THE COMMITTEE OF EUROPEAN SECURITIES REGULATORS

11-13 avenue de Friedland - 75008 PARIS - FRANCE - Tel.: 33.(0).1.58.36.43.21 - Fax: 33.(0).1.58.36.43.30

Web site: www.cesr.eu

Ref.: CESR/08-639

CESR’s technical advice to the European

Commission on Indian GAAP

CONSULTATION PAPER

October 2008

2

INDEX

I. EXECUTIVE SUMMARY ................................................................................................................................3

II. INTRODUCTION.......................................................................................................................................4

III. ASSESSMENT .............................................................................................................................................6

IV. FINAL CAVEAT IN RELATION TO THIS ADVICE ...................................................................................11

V. APPENDICES............................................................................................................................................12

3

I. Executive summary

1. CESR provides in this advice details of its work and conclusions concerning the equivalence

of Indian GAAP in accordance with a mandate from the European Commission.

2. In summary CESR's advice to the Commission is as follows:

3. CESR has conducted an assessment of the program to converge existing Indian Accounting

Standards with IFRS, focusing in particular on whether this program is comprehensive and

capable of being completed before 31 December 2011. In the timeframe given for this

assessment, CESR has only been able to undertake limited work in relation to Indian GAAP

and would point out that the information available to it has only come from three sources

namely:

- A meeting between a CESR delegation and representatives from the Institute of

Chartered Accountants of India (ICAI) and the Indian Ministry of Corporate Affairs;

- Documents supplied to CESR by the ICAI; and

- Publicly available sources concerning the Indian convergence program and its

progress (in particular the concept paper issued by the ICAI in October 2007).

4. On the basis of the information detailed above, CESR has drawn the following conclusions:

- The ICAI has made, in July 2007, a public commitment to adopt International

Financial Reporting Standards before 31 December 2011;

- The Indian Government confirmed publicly in May 2008, its intention to achieve

convergence with IFRS by 2011;

- The ICAI has noted that it might make modifications to IFRSs to reflect "Indian

conditions" such as requiring additional disclosures, changing some terminology and

omitting some options or alternative treatments. However, these changes are expected

to be minor and the stated intention of both the ICAI and the Indian Government is

that Indian Accounting Standards will to all intents and purposes be fully IFRS

compliant by the end of the program and that Indian issuers will therefore be in a

position to make an absolute statement of compliance with IFRS in their notes.; and

- Effective measures are consequently being taken to secure the timely and complete

convergence of Indian Accounting Standards to International Financial Reporting

Standards by 31 December 2011.

5. In relation to the third point in paragraph 4 above, CESR would point out that it has discussed

the effects of these proposals with representatives of the ICAI and the Indian Government and

has concluded that they would seem to fall into the category of differences to IFRS that CESR

highlighted in paragraph 24 of its advice to the EC on a mechanism for determining

equivalence (ref CESR/07-289) namely “

Regarding the comparison of measurement

principles, CESR considers that it is only necessary that the third country GAAP principles be

allowed under IFRS for these to be considered acceptable. Consequently, the principles

concerned do not need necessarily to be the same as those an IFRS issuer might have chosen

in the circumstances. This is in line with the spirit of a GAAP being equivalent not the same as

IFRS”.

6. It is clear from CESR’s interviews with the ICAI and the Indian Government that the two

bodies are working closely together to achieve these objectives.

7. CESR is consequently of the opinion that the convergence program in India is comprehensive

and has no reason to doubt that the ICAI and the Indian Government will be in a position to

achieve their objectives by 2011.

4

8. On this basis, if the Commission were minded to allow Indian issuers to use Indian GAAP

when accessing EU markets, CESR recommends the Commission accept Indian GAAP

according to article 4 of the Commission Regulation on the mechanism until it is in a position

to make a decision under article 2.

II. Introduction

Background

9. The Prospectus Directive and Regulation (“the prospectus regime”)

1

and the Transparency

Directive

2

will require the European Commission (“EC or the Commission”) to establish by

2008 whether a given third country GAAP is equivalent to IFRS

3.

10. As a result of the prospectus regime, third country issuers who have their securities admitted

to trading on an EU regulated market or who wish to make a public offer of their securities in

Europe, are required from 1st January 2007 to publish a prospectus including financial

statements prepared on the basis of IFRS adopted pursuant to EC Regulation 1606/2002 or on

the basis of a third country’s national accounting standards ("third country GAAP")

equivalent to those standards.

11. Similarly, under the Transparency Directive, from January 2007 third country issuers whose

securities are admitted to trading on an EU-regulated market will also have to provide annual

and half-yearly financial statements which should either be prepared in accordance with

IFRS adopted pursuant to EC Regulation 1606/2002 or third country GAAP equivalent to

those standards.

12. In December 2006 the EC adopted two measures

4

allowing a two-year transitional period

(until December 2008) during which third country issuers can prepare their annual

financial statements and half-yearly financial statements in accordance with the accounting

standards of Canada, Japan or the United States. The aim of these transitional provisions was

to give more time to the standard setters and regulators of those countries to continue with

their convergence processes. As other countries are also in the process of converging their

national GAAPs to IFRS over various periods of time, the Commission considered it

appropriate to allow the same two-year transitional period to third country issuers preparing

their annual and half-yearly financial statements in accordance with a GAAP that is

converging to IFRS, provided certain conditions are met.

1

Directive 2003/71/EC of the European Parliament and of the Council of 4 November 2003 on the

prospectus to be published when securities are offered to the public or admitted to trading and amending

Directive 2001/34/EC

Commission Regulation (EC) No 809/2004 of 29 April 2004 implementing Directive 2003/71/EC of the

European Parliament and the Council as regards information contained in prospectuses as well as the

format, incorporation by reference and publication of such prospectuses and dissemination of

advertisements.

2

Directive 2004/109/EC of the European Parliament and of the Council of 15 December 2004 on the

harmonisation of transparency requirements in relation to information about issuers whose securities are

admitted to trading on a regulated market and amending Directive 2001/34/EC.

3

The term “IFRS” should be understood in this paper as referring to IFRS as adopted by the EU.

4

Commission Regulation 1787/2006 of 4 December amending Commission Regulation 809/2004 on

prospectuses and Commission Decision 2006/891/EC of 4 December 2006 on the use by third country

issuers of securities of information prepared under internationally accepted accounting standards (“the

Transparency Decision”).

5

13. The abovementioned December 2006 measures envisage a different treatment of third

country issuers before and after January 2009:

- Transitional period until January 2009

. During this phase, accounting frameworks

other than IFRS, Canadian, Japanese or US GAAP may be used subject to certain

conditions

5

. The decision to accept other accounting frameworks is the responsibility

of the competent authority, although recitals in the two measures state that

“To ensure

consistency within the Community, CESR should co-ordinate the competent

authorities’ assessment as to whether those conditions are satisfied in respect of

individual third country GAAP”.

- After the transitional period

, a third country’s GAAP will be acceptable only if it has

been determined equivalent to IFRS by the European Commission pursuant to their

definition of equivalence which they will establish by 1 January 2008. The

Commission will consult CESR on the appropriateness of the definition of

"equivalence", the "equivalence mechanism" and the actual determination of

equivalence.

14. Before 1 January 2009, the Commission shall decide on the equivalence of the GAAP of third

countries, pursuant to a definition of equivalence and an equivalence mechanism that it will

have established before 1 January 2008. In order to start the process for determining

equivalence, the EC has asked CESR for advice in several phases. In March 2007 CESR

submitted to the European Commission its first advice containing a definition of equivalence.

