KATHY HOCHUL ALFONSO L. CARNEY, JR. REUBEN R. MCDANIEL, III

Governor Chair President & CEO

Memorandum

TO: Robert S. Derico, R.A., Director, Office of Environmental Affairs

FROM: Sara E. Stein, AICP, LEED-AP, Senior Environmental Manager

Office of Environmental Affairs

DATE: May 8, 2023

RE: State Environmental Quality Review (SEQR) Type II Determination for the InterAgency Council of

Developmental Disabilities Agencies, Inc., (IAC) 2023 Refinancing and New Money Projects (Other

Independent Institutions Program)

The InterAgency Council of Developmental Disabilities Agencies, Inc. (“IAC”), has requested financing

for certain not-for-profit members from the Dormitory Authority of the State of New York (“DASNY”) for its 2023

Refinancing and New Money Projects (the “Proposed Projects”), pursuant to DASNY’s Other Independent

Institutions Program. Accordingly, the Proposed Project is subject to environmental review pursuant to the State

Environmental Quality Review Act (“SEQRA”).

Based on a review of the attached Transaction Summary Update dated May 2, 2023, and other relevant

documentation, it has been determined that for purposes of SEQRA, the Proposed Action would consist of

DASNY’s authorization of the issuance of an amount not to exceed $28,000,000 in tax-exempt and/or taxable,

fixed- and/or variable-rate, Series 2023 Bonds (the “Bonds”) in one or more series, at one or more times, to be

sold through a negotiated sale and/or a private placement on behalf of IAC members. The proceeds of the bond

issuance would be used as a pool to finance or refinance outstanding indebtedness incurred by participating IAC

members, and to finance or reimburse cash expenditures made by certain participating IAC members for

property acquisition, construction and/or renovation work.

Founded in 1977, IAC is a group of approximately 130 member agencies that operate approximately 900

programs for infants, children and adults with developmental disabilities throughout New York State. Each IAC

member agency is a not-for-profit corporation, formed under the laws of the State of New York, to provide human

services programs to individuals with developmental disabilities or otherwise in need of mental health and

rehabilitation services, educational services, substance abuse services, and residential services. Together, they

serve about 90,000 clients each day in residences, special schools, job training programs, clinical and health

services, and support to families. The services provided by the IAC member agencies are largely funded by the

New York State Office for People with Developmental Disabilities (“OPWDD”).

The following seven IAC members participating in this bond issue are seeking to finance or refinance 19

individual projects, as described below.

Robert S. Derico, R.A.

May 8, 2023

Page 2

Citizens Options Unlimited, Inc., (“COU”) / Community Services Support Corporation (“CSSC”) /

Nassau County AHRC Foundation Inc., (“Foundation”). COU and CSSC, together with the Foundation, are

collectively referred to as “CSSC”. COU, an affiliate agency of the Foundation, empowers clients with intellectual

and developmental disabilities to achieve their goals through self-directed services. CSSC holds title to and

maintains properties for various programs operated by other tax-exempt organizations, such as residential

facilities for the developmentally disabled. Revenues are derived mainly from rental of its properties. The

approximate aggregate principal amount of the Bonds proposed to be issued for the CSSC projects would be

$4,545,000. CSSC would use the Bonds for the financing and/or refinancing of certain existing indebtedness

that was used to finance the acquisition, renovation, furnishing and/or equipping of the following properties:

• 10 Village Drive, Medford, New York (Suffolk County): a 2-story, approximately 2,650-gsf

building to serve as an IRA for 6 individuals;

• 1341 Saxon Avenue, Bayshore, New York (Suffolk County): a 2-story, approximately

2,610-gsf building to serve as an IRA for 6 individuals; and

• 3 Jeanne Road, Lake Grove, New York (Suffolk County): a 2-story, approximately 2,500-

gsf building to serve as an IRA for 6 individuals.

CSSC is the owner and/or operator of the CSSC projects.

Developmental Disabilities Institute, Inc., (“DDI”). DDI serves children and adults with autism and

other developmental disabilities, providing educational, residential, habilitative, vocational, transportation, and

service coordination support to the Long Island community. The approximate aggregate principal amount of the

Bonds proposed to be issued for the DDI projects would be $2,885,000. DDI would use the Bonds for the

financing and/or refinancing of certain existing indebtedness that was used to finance the acquisition, renovation,

furnishing and/or equipping of the following properties:

• 47 Birchwood Drive, Unit 47, Port Jefferson Station, New York (Suffolk County): a 2-

story, approximately 1,140-gsf condominium building to serve as an IRA for 3 individuals;

• 242 Chestnut Street, Port Jefferson Station, New York (Suffolk County): a 2-story,

approximately 1,860-gsf building to serve as an IRA for 6 individuals;

• 1407-09 Middle Road, Calverton, New York (Suffolk County): a 1-story, approximately

1,560-gsf manufactured home on a leased parcel of land to serve as an IRA for 3 individuals;

and

• 18 Alvord Court, Greenlawn, Town of Huntington, New York (Suffolk County): a 2-story,

approximately 2,500-gsf building to serve as an an intermediate care facility (“ICF”) for 6

individuals.

DDI is the owner, except where indicated as leased, and/or operator of the DDI projects.

General Human Outreach in the Community Incorporated (“GHOC”). GHOC is a not-for-profit

agency that provides support services for people with developmental disabilities, with special attention to the

needs of the underserved Asian-American community. The approximate aggregate principal amount of the

Bonds proposed to be issued for the GHOC project would be $4,425,000. GHOC would use the Bonds for the

Robert S. Derico, R.A.

May 8, 2023

Page 3

financing and/or refinancing of certain existing indebtedness previously used to finance the leasing, renovation,

furnishing and/or equipping of the following property:

• 188-52 120

th

Road, St. Albans, New York (Queens County): a 2-story, approximately

2,940-gsf building to serve as to serve as an IRA for 8 individuals; and

• 118-14 193

rd

Street, St. Albans, New York (Queens County): a 2-story, approximately

2,950-gsf building to serve as to serve as an IRA for 12 individuals.

