Integrated

planning for

a dynamic

oil and gas

industry

kpmg.com | 3esi-enersight.com

Insights from an inaugural survey of

upstream planning practices

Significant forces have reshaped the upstream sector,

exposing the limitations of traditional planning practices.

Companies are struggling to keep up with a host of

interrelated changes: the shift to unconventionals, a

more dynamic asset class; the downturn and volatility of

commodity prices; intensifying investor focus on returns;

and continuing innovations in the field.

In this environment, upstream companies are searching

for a better way to manage their businesses. In an effort

to help the industry uncover planning challenges and

identify barriers to improvement, we launched a new

survey dedicated to the planning process in the upstream

oil and gas sector.

The survey results are in, and we believe the ndings

can help upstream companies create a roadmap for real

improvement to their planning organizations.

KPMG and 3esi-Enersight share a common mission to

help the upstream oil and gas industry evolve existing

management capabilities for greater success.

From our conversations with industry

executives, planners, and information

technology (IT) professionals, it is clear

that the exploration and production (E&P)

industry has undergone massive shifts as

a result of new technologies unlocking the

vast potential of unconventional resources.

The price volatility of recent years has further

contributed to an ever-shifting E&P landscape.

Given the significant changes in how the

industry operates, business practices should

have likewise evolved substantially—but

have they?

KPMG and 3esi-Enersight combined their

respective experience in strategy consulting

and planning and reserve solutions to develop

an upstream planning survey to gain a

deeper understanding and appreciation of the

challenges facing the industry, and how these

have changed as a result of industry shifts. In

so doing, we also looked to uncover some of

the leading practices across participants.

The survey targeted the largest North

American E&P companies between August

and December 2017. Survey responses

comprised 78 individuals in approximately 10

different planning or operationally-focused

roles ranging from analysts to senior

executives, and hailing from large producers

(3 million BOE/D) down to small operators

(25,000 BOE/D). Respondents were offered

modified versions of the survey depending

on seniority, with those indicating their

position was at a director level or higher

being offered an “Executive” survey track,

and the remainder indicating positions below

a director level receiving a non-executive

survey track.

The survey included questions grouped into

the following topic areas:

Focus and value of planning. What

is the perception of an organization’s

current planning process? How does

it better the overall organization?

Anatomy of a planning cycle. What

are the various components of an

organization’s planning activities, and

where is major effort allocated?

Planning norms. What behaviors

(intended and unintended) play into

an organization’s planning process?

Information ow and tools. How

does an organization use systems to

support its planning activities?

Looking forward: The future of

planning. Where are companies

looking to invest to change their

planning practices? What new

technological developments in

planning may disrupt current

paradigms?

While the data reaffirmed many of our

hypotheses, we also uncovered evidence

that challenges some of our preconceived

notions. We are excited to share what we

learned and look forward to discussing the

insights with you.

About our survey

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

1

About the authors

KPMG helps global oil and gas companies solve

their most complicated strategy, organization, and

performance challenges. Recently, KPMG helped

several upstream oil and gas entities, including a

leading independent E&P and a major’s unconventional

business unit, to enhance their integrated planning

and performance management capabilities. KPMG

professionals take an enterprise-wide view to every

business transformation, using time-tested

approaches, advanced data and analytics, and deep

cross-functional experience to guide companies from

strategy through results.

3esi-Enersight provides the E&P industry with

integrated software and technology solutions for

innovative planning and analysis. Executives and

technical decision makers in companies around the

world, including national oil companies (NOCs), super

majors, emerging operators, investors, and consultants,

rely on 3esi-Enersight’s products and services. From

corporate strategy and planning to operations, capital

management, and reserves, 3esi-Enersight solutions

are designed to help oil and gas companies make better

investment decisions across both conventional and

unconventional assets, onshore and offshore.

The authors thank the following contributors to this paper: Andy Steinhubl, Chris Click, and Josh Hesterman

from KPMG; and Jim DuBois and Jeff Morgheim from 3esi-Enersight.

Tom Hiddemen

Managing Director,

Corporate Strategy

KPMG

Evan Howell

Vice President,

Strategic Development

3esi-Enersight

Todd Blackford

Director,

Corporate Strategy

KPMG

Lillian Warren

Principal Consultant

3esi-Enersight

Tom works across the energy value chain with a focus

on the upstream and midstream oil and gas sectors.

With more than 18 years of professional experience,

he works with clients on strategy development,

operating model transformations, enhancing integrated

planning and performance management capabilities.

Todd has more than 15 years of experience in the oil

and gas industry. He specializes in the upstream sector

with significant experience in integrated planning,

operating model design, organizational design, and

operational business process improvement, lean well

delivery programs and cost reduction.

Evan oversees 3esi-Enersight’s efforts to expand

into new markets and develop cross-functional industry

partnerships. He brings prior experience in strategy

development and portfolio management for the

upstream sector, as well as in cross-industry economic

and financial analysis.

Lillian has 20 years’ experience working with upstream

oil and gas companies ranging from small independents

to super majors and NOCs. Her focus has been working

with executive teams and planning teams on process

design and the cultural and organizational change

aspects of implementing a portfolio planning approach.

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

2

We approached our survey with the goal of assessing the state of play

for E&P planning professionals. What we found, however, suggests that

the discipline of upstream planning is still very much in its adolescence.

