Dining and Beverage Industry

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

PREFACE

This publication is designed to help you understand California’s Sales and Use Tax Law as it applies to businesses

that sell meals, or alcoholic beverages, or both—such as restaurants, bars, hotels, and catering operations. You will

also find information on complimentary food and beverages provided to guests at lodging facilities.

If you cannot find the information you are looking for in this publication, please call our Customer Service Center

at 1-800-400-7115 (CRS:711). Customer service representatives are available to answer your questions Monday

through Friday between 7:30a.m. and 5:00 p.m. (Pacific time), except state holidays.

This publication complements publication 73, Your California Seller’s Permit, which includes general information

about obtaining a permit; using a resale certificate; collecting and reporting sales and use taxes; buying, selling,

or discontinuing a business; and keeping records. Please also refer to the website or the For More Information

section of this publication for the California Department of Tax and Fee Administration (CDTFA) regulations and

publications referenced in this publication.

We welcome your suggestions for improving this or any other publication. If you would like to comment, please

provide your comments or suggestions directly to:

Audit and Information Section, MIC:44

California Department of Tax and Fee Administration

PO Box 942879

Sacramento, CA 94279-0044

Please note: This publication summarizes the law and applicable regulations in effect when the publication was written, as noted on the cover.

However, changes in the law or in regulations may have occurred since that time. If there is a conflict between the text in this publication and the law,

the decision will be based on the law and not on this publication.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

CONTENTS

Section Page

Some of Your Sales May Not Be Taxable 1

Restaurants, Bars, Hotels, and Similar Establishments 2

Food sold for consumption at your place of business 2

Parklets 2

Food sold to go 3

Nontaxable sales 5

Banquet charges 5

Caterers 7

Places Where Admission Is Charged 11

Complimentary Food and Beverages— 12

Hotels and Similar Lodging Facilities

Other Tax Issues 15

Employee meals 15

Sales from hotel mini-bars 15

Facility fees charged by retailers other than restaurants 15

or hotels

Facility fee when retailer (facility) provides food and beverage 15

Facility fee when customer provides food and beverage or 16

contracts with a caterer

Tips, service charges, and cover charges 17

Two meals for the price of one 17

Sales tax reimbursement 17

Deal-of-the-Day Instruments (DDI) 18

Inventory controls 18

Recordkeeping 19

Online ordering service 20

California seller’s permit 20

Sales suppression software programs and devices 21

For More Information 22

Appendix: Testing for the 80/80 Rule 24

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

SOME OF YOUR SALES MAY NOT BE TAXABLE

Although food products sold by restaurants, bars, hotels, catering operations and similar establishments are

generally taxable, there are some food sales by those establishments that are not subject to tax.

For information on these establishments’ nontaxable food product sales, please see Regulation 1603, Taxable Sales

of Food Products, visit our website or call our Customer Service Center

. This regulation explains the availability of tax

exemptions for the following:

• Student meals

• Sales of meals by religious organizations

• Meal and food sales by such institutions as hospitals

• Meal programs for low-income elderly persons

• Meals delivered to homebound elderly or disabled persons

• Meals and food products served to condominium residents age 62 or older

• Sales to air carriers engaged in interstate or foreign commerce

In addition, Regulation 1597, Property Transferred or Sold by Certain Nonprofit Organizations, and publication 18,

Nonprofit Organizations, explain how tax applies to sales of food by nonprofit youth organizations and parent-

teacher organizations.

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

RESTAURANTS, BARS, HOTELS, AND SIMILAR ESTABLISHMENTS

This section includes information on the taxability of food and beverage sales in restaurants and similar

establishments. See Other Tax Issues, for information on:

• Employee meals

• Self-consumed and complimentary food and beverages

• Items that are not reuseable sold with meals

• Tips, service charges, and cover charges

• Two meals for the price of one

If you would like information on the taxability of other types of sales, such as greeting cards, coffee mugs,

promotional items, please refer to publication 73, Your California Seller’s Permit.

Introduction

The discussion of the taxability of food and beverage sales is divided into two categories:

• Food and beverages sold for consumption at your place of business, which are generally taxable (see below),

and

• Food and beverages sold to go, which may or may not be taxable (see Food sold to go).

See Nontaxable sales for information on sales to the U.S. government, sales for resale, and sales of cold food

products that are not suitable for consumption at your place of business.

Food sold for consumption at your place of business

Tax generally applies to sales of food and beverages if those items are served for consumption at your place of

business.

You are considered to have a place of business where customers may consume their purchases if, for example:

• You provide tables and chairs or counters for dining, or provide trays, glasses, dishes, or other tableware; or

• You are located in a shopping mall and are near dining facilities provided by the mall. In this example, you are

located in or near a food court or near an area where tables and chairs are provided for dining.

Food and beverages are considered served if they are intended to be eaten at your place of business or if they are

provided on, or in, an individual returnable container from which they can be eaten.

It does not matter whether a food product or beverage is sold à la carte or as part of a meal. If it is sold for

consumption at your place of business, it is generally subject to tax. A meal is a combination of food products, or

a combination of food products and edible nonfood products (such as carbonated or alcoholic drinks), sold for a

single price.

Parklets

A parklet is a small park created by converting one or more parking spaces into a park that may provide amenities

such as seating, planting, bicycle parking, and art. Parklets are generally open to all members of the public. Some

parklets are designed with built-in bench seating with large butcher blocks to use as tables or counters, and others

allow for tables and chairs provided by the restaurant.

Some cities allow parklets to be private, while others require parklets to be open to the public, not just customers.

Certain cities do not allow the retailer to serve food within the parklet and customers must purchase food inside the

restaurant and take the food to the parklet for consumption. In other cities, restaurant staff provide full service at

the parklets.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

When the parklet is maintained by the restaurant it is considered to be “facilities” of the business and, as such,

any sales of food and/or beverages for consumption within the confines of the parklet are taxable. It makes no

difference that the customer is required to pick up their food and/or beverages inside at the counter or whether

full service is provided; nor does it make any difference whether the restaurant offers additional tables and chairs

within the parklet, because the parklet itself is considered “facilities” when it is maintained by the restaurant.

How do I obtain more information?

For more information, please call our Customer Service Center at 1-800-400-7115 (CRS:711) Monday through Friday

from 8:00 a.m. to 5:00 p.m. (Pacific time), except state holidays.

Food sold to go

When food is sold on a to go or take-out basis, the taxability of the sale will depend in part on whether your sales

meet the requirements under the 80/80 rule.

80/80 rule

The 80/80 rule applies to your business if:

• More than 80 percent of your business’s gross receipts come from the sale of food products (please note:

alcoholic and carbonated beverages, while taxable, are not considered food products); and

• More than 80 percent of your retail food product sales are taxable because they constitute:

• Sales of food products that you furnish, prepare, or serve for consumption at your place of business (see Food

sold for consumption at your place of business); or

• Sales of meals or hot prepared food products (see Hot prepared food products other than beverages); or

• Sales of food products by a “drive-in.” “Drive-ins” generally offer food products ordinarily sold for immediate

consumption at or near a location at which parking facilities are provided primarily for the use of patrons in

consuming the products, even though they may be sold to go.

