COVID19

InsightsfromFraud

SchemesandFederal

ResponseEfforts

Accessible Version

ReporttoCongressionalCommittees

November 2023

GAO-24-106353

United States Government Accountability Office

United States Government Accountability Office

GAOHighlights

Highlights of GAO-24-106353, a report to

congressional committees

November 2023

COVID-19

Insights from Fraud Schemes and Federal Response

Efforts

What GAO Found

The Department of Justice (DOJ) has brought federal fraud-related charges

against at least 2,191 individuals or entities in cases involving federal COVID-19

relief programs, consumer scams, and other types of fraud as of June 30, 2023.

Based on GAO’s analysis of the cases announced in DOJ press releases, at

least 1,525 individuals or entities facing fraud-related charges were found guilty

or liable. Courts have ordered individuals to pay restitution ranging up to over

$60 million and serve prison terms up to 10 years or more. GAO’s analysis of

fraud schemes highlights the resulting financial losses and impacts on taxpayers,

agency reputation, federal program goals, and health and safety. Agencies can

use information about schemes to improve their fraud risk management efforts.

Examples of Fraud Schemes Involving Federal COVID-19 Relief Programs or Consumer Scams

Key mechanism

Fraud scheme description

Conspiracy

A group allegedly conspired to obtain more than $240 million from

a federal child nutrition program in a complex fraud scheme.

Individuals colluded to open shell companies acting as program

sites to claim they were serving thousands of meals a day to

underserved children during the pandemic. Instead, these funds

were diverted for self-enrichment. Four individuals pleaded guilty

but have not been sentenced. Over 40 others are awaiting trial.

Misrepresentation

Two company owners attempted to obtain a total of $5 million by

applying for 14 Paycheck Protection Program loans and 12

COVID-19 Economic Injury Disaster Loans. They submitted

fabricated tax and other documents inflating the companies’

number of employees and payroll. The owners received almost

$650,000 in funds they used for personal items, such as a luxury

car. Both pleaded guilty, were ordered to pay more than $800,000

in restitution, and were sentenced to 2 to 3 years in prison.

Mislabeling

A company owner sold and mailed pesticide marketed as an air

purifier to kill airborne viruses such as COVID-19. The product

contained sodium chlorite, a substance declared unmailable

under U.S. postal regulations because of its propensity to cause a

fire or explosion. The owner was sentenced to 8 months in prison

and ordered to pay a total penalty of $556,443 through restitution,

fines, and forfeiture.

Health care fraud

A licensed medical practitioner pleaded guilty to selling

homeopathic immunizations, falsely claiming they provided

immunity to COVID-19. She received over $74,000 for fabricated

COVID-19 vaccination and immunization records, knowing this

would mislead school officials enforcing the state’s vaccination

laws. She was sentenced to almost 3 years in prison.

Source: GAO Antifraud Resource and analysis of court documentation (information); Icons-Studio/stock.adobe.com (icons). | GAO-24-

106353

Various interagency task forces and the Pandemic Response Accountability

Committee (PRAC) were established to combat COVID-19 fraud. For example,

the COVID-19 Fraud Enforcement Task Force conducted an enforcement sweep

and reported taking law enforcement actions against fraudsters responsible for

approximately $836 million in fraud. Similarly, the PRAC estimated its information

and resource sharing with investigative agencies supported hundreds of criminal

convictions and the recovery of more than $1 billion.

View GAO-24-106353. For more information,

contact Rebecca Shea at (202) 512-6722 or

Why GAO Did This Study

Since March 2020, Congress provided

over $4.6 trillion to help the nation

respond to and recover from the

COVID-19 pandemic. The public health

crisis, economic instability, and

increased flow of federal funds

associated with the pandemic

increased pressures on federal agency

operations and presented opportunities

for individuals to commit fraud. The

COVID-19 pandemic saw an increase

in the number of fraud-related charges,

including schemes by individuals and

large complex syndicates.

The CARES Act of 2020 includes a

provision for GAO to report regularly

on the federal response to the

pandemic.

This report describes: (1) the status of

federal COVID-19 fraud-related cases

announced by DOJ, including

examples of fraud schemes and (2)

examples of federal efforts that have

been taken to combat COVID-19 fraud.

GAO reviewed public statements from

DOJ from March 2020 through June

2023 to identify federal fraud-related

cases. Specifically, GAO identified

cases involving COVID-19 relief

program fraud; consumer scams; and

other types of fraud. GAO then

analyzed court documents for details

on fraud schemes. GAO also reviewed

federal agency documentation and

rules, proposed legislation, and

proposed antifraud efforts.

What GAO Recommends

In March 2022, GAO identified 10

actions Congress could take to

strengthen internal controls and

financial and fraud risk management

practices across the government. All

10 remain open.

Page i GAO-24-106353 COVID-19

Contents

GAO Highlight ii

Why GAO Did This Study ii

What GAO Recommends ii

What GAO Found ii

Letter 1

Background 3

DOJ Has Prosecuted Over Two Thousand COVID-19 Fraud-

Related Cases, and the Schemes Illustrate a Variety of

Participants, Mechanisms, and Impacts 14

Pandemic Oversight Entity, Interagency Task Forces, and Federal

Resources Have Been Established to Combat COVID-19 Fraud 28

Appendix I: GAO Contact and Staff Acknowledgments 38

Tables

Table 1: Key Federal COVID-19 Relief Programs and Funding 4

Accessible data for Figure 6: Court Ordered Restitution for

Individuals or Entities That Were Found Guilty or Liable

for Fraud-Related Charges Involving COVID-19 Relief

Programs, as of June 30, 2023 18

Table 2: Examples of Fraud Schemes Affecting Federal COVID-

19 Relief Programs 21

Table 3: Examples of Schemes Involving Consumer Scams

Related to COVID-19 25

Table 4: Examples of Other Fraud Schemes Related to COVID-19 27

Figures

Figure 1: Stages of Fraud Detection 6

Accessible text for Figure 1: Stages of Fraud Detection 6

Figure 2: The Four Components of the Fraud Risk Framework and

Selected Leading Practices 9

Accessible text for Figure 2: The Four Components of the Fraud

Risk Framework and Selected Leading Practices 9

Figure 3: Framework for Managing Improper Payments in

Emergency Assistance Programs 12

Page ii GAO-24-106353 COVID-19

Accessible text for Figure 3: Framework for Managing Improper

Payments in Emergency Assistance Programs 12

Figure 4: Number of Individuals or Entities That Were Found

Guilty or Liable for Fraud-Related Charges Involving One

or More COVID-19 Relief Programs, as of June 30, 2023 15

Accessible text for Figure 4: Number of Individuals or Entities That

Were Found Guilty or Liable for Fraud-Related Charges

Involving One or More COVID-19 Relief Programs, as of

June 30, 2023 15

Figure 5: Sentencing Outcomes for Individuals or Entities That

Were Found Guilty or Liable for Fraud-Related Charges

Involving COVID-19 Relief Programs, as of June 30,

2023 17

Accessible data for Figure 5: Sentencing Outcomes for Individuals

or Entities That Were Found Guilty or Liable for Fraud-

Related Charges Involving COVID-19 Relief Programs,

as of June 30, 2023 17

Figure 6: Court Ordered Restitution for Individuals or Entities That

Were Found Guilty or Liable for Fraud-Related Charges

Involving COVID-19 Relief Programs, as of June 30,

2023 18

Abbreviations

COVID-19 EIDL COVID-19 Economic Injury Disaster Loan

DOJ Department of Justice

DOL Department of Labor

EIP economic impact payment

FBI Federal Bureau of Investigation

Fraud Risk A Framework for Managing Fraud Risks in

Framework Federal Programs

FRDAA Fraud Reduction and Data Analytics Act of 2015

FTC Federal Trade Commission

HEERF Higher Education Emergency Relief Fund

HHS Department of Health and Human Services

HRSA Health Resources and Services Administration

IFFR Identity Fraud Reduction & Redress

This is a work of the U.S. government and is not subject to copyright protection in the

United States. The published product may be reproduced and distributed in its entirety

without further permission from GAO. However, because this work may contain

copyrighted images or other material, permission from the copyright holder may be

necessary if you wish to reproduce this material separately.