15. In June 2007, CESR submitted its second advice on a mechanism for determining the

equivalence of the GAAPs of third countries to the European Commission. On the basis of this

second advice, the Commission has published Regulation (EC) 1569/2007 “

Commission

Regulation establishing a mechanism for the determination of equivalence of accounting

standards applied by third country issuers of securities pursuant to Directives 2003/71/EC

and 2004/109/EC of the European Parliament and of the Council

” (“

Commission Regulation

on the mechanism

”). The Regulation lays down the conditions under which the GAAP of a

third country may be considered equivalent to IFRS pursuant to a definition of equivalence set

in article 2. The Regulation also sets out in article 4 certain conditions for the acceptance of

third country accounting standards for a limited period expiring no later than 31

st

December

2011.

16. In February 2008, CESR received a request from the Commission to provide advice on

Canadian, Indian and South Korean GAAPs. CESR published a technical advice on Canadian

and South Korean GAAP (Ref/ CESR 08-293) in May 2008. In this paper, CESR indicated that

it intended to consult on Indian GAAP subsequently as it was still - at that time - in the

process of obtaining information about the situation regarding the use of IFRS in India. This

document addresses the work on a potential decision on the equivalence or acceptance of

Indian GAAP.

17. Within CESR, the operational group CESR-Fin chaired by Fernando Restoy, executive board

member of the Spanish CNMV, has been charged with fulfilling the EC’s request.

5

According to the revised Article 35.5A (c) of the Prospectus Regulation (and the similar provision in the

Transparency Decision) these conditions are:

(i) The third country authority responsible for the national accounting standards in question has

made a public

commitment, before the start of the financial year in which the prospectus is filed,

to converge those standards with IFRS;

(ii) That authority has established a work programme

which demonstrates its intention to progress

towards convergence before 31 December 2008; and

(iii) The issuer provides evidence

that satisfies the competent authority that the conditions in (i) and

(ii) are met.

6

Public Consultation and Timetable

18. Comments are invited on all aspects of this paper but where we anticipate that feedback will

be particularly useful, we have directed stakeholders to some issues for particular comment.

19. The consultation period closes on 24 October 2008. Respondents are invited to send their

comments via CESR's website (www.cesr.eu) under the section "Consultations". CESR

acknowledges that this is still a short period but it results from the Commission’s deadline to

CESR to report to it. CESR will assess the responses received and revise its proposals if

necessary. CESR expects to submit the final advice to the Commission in early November. All

responses that have not been labelled as confidential will be published on CESR’s website.

III. ASSESSMENT

Extract from the Commission’s mandate

6

Description of the convergence program in India

20. In a concept paper published in October 2007, the Council of the Institute of Chartered

Accountants of India (ICAI), the Indian National Standards Setter, announced a plan to

converge Indian Accounting Standards with International Financial Reporting Standards

(IFRSs) issued by the International Accounting Standards Board (IASB) for public interest

entities, in particular listed companies, so that by their accounting periods commencing on or

after 1

st

April 2011, such companies would in effect be using full IFRS. “Public interest

entities” are defined in the concept paper as:

- Listed entities;

- Banks, financial institutions, mutual funds and insurance entities;

- Entities with turnover exceeding 1 billion rupees (approximately US$ 25 million);

- Entities having public deposits and/or borrowings from banks and financial

institutions in excess of 250 million rupees (approximately US$6.25 million); and

- Holding or subsidiary companies of any of the above entities.

21. The ICAI intends convergence of Indian GAAP to IFRS to take place without any carve-outs

and to become effective for accounting periods beginning on or after 1

st

April 2011. This said

the ICAI also accepts that a few minor differences may need to remain as:

- Some optional treatments allowed under IFRS may be omitted in Indian Accounting

Standards (the ICAI wants to reduce or eliminate alternative treatments allowed

under IFRS to ensure better comparability of financial statements between issuers);

- Some additional disclosures may be required in order to comply with local company

or securities laws; and

6

Please refer to appendix I for the full mandate from the European Commission.

We (the Commission) would like to as

k

you

(CESR

)

t

o

:

For the national GAAPs of countries whose national authority responsible for the national

accounting standards has established a convergence programme envisaged to be completed

before 31 December 2011 and GAAPs of countries which are in the process of converging to

IFRS, to provide an assessment of the existing convergence program focussing especially on

whether it is comprehensive and capable of being completed before 31 December 2011.

7

- Some terminology used in IFRS may need to be changed to align it more closely with

existing Indian GAAP and Indian legal terminology.

22. CESR has discussed the effects of these proposals with representatives of the ICAI and the

Indian Government and has concluded that they would seem to fall into the category of

differences to IFRS that CESR highlighted in paragraph 24 of its advice to the EC on a

mechanism for determining equivalence (ref CESR/07-289) namely “

Regarding the

comparison of measurement principles, CESR considers that it is only necessary that the third

country GAAP principles be allowed under IFRS

for these to be considered acceptable.

Consequently, the principles concerned do not need necessarily to be the same as those an

IFRS issuer might have chosen in the circumstances. This is in line with the spirit of a GAAP

being equivalent not the same as IFRS”.

23. Interpretations issued by the International Financial Reporting Interpretations Committee

(IFRIC) will also be adopted as part of the new accounting standards. All new or revised IFRSs

issued during the period of the convergence program will also be considered for adoption

before 1

st

April 2011 (for instance the Indian accounting standard equivalent to IFRS 7 has

already been issued by the ICAI).

24. CESR has been informed that the Accounting Standards Board (ASB) of the Institute of

Chartered Accountants of India (ICAI) has always sought to develop principle-based

Accounting Standards (ASs) based on IFRSs, having regard to the Indian legal and economic

environment. When formulating ASs, the aim of the ICAI has therefore always been to

comply, as far as possible with IFRS. However, in some cases, departures from IFRS have been

necessary to reflect "

Indian conditions

", for instance the existence of conflicting regulatory

requirements or the level of preparedness of the industry. The aim of the on-going

convergence program therefore is merely to further reduce these differences and does not in

any way represent a major change to the way accounting standards are set in India.

25. Consequently, the ASB is at the moment modifying Indian Accounting Standards to the extent

necessary to convergence them totally with IFRS. Details of the existing differences between

Indian standards and their matching IFRS counterpart as at 1

st

August 2008 are given in

Appendix III in as far as such differences have been notified to CESR. As the table shows,

Indian standards should be substantially similar to their IFRS counterparts by the end of the

convergence program.

26. The ICAI has also established five working groups which are in the process of identifying all

the existing conflicting legal and regulatory requirements which might stand in the way of

convergence. A group has been set up to look at conflicts in relation to banks, insurance

companies, non-financial institutions and company and securities regulation respectively.

The issues raised by these groups are in the process of being discussed with the relevant

governmental or regulatory bodies with a view to any necessary changes in laws and

regulations being put into place before 2011. An exhaustive list of all relevant legal issues is

not publicly available at the moment (as the groups are still in the process of identifying

them) and consequently has not been provided to CESR for the purposes of this assessment.

27. The ultimate objective of the ICAI and the Indian Government, as stated above, remains that

financial statements prepared under the revised Indian accounting standards will be IFRS

compliant and that issuers will therefore be in a position to make an absolute statement of

compliance with IFRS in their notes. It is clear from CESR’s interviews with the ICAI and the

Indian Government that the two bodies are working closely together to achieve this objective.