GHOC is the operator and/or operator of the GHOC projects.

HASC Center, Inc. (“HASC”). HASC is a not-for-profit agency that provides residential services, day

programs, and in-home residential habilitation services for adults and children with developmental disabilities

and their families. The approximate aggregate principal amount of the Bonds proposed to be issued for the

HASC project would be $625,000. HASC would use the Bonds for the financing and/or refinancing of certain

existing indebtedness previously used to finance the leasing, renovation, furnishing and/or equipping of the

following property:

• 918 50

th

Street (1

st

and 2

nd

Floors), Borough of Brooklyn, New York (Kings County): a

2-story approximately 1,370-gsf building to serve as an IRA for 10 individuals; and

• 3521 Avenue L, Borough of Brooklyn, New York (Kings County): a 2-story approximately

5,220-gsf building to serve as an IRA for 11 individuals.

HASC is the owner and/or operator of the HASC project.

HeartShare Human Services of New York (“HHS”). HHS nurtures and empowers children and adults

with intellectual and developmental disabilities, including Autism Spectrum Disorders, through education, life

skills and vocational training, employment, residential, case management, recreational, individual and family

supports, and health care services. The approximate aggregate principal amount of the Bonds proposed to be

issued for the HHS projects would be $5,895,000. HHS would use the Bonds for the financing and/or refinancing

of certain existing indebtedness previously used to finance the leasing, renovation, furnishing and/or equipping

of the following property:

• 172-07 35

th

Avenue, Flushing, Borough of Queens, New York (Queens County): a 2-

story, approximately 2,290-gsf building to serve as an IRA for 6 individuals;

• 79 Glascoe Avenue, Borough of Staten Island, New York (Richmond County): a 2-story,

approximately 2,300-gsf building to serve as an IRA for 7 individuals;

• 603 Beach 19

th

Street, Far Rockaway, Borough of Brooklyn, New York (Kings County):

a leased, 2-story, approximately 9,450-gsf building to serve as an IRA for 14 individuals;

• 84-29 153

rd

Avenue, Unit 2CD, Howard Beach, Borough of Brooklyn, New York (Kings

County): a 1-story, approximately 1,600-gsf condominium building to serve as an IRA for 3

individuals; and

• 246 Clarke Avenue, Borough of Staten Island, New York (Richmond County): a 2-story,

approximately 2,000-gsf building to serve as an IRA for 5 individuals.

HHS is the owner, except where indicated as leased, and/or operator of the HHS projects.

Robert S. Derico, R.A.

May 8, 2023

Page 4

Ohel Children’s Home and Family Services, Inc. (“OCHFS”). Ohel provides care and treatment to

developmentally- and physically-disabled children and adults. The approximate aggregate principal amount of

the Bonds proposed to be issued to OCHFS would be $1,415,000. OCHFS would use the Bonds to finance or

refinance certain existing indebtedness used to finance the acquisition, renovation, furnishing and/or equipping

of the following property:

• 226 Caryl Court, Village of Lawrence, New York (Nassau County): a 2-story, approximately

2,440-gsf building to serve as an IRA for 6 individuals.

Ohel is the owner and/or operator of the OCHFS projects.

Young Adult Institute, Inc. (“YAI”). YAI is a not-for-profit corporation providing human services

programs consisting of one or more of educational, vocational, medical, intervention and residential human

services for individuals with developmental disabilities or otherwise in need of mental health and rehabilitation

services, educational services, healthcare services, substance abuse services, and residential services. The

approximate aggregate principal amount of the Bonds proposed to be issued for the YAI projects would be

$8,210,000. YAI would use the Bonds for the financing and/or refinancing of certain existing indebtedness

previously used to finance the acquisition, renovation, furnishing and/or equipping of the properties:

• 120-120 1/2 West 16

th

Street, Borough of Manhattan, New York (New York County): two,

leased, 2-story buildings constituting approximately 13,680-gsf to serve as an IRA for 23

individuals; and

• 600 Deer Park Avenue, Village of Babylon, New York (Suffolk County): a 2-story

approximately 2,550-gsf building to serve as an IRA for 6 individuals.

YAI is the owner, except where indicated as leased, and/or operator of the YAI projects.

DASNY completed this environmental review in accordance with SEQRA, codified at Article 8 of the New

York Environmental Conservation Law (“ECL”), and its implementing regulations, promulgated at Part 617 of

Title 6 of the New York Codes, Rules and Regulations (“N.Y.C.R.R.”), which collectively contain the requirements

for the State Environmental Quality Review (“SEQR”) process.

It has been determined that the Proposed Project would involve the “replacement, rehabilitation or

reconstruction of a structure or facility, in kind, on the same site, including upgrading buildings to meet building,

energy, or fire codes”, which is a Type II action as specifically designated by 6 N.Y.C.R.R. § 617.5(c)(2) of SEQR.

The “…refinancing of existing debt”, the “purchase or sale of furnishings, equipment or supplies, including surplus

government property” and the “license, lease and permit renewals, or transfers of ownership thereof, where there

will be no material change in permit conditions or the scope of permitted activities” are also Type II actions as

specifically designated by 6 N.Y.C.R.R. § 617.5(c)(29), 6 N.Y.C.R.R. § 617.5(c)(31) and 6 N.Y.C.R.R. §

617.5(c)(32), respectively.

Robert S. Derico, R.A.

May 8, 2023

Page 5

Type II “actions have been determined not to have significant impact on the environment or are otherwise

precluded from environmental review under Environmental Conservation Law, article 8.”

1

Therefore, no further

SEQR determination or procedure is required for any component of the proposed project identified as Type II.

