FEDERAL RESERVE BANK OF SAN FRANCISCO

WORKING PAPER SERIES

Targeted Reserve Requirements for Macroeconomic Stabilization

Zheng Liu

Federal Reserve Bank of San Francisco

Mark M. Spiegel

Federal Reserve Bank of San Francisco

Jingyi Zhang

Shanghai University

November 2023

Working Paper 2023-13

https://www.frbsf.org/economic-research/publications/working-papers/2023/13/

Suggested citation:

Liu, Zheng, Mark M. Spiegel, Jingyi Zhang. 2023 “Targeted Reserve Requirements for

Macroeconomic Stabilization,” Federal Reserve Bank of San Francisco Working Paper

2023-13. https://doi.org/10.24148/wp2023-13

The views in this paper are solely the responsibility of the authors and should not be interpreted

as reflecting the views of the Federal Reserve Bank of San Francisco or the Board of Governors

of the Federal Reserve System. This paper was produced under the auspices of the Center for

Pacific Basin Studies within the Economic Research Department of the Federal Reserve Bank of

San Francisco.

TARGETED RESERVE REQUIREMENTS FOR MACROECONOMIC

STABILIZATION

ZHENG LIU, MARK M. SPIEGEL, AND JINGYI ZHANG

Abstract. We study the effectiveness of targeted reserve requirements (RR) as a policy

tool for macroeconomic stabilization. Targeted RR adjustments were implemented in China

during both the 2008-09 global financial crisis and the recent COVID-19 pandemic. We

develop a model in which firms with idiosyncratic productivity can borrow from two types

of banks—local and national—to finance working capital. National banks provide better liq-

uidity services, while local banks have superior monitoring technologies. Switching lenders

incurs a fixed cost, such that firms switch lenders only under sufficiently large shocks. Re-

ducing RR on local banks boosts leverage and aggregate output, whereas reducing RR on

national banks has an ambiguous output effect. Following a large recessionary shock, a tar-

geted RR policy reducing relative local bank RR can stabilize macroeconomic fluctuations.

However, the policy also boosts local bank leverage, raising default risks and liquidation

losses. Our model’s mechanism is supported by bank-level empirical evidence.

Date: November 10, 2023.

Key words and phrases. Targeted reserve requirements, macroeconomic stabilization, bank sizes, costly

state verification, business cycles.

JEL classification: E32, E52, E21.

by the National Natural Science Foundation of China Project Number 72203139 and 71633003. The views

expressed in this paper are those of the authors and do not necessarily reflect the views of the Federal Reserve

Bank of San Francisco or the Federal Reserve System.

1

TARGETED RESERVE REQUIREMENTS 2

I. Introduction

Recent macro-prudential policy initiatives attempt to mitigate financial instability through

differential capital requirements on large and small banks. For example, the Basel III frame-

work imposes higher capital requirements on large and systemically important banks than

small banks. In practice, some central banks have implemented macro-prudential initiatives

in the form of targeted reserve requirements (RR). For example, Brazil has reduced RR to

induce large banks to extend liquidity to small banks through asset purchases (e.g. Tovar,

Garcia-Escribano and Martin (2012)). Brazil’s RR system also partly exempts small banks

on a variety of deposits (Glocker and Towbin (2015)).

The People’s Bank of China (PBOC) has also implemented targeted RR adjustments. It

cut RR more aggressively for small and medium-sized banks than for large national banks

during the 2008 global financial crisis. The RR gap was subsequently narrowed as economic

conditions normalized, but the gap widened again during the financial turbulence of 2015

and in response to the COVID-19 pandemic (see Figure 1). However, unlike other countries

such as Brazil, the PBOC’s RR adjustments appear to have been motivated by the desire

to stabilize macroeconomic fluctuations rather than macro-prudential considerations. In

principal, the actual RR ratios in Chinese commercial banks can deviate from the official

targets. In practice, however, the actual RR ratios move closely in line with the PBOC’s

RR targets (Figure 2). Thus, RR policy can influence actual bank lending.

1

Indeed, using

Chinese bank-level panel data, we estimate that a 1% decrease in targeted RR raised loan

growth for targeted banks by approximately 2%. This effect is statistically significant at the

1% level (see Appendix E).

In this paper, we study the effectiveness of such targeted RR adjustments as a policy

tool for macroeconomic stabilization. We present a model that features two types of banks:

national and local. National banks face lower funding costs because they provide better liq-

uidity services, while local banks have superior monitoring technologies (e.g., due to superior

information about local borrowers), allowing both types of banks to coexist in equilibrium.

1

The RR cuts favoring small and medium-sized banks during the pandemic were described by a PBOC

official as designed to “... effectively expand these banks’ stable sources of funds to support the economy.”

The statement was issued on April 7, 2020 (see http://www.pbc.gov.cn/en/3688229/3688335/

3730270/4004637/index.html) and further stated that “lowering the RRR of small and medium-sized

banks will help to fortify their funding capacities, guide them to issue loans to MSMEs [micro, small and

medium-sized enterprises] at favorable interest rates, expand credit supply to agriculture-related industries,

foreign trade industry and those heavily hit by the COVID-19 pandemic, and enhance support for the

recovery and development of the real economy.” This channel is consistent with our model below, in which

smaller local banks have superior monitoring technologies and are more willing to lend to risky firms.

TARGETED RESERVE REQUIREMENTS 3

Figure 1. China’s required reserve ratios for banks of different sizes.

Firms face idiosyncratic productivity shocks and borrow from banks to finance working cap-

ital. Low productivity firms choose to default and costly state verification gives rise to credit

spreads, as in Bernanke, Gertler and Gilchrist (1999). A firm in a relationship with a bank

(local or national) can switch lenders, but this switch incurs a fixed cost. As a result, firms

would switch banks only when they face sufficiently large shocks—such as the 2008 financial

crisis or the COVID-19 pandemic.

In this environment, the government sets RR policy which can differ across the two types

of banks, and provides deposit insurance for all savers, financed by lump-sum taxes.

We calibrate the model to Chinese data and study the implications of targeted RR ad-

justments over business cycles. We first illustrate the transmission mechanism of targeted

RR adjustments using two extreme cases of bank switching costs. In one case, firms can

switch banks freely. In the other case, the switching cost is prohibitively high such that

firms never choose to switch banks, and credit markets are effectively segmented between

firms borrowing from local or national banks.

Under our calibration, reducing the RR ratio for local banks (denoted by τ

l

) unambiguously

raises aggregate output in both cases. Given a lower level of τ

l

, local banks face lower funding

costs, and reduce their loan interest rate. Since local banks are more efficient in monitoring

and charge a lower credit spread, the shift from national to local banks expands firm leverage

TARGETED RESERVE REQUIREMENTS 4

Figure 2. China’s actual versus required reserve ratios for banks of different

sizes.

and increases output. The expansionary effect is larger when firms can switch banks freely

than when switching costs are prohibitive.

RR adjustments for national banks (τ

n

) under free and prohibitive switching costs yield

different outcomes. In the case where firms can switch banks freely, cutting τ

n

has two oppos-

ing effects: At the intensive margin, the reduction in τ

n

lowers national bank lending rates,

raising leverage by firms that borrow from national banks. However, at the extensive margin,

the decline in τ

n

induces some firms to switch from local banks to national banks. Since local

banks are more efficient in monitoring, the switch towards national banks raises the average

credit spread and reduces aggregate leverage. Under our calibration, the extensive-margin

effect dominates when firms can switch banks freely, such that cutting τ

n

reduces aggregate

output. However, in the case where firms cannot switch banks, the impact of cutting τ

n

is

restricted to intensive margin effects, leading to higher firm leverage and boosting aggregate

output.

We then study the implications of targeted RR adjustments for macroeconomic stabiliza-

tion over the business cycle in the general case with a calibrated fixed cost of bank switching.

We postulate a targeted RR policy rule, under which the central bank can adjust two types

of required reserve ratios, one for local banks and the other for national banks, to respond

to changes in output gap measured by deviations of real GDP from its trend. We find that

TARGETED RESERVE REQUIREMENTS 5

an asymmetric RR rule that adjusts RR more aggressively for local banks than for national

banks is much more effective for stabilizing business cycle fluctuations when the economy is

buffeted by sufficiently large shocks.

