By Pat Dalton, 651-296-7434

Local Sales Taxes in

Minnesota

October 2019

Executive Summary

Local governments, except for counties, are generally prohibited by statute from imposing

sales taxes. Counties are allowed by statute to impose general sales taxes to fund

transportation and transit. Currently, 53 counties use this statutory authority.

Additionally, the legislature has authorized, through special legislation, a number of local

sales taxes. Currently, 43 cities, one sanitary district, and four counties (including three

counties imposing a tax under statutory authority) impose taxes under special law. These

local taxes have differed significantly in their characteristics and administration. In 1997, the

legislature enacted model statutory language regarding imposition and administration of new

and existing local sales taxes. The legislature modified this law significantly in 2019 to place

more emphasis on using revenues from these taxes for projects of regional significance.

This publication is divided into several sections—the first summarizes the general statute

related to seeking and administering local sales taxes including steps a local government

must follow when seeking special legislation under this statute, and the second describes the

general statutory county authority to impose local sales taxes to fund transportation and

transit and lists the counties using that authority. This is followed by tables showing all local

sales taxes imposed or authorized through special legislation. A history of the major changes

in the statutory provisions related to local sales taxes is included in an appendix.

This publication only discusses general local sales taxes, it does not include local lodging, food

and beverage, or amusement taxes.

Contents

Statutory Provisions Applying to Local Sales Tax Authority ............................................... 2

General Steps for Seeking Local Sales Tax Authority .......................................................... 6

Transportation Local Sales Taxes Authorized by Statute .................................................... 7

Other Local Sales Taxes ..................................................................................................... 10

Appendix: Legislative History ............................................................................................ 23

Local Sales Tax in Minnesota

Minnesota House Research Department Page 2

Statutory Provisions Applying to Local Sales Tax

Authority

In 1971, the legislature enacted a law that stated that no local government “…shall increase a

present tax or impose a new tax on sales or income” as a tradeoff to the state providing

significant general purpose aid to local governments.

1

Despite this prohibition, the legislature

has allowed a number of local sales taxes to be imposed via special legislation. Also beginning in

2008, counties were granted general authority to impose local sales taxes for transportation

purposes.

In 1997 the legislature codified provisions to be followed in administering current or new local

sales taxes imposed under special or general law. The statute also outlined the steps a local

government should take before seeking local sales tax authority under a special law. Over the

years these provisions have been recodified and amended, most recently in the 2019 legislative

session. Some of the administrative provisions included in this statute were required as a

condition of the state becoming a member of the Streamlined Sales and Use Tax Agreement

(SSUTA).

2

Most of the current provisions are contained in Minnesota Statutes, section 297A.99,

and are described here. Many of the administrative provisions apply to the county statutory

sales tax authority, as well as to taxes imposed under special law.

The steps a local government must take when seeking special legislation to impose a local sales

tax are scattered throughout the section but are summarized on page 6. A hi

story of the

changes made to these provisions can be found in the appendix.

Local Taxes Subject to the Statutory Provisions

The statutory provisions apply to all local sales taxes, unless the enabling legislation specifically

exempts the local authority from all or part of this statute.

3

A local government cannot impose

a separate local tax on motor vehicles in addition to the sales tax, except for a county under

the general county sales tax authority. (Minn. Stat. § 297A.99, subd. 1.)

Limits on Spending Related to Imposing Local Sales Taxes

Local governments are prohibited from spending money to advertise or otherwise spend

money to promote passage of a referendum for imposing a local sales tax. They may only spend

money to:

1) conduct the referendum;

1

The original prohibition was included as a subdivision in the local government aid law (Minn. Stat. 1971, §

477A.01, subd. 18), but the language was modified slightly and moved into a separate section – Minn. Stat. §

477A.016, when the local government aid chapter was recodified in the 1981 first special session.

2

The SSUTA is a voluntary agreement between 21 states to streamline and simplify sales taxes collection for

businesses operating in multiple states. Minnesota has been a participating state since 2001.

3

The statutory provisions preempt any contrary provisions included in local sales taxes authorized by special law

prior to June 2, 1997.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 3

2) distribute the information about the sales tax contained in the required resolution, but

only if specific proposed projects and their individual projected costs are enumerated;

and

3) host public forums on the issue, provided proponents and opponents were given

equal time to speak. (Minn. Stat. § 297A.99, subd. 1, para. (d))

Local Resolution Requirements for Seeking Special Legislation

Before a political subdivision seeks special legislation authorizing the imposition of the sales tax,

its governing body must pass a resolution indicating its desire to impose the tax. The resolution

must include information on the proposed tax rate, the amount of revenue to be raised and its

intended use, and the anticipated date when the tax will expire. Information from the

resolution is used in preparing the necessary special legislation. (Minn. Stat. § 297A.99, subd. 2)

Special Resolution for Certain Taxes Authorized in the 2019 Session

Certain cities that were authorized to impose a local sales tax in 2019 are required to pass a second resolution

before the tax may be imposed. The resolution must enumerate very specific projects to be funded by the sales

tax revenues within the broader project areas listed in the original voter-approved referendum and requires that

funds only be used for those projects. The definition of “specific project” can be found in Minne

sota Laws 2019,

first special session, chapter 6, article 6, section 34.

Cities subject to this provision are: Avon, Cambridge, Glenwood, International Falls, Two Harbors, and

Worthington.

Voter Approval Requirements Before Imposition of the Tax

Political subdivisions must hold a local referendum at a general election

4

before imposing a

local sales tax authorized by special law. Over the years, the timing of

the referendum—

whether it should be held before or after the enabling legislation had passed has changed.

Currently the sales tax must be authorized by the legislature before the voters can approve

its imposition. (Minn. Stat. § 297A.99, subd. 3)

If the enabling legislation allows the tax to fund more than one project a separate vote must be

held for each project. Only the projects approved by voters may be funded by the sales tax and

the authorized revenue to be raised and length the tax is imposed is reduced for any project

that is not approved by the voters.

4

A general election means either the state general election held on the first Tuesday after the first Monday in

November of an even-numbered year, or a regularly scheduled election for local public officials for that political

subdivision.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 4

Determination of the Local Tax Rate

The local tax rate is set in the legislation authorizing the tax. The statute clarifies that the full

local tax rate applies to all taxable sales. SSUTA allows lower rates to apply to certain items but

all current

local sales taxes have only one rate.

5

(Minn. Stat. § 297A.99, subd. 5)

Definition of the Tax Base for the Local Tax

The statute provides that the local sales tax applies to the same tax base, with the same

exemptions, as the state sales tax. A taxable service is subject to the local tax if more than one-

half of the service, based on the cost, is performed within the local jurisdiction. (Minn. Stat. §

297A.99, subds. 4 and 7)

The following sales made within the local taxing jurisdiction are exempt from the local tax:

Purchases shipped outside the taxing jurisdiction for use in a trade or business outside of

the jurisdiction

Purchases temporarily stored in the taxing jurisdiction before being shipped by common

carrier for use outside of the jurisdiction

Purchases that are subject to the direct pay provisions for interstate motor carriers under

Minnesota Statutes, section 297A.90

Requirements of a Complementary Use Tax

A complementary use tax is required in all jurisdictions with a local sales tax.

6

The use tax is

imposed on the consumption or “use” of taxable items for which no sales tax was paid. The tax

is imposed mainly on purchases by resident buyers from sellers located outside of the local

taxing jurisdiction. The use tax removes the disadvantage to local businesses from competition

with businesses located outside of the taxing area that are not required to collect the local

sales tax. (Minn. Stat. § 297A.99, subd. 6)

The statute also allows a credit against the use tax owed for a local sales or use tax paid to

another political subdivision. This is similar to the credit

against state sales and use tax for the

amount of sales taxes paid to another state. (Minn. Stat. § 297A.99, subd. 8)

A political subdivision with a local sales and use tax must notify its citizens about the local use

tax and provide information or electronic links to allow persons to get in

formation and forms

needed to pay the tax. The political subdivision must post the information on the main page of

its website and provide an annual notice with the billing statement for any public utilities

provided by the jurisdiction. (Minn. Stat. § 297A.99, subd. 12a)

5

The one-rate-per-taxing-jurisdiction requirement in SSUTA does not apply to the sale of the following items:

electricity, gas, or other heating fuels delivered by the seller, or the transfer of motor vehicles, aircraft,

watercraft, modular homes, manufactured homes, or mobile homes.