It is especially important to test for the 80/80 rule if you have just acquired a food service business or started a new

food service business. It is important to also test for the 80/80 rule if you have recently changed the product mix

in an ongoing business or if there has been a change in how you serve food. For example, you may have started

selling more hot prepared food products or extra seating is being provided to customers outside in good weather,

thereby increasing the percentage of food served for consumption at your place of business.

Evaluation for the 80/80 rule is done on a location-by-location basis. Thus, if you own multiple locations, one

location may fall under the 80/80 rule and another location may not. Each location must be considered separately.

Combination locations such as restaurant-bakeries may be treated differently. (See the Appendix, for more

information on how to test for the 80/80 rule.)

To-go sales that come under the 80/80 rule

Although both criteria of the 80/80 rule may be met, you may elect to separately account for the sale of to-go

orders of cold food products. You must report and pay tax on all food and beverages sold to go unless:

• The sale is nontaxable, see Nontaxable sales, or

• You make a special election not to report tax on to-go sales even though your sales may meet both criteria of

the 80-80 rule. Such sales include:

• Cold food products, and

• Hot bakery goods and hot beverages that are sold for a separate price.

Sales of those products must be separately accounted for and substantiated by supporting documents, such as

guest checks and cash register tapes. The cash register should have a separate key for cold food sold to go or some

other way of denoting such sales. Without adequate documentation, you are liable for tax on such sales. If your

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

sales meet both criteria under the 80/80 rule and you make this special election, you will report to-go sales in the

same manner as those who do not meet both criteria under the 80/80 rule (see below).

To-go sales if you do not come under the 80/80 rule

Items sold à la carte

The following information applies only to items sold à la carte. For information on sales of combination packages

(packages that include two or more items sold for a single price), see Combination packages below.

Beverages

Sales of the following beverages are not taxable when sold for a separate price to go:

• Hot beverages, such as coffee, hot tea, lattés, mochas, and hot chocolate. Please note: Hot soup, bouillon, and

consommé are not considered hot beverages. Their sale is taxable (see Hot prepared food products other than

beverages below).

• Noncarbonated beverages, such as fruit drinks, milk, and iced tea.

Sales of the following beverages are always taxable:

• Carbonated beverages such as soda or sparkling water

• Alcoholic beverages

Cold food products (other than cold beverages)

Cold food products include cold sandwiches, milkshakes, fruit smoothies, ice cream, cold salads, cold bakery items,

etc.

A cold food product sold individually and to go is not taxable. The sale of a cold food product sold as part of a

combination package may be taxable (see Combination packages).

Example: If you sell an egg salad sandwich to go, you are not liable for tax on the sale. However, if you sell an

egg salad sandwich as part of a combination package, you may be liable for tax (see Example below).

Hot prepared food products (other than beverages)

To-go sales of hot prepared food products are taxable see Exception for hot bakery items.

A food product is considered a hot food product if it is heated to a temperature above room temperature. Examples

of heating a food product above room temperature include; grilling a sandwich, dipping a sandwich in hot gravy,

or using infrared lights, steam tables, or microwave ovens. Examples of hot prepared food products include hot

sandwiches, pizza, barbecued chicken, soup, consommé, bouillon, steak, etc.

Food is considered “hot” even if it has cooled by the time of sale since it was intended to be sold as a hot food.

If your customer buys a cold food product to go and heats the food product in a microwave oven that is accessible

to the public, the sale is not taxable. It is considered a sale of a cold food product to go.

Exception: Sales of hot bakery goods are not taxable when sold to go, unless they are sold as part of a combination

package (see below).

Combination packages

Combination packages are two or more items sold together for a single price. The taxability of your sale depends in

part on the type of combination package being sold.

Packages that include hot items

If a combination package sold to go includes a hot prepared food, such as a hot sandwich or soup, or hot beverage,

such as coffee or hot chocolate, its sale is taxable.

Examples: You sell a combination of hot coffee and a doughnut for a single price of $1.50 or a combination

hot pastrami sandwich and iced tea for $4.50. Because each combination package includes a hot food or hot

beverage, the selling price is taxable.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

Packages that do not include hot items

If a combination package sold to go includes cold food and a carbonated beverage, the portion of the selling price

that represents the carbonated beverage is subject to tax.

If a combination package sold to go includes cold food and a cold beverage other than a carbonated or alcoholic

beverage, the sale of the package is not taxable.

Examples: You sell a value package of a cold sandwich, chips, and iced tea for a single price to go—the sale is

not taxable. You sell the same package with a carbonated soda—the portion of the selling price representing

the charge for the soda is taxable.

Exception—returnable containers. If you sell a combination of cold food products in an individual returnable

container from which the individual serving is intended to be eaten (for example, a glass plate), the sale is subject to

tax. In this instance, the sale is considered a sale of a served meal, which is generally taxable.

Nontaxable sales

Do not report tax on:

• Sales of cold food products sold in a form that is not suitable for consumption on the premises and not eaten on the

premises. A cold food product is not “suitable for consumption on the premises” if it requires further processing

by the customer, or is sold in a size not ordinarily consumed by one person. For example, the sale of a frozen

pizza is not taxable because it requires further processing by the customer. The sale of a quart of potato salad,

a quart of ice cream, or a whole pie would not be taxable because those amounts would not ordinarily be

consumed by one person when sold without eating utensils or dishes for consumption on the premises.

See

Regulation 1603, Taxable Sales of Food Products, for more examples of food not suitable for consumption on

the premises.

• Sales that are not subject to tax, such as sales to the U.S. government and sales for resale.

Banquet charges

Facility usage

Please note: The following information applies to restaurants, hotels, and similar establishments.

Charges by restaurants, hotels, and similar establishments for the use of premises where meals, food, or drinks are

served are taxable, whether or not the charge is separately stated on the invoice. For example, if you charge a $100

fee for the use of a banquet room for a holiday party, the fee is taxable.

Charges for serving customer-furnished food and beverages

Charges for cutting and serving customer-furnished food and beverages are taxable. For example, a “corkage fee”

for opening customer-furnished wine is taxable.

Dance oors, podiums, stage equipment

If you charge customers, who are staging an event where food and drink are being served, for the use of property

that is not used in connection with the furnishing or serving of meals, food, or drinks, you are considered a lessor of

the property. Examples are, charges for the use of special lighting for guest speakers, sound or video systems, dance

floors, stages, and decorative props related solely to optional entertainment, etc.

As the lessor of the property, you may or may not be required to report and pay tax on charges to your customers

for the use of that property. If you paid California sales or use tax on the purchase or rental of the property, tax does

not generally apply on charges made to your customer for the use of the property. If you did not pay California

sales or use tax on the purchase or rental of the property, the rental charges to your customer are generally taxable.

Please see Regulation 1660, Leases of Tangible Personal Property-In General, and publication 46, Leasing Tangible

Personal Property.

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

Items used to serve meals, food, and drinks

You are considered a consumer of tangible personal property normally used in the furnishing and serving of meals,

food, or drinks—such as tables, chairs, glasses, eating utensils, dishes, and linens, etc. As a consumer, you cannot

issue a resale certificate to purchase or rent such items. In this example, you are considered to be using those items

in connection with the sale of meals, rather than renting them to your customer.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

CATERERS

This section includes information on the taxability of food and beverage sales made by caterers. Under the Sales

and Use Tax Law, you are considered a caterer if you serve meals, food, or drinks on the premises of your customer,

or on premises supplied by the customer. You are not considered a caterer if you sell food to go or merely deliver

food. That is, you do not provide any dishes, flatware, etc, to serve food. See Restaurants, Bars, Hotels, and Similar

Establishments for information on the taxability of such sales.

