2022

Benefit

Guide

2022 Benefit Guide

2

Table of Contents

Welcome ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 3

Benets Overview ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 3

Benet Eligibility �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 4

KelseyCare Network Plan ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 6

KelseyCare POS Plan ������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 7

Medical Benets �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 8

Express Scripts (ESI) Prescription Drug Program �������������������������������������������������������������������������������������������������������������������������������������������� 9

Specialty Management Program ������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 9

Cigna Dental Care ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������10

VSP Choice Plan �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������11

Cigna Employee Basic Life Insurance ���������������������������������������������������������������������������������������������������������������������������������������������������������������12

Cigna Employee Supplemental Life Insurance ���������������������������������������������������������������������������������������������������������������������������������������������12

Cigna Dependent Life Insurance �����������������������������������������������������������������������������������������������������������������������������������������������������������������������13

Cigna Accidental Death & Dismemberment Insurance ����������������������������������������������������������������������������������������������������������������������������� 13

Cigna Disability ��������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������14

BPAS Flexible Spending Accounts (FSAs) �������������������������������������������������������������������������������������������������������������������������������������������������������15

Cigna Voluntary Critical Illness ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������16

Cigna Voluntary Accident Insurance ����������������������������������������������������������������������������������������������������������������������������������������������������������������16

Cigna Voluntary Hospital Indemnity Insurance �������������������������������������������������������������������������������������������������������������������������������������������16

Kelsey-Seybold 401(k) Plan ���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 17

Unum Voluntary Whole Life Insurance ������������������������������������������������������������������������������������������������������������������������������������������������������������17

2022 Premium Rate Sheets ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������18

Contact Information ����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������� 22

This document is an outline of the coverage provided under your employer’s benet plans based on information provided by your company. It does not include all

the terms, coverage, exclusions, limitations, and conditions contained in the ocial Plan Document, applicable insurance policies and contracts (collectively, the

“plan documents”). The plan documents themselves must be read for those details. The intent of this document is to provide you with general information about

your employer’s benet plans. It does not necessarily address all the specic issues which may be applicable to you. It should not be construed as, nor is it intended

to provide, legal advice. To the extent that any of the information contained in this document is inconsistent with the plan documents, the provisions set forth in

the plan documents will govern in all cases. If you wish to review the plan documents or you have questions regarding specic issues or plan provisions, you should

contact your Human Resources/Benets Department.

3

Kelsey Seybold

Welcome

Kelsey-Seybold is committed to providing you with valuable

and quality services� Use this guide to gain a better

understanding of the options available to you and your family�

Additional information is available on The Pulse�

You have the right to request and receive a paper copy of

documents that have been provided electronically� You may

obtain these copies free of charge by contacting HR Benets @

713.442.5000, option 3 or email

Benets Overview

This guide is not intended to replace the plan documents or

insurance contracts� If there are any discrepancies between the

information presented in this guide and the plan documents,

the plan documents and contracts will govern�

If you and/or your dependents have Medicare or will become

eligible for Medicare in the next 12 months, Federal Law gives

you more choices about your prescription drug coverage�

The Patient Protection Aordable Care Act requires all

employers with self-insured health plans that provide minimum

essential coverage to report on the coverage provided for the

calendar year� Kelsey-Seybold mails this document in January

for the prior year coverage�

2022 Benefit Guide

4

Benefit Eligibility

Who is Eligible?

The following employees are benefit eligible the first day of the month following hire or rehire date�

If you are hired on the first day of the month, benefits are effective on that day.

» Full-Time

» Part-Time

Per Diem employees may be eligible after being employed for one year�

» The initial look back period is 12 months in length after which an employee’s work history is reviewed to determine the

average number of hours worked per week�

» Per Diem employees who work an average of 30+ hours per week within the 12-month look back period are eligible for part-

time benets the rst day of the month following the measurement period� Those with an average of 20-29 hours per week are

eligible for medical, dental, and vision only, at part-time rates�

Eligible Dependent Denition

All dependents enrolled in Kelsey-Seybold’s plan must meet the denition of a qualied eligible dependent� An eligible

dependent is:

Spouse

» A spouse to whom you are legally united in matrimony or an informal marriage established by registering at a county

courthouse�

If your spouse is working and has access to employer-sponsored medical benets that provide minimum essential coverage,

they must enroll in their employer provided medical plan. Any medical expenses incurred by an employed spouse who has

not enrolled in their own employer-provided medical benets will be the sole responsibility of the employee.

Child

» Child up to the age of 26 that is your natural child, legally-adopted child,

stepchild, child under your court approved legal guardianship, foster child, or

child for which you have a court order�

» Child who qualies as your dependent under the terms of a Qualied Medical

Support Order�

» Disabled child over the age of 26�

Required Documentation

All employees must provide the following for any dependents enrolled in the

Kelsey-Seybold medical plans:

» A valid Social Security Number

» The relationship status

» Legal documentation within 31 days of enrollment

Examples of acceptable documentation:

» Marriage License

» Common Law Adavit

» Birth Certicate

» Adoption Paperwork

» Court Documents

5

Kelsey Seybold

Coverage Begins

New Employees – Benefits for full-time or part- time employees are effective

the first day of the month following hire or rehire date� If you are hired on the

first day of the month, benefits are effective that day.

Current Employees – Employees currently enrolled in Kelsey-Seybold

benefit plans may re-elect their benefit choices during annual open

enrollment� The coverage period related to these new benefit choices is

January 1 to December 31� Employees who do not make benefit choices

during open enrollment will continue with their current benefit plans, with

the exception of the Flexible Spending Account (FSA) plan elections�

Employees must make an annual election of FSA dollars�

Employees Transferring to a Benefit Eligible Status – Benefits for an

employee transferring to a full-time or part-time status will be effective upon

the first day of the month following the transfer date�

Qualifying Life Event

You cannot change your benefit elections during the year unless you have a

life event that allows for a change� It is your responsibility to notify HR

Benefits and make your changes within 31 days of a qualifying event� The

following are examples of qualified life events:

» Marriage

» Divorce

» Birth, Adoption, or Custodial change

» Death of a spouse or dependent child

» Change in your employment status that results in the gain or loss of

eligibility of coverage

» Gain or loss of spouse’s group coverage

» Change in dependent eligibility

Under IRS rules, changes must be made within 31 days of the qualifying

event. Changes in coverage will be eective on the rst day of the month

following notication, except for events in which the IRS allows coverage

to be retroactive.