Planning’s potential is tested, and there is strong universal belief in its

overall importance to the organization. But most operators have yet to

turn the planning discipline into a competitive advantage.

The planning function is clearly valued throughout the oil and gas

industry—it’s just not as effective as it can and should be.

Survey results confirm our conversations with operators

throughout the industry who share near-universal

agreement about the importance of effective planning.

Almost three-fourths (73 percent) of all respondents,

including 86 percent of executives, said planning

provided “significant” value to their organizations, the

highest level among all answers.

In your opinion, how much value does planning

bring to your organization?

May not equal 100% due to rounding

Approximately half of all respondents also identified

at least six functional areas through which planning

delivered material value to their companies. Planning

is deemed particularly important in the evaluation

and pursuit of alternative portfolio and asset

development scenarios.

How does your organization’s planning process

deliver material value to the company?

(select all that apply)

Multiple responses allowed

The current state of

oil and gas planning

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

3

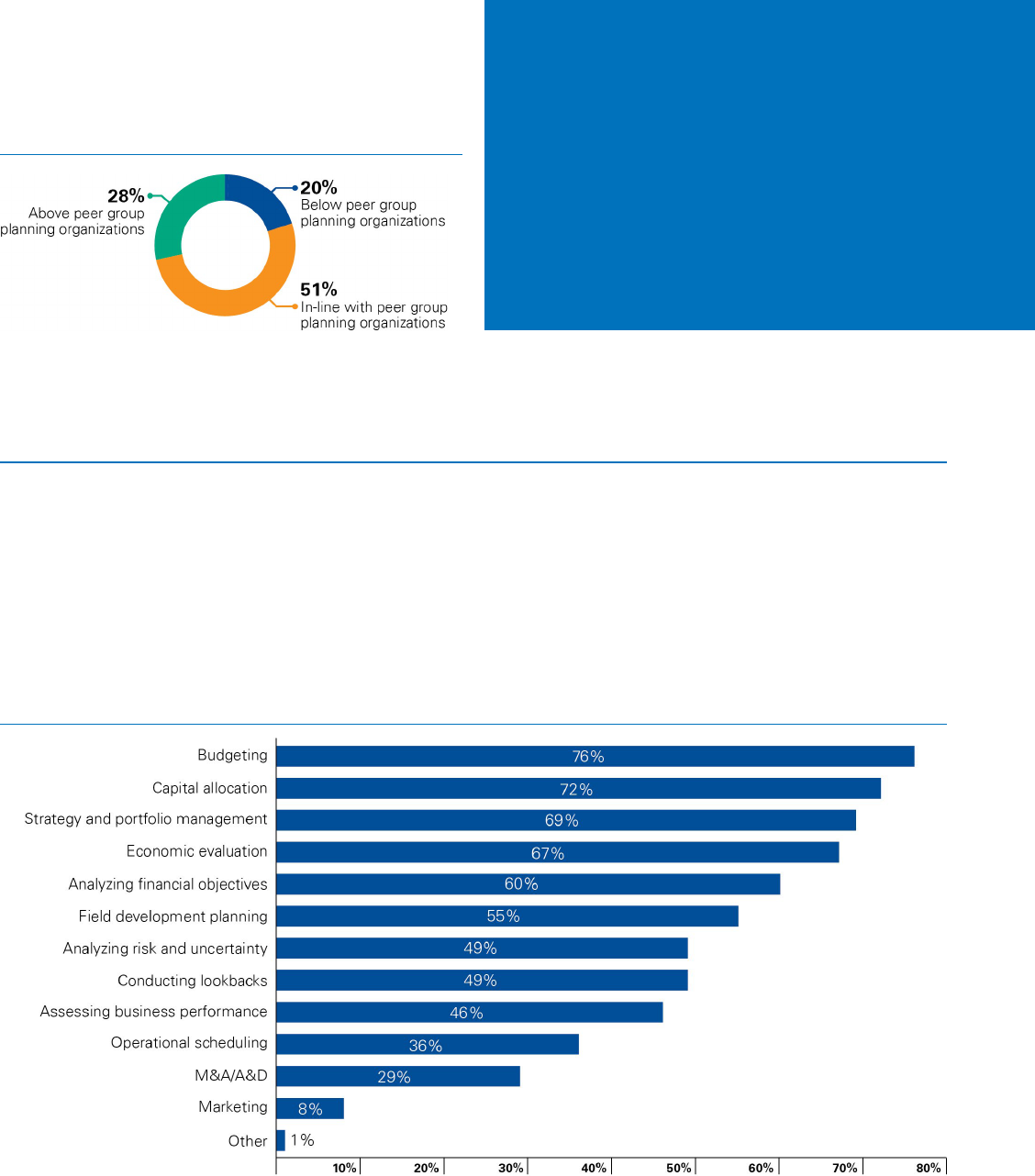

And yet, most participants grade their own planning

organizations as decidedly average compared to peers.

Do you believe your planning organization

performs above, below, or in-line with the

planning organizations of other companies within

your peer group?

May not equal 100% due to rounding

No standard denition of “planning” exists in upstream oil and gas.

When we asked survey participants to outline their

planning organization’s core responsibilities, all but

three of the available responses were selected by

nearly half or more of all respondents. This confirms our

experience: across companies, rarely do we see two

planning organizations organized the exact same way

with the exact same mission.

