Financial Report

and Audited Consolidated

Financial Statements

for the year ended

December 31, 2023

March 7,

2024

FINANCIAL REPORT FOR THE YEAR 2023

VIVENDI

European Company with a Management Board and a Supervisory Board and a share capital of €5,664,549,687.50

Head Office: 42 avenue de Friedland – 75380 PARIS CEDEX 08 – FRANCE

IMPORTANT NOTICE: READERS ARE STRONGLY ADVISED TO READ THE IMPORTANT DISCLAIMERS AT THE END OF THIS

FINANCIAL REPORT.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 3

KEY CONSOLIDATED FINANCIAL DATA FOR THE LAST FIVE YEARS ............................................................................................................. 4

I- 2023 FINANCIAL REPORT ...................................................................................................................................................................................... 6

1 EARNINGS ANALYSIS: GROUP AND BUSINESS SEGMENTS ................................................................................................................................ 6

1.1 CONSOLIDATED STATEMENT OF EARNINGS ............................................................................................................................................................ 7

1.2 ANALYSIS OF THE CONSOLIDATED STATEMENT OF EARNINGS .................................................................................................................................. 7

1.3 ANALYSIS OF REVENUES AND OPERATING RESULTS BY BUSINESS SEGMENT ............................................................................................................. 11

2 LIQUIDITY AND CAPITAL RESOURCES ............................................................................................................................................................... 20

2.1 LIQUIDITY AND EQUITY PORTFOLIO ........................................................................................................................................................................ 20

2.2 CASH FLOW FROM OPERATIONS ANALYSIS ............................................................................................................................................................ 22

2.3 ANALYSIS OF INVESTING AND FINANCING ACTIVITIES ............................................................................................................................................. 25

3 FORWARD-LOOKING STATEMENTS ................................................................................................................................................................. 26

4 OTHER DISCLAIMERS ...................................................................................................................................................................................... 26

II- APPENDIX TO THE FINANCIAL REPORT ......................................................................................................................................................... 27

1 QUARTERLY REVENUES BY BUSINESS SEGMENT ..................................................................................................................................................... 27

III- AUDITED CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2023 ............................................. 29

STATUTORY AUDITORS’ REPORT ......................................................................................................................................................................... 29

CONSOLIDATED STATEMENT OF EARNINGS .................................................................................................................................................... 34

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME ...................................................................................................................... 35

CONSOLIDATED STATEMENT OF FINANCIAL POSITION ................................................................................................................................ 36

CONSOLIDATED STATEMENT OF CASH FLOWS ............................................................................................................................................... 37

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY .............................................................................................................................. 38

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS .......................................................................................................................... 40

NOTE 1 ACCOUNTING POLICIES AND VALUATION METHODS ...................................................................................................................................... 40

NOTE 2 MAJOR EVENTS ...................................................................................................................................................................................... 60

NOTE 3 GROUP’S OUTLOOK WITH REGARD TO ECONOMIC UNCERTAINTIES .................................................................................................................. 62

NOTE 4 SEGMENT DATA ...................................................................................................................................................................................... 63

NOTE 5 EBIT ...................................................................................................................................................................................................... 68

NOTE 6 FINANCIAL CHARGES AND INCOME ............................................................................................................................................................ 69

NOTE 7 INCOME TAXES ........................................................................................................................................................................................ 70

NOTE 8 EARNINGS PER SHARE .............................................................................................................................................................................. 75

NOTE 9 CHARGES AND INCOME DIRECTLY RECOGNIZED IN EQUITY............................................................................................................................. 75

NOTE 10 GOODWILL .............................................................................................................................................................................................. 76

NOTE 11 CONTENT ASSETS AND COMMITMENTS ..................................................................................................................................................... 80

NOTE 12 OTHER INTANGIBLE ASSETS ...................................................................................................................................................................... 82

NOTE 13 TANGIBLE ASSETS ................................................................................................................................................................................... 83

NOTE 14 LEASES ................................................................................................................................................................................................... 84

NOTE 15 INVESTMENTS IN EQUITY AFFILIATES .......................................................................................................................................................... 86

NOTE 16 FINANCIAL ASSETS .................................................................................................................................................................................. 89

NOTE 17 NET WORKING CAPITAL ............................................................................................................................................................................ 90

NOTE 18 CASH POSITION ....................................................................................................................................................................................... 91

NOTE 19 EQUITY ................................................................................................................................................................................................... 92

NOTE 20 PROVISIONS ............................................................................................................................................................................................ 93

NOTE 21 EMPLOYEE BENEFITS ................................................................................................................................................................................ 94

NOTE 22 SHARE-BASED COMPENSATION PLANS ....................................................................................................................................................... 99

NOTE 23 BORROWINGS AND OTHER FINANCIAL LIABILITIES AND FINANCIAL RISK MANAGEMENT .................................................................................. 101

NOTE 24 CONSOLIDATED CASH FLOW STATEMENT ................................................................................................................................................ 106

NOTE 25 RELATED PARTIES................................................................................................................................................................................... 106

NOTE 26 CONTRACTUAL OBLIGATIONS AND OTHER COMMITMENTS .......................................................................................................................... 113

NOTE 27 LITIGATION ............................................................................................................................................................................................ 116

NOTE 28 MAJOR CONSOLIDATED ENTITIES OR ENTITIES ACCOUNTED FOR UNDER THE EQUITY METHOD ......................................................................... 127

NOTE 29 STATUTORY AUDITORS FEES .................................................................................................................................................................... 129

NOTE 30 SUBSEQUENT EVENTS............................................................................................................................................................................. 129