Coverage Ends

» Midnight on your last day of employment, except for medical, dental,

and vision, which will end 14 days after last day of employment�

» When you transfer to an ineligible status for benets�

» When a dependent becomes ineligible for coverage�

» When Kelsey-Seybold is notied a dependent is no longer eligible�

Pre-Tax Deductions

Benets deducted on a pre-tax basis include medical, dental, vision, and the healthcare and dependent care

exible spending accounts.

2022 Benefit Guide

6

Kelsey-Seybold Clinic oers a choice of two quality

medical plans (KelseyCare Network Plan and KelseyCare

POS Plan)

Kelsey-Seybold contributes to the cost of your medical insurance� Your premiums

are deducted pre-tax from your paycheck biweekly and are based on the

coverage selected� Please refer to the Benets Premium sheet for your biweekly

premium amount�

KelseyCare Network Plan

With its unique network of more than 25 clinics, Kelsey-Seybold, the nation’s rst

accredited Accountable Care Organization, is Houston’s largest and most

renowned private multi specialty physician group�

A direct provider network, consisting of Kelsey-Seybold physicians and more than

1,000 aliate providers, is available for preventative and diagnostic medical

services� You have open access to all Kelsey-Seybold physicians and clinic locations�

Coverage Highlights

» No out-of-network coverage

» $20 copayment for Primary Care oce visits

($10 copay e-visits; $20 copay video visits)

» $40 copayment for Specialty oce visits

($30 copay e-visits; $40 copay video visits)

» $10 copayment for annual vision exam

» $0 annual deductible

» $2,000 individual and $5,000 family annual out-of-pocket maximum

» $100 Urgent Care copayment

» $200 Emergency Room copayment

» $500 in-patient copayment per hospital admission (pre-certication required)

Out-of-area “Guest Privileges” benets may be available for eligible

dependents living away from the greater Houston area for a minimum of 60

days, not to exceed 2 years, unless enrolled in school program.

Contact Cigna Customer Service to nd out if you qualify for “Guest Privileges.

7

Kelsey Seybold

KelseyCare POS Plan

A Point of Service (POS) Plan combines In-Network KelseyCare and Out-of-Network benefits. The POS plan permits

an individual to choose where to seek treatment at the time services are needed.

When receiving care from Kelsey-Seybold physicians, your claims are covered as if you were in the KelseyCare Network Plan,

paying a copayment for visits, without rst meeting a deductible��

In this plan you can access medical services in three ways:

KelseyCare Network (In-Network)

This preferred network of coverage oers the highest level of coverage and is comprised exclusively of Kelsey-Seybold physicians

and authorized referrals to the Kelsey-Seybold aliate provider network�

Cigna POS Providers (Out-of-KelseyCare Network)

This feature allows members to receive care from participating Cigna providers� This is available to oer provider choice� These

claims are subject to a $500 individual deductible� After your annual deductible is met, the plan will pay 70% and you will pay a

30% coinsurance up to the out-of-pocket maximum�

Non-Kelsey/Non-Cigna POS Providers (Out-of-Network)

This allows members to select physicians outside of Kelsey-Seybold Clinic and the Cigna POS providers� These claims are subject to

a $500 individual deductible� After your deductible has been met, the plan will pay the provider 70% up to a maximum of 110% of

Medicare allowable charges� You will pay a 30% co-insurance and any amount not covered by the plan�

2022 Benefit Guide

8

Medical Benets

KelseyCare Network Plan

In-Network benets only.

No coverage for out-of-network

providers.

KelseyCare POS Plan

KelseyCare Network providers have same coverage as

KelseyCare Network Plan. All other providers are paid as

out-of-network claims.

Participating Cigna Providers

Out-of-KelseyCare Network

Non-Kelsey/Non-Cigna Participating

Providers Out-of-Network

Calendar Year Deductible

$0 Individual

$0 Family

$500 Individual

$1,000 Family

$500 Individual

$1,000 Family

Coinsurance Amount

(of eligible expenses)

30% after deductible 30% after deductible

Out-of-Pocket Maximum

(includes deductible)

$2,000 Individual

$5,000 Family

$3,000 Individual

$6,000 Family

$3,000 Individual

$6,000 Family

Doctor’s Office

Wellness

(Limited to preventative services per the

Aordable Care Act)

$0 copay $0 copay $0 copay

Primary Care Oce Visit

$20 copay

E-visits $10 and Video Visits $20

30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Specialist Oce Visit

$40 copay

E-visits $30 and Video Visits $40

30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Other Professional Charges

Radiologist, Anesthesiologist

and Pathologist

Outpatient Hospital: $0 copay

Inpatient $0 (under facility charges)

30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Routine Vision Care $10 copay every 12 months at Kelsey Seybold Clinic 30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Infertility Testing $20/$40 copay (testing/counseling) 30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Laboratory/X-Ray $0 30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Diagnostic X-Ray for complex

imaging (MRI,CAT, PET scans)

$100 copay per type of scan per day 30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Hospital Services

Outpatient Surgery $200 copay per facility use 30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Inpatient Hospital Services

Hospital Precertication Penalty

$500 copayment per hospital admission

Prior authorizations required

30% after deductible (prior authorization required)

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Urgent Care Visit $100 copayment in network facilities $100 copayment in network facilities $100 copayment in network facilities

Emergency Room Visit $200 copay (waived if admitted) $200 copay (waived if admitted) $200 copay (waived if admitted)

Durable Medical Equipment 20% after deductible 30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Mental Health/Substance Abuse Services

Inpatient Stay $500 copay per admission 30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Outpatient Individual Visits $40 copay (physician oce visit) 30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Outpatient Group Visits $40 copay 30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Other Services

Rehabilitation Services

(PT/OT, Chiropractic (60 visits/calendar year),

Speech Therapy)

$40 copay 30% after deductible

30% after deductible + amounts billed over

110% of Medicare allowable amounts

Excluded services include: Morbid Obesity, Plastic Surgery, Hearing aids, Routine foot care, Non-emergency care when traveling outside the U.S.

