1

Tuition

Remission

BENEFIT POLICY

The George Washington University

2

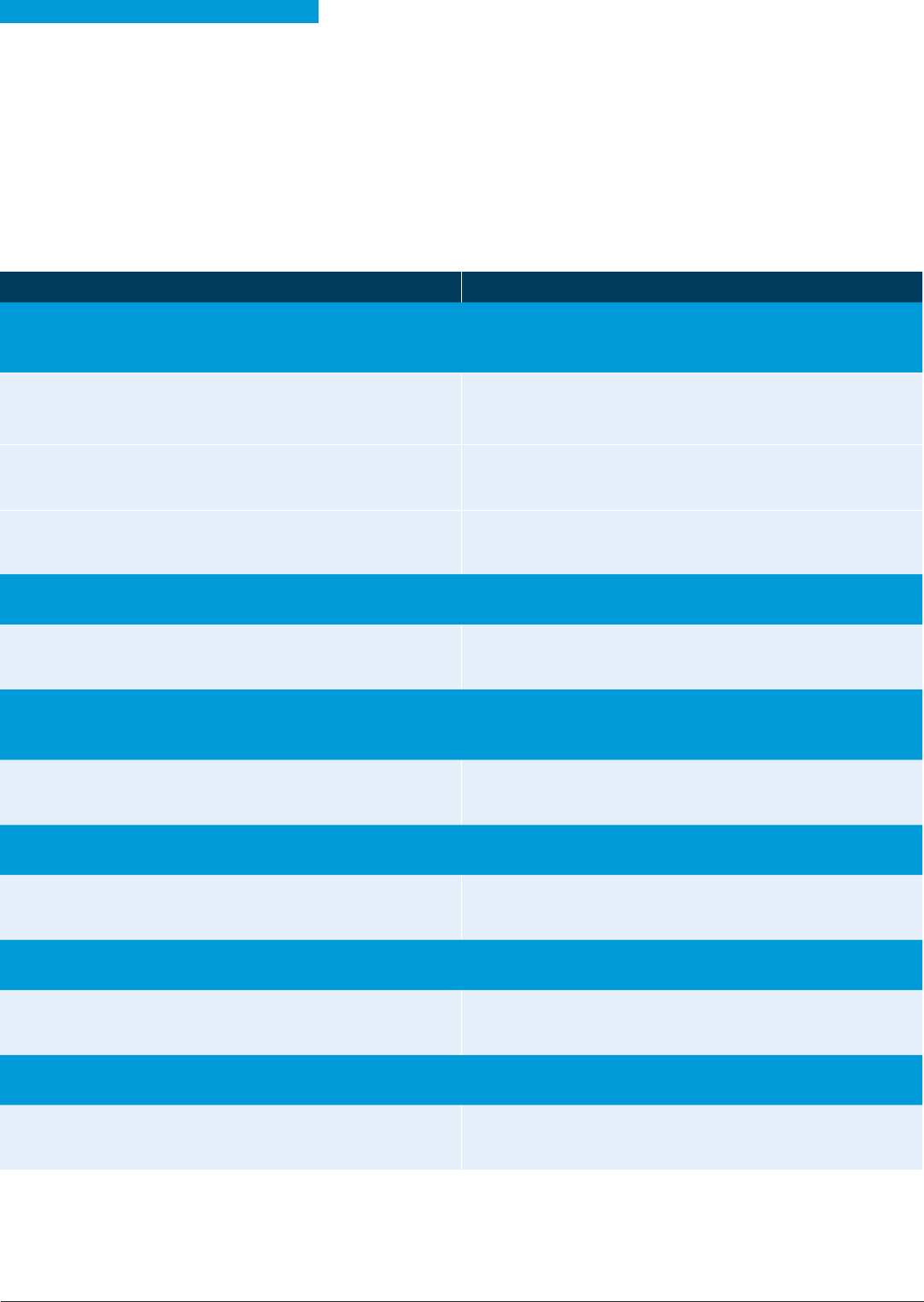

Contents

3 Introduction

4

Exclusions and Limitations

5

6

5 - 6

Eligibility

7 Full-Time Coverage

7 Employee

8 Dependents (Spouse/Domestic Partner/Children)

10 Part-Time Coverage

10 Employee

11 Dependents (Spouse/Domestic Partner/Children)

13 Tax Obligation

14 How to Apply

15 Deadlines

15 Adding and Dropping Courses/Withdrawals

16 Change in Employment Status and Loss of Eligibility

16 Employment Status Change

16 Termination

17 Leave of Absence

17 Rehired Employees

18 Retirement/Retirees

18

Survivors of Deceased Employees/Retirees

19 Glossary

20 Contact Information

TUITION REMISSION BENEFIT POLICY GW BENEFITS

Updated March 10, 2022

Employee

Dependents (Spouse/Domestic Partner/Children)

TUITION REMISSION BENEFIT POLICYGW BENEFITS

3

”When you have an education,

almost anything is possible.”

- President LeBlanc

Our “people-first” culture includes providing employees with opportunities for continuous

development. One of the most important and “Only-at-GW” benefits the university can provide is

access to our world-class courses and degree programs.

Through the tuition remission benefit, GW extends its educational resources to our employees and

their dependents. The benefit provides competitive, accessible and valuable tuition benefits to

those who seek to further develop themselves, both personally and professionally.

