Benefits

Guide

Building Resilience. WellBeing. Mindfulness.

2023

2

hisdbenefits.org

EVERYTHING YOU NEED

TO KNOW ABOUT YOUR

2023 BENEFITS

DISCLAIMER: is guide provides an overview of your benet options. e

complete provisions of the plans, including legislated benets, exclusions, and

limitations, are set forth in the plan documents or insurance contracts. e in-

surance contracts are available for your review in the Benets Department. If the

information in this guide is not consistent with the plan documents or insurance

contracts or state and federal regulations, the plan documents, insurance con-

tracts, and state and federal regulations will prevail. is guide is not intended

as a contract of employment or a guarantee of current or future employment or

benets. is enrollment guide constitutes a Summary of Material Modications

(SMM) to the HISD Summary Plan Descriptions (SPD). It is meant to

supplement and/or replace certain information in the SPDS, so retain it for future

reference along with your SPDS. Please share these materials with your covered

family members.

ADA DISCLAIMER: If you cannot read this guide due to a disability,

please email benetsoce@houstonisd.org and let us know how we can

accommodate you. All the information in this guide is also available on our

website: www.hisdbenets.org.

RESPONSABILIDADES: esta guía proporciona una descripción general

de sus opciones de benecios. Las disposiciones completas de los planes, sus

benecios, exclusiones y limitaciones legislados, se establecen en los docu-

mentos del plan o en los contratos de seguro. Los contratos de seguro están

disponibles para su revisión en el Departamento de Benecios. Si la infor-

mación en esta guía no es consistente con los documentos del plan o contratos

de seguro o regulaciones estatales y federales, prevalecerán los documentos del

plan, los contratos de seguro y las regulaciones estatales y federales. Esta guía

no pretende ser un contrato de empleo o una garantía de empleo o Benecios

actual o futuro. Esta guía de inscripción constituye un Resumen de Modica-

ciones Materiales (SMM) a la Descripción resumida del plan (SPD) de HISD.

El propósito de esta guía es complementar y / o reemplazar cierta información

en el SPD, así que guárdelo para referencia futura junto con su SPD. Sientase

con la libertad de compartir estos materiales con los miembros de su familia

que están cubiertos bajo un plan.

3

877-780-HISD (4473).

TABLE OF CONTENTS

What’s new and notable in 2023

Dependent verication services

Preventive health care

Choose your plan

Medical plan options

Prescription benets

Compare coverage options

Voluntary options

FSA

Dental

EyeMed

Life and AD&D

Legal

Aac

Enroll For Coverage

Wellness Resources

Aetna Programs

Employee Assistance Program (EAP)

Retirement

Coverage Costs

Provider Contacts

04

09

12

15

20

28

32

36

36

38

47

49

52

59

68

70

74

84

86

89

94

4

hisdbenefits.org

Welcome to annual enrollment!

It’s time to take a look at your benets and the changes and elections you may

want to make for 2023. Whether you are new to HISD or returning to the district,

we have resources, information, and useful tools to guide you through your bene-

ts information. Even if you are not enrolling in some of the benet options, as an

employee of the district you have access to benets such as the Employee

Assistance Program and resources that may be useful.

New and better access to care is our goal for 2023. ere are now additional ways to access your

healthcare needs and make it even easier to get you and your family members the health care you need

to stay healthy or to get healthier. Our goal for 2023 is to help our employees connect to care whether

they need help locating a physician or help understanding the treatment plan they have been given.

We have resources for you to use. Please use this Benets Guide as the source of information about the

benets oered at HISD. e Benets Service Center is available and ready to assist with questions you

may have, as well as your enrollment opportunities.

LET’S START BY LOOKING AT WHAT’S

NEW AND NOTABLE FOR 2023.

What’s new and notable

in Benefits for 2023

5

877-780-HISD (4473).

New and improved Benets Service Center and enrollment site through Empyrean Benets

Solutions. We will maintain the same Benets Service Center telephone number of

877-780-4473, and the hours of operation will remain the same: Monday – Friday, 7:00 a.m.

to 7:00 p.m. Central Time, except holidays. You may use the Benets Service Center for questions

about your benets, dependent verication audits, enrollment, and benet changes such as life events

and beneciary changes. e Benets Service Center will send electronic communications to your

HISD email and paper mail to your address on record with HISD, so please check your address in

OneSource and make any necessary updates. Also, check your beneciaries and make any needed

changes through the Benets Service Center. A mobile app will be available so you can conveniently

enroll or change benets directly from your phone.

Access your medical plans when needed to search for Providers or review your benets summary.

e HISD medical plans will continue through Aetna for 2023. Most employees have the employee-

only medical option, and those rates will remain the same in 2023. Some of the increased medical costs

are impacting dependent tier levels, although HISD continues to work hard to maintain healthcare

contributions for all participants. In 2023, employee and child(ren) options will have a 4% increase,

employee and family rates a 7% increase, and employee and spouse an 8% increase. e 2023 employee

contributions per paycheck are:

*Employee-only rates will remain the same. e above deduction amounts are per pay period. HISD has

increased employer contributions to the health plan by 9% starting in July 2022.

Tier Kelsey Basic

ACO

Memorial

Hermann

Basic ACO

TX Medical

Neighbor-

hood Basic

Kelsey Plus

ACO

Memorial

Hermann

Plus ACO

TX Medical

Neighborhood

Plus

Ee only $19.25 $21.18 $33.59 $38.79 $42.67 $67.63

Ee + Spouse $108.21 $119.03 $188.65 $146.07 $160.68 $243.35

Ee +

Child(ren)

$100.22 $110.25 $174.77 $135.30 $148.83 $226.17

Ee + Family $185.39 $203.94 $323.27 $250.27 $275.31 $391.01

new and notable in Benefits for 2023

6

hisdbenefits.org

Kelsey Select Medical Plan – HISD has increased the annual salary threshold for the Kelsey Select

Plan eligibility from $29,120 to $31,000 to reect the salary increase for the 2022-2023 school year.

Benets packets will be mailed to the address of record for all employees who qualify for the Kelsey

Select Plan.

Medical Plan CVS Health Hub Access – HISD employees and dependents covered in all HISD

medical plans can now access the CVS Health Hubs located in most CVS pharmacies in their

neighborhood. For Memorial Hermann and Texas Medical Neighborhood plan participants, the

full cost of the visit may be required if deductibles have not been met. Please take advantage of this

additional benet, especially if you need acute care, chronic condition management, or behavioral

health services. Please note that some locations do not oer preventive care or other services. Visits

to the Health Hubs will generally cost less than going to an urgent care center or emergency room.

* For Kelsey ACO members, a primary care copay will apply for most visits, except a specialist

copay applies for behavioral health visits.

Employee Assistance Program (EAP)

Please continue to use your EAP features such as Better

Help (online counseling sessions for your convenience) and GuidanceConnect, the digital method

for making your appointments and selecting a counselor. ese features provide improved access to

the Employee Assistance Program. To register, visit www.guidanceresources.com.

new and notable in Benefits for 2023

MORE ACCESS TO HEALTH CARE AND HEALTH PLANS

7

877-780-HISD (4473).

• Legal, nancial, and grief resources

• Travel assistance

• Legacy planning resources

• Beneciary nancial counseling

• Advisor Connection: on-demand

nancial seminars

Securian increase 1X without any previous enrollment without Evidence of Insurability (EOI).

Employees may increase their life insurance election even if they have not made any election

to 1X annual salary without answering any health questions known as Evidence of Insurability.

Employees who are already enrolled can also take advantage of the one level increase during annual

enrollment up to 5X or $600,000 without evidence of insurability.

Dental Plan – Dental plans will remain through Cigna Dental, but contributions for the PPO and

HMO plans are increasing by 5% in 2023. See the chart below for the 2023 per paycheck deduction

amounts:

*

Tier Dental HMO Dental

PPO

Dental PPO

Buy-up

Dental

Discount Plan

Ee only $7.25 $19.62 $21.74 $2.50

Ee + Spouse $13.78 $38.86 $43.08 $5.00

Ee + Child(ren) $13.78 $38.77 $42.97 $5.00

Family $17.71 $60.63 $67.22 $5.00

*Discount Dental rates remain the same.