9

Kelsey Seybold

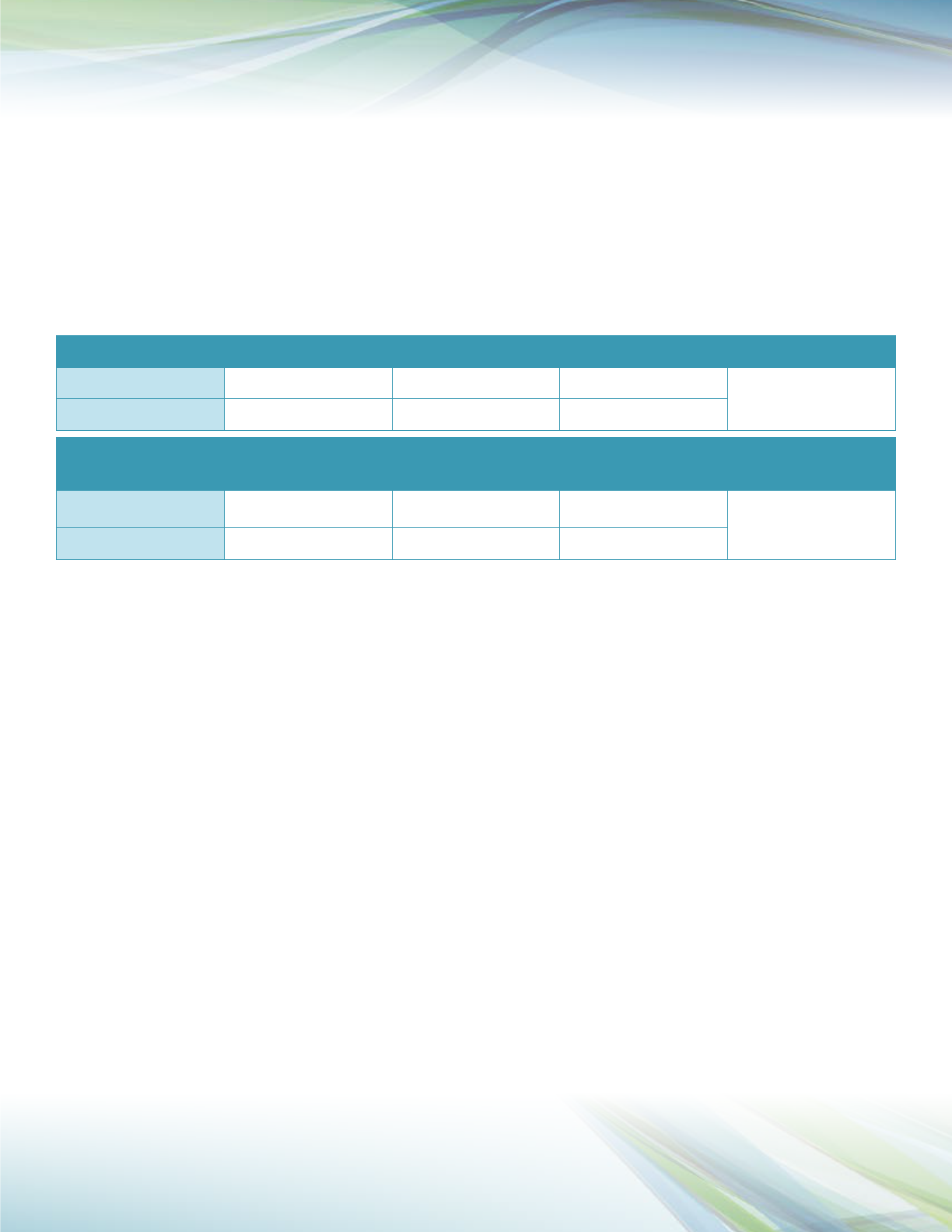

Express Scripts (ESI) Prescription Drug Program

If you enroll in medical insurance, your prescription drug coverage will be through ESI�

Coverage Highlights

» Preferred Network pharmacies are Kelsey-Seybold Pharmacies and HEB�

» Generics are mandatory, if one is available� If a brand name formulary is chosen when a generic is available, the brand

copayment plus the cost dierence between generic and brand name is required�

If a generic is not available, the standard costs for the brand name formulary will apply�

» Generic prescriptions can be lled at Preferred Network pharmacies for a lower copay�

» Prescriptions may be lled at any major pharmacy or retail store for a higher copay�

» Mail orders available for 90 day supply�

1st

Tier Generic

2nd Tier

Brand Name formulary

3rd Tier

Brand Name Non-Formulary

4th Tier

RX > $600

Preferred Network

(up to a 30-day supply)

$10 $30 $60

(up to a 30-day supply)

20% copay with $2,000

Out-of-Pocket Maximum

Preferred Network

(90-day supply)

$30 $90 $180

1st

Tier Generic

2nd Tier

Brand Name formulary

3rd Tier

Brand Name Non-Formulary

4th Tier

RX > $600

Other Pharmacies

(up to a 30-day supply)

$20 $40 $70

(up to a 30-day supply)

20% copay with $2,000

Out-of-Pocket Maximum

Mail Order Pharmacy

(90-day supply)

$60 $120 $210

Specialty Management Program

The pharmacies are focused on providing you with the best possible care while you undergo specialty medication treatment�

The Services Include

» Working as part of your care team with your healthcare provider

» Supporting you with verbal counseling and information about your medications

» Assisting you with medication self-administering training

» Communicating with your healthcare provider regarding follow up, as needed

» Helping you identify Copay Assistance Programs, when needed

» Calling you each month to coordinate the rell shipment of your medication

Our plan uses dierent types of restrictions to help our members use drugs in the most eective ways�

Prior Authorization

For certain drugs, your provider will need to get prior approval from the plan before the cost of the drug will be covered�

Step Therapy

This requires you to try less costly but just as eective drugs before the plan covers another drug�

Quantity Limits

For certain drugs, the plan will limit the amount of the drug that you can get each time you ll your prescription�

Therapeutic Resource Centers (TRC)

