Tax Exempt and Government Entities

FY 2017 Work Plan

September 28, 2016

(As amended March 8, 2017)

2

Table of Contents

Message from the TE/GE Commissioners ............................................................................................. 3

Exempt Organizations (EO) Examinations ............................................................................................. 5

Exempt Organizations (EO) Rulings & Agreements ............................................................................. 8

Employee Plans (EP) Examinations...................................................................................................... 11

Employee Plans (EP) Rulings & Agreements ...................................................................................... 14

Federal, State, and Local Governments (FSLG) ................................................................................. 16

Indian Tribal Governments (ITG) ........................................................................................................... 19

Tax-Exempt Bonds (TEB) ....................................................................................................................... 21

Government Entities Compliance Services (GECS) ........................................................................... 23

Appendix A: EO Measures Tables: ....................................................................................................... 25

Appendix B: EP Measures Tables ......................................................................................................... 27

Appendix C: GE Measures Tables ........................................................................................................ 28

3

Message from the TE/GE Commissioners

It’s amazing how much TE/GE has changed in a short period of time. We’d say

we’ve evolved, but evolution is pretty slow compared to our agenda and how fast

we’re moving to make it a reality.

Just a few years ago we were all about putting a solid foundation down – something

we could build on. We zeroed in on five focus areas as priorities. In Fiscal Year 2016,

we continued working hard on those action areas. Now, entering Fiscal Year 2017,

we keep building, keep changing, with our direction set and our principles clear.

All of this is happening in the context of the IRS’s Future State strategy, which

provides the underlying vision that is guiding our efforts. This vision foresees a

transformed taxpayer – and employee – experience: easily accessible web-based

information that provides pre-filing education, user-friendly technology that makes

filing easier, expeditious case handling and resolution if the IRS makes post-filing

contact with the taxpayer, a better-equipped and engaged work force, and more.

In TE/GE, much of our transformation has taken shape through process changes. Our

gold standard for each change is whether it will be transparent, efficient, and

effective, with the ultimate goal of providing our stakeholders with a superior

experience whenever we interact with them. We will meet our goal when we see that

a process or a project has all three of those factors.

When it comes to transparency, it’s true that, by necessity, we must keep certain information confidential.

That said, the more we provide easy-to-understand information to taxpayers, then the more we increase

voluntary compliance. Taxpayers should easily be able to find technical as well as procedural information

that assists them during pre-filing, filing and post-filing. For example, our Knowledge Network teams, or

K-Nets, have been diligently working on creating issue snapshots that provide short analyses on specific

issues commonly encountered by the field. Not only do the snapshots help us as we conduct examinations

and make issue determinations, they are also helpful to our stakeholders and they foster voluntary

compliance. In addition to being transparent, this content makes us more effective and efficient in

resolving issues raised during an exam or determination process.

1

Turning to efficiency and effectiveness, sometimes it’s not immediately apparent whether a change is

having the effect we’re seeking. For example, when we implemented Form 1023-EZ, we knew within a

short time period that the form was efficient; processing time quickly plummeted, and now has dropped to

less than 30 days. But to learn whether the change was effective, we implemented pre- and post-

determination review processes. After two years, our pre-determination review of randomly selected

Forms 1023-EZ has shown that the form and the process are not only efficient, but are effective as well.

And we continue to check effectiveness through post-determination correspondence audits. We openly

share these results of Form 1023-EZ Update Report (

https://www.irs.gov/pub/irs-

1

All issue snapshots, as well as directives and interim guidance, are publicly available in our Electronic Reading

Room (https://www.irs.gov/uac/electronic-reading-room).

Sunita Lough,

Commissioner

Donna Hansberry,

Deputy

Commissioner

4

tege/form_1023ez_update_report_final.pdf

) with the public because it matters to us that our stakeholders

know and understand our processes.

Issue snapshots and Form 1023-EZ process changes are just two examples of successful transformational

changes made here recently in TE/GE. In FY 2017, we will continue to move forward on many initiatives

started in the past two years:

• In the exam area, we will continue to review how we identify issues of non-compliance, select

and classify returns based on robust filters and modeling, assign the next-best case to the field,

and sharpen our information document request process. We are working with other IRS areas

including Research Applied Analytics and Statistics, Large Business and International, Small

Business and Self Employed, and Criminal Investigation to use a data-driven decision-making

process to more precisely focus case-selection.

• Knowledge Management and K-Nets are now completely integrated into our operations. We will

continue to develop resources, answer questions, conduct discussion forums and facilitate

collaboration.

• We have successfully combined our three case-closing functions (Exempt Organizations,

Employee Plans and Government Entities) into a single entity, and our staff is ready to be cross-

trained.

• In Tax Exempt Bonds, we have created an innovative, interactive form (8038-CP) that is

eliminating many costly filing errors. We will monitor its success, and make adjustments as we

test and learn.

More examples of work in progress are posted on TE/GE Connect on our internal Moving Forward

webpage ( http://tege.web.irs.gov/my-news/2015/08/moving-forward.asp). Our intent is that for each

initiative we undertake, we will do so transparently, efficiently and effectively.

Finally, as we move forward with the many changes, we must always strive to aptly conduct our core

responsibilities. We are reminded of an acronym that is a superb way to be successful no matter the task

at hand – The 5 Ps: Proper Planning Prevents Poor Performance. We have attached FY 2017 work plans

for each of our TE/GE functions (as well as some results from the prior two years.) There you will see

more context and detail about how thoughtful planning will lead us to good results for tax administration.

These are exciting times and, as we have said time and again, it’s your work that’s getting us where we

need to go. Thank you for everything you do to make change happen here in TE/GE.

Sunita Lough Donna Hansberry

Commissioner, TE/GE Deputy Commissioner, TE/GE

5

Exempt Organizations (EO) Examinations

FY 2017 Work Plan Briefing Document

In fiscal year 2016, Exempt Organizations Examinations embarked on an overarching compliance

strategy to ensure organizations enjoying tax-exempt status complied with the requirements for exemption

and adhered to all applicable federal tax laws. We implemented a data driven case selection process with

a goal of identifying and addressing existing and emerging high risk areas of noncompliance. We utilized

a variety of compliance treatments including educational efforts, compliance reviews, compliance checks

and correspondence and field examinations. We focused our resources on five strategic issue areas:

• Exemption: Issues include non-exempt purpose activity and private inurement;

• Protection of Assets: Issues include self-dealing, excess benefit transactions, and loans to

disqualified persons;

• Tax Gap: Issues include employment tax and unrelated business income tax liability;

• International: Issues include oversight on funds spent outside the U.S., exempt organizations

operating as foreign conduits, and Report of Foreign Bank and Financial Accounts (FBAR)

requirements; and,

• Emerging issues: Issues include non-exempt charitable trusts and IRC 501(r).

