2023 Annual Report

Even small seeds

planted today can

change the landscape

of tomorrow.

The Catholic Community Foundation makes it easy for

you to cultivate change for generations—strengthening

schools and religious education programs, parishes,

agencies and families. We focus on Catholic causes

as well as those that advance the Church’s mission,

enhancing education, leadership development, health

care for the underserved, and community-building.

Our first step is to help you find the approach that fits

your beliefs and goals. This year’s report shows how

the late Paul and Elise “Pud” Meyer set an example

of giving for their children—and chose The Catholic

Community Foundation to make a dierence in

perpetuity. For their story, see page 2.

Through cost-eective, socially responsible investment

management, carefully considered grants, and ongoing

monitoring, the Foundation and our donors help a

wide range of charitable organizations that make

Southeastern Wisconsin a better place for us all.

At our fiscal year-end, Foundation assets—the source

of this help—were $146.9 million. Grant awards totaled

$2.18 million in fiscal 2022/23 and more than $18.0

million since our inception in 2001. The most recent

recipients are listed starting on page 8.

As a not-for-profit 501(c)(3) corporation, the Foundation

is independent of the Archdiocese of Milwaukee.

Our board of directors includes Catholic religious

and community leaders. With our donors, we sustain

and advance Catholic values here in Southeastern

Wisconsin.

We’re ready to help you cultivate long-term results. Let’s

talk about your legacy—and the best way to support the

causes that matter to you.

Dave Strelitz

Chairman of the Board

Mary Ellen Markowski

President

DEAR FRIENDS,

1

SINCE 2001, The Catholic Community

Foundation has supported effective

philanthropy in Southeastern Wisconsin

through two main roles:

• Helping donors establish permanent

charitable funds to create long-lasting

support for the causes they care about

• Offering parishes, schools and other Catholic

organizations cost-effective, socially

responsible investment management to keep

endowment assets growing

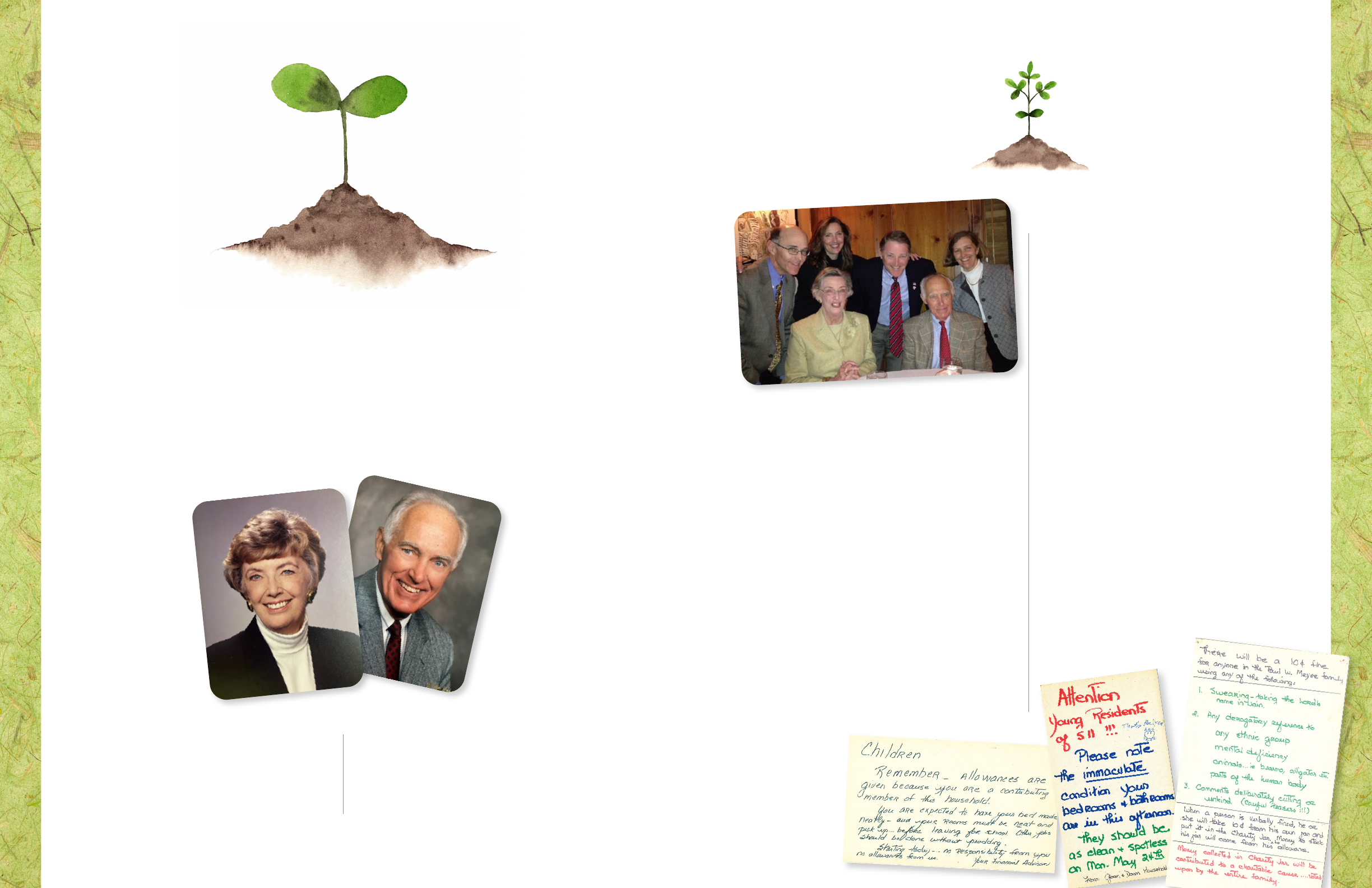

When the four Meyer siblings were

growing up, they often

came home from school

to find notes from

their mother tacked

up in the back hallway.

The messages were

humorous but pointed:

Put your “junk” away

before playing. Don’t eat

in the den, or “o with

your head!” Do your chores

without prodding – “no

responsibility from you, no

allowances from us.” That

last one was signed “Your

Financial Advisor.”

“My parents made their expectations clear, and it was done

with love,” says Cami Meyer. “They held themselves to the

same standards.”

Paul and Elise “Pud” Meyer cultivated a sense of respect,

responsibility and service in their family. They taught by

FOR THE FAMILY, AND FOR OTHERS

Cami says her parents also passed on lessons in saving.

“Dad was not frivolous. He had run a trucking company, and

he would wear the old uniforms when he was working in the

yard,” she says. “People would stop and ask if they could hire

his firm.”

But he was ready to spend money when it mattered—for

example, taking the children on trips. “My mom and dad saved

to take care of the family, and to help others,” Cami says.

The Meyers’ belief in sharing their blessings ultimately led

them to The Catholic Community Foundation.

“As they got older, they saw that the trend of their giving

was more and more Catholic. A neighbor, John Herbers, who

happened to serve on the board, asked if they’d heard of the

Foundation,” Cami says. “When my parents looked into The

Catholic Community Foundation, they said, ‘Ahhhh.’”

CULTIVATING

SERVICE

example throughout their lives,

participating in

numerous volunteer

organizations.

“My dad was a proud

Rotarian for 50 years,”

Cami says. “And we

nicknamed my mom

‘Committee Woman.’

She was on every kind of

committee and board you

could think of.”

When the Meyers volunteered,

they expected their children to

join in, be it stung envelopes

for fundraisers or wrapping presents for

a Christmas toy drive. Cami remembers

helping prepare a residence hall for a women’s shelter. “My

dad and my brothers were outside doing yard work, and my

mom and sister and I were inside scrubbing the house from

top to bottom.”

A BELIEF IN CATHOLIC EDUCATION

Meanwhile, John recruited Cami for the Foundation’s board.

She brought her parents to the annual donor reception, which

Cami says was the final selling point.