Increased lifestyle benets for members who have Securian life insurance – ese new benets

apply to participants who have basic life (all benets-eligible employees) and employees who have

elected supplemental, spouse, and child life benets. Additional benets include:

8

hisdbenefits.org

New Pharmacy ID cards will be issued to employees with coverage under the Express

Scripts pharmacy benet. e cards will feature new ESI member ID numbers to enhance

member security. You should receive your new cards before the new year. Your current card

will work until you receive your new card. Members may also access their digital ID cards

through express-scripts.com or the Express Scripts Mobile App.

e HISD Health & Wellness Center hours have changed. e clinics are open during

the lunch hour. e HMW clinic is open Monday-Friday from 9:00 a.m. to 4:30 p.m.

and Saturday from 8:00 a.m. to 1:00 p.m. e Attucks clinic is open Monday-Friday from

9:00 a.m. to 4:30 p.m. e clinics also screen for depression and can help you with your

chronic conditions, provide interim primary care, as well as meet your urgent care needs.

Give them a call!

TeleHealth and Chat for HISD medical plans – Memorial Hermann ACO and Texas

Medical Neighborhood medical plan members securely text with a doctor any day, any

time. e CareAccess Live app allows you to connect to easy, quality care from your

phone or computer. e next time you have a non-emergency medical question, try using

the CareAccess Live app to securely text with a doctor. ere is a $0 member cost share,

doctors are available 24/7, and you can talk for as long as you need to. Just download the

app from the App Store or Google Play or visit www.careaccesslive.com to sign up and

begin texting with a doctor in seconds.

Members in the Kelsey-Seybold medical plan may schedule a Telehealth visit by using the

MyKelsey app or going online to www.kelsey-seybold.com. Appointments may be made

for either a phone call or a video visit.

IMPORTANT REMINDERS

DOWNLOAD APPS FOR EACH OF THESE BENEFITS

new and notable in Benefits for 2023

9

877-780-HISD (4473).

dependent verification services

Frequently Asked Questions

ese questions and answers should provide employees with the information they need to complete

the process of adding any eligible dependents.

Q: Why is dependent verication being done?

A: At HISD, we are committed to providing aordable healthcare benets for all employees and their

eligible dependents. One way to ensure we eectively spend our benets dollars and provide an equal

level of benet to all employees is to verify we are only paying the expenses of eligible dependents as

specied in our healthcare plans.

Q: Who will be conducting the verication?

A: HISD has partnered with our Benets Service Center to conduct Dependent Eligibility Verication.

Q: Who will be included in the verication?

A: All active employees who wish to enroll in a medical, dental and/or vision plan will be required to

provide supporting documents to substantiate dependent eligibility.

Q: How do I know if my dependents are eligible?

A: e denition of eligible dependents is:

• Your legal spouse

• Your dependent children; Eligible dependent children under 26 years of age include:

• Your biological children

• Your stepchildren

• Your legally adopted children

• Your foster children, including any children placed with you for adoption

• Any children for whom you are responsible under a court order

• Your child who qualies as your dependent under the terms of a qualied medical child

support order (QMSCO )

10

hisdbenefits.org

dependent verification services

You must verify your dependents. Dependent verication is a way of showing proof that any dependent

you would like to enroll for benets coverage meets our plan guidelines for eligibility. It’s a very simple,

very important process. You only need to do it once. You will be required to show documentation that

your dependents meet the HISD plan guidelines. Employees and their dependents may lose or have their

benets eligibility suspended if they are found to have dependents on the plan who are not eligible.

For a child, one of these documents veries eligibility:

• Adoption certicate

• Birth certicate with parent’s name listed

• Documentation of legal guardianship

• Qualied medical child support order

• Adoption placement agreement

• Documentation of legal custody

• Hospital birth record (within 90 days of birth)

For a spouse, one of these documents veries eligibility:

• Declaration of informal marriage

• Marriage license or certicate. If your dependent is a stepchild, you must also provide a copy of a

marriage certicate to substantiate the child’s relationship to the employee or spouse.

If you have any questions, please call the HISD Benets Service Center at 877-780-HISD (4 473)

Q: What types of documentation do I need to provide to satisfy the verication requirements?

A: ere are multiple forms of documentation that will be accepted for your dependents.

Q: What will happen if I don’t respond to the verication letter?

A: Any dependent not veried by document submission by the verication deadline date will not have

coverage from HISD medical, dental and vision benets.

Q: Who should I contact for more information?

A: e HISD Benets Service Center will be available to you during the verication process to answer any

questions that you have. You can contact the Benets Service Center by calling 877-780-HISD (4473).

Representatives are available 7:00 a.m. to 7:00 p.m. CT, Monday-Friday (except holidays) to assist you.

11

877-780-HISD (4473).

Q: What should be provided to validate a Life Event?

A: You would need to provide any documentation that would support the life event you are declaring.

(ex. Marriage, you would prov ide a Marriage certicate that shows the date of Marriage. Dependent

Age out at 26, you would provide the notice received from the insurance company where you were

previously insured that shows you are losing coverage and shows the date coverage will be lost.

Q: What happens if I don’t receive that documentation?

A: You have 30 days to provide the documentation to support your life event . If you are experiencing

delays in receiving that information, please call the Benets Service Center immediately and let them

know you need more time, they are able to give you a small amount of additional time to receive and

submit your documents.

Q: What are some examples of life events?

A: Marriage, Birth of a Child, Adoption, adding a grandchild, divorce and death. If you have any

questions about your specic life event, you can contact the Benets Service Center at 877-780-4473

to ensure that you know how to declare your life event, as well as when to declare the life event so you

can make the changes that are consistent with that life event.

Q: What is a combo audit?

A: It is an audit that includes adding a dependent and a life event. In this case you would need to

provide documentation on your dependent such as a birth certicate or birth facts within 90 days of

birth from the hospital. For a grandchild, you would need to provide proof of guardianship or a custody

agreement from the courts that shows that you have legal custody of your grandchild.

Q: Who should I contact for more information?

A: Contact the Benets Service Center at 877-780-4473

12

hisdbenefits.org

You’re covered

Preventive care services* are covered at no extra cost through your health benefits and insurance plan when

you see a physician or provider in your plan’s network.

We’ve got you covered with no cost share**

Coverage includes routine screenings and checkups, as well as some counseling to prevent

illness, disease and other health problems.

Many of these services are covered as part of physical exams. You won’t have to pay out of pocket for these

preventive visits when they are provided in network.

They include:

Regular checkups

for adults

Routine gynecological

exams for women

Wellness exams

for children

These services are generally not preventive if you get them as part of your visit to diagnose, monitor or treat an

illness or injury. In these cases, copays, coinsurance and deductibles may apply.

Aetna follows preventive recommendations as determined by the U.S. Preventive Services Task Force, Centers

for Disease Control and Prevention and other advisory committees. Screenings, services

and other covered

preventive services can vary by age, gender and other factors. Be sure to talk with your doctor about which

services are right for you.

*Employers with grandfathered plans may choose not to cover some of these preventive services or to include cost

share (deductible, copay or coinsurance) for preventive care services. Certain religious employers and organizations

may choose not to cover contraceptive services as part of the group health coverage.

** Preventive care at no cost share covered in accordance with the Affordable Care Act.

You’re covered

Preventive care services* are covered at no extra cost through your health benefits and insurance plan when

you see a physician or provider in your plan’s network.

We’ve got you covered with no cost share**

Coverage includes routine screenings and checkups, as well as some counseling to prevent

illness, disease and other health problems.

Many of these services are covered as part of physical exams. You won’t have to pay out of pocket for these

preventive visits when they are provided in network.

They include:

Regular checkups

for adults

Routine gynecological

exams for women

Wellness exams

for children

These services are generally not preventive if you get them as part of your visit to diagnose, monitor or treat an

illness or injury. In these cases, copays, coinsurance and deductibles may apply.

Aetna follows preventive recommendations as determined by the U.S. Preventive Services Task Force, Centers

for Disease Control and Prevention and other advisory committees. Screenings, services

and other covered

preventive services can vary by age, gender and other factors. Be sure to talk with your doctor about which

services are right for you.

*Employers with grandfathered plans may choose not to cover some of these preventive services or to include cost

share (deductible, copay or coinsurance) for preventive care services. Certain religious employers and organizations

may choose not to cover contraceptive services as part of the group health coverage.

** Preventive care at no cost share covered in accordance with the Affordable Care Act.

Covered preventive services for adults

commonly include:

Screenings for:

• Abdominal aortic aneurysm (one-time screening for

men of specified ages who have ever smoked)

• Alcohol misuse

• Cholesterol (for adults of certain ages or at higher risk)

• Colorectal cancer*

• Depression

• Diabetes

• Hepatitis B surface antigen

• High blood pressure

• Human immunodeficiency virus (HIV)

• Lung cancer* (for adults with a history of smoking)

• Obesity

• Prostate cancer*

• Syphilis (for all adults at higher risk)

• Tobacco use

• Tuberculosis (TB) testing

Medicine and supplements

Doses, recommended ages and recommended populations vary.