Page iii GAO-24-106353 COVID-19

IRS Internal Revenue Service

Managing Improper A Framework for Managing Improper Payments

Payments in Emergency Assistance Programs

Framework

NUIFTF National Unemployment Insurance Fraud Task

Force

OIG Office of Inspector General

OMB Office of Management and Budget

PACE Pandemic Analytics Center of Excellence

PACER Public Access to Court Electronic Records

PIIA Payment Integrity Information Act of 2019

PPP Paycheck Protection Program

PRAC Pandemic Response Accountability Committee

SBA Small Business Administration

UI unemployment insurance

USDA Department of Agriculture

Page 1 GAO-24-106353 COVID-19

441 G St. N.W.

Washington, DC 20548

Letter

November 14, 2023

Congressional Committees

Since March 2020, Congress has provided over $4.6 trillion to help the

nation respond to and recover from the COVID-19 pandemic. The

government’s quick disbursement of funds and other assistance to those

most affected by the pandemic and its economic effects also increased

the risk of fraud to COVID-19 relief programs. When the federal

government provides emergency assistance, the risk of payment errors—

including those attributed to fraud—may increase because the need to

provide this assistance quickly can lead agencies to relax or forego

effective safeguards. Because not all fraud will be identified, investigated,

and adjudicated through judicial or other systems, the full extent of fraud

associated with the COVID-19 relief funds will never be known with

certainty.

Despite challenges identifying the full extent of fraud, some estimates of

fraud in COVID-19 relief programs exist. For instance, the Small Business

Administration’s (SBA) Office of Inspector General (OIG) estimated that

as of June 2023, SBA disbursed over $200 billion (approximately 17

percent of SBA’s total COVID-19 spending) in potentially fraudulent

pandemic relief loans.

1

In September 2023, we estimated that the fraud in

the Department of Labor’s (DOL) unemployment insurance (UI) programs

during the pandemic—from April 2020 through May 2023—was likely

between $100 billion and $135 billion.

2

Many individuals and entities facing fraud-related charges in cases

involving COVID-19 relief programs have already been found guilty of

criminal violations or were found liable for civil violations.

In addition to fraud in the COVID-19 relief programs, scammers have also

targeted consumers. Such scams can result in financial losses and

1

This includes Paycheck Protection Program (PPP) loans, COVID-19 Economic Injury

Disaster Loan (COVID-19 EIDL) program loans, EIDL Targeted Advances, and

Supplemental Targeted Advances. GAO, COVID Relief: Fraud Schemes and Indicators in

SBA Pandemic Programs, GAO-23-105331 (Washington, D.C.: May 18, 2023).

2

GAO, Unemployment Insurance: Estimated Amount of Fraud during Pandemic Likely

Between $100 Billion and $135 Billion, GAO-23-106696 (Washington, D.C.: Sept. 12,

2023).

Letter

Page 2 GAO-24-106353 COVID-19

undermine health and safety. According to the Department of Health and

Human Services OIG, COVID-19 consumer fraud schemes include

scammers using testing sites, telemarketing calls, text messages, social

media platforms, and door-to-door visits to perpetrate COVID-19-related

scams. In some instances, fraudsters offer COVID-19 services such as

home testing kits in exchange for personal details, including Medicare

information. The personal information collected can be used to

fraudulently bill federal health care programs and commit medical identity

theft.

The CARES Act includes a provision for GAO to report regularly on the

federal response to the pandemic. Specifically, the act requires us to

monitor and oversee the federal government’s efforts to prepare for,

respond to, and recover from the COVID-19 pandemic.

3

This report

describes: (1) the status and characteristics of federal COVID-19 fraud-

related cases announced by the Department of Justice (DOJ) and (2)

examples of federal efforts that have been taken to address COVID-19

fraud.

To determine the status and characteristics of federal COVID-19 fraud-

related cases announced by DOJ, we reviewed public statements from

DOJ from March 2020 through June 2023 to identify federal fraud-related

cases.

4

Specifically, we identified cases involving: (a) various federal

COVID-19 relief programs (e.g., Paycheck Protection Program (PPP),

COVID-19 Economic Injury Disaster Loan (COVID-19 EIDL) program,

and UI); (b) consumer scams (i.e., fraud resulting in losses to consumers

or other efforts to undermine health and safety); and (c) other types of

fraud related to COVID-19, such as cases involving health care fraud. We

identified these cases by establishing a search query for Westlaw Edge to

identify relevant DOJ press releases. We also analyzed corresponding

court documentation available in Public Access to Court Electronic

3

Pub. L. No. 116-136, § 19010(b), 134 Stat. 281, 580 (2020). All of GAO’s reports related

to the COVID-19 pandemic are available on GAO’s website at

https://www.gao.gov/coronavirus.

4

These statements from DOJ sometimes announce cases in the later stages of

prosecution. For example, an individual’s guilty plea may be announced without an earlier

public statement announcing the charges being brought. If those charges were brought

from March 2020 through June 2023 but the guilty plea was announced in August 2023,

that case would not be included in the scope of our review since the public statement was

made after June 2023.

Letter

Page 3 GAO-24-106353 COVID-19

Records (PACER) to describe various examples of federal COVID-19

fraud-related cases in terms of the five key elements of a fraud scheme.

5

To describe examples of federal efforts that have been taken to address

COVID-19 fraud, we reviewed agency rules and documentation,

proposed legislation, and antifraud efforts. Examples were selected to

cover the range of COVID-19 relief programs and types of fraud that

occurred. They are not exhaustive of all federal efforts to address COVID-

19 fraud, but rather are illustrative of different types of government-wide

efforts undertaken since the beginning of the pandemic.

We conducted this performance audit from October 2022 to November

2023 in accordance with generally accepted government auditing

standards. Those standards require that we plan and perform the audit to

obtain sufficient, appropriate evidence to provide a reasonable basis for

our findings and conclusions based on our audit objectives. We believe

that the evidence obtained provides a reasonable basis for our findings

and conclusions based on our audit objectives.

Background

COVID19ReliefFunding

Since March 2020, Congress has provided over $4.6 trillion through the

CARES Act and other laws that were enacted to fund federal efforts to

help the nation respond to and recover from the COVID-19 pandemic.

6

This COVID-19 relief funding included a number of programs and funds.

5

PACER is a service of the federal judiciary that enables the public to search online for

case information from U.S. district, bankruptcy, and appellate courts. Federal court

records available through this system include case information (such as names of parties,

proceedings, and documents filed) as well as information on case status. The five key

elements reflect the highest-level components of the Conceptual Fraud Model.

Systematically organized subcomponents of the full model are available for download and

exploration from GAO’s Antifraud Resource website. GAO, “The GAO Antifraud Resource”

(Washington, D.C.: Jan. 10, 2022), accessed Oct. 4, 2023,

https://gaoinnovations.gov/antifraud_resource/.

6

American Rescue Plan Act of 2021, Pub. L. No. 117-2, 135 Stat. 4; Consolidated

Appropriations Act, 2021, Pub. L. No. 116-260, div. M and N, 134 Stat. 1182 (2020);

Paycheck Protection Program and Health Care Enhancement Act, Pub. L. No. 116-139,

134 Stat. 620 (2020); CARES Act, Pub. L. No. 116-136, 134 Stat. 281 (2020); Families

First Coronavirus Response Act, Pub. L. No. 116-127, 134 Stat. 178 (2020); and the

Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020, Pub. L.

No. 116-123, 134 Stat. 146.

Letter

Page 4 GAO-24-106353 COVID-19

Key federal COVID-19 relief programs and funding are described in table

1.

Table 1: Key Federal COVID-19 Relief Programs and Funding

Small Business Administration

(SBA)

SBA’s Paycheck Protection Program (PPP) was authorized under SBA’s 7(a) small business

lending program. This program provided small businesses with funds to pay up to 8 weeks of

payroll costs, including benefits. Funds could also be used to pay interest on mortgages, rent, and

utilities. Congress provided over $800 billion for this program.

SBA’s COVID-19 Economic Injury Disaster Loan (COVID-19 EIDL) program, which was a

continuation of SBA’s existing Disaster Loan Program, provided low-interest loans to help small

businesses and non-profit organizations meet obligations or pay ordinary and necessary operating

expenses. Congress provided about $105 billion for this program.

Department of Labor (DOL)

DOL’s unemployment insurance (UI) programs served as a pandemic safety net for individuals

who lost their jobs through no fault of their own. Congress provided $701.6 billion for four

temporary UI programs.

