. Advice is part of the offer, too, and investors who use multiple

banking and investment accounts can get help with retirement investing, goal planning, and prioritizing

and tax treatment on various accounts. On-demand access to an investment advisor via Betterment

Premium cost another 0.15%, or 0.40% per year in total, but Betterment is one of the few robo-advisors

that lets clients pay a $399 hourly rate for advice on specific situations like retirement, college savings,

marriage, or other planning topics. Lower-balance investors should note that Betterment raised rates for

clients with less than $20,000 to $4 per month. However, cash and all assets held at Betterment count

toward making the hurdle, and committing to monthly investments of $250 or more also gets investors

the lower 0.25% fee.

Bett

erment's cash offering may be useful for meeting its lower-fee threshold. Betterment paid an annual

percentage yield of 4.5% as of mid-June 2023. The entire balance up to a $2 million limit is FDIC insured

because Betterment works with partner banks that ultimately hold the deposits (Wealthfront does the

same, as does Vanguard in its cash-plus accounts).

Port

folio construction is well-thought-out. Betterment bases its allocation guidance on a simple risk-

tolerance questionnaire that focuses on the amount and timing of the money a client needs. It

documents on its blog how it builds and maintains various target-risk portfolios while also attempting to

maximize their tax efficiency. It is one of the few robo-advisors that employs glide paths to gradually

make client portfolios more conservative over time. Its Core portfolio series offers a mix of low-cost ETFs

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 11 of 51

with exposure to major asset classes, such as U.S. stocks, developed- and emerging-markets non-U.S.

equities, investment-grade bonds, world bonds, and Treasury Inflation-Protected Securities. Betterment

tilts its U.S. equity portfolio toward value and smaller-cap stocks to generate higher expected returns. It

offers a growth-tilted companion series dubbed Innovative Technology, but the series overlaps with

Betterment's Core series, and it shows the firm's penchant for marketing to younger investors.

Bette

rment also offers target income, smart-beta, and sustainability-focused portfolios. In 2022, it added

four flavors of cryptocurrency portfolios—Universe, Sustainable, Metaverse, and Decentralized

Finance—for 1.0%, or 1.15% for Premium, 4 times the firm's general fee. It recommends investors put no

more than 5% of their total wealth in crypto.

Bette

rment’s disclosure hasn't been completely transparent, though. The SEC fined the firm $9 million in

April 2023 for not disclosing tax-loss-harvesting program changes and coding errors that cost about

25,000 clients a combined $4 million from 2016 through 2019. A long-running error in a robo's algorithms

is concerning, as is the lack of disclosure here.

Stil

l, Betterment offers robust core investment and financial planning options at reasonable costs, and

its website gives investors who want in-depth research and methodology documents plenty to read

before they invest. It's a strong competitor, especially for investors looking for a clean, easy-to-use

interface.

Citi W

ealth Builder | Below Average

Citi Wealth Builder's limited range of planning-related services and uncertainty owing to a recent

leadership change make it a less competitive player in the space.

The leadership change occurred on March 30, 2023, when Citigroup hired Andy Sieg to head its global

wealth arm. Sieg had been heading up Bank of America's Merrill Wealth Management unit. At Citi, Sieg

inherits an offering with a less-robust portfolio construction approach than its best-in-class rivals. Clients

must have a Citibank checking account to access the digital platform, which offers three categories of

portfolios—index, sustainability, and active—each with five risk tiers. Citi Investment Management runs

the ESG and active portfolios with its own models. In April 2023, Citi said it would bring the index

portfolios that Invesco had managed in-house. Each portfolio will continue to invest in a mix of stocks,

bonds, and short-term investments, depending on the client’s risk tolerance and time horizon, but Citi

doesn't disclose much else about its asset-allocation process or the funds it uses. Consequently, it gets a

score of 1 for portfolio construction.

On th

e positive side, Citi's flat advisory fee has dropped 30 basis points to 0.25%, the median of robo-

advisors we surveyed. Citi, however, removed fee waivers on the underlying strategies, which could

increase the offering's overall cost.

Despite the competitive fee, Citi's range of services is subpar. Clients can contact a coach at any point,

but the platform does not advertise financial planning capabilities and seems more service- than advice-

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 12 of 51

focused. Citi promotes its coaches as contacts for client questions about the program, site operations,

technical support, and limited education and informational materials, but they don't provide investment

advice.

Citi’s services fall short in other ways. It does not offer tax-loss harvesting, for example. Like other bank-

offered robo-advisors, Citi Wealth Builder is a small part of its institution's wealth management arm and

another way to get clients in the door for more profitable services.

Empower Personal Wealth/Personal Capital | Below Average

Formerly the financial technology upstart Personal Capital, Empower Personal Wealth is now ensconced

in a North American insurance and asset-management conglomerate. Though it arguably helped create

the category, Empower opted out of our survey because it does not consider itself a robo-advisor but

rather a comprehensive wealth manager that uses digital tools to reach and serve the mass affluent. The

digital component of its services, which any investor can access online, makes it a hybrid offering that

falls within this report's scope. Based on what can be gleaned from public disclosures, though,

Empower's relatively high fees result in a Below Average assessment.