Please note: This Policy does not constitute a contract between employees and GW. The university reserves the right to

amend, modify or terminate the benefits contained in this Policy, at any time. Furthermore, eligibility for tuition remission

does not guarantee admission or continued enrollment. Like all students, those who receive tuition remission benefits are

subject to all academic and non-academic policies and requirements, and for the timely payment of all charges and fees

not covered by tuition remission.

What is Tuition

Remission?

The tuition remission benefit pays a percentage of tuition costs at GW. The exact rate of

coverage relies on a number of factors, including: employee status; employee hire date;

whether the student is an employee or dependent; and the specific academic program

being pursued. The benefit is applied directly to the student’s account. The tuition benefit

does not apply to non-tuition charges, such as room, board, fees or financial penalties.

The tuition remission benefit policy follows the university’s academic calendar when

determining semester start and end dates. To review semester dates, visit https://www.gwu.

edu/academic-calendar. For more information on how to apply for the tuition remission

benefit, please see page 14.

GW manages its Tuition

Remission Benefit Policy in

accordance with Internal

Revenue Service (IRS)

regulations. While tuition

remission benefits at the

undergraduate level are

generally not taxable,

graduate tuition remission

is subject to Federal,

State, Social Security and

Medicare withholding

taxes. For more information,

please see page 13.

GW BENEFITSTUITION REMISSION BENEFIT POLICY

4

Exclusions

and Limitations

The tuition remission benefit policy applies only to courses and programs offered at and billed directly by GW and not through a third party

provider. In addition, certain programs are excluded from the tuition remission policy, including:

• Executive Programs

• M.D. degree within the Medical School

• Consortium programs in affiliation with other universities

• GW Pre-College programs

• Certificate and certification programs that are fee based and/or not offered or billed by GW

The Tuition Remission Benefit Policy applies only to courses and programs offered at and billed directly by GW.

This list is not exhaustive and is subject to change. An up-to-date full list of programs and courses ineligible for tuition remission is available at

benefits.gwu.edu/tuition-remission.

Please note: Benefits for law degree courses at the GW Law school will be remitted at the graduate level.

Class Attendance

The privilege of class attendance (online and classroom) is limited to time apart from normal working hours. Work schedule

accommodations for the purpose of class attendance require authorization from the employee’s manager.

Course Eligibility

Courses, certificates and certifications that are fee based, outsourced or have a shared revenue component with a third party (e.g., courses

and programs offered by or billed by 2U, Colloquy and EMBANET) are ineligible for tuition remission coverage. Students must confirm

online course or program benefit eligibility prior to registration by providing the course code and course registration number to the

Program Administrator of the GW school offering the course or program.

TUITION REMISSION BENEFIT POLICYGW BENEFITS

5

Eligibility

Employee

Eligibility for tuition remission benefits is dependent upon the employee classifications

defi

ned below.

Tuition remission benefits for eligible faculty and staff begin the semester that

starts on or follows their date of hire.

Faculty

Full-Time Faculty

A full-time faculty member is a benefits-eligible employee who is appointed for at least one

academic year in one of the regular, specialized (e.g., research and special service faculty) or

visiting ranks listed in the Faculty Code, devotes 100 percent effort to the duties of the position and

receives a salary through the university.

Note: The full-time faculty member classification also includes partial retirees as provided in the

Faculty Code.

Part-Time Faculty

A part-time faculty member is a benefits-eligible employee who is generally appointed for one

academic year and who devotes less than 100 percent effort to the duties of the position (with the

exception of a partial retiree, as described above).

Staff

Full-Time Staff

A full-time staff member is a benefits-eligible employee who is regularly scheduled to work at least

40 hours per week.

1

Part-Time Staff

A part-time staff member is a benefits-eligible employee who is regularly scheduled to work at

least 14 but less than 40 hours per week.

Note: The tuition remission benefit policy follows the university’s academic calendar when determining

semester start and end dates. To review dates visit https://www.gwu.edu/academic-calendar.

1 Benefits-eligible employees at the GW Biostatistics Center who work 35 or more hours per week are considered full-time

staff for the purpose of the tuition remission benefit.

THOSE WHO ARE

NOT ELIGIBLE

FOR TUITION

REMISSION

• Faculty appointed on

a temporary basis (one

semester or less) or

compensated on a per-

course basis

• Federal work study

• Individuals classified as

independent contractors

• Postdoc Scholars

• Student workers

• Temporary staff

EMPLOYMENT

CLASSIFICATIONS

If

you are unsure of your

employment classification,

contact Human Resources

Business Partner.

IF YOU AND YOUR

SPOUSE AND/OR

DEPENDENT(S) ARE

EMPLOYED BY GW

Benefits-eligible

employees and their

sponsored dependents are

not permitted to receive

dual coverage by

combining their own tuition

remission benefit coverage

with that of a spouse and/

or dependent child who is

also employed in a

benefits- eligible position

at GW. In such instances,

the greater benefit

coverage will apply.

For example: A husband

and wife are part-time

benefits-eligible

employees at GW and

share a college-age child.

The husband and wife

cannot combine their part-

time child tuition remission

benefits to equal full-time

coverage. The student can

have only one sponsor.

Postdoc Associates

Postdoctoral Associate is the title given to a postdoc who receives financial support in the form of

a salary, paid by GW payroll, that is typically funded by grants, contracts or departmental funds

secured by a faculty mentor.

On the following pages, you will find coverage details for yourself and your dependents based on

your employee classification as a full-time or part-time employee.

