RBC Express Core Services

Core Services Pre-read June 2024

1

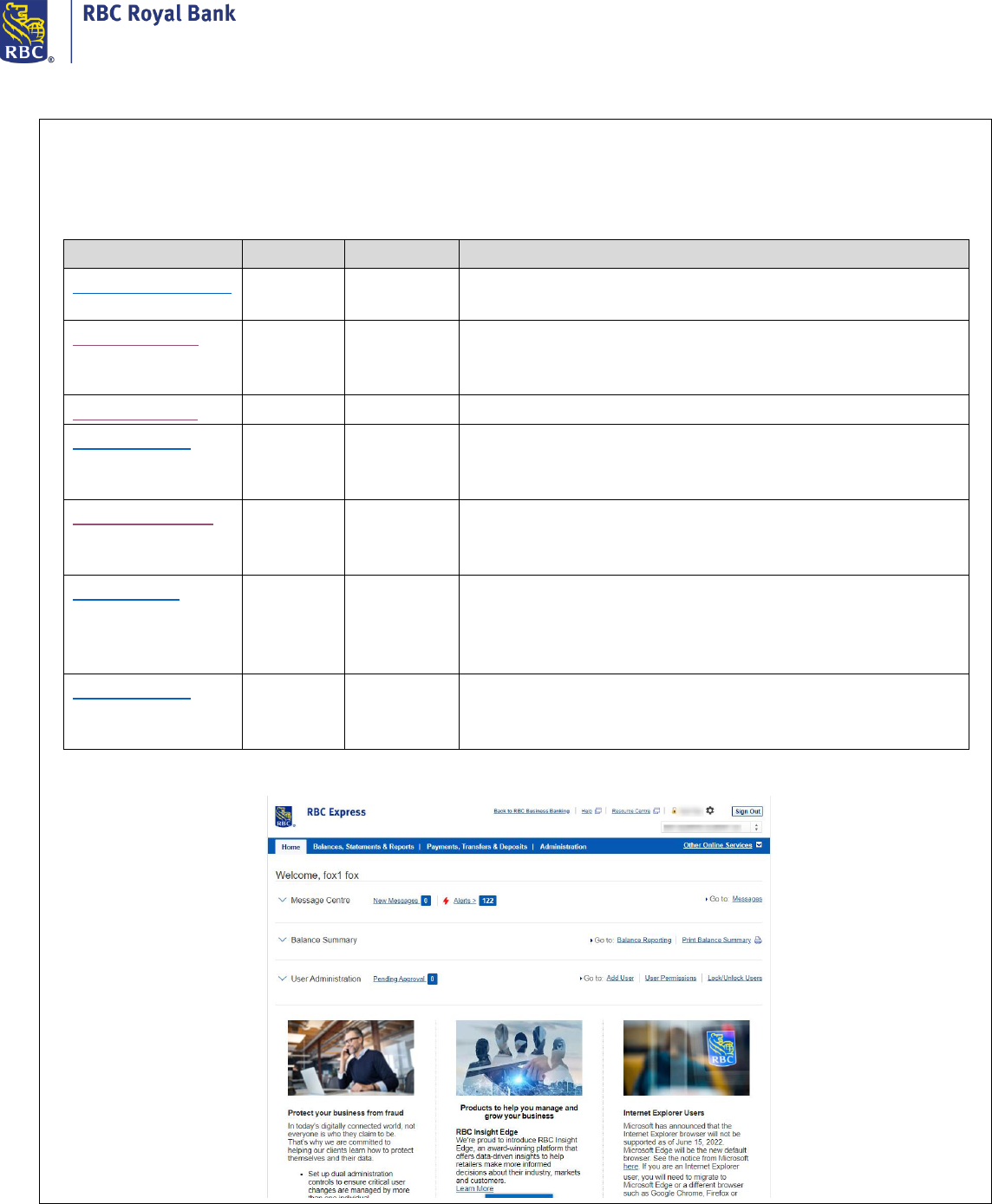

What are the Core Services?

