_____________________________________________________________________________________

CONSUMER REPORTS 1

INTRODUCTION

____________________________________________________

Consumer Reports conducts surveys on a regular basis to understand consumer concerns, attitudes,

opinions, and experiences. These surveys add rich information about consumer experiences and

opinions to Consumer Reports’ well-known reporting and advocacy on behalf of consumers. One part

of that survey work is our monthly omnibus American Experiences Survey (AES). Each AES survey

covers multiple topics and goes out to a nationally representative sample of at least 2,000 U.S. adults

by internet and phone and is offered in both English and Spanish.

Peer-to-peer payment services are digital applications that deliver the core service of enabling

individuals to digitally transfer money to, and receive money from, other individuals. As our research

shows, P2P payment services are deeply integrated into consumer life in the U.S. These popular apps

are often used to split a bill, send cash as a gift, or lend or borrow money among friends and family.

We surveyed consumers on different aspects of their experiences and opinions about peer-to-peer

(P2P) payment services on four occasions in the American Experiences Survey in 2022: in March,

August, September, and October. Taken together, these four AES sections yield an informative and

insightful picture of how consumers use and think about P2P services in 2022. This report compiles the

relevant sections from each of those four surveys.

AES MARCH 2022: P2P PREVALENCE AND USER ISSUES

______________________________________________________

We began this section with an explanation of the topic.

This section asks about peer-to-peer payment services, also called money transfer apps, such as

PayPal, Venmo, Apple Pay, Google Pay, or Zelle. These services allow users to send and receive

money to one another directly through their smartphones, tablets, or computers without using cash

or checks.

Some of these services can also be used to pay in stores or online. However, in this section, we are

only interested in person-to-person payments, not payments to businesses. We are interested in payments

for services, such as for babysitting or home repair.

HOW FREQUENTLY DO AMERICANS USE P2P SERVICES?

Four in ten Americans (40%) say they use P2P services at least once a month; 18% use them at least

once a week. Three in ten (31%) have never used P2P services.

Some Americans are less likely to have ever used P2P services. While just 15% of Americans under 45

say they have never used P2P services, this more than doubles to 33% among those 45 to 59 and rises

to 54% of those 60 and up. Similarly, Americans in rural and suburban areas are more likely to have

_____________________________________________________________________________________

CONSUMER REPORTS 2

never used P2P services than those in urban areas, and Americans with lower annual household income

are more likely to have never used P2P services than those with higher annual household incomes.

1

1

Differences are significant controlling for race/ethnicity, gender, age, income, region, and urbanicity.

5%

11%

7%

3%

1%

4%

3%

8%

6%

7%

1%

4%

13%

24%

16%

12%

3%

10%

13%

14%

14%

10%

14%

14%

23%

28%

31%

21%

14%

19%

22%

25%

20%

20%

24%

28%

23%

19%

25%

28%

21%

21%

26%

21%

15%

22%

30%

29%

5%

3%

6%

3%

8%

6%

4%

6%

6%

5%

4%

6%

31%

15%

15%

33%

54%

39%

32%

26%

39%

36%

27%

20%

All Americans

18-29

30-44

45-59

60+

Rural

Suburban

Urban

Less than

$30,000

$30,000 to

$59,999

$60,000 to

99,999

$100,000 or

more

Daily At least once a week, but less than daily

At least once a month, but less than weekly Less often than once a month

I used to use this kind of service, but do not now I have never used peer-to-peer payment services

How often, if ever, do you use peer-to-peer payment services?

Base: All respondents.

_____________________________________________________________________________________

CONSUMER REPORTS 3

MOST COMMON P2P SERVICES

Next, we asked Americans who said they used any P2P services at least once a month which services

they currently use at least once a month for payments to or from other people (not in stores or online).

Nearly half of regular P2P users use PayPal (49%) and almost as many use Venmo (48%) at least

monthly.

Common “others” include Chime and Xoom.

49%

48%

40%

39%

19%

10%

9%

4%

<1%

3%

PayPal

Venmo

Cash App

Zelle

Apple Pay Cash

Google Pay

Facebook Pay

Western Union

Remitly

Other, please specify

Percentage among Americans who use P2P services at least once a month

20%

19%

16%

16%

8%

4%

4%

2%

<1%

1%

PayPal

Venmo

Cash App

Zelle

Apple Pay Cash

Google Pay

Facebook Pay

Western Union

Remitly

Other, please specify

Percentage among all Americans

Peer-to-peer services Americans use regularly (at least once a month)

Base: Respondents who use P2P services at least one a month; all respondents.

