Washington University

Consolidated Financial Statements

June 30, 2021 and 2020

Washington University

Index

June 30, 2021 and 2020

Page(s)

Report of Independent Auditors ..................................................................................................... 1

Consolidated Financial Statements

Consolidated Statements of Financial Position ...................................................................................... 2

Consolidated Statements of Activities ................................................................................................ 3–4

Consolidated Statements of Cash Flows ................................................................................................. 5

Notes to Financial Statements .......................................................................................................... 6–32

PricewaterhouseCoopers LLP, 6 Cardinal Way, Suite 1100, St. Louis, MO 63102

T: (314) 206 8500, www.pwc.com/us

Report of Independent Auditors

To the Board of Trustees of Washington University

We have audited the accompanying consolidated financial statements of Washington University and its

affiliates (the “University”), which comprise the consolidated statements of financial position as of June

30, 2021 and 2020, and the related consolidated statements of activities and of cash flows for the years

then ended.

Management's Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial

statements in accordance with accounting principles generally accepted in the United States of America;

this includes the design, implementation, and maintenance of internal control relevant to the

preparation and fair presentation of consolidated financial statements that are free from material

misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on the consolidated financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States

of America. Those standards require that we plan and perform the audit to obtain reasonable assurance

about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in

the consolidated financial statements. The procedures selected depend on our judgment, including the

assessment of the risks of material misstatement of the consolidated financial statements, whether due

to fraud or error. In making those risk assessments, we consider internal control relevant to the

University's preparation and fair presentation of the consolidated financial statements in order to

design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing

an opinion on the effectiveness of the University's internal control. Accordingly, we express no such

opinion. An audit also includes evaluating the appropriateness of accounting policies used and the

reasonableness of significant accounting estimates made by management, as well as evaluating the

overall presentation of the consolidated financial statements. We believe that the audit evidence we

have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material

respects, the financial position of Washington University and its affiliates as of June 30, 2021 and 2020,

and the changes in their net assets and their cash flows for the years then ended in accordance with

accounting principles generally accepted in the United States of America.

St. Louis, Missouri

October 4, 2021

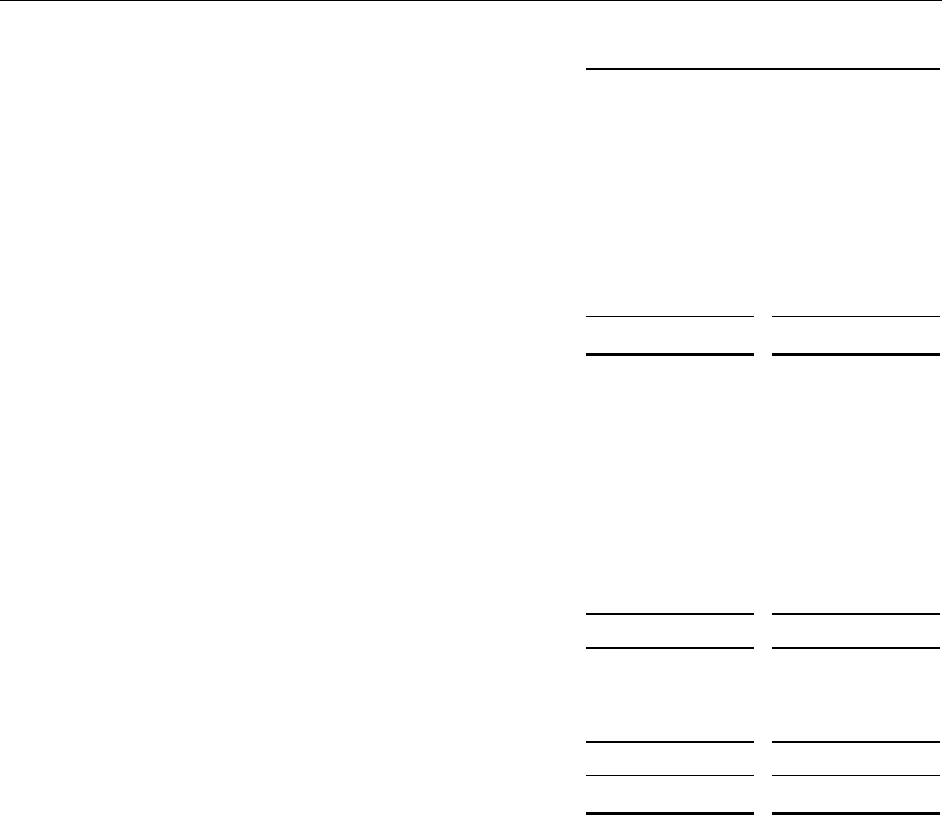

Washington University

Consolidated Statements of Financial Position

June 30, 2021 and 2020

The accompanying notes are an integral part of these consolidated financial statements.

