Treasury and Trade Solutions

Detailed Payment Status on

CitiDirect BE

®

and Proactive

Payment Status Notifications

Improved User Experience. Benefit from

New Real-Time Status.

Now Available: Real-time status tracking for funds transfers originated from the United States,

the United Kingdom, Germany, the Netherlands, Belgium, Austria, Ireland, France, Australia,

New Zealand, Bangladesh, Singapore, Denmark, Finland, Norway, Sweden, Spain, Jersey, Greece

and Luxembourg.

Where are

detailed statuses

and sub-statuses

available?

Currently, CitiDirect BE

®

users are able to see real-time, detailed payment sub-statuses on

CitiDirect BE for wire payment transactions originated from:

United States United Kingdom Germany Netherlands Belgium

Austria Ireland France Australia New Zealand

Bangladesh Singapore Denmark Finland Norway

Sweden Spain Jersey Greece Luxembourg

The goal is to provide transparency and real-time tracking so that CitiDirect BE users will

know the status of a transaction at any time just by logging into CitiDirect BE.

Where will CitiDirect BE

users see the new

real-time payment

statuses and

sub-statuses?

CitiDirect BE users can access CitiDirect from around the world to track wire payments

statuses. You will see real-time payment status and sub-statuses on CitiDirect’s Payment

Module. Here’s how: As you can see in the screenshot below, simply log onto CitiDirect

BE and navigate to CitiDirect

®

Services. From CitiDirect Services navigate to “My

Transactions & Services” and then select “View All” under “Payment Initiation.”

Frequently Asked Questions

Treasury and Trade Solutions

Where will CitiDirect BE

users see the new

real-time payment

statuses and

sub-statuses? (contd.)

CitiDirect BE users will then see all the transactions on the screen. “Status” and “Sub-

Status” will appear as two separate columns. Users may need to refresh the screen

periodically to show the next status and/or sub-status to which those transactions

have progressed.

Users can also search for the transaction by using the Search option.

Please note: users can also subscribe for proactive payment status notifications for

pending, rejected or returned payments.

Treasury and Trade Solutions

What are the

statuses? And what

do they mean?