This policy implication arises from the difference in business cycle sensitivities between

national and local banks. Local banks, due to monitoring advantages, have higher steady

state leverage and face higher default probabilities. As a result, local bank lending is more

sensitive to adverse shocks than national bank lending. If the adverse shock is sufficiently

large, then firms that originally borrowed from local banks would pay the fixed cost of

switching, and borrow from national banks instead. This switching would then disrupt

existing bank relationships and amplify the recession. In this case, a larger cut of RR for

local banks helps mitigate the costly bank-switching and improves macroeconomic stability.

However, there is a tradeoff between macroeconomic stability and financial stability. Given

a large negative shock, an asymmetric RR policy that cuts RR for local banks more aggres-

sively increases the risk-free reserve holdings for those banks, boosting their leverage and

raising the insolvency ratio relative to both the benchmark policy with no changes in RR

and the symmetric RR policy. Therefore, while the asymmetric RR policy improves macroe-

conomic stability, it results in a higher cost from liquidating insolvent local banks.

Our model’s mechanism and predictions are supported by empirical evidence. We use

Chinese bank-level annual data for the period 2008 to 2021 to examine how lending of banks

of different sizes responds differently to local shocks and how this difference in sensitivity

varies with the size of the shocks. We find that, all else being equal, a decline in local

(provincial level) GDP growth reduces the lending of small banks more than that of medium-

sized banks. Moreover, this difference is larger in periods with large shocks. This evidence

lends empirical support to our model’s mechanism.

II. Related literature

Our work is related to the literature on the positive and normative implications of capital

or reserve requirement policies. The literature highlights a tradeoff between prudential and

macroeconomic goals. den Heuvel (2008) demonstrates that restricting bank lending through

capital requirements raises borrowing costs, which reduces welfare. Nicol`o, Gamba and

Lucchetta (2014) demonstrate that this tradeoff results in an interior solution for optimal

bank capital requirements in a dynamic model aimed at discouraging excessive bank risk

taking under deposit insurance. Several studies extend this analysis to consider this tradeoff

TARGETED RESERVE REQUIREMENTS 6

under both capital and reserve requirements (e.g. Gorton, Lewellen and Metrick (2012) and

Christiano and Ikeda (2016)).

2

A recent paper by Corbae and D’Erasmo (2019) considers heterogeneity across banks

by size in the form of a single representative ”big bank” and a large number of atomistic

small banks that take interest rates as given. While their paper focuses primarily on capital

requirement policies, it obtains heterogeneous responses by large and small banks to changes

in capital requirements and possible welfare enhancement through targeted heterogeneous

changes in capital controls.

3

They also consider differential capital requirements between

large and small banks.

Changes in reserve requirements have similarly been found to influence lending activity

[e.g. Loungani and Rush (1995)], but also have implications for macroeconomic stability.

They can then be used as a tool to complement monetary policy in macroeconomic stabi-

lization. Alper, Binici, Demiralp, Kara and

¨

Ozl¨u (2018) demonstrate that RR increases, by

reducing the liquidity of the banking system, can serve as a vehicle for reducing domestic

credit and economic activity. Similarly, Brei and Moreno (2019) demonstrate in Latin Amer-

ican bank-level data increases in reserve requirements can reduce lending activity without

increasing deposit rates, and thereby serve as a useful vehicle for stemming disruptive capital

inflows. The literature documents the extensive use of reserve requirement policy as a tool

for macroeconomic stabilization in emerging market economies [e.g. Montoro and Moreno

(2011), Federico, Vegh and Vuletin (2014), and Mora (2014)], with China making particularly

frequent reserve requirement adjustments (Chang, Liu, Spiegel and Zhang (2019)). Ag´enor,

Alper and da Silva (2018) demonstrate in a DSGE framework for a small open economy

that a counter-cyclical reserve requirement rule can mitigate financial and macroeconomic

instability.

Finally, our paper is specifically related to the literature on the potential allocative ef-

fects of adjustments to the supply of or demand for reserves. On the supply side, Kashyap

and Stein (2000) demonstrate that, for example, removal of reserves by the monetary au-

thority can drag on bank lending behavior. Moreover, they demonstrate that these changes

disproportionately impact on lending by less liquid smaller banks in the financial system.

On the demand side, usually driven by changes in reserve requirements, G´ornicka (2016)

demonstrate that increases in RR can influence the share of bank intermediation relative to

“shadow banks”.

2

The robustness of this result has been called into question, as some models suggest that when deposit

rates can adjust, raising capital requirements can actually increase bank lending (e.g. Begenau (2020)).

3

Corbae and D’Erasmo (2019) do consider the implications of liquidity requirements, which can be inter-

preted as similar to minimum reserve requirements.

TARGETED RESERVE REQUIREMENTS 7

III. The model

The economy is populated by a continuum of infinitely lived households. The represen-

tative household consumes homogeneous goods produced by firms using capital and labor.

Firms face working capital constraints. Each firm finances wages and rental payments using

both internal net worth and external debt. Following Bernanke et al. (1999), we assume

that external financing is subject to a costly state verification problem. In particular, while

each firm can observe its own idiosyncratic productivity shocks, a lender needs to pay a

monitoring cost in the event of firm default.

There are two types of banks, national and local, with a continuum of each type indexed

by i ∈ [0, 1]. Both types of banks intermediate between households (savers) and firms

(borrowers) and face perfect competition in the lending and deposit markets. The two types

of banks differ in four dimensions: (1) national banks provide better liquidity services and

face lower funding costs; (2) local banks have better monitoring technologies; (3) deposits

in both types of banks are protected by deposit insurance, but treatment under bankruptcy

differs by bank type. Given bankruptcy, local banks are liquidated while national banks are

recapitalized; and (4) bank types face distinct required reserve ratios.

III.1. Households. There is a continuum of infinitely-lived and identical households with

a unit mass. The representative household has the expected utility function

U = E

∞

X

t=0

β

t

ln(C

t

) − Ψ

h

H

1+η

t

1 + η

+ Ψ

n

ln(D

n,t

)

, (1)

where E is an expectations operator, C

t

denotes consumption, H

t

denotes labor hours, and

D

n,t

denotes deposits in national banks. The parameter β ∈ (0, 1) is a subjective discount

factor, η > 0 is the inverse Frisch elasticity of labor supply, Ψ

h

> 0 reflects the disutility

of working, and Ψ

n

> 0 captures the preferences for liquidity services provided by national

banks through their deposit products.

The household faces the sequence of budget constraints

C

t

+ I

t

+ D

nt

+ D

lt

= w

t

H

t

+ r

k

t

K

t−1

+ R

d

n,t−1

D

n,t−1

+ R

d

l,t−1

D

l,t−1

+ T

t

, (2)

where I

t

denotes the capital investment, D

l,t

the deposits in local banks, w

t

the real wage rate,

r

k

t

the real rental rate on capital and K

t−1

the level of the capital stock at the beginning of

period t. R

d

n,t−1

and R

d

l,t−1

, respectively, denote the gross interest rate on deposits in national

banks and local banks from period t − 1 to period t. T

t

denotes the lump-sum transfers from

the government and earnings received from firms based on the household’s ownership share.

TARGETED RESERVE REQUIREMENTS 8

The capital stock evolves according to the law of motion

K

t

= (1 − δ)K

t−1

+

"

1 −

Ω

k

2

I

t

I

t−1

− g

I

2

#

I

t

, (3)

where we have assumed that changes in investment incur an adjustment cost, the size of

which is measured by the parameter Ω

k

. The constant g

I

denotes the steady-state growth

rate of investment.