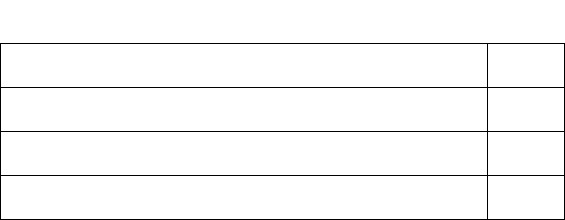

Fiscal Year 2016 Compliance Results

A

s of September 30, 2016, EO Examinations had completed 6,440 examinations. Below is a general

breakout by primary issue examined for each return closed as of September 30, 2016.

Primary Issue Area

Total

Filing, Organizational, Operational

2,774

Discontinued Operations Modifications/Revocation

250

Inurement/Private Benefit

239

Political, Legislative, Governance

87

Unrelated Business Income

760

Employment Tax Issues

1,717

Other

613

Total

6,440

• The Filing, Operational, and Organizational subcategory includes closures where the primary

issue involves verifying the exempt activities of the organization or its filing requirements. Many

instances involve the securing of delinquent returns. (Exemption Issues)

• The Revocation subcategory includes actual revocations, discontinued operations, foundation

status changes, and modifications of subsection. (Exemption Issues)

Exempt Organizations

6

• The Inurement/Private Benefit subcategory includes closures with advisories on the potential for

an organization’s activities to inure or provide private benefit to a disqualified person or other key

individual associated with the organization. Adjustments in this category may include excise

taxes.

• Unrelated Business Income subcategory items includes gaming, nonmember income, expense

allocation issues, NOL adjustments, rental activity, advertising, debt financed property rentals

and investment income. (Tax Gap)

• Employment Tax includes unreported compensation, tips, accountable plans, worker

reclassifications, and noncompliance with FICA, FUTA, and backup withholding requirements.

(Tax Gap)

B

elow is a table of final revocations for fiscal year 2016 and the primary reason for the revocations.

Fiscal Year 2016 Final Revocations by Issue

(as of September 30, 2016)

Primary Reason for Revocations

#

Not Operating for an Exempt Purpose

38

Inurement

11

Other

9

Disqualification of self-declared Exempt Status

3

ACA

Oversight: As required by the Patient Protection and Affordable Care Act (ACA), we continue to

review hospitals for compliance with IRC section 501(r). As of September 30, 2016, we had completed

968 reviews and referred 363 hospitals for field examination. Issues for which referrals were made are:

• Lack of a Community Health Needs Assessment (CHNA) under IRC 501(r)(3)

• No Financial Assistance and/or Emergency Medical Care Policies under IRC 501(r)(4)

• Billing & Collection Requirements under IRC 501(r)(6)

Post Determination Compliance Program: In fiscal year 2016, we continued post determination

compliance examinations of 1,400 exempt organizations that filed Forms 1023 or 1024 and were

approved pursuant to the streamlined process. The organizations were selected through a statistically

valid sampling process. As of September 30, 2016, we had closed 1,248 examined returns with 58%

closing as no change. The remaining 42% had changes ranging from amendments to organizational

documents and failure to file returns. In addition, five organizations were revoked or terminated.

We

also began post determination compliance examinations of exempt organizations that were granted

tax exempt status through submission of a Form 1023-EZ. A statistically valid random sample of 1,182

organizations has been selected and as of September 30, 2016; 137 examined returns have closed with

125 closing as no change, 11 requiring amendments to their organizing documents, and 1delinquent return

secured. Based on the post determination compliance examinations of the streamlined process as well as

Form 1023–EZ process, we believe that the processes are working well. We will continue this program in

FY 2017.

Exempt Organizations

7

Return Selection Using Modeling Techniques: During fiscal year 2016, we implemented Forms 990,

990-EZ, and 990-PF case selection modelling technique that uses filters previously tested. As of

September 30, 2016, we had closed 203 returns selected through this process with an examination change

rate of 85%. This is a good development, showing our selection modeling is improving. Our overall

change rate for all cases closed as of September 30, 2016 was 81%.

Fiscal Year 2017

In fiscal year 2017, we will continue our compliance strategy and utilization of data driven decisions. We

will leverage the feedback that we received from our field employees to make improvements to our 990,

990-EZ and 990-PF case selection models. We will implement newly developed models for the Forms

5227, 990-T and the post determination compliance program. We will also develop a Referral Model.

This will aid in integrating the next best referral case into our work stream. Our focus will continue to be

on our five strategic issue areas. We will continue to include the review of tax-exempt hospital's

compliance with requirements under IRC 501(r).

We

are currently working with TE/GE Research and the Research, Applied Analytics and Statistics

(RAAS) office to utilize data sources to identify organizations at risk for inurement and private benefit

issues and to identify anomalies on returns filed by private foundations. During fiscal year 2017, we will

include 400 returns in the work plan identified for high risk of private inurement and private benefit

issues and 100 private foundation returns with anomalies detected.

We will also be implementing a statistical sampling methodology to assess compliance in the Exempt

Organizations population. In conjunction with TE/GE Research and Statistics of Income (SOI), we will

develop a plan for an ongoing rolling statistical sample of 501(c) (3) and 501(c) other organizations. This

statistical sample will assist in the assessment of the overall compliance levels of the Exempt

Organizations community and address the GAO recommendations made in their FY 2015 audit, Tax

Exempt Organizations - Better Compliance Indicators and Data, and More Collaboration with State

Regulators Would Strengthen Oversight of Charitable Organizations.

Exempt Organizations

8

Exempt Organizations (EO) Rulings & Agreements

FY 2017 Work Plan Briefing Document

Determinations:

I

n FY 2016, EO Determinations focused on its objectives to improve processing of applications and

enhance customer satisfaction. We implemented several programs to accomplish these goals.

• Erroneous Revocation Prevention: On May 3, 2016, EO Rulings and Agreements formalized

procedures to identify and prevent erroneous automatic revocation before the organizations are

notified and before the revocations are posted to EO Select Check. Preventing these erroneous

revocations eliminates adverse impact to organizations and removes the burden from organizations

to identify and notify the IRS of the error (TBOR #2, The Right to Quality Service). Since March

2015, we have reviewed 24,359 potential auto-revocations and prevented 4,454 erroneous

revocations (through September 30, 2016).

• Rejection of Incomplete Applications: On November 18, 2015, we began rejecting incomplete

applications. Rejected application packages, along with any user fees paid, are returned to applicants

along with a letter explaining why the application was rejected. Rejecting incomplete application

submissions in this manner educates applicants as to the requirements of a complete application and

ensures that once the application is assigned to a revenue agent for review, it can be reviewed in a

more efficient and expeditious manner. Since we began this process in November 2015, we have

rejected 9% of all (non-Form 1023-EZ) submitted applications as incomplete (through September

30, 2016).