Respondents could select all that applied.

_____________________________________________________________________________________

CONSUMER REPORTS 4

Certain P2P services are more popular among different age groups. Use of PayPal, Venmo, and the

Cash App varies with age, as does use of Google Pay and Apple Pay. There is no significant linear

difference by age in use of Zelle, Facebook Pay, Western Union, or Remitly.

2

In other words, among

the P2P services that Americans are most likely to use regularly, only Zelle is used more or less

consistently across ages. Americans in their thirties and early forties are more likely to use PayPal

and Venmo than Americans 18 to 29, and both groups more likely to use these services than adults

over 45. (In fact, for Venmo, use among those 60 and up is even lower than use among those 45 to 59.)

For the Cash App, use is highest among the youngest Americans and drops off with age.

2

Differences are significant controlling for race/ethnicity, gender, age, income, region, and urbanicity.

49%

48%

40%

39%

49%

49%

51%

39%

56%

58%

42%

39%

41%

41%

36%

39%

42%

29%

15%

43%

PayPal

Venmo

Cash App

Zelle

All Americans 18-29 30-44 45-59 60+

Use of the top four P2P services by age group

Base: Respondents who use P2P services at least one a month; all respondents.

_____________________________________________________________________________________

CONSUMER REPORTS 5

SOURCES OF MONEY IN P2P ACCOUNTS

Among Americans who have ever used a P2P service, more than three in four (77%) say the money

they use in the service they use (or used to use) most often comes from their bank, either directly or

indirectly. About half say the money in the account they use or used most comes directly from their

checking account (51% of Americans who ever had a P2P account). Around a quarter (26%) say the

money came from a debit card linked to the P2P account.

Around one in ten Americans who use P2P services keep a balance in their P2P account (6%) or use a

prepaid card (4%). These methods are potentially more risky, because there is no bank or credit card

company to turn to in the event of fraud.

51%

26%

9%

6%

4%

1%

3%

The money [is / was] withdrawn straight from

my checking account to my P2P account

The money [is / was] withdrawn from my

checking account through a debit card that

[is/was] linked with my P2P account

Payments I [make / made] through this service

[are / were] charged to a credit card that

[is/was] linked with my P2P account

The money [is / was] withdrawn from a balance I

[keep / kept] in the P2P account from money

other people [have/had] sent me

The money [is / was] withdrawn from a prepaid

card that [is / was] linked to my P2P account

The money [comes / came] from a

cryptocurrency wallet linked to this P2P account

Other, please specify

Sources of money in most commonly used P2P account

Base: Respondents who have ever used a P2P service.

Respondents answered for the service they use (or used) the most.

_____________________________________________________________________________________

CONSUMER REPORTS 6

ISSUES WITH P2P SERVICES

A strong majority of Americans who have ever used P2P services say they have never had any issues

with a P2P service (78%). The most common issues include problems with sending money: sending

money to the wrong person (6% of Americans who have ever use P2P services); sending money for

what turned out to be a scam (6%); or sending money that the intended recipient never got (also 6%).

6%

6%

6%

4%

3%

2%

78%

Sending money to the wrong person

Sending money for what turned out to

be a scam

Sending money to someone that was

never received

Not receiving money that was sent to

you

Receiving money from someone you

don't know (sent to you mistakenly)

Other, please specify

You have never had any issues with a

peer-to-peer payment service

Which, if any, of the following issues did you have or have you had sending or

receiving money through a peer-to-peer service?

Select all that apply.

Base: Respondents who have ever used a P2P service.

Respondents answered for the service they use (or used) the most.