Please note: This section does not apply to sales of food and beverages to guests at hotels, bed and breakfast

inns, and other lodging facilities if the food and beverage charges are included in the price of the room. See

Complimentary Food and Beverages—Hotels and Similar Lodging Facilities, for information on the taxability of such

sales.

Application of tax for catering

Food and drinks

Charges by caterers for food and drinks are taxable.

Tableware, table linens, and tables

Tableware includes items such as dishes, cutlery, and glassware used for serving and eating meals at a table. If you

charge a lump-sum amount for meals that includes charges for the use of tableware, table linens, tables, and other

items used in connection with preparing and serving meals, your total lump-sum charge is taxable.* In addition, you

may not issue a resale certificate to purchase or rent tableware, table linens, tables, etc, because you are considered to

be using these items in connection with the sale of the meals, rather than renting them to your customer.

However, upon instances when you do not furnish and serve meals, food, or drinks to your customer and instead

you rent or lease items such as dishes, linen, silverware, glasses, etc. from a third-party to provide to your customer,

you are not acting as a caterer, rather you are considered the lessor of such items. If you paid sales or use tax when

you purchased or rented those items, tax does not apply to the rental to your customer. If you did not pay tax to

your supplier when you purchased or rented the property, the itemized rental charges to your customer are taxable.

Please see Regulation 1660, Leases of Tangible Personal Property-In General, and publication 46, Leasing Tangible

Personal Property.

Please note—disposable items: Charges for disposable tableware—such as paper plates, napkins, plastic utensils,

glasses, cups, and place mats—are taxable. This is true whether or not your billings are itemized.

Disposable tableware is considered sold with meals, food, or drinks, and may be purchased with a resale certificate.

* “Other tangible personal property used to serve food and beverages” includes tents, canopies, subflooring, generators, air compressors, lighting,

electrical fixtures, etc, which provide—or are an integral part of—temporary shelter for the service of meals, food, or drinks.

Labor charges and preparation charges

Charges for the serving and preparation of food and drinks—whether performed by you, an employee, or a

subcontractor—are taxable. Tax applies even if you do not provide the food and drinks.

Charges for serving customer-furnished food and beverages

Charges for cutting and serving customer-furnished food items, such as wedding cakes, are taxable. Similarly,

charges for opening and serving customer-furnished beverages are taxable. For example, a “corkage fee” for

opening and serving customer-furnished wine is taxable.

Dance oors, stage equipment, etc.

If you paid sales or use tax on the purchase or rental of a dance floor, podium, sound/video system, or other such

equipment; that is, items unrelated to serving or furnishing meals, food, or drinks, tax does not generally apply to

the rental of such property to your customers. However, if you did not pay tax to your supplier when you purchased

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

or rented the property, the rental charges to your customer are taxable. Please see Regulation 1660, Leases of

Tangible Personal Property-In General, and publication 46, Leasing Tangible Personal Property.

Parking attendants, checkroom attendants, security guards, and entertainment

Charges for the above personnel are not subject to tax, provided those persons do not also participate in the

service of food and drinks.

Miscellaneous tangible personal property

Separately stated charges for miscellaneous items such as printed programs and menus, floral or balloon

decorations, ice sculptures, pads of paper, pens, flip charts, etc, are subject to tax. Charges for photographs are also

taxable without deduction for the photographer’s hourly charges. For more information, please see publication 68,

Photographers, Photo Finishers, and Film Processing Laboratories.

Coordinator fees

Charges for professional planning or coordinating of events are taxable if the fees are charged in connection with

the sale of tangible personal property. For example, if the main purpose of planning a wedding reception is the

preparation and furnishing of food and beverages, fees charged for coordinating the reception are taxable.

Other considerations

Sales for resale

Tax does not apply if you prepare or serve food, meals, or drinks to a buyer who will sell those items at retail and

report tax on their sale. In such instances, the buyer should provide you with a valid resale certificate. Please see

Regulation 1668, Sales for Resale, and publication 103, Sales for Resale.

Sales to the U.S. government

Sales to the U.S. government are exempt from tax. To support your exempt sale, you must keep a U.S. government

purchase order showing that the sale was made directly to the U.S. government. If the purchase is paid by credit

card, keep copies of the sales invoice and the credit card receipt to support your claimed exemption. The credit card

must belong to the U.S. government. A sale paid with a personal credit card does not qualify as an exempt sale to

the U.S. government—even if the person paying will be reimbursed by the government. For more information, see

publication 102, Sales to the United States Government.

Meals served at a school

Your sales are taxable if you are:

• Hired by a school, school district, or student organization to sell meals and other food products to students at a

school, and

• Paid directly by the students or their parents—rather than the school—for the meals and other food products.

However, your sales are not taxable if your contracts and records show that all of the following conditions are met:

• The facilities you use to serve lunches to the students are routinely used by the school for other purposes, such

as sporting events and other school activities during the remainder of the school day;

• The fixtures and equipment you use to prepare and serve the meals are owned and maintained by the school;

and

• The students purchasing the meals cannot distinguish between you or your employees from the other

employees at the school.

For additional information on student meals, please see Regulation 1603, Taxable Sales of Food Products, and

Regulation 1506, Miscellaneous Service Enterprises.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

Caterer’s Invoice Example A

Catering 4 U

4 Star Food & Service

125 Meals @ $24 each $3,000.00

1

Service charge on meals 20% 600.00

Centerpieces, balloons, party favors 1,200.00

Dance floor rental 500.00

2

Subtotal 5,300.00

Tax ($5,300 x 8.25%) 437.25

Total $5,737.25

In this example, all charges to the customer are subject to tax.

Please note: Even though this and other examples show tax calculated at a rate of 8.25 percent, you must use the

rate in effect where the catering service is performed. Please see California City and County Sales and Use Tax Rates

for current tax rates.

1

Meals

There is no separate charge on the invoice for items used in connection with preparing and serving the meals. Those charges are

included as part of the price for the meal. All charges for meals, including charges for the use of tableware, table linens, tables, and

other such items used in connection with preparing and serving meals, are taxable whether you separately itemize the charges

or charge a lump sum amount (see Tableware, table linens, and tables). Catering 4 U may not issue a resale certificate when they

purchase or rent such items that are used in connection with preparing or serving meals.

2

Dance floor rental

This example assumes that Catering 4 U issued a resale certificate to its supplier for rental of the floor. Consequently, tax applies

to the invoice charge for the floor rental. If Catering 4 U had paid tax on the floor rental, tax would generally not apply to the $500

rental charge on the invoice.

Please see Regulation 1660, Leases of Tangible Personal Property-In General, and publication 46, Leasing Tangible Personal Property.

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

Caterer’s Invoice Example B

Ye Olde Wedding Chapel

125 Meals @ $18 each $2,250.00

Service charge on meals 20% 450.00

China, crystal, silver, and linen rental 1,000.00

3

Centerpieces, balloons, party favors 1,200.00

Subtotal 4,900.00

Tax ($4,900 x 8.25%) 404.25

Security officer 150.00

4

Total $5,454.25

In this example, tax applies to all charges except those for the security officer.

