BUILDING THE

FOUNDATION FOR

THE NEXT CANADIAN

“BLUE CHIP” REIT

January 2019

INVESTOR PRESENTATION

NEXUS REAL ESTATE INVESTMENT TRUST

2

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

ABOUT THIS PRESENTATION

No reliance may be placed for any purpose whatsoever on the information contained in this presentation or the completeness or accuracy of such information. No

representation or warranty, express or implied, is given by or on behalf of Nexus REIT (the “REIT”), or its unitholders, trustees, officers or employees or any other

person as to the accuracy or completeness of the information or opinions contained in this presentation, and no liability is accepted for any such information or opinions.

FORWARD-LOOKING INFORMATION

This presentation contains forward-looking statements which reflect the REIT’s current expectations and projections about future results. Often, but not always, forward-

looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “estimates”, “intends”, “anticipates” or “does not

anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur

or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or

achievements of the REIT to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this

presentation. Such forward-looking statements are based on a number of assumptions that may prove to be incorrect, including, but not limited to: the ability of the REIT

to obtain necessary financing or to be able to implement its business strategies; satisfy the requirements of the TSX Venture Exchange with respect to the plan of

arrangement; obtain unitholder approval with respect to the plan of arrangement; the level of activity in the retail, office and industrial commercial real estate markets in

Canada, the real estate industry generally (including property ownership and tenant risks, liquidity of real estate investments, competition, government regulation,

environmental matters, and fixed costs, recent market volatility and increased expenses) and the economy generally. While the REIT anticipates that subsequent events

and developments may cause its views to change, the REIT specifically disclaims any obligation to update these forward-looking statements. These forward-looking

statements should not be relied upon as representing the REIT’s views as of any date subsequent to the date of this presentation. Although the REIT has attempted to

identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other

factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on

forward-looking statements. The factors identified above are not intended to represent a complete list of the factors that could affect the REIT.

This presentation includes industry data and forecasts obtained from independent industry publications, market research and analyst reports, surveys and other publicly

available sources and in certain cases, information is based on the REIT’s own analysis and information or its analysis of third-party information. Although the REIT

believes these sources to be generally reliable, market and industry data is subject to interpretation and cannot be verified with complete certainty due to limits on the

availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey.

Accordingly, the accuracy and completeness of this data is not guaranteed. The REIT has not independently verified any of the data from third party sources referred to

in this presentation nor ascertained the underlying assumptions relied upon by such sources.

All figures in C$ unless otherwise noted.

Notice to the Reader

3

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

➢ Opportunity to unlock occupancy growth from 2045 Stanley, the Sandalwood Portfolio

and development upside on the Richmond BC asset

Overview of Nexus REIT

Nexus REIT (“Nexus” or the “REIT”) is an open-ended REIT focused on unitholder value

creation through the acquisition and ownership of commercial properties across Canada

1

Poised for Unitholder

Value Creation

2

3

4

5

INTERNALIZED ASSET MANAGEMENT

QUALITY INDUSTRIAL AND COMMERCIAL PORTFOLIO

STRONG SPONSORSHIP – RFA CAPITAL AND TRIWEST CAPITAL

LONG AVERAGE LEASE TERM WITH LOW CAPITAL INTENSITY

➢ Fully aligned management team with meaningful direct ownership in the REIT

➢ Portfolio currently consists of 66 quality, commercial properties (industrial,

retail, office and mixed-use) with stable cash flows and intensification potential

➢ Vast pipeline of off-market, accretive acquisitions sourced through RFA

and TriWest along with potential for future capital commitments

➢ Above weighted-average lease term of ~6 years and low capital intensity vs. peers

LEASE-UP / DEVELOPMENT POTENTIAL

4

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

Market Metrics and Return Performance

Summary Capitalization

Unit Price (January 25, 2019) $1.98

Basic Units Outstanding 112.4

Market Capitalization ($M) $222.6

Add: Debt $282.4

Less: Cash ($3.7)

Enterprise Value $501.3

P / 2019E FFO 8.4x

P / 2020E FFO 8.1x

P / 2019E AFFO 9.5x

P / 2020E AFFO 9.1x

Premium/(Discount) to NAV (18.7%)

Market Metrics

(1)

Total Return Performance since IPO

(2)

14-Jan-14:

Completes the acquisition of 10 properties for

$68.0M partly funded through a VTB to TriWest

for $34.0M and the conversion to a REIT

04-Feb-14:

Announces first monthly cash

distribution of $0.00742 per unit

20-Jun-17:

Announces a $147M strategic acquisition (the Sandalwood

Portfolio), financed through a $55M bought deal equity offering

and a $15M concurrent private placement by RFA Capital

03-Apr-17:

Completes the merger of Edgefront and Nobel

to create Nexus, a $300M diversified REIT

16-Jul-14:

Completes the acquisition of 3 properties for

$36.7M partly funded by a $20.0M offering

1) Based on consensus equity research

2) Total return since IPO

26-Mar-18:

Announces acquisition of 3 industrial

properties in Western Canada for

$64.0M and the sale of 2 non-core

properties for $11.3M

22-Oct-18:

Announces a $18.5M acquisition of an industrial

property in Calgary, Alberta , financed through

issuance of 1.2M REIT units for $2.10 per unit

5

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

A Diversified and Defensive Portfolio

Industrial Portfolio Retail Portfolio Office Portfolio

Stable Cash Flows, Long-Term Leases,

and Embedded Rent Escalations

Investment Grade, High-Quality

National Tenants Offering Necessity-

Based Products

Urban Office Assets Located in the

Downtown Montreal Core

• Grocery-anchored retail assets located

in the Greater Quebec City and

Montreal areas

• Sandalwood provides property

management services to a significant

portion of the retail portfolio

• High-quality tenants such as Shopper’s,

Dollarama, Metro, National Bank, Super

C, Canadian Tire, and SAQ (Quebec’s

provincial liquor retailor)

• Very well-located office properties in the

downtown Montreal core

• Class I office properties (urban

properties that have been converted into

modern office buildings)

• Tenants primarily consist of TAMI

(technology, advertising, media and

information) businesses that typically

gravitate towards these properties

• Provides stability to Nexus as cash flows

are stable, long-term, and contain

embedded yearly rent escalations

• Properties are crucial and integral to the

day-to-day operations of tenants such as

Westcan Bulk Transport, Canada

Cartage and Northern Mat & Bridge,

reducing the re-leasing risk

• The majority of Nexus’ industrial portfolio

is located in high-demand industrial

nodes in Edmonton, Lethbridge, Calgary,

and Vancouver

6

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

Value Creation - Richmond, BC

Through the redevelopment and repositioning of the

Richmond asset, Nexus is expected to create ~$20-$28M in

unlocked value for unitholders

• Purchased an industrial asset (consisting of 2 buildings) in

Richmond, BC for $57.4M

• The asset has redevelopment potential in 12-18 months to

add additional GLA and repurpose the front building as a

multi-tenant sports facility, a highly desirable use given its

urban location

• Recently appraised at ~$80M (March 2018), highlighting the

significant inherent value of the newly acquired property

• 6.5% purchase cap rate; upon redevelopment, the Richmond

asset should benefit from cap rate compression to an

anticipated 4.5% cap rate

Overview

Asset Overview and Redevelopment Value Creation

1

Off-market transaction, sourced through Nexus’

long-standing relationship with the vendor

Key Transaction Highlights

2

Attractive risk-return development profile, with

high inherent value in the property

3

Accretive to AFFO with significant NAV creation

potential

4 Vendors took back $20.3MM in units at $2.10/unit

Purchase Price $57.4M

Acquisition Cap Rate 6.5%

In-Place NOI $3.7M

Development CAPEX $15M-$20.0M

Post-Development NOI $4.5M-$6M

Stabilized Cap Rate 4.5%

Stabilized Property Value $100M- $135M

Unitholder

Value Created $20MM-

$28MM

7

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

1) Based on 2018 Q3 YTD

Demonstrated Track Record of Success

Management has demonstrated its ability to successfully make and integrate accretive acquisitions resulting in

greater AFFOPU

• April 2017, Edgefront and Nobel merge to create a $300M

diversified REIT; immediately accretive to AFFOPU

• Management internalized, portfolio diversification increased,

capital markets presence enhanced and gained proprietary access

to a robust pipeline of acquisitions from RFA

• July 2017, Nexus completed the acquisition of a portfolio of assets

located in the greater Montreal and Quebec City areas from

vending entities associated with and/or related to Sandalwood

Management Inc

• The transaction was expected to be ~4.0% accretive to AFFOPU

Acquisition of SandalwoodMerger of Edgefront and Nobel

Delivering Strong Growth in 2018

• Completed $91,420,000 of off market acquisitions with vendors taking back $37,022,000 in REIT and LP units at a premium to the

current trading price.