The firm helped create robo-advisors through entrepreneurs with connections to successful startups like

PayPal. They founded Personal Capital in 2010 as a digital financial planner and investment manager. It

eventually offered planning, budgeting, retirement, college savings, tax, and investing tools. Its Personal

Capital Dashboard became popular with younger savers and investors, especially acolytes of the

financial independence retire early, or FIRE, movement, whose adherents practice rigid frugality so they

can quit working while still young. Now known as the Empower Personal Dashboard, the service still lets

users track their spending, savings, checking, investment, and other accounts in one place and suggests

potential tweaks.

The firm’s status as an independent disruptor changed in 2020 when Montreal-based holding company

Power Corporation added Personal Capital to its collection of businesses, which include Great-West

Lifeco. By April 2023, Personal Capital moved its headquarters, changed its name, replaced its

leadership, and merged with Power subsidiary Empower Annuity Insurance Company of America. In

many ways, it is a brand-new company.

Empower Personal Wealth provides a comprehensive range of services, albeit for a steep fee. Those with

less than $250,000 in assets can expect more basic options—essentially ETF portfolios based on client

goals and risk tolerance; those with $250,000 to $1 million get more comprehensive advice, including a

dedicated certified financial planner and more customized portfolios that include individual securities; at

higher levels the firm layers in private banking and estate planning; individuals and families with more

than $5 million can invest in private equity.

This is a wide range of services, but it comes at a cost: 0.89% for accounts smaller than $1 million. The

annual levy declines with asset size, but no further than 0.49% for balances of more than $10 million,

which is still above average. Though smaller investors who accumulate enough money to walk away

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 13 of 51

from the grind early may still find Empower's tools useful, the $100,000 minimum threshold for its

investment services means this offering is not for economic underdogs.

That said, Empower's strengths extend beyond its tools. It has an experienced investment team that

uses mostly low-cost ETFs. It can also use the size of its parent company to deepen and expand its

services or pass on economies of scale to its users. However, lower fees and more clarity on how it

builds portfolios and navigates potential conflicts of interest within the Power empire would help this

digital advisor's cause.

E-Trade Core Portfolios | Below Average

E-Trade's investment management and tech teams are streamlining their offering and pulling in

resources from new overseer Morgan Stanley, but it needs to do more to be a compelling service.

Since Morgan Stanley acquired E-Trade in February 2020, E-Trade has discontinued some of its legacy

products and services while preparing new research and advisement capabilities from Morgan Stanley

Wealth Management. What hasn't changed is its overall 0.30% advisory fee, which remains middling

and doesn't include underlying fund fees. The firm estimates that underlying fees should average

roughly 0.05% on its traditional Core Portfolios, but the SRI and Smart Beta portfolios cost more.

Additionally, though E-Trade allows nonclients to see the overall asset allocations in recommended

portfolios, it does not disclose specific holdings, which would further clarify the offering's fees. This lack

of transparency also makes it difficult to ascertain the effectiveness of the firm's portfolio construction

methodology.

E-Trade now relies on Morgan Stanley's macro research capabilities for capital markets assumptions on

key asset classes, but the investment team that built the firm's portfolios, which are broadly diversified,

do not shift greatly over time, hasn’t changed. The program's asset classes seem standard, ranging from

various flavors of U.S. and non-U.S. equities to taxable and municipal bonds. It also includes

sustainability-focused holdings in the SRI portfolios and factor-based funds in the Smart Beta portfolios.

E-Trade says it employs mostly cheap, beta-focused ETFs from third-party providers, but it's hard for

potential investors to verify the claim without a full list of underlying holdings.

The portfolio assignment process is also a mixed bag. After going through a short risk questionnaire, E-

Trade assigns clients to one of six target risk portfolios, ranging from aggressive to conservative. It

makes sense for E-Trade to prevent clients from altering their portfolio assignment more than one

degree higher or lower, but it does not consider risk capacity or adjust client portfolios based on time

horizon or investing goals. E-Trade plans to add features, such as tax-loss harvesting, which Morgan

Stanley Access Investing offered before it closed to new investors in October 2022. Access Investing will

eventually merge with other managed accounts like E-Trade Core Portfolios. Even with tax-loss

harvesting, though, E-Trade lacks other compelling features, such as integrated goal planning across a

variety of internal and external accounts and a way to seek more comprehensive counsel from financial

advisors.

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 14 of 51

In fact, E-Trade has lost some features it once had. It shut its legacy hybrid robo-advisor and managed

accounts in 2021 and 2022. Morgan Stanley Wealth Management has a legion of financial advisors, but

E-Trade's offering currently does include access to this team. Despite some ad hoc access to financial

planning calls, E-Trade clients seeking more comprehensive advice must quit E-Trade and reenroll in a

Morgan Stanley Wealth Management managed account. This lack of integration is a problem, and E-

Trade still wasn't done integrating its back-office and operational systems with Morgan Stanley's as of

May 2023.