3

China, crystal, silverware, and linen rental

In this example, the caterer has separately itemized the rental charge for the china, crystal, silverware, and linens used at the event.

Because the china, crystal, silverware and linens are used in connection with the preparation and serving of meals, the charges are

subject to tax, even when separately stated.

4

Security officer

Charges for security officers are not subject to tax, provided those persons do not also participate in the service of food and drinks.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

PLACES WHERE ADMISSION IS CHARGED

This section includes information on the taxability of food and beverage sales in places where admission is charged.

If you cannot find an answer to your questions in this section, please call our Customer Service Center. Please see

Other Tax Issues for information on employee meals; complimentary and self-consumed meals and drinks; and tips

and other charges.

Taxability of food and beverage sales

In general, tax applies to sales of food products that are sold within a place where admission is charged and

the food is for consumption at that place. Places where admission is charged include sports and music events,

amusement parks, county fairs, swap meets and trade shows.

There are some exceptions where tax may not apply to sales made within a place where admission is charged.

Those exceptions include, but are not limited to, the following:

• Sales made by qualified nonprofit youth organizations or nonprofit parent-teacher organizations. Such

organizations should refer to publication 18, Nonprofit Organizations, for more information.

• Cold food products sold in a form not suitable for consumption on the premises. A cold food product is not “suitable

for consumption on the premises” if it requires further processing by the customer, or is sold in a size not

ordinarily consumed by one person. For example, the sale of unbaked pizzas, cookie dough, canned jams, and

loaves of bread would not be taxable because those items require further processing by the customer or are

sold in a size not ordinarily consumed by one person. The sale of a quart of milk, a quart of ice cream, or a whole

pie would not be taxable because those amounts would not ordinarily be consumed by one person. Additional

examples can be found in Regulation 1603, Taxable Sales of Food Products.

Places where admission is charged—a closer look

There are instances where sales are made in places that do not qualify as places where admission is charged.

Examples include the following: national and state parks, campgrounds, and recreational vehicle parks; places

where admission is based on membership dues or the use of a student body card; and places where no entrance

charge is made for spectators, such as golf courses and bowling alleys. When the place does not qualify as a place

where admission is charged, some food sales will be taxable, while others will not. Because of the variety of rules

that apply, you should contact our Customer Service Center for advice on the taxability of your sales.

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

COMPLIMENTARY FOOD AND BEVERAGES—HOTELS AND SIMILAR

LODGING FACILITIES

Who should read this section?

This section is for those who operate a hotel, motel, bed and breakfast inn, or other lodging establishment and

provide complimentary food and beverages to guests as part of the guests’ room rental.

American Plan hotels. The information provided in this section does not apply to American Plan hotels that charge

guests a fixed daily rate for guest room accommodations, all meals, and service. The sales of meals by American

Plan hotels are subject to the provisions that apply to restaurants and similar establishments (see Restaurants, Bars,

Hotels, and Similar Establishments).

Sales by institutions. For information on meal and food sales by institutions such as hospitals, see publication 45,

Hospitals and Other Medical Facilities. For information on meals and food products served to condominium residents

age 62 or older, see Regulation 1603, Taxable Sales of Food Products.

Complimentary food and beverages

You are considered to be providing “complimentary food and beverages” if you:

• Provide food and beverages, including nonalcoholic and alcoholic beverages, to guests at no additional charge;

• Do not segregate food and beverage charges from room charges on your guests’ bills; and

• Do not give the guests an option to refuse food and beverages in return for a discounted room rental.

General application of tax

If you operate a lodging facility and make sales as described above, you are considered a consumer or retailer.

If you are a retailer, you are liable for tax on your sales of food and beverages to your guests.

If you are a consumer, you are not liable for tax on your sales of food and beverages to your guests, but tax does

apply to your purchases of:

• Nonfood products, such as alcoholic beverages and carbonated beverages, for example, soda or sparkling

water.

• Containers that are not reusable and other items provided with the food and beverages such as, to-go boxes or

paper cups and plastic utensils.

• Meals from outside vendors or restaurants. If you prepare the meals, tax does not apply to your purchases of

ingredients that are food products.

Are you a consumer or a retailer of complimentary food and beverages?

The following decision table will help you to determine whether you are considered a retailer or consumer of

complimentary food and beverages. In some cases, you will be referred to a mathematical formula to help you

make the determination.

Please note: You are considered a retailer and do not need to use the following decision table when:

• Your guests pay more than their complimentary allowance for food and beverages. For example, they buy an

additional bottle of wine.

• You are compensated by non-guests for “complimentary” food and beverages.

In the above instances, you are liable for tax on your sales of food and beverages as described in Restaurants, Bars,

Hotels, and Similar Establishments.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

Decision Table

1. Do you provide coupons or similar documents that are exchanged for the complimentary food and

beverages?

Yes (go to next step) No (see formula)

2. Are the complimentary meals provided in an area of the hotel where food and beverages are served on a

regular basis to the public (restaurant)?

Yes (go to next step) No (see formula)

3. Is the eating area (restaurant) operated by the hotel? (As opposed to being operated by an outside vendor)

Yes (go to next step) No (you are considered a consumer)

4. Is the guest specifically identified by name on the coupon or similar document?

Yes (go to next step) No (you are considered a retailer)

5. Are the coupons or documents transferable?

Yes (you are considered a retailer) No (you are considered a consumer)

Formula for determining consumer or retailer status

If the decision table above directed you here, perform the following percentage test to determine whether the

retail value of the complimentary food and beverages is incidental to the room rental.

average retail value of complimentary food and beverages (ARV)

= %

average daily rate (ADR)

If the resulting percentage is ten (10) percent or less, the retail value of the complimentary food and beverages

is “incidental” to the room rental, and you are considered a consumer. If the resulting percentage is greater than

10percent, you are considered a retailer.

Before you start . . .

If your hotel has been in operation for less than one year, a slightly different calculation is used, call CDTFA’s

Customer Service Center for assistance.

Concierge floors, club levels, and similar programs, are treated like independent hotels (separate from the hotels

and lodging facilities in which they operate). The average daily rate and average retail value discussed below should

be calculated based on the guest room accommodations to which the program privileges apply.

Step 1: Determine the average daily rate (ADR)

Divide the gross room revenue for the preceding calendar year by the number of rooms rented for that year.

Gross room revenue means the full charge to the hotel guest but does not include separately stated occupancy taxes

or revenue from contract and group rentals that do not qualify for complimentary food and beverages. “Gross room

revenue” also does not include revenue from special packages (for example, New Year’s Eve packages), unless it can

be documented that the retail value of the food and beverages provided as a part of the package is 10 percent or

less of the total package charge.

Step 2: Determine the average retail value (ARV) of the complimentary food and beverages

This means the total amount of the costs of the food and beverages for the preceding calendar year, marked up by

100 percent, and divided by the number of rooms rented for that year.

“Costs of complimentary food and beverages” includes charges for delivery to the lodging establishment but do not

include discounts taken or sales tax paid to vendors.

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

Number of rooms rented for that year means the total number of times all rooms have been rented on a nightly basis,

provided the revenue for those rooms is included in the “gross room revenue.” For example, if a room is rented out for three

consecutive nights by one guest, that room will be counted as rented three times when computing the ADR.