“They heard 8th grade students from Notre Dame School of

Milwaukee speak about the importance of Catholic education,

and they were so impressed,” she says.

The Meyers met with Foundation President Mary Ellen

Markowski to talk about what they wanted to accomplish.

“Over the years, their donations had followed our schools and

the schools they had attended,” Cami says. “They always told

us, ‘Your education is the best thing we can give you.’”

Today, the Elise T. and Paul W. Meyer Fund supports several

Catholic schools. Cami says it was especially important to her

parents that after their deaths, their gift would continue to go

to programs in keeping with the Catholic faith.

It’s a sentiment she shares.

“I set up my own donor advised fund. When I’m gone, it

converts to a donor designated fund, going to my parish and

various Catholic entities that I’ve supported,” she says. “I

know how much work the Foundation sta does in vetting

the applications, vetting the agencies. I like knowing that my

money will help people in need, supporting organizations that

I’m comfortable with and that

I believe in.”

Elise and Paul Meyer

e Meyer family

32

How You Can

CULTIVATE

CHANGE

THE CATHOLIC COMMUNITY

FOUNDATION supports causes that

further the Church’s mission. As a perpetual

endowment, the Foundation seeks ongoing

growth to meet ever-growing needs. We

make philanthropy easy. You support

important causes while reaping the benefits

of professional investment management and

experienced charitable fund administration.

Start a fund, or give to an existing fund, with

a gift of cash, securities or other assets.

We can help structure your giving to fit your

goals.

Your gift is pooled with other funds in a

diversified, socially responsible investment

portfolio to minimize costs and maximize

return potential.

Investment returns add to your fund,

supporting grants for your causes.

You can be as involved as you choose in the

annual grant awards.

Robert T. Bautch and Randi L. Bautch Fund

Joseph F. and Catherine M. Bennett Family Fund

Fred and Karen Bersch Family Fund

Les and Erin Blum Family Fund

Andrew F. Boldt Memorial Scholarship Fund

Ralph A. Breit Fund

Bishop Brust Memorial Fund

The Rose M. Buckarma Fund

Building the Faith General Fund

James and Mary Crewe Rome Fund

Reverend Leslie Darnieder Scholarship Fund

Sarah M. Dean Fund

DePorres Scholarship Fund

Directors Legacies of Faith Fund

Henry and Francine Ducat Fund

Education Endowment Fund

Fischer Family, Our Lady of the Lake Fund

Grace Fund

Gra Family Fund

Carl Groth Endowment Fund

Carl and Ethel Groth Endowment Fund

Brian D. Hanley Fund

Father Gerald B. Hauser and John and Ruth Kegel

Priesthood Scholarship Fund

John C. (Jack) and Hildegard A. Heegeman Scholarship Fund

The Help Fund

John A. and Norma J. Herbers Fund

Debra A. Hintz Lay Ministry Fund

RWH and EMH Estate Fund

JCC Fund

J.O. Johnson, Victoria M. Johnson and

Eileen K. Johnson Fund

Rev. Carl M., Eugenia, and Lauretta Kazmierczak

Priesthood Support Fund

Judith A. Keyes Family Fund

Audrey J. Komarek Fund

Legacy Fund for Tomorrow’s Present: A Lasting Tribute

to the Work of Lisa-Marie Calderone-Stewart, Ed.D.

Through the Foundation, you can give to a

Catholic cause or causes that further the

Church’s mission, primarily in Southeastern

Wisconsin.

Your gift is invested in a permanent endowment,

from which we award grants each year. Choose

from the following fund types, naming your fund

to reflect your philanthropic purpose.

ADVISED FUND

You recommend charitable organizations for grants,

with the option to change recipients from year to

year. Advised funds may oer you more advantages

than a private foundation.

DESIGNATED FUND

You create a fund to benefit one or more specific

charitable agencies or organizations.

FIELD OF INTEREST FUND

You indicate a charitable area of interest, and we

find grant recipients in that area.