_____________________________________________________________________________________

CONSUMER REPORTS 7

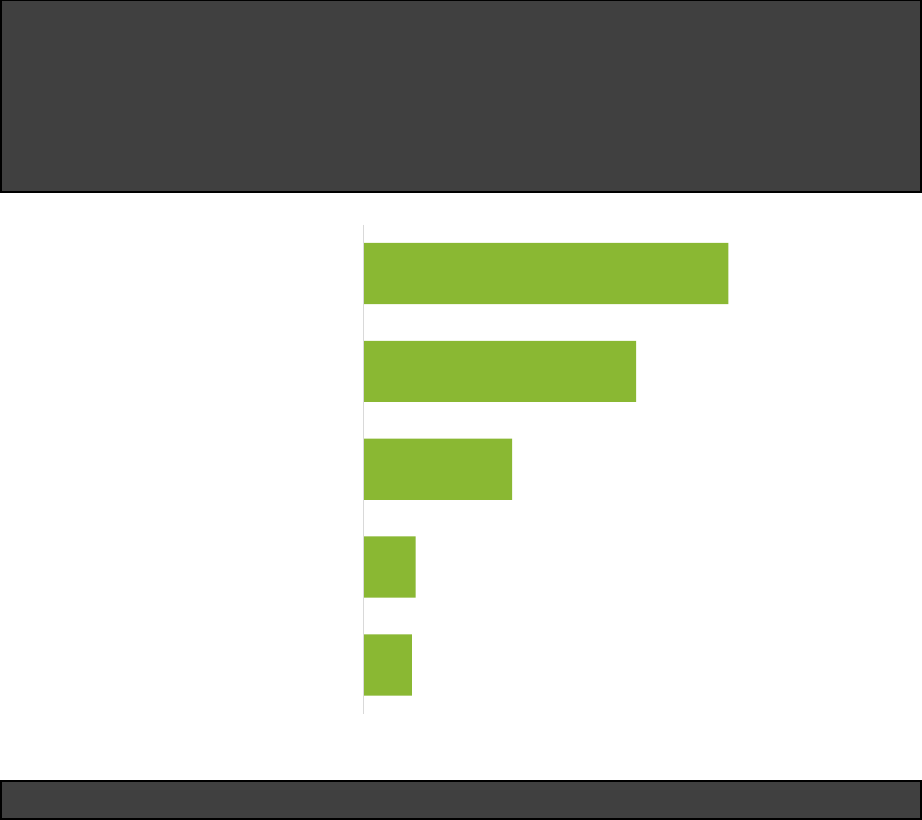

Among those who have ever used a P2P service, some groups are more likely to have experienced

problems than others. Those with a higher annual household income are less likely to have had

problems: 31% of Americans with an annual household income of less than $30,000 who have ever

used P2P services have had at least one issue with it, compared to just 16% of those with an annual

household income of $100,000 or more. Americans living in rural areas are less likely to have had

issues than those living in urban areas (17% vs 27%).

3

Among Americans who currently use at least one P2P service at least once a month, Apple Pay and

Cash App users are more likely than average to say they have ever had an issue with the P2P service,

while Zelle users are less likely than average.

4

3

Differences are significant controlling for race/ethnicity, gender, age, income, region, and urbanicity.

4

Differences are significant controlling for race/ethnicity, gender, age, income, region, urbanicity, and use of all

services listed on page 8 except “other.”

22%

31%

24%

19%

16%

27%

21%

17%

All Americans

Less than $30,000

$30,000 to $59,999

$60,000 to 99,999

$100,000 or more

Urban

Suburban

Rural

Americans who have ever had any issues with a P2P service

By group

Base: Respondents who have ever used a P2P service.

_____________________________________________________________________________________

CONSUMER REPORTS 8

ATTEMPTING TO RESOLVE ISSUES

Next, we asked those Americans who had ever had any issues with a P2P service what they did to

resolve those issues. About half (48%) of Americans who ever had any issues with a P2P service say

they contacted the service provider to attempt to resolve the issue. Other responses are more issue-

specific, such as contacting the person who received the money (41% of those who have ever had an

issue) or contacting the person who sent it, if the respondent was meant to be on the receiving end

(27% of those who have ever had an issue). Nine percent say they did not try to resolve the issue or

issues they experienced.

48%

41%

27%

5%

9%

Contacted the service provider (e.g.,

Venmo or Zelle)

Contacted the person who received the

money from me

Contacted the person who sent the money

to me

Other, please specify

I did not try to resolve the issue(s)

Which, if any, of the following did you do to try to resolve the issue?

Select all that apply.

Base: Respondents who have ever had an issue with a P2P service.

_____________________________________________________________________________________

CONSUMER REPORTS 9

CONTACTING P2P SERVICE PROVIDERS FOR ASSISTANCE

Around three in four (77%) of those who reached out to the service provider to try to resolve the issue

reported at least one kind of problem in doing so.