The Proposed Projects were also reviewed in conformance with the New York State Historic Preservation

Act of 1980 (“SHPA”), especially the implementing regulations of Section 14.09 of the Parks, Recreation, and

Historic Preservation Law (“PRHPL”), as well as with the requirements of the Memorandum of Understanding

(“MOU”), dated March 18, 1998, between DASNY and the New York State Office of Parks, Recreation, and

Historic Preservation (“OPRHP”). In compliance with Article III, Section 3.0 of the MOU, OPRHP would be

notified of the Proposed Projects being funded with the grant proceeds.

The HHS-leased property at 603 Beach 19

th

Street in Far Rockaway, Brooklyn, is the former St. Mary of

the Sea Convent-McKenna Conference Center, which is eligible for listing in the State and National Registers of

Historic Places (“S/NR”). Proposed renovations would involve interior improvements to meet the Americans with

Disabilities Act (“ADA”) regulations.

The YAI-leased property at 120-120 1/2 West 16

th

Street in Manhattan is the Former New York House

and School of Industry, which is a New York City-designated Landmark and is also eligible for listing in the S/NR.

The proposed renovation was review by OPRHP, and its letter dated December 30, 2020, OPRHP rendered an

opinion that “the project will have No Adverse Impact on this historic resource” with certain conditions that have

subsequenty been met.

It is the opinion of DASNY that the Proposed Projects would have no impact on historic or cultural

resources in or eligible for inclusion in the S/NR.

Attachments

cc: Frederick W. Clark III, Esq.

Matthew Bergin

SEQR File

OPRHP

1

6 N.Y.C.R.R. § 617.5(a).

Transaction Summary Update

InterAgency Council of Developmental Disabilities Agencies, Inc. May 2, 2023

(“IAC”)

Program: Other Independent Institutions Purpose: Refinancing and New Money

DIVISION OF PUBLIC FINANCE AND PORTFOLIO MONITORING

PORTIA LEE, MANAGING DIRECTOR

P

REPARED BY: ALEX SIRDINE (518) 257-3714

New Issue Details

One or more series of fixed and/or variable rate, tax-

exempt and/or taxable bonds in an amount not to

exceed $28,000,000 with maturities not to exceed 26

years are to be sold at one or more times through a

negotiated offering and/or a private placement.

• Lead Manager – Municipal Capital Markets Group,

Inc

.

• Co-B

ond Counsel – Barclay Damon LLP

Lewis & Munday, P.C.

• Underwriter’s Counsel – McCarter & English, LL

P

Purpose

Refinancing of outstanding indebtedness and

reimbursement for, or payment of, cash

expenditures incurred. The pool is anticipated to

include seven participating members of

InterAgency Council of Developmental Disabilities

Agencies, Inc. ("IAC") including:

− Citizen Options Unlimited, Inc./ Community

Services Support Corporation/Nassau

County AHRC Foundation, Inc. – OPWDD

PPA - NYS Office for People wit

h

D

evelopmental Disabilities (“OPWDD”) Prior

Property Approval (“PPA”) funded facilities

($3.7 million);

− Developmental Disabilities Institute, Inc. –

OPWDD PPA funded facilities ($2.3 million);

− General Human Outreach in the Community

Incorporated – OPWDD PPA funded facilities

($2.8 million);

− HASC Center, Inc. – OPWDD PPA funded

facilities ($463,000);

− HeartShare Human Services of New York -

OPWDD PPA funded facilities ($4.9 million);

− Ohel Children’s Home and Family Services,

Inc. – OPWDD PPA funded facilities ($1.2

million);

− Young Adult Institute, Inc. (YAI) – OPWDD

PPA funded facilities ($7.0 million)

E

xpected Security

• A pledge of all public funds attributable to

each financed project.

• Standby intercept of all public funds

attributable to each financed project.

• A debt service reserve fund.

• Mortgages on real property, where available.

Expected Ratings: Aa2/NR/NR

Overview

In 1976, the lack of minimum standards of adequate

care revealed at the Willowbrook State School in

Staten Island resulted in a “consent decree” which

called for New York State to engage in a planned

process for downsizing its institutions and moving

former residents into community-based homes. A

small group of 30 non-profit agencies, mostly founded

and operated by parents of children with

developmental disabilities, banded together in an

inter-agency council to work with government in

designing, developing, and operating a new service

system. IAC’s first goal was to have an agreement

with the State of New York to build and operate the

community-based homes, but only if government

funds to develop programs for those leaving the

institutions were matched on an equal basis with funds

to develop programs for those still living at home.

IAC’s present membership includes over 130

agencies that operate programs for infants, children,

and adults.

Together, they serve about 90,000 people each day in

residences, special schools, job training programs,

clinical and health services, and support to families,

providing services primarily in New York City and

Rockland, Westchester, Nassau, and Suffolk counties.

In 2009, a bill was enacted which amended the

DASNY statute and authorized DASNY to issue bonds

on behalf of IAC members. The Series 2023 Bonds

will be the sixteenth series of bonds issued under the

IAC statute. Each IAC borrower will be obligated to

repay only that portion of bond proceeds loaned to

such borrower.

Transaction Summary Update

InterAgency Council of Developmental Disabilities Agencies, Inc. May 2, 2023

(“IAC”)

Program: Other Independent Institutions Purpose: Refinancing and New Money

DIVISION OF PUBLIC FINANCE AND PORTFOLIO MONITORING

PORTIA LEE, MANAGING DIRECTOR

P

REPARED BY: ALEX SIRDINE (518) 257-3714

Approvals

• Resolution to Proceed – March 1, 2023

• PACB Approval – March 17, 2023

• TEFRA Hearing – May 5, 2023*

• SEQR – May 8, 2023*

*Anticipated date.

Recent Information

The original pool of participants presented to the

Board at the Resolution to Proceed included 7

participants and 17 projects. Since the Resolution to

Proceed, Heartshare Human Services of New York

has added two additional projects. There are now 7

participants, with 19 projects being financed, all of

which have PPAs.