Department of the Treasury

and Internal Revenue Service

(IRS)

Treasury’s Coronavirus Relief Fund provided payments to tribal governments, states, localities,

the District of Columbia, and U.S. territories to help offset costs of their response to the COVID-19

pandemic. Congress provided $150 billion for this program.

Treasury’s Emergency Rental Assistance program provided funding to grantees, such as local

governments, to help low-income households at risk of housing instability pay rent and utilities.

Congress provided about $46 billion for this program.

Treasury’s and IRS’s economic impact payments were enacted as a stimulus payment from the

IRS to help taxpayers offset the economic effects of the COVID-19 pandemic. Congress provided

nearly $860 billion for this program.

Department of Agriculture

(USDA)

USDA’s Coronavirus Food Assistance Program provided financial assistance to farmers and

ranchers that gave them the ability to offset sales losses and increased marketing costs. Congress

provided about $31 billion for this program.

USDA’s child nutrition programs received additional funding for COVID-19 to provide meals to

children involved in educational-based programs or activities. Congress provided $8.8 billion for

these programs.

Department of Health and

Human Services (HHS)

HHS’s Health Resources and Services Administration’s (HRSA) Provider Relief Fund awarded

grants to eligible health care providers for health care related expenses or lost revenues that were

attributable to the COVID-19 pandemic. Congress provided approximately $178 billion for this

program.

HRSA’s COVID-19 Uninsured Program reimbursed health care providers generally at Medicare

rates for testing, treating, and administering vaccines to uninsured individuals for COVID-19. The

federal government has paid providers about $24.5 billion for program claims.

Department of Education

The Department of Education’s Higher Education Emergency Relief Fund enabled colleges and

universities to provide cash grants to current students for educational related expenses and costs

incurred because of disruptions to their education. Congress provided about $14 billion for this

program.

Letter

Page 5 GAO-24-106353 COVID-19

Federal Reserve

The Federal Reserve established the Main Street Lending Program to support lending to small

and medium-sized for-profit businesses and non-profit organizations. Treasury made about $13.9

billion available under the CARES Act to support the Main Street Lending Program facilities. Under

the program, five facilities in total were designed to support small and mid-sized for-profit

businesses and non-profit organizations by purchasing participations in eligible loans.

a

Source: GAO analysis; SBA, DOL, Treasury, IRS, USDA, HHS, Department of Education, Federal Reserve (agency seals). | GAO-24-106353

Note: This table does not include all federal programs enacted to address COVID-19 related issues.

Also, we use the term COVID-19 relief programs to refer to the programs and assistance outlined in

six laws to help the nation respond to and recover from the COVID-19 pandemic. These six COVID-

19 relief laws are the American Rescue Plan Act of 2021, Pub. L. No. 117-2, 135 Stat. 4;

Consolidated Appropriations Act, 2021, Pub. L. No. 116-260, div. M and N, 134 Stat. 1182 (2020);

Paycheck Protection Program and Health Care Enhancement Act, Pub. L. No. 116-139, 134 Stat. 620

(2020); CARES Act, Pub. L. No. 116-136, 134 Stat. 281 (2020); Families First Coronavirus Response

Act, Pub. L. No. 116-127, 134 Stat. 178 (2020); and the Coronavirus Preparedness and Response

Supplemental Appropriations Act, 2020, Pub. L. No. 116-123, 134 Stat. 146. For the purposes of our

review, COVID-19 relief funding is the cumulative amount of funding provided in the COVID-19 relief

laws. Consequently, the COVID-19 relief funding amounts reported in this report do not reflect the

permanent rescissions enacted in the Fiscal Responsibility Act of 2023, Pub. L. No. 118-5, 137 Stat.

10.

a

The Main Street Lending Program comprised five facilities: the Main Street New Loan Facility, Main

Street Priority Loan Facility, Main Street Expanded Loan Facility, Nonprofit Organization New Loan

Facility, and Nonprofit Organization Expanded Loan Facility. The Federal Reserve Bank of Boston

administers the Main Street Lending Program.

Fraud,FraudRiskManagement,andManagingImproper

PaymentsinEmergencyAssistancePrograms

Fraud. Fraud involves obtaining something of value through willful

misrepresentation. Willful misrepresentation can be characterized by

making material false statements of fact based on actual knowledge,

deliberate ignorance, or reckless disregard of falsity. Whether an act is

fraudulent is determined through the judicial or other adjudicative system.

Fraud is challenging to detect because of its deceptive nature. As a

result, not all fraudulent activity will be detected or discovered. Generally,

once potential fraud is detected and investigated, DOJ may bring charges

of fraud against the alleged fraudster.

If a court determines that fraud took place, then fraudulent spending may

be recovered through various means. However, recoveries are often a

fraction of fraud losses and some amounts may never be recovered.

Fraud can also involve benefits that are non-financial in nature. While this

type of fraud does not result in a direct financial loss to the government, it

can have other impacts such as on trust in government and an agency’s

reputation. It can also create national security, criminal, health, safety,

and other risks.

Letter

Page 6 GAO-24-106353 COVID-19

Figure 1 illustrates stages of fraud identification, including the known—

detected potential fraud and adjudicated fraud—and unknown aspects of

fraud.

Figure 1: Stages of Fraud Detection

Accessible text for Figure 1: Stages of Fraud Detection

Unknown

· Undetected potential fraud

Letter

Page 7 GAO-24-106353 COVID-19

· Potential fraud occurs but has not been discovered by the

federal government.

Known

· Detected potential fraud

· Stage 1

Potential fraud is detected by the federal government but

has not been accepted for full investigation.

· Stage 2

Investigative agencies inquire into the facts, but referrals

have not been accepted for judicial or administrative

action.

· Stage 3

Department of Justice and agencies seek remedies using

due process, but guilt, liability, or fault of fraud are not

formally determined.

· Adjudicated fraud

U.S. Courts and other adjudicative bodies make formal

determinations of facts, as well as fault, liability, or guilt of fraud.

Source: GAO (information); thailerderden10/stock.adobe.com (iceberg); Icons-Studio/stock.adobe.com (icons). | GAO-24-106353

Fraud risk management. We have reported that federal agencies did not

strategically manage fraud risks and were not adequately prepared to

prevent fraud when the pandemic began.

7

Fraud risk is greatest when

individuals have an opportunity to engage in fraudulent activity, have an

incentive or are under pressure to commit fraud, or are able to rationalize

committing fraud. When fraud risks can be identified and mitigated, fraud

may be less likely to occur. Although the occurrence of fraud indicates

there is a fraud risk, the risk can exist even if actual fraud has not yet

happened.

The public health crisis, economic instability, and increased flow of

federal funds associated with the COVID-19 pandemic increased

pressures on federal agency operations and presented opportunities for

individuals to commit fraud. The heightened risk and prevalence of fraud

in various COVID-19 relief programs underscore the importance of

prevention and imperative for federal agencies to manage fraud risks

strategically.

In our March 2022 testimony before the Senate Committee on Homeland

Security and Governmental Affairs, we identified 10 actions that Congress

7

GAO, Emergency Relief Funds: Significant Improvements Are Needed to Address Fraud

and Improper Payments, GAO-23-106556 (Washington, D.C.: Feb. 1, 2023).

Letter

Page 8 GAO-24-106353 COVID-19

could take to strengthen internal controls and financial and fraud risk

management practices across the government.

8

For example, we

suggested Congress (1) establish a permanent analytics center of

excellence to aid the oversight community in identifying improper

payments and fraud; (2) amend the Social Security Act to make

permanent the sharing of full death data with the Department of the

Treasury’s Do Not Pay working system; and (3) reinstate the requirement

that agencies report on their antifraud controls and fraud risk

management efforts in their annual financial reports, among other actions.

These matters for congressional consideration remain open. We continue

to believe that such actions will increase accountability and transparency

in federal spending in both normal operations and emergencies.

To help federal program managers strategically manage their fraud risks

during both normal operations and emergencies, we published A

Framework for Managing Fraud Risks in Federal Programs (Fraud Risk

Framework) in July 2015.

9

A provision of the Payment Integrity

Information Act of 2019 (PIIA) requires the Office of Management and

Budget (OMB) to maintain guidelines for agencies to establish financial

and administrative controls to identify and assess fraud risks and that

incorporate leading practices from GAO’s Fraud Risk Framework.