28. CESR has analysed the proposed work program of the ICAI. Achieving convergence will mean

the issuance of 2 final standards by the end of 2008 and the issuance of 14 revised standards

by the end of 2009. CESR does not necessarily believe it is in a position to comment on

8

individual elements of the programme but has no reason to doubt that, overall, the ICAI may

well be able to achieve convergence by 2011.

Scope of the convergence program

29. In total, at least 6,000 companies listed in India (on the Bombay Stock Exchanges and the

National Stock Exchange of India) will be required to use the newly revised IFRS-based Indian

Accounting Standards when they become compulsory on 1

st

April 2011.

Legal environment

30. In India, the Accounting Standards Board of ICAI (ASB) is the independent body with all the

powers necessary to develop and establish standards and guidance governing financial

accounting and reporting. It has the power to issue and publish accounting pronouncements

on its own authority which are then made mandatory by Indian law following approval from

the Ministry of Corporate Affairs, through its National Advisory Committee on Accounting

Standards (NACAS).

31. The Securities and Exchange Board of India (SEBI) through the Listing Agreement with Indian

stock-exchanges requires all listed companies to apply the accounting standards issued by the

ICAI.

32. A recent public statement

7

of the Ministry of Corporate Affairs confirmed the intention of the

Indian Government to achieve convergence with IFRS by 2011.

Timetable – Key events

33. The following table gives the key milestones that will need to be met for the Indian

convergence program to be achieved, based on current assumptions in the concept paper and

a changeover date of 1

st

April 2011 as announced in May 2008 by the Ministry of Corporate

Affairs. The table also identifies the key decisions that both the ICAI and the Indian

Government will need to make in order to implement the convergence program.

2008 - 2009 - Revisions to be made to Indian accounting standards to converge

them with their IFRS equivalents. 14 revised Indian standards

will be issued in 2009.

- Accounting professionals to obtain training and thorough

knowledge of IFRS.

1

st

April 2010 - All Indian accounting standards to have been issued by ICAI to

allow issuers to prepare comparative information for the

changeover date.

- Any last differences from IFRS to be fixed during the year.

1

st

April 2011 - Changeover date.

- First year of reporting under new IFRS-based accounting

standards.

34. In order to ensure a smooth transition to IFRSs by 1st April 2011, the ICAI has been

discussing convergence to IFRSs with the National Advisory Committee on Accounting

Standards established by the Ministry of Corporate Affairs, Government of India, and various

7

See appendix II

9

other affected regulators such as the Reserve Bank of India, the Insurance Regulatory and

Development Authority and the Securities and Exchange Board of India. The purpose of these

discussions is to ensure that these bodies too can implement any changes or amendments to

their rules, regulations or processes to enable IFRSs to be acceptable for use by their

constituents by the changeover date.

35. The ICAI has established a separate working group for liaising with the accounting profession

and with issuers. The objectives of this working group are to prepare both of these interest

groups for transition to IFRS. In particular, the working group aims to:

- Meet with representatives of the accounting profession and trade associations

representing issuers;

- Seek the cooperation of the accounting profession in enabling issuers to get ready for

IFRS;

- Provide support to the accounting profession in conducting seminars and workshops

on IFRS for senior management and accountants both in industry and in practice;

and

- Seek views from the accounting profession on the implementation of IFRS.

36. According to the ICAI, IFRS knowledge in India is beginning to become more widespread but

over the next few years, market participants will face a number of IFRS education and

resources challenges. Aware of this fact, the ICAI is organising and holding, through its

regional councils and branches, training programs and seminars for both auditors and

preparers at the rate of approximately 4 or 5 seminars a month. In the autumn of 2008 the

ICAI intends to set up further work-shops to continue this education process.

37. In addition, a certification course on IFRS has been prepared by the Institute who hope to

finalise and commence implementing it over the next three months. The ICAI is also revising

the curriculum for training accountants in India (the Chartered Accountancy Course),

holding continuing professional education workshops, and preparing additional educational

material.

38. In all between now and 2011 the ICAI has the objective of training over 25,000 of its

members in practice and industry in the use of IFRS.

39. The ICAI has separate plans to issue some transitional guidance on IFRS (for instance on IAS

39 to help Indian banks with their transition). Such transitional guidance would deal with

the practical aspects of moving to IFRS such as advising issuers to plan to obtain comparative

information in advance of the transitional date given such information is not necessarily

always easy to obtain.

Adoption of future IFRS

40. After the changeover date, the ICAI has announced that convergence with IFRS will be a

continuing process. All future IFRSs issued by the IASB will first be translated into Hindi and

then endorsed in India as new Indian GAAP, using the same procedure as was used for the

original set of standards in preparation for 2011.

41. The ICAI plans to closely monitor the IASB’s activities and intends to play a greater role in the

IASB by:

- providing comments directly to the IASB on various discussion papers and exposure

drafts relating to IFRSs;

- involving industry and other stakeholders in the formulation of comments with a view to

influencing the formulation of IFRSs and other related pronouncements during their

development stages;

10

- identifying experts who can be selected to participate in IASB working groups;

- providing staff on a secondment basis or otherwise to participate in IASB projects;

- identifying issues regarding the interpretation of IFRSs and referring them to IFRIC; and

- providing, in those cases where IFRIC does not take a particular project onto its agenda,

guidance to its members and other affected parties.

42. The ICAI has already held several meetings with representatives of the IASB in relation to its

convergence program and its intention to become a user jurisdiction of IFRS although it has

yet to second any staff to the IASB.

43. As a result of these strategies, the ICAI believes it will be informed in a timely fashion about

any new developments within IFRS. Consequently, when a new standard is issued by the IASB,

the ICAI will have adequate time to assess and discuss internally the adoption of this standard

as an AS.

Assessment of the application of the standards

44. Under Indian law, the SEBI has the power to enforce financial reporting requirements against

issuers and to sanction them in cases where they are found to be non-compliant with Indian

accounting standards. The ICAI has set up a Financial Reporting Review Board (FRRB), the

role of which is to review the financial statements of listed entities. In the specific case of the

non-compliance of a listed company with financial reporting requirements, the FRRB is

obliged to report relevant details to the SEBI which will consider bringing sanctions against

the issuer concerned.

45. Both the ICAI (through its Code of Practice, which is given statutory effect by the Chartered

Accountants Act 1949) and the SEBI have extensive powers to take punitive action against

issuers and their directors for non-compliance with financial reporting requirements which

include disqualification, fines and, in severe cases, imprisonment. Only a court however can

actually require an issuer to restate its financial statements.

46. During the last 4 years, the FRRB has reviewed 107 companies and reported 79 cases of non-

compliance to the SEBI.

47. The ICAI has not indicated any intention of changing the structure of the enforcement system

in India as a result of moving to the use of the newly revised accounting standards during its

discussions with CESR regarding its convergence program.

Assessment of the convergence program in India

48. For the purpose of making a decision on equivalence or on whether a third country GAAP

qualifies for an extension of the existing transitional period, the European Commission has

requested CESR to provide an assessment of the convergence program in India, focusing in

particular on whether this program is comprehensive and capable of being completed before

31 December 2011. In the timeframe given for this assessment, CESR has only been able to

undertake limited work in relation to Indian GAAP as most of the information available to it

has only come from three sources:

- A meeting between a CESR delegation and representatives from the ICAI and the

Ministry of Corporate Affairs;

- Documents supplied to CESR by the ICAI; and

- Publicly available sources concerning the Indian convergence program and its

progress (in particular the concept paper).