6

Four local taxes enacted before 1997 did not include a complementary use tax—in Cook County and the cities of

Hermantown, Mankato, and St. Paul. A local use tax was imposed in these political subdivisions beginning

January 1, 2000.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 5

Collection, Administration, and Enforcement of Local Taxes

The statute requires the Commissioner of Revenue to administer and collect local sales and use

taxes. This merely codified preexisting practice.

7

The local taxes are subject to the same penalties, interest, and enforcement provisions as the

state sales tax. Refunds of excess state sales taxes paid must also include a refund of any excess

local sales tax paid. The state deducts its collection and administration costs and any local tax

refunds from the tax revenue returned to the local taxing jurisdiction. The net local tax revenue

is paid to the local taxing jurisdiction on a quarterly ba

sis. Minn. Stat. §

2

97A.99, subds. 9

and

11.

Imposing and Repealing Local Sales Tax

To facilitate state administration of local taxes, the imposition of a tax may only begin on the

first day of a calendar quarter. Repeal of a local tax is only effective at the end of a calendar

quarter. A local taxing jurisdiction must give the Department of Revenue at least 90 days’ notice

before a tax is imposed or repealed. The tax is effective after the commissioner has given sellers

located in the area at least 60 days’ notice and will apply to catalog or remote sales only after

the commissioner has given these sellers 120 days’ notice. The practical effect is that there may

be a delay in the imposition of a local tax on remote sales if the local government does not

provide at least a 120-day advance notice to the state. (Minn. Stat. § 297A.99, subd. 12)

Because of the notification and timing requirements, local taxes will usually terminate after the

authorized amount is raised. The local government may usually

keep this revenue; however,

the commissioner may keep any revenue in excess of the average quarterly revenue raised

from the tax in the previous 12-month period and deposit it into the state general fund. (Minn.

Stat. § 297A.99, subd. 3, para. (f))

The law also requires a political subdivision to wait one year after the expiration of a tax before

imposing a new tax. (Minn. Stat. § 297A.99, subd. 3, para. (d))

Despite this requirement, the legislature has granted extensions of existing sales taxes without

the required break.

8

The only local governments that let an existing tax expire for at least one

year before imposing a new tax for a different purpose are:

Cook County, which let a tax expire in 2008 and sought and received authority for a new tax

during the 2009 legislative session;

7

The city of Duluth is the only local government to ever collect and administer its own tax. At the city’s request, it

was originally exempted from the collection and administration provisions of the statute. However, the

exemption ended and the commissioner began collecting the Duluth tax January 1, 2006, to meet the SSUTA

requirement that one agency collect all state and local sales taxes.

8

Extensions have been granted without a break in imposition for the following local sales taxes since 2005: the

Central Minnesota city tax; taxes in the cities of Albert Lea, Baxter, Brainerd, Hermantown, Mankato, New Ulm,

North Mankato, Proctor, Rochester, and Worthington; and the second local tax imposed by Cook County in 2009.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 6

the city of Wilmar, which imposed a tax in 1997 that expired in 2001 and sought and

received authority for a new tax in 2005 that expired at the end of 2012; and sought and

received authority for a new tax in 2019;

the city of Fergus Falls, which let its 2010 tax expire in 2016 and received authority to

impose a new tax in 2017.

Determining the Site of a Delivery for Local Tax Purposes

Zip codes are used to determine whether a delivery sale is subject to a local sales and use tax. If

a zip code area includes more than one tax rate the lowest rate in the zip code area applies. For

example, if a zip code includes both a portion of Edina (with no local sales tax) and a portion of

Minneapolis (with a half-cent local sales tax), the Minneapolis tax may not be collected. Nine-

digit zip codes should be used, if available, to determine the tax rate. (Minn. Stat. § 297A.99,

subd. 10)

Special Authority for First-class Cities

Notwithstanding the requirement that sales tax revenues only fund the projects explicitly

specified in the enabling legislation, cities of the first class (Minneapolis, St. Paul, Duluth, and

Rochester) may also use the revenues to fund certain large capital projects of regional

significance without additional voter approval. These cities may use revenues that exceed the

amount needed to pay for the financing of the specified capital projects to help fund a sports

facility, convention center, or civic center that has a construction cost of at least $40 million.

(Minn. Stat. § 297A.9905)

9

General Steps for Seeking Local Sales Tax Authority

In order to impose a local sales tax, a political subdivision must obtain enactment of a special

law authorizing it to do so by taking the following steps (in the order listed):

1) The governing body of a local government must pass a resolution proposing the tax and

including the following:

a. the proposed tax rate;

b. a detailed description of no more than five capital projects to be funded by the

tax;

c. documentation of the regional significance of each project including the benefits

to nonlocal persons and businesses;

d. the amount of revenue to be raised for each project and the estimated time to

raise that amount; and

e. the total revenue to be raised and anticipated expiration date for the tax.

9

This authority was granted in the bill authorizing the use of the Minneapolis sales tax to fund a portion of the

Vikings football stadium. The city of St. Paul is helping to finance a minor league baseball stadium from its

existing tax.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 7

2) The local government must submit the resolution and documentation on regional

significance of the project(s) to the chair and ranking minority member of the House and

Senate tax committees by January 31 of the year that it is seeking the special law.

3) Working with a legislator, the local government must request and get enacted a special

law authorizing imposition of the tax.

4) The local government must file local approval with the secretary of state before the

start of the next regular legislative session after the session in which the enabling law is

enacted.

5) The local government must receive voter approval at a general election within two years

of receiving the local sales tax authority before it can impose the tax. A separate

question must be held for each project and only the ones approved by voters may be

funded by the sales tax. The authorized revenue to be raised and length of time that the

tax is imposed is reduced for any project that is not approved by the voters.

6) The local government must pass an ordinance imposing the tax and notify the

Commissioner of Revenue at least 90 days before the first day of the calendar quarter

on which the tax is to be imposed.

Transportation Local Sales Taxes Authorized by

Statute

In 2008, the legislature enacted two statutes to allow counties to impose local sales taxes to

help fund transportation. The Metropolitan Transportation Area sales tax provision allowed any

county in the Twin Cities seven-county metropolitan area, to join the Metropolitan

Transportation Area, which imposed a tax in the area to fund transit projects. The Metropolitan

Transportation Area was dissolved in 2017 and this provision is currently not used. The history

of this provision is included in the appendix. The Greater Minnesota transportation sales and

use tax provision now applies to all counties in the state and allows them to impose a tax singly

or as part of a joint powers agreement to fund a specified transportation or transit project, or

transit operations.

Greater Minnesota Transportation Sales and Use Tax

Any county may singly or through a joint powers agreement, impose a local sales and use tax of

up to one-half of 1 percent and a $20 excise tax on commercial sales of motor vehicles to fund a

transportation or transit project. (Minn. Stat. § 297A.993)

In order to impose the tax, the county or counties must specify a project to be funded by the

proceeds. A county only needs to pass a resolution in order to impose the tax. The tax revenue

may pay for transit capital and operating costs and capital costs for a safe routes to school

program, as well as specified transportation capital projects. Except in the cases where the tax

is funding transit operating costs, the tax expires when the specific project is completed;

Local Sales Tax in Minnesota

Minnesota House Research Department Page 8

however, a county may by resolution extend the use to a new enumerated project. A county

may also issue limited obligation bonds for the specified projects, backed only by the revenues

from the sales tax. Fifty-three out of 87 counties in the state impose a transportation sales tax.

They are listed in Table 1.