GW BENEFITSTUITION REMISSION BENEFIT POLICY

6

Eligibility

Dependents (Spouse/Domestic Partner/Child)

Dependent eligibility is reviewed at the beginning of each semester for which the dependent applies

for the benefit. In order to receive the benefit for a semester, the dependent must be eligible for the

full semester. For example, if a dependent reaches age 24 mid-semester and has not provided the

required verification timely, the benefit will be removed from the student’s account for that semester.

(See Important Notes

section below). The term “dependent” refers to spouses/domestic partners and

child dependents as defined below:

Spouse/Domestic Partner*

• Spouse with no legal separation or divorce in effect

• Common-law spouse

• Domestic partner with no dissolution in effect

*Documentation supporting relationship to employee is required.

Child - Must meet all of the following requirements:

1. Relationship Status: Child must be a natural child, stepchild, legally adopted child, child placed

for adoption or child for whom the employee or spouse/domestic partner is the legal guardian.

Documentation supporting child’s relationship to the employee is required.

2. Tax Dependent Status: Child must be a legal tax dependent of the employee. Tax dependent

status is defined by the Internal Revenue Service (IRS). To determine whether a child qualifies as a

tax dependent, please refer to the IRS Publication 501 at irs.gov.

3. Student Status: Child must be enrolled in a degree program at GW. A child enrolled in an

undergraduate degree program at another university may receive the tuition remission benefit for

summer courses taken at GW as a non-degree student.

4. If Pursuing a Graduate Degree**: If the dependent child used tuition remission benefits in an

undergraduate degree program at GW, he or she must have used less than eight semesters of

tuition remission benefits in that program to be eligible for the graduate degree benefit. Unused

semesters (the difference between eight and the number of covered undergraduate semesters)

may be used towards a graduate degree program.

Note: A course, credit or unit covered by the tuition remission benefit or the T

uition Exchange program will

constitute one full semester of coverage.

** Important Notes

• The maximum graduate degree benefit for a child dependent is eight semesters or until the dependent

no longer meets IRS definition of a tax dependent, whichever occurs first.

• For dependent children age 24 and older: A copy of pages 1 and 2 of the most recent tax return

(form 1040, with sensitive information redacted), from the dependent’s parent is required for proof of

dependent status. If the child was not a tax dependent in the previous tax year, please contact Benefits for

an alternative certification form.

• Should a dependent child be unable to matriculate in a degree program due to a documented disability,

please contact Benefits for further information.

*This is calculated by taking 8

semesters minus the

number of

semesters already started an/or

completed in an undergraduate

program.

• A GW employee with more

than 1 year of benefits-

eligible service has a

dependent who enrolls in GW

as an undergraduate the

first

semester of their Junior year.

• The employee uses the

Tuition Remission benefit for

their dependent for four

semesters of undergraduate

tuition.

• The same child dependent

would be eligible for four*

semesters of tuition remission

benefits for a graduate

degree at GW.

EXAMPLE OF USING

UNDERGRADUATE

AND GRADUATE

BENEFITS

TUITION REMISSION BENEFIT POLICYGW BENEFITS

7

Full-Time Employee

Employee Coverage

Tuition remission coverage for courses taken by full-time employees, by program type, is described in the following chart.

Rates vary by program and location. To review current rates, please visit studentaccounts.gwu.edu/tuition.

For-Credit

Undergraduate Degree 100% of the cost of up to 6 credit hours each semester (fall, spring and summer); the benefit is calculated based on

the relevant undergraduate program rate and the registered credits per semester.

Graduate Degree

100% of the cost of up to 6 credit hours each semester (fall, spring and summer); the benefit is calculated based

on the per credit rate of the relevant program*.

Doctoral Degree

100% of the current main campus per credit graduate tuition rate. There are no per credit semester limits for

doctoral programs. Eligible for one doctoral degree. Please review page 6 for information about ineligible programs.

Non-Degree Courses 100% of the cost of up to 6 credit hours each semester (fall, spring and summer); the benefit is calculated based on

the relevant per credit hour non-degree tuition rate.

Certificate and

Certification Courses

100% of the cost of up to 6 credit hours each semester (fall, spring, summer); the benefit is calculated based on the

per credit rate of the relevant program

*.

Audited Courses Eligible for same coverage as undergraduate and graduate degrees. Subject to academic credit limits per degree

program provisions.

Non-Credit

Non-Credit Courses 100% of the cost of up to 2 courses each semester (fall, spring and summer); the benefit is calculated based on the

published fee for the selected course.

Unused Credits

Students who register for less than six credit hours in a semester

cannot apply unused credits as additional coverage for subsequent

semesters.

*Graduate-level programs may use an open enrollment/deceleration rate if they do not bill by the

credit hour.

University Awards and Tuition Remission

All university awards - including GW-funded scholarships, fellowships

and grants - cannot be accepted in conjunction with payments

received through the GW tuition remission benefit.

Exceptions may apply to students who meet eligibility for need-

based awards as determined by the Office of Student Financial

Assistance. Students should contact the Office of Student Financial

Assistance at (202) 994-6620 or fi[email protected] for further

information. Be sure to adequately disclose the GW tuition remission

benefit when applying for financial aid.