• Protecting Americans from Tax Hikes (PATH) Act Implementation: The PATH Act, signed in

December 2015, requires social welfare and civic organizations to submit a notice to the IRS of

intent to operate as a 501(c)(4) organization. This requirement is a modification from the prior

statute, which allowed 501(c)(4) organizations to self-declare by submitting a Form 990. The

501(c)(4) organization notification platform was operational on July 8, 2016, concurrent with the

release of Regulations, a Revenue Procedure, and Interim Guidance. Through September 2016, we

received and successfully processed almost 1,200 notifications with 87% approved and 13%

rejected.

• Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of

the Internal Revenue Code: As a result of the IRS Chief Financial Officer’s (CFO) bi-annual user fee

review, Chief Counsel issued Rev. Proc. 2016-32 on May 31, 2016, which reduced the user fee for

Form 1023-EZ listed in Rev. Proc. 2016-8. The user fee change was implemented on July 1, 2016.

Through the fourth quarter of FY 2016, EO received 48,518 Form 1023-EZ cases (59% of overall

Form 1023 cases) and closed 48,238 Form 1023-EZ cases, including 45,394 (94%) cases approved

and 2,344 (5%) cases rejected. The remaining cases were closed as withdrawals, adverse

determinations, and other closures. It is anticipated that the reduction of the user fee will result in an

increase in the percentage of 501(c)(3) applicants using Form 1023-EZ.

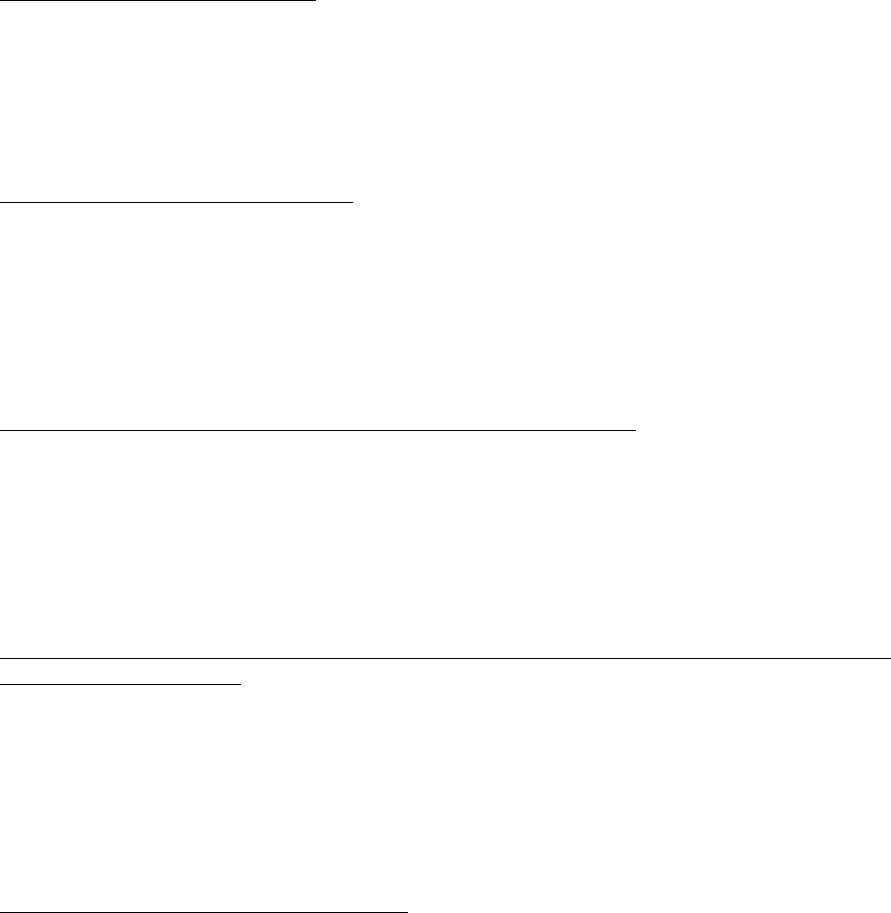

• Fiscal Year 2016 Determinations Results: Through the fourth quarter of FY 2016, EO

Determinations continued to close more applications than it received. The average age of the open

inventory (69 days) as well as the percentage of cases over 270 days old (2%) continued to decrease,

while the quality of the work remained consistent. EO Determinations approved 93.8% of all closed

Exempt Organizations

9

cases and denied less than1%. The most common reasons for denial were private benefit and

inurement, substantial non-exempt purposes, and commerciality issues.

EO

Determinations

Performance

History

FY2014

Performance

History

FY2015

FY2016

Determination

Cases Closed

117,540 101,962 92,129

Determination

Case Receipts

74,579 90,819 91,158

Fiscal Year 2017

In FY 2017, EO Determinations will continue to improve processing of applications and the new

Form

8976, Notice of Intent to Operate Under 501(c)(4) (https://www.irs.gov/charities-non-

profits/electronically-submit-your-form-8976-notice-of-intent-to-operate-under-section-501c4). The

Form 1023-EZ adoption rate is expected to slightly increase due to user fee changes, resulting in a shift of

application receipts from the Form 1023 to the Form 1023-EZ. Although projections point to an increase

in total application receipts in FY 2017, we expect that the increase will almost entirely occur in the Form

1023-EZ workstream while Form 1023 receipts are projected to slightly decline, due in large part to the

Form 1023-EZ user fee reduction in July 2016. Other form receipts, such as the Forms 1024 and 8940, are

projected to increase slightly in FY 2017 for a total receipts projection of just over 88,000 applications.

The resulting projected end-of-year open inventory would net a minimal increase of approximately 400

cases, which will be absorbed through continuous improvement in case processing.

Limited resources are expected to continue to impact the program. To mitigate the anticipated decline in

resources, management is committed to a strategy of continuous improvement in further streamlining case

processing as well as repositioning staff resources as needed to balance and maintain closures to keep

pace with receipts.

The Form 8976 notification is a new workstream. Internal Revenue Code section 506 was added by the

PATH Act and requires organizations that intend to operate under IRC section 501(c)(4) to notify the

Service within 60 days of formation. We anticipate receiving approximately 2,500 notifications in FY

2017. EO Determinations tax examiners will process this work.

We continue to mitigate Form 1023-EZ applicant compliance risks with pre-determination application

reviews and evaluation of the pre-determination data. Consistent with TE/GE’s data-driven approach, we

continue to analyze data from Form 1023-EZ pre-determination reviews and will consider future

adjustments to the application, instructions, and pre-determination program.

Knowledge Management (KM): In a continued effort to increase the technical knowledge base of EO

employees, KM has several initiatives planned for FY 2017. In particular, KM will continue preparing

and presenting approximately three to four live technical events or CPE sessions each quarter. Event

topics will be based on requests from Rulings and Agreements and Exam personnel as well as data

gathered by the Knowledge Networks (K-Nets).