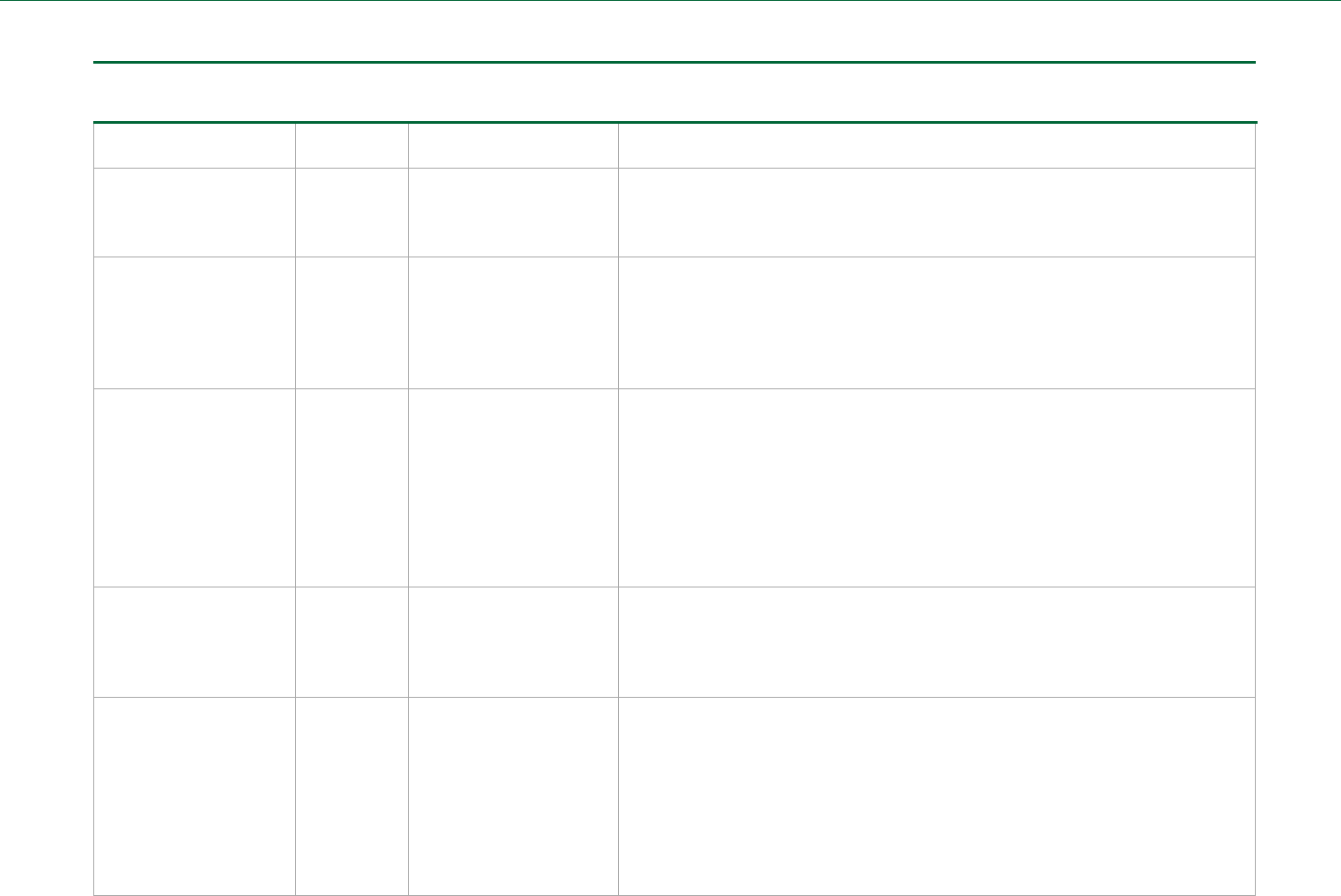

Table 1

Counties Imposing a Transportation Sales and Use Tax

County Date Tax Imposed Tax Rate

Also Imposes a $20 per

Vehicle Excise Tax

Anoka

*

10/1/2017 0.25% Yes

Becker 7/1/2014 0.50% No

Beltrami 4/1/2014 0.50% Yes

Benton 10/1/2019 0.50% No

Blue Earth 4/1/2016 0.50% No

Brown 4/1/2016 0.50% No

Carlton 4/1/2015 0.50% Yes

Carver 10/1/2017 0.50% Yes

Cass 4/1/2016 0.50% No

Chisago 4/1/2016 0.50% No

Cook 1/1/2017 0.50% No

Crow Wing 4/1/2016 0.50% No

Dakota

*

10/1/2017 0.25% Yes

Dodge 1/1/2019 0.50% No

Douglas 10/1/2014 0.50% No

Fillmore 1/1/2015 0.50% No

Freeborn 1/1/2016 0.50% No

Goodhue 1/1/2019 0.50% Yes

Hennepin

*

10/1/2017 0.50% Yes

Hubbard 7/1/2015 0.50% No

Isanti 7/1/2019 0.50% No

Kandiyohi 4/1/2018 0.50% Yes

Lake 4/1/2017 0.50% No

Lyon 10/1/2015 0.50% No

Local Sales Tax in Minnesota

Minnesota House Research Department Page 9

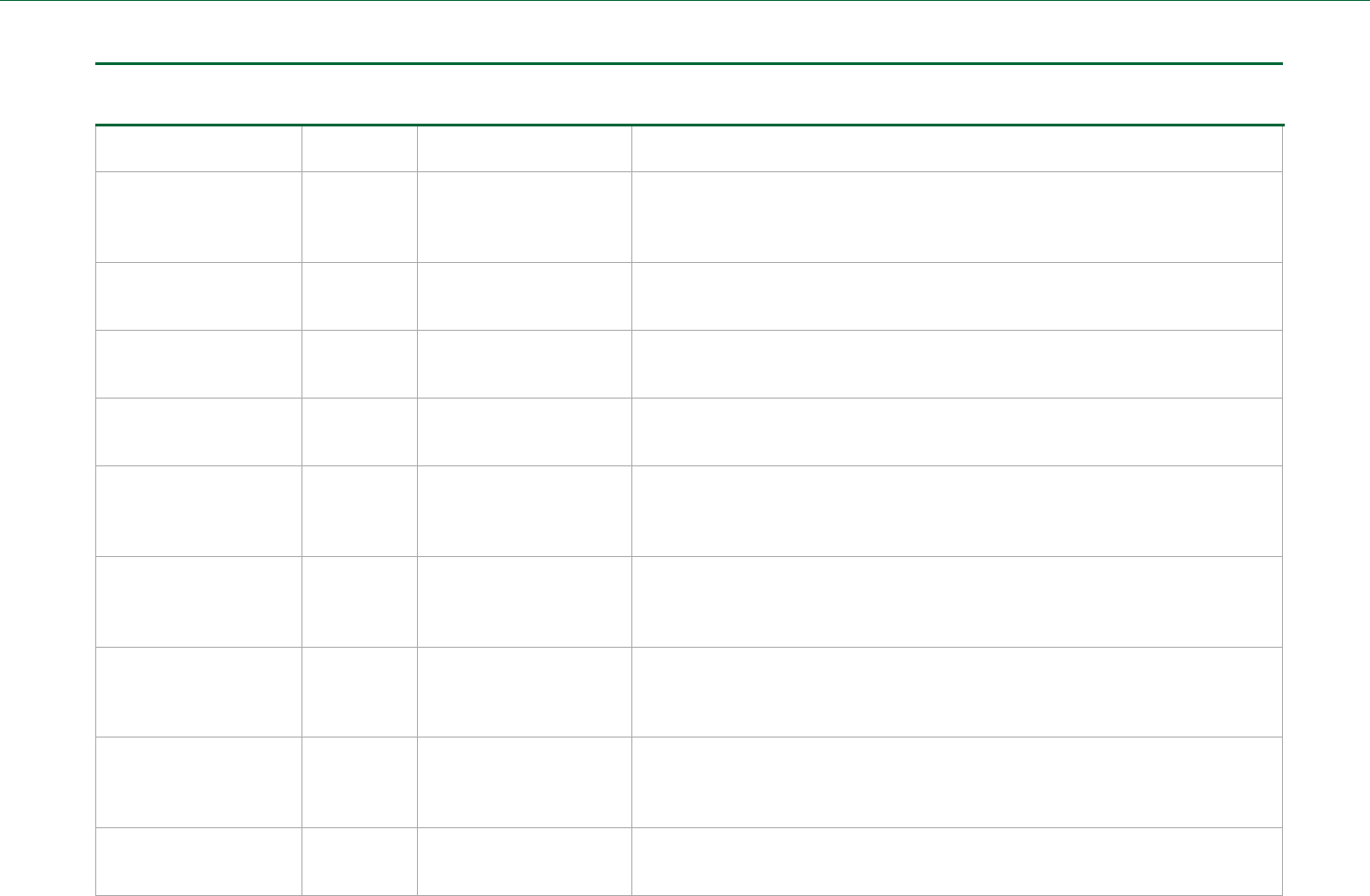

Table 1

Counties Imposing a Transportation Sales and Use Tax

Mille Lacs 1/1/2017 0.50% No

Morrison 1/1/2018 0.50% No

Mower 1/1/2018 0.50% No

Nicollet 1/1/2018 0.50% No

Olmsted

**

7/1/2017 0.50% No

Ottertail 1/1/2016 0.50% Yes

Pine 1/1/2017 0.50% No

Polk 1/1/2018 0.25% No

Ramsey

*

10/1/2017 0.50% Yes

Redwood 4/1/2019 0.50% No

Rice 1/1/2014 0.50% No

St. Louis 4/1/2015 0.50% Yes

Scott 10/1/2015 0.50% Yes

Sherburne 1/1/2019 0.50% No

Stearns 1/1/2018 0.25% No

Steele 4/1/2015 0.50% No

Todd 1/1/2015 0.50% No

Wabasha 4/1/2016 0.50% No

Wadena 4/1/2014 0.50% No

Waseca 4/1/2019 0.50% No

Washington

*

10/1/2017 0.25% Yes

Winona 1/1/2017 0.50% No

Wright 10/1/2017 0.50% No

Notes:

* One of the counties that was part of the now defunct Metropolitan Transportation Area.

** Olmsted County originally imposed a tax of 0.25% on 1/1/2014 under Minnesota Statutes,

section 469.46, to fund improvements related to the Destination Medical Center. The tax was

increased to 0.50% in 2017 under the general law.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 10

Other Local Sales Taxes

The following three tables show the general local sales taxes that have been authorized by the

legislature for individual jurisdictions. These tables do not include the transportation taxes

imposed under general law that are listed in Table 1. Table 2 contains the local sales taxes that

are currently imposed. Table 3 lists the local sales taxes that were imposed but have expired.

Table 4 lists the general local sales taxes that were authorized but never imposed or are

currently authorized but not yet imposed.

More detailed information on the individual local sales taxes, listed in this information brief,

including citations to the enabling and amending laws, is available on the sales tax area of our

website at www.house.mn/hrd/hrd.aspx.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 11

Table 2

Currently Imposed Local Sales Taxes

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

Duluth – 1973 1.0% until

September

30, 2019

1.5% as of

October 1,

2019

City council approval

Approved by voters at a

2017 general election

The tax may be used for any city purpose, as determined by the city council. No

expiration date. In 2019, the city was granted authority to increase the tax by an

additional 0.5%, based on voter approval at the city’s 2017 general election, to fund

improvements as outlined in its 2017 Street Improvement Plan. The additional tax

expires at the earlier of 25 years after imposition or when revenues are sufficient to

fund the improvements.

Rochester – 1983 0.5% until

December

31, 2015

0.75% as of

January 1,

2016

All but 1989 and 2013

extensions required voter

approval at a general or

special election

This tax has been renewed or extended six times, in 1989, 1992, 1998, 2005, 2011,

and 2013. Initially enacted at 1.0% to raise $16 million for a civic center and $16

million for flood control; the rate was lowered to 0.5% in 1992. The 1998 extension

allows the city to raise another $76 million for various higher education,

transportation, and sewer capital projects. The tax extension in the 2005 special

legislative session allowed another $40 million to be raised for a joint road project

with Olmsted County. In 2011, the tax was extended again to fund an additional

$139.5 million in projects if approved by the voters at the 2012 general election.

However, $5 million of the new $139.5 million must be shared with small cities

surrounding Rochester for economic development purposes in those communities.

In 2013, the city was granted authority to extend the tax to 2049 and/or increase

the existing rate by one-quarter of 1.0% without a referendum to generate

additional revenue to pay the city’s required match to get state aid to fund the

Destination Medical Center (DMC) project. The city chose to increase the rate

beginning January 1, 2016.

Minneapolis – 1986 0.5% Approval of the city’s

board of estimate and

taxation, and after

imposition of the local

restaurant and lodging

taxes

Fund construction and maintenance of the convention center. In 1992, the city was

authorized to use excess proceeds for neighborhood early learning centers but the