GW BENEFITSTUITION REMISSION BENEFIT POLICY

8

Full-Time Employee

Dependent Coverage

The level of tuition remission coverage for dependents of full-time employees is based on the employee’s hire date and full years of

benefits-eligible service. Percentage coverage is the same for all dependents; however, program eligibility varies between dependent

groups.The percentages listed below increase the first day of the semester beginning on or after the employee’s anniversary date. For

example, if an employee’s anniversary date is November 15, the increase will be effective with the start of spring semester.

Years of Employee’s Benefits-Eligible Service Benefit Coverage

Less than one year (first 12 months) Not eligible

1 - 3 years of service (more than 12 months) 75%

4 - 9 years of service (more than 48 months) 90%

10+ years of service (more than 120 months) 100%

Benefit Coverage and Program Eligibility by Student Type

Tuition remission eligibility and coverage for dependents of full-time employees, by program type, is described in the following charts

(no per credit semester limits). Tuition rates for all programs are available at studentaccounts.gwu.edu/tuition.

Child Dependent

For-Credit

Undergraduate Degree

The benefit coverage is based on the employee’s benefits-eligible years of service; the benefit is calculated based on

the relevant undergraduate program rate and the registered credits per semester. One undergraduate degree allowed

per eligible dependent.

Graduate Degree

The benefit coverage is based on employee’s benefits-eligible years of service; the benefit is calculated based on the

published tuition rate for the program*. Eligible dependents receive coverage for a maximum of eight semesters,

unless the dependent received the Tuition Remission benefit towards an undergraduate degree. Please refer to page 6.

Non-Degree Courses

The benefit coverage is based on employees benefits-eligible years of service; the benefit is calculated based on the

per credit hour non-degree tuition rate.

Audited Courses

Eligible for the same coverage as undergraduate and graduate degrees. Subject to academic credit limits per degree

program provisions.

*Graduate-level programs may use an open enrollment/deceleration rate if they do not bill by the

credit hour.

TUITION REMISSION BENEFIT POLICYGW BENEFITS

9

Spouse/Domestic Partner

For Credit

Undergraduate Degree The benefit coverage is based on the employee’s benefits-eligible years of service; the benefit is calculated based

on the undergraduate per credit hour rate or fixed tuition rate, depending on the program and amount of registered

credits per semester.

Graduate Degree The benefit coverage is based on employee’s benefits-eligible years of service; the benefit is calculated based on the

published tuition rate for the program*.

Non-Degree Courses The benefit coverage is based on employees benefits-eligible years of service; the benefit is calculated based on the

per credit hour non-degree tuition rate.

Audited Courses Eligible for the same coverage as undergraduate and graduate degrees. Subject to academic credit limits per

program provisions.

Doctoral Degree

The benefit coverage is based on employee’s benefits-eligible years of service; the benefit is calculated based on the

per credit hour rate of the relevant doctoral program unless otherwise noted. Eligible for one doctoral degree. Please

visit

page 4 for information about ineligible programs.

Certificate and

Certification Courses

The benefit coverage is based on employee’s benefits-eligible years of service; The benefit is calculated based on the

published tuition for the program

*.

Non-Credit

Non-Credit Courses The benefit coverage is based on employee’s benefits-eligible years of service; the benefit is calculated based on the

published fee for the selected course.

University Awards and Tuition Remission

All university awar

ds - including GW-funded scholarships, fellowships

and grants - cannot be accepted in conjunction with payments

received through the GW tuition remission benefit. Exceptions may

apply to students who meet eligibility for need-based awards as

determined by the Office of Student Financial Assistance. Students

should contact the Office of Student Financial Assistance at (202)

disclose the GW tuition remission benefit when applying for financial

aid.

*Graduate-level programs may use an open enrollment/deceleration rate if they do not bill by the

credit hour.

GW BENEFITSTUITION REMISSION BENEFIT POLICY

10

Part-Time Employee

Employee Coverage

Tuition remission coverage for courses taken by part-time employees, by program type, is described in the following chart.

Note: To review rate details, please visit studentaccounts.gwu.edu/tuition.

For-Credit

Undergraduate Degree 100% of the cost of up to 3 credit hours each semester (fall, spring and summer) for the applicable program; the

benefit is calculated based on the relevant undergraduate program rate and the registered credits per semester.

Graduate Degree 100% of up to 3 credit hours each semester (fall, spring and summer); the benefit is calculated based on the per credit

rate of the relevant program*.

Doctoral Degree 100% of up to 3 credit hours; or, 50% of 4 or more credit hours including the first 3, each semester (fall, spring, and

summer). Eligible for one doctoral degree. There are no per credit semester limits for doctoral programs. Please

review page 6 for information about ineligible programs.

Non-Degree Courses 100% of up to 3 credit hours each semester (fall, spring and summer); the benefit is calculated based on the relevant

per credit non-degree tuition rate.

Certificate and

Certification Courses

100% of up to 3 credit hours each semester (fall, spring and summer); the benefit is calculated based on the per credit

rate of the relevant program

*.

Audited Courses Eligible for same coverage as undergraduate and graduate degrees. Subject to academic credit limits per program

provisions.

Non-Credit

Non-Credit Courses 100% of the cost of 1 non-credit course each semester (fall, spring and summer); the benefit is calculated based on

the published fee for the selected course.

Unused Credits

Students who register for less than three credit hours in a semester

cannot apply unused credits as additional coverage for subsequent

semesters.

*Graduate-level programs may use an open enrollment/deceleration rate if they do not bill by the

credit hour.