2

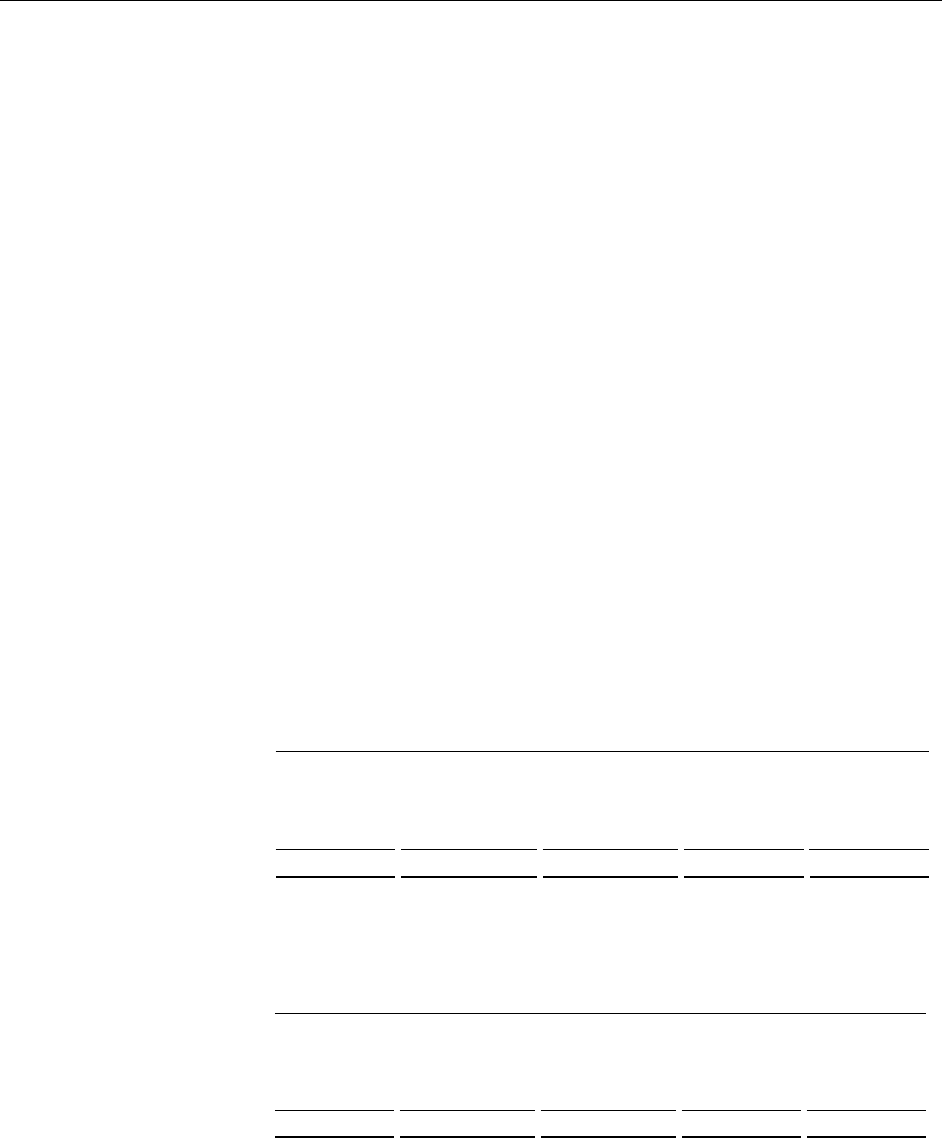

(thousands of dollars) 2021 2020

Assets

Cash and cash equivalents 263,944$ 31 6,246$

Investments 16,461,152 10,616,526

Accounts and notes receivable, net 646,996 552,592

Pledges receivable, net 407 ,232 441,909

Right-of-use assets 88,698

Other assets 327,370 273,473

Fixed assets, net 3,017 ,355 2,902,823

Total assets 21,212,7 47$ 15,103,569$

Liabilities

Accounts payable and accrued expenses 623,047$ 57 5,332$

Deposits, advances and other 34,280 33,388

Lease liability 99,666

Professional liability 95,7 93 91,493

Deferred revenue and contract liabilities 161,045 158,348

Liabilities under split-interest agreements 40,883 38,690

Government supported student loans 17 ,550 22,67 1

Notes and bonds payable 2,390,37 8 2,415,342

Total liabilities 3,462,642 3,335,264

Net Assets

Without donor restrictions 8,37 1,599 5,885,7 28

With donor restrictions 9,37 8,506 5,882,57 7

Total net assets 17,750,105 11,768,305

Total liabilities and net assets 21,212,7 47$ 15,103,569$

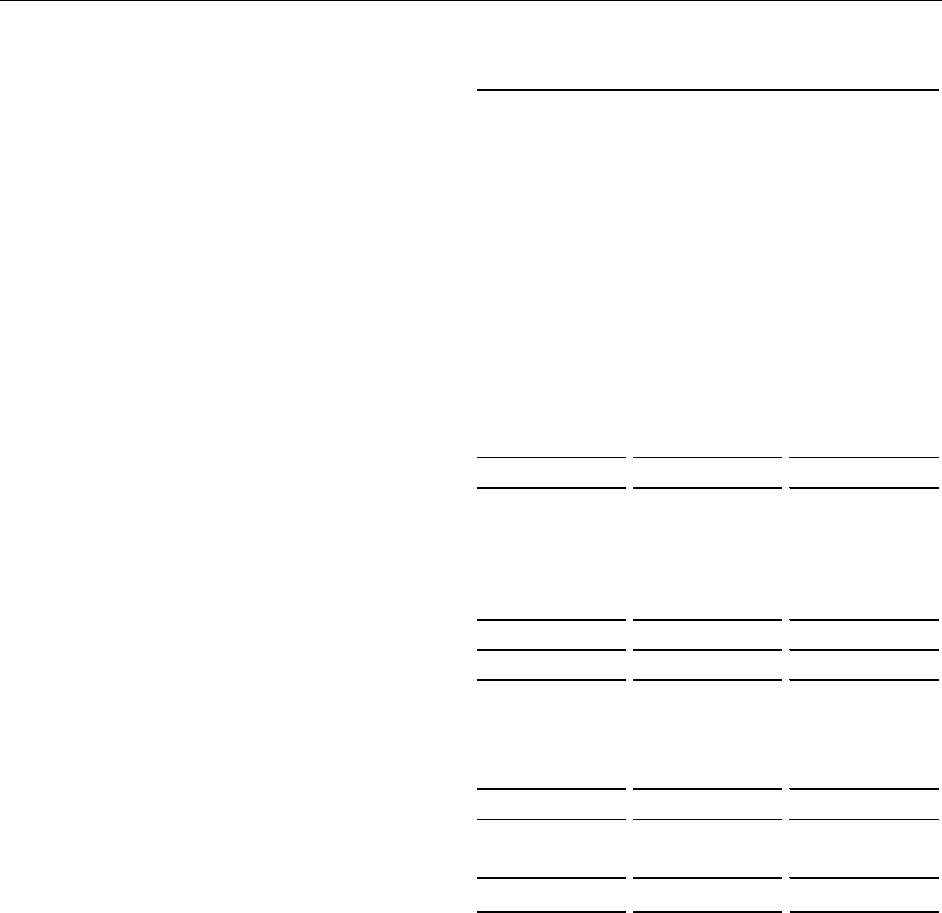

Washington University

Consolidated Statements of Activities

Year Ended June 30, 2021

The accompanying notes are an integral part of these consolidated financial statements.

3

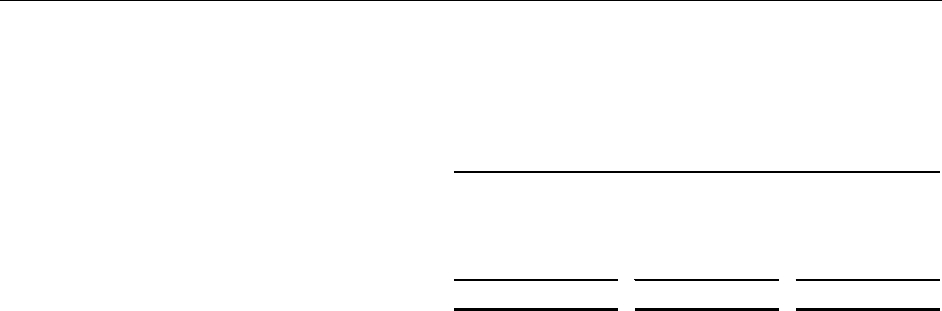

Without Donor With Donor

(thousands of dollars) Restrictions Restrictions Total

Revenues and other support

Tuition and fees 433,334$ $ 433,334$

Endowment spending distribution 354,542 11,237 365,779

Investment return 10,933 184 11,117

Gifts 76,625 81,829 158,454

Grants and contracts revenues

Direct costs recovered 507,306 507,306

Facilities and administrative costs recovered 194,793 194,793

Patient services, net 1,667,815 1,667,815

Auxiliary enterprises - sales and services 90,249 90,249

Educational activities - sales and services 215,868 215,868

Affiliated hospital revenues 154,448 154,448

Other revenue 38,492 2 38,494

Net assets released from restrictions 107,829 (107,829) -

Total Revenues and other support 3,852,234 (14,577) 3,837,657

Expenses:

Compensation expense 2,252,936 2,252,936

Supplies, services, and other 1,124,898 1,124,898

Depreciation expense 213,825 213,825

Interest expense 71,485 71,485

Total expenses 3,663,144 - 3,663,144

Net operating results 189,090 (14,577) 174,513

Non-operating revenues and (expenses):

Investment returns net of endowment spending 2,323,518 3,417,121 5,740,639

Permanently restricted gifts 71,323 71,323

Other non-operating (26,737) 22,062 (4,675)

Non-operating, net 2,296,781 3,510,506 5,807,287

Change in net assets 2,485,871 3,495,929 5,981,800

Net Assets, Beginning of the Year 5,885,728 5,882,577 11,768,305

Net Assets, End of the Year 8,371,599$ 9,378,506$ 17,750,105$

Washington University

Consolidated Statements of Activities

Year Ended June 30, 2020

The accompanying notes are an integral part of these consolidated financial statements.

4

Without Donor With Donor

(thousands of dollars) Restrictions Restrictions T otal

Revenues and other support

Tuition and fees 451,500$ $ 451,500$

Endowment spending distribution 351,383 10,489 361,87 2

Investment return 19,990 1,182 21,172

Gifts 101,843 142,845 244,688

Grants and contracts revenues

Direct costs recovered 483,265 483,265

Facilities and administrative costs recovered 17 7 ,421 17 7 ,421

Patient services, net 1,482,562 1,482,562

Auxiliary enterprises - sales and services 102,434 102,434

Educational activities - sales and services 183,97 4 183,97 4

Affiliated hospital revenues 146,460 146,460

Other revenue 94,352 2 94,354

Net assets released from restrictions 123,17 3 (123,17 3) -

Total Revenues and other support 3,718,357 31,345 3,749,702

Expenses:

Compensation expense 2,183,944 2,183,944

Supplies, services, and other 1,103,911 1,103,911

Depreciation expense 201,97 3 201,973

Interest expense 70,200 7 0,200

Total expenses 3,560,028 - 3,560,028

Net operating results 158,329 31,345 189,67 4

Non-operating rev enues and (expenses):

Investment returns net of endowment spending 307 ,030 17 1,445 47 8,47 5

Permanently restricted gifts 80,184 80,184

Other non-operating (56,517) 27,557 (28,960)

Non-operating, net 250,513 27 9,186 529,699

Change in net assets 408,842 310,531 719,373

Net Assets, Beginning of the Y ear 5,47 6,886 5,57 2,046 11,048,932

Net Assets, End of the Year 5,885,7 28$ 5,882,577$ 11,7 68,305$

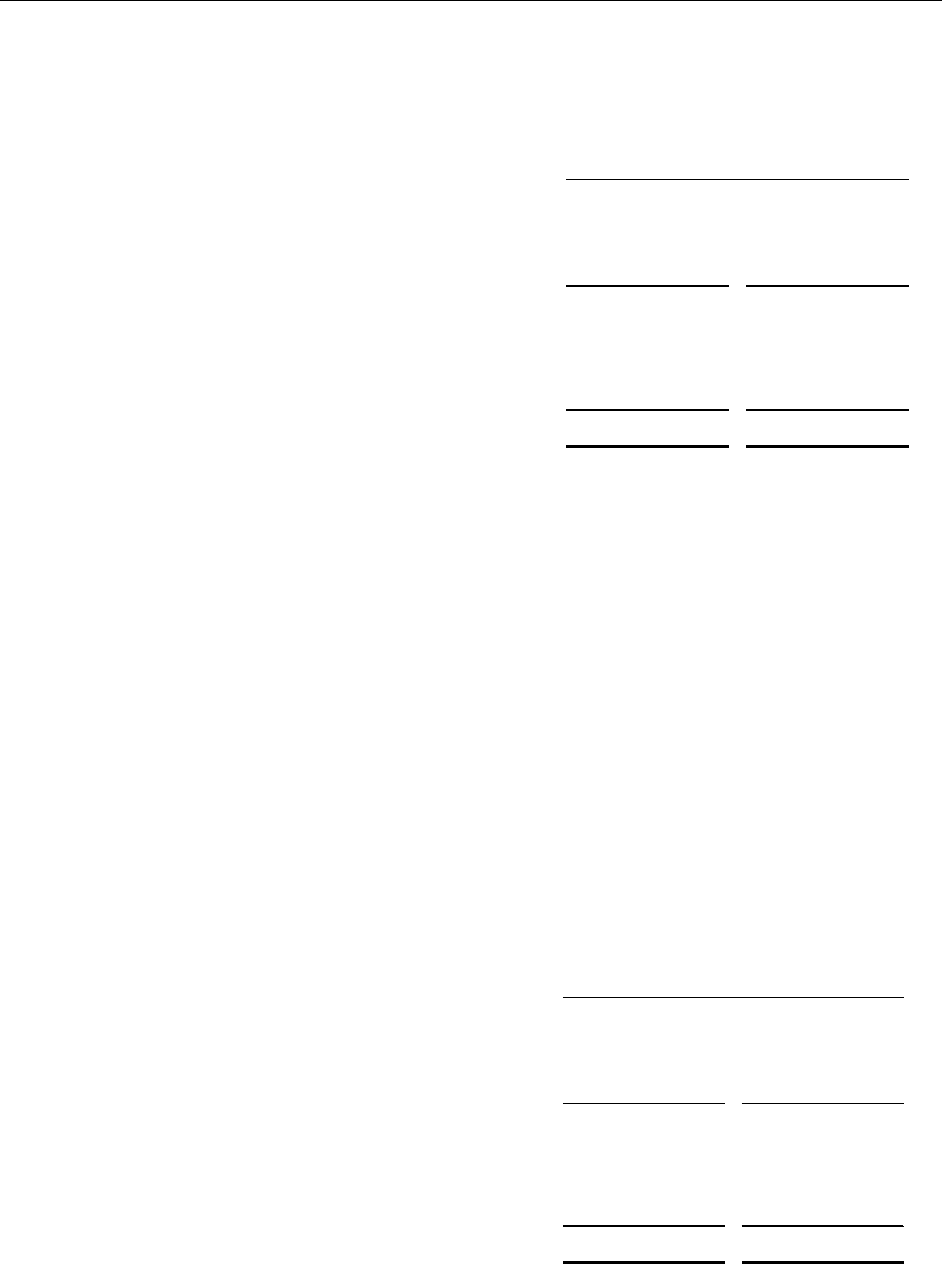

Washington University

Consolidated Statements of Cash Flows

Years Ended June 30, 2021 and 2020

The accompanying notes are an integral part of these consolidated financial statements.