city has not done so. The tax expires when all bonds are paid off. In 2009, the use of

the revenue was modified to allow the city to use revenues collected in excess of

the convention center bond payments for other city purposes. For CY 2009 and

2010, the excess revenues could be used for any purpose. Beginning in CY 2011, the

excess revenues could only be used to fund capital projects to further economic

development. In 2012, the tax was extended to 2046 without a referendum to help

fund the city’s share of a new football stadium. Beginning in 2021, when the current

convention center bonds are paid off, the state will annually retain a portion of the

city’s sales tax revenues to reimburse it for the city’s share of the stadium costs.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 12

Table 2

Currently Imposed Local Sales Taxes

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

Excess revenue not needed to pay off the convention center bonds or the football

stadium may be used to support a basketball arena as well as fund other economic

development capital projects in the city.

Mankato – 1991 0.5% Reverse referendum for

initial approval invoked

by petition of 10% of

voters in the 1992

general election; the

2017 change was

approved at the 2016

general election

To fund capital and operations of the Riverfront project, including a sports arena. In

1996 this was expanded to allow $4.5 million for an airport project. The tax was

extended again in the 2005 special legislative session to allow up to $1.5 million

annually to fund operating costs of the Riverfront facility based on approval by the

voters at a general or special election. The tax was to expire no later than 2018. In

2008 the allowed uses of the tax were modified to exclude operating costs and

include capital costs of an attached performing arts theatre and a women’s hockey

exposition center used by Minnesota State University, Mankato. The expiration date

was moved to December 31, 2022. A reverse referendum for these changes could

have been invoked by a petition of 10% of the voters at the 2008 general election,

but was not. In 2009, the requirement that the performing arts center and hockey

center be attached to the Riverfront facility was removed. In 2017, the city was

allowed to extend the tax to pay for up to an additional $47 million in various

recreational, transit, water, and other capital projects of regional significance. The

tax will now expire at the earlier of (1) when revenues are sufficient to pay for the

projects and associated bond costs, or (2) December 31, 2038.

St. Paul – 1993 0.5% A city resolution passed

before July 1, 1993,

stating the intent to

impose the tax

40% must be used to fund capital costs of the civic center, which includes the

hockey arena; the remainder may be used for other neighborhood projects. The

allowed uses of the remaining 60% of the revenues have been modified over time,

most recently in 2009. In 2013 the law was amended to allow any excess of the 40%

amount not needed for the civic center and hockey arena to go into an economic

development fund rather than neighborhood projects. This allows excess revenues

to be used to fund a minor league ballpark. The tax was set to expire December 31,

2030, but the 2013 law extended it to December 31, 2042.

Hermantown – 1996 0.5%

Changed to

1.0% on

April 1, 2013

Required voter approval

at a general or special

election for original;

increase approved at

2012 general election;

the 2017 extension was

The projects included water and sewer projects and a police/fire station. The tax

expires at the later of ten years or when sufficient funds have been raised for the

three projects. A 2008 provision added water system improvements to the list of

approved projects. In 2011 the city was given authority to increase the tax by an

additional 0.5% if approved at the 2012 general election because the original

authority had been to impose up to a 1.0% tax and the revenues from the 0.5% tax

Local Sales Tax in Minnesota

Minnesota House Research Department Page 13

Table 2

Currently Imposed Local Sales Taxes

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

approved at the 2016

general election

were insufficient to fund the authorized projects. In 2017, the city was allowed to

use tax revenues to fund a city wellness center, and the expiration date was

changed to the earlier of (1) when revenues are sufficient to fund the authorized

projects, or (2) December 31, 2036.

Two Harbors – 1998 0.5%

Changed to

1.0% on

October 1,

2019

Required voter approval

at the 1998 general

election

The projects included sewer separation, wastewater treatment, and harbor

development projects. The tax expires when sufficient funds have been raised for

the three projects. In 2019, the city was allowed to impose an additional 0.5% tax to

fund another $30 million of water and sewer infrastructure projects provided they

are enumerated in a separate resolution (see page 3). This additional tax expires at

the earlier of 25 years or when funds are sufficient to pay for the allowed projects.