KM continues to prepare and post technical Issue Snapshots for EO employees and the general public. EO

KM completed six issue snapshots (including Electronic Health Records or Regional Health Information

Organization, Abatement of Chapter 42 First Tier Taxes due to Reasonable Cause, and IRC Section 4946

Definition of Disqualified Person) and currently has over 20 Snapshots in development based on issues

raised to KM. In process snapshots include private foundation qualifying distributions, conservation

Exempt Organizations

10

easements, limited liability companies, trusts and IRC 508(a), requirements for community health needs

assessment (CHNA), 501(c)(4) and determining primary activity, and a VEBA non-discrimination

overview. Completed TE/GE Issue Snapshots (

https://www.irs.gov/government-entities/tax-exempt-and-

government-entities-issue-snapshots) are posted to the Electronic Reading Room on the IRS home page.

(http://www.irs.gov/). KM will supplement issue snapshots with new “Issue Casts”, quick and flexible

(15-20 minute) virtual recordings focusing on identified training topics for employees to access at their

convenience. These recordings may also be shared as educational outreach for the general public.

E

O Determinations Quality Assurance (EODQA): EODQA will continue to review and evaluate EO

Determinations cases for correctness and consistency. We will use this information to identify trends in

EO Determinations based on sample and mandatory quality case reviews. EODQA will identify areas for

improvement and improvement opportunities will be developed in collaborative environments between

EODQA and KM for consideration of future training events and materials.

Correspondence:

We are projecting a less than 1% increase in taxpayer correspondence in FY 2017 based

on new tax law and the new Form 8976 workstream. Also, we anticipate improvements in cycle time and

open and overage inventory in FY 2017, resulting from increased efficiencies. We continue to reduce open

correspondence inventory with the goal of responding and resolving submissions timely to match demand.

Employee Plans

11

Employee Plans (EP) Examinations

FY 2017 Work Plan Briefing Document

Examinations

In FY 2017, EP will continue to: (1) develop, maintain and refine a comprehensive collection of

enforcement strategies that identify and focus efforts on addressing retirement plan non-compliance; (2)

leverage existing programs and learned best practices to enhance voluntary compliance; and, (3) address

and eliminate fraudulent and abusive schemes that undermine the retirement system. For FY 2017, EP

will use: (1) compliance indicators to facilitate the building of project models and, (2) statistical issue-

based sampling techniques for case selection to allocate examination resources among specific “focused”

non-compliance issues that have the greatest impact on the retirement plan community. The categories of

casework (to be conducted as field work and office correspondence, as appropriate) are:

• Specialty Programs: EP will continue to apply resources into specialty program casework, focusing

on EP Team Audit (EPTA)/Large Case, multiemployer (MAP) plans, IRC 403(b)/457(b) plans, cash

balance plans, hybrid 401(k) plans (such as those with the age weighted new comparability feature),

and leveraged/non-leveraged employee stock ownership plans (ESOP). The analysis of FY 2016 case

closures as of September 30, 2016 yielded the following issues:

o EPTA/Large Case program (308 closures) – failure to pay out minimum required

distributions, incorrect benefit calculations, joint and survivor elections, improper allocation

of contributions, exceeding the maximum deduction allowable under IRC 404.

o Multiemployer Plans (129) – failure to properly calculate retirement benefits (service

crediting and allocation/accruals), failure to make required minimum distributions, failure to

adjust benefits delayed beyond normal retirement age.

o IRC 403(b)/457 Plans (305) – universal availability (coverage for salary deferrals),

contribution limitations (IRC 414(v)), age 50 catch-up and 15 year special catch-up)),

hardship withdrawals.

o Cash Balance Plans (105) – discrimination in favor of highly compensated employees

through accrual of benefits.

Issues of non-compliance to be pursued during FY 2017 include (but are not limited to) distributions

(EPTA), service crediting (MAP), universal availability (403(b)/457), allocation and contribution

limitations (cash balance), participation/discrimination (hybrid 401(k)) and stock valuation (ESOP).

• Traditional Casework: In FY 2017 EP will continue to select various plan types (profit sharing,

money purchase, 401(k), defined benefit) from within our risk-based targeted program, while

continuing to pursue taxpayer and interagency referrals, 401(k) plans, reported funding deficiencies

and non-bank trustee investigations. The analysis of FY 2016 case closures as of September 30, 2016

have thus far yielded the following issues:

o Risk-based audit program (4,056 closures) – exceeding maximum annual contributions or

benefits, discrimination in favor of highly compensated employees regarding who participates

in (or is covered by) the plan.

Employee Plans

12

o Referrals (522) – discrimination in favor of highly compensated employees via allocation of

funds/benefits, investment of funds in prohibited assets.

o Reported Funding Deficiencies (42) – failure to meet minimum funding requirements for the

plan’s trust.

o Non-bank Trustee Investigations (7) – review of custodial fiduciary accounts.

These same issues of non-compliance will continue to be pursued during FY 2017. In addition, EP is

partnering with Research Analytics Applied Statistics (RAAS) to use a data driven, issue based approach

to better identify focused issues that may represent aggressive or abusive behavior that is detrimental to

plan participants.

• F

ocused Supplemental Work: In FY 2017 additional project work will be supplemented by the

Emerging Issues program, the Learn, Educate, Self-correct, Enforce (LESE) program, the Individual

Retirement Arrangement (SEPs, SAR-SEPs, SIMPLES) program and the Form 5500-EZ (one

participant plan) program. The analysis of FY 2016 case closures as of September 30, 2016 have thus

far yielded the following issues:

o Emerging Issues program (122 closures) – unrelated business income, prohibited

transactions, IRC 415 funding violations.

o LESE (140) – trust investments, contribution/earnings allocation errors.

o Individual Retirement Arrangement program (1,159) – violation of maximum participant

rules, statutory and matched employer contributions, IRC 416(i)(6) top-heavy requirements.

o Form 5500-EZ (244) – participant loans, self-directed brokerage accounts, IRC 404 deduction

and 415 funding limitations.

These same issues of non-compliance will continue to be pursued during FY 2017.

Compliance Checks

EP will also use the Employee Plans Compliance Unit (EPCU) to identify areas of greatest non-

compliance in plan operation and from through compliance check contacts and continue with the

mandated programs: (1) collection of multiemployer certifications and validations; (2) review non–bank

trustees notifications; and, (3) review pension plan funding for funding deficiencies.

Projects conducted in FY 2016 include:

• Improper Deductions addressing discrepancies between the deduction taken on a Form 1120 and

the contribution reported on the Form 5500.