RBC Express Core services are the basic online banking funcons that allow users to view informaon about the

accounts and control the cash ow. This document is organized into 2 main parts: account informaon and account

control and will outline how to get started with using these features.

Service Name

Funcon

Purpose

Descripon

Balancing Reporng

View

Informaon

View current account balances and download recent

transacon details (6 month history)

RBC Statements

View

Informaon

View a variety of Statements ( Credit Card, Business Account,

Loan and Fee Statements ) in a PDF and CSV formats (7 year

history or as long as the account has been opened with RBC)

Account Images

View

Informaon

Images of cheques that have been processed

Stop Payments

Cheque

Processing

(outgoing)

Control

Place a Stop request on a Cheque or Preauthorized Payment

that has been wrien against your accounts

Account Transfers

Payments

- Internal

Transfer

Control

Transfers within your organizaon’s internal accounts

Bill Payments

Outgoing

Payments

Control

Pay Canadian companies that have enrolled with RBC as online

payees. Typically this is used for paying ulies: internet,

telephone, hydro, or for paying credit cards you hold with RBC

or other nancial instuons

Administraon

Access &

Security

Control

The ability to add users, assign their permissions, create

approval rules, assign tokens or approve administrave sengs

created by other Admins

RBC Express Core Services

Core Services Pre-read June 2024

2

Administraon

Before you begin – some set up is required

RBC Express is a mul-user Online Banking Plaorm. When your organizaon is new to the RBC Express Core Services the

best way to start is by going through the Administraon menu.

Administraon establishes

(a) Users - who has access

(b) User Permissions - what the access permits them to see and/or do

(c) Approval Rules - the approval process for each transacon type enrolled

1

Manage Users and

Permissions

• Use this to conrm who has access or to delegate access to others.

• Keep in mind that if you add other users you will have full control over which

accounts they can see (if any) and what transacons they can iniate and/or

complete independently (if any).

2

Approval Rules

• The Approval Rules outline the approval ow for transacons and must be

established for each payment service before payments can be sent.

• The Approval Rules can be as simple or a complex as your internal organizaon

structure requires.

• For Core Services there are two rules that need to be established:

Account Transfers and Bill Payments

RBC Express Core Services

Core Services Pre-read June 2024

3

* Dual Administraon may apply: Dual Administraon means that when one Admin creates an approval rule or a user

permission, a second Admin must approve

To learn more about Administraon click here: hps://www.rbcroyalbank.com/rbcexpress/Administraon-pre-

readmaterial-eng.pdf

Notes:

Account Informaon – View Services

These services will provide informaon about the accounts, they allow you to view the account balances and the

transacon statements

1

Balance Reporng

View current account balances and download recent transacon details (6 month

history)

2

RBC Statements

View the month end and fee statements in PDF format (7 year history)

3

Account Images

Images of cheques that have been processed (deposited on recipient’s end)

RBC Express Core Services

Core Services Pre-read June 2024

4

Balance Reporng

Balance Reporng will display the current account balances and recent account history. The account history available

here begins on the day the accounts are enrolled into RBC Express and will go back as far as 180 days (6 months). If you

need older account details, go to the RBC Statements secon.

1

Balance Summary

View account balances only – this page will not show transacons

2

Transacon Search

Use lter criteria to search for specic Transacons (no balances)

RBC Express Core Services

Core Services Pre-read June 2024

5

3

Transacon Report

Report of transacons, includes opening and closing balances

4

Preferences

Customize your use of the Balance Reporng Menu

Balances

Transacon Report

RBC Express Core Services

Core Services Pre-read June 2024

6

Use the calendars at the top to select the date range you would like to view (the other lter criteria are oponal)

RBC Express Core Services

Core Services Pre-read June 2024

7

Download Transacons

–

to a

3

rd

Party accounng soware

Within the

Transacon

Search

secon there is an opon to

Download Transacons

in a File Format that can be read by

some

e third party soware providers

Preferences

Manage Account Groups

G

roup accounts together to be able to view a

shared transacon report and /or a

cumulave balance

Bank & Currency Ordering

When viewing Balances & Transacons choose whether you

r

CAD or USD accounts

appear on top (default is CAD on top)

RBC Express Core Services

Core Services Pre-read June 2024

8

Backdated Transacons

Backdated transacons are ones that have been entered into your account

with an earlier date than the date on which the transacon was actually

processed.