UNRESTRICTED FUND

You give the Foundation full discretion in

awarding grants.

SUPPORTING FOUNDATION

Private foundations are welcome to become part

of The Catholic Community Foundation.

A LASTING LEGACY

Cami says her parents were quiet givers. “They didn’t attend a

lot of donor events. They didn’t want stu named after them,”

she says. “They gave because they believed, because it was

important to them.”

And their lesson was passed

on, as clearly as if it had

been written on a notice in

that back hallway. Today the

Meyer siblings all continue

to be active volunteers,

supporting a variety of

nonprofits.

“We do it because that’s

what Mom and Dad did,”

Cami says. “They always

believed that we had been

blessed as a family, and

they taught us that we

should give back.”

DONOR FUNDS Within the Foundation

Helping donors establish permanent charitable funds to create

long-lasting support for the causes they care about

54

Many of these agencies have multiple funds

All Saints Catholic East School System

Archdiocese of Milwaukee

Blessed Sacrament-Milwaukee

The Cathedral of St. John the Evangelist-Milwaukee

Catholic Charities Foundation Endowment Fund

Christ King-Wauwatosa

Congregation of Good Shepherd-Eden

Divine Savior Holy Angels High School

Faith In Our Future Trust

Holy Family-Fond du Lac

Holy Family-Whitefish Bay

Holy Name of Jesus-Sheboygan

Holy Sepulcher Cemetery-Cudahy

Immaculate Conception-West Bend

Lumen Christi-Mequon

Marquette University High School

Messmer Catholic Schools

Milwaukee Archdiocesan Oce for World Mission,Inc.

Our Lady of Divine Providence-Milwaukee

Our Lady of Good Hope-Milwaukee

Our Lady of the Holyland-Mt. Calvary

Our Lady Queen of Peace-Milwaukee

Sacred Heart-Racine

Sacred Heart of Jesus Congregation, St. Francis

St. Alphonsus-Greendale

St. Alphonsus-New Munster

St. Andrew-Delavan

St. Anthony on the Lake-Pewaukee

St. Bernard-Wauwatosa

St. Boniface-Germantown

St. Catherine-Milwaukee

St. Charles-Hartland

St. Charles Borromeo-Burlington

St. Dominic-Brookfield

St. Edward-Racine

St. Eugene-Fox Point

St. Frances Cabrini-West Bend

Saint Francis de Sales Seminary

St. Gregory the Great-Milwaukee

St. James-Mukwonago

St. John XXIII-Port Washington

St. John the Evangelist-Twin Lakes

St. John Vianney-Brookfield

St. Leonard-Muskego

St. Lucy-Racine

St. Luke-Brookfield

St. Martin de Porres-Milwaukee

St. Mary-Dover

St. Mary-Kenosha

St. Mary-Menomonee Falls

St. Mary-Waukesha

St. Mary’s Visitation-Elm Grove

St. Matthew-Campbellsport

St. Matthew-Oak Creek

St. Patrick-Racine

St. Patrick-Whitewater

St. Paul-Milwaukee

St. Peter-Kenosha

Ss. Peter and Paul-Milwaukee

St. Pius X-Wauwatosa

St. Richard-Racine

St. Robert Bellarmine-Union Grove

St. Roman-Milwaukee

St. Sebastian-Sturtevant

St. Stephen-Oak Creek

St. Veronica-Milwaukee

Salesianum Alumni A/E Association

The Sheboygan County Catholic Fund, Inc.

Society for the Propagation of the Faith

Three Holy Women-Milwaukee

Waukesha Catholic School System, Inc.