11

49. On the basis of the information detailed above, CESR has drawn the following conclusions:

- The ICAI has made, in July 2007, a public commitment to adopt International

Financial Reporting Standards before 31 December 2011;

- The Indian Government confirmed publicly, in May 2008, its intention to achieve

convergence with IFRS by 2011;

- The ICAI has noted that it might make modifications to IFRSs to reflect "

Indian

conditions

" such as requiring additional disclosures, changing some terminology and

omitting some options or alternative treatments. However, these changes are expected

to be minor and the stated intention of both the ICAI and the Indian Government is

that Indian Accounting Standards will to all intents and purposes be fully IFRS

compliant by the end of the program; and

- Effective measures are consequently being taken to secure the timely and complete

convergence of Indian Accounting Standards to International Financial Reporting

Standards by 31 December 2011.

50. On this basis, if the Commission were minded to allow Indian issuers to use Indian GAAP

when accessing EU markets, CESR recommends the Commission accept Indian GAAP

according to article 4 of the Commission Regulation on the mechanism until it is in a position

to make a decision under article 2.

Question: Given the circumstances described above, do you agree with CESR’s assessment on

Indian GAAP?

IV. FINAL CAVEAT IN RELATION TO THIS ADVICE

51. As stated in paragraph 66 of its May 2007 advice, CESR considers that a pre-requisite for any

GAAP to be recognised as equivalent is that "filters" at the country level, and audit assurance

and enforcement at the entity level are sufficient for investors to be able to rely on them. CESR

also stated in that advice that for the purposes of establishing equivalence, CESR would also

assume that third country GAAPs are properly applied and that the necessary filters for

ensuring market confidence are in place for third country issuers using or participating in

the EU capital markets.

52. CESR is aware that the European Commission is performing work in order to establish the

status of third country auditors under the 8

th

Directive and consequently has not attempted to

perform its own assessment of such matters in the context of this advice. CESR would

however point out that this advice will need to be considered in the light of the results of such

work.

53. Noting the above but included for the sake of completeness, CESR has also been made aware

of the following facts during the course of its work on the Indian convergence program

which relate to the oversight of the accounting profession in India:

- The Independent Disciplinary Directorate of the ICAI is empowered under the

Chartered Accountants Act 1949 to take action against audit firms in cases of

professional misconduct. The scope of the actions it may take against such firms are

similar to those detailed as available to it against issuers in paragraph 46 above.

- The ICAI is also empowered to take action against any of its members as individuals

for failure to comply with professional standards whether they are active in practice

or in industry.

- The ICAI has constituted a Peer Review Board aimed at improving and enhancing the

quality of services provided by its members particularly regarding compliance with

technical standards. The Peer Review Board has a program for reviewing the work of

Indian audit firms on a regular basis.

12

V. Appendices

Appendix I – Draft request from the European Commission to CESR for technical advice

13

14

Appendix II – Announcement from the Ministry of Corporate Affairs

15

16

1

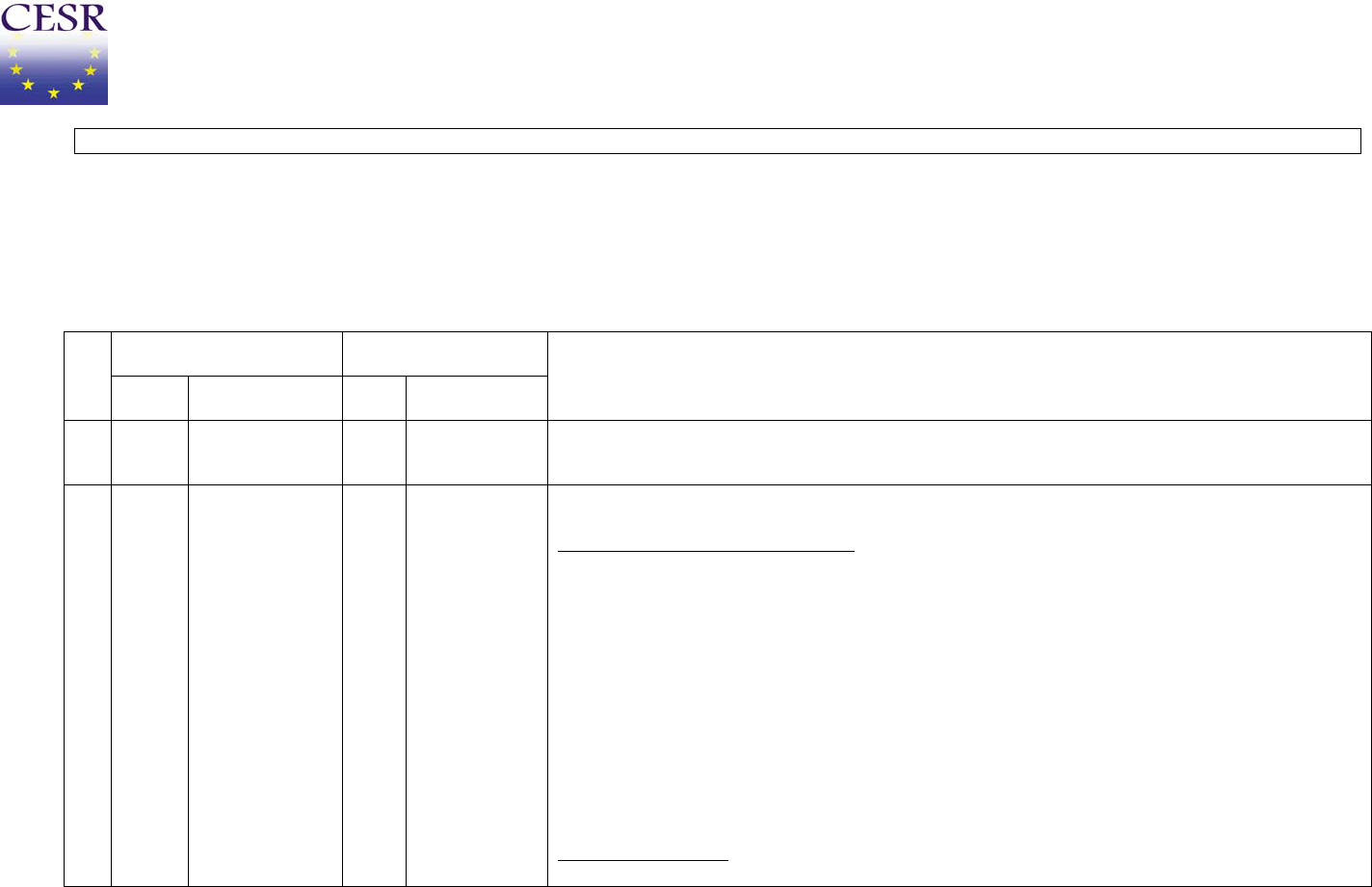

Appendix III – Major departures in Indian Accounting Standards from the corresponding IFRSs

The present position of Indian accounting standards has been depicted in the following comparative statements of International Financial Reporting

Standards and Indian Accounting Standards.

I. Indian Accounting Standards already issued by the Institute of Chartered Accountants of India (ICAI) corresponding to the International Financial

Reporting Standards.

International Financial

Reporting Standards (IFRSs)

Indian Accounting

Standards (ASs)

S.

No.

No.

Title of the

Standard

No.

