FloridaHousingFinanceCorporation

CreditUnderwritingReport

Pinnacle441

HousingCreditFinancingforAffordableHousingDevelopmentsLocatedinBroward,Duval,

Hillsborough,Orange,PalmBeachandPinellasCounties

RFA2020‐202(2021‐017C)

HousingCreditProgram

InvitationtoParticipatefortheConstructionHousingInflationResponseProgram

2022CHIRP

SectionA ReportSummary

SectionB HCAllocationRecommendationandContingencies

SectionC SupportingInformationandSchedules

Preparedby

SeltzerManagementGroup,Inc.

FinalReport

July6,2022

SMG

_____________________________________________________________________________

JULY 6, 2022

Pinnacle441

TABLEOFCONTENTS

Page

SectionA

ReportSummary

RecommendationA1‐A8

OverviewA9‐A11

UsesofFundsA12‐A18

OperatingProFormaA19‐A21

SectionB

HCAllocationRecommendationandContingencies B1

SectionC

SupportingSchedules

AdditionalDevelopmentandThirdPartyInformationC1‐C6

BorrowerInformationC7‐C10

SyndicatorInformationC11

GeneralContractorInformationC12‐C13

PropertyManagerInformationC14

Exhibits

15YearProForma1

Features/AmenitiesandResidentPrograms21‐6

CompletenessandIssuesChecklist31‐2

HCAllocationCalculation41‐3

SMG

_____________________________________________________________________________

JULY 6, 2022

SectionA

ReportSummary

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-1

JULY 6, 2022

Recommendation

SeltzerManagement Group, Inc. (“SMG” or “Seltzer”) recommendsanannual9%competitiveHousing

Credit (“HC”) allocation of $2,882,000, plus an additional $500,000 from the Construction Housing

InflationResponseProgram(“CHIRP”),foratotalannualallocation of$3,382,000beawardedbyFlorida

HousingFinanceCorporation(“FHFC”or“FloridaHousing”)forconstructionand

permanentfinancingof

Pinnacle441(“Development”).

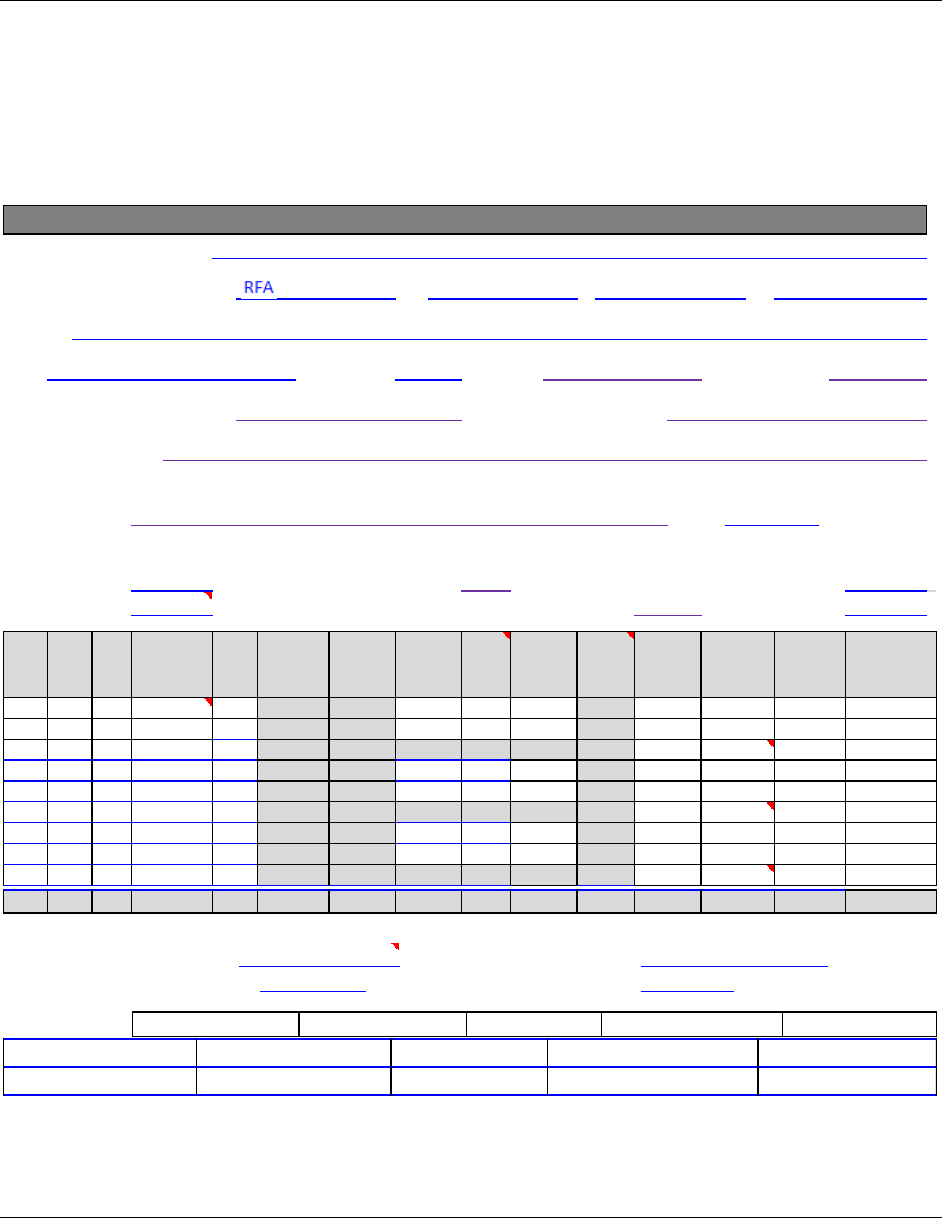

DevelopmentName:

RFA/ProgramNumbers: /

Address:

Ci ty: ZipCode: County: CountySize:

DevelopmentCategory: DevelopmentType:

Constructi on Type:

DemographicCommi tment:

Primary: oftheUnits

UnitComposition:

#ofELIUnits: ELIUnitsAreRestrictedto AMI,orless. Total#ofunitswithPBRA?

#ofLinkUnits: AretheLinkUnitsDemographicallyRestricted? #ofNHTFUnits:

Pinnacle441

$1,832

$429

$1,144

$2,610

$484

$1,107

$467

Net

Restricted

Rents

$344

$922

MKT

25%

$414

$1,107

$2,610

$467

$414

AnnualRental

Income

$8,256

$21,978

60%

1,194

2.0

22.0

32.0

1

$1,2683

32.0

DEVELOPMENT&SET‐ASIDES

Bed

Rooms

1.0

2.0

Bath

Rooms

1.0

PBRA

Contr

Rents

1

1

1

2

1.0

2.0

1

7

256

1

$105

$572

$1,373

3

31

$2,759

731

973

973

2,372

1,194

1,194

2021‐017C

NewConstruction HighRise

Masonry

2020‐202

LargeBroward33024Hollywood

NStateRoad7(US441),SWCornerofNStateRoad7(US441)andJohnsonSt

for 100%

AMI%

25%

MKT

0

0

Family

12

6

25%

Utility

Allow.

$68

Yes

GrossHC

Rent

$412

$990

731

73111

$81

$81

Units

LowHOME

Rents

60%

MKT

2

High

HOME

RentsSquareFeet

25%

60%

$495

$1,188

$105

CURents

$344

$922

$1,831.50

Applicant

Rents

$357

$952$68

$1,310

$467

$1,107

$2,610

$121,704

Appraise r

Rents

$344

$922

$1,831.50

$414

$743,904

$31,320

$16,812

$471,696

$34,776

$1,268

$33,102

$1,268

$2,758.5 $2,758.50

115,695113 $1,483,548

Buil di ngs: Resi dential ‐ Non‐Residential‐

Parking: ParkingSpaces‐ AccessibleSpaces‐

Se tAsides: Program

1

Term(Years)%AMI#ofUnits%ofUnits

200 7

0

HC

HC

12

98

10.0%

90.0%

25% 50

5060%

TheApplicantselectedtheminimumsetasidecommitmentof40%ofunitsat60%AreaMedianIncome

(“AMI”)orlower.Therefore,theDevelopmentmustsetaside10.0%ofthetotalunits(12units)asELISet‐

Aside units at 25% AMI or lower. Persons with Special Needs Set‐Aside Commitment:

The proposed

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-2

JULY 6, 2022

Developmentmustsetaside50percent(50%)oftheELISet‐Asideunits(6units)asLinkunitsforPersons

withSpecialNeeds.InordertomeetthecommitmenttosetasideELIasLINKunitsforPersonswithSpecial

Needs,theApplicantmustdevelopandexecuteaMemorandumofUnderstanding

(“MOU”)withatleast

onedesignatedSpecialNeedsHouseholdReferralAgencythatprovidessupportiveservicesforPersons

with Special Needs in Broward County. The MOU was approved by Florida Housing on September 15,

2021.FHFCalsoapprovedtheTenantSelectionPlanonJanuary6,2022.

AbsorptionRate unitspermonthfor months.

OccupancyRateatStabilization: PhysicalOccupancy EconomicOccupancy

Occu pancyComments

DDA: QCT: M ulti‐PhaseBoost: QAPBoost:

SiteAcre age: Density: Fl oodZoneDesignation:

Zoning: FloodInsuranceRequired?:

95.00%

No

4.5

AH

Yes No

C‐JS,Cen tralJohnsonStreetDistrict

3.045 37.1100

Yes

No

96.00%

25

Pinna c le441,LLC

%Owners hi p

0.00%

Applicant/Borrower:

Apprai s er:

ManagementCompany:

Archi tect:

General Contractor1:

Member

DEVELOPMENTTEAM

MitchellM.Friedman

99.99%

PC441,LLC

BankofAmeri ca ,N.A.,oritsaffili ates("BofA")

SpecialMe mber

Developer:

Member

BancofAmeri ca CDCSpecialHoldingCompa ny,Inc.

DavidO.Deutch

Pinna c leCommunities,LLC

Meri dianAppraisal Group

PCBuilding,LLC

Synd icator:

0.01%

Jose phB.Kaller&Associates,P.A.d/b/a KallerArchi tecture

MarketStudyProvi der:

Pr ofes sionalManagement,Inc.