If you select to Include Current Day backdated Transacons in reports any

backdated transacons that were processed on the current day will appear

in the report – provided the report was generated to include the previous

business day as well

You can make this selecon at the me that you generate the report;

however if you check the box in the preferences secons, backdated

transacons will be included as the default

Scheduled Reports

If you will be using the Transacon Reports feature on a regular basis to look

up specic criteria for your accounts you may want to consider scheduling a

report to be readily available when you sign in.

For example: For a specic account you may want to see all outgoing

transacons in the last week.

Using the schedule reports feature you can choose the account, the

frequency (weekly), and the transacon types (outgoing).

The report will not be emailed, Users must sign in to retrieve the report from

the Report Inbox

RBC Statements

RBC Statements refers to 4 types of statements available:

1. Business Deposit Accounts (download to a PDF le format)

2. Credit Card Accounts (download to a PDF le format)

3. Business Loan Accounts (download to a PDF le format)

4. Monthly Business Fees (download to either CSV and/or PDF le format)

RBC Express provide a 7 year history or as long as the account has been opened with RBC.

Select the type of statement from the 2 links provides

RBC Express Core Services

Core Services Pre-read June 2024

9

Select the type of statement.

Select the account enrolled from the dropdown.

Results are displayed, Click View Statement to create PDF which can be printed or saved.

If your date range includes several months the results page may list mulple statements to view – however, they must be

opened separately.

RBC Express Core Services

Core Services Pre-read June 2024

10

To open the document click View Statement - The PDF document should open up in its own window or tab on your

internet browser. *Having trouble? If the document does not appear – your browser may be blocking the pop up

window.

Monthly Business Fees statements allow you to download to either CSV and/or PDF le format.

Help for downloading to CSV format is provided on the page.

*Having trouble?

• Aer you click View Statement the statement should appear in its own window. If it does not the most likely

reason is the internet browser’s pop up blocker sengs.

• To correct this, when you click View Statements look at the very top and/or very boom of your computer

screen. Oen the browser will have some indicaon that something is being blocked from our site.

• You may also go to the browser’s sengs to allow pop ups from our sites address: www6.rbc.com

Account Images

RBC Express Core Services

Core Services Pre-read June 2024

11

Account Images enables you to view images of paper based transacons processed to your RBC business deposit

accounts – in this scenario processed refers to cheques that have been deposited by the recipient.

Searching Account Images

From the blue banner at the top of the screen select Balances, Statements and Reports. Under the Account Images

heading click the search link

Use the selecon criteria to locate the image.

The processing date selecon is limited to 30 day range at a me.

In this example the selecon criteria produces mulple results printed

RBC Express Core Services

Core Services Pre-read June 2024

12

The nal image result will appear in a blue menu window which allows the image to be ipped, magnied, saved or

printed

RBC Express Core Services

Core Services Pre-read July 2024 13

Notes:

Account Control - Payments

This secon of the document will cover the Core Services which allow you to control your cash ow: by moving funds

internally, paying bills and stopping outgoing cheques.