Pharmacy practices specialize in caring for patients with the most complex and costly conditions� Through specialized training

and regular interaction with patients, specialty TRC pharmacists and nurses handle the complex issues associated with specialty

medications and the conditions they treat� Contacting a Therapeutic Resource Center team member can help you with resolving

barriers to taking your medications, manage prescription usage associated with comorbidities, and establish a personal

relationship with you and your physicians and caregivers�

Exclude at Launch

This program excludes certain medications at their market launch to allow for appropriate review of evidence and overall clinical value�

2022 Benefit Guide

10

Cigna Dental Care

You have the option of electing either the Dental Health Maintenance Organization (HMO) plan or one of the Cigna Dental Choice

(DPPO) plans� Both plans oer preventive, basic, major and orthodontic services� Kelsey-Seybold contributes to the cost of your

dental insurance� Your premiums are deducted pre-tax from your paycheck biweekly and are based on the coverage selected�

Coverage Highlights

Cigna Dental HMO

Cigna Dental Choice (DPPO)

($2,000 Calendar Year Maximum)

» $0 annual deductible (per individual)

» $0 calendar year plan maximum

» $0 orthodontic lifetime deductible

» 24-month orthodontic lifetime maximum

» reduced, xed pre-set charges for preventive and diagnostic care (i�e�,

annual exams, cleanings, x-rays, etc�)

» reduced, xed pre-set charges for basic restorative care (i�e�, llings, root

canal, extractions, oral surgery, etc�)

» reduced, xed pre-set charges for major restorative care (i�e�, crowns,

dentures, and bridges)

» Must use a dentist in the Cigna HMO network

» $50 annual deductible (per individual)

» $2,000 calendar year plan maximum

» $1,500 orthodontic lifetime maximum, covered at 50%

» 90% (no deductible) for preventive and diagnostic care (i�e�, annual

exams, cleanings, x-rays, etc�)

» 80% (after deductible) for basic restorative care (i�e�, llings, root canal,

extractions, oral surgery, etc�)

» 50% (after deductible) for major restorative care (i�e�, crowns, dentures,

and bridges)

To nd a Dentist, go to www.mycigna.com

Select “Find a Doctor.” Under “Find a Person,” select Dentist.

Select type of Dentist. To sort by DHMO/DPPO select “Change Plan” Your Network is – “Radius Network”

11

Kelsey Seybold

VSP Choice Plan

Administered by VSP

Services In-Network Out-of-Network

Frequency

(Exams/Frames/Lenses)

Exams 12 Months

Glasses/Frames 24 months adults/12 months child glasses/Lenses 12 months

Contact Lenses 12 months (in lieu of glasses)

Exam Copay $10 Reimbursed to $40

Materials $25 Not applicable

Lenses Copay

Single 100% after copay Reimbursed to $40

Bifocal 100% after copay Reimbursed to $60

Trifocal 100% after copay Reimbursed to $80

Lenticular 100% after copay Reimbursed to $80

Frames

Retail Allowance

$160

(20% o amount above $160)

Reimbursed to $100

Contacts

Elective Contact Allowance

(in lieu of glasses)

$150, includes contacts exam Reimbursed to $150

If you enroll, you will not receive an ID card� Simply give your social security number to your VSP provider so they can verify your

enrollment� You do not need to submit a claim for In-Network benets� You must submit a claim to VSP for benet reimbursement

for Out-of-Network Services�

To Find a Provider

» Go to www.VSP.com

» Click on “Find a VSP Doctor”

» Enter Zip Code or City/State

» Click “Search”

2022 Benefit Guide

12

Cigna & New York Life

Employee Basic Life Insurance

Kelsey-Seybold recognizes the importance of life insurance to

protect your loved ones in the event of your death� All full-

time employees receive basic life insurance at no cost to them�

Additionally part-time employees can receive basic life

insurance at an additional cost�

Life insurance is subject to coverage limitations�

Coverage Highlights

Full-Time Employees

» Automatic enrollment of 2 times your Annual Benets Pay*

» Maximum coverage of $1�75 million

» No cost to employees, Kelsey-Seybold pays 100% of the

premium

Part-Time Employees

» May elect up to 2 times your Annual Benets Pay*

» Maximum coverage of $1�75 million

» Employees pay 100% of the premium

Evidence of Insurability is Required if���

» If you are a part-time employee and you do not elect basic

life insurance within 31 days of rst becoming eligible for

coverage and subsequently elect coverage�

Premiums

Premiums are based on your Annual Benets Pay�*

Cigna & New York Life

Employee Supplemental Life Insurance

U

nderstanding that each employee’s needs are different, Kelsey-

Seybold provides additional options for purchasing life

insurance� Working with Cigna, Kelsey-Seybold offers a

comprehensive life insurance plan that includes portability

options�

Life insurance is subject to coverage limitations� Any coverage

amount over the guaranteed issue limit is subject to Evidence of

Insurability (EOI)� Cigna will send you instructions on where and

how to complete the form on-line at www.mycigna.com� In

some instances, Cigna may require additional medical testing or

a physical� You must be approved by Cigna for the additional

amount of coverage and you must be actively employed for the

coverage to be effective�

Coverage Highlights

» Coverage in units of $10,000

» Maximum coverage up to the lesser of 3 times annual

benets pay or $1�75 million

» Employees pay 100% of the premium

Evidence of Insurability is Required if���

» You do not elect supplemental life insurance within

31 days of first becoming eligible for coverage and

subsequently elect coverage�

» Full-time and part-time employees can elect supplemental

life insurance up to $100,000 as an annual enrollment

election� Evidence of insurability is required for amounts

over $100,000�

» New hires can elect up to $500,000 at their initial

enrollment� EOI is required for amounts over $500,000�

Premiums

Premiums are deducted from your paycheck biweekly and

based on your age as of 1/1�

This information is a brief description of the important features of the plan. It is not a contract. Terms and conditions of life coverage are set forth in Group Life Policy No. FLX965092, FLX965011 and AD&D Policy No.