Meri dian

Apprai sal Group

Principa l1

Principa l2

Principa l3

LouisWolfsonIII

BofA

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-3

JULY 6, 2022

NLP

BrowardCounty

$9,200,000

$100,000

LienPos iti on

0.00%

5.1

Opera ti ngDeficit&

DebtServiceReserves

DebtServiceCoverage

Restricte dMarket

Fi nanc ingLTV

#ofMonthscovered

bytheReserves

1.171

N/A

16.0

30.0

Second

22.0%

20.5% 20.7%

1.171

Other

$359,382

LoantoCost‐

Cumulative

2ndSource

1stSourc e

67.3% 68.0%

21.8%

Lender/Grantor

Amount

UnderwrittenInterest

Rate

LoanTerm

5.47%

MarketRate/Market

Fi nanc ingLTV

Amorti zati on

Fi rstMortgage

5thSource4thSource3rdSource

PERMANENTFINANCINGINFORMATION

35.0

$0.94

HousingCr edit(HC)SyndicationPri c e

Year15Pr oFo rmaIncomeEs cal ati onRate

DeferredDeveloperFee

MarketRent/MarketFin ancin gStabilizedVal ue

HCAnnual Allocation‐Initi alAward

$2,882,000

RentRestrictedMarketFinan cingStabilizedValue

HCAnnual Allocation‐QualifiedinCUR

ProjectedNetOper a tingIncome(NOI) ‐15 Year

3.00%

ProjectedNetOper a tingIncome(NOI) ‐Year1

$691,440

$3,510,000

$3,382,000

$13,680,000

$3,851,893

$42,220,000

$776,869

$3,382,000

As‐IsLa ndVa lue

HCAnnual Allocation‐Equi tyLetterofInterest

Year15Pr oFo rmaExpenseEscal ati onRate

2.00%

LocalGovernmentSubsidy

HCEquity

$397,694.81

PermLoan/UnitPe rmanentConstructionLenderSource

BofA

NLP

BrowardCounty

BofA

Developer

$100,000

$14,304,429

$81,415.93

$100,000

$31,787,621

$3,851,893

$9,200,000

RegulatedMortgage

RegulatedMortgage

CONSTRUCTION/PERMANENTSOURCES:

$2,735,085

$884.96

$281,306.38

$34,087.55

$27,800,000

DeferredDeveloperFee

TOTAL $44,939,514 $44,939,514

$0.00

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-4

JULY 6, 2022

COMPARISONCRITERIA YES NO

Does the level of experience of the current team equal or exceed that of the team

describedintheapplication?

X

AreallfundingsourcesthesameasshownintheApplication?1

Are all local government recommendations/contributions still in place at the level

describedintheApplication?

X

IstheDevelopmentfeasiblewithallamenities/featureslistedintheApplication? X

Dothesiteplans/architecturaldrawingsaccountforallamenities/featureslistedinthe

Application?

X

DoestheApplicanthavesitecontrolatorabovethelevelindicatedintheApplication? X

DoestheApplicanthaveadequatezoningasindicatedintheApplication? X

HastheDevelopmentbeenevaluated forfeasibilityusingthetotallengthofset‐aside

committedtointheApplication?

X

Have the Development costs remained equal to or less than those listed in the

Application?

2

IstheDevelopmentfeasibleusingtheset‐asidescommittedtointheApplication? X

If the Development has committed to serve a special target group (e.g. elderly,large

family, etc.), do the development and operating plans contain specific provisions for

implementation?

X

HOMEONLY:Ifpointsweregivenformatchfunds,isthematchpercentagethesameas

orgreaterthanthatindicatedintheApplication?

N/A

HC ONLY: Is the rate of syndication the same as or greater than that shown in the

Application?

X

Is the Development in all other material respects the same as presented in the

Application?

3

Thefollowingareexplanationsofeachitemchecked“No”inthetableabove

1. FirstMortgage:

The first mortgage construction/permanent lender changed from Citibank, N.A. (“Citi”) to Bank of

America,N.A.(“BofA”)astheconstructionlenderandNeighborhoodLendingPartnersofFlorida,Inc.

(“NLP”)asthepermanentlender.

ThesyndicatorchangedfromCititoBofA.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-5

JULY 6, 2022

2. HigherDevelopmentCosts:

TotalDevelopment Costsunderwrittenforthe Developmentare$44,939,514,whichrepresents an

increaseof$9,763,651fromthe$35,175,863intheFHFCApplica tion.Majorfactorscontributingto

theincreaseare:

a. The$25,967,968ConstructionContractforPinnacle441is$6,631,940higherthantheprojected

figureof$19,336,028.

b. Estimat edhardcostcontingency,

costofaletter‐of‐credit,demolitionofexistingstructures,retail

spaceallowance,buildingpermits,FHFCadministrativefees,constructionloaninterest,financing

fees, developer fee, and operating deficit reserves represent the remaining increases in Total

DevelopmentCostscomparedtothe Application.

3. OtherMaterialChanges:

a. An EUA Amendment was filed by the Applicant on April 23, 2021 to change the number of

buildingsfromtwotoonebuil ding.FHFCapprovedtherequestonMay11,2021.

b. ApplicantrequestedaRuleWaivertoaddthreeadditionalmarketrateunitswithanadjustment

totheset

‐asidepercentag efrom100%to97%,whichwasapprovedattheFHFCMarch4,2022

BoardMeeting.

c. An EUA Amendment was filed by the Applicant on March 4, 202 2 to change the unit mix and

definetheset‐asidesreflectedbelowandwasapprovedbyFHFConApril

8,2022.

d. TheApplicantappliedforadditionalFHFCLoanfundingthroug hFHFC’sInvitationtoParticipate

(“ITP”) for CHIRP.The additionalfunds will be an increase in the an nual housing credits in the

amountof$500,000,increasingtherecommendeda mountfrom$2,882,000to$3,382,000.

e. OnJuly7,2021,

theApplicantmadetworequeststoFHFC:1)arequesttochangetheowner’s

address(typographicalerr o r)and2)aslightchangetothelegaldescriptiontoaccuratelyreflect

thepriordedicationmadebythecurrentownertotheFloridaDepartmentofTransportationfor

rightofwaypurposes.Thetwochanges

wereapprovedbyFHFCStaffonAugust4,2021.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-6

JULY 6, 2022

f. Broward County Housing Finance Division (“Broward County”) provided a June 21, 2022 Term

Sheetchangingtheprevious$100,000Grantintoa$100,000loan.Theloanwillhaveaninterest

rateof0%withatermof30years.Theloanwillbenon‐amortizingandthePromissoryNotewill

contain

aprovisionforforgiveness attheend oftheloantermatBrowardCounty’ssolediscretion.

TheloanrequiresthattherebetwoSHIP‐assistedunitsanditconstitutesthe“LocalGovernment

Contribution”reflectedintheapplication.TheDirectorofBrowardCountyconfirmedinaJune

27, 2022 email that

the two SHIP units are permitted to float and are not allocated to any

particularbedroomsizeandarerestrictedatorbelow80%ofAverageMedianIncome(“AMI”).

The above changes have no material adverse impact to Seltzer’s HC recommendation for the

Development.

Does the De velopment Team have any FHFC

Financed Developments on the PastDue/Noncompliance

Report?

FloridaHousing’sPastDueReport, datedMay27,2022,reflectsnoPastDueitemsfortheDevelopment

Team.

ThedatareflectedinthelatestAssetManagementNoncomplianceReport(June9,2020)isconsidered

staleandwasnotrelieduponbythecreditunderwriterforpurposesofthisanalysis/recommendation.

FHFC’sAsset

ManagementDepartmentwillconfirmthattheDevelopmentTeamhasnooutstandingpast

dueand/ornoncomplianceitemspriortoclosing.

Seltzer’s Annual HC Recommendation is subject to satisfactory resolution of any outstanding past due

and/ornoncomplianceitemspriortotheissuanceoftheannualHCAllocation.

Strengths

1. The Principals, Developer and General Contractor are experienced in the development and

constructionofaffordablemultifamilyhousing.

2. ThePrincipalsandtheManagementCompanyhavetheexperiencenecessarytosuccessfullymanage

theDevelopment.

3. TheAppraisal reflects aweightedaverageoccupancywithintheDevelopment’sCompetitiveMarket

Area of 100%, and

low capture rates, which indicates a strong market and demand for affordable

housing.

OtherConsiderations:None

WaiverRequests/SpecialConditions:

1. TheApplicantestimatedahardcostcontingencyof7.00%.Thiscontingencypercentageissupported

by the Plan and Cost Analysis (“PCA”) completed by GLE Associates, Inc. (“GLE”), however, the

percentageisinexcessoftheRuleandRFArequirements.PertheRFAandRules,themaximumhard

costcontingency is

5% . At theApril1, 2022, FHFC Telephonic Boardmeeting,theBoardde legated

staffthe authority to approve contingency reserve increases upon recommendations by the credit

underwriter. Seltzer recommendsthat FHFC approve the contingencyof7.00%.Applicant madea

formal request to FHFC on June 23, 2022 to approve the

increase in hard cost contingency and is

pendingFHFCapproval.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-7

JULY 6, 2022

AdditionalInformation:

1. ToensurethattheadjustedfirstmortgagemeetsorexceedsaminimumDSCof1.10to1.00,based

on the projections/estimates and loan amounts in this report, the interest rate of the permanent

periodFirstMortgageLoanmaynotexceed5.99.However,Seltzerwillnotbeinvolvedintheclosing

processandsizingofthefirstmortgagewillbeatthediscretionofthefirstlender.

2. TheBorrowerhasappliedtotheITPforCHIRPandSeltzerhasreceivedtheapplication.Basedonthe

sizingcriteriaandparameterssetforth intheCHIRPITP,theDevelopmentwillreceive$50 0,000

in

additionalfunding.ItisrequiredthattheBorrowerdeferatleast30%oftheDeveloperFee,whichis

currently estimated at 69.10%. It is anticipated that this funding will have terms and conditions

identicaltotheHCfundingappliedforthroughRFA2020‐202.Receiptandsatisfactoryreviewofthe

amount of CHIRP funding is a condition to close.Note that the CHIRP calculation was based on

maximum 2021 rents.It is anticipated that the Development would be able to achieve maximum

2022rents.SeltzerperformedtheCHIRPcalculationusingboth2021and2022maximu mrents(see

bothcalculationsat

theendof theCUR).Itwasde terminedthatmaximum2022rentswouldalso

qualifytheDevelopmentfor$500,000inCHIRP.

3. Applicant provided an Application and Agreement for Irrevocable Standby Letter of Credit to City

NationalBankofFloridadatedMay25,2022intheamountof$2,596,797(10%of

theGCContract)in

thenameoftheApplicant,with BofA listed as the beneficiary.Theconstruction lender,BofA,has

statedwithinitsTermSheetthata10%Letter‐of‐Creditwillberequired.BeingthatFHFCdoesnot

havealoaninvolvedinthistransaction,Seltzerdeemsthe10%

requirementacceptable.

4. According to the RFA, the Corporation will review the limited partnership agreement or limited

liability company operating agreement language on reserves for compliance with the RFA

requirement.Ifthelimitedpartnershipagreementorlimitedliabilitycompanyoperatingagreement

doesnotspecificallystatethattheparties willcomplywith

theCorporation’sRFArequirements,the

CorporationwillrequireanamendmentoftheagreementandwillnotissueIRSform(s)8609untilthe

amendmentisexecutedandprovidedtotheCorporation.TheRFAincludeslanguagerestrictingthe

dispositionofanyfunds remaininginanyoperatingdeficitreserve(s)after thetermof

thereserve’s

original purpose has terminated or is near termination. The RFA also requires the Corporation to

reviewthelimitedpartnershipagreementorlimitedliabilitycompanyoperatingagreementlanguage

onreservesforcompliancewiththeRFArequirement.WhileFloridaHousingwillcontinuetorequire

theApplicanttoadheretoallrequirements

intheRFAincludingtherestrictionsonthedispositionof

any funds in an operating deficit reserve account, Florida Housing will not monitor the limited

partnership agreement or limited liability company operating agreement lang uage for compliance

withtheserequirements,asthiswouldrequireanalysisofalegalcontract.Thisdeviation

wasincluded

asanInformationItemintheApril29,2022FHFCBoardMeeting.