University Awards and Tuition Remission

All university awards - including GW-funded scholarships, fellowships

and grants - cannot be accepted in conjunction with payments

received through the GW tuition remission benefit plan.

Exceptions may apply to students who meet eligibility for need-

based awards as determined by the Office of Student Financial

Assistance. Students should contact the Office of Student Financial

Assistance at (202) 994-6620 or fi[email protected] for further

information. Be sure to disclose the GW tuition remission benefit

when applying for financial aid.

TUITION REMISSION BENEFIT POLICYGW BENEFITS

11

Part-Time Employee

Dependent Coverage

The level of tuition remission coverage for the dependent(s) of part-time employees is based on the employee’s hire date and full years

of benefits-eligible service. Percentage coverage is the same for all dependents; however, program eligibility varies between dependent

groups. The stated percentages below increase as of the first day of the semester beginning on or after the anniversary date. For example, if

an employee’s anniversary date is November 15, the increase will be effective with the spring semester.

Length of Employee’s Benefits-Eligible Service Benefit Coverage

Less than one year (first 12 months) Not eligible

1 - 3 years of service (more than 12 months) 37.5%

4 - 9 years of service (more than 48 months) 45%

10+ years of service (more than 120 months) 50%

Benefit Coverage and Program Eligibility by Student Type

Tuition remission eligibility and coverage for dependents of part-time employees, by program type, is described in the following charts

(no per credit semester limits). T

uition rates for all programs are available at studentaccounts.gwu.edu/tuition.

Child Dependent

For Credit

Undergraduate Degree

The benefit coverage is based on the employee’s benefits-eligible years of service and calculated based on the

undergraduate per credit hour rate or fixed tuition rate, depending on the program and amount of registered credits

per semester. One undergraduate degree allowed per eligible dependent.

Graduate Degree

The benefit coverage is based on employee’s benefits-eligible years of service; the benefit is calculated based on the

published tuition rate for the program*. Eligible dependents receive coverage for a maximum of eight semesters,

unless the dependent received the Tuition Remission benefit towards an undergraduate degree. Please refer to page 6.

Non-Degree Courses

The benefit coverage is based on employee’s benefits-eligible years of service; the benefit is calculated based on the

current per credit hour non-degree tuition rate.

Audited Courses

Eligible for the same coverage as undergraduate and graduate degrees. Subject to academic credit limits per

program provisions.

*Graduate-level programs may use an open enrollment/deceleration rate if they do not bill by the credit hour.

GW BENEFITSTUITION REMISSION BENEFIT POLICY

12

Spouse/Domestic Partner

For Credit

Undergraduate Degree Percentage based on employee’s benefits-eligible years of service; the benefit coverage is calculated based on the

undergraduate per credit hour rate or fixed tuition rate, depending on the program and amount of registered credits

per semester.

Graduate Degree The benefit coverage is based on employee’s benefits-eligible years of service; the benefit is calculated based on the

published tuition rate for the program*.

Non-Degree Courses The benefit coverage is based on employee’s benefits-eligible years of service; the benefit is calculated based on the

per credit hour non-degree tuition rate.

Audited Courses Eligible for same coverage as undergraduate and graduate degrees. Subject to academic credit limits per degree

program provisions.

Doctoral Degree

The benefit coverage is based on the employee’s benefits-eligible years of service; the benefit is calculated based

on the per credit hour rate of the relevant doctoral program unless otherwise noted. Eligible for one doctoral

degree.

lease visit page 4 for information about ineligible programs.

Certificate and

Certification Courses

The benefit coverage is based on employee’s benefits-eligible years of service; The benefit is calculated based on the

published tuition for the program.

Non-Credit

Non-Credit Courses The benefit coverage is based on employee’s benefits-eligible years of service; the benefit is calculated based on the

published fee for the selected course.

University Awards and Tuition Remission

All university awards - including GW-funded scholarships,

fellowships and grants - cannot be accepted in conjunction with

payments received through the GW tuition remission benefit plan.

Exceptions may apply to students who meet eligibility for need-

based awards as determined by the Office of Student Financial

Assistance. Students should contact the Office of Student Financial

Assistance at (202) 994-6620 or fi[email protected] for further

information. Be sure to disclose the GW tuition remission benefit

when applying for financial aid.

*Graduate-level programs may use an open enrollment/deceleration rate if they do not bill by

the credit hour.

TUITION REMISSION BENEFIT POLICYGW BENEFITS

13

Tax Obligation

The value of the tuition remission benefit may be taxable at the federal and/or state level. A number of factors determine tax withholdings,

including the type of degree being pursued and whether the benefit is used for the employee or the employee’s dependent(s). We

recommend that you consult with a tax advisor to determine the impact on your income and plan accordingly for any additional tax

withholding before financially committing to your program.

Undergraduate Benefit

Undergraduate tuition benefits are generally exempt from tax withholdings (i.e. federal, state, Medicare and social security) for employees

and their dependents (exceptions are noted below).

Undergraduate tuition remission benefits are subject to federal tax withholding when utilized for:

1. a same sex spouse (if residing in a state that does not currently recognize same sex marriage);

2. a domestic partner; and

3. the children and tax dependents of (1) or (2).

4. An undergraduate course taken by the employee while enrolled in a graduate or doctoral degree program.

Graduate and Doctoral Benefit

Employee

The IRS allows up to $5,250 for graduate-level courses to be tax exempt per calendar year.