5

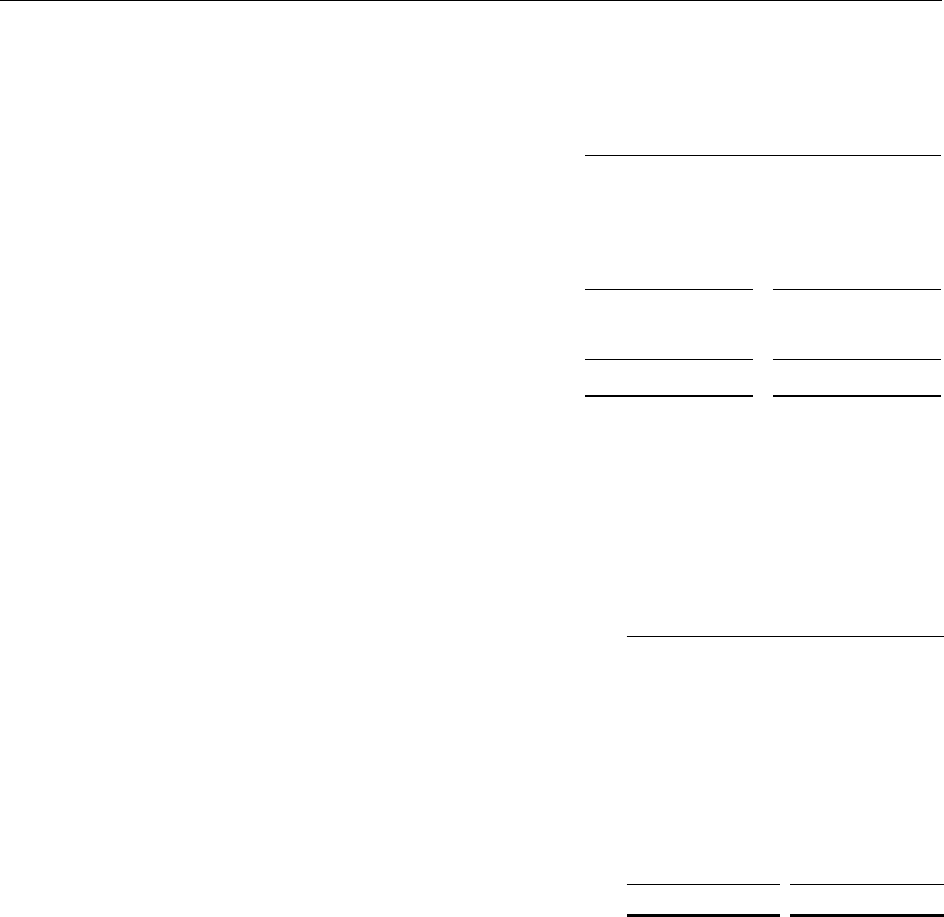

(thousands of dollars) 2021 2020

Cash flows from operating activities

Change in net assets 5,981,800$ 719,373$

Adjustments to reconcile change in net assets to cash

provided by operating activities

Realized and unrealized net gains on investments (6,177,960) (899,464)

Depreciation expense 213,825 201,973

Permanently restricted gifts (71,323) (80,184)

Investments received as gifts - not permanently restricted (12,173) (11,070)

Proceeds from sales of investments received as gifts 12,173 11,070

Debt extinguishment costs 9,635

Operating leases 10,968

Other non-cash adjustments 29,908 59,127

Changes in assets and liabilities

Accounts and notes receivable, net (67,005) 47,113

Pledges receivable, net 30,454 (49,691)

Accounts payable and accrued expenses 46,248 (6,907)

Other assets and liabilities (52,379) 18,984

Net cash (used)/provided by operating activities (55,464) 19,959

Cash flows from investing activities

Proceeds from sales and maturities of investments 6,909,906 5,805,217

Purchases of investments (6,612,196) (5,925,802)

Purchases of fixed assets (345,458) (397,220)

Student loans disbursed (14,376) (15,516)

Student loan payments received 20,565 20,459

Other 45

Net cash used in investing activities (41,559) (512,817)

Cash flows from financing activities

Principal payments of debt (185,011) (150,436)

Proceeds from long-term debt issuance 159,486 509,037

Contributions restricted for long-term investment 65,002 55,465

Proceeds from sales of investments received as gifts 10,400 19,152

Debt extinguishment costs (9,635)

Other (5,156) (14,579)

Net cash provided by financing activities 44,721 409,004

Net decrease in cash (52,302) (83,854)

Cash and cash equivalents

Beginning of year 316,246 400,100

End of year 263,944$ 316,246$

Supplemental data

Interest paid in cash 71,662$ 66,566$

Noncash activities

Contributions of securities and other noncash assets 23,103 36,211

Net change in accounts payable for investments 1,470 (114,118)

Right-of-use assets obtained in exchange for lease liabilities 686

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

6

1. Summary of Significant Accounting Policies

Organization

Washington University in St. Louis (the “university”), is an institution of higher education

that, in furtherance of its role as a charitable and educational institution, engages in various

activities, including instruction, research and provision of medical care.

Basis of Presentation and Use of Estimates

The consolidated financial statements have been prepared on the accrual basis of accounting.

The consolidated financial statements are consolidated to include the accounts of the

university and its affiliates. Significant consolidated affiliates include The Barnard Free Skin

and Cancer Hospital, Parallel Properties LLC including its affiliates, Washington University

Clinical Associates, LLC and associated physician practices, and Washington University

Physicians in Illinois, Inc.

The preparation of consolidated financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at

the date of the consolidated financial statements and the reported amounts of revenues and

expenses during the reporting period. Such estimates include, but are not limited to, the

estimated useful lives of buildings and equipment, the fair value of certain investments (see

footnote 2), the degree of precision in calculation of self-insurance reserves and adequacy of

allowances for doubtful accounts. Actual results could differ from those estimates.

Net Assets

Resources are recorded based on the absence or existence of donor-imposed restrictions.

Descriptions of the net asset categories follow:

Net assets without donor restrictions are free of donor-imposed restrictions. Board-

designated endowment funds are also included within net assets without donor

restrictions.

Net assets with donor restrictions represent net assets that consist of gifts and related

earnings that are subject to donor-imposed restrictions or legal stipulations that have not

yet been met by actions of the university and/or passage of time as well as gifts and trusts

which, by donor restriction, are required to be held in perpetuity. Net assets required to

be held in perpetuity at June 30, 2021 and 2020, are $2,442,688 and $2,365,401,

respectively.

Revenues from sources other than contributions and investment returns are reported as

increases in net assets without donor restrictions. Contributions are reported as increases in

the appropriate category of net assets, except that contributions which impose donor

restrictions that are met in the same fiscal year they are received are included in revenues

without donor restrictions. Gains and investment income that are limited to specific uses by

donor-imposed restrictions are reported as increases in net assets without donor restrictions if

the restrictions are met in the same reporting period as the gains and income are recognized,

except for gains and investment income earned by investment of donor-restricted

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

7

endowments. Such amounts remain in net assets with donor restrictions until appropriated

for expenditure. When a donor restriction expires due to the passage of time or the

university’s fulfillment of donor stipulated purpose, net assets with donor restrictions are

reclassified to net assets without donor restrictions and reported in the consolidated

statements of activities as net assets released from restrictions. Donor restricted gifts that are

to be held in perpetuity are reported in the non-operating section of the consolidated

statements of activities. Gifts of long-lived assets with explicit restrictions that specify how the

assets are to be used and gifts of cash or other assets that must be used to acquire long-lived

assets are reported as restricted support. Absent explicit donor stipulations about how long

those long-lived assets must be maintained, the university reports expirations of donor

restrictions when the donated or acquired long-lived assets are placed in service. Expenses are

reported as decreases in net assets without donor restrictions.