5. TheUnitedStatesiscurrentlyunderanationalemergencyduetothespreadofthevirusknownas

COVID‐19.Theextentofthevirus’impacttotheoveralleconomyisunknown.Morespecifically,itis

unknown as to the magnitude and timeframe the residential rental market (e.g. absorption rates,

vacancyrates,collectionlosses,appraisedvalue,etc.)andtheconstructionindustry(e.g.construction

schedules, constructioncosts,subcontractors,insurance,etc.)willbeimpacted.Recommendations

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-8

JULY 6, 2022

madebySeltzerinthisreport,inpart,relyuponassumptionsmadeby third‐partyreportsthatare

unabletopredicttheimpactsofthevirus.

IssuesandConcerns:None

MitigatingFactors:None

Recommendation

SMGrecommendsFHFCapprovea$3,382,000($2,882,000originalawardand$500,000CHIRP)annual

HCallocationbeawardedtoPinnacle441.

This recommendation is based upon the assumptions detailed in the Report Summary (Section A) and

SupportingInformationandSchedules(SectionC).Inaddition,thisrecommendationissubjecttotheHC

Allocation

Contingencies reflected in Section B. The reader is cautioned to refer to these sections for

completeinformation.

Thisrecommendationisonlyvalidforsix(6)monthsfromthedateoftheCreditUnderwritingReport.

Preparedby:Reviewedby:

KeithWhitakerJoshScribner

SeniorCreditUnderwriterCreditUnderwritingManager

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-9

JULY 6, 2022

Overview

ConstructionFinancingSources

Source Lender Applicant

Revised

Applicant Underwriter

Interest

Rate

Construction

DebtService

Fi rs tMortgage BofA $27,600,000 $27,800,000 $27,800,000 4.59% $2,023,362

Se cond Mortga ge Browa rdCounty $100,000 $100,000 $100,000 0.00% $0

HCEquity BofA $3,976,764 $14,304,429 $14,304,429

DeferredDeve l operFee Developer $3,499,099 $2,817,391 $2,735,085

Total $35,175,863 $45,021, 820 $44, 939,514 $2,023,362

FirstMortgageLoan

ApplicantprovidedaTermSheetfromBofAdatedMay31,2022toprovideafirstmortgageconstruction

loan for a maximum loan amount of $27,800,000.The loan will have a floating interest rate during

construction of 226 basis points over the Bloomberg Short Term Bank Yield Index Daily Fl oating Rate

(“BSBY”).

TheBSBYrateasofJune13,2022is0.83477%,whichishigherthan thefloorrateof0.75%.

SMG included a 150 basis point cushion to account for possible interest rate increases resulting in an

estimatedrateof4.59%.Interestonlyshallbepaidmonthly.Theloanwillhave

a30‐monthtermfrom

closingwithacommitmentfeeof0.50%oftheloanamount.SeltzerhasutilizedtheApplicant’sestimate

forconstructionloaninter estintheamountof$2,023,362basedontheanticipatedconstructiondraw

schedule.

SecondMortgageLoan–BrowardCounty

Broward County provided a June 21, 2022 Term Sheet changing the previous $100,000 Grant into a

$100,000loan.Theloanwillhaveaninterestrateof0%withatermof30years.Theloanwillbenon‐

amortizingandthePromissoryNotewillcontainaprovisionforforgivenessatthe

endoftheloantermat

Broward County’s sole Discretion.The loan requires that there be two SHIP‐assisted units and it

constitutesthe“LocalGovernmentContribution”reflectedintheapplication.TheDirectorofBroward

County confirmed in a June 27, 2022 emailthatthe two SHIP units are permitted

to float and are not

allocatedtoanyparticularbedroomsizeandarerestrictedatorbelow80%ofAMI.

OtherConstructionSourcesofFunds

Additional sources of funds for construction of the Development include HC equity from BofA in the

amountof$14,304,429andDeferred DeveloperFeeof$2,735,085.SeethePermanentFinancingSources

sectionbelowfordetails.

Construction/StabilizationPeriod:

AMay4, 2022, executed AIA Standard Form ofAgreementbetween Owner andContractor where the

basisofpaymentistheCostoftheWorkPlusaFeewithaGuaranteedMaximumPricereflectsPCBuilding,

LLC(“PCBuilding”)achievingsubstantialcompletionoftheDevelopmentnolaterthan487calendardays

(orapproximately16months)fromthedateofcommencement.InMeridian’srentalmarketanalysis,the

absorption performance of comparable/competitive apartment rentals was analyzed. It is Meridian’s

opinionthattheDevelopmentwillhaveanaverageabsorptionrateof25unitspermonth.Duetothe

currentstrongandconsistentdemandfor

low‐incomeaffordablehousing,Meridiananticipatesstabilized

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-10

JULY 6, 2022

occupancyof96%within4.5monthsoffinalconstru ctioncompletion(assumingallunitsarecompleted

asscheduled).Tobeconservative,SMGhasutilizedthefirstlender’s30‐monthconstruction/stabilization

periodforpurposesofthiscreditunderwritingreport.

PermanentFinancingSources

Source Lender Applicant

Revised

Applicant Under writ er

Interest

Rate

Amor t.

Yrs.

Term

Yrs.

Annual

Debt

Fi rs tMortga ge NLP $6,000,000 $9,200,000 $9,200,000 5.47% 35 16 $590,698

Se cond Mortgage BrowardCounty $100,000 $100,000 $100,000 0.00% N/A 30 $0

HCEqui ty BofA $26,511,749 $31,787,621 $31,787,621

Def.De ve l operFee De vel oper $2,564,114 $3,934,199 $3,851,893

Total $35,175,863 $45,021,820 $44,939,514 $590,698

FirstMortgageLoan

ApplicantprovidedaLetterofIntent(“LOI”)datedMay19,2022fromNeighborhoodLendingPartnersof

Florida,Inc.(“NLP”)toprovideafirstmortgagepermanentloanupto$9,200,000.Theinterestratewill

befixedata rateequaltothe10‐yearTreasuryplus265basispoints,withanall

‐infloorrateof5.00%.

Thecurrent10‐yearTreasuryRateasofJuly5,2022is2.82%.Theall‐inrateasofJuly5,2022wouldbe

5.47%.Principalandinterestpaymentswillbeduemonthly,basedona35‐yearamortizationwitha16‐

yearterm.An

originationfeeequalto1.00%($92,000)ofthemaximumPermanentloanamountwillbe

payableatpermanentloanconversion.AnApplicationFeeof$7,500andaLoanProcessingFeeof$3,000

willalsoberequired.

SecondMortgageLoan–BrowardCounty

Broward County provided a June 21, 2022 Term Sheet changing the previous $100,000 Grant into a

$100,000loan.Theloanwillhaveaninterestrateof0%withatermof30years.Theloanwillbenon‐

amortizingandthePromissoryNotewillcontainaprovisionforforgivenessatthe

endoftheloantermat

Broward County’s sole discretion.The loan requires that there be two SHIP‐assisted units and it

constitutesthe“LocalGovernmentContribution”reflectedintheapplication.TheDirectorofBroward

County confirmed in a June 27, 2022 emailthatthe two SHIP units are permitted

to float and are not

allocatedtoanyparticularbedroomsizeandarerestrictedatorbelow80%ofAMI.

HousingCredits

ApplicantappliedtoFHFCtoreceive9%HC.AccordingtotheMay31,2022LOIfromBofA,HCequitywill

be provided to Applicant by BofA, and, or, its affiliates according to the following terms and pay‐in

schedule:

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-11

JULY 6, 2022

CapitalContributions Amount

Percentof

Total WhenDue

1s tIns tallment $7,946,905 25.00% AtCl os i ng

2ndInsta l l me nt $3,178,762 10.00% At50%completionandnoearliertha n2/1/2023.

3rdIns tal l me nt $3,178,762 10.00% At95%compl etionandnoearliertha n10/1/2023.

4thInstal l ment $16,529,563 52.00% Constructi oncompl eti on,min i mu mDSC1.15x3

cons e cutive months ,90%occupi ed,perm.loans

fu n d e d ,C.O.issued,res e rvedfu n d ed ,dra ftcostcert.,

noearliertha n4/1/2024.

5thInsta l l ment $953,629 3.00% Form

8609

Tota l $31,787,621 100.00%

AnnualTaxCreditsperSyndicationAgreement: $3,382,000

TotalHCSyndication:$33,816,618

SyndicationPercentage(limitedpartnerinterest): 99.99%

CalculatedHCExchangeRate(perdollar): $0.94

ProceedsAvailableDuringConstruction: $14,304,429

At least 15% of the total equity will be provided prior to or simultaneously with the closing of the

constructionfinancing.

Deferred

DeveloperFee

InordertobalancetheSourcesandUsesofFundsafterallloanproceedsandcapitalcontributionshave

beenreceived,thedeveloperwillhavetodefer$3,851,893ofDeveloperFee.Thisamountis69.10%of

thetotalDeveloperFeeof$5,663,984,whichmeetstherequirementoftheCHIRP ITPtodefer

atleast

30%oftheDeveloperFee.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-12

JULY 6, 2022

UsesofFunds

CONSTRUCTIONCOSTS:

ApplicantCosts

Revised

ApplicantCosts

Underwriters

TotalCost s‐CUR CostPerUnit

HCIneligible

Costs‐CUR

Acces s oryBui ldings

$0 $0

Demolition

$150,000 $0

InstallationofPreFabUni ts

$0

NewRentalUnits

$16,829,850 $20,672,624 $20,672,598 $182,943 $1,176,000

Off‐SiteWork

$0

RecreationalAmenities

$0

RehabofExistingCommonAreas

$0

RehabofExistingRentalUni ts

$0

SiteWork

$2,076,389 $2,076,389 $18,375 $1 03,819

SwimmingPool

$0

Fur niture,Fix tur e,&Equipment

$0

HardCostConti ngency‐inConstr.Cont.

$0

Constr.Con tr .CostssubjecttoGCFee

$16,979,850 $22,749,013 $22,748,987 $ 201,318 $1,279,819

General Conditions

$2,356,178 $3,184,832 $1,364,939 $12,079

Overhea d

$454,980 $4,026

Profit

$1,364,939 $12,079

Builder'sRiskInsurance

$0

General LiabilityInsurance

$0

Pa ymentandPer for ma nc eBonds

$0

ContractCostsnotsubjecttoGCFee

$34,123 $34,123 $302

TotalCons tructi onContract/Costs

$19,336,028 $25,967,968 $25,967,968 $ 229,805 $1,279,819

HardCostConti ngency

$988,454 $1,817,757 $1,817,757 $16,086

PnPBondpaidouts ideConstr.Contr .

$0

FeesforLOCusedasCon str.Surety

$0

DemolitionpaidoutsideConstr.Contr .

$116,450 $ 116,450 $1,031 $116,450

FF&EpaidoutsideConstr.Contr.

$587,000 $535,600 $535,600 $4,740 $135,600

Other: RetailSpaceAl l owance

$202,800 $ 202,800 $1,795 $202,800

$20,911,482 $28,640,575 $28,640,575 $253,456 $1,734,669

TotalConstructionCosts:

NotestotheActualConstructionCosts:

1. The Applicant has provided an executed AIA Document A102‐2017 Standard Form of Agreement

betweenOwner,Pinnacle441,LLC,andContractor,PCBuilding,LLC,wherethebasisofpaymentis

theCostoftheWorkplusaFeewithaGuaranteedMaximumPricedated

May4,2022.Thecontract

isintheamountof$25,967,968andcallsforachievementofsubstantialcompletionnotlaterthan

487calendardaysfromthedateofcommencement.Thedateofcommencementisfivedaysafterall

requiredpermitsand approvalsfromallgovernmen t agenciesandauthoritieshavebeen

approved

andreadytobepulledbythecontractor,thedateawrittennoticetoproceedisissuedbytheowner

tothecontractorandtheownerrecordstheNoticeofCommencement.TheContractrequires10%

retainage held throughout construction on all work performed through the first 50% percent of

construction,

then0%retainagewillbe heldthereafter.