Overall, operational uncertainty, portfolio opacity, and lack of a compelling set of advice features merit a

Below Average assessment for E-Trade Core Portfolios.

Fidelity Go | Above Average

Fidelity Go stands out for its simple but effective approach, which draws on Fidelity's strong global

research and asset-allocation team. Many key executives within the Fidelity Strategic Advisors unit

overseeing this program have spent at least 15 to 20 years with the firm. Fidelity Go is free for accounts

with balances up to $25,000. Accounts above that level pay 0.35% annually, which automatically entitles

the investor to unlimited one-on-one coaching calls with a Fidelity advisor. Before 2022, such coaching

was only available to participants who opted into Fidelity Personalized Planning & Advice, a separate

premium service that has since been merged into Fidelity Go.

The program starts with a relatively thorough risk-tolerance questionnaire. Questions cover the investor's

investment goals, time horizon, household income, risk tolerance, investment experience, investment

knowledge, reaction to falling markets, emergency fund, spending as a percentage of income, likelihood

of unexpected future expenses, household financial situation including job security, and value of total

assets. Fidelity then uses this information to map investors to a taxable or retirement-oriented portfolio,

with each spanning seven different risk levels. The portfolios all focus on a short list of core asset

classes, such as U.S. stocks, international stocks, and intermediate core bonds; esoteric asset classes or

ESG-focused strategies aren't part of the offer.

Fidelity Go's 0% investment advisory fee for low balances makes it a compelling option for smaller

investors. The plan invests in a streamlined list of zero-expense-ratio Fidelity Flex funds, which keeps

total costs below average even for higher-balance participants who pay the 0.35% management fee.

The program also offers ongoing support. Text alerts and other communications let customers know how

they are progressing with their goals, as well as providing behavioral nudges to encourage long-term

investing. However, Fidelity Go does not currently offer tax-loss harvesting.

All Fidelity Go participants have access to tools for spending and debt management, while those with

balances above $25,000 also get unlimited advice and planning calls. Users can choose from a menu of

coaching solutions focused on different topics, including retirement planning and budgeting. In contrast

to Betterment and Schwab, not all of Fidelity Go's financial advisors hold the CFP designation, though

most do.

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 15 of 51

Marcus Invest | Below Average

Lowering fees was a plus, but Marcus Invest's transparency is an issue, and Goldman Sachs' early 2023

retreat from its consumer business leaves this offering well behind most competitors.

After

falling 10 basis points in late 2022, Marcus Invest's 0.25% advisory fee is now in line with the

median of robo-advisors we surveyed. However, the firm also stopped offering a rebate to investors with

Goldman Sachs ETFs in their portfolios, which partially offsets the fee savings for some investors.

Clie

nts choose from three investment styles: Core, ESG, and Smart Beta. The styles share asset-class

allocations but use different ETFs to populate their portfolios. Established Goldman Sachs teams, such as

the Investment Strategy Group and Alternative Investments and Manager Selection, design and execute

the portfolios, which vary in increments of 10 percentage points from 100% fixed income to 100% equity.

The program bases portfolio selection on investors' stated investment time horizons and risk tolerances.

Once they receive a recommended portfolio, investors can choose that portfolio or one directly above or

below it on the risk spectrum. They can also opt to start over again for a new recommendation.

Mar

cus Invest lacks features like financial planning advice and tax-loss harvesting that come with top

robo-advisors, but poor portfolio transparency and the offering's viability are larger concerns. Goldman

doesn’t share allocation information with nonclients, which leaves would-be investors in the dark on

issues such as how much may be allocated to emerging markets in different portfolios. Further, when

Goldman splintered its consumer business in October 2022, it announced a strategic pivot away from its

Marcus platform. Then, in February 2023, the firm said it would sell part of its personal loan book. Robo-

advice appears safe for now, but the retreat from a consumer-focused business raises uncertainty here.

Merr

ill Guided Investing | Below Average

Merrill Guided Investing, or MGI, and its premium cousin Merrill Guided Investing with Advisor, or MGIA.

seem like afterthoughts within Bank of America Merrill Lynch's wealth management empire and merit a

Below Average assessment.

Lau

nched in 2017, MGI is a pricey bridge between Bank of America Merrill Lynch's self-directed

investing platform and its financial advisors. MGI's 0.45% advisory fee is hefty as is MGIA's 0.85% levy,

which adds a team of financial consultants and access to hybrid active/passive portfolios. Granted, as

members of the bank's Preferred Rewards program accrue assets, fees can drop to 0.30% and 0.70%,

respectively, assuming a balance of at least $100,000. Still, clients with $20,000 or less pay the full

advisory fee. As for underlying fund charges, since Merrill doesn't offer funds of its own, it primarily uses

cheap third-party ETFs. However, the fund options become more expensive in the sustainability-focused

portfolios and higher still for active options in the hybrid portfolios.