We believe this is evidence of the core challenge facing

planning organizations today: how to consistently

add value across a diverse array of inter-disciplinary

functions. Complicating this is the fact that many of the

disciplines existing elsewhere within the typical E&P (for

example, in drilling engineering) have evolved over time

to become highly focused and specialized, a contrast to

the cross-functional nature of planning.

What are the core responsibilities of planning in your organization? (select all that apply)

So why, if planning is so important,

have more operators not turned it into

competitive advantage? Our survey

results suggest several complicating

factors.

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

4

Even within a single organization, we see evidence

that “planning” may mean different things to different

groups. Among non-executive respondents, 66 percent

said that standards existed only in certain areas of their

organizations, or not at all.

This is a particularly interesting response, since 52

percent of the executive respondents stated that one

of the ways that the planning organization provided

material value to the company was by “improving and

maintaining standards.”

To what degree is planning standardized across

your organization?

May not equal 100% due to rounding

13%

Limited to no standardization

exists

Standardization exists only in

certain areas

53%

33%

Appropriate level of

standardization exists

Overly standardized and

restrictive

2%

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

5

Performance from one company

to another varies widely.

Typical turnaround time runs the gamut from one day

to more than a week from initial request to final

report for a planning organization to perform core

business functions like updating schedules or changing

a price assumption.

For example, in generating a new company-level

portfolio scenario, 33 percent of respondents indicated

their organization could produce that in less than

two days, while 30 percent indicated it would take a

week or more.

What is the (expected) typical turnaround time for

your planning organization to update or change the

following (measured from initial request to nal

report out):

May not equal 100% due to rounding

We see a similar diversity of performance when looking

at more cyclical, large-scale processes common across

operators. More than half of survey respondents

indicated that their strategic and/or long-range plans

are updated only on an annual (or greater) basis. This

suggests not only that many operators still view at least

a portion of planning as a scheduled event rather than

as a dynamic process, but that some organizations

are simply unable to act with greater frequency--a

performance limitation.

Assuming that companies will generally seek to keep

their plans as up to date as possible, the data implies

a broad difference in capabilities across operators.

For example, while some (41 percent) can update a

drilling schedule weekly, others can only do it monthly

or quarterly (33 and 11 percent, respectively).

How frequently does your organization update the

following plans?

May not equal 100% due to rounding

It is worth noting that these differences in planning

performance have material impact outside of the

planning organization as well. Forty-two percent of

respondents said that their organizations cannot put

together a company model without burdening their

asset teams.

Our organization can model enterprise-wide

scenarios while minimizing the burden on

asset teams

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

6

In summary, while there is near universal

agreement on the value of planning, it’s

equally clear that many aspects of planning

have room for substantial improvement.

Deep-seated structural problems

underlie many of the differences

in capabilities.

Eighty-eight percent say decision-making is slowed

down or less efficient due to data issues such as

unavailable or poor-quality data, often requiring

manual manipulation and moving data from one

system to another. And when asked, a significant

number of participants have indicated that the desire to

be overly precise during planning often slows down the

process and runs counter to being agile.