Proctor – 1999 0.5%

Changed to

1.0% on

October 1,

2017

Required voter approval

at a special election held

November 2, 1999

Funded community center and transportation projects. Tax expires when sufficient

funds to pay for up to $3.6 million in bonds for the center have been raised. A 2008

provision allowed up to another $7.2 million in capital projects in the areas of public

utilities, sidewalks, bikeways and trails, and parks and recreation. In 2010 legislation

was introduced to replace the two separate bond authorities of $3.6 million and

$7.2 million with one authority for $20 million, but the final provision signed into

law replaced it with a combined authority of $10 million. In 2017, the tax rate was

allowed to increase to 1.0% but the amount allowed to be raised before the tax

expires remains unchanged.

New Ulm – 1999 0.5% Required voter approval

at the 1999 general

election; the 2017 change

was approved at the 2016

general election

Funded a civic and community center project. Tax expires when sufficient funds to

pay for up to $9 million in bonds for the center have been raised. In 2017, the city

was allowed to use the tax to pay for an additional $14.8 million in bonds to fund a

number of recreational facilities with the expiration of the tax delayed until

revenues are sufficient to pay off these new bonds.

Central Minnesota Cities

– 2002 (includes St.

Cloud, Sauk Rapids,

Sartell, St. Augusta, St.

Joseph, and Waite Park)

0.5% Required voter approval

at a general election in

each city

Funded improvements of the St. Cloud airport and other capital projects in each city.

The authorizing referenda in St. Joseph and Waite Park originally failed so the tax

was not imposed in those cities, but in 2005, Waite Park was allowed to impose the

tax based on a successful 2004 referendum. In 2005, the group of cities was allowed

to replace this tax with an identical tax to fund a new regional library in St. Cloud

and other capital projects in each city. Imposition required voter approval at a

general election, which passed in all cities, including St. Joseph. The tax was to

expire in 2018, however, during the 2013 legislative session, each city was granted

authority to extend the tax until 2038, provided it was approved at a local

Local Sales Tax in Minnesota

Minnesota House Research Department Page 14

Table 2

Currently Imposed Local Sales Taxes

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

referendum by November 7, 2017. The referendum authorizing the extension must

list the additional projects to be funded.

Albert Lea – 2005 0.5% Required voter approval

at the 2006 general

election, or a special

election on November 8,

2005

Fund a lake improvement project. Expires at the earlier of ten years or when $15

million is raised. In 2014, the ten-year expiration date was extended to 15 years

after the date imposed, because the annual revenues generated have been less than

expected. In 2017, the 15-year termination date was extended to the earlier of 30

years or when $30 million is raised.

Bemidji – 2005 0.5% Based on voter approval

at the 2002 general

election

Fund park and trail improvements. Expires when revenues are raised to pay $9.826

million in bonds.

Austin – 2006 0.5% Voter approval at a

general or special

election before January 1,

2007

Fund flood mitigation projects. Expires at the earlier of 20 years or when revenues

are sufficient to pay $14 million in bonds. Any excess revenue is deposited in the city

general fund.

Baxter – 2006 0.5% Based on voter approval

at the 2004 general

election

Fund joint water and wastewater facilities for the cities of Baxter and Brainerd and a

fire substation for Baxter. Expires at the earlier of 12 years or when revenues are

sufficient to pay $15 million in bonds. Any excess revenue is deposited in the city

capital project fund. The tax was set to expire in early 2015, however in 2014 the

law was modified to allow the city to extend the tax to December 31, 2037, to fund

payment of up to an additional $40 million in bonds if approved by voters at the

2014 general election. $8 million of the additional spending must be used on

improvements to the Brainerd Lakes Area Airport with the remainder available for

sanitary and storm sewer projects and transportation safety improvements.

Brainerd – 2006 0.5% Based on voter approval

at the 2004 general

election

Fund joint water and wastewater facilities for the cities of Baxter and Brainerd and

trail improvements. Expires at the earlier of 12 years or when revenues are

sufficient to pay $15 million in bonds. Any excess revenue is deposited in the city

capital project fund. In 2014 the law was modified to allow the city to extend the tax

for an additional 18 years and spend another $15 million for water and wastewater

infrastructure and trails if approved by voters at the 2014 general election. The

extension was set to coincide with the extension authorized in the neighboring city

of Baxter.

Hennepin County – 2006 0.15% No voter approval

required

Fund up to $260 million in costs for a baseball stadium plus up to $4 million annually

(adjusted for inflation) to fund youth, youth sports, and county libraries. Expires

Local Sales Tax in Minnesota

Minnesota House Research Department Page 15

Table 2

Currently Imposed Local Sales Taxes

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

when the stadium bonds are paid off or when reserves from the tax are sufficient to

pay the bonds. In 2011 the law was modified to include a definition of “sufficient

reserves.”

Clearwater – 2008 0.5% Based on voter approval

at the 2006 general

election

Fund the acquisition, construction, and improvement of a pedestrian bridge and

land and buildings for a community recreation center. In 2011 the allowed uses

were expanded to include park and recreation projects contained in the city’s

adopted 2006 improvement plan. In 2013 the projects included in the 2006

improvement plan were explicitly listed in the law since the city had never formally

adopted the 2006 plan. Expires at the later of 20 years after imposition or when

revenues are sufficient to fund $12 million in bonds. Any excess revenue is

deposited in the city general fund.

Cook County – 2008 1.0% Voter approval at a

general or special

election before

December 31, 2009

Fund the construction and improvements to a county community center and

recreation area, including a skateboard park, hockey rink, ball fields, tennis courts,

and associated improvements and the Grand Marais public library. Expires at the

later of 20 years after imposition or when revenues are sufficient to fund $14 million

in bonds. Any excess revenue is deposited in the county general fund. In 2009 the

authority to use revenues for a skateboard park, hockey rink, ball fields, and tennis

courts was eliminated, and the use was expanded to include construction and

improvement of a high-speed communication infrastructure network and a district

energy plant for public facilities in Grand Marais. The bonding authority was

increased from $14 million to $20 million.

North Mankato – 2008 0.5% Based on voter approval

at the 2006 general

election; the 2017 change

was approved at the 2016

general election

Fund up to $6 million in capital costs for the local share of the Trunk Highway

14/County State-Aid Highway 41 interchange project, the Taylor library, regional

parks and trails, riverfront development, and lake improvement projects. Expires

when revenues are sufficient to fund the $6 million in bonds plus associated bond

costs. Any excess revenue is deposited in the city capital project fund. In 2017, the

city was allowed to fund up to an additional $9 million in bonds to fund regional

athletic facilities with the tax terminating at the earlier of (1) when revenues are

sufficient to fund the authorized projects, or (2) December 31, 2038.

Hutchinson – 2011 0.5% Based on voter approval

at the 2010 general

election

Fund the costs of constructing the city’s water treatment facility and renovating the

city’s wastewater treatment facility. Expires at the earlier of 18 years or when

revenues are sufficient to pay for the projects and associated bond costs. Any excess

revenue is deposited in the city general fund.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 16

Table 2

Currently Imposed Local Sales Taxes

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

Lanesboro – 2011 0.5% Based on voter approval

at the 2010 general

election

Fund up to $800,000 in improvements to the local dam, city streets and utilities, and

municipal buildings. Expires when revenues are sufficient to fund the projects plus

associated bond costs. Any excess revenue is deposited in the city general fund.

Cloquet – 2011 0.5% Voter approval at a

general election

Fund up to $16.5 million in park and specified infrastructure improvements. The tax

expires at the earlier of 30 years after imposition, or when revenues are sufficient to

fund the authorized projects and associated bond costs.

Marshall – 2011 0.5% Voter approval at a

general election within

two years

Fund up to $17.29 million in costs of an emergency response and industry training

center and regional amateur sports center. The tax expires at the earlier of 15 years

after imposition, or when revenues are sufficient to fund the authorized projects

and associated bond costs.

Medford – 2011 0.5% Voter approval at the

2012 general election

To repay up to $4.2 million in loans from the Minnesota Public Facilities Authority to

improve the city’s water and wastewater treatment facilities. The tax expires at the

earlier of 20 years after imposition, or when revenues are sufficient to repay the

loans.