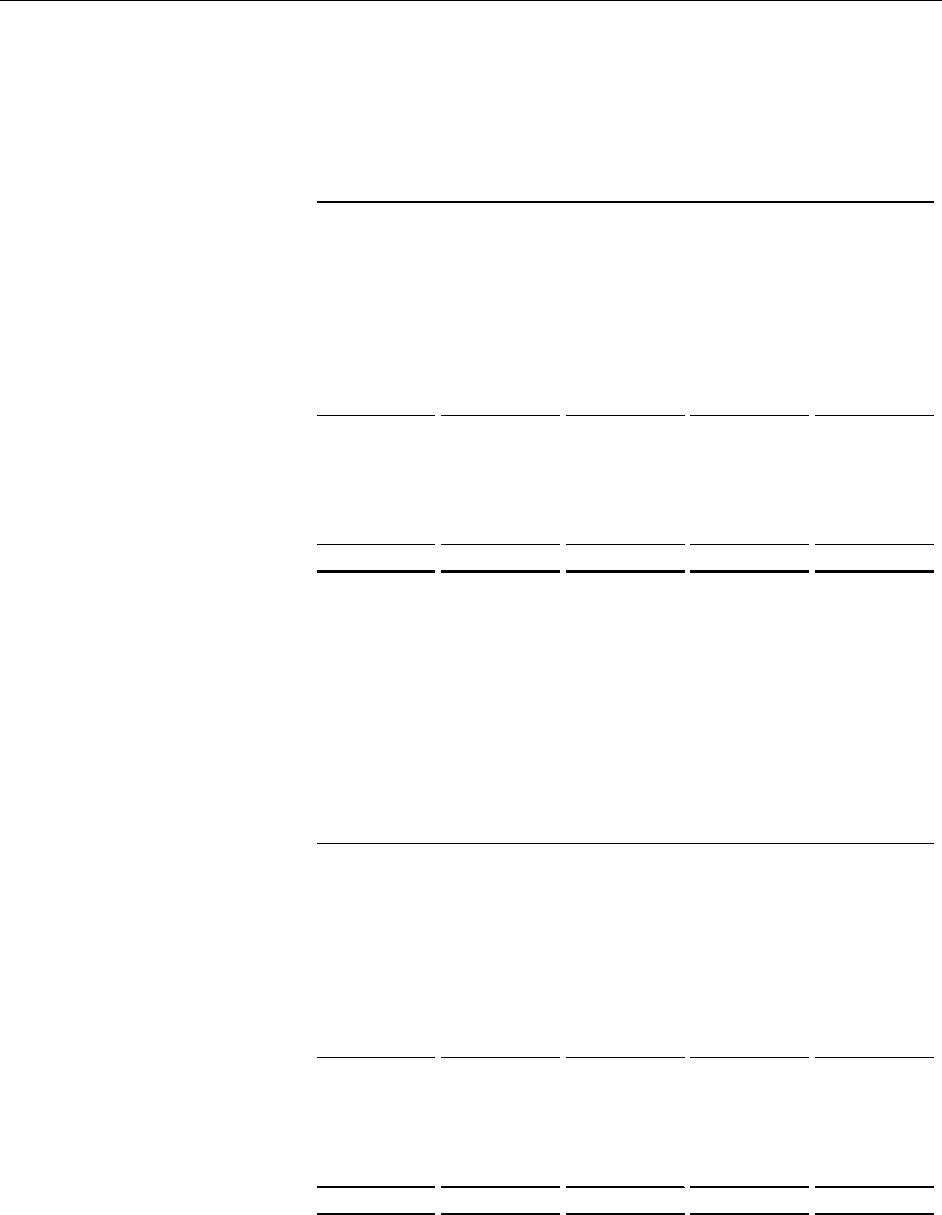

The university’s net assets as of June 30, 2021 consist of the following:

Without donor With donor

restrictions restrictions

Donor-restricted endowment funds $ 8,268,427$ 8,268,427$

Board-designated endowment funds 4,7 53,833 645,821 5,399,654

Investment in plant, net 790,380 790,380

Pledges 407 ,232 407 ,232

Other donor-restricted 57 ,026 57 ,026

Operating and other reserves 2,827 ,386 2,827 ,386

8,37 1,599$ 9,37 8,506$ 17 ,750,105$

Total

The university’s net assets as of June 30, 2020 consist of the following:

Without donor With donor

restrictions restrictions

Donor-restricted endowment funds $ 5,103,500$ 5,103,500$

Board-designated endowment funds 3,085,820 299,97 4 3,385,7 94

Investment in plant, net 7 62,165 7 62,165

Pledges 441,909 441,909

Other donor-restricted 37 ,194 37 ,194

Operating and other reserves 2,037 ,7 43 2,037 ,7 43

5,885,728$ 5,882,57 7$ 11,768,305$

Total

Investments

Investment gains (losses) in excess of endowment spending distribution and the unrealized

appreciation (depreciation) on investments are reported in the non-operating section of the

consolidated statements of activities. Investments acquired by gift or bequest are initially

recorded at market or appraised value at the date so acquired.

At June 30, 2021 and 2020, investments include $163,403 and $274,683, respectively,

purchased with unexpended proceeds from the Series 2017 A Missouri Health and Educational

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

8

Facilities Authority (MOHEFA) revenue bonds issued July 6, 2017 and the Series 2020A

taxable revenue bonds issued April 3, 2020. The 2017A MOHEFA funds and the 2020A bond

funds may be utilized for the purposes set forth in the relevant bond documents.

Fixed Assets

Fixed assets are stated at cost or at fair market values if received as a gift, less accumulated

depreciation, computed on a straight-line basis over the estimated useful lives of the assets.

Fixed assets include equipment and other assets acquired through sponsored programs during

which title is retained by the resource provider. It is probable the university will be permitted

to keep the assets when the program terminates. The cost and accumulated depreciation of

fixed assets are removed from the records at the time of disposal. Fixed assets by classification

at June 30, 2021 and 2020 consist of the following:

2021 2020

Construction in progress 320,7 01$ 311 ,806$

Land and improvements to land 190,825 17 8,356

Buildings 4,7 43,990 4,502,505

Equipment 663,409 619,921

Total cost 5,918,925 5,612,588

Accumulated depreciation (2,901,570) (2,709,765)

Total fixed assets, net 3,017 ,355$ 2,902,823$

Collections

In addition to the Mildred Lane Kemper Art Museum, the university archives rare book

collections, works of art, literary works, historical treasures and artifacts. These collections are

protected and preserved for public exhibition, education, research and the furtherance of

public service. They are neither disposed of for financial gain nor encumbered in any manner.

Accordingly, such collections are not recognized or capitalized for financial statement

purposes.

Leases

The university determines if an arrangement is or contains a lease at inception based on

whether the contract conveys the right to control the use of identified property, plant, or

equipment in exchange for consideration. The university has both leases under which it is

obligated as a lessee and leases for which it is the lessor. Operating leases in which the

university is a lessee are included in right-of-use (ROU) assets and lease liabilities on the

consolidated statements of financial position. The university has elected the short-term lease

exception under ASC 842 for all leases, and therefore, leases with an initial term of 12 months

or less are not included on the consolidated statements of financial position. ROU assets

represent the right to use an underlying asset for the lease term, and lease liabilities represent

the obligation to make lease payments arising from the lease, measured on a discounted basis.

The interest rate implicit in lease contracts is typically not readily determinable, and as such,

the university uses its collateralized borrowing rate using a period comparable with the lease

term in determining the present value of lease payments. The lease term may, at the

university’s discretion, include options to extend or to terminate the lease that the university is

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

9

reasonably certain to exercise. Lease expense for lease payments is recognized on a straight-

line basis over the lease term within the supplies, services and other line of the consolidated

statement of activities. Variable lease payments based on an index or rate, such as the

consumer price index, are initially measured using the index or rate in effect at lease

commencement. The university has lease agreements with non-lease components that relate

to the lease components. The university elected the practical expedient to account for non-

lease components and the lease components to which they relate as a single lease component

for all leases. Leasing arrangements for which the university is the lessor are not material to

the consolidated financial statements.

Financing Receivables

Financing receivables are principally loans made to students or their parents utilizing gifts,

endowment payout, and university resources designated for that purpose and from funds

provided by the United States government under the Federal Perkins and Health Professional

Student Loan programs. Loan funds are reported at estimated realizable value, as it is not

practical to determine the fair value of loan fund receivables, which include a large component

of federally sponsored student loans. Federally sponsored student loans have significant

government restrictions as to marketability, interest rates, and repayment terms. Federal

funds are ultimately refundable to the government and are recognized as a liability in the

consolidated statements of financial position.

The university’s loan portfolio includes over 5,800 individual loans and is geographically

diverse. Loans are considered past due if the minimum payment is not received within thirty-

one days past the due date. At June 30, 2021 and 2020, respectively 95% and 94% of the

parent loans and 73% and 74% of the institutional student loans were considered current.

Income earned on financing receivables is recorded on an accrual basis.

Deferred Revenue and Contract Liabilities

Deferred revenue is recognized on an accrual basis when payments for services are received in

advance of performance by the university. The principle components of deferred revenue are

clinical trial receipts, grants and contracts, and prepaid tuition and housing.

Tuition and Fees

Tuition and fee revenue, net of scholarships and other implicit price concessions, is recognized

over-time using the output method of measuring progress in the fiscal year in which the

educational programs are conducted. Students are invoiced at the commencement of each

academic period. Payment is due when invoiced. The performance obligation, delivery of

educational services, is satisfied as services are rendered. If delivery of the performance

obligation is not complete as of fiscal year-end, a contractual liability is recorded. The deferred

contract liability at June 30, 2021 and 2020 was $50,657 and $45,962, respectively, and is

reported as deferred revenue and contract liabilities on the consolidated statement of financial

position.

Demonstrated financial need is the major criteria for undergraduate students to receive

financial aid. Graduate students often receive tuition support in connection with research

assistant, teaching assistant and fellowship appointments. Total financial aid granted to

students by the university, including aid provided to employees and their dependents, for the

years ended June 30, 2021 and 2020, respectively, was $423,790 and $413,029.

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

10

The table below identifies student aid by type. Scholarships are reported net against tuition in

the consolidated statements of activities. Other amounts are reported as expenses.