Other Payment Services: the payment services in this document are Account Transfers and Bill Payments. Your prole may

include other payment types than just these Core payments. To learn more about the other transacon types refer to the

following documents:

Wire Payments hps://www.rbcroyalbank.com/rbcexpress/wire-payments.pdf

ACH Record Manager hps://www.rbcroyalbank.com/rbcexpress/Record-Manager-Pre-Read-Training.pdf

ACH Payment Manager hps://www.rbcroyalbank.com/rbcexpress/Payment-Manager-Pre-Read-Training.pdf File

Transfer hps://www.rbcroyalbank.com/rbcexpress/le-transfer-training-job-aid.pdf

Core Payments

RBC Express Core Services

Core Services Pre-read July 2024 14

1

Account Transfers

Transfers within your organizaon’s internal accounts

2

Bill Payments

Pay Canadian companies that have enrolled with RBC as online payees. Typically, this is

used for paying ulies: internet, telephone, hydro, or for paying credit cards you hold with

RBC or other nancial instuons

3

Stop Payments

Place a Stop request on a Cheque or Preauthorized Payment that has been wrien against

your accounts.

Account Transfers

An Account Transfer is a transfer of funds within your organizaon’s internal accounts Internal

accounts may include:

• CAD Business Deposit Accounts

• USD Business Deposit Accounts

Other account types such as RBC Visas, or Loans may be added on an excepon basis. Speak to your RBC representave

to nd out if your non-business deposit accounts can be added into Account Transfers. Visas specically may also be paid

through the Bill Payments feature.

Account Transfer – One Time - Nonrecurring

Using the blue banner at the top of the RBC Express screen choose Payments, Transfer and Deposits. Under the Account

Transfers heading click the Create link.

RBC Express Core Services

Core Services Pre-read July 2024 15

Keep in mind the Cut- O Time Schedule can be viewed on the le hand side of the screen – the cut o me may impact

the Value Date (due date) of the transacon.

Use the drop d

own menus to select the relevant accounts.

RBC Express Core Services

Core Services Pre-read July 2024 16

Account Transfers can be future dated or same

-

day

Enter in the amount

If conversion is required you will need to select the currency

In a case with conversion, you will be presented with a rate which you will accept or reject. If your transfer requires

approval f

r

o

m another user, you will be given an esmated rate

-

the nal approver will see the nal rate

and will have

to accept it b

efore moving forward.

Finish the transfer by providing your approval or by subming the p

ayment to be approved by others (

how to approve

Account Transfers created by others

)

RBC Express Core Services

Core Services Pre-read July 2024 17

Recurring Transfers – always the same amount, scheduled transfers

• A Recurring Account Transfer is a regularly scheduled transfer between your internal accounts where the amount

is always the same.

• Recurring Transfers can be set up with a nal payment date, with a nal number of payments or they can go on

indenitely.

• The recurring payment will be created and approved once and will only need to be re-approved if it is cancelled

or modied.

The set up the recurrence use the Create link under Recurring Account Transfers. Fill in the required elds.