• Excessive Participant Loans on One-Participant Plans

• Form 5500-EZ Non-Filers

• Failure to Provide Benefits

• 401(k) Plans Reporting 4971(a) Tax

• Return discrepancies addressing:

Final Returns with Assets

Missing Pension Feature Codes and Business Codes

Asset Mismatches between the End of Year and subsequent Beginning of Year returns

Employee Plans

13

In FY 2017, compliance checks will focus on the following projects:

• SIMPLE plans

• Merger/consolidations/transfers/spinoffs relating to Form 5310A filings

• Issues surrounding terminated/partially terminated plans

• Inflated assets and/or unusual investments

• SEP plan issues including coverage of employees

• 403(b) plan document requirements

Employee Plans

14

Employee Plans (EP) Rulings & Agreements

FY 2017 Work Plan Briefing Document

Employee Plans Determinations

I

ndividually Designed Plan (IDP) Determinations: In FY 2016 EP completed the review of the

multiemployer plans from Cycle D2 and established a cadre to review Cycle E2 governmental plans. We

have also started reviewing defined benefit plans for risk transfer language (i.e., converting annuity

streams to lump sums). Determinations expects to receive applications for initial and terminating plans

under the revised determination letter program beginning January 1, 2017 and expects to receive the final

cases under the 5-year remedial amendment cycle system (Cycle A3) by January 31, 2017.

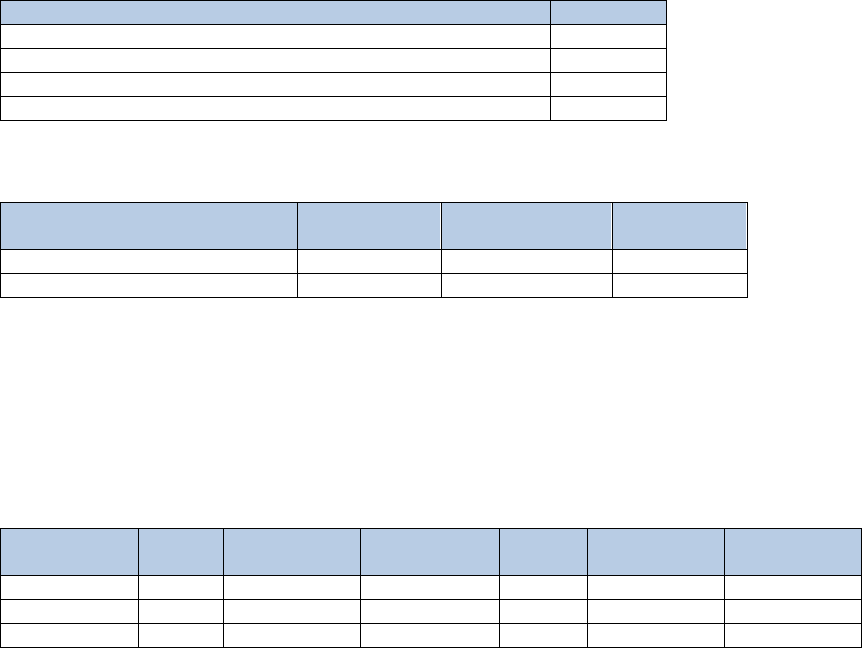

The breakdown of the expected FY 2017 IDP receipts is shown below.

Application Type

Receipts

Individually Designed Plans - Form 5300

5,700

Terminations - Form 5310

1,200

Adopters of Modified Volume Submitter Plans - Form 5307

1,300

Total

8,200

Key measures for the Determinations program are shown in the following table.

Individually Designed Plans

FY2015

Total

FY2016

Total

FY2017

Plan

Cases Closed

9,780

7,738

6,986

Case Receipts

8,973

11,353

8,200

Pre-approved Plan (PAP) Determinations: The review of both the 403(b) and defined benefit (DB)

PAP programs are in progress. Determinations expects to issue approval letters for 403(b) PAPs during

the second quarter of FY 2017 and will continue reviewing the DB PAPs, with issuance of letters

expected in FY 2018. The defined contribution PAP period is opening six months later than planned due

to the extension of the deadline to submit pre-approved DB plans because of the addition of cash balance

features. Submissions will be accepted from August 1, 2017 to July 31, 2018. A summary of PAP

submissions as of September 30, 2016 is shown below.

Plan Type

Lead

Minor

Modifiers

Word-for-

Word

Total

Filing

Deadline

Expected

Issue Date

403(b)

80

18

385

483

4/30/15

3/31/17

DB

66

0

626

692

10/30/15

3/31/18

Total

146

18

1,011

1,175

--

--

Employee Plans

15

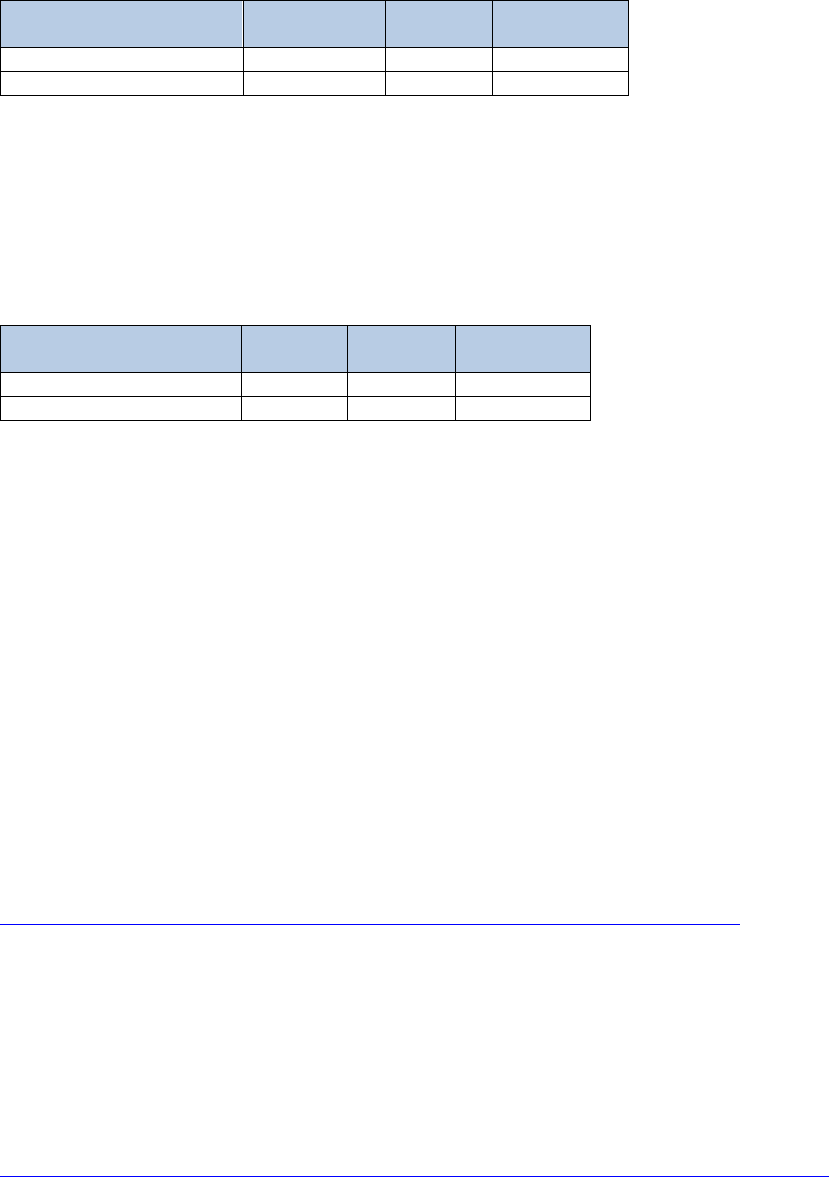

Key measures for the Determinations PAP program are shown in the following table.