2021 2020

Scholarships from unrestricted sources 227 ,169$ 221,068$

Scholarship support from gifts, endowment

and other restricted sources 7 7 ,632 7 4,081

Total scholarships 304,801 295,149

Employee and dependent tuition benefits 38,198 38,446

Stipends 7 9,221 7 7 ,326

Wo rk study 1 ,5 7 0 2,1 0 8

Total 423,7 90$ 413,029$

Gifts

Gifts, including unconditional promises to give, are recognized as revenues in the period the

gift or promise is received. Gifts received for permanent endowments or perpetual trusts are

reported as non-operating revenues. Gifts of assets other than cash are recorded at their

estimated fair value at the date of gift and, unless instructed otherwise by the donor, are

liquidated upon receipt or as soon as practical thereafter.

Conditional gifts and promises to give are not recognized until the conditions on which they

depend are substantially met. Gifts, in the form of unconditional promises to give, to be

received after one year are discounted at credit-adjusted tax exempt borrowing rates in

accordance with fair value accounting. Pledges outstanding are discounted with rates ranging

from 0.20% to 2.04%. Amortization of the discount is recorded as gift revenue. The university

has received gifts which are recorded as gift revenue in the period the gift was made but are

payable over a specified payment schedule of up to 10 years or more. During the gift payment

term, the university is exposed to credit risk for the entity or individual that has made the gift.

An allowance is made for uncollectible unconditional promises to give based upon

management’s judgment, past collections experience and other relevant factors.

A summary of pledges receivable is as follows:

2021 2020

In one year or less 152,990$ 165,399$

Between two and five years 145,37 1 153,459

Over five years 125,702 144,145

424,063 463,003

Less:

Disc o unt (8,1 32 ) (1 2 ,5 40 )

Allowance for uncollectible amounts (8,699) (8,554)

Total 407 ,232$ 441 ,909$

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

11

Grants and Contracts

The university receives grant and contract revenue from governmental and private sources.

Revenue associated with the direct costs of sponsored programs is generally recognized as the

related costs are incurred. At contract inception, the university determines whether the goods

or services to be provided are to be accounted for as a single performance obligation or as

multiple performance obligations. If multiple performance obligations are identified, the

university generally uses the cost plus a margin approach to determine the relative standalone

selling price of each performance obligation. Revenue from these contracts is earned over-

time. Invoicing of the customer, if required, will generally be in accordance with terms of the

contract with payment due when invoiced. Generally, the time between the receipt of payment

and the transfer of goods and service under these contracts is less than one year.

The university records revenue without donor restrictions upon its recovery of direct and

indirect costs applicable to those sponsored programs that provide for the full or partial

reimbursement of such costs. Most grants awarded to the university by government agencies

are conditional contributions. The principle condition attached to these awards is that the

university must incur costs in accordance with the Office of Management and Budget’s

uniform guidance before costs can be reimbursed. Total amounts promised under these grants

for which conditions have not yet been fulfilled are approximately $889,722 and $879,544 at

June 30, 2021 and June 30, 2020, respectively. The recovery of indirect costs, also referred to

as facilities and administrative costs is based on negotiated rates and represents recoveries of

facilities and administrative costs incurred under grants and contracts agreements. Recovery

of facilities and administrative costs of federally sponsored programs is at rates negotiated

with the Department of Health and Human Services.

In some cases, the sponsor will prepay amounts in anticipation of costs to be incurred. In

those cases, amounts received in excess of costs incurred are recorded as contract liabilities.

Patient Services Revenue

Net patient service revenue is reported at the amount that reflects the consideration to which

the university expects to be entitled in exchange for providing patient care. These amounts are

due from patients, third-party payers (including health insurers and government programs),

and others. Generally, the university bills the patient and third-party payers several days after

the services are performed. Revenue is recognized as performance obligations are satisfied.

Revenue for performance obligations satisfied over time is recognized based on actual charges

incurred in relation to total expected or actual charges which provides a faithful depiction of

the transfer of services over the term of the performance obligation based on the inputs needed

to satisfy the obligation.

Because the majority of its performance obligations relate to contracts with a duration of less

than one year, the university has elected to apply the practical expedient provided in FASB

ASC 606-10-50-14a, and therefore is not required to disclose the aggregate amounts of the

transaction price allocated to performance obligations that are unsatisfied or partially

unsatisfied at the end of the reporting period.

Generally patients who are covered by third-party payers are responsible for related

deductibles and coinsurance, which vary in amount. The university also provides services to

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

12

uninsured patients. The transaction price for both uninsured patients, as well as insured

patients with deductibles and coinsurance, is estimated based on historical experience and

current market conditions. The initial estimate of the transaction price is determined by

reducing the standard charge by any contractual adjustments, discounts and implicit price

concessions. The university determines its estimates of contractual adjustments and discounts

based on contractual agreements, its discount policies and historical experience. The

university determines its estimate of implicit price concessions based on historical collection

experience with these classes of patients using a portfolio approach as a practical expedient.

The portfolio approach is being used as there are a large volume of similar contracts with

similar classes of customers. Management’s judgment to group the contracts by portfolio is

based on the payment behavior expected in each portfolio category. The effect of applying a

portfolio approach to a group of contracts would not differ materially from considering each

contract separately. Contractual adjustments to patient service revenue were $2.13 billion and

$1.84 billion for the years ended June 30, 2021 and 2020, respectively.

The university has elected the practical expedient allowed under FASB ASC 606-10-32-18 and

does not adjust the promised amount of consideration from patients and third-party payors for

the effects of a significant financing component due to the expectation that the period between

the time the service is provided to a patient and the time that the patient or a third-party payor

pays for that service will be one year or less. In certain instances, the university may enter into

payment agreements with patients that allow payments in excess of one year. For those cases,

the financing component is not deemed to be significant to the contract. The university

reported net accounts receivable for patient services of $175,945 and $144,755, at June 30,

2021 and 2020, respectively.

Auxiliary Enterprises – Sales and Services

Auxiliary enterprises sales and services revenue is primarily earned over-time utilizing the

output method of measuring progress. Auxiliary enterprise sales and services contracts will

generally constitute a single performance obligation as there is a single promise. This revenue

is composed primarily of on and off campus housing charges, dining services, and parking and

transportation fees with separate contracts for each type of service. Housing, dining services

and parking fees are invoiced to undergraduate students at the beginning of each academic

period. Payment is due upon invoice issuance. Graduate students and undergraduates who

live off campus sign rental agreements providing for monthly rent payments. Each contract

for services in this category has a duration of one year or less. A contract liability is recorded

for the delivery of performance obligations that is not completed prior to the fiscal year end.

Educational Activities – Sales and Services

Clinical trial revenue is earned over-time as the university provides services. The transaction

price is negotiated with the customer and is usually based on standard rates for clinical

services and the expected cost to complete the contract. Payment terms under these contracts

vary but generally provide for the right to invoice the customer as work progresses, either

based on units performed or the achievement of billing milestones. The university has

determined that an input method using costs incurred as a basis to estimate revenue earned

best depicts the pattern of transfer of control to the customer. In those limited cases where

prepayments are significant, revenue is deferred until earned and a contract liability is

recorded. The contract liabilities at June 30, 2021 and 2020 are $50,800 and $56,325,

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

13

respectively, and are reported as deferred revenue and contract liabilities on the consolidated

statement of financial position.

Contracts in other educational sales and services cover a broad range of activities including

physician services to affiliated and unaffiliated hospitals, executive education program fees

and royalties. Revenue from the contracts in this category is earned over time as services are

rendered. The measure of progress varies according to the nature of the services provided.

Invoicing to customers is performed in the cadence required under the contracts and amounts

invoiced generally are considered due upon receipt. Accruals for services provided but not yet

invoiced are recorded at year end. Amounts receivable under service contracts are $64,239

and $72,635 at June 30, 2021 and 2020, respectively. Fees for executive education programs

are often received in advance of the program and represent a contract liability. Such amounts

are reported as deferred revenue and contract liabilities in the consolidated statement of

financial position.

Affiliated Hospital Revenues

Affiliated hospital revenue is earned over-time as the various services are provided as an

integrated performance obligation as more fully described in footnote 13. The measure of

progress towards completion of those obligations is based on the day-to-day operations of the

university’s School of Medicine and the affiliated hospitals. Payments are received under the

agreement semiannually. Amounts receivable under the agreement are $74,708 and $68,577

at June 30, 2021 and 2020 respectively.

Operating Results

The university’s measure of operations as presented in the consolidated statements of

activities includes income from tuition and fees, grants and contracts, medical services,

contributions for operating programs, the endowment spending distribution and other

revenues. Operating expenses are reported on the consolidated statements of activities as

incurred for employee compensation, depreciation, interest and supplies, services and other.

Operating results exclude investment gains (losses) except for the portion of gains utilized for

the endowment spending distribution, contributions to be held in perpetuity, and other non-

operating amounts.

Split-Interest Agreements

The university’s split-interest agreements with donors consist primarily of charitable gift

annuities and irrevocable charitable remainder trusts for which the university serves as

trustee. Assets are invested and payments are made to donors and/or other beneficiaries in

accordance with the respective agreements. Contribution revenues for charitable gift annuities

and charitable remainder trusts are recognized after recording liabilities for the present value

of the estimated future payments to be made to the respective donors and/or other

beneficiaries. The discount rate used is a credit-adjusted rate in existence at the date of the

gift. The rates used range from 0.53% to 1.98% for 2021 and 1.37% to 2.31% for fiscal year

2020. Annually, the university records the change in value of split-interest agreements by

recording at fair value the assets that are associated with each trust and recalculating the

liability for the present value of the estimated future payments to be made to the donors

and/or other beneficiaries. For the years ending June 30, 2021 and 2020, the change in fair

value was an increase of $1,661 and a decrease of $2,964, respectively. As of June 30, 2021

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

14

and 2020, the university’s liability under charitable gift annuities was $18,248 and $19,710,

respectively.

