I

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 1

Editors’ note

—

Meat production is projected to nearly double by 2050 to meet growing global demand. But the way the

world currently produces meat cannot scale to meet this demand and still achieve global climate, health,

food security, and biodiversity goals. Making meat differently via alternative proteins can help feed a

growing world safely and ef

ficiently, and will be as essential to mitigating climate change as the global

transition to renewable energy. When compared to conventional meat production, alternative protein

production dramatically reduces emissions, requires far less land, eliminates the use of antibiotics in our

food system, and feeds more people with fewer resources.

By reimagining protein, we can produce food that people love and usher in a more sustainable, secure,

and just food future. Countries have committed to halve emissions and protect 30 percent of global land

and ocean ecosystems by 2030. With just seven years to go, investing in alternative ways of making

meat, seafood, eggs, and dairy is essential.

GFI’s annual State of the Industry Reports equip food system stakeholders with a solid, in-depth

understanding of the alternative protein market, issues, and opportunities. These reports also serve as a

global call to action:

Alternative proteins are a scalable solution that, with proper levels of public, private,

and civil society support, can help address the biggest challenges of our time and

transform our global food system for the better.

Making meat from plants offers a powerful way to tackle these challenges while also advancing

personal, public, and planetary health. Across multiple studies, data increasingly points to plant-based

meats as healthier than their animal-sourced counterparts—higher in

fiber, lower in saturated fats, lower

in calories, and zero cholesterol. In the public health arena, a shift toward alternative proteins can

signi

ficantly reduce global risks including antibiotic resistance and pandemics. Plant-based meat can

also cut emissions by 90 percent, and use 99 percent less land and water than conventional

meat—actions critical for planetary health.

This report details some of the promising developments that moved the plant-based alternative protein

field forward in 2022. The sector still has miles to go, however, to reach full potential. Funding and

workforce constraints pose two of the biggest bottlenecks for scienti

fic innovation and scaling. The

industry is still early in its development, with growth patterns similar to other emerging markets and

technologies. As companies continue to innovate, and as more talent, research funding, and investments

flow into alternative proteins, the entire sector will accelerate, offering the world a fundamentally

different and far more sustainable food future.

With gratitude and deep respect to all those on this journey, we invite you to dig deep into our 2022

State of the Industry Report, Plant-based meat, seafood, eggs, and dairy.

Best,

Caroline Bushnell

VP of Corporate Engagement

Liz Specht, PhD

VP of Science and Technology

Jessica Almy

VP of Policy

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 2

About GFI’s State of the Industry Report series

GFI’s State of the Industry Report series serves as our annual alternative protein

sector deep-dive. The series compiles business developments, key technologies,

policy updates, and scientific breakthroughs from around the world that are

advancing the entire field. This year’s reports include:

○ Cultivated meat and seafood

○ Fermentation: Meat, seafood, eggs, and dairy

○ Plant-based meat, seafood, eggs, and dairy

○ Global policy: Public support, regulation, and labeling

The Plant-based meat, seafood, eggs, and dairy report synthesizes 2022 updates

across the global industry focused on plant-based alternatives to conventional

animal products. For a full primer on the latest science and technological

developments of plant-based alternative proteins, please visit GFI’s science of

plant-based meat deep dive page.

Symbols to look for

Throughout the 2022 State of the Industry Report series, look for symbols highlighting how

developments in the past year advanced the alternative protein sector in the areas of health

and nutrition, sustainability, and path-to-market progress. Dig deeper and opportunity icons

are calls to action for researchers, investors, and others seeking to learn more and advance

the

field.

Health

Sustainability

Opportunity

Path-to-market

Dig deeper

Please note that The Good Food Institute is not a licensed investment or financial advisor, and nothing in

this report is intended or should be construed as investment advice.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 3

About the Good Food Institute

—

As a nonpro

fit think tank and international network of organizations powered by philanthropy, GFI

works alongside scientists, businesses, and policymakers to make alternative proteins as delicious,

affordable, and accessible as conventional meat. In Asia Pacific, Europe, Brazil, India, Israel, and

the United States, our teams are mobilizing the international community to use markets and

technology to replace harmful practices with ones that are better for the climate and biodiversity,

for food security, and for global health.

We focus on three programmatic priorities:

Cultivating a strong

scientific ecosystem

GFI’s science and technology

teams map out the most

neglected areas that will allow

alternative proteins to compete

on taste and price. We develop

open-access research and

resources, educate and

connect the next generation of

scientists and entrepreneurs,

and fund research that benefits

alternative protein

development across the sector.

Influencing policy and

securing government

investment

GFI’s policy teams ensure

that alternative proteins are a

part of the policy discussion

around climate change

mitigation and global health.

In every region where we

have a presence, we advocate

for government investment in

alternative proteins and are

paving the way for the

approval of novel proteins

such as cultivated meat.

Supporting industry to

advance alternative

proteins

GFI’s corporate teams are

replicating past market

transformations and

partnering with companies

and investors across the

globe to drive investment,

accelerate innovation, and

scale the supply chain—all

faster than market forces

alone would allow.

Stay connected

○ Newsletters | GFI’s suite of expertly curated newsletters puts timely news, insights, and

opportunities right in your inbox, Check out g

fi.org/newsletters to find the ones most suitable

for your interests.

○ Monthly seminar series | Each month, we host online seminars with leading experts from

around the world: The Business of Alt Protein series is geared toward a commercially focused

audience on topics related to starting and scaling a good food business. The Science of Alt

Protein series addresses a technical audience and focuses on cutting-edge research

developments that enable alternative protein innovation.

This State of the Industry Report series, as well as all of GFI’s work, is made possible by gifts and

grants from our global family of donors. If you are interested in learning more about giving to GFI,

please visit here or contact philanthropy@g

fi.org.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 4

Table of contents

—

Editors’ note 2

Symbols to look for 3

About the Good Food Institute 4

Executive summary 13

Section 1: Commercial landscape 20

Overview 20

Plant-based ventures 21

Product launches 23

Facilities 28

Involvement by conventional meat and food companies 32

Partnerships 35

Consumer insights 38

Section 2: Sales 45

U.S. retail sales overview 45

Point-of-sale (POS) data 48

Consumer panel data 48

Categories 49

Closing the price gap 50

U.S. consumer dynamics and research 50

Global retail sales overview 52

U.S. foodservice sales overview 56

Section 3: Investments 61

Overview 61

Geographical distribution 67

Deal types and key funding rounds 69

Liquidity events 71

Other

financing 72

Investors 73

Section 4: Science and technology 77

Overview 77

Research across the technology stack 78

Research for environmental and social impact 85

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 5

Research on health and nutrition 87

Scienti

fic ecosystem growth 89

Section 5: Government and regulation 92

Overview 92

Regulatory and labeling updates 95

Section 6: Conclusion and forecast 101

Plant-based forecasts 101

A deeper dive into alternative protein market forecasts 103

Examining the structure of alternative protein market forecasts 106

Industry drivers 109

Industry roadblocks 110

Expert predictions 113

Conclusion 116

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 6

Executive summary

Executive summary

—

In 2022, the plant-based meat and seafood retail industry generated $6.1 billion in global

sales, growing eight percent by dollars and

five percent by weight. Combined plant-based milk,

cheese, and yogurt hit $21.6 billion on the global stage, up seven percent from 2021. Amid

challenging macroeconomic and market conditions, this rapidly evolving industry made major

strides across the areas of science, sustainability, and public and private sector support. As

consumer engagement with, and interest in, plant-based proteins increases around the world,

retailers and manufacturers are leaning in, introducing new products, developing strategic

partnerships, and building new production facilities. Public sector participation is also

increasing, with more governments around the world investing in plant-based proteins as a

research and commercialization priority.

Plant-based meat, seafood, eggs, and dairy, part of our 2022 State of the Industry Report

series, takes a

field-wide, global view of the progress made over the past year.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 8

Commercial landscape

New products and

categories.

Hundreds of new plant-based alternatives

to conventional animal products hit retail

shelves in the U.S. market in 2022,

including in emerging categories like

plant-based steak, salmon, foie gras, fish

balls, and schnitzel.

Retail and foodservice

trends.

○ Large food companies released

plant-based versions of popular branded

products, including dairy-free

Philadelphia cream cheese and Babybel

cheese, and Kellogg’s plant-based

chicken waffle Eggo sandwich.

○ Burger King launched two new

Impossible burgers in the U.S. and trialed

its first fully plant-based location and

default plant-based location in Europe.

New partnerships.

Companies continued to collaborate to

develop new products and scale

production: we tallied 25 new strategic

partnerships in 2022.

Manufacturing capacity.

Six companies opened new or expanded

production facilities, and 11 new

plant-based contract manufacturers were

added to GFI’s database, bringing the total

number of known plant-based contract

manufacturers to 127.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 9

Sales

Table 1: U.S. retail plant-based food sales metrics, 2022

Sales data note: The data presented in this graph is based on custom GFI and PBFA plant-based categories that were created by

re

fining standard SPINS categories. Due to the custom nature of these categories, the presented data will not align with standard

SPINS categories. *Share values for the total plant-based foods category out of total edibles sales (frozen, grocery, refrigerated,

and protein powders/bars). Share values of individual plant-based categories are out of their respective total plant-based plus

animal-based category. **SPINS does not report non-UPC animal-based meat counter sales. To calculate the plant-based meat

share of the total meat category, dollar and unit volume assumptions for non-UPC animal-based meat counter sales are added to

SPINS’ UPC animal-based meat sales. Household data note: SPINS uses a separate process from the sales data to pull household

panel data which may result in minor category differences.