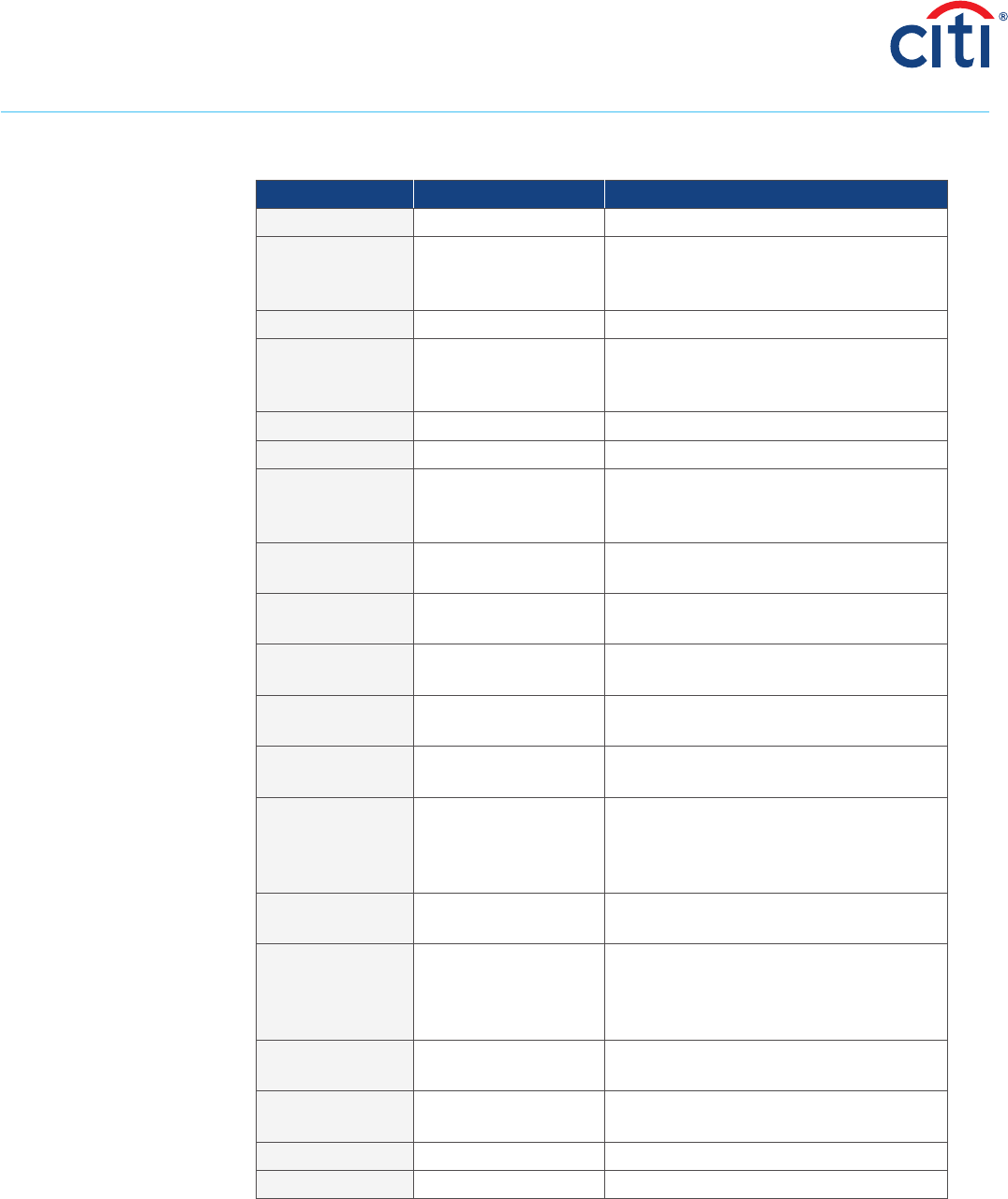

The table below shows all the possible status and sub-status designations that CitiDirect

BE users will see from the time the payment request is submitted until the transaction is

“Processed” or “Rejected” or “Returned.” CitiDirect BE users will see one combination of

status and sub-status at each point in time during the transaction processing, and both

statuses and sub-statuses will be updated in real time as the payment transaction moves

through the cycle.

CitiDirect Status CitiDirect Sub-Status CitiDirect Sub-Status Description

CB Accepted Received for

Citi processing

The payment was received and

successfully handed off for processing.

CB Pending Sent to exception

processing

Requires manual handling to expedite

further processing. Might require some

type of repair.

CB Pending Sent for balance check Completed account and compliance

validations and is sent to check available

balance or credit.

CB Pending Held for funding Due to insufficient balance, balance

check will keep retrying until sufficient

balance is available.

CB Pending Ready for release

for value date

Successfully completed initial validations.

Will be released when the value date

is reached.

CB Pending Rescheduled to next

available value date

Could not complete processing on

value date and has been rolled over for

next-day processing.

CB Pending Sent to clearing

system

Completed all validations and has been

delivered to the local clearing system

for settlement.

CB Pending Returned at clearing

system attempting

to repair

The payment failed to settle at the local

clearing system. Citi is reviewing the

payment for repair.

CB Pending Advice sent to

beneficiary bank

An advice with payment info is sent to

the beneficiary bank advising a payment

will post.

Processed Settled at clearing

System

Citi has received the acknowledgement

that the payment has successfully settled

at clearing system.

Processed Beneficiary account

credited at Citi

The payment has successfully settled

across Citi books and the beneficiary

account has been credited.

Processed Payment sent to

correspondent/

beneficiary bank

Completed processing and Citi generated

outbound payment to correspondent/

beneficiary bank.

Treasury and Trade Solutions

What are the

statuses? And what do

they mean? (contd.)

CitiDirect Status CitiDirect Sub-Status CitiDirect Sub-Status Description

CB Rejected Blocked Originator

Account

Originator account blocked — prohibiting

posting of transactions.

CB Rejected Transaction Forbidden Transaction could not be applied.

CB Rejected Insufficient Funds Insufficient funds in originator account.

CB Rejected Duplicate Payment Duplicate payment.

CB Rejected Inconsistent With

End Customer

Beneficiary name and account

do not match.

CB Rejected Missing Creditor

Address

Missing or incorrect beneficiary address.

CB Rejected Unrecognized

Initiating Party

Party who initiated the payment is not

recognized by the beneficiary.