Cash and Cash Equivalents

The university considers cash on hand and in banks and all highly liquid financial instruments

with an original maturity of 90 days or less, except those amounts assigned to and invested by

its investment managers, which amounts are classified as investments, to be cash and

cash equivalents.

Income Taxes

The university is exempt from federal income taxes under Section 501 (c)(3) of the Internal

Revenue Code except to the extent the university has unrelated business income, or

consolidated for-profit affiliates incur taxes. The Tax Cuts and Jobs Act (the “Act”) was

enacted on December 22, 2017. The Act impacts the university in several ways, including new

excise taxes on executive compensation and net investment income, increases to unrelated

business taxable income (UBTI) , changes to the net operating loss rules, repeal of the

alternative minimum tax (AMT), and the computation of UBTI separately for each unrelated

trade or business. Further, the Act reduces the U.S. federal corporate tax rate and federal

corporate unrelated business income tax rate from 35% to 21%.

As of June 30, 2021, the university has made a reasonable estimate of the determinable effects

of the enactment of the Act on existing deferred tax balances. These amounts are provisional,

subject to change and not material to the university’s consolidated financial statements.

Management believes the university has no uncertain tax positions that result in material

unrecognized tax expense/benefits.

Effects of the Pandemic

The outbreak of COVID -19 has caused domestic and global disruption in operations for

institutions of higher education. The impact (i) may affect the cost of operations and (ii) may

materially affect financial markets and consequently the returns on and value of the

university’s investments. Other adverse consequences of COVID-19 or any other similar

outbreaks in the future may include, but are not limited to, decline in enrollment, decline in

demand for university housing and decline in demand for university programs that involve

travel or have international connections. The full impact of COVID-19 or any other similar

outbreaks in the future and the scope of any adverse impact on the university’s finances and

operations cannot be fully determined at this time.

The university received funding from the federal Coronavirus Aid, Relief and Economic

Security (“CARES”) Act Provider Relief Fund, recognized as a portion of “Other Revenues” in

the consolidated statement of activities as of June 30, 2020, to be retained and used only for

reimbursement of eligible expenses and lost revenues in accordance with laws, regulations and

guidance issued by the U.S. Department of Health and Human Services.

Recent Accounting Pronouncements

During fiscal 2016, the FASB issued ASU 2016-02, Leases, along with subsequently issued

supplemental ASUs (collectively, ASC 842). This guidance requires lessees to recognize a lease

liability and a ROU asset on a discounted basis, for substantially all leases, as well as provide

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

15

additional disclosures regarding leasing arrangements (refer to footnote 8). The university

adopted this standard as of July 1, 2020, the effective date, and applied the guidance to each

lease that existed as of that date. As a result, prior comparative periods were not adjusted.

The university elected the package of practical expedients under the new standard, which

permits entities to not reassess lease classification, lease identification or initial direct costs for

existing or expired leases prior to the effective date. The university capitalized ROU assets and

lease liabilities of $104,504 and $117,989, respectively, on the balance sheet at July 1, 2020

with the excess of lease liabilities over ROU assets charged to net assets without donor

restrictions. Upon adoption, there was no material change to the consolidated net assets,

statements of activities, or cash flows.

ASU2016-13, Measurement of Credit Losses on Financial Instruments, was issued by the

FASB during June 2016 and was adopted by the university during fiscal year 2021. ASU 2016-

13 requires financial assets measured at amortized cost to be presented at the net amount

expected to be collected. This is a shift from the previous probable loss model to an expected

loss model which requires an estimate of the future collectability of cash flows. The

amendments in this update broaden the information an entity must consider when developing

its expected credit loss estimate such as past events, historical loss, experience with similar

assets, and current market and economic conditions. There was no significant impact to the

university’s financial statements or footnote disclosures upon adoption.

In August 2018, the FASB issued ASU 2018-13, Changes to the Disclosure Requirements for

Fair Value Measurement, which was adopted by the university as of July 1, 2020 (see footnote

2). The standard removes the requirements to disclose transfers between Level 1 and Level 2

of the fair value hierarchy and the changes in unrealized gains and losses for recurring Level 3

fair value measurements, among other disclosures. The standard modifies other disclosure

requirements regarding transfers into and out of Level 3 of the fair value hierarchy and

investments in entities that calculate net asset value. Finally, the standard adds requirements

for disclosures for information surrounding the unobservable input used to develop Level 3

fair value measurements.

ASU 2020-07, Presentation and Disclosure by Not-for-Profit Entities for Contributed

Nonfinancial Assets, was issued by the FASB in September 2020 in order to address

stakeholders’ concerns regarding lack of transparency in the measurement of contributed

nonfinancial assets as well as the amount of those contributions used in the university’s

programs and other activities. Under this ASU, nonprofit entities should present contributed

nonfinancial assets as a separate line item in the consolidated statement of activities and also

quantitatively disclose the disaggregation of such assets by type. In addition, an entity should

disclose various qualitative information regarding the assets such as valuation techniques, how

the assets were used, restrictions on use, etc. While the ASU adds presentation and disclosure

requirements, it does not change the recognition and measurement requirements for

contributed nonfinancial assets. The ASU is effective for annual periods beginning after June

15, 2021, however, the university has chosen to early adopt this guidance during the current

fiscal year. Contributed nonfinancial assets are not material to the university’s financial

statements and, therefore, line-item presentation and disclosure requirements have been

omitted.

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

16

2. Fair Value

The university follows FASB guidance for fair value measurements. This guidance defines fair

value, establishes a framework for measuring fair value under generally accepted accounting

principles and enhances disclosures about fair value measurements. Fair value is defined as

the exchange price that would be received for an asset or paid to transfer a liability (an exit

price) in the principal or most advantageous market for the asset or liability in an orderly

transaction between market participants on the measurement date.

The FASB guidance establishes a hierarchy of valuation inputs based on the extent to which

the inputs are observable in the marketplace. Observable inputs reflect market data obtained

from sources independent of the university and unobservable inputs reflect the university’s

assumptions about how market participants would value an asset or liability based on the best

information available. Valuation techniques used to measure fair value maximize the use of

observable inputs and minimize the use of unobservable inputs. The fair value hierarchy is

based on three levels of inputs, of which the first two are considered observable and the last

unobservable, that may be used to measure fair value.

The following describes the hierarchy of inputs used to measure fair value and the primary

valuation methodologies used by the university for financial instruments measured at fair

value on a recurring basis. The three levels of inputs are as follows:

Level 1 Quoted prices in active markets for identical assets or liabilities, such as exchange

traded equity securities.

Level 2 Inputs other than Level 1 that are observable, either directly or indirectly, such as

quoted prices for similar assets or liabilities; quoted prices in markets that are not

active; or other inputs that are observable or can be corroborated by observable

market data for substantially the same term of the assets or liabilities. Examples of

Level 2 include U.S. Treasury securities and corporate bonds.

Level 3 Unobservable inputs that are supported by little or no market activity and that are

significant to the fair value of the assets or liabilities.

A financial instrument’s categorization within the valuation hierarchy is based upon the lowest

level of input that is significant to the fair value measurement.

The following table presents the financial instruments carried at fair value as of June 30, 2021,

on the consolidated statements of financial position by caption and by the valuation hierarchy

defined above. Amounts measured at net asset value are reported using the practical

expedient under ASC topic 820 and excluded from the fair value hierarchy. Included as Level

2 fixed income are U.S. Treasury securities of approximately $774,142.

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

17

Quoted Significant

Prices in Other Significant

Active Observable Unobservable Measured Balance

Markets Inputs Inputs at Net Asset June 30,

(Level 1) (Level 2) (Level 3) Value 2021

Investments

Public equity

Do m e stic 290 , 6 1 1$ $ $ 1,625,359$ 1,915,97 0$

International 61,800 2,948,440 3,010,240

Fixed income - Nominal 1,07 6,289 1,07 6,289

Absolute return 1,027 ,832 1,027 ,832

Private capital 254,301 7 ,7 41,398 7 ,995,699

Short-term investments 348,033 11,7 56 359,7 89

Real assets 749 715,436 716,185

Other investments 210,017 7 49 68,022 36,946 315,7 34

Total investments at

fair value 910,461 1,088,7 94 323,07 2 14,095,411 16,417 ,7 38

Investments not

reported at fair value

Affiliates - Equity basis 40,87 6

Accrued investment income 2,538

Total investments 91 0,461$ 1 ,088,7 94$ 323,072$ 14,095,41 1$ 16,461,152$

The following table presents the financial instruments carried at fair value as of June 30,

2020, on the consolidated statements of financial position by caption and by the valuation

hierarchy defined above. Amounts measured at net asset value are reported using the practical

expedient under ASC topic 820 and excluded from the fair value hierarchy. Included as Level

2 fixed income are U.S. Treasury securities of approximately $656,460.

Quoted Significant

Prices in Other Significant

Active Observable Unobservable Measured Balance

Markets Inputs Inputs at Net Asset June 30,

(Level 1) (Level 2) (Level 3) Value 2020

Investments

Public equity

Domestic 134,100$ 27$ $ 938,834$ 1,07 2,961$

International 96,17 3 2,098,450 2,194,623

Fixed income - Nominal 820,224 820,224

Absolute return 1,015,840 1,015,840

Private capital 158,996 4,224,57 9 4,383,57 5

Short-term investments 137 ,437 3,824 141,261

Real assets 2,128 534,686 536,814

Other investments 314,57 4 (650) 69,7 24 31,241 414,889

Total investments at

fair v alue 682,284 823,425 230,848 8,843,630 10,580,187

Investments not

reported at fair value

Affiliates - Equity basis 33,561

Accrued investment income 2,77 8

Total investments 682,284$ 823,425$ 230,848$ 8,843,630$ 10,616,526$

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

18

Beneficial interests in perpetual trusts held by third parties are valued at the present value of

the future distributions expected to be received over the term of the agreement.