Source: Sales data - SPINS Natural Grocery Channel, SPINS Conventional Multi Outlet Channel (powered by Circana, formerly IRI

& NPD) | 52 Weeks Ending 1-1-2023. Household data - NCP, All Outlets, 52 weeks ending 1-1-23

Total U.S. retail plant-based food dollar sales reached $8 billion in 2022.

○ Price increases drove dollar sales up 7%

while unit sales declined 3% for total

plant-based foods, a trend mirrored

across many plant-based categories,

total food and beverage, and

animal-based food.

○ Plant-based meat dollar sales decreased

1% and unit sales declined 8%.

○ Plant-based milk dollar sales grew 9% to

$2.8 B while unit sales declined 2%.

○ Notable categories that saw both dollar

and unit sales growth included

plant-based eggs, plant-based seafood,

plant-based creamers, and plant-based

protein liquids and powders.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 10

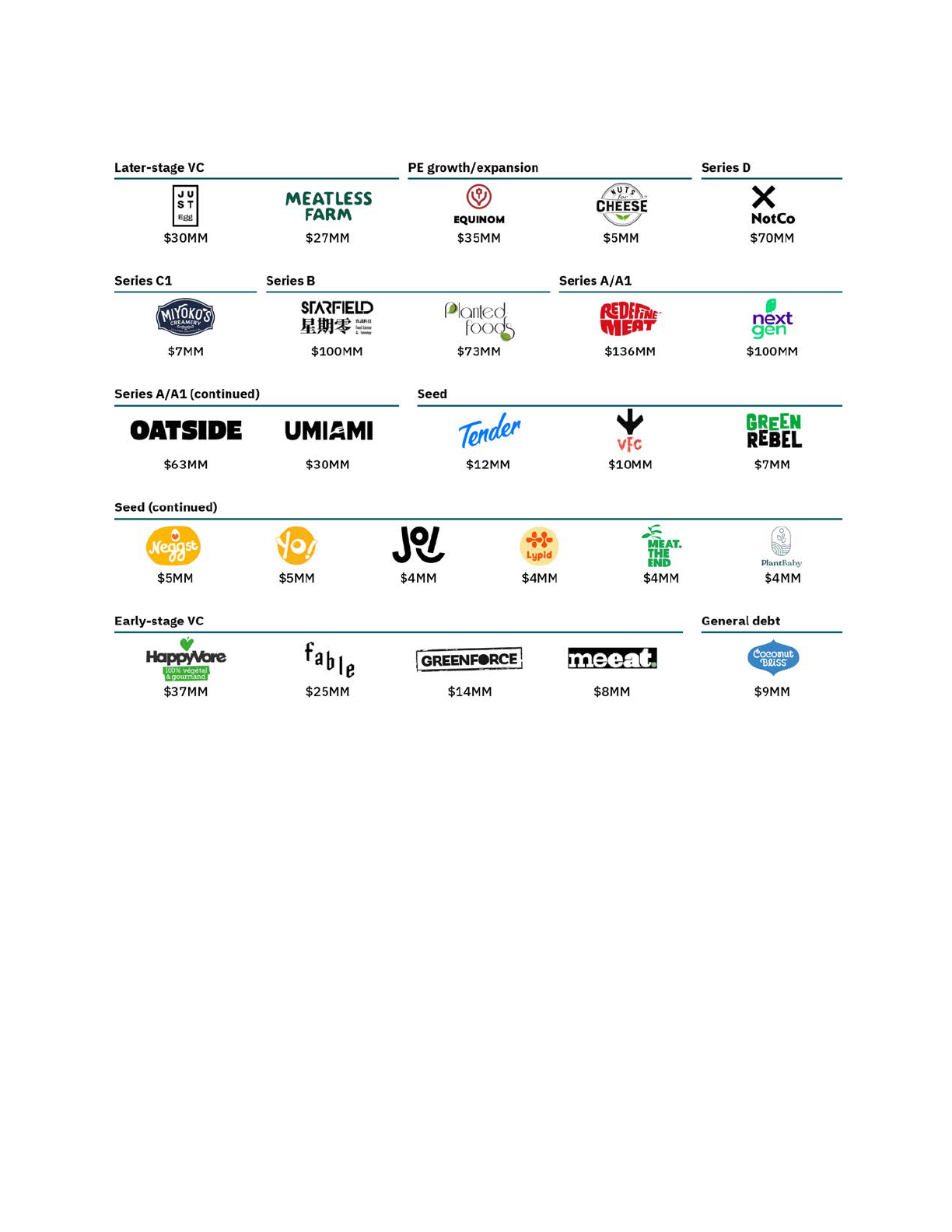

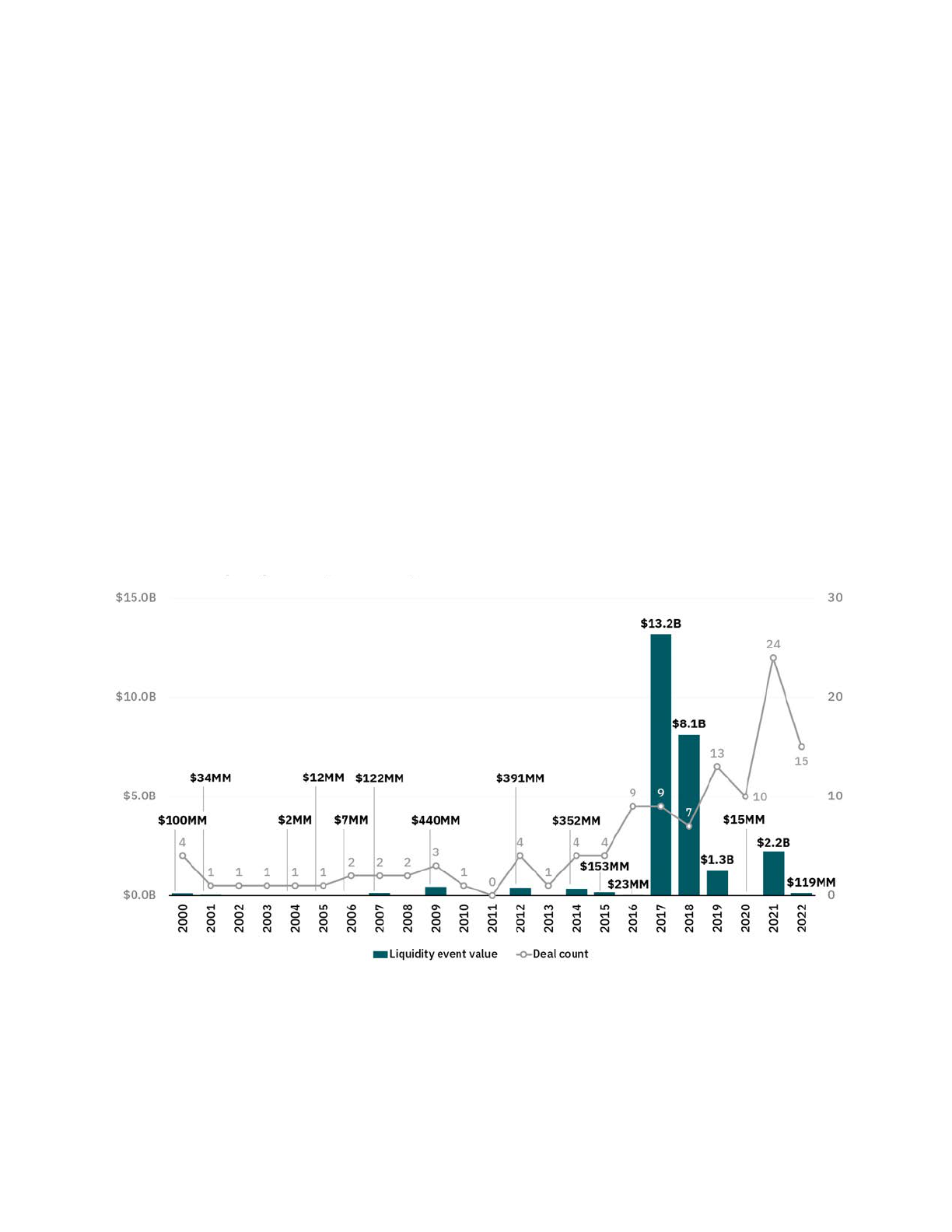

Investments

Plant-based meat, seafood, eggs, and dairy companies raised $1.2 billion in 2022 (representing

15 percent of all-time investment*), bringing total investments to $7.8 billion. The number of

unique investors in plant-based companies grew by 17 percent to more than 1,500 investors.

*investment since 1997

Table 2: Invested capital in plant-based meat,seafood, eggs, and dairy

Category

2022

1997–2022

Highlights

Total invested

capital

$1.19B

$7.78B

2022 invested capital represented

15% of all-time investment.

Invested

capital deal

count

145

935

2022’s largest investment was $135.6

million raised by Redefine Meat.

Unique

investors

222

(new)

1,521

The number of unique investors grew

by 17% in 2022.

Liquidity

event capital

$119MM

$26.9B

PlantPlus Foods, a joint venture of

ADM and Marfrig, acquired Sol Cuisine

for $102 million in 2022.

Liquidity event

count

15

121

Other

financing

capital

$15MM

$146MM

The vast majority of other financing

events are private investments in

public equity (PIPEs).

Other

financing

count

4

20

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 11

Science and technology

Crop diversification and manufacturing.

Companies increased R&D efforts for ultra-high protein chickpeas, fava beans, mung beans, and

cowpeas. Diverse plant protein ingredients are gaining traction, with progress being made to

increase their production and reduce their costs.

Health and nutrition.

In 2022, a literature review of 43 studies on the healthiness and environmental sustainability of

plant-based meat alternatives compared to animal products underscored numerous personal

health bene

fits of plant-based meat.