Raymond G. and Theresa L. Markowski Family Fund

Robert L. and Elizabeth J. McGlynn Fund

Camela M. Meyer Fund

Elise T. and Paul W. Meyer Fund

Mission Fund

Mary Agnes Navin Fund

Mary A. Navin II Fund

Frank Ortner Charitable Fund

Stanley and Shirley Planinsheck for Holy Angels School Fund

Reverend Eugene S. Pocernich Rice Bowl Fund

The Sacred Heart Fund

St. Aemilian Fund

St. Anthony Fund

St. Gerard Association Endowed Scholarship Fund

Bishop Richard Sklba Biblical Programs Fund

Bishop Richard Sklba for Ecumenical and Interreligious

Programs Within the Ten Counties of Southeastern

Wisconsin Fund

Marilyn C. Schmit, PhD Fund

Allen and Diane Spaeth Charitable Fund

Fr. William Stanfield Charitable Trust

Archbishop Rembert G. Weakland Fund

Whelandale Trust

Wieber Family Fund

Dallas and Marie Wixom Fund

Yaniak Fund

DONOR FUNDS continued

AGENCIES

The Foundation’s assets under management include endowment funds of local parishes,

schools and other Catholic organizations. Funds are pooled in a well-diversified, socially

responsible portfolio to maximize cost savings and investment performance.

76

Adult Learning Center

All Saints Catholic School, Kenosha

Andean Health & Development

Angel of Hope Clinic at Hope House

Archdiocese of Milwaukee

ARISE

Audio & Braille Literacy Enhancement, Inc.

Bakhita Catholic Worker House

Bells of St. Mary

Benedict Center

Bread of Healing Clinic

Broadscope Disibility Services

Burlington Catholic School

Cardinal Stritch University

Carmelite Sisters of the Divine Heart of Jesus

Casa Romero Renewal Center

Cathedral Center

Cathederal of St. John the Evangelist

Catherine Marian Housing

Catholic Central High School

Catholic Charities

Catholic Memorial High School

Catholic Relief Services

Chosen, Inc.

College Possible

Community Smiles Dental

Congregation of Holy Angels, West Bend

Cristo Rey Jesuit High School

Crosier Fathers

Discalced Carmelite Friars of Holy Hill, Inc.

DISMAS Ministry

Divine Mercy School

Divine Savior Catholic School, Fredonia

Divine Savior Holy Angels High School

Dominican High School

Edmundite Mission

Family Promise of Western Waukesha County

Feeding America Eastern Wisconsin

Foundation for Religious Retirement

Franciscan Peacemakers, Inc.

The Gathering of Southeast Wisconsin Inc.

Gesu Parish

Glenmary Sisters

Hebron Housing Services

Hmong American Friendship Association, Inc.

Holy Apostles School, New Berlin

Holy Family Parish, Fond du Lac

Holy Family Parish School, Whitefish Bay

Hope Center, Inc.

House of Peace – Capuchin Community Services

Hunger Task Force

IMPACT, Inc.

Jesuit Refugee Services

John Paul II Academy

Lake Area Free Clinic, Oconomowoc

Marquette University

Marquette University High School

Maryknoll Fathers and Brothers

Maryknoll Lay Missioners

Maryknoll Sisters

Medical College of Wisconsin

Messmer Catholic Schools

Milwaukee Catholic Home

Milwaukee Christian Center

Milwaukee Habitat for Humanity

Milwaukee Homeless Veterans Initiative

Milwaukee Rescue Mission

Missionary Oblates of Mary Immaculate

Nativity Jesuit Academy

New Threads of Hope

Notre Dame of Milwaukee School

Oce for World Mission

Oce of the Propagation of the Faith

Penfield Children’s Center

Peru Catholic School

Philippine Cultural & Civic Center Foundation

Pius XI High School

Prevent Blindness Wisconsin

Priests of The Sacred Heart

Project RETURN, Inc.