Olmsted County – 2013 0.25% Approval by the county

board

To fund the county’s match required to fund public transit for the Destination

Medical Center (DMC) project. A wheelage tax of $10 per vehicle was also imposed.

The taxes expire December 31, 2049, or earlier if sufficient revenues are collected to

meet the county match. The county may use excess funds collected in any year,

beyond what is needed to meet the DMC match, for other county transportation

and transit projects.

East Grand Forks – 2017 1.0% Approved at a special

election held March 7,

2016

Fund up to $2.82 million in bonds to finance improvement to the city swimming

pool. Expires at the earlier of 25 years after imposition or when the revenues are

sufficient to pay the bonds.

Fairmont – 2017 0.5% Approved at the 2016

general election

Fund up to $15 million in various recreational projects including a community center

and trails. Expires at the earlier of 25 years after imposition or when the revenues

are sufficient to pay for the projects and associated bond costs.

Fergus Falls – 2017 0.5% Approved at the 2016

general election

Fund up to $9.8 million in bonds to expand and improve the public library. Expires at

the earlier of 12 years after imposition or when the revenues are sufficient to pay

the bonds.

Moose Lake – 2017 0.5% Approved at the 2012

general election

Fund up to $3 million in bonds for parks, street, and municipal arena improvements.

Expires at the earlier of 20 years after imposition or when the revenues are

sufficient to pay the bonds.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 17

Table 2

Currently Imposed Local Sales Taxes

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

New London – 2017 0.5% Approved at the 2016

general election

Fund up to $872,000 of capital projects including construction of a library,

community room, and ambulance bay, and improvements to a senior citizen center.

Expires at the earlier of 20 years after imposition or when the revenues are equal to

$872,000 plus the associated bond costs.

Spicer – 2017 0.5% Approved at the 2016

general election

Fund $800,000 in bonds to finance improvements for public safety, parks and trails,

and community facilities. Expires at the earlier of ten years after imposition or when

the revenues are equal to $800,000 plus the associated bond costs.

Walker – 2017 1.5% Approved at the 2012

general election

Fund up to $20 million in bonds for street, gutter, and sidewalk projects. Expires at

the earlier of 20 years after imposition or when the revenues are equal to the

project costs plus the associated bond costs.

Clay County – 2017 0.5% Approved at the 2016

general election

Fund up to $52 million in bonds for a new correctional facility, law enforcement

center, and associated parking. Expires at the earlier of 20 years after imposition or

when the revenues are equal to $52 million plus the associated bond costs.

Garrison, Kathio, West

Mille Lacs Lake Sanitary

District – 2017

1.0% Approved at the 2016

general election

Repay up to $10 million in bonds and other debt related to the sewer service

agreement between the district and ML Wastewater Inc., including sewer extension

costs. Expires at the earlier of 20 years after imposition or when the revenues are

equal to $10 million plus the associated bond costs.

Avon – 2019 0.5% Approved at the 2018

general election

Fund up to $1.5 million in transportation improvement projects. The city was

required to enumerate the specific projects in a separate resolution (see page 3).

The tax terminates at the earlier of December 31, 2045, or when revenues are equal

to $1.5 million plus associated bond costs.

Blue Earth (city) – 2019 0.5% Approved at the 2018

general election

Fund up to $5 million in various sewer, street, and recreational improvement

projects. The city was required to enumerate the specific projects in a separate

resolution (see page 3). The tax terminates at the earlier of 25 years after imposition

or when revenues are equal to $5 million plus associated bond costs.

Cambridge – 2019 0.5% Approved at the 2018

general election

Fund up to $8 million for a library and $14 million for street improvement projects.

The city was required to enumerate the specific projects in a separate resolution

(see page 3). The tax terminates at the earlier of December 31, 2043, or when

revenues are equal to $5 million plus associated bond costs.

Detroit Lakes – 2019 0.5% Approved at the 2018

general election

Fund up to $6.7 million for a new police facility. The tax terminates at the earlier of

ten years after imposition or when revenues are equal to $6.7 million plus

associated bond costs.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 18

Table 2

Currently Imposed Local Sales Taxes

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

Elk River – 2019 0.5% Approved at the 2018

general election

Fund $35 million for a number of enumerated park and recreational facilities,

dredging Lake Orono, and building trail connections. The tax terminates at the

earlier of 25 years after imposition or when revenues are equal to $35 million plus

associated bond costs.

Excelsior – 2019 0.5% Approved at the 2014

general election

Fund $7 million of improvements to the city commons included in the 2017

Commons Master Plan. The tax terminates at the earlier of 25 years after imposition

or when revenues are equal to $7 million plus associated bond costs.

International Falls –

2019

0.5% Approved at the 2018

general election

Fund up to $30 million of transportation and other infrastructure projects. The city

was required to enumerate the specific projects in a separate resolution (see page

3). The tax terminates at the earlier of 30 years after imposition or when revenues

are equal to $30 million plus associated bond costs.

Rogers – 2019 0.5% Approved at the 2018

general election

Fund $16.5 million of specified projects including trail and pedestrian projects;

aquatic facilities, and various improvements at the South Community Park. The city

is also imposing a $20 motor vehicle excise tax for the same purpose. The taxes

terminate at the earlier of 20 years after imposition or when revenues are equal to

$16.5 million plus associated bond costs.

Willmar – 2019 0.5% Approved at the 2018

general election

Fund $30 million of specified recreation and stormwater infrastructure projects. The

city is also imposing a $20 motor vehicle excise tax for the same purpose. The taxes

terminate at the earlier of 13 years after imposition or when revenues are equal to

$30 million plus associated bond costs.

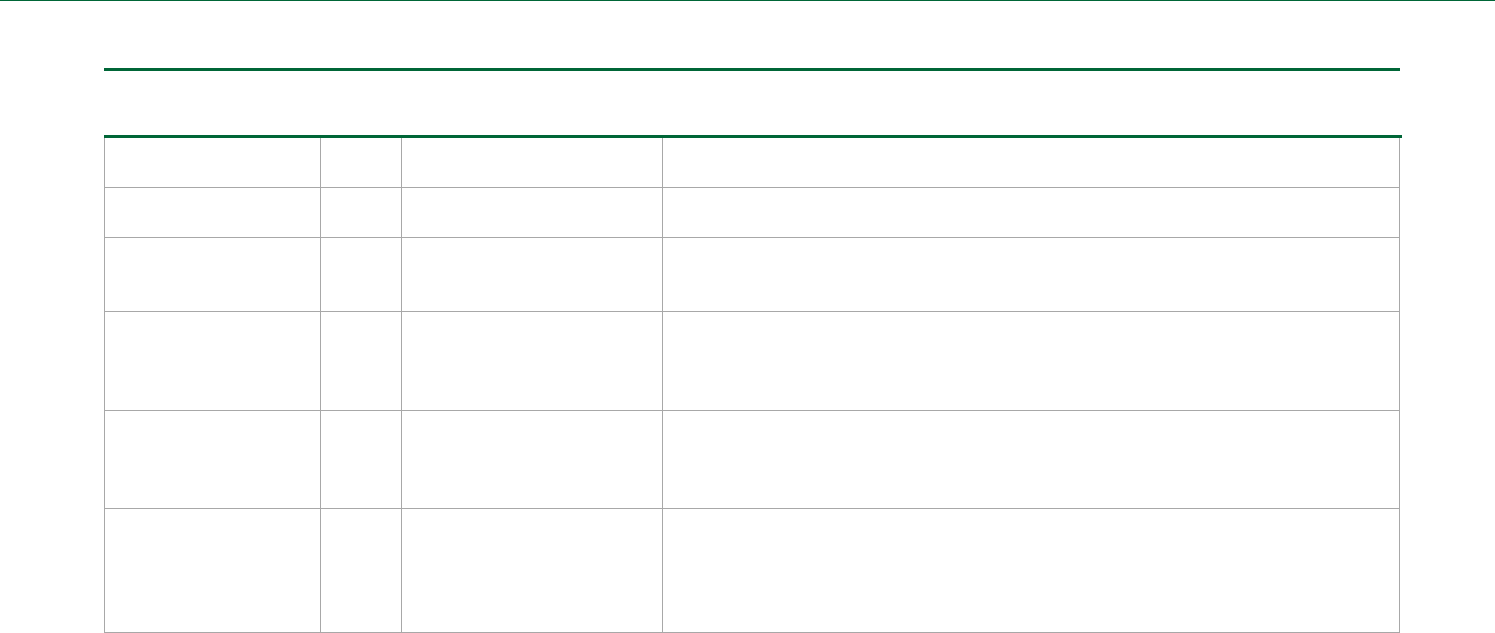

Table 3

Local Sales Taxes That Were Imposed But Have Expired

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

Cook County – 1993 1.0% Required voter approval at

a general or special

election

Originally set to expire when $4 million was raised for the Cook County hospital.