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 4

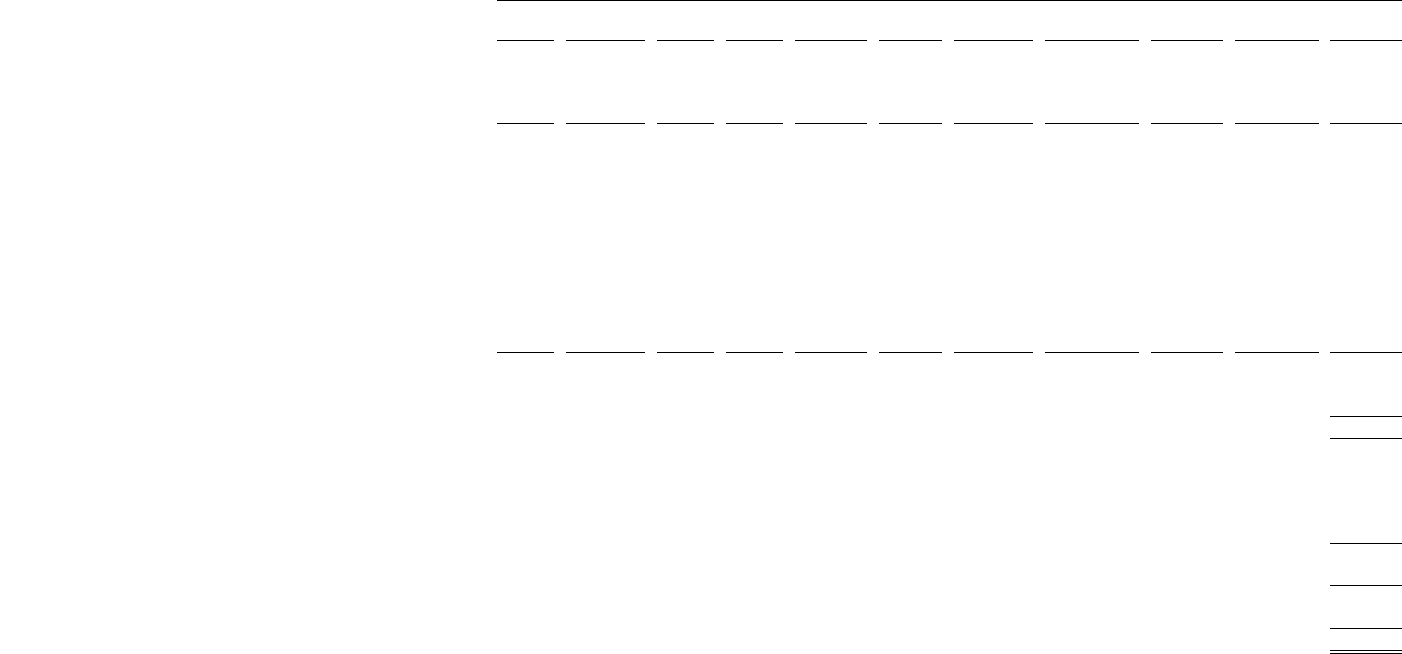

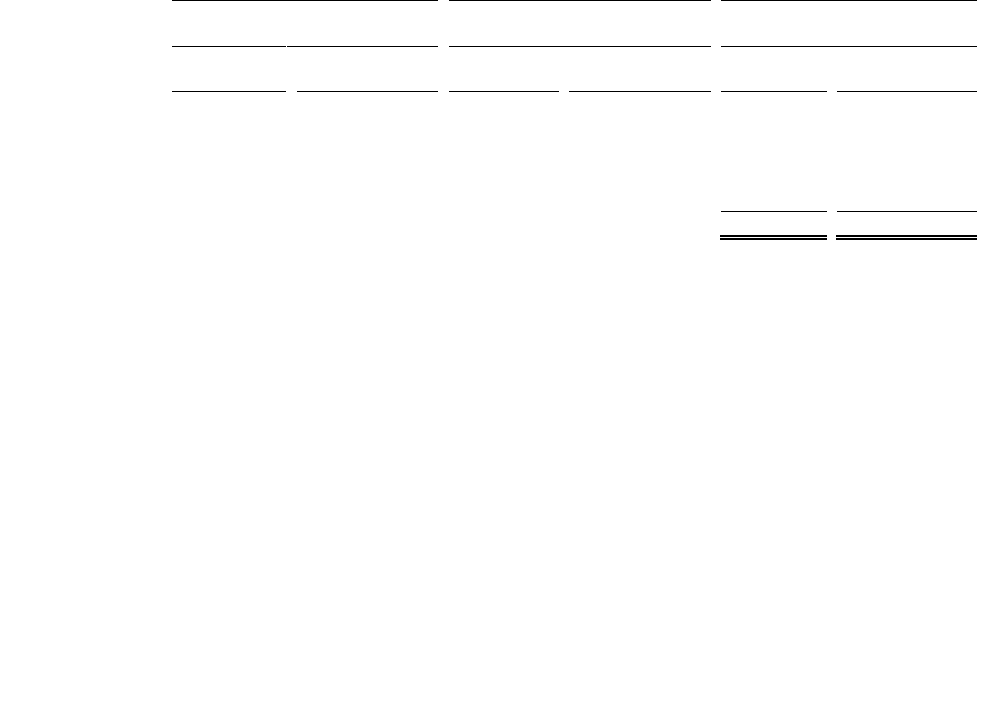

Key consolidated financial data for the last five years

Preliminary comments:

Following the takeover of Lagardère by Vivendi on November 21, 2023, Lagardère has been fully consolidated in Vivendi’s consolidated financial

statements from December 1, 2023. For a detailed description, please refer to Note 2.2 to the Consolidated Financial Statements for the year

ended December 31, 2023.

As a reminder, over the last five years, Vivendi has applied IFRS 5 - Non-current assets held for sale and discontinued operations to the

following two transactions:

• As from December 31, 2022, in anticipation of the sale of Editis, Vivendi applied IFRS 5 until June 21, 2023, the date on which Editis

was deconsolidated in accordance with IFRS 10. These adjustments were made to all periods as set out in the table of selected key

consolidated financial data below. On November 14, 2023, Vivendi completed the sale of Editis (please refer to Note 2.3 to the

Consolidated Financial Statements for the year ended December 31, 2023).

• As from September 14, 2021, the date on which the Management Board approved the loss of control of Universal Music Group

(UMG), effective as of September 23, 2021, Vivendi applied IFRS 5 to the year ended December 31, 2021 and the previous years.

The financial information below is therefore presented on a comparable basis:

Year ended December 31,

2023

2022

2021

2020

2019

Consolidated data

Revenues

10,510

9,595

8,717

7,943

8,060

Adjusted earnings before interest and income taxes (EBITA) (a)

934

868

639

260

350

Earnings before interest and income taxes (EBIT)

847

761

356

212

293

Earnings attributable to Vivendi SE shareowners

405

(1,010)

24,692

1,440

1,583

Adjusted net income (a)

722

343

613

277

749

Net Cash Position/(Financial Net Debt) (a)

(2,839)

(860)

348

(4,953)

(4,064)

Total equity

17,237

17,604

19,194

16,431

15,575

of which Vivendi SE shareowners' equity

17,108

17,368

18,981

15,759

15,353

Cash flow from operations (CFFO) (a)

881

594

695

574

177

Cash flow from operations after interest and income tax paid (CFAIT) (a)

693

410

540

674

14

Financial investments

(388)

(1,228)

(2,120)

(1,617)

(2,231)

Financial divestments

(1,329)

801

76

323

1,062

Dividends paid by Vivendi SE to its shareholders

256

261

653

690

636

Special distribution of 59.87% of UMG to Vivendi SE shareowners (b)

25,284

Purchases of Vivendi SE's treasury shares

29

326

693

2,157

2,673

Per share data

Weighted average number of shares outstanding

1,024.6

1,031.7

1,076.3

1,140.7

1,233.5

Earnings attributable to Vivendi SE shareowners per share

0.40

(0.98)

22.94

1.26

1.28

Adjusted net income per share

0.70

0.33

0.57

0.24

0.61

Number of shares outstanding at the end of the period (excluding treasury shares)

1,024.7

1,024.7

1,045.4

1,092.8

1,170.6

Equity per share, attributable to Vivendi SE shareowners

16.70

16.95

18.16

14.42

13.12

Dividends per share paid

0.25

0.25

0.60

0.60

0.50

In millions of euros, number of shares in millions, data per share in euros.

a. The non-GAAP measures of EBITA, Adjusted net income, Net Cash Position (or Financial Net Debt), Cash flow from operations (CFFO) and

Cash flow from operations after interest and income tax paid (CFAIT) should be considered in addition to, and not as a substitute for, other

GAAP measures of operating and financial performance as presented in the Consolidated Financial Statements and the related Notes or

as described in this Financial Report. Vivendi considers these to be relevant indicators of the group’s operating and financial performance.

Each of these indicators is defined in the appropriate section of this Financial Report or in its Appendix. In addition, it should be noted

that other companies may have definitions and calculations for these indicators that differ from those used by Vivendi, and therefore may

not be directly comparable.

b. As a reminder, as of September 23, 2021, Vivendi ceded control and deconsolidated 70% of Universal Music Group, following the effective

payment of a special distribution in kind of 59.87% of UMG’s share capital to Vivendi’s shareholders, including the distribution of a special

interim dividend in kind of €22,100 million in respect of fiscal year 2021.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 5

Note:

In accordance with Article 19 of Regulation (EU) No. 2017/1129, the following items are incorporated by reference in this report:

•

for the year ended December 31, 2022: the Financial Report and Consolidated Financial Statements for the year ended December 31, 2022,

prepared under IFRS and the related statutory auditors’ report on the Consolidated Financial Statements, presented on pages 286 to 421 of the

Universal Registration Document (Document d’enregistrement universel), which was filed on March 16, 2023 with the French Autorité des

Marchés Financiers (AMF) under No. D.23-0094 and on pages 286 to 421 of the English translation of such Universal Registration Document

(Document d’enregistrement universel); and

•

for the year ended December 31, 2021: the Financial Report and Consolidated Financial Statements for the year ended December 31, 2021,

prepared under IFRS and the related statutory auditors’ report on the Consolidated Financial Statements, presented on pages 240 to 377 of the

Universal Registration Document (Document d’enregistrement universel), which was filed on March 17, 2022 with the French Autorité des

Marchés Financiers (AMF) under No. D.22-0113 and on pages 240 to 377 of the English translation of such Universal Registration Document

(Document d’enregistrement universel).

Any parts of Universal Registration Documents No. D.23-0094 and No. D.22-0113 that are not referred to above are either deemed not relevant for

investors or are otherwise covered elsewhere in this Financial Report.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 6

I- 2023 Financial Report

Preliminary comments:

On March 4, 2024, the Management Board approved the Financial Report and the Audited Consolidated Financial Statements for the year

ended December 31, 2023. Upon the recommendation of the Audit Committee, which met on March 4, 2024, the Supervisory Board, at its

meeting held on March 7, 2024, reviewed the Financial Report and the Audited Consolidated Financial Statements for the year ended December

31, 2023, as previously approved by the Management Board on March 4, 2024.

The Consolidated Financial Statements for the year ended December 31, 2023 were audited and certified by the Statutory Auditors without

qualified opinion. The Statutory Auditors’ report on the Consolidated Financial Statements is included in the preamble to the Financial

Statements.

1 Earnings analysis: group and business segments

Preliminary comments:

Sale of Editis

As from December 31, 2022, and in accordance with IFRS 5 - Non-current assets held for sale and discontinued operations, Editis was presented

in Vivendi’s consolidated statement of earnings as a discontinued operation.

On June 21, 2023, the European Commission approved Editis’s administrator and its assignment contract. On that date, Vivendi transferred the

power to govern Editis's operational and financial policies to the administrator, notably by withdrawing from the direct management of Editis

and by giving the administrator the power to exercise its voting rights over 100% of Editis's share capital. As of that date, in accordance with

IFRS 10, Vivendi ceased to consolidate Editis.

From a practical perspective, income and charges from Editis have been reported as follows:

- its contribution, until its deconsolidation, to each line of Vivendi’s Consolidated Statement of Earnings (before non-controlling

interests) has been reported on the line “Earnings from discontinued operations”;

- in accordance with IFRS 5, these adjustments have been applied to all periods presented to ensure consistency of information; and

- its share of net income has been excluded from Vivendi’s adjusted net income.

On November 14, 2023, Vivendi completed the sale of Editis (please refer to Note 2.3 to the Consolidated Financial Statements for the year

ended December 31, 2023).