The household chooses C

t

, H

t

, D

nt

, D

lt

, I

t

, and K

t

to maximize (1), subject to the con-

straints (2) and (3). The optimization conditions are summarized by the following equations:

w

t

=

ΨH

η

t

Λ

t

, (4)

1 = E

t

βR

d

nt

Λ

t+1

Λ

t

+ Ψ

n

1

Λ

t

D

n,t

, (5)

1 = E

t

βR

d

lt

Λ

t+1

Λ

t

, (6)

1 = q

k

t

"

1 −

Ω

k

2

I

t

I

t−1

− g

I

2

− Ω

k

I

t

I

t−1

− g

I

I

t

I

t−1

#

+βE

t

q

k

t+1

Λ

t+1

Λ

t

Ω

k

I

t+1

I

t

− g

I

I

t+1

I

t

2

, (7)

q

k

t

= βE

t

Λ

t+1

Λ

t

[q

k

t+1

(1 − δ) + r

k

t+1

]. (8)

where Λ

t

denotes the Lagrangian multiplier for the budget constraint (2), Λ

k

t

is the La-

grangian multiplier for the capital accumulation equation (3), and q

k

t

≡

Λ

k

t

Λ

t

is Tobin’s q.

In specifying the household’s optimizing problem, we assume that national-bank deposits

provide liquidity services (i.e., D

nt

enters the household’s utility function), but local bank

deposits do not. Under this assumption, the equilibrium interest rate on national bank

deposits (R

nt

) is lower than that on local bank deposits (R

lt

). This model feature is consistent

with the empirical evidence that large banks face lower demand elasticities with respect to

deposit rates as documented by d’Avernas, Eisfeldt, Huang, Stanton and Wallace (2023),

who argue that customers of large banks value superior liquidity services more highly and

display lower deposit-rate elasticities as a result.

III.2. Firms. There is a continuum of competitive firms that produce the homogeneous

consumption good using capital and labor as inputs. Firms face idiosyncratic productivity

and working capital constraints. In particular, firms pay wage bills and capital rents prior

to observing their productivity. Firms finance working capital using both their internal

net worth and external debt borrowed from banks. After the realizations of idiosyncratic

productivity shocks, firms choose whether or not to default on bank loans. There are two

TARGETED RESERVE REQUIREMENTS 9

types of banks: national (type n) and local (type l). In each period, a firm chooses to borrow

from one bank, while a bank can lend to multiple firms.

III.2.1. Production. Consider a representative firm that borrows from a type-b bank b ∈

{n, l}. The firm produces a homogeneous consumption good Y

b,t

using capital K

b,t

, household

labor H

b,ht

, and entrepreneurial labor H

b,et

, with the production function

Y

b,t

= A

t

ω

b,t

(K

b,t

)

1−α

(H

b,et

)

1−θ

H

θ

b,ht

α

, (9)

where A

t

denotes aggregate productivity, and the parameters α ∈ (0, 1) and θ ∈ (0, 1) are

input elasticities in the production technology. The term ω

b,t

is an idiosyncratic productivity

shock that is i.i.d. across firms and time, and is drawn from the distribution F (·) with a

non-negative support.

Aggregate productivity A

t

contains a deterministic trend g

t

and a stationary component

A

m

t

so that A

t

= g

t

A

m

t

. The stationary component A

m

t

follows the stochastic process

ln A

m

t

= ρ

a

ln A

m

t−1

+ ϵ

at

, (10)

where ρ

a

∈ (−1, 1) is a persistence parameter, and the term ϵ

at

is an i.i.d. innovation drawn

from a log-normal distribution N(0, σ

a

).

The firm finances the costs of labor and capital inputs using its own beginning-of-period

net worth N

b,t

and bank loans B

b,t

, subject to the working capital constraint

N

b,t

+ B

b,t

= w

t

H

b,ht

+ w

e

t

H

b,et

+ r

k

t

K

b,t

. (11)

where w

e

t

denotes the real wage rate of entrepreneurial labor. Here, we assume that en-

trepreneurial labor and household labor are both perfectly mobile across firms and that the

working capital to be financed includes wage bills for both types of labor, in addition to

capital rental payments.

Cost-minimizing implies the conditional factor demand functions

w

t

H

b,ht

= αθ(N

b,t

+ B

b,t

), (12)

w

e

t

H

b,et

= α(1 − θ)(N

b,t

+ B

b,t

), (13)

r

k

t

K

b,t

= (1 − α)(N

b,t

+ B

b,t

). (14)

Substituting these optimal choices of input factors in the production function (9), we

obtain Y

b,t

= ω

b,t

˜

A

t

(N

b,t

+ B

b,t

), where

˜

A

t

denotes the average rate of return on the working

capital financed by both internal funds and external debt. Specifically, we have

˜

A

t

= A

t

1 − α

r

k

t

1−α

"

α(1 − θ)

w

e

t

1−θ

αθ

w

t

θ

#

α

. (15)

TARGETED RESERVE REQUIREMENTS 10

III.2.2. Optimal loan contracts. Following Bernanke et al. (1999), we assume that lenders

can only observe a borrower’s realized investment return at a cost. In the event that a firm

defaults on its debt, the lender can obtain the firm’s output, net of a monitoring cost that

equals a fraction m

b

of the output (with b ∈ {n, l}). We assume that local banks have

a better monitoring technology such that the monitoring costs faced by local banks under

liquidation is lower than that faced by national banks (i.e., m

n

> m

l

> 0). This assumption,

combined with the assumption that national banks provide better liquidity services, ensures

that both types of banks coexist in an equilibrium.

To cover the expected cost of firm default, a bank of type b charges a gross interest rate

Z

b,t

on its loans. Under this financial arrangement, there is a cutoff level of productivity ¯ω

b,t

,

such that firms with productivity below the cutoff (i.e., ω

b,t

< ¯ω

b,t

) will choose to default.

The cutoff level of productivity ¯ω

b,t

is determined by the break-even condition

¯ω

b,t

≡

Z

b,t

B

b,t

˜

A

t

(N

b,t

+ B

b,t

)

, (16)

such that firms with productivity at the cutoff level earns zero net profit. The probability

of default is therefore given by F (ω

b,t

), the cumulative density of idiosyncratic productivity

evaluated at ¯ω

b,t

.

If the firm’s productivity is above the cutoff level ¯ω

b,t

(with the probability 1−F (ω

b,t

)), then

the firm repays the bank loan at the contractual interest rate Z

b,t

and keeps the remaining

profit. The expected income for a firm that borrows from a type-b bank is therefore

Z

∞

ω

b,t

˜

A

t

ω

b,t

(N

b,t

+ B

b,t

)dF (ω) − (1 − F (ω

b,t

))Z

b,t

B

b,t

=

˜

A

t

(N

b,t

+ B

b,t

)[

Z

∞

ω

b,t

ωdF (ω) − (1 − F (ω

b,t

))ω

b,t

]

≡

˜

A

t

(N

b,t

+ B

b,t

)h(ω

b,t

), (17)

where h(ω

b,t

) is the firm’s share of investment income under the loan contract.

Under the optimal loan contract characterized by B

b,t

and ¯ω

b,t

, the expected income for

the lender is given by

(1 − F (ω

b,t

))Z

b,t

B

b,t

+

Z

ω

b,t

0

{(1 − m

b

)

˜

A

t

ω(N

b,t

+ B

b,t

)}dF (ω)

=

˜

A

t

(N

b,t

+ B

b,t

){[(1 − F (ω

b,t

))ω

b,t

+ (1 − m

b

)

Z

ω

b,t

0

ωdF (ω)}

≡

˜

A

t

(N

b,t

+ B

b,t

)g

b

(ω

b,t

), (18)

TARGETED RESERVE REQUIREMENTS 11

where g

b

(ω

b,t

) is the bank’s share of investment income. This optimal loan contract takes

into account the resource of monitoring, such that

h(

ω

b,t

) + g

b

(ω

b,t

) = 1 − m

b

Z

ω

b,t

0

ωdF (ω). (19)

The optimal contract is then a pair (¯ω

b,t

, B

b,t

) chosen at the beginning of period t to

maximize the borrower’s expected period t income,

˜

A

t

(N

b,t

+ B

b,t

)h(ω

b,t

) (20)

subject to the lender’s participation constraint

˜

A

t

(N

b,t

+ B

b,t

)g

b

(ω

b,t

) ≥ R

b,t

B

b,t

. (21)

where R

b,t

denotes the average loan return required by a type-b bank.