Choose the relevant accounts, Amount and First Transfer date

RBC Express Core Services

Core Services Pre-read July 2024 18

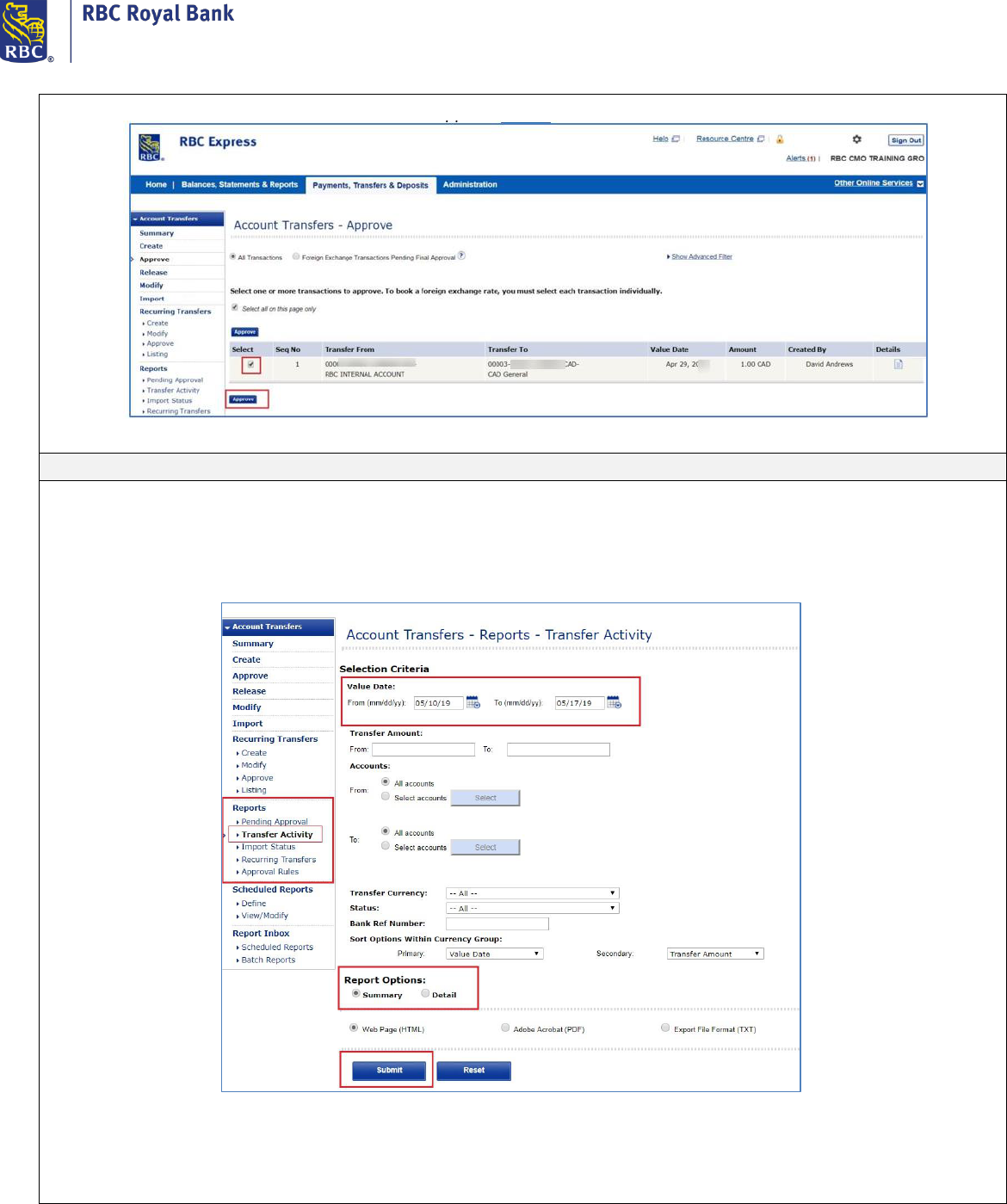

Approve an Account Transfer - Created by other Users:

RBC Express Core Services

Core Services Pre-read July 2024 19

From the home page use the tab that says Payments Transfers & Deposits Under

the Account Transfers heading choose the link that says More

By selecng More you will be brought to the Summary page for Account Transfers, any payments that are pending will

be listed on this page with a hyperlink that can be used to complete the approval.

If there is a pending payment under your own name, the payment may be approved by you. If there is a pending

payment under the business name, the payment cannot be approved by you, and must be approved by another person

within your organizaon :

RBC Express Core Services

Core Services Pre-read July 2024 20

Use the select box on the le and click the blue Approve buon

Reports

The main report is the Account Transfer Acvity Report. The report can be accessed at any me from the le had side

menu, and it has a 180 day (6 month) history

Begin by using the calendars to indicate the date (s) on which the transfer was completed. All other lter criteria is oponal

Under Report Opons there is a Summary and a Detail report

The Summary Report is the basic view:

RBC Express Core Services

Core Services Pre-read July 2024 21

Detail

will allow you s

how you

addional informaon

:

-

Name of who created and approved the payment (with me stamps)

-

Bank Reference number

-

exchange rates (if applicable)

RBC Express Core Services

Core Services Pre-read July 2024 22

Bill Payments

On RBC Express, a Bill Payment allows you to Pay Canadian companies that have enrolled with RBC as online payees also

known as corporate creditors. Typically this is used for paying ulies: internet, telephone, hydro, or for paying credit

cards you hold with RBC or other nancial instuons

Add Bill Payees – Set up Corporate creditors

If it is your rst me using bill payments, you must set up a corporate creditor (adding a payee). Please select the boom

opon on the le-hand side

Aer you have selected your corporate creditor, you must enter in your account number that you hold with them.