99%

95%

89%

83%

84%

60.0%

70.0%

80.0%

90.0%

100.0%

2014 2015 2016 2017 2018

AFFO Payout Ratio

(1)

8

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

3501 Griffen Rd. North – Lethbridge, AB 4700 & 4750 102 Avenue SE – Calgary, AB

455 Welham Road – Barrie, ON 935-965 rue Reverchon – Saint-Laurent, QC

• Acquired on July 15, 2014 and leased under a long-term lease to Triple M

housing that expires on July 14, 2029. Located in close proximity to

Highway 3.

• The property is situated on 13.54 acres, and is located in the East Shepard

Industrial Park with convenient access to Deerfoot Trail South, Stoney Trail

SE, Barlow Trail SE and 52 Street SE. The property is 100% occupied by

Canadian Cartage and is a class A cross dock facility with trailer parking.

• Located in close proximity to Highway 400 and acquired on July 17, 2015,

this property is leased under a long-term lease to Prodomax Automation

that expires on June 16, 2025

• The property is located in the city of Montréal, close to the Pierre Elliott-

Trudeau International Airport and in one of Canada’s largest industrial area.

The main tenants are Sierra Flower Trading and Litron Canada with leases

expiring in November 2023 and March 2019, respectively.

GLA (sq ft) 229,000

WALT 10.8 years

Occupancy 100%

Built/Ren 2008/2012

GLA (sq ft) 29,471

WALT 6.3 years

Occupancy 100%

Built/Ren 2009

GLA (sq ft) 109,366

WALT 6.7 years

Occupancy 100%

Built/Ren 1998/2015

GLA (sq ft) 114,236

WALT 3.8 years

Occupancy 92%

Built/Ren

1972 / 1995

Select Industrial Properties

9

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

161 Route 230 Ouest – La Pocatière, QC

(1)

3856 boulevard Taschereau – Greenfield Park, QC

(1)

7500 Boulevard Les Galeries d’Anjou – Anjou, QC

(1)

401-571 boulevard Jutras Est – Victoriaville, QC

• The property is located outside the centre of the city, adjacent to a

Bombardier plant to the south with residential neighbourhoods to the north

and east. This is the main retail center servicing the surrounding

community.

• The property is located on the commercial artery of Taschereau Boulevard,

a well-established retail cluster, on the south shore, approximately 10

kilometers east of the Montréal city center

• The property consist of Les Halles d’Anjou, an enclosed retail mall, located

in a high-profile corner location at the SW corner of Jean-Talon Street E

and des Galeries d’Anjou Boulevard in Anjou, in a retail node with several

large retail developments in the surrounding neighbourhood

• The retail property is located in the city of Victoriaville, between Montréal and

Québec City, situated on the corner of Boulevard Jutras East and Boulevard

des Bois Francs South.

GLA (sq ft) 208,800

WALT 4.4 years

Occupancy 73%

Built/Ren 1976/2003

GLA (sq ft) 213,982

WALT 4.9 years

Occupancy 97%

Built/Ren 1974/2002

GLA (sq ft) 105,398

WALT 4.6 years

Occupancy 98%

Built/Ren 1981/2015

GLA (sq ft) 377,396

WALT 5.8 years

Occupancy 95%

Built/Ren 1975/2011

Select Retail Properties

1) Nexus owns a 50% interest

10

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

10500 Avenue Ryan – Dorval, QC 410 St-Nicolas – Montréal, QC

955 Boul. Michèle-Bohec – Blainville, QC 2045 rue Stanley – Montréal, QC

(1)

• Located in Dorval in close proximity to the Trans Canada Highway; fully

occupied by Dicom Transportation Group Canada Inc. on a lease expiring

in December 2029

• The property is a 6 storey Class I office property located in the heart of Old

Montreal leased to early-stage TAMI (technology, advertising, media and

information) businesses such as Ludia, ILSC Montreal, Café 410, and GPBL

Inc.