The optimizing conditions for the contract characterize the relation between the leverage

ratio and the productivity cut-off

N

b,t

B

b,t

+ N

b,t

= −

g

′

b

(ω

b,t

)

h

′

(ω

b,t

)

˜

A

t

h(ω

b,t

)

R

b,t

. (22)

III.2.3. Bank choice. In each period, a borrower has the option of switching banks subject

to a switching cost.

4

Denote by B

t

(i) the bank type chosen by firm i in period t. Switching

to a different lender incurs a cost that equals a fraction γ > 0 of the firm’s net worth,

reflecting the fixed cost of setting up a new lender-borrower relation. Given this cost, a firm

would choose to switch lenders only if it was switching bank type., i.e. if a firm i switches

lenders in period t, then its bank type would be different from the previous period (i.e.,

B

t

(i) ̸= B

t−1

(i)).

We now characterize firms’ bank choice problem. At the end of each period, a firm survives

with probability ξ

e

. If the firm does not survive, then its terminal net worth would be

distributed to the households who own the firm. The firm chooses a bank type to maximize

the present value of the firm’s net worth

V

t

(ν

t−1

(i), B

t−1

(i)) ≡ max

B

t

(i)

E

t

X

j=0

(1 − ξ

e

)ξ

j

e

β

j

Λ

t+j

ν

t+j

(i), (23)

where ν

t

(i) denotes the firm’s net worth at the end of the period t.

4

Asymmetric information between borrowers and banks may leave it costly to switch banks (e.g. Boot,

2000). Such costs appear to be prevalent among Chinese banks. For example, Yin and Matthews (2018)

studies a sample of Chinese firms and banks over the period 1999-2012 and finds that small, opaque firms

are less likely to switch than large, transparent firms.

TARGETED RESERVE REQUIREMENTS 12

Denote by ROE

b,t

the ex-ante return on equity for a firm that borrows from a type-b bank.

In particular,

ROE

b,t

≡ h(ω

b,t

)

˜

A

t

(N

b,t

+ B

b,t

)

N

b,t

, (24)

where (¯ω

b,t

, B

b,t

) are the solution to the optimal contract problem described in Section III.2.2.

If the firm does not switch banks (i.e., B

t

(i) = B

t−1

(i)), then its present value is given by

the Bellman equation

V

t

(ν

t−1

(i), B

t−1

(i)) = (1 − ξ

e

)ROE

B

t

(i),t

ν

t−1

(i) + ξ

e

βE

t

V

t+1

(ROE

B

t

(i),t

ν

t−1

(i), B

t

(i)), (25)

If the firm switches bank type (i.e., B

t

(i) ̸= B

t−1

(i)), then it needs to pay the switching

cost γ, with the firm’s present value given by the Bellman equation

V

t

(ν

t−1

(i), B

t−1

(i)) = (1−ξ

e

)(ROE

B

t

(i),t

−γ)ν

t−1

(i)+ξ

e

βE

t

V

t+1

((ROE

B

t

(i),t

−γ)ν

t−1

(i), B

t

(i)).

(26)

To solve the bank type decision problem, we guess that the value function V

t

(ν

t−1

(i), b) is

linear in ν

t−1

(i):

V

t

(ν

t−1

(i), b) ≡ V

b,t

ν

t−1

(i), (27)

where V

b,t

is then given by,

V

b,t

= max{[(1 − ξ

e

) + ξ

e

βE

t

V

b,t+1

]ROE

b,t

, [(1 − ξ

e

) + ξ

e

βE

t

V

b

′

,t+1

](ROE

b

′

,t

− γ)}. (28)

where b

′

̸= b denotes the bank type in period t +1 that differs from the bank type b in period

t.

The optimal choice of bank type for a firm that borrows from a type-b in previous period

(B

t−1

(i) = b) is summarized by following conditions:

B

t

(i) = b

′

, if

¯

V

b

′

,t

(ROE

b

′

,t

− γ) >

¯

V

b,t

ROE

b,t

,

B

t

(i) ∈ {b, b

′

}, if

¯

V

b

′

,t

(ROE

b

′

,t

− γ) =

¯

V

b,t

ROE

b,t

,

B

t

(i) = b, if

¯

V

b

′

,t

(ROE

b

′

,t

− γ) <

¯

V

b,t

ROE

b,t

.

(29)

Here,

¯

V

b,t

denotes the firm’s expected present value per unit of its end-of-period net worth

and is given by

¯

V

b,t

= (1 − ξ

e

) + ξ

e

βE

t

V

b,t+1

. (30)

Eq. (29) identifies three possible ranges for a firm’s optimal choice of bank type. In the first

range, the firm switches from its previous bank of type b to a new bank of type b

′

because the

benefit of switching to the new bank type b

′

sufficiently exceeds the benefit of borrowing from

its previous bank type b (

¯

V

b

′

,t

ROE

b

′

,t

−

¯

V

b,t

ROE

b,t

> γ

¯

V

b

′

,t

). In the second range, the benefit

of switching exactly equals the benefit of not switching (

¯

V

b

′

,t

ROE

b

′

,t

−

¯

V

b,t

ROE

b,t

= γ

¯

V

b

′

,t

)

so that the firm is indifferent between switching and not switching banks (B

t

(i) ∈ {b, b

′

}). In

TARGETED RESERVE REQUIREMENTS 13

the third range, the firm does not switch banks because the benefit of doing so is less than

the switching cost (

¯

V

b

′

,t

ROE

b

′

,t

−

¯

V

b,t

ROE

b,t

< γ

¯

V

b

′

,t

).

III.2.4. Aggregate wealth accumulation. Given the firm survival probability ξ

e

, the average

lifespan of a firm is

1

1−ξ

e

. The managers (i.e., entrepreneurs) of the exiting firms are replaced

by an equal mass (1−ξ

e

) of new managers, so that the population size of entrepreneurs stays

constant.

Managers of all firms—new or continuing—supply entrepreneurial labor at the competitive

wage rate w

et

. New managers use their entrepreneurial labor income as start-up funds. For

simplicity, we assume that a manager’s supply of entrepreneurial labor is proportional to the

firm’s net worth such that the bank switching cost (γ) only affects the dynamic equilibrium

without changing the steady state allocations. The economy has one unit of aggregate supply

of entrepreneurial labor supply (i.e., H

et

= 1).

We assume that all firms, including continuing firms and new entrants, have an ongoing

relationship with their current bank. Thus, firms do not need to pay an additional cost if

they choose to borrow from the same bank in the next period.

Denote by

¯

N

b,t

the end-of-period aggregate net worth of all firms financed with a bank of

type b in period t, which consists of profits earned by surviving firms, net of bank switching

costs (if any), plus entrepreneurial labor income. The net worth is given by

¯

N

b,t

= ξ

e

[

˜

A

t

h(ω

b,t

)(N

b,t

+ B

b,t

) − γ max{N

b,t

−

¯

N

b,t−1

, 0}] +

N

b,t

N

n,t

+ N

l,t

w

e

t

H

et

. (31)

where N

b,t

−

¯

N

b,t−1

, if positive, measures the aggregate net worth of all firms that switch to

a bank of type b from another bank, thereby incurring a switching cost.