Non-GAAP measures

“EBITA” and “adjusted net income”, both non-GAAP measures, should be considered in addition to, and not as a substitute for, other GAAP

measures of operating and financial performance as presented in the Consolidated Financial Statements and the related Notes, or as described

in this Financial Report. Vivendi considers these to be relevant indicators for the group’s operating and financial performance.

Vivendi’s Management uses EBITA and adjusted net income for reporting, management and planning purposes because they exclude most

non-recurring and non-operating items from the measurement of the business segments’ performances. As defined by Vivendi:

• the difference between EBITA and EBIT consists of the amortization of intangible assets acquired through business combinations and

through other catalogs of rights acquired by Vivendi’s content production businesses, the impairment of goodwill and other intangibles

acquired through business combinations and through the other catalogs of rights acquired by Vivendi’s content production businesses,

other income and charges related to transactions with shareowners (except where such transactions are directly recognized in equity),

as well as items related to concession agreements (IFRS 16); and

• adjusted net income includes the following items: EBITA; income from equity affiliates – non-operational; interest (corresponding to

interest expense on borrowings net of interest income earned on cash and cash equivalents); income from investments (including

dividends and interest received from unconsolidated companies); and taxes and non-controlling interests related to these items. It does

not include the following items: amortization of intangible assets acquired through business combinations and through other catalogs

of rights acquired by Vivendi’s content production businesses; impairment of goodwill and other intangible assets acquired through

business combinations and through the other catalogs of rights acquired by Vivendi’s content production businesses; the impact of

IFRS 16 on EBITA for concession agreements; other financial charges and income; earnings from discontinued operations; provisions

for income taxes and adjustments attributable to non-controlling interests; and non-recurring tax items.

In addition, it should be noted that other companies may have definitions and calculations for these non-GAAP measures that differ from those

used by Vivendi, and therefore may not be directly comparable.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 7

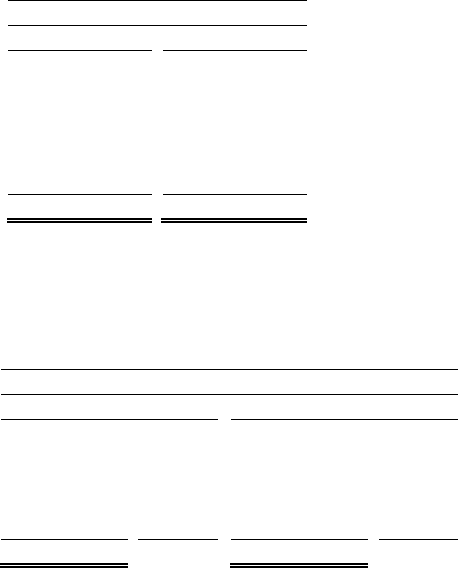

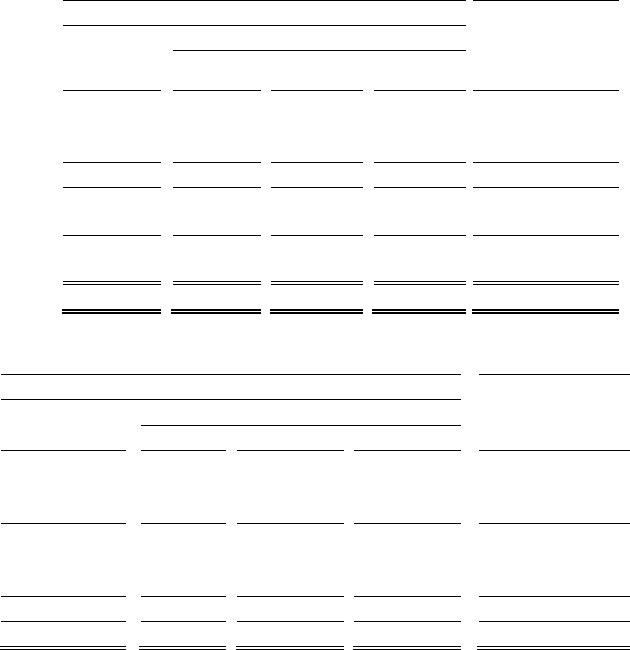

1.1 Consolidated Statement of Earnings

Year ended December 31,

% Change

2023

2022

REVENUES

10,510

9,595

+ 9.5%

Cost of revenues

(5,693)

(5,351)

Selling, general and administrative expenses excluding amortization of intangible assets acquired

through business combinations

(4,051)

(3,571)

Restructuring charges

(50)

(44)

Income from equity affiliates - operational

218

239

Adjusted earnings before interest and income taxes (EBITA)*

934

868

+ 7.5%

Amortization and depreciation of intangible assets acquired through business combinations

(87)

(107)

EARNINGS BEFORE INTEREST AND INCOME TAXES (EBIT)

847

761

+ 11.3%

Income from equity affiliates - non-operational

(103)

(393)

Interest

13

(14)

Income from investments

81

50

Other financial charges and income

(158)

(952)

(64)

(916)

Earnings before provision for income taxes

680

(548)

na

Provision for income taxes

(190)

(99)

Earnings from continuing operations

490

(647)

na

Earnings from discontinued operations

(32)

(298)

Earnings

458

(945)

na

Non-controlling interests

(53)

(65)

EARNINGS ATTRIBUTABLE TO VIVENDI SE SHAREOWNERS

405

(1,010)

na

of which earnings from continuing operations attributable to Vivendi SE shareowners

437

(712)

earnings from discontinued operations attributable to Vivendi SE shareowners

(32)

(298)

Earnings attributable to Vivendi SE shareowners per share - basic (in euros)

0.40

(0.98)

Earnings attributable to Vivendi SE shareowners per share - diluted (in euros)

0.39

(0.98)

Adjusted net income*

722

343

x 2.1

Adjusted net income per share - basic (in euros)*

0.70

0.33

Adjusted net income per share - diluted (in euros)*

0.70

0.33

In millions of euros, except per share amounts.

na: not applicable.

* non-GAAP measures.

1.2 Analysis of the Consolidated Statement of Earnings

1.2.1 Revenues

In 2023, Vivendi’s revenues were €10,510 million, compared to €9,595 million in 2022. This increase of €915 million (+9.5%) reflected the

growth of Canal+ Group (+€188 million) and Havas (+€107 million), as well as the impact of the consolidation of Lagardère from December 1,

2023 (+€670 million).

At constant currency and perimeter, Vivendi’s revenues grew by 2.6%, compared to 2022, mainly due to the performance of Canal+ Group

(+2.9%) and Havas (+4.3%).

For the second half of 2023, Vivendi’s revenues were €5,812 million, compared to €5,066 million for the second half of 2022. This increase

of €746 million (+14.7%) included the impact of the consolidation of Lagardère from December 1, 2023 (€670 million), as well as revenue

growth for the second half of 2023 at Canal+ Group (+€102 million) and Havas (+€46 million), partially offset by the revenue decrease at Vivendi

Village (-€63 million) following the cessation of its concert production activities (Olympia Production) at year-end 2022.

At constant currency and perimeter, Vivendi’s revenues in the second half of 2023 grew by 2.2% compared to the second half of 2022, mainly

due to the performance of Canal+ Group (+3.4%) and Havas (+4.4%).

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 8

For the fourth quarter of 2023, Vivendi’s revenues were €3,386 million, compared to €2,700 million for the fourth quarter of 2022. This

increase of €686 million (+25.4%) was mainly related to the consolidation of Lagardère from December 1, 2023 (€670 million).

At constant currency and perimeter, Vivendi’s revenues in the fourth quarter of 2023 grew by 1.5% compared to the fourth quarter of 2022.

This increase was mainly due to the performance of Havas (+3.5%) and Canal+ Group (+1.6%).

For a detailed analysis of revenues by business segment, please refer to Section 1.3 below and to Note 4.1.1 to the Consolidated Financial

Statements for the year ended December 31, 2023.

1.2.2 Operating results

Cost of revenues was €5,693 million, compared to €5,351 million in 2022, an increase of €342 million, notably reflecting the impact of the

consolidation of Lagardère from December 1, 2023 (€291 million).

Selling, general and administrative expenses excluding amortization of intangible assets acquired through business

combinations were €4,051 million, compared to €3,571 million in 2022, an increase of €480 million, notably reflecting the impact of the

consolidation of Lagardère from December 1, 2023 (€356 million).

Amortization and depreciation of tangible and intangible assets are included in either cost of revenues or selling, general and

administrative expenses. Amortization of tangible and intangible assets, excluding amortization of intangible assets acquired through business

combinations, amounted to €518 million (compared to €490 million in 2022), including amortization of rights-of-use relating to leases for

€136 million (compared to €149 million in 2022).

EBITA was €934 million, compared to €868 million in 2022, an increase of €66 million (+7.5%). It included income from equity affiliates –

operational of Universal Music Group (UMG) for €94 million, compared to €124 million in 2022 and Lagardère for €125 million until November

30, 2023, compared to €98 million in 2022. For a detailed description of previously published data by UMG, please refer to Note 15.2 to the

Consolidated Financial Statements for the year ended December 31, 2023.