• Aspirin for women at risk of preeclampsia and adults ages 50 – 69 with certain heart risk factors*

• Bowel preparation medication (for preventive colorectal cancer screening)

• Low-dosage statins: dependent on cardiovascular disease (CVD) and risk factors

• Tobacco-cessation medicine approved by the U.S. Food and Drug Administration (FDA), including over-the- counter

medicine when prescribed by a health care provider and

filled at a participating pharmacy

Counseling for:

• Alcohol misuse

• Domestic violence

• Nutrition (for adults with cardiovascular and

diet-related chronic disease)

• Obesity

• Sexually transmitted infection (STI) prevention (for

adults at higher risk)

• Tobacco use (including programs to help you stop

using tobacco)

Immunizations

Doses, recommended ages and recommended populations vary.

• Hepatitis A and B

• Herpes zoster

• Human papillomavirus (HPV)

• Influenza (flu)

• Measles,

mumps, rubella (MMR)

• Meningococcal (meningitis)

• Pneumococcal (pneumonia)

• Tetanus, diphtheria, pertussis (Tdap)

• Varicella (chickenpox)

*Subject to age restrictions.

Covered preventive services for adults

commonly include:

Screenings for:

• Abdominal aortic aneurysm (one-time screening for

men of specified ages who have ever smoked)

• Alcohol misuse

• Cholesterol (for adults of certain ages or at higher risk)

• Colorectal cancer*

• Depression

• Diabetes

• Hepatitis B surface antigen

• High blood pressure

• Human immunodeficiency virus (HIV)

• Lung cancer* (for adults with a history of smoking)

• Obesity

• Prostate cancer*

• Syphilis (for all adults at higher risk)

• Tobacco use

• Tuberculosis (TB) testing

Medicine and supplements

Doses, recommended ages and recommended populations vary.

• Aspirin for women at risk of preeclampsia and adults ages 50 – 69 with certain heart risk factors*

• Bowel preparation medication (for preventive colorectal cancer screening)

• Low-dosage statins: dependent on cardiovascular disease (CVD) and risk factors

• Tobacco-cessation medicine approved by the U.S. Food and Drug Administration (FDA), including over-the- counter

medicine when prescribed by a health

care provider and filled at a participating pharmacy

Counseling for:

• Alcohol misuse

• Domestic violence

• Nutrition (for adults with cardiovascular and

diet-related chronic disease)

• Obesity

• Sexually transmitted infection (STI) prevention (for

adults at higher risk)

• Tobacco use (including programs to help you stop

using tobacco)

Immunizations

Doses, recommended ages and recommended populations vary.

• Hepatitis A and B

• Herpes zoster

• Human papillomavirus (HPV)

• Influenza

(flu)

• Measles, mumps, rubella (MMR)

• Meningococcal (meningitis)

• Pneumococcal (pneumonia)

• Tetanus, diphtheria, pertussis (Tdap)

• Varicella (chickenpox)

*Subject to age restrictions.

13

877-780-HISD (4473).

Covered preventive services for adults

commonly include:

Screenings for:

• Abdominal aortic aneurysm (one-time screening for

men of specified ages who have ever smoked)

• Alcohol misuse

• Cholesterol (for adults of certain ages or at higher risk)

• Colorectal cancer*

• Depression

• Diabetes

• Hepatitis B surface antigen

• High blood pressure

• Human immunodeficiency virus (HIV)

• Lung cancer* (for adults with a history of smoking)

• Obesity

• Prostate cancer*

• Syphilis (for all adults at higher risk)

• Tobacco use

• Tuberculosis (TB) testing

Medicine and supplements

Doses, recommended ages and recommended populations vary.

• Aspirin for women at risk of preeclampsia and adults ages 50 – 69 with certain heart risk factors*

• Bowel preparation medication (for preventive colorectal cancer screening)

• Low-dosage statins: dependent on cardiovascular disease (CVD) and risk factors

• Tobacco-cessation medicine approved by the U.S. Food and Drug Administration (FDA), including over-the- counter

medicine when prescribed by a health

care provider and filled at a participating pharmacy

Counseling for:

• Alcohol misuse

• Domestic violence

• Nutrition (for adults with cardiovascular and

diet-related chronic disease)

• Obesity

• Sexually transmitted infection (STI) prevention (for

adults at higher risk)

• Tobacco use (including programs to help you stop

using tobacco)

Immunizations

Doses, recommended ages and recommended populations vary.

• Hepatitis A and B

• Herpes zoster

• Human papillomavirus (HPV)

• Influenza

(flu)

• Measles, mumps, rubella (MMR)

• Meningococcal (meningitis)

• Pneumococcal (pneumonia)

• Tetanus, diphtheria, pertussis (Tdap)

• Varicella (chickenpox)

*Subject to age restrictions.

Covered preventive services for women

commonly include:

Screenings and counseling for:

• Breast cancer chemoprevention if you’re at a higher risk

• Breast cancer (BRCA) gene counseling and genetic

testing if you’re at high risk with no personal history of

breast and/or ovarian cancer

• Breast cancer mammography*

• Cervical cancer*

• Chlamydia infection*

• Gonorrhea

• Interpersonal or domestic violence

• Osteoporosis* (depending on risk factors)

Medicine and supplements:

• Folic acid supplements (for women of childbearing ages)

• Risk-reducing medicine,

such as tamoxifen and raloxifene, for women with an increased risk for

breast cancer*

Counseling and services**:

• Prescribed FDA-approved over-the-counter or generic

female contraceptives*** when filled at a

network pharmacy

• Two visits a year for patient education and counseling

on contraceptives

• Voluntary sterilization services

Covered preventive services for pregnant women:

• Anemia screenings

• Bacteriuria, urinary tract or other infection screenings

• Breastfeeding interventions

to support and promote

breastfeeding after delivery, including up to six visits

with a lactation consultant

†

• Diabetes screenings

• Expanded counseling on tobacco use

• Hepatitis B counseling (at the first prenatal visit)

• Maternal depression screening

• Rh incompatibility screening, with follow-up testing for

women at higher risk

• Routine prenatal visits (you pay your normal cost

share for delivery, postpartum care, ultrasounds, or

other maternity procedures, specialist visits and

certain l

ab tests)

Covered preventive supplies for pregnant women:

• Breast pump supplies if you get pregnant again before you are eligible for a new pump

• Certain standard electric breastfeeding pumps (nonhospital grade) anytime during pregnancy or while you are

breastfeeding, once every three years

• Manual breast pump anytime during pregnancy or after delivery for the duration of breastfeeding

*Subject to age restrictions.

** Certain eligible religious employers and organizations may choose not to cover

contraceptive services as part of the

group health coverage.

*** Brand-name contraceptive drugs, methods or devices are only covered with no member cost sharing under certain

limited circumstances, including when required by your doctor due to medical necessity.

†

Limits may vary depending upon state requirements and applicability.

Covered preventive services for women

commonly include:

Screenings and counseling for:

• Breast cancer chemoprevention if you’re at a higher risk

• Breast cancer (BRCA) gene counseling and genetic

testing if you’re at high risk with no personal history of

breast and/or ovarian cancer

• Breast cancer mammography*

• Cervical cancer*

• Chlamydia infection*

• Gonorrhea

• Interpersonal or domestic violence

• Osteoporosis* (depending on risk factors)

Medicine and supplements:

• Folic acid supplements (for women of childbearing ages)

• Risk-reducing medicine,

such as tamoxifen and raloxifene, for women with an increased risk for

breast cancer*

Counseling and services**:

• Prescribed FDA-approved over-the-counter or generic

female contraceptives*** when filled at a

network pharmacy

• Two visits a year for patient education and counseling

on contraceptives

• Voluntary sterilization services

Covered preventive services for pregnant women:

• Anemia screenings

• Bacteriuria, urinary tract or other infection screenings

• Breastfeeding interventions

to support and promote

breastfeeding after delivery, including up to six visits

with a lactation consultant

†

• Diabetes screenings

• Expanded counseling on tobacco use

• Hepatitis B counseling (at the first prenatal visit)

• Maternal depression screening

• Rh incompatibility screening, with follow-up testing for

women at higher risk

• Routine prenatal visits (you pay your normal cost

share for delivery, postpartum care, ultrasounds, or

other maternity procedures, specialist visits and

certain l

ab tests)

Covered preventive supplies for pregnant women:

• Breast pump supplies if you get pregnant again before you are eligible for a new pump

• Certain standard electric breastfeeding pumps (nonhospital grade) anytime during pregnancy or while you are

breastfeeding, once every three years

• Manual breast pump anytime during pregnancy or after delivery for the duration of breastfeeding

*Subject to age restrictions.