CB Rejected Missing Debtor

Address

Missing or incorrect originator address.

CB Rejected Incorrect Currency Payment sent with incorrect currency.

CB Rejected Requested

By Customer

Cancellation requested by the remitter.

CB Rejected Invalid Date Invalid date (e.g., wrong settlement date).

CB Rejected Balance Info Request Balance of payments complementary info

is requested.

CB Rejected Settlement Failed Settlement failed.

CB Rejected Missing Mandatory

Information

In Mandate

Mandate related information data required

by the scheme is missing.

CB Rejected Bank Identifier

Incorrect

Bank Identifier code specified in the

message has an incorrect format.

CB Rejected Not Unique

Transaction Reference

Transaction reference is not unique

within the message.

CB Rejected Missing Debtor

Account or

Identification

Missing originator account or

identification.

CB Rejected Missing Debtor

Name or Address

Missing originator name or address.

CB Rejected Missing Creditor

Name or Address

Missing beneficiary name or address.

CB Rejected Regulatory Reason Regulatory reason.

Treasury and Trade Solutions

What are the

statuses? And what do

they mean? (contd.)

CitiDirect Status CitiDirect Sub-Status CitiDirect Sub-Status Description

CB Rejected Specific Service

offered by

Debtor Agent

Due to originator bank account

configuration.

CB Rejected Specific Service

offered by Creditor

Agent

Due to beneficiary bank account

configuration.

CB Rejected Missed Cut-Off Time Missed cut-off time.

CB Rejected Reject reason

not specified

Reject reason not specified.

Returned Due to Beneficiary

Bank Account

Configuration

Due to beneficiary bank account

configuration.

Returned Incorrect Beneficiary

Account Number

Beneficiary account number is formatted

incorrectly.

Returned Closed Beneficiary

Account Number

Beneficiary account number is closed.

Returned Blocked Originator

Account

Originator account blocked — prohibiting

posting of transactions.

Returned Transaction Forbidden Transaction could not be applied.

Returned Blocked Amount Amount of funds available to cover

specified message amount is insufficient.

Returned Wrong Amount Amount received is not the amount

agreed or expected.

Returned Invalid Control Sum Sum of instructed amounts does not equal

the control sum.

Returned Inconsistent with

End Customer

Beneficiary name and account

do not match.

Returned Missing Creditor

Address

Missing or incorrect beneficiary address.

Returned Party Who Initiated

the Payment is not

Recognized by the

Beneficiary

Party who initiated the payment is not

recognized by the beneficiary.

Returned Unknown End

Customer

End customer specified is not known at

associated Sort/National Bank Code or

no longer exists in the books.

Returned Missing or Incorrect

Originator Address

Missing or incorrect originator address.

Returned Incorrect Currency Payment sent with incorrect currency.

Returned Requested BY

Customer

Cancellation requested by the remitter.

Treasury and Trade Solutions

What are the

statuses? And what do

they mean? (contd.)

CitiDirect Status CitiDirect Sub-Status CitiDirect Sub-Status Description

Returned Invalid Date Invalid date (e.g., wrong settlement date).

Returned Unsuccessful

Correspondent/Bene

Bank Validation

Unsuccessful Correspondent/Bene Bank

validation such as invalid SWIFT ID or

incorrect Clearing Code.

Returned Regulatory Reason Regulatory reason.

Returned Balance of payments

complementary info is

requested

Balance of payments complementary info

is requested.

Returned Settlement Failed Settlement failed.

Returned No Mandate No Mandate.

Returned Missing Mandatory

Information

In Mandate

Mandate related information data required

by the scheme is missing.

Returned Refund Request

By End Customer

Return of funds requested by end

customer.

Returned End Customer

Deceased

End Customer is Deceased.

Returned Not Specified Reason

Customer Generated

Reason has not been specified by end

customer.

Returned Not Specified Reason

Agent Generated

Reason has not been specified by agent.

Returned Reject reason

not specified

Reject reason not specified.

Returned Bank identifier

Incorrect

Bank Identifier code specified in the

message has an incorrect format

(formerly Incorrect Format For

Routing Code).

Returned Not Unique

Transaction Reference

Transaction reference is not unique within

the message.