1

Tuition remission benefits received in excess of

$5,250 are included in gross wages and are taxable (i.e. Federal, State, Social Security and Medicare taxes).

If the course is job related, employees can submit a graduate course certification to request tax exemption. Each course is evaluated for tax

exemption on an individual basis. Please visit page 14 for more information or visit the Benefits website.

Spouse/Domestic Partner/Child Dependent

2

The tuition remission benefit amount is considered taxable income when it’s used for graduate-level courses taken by an employee’s

spouse/domestic partner and/or dependent child

2

and for doctoral-level courses taken by an employee’s spouse/domestic partner.

The full amount of the tuition remission benefit is included in the employee’s gross wages and is subject to tax withholding. The amount of

withholdings is based on the benefit amount received within the given semester.

Taxable Benefit and Unpaid Status

Active employees who are on unpaid leave and receiving taxable tuition remission benefits are required to make payment arrangements

by contacting Benefits at (571) 553-8249 or [email protected].

How Are Taxes Withheld From My Paycheck

Taxes are withheld from the employee’s paycheck during the same semester in which the course(s) is taken. The actual amount

withheld from each paycheck may vary.

We recommend that you consult with a tax advisor to determine the impact on your income and plan accordingly for any additional tax

withholding before financially committing to your program.

If the appropriate tax withholdings are not made, it is the employee’s responsibility to contact Benefits at (571) 553-8382 or tuition@

gwu.edu

.

1 Not applicable to spouse/domestic partner or dependent child tuition remission benefits for graduate- or doctoral-level

programs.

2 Child dependents are not eligible for doctoral programs. Please refer to page 6 for details.

GW BENEFITSTUITION REMISSION BENEFIT POLICY

14

How to

Apply

Instructions: Tuition Remission Online Application

Online tuition remission applications must be submitted by the employee for each semester that the employee, spouse/domestic partner

and/or dependent child is enrolled in courses. Students must already be enrolled in courses prior to the employee completing the online

tuition remission application. Please note the tuition remission application deadlines on page 15.

STEP 1: Visit benefits.gwu.edu/tuition-remission and select “Tuition Remission Application.”

STEP 2: Log into GWeb. Enter your email and password.

STEP 3: Click on Employee Information.

STEP 4: Click on Tuition Remission Application.

STEP 5: From the “Benefit is for:” dropdown menu, select the person for whom you are submitting the application (“Self” or “Other” if

applying for spouse or dependent child). Enter the relevant GWID in the Student’s GWID: box. After reviewing all agreement

language, check the “I accept” box and click Submit Changes.

If you receive a successful submission message, your online application has been approved. If you receive an error message, please contact

Benefits at [email protected].

Instructions: Graduate Course Online Certification for Tax Exemption

The online graduate course certification process is available only to employees of the university who are requesting tax exemption for job-

related graduate courses. Employees must submit an online graduate course certification form for each course, every semester, and should

consult their supervisors before requesting tax exemption for job-related courses. Please note the graduate course certification deadlines

on page 15.

STEP 1: Visit benefits.gwu.edu/tuition-remission and select “Graduate Course Certification.”

STEP 2: Click on the Graduate Course Certification for Tax Exemption button to complete the graduate course certification form.

STEP 3: Enter your NetID and password to log in.

STEP 4: Complete all required fields (marked *) and attach all required documents. Please note: Attached file formats should be MS

Word, MS Excel, Text or PDF. Do not include any special characters in the file names. After reviewing all agreement language,

check the I Agree to the Above box, enter your Employee Initials and click Submit.

If you receive a successful submission message, your online tax exemption request will be forwarded to the next level reviewer. If you

receive an error message, please contact Benefits at [email protected].

Please note: It is the employee’s responsibility to ensure his/her manager reviews and provides approval via the online portal by

the designated deadline.

TUITION REMISSION BENEFIT POLICYGW BENEFITS

15

Deadlines

Tuition Remission Online Application

T

uition remission applications must be submitted for each semester that you and/or your spouse/dependent children are enrolled

in classes. The application is available at benefits.gwu.edu/tuition-remission. Please note the deadlines below:

Semester Application System Opens Application System Closes

Fall July 6 October 1

Spring November 15 February 1

Summer April 14 June 15

Payment is due by the first day of the university semester as published in the Academic Calendar. If you apply for the tuition r

emission

benefit after that date you may be subject to late fees or other penalties.

Graduate Course Online Certification for Tax Exemption

Employees who wish to have graduate courses considered for job-related tax exemption must submit a graduate course certification

for each course, every semester. To submit your certification visit benefits.gwu.edu/tuition-remission.

Please note the deadlines below:

Semester Certification System Opens Certification System Closes

Fall

July 6

August 17

Spring October 3 January 5

Summer April 14 May 11

Note: If a tuition application or certification deadline (as noted above), falls on a weekend, the deadline will be extended to the following

Monday.

Adding and Dropping

Courses/Withdrawals

If a student adds or drops a course while utilizing the tuition remission benefit, the benefit will adjust accordingly. At no time will the

adjusted benefit be issued to the student as a refund or credit for a subsequent semester.

For more information regarding on- and off-campus registration adjustment, including withdrawals, please visit registrar.gwu.edu. Navigate

to the Registration menu and select “Withdrawals & Refunds.”