** Certain eligible religious employers and organizations may choose not to cover contraceptive

services as part of the

group health coverage.

*** Brand-name contraceptive drugs, methods or devices are only covered with no member cost sharing under certain

limited circumstances, including when required by your doctor due to medical necessity.

†

Limits may vary depending upon state requirements and applicability.

14

hisdbenefits.org

Covered preventive services for women

commonly include:

Screenings and counseling for:

• Breast cancer chemoprevention if you’re at a higher risk

• Breast cancer (BRCA) gene counseling and genetic

testing if you’re at high risk with no personal history of

breast and/or ovarian cancer

• Breast cancer mammography*

• Cervical cancer*

• Chlamydia infection*

• Gonorrhea

• Interpersonal or domestic violence

• Osteoporosis* (depending on risk factors)

Medicine and supplements:

• Folic acid supplements (for women of childbearing ages)

• Risk-reducing medicine,

such as tamoxifen and raloxifene, for women with an increased risk for

breast cancer*

Counseling and services**:

• Prescribed FDA-approved over-the-counter or generic

female contraceptives*** when filled at a

network pharmacy

• Two visits a year for patient education and counseling

on contraceptives

• Voluntary sterilization services

Covered preventive services for pregnant women:

• Anemia screenings

• Bacteriuria, urinary tract or other infection screenings

• Breastfeeding interventions

to support and promote

breastfeeding after delivery, including up to six visits

with a lactation consultant

†

• Diabetes screenings

• Expanded counseling on tobacco use

• Hepatitis B counseling (at the first prenatal visit)

• Maternal depression screening

• Rh incompatibility screening, with follow-up testing for

women at higher risk

• Routine prenatal visits (you pay your normal cost

share for delivery, postpartum care, ultrasounds, or

other maternity procedures, specialist visits and

certain l

ab tests)

Covered preventive supplies for pregnant women:

• Breast pump supplies if you get pregnant again before you are eligible for a new pump

• Certain standard electric breastfeeding pumps (nonhospital grade) anytime during pregnancy or while you are

breastfeeding, once every three years

• Manual breast pump anytime during pregnancy or after delivery for the duration of breastfeeding

*Subject to age restrictions.

** Certain eligible religious employers and organizations may choose not to cover contraceptive

services as part of the

group health coverage.

*** Brand-name contraceptive drugs, methods or devices are only covered with no member cost sharing under certain

limited circumstances, including when required by your doctor due to medical necessity.

†

Limits may vary depending upon state requirements and applicability.

Covered preventive services for children

commonly include:

Screening and assessments* for:

• Adolescent depression screening

• Alcohol and drug use

• Anemia

• Attention deficit disorder (ADD)

• Autism

• Behavioral and psychological issues

• Congenital hypothyroidism

• Development

• Hearing

• Height, weight and body mass index

• Hematocrit or hemoglobin

• Hemoglobinopathies or sickle cell

• Hepatitis B

• HIV

• Lead (for children at risk for exposure)

• Lipid disorders (dyslipidemia screening for

children at higher risk)

• Medical history

• Newborn blood screen

ings

• Obesity

• Oral health (risk assessment)

• STIs

• TB testing

• Vision

Medicine and supplements:

• Gonorrhea preventive medicine for the eyes of all newborns

• Oral fluoride for children* (prescription supplements for children without fluoride in their water source)

• Topical application of fluoride varnish by primary care providers

Counseling for:

• Obesity

• STI prevention (for adolescents at higher risk)

Immunizations

From birth to age 18 — doses, recommended ages and recommended populations vary.

• Haemophilus influenzae type B

• Hepatitis A and B

• HPV

• Inactivated poliovirus

• Influenza

• Meningococcal (meningitis)

• MMR

• Pneumococcal (pneumonia)

• Rotavirus

• Tdap/diphtheria, tetanus, pertussis (DTaP)

• Varicella (chickenpox)

*Subject to age restrictions.

Covered preventive services for children

commonly include:

Screening and assessments* for:

• Adolescent depression screening

• Alcohol and drug use

• Anemia

• Attention deficit disorder (ADD)

• Autism

• Behavioral and psychological issues

• Congenital hypothyroidism

• Development

• Hearing

• Height, weight and body mass index

• Hematocrit or hemoglobin

• Hemoglobinopathies or sickle cell

• Hepatitis B

• HIV

• Lead (for children at risk for exposure)

• Lipid disorders (dyslipidemia screening for

children at higher risk)

• Medical history

• Newborn blood screen

ings

• Obesity

• Oral health (risk assessment)

• STIs

• TB testing

• Vision

Medicine and supplements:

• Gonorrhea preventive medicine for the eyes of all newborns

• Oral fluoride for children* (prescription supplements for children without fluoride in their water source)

• Topical application of fluoride varnish by primary care providers

Counseling for:

• Obesity

• STI prevention (for adolescents at higher risk)

Immunizations

From birth to age 18 — doses, recommended ages and recommended populations vary.

• Haemophilus influenzae type B

• Hepatitis A and B

• HPV

• Inactivated poliovirus

• Influenza

• Meningococcal (meningitis)

• MMR

• Pneumococcal (pneumonia)

• Rotavirus

• Tdap/diphtheria, tetanus, pertussis (DTaP)

• Varicella (chickenpox)

*Subject to age restrictions.

15

877-780-HISD (4473).

Know your options

HISD provides a wide array of valuable benets, from medical coverage to life insurance, and from

dental plans to wellness programs. HISD also provides an excellent selection of voluntary benets

such as Accident, Cancer and Specied Diseases, Critical Illness, and Hospital Indemnity, as well as

Disability and additional life insurance and legal plans. Many of these plans provide additional benets,

including cash payouts that are paid in addition to other benets such as your medical plan benets.

Take your time. Study your options.

Everyone has dierent needs, health challenges, budgets, and goals. By choosing your options carefully,

you and your family can get the coverage that ts your needs—and the support to use your benets to

your advantage.

Complete your Health Risk Assessment on aetna.com

Just think of it as a condential mini survey of your health history and habits with instant

results and advice that you can take with you forever.

You can:

• Learn about your health risks and how to lower them

• Gain real-life tips for better well-being

• Share results with your doctor

CHOOSE YOUR PLAN

Are you ready to get healthy or maintain your health?

Here are the steps you can take toward a healthy you (dependents covered under the medical plan

can also take these steps).

Register on aetna.com

is will allow you to access all your benets for medical, HRA, FSA, and claims. Most

importantly, you can access your ID cards immediately.

Select a Primary Care Physician (PCP)

If you don’t have a regular doctor with whom you have established a relationship, now is the time

to nd one using aetna.com. Selecting a Primary Care Physician will help you build a relationship

with your own selected medical professional who will gather and keep up with your medical

history, as well as help coordinate your care. A PCP can be a doctor who practices general

medicine, family medicine, internal medicine or a pediatrician for your children.

Know your benefits

Read your Explanation of Benets (EOB) each time you visit a healthcare professional and they

le a claim. Be sure you understand the terms and how claims are paid. is will help to ensure

your benets are administered correctly.

1

2

3

16

hisdbenefits.org

Important reminders

Take advantage of the tools on HISDbenets.org

to get started.

Other items to note

Working couples

If you and your spouse both work for HISD, each of you may have coverage, but only one of you

can cover your eligible dependents. In addition, only one employee can enroll in life insurance for

their spouse.

Eligible dependents coverage

Every year it is important to review your eligible dependents, as they are the only dependents

who can be covered under your plans. It is your responsibility to change coverage levels if you

have over-age dependents (life, accident, hospital indemnity, critical illness, cancer, etc.).

If you have a dependent who no longer qualies as an eligible dependent, you must notify

the Benets Service Center at 877-780-4473 immediately. If you fail to do so, we will make an

adjustment to remove the dependent when we discover the ineligible dependent while auditing

our plans, and there will be no refund of premiums paid.

Employer-provided Life and AD&D Insurance

HISD provides $10,000 each of Life and Accidental Death and Dismemberment (AD&D)

insurance coverage at no cost to all employees who are eligible for health benets. You also

may purchase supplemental life with a matching AD&D benet for you, your spouse, and your

dependent children.

Annual Enrollment Is

November 1-18, 2022

17

877-780-HISD (4473).

Choosing benefits plan

Choose the plan that’s the right fit

HISD oers several options for your medical plan. Be clear on what’s important to you.

Verify which network your doctors are in with Aetna. And this year, pay particular

attention to your plan options to ensure you nd the right t for the things that are

most important to you. Once your plan starts you will not be able to make changes

without a qualied life event.