Step 3: Apply the formula

Divide the answer in Step 2 by the answer in Step 1. If the resulting percentage of the formula is ten (10) percent

or less, your food and beverage costs are considered incidental and you are considered a consumer, rather than

a retailer. If the result is more than 10 percent, you are considered a retailer and your sales are subject to tax

measured by the fair retail value of similar food products sold to the general public. If you do not sell similar items

to the general public, the amount subject to tax is the cost of the complimentary food and beverages plus at least a

100 percent markup.

Examples:

The following example illustrates the application of the formula:

First: Determine the average daily rate

$257,000 (gross room revenue)

2,252 (rooms rented for the year)

$257,000 ÷ 2,252 = $114.12 (ADR)

Second: Determine the average retail value of complimentary food

and beverages

$4,166.00 (cost of complimentary food/beverages)

+ 4,166.00 (100% markup)

$8,332.00

$8,332.00 ÷ 2,252 rooms = $3.70 (ARV)

Third: Divide the average retail value by the average daily rate

$3.70 ÷ $114.12 = 3.24 %

In this example, because the percentage is 10 percent or less, the hotel is considered a consumer.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY 15

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY 15

OTHER TAX ISSUES

Employee meals

If you furnish meals to employees and make a specific charge for those meals, the meal charges are taxable and

must be reported on your sales and use tax return.

A specific charge is considered to have been made if one or more of the following conditions exist:

• The employee pays cash for meals consumed

• The value of the meals is deducted from the employee’s paycheck

• The employee receives meals in lieu of cash to bring compensation up to legal minimum wage

• The employee has the option to receive cash for meals not consumed

There is no specific charge when a value is placed on the meals solely for payroll tax purposes for employees

receiving the minimum wage or more.

Sales from hotel mini-bars

Mini-bars, located in rooms and suites rented to hotel customers, generally contain carbonated beverages, alcoholic

beverages and various snack food items provided as a convenience to hotel guests. At checkout, guests are charged

for items consumed from the mini-bars. When the items sold are cold food products, the sale to hotel guests is not

taxable. However, sales of nonfood items, such as sodas, alcoholic beverages, etc, are taxable whether sold from

hotel mini-bars or other hotel locations.

Facility Fees

Facility fees charged by retailers other than restaurants or hotels

Retailers whose facilities are not regularly used for serving food and beverages may contract to provide facilities

and food and/or beverages for a customer’s event. For example, a winery, zoo, art gallery, museum, country club,

or an aquarium may contract to provide meals at their facilities for a customer’s event such as a wedding, birthday

celebration, or retirement party.

Whether the retailer’s facility charge for an event at which food/beverages are served is taxable depends upon,

in part, whether it’s the retailer (facility owner) or the customer (for example, through an outside caterer) who is

furnishing and serving the food and/or beverages at the event.

Facility fee when retailer (facility) provides food and beverage

In general, when a retailer with facilities (not regularly used for serving food/beverages) contracts to provide and

serve food/beverages for an event and provides facilities whose primary purpose at the event is to serve the food/

beverages, the charge for facilities is taxable, even if separately stated. The retailer is considered to be functioning

as a restaurant and the charge for the use of its facilities is part of the sale of food/beverages.

Example:

A winery has a courtyard area designed for wedding receptions and contracts to furnish and serve food and

beverages for a customer’s wedding reception (event) under a lump sum charge. The winery’s courtyard has tables

and chairs for the wedding reception and the winery provides all tableware, linens, glasses, etc., in addition to the

food and beverages. In this case, the winery is functioning as a restaurant and the winery’s facility charge for use of

the courtyard is taxable, even if the charge is separately stated.

However, when a retailer contracts to provide and serve food/beverages at its facilities, but also rents a separate

area of its facility to the customer for a use other than serving food/beverages, the charge for the use of the separate

area unrelated to the serving of food/beverages is not subject to tax if the charge is separately stated on the

invoice. A nontaxable facility charge could include a charge for a location for the bride and groom to prepare for the

wedding or a charge for a room for the bride and groom to spend their wedding night.

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

Example:

Same scenario as the previous example (that is, winery contracts to provide and serve food/beverage for a

customer’s wedding reception), except in this case the winery also rents the wedding party a separate area to hold

the wedding ceremony. This area is separate from the courtyard and no food or beverages will be served in the

area where the wedding ceremony occurs. The winery separately states the charge for the use of this area that is

unrelated to the serving of the food/beverages. Because the primary purpose of the area for the wedding ceremony

is not to serve food/beverages, the separately stated charge is not subject to tax. Under these circumstances, only

the charge for the facilities where food/beverages are served is taxable.

A retailer’s charge for the use of its facilities for an event where the primary purpose at the event is to serve food/

beverages is taxable even if the retailer only provides either the food or the beverages at the event.

Example:

A winery has a courtyard area designed for wedding receptions and contracts to serve its wine at the wedding

reception. However, the customer contracts directly with a caterer, unrelated to the winery, to provide and serve the

food at the reception. The winery’s facility charge for the use of its courtyard area is taxable because the winery is

providing and serving the wine at the event, even though the food is provided and served by an outside caterer. The

facility charges are taxable even if the charges are separately stated.

It makes no difference that the facilities are not primarily used for serving meals, food, or drinks in the normal

course of business; such as an exhibit in a museum or an aquarium. When a retailer contracts to furnish and serve

food or drinks for an event and provides facilities whose primary purpose at the event is to serve food or drinks, the

charge for those facilities is taxable, even if separately stated.

Example:

A museum operates a cafeteria on its premises and has separate wings and exhibits that can be used for private

parties. The museum contracts to furnish and serve food/beverage from its cafeteria for a retirement party in one

of its wings. In such cases, even though the wing of the museum is generally used for showing exhibits, since the

primary purpose of the event is to serve food and beverages, the facility charge for the wing is taxable.

Facility fee when customer provides food and beverage or contracts with a caterer

In some instances, a retailer, whose facilities are not regularly used for serving food/beverages, may rent or lease its

facilities for an event without furnishing and serving food or beverages. Instead, the customer provides the food/

beverages for the event; for example, the customer hires a caterer, unrelated to the retailer, to furnish and serve

meals at the event.

In general, when a retailer contracts with a customer for use of its facility only, the retailer’s facility charge is not

subject to tax. Under these circumstances, the retailer is not considered to be acting as a restaurant because it

is not responsible for furnishing and serving the food/beverages at the event. The retailer is merely leasing its

premises and the separately stated charge for the use of its facilities is not taxable.

Example:

A customer rents an area in a zoo for a retirement party. The customer contracts directly with a caterer to furnish

and serve meals and beverages for the event (retirement party) at the zoo. In addition to providing the food and

beverages, the caterer also provides tables, chairs, linens, and all dishes, glasses, tableware, etc., needed for serving

the meals at the event. The zoo’s charges to the customer for the rental of its facility for the retirement party are not

subject to tax as it is considered a lease of premises and the zoo is not furnishing and serving the food/beverages at

the event.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

Tips, service charges, and cover charges

Tips, gratuities, and service charges

Payments of tips, gratuities, and service charges are not taxable if they are paid by customers on an entirely optional

basis and are retained by employees. Generally, such a payment is optional if your customer adds the amount to the

bill, or leaves a separate amount in addition to the actual amount due from your sale of meals, food, and drinks that

include services.