GW BENEFITSTUITION REMISSION BENEFIT POLICY

16

Employment Status

Changes and Loss

of Eligibility

Employment Status Changes

Tuition remission benefit coverage adjustments resulting from a change in employment status, benefits-eligibility, or position are effective

the semester following the effective date of the change; changes coincident with the semester start date are effective on the semester start

date. Please see examples below:

EXAMPLE 1: Employee transfers from a benefits-eligible part-time

position to a benefits-eligible full-time position at GW on March

1 (during the spring semester). Part-time benefit coverage will

continue for the duration of the spring semester, and full-time benefit

coverage will become effective at the start of the summer semester.

EXAMPLE 2: Employee transfers from a temporary position

(benefits-ineligible) to a benefits-eligible full-time position at GW

on October 1 (during fall semester). Full-time benefit coverage will

become effective at the start of the spring semester.

EXAMPLE 3: Employee transfers from a bene

fits-eligible to a

benefits-ineligible position on April 15 (during spring semester)

while receiving the tuition remission benefit for spring semester. The

benefit coverage will continue through the end of the current spring

semester.

EXAMPLE 4: An employee is hired on September 1 in a full-

time benefits-eligible position. The academic fall semester

officially begins on August 26, while the course of interest begins

on September 30. The employee is ineligible to use the tuition

remission benefit since their hire date falls after the start of the

academic semester (see Academic Calendar).

Termination

When leaving the university, it’s important to understand the impact on the tuition remission benefit.

Tuition remission benefits end and will be pro-rated based on the date that the employee separates from service at the university.

Spring and Fall Semesters

If an employee separates from the university while utilizing the tuition remission benefit during the spring and fall semesters, the benefit

will be pro-rated and the employee will be billed by the Student Accounts Office for the balance. The prorated amount is the difference

between the last date of employment and the last day of the University’s final exam period (see Academic Calendar), not the last day of

class(es).

Summer Semester

If an employee separates from the university while utilizing the tuition remission benefit during the semester, the benefit will be pro-rated

and the employee will be billed by the Student Accounts Office for the balance. The prorated amount is based on the percentage of

academic period completed while employed. Benefits are prorated by individual sessions, not by semester.

If you have questions about a pro-rated tuition remission benefit, please contact Student Accounts at (202) 994-7350 or [email protected].

TUITION REMISSION BENEFIT POLICYGW BENEFITS

17

Leave of Absence

Active employees on a leave of absence will continue to be eligible for tuition remission benefits for themselves as well as for their

spouses/domestic partners and eligible dependent children, for the duration of the leave.

Note: Please review the Tax Obligation section on page 13 for information regarding taxable tuition payment during unpaid leaves of

absence.

Long-Term Disability Recipients

Employees who were approved for long-term disability (LTD) prior to separation from the university will continue to be eligible for tuition

remission benefits for themselves, as well as for their spouses and eligible dependent children, for the duration of the approved LTD.

• If LTD was approved on or after June 1, 2017:

When calculating the level of tuition remission benefits available, consideration is given only

to the length of time the LTD recipient was an active, benefits-eligible employee.

• If LTD was approved before June 1, 2017: When calculating the level of tuition remission benefits available, consideration is given to the

overall years of service (including years of time as an LTD recipient as well as years of time as an active, benefits-eligible employee)

Note: Tuition remission benefits received for graduate and doctoral programs on behalf of the LTD recipient, or the LTD recipient’s spouse or

dependent children, are taxable and will be reported to the IRS. LTD recipients will receive a W-2 statement. Tuition remission benefits

received for undergraduate programs are not taxable.

Rehired Employees

Employees rehired within one year (365 days) of the date of their separation from service at the university or loss of eligibility from a

benefits eligible position will retain accrued service credit.

There is no prior service credit for employees with one or more years (more than 365 days) between their separation of service from the

university and loss of eligibility or rehire.

GW BENEFITSTUITION REMISSION BENEFIT POLICY

18

Retirement/Retirees

The retiree tuition remission benefit is based on years of benefits-eligible service. The benefit is available to retirees who meet one of the

following requirements on the date of their retirement from the university:

• Age 65;

• Age 60 with a minimum of ten (10) years of continuous full-time or equivalent benefits-eligible service; or,

• Age 55 with a minimum of twenty (20) years of continuous full-time or equivalent benefits-eligible service;

More information about retirement benefits, including eligibility is available on the Benefits website.

Retiree With Less Than 10 Full Years of Continuous or Equivalent Benefits-Eligible Service¹

Employees with less than 10 years of benefits eligible service are eligible for continued tuition remission benefits upon retirement.

The benefit will continue for the retiree’s spouse and eligible dependent children, if they were receiving the benefit at the time of the

employee’s retirement.

Retiree With More Than 10 Full Years of Continuous (or Equivalent) Benefits-Eligible Service¹

Employees with 10 or more years of benefits-eligible service are eligible for continued tuition remission benefits upon retirement. The

retiree’s spouse and eligible dependent children are also eligible for tuition remission benefits, regardless of whether or not they were

receiving the benefit at the time of the employee’s retirement. Dependents acquired through marriage, domestic partnership, adoption or

guardianship subsequent to the retirement date are not eligible for tuition remission benefits.

The scope of tuition remission benefits is determined by the employee’s employment status at the time of retirement:

• Full-time employee coverage for prior full-time employment, same as

full-time employee.

• Full-time spouse coverage for prior full-time employment, same as

full-time spouse.

• Full-time dependent child coverage for prior full-time employment,

same as full-time dependent child.