• Located in downtown Montreal; the building is currently being redeveloped,

with The Chambre des notaires du Quebec occupying a significant portion of

the property under a 20 years lease

GLA (sq ft) 52,372

WALT 11.2 years

Occupancy 100%

Built/Ren 2014

GLA (sq ft) 154,515

WALT 2.0 years

Occupancy 96%

Built/Ren 1902/2004

GLA (sq ft) 33,461

WALT 7.7 years

Occupancy 100%

Built/Ren 2012

GLA (sq ft) 113,714

WALT 17.6 years

Occupancy 67%

(2)

Built/Ren 1977/2005

Select Office Properties

1) Nexus owns a 50% interest

2) Total committed occupancy is 82%

• The property is located alongside Highway 15, in Blainville’s business

park. Main tenants include Sun Life Financial and Government Services

Canada.

11

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

1

1

1

11

5

2

2

8

18

13

1

1

Office14

Industrial

28

Retail20

4 Mixed-Use

66 properties located across Canada

Nationwide Asset Base

Base Rent by Province/Territory

(1)

Base Rent by Sector

(1)

2

1) As at September 30, 2018

42.2%

27.8%

17.7%

12.3%

Industrial Retail Office Mixed-use

50.7%

23.6%

11.1%

4.5%

3.9%

4.3%

1.6%

0.3%

Quebec Alberta

British Columia Saskatchewan

New Brunswick Ontario

Northwest Territories Prince Edwards Island

12

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

Overview:

• Privately held real estate investment and

asset management firm

• One of Canada’s leading private equity firms

Founded: • 1996 • 1998

Experience in

Real Estate:

• Invests in office, retail, industrial and

multi-family properties in the major

Canadian markets as well as mortgages

and CMBS

• Over the past 20 years, has invested in

over $15B of commercial mortgages

• Indirectly own a significant amount of real

estate through current ownership of 20

companies

• Primarily focused on the industrial sector

in Western Canada

Headquarters: • Toronto, ON • Calgary, AB

Other:

• Canada’s first and largest investor in non-

investment grade CMBS

• 19 years experience investing in 38

companies representing a broad cross-

section

of the economy

Sourced

Acquisitions:

• 27 acquisitions sourced through RFA • 14 acquisitions sourced through TriWest

Strong partnerships to provide pipeline for accretive growth

Strategic Relationships with Access to Quality Assets

13

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

Name Title

Board of TrusteesManagement Team

Experience

1) Also serves as a trustee

2) Chair of the board of trustees of Nexus

Kelly

Hanczyk

(1)

CEO

• Former CEO and Trustee of TransGlobe

Apartment REIT

• Extensive experience in all disciplines of

industrial, commercial and residential

real estate

Robert

Chiasson

CFO

•

Former Corporate Controller of InStorage

REIT

• Former Director of Accounting and

Finance of Samuel Manu-Tech

• Obtained the CPA, CA designation while

articling with KPMG

Lorne

Jacobson

(2)

• Co-founder and Vice Chairman of TriWest Capital

Partners

• Former partner of Bennett Jones LLP

Mario

Forgione

• Principal and Managing Partner of Windermere Realty

Corp.

• President and Co-Founder of Edgemere Capital

• Former Chairman of Nexus Realty, a predecessor to

Edgefront REIT

Brad Cutsey

• President of InterRent REIT

• Former Managing Director, Real Estate Investment

Banking at Dundee Capital Markets

Ben Rodney

• Principal and Managing Partner of RFA Capital

• Has structured and closed over $15B of Canadian real

estate and mortgage transactions

Nick

Lagopoulos

• Principal and Managing Partner of RFA Capital

• Previously with GE Capital and Credit Suisse

Name Experience

Leadership Team

14

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

Research Analyst Overview

DESJARDINS

23-NOV-18

“Financial results/ operating performance were in line with our expectations, and revisions to our NAV and earnings outlook

are not material. Rue Stanley is slowly but surely progressing toward stabilization. Although the timing of the potential

announcement has been pushed out, we continue to see the expansion/redevelopment of the sports mall complex as a

meaningful catalyst.”

Select Analyst Commentary

GMP

22-NOV-18

“In the context of recent volatility in the markets, we believe Nexus is a good combination of stable income and growth, and

a compelling small cap name within the real estate sector.

Nexus provides the stability of a high distribution yield of ~8% with an expected AFFO payout ratio of <85% in 2019. Value-

add initiatives like the Richmond property and 2045 Rue Stanley lease-up provide a significant potential NAV upside.”