39%

36%

35%

30%

5%

23%

I found it difficult to get a response from

online support

I found it difficult to locate a contact phone

number

I was on hold for a long time when I called

I found it difficult to locate contact

information for online support

Other, please specify

I had no issues accessing assistance from

the service provider

Which, if any, of the following are issues you had accessing assistance from the

service provider?

Base: Respondents who tried to resolve an issue by contacting the P2P service provider.

_____________________________________________________________________________________

CONSUMER REPORTS 10

OUTCOMES

Finally, we asked Americans who had attempted to resolve any issues in any way what the outcome

was the most recent time they had tried to do so. Around a quarter (26%) say that the service provider

resolved the issue—but one in five (21%) say that they were not able to resolve the issue. (Note that

many of the other response options are specific to the type of problem the person experienced most

recently, so it makes sense that they would be less common than the “provider” response.)

26%

22%

15%

14%

12%

6%

21%

The service provider resolved the issue

I was reimbursed by the person who

received the money from me

I reimbursed the person who mistakenly

sent the money to me

The person who sent me money had to send

it a second time

I had to pay the person I sent money to a

second time

Other, please specify

I was not able to resolve the issue

When you tried to resolve your most recent issue with a P2P service, what was the

outcome?

Select all that apply.

Base: Respondents who have ever had an issue with a P2P service.

_____________________________________________________________________________________

CONSUMER REPORTS 11

AES AUGUST 2022: PRIVACY IN FINANCIAL APPS

______________________________________________________

This section is about privacy in financial apps. By financial apps, we mean apps for your smartphone

or tablet such as: bank apps that let you access your bank account on your phone, apps to help make

payments like PayPal or Venmo, Buy Now Pay Later apps that let you pay for a purchase in

installments like Klarna or Affirm, apps to help manage loans or mortgages, budgeting apps,

investment apps, or any other kind of mobile device software application that helps you manage your

money.

Most Americans say they use at least one kind of financial app. The

most common is a banking app (76%), followed by a payments app

to send money to other people (50%), and a digital wallet (26%).

Older adults, however, are less likely to use financial apps (69%)

compared to younger people (90% of those under age 60 use

financial apps).

* Full text: “A payments app to make payments at stores, such as a store account app or a Buy Now Pay Later app”

76%

50%

26%

15%

15%

12%

12%

5%

5%

5%

5%

3%

2%

2%

1%

17%

A banking app

A payments app to send money to other people

A digital wallet

An app for checking or improving your credit score

An investment app

A payments app to make payments at stores*

An app for filing taxes

A budgeting app

An app to apply for or manage a car loan

An app to apply for or manage a home mortgage

An app to help you save money

An app to manage a student loan

An app to apply for or manage a personal loan

A paycheck advance app

Other, please specify

I don't use any financial apps of any kind

Which, if any, of the following kinds of financial apps do you use?

Select all that apply.

Base: All respondents.

83%

USE ANY KIND

OF FINANCIAL APPS

_____________________________________________________________________________________

CONSUMER REPORTS 12

This information was provided to respondents on the survey:

Financial apps collect and store data about their users. Some of this information is given to them by the user,

like their name and email address. Other information is collected and stored through how the user interacts with

the app. For example, a payments app stores data about what payments the user makes. Financial apps may

also collect data from other financial companies that they interact with on their users' behalf, or from other third

parties such as social media companies. Finally, they also may collect data from the user's device, such as their

location or what other apps they are using.

Close to two-thirds of Americans are at least somewhat concerned about how much information

financial apps collect and store about their users. But,

nearly six in ten say they are at least

somewhat confident that these apps adequately secure the information, to protect users’ data from

being seen by other users, or from being vulnerable to hacking or a data breach.

Those individuals who use at least one financial app are less likely to say they are “very concerned”

than those people who do not use financial apps (20% versus 44%).

Concerns about financial apps collecting information and data security

Base: All respondents.

_____________________________________________________________________________________

CONSUMER REPORTS 13

We asked respondents to select from several statements regarding which one best represents their

views about

financial apps sharing their users' data with other companies.

Over half of Americans do not believe that financial apps should be

allowed to share their users’ data with other companies. Nine percent

say they have no opinion. Among the 37% who say it is okay for

financial apps to do this, the most commonly selected reasons why

are “as long as they only use it to prevent fraud” and “as long as you

can opt out without any penalty.” Those aged 60 and up are more

likely to think this should not be allowed (62%) compared to younger

individuals (39% of those aged 18 to 29).