Mandatory “tips” or required service charges, on the other hand, are taxable. In the case of banquets, any gratuities

that are agreed to in advance are considered required, not voluntary, and as a result are subject to tax. For example,

if your standard banquet agreement states “the suggested gratuity is 15 percent” and prior to the event, your

customer agrees to this or some other negotiated amount, the gratuity is taxable.

For more information, please see publication 115, Tips, Gratuities, and Service Charges.

Cover charges

Cover charges that customers may recoup in food and beverages are taxable, whether or not the customer actually

recoups those charges. On the other hand, separate charges solely for admission or for a ticket to a place furnishing

entertainment are not subject to tax.

Two meals for the price of one

If you accept two-for-one coupons or other discount coupons or cards that allow customers to purchase food or

beverages at a reduced price, your tax liability is based on the amount received for the sale.

Examples:

You serve two $12 meals for the price of one under a dine-out plan and charge your customer a total of $12

for both meals. Tax applies to the $12 total, before the optional tip.

You serve a $15 meal and an $11 meal, and your customer gives you a coupon which indicates the cheaper

of the two meals is free. You charge your customer $15 for the two meals. Tax applies to the $15, before the

optional tip.

Your customer uses a dine-out plan that entitles the holder to receive a 50 percent discount off the regular

meal price, with a maximum discount of $4. Your customer orders a $10 meal and you reduce the price by $4.

Tax applies to the $6 charged for the meal, before the optional tip.

Please note: If a dine-out plan provides for any reimbursement from the promoter, that amount is subject to tax and

must be included as part of total (gross) sales on your sales and use tax return. If, in the first example, you receive

$2 from the promotion agency for a redeemed coupon, sales tax applies to $14—the total of $12 received from

the customer plus $2 received from the promotion agency. For additional information on this type of promotional

program, see publication 113, Coupons, Discounts and Rebates.

Sales tax reimbursement

Although you are liable for paying the sales tax on your taxable retail sales, the law provides that you can be

reimbursed by your customers for the tax. You can be reimbursed under one of the following conditions:

• Printed material directed to the purchasers such as a menu or advertisement, which includes a notice to the

effect that sales tax will be added to the sales price of all items or certain items, whichever is applicable.

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

• Sales tax is shown on the sales check or other proof of sale.

• The agreement of sale expressly provides for such addition of sales tax.

• You post on the premises, in a location visible to purchasers, the amount of tax.

Sign posting requirements

Some bar operators include sales tax in the price of drinks sold and consumed at the bar, but add tax as a separately

stated amount when the waiter serves the drink at a table or elsewhere on the premises.

If you sell drinks at a tax-included price throughout the premises, including bar, cocktail lounge, and dining room

and want to claim a deduction for sales tax included, CDTFA will consider that sales tax is included in the total

selling price if you post a notice on your premises that reads substantially as follows:

All prices of taxable items include sales tax reimbursement computed to the nearest mill.

When selling drinks at a tax-included price at the bar and in the cocktail lounge only, or at the bar only, a sign

similar to that above, which indicates the areas to which the sign applies, should be prominently displayed in the

areas in which the drinks are served.

When adding tax separately to the price of drinks served by a waiter at a table or elsewhere, a statement should be

included on the menu, or placed on the tables, reading substantially as follows:

Sales tax will be added to the price of all food and beverage items served.

When the same type of drink is sold at both tax-included and tax-added prices as described above, a strict and

accurate segregation should be made of sales under each tax reimbursement method.

If you have collected too much tax from your customer

If you collect more than the required amount of tax for a sale, the excess amount must be returned to the purchaser

or paid to the state.

Deal-of-the-Day Instruments

Third party Internet-based companies such as Groupon or LivingSocial offer Deal-of-the-Day Instruments (DDI) for

sale on their website. DDIs with certain specific terms and conditions are considered retailer coupons and you, the

retailer, are considered the issuer of the DDI. The sale of a DDI to a customer is not subject to tax. However, when

the DDI is redeemed for taxable merchandise/service (for example, hot food or food sold for consumption at the

retailer’s place of business), your gross receipts subject to tax include the consideration paid by the customer for

the DDI plus any additional cash, credit, or other consideration paid to you by the customer at the time of the sale.

When the type of sale is normally not subject to tax, then tax would not apply to the sale of the merchandise and/

or service when a DDI is redeemed by the customer. For additional information please refer to publication 113,

Coupons, Discounts and Rebates.

Inventory controls

It is recommended that bar and restaurant owners pay special attention to inventory controls. In a highly

competitive environment, lax handling of inventories can mean the difference between success or failure for a

business. And, of course, good inventory controls minimize the possibility of additional tax assessments.

As a business operator, you must be able to account for merchandise that you have purchased for resale to your

customers. It is important that your records of purchases for resale are accurate and complete and do not include

supplies or other items not for resale.

To prevent losses that cannot be accounted for, you should also maintain inventory controls from the time goods

are purchased until they are sold or used.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

Inventory controls—bar operators

Some methods used for proper inventory control include the following:

• All deliveries are checked in, and the manager is present while delivery is being made.

• The bulk of liquor purchases are stored in a locked storeroom. Keys to the storeroom are in the possession of

the bar owner, manager, or other designated responsible person only.

• Liquor issued from the storeroom is recorded as it is issued.

• A complete inventory of all bar merchandise is taken at least monthly, and the calculated cost of liquor sold is

compared with the desired percentage of cost set as the goal.

• Purchases, as shown on invoices, are posted on an inventory card by brands, and checked off the card when

issued to the dispensing bars. This provides a perpetual inventory which can be easily verified by frequent

counts.

• A bar schedule is established for each bar. This consists of a definite number of bottles of each brand that

should be constantly stocked at each bar (such as 4 quarts of Cutty Sark, 12 quarts of Bar Vodka, 1 bottle of Gran

Marnier, etc).

• All empty bottles are retained at the bar. The bar manager, owner, or someone in charge replaces each empty

with a full bottle of the same brand out of the storeroom.

• Banquet or service bars that can be locked are handled in a similar manner. The banquet bar, if not locked, is

stocked with a scheduled number of bottles of each variety prior to each banquet, and removed thereafter.

Merchandise losses from theft, re, or natural disaster

If you have lost merchandise as the result of shoplifting, robbery, internal theft, fire, or natural disaster, it is

important that you be able to document those losses if you are audited. Proof may be in the form of a report from a

private agency employed to track down losses, a police report, insurance claim, or other documentary evidence.

Please note: Because sales tax is measured by sales, robberies of cash are not deductible for sales tax purposes. You

are required to pay sales tax on taxable sales in the usual manner despite a loss of the proceeds from those sales.

Recordkeeping

Don’t mix bar and restaurant receipts and purchases

If you operate a restaurant in conjunction with a bar, ensure that all purchases and sales for the restaurant

operations are segregated in your books and records from the bar operations.

The bar and the restaurant usually have different profit margins. Accurate segregation of sales and costs of goods

sold will help determine whether you are realizing the desired percentage of gross profits. It will also help detect

any leakage or pilferage.