Returned Missing Debtor

Account or

Identification

Specification of the debtor's account or

unique identification needed for reasons

of regulatory requirements is insufficient

or missing.

Returned Missing Debtor

Name or Address

Missing originator name or address.

Returned Missing Creditor

Name or Address

Missing beneficiary name or address.

Returned Missed Cut-Off Time Missed cut-off time.

Returned Duplicate Payment Duplicate payment.

Treasury and Trade Solutions

What are the

statuses? And what do

they mean? (contd.)

CitiDirect Status CitiDirect Sub-Status CitiDirect Sub-Status Description

Returned Too Low Amount Specified transaction amount is less than

agreed minimum.

Returned Zero Amount Specified message amount is equal

to zero.

Returned Due to originator bank

account configuration

Due to originator bank account

configuration.

Returned Bank Identifier

Incorrect

Bank Identifier code specified in the

message has an incorrect format.

Returned Not Allowed Amount Specific transaction/message amount is

greater than allowed maximum.

Returned Incorrect Currency Specified message amount is a

non-processable currency outside

of existing agreement.

Returned Insufficient Funds Insufficient funds in originator account.

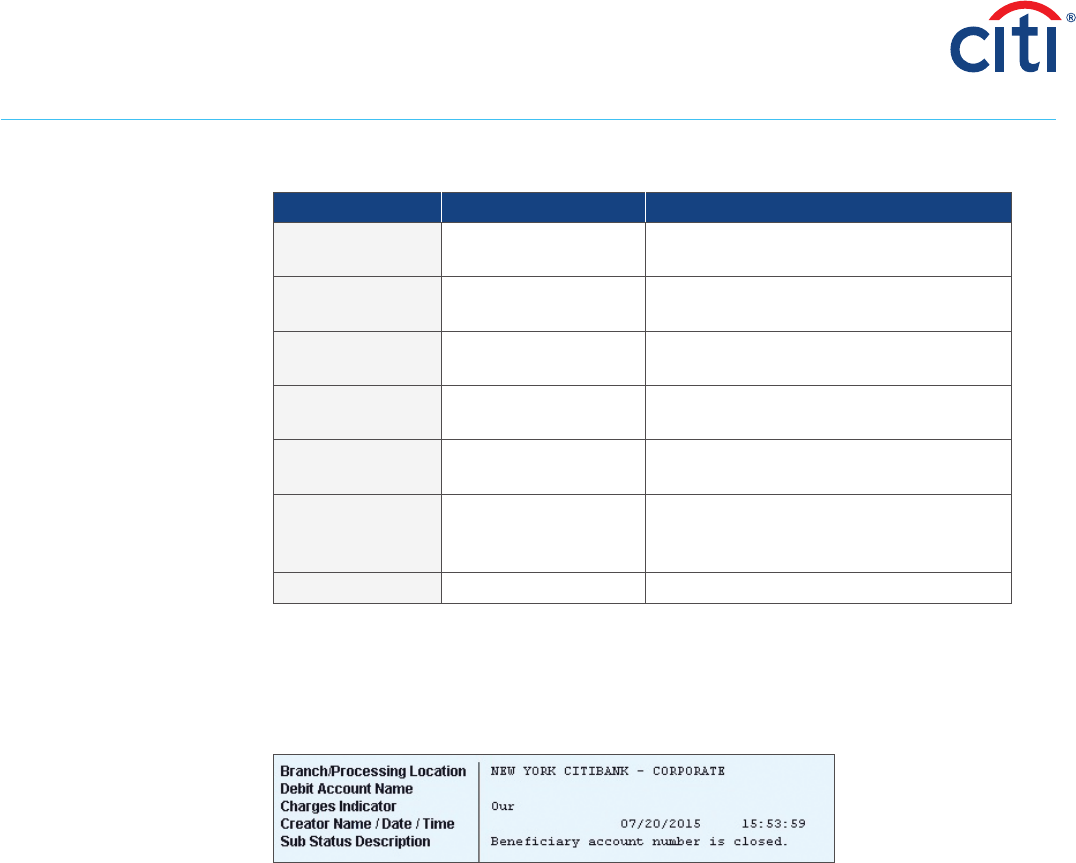

Status descriptions at the bottom of the preview pane:

When users click one of the transactions on the “View All” screen, they can view more

information about that transaction in the preview pane at the bottom of the screen, as

usual. The last line in the preview pane will display the description of the payment status

for the highlighted transaction.