Recommendation

Staff recommends that the Board adopt the necessary

documents for one or more series of bonds with

maturities not to exceed 26 years in an amount not to

exceed $28,000,000.

This Transaction Summary Update was prepared solely to

assist DASNY in its review and approval of the proposed

financing described therein and must not be relied upon by

any person for any other purpose. DASNY does not warrant

the accuracy of the statements contained in any offering

document or any other materials relating to or provided by

the Institutions in connection with the sale or offering of the

Bonds, nor does it directly or indirectly guarantee, endorse

or warrant (1) the creditworthiness or credit standing of the

Institutions, (2) the sufficiency of the security for the Bonds

or (3) the value or investment quality of the Bonds.

The Bonds are special limited obligations of DASNY that are

secured only by the amounts required to be paid by the

Institutions pursuant to the Loan Agreement, certain funds

established under the Resolution and other property, if any,

pledged by the Institutions as security for the Bonds.

Transaction Summary

InterAgency Council of Developmental Disabilities Agencies, Inc. February 21, 2023

(“IAC”)

Program: Other Independent Institutions Purpose: Refinancing and New Money

DIVISION OF PUBLIC FINANCE AND PORTFOLIO MONITORING

PORTIA LEE, MANAGING DIRECTOR

P

REPARED BY: ALEX SIRDINE (518) 257-3714

New Issue Details

Approximately $23,860,000 in tax-exempt and/or

taxable, fixed, and/or variable rate, Series 2023 Bonds

in one or more series, at one or more times, for a term

not to exceed 26 years, are to be sold through a

negotiated sale and/or a private placement.

Purpose

Refinancing of outstanding indebtedness and

reimbursement for, or payment of, cash

expenditures incurred. The pool is anticipated to

include seven participating members of

InterAgency Council of Developmental Disabilities

Agencies, Inc. ("IAC") including:

− Citizen Options Unlimited, Inc./ Community

Services Support Corporation/Nassau

County AHRC Foundation, Inc. – OPWDD

PPA - NYS Office for People with

Developmental Disabilities (“OPWDD”) Prior

Property Approval (“PPA”) funded facilities

($3.6 million);

− Developmental Disabilities Institute, Inc. –

OPWDD PPA funded facilities ($2.3 million);

− General Human Outreach in the Community

Incorporated – OPWDD PPA funded facilities

($3.7 million);

− HASC Center, Inc. – OPWDD PPA funded

facilities ($463,000);

− HeartShare Human Services of New York -

OPWDD PPA funded facilities ($3.5 million);

− Ohel Children’s Home and Family Services,

Inc. – OPWDD PPA funded facilities ($1.2

million);

− Young Adult Institute, Inc. (YAI) – OPWDD

PPA funded facilities ($7.0 million)

Expected Security

• A pledge of all public funds attributable to

each financed project.

• Standby intercept of all public funds

attributable to each financed project.

• A debt service reserve fund.

• Mortgages on real property, where available.

See Attachment I.

Expected Ratings: Aa2/NR/NR

Overview

In 1976, the lack of minimum standards of adequate

care revealed at the Willowbrook State School in

Staten Island resulted in a “consent decree” which

called for New York State to engage in a planned

process for downsizing its institutions and moving

former residents into community-based homes. A

small group of 30 non-profit agencies, mostly founded

and operated by parents of children with

developmental disabilities, banded together in an

inter-agency council to work with government in

designing, developing, and operating a new service

system. IAC’s first goal was to have an agreement

with the State of New York to build and operate the

community-based homes, but only if government

funds to develop programs for those leaving the

institutions were matched on an equal basis with funds

to develop programs for those still living at home.

IAC’s present membership includes over 130

agencies that operate programs for infants, children,

and adults.

Together, they serve about 90,000 people each day in

residences, special schools, job training programs,

clinical and health services, and support to families,

providing services in primarily New York City and

Rockland, Westchester, Nassau, and Suffolk counties.

In 2009, a bill was enacted which amended the

DASNY statute and authorized DASNY to issue bonds

on behalf of IAC members. The Series 2023 Bonds

will be the sixteenth series of bonds issued under the

IAC statute. Each IAC borrower will be obligated to

repay only that portion of bond proceeds loaned to

such borrower.

Additional Information

• Essentiality: The seven borrowers in this pool are

all 501(c)(3) organizations that provide services

that are an essential function of state government.

These services are State mandated and benefit

New York State residents who have developmental

disabilities.

• History and Experience of the Not-For-Profit

Borrowers: The seven borrowers in this pool have

experience and a history of providing needed

services to this population.

• OPWDD Prior Property Approvals (PPA): OPWDD

has issued PPAs for all 17 projects. The PPA

evidences OPWDD’s commitment to pay funds

directly to the provider sufficient to pay depreciation

Transaction Summary

InterAgency Council of Developmental Disabilities Agencies, Inc. February 21, 2023

(“IAC”)

Program: Other Independent Institutions Purpose: Refinancing and New Money

DIVISION OF PUBLIC FINANCE AND PORTFOLIO MONITORING

PORTIA LEE, MANAGING DIRECTOR

P

REPARED BY: ALEX SIRDINE (518) 257-3714

and interest payments associated with the

financing undertaken to effectuate each PPA

project, which commitment is subject to

appropriation.

• Standby Intercept of Public Funds including

OPWDD: The financing structure will provide for a

standby intercept of OPWDD funds up to each

borrower’s allocable share of debt service.

• Replacement Operators: If a provider does not

deliver adequate service or the provider is no

longer able to operate the project in a fiscally viable

manner, OPWDD may take administrative action to

replace the operator and ensure that services

continue to be provided. For PPA projects, the

amounts payable under the PPA, subject to annual

appropriations, will continue to flow to pay debt

service as long as the project continues to be

operated.