Environmental and social impact.

Valorizing sidestreams for alternative proteins continued to gain momentum, including protein

extraction from leaves destined for waste and upcycling of sunflower, canola, and barley proteins.

Government and regulation

Government support.

Europe led investments in plant-based protein with commitments from Denmark, Sweden, and

Switzerland to invest more than $150 million in R&D. Canada emerged as a global leader in

public support for plant-based proteins in R&D, commercialization, and regulatory policy.

Singapore’s government launched a number of programs to support alternative protein startups

and accelerate innovation. In the U.S., support for alternative protein R&D was secured at both

the federal and state levels, with Congress allocating nearly $6 million to USDA and California

allocating $5 million to three universities.

Label censorship.

In 2022, the French legislature passed a decree banning the use of many meat terms on

plant-based labels, but the country’s highest court temporarily suspended the enactment of the

ban. In the U.S., a federal court found an Arkansas food label censorship law to be unconstitutional

and permanently blocked enforcement of the law against Tofurky when the company uses terms

like “sausage” and “burger” accompanied by words like “vegan” or “plant-based.”

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 12

Section 1

Commercial landscape

Section 1: Commercial landscape

—

Overview

The plant-based meat, seafood, egg, and dairy industry—currently striving to create delicious,

healthier, affordable, and more sustainable alternatives to conventional animal products—is

just getting warmed up.

In 2022, according to Euromonitor data, total global retail sales of plant-based meat, seafood,

milk, yogurt, and cheese reached $28 billion. (Euromonitor does not report on plant-based

eggs.) While impressive, the global plant-based market today is a tiny fraction of the

multi-trillion-dollar market for conventional animal products. On the road ahead to mass

market adoption, advances are needed on multiple fronts—and taste and price parity are

among the biggest opportunities.

Notably, consumer interest in plant-based proteins is on the rise around the world. Retailers

and manufacturers are introducing new products, new strategic partnerships, and new

facilities. Intellectual property for plant-based meat has grown three times in the last decade.

In 2022 alone:

○ Quick-service restaurant chains including

Starbucks, Burger King, and KFC

expanded plant-based options in a

number of regions. Burger King opened

their first fully plant-based location and a

default plant-based location.

○ Large food brands developed plant-based

versions of familiar products, like

Philadelphia cream cheese, Kit Kat bars,

and Babybel cheese.

○ Companies launched new product

formats to retail, like plant-based steak,

foie gras, luncheon meat, and schnitzel.

○ Companies continued to collaborate to

develop new products and scale

production to lower costs: we tallied 25

new strategic partnerships in 2022.

○ Eleven new plant-based contract

manufacturers were added to GFI’s

database, and six companies opened new

or expanded production facilities.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 14

Check out our monthly Alternative Protein Opportunity

newsletter for updates

Across the globe, plant-based products launch or expand distribution every week. GFI’s

monthly Alternative Protein Opportunity newsletter tags and categorizes notable

plant-based distribution updates, new product launches, partnerships, facility openings,

and more, helping you keep up with the fast-moving plant-based landscape. Sign up here.

Plant-based ventures

Tables 1 and 2 provide alphabetized lists of plant-based meat and milk brands by U.S. retail

dollar sales in 2022. GFI and the Plant Based Foods Association commissioned the sales data

from SPINS and re

fined it using custom coding. The list of 10 brands with the most dollar sales

in each of these categories did not change from 2021 to 2022.

Table 3: Brands with the most total plant-based meat dollar sales in U.S. retail (alphabetized)

Brand

Parent company

Country

Year founded

Beyond Meat

n/a

United States

2009

Boca

The Kraft Heinz Company

United States

1979

Dr. Praeger’s

n/a

United States

1994

Field Roast

Maple Leaf Foods

Canada

1997

Gardein

Conagra

United States

2003

Impossible Foods

n/a

Canada

2011

Lightlife

Maple Leaf Foods

United States

1979

MorningStar Farms

Kellogg’s

United States

1975

Quorn

Monde Nissin

United Kingdom

1985

Tofurky

Morinaga

United States

1980

Source: GFI analysis of SPINS Natural Grocery Channel, SPINS Conventional Multi Outlet Channel (powered by Circana, formerly IRI

& NPD) | 52 Weeks Ending 1-1-2023. © 2022 The Good Food Institute, Inc.

Sales data note: The data presented in this table is based on custom GFI and PBFA plant-based categories that were created by

re

fining standard SPINS categories. Due to the custom nature of these categories, the presented data will not align with standard

SPINS categories.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 15

Table 4: Brands with the most total plant-based milk dollar sales in U.S. retail

(alphabetized)

Brand

Parent company

Country

Year founded

Blue Diamond

Blue Diamond

Growers

United States

1910

Califia Farms

n/a

United States

2010

Chobani

n/a

United States

2005

Dream Brands

SunOpta

Canada

1982

Oatly

n/a

Sweden

1994

Planet Oat

HP Hood LLC

United States

2018

Ripple

n/a

United States

2014

Silk

Danone

United States

1977

Simply

Coca-Cola

United States

2001

So Delicious

Danone

United States

1987

Source: GFI analysis of SPINS Natural Grocery Channel, SPINS Conventional Multi Outlet Channel (powered by Circana, formerly IRI

& NPD) | 52 Weeks Ending 1-1-2023. © 2022 The Good Food Institute, Inc.

Sales data note: The data presented in this table is based on custom GFI and PBFA plant-based categories that were created by

re

fining standard SPINS categories. Due to the custom nature of these categories, the presented data will not align with standard

SPINS categories.

More information on these and other companies is available in GFI’s company database.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 16

Product launches

Around the world, new plant-based products launch or gain distribution across retail, food

service, and e-commerce channels regularly. While not a comprehensive list of every launch in

2022, the following are notable product introductions that illustrate how this sector is growing,

diversifying, and innovating.

Retail

One signi

ficant retail trend in 2022 was large food companies releasing plant-based versions of

longstanding, popular, branded products. This is exciting news for consumers who want more

sustainable versions of their favorite foods, and a signal that companies are betting on

plant-based alternatives by lending valuable household brand names to plant-based products.

○ Kraft-Heinz’s cream cheese brand

Philadelphia launched their first

dairy-free cream cheese in the United

Kingdom and the United States.

○ Kellogg’s released their first plant-based

Eggo waffle in a plant-based chicken

waffle sandwich product made with

MorningStar Farms’ chicken.

○ Large CPG brand Bel Group launched a

plant-based version of the company’s

popular Babybel wax-covered cheeses

into retail stores in Canada, the United

States, and the United Kingdom. The

company stated that the launch was part

of a strategy to make half their offerings

plant-based by 2030.

○ Nestlé rolled out a plant-based Kit Kat

across 15 European countries.

Private label retail and convenience stores offer an opportunity to make plant-based products

more accessible to consumers at lower price points. Private label innovation and convenience

store distribution in plant-based foods continued in 2022:

○ Trader Joe’s launched a private label

liquid plant-based egg.

○ UK retailer Asda launched a range of

private label plant-based barbecue

products that included plant-based

burgers, chicken wings, lamb, sausages,

and seafood.

○ Chinese convenience store Lawson added

two plant-based meat brands—Haofood

and Beyond Meat—to their stores in more

than 2,000 locations across China.

Plant-based meat brand Haofood gained

a distribution agreement with Chinese

convenience store Lawson.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 17

While plant-based offerings have greatly expanded over the past four years, there is still

signi

ficant room for innovation. While plant-based burgers are widely available across many

geographies, a number of animal products still lack any plant-based alternative at retail. These

are among the noteworthy new plant-based product offerings in 2022:

○ Beyond Meat launched a sliced

plant-based steak—the company’s first

whole-cut product and one of the first

plant-based steaks available in U.S. retail.

○ Vivera, a plant-based meat brand

acquired last year by JBS, launched a

plant-based salmon in grocery chains in

the Netherlands.

○ Garden Gourmet, Nestle’s plant-based

brand, announced the launch of Voie

Gras, the brand’s plant-based alternative

to foie gras, in supermarkets in

Switzerland and Spain.

○ Leading conventional seafood company

Thai Union launched plant-based shrimp

dumplings and expanded the distribution

of their plant-based tuna.

○ Century Pacific, the largest branded food

company in the Philippines, launched

plant-based canned ham in select grocery

stores in the Midwest, East Coast, and

Texas, before launching to Walmart stores

across the U.S. in 2023.

○ v2food launched new plant-based

chicken products in Woolworths stores

across Australia, including a breaded

chicken schnitzel.

“In an effort to reduce the impact of our ice cream and food products

on the environment, we are moving to more plant-based products and

are exploring other alternative proteins as ingredients. Fermentation

may become an important technology in the production of alternative

proteins to build a more resilient supply chain and to reduce

greenhouse gas emissions in our journey to net zero.”

– Manfred Aben, Nutrition & Ice Cream R&D Head of Science and

Technology at Unilever

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 18

Foodservice

After an unprecedented contraction in 2020, foodservice has returned as an attractive

go-to-market strategy for plant-based companies. Launching into foodservice allows companies

greater control over how their product is prepared, and it also plays an important role in

ensuring plant-based products continue to become more accessible and familiar to consumers

across regions. In 2022, plant-based products expanded into every level of foodservice, from

fast food chains to upscale restaurants to settings like airlines and schools:

○ Starbucks added plant-based meat to menus in several geographies, including an

OmniFoods plant-based

fish sandwich in Hong Kong, a plant-based sausage croissant roll in

collaboration with Imagine Meats in India, a plant-based crab cake brioche sandwich in

Thailand, and several menu items using JUST Egg and Daring Chicken in a trial in the

United States. Notably, Starbucks also dropped their plant-based milk surcharge in the

United Kingdom.