How long does it typically

take for a payment

to go through the

entire cycle?

The entire payment cycle varies depending on the type of transaction and the systems

that it goes through. It might take anywhere from a few minutes to a few days for a

payment transaction to be processed or rejected. Cross-Border Funds Transfer can

take up to three business days for the beneficiary to receive the credit.

Whom should I contact

with questions?

For further questions: Please contact your designated Citi Account Manager or Service

Representative. You can find Local Service contacts on CitiDirect Online Banking by

accessing the “Contacts” link from the homepage.

Treasury and Trade Solutions

Will all payments show the

enhanced sub-statuses?

CitiDirect BE users will see the new sub-statuses for their payments that meet ALL OF

THE FOLLOWING THREE CRITERIA:

1) Payments that are originated from an account domiciled in:

United States United Kingdom Germany Netherlands Belgium

Austria Ireland France Australia New Zealand

Bangladesh Singapore Denmark Finland Norway

Sweden Spain Jersey Greece Luxembourg

2) Ad hoc payment requests that are initiated on CitiDirect or files uploaded via CitiDirect

(such as Citi File Exchange

®

and Citi Swift Exchange

®

). The new sub-statuses do

not apply to payments that are initiated via other channels, including SWIFT via

CitiSwitch

®

, since those payments are not reported on CitiDirect.

3) Wire payments that belong to one of the following categories:

• Book Transfer

• Cross-Border and Domestic Funds Transfer

• The detailed sub-statuses do not apply to ACH and Checks transactions at this time.

What is Proactive Payment

Status Notifications

capability?

This capability gives CitiDirect BE users the option to subscribe for email or/and SMS

notifications about their payment status changes from CitiDirect BE, instead of calling

Service representative or logging into CitiDirect BE.

Does a user have to be an

active mobile user to

subscribe for Payment

Status alerts?

No, all users can receive payment status notifications even if they are not enabled for

CitiDirect BE Mobile.

How can users subscribe

for Proactive Payment

Status Notifications?