Complimentary meals and drinks

Keep a written record of your policy regarding complimentary drinks to customers and drinks consumed by

employees. In addition, maintain a record of complimentary merchandise. There are several good reasons for this

record keeping:

• Ownership controls over business operations are greatly improved.

• You are considered the consumer rather than the seller of these complimentary meals and drinks, and as a

result are liable only for the tax on the cost of nonfood items that are given away (such as alcoholic beverages

and carbonated soft drinks).

• It supports the amounts reported on returns, thus avoiding the use of estimates.

The types of records you use may vary from memo sales slips prepared at the time of issuance of free meals or

drinks, to a record maintained on a daily basis. At the end of the reporting period, the total cost of the taxable items

given away or consumed is computed and included in the sales and use tax return for that period as self consumed

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

merchandise. Self-consumed merchandise is reported under “Purchases subject to use tax” on your sales and use

tax return. Be sure to keep all records that show your computations.

Price changes and “happy hours”

Be sure to keep evidence of price changes, changes in the size of glasses, sales during “Happy Hours,” or other

variations from your usual pricing practices.

If your business is audited, the auditor may prepare a “markup test” to determine whether recorded sales are

essentially accurate. Price changes and changes in glass sizes may significantly affect the outcome of this test.

We suggest you keep the following records:

• Changes in glass sizes. Keep dated purchase invoices which indicate the period in which a different glass size

was first put into service.

• Price changes. Retain old menus, or make a note in the records, showing the price change and date of the

change. Cash register tapes or invoices should be retained as supporting documents.

• Happy Hours. “Happy Hour” is a period when drinks are sold at lower prices than during normal business hours.

Retain menus, “Happy Hour” sale signs, and cash register tapes showing sales made during “Happy Hours.”

These should be incorporated in your business records.

• Size of the pour. Establish the amount of the liquor served in cocktails—both on the stem and on the rocks—as

part of your control procedure.

Online ordering service

If you contract with an online ordering service provider that takes orders from customers for meals you will provide,

you are liable for the tax on those meal sales when an agency relationship exists.

Some restaurants contract with online ordering service providers to take a customer’s order, receive payment, and in

some cases, deliver the meal. It is important that a written agreement between the restaurant and the online ordering

service provider is prepared, which adequately describe the responsibilities of each party involved. It should be made

clear whether the online ordering service provider is acting as an agent of the restaurant in the advertising, ordering,

and delivery of the meal, or whether the online ordering service provider is purchasing the meals for resale.

When an online ordering service provider acts as an agent for a restaurant, the restaurant is considered the retailer

of the meals sold through the online ordering service and is liable for the tax measured by the full selling price of

those sales, without any deduction of the commission retained by the service provider. However, if the agreement

between the restaurant and the online ordering service provider does not establish an agency relationship, such

service providers would be considered a retailer that is required to hold a seller’s permit and is liable for the tax

on the sales of meals through the online ordering service. When an agency relationship does not exist, restaurant

owners must obtain a resale certificate from the online service provider(s) that purchase the meals for resale.

For assistance on seller’s permit requirements, please see publication 73, Your California Seller’s Permit, or call our

Customer Service Center at 1-800-400-7115 (CRS:711).

California seller’s permit

When you sell or lease merchandise, or other tangible personal property in California, even temporarily, you are

generally required to register with CDTFA for a seller’s permit to report and pay sales tax on your taxable sales. If you

hold a seller’s permit, you can report and pay use tax on purchases made from out-of-state vendors or items purchased

for resale that you do not sell but instead use in your business operations (under, Purchases subject to use tax).

Most businesses in the dining and beverage industry are required to hold a seller’s permit.

For assistance on seller’s permit requirements please see publication 73, Your California Seller’s Permit, or call our

Customer Service Center.

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

Sales suppression software programs and devices

It is a crime for anyone to knowingly, sell, purchase, install, transfer or possess software programs or devices that are

used to hide or remove sales and to falsify records.

Using these devices gives an unfair competitive advantage over business owners who comply with the law and pay

their fair share of taxes and fees. Violators could face up to three years in county jail, fines of up to $10,000, and will

be required to pay all illegally withheld taxes, plus penalties including applicable interest and fees.

DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

INTERNET

www.cdtfa.ca.gov

You can visit our website for additional information—such as laws, regulations, forms, publications, industry guides,

and policy manuals—that will help you understand how the law applies to your business.

You can also verify seller’s permit numbers on our website (see Verify a Permit, License, or Account).

Multilingual versions of publications are available on our website at www.cdtfa.ca.gov/formspubs/pubs.htm.

Another good resource—especially for starting businesses—is the California Tax Service Center at www.taxes.ca.gov.

TAX INFORMATION BULLETIN

The quarterly Tax Information Bulletin (TIB) includes articles on the application of law to specific types of

transactions, announcements about new and revised publications, and other articles of interest. You can find

current TIBs on our website at www.cdtfa.ca.gov/taxes-and-fees/tax-bulletins.htm. Sign up for our CDTFA updates

email list and receive notification when the latest issue of the TIB has been posted to our website.

FREE CLASSES AND SEMINARS

We offer free online basic sales and use tax classes including a tutorial on how to file your tax returns. Some classes are

offered in multiple languages. If you would like further information on specific classes, please call your local office.

WRITTEN TAX ADVICE

For your protection, it is best to get tax advice in writing. You may be relieved of tax, penalty, or interest charges that

are due on a transaction if we determine that we gave you incorrect written advice regarding the transaction and

that you reasonably relied on that advice in failing to pay the proper amount of tax. For this relief to apply, a request

for advice must be in writing, identify the taxpayer to whom the advice applies, and fully describe the facts and

circumstances of the transaction.

For written advice on general tax and fee information, please visit our website at www.cdtfa.ca.gov/email to email

your request.

You may also send your request in a letter. For general sales and use tax information, including the California

Lumber Products Assessment, or Prepaid Mobile Telephony Services (MTS) Surcharge, send your request to:

Audit and Information Section, MIC:44, California Department of Tax and Fee Administration, P.O. Box 942879,

Sacramento, CA 94279-0044.

For written advice on all other special tax and fee programs, send your request to: Program Administration Branch,

MIC:31, California Department of Tax and Fee Administration, P.O. Box 942879, Sacramento, CA 94279-0031.

TAXPAYERS’ RIGHTS ADVOCATE

If you would like to know more about your rights as a taxpayer or if you have not been able to resolve a problem

through normal channels (for example, by speaking to a supervisor), please see publication 70, Understanding Your

Rights as a California Taxpayer, or contact the Taxpayers’ Rights Advocate Office

for help at 1-888-324-2798. Their fax

number is 1-916-323-3319.

If you prefer, you can write to: Taxpayers’ Rights Advocate, MIC:70, California Department of Tax and Fee Administration,

P.O. Box 942879, Sacramento, CA 94279-0070.

FOR MORE INFORMATION

For additional information or assistance, please take advantage of the resources listed below.

CUSTOMER SERVICE CENTER

1-800-400-7115 (CRS:711)

Customer service representatives are available

Monday through Friday from 7:30 a.m. to 5:00 p.m.

(Pacific time), except state holidays. In addition to

English, assistance is available in other languages.

OFFICES

Please visit our website at

www.cdtfa.ca.gov/office-locations.htm

for a complete listing of our office locations. If you

cannot access this page, please contact our

Customer Service Center at 1-800-400-7115 (CRS:711).