Compare your coverage options

You can expect to pay more in premiums when you choose a medical plan with greater

exibility in the doctors you use - or one that requires you to pay less when you use your

health care. It’s a trade o that may not always be worth it. ink about how you use care,

and gauge your comfort level to nd the right balance.

Consider your voluntary options

Add on the extras that make sense for you and your family.

Now you’re ready to enroll

Log onto myHISD to get started.

A step-by-step guide to

choosing the benefits

that work for you

Check plan networks for the doctors you use.

18

hisdbenefits.org

Everyone has dierent needs, health challenges, budgets, and goals. By carefully considering

your medical plan options, you can choose the plan that works best for you and your family.

With options being oered for 2023, it’s especially important to:

• Know how the plans work. is section has descriptions of your 2023 medical plan options.

Be sure to read about each plan before you enroll for benets during Annual Enrollment.

Check Medical Plan 101 below for denitions of common terms.

• ink about how you and your family use health care. Do you use mostly preventive services

during the year? Are you anticipating a hospital stay? Do you live with a chronic medical

condition? e more health care you use, the more coverage you may need.

• Consider your budget. Check the plan charts in this section to see what you will pay in contributions

for each option. Compare contributions to see how much you pay for care versus how much the plan

pays. e more you pay of your own healthcare costs, the less you will pay in contributions and

vice versa.

While your 2023 plan options oer dierent coverage levels and contribution rates, they have

features in common.

HISD no longer contributes to the Healthcare Reimbursement Account (HRA). e HRA is an

HISD-funded account for those who were previously enrolled in one of the legacy Consumer or

Select plan options that may be used to pay for covered services under the medical and pharmacy plan,

up to plan limits. Members may continue to use any funds left over from previous years to pay for eli-

gible expenses, as long as they are currently enrolled in an HISD medical plan. Unused HRA balances

are forfeited when an employee is no longer enrolled in an HISD medical plan or is no longer

employed with HISD.

For members who have existing HRAs, your amounts will rollover until exhausted, and these funds

have been added to your debit card. e HRA account will pay rst when you have eligible expenses,

and then your exible spending account healthcare funds will be used.

Should you have questions, please contact PayFlex at 888-678-8242.

medical plan 101

Choosing benefits plan

19

877-780-HISD (4473).

All medical plan options pay benets ONLY when you receive care from network providers.

If you seek care outside the network, you will pay the full cost of care out of your own pocket

unless you seek emergency medical services.

If you choose a plan with a low deductible, the plan will start to pay sooner, but you will pay

more in contributions. A plan with a higher deductible will cost less in contributions, but you will

pay more of your own expenses before the plan starts to pay.

• Once you meet the deductible, the plan pays a percentage of covered services. You pay a

percentage as well. is is called your coinsurance. For example, if the plan covers a service

at 80%, your coinsurance is 20% once you’ve met the deductible. Plans that pay a higher

percentage of your covered expenses cost more in contributions than those that pay a

lower percentage.

• If there is money in your HRA, you may swipe your Payex debit card to pay for eligible

expenses. If not, and you elect a Health Care Flexible Spending Account (FSA) during

Annual Enrollment, you can use your FSA to pay toward your out-of-pocket expenses.

In addition to assisting with medical conditions, CareAccess Live doctors provide help with

psychiatric diagnosis and treatment of mental health conditions that can be safely managed through

telemedicine. CareAccess Live can treat and provide longitudinal care including starting or adjusting

medications – for behavioral health conditions such as depression, anxiety, insomnia, and

adjustment disorders.

Services available to you and your dependants

• Message a doctor 24/7

• Connect with a doctor in seconds

• Access to care from anywhere

• No appointments or wait times

For conditions consistent with complex mood disorders or psychotic illness, CareAccess Live works

with the patient to get them connected to the right resources for care. For substance abuse disorders,

CareAccess Live providers advise the patient on ways to stay safe and understand their willingness to

engage in the treatment and direct the member to the ER if clinically appropriate.”

CareAccess Live-Memorial Hermann ACO and Texas Medical Neighborhood plan members

20

hisdbenefits.org

your 2023 medical PLAN OPTIONS

If you enroll in an Accountable Care Organization (ACO) plan, you will have a care team of

doctors, nurses, and other providers who belong to the ACO network. ey are dedicated to your

good health and work to:

• Help you get and stay healthy

• Achieve better outcomes when you need care

• Share information and coordinate services

• Spot potential problems

• Encourage you to play an active role in your health and health care

• For some types of medical or prescription drug expenses, you may pay a at fee or copay.

If you elect a Health Care Flexible Spending Account during Annual Enrollment, you can

use your healthcare FSA to pay copays.

• Once the total amount you pay in deductible and coinsurance reaches the annual out-of-pocket

maximum, the plan pays covered expenses at 100% for the rest of the plan year.

You’ll be able to view Explanation of Benets (EOB) statements on your member website at Aetna.com.

e charts in this guide show each plan’s deductible, coinsurance, copay,

and out-of-pocket maximum amounts.

Each time your network doctor or other care provider les a claim with Aetna, an Explanation

of Benets (EOB) statement is generated. It shows the service provided, how the claim was

processed, any amounts paid, and how much you may owe. It also shows your progress toward

meeting the plan’s deductible and out-of-pocket maximum.

21

877-780-HISD (4473).

a Go to Aetna.com

a Select Find a doctor

a Under guests, select “Plan from an employer”

a Under continue as guest, enter your zip code or city (you can also select number

of miles to look within)

a Click Search (this takes you to the networks)

a Go to the category State-Based Plans

a Select TX Medical Neighborhood – Houston Aetna Select

a Select (under State-Based Plans) TX KelseyCare – HMO

a Go to Aetna Whole Health Plans (this is the very rst group)

a Select TX Aetna Whole Health – Memorial Hermann Accountable Care Network

Elect Choice/Aetna Select

Are your doctors in the network?

You can nd out by...

Texas Medical Neighborhood

KelseyCare ACO

Memorial Hermann ACO

There are three Networks

* If you have registered an out of area dependant refer to instructions you were provided

at the time of enrollment.

22

hisdbenefits.org

There are two Memorial Hermann plan options.

memorial hermann aco plans

• More than 900 primary care doctors

• More than 5,000 specialists

• 12 acute care hospitals

• 62 walk-in clinics

• 86 urgent care centers

• Help keep you healthy or improve your health, not just treat you when you’re sick or injured

• Better coordinate your care and keep tabs on your prescriptions, lab results, health history, and more

• Spot problems and build personalized care plans to treat you

• Encourage you to play an active and informed role in your health and healthcare decisions

e Memorial Hermann ACO network plans are designed to improve the quality of your care, provide

a better experience for you and your family, and save you money. You will have access to an integrated

network of primary care doctors, specialists, and hospitals focused on you. Led by a primary care doc-

tor you choose (recommended but not required), your care team will work with you to:

Important: e Memorial Hermann ACO plan pays benets ONLY when you receive

care from the Memorial Hermann ACO network providers. If you seek care outside the

network, you will pay the full cost of care out of your own pocket.

Both plan options include prescription drug benets administered by Express Scripts. You

meet a separate prescription drug deductible each year and then pay the appropriate copay

for your prescriptions.

The Basic plan

oers lower contributions than Plus

options but has higher deductible and

coinsurance amounts. is means you

will pay more when you need health care.

If you don’t visit the doctor oen and use

the plan mostly for preventive care, the

Basic option may be right for you.

The Plus plan

has higher contributions than the Basic

plan, but the deductible and coinsurance

amounts are lower. is means more of

your expenses will be covered when you

need care. If you think you will visit the

doctor oen and need more care, the

Plus option may be right for you.

e Memorial Hermann ACO network is a healthcare system with:

23

877-780-HISD (4473).