Title of the

Standard

Major Differences

1. IAS 1 Presentation of

Financial

Statements

AS 1 Disclosure of

Accounting

Policies

AS 1 is based on the pre-revised IAS 1. AS 1 is presently under revision to bring it in line with the IAS 1.

The Exposure Draft of the revised AS 1 is being finalised on the basis of the comments received on its limited

exposure amongst the specified outside bodies. There is no difference between the Exposure Draft and IAS 1.

2. IAS 2 Inventories AS 2 Valuation of

Inventories

AS 2 is based on IAS 2 (revised 1993). IAS 2 has been revised in 2003 as a part of the IASB’s improvement

project. Major differences between AS 2 and IAS 2 (revised 2003) are as follows:

Differences due to level of preparedness

1. IAS 2 specifically deals with costs of inventories of an enterprise providing services. However, keeping

in view the level of understanding that was prevailing in the country regarding the treatment of inventories

of an enterprise providing services at the time of last revision of AS 2, the same are excluded from the scope

of AS 2.

2. Keeping in view the level of preparedness in the country at the time of last revision of AS 2, AS 2

requires lesser disclosures as compared to IAS 2.

3. IAS 2 specifically provides that the measurement requirements of the Standard do not apply to the

measurement of inventories held by commodity broker-traders who measure their inventories at fair value

less costs to sell. AS 2 does not contain any exclusion or separate provisions relating to inventories held by

commodity broker-traders. (Broker-traders are those who buy or sell commodities for others or on their

own account. The inventories are principally acquired by a broker-trader with the purpose of selling in the

near future and generating a profit from fluctuations in price or broker-traders’ margin.) By implication,

the measurement basis laid down in the standard, lower of cost and net realisable value, applies to

inventories of commodity trader-brokers.

Conceptual differences

4. AS 2 specifically excludes “selling and distribution costs” from the cost of Inventories and provides that

2

it is appropriate to recognise them as expenses in the period in which they are incurred. However IAS 2

excludes only “Selling Costs” and not “Distribution Costs”.

5. AS 2 does not deal with the issues relating to recognition of inventories as an expense including the

write down of inventories to net realisable value and any reversal of such write down.

6. AS 2 provides that the cost of inventories of items other than those which are not ordinarily

interchangeable and goods or services produced and segregated for specific projects should be assigned by

using the first-in, first-out (FIFO), or weighted average cost formula. It is specifically required by AS 2 that

the formula used should reflect the fairest possible approximation to the cost incurred in bringing the items

of inventory to their present location and condition. However IAS 2 does not require the same for the choice

of the formula to be used, rather it requires that same cost formula should be used for all inventories having

a similar nature and use to the entity.

Exposure Draft of AS 2 is being issued to converge with IAS 2. There is no difference between the ED and

IAS 2.

3. The

corresponding

IAS has been

withdrawn

AS 6 Depreciation

Accounting

AS 6 was formulated on the basis of IAS 4,

Depreciation Accounting

, which has been withdrawn since. The

corresponding Indian Accounting Standard (AS) 10,

Accounting for Fixed Assets,

is being revised

to bring it

in line with IAS 16. The Council has approved the draft of the revised AS 10 and the same will be issued

shortly. Upon issuance of the revised AS 10, AS 6 would be withdrawn.

4. IAS 7 Cash Flow

Statements

AS 3 Cash Flow

Statements

AS 3 is based on the current IAS 7. The major differences between IAS 7 and AS 3 are as below:

Differences due to removal of alternatives

1. In case of enterprises other than financial enterprises, unlike IAS 7, AS 3 does not provide any option with

regard to classification of interest paid. It requires interest paid to be classified as financing cash flows.

2. In case of enterprises other than financial enterprises, AS 3 does not provide any option with regard to

classification of interest and dividend received. It requires interest and dividend received to be classified as

investing cash flows.

3. AS 3 also does not provide any option regarding classification of dividend paid. It requires dividend paid

to be classified as financing cash flows.

AS 3 is presently under revision to converge with IAS 7.

5. IAS 8 Accounting

Policies, Changes

in Accounting

Estimates and

Errors

AS 5 Net Profit or

Loss for the

Period, Prior

Period Items

and Changes in

Acc. Pol.

AS 5 is based on the earlier IAS 8. AS 5 is presently under revision to bring it in line with the current IAS 8.

The exposure draft of the revised AS 5 is being prepared on the basis of the comments received on its limited

exposure among the specified outside bodies. There is no major difference between IAS 8 and the draft

revised standard.

6. IAS 10 Events After the

Balance Sheet

Date

AS 4 Contingencies

and Events

Occurring after

AS 4 is based on the pre-revised IAS 10 which dealt with the Contingencies as well as the Events Occurring

After the Balance Sheet Date. Recently, on the lines of IAS 37, the ICAI has issued AS 29. Pursuant to the

issuance of AS 29, the portion of AS 4 dealing with the Contingencies, except to the extent of impairment of

3

the Balance

Sheet Date

assets not covered by other accounting standards, stands superseded. AS 4 now deals with the Events After

the Balance Sheet Date. AS 4 is presently under revision to bring it in line with the corresponding IAS 10.

Difference due to legal and regulatory environment

1. As per IAS 10, proposed dividend is a non-adjusting event. However, as per the Indian law governing

companies, provision for proposed dividend is required to be made, probably as a measure of greater

accountability of the company concerned towards investors in respect of payment of dividend. While

attempts are made, from time to time, at various levels, to persuade the Government for changes in law; it

is a time-consuming process.

2. As per IAS 10, non-adjusting events, which are material, are required to be disclosed in the financial

statements. However as per AS 4, such disclosures are required to be made in the report of the approving

authority and not in the financial statements.

7. IAS 11 Construction

Contracts

AS 7 Construction

Contracts

AS 7 is based on the current IAS 11.

There is no difference between AS 7 and IAS 11.

8. IAS 12 Income Taxes AS 22 Accounting for

Taxes on

Income

Differences due to level of preparedness

Keeping in view the level of preparedness in the country at the time of issuance of AS 22, AS 22 was based

on the Income Statement Approach.

ICAI is revising AS 22 to bring it in line with IAS 12.

9. IAS 14 Segment

Reporting

AS 17 Segment

Reporting

AS 17 is based on the current IAS 14. The major differences between IAS 14 and AS 17 are described

hereinafter.

Differences due to removal of alternatives

1. IAS 14 encourages, but does not require, the reporting of vertically integrated activities as separate

segments. However, under AS 17, in case a vertically integrated segment meets the quantitative norms for

being a reportable segment, the relevant disclosures are required to be made.

2. As per IAS 14, a segment identified as a reportable segment in the immediately preceding period on

satisfying the relevant 10% threshold, shall be reportable segment in the current period also if the

management judges it to be of continuing significance. However as per AS 17, this reporting is mandatory

without considering the management’s judgement.

Differences due to level of preparedness

3. IAS 14 prescribes certain additional disclosure requirements regarding enterprise’s share of profit or

loss of associates and joint ventures and regarding restatement of prior year information, etc. At the time

of issuance of AS 17, there were no Accounting Standards in India dealing with accounting for investments

in associates and joint ventures, etc. Accordingly, these disclosures are not specifically covered in AS 17.

4. As per IAS 14, for a segment to qualify as a reportable segment, it is required for it to earn the majority

of its revenue from external customers in addition to meeting the 10% threshold criteria of revenue,

operating results or total assets required in AS 17.