Denote by

¯

N

t

the aggregate net worth of all firms by the end of period t, which is given

by

¯

N

t

=

¯

N

n,t

+

¯

N

l,t

. (32)

Since N

b,t

is the aggregate net worth of firms that choose a bank of type b at the beginning

of period t, we have

N

l,t

+ N

n,t

=

¯

N

t−1

, (33)

Figure 3 illustrates the timeline of firms’ financing decisions and the evolution of firms’

aggregate net worth. In the beginning of period t, firms choose the types of banks (national

or local) from which they borrow. Then firms and banks choose the optimal loan contracts

before observing idiosyncratic productivity shocks. Production takes place after the real-

ization of productivity shocks. Firms then decide whether they want to repay the loans or

default. At the end of the period, some firms survive while others exit, and the managers of

TARGETED RESERVE REQUIREMENTS 14

Period t Period t+1

Choose

bank type

Determine

financial

contract

Individual

firm timeline

Idiosyncratic

shock realizes

Obtain firm

revenues

Default or

make loan

repayments

Survive or be

replaced by

new

managers

Firms that

choose national

banks in period t:

𝑁

𝑛,𝑡

Firms that

choose local

banks in period t:

𝑁

𝑙,𝑡

Firms that

choose national

banks in period t:

𝑁

𝑛,𝑡

Firms that

choose local

banks in period t:

𝑁

𝑙,𝑡

Aggregate

net worth

evolution

Firms that

choose national

banks in period

t+1: 𝑁

𝑛,𝑡+1

Firms that

choose local

banks in period

t+1: 𝑁

𝑙,𝑡+1

Choose

bank type

𝑁

𝑡−1

𝑁

𝑡

Figure 3. The timeline of individual firms’ financing decisions and the evo-

lution of the aggregate net worth of firms.

exiting firms are replaced by an equal mass of new entrepreneurs. Aggregate net worth of

firms that borrow from each type of banks is also determined at the end of the period.

5

III.3. Banks. There are two types of commercial banks, national banks (type n) and local

banks (type l), competing with each other in the loan market. There is a unit continuum of

banks for each type. Consider a type-b bank i, with b ∈ {n, l}, i ∈ [0, 1]. At the beginning

of each period t, the bank obtains household deposits d

b,t

(i) at interest rate r

d

b,t

(i) subject to

the demand schedule,

d

b,t

(i) =

r

d

b,t

(i)

R

d

b,t

!

θ

d

D

b,t

, (34)

The above demand schedule is derived under the assumption that the unit of type-b

(b ∈ {n, l}) deposits held by the households is a composite CES basket of differentiated

deposits supplied by individual banks, with elasticity of substitution equal to −θ

d

, with

5

Appendix A provides more details on how the aggregate net worth of firms that borrow from each type

of banks changes (from

¯

N

b,t−1

to N

b,t

) following bank switching at the beginning of each period.

TARGETED RESERVE REQUIREMENTS 15

θ

d

> 0.

6

Under this assumption, the aggregate-individual relations of deposits and deposit

rates are given by,

D

b,t

=

Z

1

0

d

bt

(i)

θ

d

+1

θ

d

di

θ

d

θ

d

+1

, (35)

R

d

b,t

=

Z

1

0

r

d

b,t

(i)

1+θ

d

di

1

1+θ

d

, (36)

Each bank is required to hold a fraction τ

b,t

of its deposits as reserves with no inter-

est earnings. It can lend the remaining funds to firms. The bank faces the flow-of-funds

constraint

b

b,t

(i) = (1 − τ

b,t

)d

b,t

(i), (37)

where b

b,t

(i) denotes the amount of loans.

The bank faces default risks on firm loans. These loans generate a random return ϵ

bt

R

b,t

at the end of period t, where R

b,t

denotes the average return on the loan and ϵ

bt

denotes

an idiosyncratic loan quality shock observed after the loans have been granted. The loan

quality shock ϵ

bt

is drawn from the distribution Φ(·) with a nonnegative support, and it

is i.i.d. across banks and time. We normalize the average loan quality shock to one (i.e.,

E(ϵ

bt

) = 1) .

The bank’s gross return from its asset holdings by the end of period t is then given by,

τ

b,t

d

b,t

(i) + ϵ

bt

R

b,t

b

b,t

(i)

With a sufficiently low value of realized ϵ

bt

, the bank would be insolvent because the gross

return from its asset holdings would be inadequate to service its deposit obligations. We

define ¯ϵ

b,t

(i) ≥ 0 as the threshold value of loan quality, below which the bank would be

insolvent. The insolvency threshold is given by

¯ϵ

b,t

(i) =

r

d

b,t

(i)d

b,t

(i) − τ

b,t

d

b,t

(i)

R

b,t

b

b,t

(i)

. (38)

The government provides full deposit insurance, such that households do not suffer any

losses when a bank default occurs. For simplicity, we assume that the government does

not charge a deposit insurance premium on banks; instead, it levies lump-sum taxes on

6

We assume monopsonistic competition on the deposit market to ensure the existence of solvent banks in

our model’s equilibrium. Otherwise, perfection competition would force banks’ expected profit to be zero,

which, together with the limited liability assumption, implies that all banks become insolvent and earn zero

profits in the equilibrium. This assumption is a widely-used modeling device to capture the existence of

market power in the banking industry. For a similar approach, see, for example, Ulate (2021), Angelini,

Neri and Panetta (2014), and Gerali, Neri, Sessa and Signoretti (2010). Alternatively, one could ensure the

existence of solvent banks in the equilibrium by imposing borrowing constraints on banks, as in Gertler and

Kiyotaki (2010), which won’t change our key model mechanisms.

TARGETED RESERVE REQUIREMENTS 16

households to compensate the depositors in the event of a bank default. The government

also treats national banks differently from local banks in the event of a default. An insolvent

national bank would be fully recapitalized (financed by lump-sum taxes on households),

whereas an insolvent local bank would be liquidated. Liquidating a local bank incurs a

resource cost equal to a fraction µ

l

of a local bank’s gross return from its asset holdings.

The presence of deposit insurance distorts banks’ lending decisions. Under limited liability,

a bank’s expected profit at the end of period t is given by

π

t

(i) =

Z

+∞

¯ϵ

b,t

τ

b,t

d

b,t

(i) + ϵ

bt

R

b,t

b

b,t

(i) − r

d

b,t

(i)d

b,t

(i)

dΦ(ϵ

bt

). (39)

The bank chooses deposits d

b,t

and loans b

b,t

to maximize the expected profit (39), subject

to the flow-of-funds constraint (37) and the deposit demand schedule (34). The bank’s

optimizing decisions imply that

7

θ

d

θ

d

+ 1

"

R

+∞

¯ϵ

b,t

(i)

ϵ

bt

dΦ(ϵ

bt

)

1 − Φ(ϵ

b,t

(i))

R

b,t

(1 − τ

b,t

) + τ

b,t

#

= r

d

b,t

(i). (40)

Thus, the marginal return on lending conditional on bank solvency equals the marginal cost

of funding. The cost of an extra unit of deposits equals the deposit interest rate. By taking

an extra unit of deposits, the bank can lend out 1 − τ

b,t

units of loans under the reserve

requirements. The bank earns the return on lending only if it remains solvent, with the

probability of solvency given by 1 − Φ(ϵ

b,t

(i)). At the end of the period, the bank obtains

the expected return on lending (conditional on solvency) plus the required reserves. With

market powers in the deposit markets, the bank“marks down” the deposit interest rate, such

that the deposit rate r

d

b,t

(i) is lower than the expected return on lending (since

θ

d

θ

d

+1

< 1). In

a symmetric equilibrium, we have r

d

b,t

(i) = R

d

b,t

for all i and for b ∈ {n, l}.

Under limited liability, a bank’s internal valuation of loans reflects only the returns on

those loans with sufficiently high quality (i.e., with ϵ

b,t

(i) ≥ ¯ϵ

b,t

). This leads to excessive

lending. Eq. (38) shows that the excessive lending problem can be mitigated by raising the

reserve requirements τ

b,t

. By reducing the loanable funds, an increase in τ

b,t

would reduce

over-lending and thus lower the probability of bank insolvency. In the extreme case where τ

b,t

is sufficiently high, the probability of bank insolvency can be reduced to zero (i.e., ϵ

b,t

= 0),

eliminating excessive lending distortions.

7

Under monoposonistic competition in the deposit markets, the solvency threshold ¯ϵ

b,t

is a function of the

individual bank’s deposits and loans. However, Eq. (38) implies that the flow profit (i.e., the term within

the squared brackets in Eq. (39) evaluated at ¯ϵ

b,t

is zero, such that the partial derivatives of ¯ϵ

b,t

with respect

to the bank-level decision variables vanish from the first order conditions.