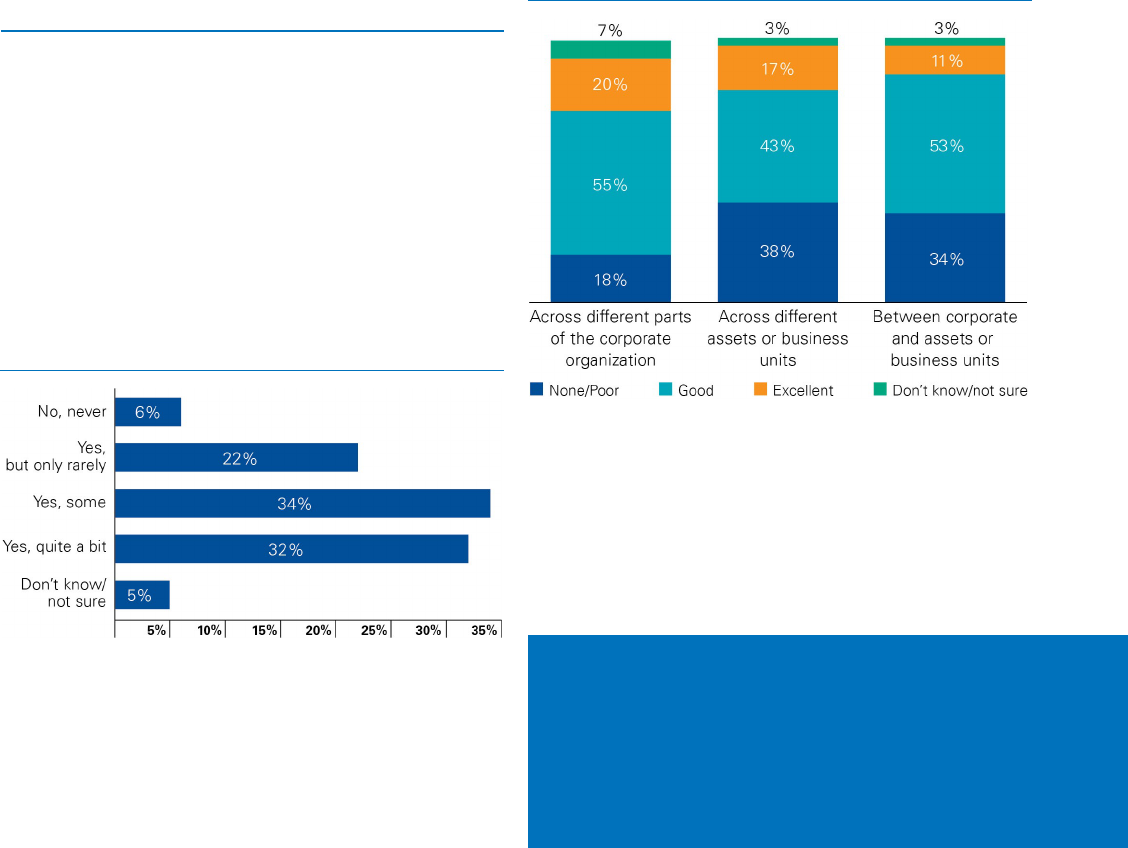

In your experience, is decision making signicantly

slowed and/or made inefcient by the desire

to ensure corporate planning models are fully

reconciled with asset and operational plans?

May not equal 100% due to rounding

Perhaps most concerning is that approximately one

out of three respondents indicated there was poor or

no collaboration at all between business units and the

corporate organization, or among various business units.

The resulting incongruous data assumptions among

parties leads to time wasted trying to reconcile models,

and a lack of trust or confidence.

How would you characterize the level of

collaboration between planning teams within

your organization?

May not equal 100% due to rounding

One of the more intriguing results from the survey was

that minimizing staff burnout is an issue for 83 percent

of respondents’ organizations and is the single largest

area of concern for both executive and non-executive

respondents evaluating their own planning technology

and systems.

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

7

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

8

Oil and gas production from unconventional sources is

at an all-time high, and energy companies are projecting

continued capital expenditure in shale projects for

the next decade and more. Yet, most industry

participants are failing to achieve healthy returns on

their investments in unconventional assets.

Capital efciency of independent E&Ps* ROCE

(2012–2016)

The dynamic nature of unconventional onshore drilling

programs requires greater collaboration, communication,

and synchronization among various levels of

organizations and across assets in order to efficiently

and effectively adopt new learnings and address

changing market conditions—a marked difference from

large offshore mega projects for which major business

decisions must largely be made up front before project

execution. Organizations have been slow to adjust their

business practices, and they have suffered as a result.

Indeed, even while many companies tout a new “factory

model” of unconventionals as a volume-driven, margin-

focused business, we still see the creep of legacy

planning practices into this supposedly new approach.

Many E&Ps continue to plan on an annual cycle, place

greater focus on production over other metrics, and

create budgets based on final project delivery.

The ability to constantly tweak and adjust an

unconventional asset base leads to a desire for more

detail at a more granular level than before. This feedback

loop creates added bulk in the system, which results in

less planning agility within a system explicitly designed

to exploit the same.

Ultimately, while the nature of oil and gas assets have

changed, traditional planning processes have largely

stayed the same.

Our survey data points to a clear divide between the stated

importance of planning and the reality of its execution. But before

oil and gas companies can begin to fix the issues, they must

first diagnose why this division exists. We see five obstacles to

change that help to explain why the effectiveness gap exists,

and why improvement is such a challenge.

Diagnosing the

effectiveness gap

Heritage business practices don’t work in today’s

environment where unconventional assets play a key

role for most operators.