TheOwner’sfinalpaymenttotheContractorshallbemadenolaterthan30daysaftertheArchitect’s

finalCertificateforPayment.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-13

JULY 6, 2022

Theconstructioncontract,ScheduleofValues(“SOV”)andPCAhavebeenreviewedandthefollowing

allowanceswerenoted:Signage($52,000),Irrigation($75,000)andBuildingAccessControlandCCTV

($75,000).GLEstatestheallowancesarewithinanacceptablerangeforthescopeofworkindicated.

2. SMGreceivedtheGeneralContractor’sCertification

ofRequirementsindicatinganunderstandingof

GCconditionsperRule67‐48,F.A.C.

3. IneligiblecostsrelatedtoNewRentalUnitsincludestheshellconstructionoftheretailspace.

4. IneligiblecostsrelatedtoSiteWorkarebasedonSeltzer’sestimate.

5. GeneralContractorfeesas statedare within the

14%maximumperthe Rule. Costofthe Letter of

Credit ($34,123) is included within the GC Contract but excluded from the general contractor fee

calculation.

6. TheHardCostContingencyforthisdevelopmenthasbeenlimitedtotheApplicant’srequestof7.00%

of the total construction contract, which exceeds the

5% limit per Rule for new construction.

However,thePCAproviderrecommendsbetweena 6%to8%contingencyforadevelopmentofthis

scopeandsizeandisdeemedreasonablebySeltzer.Thehardcostcontingencyisnotincludedinthe

constructioncontractamount.

7. SMGengagedandreceiveda

PCAfromGLEdatedMay13,2022.Completeresultsaresetforthin

SectionCofthiscreditunderwritingreport.

8. Thereisalsodemolitionandasbestosabatementcostof$96,500underseparatecontractwithFlorida

Demolition,Inc.asevidencedbyaStandardContractAgreementdatedOctober21,2021.GLEstates

theAgreementappears satisfactory butdoesnotincludea cost breakdown of General Conditions,

Profitand Overhead.The Applicant statedon May 10,2022that demolitioniswell underway and

therearesomechangeordersduetoanasbestospipebelowtheslab.TheApplicanthasbudgeted

demolitionandasbestos

abatementcostat$116,450.

9. The FF&E paid outside of the Construction Contract includes costs for furniture, fixtures and

equipment($400,000)andpurchasesofincomeproducingwashersanddryers($135,600),whichare

shownasineligiblecosts.

10. The Development contains retail space of approximately 6,760 square feet.The Applicant has

budgeted

a retail space allowance of $202,800 for the ground floor retail space based on $30 per

squarefoot.Thetenantwillperformthefinished,buildoutworkwiththisallowance.Thecostwill

notbeincludedineligiblebasis.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-14

JULY 6, 2022

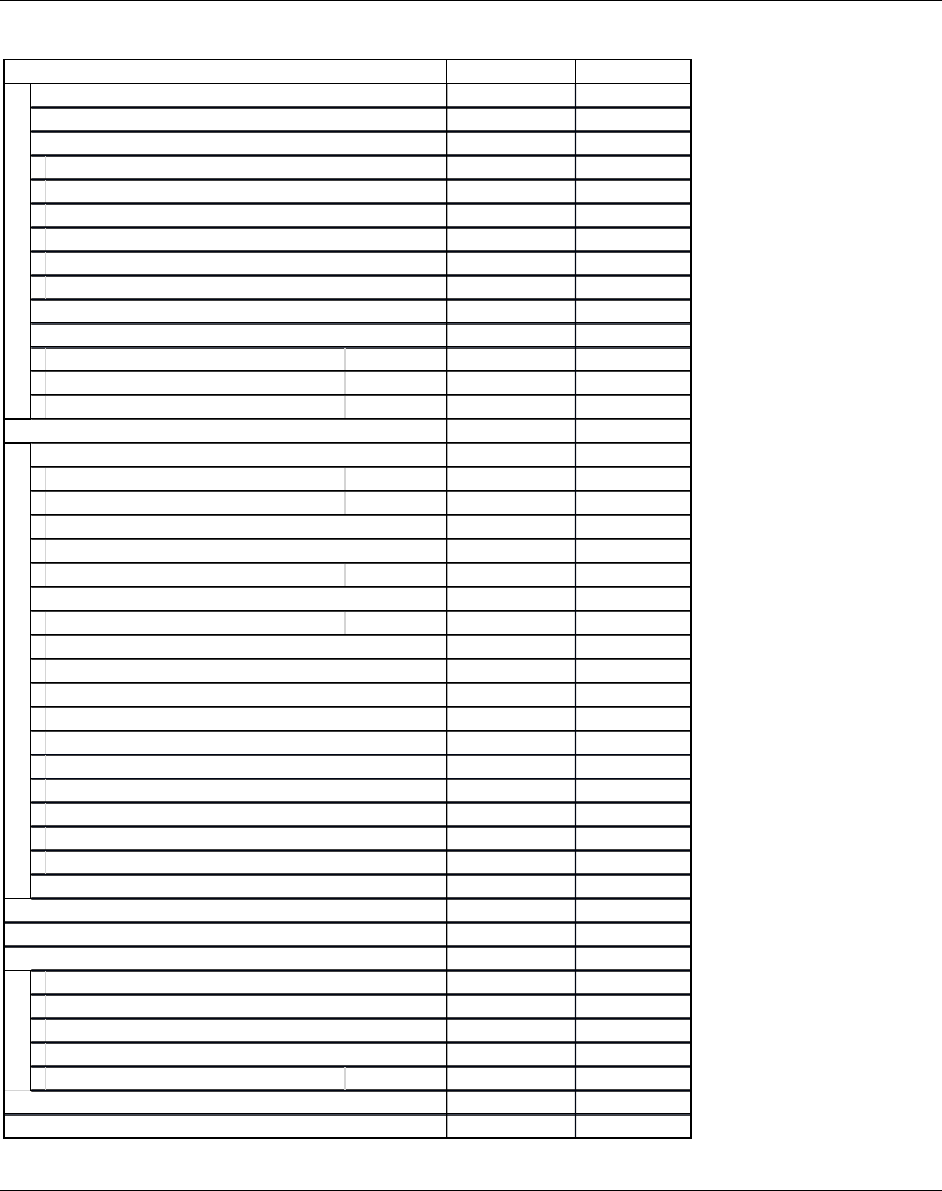

GENERALDEVELOPMENTCOSTS:

ApplicantCosts

Revised

ApplicantCosts

Underwriters

TotalCost s‐CUR CostPerUnit

HCIneligible

Costs‐CUR

AccountingFees

$75,000 $75,000 $75,000 $664 $37,500

Apprai s al

$11,200 $6,500 $6,500 $58

Archi tect's Fee‐Site/BuildingDesign

$517,500 $464,400 $464,400 $4,110

Archi tect's Fee‐Supervision

$57,500 $51 ,600 $51,600 $457

Bui ldingPermi ts

$479,374 $561,706 $561,706 $4,971

Builder'sRiskInsurance

$211,046 $233,712 $233,712 $2,068

Capita lNeeds Assessment/Rehab

$0

EngineeringFees

$354,025 $383,400 $383,400 $3,393

EnvironmentalReport

$45,000 $62 ,550 $62,550 $554

FederalLaborStanda r dsMonitoring

$0

FHFCAdmi ni s trati veFees

$259,380 $304,380 $304,380 $2,694 $304,380

FHFCApplicationFee

$3,000 $3,000 $3,000 $27 $3,000

FHFCCreditUnderwriti ngFee

$14,546 $14 ,721 $19,717 $174 $19,717

FHFCComplianceFee

$219,296 $219,333 $223,180 $1,975 $223,180

FHFCOtherProc es singFee(s)

$25,500 $25,500 $226 $25,500

ImpactFee

$370,990 $297,223 $297,223 $2,630

LenderInspectionFees/ConstAdmi n

$60,000 $48 ,900 $48,900 $433

Gree nBuildingCert.(LEED,FGBC,NGBS)

$35,000 $30 ,000 $30,000 $265

HomeEnergyRatingSystem(HERS)

$0

Insurance

$99,000 $79 ,100 $79,100 $700

Legal Fees‐Organi zati onalCosts

$400,000 $400,000 $400,000 $3,540 $200,000

Loca l SubsidyUnderwriti ngFee

$0

Market Study

$5,500 $5,500 $5,500 $49 $5,500

MarketingandAdvertising

$100,000 $100,000 $100,000 $885 $100,000

Pl anandCostReviewAnal ysi s

$1,400 $12

PropertyTaxes

$218,400 $222,000 $222,000 $1,965

SoilTest

$5,000 $6,950 $6,950 $62

Sur vey

$62,475 $42 ,600 $42,600 $377 $10,650

TenantRe locationCosts

$0

Titl eInsuranceandRecordingFees

$200,000 $200,000 $200,000 $1,770 $50,000

TrafficStudy

$0

UtilityConnection Fees

$362,901 $343,133 $343,133 $3,037

SoftCostContingency

$208,306 $209,260 $209,260 $1,852

Other: CHIRP UWFee

$4,000 $0

$4,374,439 $4,398,468 $4,400,711 $38,944 $979 ,427

TotalGeneralDevelopmentCosts:

NotestotheGeneralDevelopmentCosts:

1. TheAppraisalandMarketStudylineitemsreflecttheactualcostofthesethirdpartyreportsordered

bySMGandthelenders.

2. Architect’sFeesforSite/BuildingDesignandSupervisionarebasedoncontractedandanticipatedfees

asstipulatedintheArchitectContractdated

January27,2021betweentheApplicantandJosephB.

Kaller&Associates,P.A.d.b.a.KallerArchitect.

3. EngineeringFeesarebasedonthefeeschedulestipulatedintheAgreementforProfessionalServices

datedDecember17,2020betweentheApplicantandKeithandAssociates,Inc.d.b.a.KEITH.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-15

JULY 6, 2022

4. TheFHFCAdministrativeFeeisbasedon9%oftherecommendedannualallocationofHC.TheFHFC

Application Fee is reflective of the application fee stated in RFA 2020‐202. The total FHFC Credit

UnderwritingFeereflectstheactualfeespaidfor9%housingcredits($13,063),thePreliminaryReport

($1,658)

andConstructionHousingInflationResponseProgram(“CHIRP”)underwriting($4,996).The

ComplianceFeeisestimatedbasedon2022ComplianceFeeCalculatorSpreadsheet.TheFHFCOther

Processing Fees include $25,000 for a Carryover extension fee (including a $10,000 Notice of

CommencementExtension,$10,000LPAextensionanda$5,000CURextension).

5. Applicant

committed to ICC 700 National Green Building Standard (“NGBS”) and provided a NGBS

contractfromAbney+AbneyGreenSolutionsdatedJanuary12,2021.

6. ThePCAlineitemreflectstheactualcostofthePCApreparedbyGLEandengagedbySeltzer.

7. The Soft Cost Contingency budget does not

exceed the maximum per Rule of 5% of general

developmentcosts.