10

OMB

Circular A-123, Management’s Responsibility for Enterprise Risk

Management and Internal Control implements this requirement and

8

GAO, Emergency Relief Funds: Significant Improvements Are Needed to Ensure

Transparency and Accountability for COVID-19 and Beyond, GAO-22-105715

(Washington, D.C.: Mar. 17, 2022).

9

GAO, A Framework for Managing Fraud Risks in Federal Programs, GAO-15-593SP

(Washington, D.C.: July 28, 2015).

10

The Fraud Reduction and Data Analytics Act of 2015 (FRDAA) originally required OMB

to establish these guidelines for agencies in 2016. Pub. L. No. 114-186, 130 Stat. 546

(2016). FRDAA was repealed and replaced by PIIA in 2020. PIIA requires these

guidelines to remain in effect, subject to modification by OMB as necessary, and in

consultation with GAO. Pub. L. No. 116-117, § 2(a), 134 Stat. 113, 131 - 132 (2020),

codified at 31 U.S.C. § 3357.

Letter

Page 9 GAO-24-106353 COVID-19

directs agencies to follow the leading practices outlined in the Fraud Risk

Framework.

11

The Fraud Risk Framework describes leading practices in four

components: commit, assess, design and implement, and evaluate and

adapt, as depicted in figure 2.

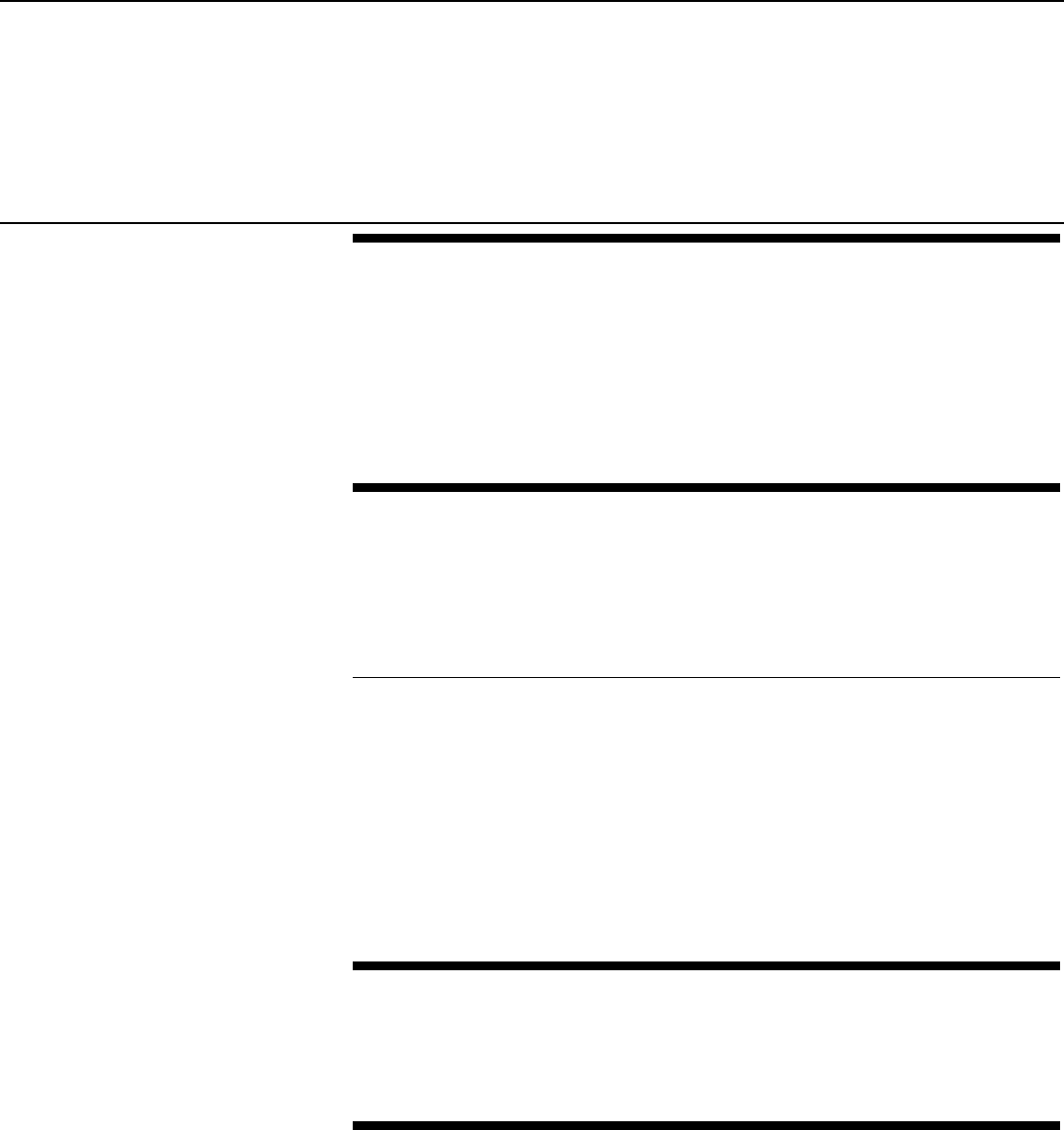

Figure 2: The Four Components of the Fraud Risk Framework and Selected Leading

Practices

Accessible text for Figure 2: The Four Components of the Fraud Risk Framework

and Selected Leading Practices

1. Commit to combating fraud by creating an organizational culture and

structure conducive to fraud risk management.

2. Plan regular fraud risk assessments, and assess risks to determine a

fraud risk profile.

3. Design and implement a strategy with specific control activities to

mitigate assessed fraud risks, and collaborate to help ensure effective

implementation.

11

In October 2022, OMB issued a Controller Alert reminding agencies that consistent with

the guidelines contained in OMB Circular A-123, they must establish financial and

administrative controls to identify and assess fraud risks. In addition, OMB reminded

agencies that they should adhere to the leading practices in GAO’s Fraud Risk Framework

as part of their efforts to effectively design, implement, and operate an internal control

system that addresses fraud risks. OMB, CA-23-03, Establishing Financial and

Administrative Controls to Identify and Assess Fraud Risk (Oct. 17, 2022).

Letter

Page 10 GAO-24-106353 COVID-19

4. Evaluate outcomes using a risk-based approach, and adapt activities

to improve fraud risk management.

Source: GAO (information and icons). | GAO-24-106353

To further assist federal managers in their efforts to manage fraud risk,

we created the online Antifraud Resource to help federal officials and the

public better understand and combat federal fraud.

12

The Antifraud

Resource provides insight on fraud schemes that affect the federal

government, their underlying concepts, and how to combat such fraud,

and is based on a conceptual model of fraud in the federal government.

13

The conceptual fraud model identifies five key elements of fraud

schemes: (1) affected federal programs or operations; (2) participants

(those involved in the execution of the scheme and those affected by it);

(3) types of fraud activities (e.g., wire fraud, grant fraud, identity fraud); (4)

mechanisms (processes, techniques, or systems used to execute the

activity); and (5) impacts (financial or non-financial). We describe COVID-

19 fraud cases in terms of the five key elements of a fraud scheme in this

report.

Managing improper payments in emergency assistance programs.

Our oversight of emergency assistance programs—including COVID-19

relief programs—has identified substantial shortcomings in agencies’

application of fundamental internal controls as well as fraud risk

management practices. These shortcomings can result in significant

improper payments—payments that should not have been made or were

made in the incorrect amount as a result of mismanagement, errors,

abuse, or fraud. While all payments resulting from fraudulent activity are

considered improper, not all improper payments are the result of fraud.

When the federal government provides emergency assistance, the risk of

improper payments may be higher than in non-emergency programs

because the need to provide such assistance quickly can detract from the

planning and implementation of effective controls. Our past work has

shown that federal agencies should better plan for and take a more

strategic approach to managing improper payments in emergency

assistance programs. In response, in July 2023, we published A

Framework for Managing Improper Payments in Emergency Assistance

12

https://gaoinnovations.gov/antifraud_resource/.

13

The Conceptual Fraud Model is organized as an “ontology.” An ontology is an explicit

description of categories in a subject area and their characteristics, as well as the

relationships among them. To develop our fraud model, we collected, reviewed, and

analyzed multiple sources of information, including over 200 adjudicated federal criminal

and civil fraud cases to validate and refine the fraud model.

Letter

Page 11 GAO-24-106353 COVID-19

Programs (Managing Improper Payments Framework) to help Congress

and federal program managers.