1

*Return on capital employed (ROCE) analysis conducted on 17 of the largest

independent shale producers

Source: CAP IQ

Target ROCE

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

9

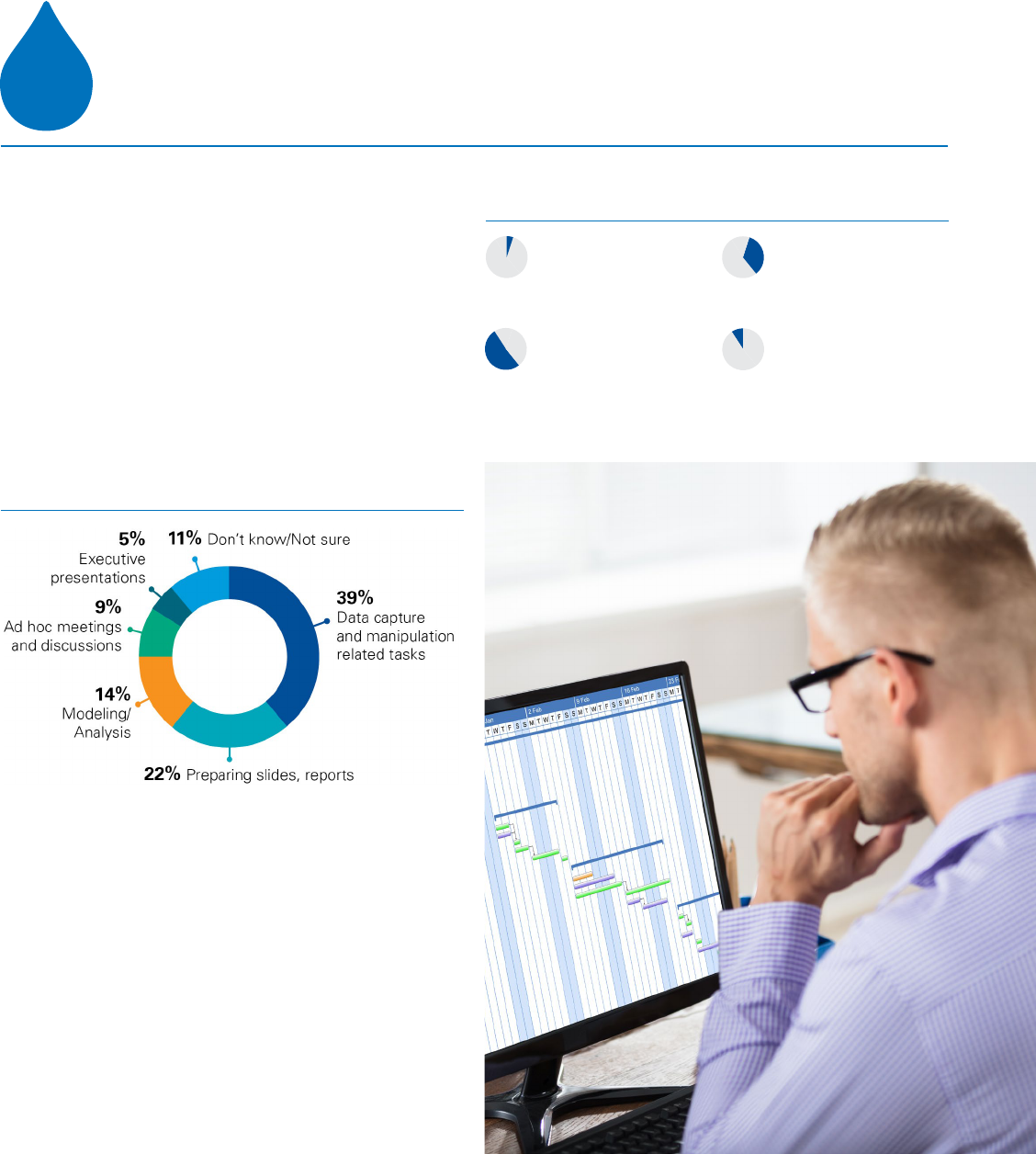

Low-value-added activities such as manual data

gathering and report generation occupy too much time

from high-value staff. Our research broadly supports that

poorly constructed planning systems shoulder a large

part of the blame.

Data-related endeavors appear to be particularly

egregious offenders. Almost 40 percent of respondents

indicated data-related tasks were the single largest

draw on their time, while only one in seven survey

respondents indicated they spent more time on

modeling and analysis.

Over the course of a year, which of the following

type of task consumes the largest amount of your

organization’s planning time?

Our results suggest these may be symptoms of a larger

problem: planning systems are not enabling staff to

allocate high-value time to high-value activities. Only

one in ten respondents said their organization’s planning

systems (encompassing data, information, and tools)

were “very” integrated, while 39 percent said their

organization’s systems were “minimally” integrated or

not integrated at all (the two lowest choices offered).

How well integrated are your organization’s planning

systems (including data, information, and tools)?

May not equal 100% due to rounding

Existing planning information systems are simply not

up to the task.

2

5%

Not integrated at all Minimally integrated

34%

51%

Somewhat integrated Very integrated

9%

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

10

In fact, at least a third of respondents identified critical

weaknesses or at the very least a need for improvement

among every area of the planning system, including

speed, insight, ease of use, reliability, cost, and burden.

Rate the performance of your organization’s

planning technology and systems in the following

areas:

May not equal 100% due to rounding

Importantly, a planning system includes more than

pure software and tools. Processes also are suffering

from underinvestment. Only one in three respondents

thinks there is an appropriate amount of standardization

in planning across their organization, and even fewer,

one in ten, believes their organization has “strong”

governance.

How would you describe the current governance

model that is in place to manage changes to critical

planning input data (e.g., decline curves, drilling cost

assumptions, etc.)?

May not equal 100% due to rounding

Further, 30 percent of respondents say they do not

perform any type of routine lookback analysis.

Does your company perform meaningful lookbacks

or reviews in an effort to course correct or drive new

learnings?

May not equal 100% due to rounding

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

11

The dynamics between groups within the planning

process appear frayed. Nowhere is this more apparent

than between operating elements of the company and

the central corporate structure.

A significantly high 84 percent of respondents describe

some level of distrust and a lack of transparency

between business units and corporate.

In your opinion, how would you describe the

level of trust and transparency between corporate

and assets?

When asked about the level of “collaboration” between

the two, one in three respondents described the

interaction as “poor” or “none.”

Our results also suggest a similar gulf between senior

management and line staff, with the former having a

more positive perception of value, performance, and

capability of the company’s planning function.

Executives were more likely to self-grade their

organization as outperforming their peers and were

more likely to agree with statements such as “there is

clear strategic intent for each asset” and “planning is

integral to driving long-term performance.”

As it relates to your opinion of your organization

today, please indicate the extent to which you agree

or disagree with the following statements.

May not equal 100% due to rounding

In our work with E&P clients, it was not uncommon to

see teams add “buffers” to their planning submissions,

or likewise, corporate planning modify data submissions

to “fix” them. While we cannot assign causality, our

findings do suggest this behavior is correlated to a

material erosion of trust throughout the organization.

While some degree of tension between teams seems

natural, we see our results as evidence of more than

that, with potentially dire consequences. If executives

cannot trust what they are hearing, a fundamental value

of planning is lost.

Cultural barriers and lack of trust hinder

development.