We asked people if they would be interested in seeing all of the

personal data

that a financial app has about them. A majority of

Americans are interested (53% say they would definitely want to see

it, and 27% say they are somewhat interested).

53%

THINK THIS SHOULD

NOT BE ALLOWED

80%

AT LEAST SOMEWHAT

INTERESTED

_____________________________________________________________________________________

CONSUMER REPORTS 14

AES SEPTEMBER 2022: FINANCIAL SAFETY IN P2P PAYMENT

APPS

______________________________________________________

We began this section with an explanation of the topic.

This section asks about peer-to-peer payment services, also called mobile cash payment apps or

money transfer apps, such as PayPal, Venmo, Apple Pay, Google Pay, or Zelle. These services allow

users to send and receive money to one another directly through their smartphones, tablets, or

computers without using cash or checks. In this survey, we will refer to these as “P2P” services or

apps.

Some of these services can also be used to pay in stores or online. However, in this section, we are

only interested in person-to-person payments, not payments to businesses. We are interested in informal

payment for services, such as for babysitting or home repair.

USE OF IDENTITY VERIFICATION AMONG P2P APP USERS

Over half (58%) of Americans say they use a P2P app. Older Americans, aged 60 and up, are less

likely to use a P2P app than younger Americans. In the 60 years and up age group, 39% use a P2P

app, compared with, for example, 74% of the 18-29 age group.

5

Of those who use a P2P app, 72% say it requires identity verification and 28% say it does not.

5

Difference is statistically significant controlling for race/ethnicity, gender, age, income, education, region,

urbanicity, and political leaning.

42%

51%

51%

39%

29%

16%

23%

19%

16%

10%

42%

26%

29%

45%

61%

All Americans

18-29

30-44

45-59

60+

Yes, the P2P app requires identity verification

No, the P2P app does not require identity verification

I don't use any P2P apps

When you open the P2P app you use the most to access your account, do you need to

do anything in the app to verify that it's really you?

Base: All respondents.

_____________________________________________________________________________________

CONSUMER REPORTS 15

DEFAULT IDENTIFICATION SETTINGS

Over one-third of P2P users (39%) are using the app’s default identity verification settings. A similar

number, 37%, have turned identity verification settings on in their P2P app. Another 7% have

actively managed their app’s security by turning some settings on and turning others off.

Unsurprisingly, 13% could not recall if they have changed their app’s settings.

P2P users in the 60 years and up age group are more likely to be using the default settings than

those in other age groups (51% compared to 36% among younger people).

6

6

Difference is statistically significant controlling for race/ethnicity, gender, age, income, education, region,

urbanicity, and political leaning.

39%

37%

7%

4%

13%

I have not changed any identity verification

settings

I have turned an identity verification setting

on

I have changed identity verification settings

by turning some on and others off

I have turned an identity verification setting

off

Don't remember

Base: Respondents who use a P2P app.

In the P2P app you use most, are you using the default identity verification settings, or

have you changed any of them? That is, are you using the app the way it came when

you first got it, or have you intentionally turned any identity verification settings on or

off?

_____________________________________________________________________________________

CONSUMER REPORTS 16

CONFIDENCE IN P2P APPS’ DATA SECURITY

We introduced this topic with a definition:

Your payment data is the information that you have given a P2P app to use to make payments that

you want to send. This could be your bank account information, a credit card or debit card number,

a prepaid card, a cryptocurrency wallet, or any other source of money that you use to make payments

through the app.

Over two-thirds of P2P users believe that their app adequately protects their payment data from

security risks like hacking or identity theft (72% agree or strongly agree that it does). Fifteen percent

disagree or strongly disagree that their app adequately protects their payment data. Another 13%

say they don’t know.

14%

58%

12%

3%

13%

Strongly

agree

Agree Disagree Strongly

disagree

Don't know

Please indicate to what extent you agree or disagree with the following statement:

Thinking about the P2P app that I use the most, and with the settings that I currently have in

place for that app, I believe that the app adequately protects my payment data from security

risks like hacking or identity theft.

Base: Respondents who use a P2P app.