Excluding income from equity affiliates – operational of UMG and Lagardère, EBITA was €715 million, compared to €646 million in 2022,

increasing by €69 million (+10.6%) notably due to the growth of Havas (+€24 million) and Canal+ Group (+€10 million), as well as the reduction

of Vivendi Village’s losses (+€19 million) following the cessation of its concert production activities (Olympia Production) at year-end 2022.

This change also reflected the impact of the consolidation of Lagardère from December 1, 2023 (€20 million).

At constant currency and perimeter, EBITA increased by €98 million (+11.7%). Excluding income from equity affiliates – operational, EBITA

increased by €77 million (+12.1%) at constant currency and perimeter. This increase was mainly due to the performance of Havas (+8.0%),

Vivendi Village (x2.4) and New Initiatives (+26.3%).

For a detailed analysis of EBITA by business segment, please refer to Section 1.3 below.

EBIT was €847 million, compared to €761 million in 2022, an increase of €86 million (+11.3%). It included amortization and depreciation of

intangible assets acquired through business combinations for €87 million, compared to €107 million in 2022.

1.2.3 Income from equity affiliates - non-operational

In 2023, income from equity affiliates - non-operational was a loss of -€103 million, including MutiChoice Group (-€89 million) and Viu

(-€14 million); please refer to Note 15 to the Consolidated Financial Statements for the year ended December 31, 2023. In 2022, this amount

corresponded to Vivendi’s share of Telecom Italia’s loss (-€393 million). As a reminder, Vivendi ceased to account for its interest in Telecom

Italia under the equity method as of December 31, 2022.

1.2.4 Financial results

In 2023, interest was an income of €13 million, compared to a charge of €14 million in 2022. Of this amount:

• interest expense on borrowings was €52 million (compared to €31 million in 2022). As average outstanding borrowings remained stable

at €3.9 billion (compared to an equivalent average outstanding borrowings in 2022), this change reflected an increase in the average

interest rate on borrowings to 1.34% (compared to 0.80% in 2022), which included the impact of the consolidation of Lagardère from

December 1, 2023; by excluding Lagardère, the average interest rate on Vivendi’s borrowings would have amounted to 1.19%.

• interest income earned on the investment of cash surpluses was €62 million (compared to €13 million in 2022) due to the increase in

the average interest rate to 2.69% (compared to 0.43% in 2022), despite the decrease in the average outstanding cash investments to

€2.3 billion (compared to €3.1 billion in 2022); and

• Vivendi received interest on intra-group financings to Editis totaling €3 million (compared to €4 million in 2022).

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 9

Income from investments was €81 million, compared to €50 million in 2022, an increase of €31 million. In 2023, it mainly included dividends

from FL Entertainment for €29 million, MediaForEurope for €28 million (unchanged compared to 2022) and Telefonica for €18 million

(unchanged compared to 2022).

Other financial charges and income were a net charge of €158 million, compared to a net charge of €952 million in 2022, i.e., a favorable

change of €794 million. As a reminder, as of December 31, 2022, Vivendi ceased to account for its interest in Telecom Italia under the equity

method and, therefore, in accordance with IAS 28, Vivendi recorded the difference between the carrying amount of its interest in Telecom

Italia as of December 31, 2022 (€0.5864 per share) and the fair value calculated on the basis of the share price at that date (€0.2163 per share)

in the 2022 earnings, i.e., a fair value adjustment leading to a charge of -€1,347 million. In 2022, it also included the capital gain of €515 million

realized on June 30, 2022 following the contribution of Vivendi’s interest in Banijay Group Holding to FL Entertainment, prior to the public

listing of the latter on July 1, 2022 as well as the impact of the fair value adjustment (€49 million) of the bond (ORAN 2) that was subscribed

to by Vivendi in 2016 in connection with its investment in Banijay Group Holding, which was redeemed on July 5, 2022 at its nominal value

plus interest.

For a detailed description of other financial charges and income, please refer to Note 6.2 to the Consolidated Financial Statements for the year

ended December 31, 2023.

1.2.5 Provision for income taxes

In 2023, provision for income taxes reported to adjusted net income was a net charge of €155 million, compared to €156 million in 2022.

The effective tax rate reported to adjusted net income was 19.1%, compared to 23.5% in 2022. This change was notably due to a favorable

impact of certain non-recurring items in 2023.

In 2023, provision for income taxes reported to net income was a net charge of €190 million, compared to €99 million in 2022,

representing an increase of €91 million. This change was mainly due to changes in deferred tax assets related to expected savings from Vivendi

SE’s French Tax Group, which amounted to a charge of €41 million in 2023 (compared to an income of €41 million in 2022).

1.2.6 Earnings from discontinued operations

In accordance with IFRS 5, until June 21, 2023, Editis’s contribution to the group’s activities was reported in “Earnings from discontinued

operations”. In 2023, earnings from discontinued operations amounted to a loss of -€32 million, which included the following items: Editis’s

contribution to net earnings (before non-controlling interests) until June 21, 2023 (-€14 million, compared to €2 million in 2022); in accordance

with IFRS 5, the discontinuation of amortization of Editis’s non-current assets (+€32 million); and the loss on the deconsolidation of Editis

(-€50 million), reflecting the terms of the put option agreement entered into with International Media Invest a.s. (IMI) on April 23, 2023.

As a reminder, as of December 31, 2022, Vivendi tested the value of goodwill allocated to Editis. In accordance with IFRS 5, Editis’s recoverable

amount was calculated at the lower of its carrying amount and fair value, less costs to divest, which, in practice, was based on the indicative

sale value of a controlling interest in Editis to an investor having considered offers received by Vivendi. On this basis, Vivendi’s Management

concluded that, as of December 31, 2022, Editis’s recoverable amount was less than its carrying amount, which led to a related goodwill

impairment loss of €300 million.

1.2.7 Non-controlling interests

In 2023, earnings attributable to non-controlling interests were €53 million, compared to €65 million in 2022.

1.2.8 Earnings attributable to Vivendi SE shareowners

In 2023, earnings attributable to Vivendi SE shareowners amounted to a profit of €405 million (or €0.40 per share - basic), compared to

a loss of €1,010 million in 2022 (-€0.98 per share - basic), an increase of €1,415 million. In 2022, such earnings included the fair value

adjustment of the Telecom Italia shares (-€1,347 million) as of December 31, 2022 (at which time Vivendi ceased to account for its interest in

Telecom Italia under the equity method), Vivendi’s share of Telecom Italia’s net earnings (-€393 million) as well as the goodwill impairment

loss of €300 million in relation to Editis, which was partially offset by the capital gain realized on the contribution of the interest in Banijay

Group Holding to FL Entertainment (+€515 million).

1.2.9 Adjusted net income

In 2023, adjusted net income was a profit of €722 million (or €0.70 per share - basic), compared to €343 million in 2022 (or €0.33 per share

- basic), an increase of €379 million (x2.1). In 2022, it notably included Vivendi’s share of the net earnings of Telecom Italia (-€334 million)

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 10

accounted for under the equity method - non-operational. As a reminder, Vivendi ceased to account for its interest in Telecom Italia under the

equity method as of December 31, 2022.

Year ended December 31,

% Change

(in millions of euros)

2023

2022

Revenues

10,510

9,595

+ 9.5%

EBITA

934

868

+ 7.5%

Income from equity affiliates - non-operational

(83)

(334)

Interest

13

(14)

Income from investments

81

50

Adjusted earnings from continuing operations before provision for income taxes

945

570

+ 65.6%

Provision for income taxes

(155)

(156)

Adjusted net income before non-controlling interests

790

414

+ 90.8%

Non-controlling interests

(68)

(71)

Adjusted net income

722

343

x 2.1

Reconciliation of earnings attributable to Vivendi SE shareowners to adjusted net income

Year ended December 31,

(in millions of euros)

2023

2022

Earnings attributable to Vivendi SE shareowners (a)

405

(1,010)

Adjustments

Amortization and depreciation of intangible assets acquired through business combinations (a)

87

107

Amortization of intangible assets related to equity affiliates - non-operational

20

59

Other financial charges and income (a)

158

952

Earnings from discontinued operations (a)

32

298

Provision for income taxes on adjustments

35

(57)

Minority interests in adjustments

(15)

(6)

Adjusted net income

722

343

a. As reported in the consolidated statement of earnings.

Adjusted net income per share

Year ended December 31,

2023

2022

Basic

Diluted

Basic

Diluted

Adjusted net income (in millions of euros)

722

722

343

343

Number of shares (in millions)

Weighted average number of shares outstanding (a)

1,024.6

1,024.6

1,031.7

1,031.7

Potential dilutive effects related to share-based compensation

-

2.4

-

2.5

Adjusted weighted average number of shares

1,024.6

1,027.0

1,031.7

1,034.2

Adjusted net income per share (in euros)

0.70

0.70

0.33

0.33

a. Net of the weighted average number of treasury shares (39.9 million shares in 2023, compared to 76.9 million shares in 2022).