Memorial Hermann

Basic ACO

Memorial Hermann

Plus ACO

RATES

Based on 24 pay periods Employee only $21.18 $42.67

Employee + spouse $119.03 $160.68

Employee + child(ren) $110.25 $148.83

Employee + family $203.94 $275.31

PLAN LIMITS

Annual deductible Individual $2,500 $1,750

Family $5,000 $3,500

Annual out-of-pocket max

(includes all medical and pharmacy deductibles,

copays, and coinsurance)

Individual $6,900 $5,150

Family $13,800 $10,300

COST FOR COVERED SERVICES AFTER YOUR DEDUCTIBLE HAS BEEN MET

Preventive care exams

6

Free Free

Primary care (PCP) 25% 20%

Specialists 25% 20%

HISD clinics

2

Free Free

Inpatient—hospital

3

25% 20%

Outpatient—hospital

3

25% 20%

Outpatient—freestanding and surgical center

3

25% 20%

Emergency care

25% + $300 copay

(Copay waived if admitted)

20% + $300 copay

(Copay waived if admitted)

Virtual Health/Telemedicine

CareAceess Live

Free Free

N/A N/A

Urgent care facility 25% 20%

Lab, X-ray, diagnostic mammogram 25% 20%

Diagnostic scans (MRI, MRA, CAT, PET) 25% 20%

Maternity—delivery 25% 20%

Mental

health and substance abuse—inpatient 25% 20%

Mental health and substance abuse—outpatient 25% 20%

1. Kelsey ACO PCP and specialist copays do not count toward the annual deductible but do apply toward the annual out-of-pocket maximum

2. Free if you are enrolled in an HISD medical plan

3. Pre-certication may be required

4. OBGYN Specialists are tiered.

5. Copay applies aer pharmacy deductible has been met

6. Preventive services are not subject to the deductible

7. e copays in the Kelsey plans are not subject to the deductible

If footnote is not shown on this chart it does not apply to this plan option.

24

hisdbenefits.org

There are three Kelsey-Seybold plan options.

Important: the Kelsey-Seybold ACO plan pays benets ONLY when you receive care from

Kelsey Seybold ACO network providers. If you seek care outside the network, you will pay the

full cost of care out of your own pocket.

All plan options include prescription drug benets administered by Express Scripts. With

the exception of the Kelsey Select plan, you must meet a separate prescription drug deductible

each year and then pay the appropriate copay for your prescriptions.

The Kelsey-Seybold ACO network

e Kelsey-Seybold ACO network is a provider group that includes:

• More than 500 doctors representing 55 medical specialties at 31 Houston-area Kelsey-Seybold

Clinic locations with two more locations opening by the end of 2022

• More than 300 primary care doctors and 400 specialists

• 2 accredited ambulatory surgery centers

• 2 cancer center locations

• 1 sleep center

If you need hospital care, your Kelsey-Seybold doctor will determine the most appropriate

hospital for your care.

Kelsey-Seybold has onsite pharmacies located at most of their clinics. Kelsey-Seybold is also

approved by Express Scripts as a Smart 90 pharmacy, so you can even get your 90-day

maintenance medications lled at a Kelsey-Seybold pharmacy.

The Basic plan

oers lower contributions than Plus

options but has higher deductible and

coinsurance amounts. is means you

will pay more when you need health care.

If you don’t visit the doctor oen and use

the plan mostly for preventive care, the

Basic option may be right for you.

The Plus plan

has higher contributions than the Basic

plan, and the deductible and coinsurance

amounts are lower. is means more of

your expenses will be covered when you

need care. If you think you will visit the

doctor oen and need more care, the

Plus option may be right for you.

The Kelsey select plan

has the lowest deductible and out-of-pocket maximum, but this option is only available to

employees who make $31,000 or less in annual base salary.

Kelsey-Seybold aco plans

25

877-780-HISD (4473).

Kelsey

Basic ACO

Kelsey

Plus ACO

RATES

Based on 24 pay periods Employee only

Employee + spouse

Employee + child(ren)

Employee + family

PLAN LIMITS

Annual deductible Individual

Family

Annual out-of-pocket max

(includes all medical and pharmacy deductibles,

copays, and coinsurance)

Individual

Family

COST FOR COVERED SERVICES AFTER YOUR DEDUCTIBLE HAS BEEN MET

Preventive care exams

6

Free Free

Primary care (PCP) $30 copay

1

$30 copay

1

Specialists $65 copay

1

$65 copay

1

HISD clinics

2

Free Free

Inpatient—hospital

3

25% 20%

Outpatient—hospital

3

25% 20%

Outpatient—freestanding and surgical center

3

25% 20%

Emergency care

25% + $300 copay

(Copay waived if admitted)

20% + $300 copay

(Copay waived if admitted)

Virtual Health/Telemedicine N/A N/A

Kelsey Telemedicine

$20 PCP/$55 Specialist

1

$20 PCP/$55 Specialist

1

Urgent care facility 25% 20%

Lab, X-ray, diagnostic mammogram 25% 20%

Diagnos

tic scans (MRI, MRA, CAT, PET) 25% 20%

Maternity—delivery 25% 20%

Mental health and substance abuse—inpatient 25% 20%

Mental health and substance abuse—outpatient $65 Copay

1

$65 Copay

1

$38.79

$146.07

$135.30

$250.27

$1,750

$3,500

$5,150

$10,300

$19.25

$108.21

$100.22

$185.39

$2,500

$5,000

$6,900

$13,800

1. Kelsey ACO PCP and specialist copays do not count toward the annual deductible but do apply toward the annual out-of-pocket maximum

2. Free if you are enrolled in an HISD medical plan

3. Pre-certication may be required

4. OBGYN Specialists are tiered.

5. Copay applies aer pharmacy deductible has been met

6. Preventive services are not subject to the deductible

7. e copays in the Kelsey plans are not subject to the deductible

If footnote is not shown on this chart it does not apply to this plan option.

26

hisdbenefits.org

texas medical neighborhood plans

There are two Texas Medical Neighborhood plan options.

The Basic plan

oers lower contributions each month but

has higher deductible and co–insurance

amounts. is means you will pay more

when you need health care. If you don’t

visit the doctor oen and use the plan

mostly for preventive care, the Basic

option may be right for you.

The Plus plan

has higher contributions than the Basic

plan, but the deductible and coinsurance

amounts are lower. is means more of

your expenses will be covered when you

need care. If you think you will visit the

doctor oen and need more care, the

Plus option may be right for you.

When you enroll in the plan, you are required to select a Primary Care Physician from the Texas

Medical Neighborhood Network. If you do not select a Primary Care Physician, one will be assigned

to you based on your zip code. Your primary care doctor will provide routine and preventive care, and

help you nd the right network specialists when you need one. However, specialist referrals are not

necessary if you want to see a specialist.

Important: e Texas Medical Neighborhood Network plan pays benets ONLY when you re-

ceive care from network providers. If you seek care outside the network, you will pay the full cost

of care out of your own pocket. Both plans include prescription drug benets administered

by Express Scripts. You must meet a separate prescription drug deductible each year and then

pay the appropriate copay for your prescriptions.

The Texas Medical Neighborhood Network

For the Texas Medical Neighborhood plan participants, there are 20 specialties that are tiered. Tier

1 is Maximum Savings and Tier 2 is Standard Savings. When you see a physician in one of these

specialties, you will save more if you select one where Maximum Savings are indicated. is is

just a guide to help you save on your health care. As long as your physicians are in your network,

benets will pay in accordance with your plan. Maximum Savings will save you from paying more

out of pocket than needed. e 20 specialties are:

• Allergy/Immunology

• Cardiology

• Cardiothoracic Surgery

• Dermatology

• Endocrinology

• Gastroenterology

• Infectious Disease

• Nephrology

• Neurology

• Neurosurgery

• Obstetrics/Gynecology

• Ophthalmology

• Orthopedics

• Otolaryngology

• Plastic Surgery

• Pulmonary/Critical Care

• Rheumatology

• Surgery

• Urology

• Vascular Surgery

27

877-780-HISD (4473).

TX Medical

Neighborhood Basic

TX Medical

Neighborhood Plus

RATES

Based on 24 pay periods Employee only

Employee + spouse

Employee + child(ren)

Employee + family

PLAN LIMITS

Annual deductible Individual

Family

Annual out-of-pocket max

(includes all medical and pharmacy deductibles,

copays, and coinsurance)

Individual

Family

COST FOR COVERED SERVICES AFTER YOUR DEDUCTIBLE HAS BEEN MET

Preventive care exams

6

Free Free

Primary care (PCP) 25% 20%

Specialists 25%/45% 20%/40%

HISD clinics

2

Free Free

Inpatient—hospital

3

25% 20%

Outpatient—hospital

3

25% 20%

Outpatient—freestanding and surgical center

3

25% 20%

Emergency care

25% + $300 copay

(Copay waived if admitted)

20% + $300 copay

(Copay waived if admitted)

Virtual Health/Telemedicine

CareAceess Live

Free Free

N/A N/A

Urgent care facility 25% 20%

Lab, X-ray, diagnostic mammogram 25% 20%

Diagnostic scans (MRI, MRA, CAT, PET) 25% 20%

Maternity—delivery 25%/45%

4

20%/40%

4

Mental health and substance abuse—inpatient 25% 20%

Mental health and substance abuse—outpatient 25% 20%

$33.59

$188.65

$174.77

$323.27

$2,500

$5,000

$6,900

$13,800

$67.63

$243.35

$226.17

$391.01

$1,750

$3,500

$5,150

$10,300

1. Kelsey ACO PCP and specialist copays do not count toward the annual deductible but do apply toward the annual out-of-pocket maximum

2. Free if you are enrolled in an HISD medical plan

3. Pre-certication may be required

4. OBGYN Specialists are tiered.

5. Copay applies aer pharmacy deductible has been met

6. Preventive services are not subject to the deductible

7. e copays in the Kelsey plans are not subject to the deductible

If footnote is not shown on this chart it does not apply to this plan option.