Por

tfolio construction is fairly standard, with five risk-tolerance levels across a handful of portfolio types.

Clients in MGI have access to both taxable and tax-aware core portfolios, which consist of low-cost

passive ETFs (the tax-aware version substitutes munis for taxable bonds), and a taxable-only

sustainability-focused passive offering that tilts toward holdings with better environmental, social, and

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 16 of 51

governance scores. MGI has a $1,000 investment limit but puts clients with less than $5,000 into a

"strategic" version of one of these three portfolios, which employ one ETF per broad asset class,

including U.S. and non-U.S. equity, and bonds.

MGIA offers the same suite of portfolios (without the simplified Strategic Asset Allocation option). It also

grants access to hybrid active/passive versions of the three taxable, tax-aware, and sustainability

portfolios. Investors can see the asset-allocation details of these hybrid MGI portfolios without signing

up for the service but not the recommended active options themselves, which makes it difficult to

recommend the portfolios.

Merrill's short risk-tolerance questionnaire also could also be improved. Clients can gauge the likelihood

of achieving a set goal over timelines they provide while signing up, but MGI does not consider a client's

risk capacity, and an account’s funding level seems to play an undue role in the asset-allocation process.

Merrill's relatively active asset-allocation approach is unique. A large veteran team oversees macro

research, asset allocation, and manager selection for both simple passive ETFs and complex active

strategies. Through a series of investment subcommittees, team members determine both a set of

infrequently updated Strategic Asset Allocation targets, which represent broad weightings to equities

and bonds, and Tactical Asset Allocation targets. Team members update the latter at least quarterly,

though in practice more frequently. Shifts can be as minor as adjusting allocations between developed-

and emerging-markets non-U.S. equities or as major as adding a subasset class. The results of Merrill's

asset-allocation approach don't stand out, however. Composite returns provided for each target

allocation don't show an edge. The firm's historic preference for value stocks over growth stocks and

late-2022 decision to diversify across fixed income have not led to a significant net-of-fees performance

advantage versus asset-class benchmarks.

The platform's dearth of additional features is noteworthy given its relatively lofty fees and lack of

integration with Bank of America's more extensive, and impressive, research and educational offerings

on its brokerage platform. When setting goals, MGI's software suggests time horizon and contribution

changes if Monte Carlo simulations project a low probability of success. Yet, it doesn't provide more

extensive advice if it looks like clients won't hit their goals, nor does it provide tailored advice toward

achieving multiple goals. Tax-loss harvesting capabilities or integration of external accounts are absent.

MGIA also provides only access only to Series 6 and Series 7 certified "financial consultants" rather than

CFP-certified advisors. Clients who want access to CFPs must unenroll from this program and reenroll in

one of Merrill’s more extensive managed account or advisory relationship offerings.

Schwab Intelligent Portfolios/Schwab Intelligent Portfolios Premium | Above Average

Schwab's robo-advisor program narrowly misses greatness because of one fatal flaw.

Schwab Intelligent Portfolios—especially with the addition of the Premium service—comes closer than

most of its peers to matching the value-add of a human financial planner. The program's comprehensive

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 17 of 51

financial planning services include advice on mortgages, college savings, retirement savings, retirement

income, and budgeting. Unlimited one-on-one guidance from a CFP professional is also available.

That makes Schwab one of the most compelling robo-advisors, with only Betterment and Vanguard

providing a similar range of financial planning tools and advice. Schwab's pricing is relatively attractive,

especially for higher account values. After paying a one-time $300 planning fee for the first year, an

investor with a $200,000 account would pay just $360 annually for Schwab's Premium account offering,

compared with $800 for Betterment, $700 for Fidelity Go, and $600 for Vanguard Personal Advisor

Services.

Schwab's portfolio construction process is also above average. It uses an extensive risk-tolerance

questionnaire to match investors with a portfolio designed for one of 12 risk levels. The portfolios

provide comprehensive asset-class exposure, including large- and small-cap stocks in the U.S. and

international markets, gold, TIPS, REITs, corporates, mortgages, Treasuries, high-yield bonds, municipal

bonds, world bonds, and emerging-markets debt. The quality of the underlying investment offerings is

solid, and Schwab takes a well-considered, research-based approach to portfolio construction. The firm

is also thoughtful about rebalancing and tax management.

Excessive cash allocations are an Achilles' heel, however. They range from 6% to 30% of assets

depending on the portfolio's risk level, which is a significant drag on returns for clients. Schwab's Total

Return Taxable Portfolio—8, which held about 63.8% of assets in stocks, 25.3% in bonds, and 8.9% in

cash at year-end 2022 is a case in point. The cash buffer helped it lose roughly 1 percentage point less

than the moderate allocation Morningstar Category average (negative 12.67% versus negative 13.84%)

during 2022’s bear market. But over the trailing five-year period through March 31, 2023, the Schwab

portfolio lagged that category norm by 1.9 percentage points per year, on average.