Pre-approved Plans

FY2015

Total

FY2016

Total

FY2017

Plan

Cases Closed

198

106

691

Case Receipts

679

593

300

Voluntary Compliance (VC)

I

n FY 2016, a large portion of VCP submissions were concentrated on failures involving late amendments

or failures to adopt amendments, participant loan failures, and the failure to make minimum required

distributions.

Key measures for the VC program are shown in the following table.

Voluntary Compliance

FY2015

Total

FY2016

Total

FY2017

Plan

Cases Closed

3,990

4,001

2,983

Case Receipts

3,437

4,098

3,434

I

n April 2016, VC implemented a new umbrella closing agreement procedure to allow pre-approved

sponsors to correct plan document failures that affect many of their adopting employers rather than

having each adopting employer filing individually.

In FY 2016, VC conducted a Lean Six Sigma (LSS) review of its processes and in FY 2017, VC will

focus on resulting recommendations, including, streamlining its processes and modifying its existing case

inventory management system to accommodate electronic case inventory processing.

A new Employee Plans Compliance Resolution System (EPCRS) revenue procedure was issued in

September 2016 that modifies and supersedes Rev. Proc. 2013-12, 2013-4 I.R.B. 313. The major changes

are removing required determination letter filings for individually designed plans, changing eligibility for

the Self-Correction Program to accommodate the changes in the determination letter application program,

and incorporating prior changes made to EPCRS by Rev. Procs. 2015-27, 2015-28 and 2016-8.

VC continues to accept voluntary requests for closing agreements. This initiative allows plan sponsors or

other third parties to submit proposals to correct compliance issues that are ineligible for EPCRS. More

information may be found by clicking on the following link:

https://www.irs.gov/retirement-plans/employee-plans-voluntary-closing-agreements

EP Technical

Technical will continue to enhance the three EP Knowledge Networks (Defined Contribution Plans,

Defined Benefit Plans, and Specialized Plans) by evaluating best practices used in LB&I and EO in order

to provide a more effective way to search for documents in our knowledge management electronic library.

Technical produces Issue Snapshots job aids that provide analysis and resources for a given technical tax

issue to be used by employees when working cases. These aids can be found at

https://www.irs.gov/government-entities/tax-exempt-and-government-entities-issue-snapshots

.

Indian Tribal Governments

16

Federal, State, and Local Governments (FSLG)

FY 2017 Work Plan Briefing Document

FSLG’s strategy for FY 2017 will build upon efforts to increase audit efficiency and to invest our limited

resources in areas that provide the greatest impact. This includes large entity examinations that allow us

to maximize our wage base coverage while also addressing material and significant compliance issues.

FSLG will continue to address compliance through a balanced approach that includes outreach, education

and examination activities. We will seek additional opportunities to improve our auditing approach,

auditing efficiency and employee skillsets.

The primary work plan focus areas include:

• Focus on data to identify best cases;

• Focus on large entity examinations;

• Increase use of limited scope examinations;

• Work with the GECS on projects that impact compliance of FSLG customers including: refund

claims, compliance checks projects and small, focused examination projects;

• Focus outreach/education on national web-based events and web tools; and

• Invest in the Employment Tax Knowledge Network (ET K-Net) to enhance technical knowledge.

Examinations

We will continue to utilize an examination work plan consisting of five distinct gross wage categories

based on Form 941 filings by government entities:

• $0 – $2.5 million;

• $2.5 – $10 million;

• $10 – $40 million;

• $40 – $100 million; and

• Greater than $100 million.

Our examinations will cover all gross wage categories but with an emphasis on entities with gross wages

of $10 million or more; approximately 75% of examination closures will be of these returns. The focus on

these larger entities directly correlates with our need to address the tax gap and the greatest risk of non-

compliance since these organizations represent a significant percentage of the gross wage base.

FSLG uses selection criteria to identify returns for high risk of non-compliance. We also conduct specific

Compliance Initiative Projects (CIP) to determine high risks of non-compliance with a specific issue and

to test a hypothesis about a possible non-compliance pattern or theory of non-compliance that will lead to

a better case selection method. In addition, these projects allow us to learn more about emerging or

significant compliance issues, which we then use to prepare outreach and guidance to help taxpayers

understand and comply with their tax responsibilities.

In FY 2017, FSLG is committed to improving its case selection process by using examination results data

to identify the current selection criteria that result in the best cases.

The following table illustrates percentages of total wages adjustments by issue for FY 2016. We will use

this data, analyzed by issue and wage strata, to select cases with the greatest likelihood of non-

compliance.

Indian Tribal Governments

17

Issue

Percent of All Wages Adjusted

FICA Adjusted Wages 36%

Worker Reclassification 16%

Unreported Compensation 37%

Total* 89%

*89% of adjustments found in three issue areas

We will seek new sources of data to identify new patterns of filing/reporting that uncover high risk for

non-compliance and develop additional compliance initiative projects. In addition, we will attempt to

determine the “right” balance of cases between CIP examinations, which answer questions about our

population and compliance programs, versus cases selected based upon standard case selection criteria.

We will conduct the following CIP based upon data analytics:

• Early Retirement Incentive Plans (high-risk non-compliance issue): Addresses entities that

provide cash (and other) options to their employees as an incentive to encourage them to

voluntarily retire early. This often results in employment tax issues that were not handled

correctly by taxing the benefits under constructive receipt rules.

• Worker classification project to identify misclassified workers: This project is expected to

identify worker classification non-compliance. This will be accomplished through research and

analysis to identify volume issuers of high dollar Forms 1099-MISC where the income is the

primary or significant source of reported self-employment income.

• Project to identify wages incorrectly treated as non-employee compensation (payment

misclassification): This project is expected to identify payments that should have been treated as

wages but were not. This will be accomplished through research and analysis of employer filed

information returns to identify improper characterization of payments (i.e. Form 1099-Misc vs.

W-2 wages).

• Project to use Federal Audit Clearinghouse to identify entities with high risk of non-

compliance: This project may identify non-compliance with taxable fringe benefits, worker

classification, and unreported income based upon audit reports available from the Federal Audit

Clearinghouse.