8. OtherGeneralDevelopmentCostsarebasedonApplicant’sestimates,whichappearreasonable.

ApplicantCosts

Revised

ApplicantCosts

Underwrite rs

TotalCost s‐CUR CostPerUnit

HCIneligible

Costs‐CUR

Cons tructi onLoanCommi tmentFee

$461,000 $139,000 $139,000 $1,230

Cons tructi onLoanClosingCosts

$0

Cons tructi onLoanInteres t

$1,415,998 $2,023,362 $2,023,362 $1 7,906 $1,007,367

Cons tructi onLoanServicingFees

$0

Per manentLoanAppli cati onFee

$10,500 $10,500 $93 $10,500

Per manentLoanUnderwri tingFee

$0 $0

Per manentLoanSubsidyLayeringRev.

$0 $0

Per manentLoanCommitmentFee

$60,000 $92 ,000 $92,000 $814 $92,000

Legal Fees‐FinancingCosts

$100,000 $ 100,000 $885 $1 00,000

$1,936,998 $2,364,862 $2,364,862 $20,928 $1 ,209,867

$27,222,919 $35,403,905 $35,406,148 $313,329 $3,923,963

Dev.CostsbeforeAcq.,Dev.Fee&Reserves

FINANCIALCOSTS:

TotalFinancialCosts:

NotestotheFinancialCosts:

1. ConstructionLoanCommitmentFeeof$139,000is0.50%oftheBofAconstructionloanamountof

$27,800,000.

2. ConstructionLoanInterestisanesti mateprovidedbytheApplicantbasedontheConstructionDraw

Schedule.

3. Permanent Loan Application Fee of $10,500 represents an Application Fee

of $7,500 plus a Loan

ProcessingFeeof$3,000.

4. Permanent Loan Commitment Fee of $92,000 is 1% of the approved permanent loan amount of

$9,200,000bythelender.

5. LegalFees–FinancingCostsareestimatedlegalfeesbytheApplicant.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-16

JULY 6, 2022

ApplicantCosts

Revised

ApplicantCosts

Underwrite rs

TotalCost s‐CUR CostPerUnit

HCIneligible

Costs‐CUR

BrokerageFees‐Building

$0

Bui ldingAcquisiti onCost

$0

Develo perFeeonNon‐LandAcq.Costs

$0 $0

$0 $0 $0 $0 $0

NON‐LANDACQUISITIONCO STS

TotalNon‐LandAcquisitionCosts:

NotestotheNon‐LandAcquisitionCosts:

1. Sincethisisanewconstructiondevelopment,th ere arenonon‐landacquisitioncosts.

ApplicantCosts

Revised

ApplicantCosts

Underwrite rs

TotalCost s‐CUR CostPerUnit

HCIneligible

Costs‐CUR

Develo perFee‐Una pportioned

$4,352,944 $5,663,984 $5,573,984 $4 9,327

DFtofundOper ati ngDebtReserve

$0

DFtoBroke rageFees‐Land

$0

DFtoExcessLandCosts

$90,000 $796

DFtoExcessBldgAcquisitionCosts

$0

DFtoConsulta ntFees

$0

DFtoGuarantyFees

$0

$4,352,944 $5,663,984 $5,663,984 $50,124 $0

DEVELOPERFEEONNON‐ACQUISTIO NCO STS

TotalOther DevelopmentCosts:

NotestotheDeveloperFeeonNon‐AcquisitionCosts:

1. DeveloperFeeiswithin16%oftheTotalDevelopmentCost,exclusiveoflandacquisition costsand

reserves,asrequiredperRule.

ApplicantCosts

Revised

ApplicantCosts

Underwrite rs

TotalCost s‐CUR CostPerUnit

HCIneligible

Costs‐CUR

BrokerageFees‐Land

$0 $0

LandAcquisitionCost

$3,600,000 $3,600,000 $3,510,000 $3 1,062 $3,510,000

Land

$0 $0

LandLeasePa yment

$0 $0

LandCarryingCosts

$0 $0

$3,600,000 $3,600,000 $3,510,000 $31,062 $3,510,000

LANDACQUISITIONCOSTS

TotalAcquisitionCosts:

NotestotheLandAcquisitionCosts:

1. The Applicant provided an executed Closing Statement dated November 30, 2021 between Betty

Andrews Lantz, individually and as personal representative of the Estate of Constantine P. Lantz

(“Seller”) and Pinnacle 441 (“Buyer”), reflecting a purchase price of $3,600,000.Applicant also

providedanexecuted

SpecialWarrantyDeedbetweensaidpartiesdatedNovember30,2021.

Basedonthe“as‐is”appraisedvalueof$3,510,000,thereareexcesslandacquisitioncostsof

$90,000,whichareshownasasubsetofDeveloperFeeasreflectedabove.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-17

JULY 6, 2022

ApplicantCosts

Revised

ApplicantCosts

Underwrite rs

TotalCost s‐CUR CostPerUnit

HCIneligible

Costs‐CUR

Opera ti ngDeficitRe serve(FHFC)

$0 $0

Opera ti ngDeficitRe serve(Lender )

$0 $0

Opera ti ngDeficitRe serve(Synd icator)

$353,931 $ 359,382 $3,180 $359,382

$0 $3 53,931 $359 ,382 $3,180 $3 59,382

RESERVEACCOUNTS

TotalReserveAccounts:

NotestotheTotalReserveAccounts:

1. Perthe May31,2022 LOIfromthe Syndicator,theOperatingDeficit Reservewillbefundedinthe

amountof$359,382basedonuptothreemonthsofoperatingexpenses.

InexchangeforreceivingfundingfromFHFC,FHFCreservestheauthoritytorestrict

thedisposition

of any funds remaining in any operating deficit reserve(s) after the term of the reserve’s original

purposehasterminatedorisneartermination.Authorizeddispositionusesarelimitedtopayments

towardsanyoutstandingloanbalancesoftheDevelopmentfundedfromFHFC,anyoutstandingFHFC

fees,anyunpaidcostsincurred

inthecompletionoftheDevelopment(i.e.deferredDeveloperFee),

the Development’s capital replacement reserve account (provided, however, that any operating

deficit reserve funds deposited to the replacement reserve account will not replace, negate, or

otherwise be considered an advance payment or pre‐funding of the Applicant’s obligation to

periodically

fundthereplacementreserveaccount),thereimbursementofanyloan(s)providedbya

partner,memberorguarantorassetforthintheApplicant’sorganizationalagreement(i.e.,operating

orlimitedpartnershipagreement)wherebyitsfinaldispositionremainsunderthissamerestriction.

The actual direction of the disposition is at the Applicant’s discretion

so long as it is an option

permittedbyFHFC.Innoevent,shallthepaymentofamountstotheApplicantortheDeveloperfrom

anyoperatingdeficitreserveestablishedfortheDe velopment causetheDev eloper Feeor General

Contractorfeetoexceedtheapplicablepercentagelimitationsprovidedforin

theRFA.

Attheendofthecomplia nceperiod, anyremainingbalanceof theODR lessamountsthat maybe

permittedtobedrawn(whichincludesDeferredDeveloperFeeandreimbursementsforauthorized

member/partner and guarantor loan(s) pursuant to the operating/partnership agreement), will be

usedtopayFHFCloandebt;if

thereisnoFHFCloandebtontheproposedDevelopmentattheendof

thecomplianceperiod,anyremainingbalanceshallbeusedtopay anyoutstanding FHFCfees.Ifany

balance is remaining in the ODR after the payments above, the amount should be placed in a

ReplacementReserve

accountfortheDevelopment.Innoevent shallthepaymentsofamountsto

applicantortheDeveloperfromtheReserveAccountcausetheDeveloperFeeorGeneralContractor

Feetoexceedtheapplicablepercentagelimitations providedforintheRule.Anyandalltermsand

conditionsoftheODRmustbe

acceptabletoFloridaHousing,itsLegalCounselanditsServicer.

ApplicantCosts

Revised

ApplicantCosts

Underwrite rs

Total Cost s‐CUR CostPerUnit

HCIneligible

Costs‐CUR

$35,175,863 $45,021,820 $44,939,514 $397,695 $7,793,345

TOTALDEVELOPMENTCOSTS:

TOTALDEVELOPMENTCOSTS

1. PerRFA2020‐202,theFHFCTotalDevelopmentCost(“TDC”)arelimitedonaperunitbasis,basedon

the construction type of the units. The Applicant indicated a construction type of High Rise (new

construction),whichat applicationhadaTDCperunitlimitationof$343,000.Basedonchanges

to

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-18

JULY 6, 2022

TDClimitsasapprovedattheApril1,2022TelephonicBoardMe eting,themaximumallowableper

unit cost is $513,429.84. The Development’s final TDC per unit (without land and reserves) is

$360,627.27,whichdoesnotexceedthemaximumTDC.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-19

JULY 6, 2022

OperatingProforma

ANNUAL PERUNIT

$1,483,548 $13,129

$0 $0

$67,600 $598

$13,560 $120

$47,460 $420

$0 $0

$0 $0

$0 $0

$1,612,168 $14,267

Economi cLos s ‐Percenta ge : 0.0% $0 $0

Physi ca l VacancyLos s ‐Pe rce nta ge : 4.0% ($64,487) ($571)

Col l e cti onLoss‐Percenta ge : 1.0% ($16,122) ($143)

$1,531,560 $13,554

GroundLeas e $0 $0

Sub ‐Grou nd Lease $0 $0

$243,177 $2,152

$84,750 $750

Other $0 $0

Ma na geme ntFe e ‐Percenta ge: 5.0% $76,578 $678

$45,200 $400

$158,200 $1,400

$110,175 $975

$5,650 $50

$22,600 $200

$22,600 $200

$0 $0

$37,290 $330

$0 $0

$0 $0

$33,900 $300

$840,120 $7,435

$691,440 $6,119

$590,698 $5,227

$0 $0

$0 $0

$0 $0

AllOtherMortga ge s Fe e s‐ $0 $0

$590,698 $5,227

$100,742 $892

Fi rs tMo rtgage Fees‐NLP

Se condMortga ge Fe e s‐Browa rdCounty

OPERATINGPROFORMA

INCOME

GrossPotentia l Ren ta lIncome

Re n tSub s id y(ODR)

OtherIncome:

Anci l l a ryIncome‐Reta ilSpace

Mi s ce l l a ne ous

Wash er/DryerRe n ta ls

Cabl e/Satel l i teIncome

Re n tConcessions

AlarmIncome

GrossPotentia l Income

Less:

TotalEffectiveGrossRevenue

TotalExpenses

Ge nera landAdministrative

Pa yrol l Expens es

Utilities

Ma rke ti ngandAdvertising

Ma i ntena nceandRe p airs

Grounds Ma i ntena nceandLa nds ca ping

EXPENSES

Fi xe d:

Re alEs ta teTaxes

Insurance

Variable:

Res i de ntProgra ms

Contra ctSe rvices

Se curity

Other‐Pe s tControl

Re se rve fo rReplacements

NetOperatingIncome

DebtServicePayments

DEBTSERVICE

Fi rs tMo rtgage ‐NLP

Se condMortga ge ‐Browa rdCounty

TotalDebtServicePayments

CashFlowAfterDebtService

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-20

JULY 6, 2022

1.171

1.171

54.9%

89.0%

DSC‐Se co nd Mortgage plus Fe e s

DebtServiceCoverageRatios

DSC‐Fi rs tMortga ge pl usFe e s

OperatingExpe nseRa ti o

Break‐EvenRati o

FinancialRatios

NotestotheOperatingProformaandRatios:

1. ThisDevelopmentwillbeutilizingHCfinancingwhichwillimposerentrestrictions.Therestrictedrent

schedule is based upon the lesser of 2021 maximum net HC rents, the Appraiser’s estimates or

management’s projections. The Appraiser estimates the property will achieve 2021

maximum HC

rents, less utility allowances as required by the HC Program based upon a HUD Utility Allowance

ScheduleforBrowardCountyHousingAuthority(HighRise),datedJanuary1,2022.Theallowances

reflectthere sidentpayingforelectricityandtheApplicantpayingforwater,sewer,trashremovaland

pestcontrol.The

rentrollisshownbelow:

MSA/County: FortLauderdaleHMFA;Miami‐FortLauderdale‐WestPalmBeach/Broward

$1,832

$429

$1,144

$2,610

$484

$1,107

$467

Net

Restricted

Rents

$344

$922

MKT

25%

$414

$1,107

$2,610

$467

$414

AnnualRental

Income

$8,256

$21,978

60%

1,194

2.0

22.0

32.0

1

$1,2683

32.0

Bed

Rooms

1.0

2.0

Bath

Rooms

1.0

PBRA

Contr

Rents

1

1

1

2

1.0

2.0

1

7

256

1

$105

$572

$1,373

3

31

$2,759

731

973

973

2,372

1,194

1,194

AMI%

25%

MKT

Utility

Allow.