TARGETED RESERVE REQUIREMENTS 17

III.4. Market clearing and equilibrium. In equilibrium, the markets for goods, interme-

diate goods, capital and labor inputs, and loans all clear.

Goods market clearing implies that

Y

t

= C

t

+ I

t

+

X

b=n,l

˜

A

t

(N

b,t

+ B

b,t

)m

b

Z

ω

bt

0

ωdF (ω)

+µ

l

Z

¯ϵ

l,t

0

ϵ

l,t

R

l,t

b

l,t

dΦ(ϵ

l,t

) +

X

b=n,l

γ max{N

b,t

−

¯

N

b,t−1

, 0}. (41)

where Y

t

= Y

nt

+ Y

lt

denotes gross output, which is used for financing consumption and

investment spending and for covering the costs of monitoring defaulting firms, liquidating

insolvent local banks, and switching borrowers. We define GDP as the aggregate value

added, which equals gross output net of the resource costs for monitoring firms, liquidating

insolvent local banks, and switching borrowers. Thus, real GDP corresponds to the sum of

consumption and investment and is given by

GDP

t

= C

t

+ I

t

. (42)

Factor market clearing implies that

K

t−1

= K

n,t

+ K

l,t

, H

t

= H

n,ht

+ H

l,ht

. (43)

The loans market clearing implies that,

B

n,t

=

Z

1

0

b

n,t

(i)di, B

l,t

=

Z

1

0

b

l,t

(i)di. (44)

IV. Calibration

We solve the model numerically based on calibrated parameters. Where possible, we

calibrate the model parameters to match moments in Chinese data. Three sets of parameters

need to be calibrated. The first set includes those in the household decision problem. These

include β, the subjective discount factor; η, the inverse Frisch elasticity of labor supply; Ψ

h

,

the utility weight on leisure; Ψ

n

, the utility weight on liquidity services; θ

d

, (the negative of)

the elasticity of substitution across individual bank deposits; δ, the capital depreciation rate;

and Ω

k

, the investment adjustment cost parameter. The second set includes parameters for

firms and financial intermediaries. These include g, the average trend growth rate; F (·), the

distribution of the firm idiosyncratic productivity shock, respectively; α, the capital share in

the production function; θ, the share of labor supplied by the household; m

b

, the monitoring

cost by type b banks; ξ

e

, the survival rates of firm managers; and Φ(·) , the distribution of

the idiosyncratic loan quality shock. The third set of parameters are those in government

policy and the shock processes, which includes ¯τ

n

and ¯τ

l

, the average RR on national banks

and local banks, respectively; µ

l

, the cost of liquidating insolvent local banks; and ρ

a

and

TARGETED RESERVE REQUIREMENTS 18

σ

a

, the persistence and standard deviation of the productivity shock. Table 1 summarizes

the calibrated parameter values.

A period in the model corresponds to one quarter. We set the subjective discount factor

to β = 0.9975. We set η = 1, implying a Frisch labor elasticity of 1, which lies in the

range of empirical studies. We calibrate Ψ

h

= 7.5 such that the steady state value of labor

hour is about one-third of total time endowment (which itself is normalized to 1). We

calibrate the utility weight on liquidity services Ψ

n

= 0.005 and the negative elasticity of

substitution θ

d

= 163 such that national banks’ lending rate 4(R

n

− 1) and deposit rate

4(R

d

n

− 1), respectively, equals 6% per annum and 3% per annum, which is consistent with

the historical average of the policy lending rate and policy deposit rate in China. For

the parameters in the capital accumulation process, we calibrate δ = 0.035, implying an

annual depreciation rate of 14%, which also matches Chinese data. We set the investment

adjustment cost parameter Ω

k

= 5, which lies in the range of empirical estimates of DSGE

models (Christiano, Eichenbaum and Evans, 2005; Smets and Wouters, 2007).

For the technology parameters, we set the steady-state balanced growth rate to g = 1.0125,

implying an average annual growth rate of 5%. We assume that firms’ idiosyncratic produc-

tivity shocks are drawn from a unit-mean log normal distribution such that the logarithm of

ω follows a normal distribution N(−σ

2

/2, σ

2

). We calibrate the distribution parameter σ to

match empirical estimates of cross-firm dispersions of TFP in the manufacturing industries

in China. In particular, Hsieh and Klenow (2009) estimated that the annualized standard

deviation of the logarithm of TFP across Chinese manufacturing firms is about 0.63 in 2005.

This implies that σ = 0.63/2. We calibrate the labor income share to α = 0.5, consistent

with empirical evidence in Chinese data (Brandt, Hsieh and Zhu, 2008; Zhu, 2012).

For the parameters associated with financial frictions, we follow Bernanke et al. (1999)

and set the monitoring cost for local banks to m

l

= 0.1. We set the managerial labor share to

1−θ = 0.04, such that entrepreneurs’ labor income accounts for 2% of aggregate output. We

jointly calibrate the monitoring cost for national bank (m

n

) and the firm survival probability

(ξ

e

) to target a steady-state loan default ratio of 0.10 and a steady-state share of local bank

loans of 0.5. These targeted moments match, respectively, the average delinquency ratio

on business loan reported by the People’s Bank of China and the average share of business

loans granted by small and medium-sized banks (including city commercial banks and rural

commercial banks) reported by the Banking Regulatory Commission of China.

For the parameters associated with the banking sector, we assume that the idiosyncratic

shocks to loan quality (ϵ

b

) are drawn from a log normal distribution with a unit mean, such

that ln(ϵ

b

) follows the normal distribution N(−σ

2

b

/2, σ

b

). We set σ

b

= 0.01/2 to match the

annualized standard deviation of loan delinquency ratios across individual banks of 0.01 in

TARGETED RESERVE REQUIREMENTS 19

Table 1. Calibrated values.

Variable Description Value

A. Households

β Subjective discount factor 0.9975

η Inverse Frisch elasticity of labor supply 1

Ψ

h

Weight of disutility of working 7.5

Ψ

n

Weight of utility of liquidity services 0.005

θ

d

Negative elasticity of substitution of deposits 163

δ Capital depreciation rate 0.035

Ω

k

Capital adjustment cost 5

B. Firms and financial intermediaries

g Steady state growth rate 1.0125

σ Volatility parameter in log normal distribution of firm idiosyncratic shocks 0.315

α Capital income share 0.5

m

n

National bank monitoring cost 0.2

m

l

Local bank monitoring cost 0.1

ξ

e

Firm manager’s survival rate 0.86

θ Share of household labor 0.96

σ

b

Volatility parameter in log normal distribution of bank idiosyncratic shocks 0.005

γ Bank switching cost 0.009

C. Government policy and shock processes

¯τ

n

RR on National bank 0.15

¯τ

l

RR on Local bank 0.15

µ

l

Liquidation cost of local banks 0.03

ρ

z

Persistence of TFP shock 0.95

the data. Firms’ bank switching cost is set to γ = 0.009 to match the volatility of the share

of firm loans granted by local banks of 0.01 in the data.

8

For the government policy parameters, we calibrate the steady-state RR to 0.15 for both

national banks and local banks. We have less guidance for calibrating the parameter µ

l

,

the cost of liquidating insolvent local banks. We set µ

l

= 0.03 as a benchmark, implying

that the liquidation cost accounts for a small share (0.1%) of aggregate output in the steady

state. For the parameters related to the shock process, we follow the standard business

cycle literature and set the persistence parameter to ρ

a

= 0.95 for the technology shocks. In

Section VI, We consider a variety of shock sizes for each shock to examine how the size of

the shocks affect the effectiveness of targeted RR policy.

8

Our model features a steady-state equilibrium with no firms switching banks in the absence of stochastic

shocks. Since firms that borrow from the two types of banks accumulate net worth with the same survival

rate and the same entrepreneurial labor income share, these firms end up with the same return on equity

and therefore there are no differences between the two types of banks in the steady-state equilibrium. As a

consequence, the steady-state values of the model is independent of the size of firms’ bank switching γ, as

long as the later is positive. That’s why we calibrate γ to match a second-order moment (volatility) instead

of a first-order moment (mean) in the data.