○ KFC launched several plant-based chicken options in different regions. KFC UK made the

plant-based chicken burger a permanent menu item, KFC U.S. expanded the Beyond Fried

Chicken test to every KFC location for a limited time, and KFC Canada partnered with

Lightlife to trial a plant-based chicken entree.

○ Burger King increased their commitment to plant-based offerings with new product

launches in a number of regions.

● Burger King U.S. launched two more Impossible burgers (the Impossible King and Southwest

Bacon Impossible Whopper) and trialed an Impossible plant-based chicken patty.

● Burger King UK launched plant-based chicken nuggets in partnership with The

Vegetarian Butcher (owned by Unilever).

● Burger King Israel launched a plant-based Whopper and chicken nuggets in partnership

with Israeli plant-based startup Meat. The End.

● Burger King Germany began offering plant-based versions of everything on their

standard menu.

● Burger King has also taken impressive strides to place plant-based options at the heart of

their offerings: Burger King UK announced that half their menu items would be plant-based

by 2030 (reportedly in a bid to lower the chain’s carbon emissions), and the chain has

tested both entirely plant-based and default plant-based locations in Portugal, Spain, the

United Kingdom, Switzerland, and Austria.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 19

Making plant-based items the default can nudge consumers to choose

plant-based and lower a company’s emissions

In the past year, Burger King announced developments largely unprecedented by a major

fast-food chain. Burger King Austria ran a limited-time campaign defaulting their menu

to plant-based—consumers were given plant-based options by default unless they

speci

fied otherwise. GFI analysis of several consumer research studies indicates that

changing the default menu option to plant-based is a powerful lever for increasing

plant-based consumption.

In addition, Burger King tested entirely plant-based locations in Spain, the United

Kingdom, Portugal, Austria, and Switzerland before permanently transitioning their menu

to plant-based in one Vienna location. Starbucks is the only other top 10 global

quick-service restaurant to have trialed an entirely plant-based location, which the

company did in Seattle in 2021.

Changing default options can also be an effective strategy for noncommercial foodservice

locations, like corporate cafeterias, school dining halls, and hospitals. In 2022, LinkedIn

corporate of

fices piloted a default plant-based menu strategy with the support of Greener By

Default, an organization that works with institutions to adopt plant-forward menu strategies.

While quick-service restaurant (QSR) launches help bring plant-based food to mass markets,

many new products start in upscale/specialty restaurants. This can be an attractive

go-to-market strategy because it allows companies to showcase products in specialty dishes

and earn revenue before production is scaled up enough to supply thousands of distribution

points. Select examples of restaurant launches in 2022 include:

○ Chunk Foods debuted their marbled

plant-based steak, one of the first

plant-based meat whole-cut products

commercialized in the United States, at

Coletta, an upscale Italian restaurant in

New York City.

○ Israeli plant-based protein startup

Redefine Meat announced a distribution

deal with Giraudi Meats, a distributor

specializing in high-end cuts in Europe’s

foodservice sector. The company is also

launching plant-based tenderloin,

striploin, pulled beef, pulled pork, and

pulled lamb products.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 20

○ U.S.-based startup Umaro Foods

launched their seaweed-based bacon at

restaurants in San Francisco, New York

City, and Nashville.

○ Plant-based company Black Sheep Foods

secured an agreement with specialty

foods distributor The Chef’s Warehouse

to launch plant-based lamb at restaurants

throughout New York City.

In addition to commercial foodservice channels like QSR and specialty restaurants, plant-based

distribution made strides in noncommercial foodservice, including institutional channels like

airlines and school cafeterias:

○ Aramark, the largest foodservice provider

in the United States, announced a

commitment to make 44% of their

residential dining menu offerings

plant-based by 2025 (up from 26 to 30%

today).

○ Delta Airlines added Impossible Foods

meatballs and burgers and Black Sheep

Foods meatballs to their menu for select

flights.

○ Taiwan-based China Airlines debuted a

new plant-based inflight menu featuring

plant-based fish filet, plant-based meat

with cream sauce, and braised

plant-based meat with rice.

○ Impossible Foods launched a new

pre-cooked Impossible Burger patty for

distribution in K-12 cafeterias.

○ Rebellyous Foods, who distributes

plant-based chicken in 46 school districts,

announced the development of a

production system that the company says

can produce plant-based meat at price

parity with conventional meat.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 21

E-commerce

E-commerce is another popular go-to-market channel for plant-based companies. E-commerce

tends to attract younger consumers who are more likely to be interested in alternative proteins.

It can also give manufacturers more control over their time to market compared to retail or

foodservice channels, where brands need to work with external partners to get their products

on shelves or menus. E-commerce developments in 2022 include:

○ Plant-based seafood company Kuleana

rebranded as Current Foods and

launched their plant-based tuna and

salmon direct to consumer before their

first retail launch at Berkeley Bowl market

in San Francisco.

○ Plant-based steak company Juicy

Marbles debuted their plant-based filet

mignon steak and whole-cut loin directly

to consumers in the United States and

Europe.

○ Vienna-based Revo Foods (previously

Legendary Vish) announced that their

plant-based smoked salmon slices made

with pea protein and algae extracts are

now available via UK e-commerce

website GreenBay.

○ Beyond Meat launched their plant-based

sausage on the popular Chinese

e-commerce platform Pinduoduo.

○ Love Handle, Asia’s first plant-based

butcher, partnered with online retailer

RedMart to offer plant-based meat

products for delivery in Singapore,

including a co-branded meatball product:

Love Handle x Impossible Butcher

Meatballs.

Facilities

Manufacturing capacity remains one of the most significant barriers to achieving price parity for

plant-based proteins. Plant-based companies typically use contract manufacturers or build

facilities to manufacture in-house (or some combination of the two), and there is an urgent need

for capital to construct additional facilities optimized for plant-based food production.

In 2022, GFI added 11 new contract manufacturers to our database of known contract

manufacturers, bringing the total to 127. The number of company-owned facilities dedicated to

producing plant-based protein in-house also modestly increased in 2022.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 22

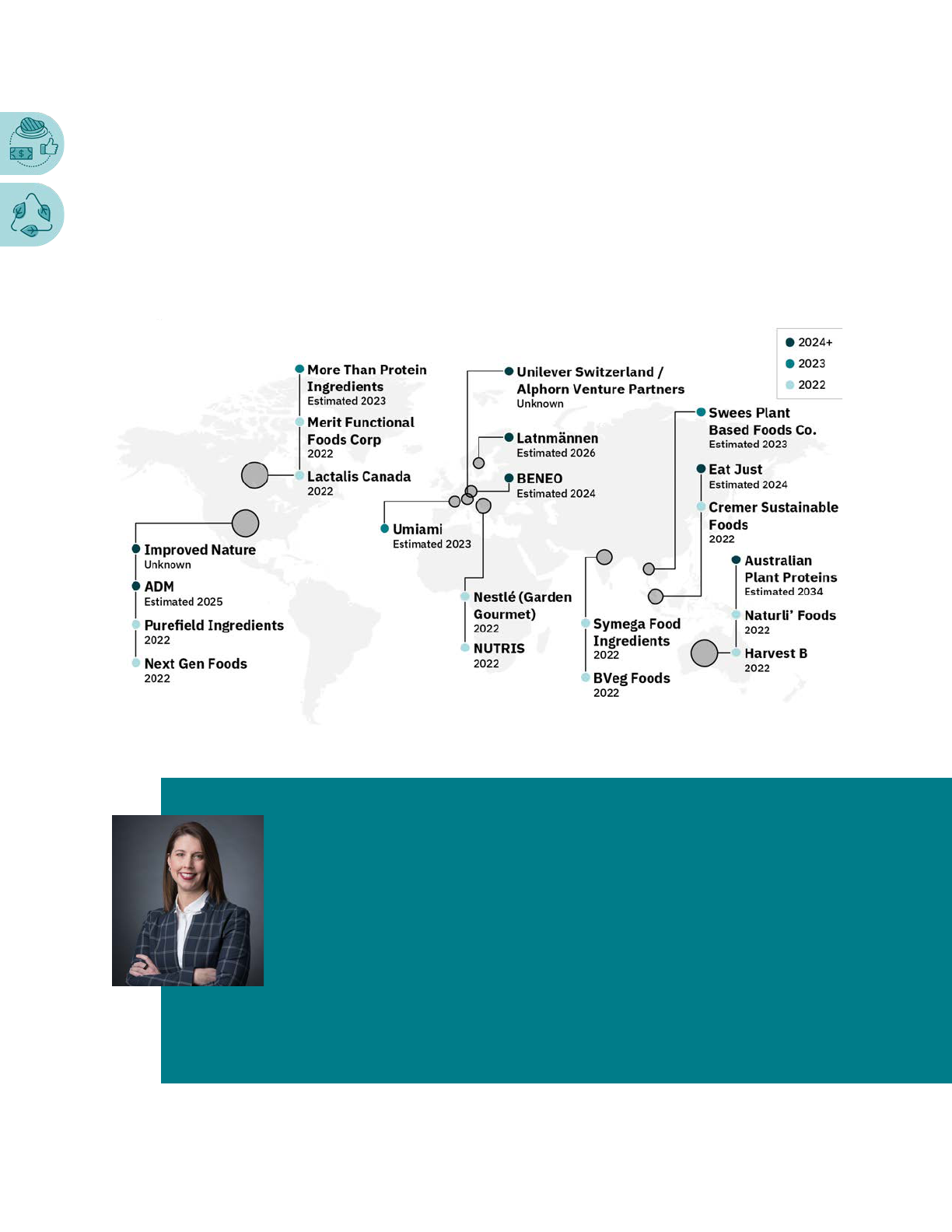

Facilities that opened in 2022:

○ Danish plant-based company Naturli

Foods opened a new manufacturing

facility in Sydney, Australia.