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 11

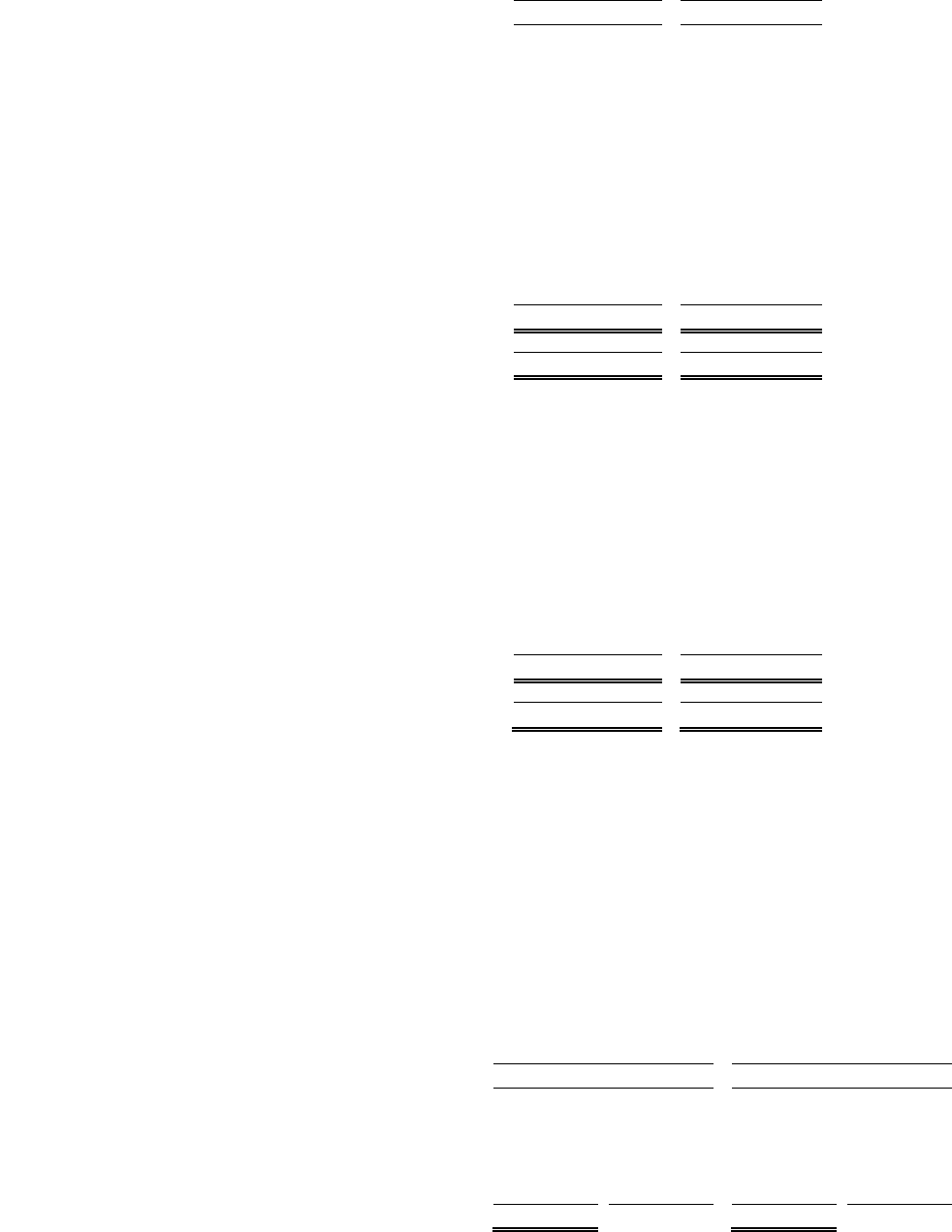

1.3 Analysis of revenues and operating results by business segment

Year ended December 31,

(in millions of euros)

2023

2022

% Change

% Change at

constant

currency

% Change at

constant

currency and

perimeter (a)

Revenues

Canal+ Group

6,058

5,870

+3.2%

+3.2%

+2.9%

Lagardère

670

na

na

na

+4.0%

Havas

2,872

2,765

+3.9%

+6.1%

+4.3%

of which net revenues (b)

2,695

2,590

+4.1%

+6.3%

+4.4%

Prisma Media

309

320

-3.4%

-3.4%

-3.5%

Gameloft

311

321

-3.0%

-2.6%

-2.6%

Vivendi Village

180

238

-24.2%

-23.7%

-22.0%

of which ticketing and festivals

151

140

+7.6%

+8.9%

+8.9%

New Initiatives

152

122

+23.9%

+23.9%

+22.4%

Generosity and solidarity

3

3

Elimination of intersegment transactions

(45)

(44)

Total Vivendi

10,510

9,595

+9.5%

+10.2%

+2.6%

EBITA

Canal+ Group

525

515

+2.0%

+1.4%

+1.3%

Lagardère

20

na

na

na

na

Havas

310

286

+8.3%

+10.3%

+8.0%

Prisma Media

28

31

-10.6%

-10.6%

-9.8%

Gameloft

5

12

-57.5%

-58.9%

-58.9%

Vivendi Village

13

(6)

na

na

na

New Initiatives

(43)

(46)

+5.2%

+5.2%

+26.3%

Generosity and solidarity

(13)

(13)

-

-

-

Corporate

(130)

(133)

+2.2%

+2.0%

+2.0%

Subtotal EBITA of the business segments

715

646

+10.6%

+10.8%

+12.1%

Vivendi's share of Universal Music Group's earnings (c)

94

124

-24.2%

-24.2%

-24.2%

Vivendi's share of Lagardère's earnings (c)

125

98

+27.5%

+27.5%

+67.5%

Total Vivendi

934

868

+7.5%

+7.7%

+11.7%

na : not applicable.

a. Constant perimeter notably reflects the impacts of the combination with Lagardère, which has been fully consolidated from December 1,

2023. Please refer to Note 2.2 to the Consolidated Financial Statements for the year ended December 31, 2023.

b. Net revenues, a non-GAAP measure, relates to Havas’s revenues less pass-through cost rebilled to customers.

c. Includes share of earnings of companies accounted for by Vivendi under the equity method.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 12

1.3.1 Canal+ Group

Year ended December 31,

(in millions of euros)

2023

2022 (a)

% Change

% Change at

constant

currency

% Change at

constant

currency and

perimeter

International TV

2,372

2,345

+1.2%

+1.1%

+0.5%

TV in mainland France (b)

3,223

3,119

+3.3%

+3.3%

+3.3%

Studiocanal

463

406

+13.8%

+14.1%

+12.7%

Revenues

6,058

5,870

+3.2%

+3.2%

+2.9%

EBITA before restructuring charges

530

527

EBITA before restructuring charges margin

8.7%

9.0%

-0.4 pt

Restructuring charges

(5)

(12)

EBITA

525

515

+2.0%

+1.4%

+1.3%

EBITA margin

8.7%

8.8%

0.0%

Canal+ Group subscribers (in thousands)

Mainland France

9,798

9,508

+290

Europe (excluding mainland France)

6,533

6,335

+198

Africa

8,091

7,597

+494

Asia Pacific

1,169

1,230

-61

Other territories (c)

768

824

-56

Total Canal+ Group subscribers

26,359

25,494

+865

of which self-distributed

19,286

19,141

+145

a. Integrates intersegment reclassifications to reflect organizational changes.

b. Relates to pay-TV services and free-to-air channels (C8, CStar and CNews) in mainland France.

c. Relates to French overseas territories, Comoros, Haiti, Mauritius, Dominican Republic.

At year-end 2023, Canal+ Group's total subscriber portfolio (individual and collective) reached 26.4 million, compared to 25.5 million at the

year-end 2022.

In 2023, Canal+ Group's revenues were €6,058 million, up 3.2% compared to 2022 (+2.9% at constant currency and perimeter).

Revenues from television operations in mainland France increased by 3.3% at constant currency and perimeter compared to 2022, driven by

growth in the subscriber base and ARPU (Average Revenue Per User). The total subscriber portfolio in mainland France recorded a net growth

of 290,000 subscribers over the past twelve months, reaching 9.8 million subscribers.

Revenues from international operations increased by 1.2% compared to 2022 (+0.5% at constant currency and perimeter). The total subscriber

portfolio outside mainland France has recorded a net growth of 575,000 subscribers over the past twelve months, reaching a total of

16.6 million subscribers at year-end 2023.

Studiocanal achieved a record year in 2023, due to successful film releases in theaters, both in France (e.g., over 4 million admissions for

Alibi.com 2, 1.2 million admissions for All Your Faces, and 1.1 million admissions for The Animal Kingdom) and in other Studiocanal markets,

as well as strong growth in international sales and very good performance of its catalog.

In 2023, Canal+ Group's EBITA amounted to €525 million, up 2.0% (+1.3% at constant currency and perimeter) compared to 2022.

During the fourth quarter of 2023, Canal+ Group continued its international development and further strengthened its content offering, in

particular with:

- the launch of a new streaming platform in the Netherlands, offering a combination of linear TV channels and a rich catalog of films

and series on demand. After recent successful launches in Austria, Czech Republic and Slovakia, Canal+ Group takes another step in

its European development;

- the renewal of exclusive broadcasting rights for the PGA Tour (American golf circuit) in France until 2030; and;

- the acquisition of the WTA (women's tennis) circuit rights in the Czech Republic and Slovakia.