Following is a description of the university’s valuation methodologies for assets and liabilities

measured at fair value. The methods described below may produce a fair value calculation that

may not be indicative of net realizable value or reflective of future fair values. Furthermore,

while the university believes its valuation methods are appropriate and consistent with other

market participants, the use of different methodologies or assumptions to determine the fair

value of certain financial instruments could result in a different estimate of fair value at the

reporting date.

Fair value for Level 1 is based upon quoted prices in active markets that the university has the

ability to access for identical assets and liabilities. Market price data is generally obtained

from exchange or dealer markets. The university does not adjust the quoted price for such

assets and liabilities.

Fair value for Level 2 is based on quoted prices for similar instruments in active markets,

quoted prices for identical or similar instruments in markets that are not active and model-

based valuation techniques for which all significant assumptions are observable in the market

or can be corroborated by observable market data for substantially the full term of the assets.

Inputs are obtained from various sources including market participants, dealers, and brokers.

Fair value for Level 3 is based on valuation techniques that use significant inputs that are

unobservable as they trade infrequently or not at all. Trustees determine the valuation for

beneficial interest trusts and split-interest agreements. Strategic real estate is valued at

historical cost and is evaluated annually for impairment.

Investments measured at net asset value primarily consist of the university’s ownership in

alternative investments (principally limited partnership interests in absolute return, private

capital investments, real assets, and other similar funds). The fair values (Net Asset Value

(“NAV”) or partner’s capital per share) of the securities held by limited partnerships that do

not have readily determinable fair values are determined by the respective general partners

and are based on appraisals or other estimates that require varying degrees of judgment. If no

public market exists for the investments, the fair value is determined by the general partners

taking into consideration significant unobservable inputs including, among other things, the

cost of the investments, prices of recent significant placements of investments of the same

issuer, and subsequent developments concerning the companies to which the investments

relate. Excluding the cost of the investment, significant increases or decreases in the

remainder of those inputs could result in a significantly higher or lower fair value

measurement. The university has performed due diligence with respect to these investments

to ensure NAV or partner’s capital per share is an appropriate measure of fair value as of

June 30. NAVs are calculated by the investees in a manner consistent with generally accepted

accounting principles for investment companies.

Significant terms of agreements with external investment managers or funds by major classes

of investments are provided in the following tables.

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

19

The following table summarizes the significant terms of the agreements with external

investment managers or funds by major category at June 30, 2021:

Unfunded Remaining Redemption Redemption

Investments Commitment (1) Life (2) Terms Restrictions

Public equities $ No Limit Daily to Lock-up provision

annually, with periods range from 0 to

same day-180 day 5 years. Certain

notice investments include side

pockets subject to

external manager

discretion.

Fixed income No Limit Daily, 1-2 No lock-up provision

and short-term days notice periods

investments

Absolute return No Limit Lock-up provision

periods range from 0 to

3 years. Certain

investments include side

pockets subject to

external manager

discretion.

Private capital 1,691,267 0 - 28 Years Not eligible Not redeemable

for redemption

Real assets 337,723 0 - 11 Years Not eligible Not redeemable

for redemption

Total 2,028,990$

Quarterly to

semi-annually

with 45 – 180

days notice

Footnote (1): Includes $21 million nonbinding unfunded commitments. The university is

obligated under certain agreements to fund capital calls periodically up to specified

commitment amounts. Such commitments are expected to be called over the life of the

agreement and are not expected to be fully funded in the subsequent year.

Footnote (2): For private equities and real assets, assuming all extension options under the

agreements are exercised and approved except for funds with no fund life end date or

unlimited extension.

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

20

The following table summarizes the significant terms of the agreements with external

investment managers or funds by major category at June 30, 2020:

Unfunded Remaining Redemption Redemption

Investments Commitment (1) Life (2) Terms Restrictions

Public equities 1,805$ 2 Years - No Limit Daily to Lock-up provision

annually, with periods range from 0 to

1 day-1 year 5 years. Certain

notice investments include side

pockets subject to

external manager

discretion.

Fixed income No Limit Daily, 1-2 No lock-up provision

and short-term days notice periods

investments

Absolute return 1 Year - No Limit Lock-up provision

periods range from 0 to

3 years. Certain

investments include side

pockets subject to

external manager

discretion.

Private capital 1,700,420 0 - 29 Years Not eligible Not redeemable

for redemption

Real assets 335,813 0 - 11 Years Not eligible Not redeemable

for redemption

Total 2,038,038$

Quarterly to

semi-annually

with 45 – 180

days notice

Footnote (1): Includes $28 million nonbinding unfunded commitments. The university is

obligated under certain agreements to fund capital calls periodically up to specified

commitment amounts. Such commitments are expected to be called over the life of the

agreement and are not expected to be fully funded in the subsequent year.

Footnote (2): For private equities and real assets, assuming all extension options under the

agreements are exercised and approved except for funds with no fund life end date or

unlimited extension.

Public Equities

Public equities include investments in publicly–traded securities in domestic, developed

international, emerging, and frontier markets. The majority of assets are held in pooled

comingled funds which are valued at NAV as described above. Investments held in custody

accounts are valued at quoted market price in accordance with Level 1 and Level 2 valuation

techniques as described above.

Fixed Income and Short-Term Investments

Investments in this class include domestic and international nominal fixed income

instruments. Fixed income investments are held principally as liquid vehicles for operating

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

21

needs and as a source of diversification. A significant component of non-endowment fixed

income investments is held in highly liquid funds. The valuation of these funds is determined

using a market approach in accordance with the techniques for Level 2 as described above.

Absolute Return

Investments in absolute return are typically held in commingled funds that employ various

uncorrelated investment strategies including but not limited to equity hedged and event

driven. These funds are valued at net asset value as described above.

Private Capital

Investments in private capital strategies are made in targeted categories including growth

equity, venture capital, distressed credit, and corporate finance. Redemptions of such funds

are not permitted and distributions are received as underlying investments are liquidated.

These funds are primarily valued at net asset value as described above.

Real Assets

Investments in the real assets class are made in targeted categories. The majority of these

assets are held in non-redeemable fund structures that invest primarily in real estate and

natural resources. These funds are primarily valued at net asset value as described above.

The following tables roll forward the consolidated statement of financial position amounts for

financial instruments classified by the university within Level 3 of the fair value hierarchy

defined above for the years ended June 30, 2021 and 2020.

Net Realized Purchases, Sales T ransfers

Balance and Unrealized and Settlements in/(out) of Balance

June 30, 2020 Gains (Losses) Net Level 3, net June 30, 2021

Investments (by strategy)

Private capital 158,996$ 246,61 1$ (202,365)$ 51,059$ 254,301$

Real assets 2,128 101 (1,480) 7 49

Other investments 69,7 24 9,928 2,519 (14,149) 68,022

Total 230,848$ 256,640$ (201,326)$ 36,910$ 323,07 2$

Net Realized Purchases, Sales T ransfers

Balance and Unrealized and Settlements in/(out) of Balance

June 30, 2019 Gains (Losses) Net Level 3, net June 30, 2020

Investments (by strategy)

Private capital 130,923$ (1 ,296)$ 31,425$ (2,056)$ 158,996$

Real assets 110,600 363 (108,835) 2,128

Other investments 70,183 643 102 (1,204) 69,724

Total 311,7 06$ (290)$ (7 7 ,308)$ (3,260)$ 230,848$

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

22

The amount of realized and unrealized gains (losses) for Level 3 investments for the period

included in net assets attributable to the change in unrealized gains or losses relating to assets

still held at June 30, 2021 and 2020 respectively, reported as investment returns net of

endowment spending in the consolidated statements of activities by type of investment is:

2021 2020

Private capital 43,818$ (1 29)$

Real assets (823) 3,97 3

Other investments 8,023 (341)

Total 51,01 8$ 3,503$

3. Investment Return

The following summarizes the return on investments. Investment income represents earnings

on non-endowed funds. Return on investments is presented net of investment management

fees. Certain investments, including some but not all of those in the absolute return and

private capital categories, report investment returns net of fees.

2021 2020

Investment income 11,117$ 21 ,1 7 2$

Pooled endowment dividends and interest income,

net of investment management fees (71,542) (59,117)

Pooled endowment distribution in excess of income 437 ,321 420,989

Pooled endowment spending distribution 365,7 7 9 361,87 2

Investment gains, net 6,17 7 ,960 899,464

Gains distributed as endowment distribution (437 ,321) (420,989)

Investment gains net of endowment

spending distribution 5,740,639 478,475

Net investment return 6,117 ,535$ 861,51 9$

4. Endowment

The state of Missouri has adopted legislation that incorporates the provisions outlined in the

Uniform Prudent Management of Institutional Funds Act (UPMIFA). The statutory guidelines

contained in this legislation relate to the prudent management, investment, and expenditure of

donor-restricted endowment funds held by charitable organizations. Additionally, the

legislation specifies factors for fiduciaries to consider prior to making a decision to appropriate

from or accumulate into an institution’s endowment funds.

At June 30, 2021, the university’s endowment consists of 3,785 individual donor-restricted

endowment funds and Board of Trustees or management-designated endowment funds for a

variety of purposes plus split-interest agreements and other net assets where the assets have

been designated for endowment. The net assets associated with endowment funds, including

funds designated by the Board of Trustees or management to function as endowments, are

classified and reported based on the existence or absence of donor-imposed restrictions.