Even now that cash yields have topped 5% as of early June 2023 (and Schwab took the positive step of

linking the monthly yield on customers’ cash balances to Schwab Government Money Fund SWGXX),

above-average cash allocations will probably be a negative over longer periods. Schwab, meanwhile,

has an incentive to park customers' assets in its proprietary deposit accounts. Schwab paid $187 million

in settlements and fees for its previous disclosure practices related to its use of cash.

Even with this flaw, Schwab still ranks among the best robo-advisor options, especially for investors with

enough assets to benefit from its comprehensive advice on financial planning and retirement income.

SigFig | Average

SigFig is a lean offering that checks a lot of the right boxes for a robo-advisor, though it doesn't possess

the same scale of resources as some competitors.

Following its 2006 launch as an online forum for sharing investment ideas, what was then called

Wikinvest pioneered features now common among robo-advisors. After pivoting toward automated

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 18 of 51

investment advice in 2011, the firm curated a group of financial advisors to provide in-person

consultations. It also introduced tax-advantaged and taxable portfolios as well as tax-loss harvesting.

SigFig's management fee remains competitive. The program is free for accounts with less than $10,000

and charges 0.25% for accounts at and above that size. It uses low-cost ETFs for its portfolios (the ETFs

differ depending on which custodian the customer chooses for the account) but does not waive or return

fees on these holdings.

SigFig's portfolio construction approach is simple but sensible. Allocations are strategic and updated

periodically, depending on the market environment and SigFig's capital markets assumptions. Those

allocations are generally reasonable, with equity weightings for taxable portfolios ranging from 26% to

90% of assets, depending on the risk level, and 13% to 85% for tax-advantaged portfolios. Regardless of

risk tolerance, however, all the tax-deferred portfolios allocate at least 7% of assets to emerging-markets

debt, which seems aggressive, as well as 5% to REITs. In addition, the portfolios rely on one broad index

for U.S. stock exposure, with no granularity for separate style or market-cap allocations.

The firm's executive team appears well-resourced, although a few senior leaders have left in recent

years. Chief investment officer Terry Banet, who joined in 2011, has extensive experience from

investment research and asset-allocation roles at J.P. Morgan and elsewhere. The firm's size peaked in

2019, however, and appears to have shrunk significantly since.

The service has some weaknesses. It does not provide advice for multiple investment goals and lacks

more dedicated educational resources that could help clients make SigFig their one-stop shop. In

addition, the privately held firm's focus on partnering with larger corporations like UBS and Wells Fargo

raises questions about whether it will remain a stand-alone robo-advisor. Several stand-alone robo-

advisor firms have been acquired in recent years, and SigFig's small size and limited revenue base could

make it a more likely acquisition target than some of its peers.

SoFi Wealth | Average

SoFi clients can start a robo-advisor account with as little as $1 and talk with a financial planner at no

additional cost. While those attributes are attractive, the service has some questionable features that

lessen its appeal.

Originally a student loan refinancing service, SoFi has expanded into personal loans, mortgages, banking

services, and insurance. The company launched SoFi Automated Investing in 2017. SoFi's business

strategy relies on retaining clients in its ecosystem of personal finance products. The company calls this

the "Financial Services Productivity Loop," which emphasizes monetization through cross-selling as

much as serving investment needs. As a publicly traded firm since June 1, 2021, SoFi is now under

pressure to generate earnings, but it has lost a total of $1.5 billion since 2018. That raises concerns

about SoFi's client acquisition strategy in comparison to loss-leader approaches used by profitable firms

like Fidelity.

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 19 of 51

Despite its losses, SoFi has been waiving the 0.19% annual fees for the proprietary ETFs it uses as the

main equity exposure in clients' portfolios. This is likely an asset-gathering strategy for the two ETFs,

which have around $500 million in assets combined. Should those waivers expire, the ETFs' expense

ratios would no longer be in line with SoFi’s low-cost aims.

These two SoFi ETFs also have an inherent growth bias that might not be suitable for a core equity

allocation. While SoFi does offer five different equity/fixed-income allocations, depending on client risk

tolerance, the growth-leaning ETFs still account for two thirds of the equity exposure. The portfolios also

tilt more toward U.S. stocks than broad global benchmarks. These two biases have enhanced back-

tested results that SoFi marketing material has used to promote its offer's performance versus a blended

benchmark that also includes a 0.48% management fee, even though benchmark-tracking passive

options are available for a fraction of that fee.

SoFi offers clients access to financial advisors by phone, virtual meetings, and electronic messages at no

extra charge. SoFi's advisors must have Series 65 licenses and either have the CFP designation or be

actively working toward it. SoFi also provides an online library of articles on a broad range of topics

including goals, saving, investing, budgeting, debt repayment, home buying, and insurance. These

articles might double as marketing for its various personal finance services, though.

Titan | Low

Despite making several improvements, Titan remains aggressive, narrowly focused, and unproven; it

remains the least attractive robo-advisor among those evaluated.