$68

GrossHC

Rent

$412

$990

731

73111

$81

$81

Units

LowHOME

Rents

60%

MKT

2

High

HOME

RentsSquareFeet

25%

60%

$495

$1,188

$105

CURents

$344

$922

$1,831.50

Applicant

Rents

$357

$952$68

$1,310

$467

$1,107

$2,610

$121,704

Appraiser

Rents

$344

$922

$1,831.50

$414

$743,904

$31,320

$16,812

$471,696

$34,776

$1,268

$33,102

$1,268

$2,758.5 $2,758.50

115,695113 $1,483,548

2. MeridianestimatesRetailSpaceIncomebasedon$10persquarefoot(6,760sq/ft)or$67,600.

3. MiscellaneousIncome (i.e., vending income,latecharges, petdeposits, forfeited security deposits,

etc.)at$10perunitpermonth(or$13,560annually)isconsistentwithmarketcomparablesandthe

MeridianAppraisal.

4. Applicant

will offer full‐size washer/dryer appliances to rent to residents.Meridian projects a

participationrateof70%andamonthlypremiumof$50,or$47,460annually.

5. Vacancy Loss at 4.0% and Collection Loss Allowance at 1.0% are projected by Meridian, which

projectionsappearreasonable.

6. ApplicantprovidedanexecutedManagement

AgreementbeginningJuly 1,2023andendingJuly1,

2024andthereafterforyearlyperiods.TheManagementFeeisequaltothegreaterof$3,500per

monthor5%ofthemonthlygrossreceiptsfromoperations.

7. ResidentProgramcostsarecoveredunderGeneralandAdministrativecost.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE A-21

JULY 6, 2022

8. Replacement Reserves of $300 per unit per year are required by BofA, which meets the Florida

HousingRuleminimumreserverequirementof$300perunitperyear.

9. Otheroperatingexpenseprojectionsarebaseduponmarketcomparablesthataresupportedbythe

Appraisal.

10. A15‐yearincomeandexpense

projectionreflectsincreasingdebtservicecoveragethroughoutthe15

years.ThisprojectionisattachedtothisreportasExhibit1.

SMG

JULY 6, 2022

SectionB

HC Allocation Recommendation and Contingencies

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 PAGE B-1

JULY 6, 2022

HousingCreditAllocationRecommendation

Seltzer Management Group, Inc. recommends a Prelimi nary Annual Housing Credit Allocation of

$3,382,000($2,882,000originalawardand$500,000CHIRP).Pleasesee the HC Allocation Calculation

sectionofthisCreditUnderwritingReportforfurtherdetails.

Contingencies

Seltzer’sAnnualHCAllocationRecommendationiscontingentuponreceiptandsatisfactoryreviewofthe

following items by Seltzer Management Group, Inc., (“SMG” or “Seltzer”) and Florida Housing Finance

Corporation(“FHFC” or“FloridaHousing”)bythede adlineestablishedinthePreliminaryHCAllocation.

Failuretosubmittheitemswithinthistimeframemay

resultinforfeitureoftheHCAllocation.

1. Satisfactoryresolution(asdeterminedbyFHFC)ofanyoutstandingPastDueand/orNoncompliance

items.

2. AnyreasonablerequirementsofFloridaHousingand/orSMG.

Exhibit1

Pinnacle441

15YearIncomeandExpenseProjection

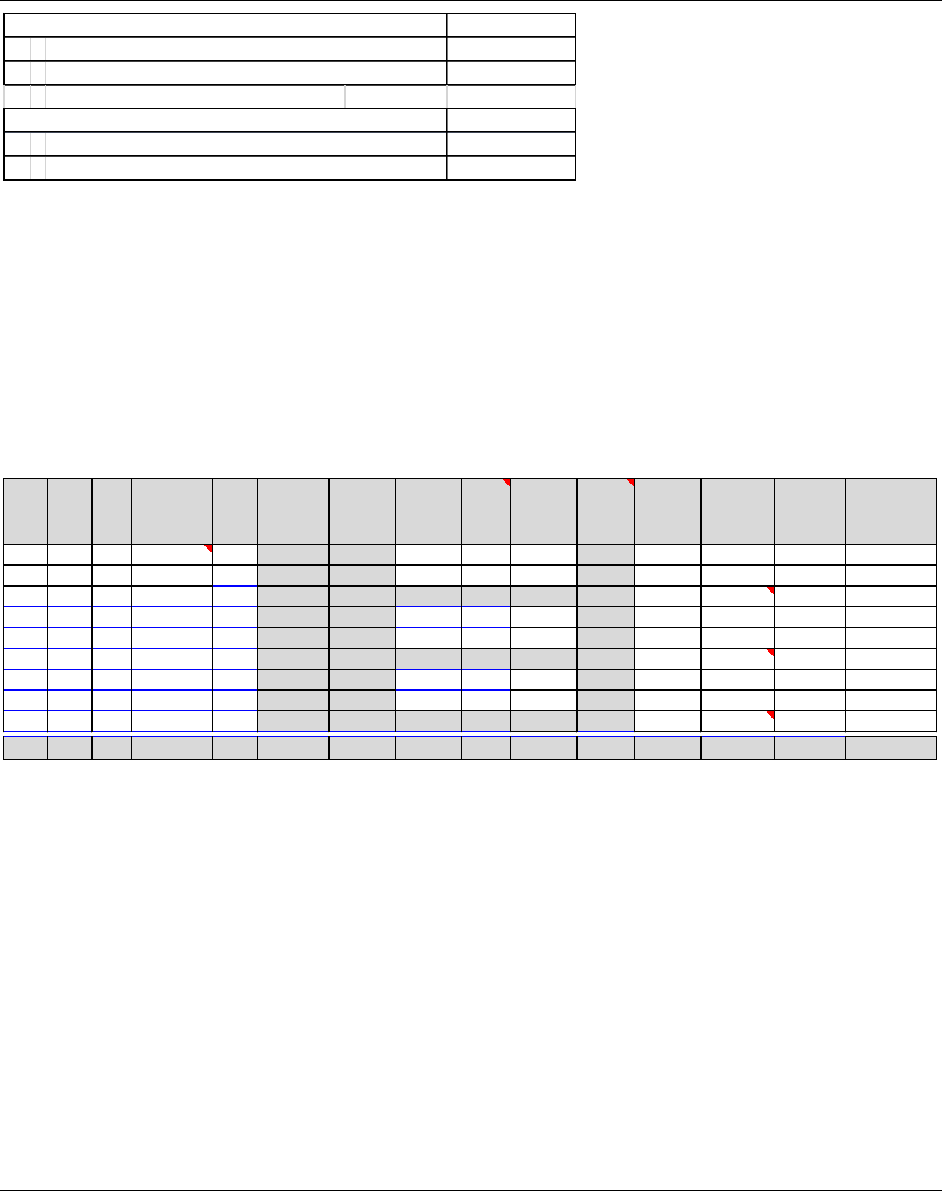

Year1Year2Year3Year4Year5Year6Year7Year8Year9Year10 Year11 Year12 Year13 Year14 Year15

$1,483,548 $1,513,219 $1,543,483 $1,574,353 $1,605,840 $1,637,957 $1,670,716 $1,704,130 $1,738,213 $1,772, 977 $1,808, 437 $1,844, 605 $1,881,498 $1,919,128 $1,957,510

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$67,600 $68,952 $70,331 $71,738 $73,172 $74,636 $76,129 $77,651 $79,204 $80,788 $82,404 $84,052 $85,733 $87,448 $89,197

$13,560 $13,831 $14,108 $14,390 $14,678 $14,971 $15,271 $15,576 $15,888 $16,205 $16,530 $16,860 $17,197 $17,541 $17,892

$47,460 $48,409 $49,377 $50,365 $51,372 $52,400 $53,448 $54,517 $55,607 $56,719 $57,853 $59,011 $60,191 $61,395 $62,622

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$1,612,168 $1,644,411 $1,677,300 $1,710,846 $1,745,062 $1,779,964 $1,815,563 $1,851,874 $1,888,912 $1,926, 690 $1,965, 224 $2,004, 528 $2,044,619 $2,085,511 $2,127,221

EconomicLoss‐Percentage:

PhysicalVacancyLoss‐Percentage: 4.0% ($64,487) ($65,776) ($67,092) ($68,434) ($69,803) ($71,199) ($72,623) ($74,075) ($75,556) ($77,068) ($78,609) ($80,181) ($81,785) ($83,420) ($85,089)

CollectionLoss‐Percentage: 1.0% ($16,122) ($16,444) ($16,773) ($17,108) ($17,451) ($17,800) ($18,156) ($18,519) ($18,889) ($19,267) ($19,652) ($20,045) ($20,446) ($20,855) ($21,272)

$1,531,560 $1,562,191 $1,593,435 $1,625,303 $1,657,809 $1,690,966 $1,724,785 $1,759,281 $1,794,466 $1,830, 355 $1,866, 963 $1,904, 302 $1,942,388 $1,981,236 $2,020,860

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$243,177 $250,472 $257,986 $265,726 $273,698 $281,909 $290,366 $299,077 $308,049 $317,291 $326,810 $336,614 $346,712 $357,114 $367,827

$84,750 $87,293 $89,911 $92,609 $95,387 $98,248 $101,196 $104,232 $107,359 $110,580 $113,897 $117,314 $120,833 $124,458 $128,192

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

ManagementFee‐Percentage: 5.0% $76,578 $78,110 $79,672 $81,265 $82,890 $84,548 $86,239 $87,964 $89,723 $91,518 $93,348 $95,215 $97,119 $99,062 $101,043

$45,200 $46,556 $47,953 $49,391 $50,873 $52,399 $53,971 $55,590 $57,258 $58,976 $60,745 $62,567 $64,444 $66,378 $68,369

$158,200 $162,946 $167,834 $172,869 $178,055 $183,397 $188,899 $194,566 $200,403 $206,415 $212,608 $218,986 $225,555 $232,322 $239,292

$110,175 $113,480 $116,885 $120,391 $124,003 $127,723 $131,555 $135,501 $139,566 $143,753 $148,066 $152,508 $157,083 $161,796 $166,650