28

hisdbenefits.org

All medical plan options include prescription drug benets through Express Scripts available

at any participating pharmacy and through mail order.

Here’s how the plan works:

• You pay a separate prescription drug deductible each year before the plan starts to pay its share of your

prescription drug costs.

• Once you have met your deductible, you pay a copay for your prescriptions.

• e money you pay out of pocket for drugs, either in copays or in meeting your deductible, is applied

toward meeting your medical plan’s annual out-of-pocket maximum, except for the specialty drug

copays through the SaveonSP Manufacturer Copay Assistance Program.

• When your medical annual out-of-pocket maximum is met, your prescription drugs will be

covered at no cost to you for the remainder of the plan year.

No-cost prescriptions for high blood pressure, high cholesterol,

and diabetes

Generic drugs for high blood pressure, high cholesterol, and diabetes (including injectable insulin)

remain available at no cost to you, as long as you are enrolled in an HISD medical plan and purchase

90-day supplies through Express Scripts or at an Express Scripts retail Smart90 pharmacy partner.

HISD plans also cover women’s generic contraceptives (as well as those that have no generic available)

at 100%.

Filling prescriptions at retail pharmacies

With Express Scripts, HISD’s pharmacy benets management company, you have a choice of

participating pharmacies. If you need a short-term prescription like an antibiotic or pain medication,

take the prescription and your Express Scripts member ID card to any of the participating pharmacies.

For long-term and maintenance medications, the Smart90 Program allows you to receive a 90-day

supply of your medication in two ways—either through the Express Scripts' Mail Service Pharmacy

(online, by phone or through mail) or at a Smart90 retail pharmacy near you. No matter which option

you choose, your copay remains the same. You must obtain a 90-day prescription from your physician,

and you can pick up your 90-day maintenance prescription locally at Costco, HEB, Kelsey-Seybold,

Kroger, Randall's, and Walmart or through mail order. Refer to www.Express-Scripts.com or

call Express Scripts at 855-712-0331 for the most current network information.

YOUR PRESCRIPTION BENEFITS

29

877-780-HISD (4473).

For new long-term drug prescriptions, you can get two 30-day supplies of your medication at any

network retail pharmacy for the retail copay, but aer that you will need to use the Smart 90 Program

described above or you will have to pay the mail copay to receive a 30-day supply at any network retail

pharmacy. Ordering a 90-day supply through Express Scripts Mail Service Pharmacy or a Smart90 retail

pharmacy (retail location or mail order) will result in substantial savings to you for long-term and mainte-

nance medications.

Filling prescriptions with the mail order service

e Express Scripts mail order service is a cost-eective and convenient choice for lling long-term

prescriptions, including those for maintenance medications provided at no charge. To use the mail

order service:

• Go to HISDBenets.org and click on Resources then forms.

• Complete the mail order form and mail to the address indicated.

• Once you’ve placed your order, you can sign up for the Express Scripts automatic rell

program. Express Scripts will even request a new prescription from your doctor when your rells

are up or your prescription has expired.

If you need specialty drugs

When you have chronic or complex medical conditions such as multiple sclerosis or rheumatoid arthritis,

your doctor may prescribe specialty drugs. ese drugs typically require special handling, administration

or monitoring. You can order specialty drugs through Accredo, the Express Scripts specialty mail order

pharmacy.

You also may be able to take advantage of the Express Scripts SaveonSP (Specialty Pharmacy)

Manufacturer Copay Assistance Program. is program is designed to help you save money on

certain specialty medications. If you participate, certain specialty medications will be free of charge ($0).

Your prescriptions will still be lled through Accredo, your existing specialty mail pharmacy.

Express Scripts will contact you if you are eligible to participate in the SaveonSP program. Enrollment

in the program is voluntary. If you choose not to participate, you will be responsible for the applicable

prescription copay. Keep in mind that the copay will not count toward your deductible or out-of-pocket

maximums.

For more information about the SaveonSP Manufacturer Copay Assistance Program, please contact

SaveonSP at 800-683-1074 Monday-ursday 8:00 a.m.-8:00 p.m., and Friday 8:00 a.m.-6:00 p.m.

Eastern Time.

30

hisdbenefits.org

The Express Scripts Discount Rx Program

If you waive HISD-sponsored medical coverage, you may enroll in the Express Scripts Discount

Rx program. Eligible employees can enroll by:

• Signing up via the HISD portal

• Calling the HISD Benets Service Center from 7:00 a.m.- 7 p.m., Monday-Friday,

at 877-780-HISD (4473).

You can enroll at initial eligibility, annual enrollment or during a qualifying life event change.

e program entitles you to a cash discount through Express Scripts participating pharmacies and

mail service. e Discount Rx card is not insurance, and you do not have a copay amount. You are

responsible for paying 100% of the discounted Express Scripts price and any dispensing fee. Express

Scripts will provide you an ID card when you enroll.

THINGS TO CONSIDER ABOUT YOUR PHARMACY PLAN

Express Scripts prior authorization drives plan savings by monitoring the dispensing of high-cost

medications and those with the potential for misuse.

e Step erapy program applies edits to drugs in specic therapeutic classes at the point of sale.

Coverage for back-up therapies (second/third step) is determined at the patient level based on the

presence or absence of front-line drugs or other automated factors in the patient’s claims history.

e Drug Quantity Management program manages prescription costs by ensuring that the quantity

of units supplied for each copayment is consistent with clinical dosing guidelines. e program is

designed to support safe, eective, and economic use of drugs while giving patients access to

quality care.

YOUR PRESCRIPTION BENEFITS

31

877-780-HISD (4473).