OK966540. The group policy is subject to the laws of the jurisdiction in which it is issued. The availability of this oer may change. Please keep this material as a reference. Coverage is underwritten by Life Insurance

Company of North America. As used in this brochure, the term Cigna and Cigna Group Insurance are registered service marks of Life Insurance Company of North America, a CIGNA company, which is the insurer of the

Group Policy. Insurance products and services are provided by the individual CIGNA companies and not by the Corporation itself. ©

*Annual Benets Pay: Equal to your base pay (including inventive compensation for executives of KS Management Systems and members of KS Management Services and members of Kelsey-Seybold Medical Group,

PA) as of October 1, 2021 or salary at time of hire in 2022.

13

Kelsey Seybold

Cigna & New York Life

Dependent Life Insurance

Dependent life coverage is available if you would like to

insure your dependent child(ren) or spouse�

Coverage Highlights

Child

» You may cover your dependent child(ren) for $10,000 per

child

» Employees pay 100% of the premium

» Children never require Evidence of Insurability

Spouse

Spouse Lif

e insurance is subject to coverage limitations� Any

coverage amount over $50k is subject to Evidence of Insurability

(EOI)� Cigna will send you instructions on where and how to

complete the form on-line at www.mycigna.com� In some

instances, Cigna may require some additional medical testing or

a physical� Your spouse must be approved by Cigna for the

additional amount of coverage and they cannot be an inpatient

in a hospital, hospice, rehabilitation or convalescence center, or

custodial care facility; or conrmed to his or her home under the

care of a physician�

You may cover your spouse in units of $10,000 up to $500,000�

The amount cannot exceed 100% of Employee Basic Life +

Supplemental Life combined�

Evidence of Insurability is Required if���

» You do not elect spouse life insurance within 31 days of

rst becoming eligible for coverage and subsequently elect

coverage�

» You elect spouse life coverage that exceeds $50,000�

Please refer to the Certicate of Coverage for more highlights

related to your life insurance coverage�

Premiums

Premiums are deducted from your paycheck biweekly and based

on your age� Your premium will increase 1/1 the following year

after your age puts you in a higher age bracket�

Cigna & New York Life

Accidental Death & Dismemberment

Insurance

Accidental Death & Dismemberment (AD&D)insurance pays a

lump sum benefit for accidental injuries that result in death

or dismemberment suffered by you or a covered dependent�

Coverage Highlights

» You may elect to cover yourself only or yourself and your

family The employee election is in units of $10,000 with

child and spouse coverage as a percentage of the

employee’s volume��

» Certain benet riders and payable benet amounts apply�

Please refer to the Summary Plan Description for more

details�

» Maximum coverage of lesser of 5 times annual benet pay

or $1 million dollars�

Premiums

» Premiums are deducted from your paycheck biweekly and

are based on your plan election and your Annual Benets

Pay�*

» If you and your spouse are both employed by Kelsey-

Seybold and eligible to enroll for coverage under the Plan,

one but not both, may purchase Family Coverage� The

other spouse may not elect coverage as they are already

covered under family coverage�

*Annual Benets Pay: Equal to your base pay (including inventive compensation for executives of KS

Management Systems and members of KS Management Services and members of Kelsey-Seybold

Medical Group, PA) as of October 1, 2021 or salary at time of hire in 2022.

2022 Benefit Guide

14

Cigna & New York Life Disability

Disability coverage provides income protection in the event you become sick , injured or pregnant, and are unable to work for an

extended period of time� Cigna conveniently handles your claims process from start to nish to reduce the stress related to

administration of these bene

ts�

If you elect Long-Term Disability, Kelsey-Seybold will provide, at no cost to you, a core Short-Term Disability benet. In

addition, employees may elect, at their own expense, Supplemental Short-Term Disability.

Disability Denition Waiting Period Benets Paid Maximum Benet Duration

Short-Term Disability

Receiving appropriate care and treatment

from a doctor on a continuing basis and

unable to earn more than 80% of your pre-

disability earnings at your own occupation.

14 calendar days from date of disability Core Plan (100% of premiums paid by

Kelsey): 60% of pre-disability earnings up

to $1,000 per week

Supplemental Plan (100% of premiums

paid by employee). 66.67% of pre-

disability earnings up to $2,500 per week

26 weeks from date of disability

Long-Term Disability

Receiving appropriate care and treatment

from a doctor on a continuing basis.

Unable to earn more than 80% of your pre-

disability earnings at your own occupation

due to sickness, injury or pregnancy.

180 calendar days from date of disability Option 1: 50% of pre-disability earnings up

to $10,000 per month

Option 2: 65% of pre-disability earnings up

to $25,000 per month

Dependent upon: Type of medical

condition; Age at the time the disability

occurs

Denition of Pre-Disability earnings: Equal to your base pay (including incentive compensation) as of October 1, 2021 or, if

hired in 2022, salary at the time of hire�

Review the Plan summary for pre-existing condition limitations, denition of disability and maximum duration details.

15

Kelsey Seybold

BPAS Flexible Spending Accounts (FSAs)

A Flexible Spending Account (FSA) allows you to set aside pre-tax dollars in a special account to use to pay for qualied expenses

in the coming year� There are two types of FSA accounts: Healthcare and Dependent Care� You can select one or both� You can save

as much as 30% on eligible expenses incurred by you or your dependent(s) by reducing your taxable income, thereby paying less

in taxes�

You select the deduction amount during Open Enrollment. These annual contributions must be elected each year and funds

do not carry over from year to year. IRS guidelines state that any funds in your FSA account that you do not use by March 15th

of the following year will be forfeited. Therefore, you should carefully estimate your expected eligible expenses before

making your annual contribution election. Claims for eligible expenses must be submitted by April 30.

Flexible Spending Account - Administered by BPAS

Healthcare Spending Account Dependent Care Spending Account

When are funds available? January 1 of the Plan Year You may use funds as they accrue via payroll deductions

What are the Qualied

Expenses?

Healthcare services that are not fully covered or are ineligible for payment under your

healthcare plans, such as plan deductibles, copayments, eye glasses, dental visits,

or amounts exceeding maximum out-of-pocket expenses. Certain services such as

cosmetic procedures are not qualied expenses.

Child care services for children under age 13 which make it possible for you (or

spouse, if applicable) to work. Under certain circumstances, it may also be used to

pay for the care of elderly parents or a disabled spouse or dependent.

How do I access my account

or submit a claim?