$5,650 $5,820 $5,994 $6,174 $6,359 $6,550 $6,746 $6,949 $7,157 $7,372 $7,593 $7,821 $8,056 $8,297 $8,546

$22,600 $23,278 $23,976 $24,696 $25,436 $26,200 $26,986 $27,795 $28,629 $29,488 $30,373 $31,284 $32,222 $33,189 $34,185

$22,600 $23,278 $23,976 $24,696 $25,436 $26,200 $26,986 $27,795 $28,629 $29,488 $30,373 $31,284 $32,222 $33,189 $34,185

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$37,290 $38,409 $39,561 $40,748 $41,970 $43,229 $44,526 $45,862 $47,238 $48,655 $50,115 $51,618 $53,167 $54,762 $56,404

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$33,900 $33,900 $33,900 $33,900 $33,900 $33,900 $33,900 $33,900 $33,900 $33,900 $34,917 $35,965 $37,043 $38,155 $39,299

$840,120 $863,541 $887,649 $912,465 $938,009 $964,303 $991,370 $1,019,232 $1,047,912 $1,077,435 $1,108,843 $1,141,175 $1,174,458 $1,208,720 $1,243,991

$691,440 $698,650 $705,786 $712,839 $719,800 $726,662 $733,415 $740,049 $746,554 $752,920 $758,120 $763,127 $767,930 $772,515 $776,869

$590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698 $590,698

$100,742 $107,952 $115,088 $122,141 $129,103 $135,965 $142,717 $149,351 $155,857 $162,223 $167,422 $172,429 $177,232 $181,818 $186,171

1.171 1.183 1.195 1.207 1.219 1.230 1.242 1.253 1.264 1.275 1.283 1.292 1.300 1.308 1.315

1.171 1.183 1.195 1.207 1.219 1.230 1.242 1.253 1.264 1.275 1.283 1.292 1.300 1.308 1.315

54.9% 55.3% 55.7% 56.1% 56.6% 57.0% 57.5% 57.9% 58.4% 58.9% 59.4% 59.9% 60.5% 61.0% 61.6%

89.0% 88.7% 88.4% 88.1% 87.9% 87.6% 87.4% 87.2% 87.0% 86.8% 86.7% 86.6% 86.6% 86.5% 86.5%

AllOtherMortgages‐

FirstMortgageFees‐NLP

AllOtherMortgagesFees‐

TotalDebtServicePayments

Break‐EvenRatio

DSC‐AllMortgagesandFees

FinancialRatios

OperatingE xpenseRatio

DebtServiceCoverageRatios

DSC‐FirstMortgageplusFees

CashFlowAfterDebtService

DEBTSERVI

FirstMortgage‐NLP

TotalExpenses

NetOperatingIncome

DebtServicePayments

EXPENSES

Fixed:

GroundLease

Sub‐GroundLease

RealEstateTaxes

Other‐PestControl

ReserveforReplacements

TotalEffectiveGrossRevenue

Security

Insurance

Other

Variable:

GeneralandAdministrative

PayrollExpenses

Utilities

MarketingandAdvertising

MaintenanceandRepairs

GroundsMaintenanceandLandscaping

ResidentPrograms

ContractServices

FINANCIALCOSTS:

OPERATINGPROFORMA

INCOME

GrossPotentialRentalIncome

RentSubsidy(ODR)

OtherIncome:

AncillaryIncome‐Parking

Miscellaneous

Washer/DryerRentals

Cable/SatelliteIncome

RentConcessions

AlarmIncome

GrossPotentialIncome

Less:

SeltzerManagementGroup,Inc. Page1of1 7/6/2022

HC CREDIT UNDERWRITING REPORT SMG

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

PINNACLE 441EXHIBIT 2, PAGE 1

PINNACLE441

RFA2020‐202(2021‐017C)

DESCRIPTIONOFFEATURESANDAMENITIES

TheDevelopmentwillconsistof:

113apartmentunitslocatedin1high‐riseresidentialbuildings.

UnitMix:

Fourteen(14)onebedroom/onebathunits;

Sixty‐four(64)twobedroom/twobathunits;and

Thirty‐five(35)threebedroom/twobathunits.

113TotalUnits

Allunitsareexpectedtomeetall

requirementsasoutlined below.IftheproposedDevelopmentconsists

of rehabilitation, the proposed Development’s ability to provide all construction features will be

confirmedasoutlinedinExhibitF.ThequalityoftheconstructionfeaturescommittedtobytheApplicant

issubjecttoapprovaloftheBoardofDirectors.

a. FederalRequirements

andStateBuildingCodeRequirementsforallDevelopments

All proposed Developments must meet all federal requirements and state building code

requirements,includingthefollowing,incorporatingthemostrecent amendments,regulations,

andrules:

Florida Accessibility Code for Building Construction as adopted pursuant to Section

553.503,FloridaStatutes;

TheFair

HousingActasimplementedby24CFR100;

Section504oftheRehabilitationActof1973*;and

TitlesIIandIIIoftheAmericanswithDisabilities Actof1990asimplementedby28CFR

35.

*All Developments must comply with Section 504 of the Rehabilitation Act of 1973,

as

implementedby24CFRPart8(“Section504anditsrelatedregulations”).AllDevelopments

mustmeetaccessibilitystandardsofSection504.Section504accessibilitystandardsrequire

a minimum of 5 percent of the total dwelling units, but not fewer than one unit, to be

accessible for individuals with mobility

impairments.An additional 2 percent of the total

units, but not fewer than one unit, must be accessible for persons with hearing or vision

impairments.

To the extent that a Development is not otherwise subject to Section 504 and its related

regulations, the Development shall nevertheless comply with Section 504 and

its related

regulationsasrequirementsoftheCorporationfundingprogramtothesameextentasifthe

HC CREDIT UNDERWRITING REPORT SMG

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

PINNACLE 441EXHIBIT 2, PAGE 2

DevelopmentweresubjecttoSection504anditsrelatedregulationsinallrespects.Tothat

end, all Corporation funding shall be deemed “Federal financial assistance” within the

meaningofthattermasusedinSection504and

itsrelatedregulationsforallDevelopments.

b. GeneralFeatures

TheDevelopmentwillprovidethefollowingGeneralFeatures:

Termiteprevention;

Pestcontrol;

Windowcove ringforeachwindowandglassdoorinsideeachunit;

CableorsatelliteTVhook‐upineachunitand,iftheDevelopment

offerscableorsatellite

TVservicetotheresidents,thepricecannotexceedthemarketrateforserviceofsimilar

quality available to the Development’s residents from a primary provider of cable or

satelliteTV;

Washer and dryer hook ups in each of the Development’s units or an on‐site

laundry

facilityforresidentuse.IftheproposedDevelopmentwillhaveanon‐sitelaundryfacility,

thefollowingrequirementsmustbemet:

o Theremustbeaminim umofoneEnergyStarcertifiedwasherandoneEnergyStar

certifiedorcommercialgrade dryerperevery15 units.Todeterminethe

required

numberofwashersanddryersfortheon‐sitelaundryfacility;dividethe totalnumber

of the Development’s units by 15, and then round the equation’s total up to the

nearestwholenumber;

o At leastone washing machine and one dryer shall be front loading that meets the

accessibilitystandardsofSection504;

o If theproposedDevelopmentconsistsofScatteredSites,thelaundryfacilityshallbe

locatedoneachoftheScatteredSites,ornomorethan1/16milefromtheScattered

Sitewiththemostunits,oracombinationofboth;

Atleasttwofull

bathroomsinall3bedroomorlargernewconstructionunits;

Bathtub with shower in at least one bathroom in at least 90 percent of the new

constructionnon‐Elderlyunits;

Elderly Developments must have a minimum of one elevator per residential building

providedforallEld erly Set‐Aside Units

thatare located on a floor higher than the first

floor;and

Full‐sizerangeandoveninallunits.

c. RequiredAccessibilityFeatures,regardlessoftheageoftheDevelopment

Federal and state law and building code regulations requires that programs, activities, and

facilitiesbereadilyaccessibleto

andusablebypersonswithdisabilities.FloridaHousingrequires

thatthedesign,construction,oralterationofitsfinancedDevelopmentsbeincompliancewith

federalandstateaccessibilityrequirements.Whenmorethanonelawandaccessibilitystandard

applies, the Applicant shall comply with the standard (2010 ADA Standards, Section 504, Fair

HousingAct,orFloridaBuildingCode,Accessibility)whichaffordsthegreaterlevelofaccessibility

fortheresidentsandvisitors.Areasrequiredtobemadeaccessibletomobility‐impairedresidents

HC CREDIT UNDERWRITING REPORT SMG

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

PINNACLE 441EXHIBIT 2, PAGE 3

andtheirvisitors,includingthoseinw heelchairs,shallinclude,butnotbelimitedto,accessible

routes and entrances, paths of travel, primary function areas, parking, trash bins, mail and

package receiving areas for residents, pool and other

amenities, including paths of travel to

amenitiesandlaundryrooms,includingwashersanddryers.

(1) RequiredAccessibilityFeaturesinallUnits

Primary entrance doors on an accessible route shall have a threshold with no

morethana½‐inchrise;

All door handles on primary entrance door and

interior doors must have lever

handles;

Leverhandlesonallbathroomfaucetsandkitchensinkfaucets;

Mid‐point on light switches and thermostats shall not be more than 48 inches

abovefinishedfloorlevel;and

Cabinetdrawerhandlesandcabinetdoorhandlesinbathroomandkitchenshall

be

leverorD‐pulltypethatoperateeasilyusingasingleclosedfist.

(2) Inadditiontothe5percentmobilityrequirementoutlined above,allFamilyDemographic

Developmentsmustprovidereinforcedwallsforfutureinstallationofhorizontalgrabbars

in place around each tub/shower and toilet, or a Corporation‐approved

alternative

approachforgrabbarinstallation.Theinstallationofthegrab barsmustmeetorexceed

the2010ADAStandardsforAccessibleDesign.

At the request of and at no charge to a resident household, the Development shall

purchaseandinstallgrabbarsaround eachtub/showerunitandtoiletin

thedwellingunit.

Theproductspecificationsandinstallationmustmeetorexceed2010ADAStandardsfor

Accessible Design. The Development shall inform a prospective resident that the

Development,uponaresidenthousehold’srequestandatnochargetothehousehold,

willinstallgrabbarsaround adwellingunit’stub/showerunit

andtoilet,pursuanttothe

2010 ADA Standards. At a minimum, the Development shall inform each prospective

lesseebyincludinglanguageintheDevelopment’swrittenmaterialslistinganddescribing

theunit’sfeatures,aswellasincludingthelanguageineachhousehold’slease.

d. RequiredGreenBuildingFeaturesinallDevelopments

(1) Allunitsmusthavethefeatureslistedbelow:

LoworNo‐VOCpaintforallinteriorwalls(Low‐VOCmeans50gramsperliterorless

forflat;150gramsperliterorlessfornon‐flatpaint);

Low‐flowwaterfixturesinbathrooms—WaterSenselabeled

productsor

thefollowingspecifications:

o Toilets:1.28gallons/flushorless,

o Urinals:0.5 gallons/flush,

o LavatoryFaucets:1.5gallons/minuteorlessat60psiflowrate,

o Showerheads:2.0gallons/minuteorlessat80psiflowrate;

EnergyStarcertifiedrefrigerator;

EnergyStarcertifieddishwasher;

HC CREDIT UNDERWRITING REPORT SMG

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

PINNACLE 441EXHIBIT 2, PAGE 4

EnergyStarcertifiedventilationfaninallbathrooms;

Waterhea terminimumefficiencyspecifications:

o ResidentialElectric:

Upto55gallons=0.95EFor0.92UEF;or

Morethan55gallons=Energy

Starcertified;or

Tankless=0.97EFandMaxGPMof≥2.5overa77◦riseor0.87UEFandGPM

of≥2.9overa67◦rise;

o ResidentialGas(storageortankless/instantaneous):EnergyStarcertified;

o CommercialGasWaterHeater:EnergyStarcertified;

EnergyStarcertifiedceiling

fanswithlightingfixturesinbedrooms;

AirConditioning (in‐unitorcommercial):

o Air‐SourceHeatPumps–EnergyStarcertified:

≥8.5HSPF/≥15SEER/≥12.5EERforsplitsystems

≥ 8.2 HSPF≥15 SEER/≥12 EER for single package equipment including

gas/electricpackageunits

o CentralAir

Conditioners–EnergyStarcertified:

≥15SEER/≥12.5EER*forsplitsystems

≥15 SEER/≥12 EER* for single package equipment including gas/electric

packageunits.