32

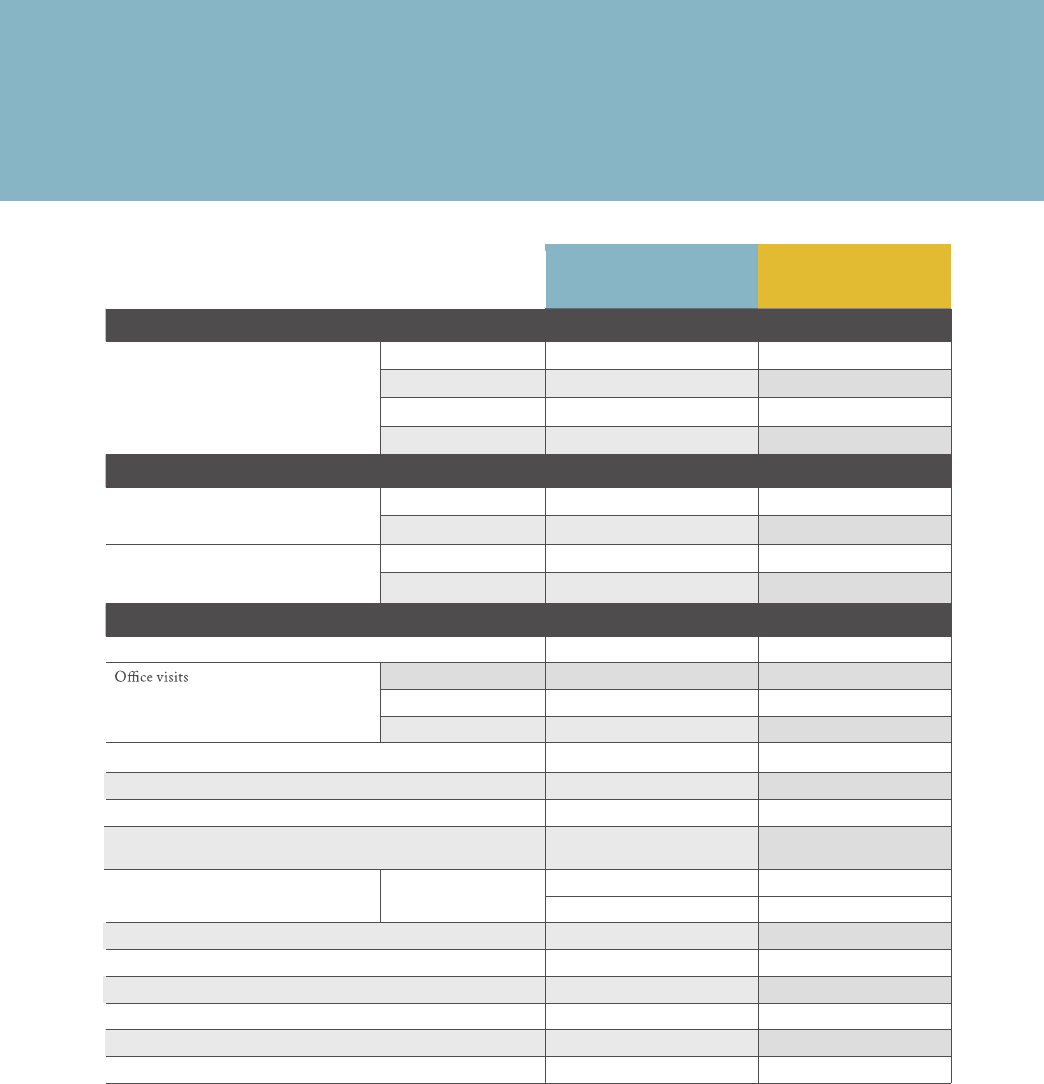

hisdbenefits.org

Kelsey

Basic ACO

Memorial Hermann

Basic ACO

TX Medical

Neighborhood Basic

Kelsey

Plus ACO

Memorial Hermann

Plus ACO

TX Medical

Neighborhood Plus

RATES

Based on 24 pay periods Employee only $19.25 $21.18

$33.59

$38.79 $42.67 $67.63

Employee + spouse $108.21 $119.03

$188.65

$146.07 $160.68 $243.35

Employee + child(ren) $100.22 $110.25

$174.77

$135.30 $148.83 $226.17

Employee + family $185.39 $203.94

$323.27

$250.27 $275.31 $391.01

PLAN LIMITS

Annual deductible Individual $2,500 $2,500

$2,500

$1,750 $1,750 $1,750

Family $5,000 $5,000

$5,000

$3,500 $3,500 $3,500

Annual out-of-pocket max

(includes all medical and pharmacy deductibles,

copays, and coinsurance)

Individual $6,900 $6,900

$6,900

$5,150 $5,150 $5,150

Family $13,800 $13,800

$13,800

$10,300 $10,300 $10,300

COST FOR COVERED SERVICES AFTER YOUR DEDUCTIBLE HAS BEEN MET

Preventive care exams

6

Free Free Free Free Free Free

Primary care (PCP) $30 copay

1,7

25% 25% $30 copay

1,7

20% 20%

Specialists $65 copay

1,7

25% 25%/45% $65 copay

1,7

20% 20%/40%

HISD clinics

2

Free Free Free Free Free Free

Inpatient—hospital

3

25% 25% 25% 20% 20% 20%

Outpatient—hospital

3

25% 25% 25% 20% 20% 20%

Outpatient—freestanding and surgical center

3

25% 25% 25% 20% 20% 20%

Emergency care

25% + $300 copay

(Copay waived if admitted)

25% + $300 copay

(Copay waived if admitted)

25% + $300 copay

(Copay waived if admitted)

20% + $300 copay

(Copay waived if admitted)

20% + $300 copay

(Copay waived if admitted)

20% + $300 copay

(Copay waived if admitted)

Virtual Health/Telemedicine

Kelsey Telemedicine

CareAceess Live

$20 PCP/$55 Specialist

1

CareAcess Live CareAcess Live $20 PCP/$55 Specialist

1

CareAcess Live CareAcess Live

Urgent care facility 25% 25% 25% 20% 20% 20%

Lab, X-ray, diagnostic mammogram 25% 25% 25% 20% 20% 20%

Diagnostic scans (MRI, MRA, CAT, PET) 25% 25% 25% 20% 20% 20%

Maternity—delivery 25% 25% 25%/45%

4

20% 20% 20%/40%

4

Mental health and substance abuse—inpatient 25% 25% 25% 20% 20% 20%

Mental health and substance abuse—outpatient $65 Copay

1

25% 25% $65 Copay

1

20% 20%

2023

Medical plan comparison

1. Kelsey ACO PCP and specialist copays do not count toward the annual deductible but do apply toward the annual out-of-pocket maximum

2. Free if you are enrolled in an HISD medical plan

3. Pre-certification may be required

4. OBGYN Specialists are tiered.

5. Copay applies after pharmacy deductible has been met

6. Preventive

services are not subject to the deductible

7.

COMPARE YOUR COVERAGE OPTIONS

33

877-780-HISD (4473).

Kelsey

Basic ACO

Memorial Hermann

Basic ACO

TX Medical

Neighborhood Basic

Kelsey

Plus ACO

Memorial Hermann

Plus ACO

TX Medical

Neighborhood Plus

RATES

Based on 24 pay periods Employee only $19.25 $21.18

$33.59

$38.79 $42.67 $67.63

Employee + spouse $108.21 $119.03

$188.65

$146.07 $160.68 $243.35

Employee + child(ren) $100.22 $110.25

$174.77

$135.30 $148.83 $226.17

Employee + family $185.39 $203.94

$323.27

$250.27 $275.31 $391.01

PLAN LIMITS

Annual deductible Individual $2,500 $2,500

$2,500

$1,750 $1,750 $1,750

Family $5,000 $5,000

$5,000

$3,500 $3,500 $3,500

Annual out-of-pocket max

(includes all medical and pharmacy deductibles,

copays, and coinsurance)

Individual $6,900 $6,900

$6,900

$5,150 $5,150 $5,150

Family $13,800 $13,800

$13,800

$10,300 $10,300 $10,300

COST FOR COVERED SERVICES AFTER YOUR DEDUCTIBLE HAS BEEN MET

Preventive care exams

6

Free Free Free Free Free Free

Primary care (PCP) $30 copay

1,7

25% 25% $30 copay

1,7

20% 20%

Specialists $65 copay

1,7

25% 25%/45% $65 copay

1,7

20% 20%/40%

HISD clinics

2

Free Free Free Free Free Free

Inpatient—hospital

3

25% 25% 25% 20% 20% 20%

Outpatient—hospital

3

25% 25% 25% 20% 20% 20%

Outpatient—freestanding and surgical center

3

25% 25% 25% 20% 20% 20%

Emergency care

25% + $300 copay

(Copay waived if admitted)

25% + $300 copay

(Copay waived if admitted)

25% + $300 copay

(Copay waived if admitted)

20% + $300 copay

(Copay waived if admitted)

20% + $300 copay

(Copay waived if admitted)

20% + $300 copay

(Copay waived if admitted)

Virtual Health/Telemedicine

Kelsey Telemedicine

CareAceess Live

$20 PCP/$55 Specialist

1

CareAcess Live CareAcess Live $20 PCP/$55 Specialist

1

CareAcess Live CareAcess Live

Urgent care facility 25% 25% 25% 20% 20% 20%

Lab, X-ray, diagnostic mammogram 25% 25% 25% 20% 20% 20%

Diagnostic scans (MRI, MRA, CAT, PET) 25% 25% 25% 20% 20% 20%

Maternity—delivery 25% 25% 25%/45%

4

20% 20% 20%/40%

4

Mental health and substance abuse—inpatient 25% 25% 25% 20% 20% 20%

Mental health and substance abuse—outpatient $65 Copay

1

25% 25% $65 Copay

1

20% 20%

2023

Medical plan comparison

1. Kelsey ACO PCP and specialist copays do not count toward the annual deductible but do apply toward the annual out-of-pocket maximum

2. Free if you are enrolled in an HISD medical plan

3. Pre-certification may be required

4. OBGYN Specialists are tiered.

5. Copay applies after pharmacy deductible has been met

6. Preventive

services are not subject to the deductible

7.

34

hisdbenefits.org

Annual pharmacy deductible $50 per person $50 per person

$50 per person $50 per person $50 per person $50 per person

Prescription drugs

(30-day retail)

5

Generic $20 $20

$20 $15 $15 $15

Preferred brand $50 $50

$50 $40 $40 $40

Non-preferred brand generic $70 $70

$70 $60 $60 $60

Prescription drugs

(90-day mail or retail)

5

Generic $50 $50

$50 $37.50 $37.50 $37.50

Preferred brand $125 $125

$125 $100 $100 $100

Non-preferred brand generic $175 $175

$175 $150 $150 $150

Specialty (30-day supply)

5

$150 $150

$150 $100 $100 $100

5. Copay applies after pharmacy deductible has been met

Kelsey

Basic ACO

Memorial Herman

n

Basic ACO

TX Medical