• Part-time employee coverage for prior part-time employment, same as

part-time employee.

• Part-time spouse coverage for prior part-time employment, same as

part-time spouse.

• Part-time dependent child coverage for prior part-time employment,

same as part-time dependent child.

¹For example, four years of part-time work on a 50% schedule would equal two years of full-time service

Note: Tuition remission benefits received for graduate and doctoral programs on behalf of the retiree, or the retiree’s spouse or dependent

children, are taxable and will be reported to the IRS. Retirees will receive a W-2 statement. Tuition remission benefits received for

undergraduate programs are not taxable.

Surviving Spouses and Dependent Children

Surviving spouses and dependent children of deceased employees and retirees are eligible for tuition remission benefits if the employee

was otherwise eligible for tuition remission benefits at the time of death. Surviving children must meet the definition of eligible dependents

as described on page 5. For more information, please contact Benefits at (571) 553-8382 or [email protected].

TUITION REMISSION BENEFIT POLICYGW BENEFITS

19

Glossary

CERTIFICATE: Documented completion of a course or series

of courses with a specific focus. Certificates are awarded by an

educational program or institution, and demonstrate knowledge

with no ongoing requirements.

DEPENDENT (OR TAX DEPENDENT): Child eligible for tuition

remission benefits * including a natural child, stepchild, legally

adopted child, child placed for adoption or child for whom the

employee or his or her spouse is the legal guardian. Dependent

status is defined by the Internal Revenue Service (IRS). To

determine whether a child qualifies as a dependent please refer to

the IRS Publication 501: www.irs.gov.

* Documentation supporting relationship to employee is required.

DOMESTIC PARTNER: Person in a registered Domestic

Partnership or Declaration of Domestic Partnership (including,

but not limited to, are unmarried and unrelated, share a

common residence, and have been emotionally and financially

interdependent for at least the past six months).

DUAL COVERAGE: The act of combining the individual benefit

coverage of two related, benefits-eligible employees to provide

a greater level of coverage to one family member. An employee

eligible for tuition remission benefits at GW is not permitted to

combine his or her own benefit coverage with that of a spouse

or dependent child who is also employed in a benefits eligible

position at GW. In such instances, the greater benefit coverage will

apply.

DOCTORAL DEGREE: The highest level of academic degree.

Students typically begin the doctoral degree program either

immediately following, or within a few years of receiving, a master’s

degree. Some programs may allow a combined curriculum for a

dual degree at the master’s/doctoral level.

GRADUATE DEGREE: Master’s degree program in a specialized

field of study. Graduate students are required to complete an

undergraduate program prior to admission; however, some

programs may allow a combined curriculum for a dual degree at

the undergraduate/master’s and master’s/doctoral levels.

NON-CREDIT COURSE: Course(s) with no academic credit; some

non-credit courses may provide educational units applicable to a

certificate or certification program.

NON-DEGREE COURSE: Courses that are either non-applicable to

a degree program or are taken solely for personal development or

interest without being enrolled in a degree-seeking program.

SEMESTER: Defined period in an academic year.

Note: For tuition remission benefit purposes, courses taken during

the summer session(s) constitute one semester. For example, if a

student takes one course during summer session one, and another

course during summer session two, this constitutes one semester.

If a student takes one course during summer session one only, this

also constitutes one semester.

SPOUSE: Includes a spouse (same or opposite sex) with no legal

separation or divorce in effect; common-law spouse*; and domestic

partner* (same or opposite sex), with no dissolution in effect.

* Documentation supporting relationship to employee is required.

UNDERGRADUATE DEGREE: A diploma issued to a student

by a college or university following successful completion of an

undergraduate program. Undergraduate degrees are often referred

to as bachelor’s or baccalaureate degrees, with designations

including Bachelor of Arts (B.A.), Bachelor of Science (B.S.) and

Bachelor of Fine Arts (B.F.A.).

GW BENEFITSTUITION REMISSION BENEFIT POLICY

20

Contact

Information

Who to Call Contact Information

Admissions

Office of Undergraduate Admissions

(Undergraduate Degree Seeking)

(202) 994-6040

undergraduate.admissions.gwu.edu

Graduate Enrollment Management

(Graduate Degree Seeking)

(202) 994-5984

graduate.admissions.gwu.edu

Office of Non-Degree Students

(Non-Degree)

(202) 994-1972

nondegree.gwu.edu

Student Accounts/Tuition Billing

For information regarding student account billing information, including adjustments.

Student Accounts Office

(202) 994-7350

studentaccounts.gwu.edu

Student Financial Assistance/Awards

For information on financial aid—including grants, scholarships and other award offerings—as well as information regarding financial awards that

are either reduced or voided due to acceptance of the tuition remission credit.

Office of Student Financial Assistance

202) 994-6620

financialaid.gwu.edu

Registration - Add/Drop Courses

For information regarding on how to register for classes online and add/drop classes

Office of the Registrar

(202) 994-994-4900

registr[email protected]

registrar.gwu.edu

Tuition Remission Benefits and Taxable Tuition

For information regarding the tuition remission benefit, eligibility and tax withholdings associated with taxable tuition.

GW Benefits

(571) 553-8382

benefits.gwu.edu

Federal (W-4) and State Tax Withholdings/Paycheck

For information regarding federal and state tax withholdings, and other paycheck-related matters.

Payroll Services

(571) 553-4277

payroll.gwu.edu