4

The IASB has recently issued IFRS 8 on ‘Operating Segments’ which would supersede IAS 14 with effect

from January 2009. The ASB of the ICAI would consider the above differences between AS 17 and IAS 14

while revising AS 17 to bring it in line with IFRS 8 on ‘Operating Segments’.

10. IAS 16 Property, Plant

and Equipment

AS 10 Accounting for

Fixed Assets

AS 10 is based on the earlier IAS 16. AS 10 has now been revised to bring it in line with the current IAS 16.

The revised AS 10 has been approved by the Council and the NACAS. The following is the major difference

between IAS 16 and the revised AS 10:

Differences due to legal and regulatory environment

In India, the law governing the companies prescribes minimum rates of depreciation. Keeping this in view,

the revised AS 10 recognises that depreciation rates prescribed by the statute would be the minimum rates

of depreciation.

11. IAS 17 Leases AS 19 Leases AS 19 is based on IAS 17 (revised 1997). IAS 17 has been revised in 2004. The major differences between

IAS 17 and AS 19(revised 2004) are described hereinafter.

Conceptual differences

1. Keeping in view the peculiar land lease practices in the country, lease agreements to use lands are

specifically excluded from the scope of AS 19 whereas IAS 17 does not contain this exclusion.

2. IAS 17 specifically provides that the Standard shall not be applied as the basis of measurement for:

(a) property held by lessees that is accounted for as investment property;

(b) investment property provided by lessors under operating leases;

(c) biological assets held by lessees under finance leases; or

(d) biological assets provided by lessors under operating leases

However, AS 19 does not exclude the above from its scope.

5. AS 19 specifically prohibits upward revision in estimate of unguaranteed residual value during the

lease term. However IAS 17 does not prohibit the same.

6. As per IAS 17 initial direct costs incurred by a lessor other than a manufacturer or dealer lessor have to

be included in amount of lease receivable in the case of finance lease resulting in reduced amount of

income to be recognised over lease term and in the carrying amount of the asset in the case of operating

lease as to expense it over the lease term on the same basis as the lease income. However, as per AS 19,

these can be either charged off at the time of incurrence in the statement of profit and loss or can be

amortised over the lease period.

12. IAS 18 Revenue AS 9 Revenue

Recognition

AS 9 is based on the earlier IAS 18. AS 9 is presently under revision to bring it in line with the current IAS

18. AS 9 is presently under revision to converge with IAS 18.

13. IAS 19 Employee Benefits AS 15 Employee

Benefits

AS 15 is based on the current IAS 19. The major differences between IAS 19 and AS 15 are described

hereinafter.

Difference due to removal of alternatives

5

1. Unlike IAS 19, AS 15 does not provide any option with regard to recognition of actuarial gains and

losses. It requires such gains and losses to be recognised immediately in the statement of profit and loss.

Conceptual Difference

2. Regarding recognition of termination benefits as a liability, it is felt that merely on the basis of a detailed

formal plan, it would not be appropriate to recognise a provision since a liability cannot be considered to be

crystallised at this stage. Accordingly, AS 15 provides criteria for recognition of a provision for liability in

respect of termination benefits on the basis of the general criteria for recognition of provision as per AS 29,

Provisions, Contingent Liabilities and Contingent Assets

(corresponding to IAS 37).

It may be noted that the IASB has recently issued an Exposure Draft of the proposed Amendments to IAS 19

whereby the criteria regarding recognition of termination benefits as a liability are proposed to be amended.

The Exposure Draft proposes that voluntary termination benefits should be recognised when employees

accept the entity’s offer of those benefits. We, in our comments on the Exposure Draft, have pointed out

that in a country such as India, such a requirement would give erroneous results since the schemes

generally have the following characteristics in terms of the steps involved in implementing the scheme:

(i) Announcement of the scheme by an employer, which is considered as an ‘invitation to offer’ to the

employees rather than the offer to the employees for voluntary termination of their services.

(ii) Employees tender their applications under the scheme. This does not confer any right to the employees

under the scheme to claim termination benefits. In other words, tendering of application by an employee is

considered as an ‘offer’ in response to ‘invitation to offer’, rather than acceptance of the offer by the

employee.

(iii) The acceptance of the offer made by the employees as per (ii) above by the management.

Keeping in view the above, we have suggested that as per the above scheme, liabilities with regard to

voluntary termination benefits should be recognized at the time when the management accepts the offer of

the employees rather than at the time the employees tender their applications in response to the ‘invitation

to offer’ made by the management.

If our comments on the Exposure Draft are accepted, the amended criteria in IAS 19 would result into

recognition of the liability broadly at the same time as under the criteria prescribed in AS 15.

Incidentally, it may be mentioned that the treatment prescribed in AS 15 is also in consonance with the legal

position in India.

14. IAS 20 Accounting for

Government

Grants

AS 12 Accounting for

Government

Grants

AS 12 revised corresponding to IAS 20 has been approved by the Council and the NACAS. There is no

difference between the Draft of the standard and IAS 20.

15. IAS 21 The Effects of

Changes in

Foreign Exchange

Rates

AS 11 The Effects of

Changes in

Foreign

Exchange Rates

Difference due to level of preparedness

1. AS 11 is based on the integral and non-integral foreign operations approach, i.e., the approach which

was followed in the earlier IAS 21 (revised 1993).

2. The current IAS 21, which is based on ‘Functional Currency’ approach, gives similar results as that

6

under pre-revised IAS 21, which was based on integral /non-integral foreign operations approach.

Accordingly, there are no significant differences between IAS 21 and AS 11.

3. The current AS 11 has recently become effective, i.e., from 1-4-2004. It is felt that some experience

should be gained before shifting to the current IAS 21.

16. IAS 23 Borrowing Costs AS 16 Borrowing

Costs

There is no major difference between AS 16 and IAS 23 (revised 2007).

17. IAS 24 Related Party

Disclosures

AS 18 Related Party

Disclosures

AS 18 is based on IAS 24 (reformatted 1994) and following are the major differences between the two.

Conceptual differences

1. According to AS 18, as notified by the Government, a non-executive director of a company should not

be considered as a key management person by virtue of merely his being a director unless he has the

authority and responsibility for planning, directing and controlling the activities of the reporting enterprise.

However, IAS 24 provides for including non-executive director in key management personnel.

2. In AS 18 the term ‘relative’ is defined as “the spouse, son, daughter, brother, sister, father and mother

who may be expected to influence, or be influenced by, that individual in his/her dealings with the

reporting enterprise” whereas the comparable concept in IAS 36 is that of ‘close members of the family of

an individual’ who are “those family members who may be expected to influence, or be influenced by, that

individual in their dealings with the entity. They may include:

(a) the individual’s domestic partner and children;

(b) children of the individual’s domestic partner; and

(c) dependants of the individual or the individual’s domestic partner.”

18. IAS 27 Consolidated and

Separate

Financial

Statements

AS 21 Consolidated

Financial

Statements

AS 21 is based on IAS 27 (revised 2000). AS 21 is presently under revision to converge with IAS 27.

Difference due to legal and regulatory environment

Keeping in view the requirements of the law governing the companies, AS 21 defines control as ownership

of more than one-half of the voting power of an enterprise or as control over the composition of the

governing body of an enterprise so as to obtain economic benefits. This definition is different from IAS 27,

which defines control as “the power to govern the financial and operating policies of an enterprise so as to

obtain benefits from its activities”.