• Funding Subject to Government Appropriations:

The projects and services are paid for through

reimbursement arrangements with OPWDD.

OPWDD receives much of its funding through

governmental appropriations, which, if decreased,

could have a negative impact on the revenues of

the borrowers.

Recommendation

The attached staff report recommends that the Board

adopt a Resolution to Proceed for one or more series

of bonds with maturities not to exceed 26 years in an

aggregate amount not to exceed $28,000,000.

This Transaction Summary was prepared solely to assist

DASNY in its review and approval of the proposed financing

described therein and must not be relied upon by any person

for any other purpose. DASNY does not warrant the

accuracy of the statements contained in any offering

document or any other materials relating to or provided by

the Institution in connection with the sale or offering of the

Bonds, nor does it directly or indirectly guarantee, endorse

or warrant (1) the creditworthiness or credit standing of the

Institution, (2) the sufficiency of the security for the Bonds or

(3) the value or investment quality of the Bonds.

The Bonds are special limited obligations of DASNY that are

secured only by the amounts required to be paid by the

Institution pursuant to the Loan Agreement, certain funds

established under the Resolution and other property, if any,

pledged by the Institution as security for the Bonds.

Division of Public Finance and Portfolio Monitoring

February 21, 2023

1

Transaction Report

InterAgency Council

THE PROGRAM: InterAgency Council of Developmental

Disabilities Agencies, Inc. (IAC) was founded in 1977 and

is a not-for-profit membership corporation of voluntary

providers of services to the developmentally disabled in

the New York City metropolitan area. IAC is supported by

over 130 agencies that serve the needs of the residents

of New York State who have developmental disabilities.

Prior to 1972, most individuals in the State with

developmental disabilities lived in state institutions

referred to as “State Schools.” In 1973, the parents of

individuals living at the Willowbrook State School filed

suit in federal court over the living conditions at the

Willowbrook State School. Subsequently, the plaintiffs,

and those similarly situated, were certified as a class (the

“Willowbrook Class”) for purposes of the suit. In 1975, as

a result of the Willowbrook Class action suit, the State of

New York entered into a consent decree (the

“Willowbrook Consent Decree”) committing itself to a

program of improving community placement for the

Willowbrook Class. In the Willowbrook Consent Decree,

the State acknowledged the right of the Willowbrook

Class to active treatment and resolved to reduce the

number of individuals with developmental disabilities in

State Schools to 250 by 1981. Shortly thereafter,

Governor Hugh Carey extended similar benefits to all

qualifying individuals with developmental disabilities. To

achieve the goals of the Willowbrook Consent Decree,

the State agreed to provide people with developmental

disabilities with an opportunity for growth and

development in the “least restrictive environment” and to

provide them with a full and suitable education program.

In an effort to formalize the State’s compliance with the

Willowbrook Consent Decree, a statute creating OMRDD

was signed into law in 1977 and OMRDD began

operating on April 1, 1978. OMRDD’s name was

subsequently changed to the Office for People with

Developmental Disabilities (“OPWDD”). As a result of the

efforts of the State and OPWDD, most individuals with

developmental disabilities receive housing in community

residences, or at home with the assistance of family

support services, rather than at State schools. In

addition, they attend suitable day schools or day

habilitation programs in the community. These services

are provided primarily by the numerous not-for-profit

corporations approved, and largely funded, by OPWDD.

Historically, IAC members financed their capital needs

through the New York State Medical Care Facilities

Finance Agency (“MCFFA”) voluntary agency program.

More recently, IAC members financed their capital needs

through numerous IDAs throughout the state, most

notably the New York City IDA. IAC represents

approximately 130 voluntary providers in the New York

metropolitan area. IAC members provide services in the

areas of clinical and diagnostic service; early

intervention, preschool, and school-age education;

residential service; vocational

rehabilitation; adult day services, and transportation and

family support services. The main purpose of IAC is to

plan, coordinate and integrate the voluntary-operated

services to this population in the metropolitan area, and

promote both private and public policies and programs in

furtherance of the welfare of this population.

DASNY Financing History: This will be the sixteenth

issuance of bonds issued through DASNY for members

of IAC under this program. All seven of the borrowers

have issued debt through DASNY previously. Set forth

below are tables detailing bonds issued using the IAC

pool structure as well as bonds previously issued on

behalf of the individual borrowers included in this pooled

IAC financing.

THE BORROWERS AND THE PROJECTS: The

borrowers in this IAC transaction provide services that

are an essential function of State government serving

New York State residents who have developmental

disabilities.

It is expected that seven IAC members will borrow the

proceeds of the Series 2023 Bonds. The proceeds of the

Series 2023 Bonds will be used to refinance taxable

loans incurred by these borrowers to acquire and/or

Division of Public Finance and Portfolio Monitoring

February 21, 2023

2

renovate their respective facilities and to reimburse

certain borrowers for cash expended on capital projects.

All these members are not-for-profit organizations

exempt from income tax under Section 501(c)(3) of the

Internal Revenue Code.

Historically, the borrowers have drawn funds from their

working capital lines of credit to acquire and/or renovate

new facilities. When renovations are completed, the

borrowers refinance their short-term debt with long-term

tax-exempt bonds. Each of the projects originally

entailed the acquisition and/or renovations of facilities.

Table 2 below shows the project costs and the funding

sources for the projects to be financed.

Table 2

InterAgency Council Pool

Funding Source

Borrower

Year

Founded

Project Costs

PPA OPWDD

Total

Citizens Options Unlimited, Inc.

1982

$3,573,345

$3,573,345

$3,573,345

Developmental Disabilities Institute, Inc.

1961

2,274,619

2,274,619

2,274,619

General Human Services in the Community

1992

3,671,264

3,671,264

3,671,264

Incorporated

HASC Center, Inc.

1963

462,549

462,549

462,549

HeartShare Human Services of New York

1914

3,458,810

3,458,810

3,458,810

Ohel Children’s Home and Family Services, Inc.