Province of St. Joseph of the Capuchin Order

Safe Place for Newborns

St. Alphonsus Parish School

St. Andrew Parish School, Delavan

St. Ann Center for Intergenerational Care

St. Benedict the Moor Parish

St. Ben’s Clinic at The Cathedral Center

St. Ben’s Community Meal – Capuchin Community Services

St. Bruno Parish School, Dousman

St. Catherine High School, Racine

St. Charles Borromeo School

St. Eugene School

Saint Francis de Sales Seminary

St. Francis of Assisi Parish

St. Joan Antida High School

St. John the Baptist Parish School, Plymouth

St. John the Evangelist Parish School

St. Joseph Parish, Grafton

St. Joseph Parish School, Big Bend

St. Lawrence Seminary, Mt. Calvary

St. Leonard Parish School, Muskego

St. Mary Parish School, Hales Corners

St. Mary Springs High School, Fond du Lac

St. Mary Visitation

St. Matthew Parish School, Oak Creek

St. Peter Parish, Slinger

St. Thomas More High School, Inc.

St. Vincent de Paul Society

Salesian Missions

Salvatorian Mission Warehouse

Salvatorian Priests and Brothers

School Sisters of Notre Dame

School Sisters of St. Francis

SecureFutures Foundation

Senior Companion Program

Serenity Inns

Seton Catholic Schools

Seton Dental Clinic

Siena Catholic Schools of Racine

Sisters of St. Francis of Assisi

Sisters of the Divine Savior

Soaring Eagle

Three Holy Women Parish

Trinity Missions

United Community Center, Inc.

Veritas Society – Wisconsin Right to Life

Vision Forward Association

Vivent Health

Walkers Point Youth and Family Center

Waukesha Catholic School System

Wisconsin Veterans Network

Women’s Care Center Milwaukee

Women’s Support Center of Milwaukee

GRANT RECIPIENTS

The following organizations received grants from donor funds

within the Foundation.

The Catholic Community Foundation has

awarded more than $18.0 million in grants

since inception.

This fiscal year 2022/2023 we awarded $2.18

million in grants for programs and projects that

support four priorities.

EDUCATION

For students in Catholic schools and religious

programs in kindergarten through twelfth grade.

COMMUNITY BUILDING

To strengthen families, parishes and those suering

from poverty, discrimination and violence.

LEADERSHIP DEVELOPMENT

Informing leaders for parishes, schools and agencies

that help advance the church.

HEALTH CARE

For the underserved in Milwaukee.

98

1110

ASSETS 2023 2022

CURRENT ASSETS

Cash and Cash Equivalents

Foundation $ 425,705 $ 199,761

Agency funds 232,840 492,085

Total Cash and Equivalents 658,545 691,846

Accounts Receivable

Accrued administrative fees on agency funds 85,815 82,844

Other receivables 40,660 46,054

Total Current Assets 785,020 820,744

OTHER ASSETS

Prepaid expenses 3,225 4,025

Property and equipment (net) 1,112 6,189

Operating lease right of use assets 88,142 —

Investments (at fair value)

Long-term investments 56,595,190 51,651,779

Agency funds 89,525,853 80,746,197

Total Investments 146,121,043 132,397,976

Total Other Assets 146,213,522 132,408,190

Total Assets $ 146,998,542 $ 133,228,934

LIABILITIES AND NET ASSETS 2023 2022

CURRENT LIABILITIES

Accounts Payable

Foundation $ 20,232 $ 24,364

Agency funds 195,518 137,555

Accrued liabilities 87,877 50,509

Current portion of operating lease liability 26,548 —

Total Current Liabilities 330,175 212,428

LONG-TERM LIABILITIES

Operating lease liability, net of current portion 62,709 —

Agency funds 89,563,175 81,100,727

Total Long-Term Liabilities 89,625,844 81,100,727

Total Liabilities 89,965,059 81,313,155

NET ASSETS

Without Donor Restrictions

Undesignated 2,340,115 1,905,620

Board-designated – field of interest,

donor-advised and donor-designated

46,025,177 41,883,752

With Donor Restrictions

Purpose restrictions 8,677,191 8,126,407

Total Net Assets 57,042,483 51,915,779

Total Liabilities and Net Assets $ 146,998,542 $ 133,228,934

STATEMENT OF FINANCIAL POSITION

June 30, 2023 and 2022

1312

PUBLIC SUPPORT WITHOUT DONOR WITH DONOR YEAR ENDED WITHOUT DONOR WITH DONOR YEAR ENDED

AND REVENUE RESTRICTIONS RESTRICTIONS 2023 TOTAL RESTRICTIONS RESTRICTIONS 2022 TOTAL

Interest and dividend income $ 1,179,423 $ 216,785 $ 1,396,208 $ 1,245,083 $ 243,794 $ 1,488,877