TARGETED RESERVE REQUIREMENTS 20

V. Transmission mechanism for RR shocks

We first use the calibrated model to explore the dynamics of the economy following unex-

pected changes in RR policies. In particular, we consider an unexpected cut in the RR for

each bank type:

τ

b,t

= τ

b

+ ϵ

b

τ,t

. (45)

To illustrate the role of switching costs when borrowers switch banks in the transmission

mechanism of RR policies, we compare the impulse response to two types of RR changes

in two cases: one case with no switching costs (γ = 0), and the other case with infinite

switching costs (γ = +∞).

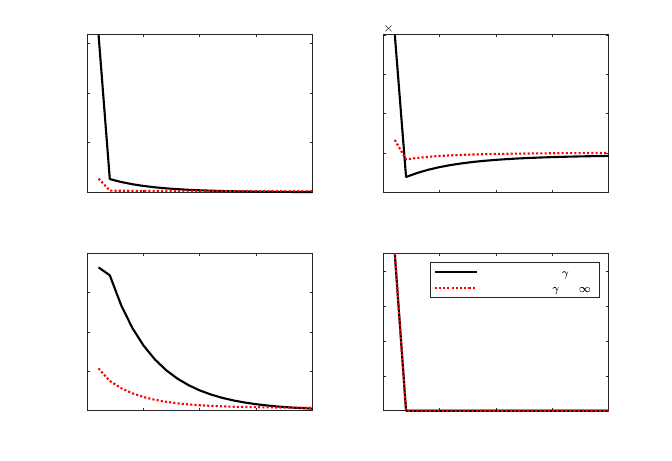

V.1. Reducing local bank RR. Figure 4 displays the impulse responses to a 1% negative

RR shock on local banks (ϵ

l

τ,t

= −0.01). Reducing τ

l

lowers the local banks’ funding cost

and thus their required return on lending. However, reducing τ

l

also leads local banks to

hold less riskless bank reserves and raise local banks’ probability of insolvency. The increase

in the probability of local banks’ insolvency raises the overvaluation distortion on local bank

lending and eases their lending terms. As local banks expand their credit supply, the national

banking sector shrinks and the liquidity services provided by national banks become more

valuable. This reduces the national bank deposit rate and the probability of national bank

insolvency.

In the case with no switching costs (γ = 0), reducing τ

l

lowers the interest charged by

local banks’ on lending, and leads some firms to switch their borrowing from national banks

to local banks. Since local banks have superior monitoring technology and are willing to

accept riskier borrowers, the shift to local banks raises average firm leverage and default

ratios. As a result, firms’ leverage and output are increased. However, firm default costs

and local bank bankruptcy costs also increase.

In the case with infinite switching costs (γ = +∞), reducing τ

l

also lowers the local

banks’ required return on lending, and firms again respond by increasing their leverage

and raising output. However, compared with the case with no switching costs (γ = 0), the

stimulative impact is much weaker because the restrictions against switching banks eliminates

the expansionary extensive-margin effect.

V.2. Reducing national bank RR. Figures 5 displays the impulse responses to a 1%

negative RR shock on national banks (ϵ

n

τ,t

= −0.01). In the case with no switching costs

(γ = 0), cutting τ

n

has two opposite effects: At the intensive margin, it lowers national

banks’ required return on lending falls, which and encourages increased firms borrowing

from national banks to take on more leverage. At the extensive margin, firms shift from local

banks to national banks. This lowers the average firm leverage ratio as local banks’ superior

TARGETED RESERVE REQUIREMENTS 21

0 5 10 15 20

0

0.5

1

1.5

Local bank loan share

0 5 10 15 20

-5

0

5

10

15

10

-3

GDP

0 5 10 15 20

0

0.01

0.02

0.03

0.04

Average firm debt ratio

0 5 10 15 20

0

0.1

0.2

0.3

0.4

Local bank insolvency ratio

Free switching ( = 0)

No switching ( = + )

Figure 4. Impulse responses of a 1% negative RR shock on local banks (ϵ

l

τ,t

=

−0.01). Black solid lines: no switching costs (γ = 0); red dotted lines: infinite

switching costs (γ = +∞). The horizontal axes show the quarters after the

impact period of the shock. The horizontal axes show the quarters after the

impact period of the shock. The units on the vertical axes are percentage-point

deviations from the steady state levels for local bank insolvency ratio. The

units on the vertical axes are percent deviations from the steady state levels

for other variables.

monitoring technologies induce them to accept riskier borrowers. Under our calibration, the

extensive-margin effect dominates and cutting τ

n

leads to a fall in total output.

In the case with infinite switching costs (γ = +∞), firms do not switch between banks,

so the extensive-margin effect no longer operates. Cutting τ

n

raises national bank lending,

reducing firm funding costs and raising output.

VI. Business cycle analysis for China RR policy

In this section, we consider the dynamic implications of pursued RR policy in China in

the wake of adverse technology shocks. We characterize China RR policy in terms of two

alternative feedback rules which the central bank follows in response to deviations of the real

GDP from its trend. One rule is assumed to prevail under normal conditions, and the other

is adopted in response to deep downturns. We compare these dynamics to a benchmark

regime where RR of both types of banks are kept constant at their steady state levels over

the course of the cycle.

TARGETED RESERVE REQUIREMENTS 22

0 5 10 15 20

-1.5

-1

-0.5

0

Local bank loan share

0 5 10 15 20

-10

-5

0

5

10

-3

GDP

0 5 10 15 20

-0.03

-0.02

-0.01

0

0.01

Average firm debt ratio

0 5 10 15 20

-5

0

5

10

15

10

-4

Local bank insolvency ratio

Free switching ( = 0)

No switching ( = + )

Figure 5. Impulse responses of a 1% negative RR shock on national banks

(ϵ

n

τ,t

= −0.01). Black solid lines: no switching costs (γ = 0); red dotted lines:

infinite switching costs (γ = +∞). The horizontal axes show the quarters after

the impact period of the shock. The horizontal axes show the quarters after

the impact period of the shock. The units on the vertical axes are percentage-

point deviations from the steady state levels for local bank insolvency ratio.

The units on the vertical axes are percent deviations from the steady state

levels for other variables.

Under our calibration, firms borrow from both types of banks and are indifferent between

the two types of banks in the initial steady state. As is implied by (A1), they switch across

banks only when the economy is hit by a sufficiently large shock that the improvement in

the their return to equity of switching from one bank to another exceeds the switching cost.

This implies that our model contains occasionally binding constraints.

9

VI.1. RR rules. The central bank adjusts the required reserve ratio (τ

n,t

or τ

l,t

) to respond

to deviations of real GDP from trend.

τ

l,t

= ¯τ

l

+ ψ

ly

ln

˜

GDP

t

(46)

τ

n,t

= ¯τ

n

+ ψ

ny

ln

˜

GDP

t

(47)

9

We solve the model using a popular model solution toolbox called OccBin developed by Guerrieri and

Iacoviello (2015). The toolbox adapts a first-order perturbation approach and applies it in a piecewise fashion

to solve dynamic models with occasionally binding constraints.

TARGETED RESERVE REQUIREMENTS 23

where the parameters ψ

ly

and ψ

ny

measure the responsiveness of the require reserve ratios

to the output gap.

We first consider a symmetric RR rule which characterizes PBOC policy under normal

conditions, under which the reaction coefficients satisy ψ

ly

= ψ

ny

= 1. We estimate the value

of the reaction coefficient by regressing the RRs on the real GDP gap and the CPI inflation

rate using Chinese quarterly data from 2000 to 2020.

Our second RR rule is asymmetric, under which the RR reaction coefficients ψ

ly

= 2 and

ψ

ny

= 0, and reflects pursued PBOC policy in the wake of deep adverse shocks. Under this

rule, the central bank aggressively cuts RRs on local banks in response to downturns but

only modestly adjusts RRs on national banks. This fits the pattern of pursued policy during

the recent coronavirus pandemic.

10

VI.2. Macro implications.