14

This framework includes leading

practices to help federal agencies combat improper payments, including

those stemming from fraud, in emergency and non-emergency programs

before they occur. It includes an overall five-step approach described in

figure 3.

14

GAO, A Framework for Managing Improper Payments in Emergency Assistance

Programs, GAO-23-105876 (Washington, D.C.: July 13, 2023). This framework should be

used by federal agencies in conjunction with existing requirements related to managing

improper payment, including those stemming from fraud.

Letter

Page 12 GAO-24-106353 COVID-19

Figure 3: Framework for Managing Improper Payments in Emergency Assistance

Programs

Accessible text for Figure 3: Framework for Managing Improper Payments in Emergency Assistance Programs

1

2

3

4

5

Commit to managing improper

payments

Identify and assess

improper payment risks,

including fraud

Design and implement

effective control

activities

Monitor the effectiveness

of controls in managing

improper payments

Provide and obtain

information to

manage improper

payments

Letter

Page 13 GAO-24-106353 COVID-19

1

2

3

4

5

· Develop internal control

plans in advance to

prepare for future

emergencies

· Identify data-sharing

opportunities

· Assign clear roles and

responsibilities for

managing improper

payments

· Implement open

recommendations related

to improper payments

· Apply lessons learned

from past emergencies

· Leverage prior risk

assessments

· Quickly identify and

assess new

improper payment

risks

· Support nonfederal

entities in

assessing and

managing improper

payment risks

· Define risk

tolerance

· Periodically assess

whether programs

are susceptible to

significant improper

payments,

including fraud

· Establish control

activities at the

beginning of the

program

· Leverage existing

resources to create

controls quickly

· Prioritize

prepayment

controls and avoid

overreliance on

“pay and chase”

controls

· Ensure controls

align with statutory

requirements

· Establish timely

ongoing monitoring

and separate

evaluations

· Estimate improper

payments

· Analyze the root

cause of improper

payments

· Monitor nonfederal

entities’

implementation of

emergency

· assistance programs

· Develop corrective

actions

· Provide

improper

payment

information to

nonfederal

entities

· Provide

improper

payment

information to

oversight entities

· Obtain and use

information from

nonfederal

entities and state

and local

auditors

Source: GAO (analysis and icons). | GAO-24-106353

This approach includes principles that align with leading practices

described in our Fraud Risk Framework, such as identifying and

assessing fraud risks that cause improper payments.

Letter

Page 14 GAO-24-106353 COVID-19

DOJHasProsecutedOverTwoThousand

COVID19FraudRelatedCases,andthe

SchemesIllustrateaVarietyofParticipants,

Mechanisms,andImpacts

About1,400FraudRelatedCasesInvolvingCOVID19

ReliefProgramsHaveResultedinFindingsofGuilt

At least 1,399 individuals or entities were found guilty or liable in cases

involving federal COVID-19 relief programs, based on our analysis of

DOJ’s public statements and court documentation from March 2020

through June 2023.

15

The cases with findings of guilt or liability involve

COVID-19 relief programs such as SBA’s PPP and COVID-19 EIDL

program, DOL’s UI programs, and Treasury’s economic impact payments

(see fig. 4).

15

The federal government may enforce laws through civil or criminal action. Such action

may be resolved through a trial, a permanent injunction, a civil settlement, or a guilty plea.

Our analysis is limited to the cases we identified from public sources and may not include

all criminal and civil cases charged by DOJ as of June 30, 2023. Additionally, details of

fraud cases and schemes presented in court documents may not be complete. Further,

cases that reach the prosecution stage in the fraud identification lifecycle represent a

fraction of the instances of fraud or all possible fraud cases.

Letter

Page 15 GAO-24-106353 COVID-19

Figure 4: Number of Individuals or Entities That Were Found Guilty or Liable for Fraud-Related Charges Involving One or More

COVID-19 Relief Programs, as of June 30, 2023

Accessible text for Figure 4: Number of Individuals or Entities That Were Found Guilty or Liable for Fraud-Related Charges

Involving One or More COVID-19 Relief Programs, as of June 30, 2023

COVID-19 Relief Programs

Number of

individuals

or entities

Coronavirus Food Assistance Program

3

Coronavirus Relief Fund

8

COVID-19 Economic Injury Disaster Loans

125

COVID-19 Economic Injury Disaster Loans and Restaurant Revitalization Fund

1

COVID-19 Economic Injury Disaster Loans and Unemployment Insurance

25

Letter

Page 16 GAO-24-106353 COVID-19

COVID-19 Relief Programs

Number of

individuals

or entities

Economic Impact Payments

38

Economic Impact Payments and COVID-19 Economic Injury Disaster Loans

3

Emergency Rental Assistance Program

1

Families First Coronavirus Response Act

1

Federal Child Nutrition Program

10

Higher Education Emergency Relief Fund

2

Health Resources and Services Administration COVID-19 Uninsured Program

2

Main Street Lending Program

1

Paycheck Protection Program

446

Paycheck Protection Program and Coronavirus Relief Fund

2

Paycheck Protection Program and EIDL

211

Paycheck Protection Program and Unemployment Insurance

10

Paycheck Protection Program, COVID-19 Economic Injury Disaster Loans, and Main Street Lending Program

1

Paycheck Protection Program, COVID-19 Economic Injury Disaster Loans, and Provider Relief Fund

2

Paycheck Protection Program, COVID-19 Economic Injury Disaster Loans, and Restaurant Revitalization Fund

1

Paycheck Protection Program, COVID-19 Economic Injury Disaster Loans, and Shuttered Venue Operators Grant

1

Paycheck Protection Program, COVID-19 Economic Injury Disaster Loans, and Unemployment Insurance

17

Paycheck Protection Program, COVID-19 Economic Injury Disaster Loans,; Families First Coronavirus Response Act

1

Paycheck Protection Program; the Accelerated and Advance Payment Program; and Provider Relief Fund

1

Provider Relief Fund

6

Small Business Administration loans (unspecified)

1

State or local programs funded by CARES Act grants

1

Unemployment Insurance

474

Unemployment Insurance and Economic Impact Payments

1

Unemployment Insurance and Families First Coronavirus Response Act

1

Unemployment Insurance and Small Business Administration loans (unspecified)

2

Unspecified COVID-relief funding

1

Source: GAO analysis of Department of Justice case information. | GAO-24-106353

Note: The federal government may enforce laws through civil or criminal action. Such action may be

resolved through a trial, a permanent injunction, a civil settlement, or a guilty plea.

Of the individuals found guilty, at least 1,051 had been sentenced as of

June 30, 2023 (see fig. 5). The range in length of prison sentencing varies

Letter

Page 17 GAO-24-106353 COVID-19

in part based on other relevant factors, such as prior convictions and

whether there were other charges in addition to COVID-19 related fraud.

16

Figure 5: Sentencing Outcomes for Individuals or Entities That Were Found Guilty

or Liable for Fraud-Related Charges Involving COVID-19 Relief Programs, as of

June 30, 2023

Accessible data for Figure 5: Sentencing Outcomes for Individuals or Entities That

Were Found Guilty or Liable for Fraud-Related Charges Involving COVID-19 Relief

Programs, as of June 30, 2023

Length of prison sentence

Number of individuals

Time served, supervised release, or probation

a

216

Less than 1 year

111

1 to under 5 years

536

16

Courts refer to the United States Sentencing Commission Guidelines to determine the

particular sentence in each individual case. Under 28 U.S.C. § 994, the Guidelines should

reflect a variety of factors and considerations to determine an appropriate sentence. The

Guidelines set a base offense level and then add or subtract levels due to aggravating or

mitigating circumstances, such as the dollar amount of the loss caused by offense and the

defendant’s criminal history, ultimately arriving at a suggested sentencing range.

Additionally, many of the defendants we reviewed were convicted on additional charges

beyond fraud against COVID-19 relief programs, which would impact the length of their

sentences.

Letter

Page 18 GAO-24-106353 COVID-19

Length of prison sentence

Number of individuals

5 to under 10 years

155

10 or more years

33

Source: GAO analysis of Department of Justice case information. | GAO-24-106353

Note: Some of these individuals or entities were sentenced for additional charges not related to

COVID-19 relief programs. In addition to prison time, sentences can include restitution, fines, or other

fees. The federal government may enforce laws through civil or criminal action. Such action may be

resolved through a trial, a permanent injunction, a civil settlement, or a guilty plea.

a

These individuals were sentenced to time served, supervised release, or probation but no prison

sentence.