Extended in 1997 to allow an additional $2.2 million to be raised for the North Shore

care center. Expired April 1, 2008.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 19

Table 3

Local Sales Taxes That Were Imposed But Have Expired

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

Willmar – 1997 0.5% Required voter approval at

the 1996 general election

Funded library improvements. Expired December 31, 2001, after $4.5 million was

raised.

Winona – 1998 0.5% Required voter approval at

the 1998 general election

Dredged Lake Winona. Expired December 31, 2001, after raising $4.0 million.

Willmar – 2005 0.5% Based on voter approval at

the 2004 general election

Funded an airport, park and trails, and civic center improvement projects. Expired at

the later of seven years or when revenues raised were sufficient to pay $8 million in

bonds. Any excess revenue is deposited in the city general fund. Expired December

31, 2012.

Worthington – 2005 0.5% Voter approval by a

general election held

before December 31, 2009

Funded a community center and renovations to the Memorial Auditorium. Originally

expired at the earlier of ten years or when revenues raised were sufficient to pay $6

million in bonds. In 2014 the city was granted authority to extend the tax through

2039 if revenues were used to pay for the city’s share of the local match needed to

get state aid to fund the Lewis and Clark water project. In 2017, the city was allowed

to extend the tax to fund an additional $1.3 million in bonds, subject to a reverse

referendum, to construct public athletic facilities. The tax expired September 30,

2018.

Owatonna – 2006 0.5% Required voter approval at

the 2006 general election

Funded transportation projects, regional parks and trails, a fire hall, and library

improvements. Expired at the earlier of ten years or when revenues were sufficient

to pay $12.7 million in bonds. Expired June 30, 2011.

Fergus Falls – 2011 0.5% Based on voter approval at

the 2010 general election

Funded up to $6 million in costs related to a community ice arena facility. Expired

when revenues raises are sufficient to finance the facility and pay associated bond

costs. Any excess revenue is deposited in the city general fund. Expired December

31, 2016.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 20

Table 4

Authorized Local Sales Taxes That Have Not Been Imposed

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

Bloomington – 1986 1.0% City council approval Mall of America site improvements. This tax was only authorized for sales at the Mall

of America site. The city did not impose the tax before legislative authority was

repealed in 1987.

Thief River Falls – 1992 0.5% Voter approval at the 1992

general election

Tourism and convention facilities. Referendum not held and authority expired.

Ely – 1992 1.0% Voter approval at the 1992

general election

Wilderness Gateway project. The imposition of the tax was defeated at the required

referendum.

Garrison – 1993 0.5% Voter approval at a general

or special election

City sewer system project. The referendum was never held. This authority was repealed

in 2014.

Detroit Lakes – 1998 0.5% Voter approval at the 1998

general election

Community center. The imposition of the tax was defeated at the required referendum.

Fergus Falls – 1998 0.5% Voter approval at the 1998

general election

Convention and recreational center. The imposition of the tax was defeated at the

required referendum.

Owatonna – 1998 0.5% Voter approval at the 1998

general election

Owatonna Economic Development 2000 project. The imposition of the tax was

defeated at the required referendum. New authority was enacted in 2006 to fund a

number of capital projects (see Table 1).

Hutchinson – 1998 0.5% Voter approval at a 1998

general or special election

Civic center and recreational facilities. The imposition of the tax was defeated at the

required referendum.

Bemidji – 1998 1.0% Voter approval at the 1998

general election

Convention center. Referendum not held and the authority expired. In 2005 new

authority was enacted to fund park and trail improvements (see Table 1).

Central Minnesota

Cities – 1998 (includes

St. Cloud, Sauk Rapids,

Sartell, St. Joseph, and

Waite Park)

1.0% Each city had to get voter

approval at the 1999 general

election

Central Minnesota Events Center and other regional infrastructure projects. The

imposition of the tax was defeated at the required referendum in all cities except

Sartell. New authority for a local sales tax in these cities was enacted in 2002 to fund

airport and other improvements (see Table 1).

Winona – 2005 0.5% Voter approval at a general

election

Fund transportation projects. The imposition of the tax was defeated at the required

referendum.

Winona – 2008 0.5% Voter approval at a general

or special election held

before December 31, 2009

Fund up to $8 million in street improvements. The referendum was never held.

Luverne – 2014 0.5% City council approval Fund the local government match to qualify for state aid to finance the Lewis and Clark

water project. Revenues generated in any year in excess of the amount needed to fund

Local Sales Tax in Minnesota

Minnesota House Research Department Page 21

Table 4

Authorized Local Sales Taxes That Have Not Been Imposed

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

the city’s share of the local match may be used to fund other capital projects in the city.

The city never filed the required approval with the secretary of state so the authority

has lapsed.

Nobles County – 2014 0.5% County board approval Fund the local government match to qualify for state aid to finance the Lewis and Clark

water project. Revenues generated in any year in excess of the amount needed to fund

the county’s share of the local match may be used to fund other capital projects in the

county. The county also has the option to impose the tax only in the portion of the

county outside of the city of Worthington while the city’s current 0.5% sales tax is in

effect. In 2015 the state fully financed the next stage of the water project so this tax

never needed to be imposed.

Rock County – 2014 0.5% County board approval Fund the local government match to qualify for state aid to finance the Lewis and Clark

water project. Revenues generated in any year in excess of the amount needed to fund

the county’s share of the local match may be used to fund other capital projects in the

county. The county also has the option to impose the tax only in the portion of the

county outside of the city of Luverne, if that city chooses to impose a 0.5% sales tax to

fund this project as well. In 2015 the state fully financed the next stage of the water

project so this tax never needed to be imposed.

Bloomington – 2008 0.5% -

1.0%

City council must charter a

special taxing district

The city of Bloomington is allowed to charter a special taxing district in the Mall of

America area and impose a sales tax in the district to fund parking facilities and other

public improvements related to the Mall of America Phase II. In 2010 the requirement

that the rate be between 0.5% and 1.0% was modified to allow a rate below 0.5%. The

tax has not yet been imposed and the authority has no expiration date.

Glenwood – 2019 Up to

0.5%

Approved at the 2018

general election

Fund up to $2.8 million in various local projects including roads, recreational facilities,

and a city hall and police station. Before imposing the tax, the city must enumerate the

specific projects in a separate resolution (see page 3). The tax terminates at the earlier

of 20 years after imposition or when revenues are equal to $2.8 million plus associated

bond costs. The tax was not imposed as of October 1, 2019.

Perham – 2019 Up to

0.5%

Approved at the 2018

general election

Fund up to $5.2 million for the Perham Area Community Center project. The tax

terminates at the earlier of 20 years after imposition or when revenues are equal to

$5.2 million plus associated bond costs. The tax was not imposed as of October 1, 2019.

Sauk Centre – 2019 Up to

0.5%

Approved at the 2018

general election

Also includes authority to impose a $20 motor vehicle excise tax. Revenues will fund up

to $10 million for infrastructure projects related to the reconstruction of trunk highway

71. The tax terminates at the earlier of December 31, 2045, or when revenues are equal

Local Sales Tax in Minnesota

Minnesota House Research Department Page 22

Table 4

Authorized Local Sales Taxes That Have Not Been Imposed

Taxing Jurisdiction &

Year Authorized

Rate Approval Required Use of Revenues/Other Comments

to $10 million plus associated bond costs. The tax was not imposed as of October 1,

2019.

Scanlon – 2019 Up to

0.5%

Approved at the 2018

general election

Fund up to $400,000 for street and sewer improvements. The tax terminates at the

earlier of ten years after imposition or when revenues are equal to $400,000 plus

associated bond costs. The tax was not imposed as of October 1, 2019.