On January 6, 2024, Canal+ Group and Warner Bros. Discovery announced the renewal of their exclusive premium agreement for Warner

Bros. Pictures films. This multi-year agreement will allow Canal+ Group to continue to offer its subscribers exclusive access to Warner Bros.

Pictures films, such as Barbie (the biggest American box office success of 2023), just six months after their theater release in France.

On January 30, 2024, telecommunications operator Free launched its new Freebox Ultra, which includes the Canal+ Live channel at no extra

cost. This new offering is unique, and its durable integration into an operator's box is a first in the history of Canal+ Group.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 13

On January 31, 2024, following approval from the French Competition Authority, Canal+ Group completed the acquisition of the OCS pay-TV

package and Orange Studio, the film and series co-production subsidiary, from its historical partner Orange. The French Competition Authority

authorized the transaction after a detailed analysis of its effects on the market and made it subject to compliance with several commitments

given by Canal+ Group.

Following the recapitalization of Viaplay, the leading pay-TV operator in the Nordic countries, which was completed on February 9, 2024,

Canal+ Group holds 29.33% of the company's capital and remains its largest shareholder.

Canal+ Group also announced on February 26, 2024 that it took another step in its ambition to make Asia its next growth driver by increasing

its stake in Viu to 30%, in accordance with the terms of the transaction announced on June 21, 2023.

On February 1, 2024, Canal+ Group, MultiChoice Group’s largest shareholder crossed the 35% threshold of the share capital of the company

and announced that it had submitted to MultiChoice Group's Board of Directors a non-binding indicative offer (NBIO) to acquire all the issued

ordinary shares of MultiChoice Group that it does not already own. This NBIO was rejected by MultiChoice Group's Board of Directors on

February 5, 2024.

On February 28, 2024, the South African Takeover Regulation Panel (TRP) ruled that Canal+ Group is under the obligation to launch a public

tender offer for all the shares in MultiChoice Group that it does not already own.

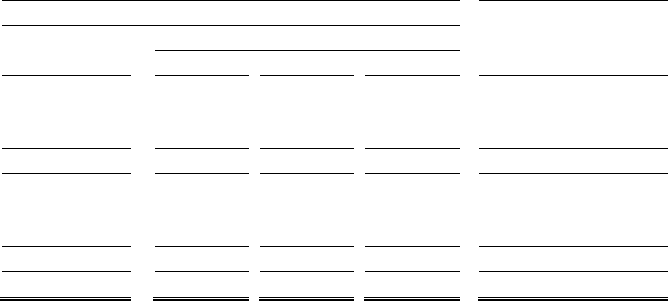

1.3.2 Lagardère

Year ended

December 31,

2023 (a)

12-month data

as published by Lagardère

(in millions of euros)

2023

2022

% Change

% Change at

constant

currency and

perimeter

Lagardère Publishing

209

2,809

2,748

+2.2%

+1.9%

Lagardère Travel Retail

434

5,018

3,927

+27.8%

+23.4%

Other activities (b)

27

254

254

-

-3.3%

Revenues

670

8,081

6,929

+16.6%

+14.0%

Lagardère Publishing

17

301

302

-0.3%

-

Lagardère Travel Retail

9

245

136

+80.1%

+59.3%

Other activities (b)

(2)

(26)

-

na

na

Recurring EBIT (c)

24

520

438

+18.7%

+14.0%

Restructuring charges

(2)

Income (loss) from equity-accounted companies - operational

(1)

Other

(1)

EBITA

20

Revenues by geographic area (in %)

2023

2022

France

24%

25%

Western Europe

27%

25%

Eastern Europe

12%

10%

United States and Canada

26%

29%

Asia-Pacific

7%

7%

Latin America, Middle East and Africa

4%

4%

100%

100%

na : not applicable.

a. Vivendi has fully consolidated Lagardère from December 1, 2023. Until November 30, 2023, Vivendi accounted for Lagardère under the

equity method and recorded a share of Lagardère’s net earnings included in EBITA for €125 million in 2023, compared to €98 million in

2022. For a description of the Lagardère transaction, please refer to Note 2.2 to the Consolidated Financial Statements for the year ended

December 31, 2023.

b. Includes Lagardère News (Paris Match, Le Journal du Dimanche, JDD Magazine and the Elle license), Lagardère Radio (Europe 1, Europe

2, RFM and Advertising Sales Brokerage businesses), Lagardère Live Entertainment, Lagardère Paris Racing and the Corporate Group.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 14

c. Recurring EBIT, a non-GAAP measure, includes recurring operating profit of fully consolidated companies, as publicly disclosed by

Lagardère, used as a performance indicator. For a definition of recurring EBIT, please refer to Note 1.2.3 to the Consolidated Financial

Statements for the year ended December 31, 2023.

Revenue for the Lagardère group came in at €8,081 million for 2023, up 16.6% as reported and up 14.0% like for like. The difference between

reported and like-for-like revenue is essentially attributable to an €83 million negative currency effect (of which €50 million linked to the US

dollar and €17 million to the pound sterling). The €242 million positive scope effect was mainly due to the acquisitions of Marché International

(€149 million), Costa Coffee Poland (€36 million) and Tastes on the Fly (€27 million) at Lagardère Travel Retail, as well as the acquisition of

Welbeck Publishing (€33 million) and the consolidation of Ivory Coast subsidiary NEI-CEDA (€14 million) at Lagardère Publishing.

In 2023, Group recurring EBIT totalled €520 million, a €82 million improvement on the figure recorded in 2022.

Lagardère Publishing

Revenue came in at €2,809 million for 2023, up 2.2% as reported and up 1.9% like for like in a generally subdued environment. The difference

between reported and like-for-like revenue is attributable to a €50 million positive scope effect linked chiefly to the acquisition of Welbeck

Publishing Group and the consolidation of Ivory Coast subsidiary NEI- CEDA. The €41 million negative currency impact for the period primarily

reflected the depreciation of the US dollar (€21 million negative impact) and the pound sterling (€15 million negative impact).

Amid a highly inflationary environment, Lagardère Publishing maintained a very high level of like-for-like revenue.

The figures below are presented on a like-for-like basis.

France posted 6.1% revenue growth, outperforming the market. This strong performance was primarily driven by Illustrated Books, which was

boosted by the publication of a new Asterix album (The White Iris) as well as an illustrated album (Asterix & Obelix: L'Empire du Milieu). A

very good year in the Young Adult Dark Romance segment helped drive revenue growth too, including the success of Sarah Rivens’ Captive

trilogy. General Literature also had a bumper year, despite the absence of a new Guillaume Musso title in 2023 (compared with one hardcover

title and two paperback titles in 2022), buoyed by another record performance for Le Livre de Poche and some notable hardcover publishing

successes, such as Cédric Sapin-Defour’s Son odeur après la pluie (Stock) and Le Suppléant by Prince Harry (Fayard).

Revenue in the United Kingdom advanced 6.1%, spurred in particular by a number of very successful Adult Trade titles (fiction and non-fiction),

including the first two volumes of Rebecca Yarros’ The Empyrean trilogy and two titles by Freida McFadden (The Housemaid and The

Housemaid's Secret). Revenue growth was also driven by impressive backlist sales on the back of the success of Ana Huang’s Twisted saga

and Matthew Perry's autobiography, published at the end of 2022. However, sales in the Young Adult segment were down (no equivalent to

last year's Heartstopper phenomenon).

Revenue in the United States fell by 6.8% in a declining market. The decline was due in particular to Grand Central Publishing, which had

benefited from exceptional sales of Colleen Hoover's Verity in 2022, and to Little, Brown Adult, which had been buoyed by the success of Run,

Rose, Run, a novel co-written by Dolly Parton and James Patterson.

In Spain/Latin America, revenue grew sharply by 17.9%. In Spain, the Education segment enjoyed vigorous growth, with activity benefiting

from the peak in the national curriculum reform campaign launched in 2022, while the publication of a new Asterix album lifted the Trade

business. In Mexico, growth reflected an excellent year at Trade, led notably by dictionary sales.

Revenue from Partworks was down 7.0%, owing to a less dynamic launch campaign in the first half of 2023, particularly in Japan.

In 2023, digital audiobooks accounted for 4.5% of Lagardère Publishing’s total revenue (versus 4.3% in 2022), and e- books accounted for

7.8% of the division’s total revenue, stable compared to 2022.

Recurring EBIT came out at €301 million, stable versus 2022. Profitability remained high at 10.7%, well ahead of pre- Covid levels (9.2% in

2019), despite ongoing inflationary pressures on costs. This figure includes the impact of the logistics and IT transformation project costs

incurred in France over the year.

Lagardère Travel Retail

Revenue came in at €5,018 million for full-year 2023, up 27.8% as reported and up 23.4% like for like. The difference between reported and

like-for-like data was attributable to (i) a €42 million negative currency effect, mainly resulting from the depreciation of the US dollar (€28

million negative impact) and Chinese yuan (€15 million negative impact), and (ii) a €183 million positive scope effect relating to the acquisition

of Costa Coffee Poland (€36 million), Marché International (€149 million) and Tastes on the Fly (€27 million).

The figures below are presented on a like-for-like basis.