Some individuals and entities found guilty have also been ordered to pay

restitution and fines. Courts ordered restitution amounts ranging from

zero to over $60 million. Individuals or entities in over 200 cases were

ordered to pay $1 million or more in restitution (see fig. 6).

Figure 6: Court Ordered Restitution for Individuals or Entities That Were Found

Guilty or Liable for Fraud-Related Charges Involving COVID-19 Relief Programs, as

of June 30, 2023

Accessible data for Figure 6: Court Ordered Restitution for Individuals or Entities That Were Found Guilty or Liable for Fraud-

Related Charges Involving COVID-19 Relief Programs, as of June 30, 2023

Restitution

Number of individuals or entities

No restitution ordered or identified in judgment

94

Letter

Page 19 GAO-24-106353 COVID-19

Restitution

Number of individuals or entities

Less than $100,000

377

$100,000 to $249,999

152

$250,000 to $499,999

117

$500,000 to $999,999

105

$1 million or more

206

Source: GAO analysis of Department of Justice case information. | GAO-24-106353

Note: The federal government may enforce laws through civil or criminal action. Such action may be

resolved through a trial, a permanent injunction, a civil settlement, or a guilty plea.

HundredsofCOVID19FraudRelatedCasesAre

Pending

In addition to those individuals and entities with findings of guilt, there

were also federal fraud-related charges pending against at least 599

other individuals or entities involving federal COVID-19 relief programs as

of June 30, 2023.

17

The number of individuals or entities facing fraud-

related charges related to COVID-19 relief programs has grown since

March 2020 and will likely continue to increase, as these cases take time

to develop. For example, an individual charged in an indictment in 2022

may not receive a trial until 2023 and if found guilty, the sentencing may

occur in 2024 or later. As of August 2022, the statute of limitations has

been extended to 10 years to prosecute individuals who committed PPP

and COVID-19 EIDL-related fraud.

FraudSchemesIllustrateaVarietyofParticipants,

Mechanisms,andImpacts

We identified examples of various fraud schemes through our analysis of

court documentation for adjudicated cases involving federal COVID-19

fraud-related charges. We found that the fraud scheme participants

ranged from individuals with co-conspirators to very large complex fraud

syndicates that include foreign nationals.

Fraud schemes are achieved through various mechanisms. A mechanism

is a process, technique, or system used by fraudsters to execute

fraudulent activities. Mechanisms include misrepresentation, cybercrime,

and document falsification. A mechanism can be an individual action or a

17

A charge is merely an allegation, and all defendants are presumed innocent until proven

guilty beyond a reasonable doubt in a court of law.

Letter

Page 20 GAO-24-106353 COVID-19

group of actions working in concert. These schemes result in financial

loss and impacts on taxpayers, agency reputation and integrity, federal

program goals, and other areas such as public health and safety.

Program managers can use the details of existing fraud schemes

identified in their programs—including information on the impact of these

schemes—to identify program vulnerabilities. Moreover, program

managers can leverage details on fraud schemes and their corresponding

impacts to evaluate and adapt fraud risk management activities in

alignment with leading practices outlined in GAO’s Fraud Risk

Framework.

18

Three components in the Fraud Risk Framework include

the following leading practices related to using past schemes and related

information to help combat fraud:

· The assess component directs program managers to consider the

financial and non-financial impacts of fraud risks and identify specific

tools, methods, and sources for gathering information about fraud

risks, including data on fraud schemes and trends from monitoring

and detection activities.

· The design and implement component directs agencies to analyze

information on previously detected fraud and consider known or

previously encountered fraud schemes to design data analytics.

· The evaluate and adapt component directs agencies to collect and

analyze data, including data from reporting mechanisms and

instances of detected fraud.

Table 2 provides examples of various fraud schemes affecting federal

COVID-19 relief programs. The examples include some of the

mechanisms used to carry out the fraud activity, as well as the

participants and impacts. Although the examples are categorized by a

particular mechanism, the same mechanisms may be present in other

fraud scheme examples as well. Also, the examples below do not reflect

all of the fraud schemes, mechanisms, or affected COVID-19 relief

programs.

18

GAO-15-593SP.

Letter

Page 21 GAO-24-106353 COVID-19

Table 2: Examples of Fraud Schemes Affecting Federal COVID-19 Relief Programs

Key mechanism

Fraud scheme description

Conspiracy. Cases involve a secret

agreement by two or more individuals to

commit a crime.

Participants and affected program: Nearly 50 individuals are alleged to have engaged

in a complex scheme to defraud a federal child nutrition program. The ringleaders of the

scheme operated a non-profit organization that served as a program sponsor prior to the

pandemic. Other individuals—recruited by employees of the non-profit to participate in

the scheme—set up sham program delivery sites to fraudulently claim reimbursements

for meal delivery.

Fraud scheme: Employees of the non-profit recruited individuals to establish dozens of

shell companies to enroll as program delivery sites throughout the state in order to

fraudulently claim program reimbursements. The non-profit employees solicited and

received bribes and kickbacks from the sponsored delivery sites. Owners of the sham

delivery sites claimed to be serving meals to thousands of children a day within just days

or weeks of being formed. They created fictitious names and ages of children for their

enrollment applications, created and submitted false documentation such as fraudulent

meal count sheets, invoices, and attendance rosters, and used shell companies to

receive and launder program proceeds.

Impacts: As of June 30, 2023, four defendants have pleaded guilty to relevant charges

but have not yet been sentenced. The remaining individuals are still awaiting trial. In

exchange for sponsoring these sites’ fraudulent participation in the program, the non-

profit received more than $18 million in administrative fees to which it was not entitled. In

total, the non-profit organization claimed to have opened more than 250 sites throughout

the state of Minnesota and fraudulently obtained and disbursed more than $240 million in

program funds for their own financial benefit instead of using the funds as intended to

feed underserved children.

Participants and affected program: Two foreign nationals and suspected leaders of an

overseas-based transnational organized crime group fraudulently obtained

unemployment insurance (UI) benefits.

Fraud scheme: The two foreign nationals submitted multiple fraudulent applications to

receive UI benefits. They both fraudulently claimed to be U.S. citizens and provided fake

Social Security numbers. They used the illicit funds from unemployment benefits, along

with funds they received by pawning stolen goods, and laundered these funds through

wiring money to entities in another country. Their crimes included the robbery of $1.4

million in jewelry from residents of elderly communities.

Impacts: Together with their co-conspirators, the two foreign nationals received a total of

approximately $32,250 in UI benefits they were not eligible to receive. They both pleaded

guilty to conspiracy to launder monetary instruments, but have not been sentenced as of

June 30, 2023.

Letter

Page 22 GAO-24-106353 COVID-19

Key mechanism

Fraud scheme description

Misrepresentation. Cases involve a false

statement of a material fact made by one

party that affects another party’s decisions.

This includes other mechanisms such as

document manipulation, eligibility

misrepresentation, and false statements.

Participants and affected program: Two individuals owned and operated seven

companies engaged in a fraud scheme involving the Paycheck Protection Program (PPP)

and COVID-19 Economic Injury Disaster Loan (COVID-19 EIDL) program.

Fraud scheme: The individuals applied for 14 PPP loans for approximately $2 million

and 12 COVID-19 EIDL loans seeking approximately $3 million. In their applications they

submitted false documents, including fabricated tax documents, that inflated the number

of employees and corresponding payroll of their companies.

Impacts: The individuals received almost $650,000 in funds intended to help businesses

keep their workforce employed during the pandemic, but these funds were instead used

for personal gain, including the purchase of a $100,000 luxury car. Both individuals

pleaded guilty and were ordered to pay more than $800,000 in restitution. One defendant

was sentenced to more than 3 years in prison, while the other was sentenced to over 2

years in prison.

Participants and affected program: Two individuals engaged in PPP and COVID-19

EIDL fraud.

Fraud scheme: These individuals submitted applications claiming bogus employees.

They used residential addresses claiming they were farmers employing 15 total

employees with annual earnings over $1.2 million. In actuality they employed no one and

the farms did not exist.

Impacts: They obtained over $1 million in PPP and COVID-19 EIDL funds. This money

that was intended to help businesses keep their workforce employed during the

pandemic were instead used for personal gain. Collectively they were ordered to pay

over $218,000 in restitution. One individual was sentenced to 18 months in prison and

the other was sentenced to 30 months in prison.