1969

1,165,044

1,165,044

1,165,044

Young Adult Institute, Inc.

1957

6,946,845

6,946,845

6,946,845

TOTAL

$21,552,476

$21,552,476

$21,552,476

FINANCING DETAILS: Attachment II provides the detail

for the proposed $23.9 million in Series 2023 Bonds.

Issuance expenses, including the DASNY fee, the

various counsels’ fees and the underwriter’s discount are

estimated at approximately $1.5 million. A debt service

reserve fund will also be funded with bond proceeds.

Public Purpose/Essentiality: The State has a long

history of providing care for developmentally disabled

persons. The method of caring for this population,

however, changed in the 1970’s from institutional settings

to more home-like settings. In addition, as a result of the

Willowbrook Consent Decree, the State committed itself

to a program of improving community placement for this

population. The State has addressed its responsibility

with respect to these individuals by increasing community

placement and closing state-operated facilities. These

community-based service providers deliver an essential

function of State Government and combined, are so

numerous that the State system of serving

developmentally disabled individuals cannot exist without

them.

The not-for-profit borrowers included in these financings

provide community-based services that are an essential

function of State Government and have long and

established track records of providing services to this

population.

Expected Security Provisions: Each borrower’s

obligation under its Loan Agreement will be secured by a

pledge of public funds attributable to the financed

projects. Security provisions will also include standby

intercepts of these funds, certain mortgages on real

property and a debt service reserve fund.

Sources of State Assistance: PPA related OPWDD

funding provides a portion of the revenues through

contracts and reimbursement arrangements for the

provision of their services. Contracts between the

borrowers and OPWDD are subject to annual

appropriation.

OPWDD Prior Property Approval Process (“PPA”): All

OPWDD projects are supported through PPA related

contract and reimbursement arrangements with OPWDD.

Prior to initiating the development of a PPA project to

serve developmentally disabled individuals, a non-profit

provider is required to obtain a Prior Property Approval

from OPWDD. The PPA identifies funding and financing

sources for capital costs and the level and method of

reimbursement to the provider. Medicaid reimbursement

represents a substantial source of OPWDD revenue for

service providers. The State commits to support the

development and operation of the project if it is

completed in conformance with the PPA subject to

annual appropriation of sufficient moneys by the State

Legislature. More specifically, the PPA evidences

OPWDD’s commitment to pay funds directly to the

provider sufficient to pay depreciation and interest

payments associated with the financing of the facility. As

such, each PPA represents approximately 1:1 coverage

Division of Public Finance and Portfolio Monitoring

February 21, 2023

3

on the Series 2023 Bonds attributable to each of the

OPWDD PPA projects. In addition, as discussed further

below, there is a standby intercept of OPWDD funds.

As further evidence of the State’s involvement with these

facilities, it should be noted that prior to initiating the

development of a project to serve individuals with

developmental disabilities, a not-for-profit provider is

required by regulation to complete a Certificate of Need

(“CON”) process. The CON is reviewed by the OPWDD

Developmental Disabilities Services Office for

compliance with local government and general State

plans for needed development as to the type of

individuals to be served and the program to be provided.

As mentioned above, each Borrower is under contract

with OPWDD to provide one or more services to persons

with developmental disabilities. There are 17 projects to

be financed, all of which have PPAs.

The liability for the payment of the allocable portion of

principal and interest on the bonds is the sole

responsibility of each of the borrowers and is not an

obligation of the State of New York. Each borrower will

have its own individual loan agreement and the loans are

not cross-collateralized.

OPWDD State Appropriations: The State of New York

has had a long commitment to ensuring that people with

developmental disabilities experience health and growth

while living in homes to fully participate in communities of

their choice. OPWDD has had a long history of paying

funds directly to the providers sufficient to pay

depreciation and interest associated with the financing of

the PPA approved facilities. Most recently the

appropriations for OPWDD have exceeded $7.0 billion.

Standby Intercept of Public Funds including OPWDD

Funds: The Series 2023 Bonds will have a standby

intercept of public funds attributable to each financed

project. Pursuant to law, DASNY has the right to

intercept all funds payable by any Federal, State or local

agency or social services district otherwise payable to the

participating IAC borrowers to meet their debt service

obligations. Such Public Funds attributable to each

financed project, including the OPWDD revenues and

Medicaid revenues, will be pledged by the borrowers to

secure their respective payment obligations in connection

with the Series 2023 Bonds.

OPWDD Commissioner’s Ability to Replace an Operator:

If a provider does not deliver adequate service or the

provider is no longer able to operate the project in a

fiscally viable manner, OPWDD may take administrative

action to replace the operator and ensure that services

continue to be provided. For PPA projects, the amounts

payable under the PPA, subject to annual appropriations,

will continue to flow to pay debt service if the project

continues to be operated. OPWDD has a responsibility to

ensure that the persons served by these not-for-profits

are provided with quality care. These providers are

regulated and licensed. As such, OPWDD is monitoring

the care and services provided by its not-for-profit

partners.

SUMMARY: The State’s programs and policies

demonstrate the essentiality of community-based

services to the developmentally disabled population in

the State of New York and the seven borrowers in this

pool have had experience in providing needed services

to this population. Accordingly, staff recommends the

adoption of a Resolution to Proceed with a financing in

an amount not to exceed $28,000,000.

This Transaction Report was prepared solely to assist

DASNY in its review and approval of the proposed

financing described therein and must not be relied upon

by any person for any other purpose. DASNY does not

warrant the accuracy of the statements contained in any

offering document or any other materials relating to or

provided by the Institution in connection with the sale or

offering of the Bonds, nor does it directly or indirectly

guarantee, endorse or warrant (1) the creditworthiness

or credit standing of the Institution, (2) the sufficiency of

the security for the Bonds or (3) the value or investment

quality of the Bonds.