Knowledge Management

We will continue to develop the Employment Tax K-Net to ensure that we are able to transfer

institutional knowledge and skills. This K-Net will include employees who will collaborate to develop

employment tax technical training, job aides, etc., affecting federal agencies, state and local government

entities, exempt organizations and Indian Tribal Governments. The K-Net has developed issue snapshots

for IRC 5000C, H1-B Visas, Qualified Parking Fringe Benefits and Totalization Agreements, which are

available on the TE/GE Issue Snapshots (

https://www.irs.gov/government-entities/tax-exempt-and-

government-entities-issue-snapshots) web page. The K-Net is currently working on issue snapshots for

failure to deposit penalties, mileage reimbursements for board members, Section 530 of the Revenue Act

of 1978, Student FICA and a revision of the issue snapshot for IRC 5000C, now that final regulations

have been released. As we move towards a greater focus on large entity examinations, we will invest

significant resources in the development of our employees through training and, when appropriate,

Indian Tribal Governments

18

through team-based examination experiences. The K-Net is one example of an excellent resource for

employees to use in developing their technical skills.

Customer Education & Outreach

FSLG will continue to invest time and resources into customer education and outreach at levels similar to

prior years. We will continue to limit the number of face-to-face outreach events, and we will work to

develop and deliver national web-based events including supporting the development and delivery of

ACA outreach events. A primary focus for FY 2017 will be to work with C&L to develop additional

online tools to help FSLG customers understand and comply with their tax responsibilities including tools

focused on the small entity community.

Indian Tribal Governments

19

Indian Tribal Governments (ITG)

FY 2017 Work Plan Briefing Document

We a

re continuing what began last year with a focus to reinforce our infrastructure by strengthening the

integrity of our knowledge base within the organization, building sustainable outreach products, and

maintaining focused compliance examinations.

For example, two new programs rolled out in FY 2016 are already showing results that will inform our

FY 2017 direction. Tip Compliance Review (TCR) cases have resulted in several customers voluntarily

updating their tip agreements. A TCR is issued for entities that currently have a tip agreement with the

IRS, but have not been timely or correctly supplying additional annual documentation per the tip

agreement requirements. Technical Assistance Visit (TAV) program provides in-depth data relating to

taxpayer assistance requests, allowing us to focus our products and training on the most frequent and

urgent issues. Though TAVs are not counted as closures, the ability to determine what our customers need

has driven many of our infrastructure, outreach and compliance projects for both this year and FY 2017.

Infrastructure

As our workforce continues to shrink, we will modify our infrastructure for this new reality while we

have the people and knowledge to build it. When we look to disseminating information and procedures,

we have to learn to rely less on people and more on products.

We will maintain TE/GE Knowledge Management (KM) structure and procedures to monitor and provide

updates to this site.

We will implement our new customer satisfaction survey with both a new format (online) as well as more

applicable respondents (business personnel rather than the tribal leader).

We will develop a training suite for IRS Collection employees (tutorial, OJT material and Continuing

Professional Education delivery) to learn and use when they are working with Tribal entities or individual

Tribal members, in conjunction with ITG personnel.

Compliance and Enforcement Strategy

Although we have reduced our overall examination focus from past years, we will continue to have a

compliance presence. The primary non-compliance issues for our customers are general employment

taxes and information returns underreporting.

Our compliance goals will remain similar to the goals for FY 2016. Nationwide classification will

continue, with a focus on only the most egregious non-compliance being selected for audit. We will

continue to use non-audit work types such as compliance checks and tip compliance reviews to maintain a

compliance presence.

In our Tip compliance program, we will continue, in conjunction with Small Business Self Employed

(SBSE), to convert Tip Rate Determination Agreement (TRDA) gaming tip agreements to the more

appropriate Gaming Industry Tip Compliance Agreement (GITCA) agreements. We will again use TCR

to monitor adherence to tip agreements.

Indian Tribal Governments

20

ITG Outreach and Education Strategy

I

n FY 2017, we will continue to develop innovative education products to allow our customers to find

answers to questions and solutions to problems, as well as provide nationwide webinars to cover

emerging, and problematic topics in Tribal tax administration.

We will complete the effort to tailor our current IRS.gov content to better meet ITG customer needs and

goals. At the conclusion of the ITG IRS.gov rearrangement, we will provide Webinar based training for

our customers to orient them to the new ITG site.

For our customers with little to no Internet access, we are creating templates, guides and products, which

will be available on CD or DVD. We are also making a guide for Tribal members addressing tax issues

unique to this population, and are planning a series of podcasts to highlight specific topics.

We will hold multiple collaborative WebInterpoint outreach sessions delivered jointly by ITG & Tribal

officials. These sessions will cover current issues of concern and any new legislation or developments.

We will develop an interactive web-based gaming tool to direct customers to proper form and reporting

thresholds, and update and redesign our Publication 4268, ITG Employment Tax Desk Guide, to both

make it more accessible and include additional topics needed by our customers.

ITG Supports to Treasury Initiatives and Consultation

Throughout FY 2016, ITG has provided direct support to various Treasury initiatives coordinated by the

Treasury Point of Contact for Tribal Consultation (POCTC) including providing technical expertise on a

wide range of tax topics at various joint speaking engagements including: Affordable Care Act (ACA)

implementation and technical issues with tribal leaders at the National Indian Health Board (NIHB)

annual meeting; social security and wage tax issues with the National Congress of American Indians

(NCAI); general welfare exclusion (GWE) implementation status at both the National Intertribal Tax

Alliance (NITA) and the Native American Finance Officers Association (NAFOA), and in numerous

formal Consultation sessions on tax issues. ITG has also provided extensive support in the development

of published guidance and inter-agency coordination, particularly with the Department of Interior, as well

as support in the formation of the Treasury Tribal Advisory Committee (TTAC). Those efforts are

expected to continue to be significant in FY 2017.

Tax-Exempt Bonds

21

Tax-Exempt Bonds (TEB)

FY 2017 Work Plan Briefing Document

TEB continues to critically review each of its programs for improvements, greater efficiency, and

alignment with TE/GE and IRS priorities and long-term goals, including the Future State vision.

Examinations

TEB’s highest priority examination cases are claims and returns that have been identified because of

evidence of noncompliance, such as referrals. The next priority is returns having issues for which past

information, including past examinations and VCAPs, indicate a higher risk of noncompliance.

Thereafter, TEB will devote resources to identifying new issues and fact patterns with a higher risk of

noncompliance, and developing methods to find these new issues.