3

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

12

While leading practices in strategic planning are not yet

widespread, several leading practices are coming to the forefront.

There is a move toward a more

dynamic planning model, as

36 percent of respondents indicated

that they are updating their capital

budgets on a quarterly basis.

Systems are becoming more

integrated, with 46 percent of

respondents indicating that their

systems are at least somewhat

integrated.

Organizations are shifting away

from complete reliance on Excel

as the primary tool for planning,

with 60 percent of respondents

investing in a commercial planning

system.

Bright points:

Emerging technologies and solutions

Survey participants also showed excitement around

several technology advancements on the horizon.

Data platforms and integration.

The market is moving toward one

integrated platform, compared to

the separate tools used by different

groups today.

Market intelligence and data

analytics. Increasing amounts of

market and competitor data are

available, enabling faster, better-

informed target analysis.

Risk and uncertainty. New tools for

project characterization and portfolio

modeling are enabling oil and gas

companies to better incorporate risk

in their planning strategies as well as

gauge uncertainty around technical

forecasts and their ability to achieve

goals. Companies will continue

to develop capabilities to apply

probabilistic planning methodology

to supplement traditional

deterministic approaches.

Improved portfolio analysis will

determine the most efficient project

mix selection, allowing management

to focus on risk appetite rather than

on project return expectations.

Which of the below technologies do you think represent promising

near-term (within three years) advancements for planning in the

upstream oil and gas industry? (select all that apply)

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

13

What E&Ps told us

about planning:

The Top 10 survey

takeaways

Oil and gas companies believe

their planning functions can

provide signicant value, but

results are falling short of

expectations.

One

Staff burnout is the biggest

issue facing planning

organizations today, with four

in ve respondents citing it as

a weakness.

Two

Much effort is wasted on

data manipulation and report

generation, rather than spent

on generating insights to help

run the business.

Three

The typical lack of integration

between systems only makes

data access and analysis even

more difcult.

Four

Executives have a generally

positive view of their

planning organization’s

capability and effectiveness,

but this rosy view is not

shared by their staff.

Five

Most E&Ps experience distrust

and a lack of transparency

between business units and

corporate, hampering the

planning process.

Six

Planning organizations need

greater standardization as

few organizations have

meaningful requirements or

governance models in place.

Seven

Probabilistic information is

rarely incorporated into

planning work, yet the

consensus is that doing so

would improve results, either

somewhat or substantially.

Eight

The majority of companies

have the capital to invest in

planning improvements; the

chief obstacles are prioritizing

planning against other

initiatives and having staff

time to support the work.

Nine

Despite the obstacles,

companies are currently

investing in growing their

future planning capabilities

with a focus on data

integration, quality and

consistency, and improved

analytic capability.

Ten

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

14

Survey participants largely agree that their organizations’

planning processes are integral to driving competitive

performance and believe their companies should invest

in planning capabilities.

But we have found that even the organizations that

deem planning important still don’t prioritize efforts to

improve it.

How much investment should your organization be

making over the next year in improving its planning

capabilities?

May not equal 100% due to rounding

Planning competes for attention and resources

against other organizational imperatives that are often

considered more critical to value generation. One reason

improvements in planning may not rise to the top of the

priority list is that any weaknesses in the process may

not be visible to the executives.

For instance, consistent standards across an

organization both ease the process for the planning staff

and increase executive confidence in the results. When

asked to what degree planning is standardized across

the organization, 60 percent of executive respondents

said it was at the appropriate level, while only 33

percent of the non-executives responded that this was

the case.

To what degree is planning standardized across

your organization?

May not equal 100% due to rounding

Oil and gas executives have poor visibility of

the front line from the top.

4

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

15

Additionally, 29 percent of executives surveyed thought

that data capture and manipulation was the most

time-consuming aspect of the planning process, while

43 percent of non-executives reported that it was.

Over the course of a year, which of the following

type of task consumes the largest amount of your

organization’s planning time?

May not equal 100% due to rounding

Only 25 percent of executives stated that their planning

systems were minimally integrated or not integrated at

all, while 44 percent of non-executives responded that

this was the case.

How well integrated are your organization’s planning

systems (including data, information, and tools)?

The result is a catch 22. Staff in the trenches who

personally experience the pain and see the inefficiencies

don’t feel they have the authority or the mandate to

improve the situation. Meanwhile, executives who might

logically have such a mandate are buffered from the

realities.

Improving planning requires full

alignment across the organization;

here’s where to start.

Even though many companies have recently launched

targeted initiatives to make improvements to their

planning process, they continue to struggle.

Part of the problem is that the scope of integrated

planning varies considerably across, and at different

levels within, the organization, leading to disagreement

about what problems need to be solved, and in what

sequence. Often so many disciplines have a hand in

the process it requires a major cross-functional,

coordinated, and vision-led effort to realize meaningful

benefits from change.

Further, our survey results suggest many practitioners

define planning based on their individual roles within

their organization, rather than through a more holistic

approach. With such a limited view on what issues

are actually driving the pain points within planning,

organizations are often unable to pinpoint what actually

needs to be improved.

The complex cross-functional nature of planning

can obscure the vision for what planning ultimately

should be.

5

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

16

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

17

Adopting a dynamic

operating model

Leading companies are adopting operating models designed

for today’s more dynamic oil and gas industry environment.