Conceptual Differences

Goodwill/Capital reserve is calculated by computing the difference between the cost to the parent of its

investment in the subsidiary and the parent’s portion of equity in the subsidiary in AS 21 whereas in IAS 27

fair value approach is followed.

19. IAS 28 Investments in

Associates

AS 23 Accounting for

Investments in

Associates

AS 23 is based on the IAS 28 (revised 2000).. AS 23 is presently under revision to converge with IAS 28.

Conceptual Differences

The conceptual differences, explained in relation to IAS 27, are relevant in this case also.

7

20. IAS 31 Interests in Joint

Ventures

AS 27 Financial

Reporting of

Interests in Joint

Ventures

AS 27 is based on the IAS 31 (revised 2000). AS 27 is presently under revision to converge with IAS 31.

Difference due to removal of alternatives

1. Unlike IAS 31, AS 27 does not provide any option for accounting of interests in jointly controlled entities in

the consolidated financial statements of the venturer. It requires proportionate consolidation to be followed and

venturer’s share of each of the assets, liabilities, income and expenses of a jointly controlled entity to be reported

as separate line items.

Conceptual Differences

2. The conceptual differences, explained in relation to IAS 27, are relevant in this case also.

21. IAS 32 Financial

Instruments:

Presentation

AS 31 Financial

Instruments:

Presentation

ICAI has recently issued AS 31 corresponding to IAS 32 and which will come into effect in respect of

accounting periods commencing on or after 1-4-2009 and will be recommendatory in nature for an initial

period of two years. There is no difference between AS 31 and corresponding IAS 32.

22. IAS 33 Earnings Per

Share

AS 20 Earnings Per

Share

AS 20 is based on the IAS 33 (issued 1997). Revisions made to IAS 33 are being looked into by the ASB of

the ICAI.

Differences due to level of preparedness

1. As per IAS 33 revised, basic and diluted amounts per share for the discontinued operation are required to be

disclosed. However AS 20 does not require such disclosures.

2. IAS 33 revised requires the disclosure of antidilutive instruments also which is not required by AS 20.

23. IAS 34 Interim Financial

Reporting

AS 25 Interim

Financial

Reporting

AS 25 is based on the current IAS 34. The major differences between IAS 34 and AS 25 are described

hereinafter.

Differences due to legal and regulatory environment

1. In India, at present, the statement of changes in equity is not presented in the annual financial

statements since, as per the law, this information is required to be disclosed partly in the profit and loss

account below the line and partly in the balance sheet and schedules thereto. Keeping this in view, unlike

IAS 34, AS 25 presently does not require presentation of the condensed statement of changes in equity.

However as a result of proposed revision to AS 1, limited revision to AS 25 has also been proposed, which

requires to present the condensed statement of changes in equity as part of condensed financial statements

and limited exposure for the same has been made.

2. Keeping in view the legal and regulatory requirements prevailing in India, AS 25 provides that in case a

statute or a regulator requires an enterprise to prepare and present interim information in a different form

and/or contents, then that format has to be followed. However, the recognition and measurement

principles as laid down in AS 25 have to be applied in respect of such information.

24. IAS 36 Impairment of

Assets

AS 28 Impairment of

Assets

AS 28 is based on the IAS 36 (issued 1998). At the time of issuance of AS 28, there was no major difference

between AS 28 and IAS 36.

IASB, pursuant to its project on Business Combinations, has made certain changes in IAS 36. AS 28 is

presently under revision to converge with IAS 36.

8

25. IAS 37 Provisions,

Contingent

Liabilities and

Contingent Assets

AS 29 Provisions,

Contingent

Liabilities and

Contingent

Assets

AS 29 is based on the current IAS 37. The major differences between IAS 37 and AS 29 are described

hereinafter.

Difference due to level of preparedness

1. AS 29 requires that the amount of a provision should not be discounted to its present value since

financial statements in India are prepared generally on historical cost basis and not on present value basis.

However a limited revision is being proposed to bring it in line with IAS 39 insofar as this aspect is

concerned.

Conceptual Differences

2. IAS 37 deals with ‘constructive obligation’ in the context of creation of a provision. The effect of

recognising provision on the basis of constructive obligation is that, in some cases, provision will be

required to be recognised at an early stage. For example, in case of a restructuring, a constructive obligation

arises when an enterprise has a detailed formal plan for the restructuring and the enterprise has raised a

valid expectation in those affected that it will carry out the restructuring by starting to implement that plan

or announcing its main features to those affected by it. It is felt that merely on the basis of a detailed formal

plan and announcement thereof, it would not be appropriate to recognise a provision since a liability cannot

be considered to be crystalised at this stage. Further, the judgment whether the management has raised valid

expectations in those affected may be a matter of considerable argument.

In view of the above, AS 29 does not specifically deal with ‘constructive obligation’. AS 29, however,

requires a provision to be created in respect of obligations arising from normal business practice, custom

and a desire to maintain good business relations or act in an equitable manner. In such cases, general

criteria for recognition of provision are required to be applied.

Incidentally, it may be mentioned that the treatment prescribed in AS 29 is also in consonance with the legal

position in India.

3. Unlike IAS 37, as a measure of prudence, AS 29 does not require contingent assets to be disclosed in the

f

inancial statements.

26. IAS 38 Intangible Assets AS 26 Intangible

Assets

AS 26 is based on IAS 38 (issued 1998). IASB, as a part of its project on Business Combinations, has revised

IAS 38. AS 26 is presently under revision to converge with IAS 38.

Following are the major differences between AS 26 and IAS 38:

Conceptual Differences

1. An intangible asset is defined as an identifiable non-monetary asset, without physical substance, held for

use in the production or supply of goods or services, for rental to others, or for administrative purposes

whereas IAS 38 defines an intangible asset ‘as an identifiable non-monetary asset without physical

substance’.

2. AS 26 is based on the assumption that the useful life of the intangible asset is always definite. In regard to

assets with definite life also there is a rebuttable presumption that the useful life of an intangible asset will

not exceed ten years from the date when the asset is available for use. Whereas IAS 36 recognises that an

9

intangible asset may have an indefinite life. In respect of intangible assets having a definite life, the Standard

does not contain rebuttable presumption about their useful life.

3. As per AS 26 if control over the future economic benefits from an intangible asset is achieved through

legal rights that have been granted for a finite period, it is required that the useful life of the intangible asset

should not exceed the period of the legal rights unless:

(a)the legal rights are renewable; and

(b)

renewal is

virtually certain

.

However, IAS 38 requires ‘evidence to support renewal’ instead of virual certainty for renewal.

27. IAS 39 Financial

Instruments:

Recognition and

Measurement

AS 30 Financial

Instruments:

Recognition and

measurement

ICAI has recently issued AS 30 corresponding to IAS 39 and which will come into effect in respect of

accounting periods commencing on or after 1-4-2009 and will be recommendatory in nature for an initial

period of two years. There is no difference between AS 30 and IAS 39.

28. Corresponding

IAS has been

withdrawn

AS 13 Accounting for

Investments

AS 13 was formulated on the basis of IAS 25,

Accounting for Investments

. Pursuant to the issuance of IAS 32,

IAS 39, IAS 40 and IFRS 7, IAS 25 has been superseded.

AS 13 shall also stand withdrawn on the date, AS 30 and AS 31 becoming mandatory except to the extent it

relates to accounting for investment properties.