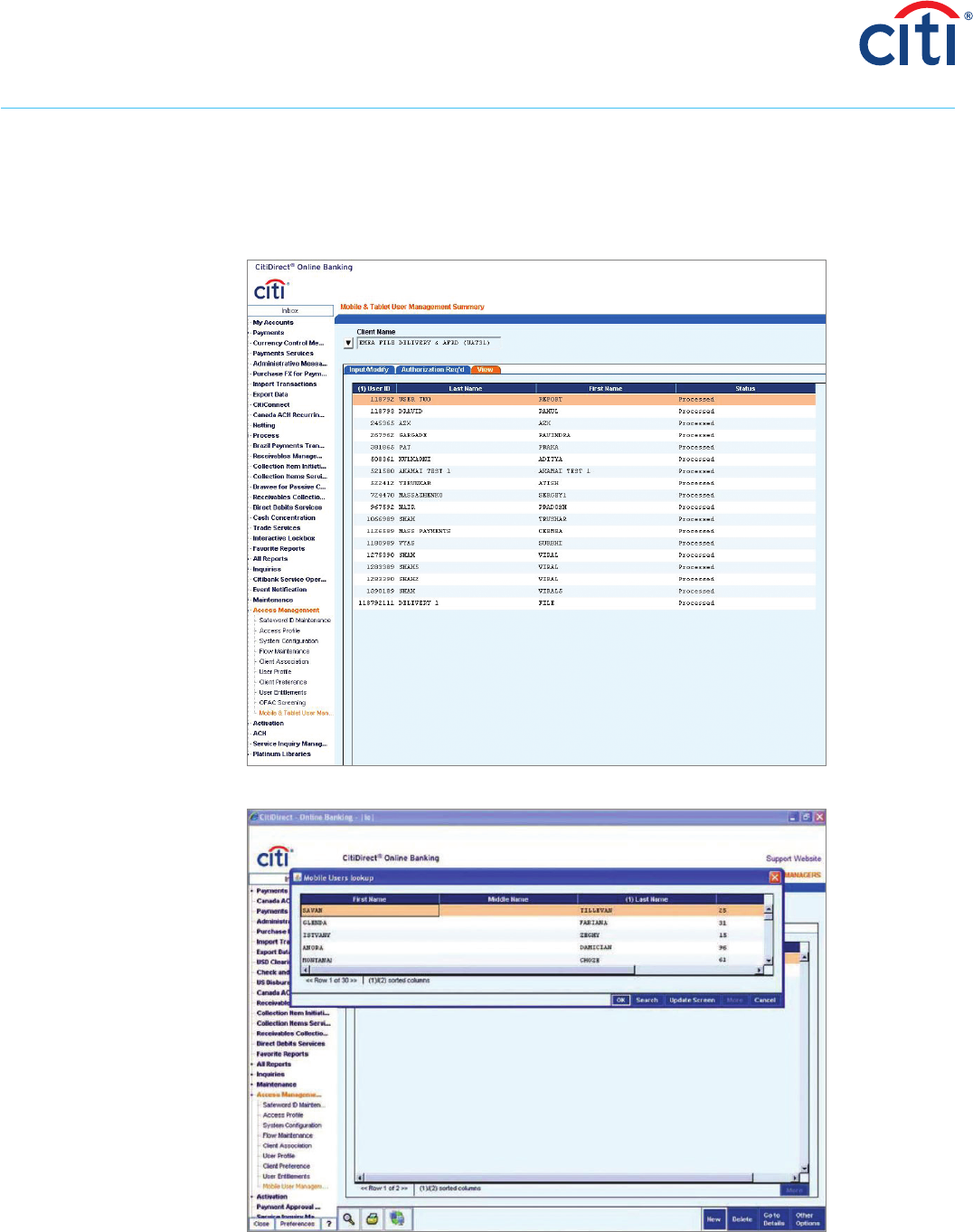

Security Administrator can subscribe users for Payment Status Notifications through

Mobile & Tablet User Management access setup.

To begin the user set up, Security Administrator should select “Mobile & Tablet User

Management” under “User Administration” dropdown.

• Security Administrator then should make a selection of user that belongs to the selected

client that needs the setup. Also, the look up will display only users that are not already

set up for notifications.

• It is possible to select multiple users on the Input/Modify, Authorization Req’d and View

tabs in order to improve the efficiency of granting and adjusting user entitlements.

Highlight multiple users and select “Go to details.” It will be possible to click “Next” at

the bottom of the screen, which will save changes and move to the next selected user.

Treasury and Trade Solutions

How can users subscribe

for Proactive Payment

Status Notifications?

(c ontd.)

• To set up new notifications preferences for Payments Status Notifications, Security

Administrator should click on the New button on the summary grid. The popup page will

open up. Select “Payments” under “Services” and required statuses under “Processes.”

Treasury and Trade Solutions

How can users subscribe

for Proactive Payment

Status Notifications?

(c ontd.)

What payment statuses

are supported for

Proactive Payment

Status Notifications?

• CB Rejected

• Returned

• Pending with the following sub-statuses:

– Sent to Exception Processing (sent to repair for manual handling)

– Held for funding

– Rescheduled to next available value date (rolled over for next day processing)

– Sent for FX Conversion

Does Citi charge for

Proactive Payment

Status Notifications?

No, Citi does not charge for this service.

Are emails delivered as

regular emails or as

secured messages?

Emails are delivered as regular emails.

Can user select multiple

email ID’s to deliver

email notifications?

The user can select up to two email ID’s which must end with “.com” in order

to be supported.

Treasury and Trade Solutions

What languages are

email notifications

available in?

Email alerts are available in English, Polish, Turkish and Italian.

What details will SMS

notification provide?

SMS notification will provide the beneficiary name, amount, currency, value date and

payment status.

Due to the limitation of the allowed number of SMS characters, we are not passing the

payment sub-status or description through the SMS notification.

What details will email

notification provide?

Email notification will provide the beneficiary name, masked beneficiary account number,

amount, currency, value date, payment status and sub-status.

Treasury and Trade Solutions

citi.com/treasuryandtradesolutions

© 2015 Citibank, N.A. All rights reserved. Citi and Arc Design, CitiDirect and CitiDirect BE are registered

service marks of Citigroup Inc. All other trademarks are the property of their respective owners.

1377261 GTS06236 11/15