Pricing is better. Titan eliminated a monthly fee for accounts with less than $10,000 and dropped its flat

1% asset-based charge for accounts with $10,000 or more in favor of a tiered, asset-based levy ranging

from 70 to 90 basis points, depending on asset size. When it rolled out stock and bond ETF portfolios in

2023, it also chose not to charge a management fee on top of those of the underlying funds, which

dropped the blended fee for a $15,000 account to 0.495%.

Titan's charges remain above average, however, and the underlying fees of some of the strategies in its

client portfolios are very high. Titan styles itself as a lower-cost wealth manager for younger, tech-savvy,

up-and-coming investors who still cannot afford a private banker, but it is far from a low-cost option.

Increased diversification is laudable. The firm added broad stock and bond strategies to the mix of

options it uses as building blocks for clients. Sample portfolios provided to Morningstar now rest on a

foundation of cheap, diversified equity and fixed-income ETFs. Client portfolios had previously included

only Titan's in-house concentrated equity and cryptocurrency accounts and a handful of third-party,

closed-end funds.

Those problematic options remain, though. The external closed-end funds invest in esoteric asset

classes, such as private credit and venture capital, that most investors do not need and would not miss.

Meanwhile, Titan's in-house strategies have mixed records, at best, and are concentrated and risky. Its

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 20 of 51

three equity strategies invest in 15 to 25 stocks each, with Flagship focusing on U.S. large caps,

Opportunities on U.S. small- and mid-caps, and Offshore on non-U.S. companies. Titan Crypto has

simplified its strategy—from shifting among five to 10 digital currencies to holding equal weights of

bitcoin and ethereum and rebalancing quarterly—but it remains wildly volatile, vaulting 58% in 2023's

first three months after dropping more than 72% throughout 2022.

Titan plans to develop its services further, but it is not a holistic planner. It does not provide tax advice or

manage its portfolios to minimize tax consequences, which means rebalancing portfolio allocations

among its volatile equity and crypto strategies can result in big tax bills for taxable clients. Titan uses

client information to place them in aggressive, moderate, or conservative portfolios. It tries to hedge its

in-house strategies: 0%, 5%, and 10%, respectively, when not in a market downturn, and 5%, 10%, and

20% during one. Titan uses technical signals to differentiate a hedge-worthy downturn from normal

volatility, a notorious challenge even for investors who are not also trying to build and run a digital

wealth management platform.

Titan's in-house active management team continues to lack depth and experience. The five-member

squad averages fewer than three years with Titan and nine in the investment industry. The firm's chief

investment officer and most senior investment team member Clayton Gardner just hit 10 years of

industry experience in July 2022 and serves as co-CEO and co-founder.

Titan has made strides, and it provides younger investors who have smaller account balances access to

asset classes that are usually the reserve of older and more well-heeled clients. But compared with

other robo-advisors, its fees are not competitive, its portfolios aggressive, and its advice offering a work

in progress.

UBS Advice Advantage | Below Average

UBS has been busy lately, but its Advice Advantage program doesn't seem like a priority.

UBS' priorities shifted with its March 2023 acquisition of Credit Suisse and then shifted further with

Sergio Ermotti’s April 2023 return as CEO, a role he held from 2011 to 2020. Ermotti, who will oversee

the Credit Suisse integration, has a different approach to the future of wealth management than his

predecessor at UBS, Ralph Hamers. Ermotti wants to focus on the rich and avoid going downstream to

bring in new clients, while Hamers emphasized mass-oriented digital offerings like the Advice

Advantage program and well-respected competitor Wealthfront, which UBS tried to acquire in early

2022. But that acquisition fell through in September 2022, and since then it has not been clear how

Advice Advantage fits into UBS' plans, especially given Ermotti's priorities.

Meanwhile, hefty costs and poor transparency remain significant negatives for UBS Advice Advantage.

The program's 0.75% annual fee makes it among the priciest robo-advisors, and those fees are in

addition to underlying fund expense ratios, which are difficult to determine because UBS does not

disclose the funds it uses. Although UBS halved its account minimum to $5,000, it is still less accessible

than some competitors.

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 21 of 51

UBS Advice Advantage leverages SigFig's algorithm, as it has since the program’s 2018 debut. It offers

investment advice, custody, trading/execution, and performance reporting. Investors can choose from

five different portfolio risk levels based on a standard risk-tolerance questionnaire. UBS develops and

maintains the model portfolios while using the algorithm for ongoing monitoring, rebalancing, and tax-

loss harvesting. UBS portfolio allocations draw from its capital markets assumptions and related

strategic asset allocations as well as covariance estimates. However, key executives listed in Form ADV

are all part of UBS' larger Wealth Management platform, so it is unclear whether this program has a

dedicated investment management team. In addition, UBS' lack of transparency extends not just to the

funds it uses but to the asset classes themselves.