29. IAS 40 Investment

Property

- Dealt with by

Accounting

Standard 13

AS 13 was formulated on the basis of IAS 25,

Accounting for Investments

. Pursuant to the issuance of IAS

32, IAS 39 and IAS 40, IAS 25 has been superseded. The proposed Indian Accounting Standard

corresponding to IAS 40 is under preparation.

30. IFRS 3 Business

Combinations

AS 14 Accounting for

Amalgamations

AS 14 was formulated on the basis of earlier IAS 22,

Business Combinations

.

Pursuant to the issuance of IFRS 3,

Business Combinations

, IAS 22 has been superseded.

AS 14 is presently under revision to bring it in line with the IFRS 3.

31. IFRS 5 Non-current

Assets Held for

Sale and

Discontinued

Operations

AS 24 Discontinuing

Operations.

AS 24 is based on the IAS 35,

Discontinuing Operations

, which has been superseded pursuant to the

issuance of IFRS 5,

Non-current Assets Held for Sale and Discontinued Operations

.

An Indian Accounting Standard corresponding to IFRS 5 is under preparation.

After the issuance of this Indian accounting standard, AS 24 is proposed to be withdrawn.

32. IFRS 7 Financial

Instruments:

Disclosures

AS 32 Financial

Instruments:

Disclosures

AS 32 has been finalised for issuance which will come into effect in respect of accounting periods

commencing on or after 1-4-2009 and will be recommendatory in nature for an initial period of two years.

There is no difference between AS 32 and IFRS 7.

10

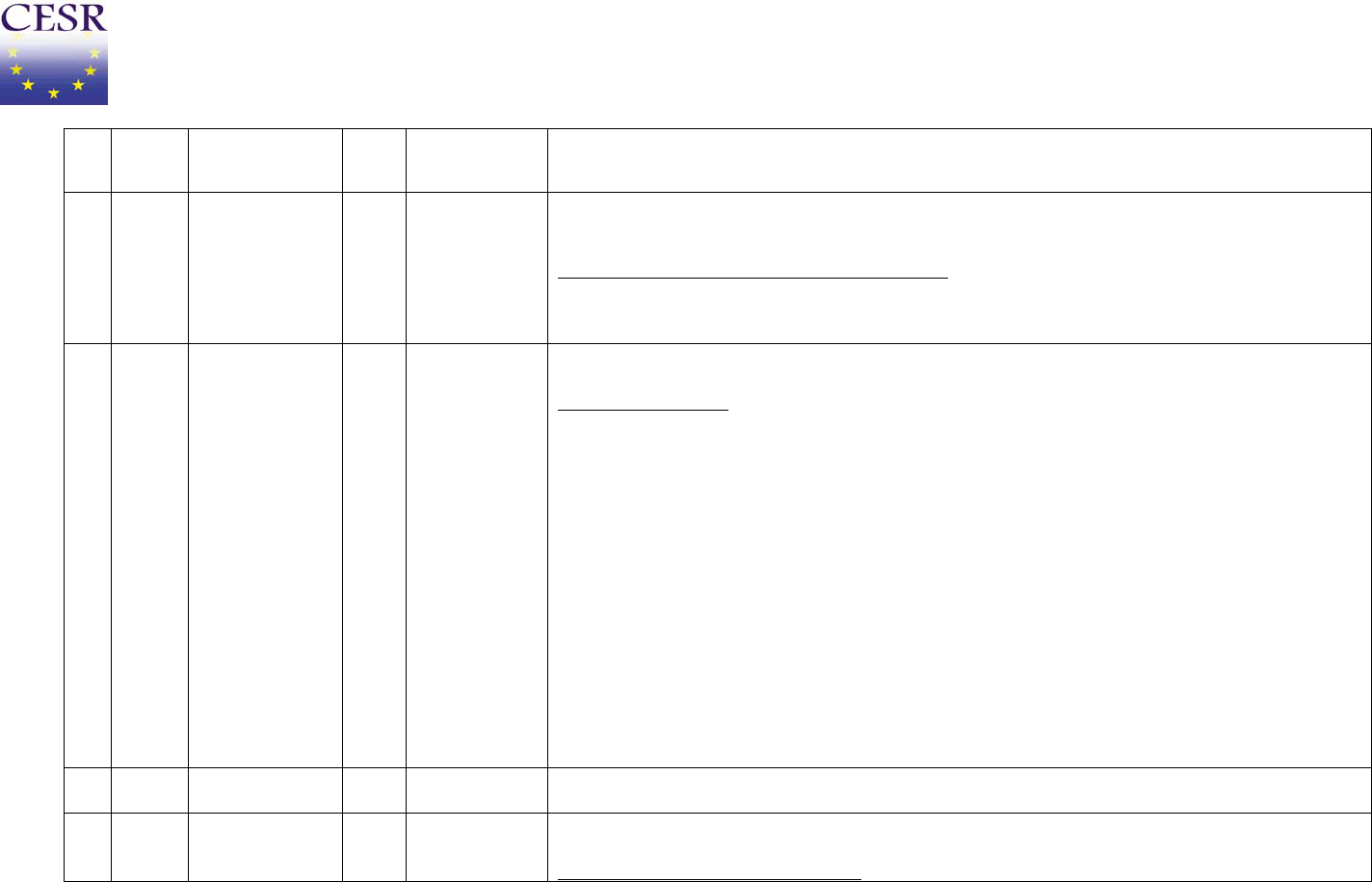

II. International Financial Reporting Standards which shall be adopted from the period starting from 1

st

April 2011 for the reasons indicated.

International Financial Reporting Standard

S. No.

No. Title of the Standard

Reasons

1. IAS 26 Accounting and Reporting by Retirement

Benefit Plans

IAS 26 is having some conceptual problems and IASB is also considering for its revision, so it has

been decoded not to take up it presently.

2. IAS 29 Financial Reporting in Hyper-inflationary

Economies

The Institute notes that the hyper-inflationary conditions do not prevail in India. Accordingly, the

subject is not considered relevant in the Indian context.

3. IAS 41 Agriculture Keeping in view the existing Indian conditions, its application is considered too onerous as the IAS is

fair value based.

4. IFRS1 First-time Adoption of International

Financial Reporting Standards

IFRS 1 will be relevant only on adoption of IFRSs from 1

st

April 2011 in India.

5. IFRS 4 Insurance Contracts This IFRS has not been taken up as there are certain issues involved in relation to laws/regulations

governing insurance entities, which are being taken-up with Insurance Regulatory and

Development Authority of India (IRDA).

III. Accounting Standards presently under preparation corresponding to the International Financial Reporting Standards

S. No. International Financial Reporting Standards

No. Title of the Standard

Status of the corresponding Indian Standard

1. IAS 40 Investment Property Under preparation. At present, covered by Accounting Standard (AS) 13,

Accounting for

Investments

.

2. IFRS 2 Share-based Payment Under preparation. At present, Employee-Share based Payments, are covered by a Guidance Note

issued by the ICAI, which is based on IFRS 2. Further, some other pronouncements deal with other

share-based payments, e.g., AS 10, Accounting for Fixed Assets.

11

IV. Guidance Note issued by the Institute of Chartered Accountants of India (ICAI) corresponding to the International Financial Reporting Standard

International Financial Reporting Standard

S. No

No. Title of the Standard

Title of the Guidance Note

1. IFRS 6 Exploration for and Evaluation of Mineral

Resources

Guidance Note on Accounting for Oil and Gas Producing Activities. The Guidance Note is

comprehensive as it deals with all accounting aspects and is based on the corresponding US GAAPs.