• Referrals/Claims: Exam priority will be given to claims and referrals warranting examination

resources, including whistleblower referrals. During FY 2016, TEB completed examinations of 22

returns selected from referral information. The principal issues found in these referrals were private

use of bond financed property and arbitrage compliance failures. TEB receives two types of claims:

claims for a return of an overpayment of rebate and refund claims for direct pay bonds. In FY 2016,

TEB finished reviews of 103 rebate claims and granted over 83% of those claims. In FY 2016, TEB

revised its direct pay bond refund process, and as a result, in FY 2017, TEB expects to receive fewer

direct pay bond referrals, but these referrals will be returns that likely have a higher risk of

noncompliance than found generally in returns referred under the prior process.

• Projects based on historical experience indicating noncompliance: During FY 2017, TEB will

continue developing examination projects based on identified past noncompliance. This initiative

began in FY 2016 and includes examinations of returns for prison financings and small issue bonds to

occur during FY 2017.

• New Areas of Noncompliance: TEB will use methods, including market scans and data analytics, to

identify new areas of noncompliance for examination. These methods will include exploring ways to

integrate external data with TEB-specific and non-TEB specific IRS databases to enhance

classification results. Research, Applied Analytics and Statistics (RAAS) is scheduled to hold a data

summit with TEB in October 2016 to further this effort.

o Noncompliance Identified Primarily Through Data Analytics of Returns: TEB is developing

a methodology to identify returns with multiple or especially significant indicators of potential

noncompliance. TEB expects to begin producing classified returns for assignment during the

second half of FY 2017 with examinations that continue into FY 2018. TEB is also working on

methods to better identify outlier returns to review for potential noncompliance and to spot

trends. Trend analysis will enable us to plan for and respond to changes in the market with

enforcement initiatives, voluntary compliance programs, compliance checks or other soft

contacts, and educational efforts.

o Noncompliance Identified through Issue/Fact Pattern Selection (Revised Market Segment):

TEB uses experience as well as market scans to identify new issues or fact patterns that have a

higher risk of noncompliance. In the second half of FY 2015 and FY 2016, TEB revised its

market segment program with the goal of better selecting returns for market segments that had a

higher risk of noncompliance. Representative market segments included advance refunding issues

Tax-Exempt Bonds

22

with variable interest rates or escrows funded with open market escrow securities and solid waste

financing for projects that included manufacturing processes. TEB tested for noncompliance in

the segments identified using statistical sampling. TEB has made significant progress in these

examinations, with some being more than 80% completed. In FY 2017, TEB expects to continue

to identify market segment areas.

Voluntary Compliance Agreement Program (VCAP)

Tax law specialists will continue to give VCAP cases priority; however, TEB expects that VCAP will

require fewer resources than in the past. We have revised the closing agreement process to increase

efficiency and transparency and ensure consistency and enforceability. We also have seen a considerable

drop in the number of VCAP requests. TEB will continue to develop streamlined VCAP programs that

enable resolution with minimized IRS and issuer resources. In FY 2017, we anticipate a streamlined

VCAP program for certain arbitrage violations.

Knowledge Management (KM)

In FY 2017, we will emphasize making the K-Net processes more valuable to TEB employees. We will

continue to integrate the K-Net with examinations of returns having the same potential noncompliance

(e.g., project and revised market segment examinations), including providing technical resources. In FY

2016, we loaded links to significant amounts of published guidance, posted four audit tools, held three K-

Net events discussing tax compliance, and developed issue snapshots on the expenditure requirements for

exempt facility bonds and qualified tax credit bonds; these snapshots are available on the

TE/GE Issue

Snapshots (https://www.irs.gov/government-entities/tax-exempt-and-government-entities-issue-

snapshots) web page. In FY 2017, we expect to focus on K-Net events, to develop additional issue

snapshots and other tools for employees, and to use the K-Net platform to facilitate traditional activities

such as issue focus group meetings, CPE and other training, technical/emerging issue updates, and issue

coordination meetings. We will develop several additional issue snapshots, including snapshots on the

effective dates for arbitrage regulations and refundings of certain tax credit bonds.

Customer Education and Outreach

In FY 2016, we published revisions to several TEB publications and posted two webcasts. TEB personnel

also presented at 11 industry events. TEB also took an active role in helping stakeholders understand the

changes TE/GE made to the direct pay bond refund process, including posting information on the website,

discussing changes at stakeholder conferences and providing individual short phone presentations to the

most active paying agents. TEB also created a new interactive Form 8038-CP in FY 2016 to help prevent

filer errors. In FY 2017, we will continue to devote resources to customer education and outreach efforts,

in particular outreach for the new or infrequent issuer. These efforts will be focused on "virtual" outreach

contacts, such as podcasts, as well as web-based educational resources.

Government Entities Compliance Services

23

Government Entities Compliance Services (GECS)

FY 2017 Work Plan Briefing Document

GE

CS continues to provide support to the compliance strategies of the GE functions to better identify

compliance priorities and prioritize compliance issues while exploring new ways to improve the processes

in the area of government entities. GECS will be taking on correspondence, single issue exam projects,

compliance checks, and soft contacts from FSLG, TEB and ITG.

The primary areas of focus in FY 2017 will be driven by:

• Focused examinations of refund claims

• Compliance Check cases from the other GE functions

• Greater reliance on data-driven project cases

• Utilizing the knowledge libraries within each K-Net, which contain technical resources

searchable by key issue areas and resource type

.

G

ECS projects will be based upon use of a case selection method related to one of the following:

• A high risk or noncompliance with a specific issue,

• A test of a possible noncompliance pattern or theory of noncompliance that will lead to better

case selection method, and/or

• A test to provide a better understanding of government entity compliance.

FSLG will support GECS by identifying FSLG sourced work streams suitable for correspondence

compliance contacts:

FY

2017 Programs:

• Credit Balance-No Returns Filed (Non-Filer Compliance Checks): The objective is to bring

governmental non-filers into compliance by securing delinquent returns and/or identifying

potential misapplied payment situations.

• Form 1099-MISC Stop Filer Campaign (Compliance Checks): The objective is to inform

government entities that IRS has no record of receiving any information returns reporting

payments made by the entity for tax periods identified.

ITG has provided support to GECS by identifying ITG project suitable for correspondence

compliance contacts;

FY

2017 Project:

• Unreported Tip Income: The objective is to identify individual taxpayers with potential

unreported tip income.

Government Entities Compliance Services

24

TEB has provided support to GECS by identifying TEB sourced work streams and projects

suitable for correspondence compliance contacts:

On-goi

ng Project carried over to FY 2017:

• Direct Pay Bond: The recent LSS review of the TE/GE compliance review of direct pay bond

s

r

esulted in changes to improve efficiencies in the processing of claims, and to follow “normal

processing” whenever practical. With the new streamline processes, more responsibility will be

done on the Campus/Submission Processing side as they code and edit returns.

FY 2017 Programs/Projects:

• Noncompliance on Face of Return: In FY 2017, TEB will identify returns for which the

issuer’s entries on the return reflect noncompliance.

• Late Filed Information Returns. TEB will explore opportunities for streamlined approaches to

reviewing late filed Forms 8038.