_____________________________________________________________________________________

CONSUMER REPORTS 17

SENDING TO THE RIGHT PERSON

Sending money to the wrong person through a P2P app, often through a minor user mistake such as

a typo, is a pain point for consumers. Money that is sent through a P2P app is unrecoverable and P2P

apps as a rule do not take responsibility for those losses. Some P2P apps attempt to address this

issue by exhorting their users to check to make sure they are sending to the right person before they

hit the “send” button.

About two-thirds (66%) of P2P users say they always check that it’s the right person when sending

money to someone for the first time. Around four in ten (39%) say they always check when sending

money to someone they have sent to previously. Seven percent say they never check the first time,

and 17% say they never check when sending money to someone they have sent to previously.

66%

19%

7%

8%

39%

36%

17%

8%

Always Sometimes Never It depends on the app

The first time you send money to this person

through this app

Sending money again to a person you have

previously sent money to through this app

When you send money using a P2P app in each of the circumstances listed below,

about how often, if at all, would you say you check to make sure you're sending it to

the right person?

Base: Respondents who use a P2P app.

_____________________________________________________________________________________

CONSUMER REPORTS 18

SENDING TO A PERSON YOU HAVE NOT MET

P2P apps are extremely convenient for sending money to people you don’t know. For instance,

imagine that you learn from social media that someone in your neighborhood has an extra ticket to

a concert that you want to go to. They can send you the ticket digitally and you can pay them

through a P2P app without ever having to meet or even give them your phone number. There are

obvious risks to this arrangement, as neither party has a basis for trusting the other to follow through

on their part of the deal. In fact, some scams are perpetuated through arrangements like these.

Four out of ten P2P users (41%) have never sent money through a P2P app to a person they have not

met. Another three out of ten (31%) have done it once or twice. The remaining 28% have digitally

sent money to a stranger at least three times.

41%

31%

17%

6%

5%

I have never done this

Once or twice

3 to 9 times

10 to 19 times

At least 20 times

How many times, if ever, would you say you have sent money through a P2P app to

someone you have not met?

For example, this could be paying for an item or service you purchased before receiving that

item or service, such as when buying online though a neighborhood group or Facebook

Marketplace. Again, we are only interested in payments to individuals, not businesses.

Base: Respondents who use a P2P app.

_____________________________________________________________________________________

CONSUMER REPORTS 19

Older P2P users (aged 60 and up) are more likely than younger people to say they have never sent

money through a P2P app to a person they have not met.

7

7

Difference is statistically significant controlling for race/ethnicity, gender, age, income, education, region,

urbanicity, and political leaning.

Never, 36%

33%

43%

59%

Once or twice,

34%

31%

35%

20%

19%

20%

14%

11%

5%

8%

5%

5%

5%

8%

3%

5%

18-29

30-44

45-59

60+

Never

Once or twice

3 to 9 times

10 to 19 times

At least 20 times

How many times, if ever, would you say you have sent money through a P2P app to

someone you have not met?

By age group.

Base: Respondents who use a P2P app.

_____________________________________________________________________________________

CONSUMER REPORTS 20

AES OCTOBER 2022: PEER-TO-PEER PAYMENT SERVICES

TRANSPARENCY

______________________________________________________

We began this section with an explanation of the topic.

This section asks about peer-to-peer payment services, also called mobile cash payment apps or

money transfer apps, such as PayPal, Venmo, Apple Pay, Google Pay, or Zelle. These services allow

users to send and receive money to one another directly through their smartphones, tablets, or

computers without using cash or checks. In this survey, we will refer to these as “P2P” services or

apps.

Some of these services can also be used to pay in stores or online. However, in this section, we are

only interested in person-to-person payments, not payments to businesses.

Survey respondents were given this instruction: Some of these services can also be used to pay in stores or

online. However, in this section, we are only interested in person-to-person payments, not payments to

businesses.

P2P APP USAGE

Six out of ten Americans say they have ever used a peer-to-peer

payment service to either send to or receive money from other people

(35% say no; 5% say they are unsure if they’ve used this type of

service). Younger individuals are more likely to have used P2P apps

(67% of those under age 60 versus 44% of those aged 60 and up).

And, those people with a higher income are more likely to have used

this type of service (76% of those who make $100,000 or more

compared to 42% of those who make less than $30,000).

UNDERSTANDING OF P2P SERVICES

Like all businesses, P2P companies must make money, or earn revenue, in order to run. We asked all

respondents, whether or not they have used a P2P service, to tell us if they know which types of

methods are used to earn revenue.