Realized gains (losses) on investments (96,616 ) (19,018 ) (115,634 ) 1,580,110 318,078 1,898,188

Unrealized gains (losses) on investments 4,765,077 863,995 5,629,072 (11,888,913 ) (2,286,606 ) (14,175,519 )

Investment management fees (321,520 ) (58,719) (380,239) (339,728 ) (66,067 ) (405,795 )

Net Investment Income (loss) 5,526,364 1,003,043 6,529,407 (9,403,448 ) (1,790,801 ) (11,194,249 )

Contributions 1,104,206 — 1,104,206 3,039,127 — 3,039,127

Administrative fee on agency endowments 329,916 — 329,916 351,729 — 351,729

Net assets released from restrictions 452,259 (452,259) — 454,892 (454,892 ) —

Total Public Support and Revenue 7,412,745 550,784 7,963,529 (5,557,700 ) (2,245,693 ) (7,803,393 )

EXPENSES

Program Services

Grants for charitable purposes 2,181,760 — 2,181,760 1,980,574 — 1,980,574

Grant administration expense 156,467 — 156,467 146,790 — 146,790

Supporting Services

Management and general 306,023 — 306,023 274,000 — 274,000

Fundraising 192,575 — 192,575 183,863 — 183,863

Total Expenses 2,836,825 — 2,836,825 2,585,227 — 2,585,227

Change in Net Assets 4,575,920 550,784 5,126,704 (8,142,927 ) (2,245,693 ) (10,388,620 )

Net Assets - July 1 43,789,372 8,126,407 51,915,779 51,932,299 10,372,100 62,304,399

Net Assets - June 30 $ 48,365,292 $ 8,677,191 $ 57,042,483 $ 43,789,372 $ 8,126,407 $ 51,915,779

STATEMENT OF ACTIVITIES

June 30, 2023 and 2022

1514

INVESTMENTS

AS OF JUNE 30, 2023 COST FAIR VALUE

Cash and cash equivalents $ 797,717 $ 797,717

Large-cap equities and S&P 500 index fund 20,020,127 27,894,899

Mid-cap equities 10,176,630 10,391,251

Small-cap equities 10,245,635 9,612,743

International equities 54,385,961 53,140,675

Commodities and inflation hedges 9,388,829 9,705,889

Bond mutual funds and commingled investment pool 33,955,350 32,613,231

Real estate 547,266 1,964,638

Total Investments $ 139,517,515 $ 146,121,043

INVESTMENTS

AS OF JUNE 30, 2022 COST FAIR VALUE

Cash and cash equivalents $ 799,842 $ 799,842

Large-cap equities and S&P 500 index fund 18,985,723 22,628,375

Mid-cap equities 10,181,732 8,625,545

Small-cap equities 11,027,038 8,527,579

International equities 53,236,886 46,667,712

Commodities and inflation hedges 10,421,204 10,357,033

Bond mutual funds and commingled investment pool 35,067,170 32,784,333

Real estate 598,577 1,946,433

Hedge composite — 61,124

Total Investments $ 140,318,172 $ 132,397,976

ESTIMATES

The preparation of financial statements in

conformity with accounting principles generally

accepted in the United States of America

requires management to make estimates and

assumptions that aect the reported amounts of

assets, liabilities, revenues and expenses and the

disclosures of contingent assets and liabilities at

the date of financial statements. Actual results

could dier from these estimates.

TAX-EXEMPT STATUS

The Foundation is exempt from federal and state

income taxes on related exempt function income

under Section 501(c)(3) of the Internal Revenue

Code and has been classified as an organization

other than a private foundation.