○ Purefield Ingredients, the largest

domestic supplier of wheat protein in the

United States, completed an expansion of

their Kansas facility. The expansion will

increase Purefield’s annual production by

50 percent.

○ Ingredients company NUTRIS opened a

€30 million ($32.1 million) fava bean and

potato protein processing facility in Novi

Senkovac, Croatia.

○ India-based BVeg Foods unveiled their

new plant-based production facility,

which can currently produce 4,000 metric

tons of plant-based meat a year, with

plans to scale up to 12,000 metric

tons/year.

○ Lactalis Canada, maker of Siggi’s yogurt,

announced that they would transition

their Ontario dairy plant to a dedicated

plant-based production facility to meet

the demand for the company’s

plant-based yogurts and milks.

○ Harvest B, a plant-based food technology

company based in Sydney, opened a

facility that will be capable of producing

up to 1,000 metric tons of plant-based

protein made from Australian-grown

grains. The company received $1 million

in assistance from the Australian

government's Advanced Manufacturing

Growth Centre and is Australia's first

facility dedicated entirely to plant-based

meat ingredients.

○ Cremer Sustainable Foods, a joint

venture between Cremer and

Temasek-owned Nurasa (formerly known

as Asia Sustainable Foods Platform)

opened their first plant-based protein

contract manufacturing facility in

Singapore. The 11,000-square-foot

facility can manufacture up to 1,300 tons

of plant-based protein per year.

Facilities that broke ground in 2022:

○ California-based Eat Just broke ground on their new production facility in Singapore. The

$120 million facility will produce plant-based JUST Egg.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 23

Facilities that were announced in 2022:

○ Nestlé announced plans for a $73 million

production plant in Serbia. The facility will

be used solely to produce Nestlé’s

plant-forward Garden Gourmet line.

○ Plant-protein processing company

Australian Plant Proteins will construct

three new production plants for AU$378

million ($285.2 million). The project is

funded by the Australian federal and state

governments as well as several large

meat and ingredients companies

including Thomas Foods International, a

major red meat producer, and the

Australian Milling Hub.

○ Ingredients company ADM announced

plans for a $300 million expansion of its

Illinois-based soy protein concentrate

facility. ADM expects to double the

facility’s extrusion capacity and will also

open a new Protein Innovation Center.

○ Ingredient manufacturer BENEO will

invest $54 million to build a new pulse

processing facility in Offstein, Germany.

The facility will initially process protein

concentrate, flour, and hulls from fava

beans, with the option to expand to other

types of pulses in the future.

○ India-based food manufacturer Symega

Food Ingredients is investing Rs. 100

crore ($10.3 million) to build a dedicated

plant-based production facility with an

on-site R&D laboratory located in Kochi,

India.

○ Merit Functional Foods Corp. received

funding from the Canadian government to

construct a 94,000-square-foot plant

protein processing facility in Winnipeg.

○ Swedish agricultural cooperative

Lantmännen is investing $91 million to

construct a new pea protein facility in

Lidköping, Sweden that will be completed

in 2026.

○ Thailand-based plant-based cheese

startup Swees Plant Based Foods Co.

will open Thailand’s first plant-based

cheese factory in early 2023.

○ Plant-based ingredient company More

Than Protein Ingredients is constructing

a new processing facility near Bowden,

Alberta, with support from Protein

Industries Canada. The facility is

scheduled to be operational by spring

2023.

○ Improved Nature, a plant-based meat

manufacturer based in North Carolina,

announced plans to build a new facility in

Smithfield, North Carolina to produce

their soy-based meat products. The

facility is expected to employ 96 people

at full operation.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 24

Notably, several facilities including those of Harvest B, Australian Plant Proteins, Merit

Functional Foods Corp, and More Than Protein Ingredients have been

financially supported

by governments. Funding plant protein infrastructure—one of the biggest bottlenecks in the

sector—allows governments to contribute to climate goals while supporting local

manufacturing and job creation.

Figure 1: New plant-based facilities announced in 2022

“Exploration of opportunities across the plant-based space continues

to be an important focus area in our innovation and R&D work. This is

true for retail products, as well in the out-of-home space. Coming out

of the pandemic, restaurant operators believe plant-based meats have

the ability to drive sales and traf

fic through their doors. We’re seeing

this trend

firsthand through our Nestle Professional Sweet Earth

business; over 2000 locations are now serving Sweet Earth’s

plant-based recipes out-of-home.”

– Mel Cash, Chief Marketing & Innovation Of

ficer, Nestlé USA

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 25

Involvement by conventional meat

and food companies

Most of the leading global consumer packaged goods (CPG) and meat companies are involved in

the plant-based industry in some capacity. Involvement by large conventional food

companies—through investment, acquisitions, partnerships, and developing and manufacturing

products—can support the growth of the industry, as these companies already have funding,

infrastructure, and distribution partnerships that can be leveraged to improve the accessibility

of alternative protein products.

○ A number of large meat and food companies have made investments in or acquisitions of

plant-based food companies. Notable acquisitions include Nestlé’s acquisition of Sweet

Earth in 2017 and JBS’s acquisition of Vivera Foods in 2021.

○ Notable partnerships between international conventional meat and food companies and

plant-based companies include PepsiCo’s joint venture with Beyond Meat, Kraft Heinz’s

joint venture with NotCo, and Cargill’s partnership with Bflike.

○ Several large global meat and food companies manufacture their own plant-based products.

Examples of plant-based brands owned by large food companies include Garden Gourmet

and Sweet Earth, owned by Nestlé, BOCA, owned by Kraft Heinz, Morningstar Farms,

owned by Kellogg’s, and The Vegetarian Butcher, owned by Unilever.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 26

Table 5: Conventional companies with involvement in alternative proteins

Table 6: Conventional companies with involvement in plant-based

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 27

Another opportunity for conventional meat companies to become involved in the alternative

protein industry is by incorporating plant protein and vegetables into meat products. In the

last few years, several meat companies have launched blended meat products, including

Perdue, Hormel, and Tyson. Communicating the bene

fits of blended products to consumers

may require nuanced product positioning, as this is a relatively new and subtle category that

requires a clear value proposition. Targeting the right consumer groups will be critical—for

example, parents who want to incorporate more vegetables into their children’s meals. Indeed,

blended products may provide value to health-focused consumers looking to increase their

consumption of vegetables and plant proteins (or reduce their consumption of meat), and have

a relatively lower environmental impact than conventional meat products, which could help

manufacturers reach their sustainability goals.

“Adding new blended vegetable and meat products to the PERDUE®

brand portfolio helps us meet the needs of consumers who are

increasingly looking to incorporate more vegetable nutrition in their

diets—without sacri

ficing taste or quality. We’ve blended family favorites,

like nuggets and tenders, with high-quality plant protein to meet the

evolving needs of consumers today. Our blended product line has been

extremely successful since launching in 2019, and we’ve since expanded

the line by adding new flavors and snacking options.”

– Jon Swadley, Vice President of Marketing, Perdue Premium Prepared Foods

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 28

Partnerships

Strategic partnerships are another important tool to support industry growth. Partnerships

allow companies to access one another’s expertise or infrastructure, including in product

development, manufacturing capacity, or distribution channels. Partnerships in the

plant-based industry developed rapidly in 2022. While not comprehensive of all plant-based

partnerships in 2022, the list below highlights some of the most notable partnerships

propelling the industry forward.

Product development partnerships

Product development partnerships are very common for plant-based companies. Such

partnerships allow companies to leverage one another’s ingredients, R&D capacity, and

product portfolios.

Companies/organizations

Details

Above Food and Umiami

Developing whole-cut, plant-based meat products

Upfield and OGGS

R&D in liquid plant-based eggs

Kroger and Impossible Foods

Private label product development

Nestlé and Corbion

Developing microalgae ingredients for plant-based

foods

Evo Foods and Ginkgo Bioworks

Developing animal-free eggs

InnovoPro and Milkadamia

Developing chickpea-based ice cream

International Flavors and Fragrances and

SimpliiGood

Developing spirulina-based smoked salmon products

Republic Polytechnic and SoiLabs

Developing plant-based cheese from okara

UNLIMEAT and Bayerische Fleischerschule

Landshut

Developing plant-based deli products

Nomoo and Nestlé

Developing plant-based meat product lines

Barvecue and Arbiom

Developing plant-based meat products

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 29

Companies/organizations

Details

Mirai Foods and Rügenwalder Mühle

Developing hybrid plant-based and cultivated meat

products

Peas of Heaven and Mycorena

Developing plant-based products with mycelium

ingredients

Meatable and Love Handle

Establishing a Future of Meat Innovation Center to

codevelop plant-based and cultivated meat hybrid

products

Next Meats, Dr. Food, and ImpacFat

Codevelop plant-based products with cultivated fat

Sophie’s Bionutrients and Danish

Technological Institute

Developing chlorella-based ice cream

Joint ventures

Joint ventures allow companies to access one another’s brand equity along with manufacturing

and distribution infrastructure.

Companies/organizations

Details

Kraft Heinz and NotCo

The Kraft Heinz Not Company distributes co-branded

plant-based products

Cale & Daughters and Vgarden

Vgarden Australia Pty Ltd involves an IP exchange and

joint product production

PepsiCo and Beyond Meat

Distributing cobranded plant-based jerky products

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 30

Scale-up

Manufacturing capacity is one of the most signi

ficant barriers to growth in alternative proteins.