Executives that clearly define objectives for their planning function

and align their operating models accordingly are better able to

lead their organizations and deliver differentiated performance.

Future state operating model

Governance

New process model requires increased clarity

of decision rights due to shared information,

increased collaboration, as well as segmented

organizational roles

Management

processes

A defined, integrated,

dynamic, and well-understood

process model; quarterly

cycle, which allows more

frequent plan updates

with more forward-looking

information

Information ow

and tools

System architecture

tailored to accommodate

unconventional

requirements; standardized

and accessible information;

common tools with less

manual work-arounds; robust

management of change

Roles and structure

Well-defined roles in a

streamlined, fit-for-purpose

structure that is aligned with

new process model; elimination

of duplication of work tasks;

clear accountabilities

Metrics and incentives

A common view of value

drivers and performance

objectives; cascading metrics

through the organization

fostering “line of sight” and

stewardship; competitive

comparisons

Behaviors and culture

Adherence to agreed-upon behavioral

norms and standards enabling

heightened speed and quality of

decisions; increased collaboration and

transparency across organization

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

18

— A more dynamic, fully integrated planning process

and performance management model

— Planning calendar is balanced and integrated across

asset and corporate requirements

— Performance reviews, lookbacks, and data refreshes

have a defined cadence and are done in sync with a

planning cycle purpose-built around the dynamic

nature of the company’s business

Management processes

— Source data is used for both asset- and corporate-

level planning

— Tools are standardized across assets, providing for

more like-to-like comparison

— System architecture and data flows are well known

and integrated to allow information to be easily

accessible throughout the organization

Information ow and tools

— Organizational model is designed to provide clear

ownership and accountability

— Roles are clearly defined and aligned to process

model, eliminating duplicative work

— Central planning team established with embedded

planning resources in the asset

Roles and structures

— Clear line of sight exists on how functional level

metrics align to corporate goals

— A competitive intelligence capability exists, allowing

true external performance comparison

— Metrics and definitions are standard across assets,

allowing for true performance comparison

Metrics and incentives

— Delegation of authority is right-sized to allow

decisions to be made at the correct level within the

organization

— Adequate controls are in place to help ensure assets

are following standard process and guidelines

— Clear decision rights and trust exist across planning

roles, eliminating need for duplicative activities and

excessive oversight

GovernanceBehaviors and culture

— Trust exists across organization levels with full

transparency of analysis and planning results

— Collaboration exists across planning teams,

encouraging leading practice sharing and solutions

— Behaviors are consistent with dynamic nature of

business, accepting metric tolerance levels,

directional plans, and making decisions based on

imperfect information

Examples of leading practices associated with the

six elements of the future state operating model

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

19

The path to a future state

operating model can

seem challenging, but the

rst step in a successful

transformation is triage:

understanding where

problems exist (or don’t),

and which problems are

most severe.

Below is a planning process Maturity Chart describing levels 1 through 4

for each of the elements of the planning operating model, with level 1

representing the least favorable performance, and level 4 representing

leading practices.

You can use this chart as an assessment tool by marking where your

organization’s integrated planning process is today, as well as your goal

level, to help determine the changes required to achieve leading practices.

Note that level 4 across all operating model elements is not the right

goal for every organization. Rather, the right level depends on the role and

objective of the planning function, as well as on size and complexity of

your organization.

Maturity levels

1 2 3 4

Information ow

and tools

Limited to no systems,

rely on manual

spreadsheets

Functional-based

solutions with limited to

no integration

Functional-based

solutions linked together

via homegrown

solutions

Fully integrated system

architecture with

standard tools and

information flow

Management

processes

No defined process,

rely on employee

experiences

A few processes are

defined, but are used as

guidelines

Each functional

department has

established processes,

but limited integration

Fully defined and

integrated process

model aligned to current

strategy

Roles and

structure

No clear structure

exists, rely on individual

skills and experiences

Structure exists, but

roles not well defined,

creating duplicative

activities

Structure exists and

roles defined across

functional departments

Well-defined roles in a

fit-for-purpose structure

aligned with process

model

Metrics and

incentives

Limited to no metrics or

performance objective

used throughout the

organization

Outcome-based metrics

in place, primarily

used for financial

performance

Outcome-based metrics

in place with clear

performance objectives

Cascading value-based

metrics fostering

performance objectives

Governance and

decisions

Unclear decision rights

and limited to no

governance model in

place

Top-down decision

rights and governance

model in place

Delegation of authority

established but decision

rights are still unclear

Well-defined and clear

decision rights aligned

to dynamic operating

model

Behaviors and

culture

Opt-out culture, with

lack of trust and inability

to have honest dialogue,

and excessive company

politics

A micromanaging

culture with limited trust

between corporate and

assets

Target behaviors have

been established

but not consistently

demonstrated across

organization

Adherence to behavioral

norms and standards

enabling heightened

speed and quality of

decisions

Assess your

planning process

Develop an honest

baseline.

Assess your company using the

Maturity Model, considering all

areas of the dynamic operating

model. Many companies jump the

gun and focus on one area such

as information flow and tools.

This is insufficient and can prolong

the transformational process or,

worse yet, sap the organization of

focus and effort to support broader

change.

Resist the temptation to rely on

the perceptions of a few people.

Assess your organizational maturity

by gathering perceptions across

different levels and different areas

within the planning process.