APRIL 2022

|

DINING AND BEVERAGE INDUSTRY

Regulations, forms, and publications

Lists vary by publication

Selected regulations, forms, and publications that may interest you are listed below. A complete listing of the

available sales and use tax regulations, forms, and publications appears on our website. Multilingual versions of our

publications and other multilingual outreach materials are also available on our website.

Regulations

1506 Miscellaneous Service Enterprises

1597 Property Transferred or Sold by Certain Nonprofit Organizations

1602 Food Products

1603 Taxable Sales of Food Products

1660 Leases of Tangible Personal Property—In General

1668 Sales for Resale

1669 Demonstration, Display, and Use of Property Held for Resale—General

1698 Records

1700 Reimbursement for Sales Tax

1821 Foreword—District Taxes

Publications

17 Appeals Procedures: Sales and Use Taxes and Special Taxes and Fees

18 Nonprofit Organizations

44 District Taxes

45 Hospitals and Other Medical Facilities

46 Leasing Tangible Personal Property

51 Resource Guide to Tax Products and Services for Small Businesses

61 Sales and Use Taxes: Exemptions and Exclusions

68 Photographers, Photo Finishers, and Film Processing Laboratories

70 Understanding Your Rights as a California Taxpayer

73 Your California Seller’s Permit

74 Closing Out Your Account

75 Interest, Penalties, and Collection Cost Recovery Fee

76 Audits

102 Sales to the United States Government

103 Sales for Resale

113 Coupons, Discounts and Rebates

115 Tips, Gratuities, and Service Charges

116 Sales and Use Tax Records

126 Mandatory Use Tax Registration for Service Enterprises

24 DINING AND BEVERAGE INDUSTRY

|

APRIL 2022

APPENDIX

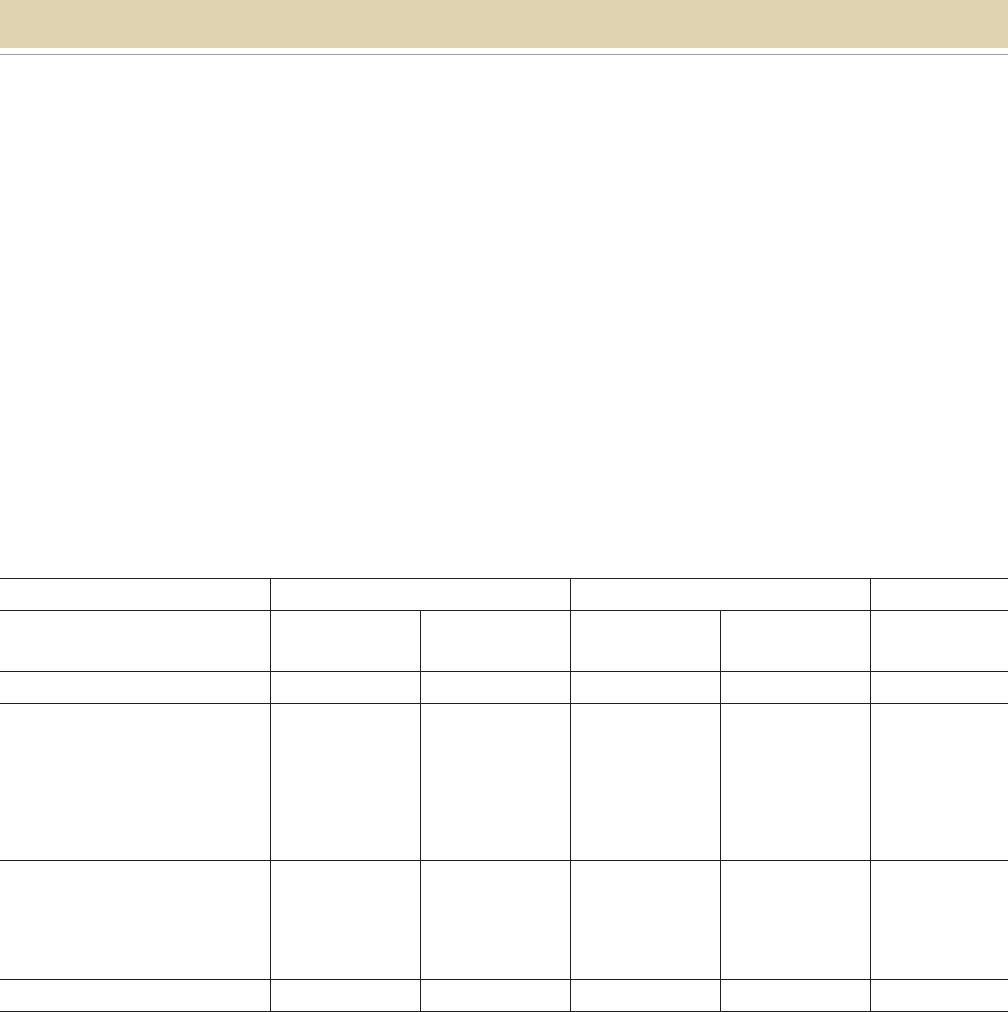

Testing for the 80/80 rule

As noted in Food sold to go, the taxability of your to-go sales will depend on whether you come under the 80/80

rule. You come under this rule if:

• More than 80 percent of your gross receipts come from the sale of food products, and

• More than 80 percent of your retail food product sales would normally be taxable. For example, food products

served as meals; sold for consumption at facilities you provide; sold as hot prepared foods; or sold at an

establishment defined as a drive-in.

It may be readily apparent that you qualify; most fast food restaurants qualify, for example. Or it may be necessary

to use the table below to evaluate your sales more closely.

Although you may meet both criteria of the 80/80 rule, you may elect to separately account for the sale of to-go

orders of cold food products or you may begin immediately to report tax as explained in, To-go sales if you come

under the 80/80 rule.

If you do not qualify at this time, you should monitor your sales and at the end of every 90 days reevaluate your

sales to determine whether your status has changed. You should retain the records of your 90-day tests. In the event

of an audit, you may need to provide proof that you do not qualify under the 80/80 rule.

Food Sales Total Total Sales

90-Day Test Taxable Nontaxable Food Sales Nonfood Sales

Hot Prepared Food Products $85,000

Cold Food Products

(for example, cold salad, milk)

Sold to go

Sold for consumption on the

seller’s premises

4,000

5,000

Nonfood Items

(for example, carbonated and

alcoholic beverages, cigarettes,

souvenirs)

$6,000

TOTAL $89,000 $5,000 $94,000 $6,000 $100,000

Please note: Do not include alcoholic and carbonated beverages as part of your food product sales. Although

subject to tax, they are not considered food products.

In the above example, the retailer comes under the 80/80 rule since over 80 percent of the retailer’s sales are

food sales ($94,000 ÷ $100,000 = 94%), and over 80 percent of food sales are taxable ($89,000 ÷ $94,000 = 95%).

Therefore, all food sold in a form suitable for consumption on the seller’s premises is subject to tax unless the seller

makes a special election for cold food sold to go, as explained under To-go sales if you come under the 80/80 Rule.

When evaluating sales under the 80/80 rule, each location must be considered separately. A combination location

such as a bakery restaurant or food court location may be considered one operation for purposes of the above

calculation even though the sales are segregated in the books and records.