Money laundering. Cases involve the

processing of criminal proceeds to disguise

their illegal origin (e.g., money mules).

Participants and affected program: A social media influencer engaged in PPP and

COVID-19 EIDL fraud.

Fraud scheme: The influencer applied for PPP and COVID-19 EIDL funds through

fraudulent documents he created, such as tax forms and bank statements. He deposited

fraudulently obtained funds into accounts he opened specifically for that purpose. He

then laundered the funds by engaging in several monetary transactions, including

purchasing and trading securities and cryptocurrency, settling personal debts and making

payments to his girlfriend.

Impacts: In total, the influencer fraudulently applied for and received $146,000 in PPP

funds and $284,000 in COVID-19 EIDL funds intended to help sustain businesses during

the pandemic. The influencer pleaded guilty to wire fraud, aggravated identity theft, and

money laundering involving PPP and COVID-19 EIDL. The individual has not been

sentenced as of June 30, 2023.

Participants and affected program: An owner of an internet clothing retailer defrauded

the Main Street Lending Program.

Fraud scheme: The individual claimed the funds requested would be used for working

capital and payroll only, but they but were not. Instead the individual transferred amounts

from the company account to her personal account and used the funds to pay for

construction on her home and a down payment for a personal vehicle.

Impacts: She received $424,168 from the Main Street Lending Program. Funds set

aside to help small businesses remain operational were instead used for her personal

gain. She pleaded guilty to bank fraud and wire fraud and has not been sentenced as of

June 30, 2023.

Letter

Page 23 GAO-24-106353 COVID-19

Key mechanism

Fraud scheme description

Conflict of interest. Cases involve an

individual or a corporation (either private or

governmental) in a position to exploit their

own professional or official capacity in

some way.

Participants and affected program: An individual who worked for the U.S. Postal

Service committed fraud involving Treasury’s economic impact payments (EIP).

Fraud scheme: The individual stole credit cards and blank checkbooks from the mail at

the post office where she was employed as a clerk, and provided them to her co-

conspirators in exchange for cash. She worked with her co-conspirators to create

counterfeit EIP checks to deposit in accounts of solicited accountholders for them to later

withdraw for cash. She also filed false and fraudulent COVID-19 EIDL applications for

fake businesses that did not exist, but those applications were not approved by the Small

Business Administration (SBA).

Impacts: Along with her co-conspirators, they deposited or attempted to deposit

thousands of dollars of counterfeit EIP checks. She pleaded guilty to conspiracy to

commit bank fraud and false statements to the SBA and was sentenced to 3 years in

prison and ordered to pay more than $60,000 in restitution.

Participants and affected program: An individual was a lead claims examiner at a

state’s UI agency and engaged in UI benefit fraud.

Fraud scheme: This individual worked with outside co-conspirators to use his network

credentials to override “fraud stops” on UI claims that the state’s system had identified as

potentially fraudulent. Some of these claims were made in the name of people who did

not exist.

Impacts: In total, his actions resulted in the fraudulent disbursement of over $1.1 million

of federal and state UI funds, with an additional attempt to override another $761,000 in

funds that was prevented. He pleaded guilty to conspiracy to commit wire fraud and was

sentenced to 24 months in prison and approximately $1 million in restitution.

Theft. Cases involve the act of stealing,

such as monetary theft and personally

identifiable information theft.

Participants and affected program: Three individuals engaged in UI benefit fraud.

Fraud scheme: The group used information stolen from prison inmates to file

approximately 50 applications for UI benefits. An incarcerated cousin of one of the

individuals provided the inmate information. These funds were transferred to electronic

benefits transfer debit cards accounts held in the names of persons, including prison

inmates, who were not entitled to receive UI benefits.

a

Impacts: In total, the group fraudulently received around $1.2 million in UI benefits.

Given the amount the group was able to obtain from the program and the fact that the

fraud ring used state prisoners to accomplish their scheme, the state may suffer

reputational damage. The group all pleaded guilty to fraud in connection with emergency

benefits and wire fraud. The longest sentence one individual in the group received was

for almost 2 years in prison. This individual was also ordered to pay more than $450,000

in restitution.

Participants and affected program: Two college students engaged in fraud involving

the Higher Education Emergency Relief Fund (HEERF).

Fraud scheme: The two students used stolen personally identifiable information,

specifically nine individual’s student identification numbers and passwords, to access

their school’s online student portal to apply for emergency financial aid from HEERF.

Impacts: One of the students fraudulently obtained $800 in HEERF funds while the other

student obtained $400 in HEERF funds. In total nine individuals were affected by the

identity theft scheme, which can result in them having to take steps to address the fraud

committed in their name. Both students pleaded guilty to theft of government money

under $1,000 and were sentenced to 1 year of probation and ordered to pay $5,600 in

restitution.

Source: GAO Antifraud Resource and analysis of court documentation; Icons-Studio/stock.adobe.com (icons). | GAO-24-106353

Note: Although the examples are categorized by a particular mechanism, the same mechanisms may

be present in other fraud scheme examples as well.

Letter

Page 24 GAO-24-106353 COVID-19

a

Electronic benefits transfer is a system similar to a debit card that allows recipients of government

assistance to pay directly for purchases.

NumerousProsecutionsHaveTargetedCOVID19Fraud

RelatedCasesInvolvingConsumerScamsandOther

TypesofFraud

Fraud involving consumer scams. In addition to fraud against federal

relief programs, COVID-19 related fraud can result in financial losses to

consumers and undermine health and safety. Fraud involving consumer

scams are cases that involve deceptive business practices that may

cause consumers (individuals or businesses) to suffer financial or other

losses. At least 37 individuals or entities facing federal fraud-related

charges involving consumer scams related to COVID-19 have pleaded

guilty and three individuals or entities received a guilty verdict at trial,

according to DOJ public information and court information from March

2020 through June 2023.

19

Table 3 provides examples of various fraud schemes involving consumer

scams related to COVID-19. The examples include some of the

mechanisms used to carry out the fraud activity, as well as the

participants and impacts. Although the examples are categorized by a

particular mechanism, the same mechanism may be present in other

fraud scheme examples as well. Mechanisms reflect how fraud activities

are carried out and are therefore present across many different types of

schemes.

19

There were also federal charges pending against at least 40 other individuals or entities

related to consumer scams as of June 30, 2023.

Letter

Page 25 GAO-24-106353 COVID-19

Table 3: Examples of Schemes Involving Consumer Scams Related to COVID-19

Key mechanism

Fraud scheme description

Health care fraud. Cases that involve an

individual, a group of people, or a company

knowingly misrepresenting or misstating

something about the type, the scope, or the

nature of the medical treatment or service

provided, in a manner that could result in

unauthorized payments being made.

Participants: A licensed medical practitioner engaged in a health care fraud

scheme related to the COVID-19 pandemic.

Fraud scheme: The practitioner used the COVID-19 pandemic as an opportunity to

sell products known as homeopathic immunizations, falsely claiming they would

provide lifelong immunity to COVID-19. She provided customers purchasing these

products vaccine record cards to make it appear that they received government-

approved vaccines.

Impacts: She received $74,483 in payments for the provision of fabricated COVID-

19 vaccination record cards. She provided the false documents knowing that the

vaccine record cards would be used to mislead school officials enforcing the state’s

vaccination laws, creating health and safety risks for customers and the public at

large. She pleaded guilty to wire fraud and false statement, and was sentenced to

almost 3 years in prison.

Embezzlement. Cases involve the unlawful

misappropriation or misapplication by an

offender to his or her own use or purpose of

money, property, or some other thing of value

entrusted to his or her care, custody, or control.

Participants: An office manager engaged in fraud involving the Paycheck

Protection Program (PPP).

Fraud scheme: The office manager and her husband devised a scheme to defraud

the company she was employed by. The company appropriately received a PPP

loan. However, the office manager used her access to the company’s bank accounts

and credit cards to make transfers of more than $43,000 from the loan to pay

personal bills or to bank accounts she and her husband controlled.

Impacts: The office manager’s actions took federal funds from the company so it

could not use those funds for their intended purpose. The office manager pleaded

guilty to wire fraud, and was sentenced to 4 years in prison and ordered to pay

approximately $587,000 in restitution.

Mislabeling. Cases involve mislabeling

products.

Participants: A business owner mislabeled products related to the COVID-19

pandemic.