Overall, about three in ten Americans say they are at least somewhat familiar (among those who

use P2P, this increases to four in ten). While P2P usage is the strongest predictor of familiarity, other

significant factors include age and gender (younger individuals are more likely to be familiar with

this; women tend to say they are less familiar than men do).

60%

HAVE EVER USED A P2P

PAYMENT SERVICE

_____________________________________________________________________________________

CONSUMER REPORTS 21

How familiar, if at all, are you about the ways in

which P2P services make their money?

Total

Among those who have:

Used

P2P services

NOT used

P2P services

% % %

Very familiar 6 9 2

Somewhat familiar 23 30 12

Not too familiar 29 31 24

Not familiar at all 43 30 62

Base: All respondents.

Next, a list of possible ways that P2P services might make money was presented. Respondents were

given the instruction that: Companies may do more than one of these practices to earn revenue, while some

of the items listed are not actually in use by P2P companies. They were then asked to pick their

top three

choices of how they believe P2P services make the most money.

The most commonly selected include charging businesses a fee, selling customer data, charging users

a fee each time they send money, charging users a fee to rush or expedite a transfer, and advertising.

35%

34%

34%

33%

31%

21%

16%

16%

15%

1%

Charging businesses a fee to accept payment from

users, like a credit card company does

Selling their customers' data

Charging users a fee each time they send money

Charging a fee for users to rush or expedite a transfer

(that is, instantly or faster than a typical P2P transfer)

Advertising on the app and website

Charging fees for additional, non-P2P, services they

provide, such as crypto investing or credit cards

Charging a fee when a customer can't cover a

payment

Investing the money that customers keep in their

balances, like a bank does

Collecting membership fees to use the app

Other

From which of these do you think P2P services make the most money?

Base: All respondents.

Respondents selected up to three choices.

_____________________________________________________________________________________

CONSUMER REPORTS 22

This set of five is consistently at the top among users and non-users alike, along with people who say

they are at least somewhat familiar with how P2P services make their money and those who say they

are less familiar.

The graphs below show that even among P2P users, they are not particularly confident in their

knowledge about P2P apps. Only

about half of users (51%) agree that they are fully informed about

the potential risks to users (and even fewer say so among non-P2P users—26%). And,

seven out of

ten users (71%) believe themselves to be knowledgeable about the steps to use, settings, and

functionality of the P2P app they use most often (just 15% say “very knowledgeable”). More younger

P2P users feel that they are knowledgeable on how to use their chosen P2P app (85% of those aged

18 to 29) compared to older P2P users (59% of those aged 60 and up).

Knowledge about P2P services, by users

Base: Respondents who have used P2P services.

_____________________________________________________________________________________

CONSUMER REPORTS 23

METHODOLOGY

____________________________________________________

Every month since January 2020, Consumer Reports has conducted a nationally representative multi-

mode American Experiences Survey. This omnibus survey reflects the ongoing work of Consumer

Reports by fielding multiple sections on different topics of consumer interest each month.

NORC at the University of Chicago administers the survey through its AmeriSpeak® Panel to a

nationally representative sample of U.S. adult residents. A general population sample of U.S adults

age 18 and older is selected from NORC’s AmeriSpeak® Panel for this study each month. Funded and

operated by NORC at the University of Chicago, AmeriSpeak®

is a probability-based panel designed

to be representative of the US household population. Randomly selected US households are sampled

using area probability and address-based sampling, with a known, non-zero probability of selection

from the NORC National Sample Frame. These sampled households are then contacted by US mail,

telephone, and field interviewers (face to face). The panel provides sample coverage of approximately

97% of the U.S. household population. Those excluded from the sample include people with P.O. Box

only addresses, some addresses not listed in the USPS Delivery Sequence File, and some newly

constructed dwellings. While most AmeriSpeak households participate in surveys by web, non-internet

households can participate in AmeriSpeak surveys by telephone. Households without conventional

internet access but having web access via smartphones are allowed to participate in AmeriSpeak

surveys by web. AmeriSpeak panelists participate in NORC studies or studies conducted by NORC on

behalf of governmental agencies, academic researchers, and media and commercial organizations.

Detailed documentation follows for each of the four surveys referenced in this report.

March 2022

This multi-mode survey was fielded by NORC at the University of Chicago using a nationally

representative sample. The survey was conducted from March 11 – 22, 2022. Interviews were

conducted in English (n = 2,031) and in Spanish (n = 85), and were administered both online (n = 1,982)

and by phone (n = 134).