AGENCY ENDOWMENT FUNDS

Certain Catholic parishes and other organizations

have transferred funds to the Foundation for

management. These funds are invested with

the other funds of the Foundation, but title is

retained by the transferring organization and the

funds are reflected in the statements of financial

position of the Foundation as investments and the

corresponding amounts listed as current and long-

term liabilities.

NET ASSETS

Net assets, revenues, gains and losses are classified

based on the existence or absence of donor-imposed

restrictions. Accordingly, net assets of the Foundation

are classified and reported as follows:

NET ASSETS WITHOUT

DONOR RESTRICTIONS

Net assets that are not subject to donor-imposed

stipulation. The governing board has designated,

from assets without donor restrictions, net assets

for purposes of maintaining field of interest,

unrestricted, donor-advised and donor-designated

funds in perpetuity.

NET ASSETS WITH

DONOR RESTRICTIONS

Net assets subject to donor (or certain grantor)

imposed restrictions. Some donor-imposed

restrictions are temporary in nature, such as those

that will be met by the passage of time or by actions

of the Foundation pursuant to those stipulations

prescribed by the donor. Other donor-imposed

restrictions are perpetual in nature, where the donor

stipulates that resources be maintained in perpetuity.

Donor-imposed restrictions are released when a

restriction expires, that is, when the stipulated time

has elapsed, when the stipulated purpose for which

the resource was restricted has been fulfilled, or

both. The Foundation had no net assets with donor

restrictions required to be maintained in perpetuity

during the years ended June 30, 2023 and 2022.

NOTES TO FINANCIAL STATEMENTSSUMMARY OF INVESTMENTS

June 30, 2023 and 2022

The Catholic Community Foundation is audited

annually. Copies of the complete audit reports are

available upon request.

MARY ELLEN MARKOWSKI

President

The Catholic Community Foundation

CAROL MCINERNY

Community Volunteer

former Domestic Tax Director

Johnson Controls International, PLC

ANTHONY NGUYEN

Region Bank President, Wisconsin Region

Wells Fargo Bank, N.A.

THOMAS J. NOLTE

Director, Madison Investments

MOST REV. JAMES SCHUERMAN

Auxiliary Bishop

Vicar General

Archdiocese of Milwaukee

KEITH B. SIERRA

Senior Financial Associate

RBC Wealth Management

ANNE C. TRUNZO

Community Volunteer

Co-Founder Impact100 Greater Milwaukee

STAFF

1716

JOHN BLICKLE

Controller

ANGELA GUNJA

Administrative Coordinator

DAVID R. STRELITZ, CHAIRMAN

Senior Vice President & Regional Manager

Associated Bank Private Wealth

MARK J. ANDRES

Attorney

Amundsen Davis LLC.

CHRISTOPHER P. BROWN

Treasurer and Chief Financial Ocer

Archdiocese of Milwaukee

BARBARA ANNE CUSACK

Chancellor

Archdiocese of Milwaukee

MATTHEW B. FAHEY

Community Volunteer,

former Managing Director

BMO Global Asset Management

KATHLEEN M. HUEVLER

Program Manager

ALS Association Wisconsin Chapter

AMY S. KIISKILA

Wealth Manager

Annex Wealth Management

BRIAN LUCARELI

Director, Foley Private Client Services

Foley & Lardner LLP

BOARD OF DIRECTORS

MARY ELLEN MARKOWSKI

President

The Catholic Community Foundation

DAVID R. STRELITZ

Chairman

Senior Vice President & Regional Manager

Associated Bank Private Client Services

637 EAST ERIE STREET n MILWAUKEE, WI 53202

T: 414.431.6402 n F: 414.431.6407 n legaciesoffaith.org

The Catholic Community Foundation is a not-for-profit Wisconsin Corporation, tax-exempt pursuant to

Section 501(c)(3) of the Internal Revenue Code and governed by its own Board of Directors.

The Foundation is a separate civil and canonical entity independent of the Archdiocese of Milwaukee.

For more information on how you can provide for your community — in perpetuity — visit legaciesoaith.org