UBS Advice Advantage includes access to financial advisors as well as portfolio diagnostics, which

incorporate outside holdings. It seems to play a secondary role within UBS' larger universe, though.

With

a disappointing amount of publicly available information, no details disclosed about underlying

funds, and its viability in question, this offering deserves little credit.

U.S.

Bancorp | Average

U.S. Bancorp Automated Investor is a straightforward offering that delivers on its simple promises.

U.S.

Bancorp launched Automated Investor in 2018 and lowered the minimum investment from $5,000

to $1,000 in 2021 as part of a product revamp. The service charges a flat fee of 0.24%, lower than the

average annual fee from surveyed providers. A matrix of three major goals and five risk levels sorts client

portfolios into varying allocations of global equity and U.S. fixed-income ETFs, which is adequately

granular.

Well-constructed portfolios stand out as the service's strong point. The service automatically applies

glide paths for clients with a retirement or major purchase goal, a useful yet still rare feature among

other providers. This scales down the portfolio's equity exposure as the end date approaches to limit risk

and maximize capital preservation. The underlying funds consist of low-cost, third-party ETFs tracking

sensible indexes, which provide access to a standard range of asset classes. The nontaxable portfolio

holds a diversified mix of large- and mid-cap U.S. equity, real estate, developed- and emerging-markets

equity, alongside core and high-yield U.S. bonds. The tax-efficient version swaps the core bond exposure

for a broad municipal-bond ETF. U.S. Bancorp does not put clients' assets in any gimmicky products or

niche market areas, in line with its long-term, goal-oriented investment philosophy.

A third-party trading algorithm automatically rebalances the portfolios and harvests losses for taxable

accounts. Tax-loss harvesting capabilities notwithstanding, U.S. Bancorp lacks core features such as

retirement withdrawal advice or outside account aggregation that prevent it from being a one-stop shop

for clients. Its simple three-question risk assessment could also use improvement.

The service is currently only available to existing U.S. Bank customers, though the firm plans to open the

platform to nonbank customers soon, likely as part of an effort from parent U.S. Bancorp to branch out to

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 22 of 51

lower-net-worth clients. Despite well-publicized turmoil in regional banks earlier this year, U.S.

Bancorp's stable market position as the fifth-largest U.S. bank has shielded it from severe stress thus far.

Vanguard Digital Advisor/Vanguard Personal Advisor Services | High

Vanguard Digital Advisor, or VDA, and its hybrid sibling Vanguard Personal Advisor Services, or PAS,

which combines automation with human expertise, once again earn the top spot among robo-advisors

we surveyed. In fact, Vanguard has extended its lead through multiple enhancements, with only an

uncharacteristic pricing misstep keeping it from a perfect score.

Vanguard has been in the advice business since 1996, but it did not move into discretionary asset

management until the respective May 2015 and May 2020 launches of PAS and VDA. Aiming to

transform advice in the same way its retail indexing business revolutionized investment management,

Vanguard has spent heavily on both services through hiring personnel, increasing choice among

investment strategies, and adding capabilities. In recent years, Vanguard has introduced ESG options,

active equity and fixed-income funds, and a municipal-bond strategy. Tax-loss harvesting is now

available to all advice clients, who also benefit from tax-efficient implementation, including a completion

methodology that tailors exposures around 90 existing Vanguard strategies so investors transitioning to

VDA can avoid realizing capital gains on existing holdings.

The core of VDA, however, remains its four broadly diversified passive ETFs focusing on U.S. and non-

U.S. stocks and U.S. and non-U.S. bonds along with a portfolio construction approach that combines

relative simplicity with customization. Using those ETFs, or similar exposures crafted from Vanguard’s

advice-eligible investment options, VDA draws on the Vanguard Life-Cycle Investing Model to create

more than 300 glide paths based on an investor's age, goals, and risk tolerance. The risk-tolerance

assessment uses third-party Capital Preferences' well-researched scenarios. VDA then evaluates

portfolios daily and rebalances when any asset class is off target by more than 5 percentage points. The

glide paths are updated annually as model inputs change.

VDA and PAS have evolved into an ecosystem of advice, united by a common investment philosophy,

similar if not identical investment strategy building blocks, and low costs. Where they differ is in the

degree of customization and suite of services available. Clients with at least $3,000 can enter the digital-

only version of that ecosystem, VDA, for as little as 0.20% per year (including underlying fund fees) and

utilize an impressive array of planning tools, including outside account aggregation, custom goal

planning, debt planning, a rainy day tool, healthcare estimator, and Medicare match. Clients with at

least $50,000 can opt for the hybrid PAS service for a 0.30% annual advisory fee (not including

underlying fund fees) and have unlimited access to a pool of CFPs, who can further customize their

portfolios around non-Vanguard fund holdings and individual stock ownership. At $500,000, clients

receive a dedicated CFP who touches base at least twice a year. Clients with more than $5 million have

access to a private equity option and estate planning and trust services, all for declining fees that drop

to 0.20% for assets exceeding $5 million to $10 million, 0.10% for the next $15 million, and 0.05% for

assets above $25 million.