In total NORC collected 2,116 interviews. The margin of error for the sample of 2,116 is +/- 2.83 at the

95% confidence level. Smaller subgroups will have larger error margins. Panelists were offered the

cash equivalent of $3 for completing the survey.

Final data are weighted by age, gender, race/Hispanic ethnicity, housing tenure, telephone status,

education, and Census Division to be proportionally representative of the U.S. adult population. Key

demographic characteristics (after weighting is applied) of this sample are presented below:

• 52% female

• Average age of 48 years old (median 47)

• 62% white, non-Hispanic

• 35% 4-year college graduates

• 54% have a household income of $50,000 or more

_____________________________________________________________________________________

CONSUMER REPORTS 24

August 2022

This multi-mode survey was fielded by NORC at the University of Chicago using a nationally

representative sample. The survey was conducted from August 5-15, 2022. Interviews were conducted

in English and in Spanish, and were administered both online and by phone.

In total NORC collected 2,123 interviews, 2,028 by web mode and 95 by phone mode, 2,038 in English

and 85 in Spanish. The margin of error for the sample of 2,123 is +/- 2.63% at the 95% confidence

level. Smaller subgroups will have larger error margins. Panelists were offered the cash equivalent of

$3 for completing the survey.

Final data are weighted by age, gender, race/Hispanic ethnicity, housing tenure, telephone status,

education, and Census Division to be proportionally representative of the U.S. adult population. Key

demographic characteristics (after weighting is applied) of this sample are presented below:

• 51% female

• Median age of 48 years old

• 62% White, Non-Hispanic

• 35% 4-year college graduates

• 61% have a household income of $50,000 or more

September 2022

This multi-mode survey was fielded by NORC at the University of Chicago using a nationally

representative sample. The survey was conducted from September 9-21, 2022. Interviews were

conducted in English (n = 2,452) and in Spanish (n = 67), and were administered both online (n = 2,386)

and by phone (n = 133).

In total NORC collected 2,519 interviews. The margin of error for the sample of 2,519 is +/- 2.47 at the

95% confidence level. Smaller subgroups will have larger error margins. Panelists were offered the

cash equivalent of $3 for completing the survey.

Final data are weighted by age, gender, race/Hispanic ethnicity, housing tenure, telephone status,

education, and Census Division to be proportionally representative of the U.S. adult population. Key

demographic characteristics (after weighting is applied) of this sample are presented below:

• 51% female

• Average age of 48 years old (median 47)

• 62% white, non-Hispanic

• 35% 4-year college graduates

• 58% have a household income of $50,000 or more

_____________________________________________________________________________________

CONSUMER REPORTS 25

October 2022

This multi-mode survey was fielded by NORC at the University of Chicago using a nationally

representative sample. The survey was conducted from October 6-17, 2022. Interviews were

conducted in English and in Spanish, and were administered both online and by phone.

In total NORC collected 2,084 interviews, 1,987 by web mode and 97 by phone mode, 1,963 in English

and 121 in Spanish. The margin of error for the sample of 2,084 is +/- 2.66% at the 95% confidence

level. Smaller subgroups will have larger error margins. Panelists were offered the cash equivalent of

$3 for completing the survey.

Final data are weighted by age, gender, race/Hispanic ethnicity, housing tenure, telephone status,

education, and Census Division to be proportionally representative of the U.S. adult population. Key

demographic characteristics (after weighting is applied) of this sample are presented below:

• 51% female

• Median age of 48 years old

• 62% White, Non-Hispanic

• 36% 4-year college graduates

• 60% have a household income of $50,000 or more

Toplines

Toplines from each of the surveys are available on Consumer Reports’ website at the following

addresses:

March 2022:

https://article.images.consumerreports.org/prod/content/dam/surveys/Consumer_Reports_AES_Mar

ch_2022

August 2022:

https://article.images.consumerreports.org/prod/content/dam/surveys/Consumer_Reports_AES_Aug

ust_2022.pdf

September 2022:

https://article.images.consumerreports.org/image/upload/v1664486045/prod/content/dam/surveys/

Consumer_Reports_AES_September_2022.pdf

October 2022:

https://article.images.consumerreports.org/image/upload/v1666902955/prod/content/dam/surveys/

Consumer_Reports_AES_October_2022.pdf