After enrollment, you will receive an FSA debit card to use to pay for qualied

healthcare expenses for you and your dependents. You must keep documentation

of expenses purchased with the debit card. You may be required to submit these

itemized receipt to BPAS. If you do not do so in a timely manner, your account could

be suspended. NOTE: a prescription is required to use the debt card for most over-

the-counter (OTC) medications; see the list of qualied OTC drugs on The Pulse.

If your healthcare provider does not accept debit cards, you may submit a claim form

along with your itemized receipt of the purchase to BPAS.

After paying for your qualied dependent care expenses, submit a claim form along

with receipts of the expense to BPAS, our FSA administrator. Expenses may be paid to:

Daycare Centers

Nanny Services

Day Camps

Preschool

After School Care

Elder Care, or

Family Members (if not listed as dependents)

FSA Annual Contribution Table Min Max

Healthcare FSA $260 $2,750

Dependent Care FSA (married, ling jointly) $260 $5,000

Dependent Care FSA (married, ling separately) $260 $2,500

By using www.bpas.com, you can learn what is an eligible expense, review your reimbursements and submit documentation�

Through the mobile app you can receive text alerts and make mobile claim submissions� To set up your account, go to www.bpas.

com If you need assistance logging in, please contact BPAS Customer Service Department at 866.401.5272; select Option 3�

2022 Benefit Guide

16

Cigna Voluntary Critical Illness

Cigna Critical Illness pays a lump-sum cash benet to help you

cover the out of pocket expenses associated with a critical

illness� The plan pays a single-payment benet directly to you

to use any way you like when you are diagnosed with one of

the covered illnesses�

Plan Features

» Lump Sum Benet Policy of $15,000 or $30,000�

» Tax free single payment, regardless of what is covered by

other sources directly to the policyholder�

» Annual Wellness Benet – Pays $50 once per calendar year

per covered person when a covered wellness checkup is

performed, including pap smear, mammogram,

colonoscopy, etc� Diagnosis of an illness is not required�

» Second Event – Policy will pay twice on each covered

illness (except Cancer) as long as there is a 12 month

separation between dates of diagnosis�

» Portable policy, so it stays with you if you retire or change

jobs�

» Covers a broad range of conditions most likely to cause

major lifestyle changes including:

» Invasive Cancer

» Heart Attack

» Stroke

» Kidney Failure

» Coronary Artery Bypass

» Major Organ Transplant

» Carcinoma in Situ

Cigna Voluntary Accident Insurance

O The Job Accident Policy

Provides supplemental coverage for those enrolled with

expenses they may incur as a result of an accident o the job�

Common activities which may lead to an injury include

football, baseball, basketball, soccer, tennis, biking,

cheerleading, motorcycle riding, automobiles, etc�*

With over 30 named benets, the accident policy covers many

of the common injuries and treatments sustained as a result of

a covered accident including:

» Urgent Care and Emergency Room

» Hospital Connements

» Fractures and Dislocations

» Crutches

» Lacerations

Benefits are paid based on how treatment is prescribed by a physician�

The policy also includes a wellness, health screening and

preventive care benet of $50 per insured per year� Some

examples include (but are not limited to) routine

gynecological exams, general health exams, mammography,

and certain blood tests

*Some activities have restrictions. Please refer to the brochure and policy for a complete listing of

benets, limitations, and exclusions. Where any discrepancy exists, policy language will overrule.

There is no pre-existing condition waiting period for the

Accident Policy� Coverage may include you, your spouse and

your dependent children� You may even be eligible to continue

coverage when coverage under the policy ends� Please note

an accident must occur after the eective date of coverage,

January 1, 2022, to be a claimable event�

Cigna Voluntary Hospital Indemnity Insurance

Provides supplemental coverage for you and your family as additional nancial protection for expense associated with

hospitalizations� Hospital indemnity helps cover out-of-pocket costs for inpatient hospital stays� The plan coverage includes

inpatient admission for illnesses, injuries and maternity stays� The plan has no pre-existing exclusions�

You choose how to spend or save your benet� Benet examples include: Hospital Admission, Hospital Chronic Condition

Admission, Hospital Daily Stays, Hospital Intensive Care Unit (ICU) Stays, Hospital Observation Stay�

Plan Features

» Cash benefit paid directly to you. No copays, deductibles, coinsurance, or network requirements�

» Use the money however you want. Pay for costs, such as medical copays and deductibles, travel to see a specialist, child

care, help around the house, alternative treatments and more� It’s up to you�

» Cost-effective coverage. By signing up through your employer, you get coverage at a low group rate�

» Take it with you. You may be able to take your coverage with you if you leave your employer – benets won’t change if you

port your coverage

17

Kelsey Seybold

Kelsey-Seybold 401(k) Plan

All employees of Kelsey-Seybold Clinic are eligible to

participate in the Kelsey-Seybold 401(k) Plan immediately

upon hire� The 401(k) Plan allows you to save for retirement in

a tax deferred manner�

Employee Contribution

New hires and employees are automatically enrolled at a 4%

pre-tax payroll deduction rate each pay period� Employees can

elect to defer additional, or less, contributions as Traditional

pre-tax contributions or Roth after-tax contributions� You can

change your Plan contribution at any time and the change will

be eective as soon as administratively possible�

Employer Contribution

Kelsey-Seybold contributes to your retirement by making the

following contributions to the Plan�

» Employer Match – Kelsey-Seybold contributes a 50%

matching contribution to the Plan, up to 6% of your

eligible compensation each pay period, for a maximum

matching amount of up to 3% of your eligible pay�

» Discretionary Contribution – Kelsey-Seybold may make an

annual employer discretionary contribution to your 401(k)

retirement account (after the end of the calendar year)�

You must have 12 months of service prior to the

beginning of the plan year and be employed on the last

day of the year to be eligible for this contribution� The plan

year begins on 1/1 and ends on 12/31� An employer

discretionary contribution is based on your eligible

compensation for any year it is declared�

» Employer Contributions are subject to a 3 year vesting

schedule� You must work 1000 hours in a year to receive

vesting credit for one year�

Investments

The plan oers a wide range of investment options in which to

invest your retirement funds� If you do not make an Investment

Election your funds are invested in a Qualied Default

Investment� You have the right to make changes to the

investment of your future contributions as well as redirect the

investment of your existing accounts at any time�

To set up your account or make changes:

Kelsey-Seybold.retirepru.com

Or 877.778.2100

Unum Voluntary Whole Life Insurance

As a complement to our group term life coverage, we oer

Unum voluntary individual Interest Sensitive Whole Life

Insurance� The premiums are aordable and are guaranteed

not to increase as you get older� You enroll in the amount of

coverage you can aord that best meets the needs of your

family and coverage can be increased annually to meet your

changing needs�

No physical exam is required to obtain coverage� Coverage is

eective on January 1st after you enroll in the plan� Policies are

portable so that they stay with you if you retire or change jobs

and you keep the same premium amount�

Plan Features

» Cash Value Accumulation – Your policy can build cash

value that earns interest, never less than the guaranteed

minimum of 4�5%, that you can utilize while you are still

alive�

» The overall maximum face amount for an employee is

$200,000� The overall maximum face amount for a spouse

is $50,000�

» Advance Benet Option Rider – Allows policy owner to

request an advance of the policy’s death benet up to

50% of the policy’s face amount – to a maximum of

$100,000 - if the insured is diagnosed with a medical

condition limiting life expectancy to 6 months or less�

» Accidental Death Benet Rider – For an additional premium,

this rider provides an additional death benet equal to the

face amount, up to a maximum of $150,000, if the insured

dies as a result of an accident before age 70�

» Premiums are based on the insured’s age at policy issue and

do not increase as you get older�

2022 Benefit Guide

18

2022 Premium Rate Sheet: Full-Time

Medical Insurance

(Select one: KelseyCare Network, KelseyCare POS)

Benet Plan Pay Period Cost

KelseyCare Network

Employee $86.25

Employee + Spouse $231.16

Employee + Child(ren) $155.26

Family $312.23

Kelsey Care Cigna POS

Employee $116.43

Employee + Spouse $312.06

Employee + Child(ren) $209.60

Family $421.51

Dental and Vision Insurance

(DHMO or Choice of DPPO Plan)

Benet Plan Pay Period Cost

Cigna DHMO

Employee $3.60

Employee + Spouse $7.26

Employee + Child(ren) $7.21

Family $11.74

Cigna DPPO $2,000

Employee $15.49

Employee + Spouse $33.06

Employee + Child(ren) $29.92

Family $49.49

VSP Choice

Employee $3.14

Employee + Spouse $5.49

Employee + Child(ren) $5.77

Family $10.73

Reimbursement Accounts (select one or both or none)

Pay Period Cost

Healthcare Annual Cost (maximum $2,750 divided by 26) $

Dependent Care Annual Cost (maximum $5,000 divided by 26) $

Life Insurance

Pay Period Cost

Basic Employee Life—

KSC pays two times your Annual Benet Salary at no cost to you

0

Supplemental Employee Life Calculation —

To calculate your pay period cost, take your elected amount / 10,000 x age rate table and divide nal number

by 26� (Use age rate table) Due to rounding, this may be o a few cents�

$

Your elected amount / 10,000 = x your age rate = annual rate divided by 26

Spouse Life Calculation —

Available in $10,000 increments up to $500,000—Take your Selected Spouse Life Insurance Amount / 10,000 x

age rate table (use age rate table) Due to rounding, this amount may be o a few cents�

$

Spouse Benet / 10,000 = x your age rate = ____________ divided by 26

Child(ren) Life Biweekly Cost Pay Period Cost

$10,000 $0.55 $

Age Rate Table for Supplemental Life/Spouse Life

Under 19 3.48 35-39 6.96 55-59 42.72

20-24 3.48 40-44 9.24 60-64 57.72

25-29 4.56 45-49 13.80 65-69 90.00

30-34 4.56 50-54 23.04 70+ 163.80

19

Kelsey Seybold

2022 Premium Rate Sheet: Full-Time

Accidental Death & Dismemberment

Pay Period Cost

EE Only—

To calculate your pay period cost - divide nal number by 26

*Due to rounding, this amount may be o a few cents

$

Your elected amount / 10,000 = ______ x 1�92 = annual rate

EE + Family—

To calculate your pay period cost - divide nal number by 26

$

Your elected amount / 10,000 = ______ x 1�92 = annual rate

Long-Term Disability Insurance

Select one of the following and Kelsey-Seybold will provide a core Short-Term Disability benefit�

Pay Period Cost

Base LTD (50% replacement income)

To calculate your pay period cost—divide nal number by 26

$

Your Annual Benet Salary / 100 = x 0�46 =

Supplemental (65% replacement income)

To calculate your pay period cost—divide nal number by 26

$

Your Annual Benet Salary / 100 = x 0.68 =

Short-Term Disability Buy-Up Insurance

Pay Period Cost

Your Annual Salary (Max $194,000) / 52 = x 66�67% = /10= x $0�17= Monthly Premium $

To calculate your pay period cost - multiply nal number by 12 and divide by 26� $

Voluntary Benet – Allstate Group Critical Illness

$15,000 Coverage $30,000 Coverage

Age

EE only

EE + Child(ren)

EE + Spouse

EE + Family

EE Only

EE + Child(ren)

EE + Spouse

EE + Family

Pay Period Cost

0-35 $5.00 $7.54 $8.94 $13.48 $

36-50 $12.06 $18.14 $23.06 $34.66 $

51-60 $25.70 $38.60 $50.24 $75.58 $

61-63 $40.36 $60.60 $79.70 $119.60 $

64+ $60.16 $90.30 $119.30 $179.00 $

Cigna Group Accident

EE only EE + Spouse EE + Child(ren) EE + Family Pay Period Cost

$5.78 $8.48 $11.66 $14.58 $

Cigna Group Hospital Indemnity

EE only EE + Spouse EE + Child(ren) EE + Family Pay Period Cost

$9.12 $15.98 $14.68 $21.54 $

2022 Benefit Guide

20

2022 Premium Rate Sheet: Part-Time/Benet Eligible

Use these rates if you are Part-Time regularly scheduled to work 20–29 hours per week or Benet Eligible�

Medical Insurance

(Select one: KelseyCare Network, KelseyCare POS)

Benet Plan Pay Period Cost

KelseyCare Network

Employee

$86.25

Employee + Spouse

Employee + Child(ren)

$362.30

Family

$810.80

Kelsey Care Cigna POS

Employee

$116.43

Employee + Spouse

$562.31

Employee + Child(ren)

$410.93.