Reminder: If you are unsure of what account number to enter here try the following:

• review your most recent bill or invoice from the corporate creditor

• Search their name through this link for a general descripon of their account number criteria (example: the

account number is 10 characters long and begins with XX) hp://www.rbcroyalbank.com/online/online-

billpayees.html

• If you are sll unsure – Please follow up with the creditor/payee in queson.

RBC Express Core Services

Core Services Pre-read July 2024 23

Pay a Bill - Nonrecurring (One me)

Use the drop down menus to select the account you will be paying from, and the Corporate Creditor you are paying.

RBC Express Core Services

Core Services Pre-read July 2024 24

Use the drop down menus to select the account you will be paying from, and the Corporate Creditor you are paying.

Keep in mind that the Approval Rules, created by your organizaon’s Administrators may indicate that this payment

requires further approval.

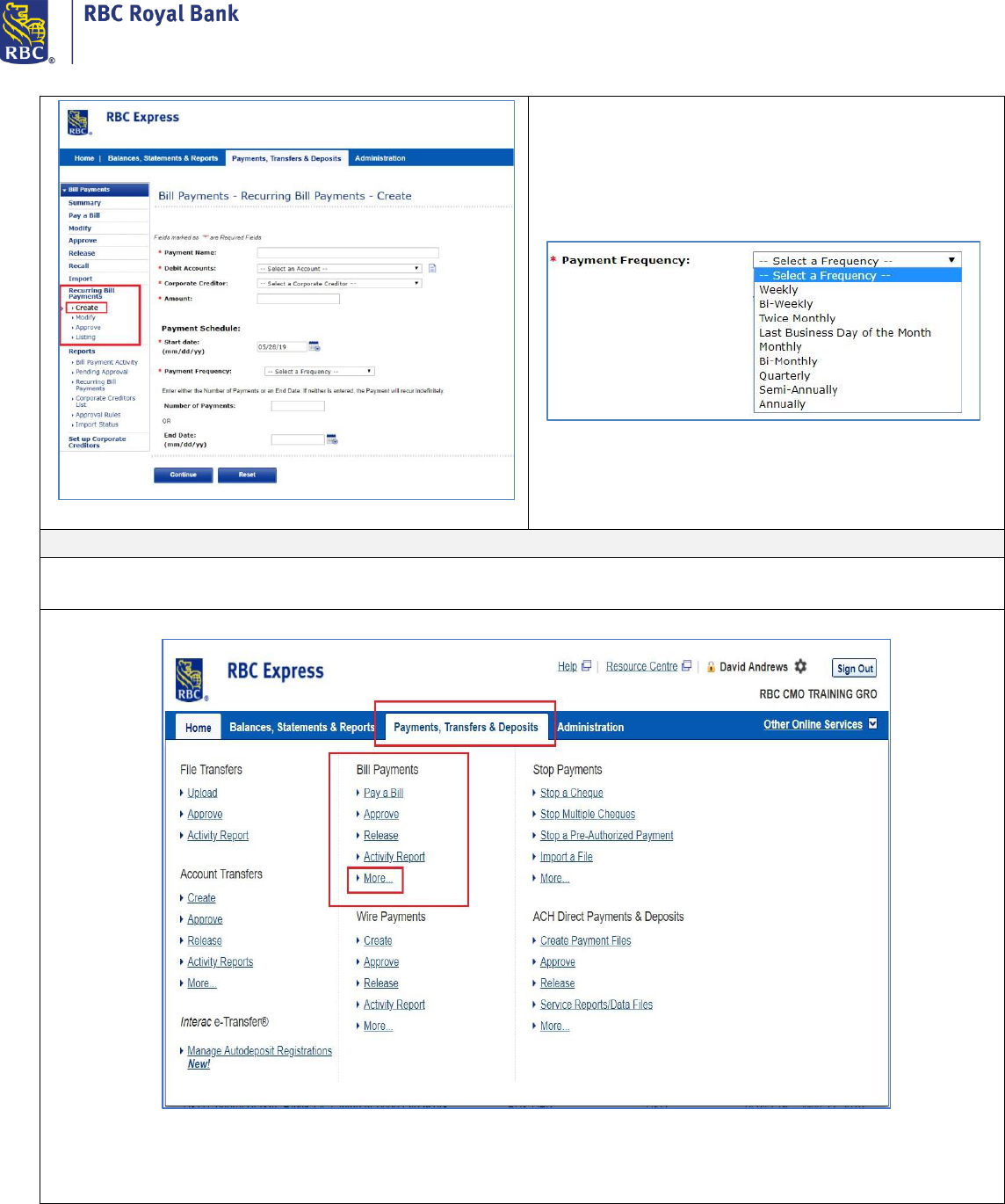

How do you create a recurring Bill Payment?

When the bill amount is always same and is due on a regularly scheduled basis – this can be set up in the recurring

secon of the Bill Payments menu

RBC Express Core Services

Core Services Pre-read July 2024 25

Approve a Bill Payment – created by others

Begin by using the Payments, Transfers, & Deposits tab on the blue banner at the top of the screen, Under the Bill

Payments heading choose the blue More link

RBC Express Core Services

Core Services Pre-read July 2024 26

The “More…” link leads to a summary page where all pending payments are tracked. Use the blue Pending Approval

link to view and complete the payment.

Review the details of the pending payment and use the check box on the le to select and approve the payment.

Approval for Bill Payments requires a password, (in some cases your organizaon may require a token as well) You will

also be asked if the payment should be released now or released later.

RBC Express Core Services