Partnerships focused on scaling up ingredients allow companies to access one another’s

infrastructure and process expertise.

Companies/organizations

Details

ADM and Benson Hill

Scaling production of soy protein

Planet Based Foods and Cedarlane Natural

Foods

Manufacturing partnership

Distribution

Securing product distribution is another key challenge for startups, many of whom must enter

distribution channels from scratch, using cold outreach to distributors, foodservice companies,

and retailers. Partnering with an established company can offer a shortcut to growing a

company’s distribution network.

Companies/organizations

Details

Upfield and OGGS

Leveraging Upfield’s distribution network and

Upfield Professional foodservice channel

Beyond Meat and Pinduoduo

Selling Beyond products via e-commerce in

mainland China

Vandersterre and Max & Bien

Leveraging Vandersterre’s distribution and

marketing channels

Thai Union, Chicken of the Sea, and The ISH

Food Company

Leveraging conventional seafood producers’

distribution channels

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 31

Consumer insights

Global trial and demand

In the United States, 40 percent of all shoppers have purchased plant-based meat or dairy in

the past six months, according to consumer research from Acosta. Yet just 10 percent of those

shoppers purchasing plant-based products report adhering to a fully plant-based diet. It’s clear

that omnivore shoppers are the largest market for plant-based proteins. Indeed, one study

analyzing household purchasing data found that 86 percent of households that purchased meat

alternatives also purchased conventional meat.

Globally, consumers report increased engagement with plant-based proteins:

○ A recent study conducted by GFI Europe surveyed consumers across four European

countries

finding that between 27 and 50 percent reported eating plant-based meat at least

once a month.

○ A survey from GFI Brazil shows that the percentage of respondents who say they are

reducing their meat consumption grew from 50 percent in 2020 to 67 percent in 2022.

According to CONAB 2022, meat consumption in Brazil decreased by 4.4 percent between

2021 and 2022. Drivers of this decline could include shifting consumer behavior as well as

less availability (and thus higher prices) of conventional meat products, given the preference

of producers for exportation.

○ A survey conducted by BCG and Blue Horizon found that 60 percent of consumers surveyed

across seven countries reported at least having tried alternative proteins.

○ When we look at young consumers (ages 16–40) across 10 countries, 66 percent plan to

spend more on plant-based meat and dairy alternatives in the future.

Motivations

When it comes to what consumers are looking for, according to FMI, taste, quality, and value

rise to the top when considering all grocery purchases. This holds true when consumers are

considering their overall protein purchases as well as plant-based food consumption.

Consumer research commissioned by GFI in Singapore, Thailand, Japan, and South Korea found

that taste was the top motivator for consuming alternative seafood, but that a guaranteed lack

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 32

of mercury and other heavy metal contamination was also a driver of interest in alternative

seafood across all four countries.

In addition to these motivators, consumers continue to identify health as a top reason for

purchasing plant-based proteins, including meat alternatives.

Figure 2: Plant-based protein motivators by dietary preference

Source: Mintel Reports US, Plant-based Proteins, 2022.

Questions: What are the main reasons you eat plant-based proteins? Which of the following dietary preferences best describes you?

As discussed in a recent migration analysis released by PBFA, in partnership with Kroger,

consumers who are limiting their consumption of animal-based foods in favor of plant-based

items cite health-related factors as a top motivator.

Notably, the environmental and animal welfare bene

fits of plant-based foods often take a back

seat to the previously mentioned considerations. However, certain consumer groups including

flexitarians and younger cohorts tend to voice these considerations more frequently than the

general consumer. Between 60 and 90 percent of young consumers (ages 16–40) across 10

countries say they consider the environmental sustainability of their food purchases.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 33

“Highlighting sustainability alone will not be enough: only a small

group of consumers make food purchasing decisions based on

sustainability, and most consumers—the “mainstream”—are concerned

about sustainability in food but are not yet acting on it.

To win with mainstream consumers, alternative protein companies

must connect their products to top needs that drive consumer behavior

in food choices (typically taste and health). First, consumers want to

see innovations that improve taste, texture, and price, where gaps

relative to traditional meat remain. Second, brands need to tailor their

messaging and marketing to clearly connect existing products to

consumers’ emotional and functional needs.”

– Neeru Ravi, Principal, Boston Consulting Group

Barriers

Despite stated consumer interest in plant-based foods, key barriers remain, limiting the growth

of the industry:

○ FMI found that consumers identi

fied taste as the top reason why consumers who have tried

meat alternatives didn’t continue to do so. Additionally, preemptive perceptions about the

taste of plant-based products may limit initial trials.

○ Mintel’s 2022 report further validates taste and flavor concerns as primary barriers. Taste,

and speci

fically replicating the flavor, texture, and aroma of conventional meat, is critical for

consumer adoption of plant-based meat alternatives, with 53 percent of individuals

agreeing that plant-based meat products should taste just like meat. Additionally, among

U.S. consumers not eating plant-based proteins (including beans, legumes, nuts, tofu, meat

alternatives, etc.), 49 percent state they haven’t tried them because of taste and flavor

concerns. Additional consumer perceptions and concerns include the idea that “meat is a

better source of nutrients” and that plant-based proteins are “too expensive.”

○ Notably, FMI found a possible decline in health as a motivator for plant-based food

consumption. In 2020, 50 percent of consumers stated “I think they are healthy” as a top

motivator for preparing plant-based meat alternatives compared to 38 percent in FMI’s

latest 2022 survey.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 34

○ Beyond consumer-based preferences and perceptions, institutional factors affect the growth

of the alternative protein industry. In early 2023, an article published by Insper, one of

Brazil’s top business schools, unpacked the barriers and enablers of sustainable protein

innovation in Brazil. The study found that tax incentives, access to funding, and entrepreneur

network expansion are important external factors that drive alternative protein innovation. In

addition, the acknowledgment that alternative proteins are a pathway for the private sector

to create shared value and address public problems (e.g., climate, biodiversity, food security)

can be a driver, as ESG-driven decision making becomes the norm.

Prioritizing sensory characteristics like taste and texture, ensuring that consumer needs are

met, improving access and variety, and incentivizing innovation and partnerships will be key

to driving not only interest and trial but also sustained growth for years to come.

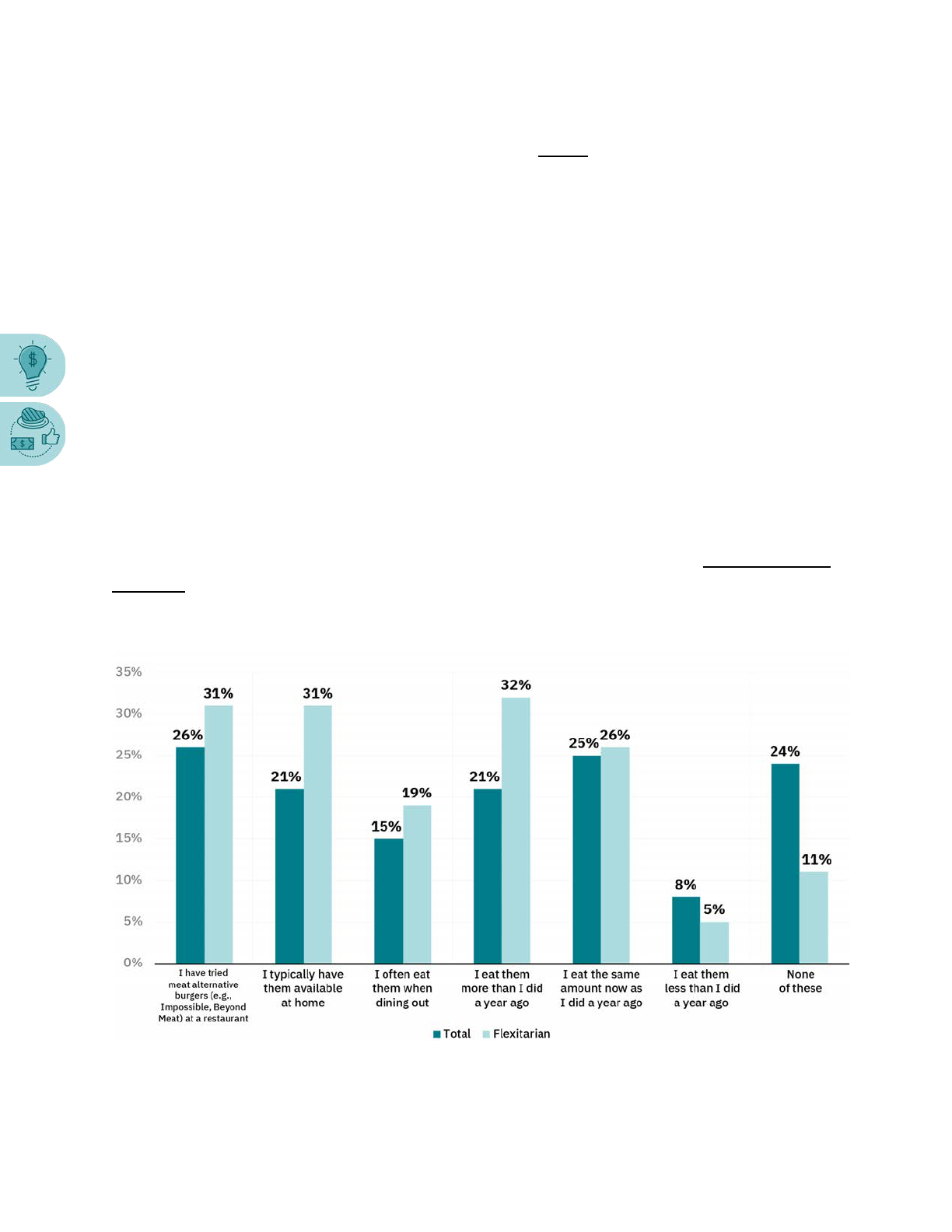

A note on foodservice

The foodservice industry is a critical avenue for growth within alternative proteins. Roughly one

in four consumers reports having tried a meat alternative burger at a restaurant while 15

percent of consumers say they eat plant-based meat alternatives often when dining outside of

the home.