Consider using the structure,

questions, and findings of this

survey to conduct an internal

information-gathering exercise.

Once you have adequately assessed

your current process, compare

your findings to the maturity model

and place a dot on the place in the

model that best describes your

current state.

While level 4 scores across all

operating model elements are not

needed by every organization, a

total score of less than 20 suggests

changes to some or all elements

of the model may provide material

value gains to the organization.

Benchmark against

leading practices.

Determine at what level on the

maturity model your organization

should be in order to fulfill the

defined role of the planning

function and have a high-performing

integrated planning process.

Once you have determined the

appropriate target level across

each one of the operating model

elements, place another dot on the

maturity model.

This exercise identifies the areas

of the operating model that need

the most improvement in order to

reach target performance. The

assessment can then be used to

help communicate to others within

your organization to determine the

degree to which your planning

process needs to improve, as well

as prioritize the areas likely to drive

the greatest impact.

Articulate the need

for improvement

Develop a plan for communicating

the need for change. The following

is a list of questions to help your

organization think about how to start

the journey:

— Do we have a clearly defined and

understood role and objective for

the planning function?

— Are company leaders able to

effectively utilize existing planning

processes to deliver superior

performance? Is planning a

source of competitive advantage

for our organization?

— What elements of the operating

model should be changed?

— What degree of change will be

required, and what would be the

scope of change? What would be

the value of improvement in just

one area of the operating model?

— What level of support from senior

leadership will be needed?

— Do we have adequate resources

and know-how to deliver a

planning transformation, and are

there opportunities to engage

with external experts?

— What is the organization’s

readiness for change?

Step 1 Step 2 Step 3

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

21

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

22

Case Study:

The power of the cloud and a window

into the future of E&P planning

The challenge will sound familiar to

any large operator: This upstream

producer was struggling to

consistently forecast its production

due to well failures and unplanned

maintenance events. As a result,

the company could not make timely

contracting decisions around

short-term capacity.

Complicating this problem was

scale: the company’s position

included many thousands of wells

with an intricate gathering structure

and a complex economic model.

This limited the company’s ability

to run “full asset” scenarios, as

such analysis required computing

power beyond their existing desktop

computing capabilities.

The company sought an integrated,

full-field system that would shrink

the “time to decision” of the old

spreadsheet and Access-based

systems.

Deploying a multitenant, cloud-

based asset development solution

gave the subsurface, economics

and commercial teams a single

workspace in which to collaborate.

The solution was designed so

that individual plan components

(subsurface characterizations,

surface constraints, etc.) could be

contributed by the appropriate team

but would be viewed and analyzed

as a holistic, integrated system.

The cloud-based architecture of the

solution allowed any individual user

to recruit additional processing

power on demand. A user had the

ability to access up to 20 times their

base computing allotment, with no

IT intervention or behind-the-scenes

scripting required.

This capability facilitated one team

in developing a field-wide Monte

Carlo-based assessment of well

failure timing, enabling a more

accurate prediction of when wells

would experience production

impairments and to what degree.

This analysis was ultimately

systematized and applied to

company’s ongoing monthly

production forecasting process.

The new system ultimately

provided the client a 60 percent

reduction in overall process time

and took a forecast of operating

activities from +/- 20 percent

accuracy to 1.09 percent in their

most recent lookback period.

The cloud made massively scalable

computing power easily available

for modeling complicated integrated

problems, allowed integration with

third-party applications through

Web services, and provided data

security and backup. Additional

improvements included the

following:

New capabilities for risk and

uncertainty analysis:

Large-scale Monte Carlo simulation

was now possible as a result of

additional off-site computing

resources that could be tapped

as needed.

Increased transparency:

An integrated system meant data

transformations were controlled

and models could be shared

across teams (or even to partner

companies), all within a single

framework.

Better IT performance:

Dynamic version and user control,

automated deployment/upgrades,

and low overall Total Cost of

Ownership (TCO) are all part of the

improved experience.

The challenge The change The business impact

Source: 3esi-Enersight, Houston, 2016

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

23

23Integrated planning for a dynamic oil and gas industry

Concluding thoughts

The pace of change challenging the upstream oil and gas

industry is unlikely to slow. As the business and technical

environment becomes increasingly difficult to predict

and adapt to, the importance of agile, effective planning

grows. Organizations that are equipped to analyze, plan,

and manage an integrated view of their strategy and their

operations will have an edge over their competition.

We anticipate that this survey will prove to be a valuable benchmark

against which the industry can measure the effectiveness of its

planning processes. This year is just the beginning, as oil and gas

companies learn about and implement additional leading practices.

Future analysis of the sector will shine a light on our collective

success in addressing challenges such as staff burnout, trust, and

transparency, as well as incorporating technical advances in areas

such as data integration and probabilistic analysis. We look forward

to sharing updates on the industry’s progress with you.

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

24

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

25

The information contained herein is of a general nature and is not intended to address the circumstances of any particular

individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such

information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon

such information without appropriate professional advice after a thorough examination of the particular situation.

The KPMG name and logo are registered trademarks or trademarks of KPMG International.

© 2018 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent

member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2018 3ES Innovation Inc. All rights reserved.

The 3ES, 3esi and Enersight names and logos are registered trademarks or trademarks of 3ES Innovation Inc.

Some of the services described herein may not be permissible for

KPMG audit clients and their affiliates or related entitites.