Core Services Pre-read July 2024 27

Reports

The Bill Payment Acvity report has a 180 day (6 month) history

• use the calendar to indicate the date (s)

• use the other oponal lter criteria

• choose Summary or Detail

Detail will provide more informaon than summary

RBC Express Core Services

Core Services Pre-read July 2024 28

The report will provide a “status: completed” and a conrmaon number once it has been completely approved and

released

Stop Payments

This feature allows you to place a Stop request on a Cheque or Preauthorized Payment that has been wrien against your

accounts.

• A Stop payment instrucon will be completed on a best eort basis

• The Stop must be submied before the cheque or payment has been processed by the recipient

• We recommend you nofy the recipient that a Stop Payment has been requested

To submit a stop payment start by using the Payments Transfers & Deposits tab on the blue banner at the top of your

screen. If you have access to Stop Payments it will be visible on this menu

RBC Express Core Services

Core Services Pre-read July 2024 29

• When stopping a cheque, all elds must be entered and be completely accurate. Stopping a cheque is subject to

failure if any of these elds have an error entered (e.g. the serial number you entered on the stop payment diers

from the stop payment on the cheque).

• When stopping a pre-authorized payment, all elds must be entered and be completely accurate. Stopping a pre-

authorized payment is subject to failure if any of these elds have an error entered (e.g. the payment date you

have entered diers from the actual payment date in the account)

Conrming a stop payment

Contact RBC Business Banking: 1-800 -769 -2520

For security reasons, caller authencaon is required. The Business Banking team is only able to share informaon with

the signing ocers of the account(s). If a signing ocer is not available to make this call you may also contact your RBC

representave for alternave measures.

RBC Express Core Services

Core Services Pre-read July 2024 30