VI.2.1. Large shocks versus small shocks. To begin with, we explore the macro implications

of technology shocks with different shock sizes in a benchmark regime where RR of both

types of banks are kept constant at their steady state levels. Figure 6 compares the impulse

responses of a relatively small negative technology shock ϵ

at

= −0.01 and a relatively large

negative technology shock ϵ

at

= −0.05 in the benchmark regime.

We first focus on a relatively small negative technology shock ϵ

at

= −0.01, whose responses

are shown in black solid lines. The negative technology shock reduces firms’ return to

investment, imposing upward pressure on firm default possibilities and credit spreads at

existing lending levels. In response to higher spreads and reduced profitability, firms respond

by reducing their leverage ratio. This leads to reduced returns on equity.

Firms that borrow from local banks are more negatively affected than those that borrow

from national banks. Local banks, due to their monitoring advantages, have higher steady

state leverage and default probabilities. This leaves local bank terms more sensitive to ad-

verse shocks than national banks. However, under the small technology shock the switching

cost is too high, precluding firms borrowing from local banks from switching to national

banks.

Alternatively, consider a relatively large negative technology shock ϵ

at

= −0.05, whose

responses are shown in red dotted lines. the negative technology shock reduces all firms’

return to equity, although more acutely for firms borrowing from local banks. In this case,

the improvement in returns to equity from switching to national banks are large enough to

10

As shown in Figure 1, the PBOC dropped RR for both large banks as well as medium and small banks

during the 2008 global financial crisis. However, it dropped those for medium and small banks far more

aggressively than it did for large banks, in line with the asymmetry pursued during the pandemic.

TARGETED RESERVE REQUIREMENTS 24

0 10 20

-6

-4

-2

0

GDP

0 5 10 15 20

0

1

2

Change in the share of national bank borrowers’ net worth caused by firm switching

0 10 20

-10

-5

0

Total bank loan

0 10 20

-15

-10

-5

0

Local bank loan

0 10 20

-6

-4

-2

0

National bank loan

Small shock

Large shock

Figure 6. Impulse responses to a small negative technology shock (ϵ

at

= −0.01, black

solid lines) and to a large negative technology shock (ϵ

at

= −0.05, red dotted lines). The

horizontal axes show the quarters after the impact period of the shock. The units on the

vertical axes are percentage-point deviations from the steady state levels for the variable

“Change in the share of national bank borrowers’ net worth caused by firm switching,”

which, denoted by

N

n,t

−

¯

N

n,t−1

¯

N

t−1

, refers to the ratio of the net worth of firms that switch from

local banks to national banks to the net worth of all firms. The units on the vertical axes

are percent deviations from the steady state levels for other variables.

cover the switching cost for some local bank borrowers. As a result, while total lending falls,

national bank lending rises relative to local bank lending. The shift to national banks also

lowers the average leverage ratio, further reducing total lending and output.

An important take-away from Figure 6 is that local banks’ credit supply are more cycli-

cally sensitive than national banks. Furthermore, this extra sensitivity is larger in times of

large shocks, attributed to firm switching across the two types of banks. These results are

supported by the empirical evidence using Chinese bank-level data, which we will show later

in Section VII.

VI.2.2. Symmetric versus asymmetric RR rule under small shocks. Figure 7 displays the

impulse responses to a relatively small negative technology shock ϵ

at

= −0.01 under alter-

native policy rules. With no switching taking place, the decline in aggregate TFP leads to

a fall in real GDP. In this case, the symmetric RR policy and the asymmetric RR policy are

almost equally effective in stabilizing the output. In particular, the RR cut on both types

of banks under the symmetric rule reduces the funding costs of both types of banks and

mitigates the fall in real GDP by raising credit supply in both banking sectors. In contrast,

the asymmetric cut that only reduces RR on local banks stimulates the credit supply by

local banks but tightens the credit supply by national banks.

TARGETED RESERVE REQUIREMENTS 25

0 10 20

-1

-0.9

-0.8

-0.7

GDP

0 5 10 15 20

-0.01

0

0.01

Change in the share of national bank borrowers’ net worth caused by firm switching

0 10 20

-2

-1.5

-1

-0.5

Total bank loan

0 10 20

-4

-2

0

2

Local bank loan

0 10 20

-2

-1.5

-1

-0.5

National bank loan

Benchmark

Symmetric RR policy

Asymmetric RR policy

Figure 7. Impulse responses to a small negative technology shock (ϵ

at

= −0.01) under

alternative policy rules. Benchmark rule: black solid lines; symmetric RR rule: blue dashed

lines; assymmetric rule: red dotted lines. The horizontal axes show the quarters after the

impact period of the shock. The units on the vertical axes are percentage-point deviations

from the steady state levels for the variable “Change in the share of national bank borrowers’

net worth caused by firm switching.” The units on the vertical axes are percent deviations

from the steady state levels for other variables.

VI.2.3. Symmetric versus asymmetric RR rule under large shocks. Figure 8 displays the

impulse responses to a large negative technology shock ϵ

at

= −0.05 under alternative policy

rules. Given the large shock, the RR cut on both types of banks helps to reduce all banks’

funding costs and mitigates the fall in the real GDP. However, the asymmetric cut stabilizes

real GDP better than cutting RRs symmetrically across bank types. This is because the

asymmetric RR cut lowers the local bank lending rate relative to that of national banks,

preventing firms switching to national banks and taking lower leverages. By comparison,

while the symmetric cut stimulates both types of bank lending, it does not raise the total

credit as much because firms switch to national banks.

VI.3. Macro stability versus financial stability. In our model, as is shown in (41),

the GDP is defined as the gross output net of the resource costs for monitoring defaulting

firms, liquidating insolvent local banks, and switching borrowers. Therefore, to stabilize the

GDP, the government needs to lessen the fluctuations not only in the gross output, which

could be achieved by stabilizing firms’ borrowing and production activities, but also of the

resource costs associated with various financial activities. We now compare the symmetric

and asymmetric RR policies in terms of their performance in stabilizing the gross output as

well as the financial resource costs.

TARGETED RESERVE REQUIREMENTS 26

0 10 20

-5

-4.5

-4

-3.5

GDP

0 5 10 15 20

-5

0

5

Change in the share of national bank borrowers’ net worth caused by firm switching

0 10 20

-10

-5

0

Total bank loan

0 10 20

-20

0

20

40

Local bank loan

0 10 20

-30

-20

-10

0

National bank loan

Benchmark

Symmetric RR policy

Asymmetric RR policy

Figure 8. Impulse responses to a large negative technology shock (ϵ

at

= −0.05) under

alternative policy rules. Benchmark rule: black solid lines; symmetric RR rule: blue dashed

lines; assymmetric rule: red dotted lines. The horizontal axes show the quarters after the

impact period of the shock. The units on the vertical axes are percentage-point deviations

from the steady state levels for the variable “Change in the share of national bank borrowers’

net worth caused by firm switching.” The units on the vertical axes are percent deviations

from the steady state levels for other variables.

Table 2 displays the total fluctuations in the GDP and its determinants in response to

negative technology shocks with different shock sizes, calculated as the sum of the deviation

of the corresponding variable to its steady-state level on each quarter after the impact period

of the shock and expressed as a fraction of the steady-state GDP level.

Under the benchmark regime with constant RRs, a 1% negative technology shock reduces

the gross output by 46.44% and the GDP by 45.87%. The smaller fall in the GDP is

attributed to the decline in financial activities, reducing the cost from monitoring default

loans by 0.5% and the cost from liquidating insolvent local banks by 0.07%. For a larger

shock (5% negative technology shock), the fluctuations in the GDP and its determinants are

similar, except that firms begin to switch between banks. In this case, the extensive-margin

effect from bank switching exaggerates the output fluctuations and incurs a very small firm

switching cost that equals 0.004% of steady state GDP.

We now consider the performance of the symmetric and asymmetric RR policies relative

to the benchmark regime. Table 2 shows that, the asymmetric RR adjustments on local

banks are more efficient in stabilizing the gross output than the symmetric RR adjustments.

This difference is also larger under larger shocks. The reason is demonstrated in our impulse