The Bonds are special limited obligations of DASNY that

are secured only by the amounts required to be paid by

the Institution pursuant to the Loan Agreement, certain

funds established under the Resolution and other

property, if any, pledged by the Institution as security for

the Bonds.

Division of Public Finance and Portfolio Monitoring

February 21, 2023

4

THE BORROWERS AND THE EXPECTED ADDRESSES OF THE PROJECTS

Citizens Options Unlimited, Inc./Community Services

Support Corporation/Nassau County AHRC

Foundation, Inc. ($3.6 million)

Citizen’s Options Unlimited, Inc. empowers people with

intellectual and developmental disabilities to achieve their

goals through self-directed services.

They are proposing

to refinance the residence facilities at the following

addresses:

• 10 Village Dr., Medford, NY 11763

• 1341 Saxon Ave, Bayshore, NY 11706

• 3 Jeanne Rd., Lake Grove, NY 11755

The governmental funding source for these facilities is

OPWDD (PPA funding).

Developmental Disabilities Institute, Inc. ($2.3

million)

Developmental Disabilities Institute, Inc. serves children

and adults with autism and other developmental

disabilities, providing educational, residential,

habilitative, vocational, transportation, and service

coordination support to the Long Island community. They

are proposing the refinancing of the residential facilities

at the following addresses:

• 47 Birchwood Dr., Port Jefferson Station, NY 11776

• 242 Chestnut St., Port Jefferson Station, NY 11776

• 1407-09 Middle Rd., Calverton, NY 11933

• 18 Alvord Ct., Greenlawn, NY 11740

The governmental funding source for these facilities is

OPWDD (PPA funding).

General Human Outreach in the Community,

Incorporated, Queens, New York ($3.7 million)

General Human Outreach in the Community, Inc.

provides a wide range of services to individuals with

developmental disabilities. They are proposing to finance

the following facility at the following address:

• 188-52 120

th

Rd., St. Albans, NY 11412

• 118-14 193

rd

St., St. Albans, NY 11412

The governmental funding source for this facility is

OPWDD (PPA funding).

HASC Center, Inc., Brooklyn, NY ($463,000)

HASC Center, Inc. is dedicated to providing people with

special needs the necessary empowerment tools to live

as independently as possible.

They are proposing to

finance the following facility at the following addresses:

• 918 50

th

St., 1

st

& 2

nd

Fl, Brooklyn, NY 11219

• 3521 Avenue L, Brooklyn, NY 11210

The governmental funding source for these facilities is

OPWDD (PPA funding).

Heartshare Human Services of New York ($3.5

million)

HeartShare Human Services of New York

nurtures and

empowers children and adults with intellectual and

developmental disabilities, including Autism Spectrum

Disorders, through education, life skills and vocational

training, employment, residential, case management,

recreational, individual and family supports, and health

care services. They are proposing improvements and the

refinancing of the facilities at the following addresses:

• 172-07 35

th

Ave, Flushing, NY 11358

• 79 Glascoe Ave., Staten Island, NY 10314

• 603 Beach 19

th

St., Far Rockaway, NY 11691

The government funding source for these facilities is

OPWDD (PPA funding).

Ohel Children’s Home and Family Services, Inc.,

Brooklyn, New York ($1.2 million)

Ohel Children’s Home and Family Services, Inc.

provides

care and treatment to developmentally and physically

disabled children and adults. They are proposing to

refinance the following IRA facilities, a Day Habilitation

Program facility and an ICF at the following addresses:

• 226 Caryl Ct., Lawrence, NY 11559

The governmental funding source for these facilities is

OPWDD (PPA funding).

Young Adult Institute, Inc., New York, NY ($7.0

million)

Young Adult Institute, Inc. provides a wide range of

services to individuals with developmental disabilities and

their families. They are proposing to refinance the

residential facilities, at the following addresses;

• 120-120 ½ W. 16

th

St., New York, NY 10011

• 600 Deer Park Ave, Babylon, NY 11702

The governmental funding source for these facilities is

OPWDD (PPA funding).