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 23 of 51

The pricing misstep affected Vanguard's Provider score as it involves the "Invest for Amex by Vanguard"

partnership. Although that partnership has become more attractive since its April 2022 debut by

dropping its investment minimum to $3,000 from $10,000, for example, its gross advisory fee remains 30

basis points higher than that of Vanguard's in-house offering. American Express reward points, which

begin tallying once an account has $50,000, may make up for some of that difference but not all of it.

More problematic still, the partnership’s additional fees run counter to Vanguard’s generally rock-solid

commitment to keeping costs low and avoiding layered fees. Indeed, from 2021 to 2022 Vanguard's non-

U.S. fund business returned $125 billion in assets to their institutional owners because those institutions

had been acting as intermediaries in layering on fees that hurt end investors.

Overall, though, Vanguard continues to set the standard for low-cost digital financial advice.

Wealth

front | Above Average

Wealthfront has considerable merits, but strategic shifts and questionable allocations hold it back.

The merits start with competitive fees. Its 0.25% annual advisory charge matches the median of robo-

advisors we survey while the expense ratios for most of the underlying funds used in the portfolios are

reasonable. The quality of the underlying funds is also generally strong; most of them receive

Morningstar Medalist Ratings of Gold or Silver. The program includes a thorough questionnaire that

incorporates behavioral economics research to evaluate both risk tolerance (an investor’s subjective

willingness to take risk) and risk capacity (their objective ability to take risk given their financial assets

and other resources).

Wea

lthfront uses the responses to slot investors into a portfolio matching one of 20 risk levels spanning

three account types: taxable, retirement, and socially responsible investing. Customers also have access

to financial planning tools, though not to human financial advisors, for spending, savings, income,

inflation, Social Security, taxes, college planning, and home equity. The website includes information on

a wide range of planning-related questions, as well as numerous methodology papers and performance

disclosures.

In addition, Wealthfront has one of the best user interfaces we’ve seen. The program’s goal-centric

approach is specifically designed to help investors focus on the long term. Investors can set multiple

goals and experiment with various assumptions to see if they're on track or not. Wealthfront also takes a

more precise approach to tax-loss harvesting that incorporates direct indexing, which enables it to

harvest losses at the individual stock level. It embraces a "play-to-learn" philosophy that lets investors

buy and sell individual stocks, but still encourages them to build diversified portfolios.

Stil

l, popular but not necessarily prudent investment trends seem to drive some of Wealthfront's

strategic decisions. Many of its portfolios are on the aggressive side; for example, its retirement

portfolios allocate up to 19% to emerging-markets stocks, 15% to real estate, and 10% to emerging-

markets debt. It previously opted investors into a risk parity strategy that ranked in the global allocation

Morningstar Category's bottom 2% for the trailing five-year period through May 2023. Wealthfront also

Reprinted by permission of Morningstar, August 2023

2023 Robo-Advisor Landscape | 22 July 2023 | See Important Disclosures at the end of this report.

Page 24 of 51

allows investors to invest up to 10% of their assets in cryptocurrency through Grayscale Bitcoin Trust

GBTC and/or Grayscale Ethereum Trust ETHE, which are high-cost vehicles whose grantor trust structure

leads to significant performance divergences from the benchmark. Finally, Wealthfront had previously

agreed to be acquired by Swiss banking giant UBS, but the two firms have now mutually agreed to

terminate their merger agreement.

Ove

rall, though, there are more positives than negatives here.

Wel

ls Fargo Intuitive Investor | Average

Wells Fargo Intuitive Investor's recent improvements aside, it remains a middle-of-the-road offering,

though not a bad choice for existing Wells Fargo clients.

Des

igned exclusively for those who are already banking clients, the program's 0.35% asset-based fee is

10 basis points higher than the median of robo-advisors we surveyed, but the investment minimum has

fallen to $500 from $5,000 a year prior. Expense ratios for the underlying funds are between 0.07% and

0.15%, however, which partially offsets the impact of above-average fees at the program level.

Like

UBS, Wells Fargo uses SigFig's proprietary portfolio management algorithm to monitor, rebalance,

and harvest tax losses. Investors begin with a questionnaire that assesses risk tolerance, time horizons,

and specific investment objectives. Clients can move up or down one risk level from the recommended

investment objective. Suggested asset-allocation strategies include a series of nine portfolio risk levels

with a globally diversified overlay or sustainability-focused one, which Wells added over the past year.

Each portfolio comprises seven to 11 ETFs, mostly iShares ETFs and Goldman Sachs Smart Beta

products. Wells Fargo intends the portfolios to be well-diversified, cost-effective, and long-term-

oriented, thanks to an investment philosophy that shies away from niche products. Portfolio allocations

are reasonable, with minimal cash allocations and adequate exposure to major asset classes. In addition,

portfolio transparency has moderately improved.

The

breadth of services is average. Access to a financial advisor at no cost and tax-loss harvesting are