Family

$893.92

Dental and Vision Insurance

(DHMO or Choice of DPPO Plan)

Benet Plan Pay Period Cost

Cigna DHMO

Employee $3.60

Employee + Spouse $7.26

Employee + Child(ren) $7.21

Family $11.74

Cigna DPPO $2,000

Employee $15.49

Employee + Spouse $33.06

Employee + Child(ren) $29.92

Family $49.49

VSP Choice

Employee $3.14

Employee + Spouse $5.49

Employee + Child(ren) $5.77

Family $10.73

Reimbursement Accounts (select one or both or none)

Pay Period Cost

Healthcare Annual Cost (maximum $2,750 divided by 26) $

Dependent Care Annual Cost (maximum $5,000 divided by 26) $

Life Insurance

Pay Period Cost

Basic Employee Life—

You can elect up to 2x your Annual Benet Salary� Employee pays 100% of Premium�

0

Supplemental Employee Life Calculation —

To calculate your pay period cost, take your elected amount / 10,000 x age rate table and divide nal number by

26� (Use age rate table) Due to rounding, this may be o a few cents�

$

Your elected amount / 10,000 = x your age rate = annual rate divided by 26

Spouse Life Calculation —

Available in $5,000 increments up to $500,000—Take your Selected Spouse Life Insurance Amount/ 1,000 x age

rate table (use age rate table) Due to rounding, this amount may be o a few cents�

$

Spouse Benet / 10,000 = x your age rate = ______ divided by 26

Child(ren) Life Biweekly Cost Pay Period Cost

$10,000 $0.55 $

Age Rate Table for Supplemental Life/Spouse Life

Under 19 3.48 35-39 6.96 55-59 42.72

20-24 3.48 40-44 9.24 60-64 57.72

25-29 4.56 45-49 13.80 65-69 90.00

30-34 4.56 50-54 23.04 70+ 163.80

$500.28

21

Kelsey Seybold

2022 Premium Rate Sheet: Part-Time/Benet Eligible

Accidental Death & Dismemberment

Pay Period Cost

EE Only—

To calculate your pay period cost - divide nal number by 26

*Due to rounding, this amount may be o a few cents

$

Your Annual Benet Salary / 1,000 = x .192 = x 1, 2, 3, 4 or 5 (level of coverage) = $

EE + Family—

To calculate your pay period cost - divide nal number by 26

$

Your Annual Benet Salary / 1,000 = x .384 = x 1, 2, 3, 4 or 5 (level of coverage) = $

Long-Term Disability Insurance

Select one of the following and Kelsey-Seybold will provide a core Short-Term Disability benet� Select one of the following and

Kelsey-Seybold will provide a core Short-Term Disability benet�

Pay Period Cost

Base LTD (50% replacement income)

To calculate your pay period cost—divide nal number by 26

$

Your Annual Benet Salary / 100 = x 0�46 =

Supplemental (65% replacement income)

To calculate your pay period cost—divide nal number by 26

$

Your Annual Benet Salary / 100 = x 0.68 =

Short-Term Disability Buy-Up Insurance

Pay Period Cost

Your Annual Salary (Max $194,000) / 52 = x 66�67% = /10= x $0�17= Monthly Premium $

To calculate your pay period cost - multiply nal number by 12 and divide by 26� $

Group Critical Illness

$15,000 Coverage $30,000 Coverage

Age

EE only

EE + Child(ren)

EE + Spouse

EE + Family

EE Only

EE + Child(ren)

EE + Spouse

EE + Family

Pay Period Cost

0-35 $5.00 $7.54 $8.94 $13.48 $

36-50 $12.06 $18.14 $23.06 $34.66 $

51-60 $25.70 $38.60 $50.24 $75.58 $

61-63 $40.36 $60.60 $79.70 $119.60 $

64+ $60.16 $90.30 $119.30 $179.00 $

Cigna Group Accident

EE only EE + Spouse EE + Child(ren) EE + Family Pay Period Cost

$5.78 $8.48 $11.66 $14.58 $

Cigna Group Hospital Indemnity

EE only EE + Spouse EE + Child(ren) EE + Family Pay Period Cost

$9.12 $15.98 $14.68 $21.54 $

2022 Benefit Guide

22

Contact Information

If you have specic questions about a benet plan, please contact the administrator listed below, or your local Human Resources

department�

Benet Administrator Phone Group #

Eligibility, Enrollment, COBRA and

Cost

Benets Department 713.442.5000 opt. 3

Medical Coverage

KelseyCare Network

KelseyCare Cigna POS Network

800.244.6224

PHY 2464734

EE 2466930

Pharmacy Coverage Express Scripts (ESI) 888.296.4876

Vision Coverage VSP 800.877.7195

Dental Coverage Cigna 800.244.6224

PHY 2464734

EE 2466930

Life Cigna

Basic FLX 965092

SuppFLX 965011

Accidental Death & Dismemberment Cigna OK 966540

Disability

Cigna & New York Life

800.238.2125

PHY: STD - FLK961073 | EE: STD - FLK 0961030

LTD - VDT962922 | LTD - VDT962686

Flexible Spending Account BPAS 866.401.5272 Your Social Security Number

Employee Assistance Account United Behavioral Health 800.788.5614

Retirement Prudential 877.778.2100

Voluntary Benets

Micha Castro Voluntary Bene ts Account

Critical Illness, Accident,

Hospital Indemnity Insurance

210.757.4273 or 800.840.6580 ext. 4

Unum Whole Life 713.706.4761 or 800.543.8686

KelseyCare Concierge KelseyCare 713.442.9540

KelseyCare Advantage KelseyCare 713.442.2273

23

Kelsey Seybold

Notes

22BG-KEL

Kelsey-Seybold Clinic

Human Resources

11511 Shadow Creek Parkway

Pearland, Texas 77584

713.442.5000

is benet summary prepared by