1) Implied total return is calculated as the implied relative return to the target price plus the compounded annual distribution yield

Source: FactSet and Equity Research as at January 3, 2019

AFFO/Unit

2019E 2020E 2019E 2020E

Desjardins Capital Markets Michael Markidis 23-Nov-18 Buy $2.30 31.9% $0.22 $0.22 $0.19 $0.20 $2.30 (18.7%)

Echelon Wealth Partners Stephane Boire 23-Nov-18 Buy $2.50 42.6% $0.23 n/a $0.21 n/a $2.30 (18.7%)

iA Securities Brad Sturges 23-Nov-18

Strong Buy

$2.30 31.9% $0.22 $0.24 $0.20 $0.21 $2.30 (18.7%)

GMP Himanshu Gupta 22-Nov-18 Buy $2.40 37.2% $0.22 n/a $0.19 n/a $2.30 (18.7%)

Average (Consensus) $2.38 35.9% $0.22 $0.23 $0.20 $0.21 $2.30 (18.7%)

Average (Excluding High/Low) $2.35 34.6% $0.22 n/a $0.20 n/a $2.30 (18.7%)

PREMIUM

(DISCOUNT)

/ NAV

BROKER

ANALYST

DATE

RATING

TARGET

PRICE

IMPLIED

TOTAL

RETURN (%)

(1)

FFO/Unit

NAVPU

($)