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

23

The university has interpreted Missouri UPMIFA as requiring the preservation of the original

gift as of the gift date of the donor-restricted endowment funds absent explicit donor

stipulations to the contrary. As a result of this interpretation, the university classifies as net

assets with donor restrictions, (a) the original value of gifts donated to the donor-restricted

endowment, (b) the original value of subsequent gifts to the donor-restricted endowment, (c)

accumulations to the donor-restricted endowment made in accordance with the direction of

the applicable donor gift instrument at the time the accumulation is added to the fund. The

remaining portion of donor-restricted endowment funds that are not restricted in perpetuity

are considered restricted until the donor-imposed stipulations attached to those amounts have

been met by actions of the university and/or passage of time and appropriated for expenditure

in a manner consistent with the standard of prudence prescribed by UPMIFA.

Endowment net asset composition, which includes the effect of changes in endowment

investments as well as other endowment-related assets and liabilities, by type of fund as of

June 30, 2021:

Without Donor With Donor

Restriction Restriction Total

Donor-restricted endowment funds $ 8,268,427$ 8,268,427$

Board-designated endowment funds 4,753,833 645,821 5,399,654

Total endowment funds 4,753,833$ 8,914,248$ 13,668,081$

Changes in endowment net assets for the year ended June 30, 2021:

Without Donor With Donor

Restriction Restriction Total

Endowment net assets, beginning of year 3,085,820$ 5,403,474$ 8,489,294$

Investment return

Net investment income (29,528) (40,961) (70,489)

Net appreciation (realized and

unrealized) 2,468,932 3,714,753 6,183,685

Total investment return 2,439,404 3,673,792 6,113,196

Gifts 109 78,578 78,687

Appropriation of endowment assets for

expenditure (150,971) (214,808) (365,779)

Net transfers of funds 29,884 2,797 32,681

Allocation of endowment return to treasurer's

investment pool (653,549) (29,804) (683,353)

Other activity 3,136 219 3,355

Endowment net assets, end of year 4,753,833$ 8,914,248$ 13,668,081$

Of the amount classified as endowment net assets with donor restrictions, $ 5,540,335

represents the portion of endowment funds subject to time restrictions under Missouri’s

enacted version of UPMIFA.

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

24

Endowment net asset composition by type of fund as of June 30, 2020:

Without Donor With Donor

Restriction Restriction Total

Donor-restricted endowment funds $ 5,103,500$ 5,103,500$

Board-designated endowment funds 3,085,820 299,97 4 3,385,7 94

Total endowment funds 3,085,820$ 5 ,403,47 4$ 8,489,294$

Changes in endowment net assets for the year ended June 30, 2020:

Without Donor With Donor

Restriction Restriction Total

Endowment net assets, beginning of yea

r

2,845,594$ 5,163,331$ 8,008,925$

Investment return

Net investment income (24,515) (33,356) (57,871)

Net appreciation (realized and

unrealized) 446,000 438,638 884,638

Total investment return 421,485 405,282 826,767

Gifts 83 79,937 80,020

Appropriation of endowment assets for

expenditure (150,064) (211,808) (361,872)

Net transfers of funds 15,834 (2,815) 13,019

Allocation of endowment return to treasurer's

investment pool (51,171) (28,772) (79,943)

Other activit

y

4,059 (1,681) 2,378

Endowment net assets, end of year 3,085,820$ 5,403,474$ 8,489,294$

Of the amount classified as endowment net assets with donor restrictions, $2,686,050

represents the portion of endowment funds subject to time restrictions under Missouri’s

enacted version of UPMIFA.

Endowment by Purpose

The purpose of endowment funds as of June 30, 2021:

Without Donor With Donor

Restriction Restriction T otal

Restricted for general activities 3,47 9,522$ 6,052,357$ 9,531,87 9$

Restricted for student assistance 687 ,806 1,57 1,424 2,259,230

Restricted for buildings and renovations 586,505 1,244,7 25 1,831,230

Life income 45,7 42 45,7 42

Total endowment net assets 4,7 53,833$ 8,914,248$ 13,668,081$

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

25

The purpose of endowment funds as of June 30, 2020:

Without Donor With Donor

Restriction Restriction Total

Restricted for general activities 2,321,054$ 3,621,441$ 5,942,495$

Restricted for student assistance 407,464 1,013,383 1,420,847

Restricted for buildings and renovations 357,278 743,597 1,100,875

Life income 24 25,053 25,077

Total endowment net assets 3,085,820$ 5,403,474$ 8,489,294$

Endowment Funds with Deficits

As determined under UPMIFA, the fair value of assets associated with individual donor-

restricted endowment funds may fall below the value of the initial and subsequent donor gift

amounts (i.e., deficit). When donor endowment deficits exist, they remain classified as net

assets with donor restrictions. Deficits of this nature were immaterial as of June 30, 2021 and

2020. The deficits resulted largely from unfavorable market fluctuations.

Return Objectives and Risk Parameters

The university has adopted endowment investment and spending policies that attempt to

provide a predictable stream of funding to programs supported by its endowment while

seeking to maintain the purchasing power of endowment assets. Under this policy, the return

objective for the endowment assets, measured over a full market cycle, shall be to meet or

exceed the return of its policy benchmark, based on the endowment’s target allocation applied

to the appropriate individual benchmarks. The university expects its endowment funds, over

time, to provide an average rate of return that will exceed the sum of inflation and the

spending rate. Actual returns in any given year may vary from this amount.

Strategies Employed for Achieving Investment Objectives

To achieve its long-term rate of return objectives, the university relies on a total return strategy

in which investment returns are achieved through both capital appreciation (realized and

unrealized gains) and current yield (interest and dividends). The university targets a

diversified global asset allocation that places greater emphasis on equity-based and alternative

investments to achieve its long-term objectives within prudent risk constraints.

Endowment Spending Allocation and Relationship of Spending Policy to

Investment Objectives

The university has an endowment spending distribution policy designed to stabilize annual

spending levels and preserve the real value of the endowment over time. Under this policy,

earnings of the pooled endowment are distributed at a rate set annually to the schools and

other units of the university. Consideration is given to the provisions of UPMIFA in

determining the amount to appropriate. This spending rate must fall within the range of 3.0%

to 5.5% of the five-year average market value of a unit of the pooled endowment. For 2021, the

spending rate from the pooled endowment was 4.4% of the beginning market value of the

pooled endowment. The spending rate is funded from current earnings and, in years when

current earnings are insufficient, from previously accumulated earnings of the endowment.

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

26

The university’s endowment assets at June 30 are as follows:

2021 2020

Pooled endowment and other funds 15,310,698$ 9,547,820$

Life income trusts and pools 88,583 76,091

Externally administered trusts 37,338 30,804

Separately invested endowment 9,674 8,577

Total 15,446,293 9,663,292

Less: Operating funds invested in pool (1,780,908) (1,148,092)

Net endowment assets 13,665,385$ 8,515,200$

The amounts above include term endowments of $150,012 and $102,870 as of June 30, 2021

and 2020, respectively.

5. Liquidity and Availability of Resources

At June 30, 2021 and 2020, the university’s financial assets available for general expenditures

within one year of the balance sheet date are as follows:

2021 2020

Total assets at year end 21,212,7 47$ 1 5,103,569$

Less:

Accounts and notes receivable due in more than one year (96,258) (104,244)

Pledges receivable unavailable for general expenditure (307 ,854) (332,861)

Donor-restricted endowment funds (8,283,442) (5,135,123)

Board-designated endowment funds (5,381,943) (3,380,07 7 )

Other long-term investments (2,089,396) (1,590,7 48)

Right-of-use assets (88,698)

Othe r asse ts (32 7 ,3 7 0 ) (27 3,47 3 )

Fixed assets (3,017 ,355) (2,902,823)

Total financial assets available within one year

1,620,431$ 1 ,384,220$

The university’s endowment funds consist of donor-restricted and board-designated

endowment funds. As described in Note 4, the university has an endowment spending

distribution policy with a spending rate range of 3.0% to 5.5% of the five-year average market

value of a unit of the pooled endowment. For fiscal year 2022, the Board of Trustees approved

a spending rate which will generate an endowment payout equaling or exceeding that of fiscal

year 2021, including an allocation to the treasurer’s investment pool, that will be available for

operations during fiscal year 2022.

In addition to these available financial assets, the university’s annual expenditures will be

primarily funded by current year operating revenues including tuition, patient services

income, and sponsored research income. As part of the university’s liquidity management, a

policy is in place to structure its financial assets to be available as general expenditures,

liabilities, and other obligations come due. The university also invests cash in excess of daily

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

27

requirements in short-term investments. Furthermore, although the university does not

intend to spend from its board-designated endowment funds other than amounts appropriated

for general expenditure as part of its annual budget approval and appropriation process,

amounts from its board-designated endowment that are free from investment restrictions

could be made available if necessary. Other long-term investments are primarily composed of

amounts designated by the university as reserves. Such investments are without donor

restriction and could be drawn upon in the event of extreme stress. In the event of an

unanticipated liquidity need, the university could also draw upon $250,000 of available lines

of credit at June 30, 2021.

6. Accounts and Notes Receivable

Accounts and notes receivable at June 30 were as follows:

2021 2020

Patient services 489,7 26$ 418,149$

Student and parent loans

Parent loan fund 43,037 44,928

Gov ernment student lo ans 1 5 ,65 6 20 ,042

Institutional student loans 19,127 21,987

Due from affiliates 1 55 ,096 1 57 ,27 6

Sponsored project receivables 98,222 7 1,590

Other 145,830 98,67 3

966,694 832,645

Less: Allowance for contractual adjustments

and doubtful accounts (319,698) (280,053)

Total 646,996$ 5 52,592$

Washington University

Notes to Consolidated Financial Statements

June 30, 2021 and 2020

(All amounts in thousands of dollars)

28

7. Notes and Bonds Payable

Outstanding principal on bonds and notes payable at June 30, 2021 and 2020 consists of the

following:

Rates at

June 30, 2021 Maturity 2021 2020