Figure 3: Meat alternative behaviors by dietary preference

Source: Mintel Reports US, Plant-based Proteins, 2022

Questions: Which of the following statements about plant-based meat alternatives (e.g., Gardein, Impossible Burger) do you agree

with? Which of the following dietary preferences best describes you?

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 35

Notably, consumers are looking for more. Half of omnivores and 8 in 10 flexitarians agree that

more restaurants should serve plant-based meat alternatives. GFI commissioned a

plant-based meat alternative buyer analysis from Circana covering 2019 through 2022. This

analysis captures consumers’ foodservice purchases via uploaded receipts, speci

fically those of

consumers who purchase plant-based meat alternatives. The key insights are captured below.

For more on the methodology see box 5 below.

Key insights:

○ The percentage of U.S. consumers buying plant-based meat in commercial foodservice over

each of the last four years has remained steady at around 9 percent. However, the average

frequency of purchase has increased by 30 percent since 2019.

○ Opportunities remain to drive repeat purchases: 63 percent of alternative meat buyers

purchased these items just once in 2022 and 37 percent purchased these items two times

or more within the year.

○ Plant-based meat buyers are valuable to operators. They make 30+ more foodservice visits

and spend over $400 more annually compared to the average buyer.

○ Demographically, plant-based meat items are more likely to attract buyers aged 18–24,

male buyers, and multicultural buyers.

Foodservice environments are important avenues for driving consumers to try plant-based

proteins because taste and flavor experiences are often elevated relative to home cooking, and

price sometimes plays a lesser role as a barrier to consumption. Consumers and operators are

showing an increased interest in plant-based proteins out of the home, but opportunities

remain for industry players to drive product innovation and renovation to meet consumer

needs and preferences, bring down costs, and increase distribution to make these products

more appealing and accessible to consumers across all channels and markets.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 36

“What we’ve witnessed is that our consumer base is similar around the

globe, particularly in urban locations. Many of our consumers are

between 18-35 years old and are often seeking experiences with food

that are noteworthy and memorable. Our consumer base in Singapore,

for example, is not unlike our customers in New York City or London or

Munich. For some in this group, there’s a growing awareness that

there’s a connection between meat production and environmental

impacts, but it’s not completely obvious yet. It’s even more important

as a brand and young company for us to focus on education of the food

and planet connection—and partner with some of the best chefs and

restaurants in the world to help communicate that plant-based dining

can be both exciting and delicious (and not offer any compromise).”

– Andre Menezes, CEO and Co-Founder, TiNDLE

Are we missing your company? Did we get something wrong in this Commercial

Landscape section? We’d appreciate your feedback via this form.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 37

Section 2

Sales

Section 2: Sales

—

U.S. retail sales overview

Insights released by the Good Food Institute (GFI) and the Plant Based Foods Association

(PBFA) based on retail sales data commissioned from SPINS show that the plant-based food

market in U.S. retail in 2022 is worth $8 billion, with dollar sales up seven percent from 2021,

and unit sales down three percent, mirroring total food and beverage and animal-based food.

While dollar sales are up across several categories due to price increases, notable plant-based

categories that saw unit sales growth in 2022 despite challenging market conditions include

plant-based eggs, plant-based seafood, plant-based creamers, and plant-based protein liquids

and powders. Yet, with inflation and consumer spending concerns affecting the retail market in

2022, many plant-based categories saw overall dollar sales increases and unit declines.

Key insights:

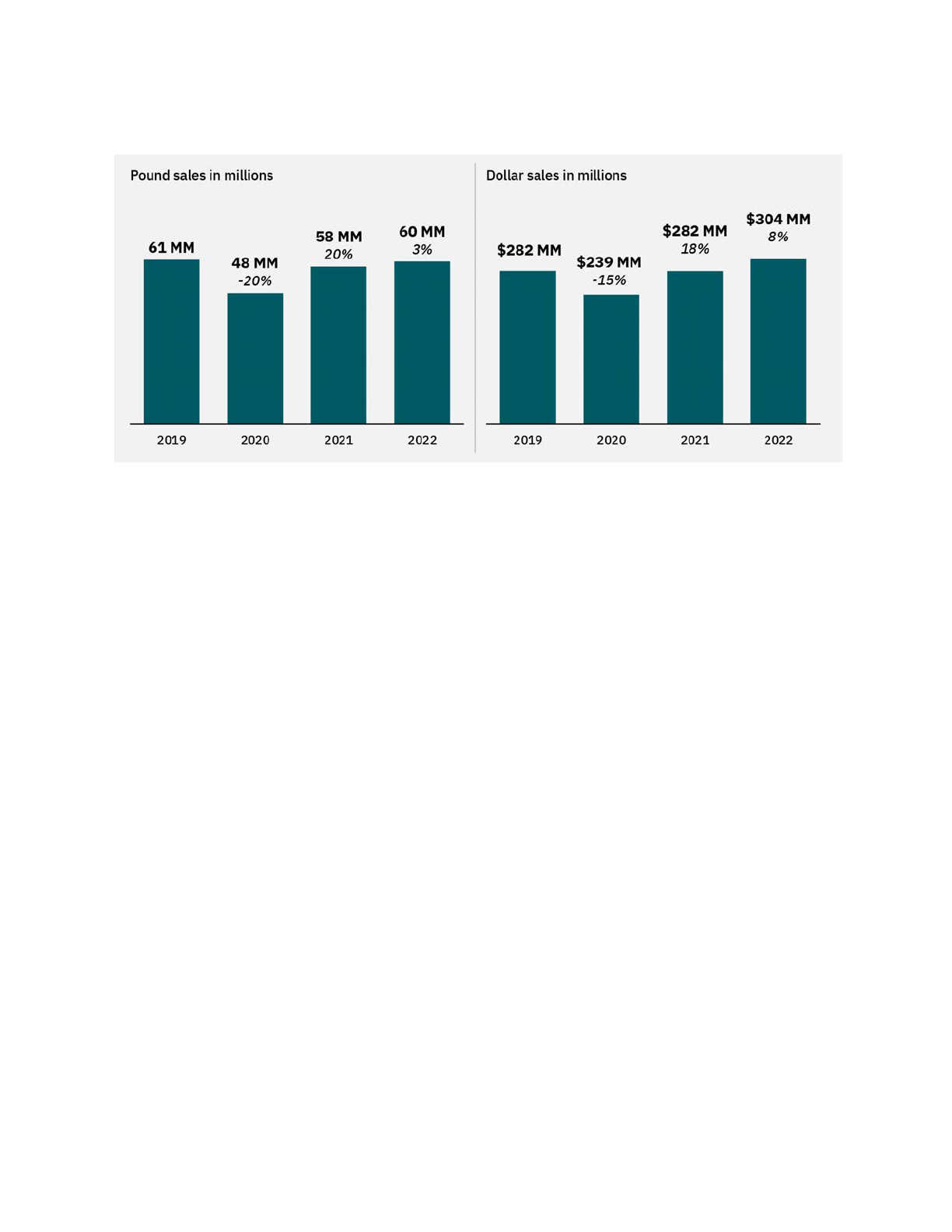

○ As with total food and beverage at

retail in 2022, several plant-based

categories saw dollar volume growth

alongside unit volume declines.

However, a few notable categories grew

in both dollar and unit sales in 2022,

including plant-based creamers, eggs,

and protein liquids and powders.

○ Plant-based milk is the most developed

of all plant-based categories.

Plant-based milk dollar sales were $2.8

billion in 2022, making up over a third of

all plant-based sales.

○ Plant-based meat dollar sales are down

slightly by 1% and unit sales are down

8%. This indicates an opportunity to

further attract and retain consumers in

the category by delivering great-tasting,

affordable products that meet consumer

needs.

○ The smallest category, and the

fastest-growing, is plant-based eggs. At

$45 million in dollar sales in 2022,

plant-based eggs is a modest category

that has grown 4x its size in 2019, albeit

on a very small base. Plant-based eggs

have also seen a significant closing in the

price gap with animal-based eggs, driven

by both price increases for animal-based

eggs and price per unit decreases for

products in the plant-based egg category.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 39

Figure 4: Plant-based foods market, U.S. retail (2019–2022)

Sales data note: The data presented in this graph is based on custom GFI and PBFA plant-based categories that were created by

re

fining standard SPINS categories. Due to the custom nature of these categories, the presented data will not align with standard

SPINS categories.

Source: SPINS Natural Grocery Channel, SPINS Conventional Multi Outlet Channel (powered by Circana, formerly IRI & NPD) | 52

Weeks Ending 1-1-2023

©2023 The Good Food Institute, Inc

Inflation

Inflation was a major story across the globe in 2022, particularly in the food sector. In the U.S.,

from December 2021 to December 2022, food-at-home prices rose 12 percent, which

influenced how consumers shopped. According to IRI’s December primary shopper survey as

reported by 210 Analytics, 8 in 10 consumers reported making changes to their shopping

behavior as a result of price increases. Full-year 2022 data on total edibles shows a decline in

total food and beverage consumption with unit sales down three percent and dollar sales up 11

percent versus the prior year. Notably, categories like conventional meat and plant-based meat

experienced gaps between dollar sales changes and unit sales changes, representing

signi

ficant price-per-unit increases.