NOTE: Window air conditioners and portable air conditioners are not allowed.

Package Terminal Air Conditioners (PTACs) / Package Terminal Heat Pumps

(PTHPs)are

allowedinstudioand1bedroomunits;

(2) In addition to the required Green Building features outlined in (1) above, this New

ConstructionDevelopmentcommitstoachievethefollowingGreenBuildingCertification

Program:

________LeadershipinEnergyandEnvironmentalDesign(LEED);

________FloridaGreenBuildingCoalition(FGBC);

________EnterpriseBuilding

Communities;or

____X____ICC700NationalGreenBuildingStandard(NGBS).

e. ThisFamilyDevelopmentwillprovidethefollowingresidentprograms:

(1) AdultLiteracy

The Applicant or its Management Company must make available, at no cost to the

resident,literacytutor(s)whowillprovideweeklyliteracylessonstoresidentsinprivate

spaceon‐site.Variousliteracyprogrammingcanbeofferedthatstrengthenspa rticipants’

reading,writingskills,andcomprehension,butataminimum,thesemustincludeEnglish

proficiencyandbasicreadingeducation.

Trainingmustbeheldbetweenthehours of8:00a.m.and7:00p.m.andelectronicmedia,

ifused,mustbe

usedinconjunctionwithliveinstruction.IftheDevelopmentconsistsof

HC CREDIT UNDERWRITING REPORT SMG

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐

PINNACLE 441EXHIBIT 2, PAGE 5

ScatteredSites, this residentprogram mustbeprovided ontheScattere d Site withthe

mostunits.

(2) HomeownershipOpportunityProgram

Applicant commits to provide a financial incentive which includes the following

provisions:

Theincentive

mustbeapplicabletothehomeselectedandmaynotberestricted

toorenhancedbythepurchaseofahomeinwhichtheApplicant,Developer,or

otherrelatedpartyhasaninterest;

theincentivemustbenotlessthan5percentoftherentreceivedbytheowner

for

theunitduringtheentireoccupancybythehousehold(Note:Theincentive

will be paid for all months for which the household is in compliance with the

termsandconditionsofthelease.Damagestotheunitinexcessofthesecurity

depositwillbedeductedfromtheincentive.);

thebenefitmustbeintheformofagiftorgrantandmaynotbealoanofany

nature;

thebenefitsoftheincentivemustaccruefromthebeginningofoccupancy;

thevestingperiodcanbenolongerthan2yearsofcontinuousresidency;and

no

fee,depositoranyothersuchchargecanbeleviedagainstthehouseholdasa

conditionofparticipationinthisprogram.

(3) FinancialManagementProgram

TheApplicantorits Management Company shall provide a series of classes to provide

residentstraininginvariousaspectsofpersonalfinancialmanagement.Classes

mustbe

heldatleastquarterly,consistingofatleasttwohoursoftrainingperquarter,andmust

be conductedby parties that are qual ifiedto provide training r egardingthe respective

topicarea.IftheDevelopmentconsistsofScatteredSites,theResidentProgrammustbe

heldon theScatteredSite

withthemostunits.Residentsresidingattheothersitesofa

ScatteredSiteDevelopmentmustbeofferedtransportation,atnocosttothem,tothe

classes.Thetopicareasmustinclude,butnotbelimitedto:

Financial budgeting andbi ll‐payingincludingtrainin g intheuseoftechnologies

andweb‐basedapplications;

Taxpreparationincludingdo’sanddon’ts,commontips,andhowandwhereto

file,includingelectronically;

Fraudpreventionincludinghowtopreventcreditcardandbankingfraud,identity

theft,computerhackingandavoidingcommonconsumerscams;

Retirement planning & savings options including preparing a

will and estate

planning;and

Homebuyer education including how to prepare to buy a home, and how to

accesstofirst‐timehomebuyerprogramsinthecountyinwhichthedevelopment

islocated.

Differenttopicareasmustbeselectedforeachsession,andnotopicareamaybe

repeatedconsecutively.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 EXHIBIT 3 - PAGE 1

JULY 6, 2022

COMPLETENESSANDISSUESCHECKLIST

DEVELOPMENTNAME:Pinnacle441

DATE:July6,2022

In accordance with applicable Program Rule(s), the Applicant is required to submit the information

required to evaluate, complete, and determine its sufficiency in satisfying the requirements for Credit

UnderwritingtotheCreditUnderwriterinaccordancewiththescheduleestablishedbytheFlor idaHousing

FinanceCorporation(“FloridaHousing”or“FHFC”). Thefollowing

itemsmustbesatisfactorilyaddressed.

“Satisfactorily”meansthattheCreditUnderwriterhasreceivedassurancesfromthirdpartiesunrelatedto

theApplicant thatthetransactioncanclosewithintheallottedtimeframe.Unsatisfactoryitems,ifany,

arenotedbelowandinthe“IssuesandConcerns”sectionoftheExecutiveSummary.

CREDIT

UNDERWRITING

REQUIREDITEMS:

STATUS NOTE

Satis./

Unsatis.

1. The development’s final “as submitted for permitting ” plans and

specifications.

Note: Final “signed, sealed, and approved for construction” plans and

specificationswillberequiredthirtydaysbeforeclosing.

Satis.

2. Finalsiteplanand/orstatusofsiteplanapproval. Satis.

3. PermitStatus. Satis.

4. Pre‐constructionanalysis(“PCA”). Satis.

5. Survey. Satis.

6. Complete,thoroughsoiltestreports. Satis.

7. Full or self‐contained appraisal as defined by the Uniform Standards of

ProfessionalAppraisalPractice.

Satis.

8. MarketStudyseparatefromtheAppraisal. Satis.

9. EnvironmentalSiteAssessment–PhaseIand/orPhaseIIifapplicable(IfPhase

Iand/orIIdisclosedenvironmental problemsrequiring remediation, a plan,

includingtimeframeandcost,fortheremediationisrequired).Ifthereport

is not dated within one year of the application date, an update from the

assessormustbeprovidedindicatingthecurr entenvironmentalstatus.

Satis.

10. Audited financial statements for the most recent fiscal year ended or

acceptable alternative as stated in the Rule for credit en hancers, applicant,

generalpartner,principals,guarantorsandgeneralcontractor.

Satis.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 EXHIBIT 3 – PAGE 2

JULY 6, 2022

11. Resumes and experience of applicant, general contractor and managemen t

agent.

Satis.

12. Creditauthorizations;verificationsofdepositsandmortgageloans. Satis.

13. ManagementAgreementandManagementPlan. Satis.

14. Firmcommitmentfromthecreditenhancerorprivateplacementpurchaser,

ifany.

N/A

15. Firmcommitmentletterfromthesyndicator,ifany. Satis.

16. Firmcommitmentletter(s)foranyotherfinancingsources. Satis.

17. Updatedsourcesandusesoffunds. Satis.

18. Draft construction draw schedule showing sources of funds during each

monthoftheconstructionandlease‐upperiod.

Satis.

19. Fifteen‐yearincome,expense,andoccupancyprojection. Satis.

20. Executedgeneralconstructioncontractwith“nottoexceed”costs. Satis.

21. HCONLY:15%of the totalequitytobeprovidedpriortoor simultaneously

withtheclosingoftheconstructionfinancing.

Satis.

22. Anyadditionalitemsrequiredbythecreditunderwriter. Satis.

NOTESANDAPPLICANT’SRESPONSES:None

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 EXHIBIT 4 – PAGE 1

JULY 6, 2022

HCAllocationCalculation

$44,939,514

Les s LandCos t ($3,510,000)

Les s Fe d e ral Fu nds $0

Les s OtherIneligibleCos t ($4,283,345)

Les s Di s proporti onate Sta nd a rd $0

$37,146,169

96.2859241972427%

130.00%

$46,496,491

9.00%

$4,184,684

SectionI:QualifiedBasisCalculation

De ve l opmentCos t

TotalEligibleBasis

ApplicableFra ction

DDA/QCTBasisCre di t

QualifiedBasis

HousingCre di tPercenta ge

AnnualHo usin gCre di tAllocation

NotestotheQualifiedBasisCalculation:

1. OtherIneligibleCostsprimarilyincludedemolition,retailspace,certainsitework,washer/dryercosts,

FHFCadministrative,applicationandHCcompliancefees,portionsoftheaccounting,surveyandtitle

insurance,marketing,legalfees,permanentloanoriginationfees,closingcostsandoperatingdeficit

reserverequiredby

thesyndicator.

2. Applicantcommitted to a 97% set aside;therefore,theapplicablefraction is the lesseroftheunit

fractionof97.35%orthefloorfractionof96.2859241972427%.

3. This development is located in Broward County and is located in a SADDA, 33024.Ther efore, a

130.00%BasisCredithasbeen

applied.

4. The HC percentage is 9.00% per the Fiscal Year 2016 Omnibus Spending and Tax Bill passed by

Congress.

HC CREDIT UNDERWRITING REPORT SMG

PINNACLE 441 EXHIBIT 4 – PAGE 2

JULY 6, 2022

$44,939,514

Les s Mortgages ($9,300,000)

Les s Gra n ts $0

$35,639,514

99.99%

$0.94

$37,918,168

$3,791,817

TotalDe ve l opmentCos t(Incl udi ngLa ndandIneligibleCosts)

SectionII:GapCalculation

Equi tyGap

Percenta ge toInvestmentPartne rs hi p

HCSyndicationPricing

HCRe qu ired toMeetGap

AnnualHCRe q uire d

NotestotheGapCalculatio n:

1. Thequalifyingfirstmortgageof $7,124,661.81 asdetermined by Chapter67‐48.0072(29)(g), isless

than the actual first mortgage and therefore does not apply.Mortgages represent NLP’s First

MortgageLoanof$9,200,000and$100,000BrowardCountySecondMortgage.

2. HCSyndicationPricing andPercentage

toInvestmentPartnershiparebasedupontheMay31,2022

LOIfromBofA.

$3,382,000

$4,184,684

$3,791,817

$3,382,000

HCperQualifiedBasis

SectionIII:Summary

HCperApplicantReque s t

HCperGapCalculation

AnnualHCRe comme n de d

NotestotheSummary:

1. Seltzer’sAnnualHCRecommendationislimitedbyApplicantRequest.