Virginia – 2019 Up to

1.0%

Approved at the 2018

general election

Fund up to $30 million for the Miners Memorial Recreational Complex and Convention

Center project. The tax terminates at the earlier of 20 years after imposition or when

revenues are equal to $30 million plus associated bond costs. The tax was not imposed

as of October 1, 2019.

West St. Paul – 2019 Up to

0.5%

Approved at the 2018

general election

Fund up to $28 million for repair of specified transportation corridors and ancillary

roads. The tax terminates at the earlier of 20 years after imposition or when revenues

are equal to $28 million plus associated bond costs. The tax was not imposed as of

October 1, 2019.

Worthington – 2019 Up to

0.5%

Approved at the 2018

general election

Fund up to $25 million in various recreational and amenity projects. Before imposing

the tax, the city must enumerate the specific projects in a separate resolution (see page

3). The tax terminates at the earlier of 15 years after imposition or when revenues are

equal to $25 million plus associated bond costs. The tax was not imposed as of October

1, 2019.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 23

Appendix: Legislative History

General local sales tax rules codified in Minnesota Statutes, section

297A.99

In 1997, the sales tax advisory council—a group of legislators, administration staff, and

representatives of the business community—recommended that the legislature adopt model

statutory language for the imposition and administration of local sales taxes. The goal was to

create consistency in the application of new and existing local taxes that would (1) ease the

compliance costs for businesses located outside the taxing jurisdiction who were required to

collect the local tax, and (2) simplify the Department of Revenue’s administration of these

taxes.

The proposed local sales tax statute laying out these rules was enacted in the 1997 session.

10

Language was added in 1998 and 1999 to incorporate some standards that the House and

Senate tax committees had started to use in evaluating proposals for new local sales tax

authority and to clarify some additional administration issues. Further changes were made

during the 2003 session to make the law conform to the Streamlined Sales and Use Tax

Agreement (SSUTA).

11

In 2019 the legislature made major modifications to both the process of

seeking sales tax authority and to the types of projects to be funded from sales tax revenues. In

addition it required some cities granted local sales tax authority in the 2019 session to go back

and pass more detailed resolutions before imposing a tax.

Below is a timeline of major changes to this statute:

1997 – The first codified provision related to the administration of local sales taxes authorized

under special law is enacted. All local sales taxes are required to use the state tax base, start

and end on a calendar quarter, and be collected and administered by the commissioner of

revenue, who may keep a portion of the revenue collected to cover administration costs.

Outlines the treatment of sales in transit or transported out of the jurisdiction. (Laws 1997, ch.

231, art. 7, §30; codified in Minn. Stat. §297A.48)

1998 – Begins requiring local governments to pass a resolution prior to seeking local sales tax

authority that contains information needed to draft the special law (Laws 1998, ch. 389, art. 8,

§

20)

1999 – Begins requiring voter approval of a local sales tax at a general election prior to

imposition of a local sales tax and requires that the specific project to be funded with the tax

10

The original provisions were codified in Minnesota Statutes, section 297A.48, and were moved to Minnesota

Statutes, section 297A.99, in 2000, as part of a recodification of the sales tax chapter.

11

The Streamlined Sales and Use Tax Agreement (SSUTA) is a voluntary agreement in which participating states

simplify and standardize sales tax administration and definitions between states. Minnesota is a

member—see

Minn. Stat. § 297A.995. Remaining in compliance allows the state to collect sales tax revenues from certain out-

of-state businesses that it would otherwise not collect due to nexus requirements.

Local Sales Tax in Minnesota

Minnesota House Research Department Page 24

proceeds be designated at least 90 days before the general election. Also requires that zip

codes be used to determine tax rate and requires that the lowest local rate within a zip code

applies to sales in that area. (Laws 1999, ch. 243, art. 4, §§ 12 and 13)

2000 – Moves the provisions from Minnesota Statutes, section 297A.48 to section 297A.99 as

part of a complete recodification of the general sales tax chapter (Laws 2000, ch. 418, art. 1, §

42)

2001 – Requires that all local sales taxes be collected and administered by the commissioner of

revenue by January 1, 2003 (Duluth was the only city collecting its own local tax). Requires the

Department of Revenue to develop zip code and geo-based databases required under the

Streamlined Sales and Use Tax Agreement to effectively administer local sales taxes. (Laws

2001, 1

st

spec. sess., ch. 5, art. 12, §§ 82 and 83)

2003 – The remaining modifications regarding timing and administration of local sales taxes

needed for the state to conform to the Streamlined Sales and Use Tax Agreement are adopted.

(Laws 2003, ch. 127, art. 1, §§ 28-30)

2005 – Allows the commissioner of revenue to bill a local government for repayment of any

local tax refunds if the local tax has expired and the refund amount exceeds the amount of local

tax that the state has not yet remitted to the local government. Also requires local

governments to notify residents of local use tax obligations through their website and in

mailings of public utility bills. (Laws 2005, 1

st

spec. sess. ch. 3, art. 5, §§ 22 and 23)

2008 – Prohibited a political subdivision from advertising, promoting, expending funds, or

holding a referendum to support imposing a local option sales tax unless it is for extension of an

existing tax or the tax was authorized by a special law enacted prior to May 20, 2008. The

prohibition was for the period from May 30, 2008, until May 31, 2010. (Laws 2008, ch. 366, art.

7, § 7)

2011 – Permanently prohibited a political subdivision from using funds to promote a local sales

tax but allowed them to expend funds for holding a referendum on the issue. Required a local

government to get voter approval for a local sales tax at a general election prior to coming to

the legislature to get local sales tax authority. (Laws 2011, 1

st

spec. sess. ch. 7, art. 4, §§ 1 and 2)

2013 – Allows a political subdivision to spend funds to provide factual information related to a

local sales tax and hold forums on imposition of a local sales tax provided that both proponents

and opponents are given equal time. (Laws 2013, ch. 143, art. 8, § 43)

2019 - Requires a local government to pass a more detailed resolution outlining and limiting

the specific projects to be funded to no more than five and providing more project specific

costs, and documentation of a project’s regional significance by the end of January in the year

in which a local sales tax authority is sought. Also requires that voter approval be sought only

after the authority is granted and requires the voters to approve each project to be funded in a

separate question in a general election. Only projects that are approved by the voters may be

funded with the tax, and the tax authority will be adjusted down to reflect any project

Local Sales Tax in Minnesota

Minnesota House Research Department Page 25

referendum that fails. Also eliminated the provision allowing a local government to impose a

separate tax on motor vehicles. (Laws 2019, 1

st

spec. sess. ch. 6, art. 6, §§ 1-4)

Metropolitan Transportation Area sales tax codified in Minnesota Statutes,

section 297A.992

The authority for the Metropolitan Transportation Area sales tax was enacted in 2008. It

underwent minor modifications in 2009 and 2011. Anoka, Dakota, Hennepin, Ramsey, and

Washington counties, by resolution of their county boards, joined the now defunct

Metropolitan Transportation Area joint powers agreement. A 0.25 percent tax was imposed in

the participating counties under the joint powers agreement. Carver and Scott counties,

although eligible, did not join the agreement. Scott County chose to impose its own separate

tax under the Greater Minnesota transportation sales and use tax authority.

The tax in a county did not expire unless the county withdrew from the joint powers

agreement. The revenues raised were used for studies, property acquisition, capital projects,

and operating assistance for transit projects.

12

The five counties making up the joint powers

agreement that imposed this tax voluntarily terminated the agreement on September 30, 2017.

The law was amended during the 2017 special session to facilitate the dissolution of the

agreement and ensure payment of all outstanding debt. All of these counties now impose a

local transportation tax under the Greater Minnesota transportation sales and use tax authority

instead.

Minnesota House Research Department provides nonpartisan legislative, legal, and

information services to the Minnesota House of Representatives. This document

can be made available in alternative formats.

www.house.mn/hrd | 651-296-6753 | 600 State Office Building | St. Paul, MN 55155

12

For more detailed information on the structure and operation of the board and use of the sales tax revenues,

please consult the House Research Information Brief 2008 Transportation Finance Legislation: Laws 2008,

Chapter 152, pp. 22-24.