15

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

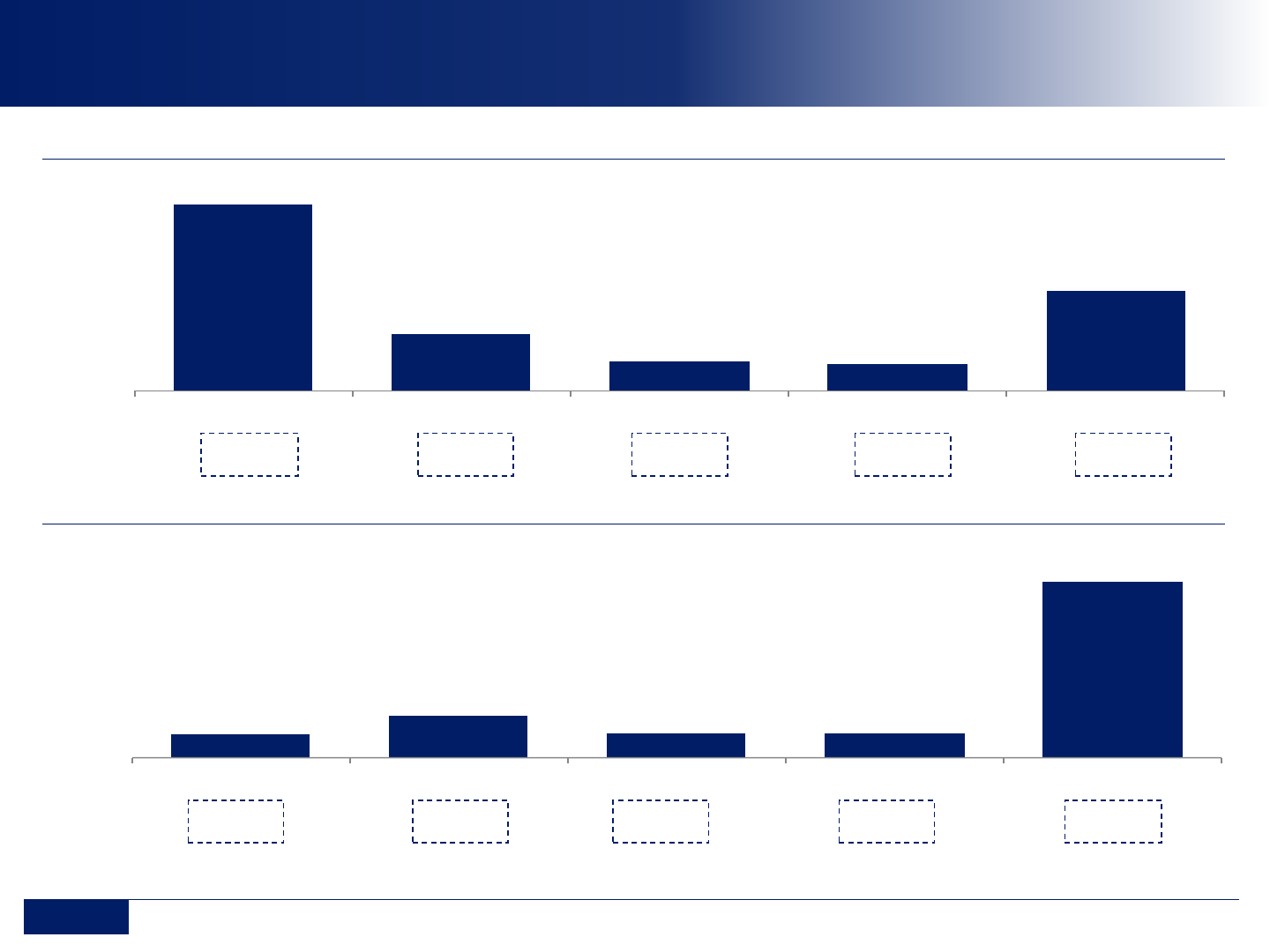

Lease Expiry Schedule (Sq. Ft. ‘000s)

(1)

Debt Maturity Schedule ($M)

(1)

% of Total

Debt

% of Total

Leased GLA

Balanced Debt Maturities and Lease Expiries

$128.8

$39.0

$20.8

$19.3

$69.1

2019 2020 2021 2022 Thereafter

46.5% 14.1% 7.5%

7.0% 24.9%

281.2

497.4

293.2

300.0

2,033.0

2019 2020 2021 2022 Thereafter

8.3% 14.6% 8.6%

8.8% 59.7%

Note: Excludes debt and leases maturing in Q4 2018

1) As at Q3 2018 MD&A; debt maturities exclude debt related to proportionate interests

16

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

98.4%

98.1%

97.0%

94.0%

93.7%

90.3%

89.7%

SMU PRV TNT NXR ACR MR BTB

10.8%

10.5%

9.6%

8.9%

8.6%

5.7%

5.5%

PRV TNT BTB MR NXR ACR SMU

16.9x

13.6x

12.4x

11.0x

9.6x

9.5x

8.8x

SMU ACR BTB MR TNT NXR PRV

118.9%

100.7%

98.3%

95.5%

92.6%

78.0%

77.8%

BTB TNT MR PRV SMU NXR ACR

Occupancy

2019E AFFO Payout RatioP/2019 AFFO

Distribution Yield

Positioning of Nexus vs. Peers

Source: Company Filings

Nexus has all the characteristics of a quality REIT: high occupancy, high yield, a low payout

ratio and trades at an attractive valuation

17

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

Unitholder Value Creation

Capitalize on accretive acquisitions at the most opportune time

1

Lease-Up and Re-Positioning of Assets

2

Substantial Rent Increases in Western Canada Industrial Portfolio

3

Nexus expects to grow its unit price in the near term through the following:

➢ Acquisition criteria: strong security of cash flows, potential for capital appreciation, and potential for increasing value

through more efficient management of the assets in markets with positive industry fundamentals

➢ Acquisitions to be made when its cost of capital is low

➢ Off market acquisitions sourced through sponsorship partners

➢ Lease-up of the Stanley Property to increase Nexus’ NOI

➢ Re-positioning and intensification of properties to increase NAV (Richmond Asset)

Capital Markets Initiatives

4

➢ Greater capital markets presence (larger equity research and institutional investor following)

➢ Increase liquidity and float

➢ Linked to CPI and generates over $125K of incremental NOI annually

18

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

Key Takeaways

1. Internalized asset management function

2. High current distribution yield ~8.6%

3. Conservative capital structure with Debt to

Assets of ~54%

4. Strong sponsorship from RFA Capital and

TriWest Capital with vast pipeline of accretive

off-market acquisitions

5. Portfolio of high quality assets in markets with

positive industry fundamentals

6. Experienced management team, fully aligned

through direct ownership in the REIT

7. Strong historical performance with consistent

AFFOPU and NOI growth

8. Substantial rent increases in Western Canada

industrial portfolio

Nexus provides investors with

the opportunity to invest in an

investment vehicle that

acquires and operates quality

commercial real estate assets

across Canada at a valuation

that represents a significant

discount to NAV

19

INVESTOR PRESENTATION | JANUARY 2019

NEXUS

Kelly Hanczyk

CEO

Phone: (416) 906-2379

Email: khancz[email protected]

Contact Information

Rob Chiasson

CFO

Phone: (416) 613-1262

Email: rchiasson@nexusreit.com