In addition to price increases for a given category, inflation cuts into consumer budgets and

tends to influence consumers to trade down from existing premium categories—almost all

plant-based categories continue to sell at a price premium per pound compared to their

animal-based counterparts.

Reaching price parity with conventional meat remains a large barrier to mass adoption for the

plant-based meat category. According to Mintel, 26 percent of consumers who don’t eat

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 40

plant-based proteins today say the products are too expensive. Research from FMI shows that

cost is a major factor identi

fied by almost a third of consumers who stop buying plant-based

meat or dairy. Overall, the premium prices of plant-based foods present a barrier to reaching

more consumers and with more frequency, particularly given that consumers are likely to be

increasingly mindful of prices in the current economic environment.

Supply chain disruptions

A major contributor to the decreased affordability and availability of food in 2022 was

continued ingredient shortages and supply chain disruptions. Events including the war in

Ukraine, extreme weather, continued pandemic impacts like labor shortages, and avian flu

outbreaks have had ripple effects across the global food network.

Neither plant-based nor animal-based foods have been entirely immune to these challenges.

Both plant- and animal-based proteins were impacted by lower-than-anticipated global pea

and soybean yields, sanctions on Russia—the world’s largest fertilizer exporter—and elevated

energy costs, all of which drove up costs of production. Rising sea and rail freight costs also

contributed to price increases for both plant and animal proteins. Yet the environmental

bene

fits, production efficiencies at scale, and minimized supply chain vulnerabilities compared

to the animal agriculture industry make plant-based foods a powerful tool in building a stable

food supply. The plant-based industry is still small relative to the total food industry.

Plant-based milk has a 15 percent dollar share of total milk, plant-based meat has a 1.3

percent dollar share of total meat, and the plant-based egg category has a 0.5 percent dollar

share of overall eggs in U.S. retail. Continued public and private investments are needed to

scale the industry, improve taste and price parity with conventional meat, egg, and dairy

products, and improve the industry’s ability to attract and retain consumers.

Lingering impacts of the pandemic

Looking at the retail channel alone risks missing the larger picture of plant-based food sales in

the U.S. given individual channel volatility across retail, foodservice, and e-commerce in the

past four years. In 2020, due to the pandemic, a large portion of foodservice dollars shifted to

retail. Across categories, this resulted in unprecedented retail growth—and high bars for

lapping this growth. Both 2021 and 2022 have seen the foodservice channel earn back much

of its prior volume, and retail volume has started to settle. Meanwhile, e-commerce sales have

grown rapidly, although on a very small base, stimulated by the pandemic.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 41

Today, although restrictions have continued to lift and purchases have stabilized, the pandemic

continues to have lasting impacts on the broader food industry and consumer behavior. A brief

example of an opportunity for plant-based foods at retail is consumers buying in bulk, which is

one of the pandemic’s lasting impacts on shoppers’ habits. However, many plant-based

products are not available in bulk sizes, which can offer consumers greater ef

ficiencies in

per-pound prices.

Box 1: U.S. retail market data collection

Point-of-sale (POS) data

To size the U.S. retail market for plant-based foods, GFI and PBFA commissioned retail sales data from the market

research firm SPINS. The firm built the dataset by first pulling in all products with the SPINS “plant-based

positioned” product attribute, followed by adding plant-based private label products. Inherently, plant-based foods,

such as chickpeas and kale, are not included. Due to the custom nature of these categories, the retail data

presented on this page may not align with standard SPINS categories. Additionally, SPINS pulled in relevant

mainstream subcategories (excluding plant-based positioned products) to create the conventional categories

discussed above. Finally, the total edibles category pulled in all grocery, frozen, and refrigerated edible items across

the retail grocery landscape as well as protein powders and bars. SPINS obtained the data over the 52-week,

104-week, 156-week, and 208-week periods ending January 1, 2023, from the SPINS Natural Grocery Channel and

Conventional Multi-Outlet Channel (powered by Circana, formerly IRI & NPD).

SPINS defines these channels as follows:

○ Conventional Multi Outlet (MULO): More than 110,000 retail locations spanning the grocery outlet, the drug

outlet, and selected retailers across mass merchandisers, including Walmart, club, dollar, and military.

○ Natural Enhanced: More than 1,900 full-format stores with $2 million+ in annual sales and 40% or more of

UPC-coded sales from natural/organic/specialty products.

This is generally considered the broadest available view of retail food sales, although not all retailers are

represented. Some companies, such as Whole Foods Market, Trader Joe’s, and Costco, do not report their scan data

to SPINS or Circana (formerly IRI & NPD). Please note that this methodology has changed compared to that used in

previous reporting by GFI. We do not recommend comparing data released in prior years to the data included here.

Consumer panel data

To understand consumer purchasing dynamics and demographics, GFI and PBFA also commissioned consumer

panel data from SPINS. The process for pulling the panel data was separate from that for the POS data, which may

result in minor category differences. SPINS acquires its panel data through the National Consumer Panel, a Nielsen

and Circana (formerly IRI & NPD) joint venture composed of roughly 100,000 households. SPINS obtained the data

over the 52-week, 104-week, 156-week, and 208-week periods ending January 1, 2023, from all U.S. outlets.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 42

Categories

Plant-based food categories are in various stages of development. Plant-based milk is a

multi-billion-dollar category with a 15 percent market share of total milk dollar sales, while

small but emerging categories such as plant-based eggs saw continued growth in 2022.

Table 7: Plant-based food category dollar sales, dollar sales growth, unit sales, and unit

sales growth 2022

Category

2022

dollar sales

1-year dollar

sales growth

3-year dollar

sales growth

2022

unit sales

1-year unit

sales growth

3-year unit

sales growth

(2021–2022)

(2019–2022)

(2021–2022)

(2019–2022)

Plant-based milk

$2.8 B

9%

36%

749 MM

-2%

19%

Plant-based meat

$1.4 B

-1%

43%

255 MM

-8%

20%

Plant-based creamer

$645 MM

24%

119%

137 MM

12%

77%

Plant-based meals

$531 MM

1%

49%

112 MM

-7%

33%

Plant-based ice cream

and frozen novelty

$437 MM

-4%

25%

83 MM

-9%

14%

Plant-based yogurt

$425 MM

5%

39%

174 MM

-5%

16%

Plant-based protein

liquids and powders

$341 MM

14%

39%

24 MM

13%

35%

Plant-based butter

$311 MM

15%

55%

71 MM

-11%

10%

Plant-based

ready-to-drink

beverages

$239 MM

17%

76%

57 MM

11%

62%

Plant-based cheese

$233 MM

-2%

51%

47 MM

-5%

44%

Plant-based bars

$202 MM

13%

-2%

47 MM

-8%

-30%

Tofu, tempeh, and seitan

$185 MM

4%

41%

65 MM

-0%

26%

Plant-based cream

cheese, sour cream, and

spreads

$129 MM

7%

104%

24 MM

2%

86%

Plant-based condiments,

dressings, and mayo

$89 MM

6%

47%

16 MM

-3%

32%

Plant-based eggs

$45 MM

14%

348%

10 MM

21%

611%

Plant-based baked

goods

$35 MM

13%

38%

6 MM

3%

-3%

TOTAL

$8.0 B

7%

44%

1.9 B

-3%

23%

Sales data note: The data presented in this graph is based on custom GFI and PBFA plant-based categories that were created by

refining standard SPINS categories. Due to the custom nature of these categories, the presented data will not align with standard

SPINS categories. Source: SPINS Natural Grocery Channel, SPINS Conventional Multi Outlet Channel (powered by Circana,

formerly IRI & NPD) | 52 Weeks Ending 1-1-2023

©2023 The Good Food Institute, Inc

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 43

Closing the price gap

The majority of plant-based categories and every animal-based category had positive dollar sales

growth in 2022. However, all animal-based categories and most plant-based categories experienced

unit sales declines, indicative of the trends in U.S. retail of increasing average price-per-unit.

Plant-based products tend to be sold at a signi

ficant price premium compared to conventional

products. Closing this price gap represents an opportunity to appeal to more consumers and

position products as more feasible swap-outs for conventional products. GFI analysis of

multiple data sources indicates that, in 2022, pound for pound, the overall price premium for

plant-based meat was 67 percent, and for plant-based eggs was 122 percent. Gallon for

gallon, the overall price premium for plant-based milk was 87 percent.

The plant-based egg category made notable progress toward price parity in 2022. In 2021,

plant-based eggs cost about $5 more per pound than animal-based eggs. This gap shrank to

$3.50 in 2022, driven primarily by animal-based egg price increases and secondarily by

decreases in plant-based egg prices.

For a comprehensive overview of U.S. retail sales data, including coverage of all plant-based

categories and additional detail on the plant-based meat and plant-based milk categories, as

well as consumer purchase dynamics, check out GFI’s market data page.

U.S. consumer dynamics and research

Mainstream consumer awareness of and interest in plant-based foods is a critical factor in

growing this emerging market. Plant-based meat, eggs, and dairy continue to gain mainstream

status but improvements on key consumer drivers like taste and price will be crucial to

increasing repeat purchases and expanding household penetration.

Consumer demographics for overall plant-based foods

Plant-based food consumption over indexes among several consumer groups. Compared to the

average consumer, purchasers of plant-based products tend to be younger and from higher

income brackets and tend to have college or graduate degrees. Asian consumers are more

likely to be buyers of plant-based foods.

In addition to sales data, other key metrics including household penetration and repeat

purchase rate demonstrate growth opportunities for plant-based categories.

State of the Industry Report | Plant-based meat, seafood, eggs, and dairy 44

Table 8: Purchase dynamics of plant-based foods 2022

Household data note: SPINS uses a separate process from the sales data to pull household panel data which may result in minor