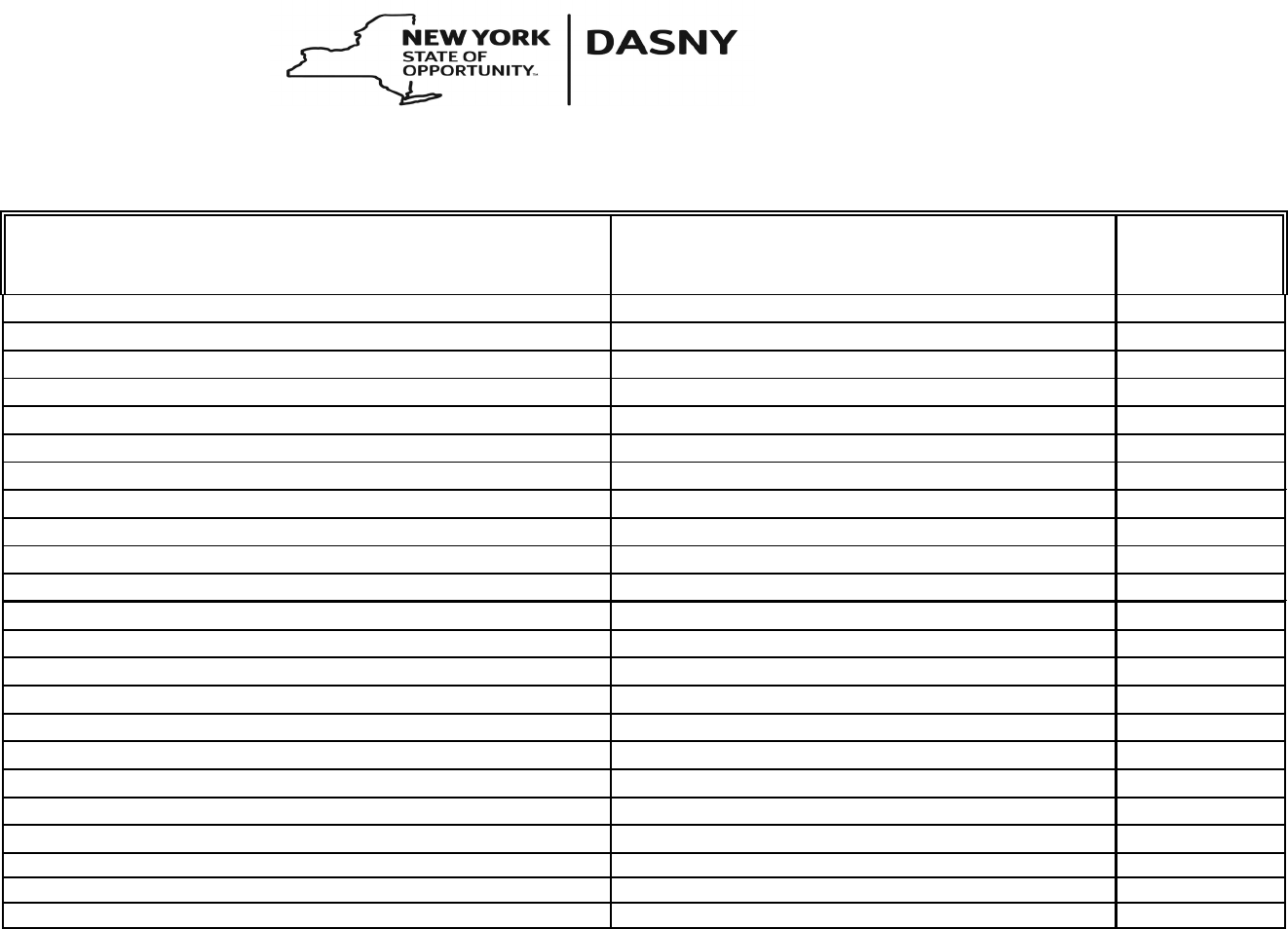

Attachment I

BORROWER EXPECTED PROPERTY ADDRESS

EXPECTED

MORTGAGE

OR LEASE

Citizens Options Unlimited, Inc/Community Services Support

10 Village Dr, Medford

Mortgage

Corporation/Nassau County AHRC Foundation, Inc.

1341 Saxon Ave, Bayshore

Mortgage

3 Jeanne Rd, Lake Grove

Mortgage

Developmental Disabilities Institute, Inc.

47 Birchwood Dr., Port Jefferson Station, NY 11776

Mortgage

242 Chestnut St., Port Jefferson Station, NY 11776

Mortgage

1407-09 Middle Rd., Calverton, NY 11933

Lease

18 Alvord Ct., Greenlawn, NY 11740

Mortgage

General Human Outreach in the Community (GHO)

188-52 120th Rd, St.Albans, NY 11412

Mortgage

118-14 193rd St, St. Albans, NY 11412

Mortgage

HASC Center, Inc.

918 50th St., 1st & 2nd Fl, Brooklyn, NY 11219

Mortgage

3521 Avenue L, Brooklyn, NY 11210

Mortgage

HeartShareHuman Services of New York

172-07 35th Ave, Flushing, NY 11358

Mortgage

79 Glasgoe Ave., Staten Island, NY 10314

Mortgage

603 Beach 19th St., Far Rockaway, NY 11691

Lease

Ohel Children's Home and Family Services, Inc.

226 Caryl Ct., Lawrence, NY 11559

Mortgage

Young Adult Institute, Inc.

120-120 1/2 W. 16th St., NY, NY 10011

Lease

600 Deer Park Ave, Babylon, NY 11702

Mortgage

InterAgency Council Pooled Loan Program

Attachment II

Sources of Funds: Tax-Exempt

Taxable Total

Bond Proceeds 23,040,000$ 820,000$ 23,860,000$

Total Sources 23,040,000$ 820,000$ 23,860,000$

Uses of Funds: % of Par

Deposit to Project Fund 21,552,476$ -$ 21,552,476$

Deposit to Debt Service Reserve Fund 756,364 16,500 772,864

Costs of Issuance

Dormitory Authority Fee 270,000 0 270,000 0.00%

Bond Counsel - 200,000 200,000 0.84%

Printing - 10,000 10,000 0.04%

Ratings - 30,000 30,000 0.13%

Trustee - 12,000 12,000 0.05%

Institution's Counsel - 95,000 95,000 0.40%

IAC Admin Fee - 59,650 59,650 0.25%

Title & Survey - 160,000 160,000 0.67%

DAC Fee - 70,000 70,000 0.29%

Miscellaneous 19,960 20,922 40,882 0.09%

Underwriter Discount 441,200 145,928 587,128 2.46%

Total Uses 23,040,000$ 820,000$ 23,860,000$

InterAgency Council

Sources and Uses of Funds

Dormitory Authority Meeting March 1, 2023

A RESOLUTION OF THE DORMITORY AUTHORITY OF THE STATE OF NEW

YORK (DASNY) AUTHORIZING STAFF AND BOND COUNSEL TO

PROCEED TO TAKE THE NECESSARY ACTION TO PREPARE

THE APPROPRIATE DOCUMENTS TO PROVIDE FOR THE

FINANCING OF FACILITIES FOR INTERAGENCY

COUNCIL FOR DEVELOPMENTAL

DISABILITIES AGENCIES, INC.

Resolved that the staff and bond counsel be authorized to proceed to take the

necessary action and prepare the appropriate documents to provide for the financing of

facilities for InterAgency Council for Developmental Disabilities Agencies., Inc.,

provided, however, that the adoption of this Resolution imposes no duty on the part of

DASNY to issue obligations for or on behalf of InterAgency Council for Developmental

Disabilities Agencies, Inc.

This Resolution shall take effect immediately.