Fraud scheme: A company and its business owner unlawfully imported, sold, and

mailed unregistered pesticide product marketed as a killer of airborne viruses such

as COVID-19. The product was falsely described as an air purifier rather than a

pesticide. The company shipped products to individuals who purchased from their

website via U.S. mail. The product contained sodium chlorite, which is an item

declared to be unmailable under U.S. postal rules and regulations because of its

propensity to cause a fire or explosion.

Impacts: The company and its business owner were ordered to jointly pay

restitution of $86,754 and forfeit $427,689 in proceeds. In addition, the company

agreed to pay a fine of $42,000, for a total financial penalty of $556,443. The

company sold this mislabeled product to customers purchasing it with the hopes of

killing the COVID-19 virus, creating potential health and safety risks for customers

and the public at large. The business owner pleaded guilty to the entry of goods

falsely classified and was sentenced to 8 months in prison.

Letter

Page 26 GAO-24-106353 COVID-19

Key mechanism

Fraud scheme description

Smuggling. Cases involve exporting or

importing something in violation of customs

laws.

Participants: An individual engaged in smuggling mislabeled products to treat

COVID-19.

Fraud scheme: The smuggler imported chloroquine from a manufacturer overseas

with the intent to divide it into gel capsules and distribute it to others for preventing

and treating COVID-19. He was not a licensed medical provider or pharmacist and

has no medical background or training.

Impacts: The smuggler caused the package in which the chloroquine was shipped

to be mislabeled and undervalued to evade detection at the U.S. border creating

potential health and safety risks for customers and the public at large. He pleaded

guilty to a violation of the Federal Food, Drug and Cosmetics Act, and was

sentenced to 2 years of probation and ordered to pay a $1,000 fine.

Source: GAO Antifraud Resource and analysis of court documentation; Icons-Studio/stock.adobe.com (icons). | GAO-24-106353

Note: Although the examples are categorized by a particular mechanism, the same mechanisms may

be present in other fraud scheme examples as well.

Other fraud cases. In addition, we identified other types of COVID-19

fraud-related cases that either involve a federal program that is not a

COVID-19 relief program or involve a COVID-19 related issue other than

consumer scams. Eighty-one individuals or entities pleaded guilty to

federal charges related to these other federal cases and five individuals

or entities received a guilty verdict at trial according to DOJ public

information and court information we reviewed from March 2020 through

June 2023.

20

Table 4 provides examples of fraud schemes involving COVID-19 fraud in

a federal program that is not a COVID-19 relief program or involves a

COVID-19 related issue other than consumer scams. The examples

include some of the mechanisms used to carry out the fraud activity, as

well as the participants and impact of fraud. Although the examples are

categorized by a particular mechanism, the same mechanisms may be

present in other fraud scheme examples as well.

20

In addition to the individuals or entities who pleaded guilty to these other types of federal

charges that were related to COVID-19 fraud, there were also federal charges pending

against at least 27 other individuals or entities as of June 30, 2023

Letter

Page 27 GAO-24-106353 COVID-19

Table 4: Examples of Other Fraud Schemes Related to COVID-19

Key mechanism

Fraud scheme description

Medical self-referral. Cases whereby a

physician unlawfully refers certain designated

health services payable by Medicare to an

entity with which the physician or an immediate

family member has a financial relationship

(ownership, investment, or compensation),

unless an exception applies.

Participants: Three individuals were involved in a fraud scheme to commit Medicare

fraud that included purported COVID-19 testing.

Fraud scheme: Two of the individuals solicited, received, and concealed kickbacks

and bribes from a third conspirator who owned a company that purportedly provided

genetic and COVID-19 testing and other laboratory testing services. The company

owner billed Medicare for various purported services, without regard to whether the

patients needed any tests or were eligible for Medicare reimbursement. The

company owner also paid over $190,000 to the co-conspirators in kickbacks for the

referrals.

Impacts: Medicare paid more than $800,000 based on the fraudulent claims

submitted. By stealing from federal health care programs, this scheme victimized

beneficiaries and violated the public’s trust during a national emergency. The two co-

conspirators pleaded guilty to conspiring with a clinical laboratory to commit

Medicare fraud, and wire fraud. The company owner who paid kickbacks and bribes

received the longest sentence of more than 6 years in prison and was ordered to pay

almost $3 million in restitution.

Spoofing. Case that uses deliberately falsified

contact information (phone number, email, and

website) to mislead and appear to be from a

legitimate source.

Participants: A foreign national was involved in a spoofing scam to obtain COVID-

19 related medical equipment.

Fraud scheme: During the COVID-19 pandemic, the foreign national impersonated

procurement officials of eight U.S. states and local governments and three

educational institutions to fraudulently obtain medical equipment, such as

defibrillators. He used a web hosting company to spoof state procurement email

addresses and sought quotes for medical, laboratory, and computer equipment from

targeted suppliers. The targeted suppliers were known to do business with the

entities the foreign national was impersonating. The foreign national used the

payment terms of “net 30 days”, which is a standard term for government and

educational entities that requires payment for the goods within 30 days of delivery.

He exploited this industry standard to fraudulently obtain equipment without providing

any advance payment information or deposit prior to delivery of the equipment.

Impacts: Through this impersonation, the foreign national obtained and attempted to

obtain millions of dollars of medical equipment, laboratory products, computer

equipment and hardware, and other merchandise. This type of medical equipment,

like defibrillators, were in dire need during the COVID-19 pandemic because the high

demand and stress on supply chains caused shortages and reduced accessibility to

life-saving equipment. The foreign national pleaded guilty to wire fraud and was

sentenced to more than 4 years in prison and ordered to pay more than $300,000 in

restitution.

Source: GAO Antifraud Resource and analysis of court documentation; Icons-Studio/stock.adobe.com (icons). | GAO-24-106353

Note: Although the examples are categorized by a particular mechanism, the same mechanisms may

be present in other fraud scheme examples as well.

Letter

Page 28 GAO-24-106353 COVID-19

PandemicOversightEntity,InteragencyTask

Forces,andFederalResourcesHaveBeen

EstablishedtoCombatCOVID19Fraud

ThePandemicResponseAccountabilityCommittee’s

OngoingEffortstoAddressCOVID19Fraud

The Pandemic Response Accountability Committee (PRAC) was created

to help ensure pandemic response spending was administered efficiently

and effectively, and COVID-19 relief and recovery funds were awarded

appropriately.

21

The PRAC is composed of 21 federal inspectors general.

To carry out its mission and address the subsequent fraud occurring in

these programs, the PRAC has several ongoing reporting efforts and has

developed data analytics tools to detect potential fraud.

Oversight and lessons learned reporting. The PRAC has issued six

semiannual reports to Congress about the status of its work. The most

recent report, released in June 2023, included updates on investigations,

reports, and alerts that focus on fraud, waste, and abuse in the use of the

federal pandemic funds.

22

Specifically, the report outlined information on

the PRAC’s initiatives related to holding wrongdoers accountable through

the Fraud Task Force and mitigating major risks that cut across program

boundaries through their data analytics efforts.

The PRAC also issued an updated lessons learned report in June 2022 to

help identify changes to make pandemic spending more effective.

23

This

work highlighted the major lessons the PRAC and its state partners have

found in their oversight of pandemic relief and recovery programs. The

report identifies 10 key areas for agencies to focus on. The areas related

to mitigating fraud are: validating self-certifying information before

payments are sent, using existing federal data sources to determine

benefits eligibility, ensuring watchdogs have access to data to find fraud,

21

The PRAC was established by the CARES Act to conduct oversight of the federal

government’s pandemic response and recovery effort.

22

Pandemic Response Accountability Committee, Semiannual Report to Congress,

October 1, 2022 - March 31, 2023 (Washington, D.C.: June 6, 2023).

23

Pandemic Response Accountability Committee, Lessons Learned in Oversight of

Pandemic Relief Funds (Washington, D.C.: June 8, 2022).

Letter

Page 29 GAO-24-106353 COVID-19

improving agency collaboration to oversee pandemic relief programs, and

accurate reporting to track pandemic relief spending.

Pandemic Analytics Center of Excellence. The PRAC created the

Pandemic Analytics Center of Excellence (PACE), which helps agencies

find the highest risk areas to investigate by combining oversight data in

one place with a suite of analytic tools, with the purpose to be shared and

used to find fraud. According to the PRAC, the PACE promotes best

practices, provides services to OIGs who lack data analytics capabilities,