In France, trading for the division continued to recover, with revenue up 15.9% on the back of robust sales at regional airports.

The EMEA region (excluding France) reported 26.6% growth, driven by the increase in international tourist traffic, as well as by excellent

performances in Italy and Poland and network expansion.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 15

The Americas region continued to grow, with revenue advancing 16.3% against an already high comparison basis, benefiting from a favorable

local economic environment (particularly in the United States), and the strong rebound in international traffic in Canada.

Asia-Pacific revenue jumped 52.1% from a low 2022 comparison basis in the region following the delayed reopening of borders in China.

Lagardère Travel Retail recurring EBIT hit an all-time high of €245 million in 2023, a rise of €109 million versus 2022 with all geographic areas

contributing to the growth effort. This performance was attributable to revenue growth combined with disciplined margin control amid high

inflation, government aid in the US and the efficiency gains brought about by the ramp-up of the LEaP operational efficiency plan.

Other activities

Revenue came in at €254 million for the Other Activities segment in 2023, stable as reported and down 3.3% like for like. The difference

between reported and like-for-like revenue is due to a €9 million positive scope effect related mainly to the acquisition of Euterpe Promotion

at Lagardère Live Entertainment.

Radio was down 8.3%, due to lower audience figures at the Radio unit, despite early signs of an uptick in listeners at Europe 1.

Press revenue retreated 9.4% on account of lower circulation at points of sale and through subscriptions. Revenue from the international Elle

brand licences was broadly stable year on year. Lagardère Live Entertainment reported an 8% rise in revenue owing to a favorable comparison

basis in the first half of 2023.

Recurring EBIT was a negative €26 million, €26 million lower than in 2022, due to the Radio and Press businesses and higher specific variable-

rate financing costs for sales of trade receivables.

Lagardère SA has received from the LVMH group an offer to acquire magazine title Paris Match. At its meeting of February 27, 2024, the Board

of Directors decided to enter into exclusive discussions with the LVMH group. The employee representative bodies would be consulted on the

mooted disposal in due course.

1.3.3 Havas

Year ended December 31,

(in millions of euros)

2023

2022

% Change

% Change at

constant

currency

% Change at

constant

currency and

perimeter

Revenues

2,872

2,765

+3.9%

+6.1%

+4.3%

Net revenues (a)

2,695

2,590

+4.1%

+6.3%

+4.4%

EBITA before restructuring charges

343

300

+14.3%

+16.3%

+14.0%

EBITA before restructuring charges/net revenues

12.7%

11.6%

+1.1 pt

Restructuring charges

(33)

(14)

EBITA

310

286

+8.3%

+10.3%

+8.0%

EBITA/net revenues

11.5%

11.0%

+0.5 pt

Net revenues by geographic area

Europe

1,288

1,250

+3,0%

+4,1%

+1,7%

North America

983

979

+0,5%

+3,0%

+1,9%

Asia Pacific and Africa

248

227

+9.1%

+15,7%

+9,9%

Latin America

176

134

+31.2%

+42,1%

+42,1%

2,695

2,590

+4.1%

+6.3%

+4.4%

Net revenues by segment (in %)

Havas Creative

42%

43%

Havas Health & You

25%

25%

Havas Media

33%

32%

100%

100%

a. Net revenues, a non-GAAP measure, relates to Havas’s revenues less pass-through costs rebilled to customers. Please refer to Note

1.3.5.2 to the Consolidated Financial Statements for the year ended December 31, 2023.

In 2023, Havas achieved another year of dynamic growth with net revenues

1

of €2,695 million, up 4.1% compared to 2022 (+4.4% at constant

currency and perimeter), supported by its three divisions (Creative, Health & You and Media). This growth momentum strengthened in the

1

Net revenues, a non-GAAP measure, is calculated as Havas’s revenues less pass-through costs rebilled to customers.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 16

fourth quarter of 2023, with net revenues of €776 million, up +4.3% compared to the fourth quarter of 2022 (+4.7% at constant currency and

perimeter).

Acquisitions contributed to an increase of 1.9% and currency effects had a negative impact of 2.2%. All geographical regions recorded solid

organic performances: Europe (+1.7%) and North America (+1.9%) were the largest contributors (84% of 2023 net revenues), recording very

satisfactory organic growth. Asia-Pacific (+9.9%) and Latin America (+42.1%), which provided a less significant contribution, nonetheless

experienced strong growth throughout the year.

Havas's revenues amounted to €2,872 million in 2023, up 3.9% compared to 2022 (+4.3% at constant currency and perimeter).

In 2023, EBITA reached €310 million, up 8.3%, due to sustained organic growth and a continued optimization of the cost base. The EBITA

margin thereby reached 11.5% of net revenues, continuing a trend of steady growth in EBITA margin over last few years: from 10% in 2019 to

10.7% in 2021, 11.0% in 2022, and 11.5% in 2023.

Havas continued its strong dynamic of targeted acquisitions with ten new agencies joining the group in 2023. True to its entrepreneurial,

creative and resolutely innovative approach, the group strengthened its position in strategic geographical regions and specific activities, with

Uncommon, the UK's most awarded independent creative agency, Pivot Roots and PR Pundit in India, HRZN and Eprofessional in Germany, and

Noise in Canada. Australian Public Affairs in Australia, Cunha Vaz & Associados in Portugal and Klareco in Singapore have also strengthened

the international H/Advisors network, a leader in strategic communications. Finally, Havas has also invested in the United States with Trinity

Life Sciences, a leader in global life sciences solutions.

In addition, during 2023, Havas has pursued the development of transforming solutions and forged important strategic partnerships with Adobe,

a world leader in the development of cutting-edge software, Mirakl, the world's leading marketplace technology solution, and Future4Care, a

major accelerator for e-health startups in Europe, to offer the very best technology to its customers and teams, and to anticipate changes in

the sector.

Finally, Havas's agencies continued their business development by winning several new clients and brands both locally and globally. Their

creativity was rewarded with nearly 1,400 awards around the world.

Main accounts and awards won in 2023:

Main accounts won

• Havas Media: CCU (Argentina), Claro (Colombia, Chile), Cooper (France, Austria, Portugal, Spain, Belgium, Italy, Netherlands,

Germany), Delivery Hero (Northern Europe), Glovo (South Africa), KFC (France), Lidl (Germany, Austria, Poland, Slovakia, Estonia,

Lithuania, Malta, Portugal), LG (Middle East), Nakheel (Middle East), Natura & Co (Latin America), New York Presbyterian (United

States), Orange Digital (Spain), Pernod Ricard (Portugal), PNC Bank (USA), Power (Sweden), Santander (Brazil), Shell (Worldwide),

Sun Life (Hong Kong, Canada), The Home Depot (Mexico), Vivo (Latam), European Payment Initiative (France), VLCC (India), XXX Lutz

(Switzerland).

• Havas Creative: Alibaba (Havas Shanghai), Aéroports de Paris (Havas France), Banco Santander (BETC Sao Paulo), Danone (BETC

and Havas Creative Network), Enterprise Holdings (Havas New York), Hilton (Havas Chicago), Nespresso (Havas Switzerland), Netflix

(Australia), NTT Data (Havas CX), PNC Bank (Arnold Boston), Société Du Grand Paris (Havas Paris), Tourism Tasmania (Australia),

Toyota (Havas Events), Wayfair (Havas Chicago).

• Havas Health & You: Amgen, AstraZeneca, CSL Vifor, Fosun, Johnson & Johnson, Lantheus, Novartis, Pfizer/Myovant, Renegade

Therapeutics et Sanofi.

Main awards won

2023 was an excellent year in terms of creativity with 1,389 awards and distinctions received by the Havas group's agencies, at the most

prestigious festivals and ceremonies around the world, the most important of which are reported below.

• WARC (World Advertising Research Center):

- BETC: 3

rd

best agency in the world;

- Havas Creative: Top six ;

- Havas: Top cinq; and

- Havas Middle East: Grand Prix.

• International Festival of Creativity in Cannes:

- 19 Lions won by 7 Havas agencies;

- BETC for Canal+: Lion d’or;

- BETC for Lacoste: Lion de Bronze; and

- Anne de Gaulle (Havas Paris): Grand Prix for Good.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 17

• Clio Awards:

- BETC: 22 prizes;

- Buzzman et Havas Paris;

- BETC/Havas Sao Paulo, Havas Republica et Arnold Boston: 3 Gold, 4 Silver and 2 Bronze at Clio Sports.

• LIA Awards: 48 prizes (of which 2 Grands Prix, 16 Gold, 16 Silver and 14 Bronze).

• Epica Awards: 3 Gold, 3 Silver and 5 Bronze.

• Eurobest : 19 prizes (of which 2 Grand Prix for BETC and Havas London, 4 Gold, 8 Silver and 5 Bronze).

• Grand Prize for Advertising Strategies: 24 rewards (of which 1 Grand Prix, 2 Winner, 6 Gold, 12 Silver and 3 Bronze)

• Grand Prix Media Strategies: 10 rewards (of which 1 Grand Prix, 5 Gold and 4 Silver).

1.3.4 Prisma Media

Year ended December 31,

(in millions of euros)

2023

2022

% Change

% Change at

constant

currency

% Change at

constant currency

and perimeter

Distribution

178

183

-2.7%

-2.7%

-2.8%

Advertising and BtoB

131

137

-4.2%

-4.2%

-4.3%

Revenues

309

320

-3.4%

-3.4%

-3.5%

EBITA

28

31

-10.6%

-10.6%

-9.8%

Revenues by segment (in %)

Print

67%

65%

Digital

33%

35%

100%

100%

For the fourth quarter of 2023, Prisma Media’s revenues were €85 million, up 4.4% compared to the same period in 2022 with digital revenues

growing by 14% (at comparable perimeter). Digital revenues represented 38% of total revenues in the fourth quarter of 2023 compared to 34%

during the same period in 2022, driven by organic growth in digital advertising and the acquisition of the M6 Digital division which includes

pure players such as Passeport Santé and Cuisine AZ.

In 2023, Prisma Media’s revenues were €309 million, stable compared to 2022 excluding non-recurring items. Revenues were down 3.4%

compared to 2022 due to certain non-recurring items which beneficially impacted revenue in 2022 and the impact of the sale of Gala magazine

on November 21, 2023, as part of the combination between Vivendi and Lagardère and the remedies submitted to the European Commission.

At the end of November 2023, Prisma Media brands retained their leading positions in digital audiences (in terms of number of unique visitors):

Télé Loisirs is No. 1 in the Entertainment segment, Voici is No. 1 in the People segment and Femme Actuelle remains No. 1 in the Women’s

segment, and Capital is the leading media site in the "Economy/Finance" category. With the acquisition of Passeport Santé and the

development of Dr.GOOD!, Prisma Media also becomes the leading bi-media health publisher, reaching over 23 million French people every

month.

Following the launch of Harper's Bazaar at the beginning of the year, in July 2023, Prisma Media acquired a majority interest in MilK, a

publisher of high-end interior decoration and fashion magazines. On November 30, 2023, Prisma Media acquired Côté Maison group, a publisher

specializing in high-end interior decoration. These operations fully align with Prisma Media’s strategy to build an ambitious luxury and interior

decoration division.

In June 2023, Prisma Media and Mr Tan & Co, publisher of the famous comic strip Mortelle Adèle, launched Mortelle Adèle le mag, making

its entry into the children's press segment (8-12 years). The magazine has already been a great success, selling an average of 50,000 copies

in 2023, and has established itself as the number 1 children’s magazine on newsstands.

At the end of September 2023, Prisma Media completed the acquisition of the assets of the M6 Digital Services division and created a division

of purely digital players called “Digital Prisma Player”. This division comprises six portals on everyday topics that attract almost 18 million

unique visitors each month.

Prisma Media, which already generates nearly a third of its revenues from its digital activities, is the leading digital media group in France,

reaching nearly 34 million French people each month. Digital affiliation (e-commerce) and advertising revenues on social media has grown by

more than 30% compared to 2022.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 18

On September 19, 2023, Prisma Media announced the launch of the PassPresse platform, which offers more than 200 titles. PassPresse enables

readers to access content that is not available on other digital newsstands. Canal+ subscribers have access to this platform.

In 2023, Prisma Media's EBITA was €28 million, a decrease of €3 million compared to 2022. EBITA was impacted by the sale of the Gala

magazine and the raw material costs stay remained high, particularly the increase of paper prices.

1.3.5 Gameloft

Year ended December 31,

(in millions of euros)

2023

2022

% Change

% Change at

constant

currency

% Change at

constant

currency and

perimeter

PC/Consoles

113

88

+27,4%

+27,9%

+27,9%

Mobile

173

215

-19,4%

-21,3%

-21,3%

BtoB

25

18

+43,8%

+124,4%

+124,4%

Revenues

311

321

-3.0%

-2.6%

-2.6%

EBITA

5

12

Revenues by geographic area

North America

138

138

EMEA (Europe, the Middle East, Africa)

113

102

Asia Pacific

45

66

Latin America

15

15

311

321

In 2023, Gameloft's revenues were €311 million, down 2.6% at constant currency and perimeter compared to 2022.

Gameloft continued its diversification strategy around PC-Console-Mobile multiplatform games in 2023 with the release of Disney Speedstorm

in April 2023, simultaneously on all PC and console platforms. Disney Dreamlight Valley, launched in September 2022 on PC and consoles, also

continued to perform very well on the GaaS (Game as a Service) model with the launch of the game's first paid expansion in December 2023.

In 2023, PC/Console revenues represented 36% of Gameloft's total revenues, up 27.9% at constant currency and perimeter compared to 2022,

and mobile revenues represented 56%.

Disney Dreamlight Valley, Asphalt 9: Legends, Disney Magic Kingdoms, March of Empires and Dragon Mania Legends represented 56% of

Gameloft’s revenues and ranked as the five best sellers in 2023.

In 2023, Gameloft’s EBITA was €5 million. Excluding restructuring charges, EBITA was €10.6 million, compared to €12 million in 2022.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 19

1.3.6 Vivendi Village

Year ended December 31,

(in millions of euros)

2023

2022

% Change

% Change at

constant

currency

% Change at

constant

currency and

perimeter

Revenues

180

238

-24.2%

-23.7%

-22.0%

of which ticketing and festivals

151

140

+7.6%

+8.9%

+8.9%

EBITA

13

(6)

In 2023, Vivendi Village’s revenues were €180 million, compared to €238 million in 2022. This decrease was due to the cessation of its concert

production activities (Olympia Production) at the end of 2022.

The ticketing and festivals activities generated revenues of €151 million, up 8.9% compared to 2022. Close to 44 million tickets were sold in

Europe and the United States, compared to 39 million in 2022. The festivals, mainly in France and Great Britain attracted 400,000 people during

the summer of 2023.

The sale process regarding the ticketing and festival activities is ongoing and should lead to an announcement over the next weeks. The

concert halls in France (L'Olympia and the théâtre de l'Œuvre) are not part of this proposed sale, nor are the movie theaters in Africa

(CanalOlympia), which are accounted for under the "generosity and solidarity" segment.

The Olympia, which celebrated its 130th anniversary in 2023, hosted a record 280 shows, attracting almost 500,000 spectators.

Vivendi Village’s EBITA was €13 million compared to a loss of €6 million in 2022 (+26.3% at constant currency and perimeter) due to the stop

of the concerts production activities at the end of 2022.

1.3.7 New Initiatives

In 2023, New Initiatives, which mainly brings together Dailymotion and GVA entities, recorded revenues of €152 million, compared to

€122 million in 2022 (+22.4% at constant currency and perimeter).

GVA is Vivendi's subsidiary dedicated to providing ultra-high-speed Internet access in Africa, thanks to its FTTH (fiber to the home) networks

already installed in thirteen cities and eight countries in sub-Saharan Africa (Burkina Faso, Ivory Coast, Congo-Brazzaville, Democratic Republic

of Congo, Gabon, Rwanda, Uganda and Togo).

Very high-speed Internet access offers are aimed at the residential and professional markets, under the "CanalBox" brand. By the end of 2023,

CanalBox covered more than 2.7 million eligible households and businesses.

In 2023, Dailymotion's global audience reached a record level, growing 20% compared to 2022. In the fourth quarter of 2023, this growth was

boosted by the signing of new partnerships, in particular with The Verge, The List and Vox in the United States, La Reforma and Telemetro in

Latin America, Olympique de Marseille in France, El Independiente in Spain, and BQ Prime and Dailyhunt in India.

Between the launch of its new application in May 2023 and the end of December 2023, Dailymotion has attracted more than 600 new French

creators, including Valinfood, French Startupper, Fabien Olicard, Jojol, Bruno Maltor and Athéna Sol, who have joined the platform in a wide

range of verticals (sport, culture, music, gaming, technology, cooking, health, etc.), reinforcing its new positioning strategy to reach a wider

audience, particularly among the younger generations.

New Initiatives’s EBITA was a loss of €43 million, compared to €46 million in 2022.

1.3.8 Generosity and solidarity

In 2023, EBITA of the Generosity and solidarity segment, which brings together CanalOlympia and the Vivendi Foundation, which is part of the

solidarity program Vivendi Create Joy, amounted to a loss of €13 million, stable compared to 2022.

1.3.9 Corporate

In 2023, Corporate’s EBITA was a net charge of €130 million, compared to a net charge of €133 million in 2022, a €3 million decrease mostly

due to a decrease in non-recurring items.

Thursday March 07, 2024

Financial Report and Audited Consolidated Financial Statements for the year ended December 31, 2023 Vivendi / 20

2 Liquidity and capital resources

2.1 Liquidity and equity portfolio

Preliminary comments:

• “Net Cash Position” and “Financial Net Debt”, non-GAAP measures, should be considered in addition to, and not as a substitute for, GAAP

measures presented in the consolidated statement of financial position, as well as any other measure of indebtedness reported in

accordance with GAAP. Vivendi considers these to be relevant indicators of the group’s liquidity and capital resources. Vivendi’s

Management uses these indicators for reporting, management and planning purposes.

• “Net Cash Position” (and “Financial Net Debt”) are calculated as the sum of: