6/13/2019

1

IRS

CSED Tolling

Events

Presentation

Learn how to identify, verify, and

contest CSEDs & CSED tolling events.

Roger Nemeth, EA

Started managing tax franchises in 2006.

Developed Audit Detective in 2010.

Qualified as an N.T.P.I. Fellow in 2015.

Worked as a programmer for the largest Tax Resolution

Company integrating automated transcript systems into

workflow programs.

Assisted in the downloading and research of over 30 million

transcripts.

To date our software has been used to download one-fifth of a

billion transcripts.

6/13/2019

2

SPECIAL OFFER

Good Until Midnight Tonight 6/13/2019

Try the fully loaded Tax Help Software Executive Product for six

months for only $250. Get the only product on the market that

calculates accurate CSED’s (More accurate than the IRS

calculations).

This product can also detect IRS Audits and CP2000s six months in

advance of the IRS Notice.

Purchase at: taxhelpsoftware.com/ASTPS.html (case sensitive)

or taxhelpsoftware.com and click “ASTPS” in footer at bottom of page

Presentation Overview

This class will cover how to obtain the IRS CSED and calculate the

CSED from available data (IRS Transcripts) and compare them for

accuracy and opportunities.

In addition, this class will also cover how to verify the tolling events

have been entered correctly and if they qualify as tolling events.

This is one of the fastest growing tax controversy areas in tax

resolution.

6/13/2019

3

What Is “Statute Of Limitations”

IRS IRM 25.6.1.2 (10-01-2001)

What is a Statute of Limitation

1. A statute of limitation is a time period established by law to review, analyze

and resolve taxpayer and/or IRS tax related issues.

2. The Internal Revenue Code (IRC) requires that the Internal Revenue Service

(IRS) will assess, refund, credit, and collect taxes within specific time limits.

These limits are known as the Statutes of Limitations. When they expire, the

IRS can no longer assess additional tax, allow a claim for refund by the

taxpayer, or take collection action. The determination of Statute expiration

differs for Assessment, Refund, and Collection.

Layman’s Definition

The Statutes are deadlines, defined by law, that affect the

taxpayers debits and credits on their IRS Accounts known as

Modules or Periods.

6/13/2019

4

Collection Statute

Expiration Date (CSED)

• The CSED defines how long the IRS has to collect tax for a

specific assessment.

• The CSED is calculated as 10 years after the assessment date.

• Each assessment carries it’s own CSED.

• The CSED can be extended by tolling events.

Refund Statute

Expiration Date (RSED)

The RSED defines how long the taxpayer has to file a claim for refund for a specific

module/period.

The RSED has two components and is the later of the 2 dates:

3-Year Look Back – 3 years since the received date of the original return.

2-Year Look Back – Any payment made within the past 2 years.

Presentation Note: There is a lot of confusion about the 3 year look back due to the wording

of the IRM. This will be addressed later in this presentation.

6/13/2019

5

40% Of IRS CSED’s With Tolling

Are Inaccurate

According to the TIGTA Report: Recalculations of the Collection Statute Expiration Date

Were Not Always Accurate from September 16, 2013 Reference Number: 2013-30-098

“Test results of a statistical sample of 75 tax modules from a population of 1,085 with manually recalculated CSEDs

showed that 29 (39 percent) of the 75 tax modules contained errors. Twenty-one had inaccurate CSEDs and eight

were missing the required documentation to support the CSEDs. Based on the results of our case review from a

population of 1,085 tax modules that were manually recalculated between July 1, 2011, and June 30, 2012, we

estimate that CSEDs for 260 tax modules were extended longer than they should have been, 43 tax modules were

not extended as long as they should have been, and 116 tax modules were unverifiable.”

In both reviews over 10% of the cases the tolling events could not be verified.

8/75 = 10.6%

116/1,085 = 10.6%

IRS CSED Vs Calculated CSED

1. IRS CSED – The CSED for each assessment as calculated by the IRS in the IRS IDRS

(Computer System).

2. Calculated CSED – This is the CSED calculated by the tax professional manually

and/or using software.

Use caution when just relying on software to calculate the CSED.

Not all transcript softwares are the same. Softwares have different levels of

accuracy.

All software-calculated CSEDs should be reviewed manually.

Presentation Note: It also helps to reconstruct the IRS CSED calculations to support your

position.

6/13/2019

6

Procedure To Verify IRS CSED

1. Calculate the CSED from Account Transcripts and Tax Mod A if available.

2. Verify the CSED with the IRS by calling the IRS.

3. If there is a discrepancy try to determine the cause (Makes the appeal easier to

present).

4. If the IRS CSED matches the calculated CSED determine if the tolling events need to

be reviewed.

Most tolling events are manually entered in the IRS system and are subject to

human interpretation, miscalculations and input errors.

As stated in previous slides over 10% of tolling events recorded in the IRS

system do not have the required supporting information to make them valid.

After IRS CSED Expires When

Does Debt Get Written Off

Normally the debt is written off within 90 days after the IRS CSED.

Occasionally the IRS misses the CSED and it just remains on the account.

The RSED still applies even if the IRS makes a mistake.

Example if a taxpayer makes a payment after the CSED is expired and the

IRS does not catch it the taxpayer only has two years to file a claim for

refund.

6/13/2019

7

Timing To Appeal CSED

If a discrepancy exists between the calculated CSED and the IRS CSED or a tolling

event has not been recorded properly review the overall case to determine when to

start the appeal.

If the CSED is appealed too early the IRS may have time to levy or convert the

assessment to a judgement before the calculated CSED or the appeal may

involve a new tolling event which will extend the CSED.

The tax professional should wait at least 90 days after the calculated CSED

before notifying the IRS unless the taxpayer is under active levy, but they need

to be RSED aware as well

See the examples on the following slides.

Need To Be RSED Aware

Anytime the tax professional is determining the best strategy for a CSED dispute they

should consider if there are any refunds or offsets available. The RSED 2-year

lookback will usually apply as opposed to the 3-year lookback. If the tax professional

delays the CSED challenge the RSED does not change. The claim for refund (or offset)

is what determines the claim date. As long as the claim for refund is made within the

2-year lookback period the money can still be refunded or offset.

Presentation Note: This author recommends waiting 90 days after the calculated

CSED to dispute it. If there are payments made on the module and the RSED is about

to expire on the 2-year lookback for some of those payments the claim for refund and

dispute needs to be made before those opportunities expire.

6/13/2019

8

Calculated CSED Not Expired Yet

In very few instances should a CSED be reported to the IRS as incorrect prior to

the calculated CSED plus 90 days when possible.

If the tax professional makes the IRS aware of the discrepancy prior to the

calculated CSED the IRS may start enforced collection action.

Calculated CSED Expired And

IRS CSED Not Expired

If there is a small difference between the calculated and IRS CSED (less than a year)

and the taxpayer is not under forced collections the tax professional may want to just

wait (Sometimes doing nothing is the best solution).

If the RSED 2-year look back has any payments about to expire that should be taken

into account.

6/13/2019

9

Calculated CSED Is Greater

Than The IRS CSED

If the tax professional determines the IRS CSED is less than the calculated CSED they

are under no requirement to report the discrepancy. The tax professional just needs

to be aware of the discrepancy and that the IRS could correct it prior to the CSED

expiration date.

Presentation Note: This author has never observed a case where the IRS CSED

expired, the debt was written off, and then the IRS determined the CSED was

incorrect and reinstated the tax due. This does not mean they cannot reassess just

that it would be highly unusual.

CSED Tolling Events

TC 520 Tax Court or IRS Instituted Litigation (suspends CSED)

TC 520 Bankruptcy (suspends CSEDs)

TC 520 Collection Due Process (suspends CSED)

TC 971 Pending Installment Agreement

TC 971 Terminated Installment Agreement

TC 480 Offer in Compromise Pending (suspends CSED)

TC 500 Military Deferment (suspends CSED)

TC 971 Innocent Spouse

TC 550 Waiver Extension of Date Collection Statute Expires

(extends the CSED to date

input)

TC 550 Manually Adjusted Tolling Events (Listed on next slide)

TC 488 Installment and/or Manual Billing (extends CSED) (never seen one, not

covered)

Presentation Note: IRS Transaction Code = TC

6/13/2019

10

550 Manually Adjusted

Tolling Events

Form 900 Tax Collection Waiver

Assets in Custody of the Court

Bankruptcy (incorrect CSED computation)

Judgment

Taxpayer Assistance Order (TAO)

Military Deferment

Offer in Compromise (incorrect CSED computation)

Wrongful Seizures (not covered in presentation)

Taxpayer Living Outside the U.S.

Innocent Spouse

Other (Collection Due Process)

Why Analyze CSED Tolling Events

In the past five years this author has reviewed hundreds of cases for CSED

calculations. A disturbing trend started to appear where tolling events were applied

when they did not meet the IRM criteria or an error was made in data entry.

IRS employees have also been caught extending tolling events when they should not

have been extended.

Tolling events suspend or extend the CSED since the IRS is barred from collections

during the tolling event. Always check if any forced collections occurs during a tolling

event. A wage levy started before a tolling event does not stop automatically (except

for bankruptcy) when the tolling event begins. A request needs to made with the IRS,

but they are usually granted.

6/13/2019

11

Calculating CSED Tolling Events

CSED tolling events have start and end dates followed by additional tolling days

usually to account for denial of appeals and give the IRS a chance to discover the

tolling event has stopped.

Example: If an offer in compromise is submitted on January 1, 2012 and rejected on

June 1, 2012 the tolling event tolls the CSED for 152 days plus another 30 days for the

appeal for a total of 182 days.

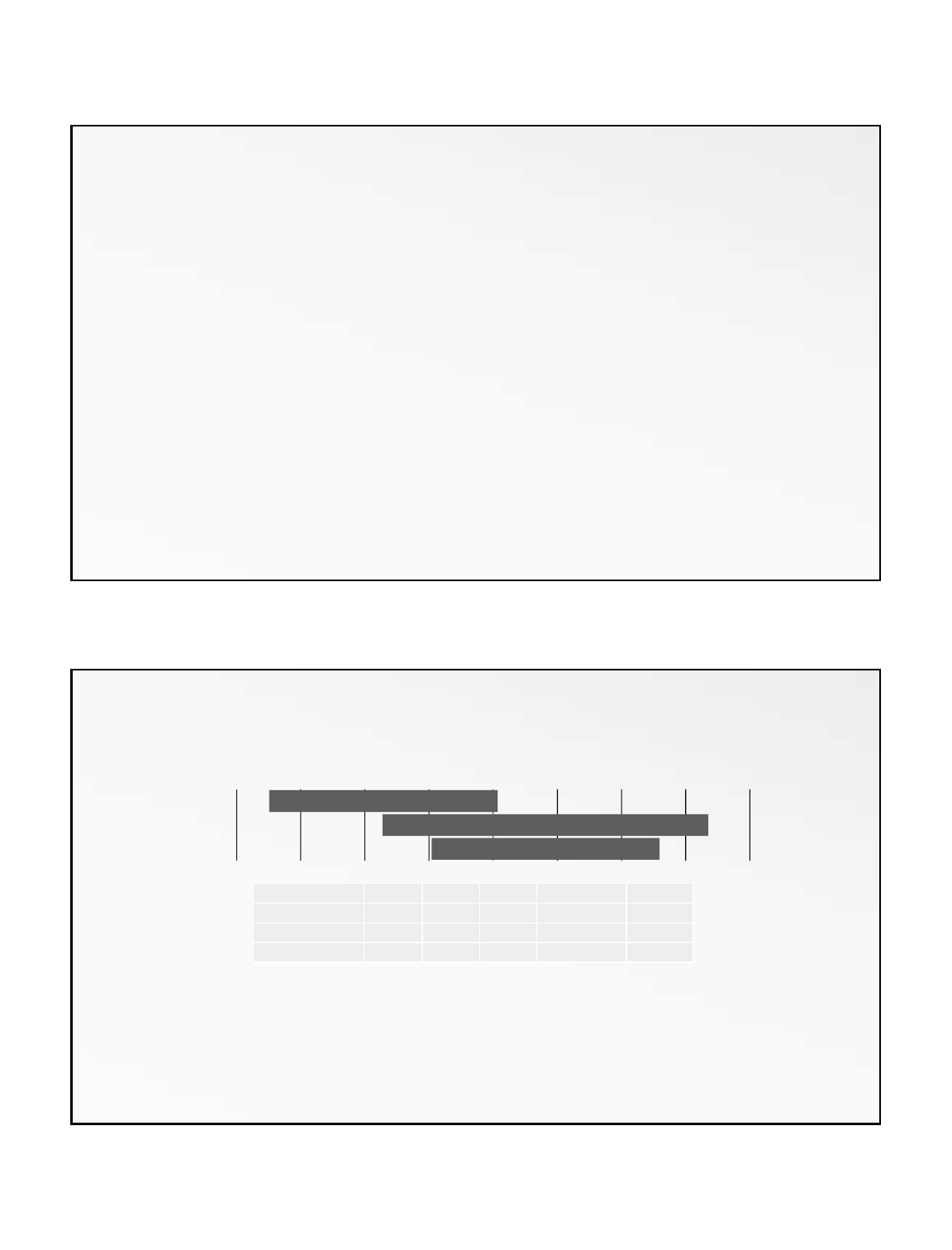

Tolling Event Calculations

If two or more tolling events overlap the days in the overlap are only tolled one time.

The CDP tolls from the start date until the end date.

The Bankruptcy only tolls from the end of the CDP until the end date.

The Pending IA does not toll because it overlaps completely with the previous events.

10/1/05 1/29/06 5/29/06 9/26/06 1/24/07 5/24/07 9/21/07 1/19/08 5/18/08

CDP

Bankruptcy

Pending IA

Tolling Event Start Date Duration End Date Duration In Days Days Tolled

CDP 12/1/2005 427 2/1/2007 427 427

Bankruptcy 7/1/2006 609 3/1/2008 609 394

Pending IA 10/1/2006 426 12/1/2007 426 0

6/13/2019

12

IRS Transaction Closing Codes

IRS Transaction closing codes define how the transaction is treated. These

codes do not show up on a IRS Account Transcript. Closing codes are

included in the Tax Mod A transcript.

For Example: 971 Pending installment agreement may or may not toll

depending on the closing code.

Tolling Events That Only Apply

To One Spouse

Certain tolling events can apply to one spouse and not the other. This is fairly

common. In some instances one spouse can negotiate with the IRS independent of the

other spouse or even file bankruptcy without their spouse.

Often times the IRS will create Separate Assessments for the MFJ taxpayers, but not

always. Best practice is to always request Separate Assessment transcripts to avoid

surprises.

Always confirm that the tolling event applies to the taxpayer you are representing and

not just their spouse (or former spouse).

6/13/2019

13

Processes Used To Verify Tolling

Events

IRS Account Transcripts – Obtained from PPL, e-Services or Get Transcript.

Tax Mod A Transcript – Obtained by calling PPL, ACS, or RO.

PAC ER - Public Access to Court Electronic Records (Federal Courts)

Tax Court

Bankruptcy Court

District Court

FOIA - Freedom Of Information Act Request

Taxpayer’s own paperwork – Any record in the taxpayer’s possession which can

confirm the date of an event such as IRS letters, passport, military orders, etc…

IRS Account Transcripts

The IRS Account Transcripts are the primary reference a tax professional should use

when manually calculating the CSED. If a Separate Assessment is present they should

also be used in the calculations. If a Separate Assessment exists the spouses may have

different CSEDs.

Remember the account transcript by themselves are usually not considered evidence

in tax court. From Grauer v. Commissioner, T.C. Memo. 2016-52 (Mar. 22, 2016) - As

the court noted, the IRS’s “only evidence that such an agreement exists is an

account transcript that [it] concedes is inaccurate and an indecipherable and

unconvincingly explained collection of numerical codes.”

6/13/2019

14

Grauer v. Commissioner, T.C.

Memo. 2016-52 (Mar. 22, 2016)

The important takeaway from this case was the taxpayer just had to prove the IRS

attempted to collect after the ten years. After that the burden of proof shifted to the

IRS to prove they had valid statutory reason to extend or toll the CSED.

The taxpayer does not need to disprove the tolling event. The IRS needs to prove it

and the taxpayer can challenge their evidence. The transcript was not considered

evidence in this case as stated in the previous slide.

This also brings into play not “Did the tolling event happen?”, but instead “Can the IRS

prove the tolling event happened?”

The TIGTA report mentioned earlier determined that 10.6% of tolling events

reviewed were not properly documented to justify tolling.

Tax Mod A Transcripts

The Tax Mod A transcripts have more detail than regular account transcripts. The Tax

Mod A shows the IRS Closing Codes for certain IRS Transaction codes. The Tax Mod A

shows the CSEDs, but use caution as certain screen shots only show one CSED

(Usually the oldest one) which can cause confusion.

Tax Mod A transcripts can be difficult to acquire and it is unknown how the no faxing

policy will affect Tax Mod A requests. It is unknown at this time if the IRS can

download a Tax Mod A to the SOR e-Services Mailbox. (This author believes the Tax

Mod A cannot be sent to the SOR due to technical restrictions). US Mail is probably the

only option available to the IRS but they restricted data that can be mailed to third

parties as well.

6/13/2019

15

Pacer

Public Access to Court Electronic Records (PACER) is an electronic public access

service that allows users to obtain case and docket information online from federal

appellate, district, and bankruptcy courts. PACER is provided by the Federal Judiciary

in keeping with its commitment to providing public access to court information via a

centralized service.

Tax Court Docket Inquiry:

https://www.ustaxcourt.gov/UstcDockInq/Default.aspx?PartyName

Bankruptcy Inquiry (Select which court at login or after login):

https://pacer.login.uscourts.gov/csologin/login.jsf

IRS FOIA Request

FOIA requests can be used to obtain IRS records that are not available from other

sources. Occasionally a FOIA needs to be used to obtain the Tax Mod A transcript, but

often times they can be obtained under 2848 through PPL, ACS or the RO.

IRS FOIA Instruction Page:

https://www.irs.gov/privacy-disclosure/freedom-of-information-act-foia-guidelines

IRS Online FOIA Request:

https://www.foia.gov/request/agency-component/2f6bdfbe-aa71-4dd6-ac88-3d6587fafa83/

6/13/2019

16

Taxpayer’s Records

Any record the taxpayer has in their possession to substantiate or disprove a tolling

event.

Under each tolling event later in this presentation a list of supporting example

documents will be listed. This is not an all inclusive list.

Tolling Event Section

Each tolling event is reviewed and best practices for each are listed.

This presentation will not cover a couple of the rare/obscure tolling events that this

author has not observed:

TC 488 Installment and/or Manual Billing (extends CSED) (never seen one, not

covered)

TC 550 Wrongful Seizures (not covered in presentation)

6/13/2019

17

Challenge Calculating Tolling For

Tax Court, Bankruptcy, & CDP

Tax Court, Bankruptcy (including Assessment Reduced To Judgement ), and CDP are

indicated on the transcript with the TC 520 Bankruptcy or other legal action filed.

CDP will have TC 971 Collection due process request received timely.

It is usually impossible to distinguish between a bankruptcy and tax court from

the transcript alone. Occasionally a bankruptcy payment or transaction code

will be listed but only occasionally.

Tax Court & Bankruptcy Tolling

These two tolling events will be covered together since they share the same

transaction code.

The CDP also shares this code but has different procedures and has it’s own

section.

Tax Court, Bankruptcy, and Collection Due Process Hearing (CDP) all use the TC

520 Bankruptcy or other legal action filed transaction code.

Bankruptcy tolls for an additional six-months after it is concluded. Tax court does

not have any additional tolling.

The IRS Insolvency Unit struggles to accurately enter information in regards to

bankruptcy.

6/13/2019

18

Tax Court/Bankruptcy Tolling

Codes

Tax Court or Bankruptcy – start of tolling

520 Bankruptcy or other legal action filed

Tax Court or Bankruptcy– end of tolling

521 Removed bankruptcy or other legal action

Bankruptcy plus six months

No additional tolling for Tax Court

Reversed Tax Court or Bankruptcy – event reversed no tolling

522 Removed bankruptcy or other legal action

Tax Court & Bankruptcy

Validation

Tax Court and Bankruptcy information can be found in PACER.

See example later in presentation.

CDP hearings are not in PACER unless the taxpayer exercises their Tax Court

rights. The Tax Court portion will be in PACER.

Taxpayer’s records – the taxpayer should have filing dates and discharge dates in

their paperwork to review or obtained from their lawyer.

6/13/2019

19

(Ref)

Bankruptcy

5.1.19.3.1.1 (07-19-2012) Transaction Codes for Bankruptcy

1. A TC 520/521 suspends a CSED by the amount of time beginning on the TC

520 (posted Cycle 8624 or later) transaction posting date and ending on the

associated TC 521 posting date, plus six months.

2. A TC 520 with a closing code 60 through 67, 83, or 85 through 89

systemically suspends the CSED unless a TC 550 (new CSED) is posted with a

later transaction date. For more information see IRM 5.17.8.28, Effect of

Bankruptcy on the Limitation Period for Assessment and Collection.

Unique Bankruptcy Issues

Married taxpayers and former spouses with joint tax liabilities can be difficult to

evaluate especially in community property states.

When evaluating bankruptcy tolling confirm the taxpayer you represent filed

the bankruptcy and not their spouse or former spouse. This one topic could

be discussed for two hours and is beyond the scope of this presentation.

There have been instances where the tax should have discharged in bankruptcy

but did not. It might be worth a conversation with the taxpayers attorney. In some

cases they can go back to the court.

This author gets numerous calls about E&O cases in reference to bankruptcies

filed too early (prior to the bankruptcy discharge dates). Some tax professionals

assist clients with their E&O claims against their bankruptcy attorney. This is an

accepted resolution method.

The TC 550 Manual CSED adjustment “Assets in the custody of the court” applies

when the bankruptcy is discharged, but some of the assets remain in the custody

of the court (Never seen one).

6/13/2019

20

PACER Example

In the following example this author searched PACER for my taxpayer’s SSN

(shown as Santa Claus 999-00-9999). (Used a real case and changed name).

Best Practice is not to search the specific court query site but search overall query.

For Bankruptcy opt to search for SSN (with or without dashes it searches both

ways).

PACER charges $.10 (one dime) per page on query results.

This query cost me $.20 (I actually downloaded the complete case summary – 34

pages and was charged $3.00, some docs cap at $3.00).

PACER Example

6/13/2019

21

PACER Example

PACER Example

6/13/2019

22

Collection Due Process Hearing

(CDP)

CDP shares the TC 520 Bankruptcy or other legal action filed.

CDP has an additional TC of 971 Collection due process request received timely.

The additional tax court component could be a separate event or combined into

the original CDP.

CDP Tolling Codes

CDP begins – start of tolling

520 Bankruptcy or other legal action filed

971 Collection due process request received timely

CDP ends – end of tolling (Add 90 days only if CSED expires in less than 90

days)

521 Removed bankruptcy or other legal action

CDP reversed – event reversed no tolling

522 Removed bankruptcy or other legal action

6/13/2019

23

CDP Validation

FOIA is the best source to determine what happened in the CDP.

PACER can be used, but only if the taxpayer exercises the Tax Court rights

allowed by the CDP.

Taxpayer paperwork can also be used if the taxpayer retained the records,

but remember this may not be complete.

The next slide will cover CDP or Equivalency Hearing.

CDP Or Equivalency Hearing

The tax professional should also review if the request for CDP was actually filed

timely.

A CDP is a tolling event, but an Equivalency Hearing is not. This author has

witnessed several instances of the request for CDP being received by the IRS after

the 30 day deadline and being entered as timely filed.

TC 971 Collection due process Notice of Intent to Levy – issued on the account

transcript indicates the date on the 1058 Letter or LT11. (Not sure if the NFTL

Letter 3172 shows on the transcript).

If there are more than 30 days between the TC 971 Collection due process Notice

of Intent to Levy and the 520 Bankruptcy or other legal action filed (accompanied

by the 971 Collection due process request received timely) then it is not a tolling

event it is just an Equivalency Hearing.

6/13/2019

24

(Ref)

CDP Hearing

5.1.19.3.3 (04-26-2018) Collection Due Process (CDP)

1. The CSED is suspended from the date the Service receives a timely filed

request for a CDP hearing to the date the taxpayer withdraws their request

for a CDP hearing or the date the determination from Appeals becomes final,

including any court appeals. See IRC 6330 (e)(1).

2. If less than 90 days of the statute of limitations remains when the

determination becomes final, the statute of limitations is extended to equal

90 days. The collection statute is not extended for equivalency hearings. See

IRC 6330 (e)(1).

3. For more information see IRM 5.1.9.3.6, Suspension of Collection Statute of

Limitations, and Treas. Reg. § 301.6330–1(g)(3), ex. 1.

Pending Installment

Agreements

Pending IA’s are extremely challenging to determine accurate tolling.

The IRS recently implemented a closing code for “rejected installment

agreement”, but it is difficult to distinguish between a reversal and a

rejection.

This author has reviewed multiple Tax Mod A’s and have trouble finding the

rejected date in there as well.

Often times the IRS Pending IA’s should never have been applied because they

do not meet the criteria.

6/13/2019

25

Pending IA Tolling Codes

Pending IA – start of tolling

971 Pending installment agreement

Established IA – end of tolling

971 Installment agreement established

Rejected IA – end of tolling (additional 30 days are included already do not

add)

972 Removed installment agreement

Reversed Pending IA – event reversed no tolling

972 Removed installment agreement

(Ref)

Pending IA

5.1.19.3.5 (04-26-2018) Installment Agreements

5. The Service is prohibited from levying, and the CSED is suspended under these

provisions:

a. While the request for installment agreement is pending with the Service,

b. For 30 days immediately following rejection of the installment agreement request,

and

c. If an appeal is requested within the 30-day period, during the period while the

rejection is being considered in Appeals.

d. During the 30 days after the date of termination, and

e. If an appeal is requested within the 30-day period, during the period while the

termination is being considered in Appeals

6. …

Note: The CSED is not suspended while an installment agreement is in effect.

6/13/2019

26

What Qualifies A Pending Installment

Agreement A Tolling Event

IRS IRM 5.14.1.3 (01-01-2016) Identifying Pending, Approved and Rejected Installment

Agreement Proposals on IDRS

4. Taxpayers need to provide specific information for installment agreement requests to be

processed. Also, if the information in (a) through (d) below is provided, but it is determined that

the agreement request was made to delay collection action, accounts should not be identified as

being in pending installment agreement status. (See IRM 5.14.3.2.) To identify accounts as

"pending" installment agreements, taxpayers must:

1. Provide information sufficient to identify the taxpayer: generally, the taxpayer’s name

and taxpayer identification number (TIN). If a taxpayer furnishes a name, but no TIN,

and the taxpayer ’s identity can be determined, then pending status should be

identified;

2. Identify the tax liability to be covered by the agreement;

3. Propose a monthly or other periodic payment of a specific amount;

4. Be in compliance with filing requirements. (See IRM 5.14.1.4.1.)

IRS Personnel Abusing

Pending Installment Agreements

This author participated in a case recently where a revenue officer denied a Pending

IA that was on the transcript for four years. This extended a CSED that was about to

expire by four years.

The Notice of Intent to Levy was sent 2 weeks after the Pending IA input on the

transcript. The client was also levied during the tolling event.

The tax professional filed with Taxpayer Advocate and advised the client wanted their

levied funds back or remove the pending IA Tolling Event and let the remainder of the

assessed amount drop off. They opted for writing off the balance due to the CSED.

In the time since I first gave this webinar two years ago I have personally observed

over a dozen instances of this type of abuse.

6/13/2019

27

Pending IA’s That Are Not

Accepted Or Rejected Do Not Toll

Pending IA’s are a challenge. In my experience if the Pending IA is not closed it does

not toll. Often times someone at the IRS places the Pending IA on the account, but

nobody ever follows up. It is never accepted or rejected and it just hangs. I have seen

CSED’s expire with open Pending IA’s on them.

Occasionally multiple pending IA’s are on a transcript some with endings and some

with out. FOIA is the best method here as well as reconstructing the CSED to

determine how the IRS calculated the CSED.

Reasonable Time For A Pending IA

An account has an unreversed pending IA open for more than 14 weeks, if reversing

transaction was input prior to January 21, 2016; 26 weeks if the reversing transaction

was input on or after January 21, 2016 and there is no evidence of an IA request.

6/13/2019

28

SITUATIONS THAT DO RESULT IN IDENTIFICATION OF PENDING INSTALLMENT AGREEMENTS

Example:

(1) A taxpayer calls the IRS, provides her name, social security number (SSN), identifies the outstanding liability (or balances due), is in

compliance with all filing requirements, fits streamlined installment agreement criteria and states she wants to pay $500 per month. If

the $500 proposed payment meets the minimum payment required under the Streamlined Criteria and the installment agreement can

be immediately closed, do not request a TC 971 AC 043. If the payment does not meet the minimum required payment, the taxpayer

can't make the minimum payment required for Streamlined criteria, and additional information will need to be secured, input the TC

971 AC 043.

Example:

(2) A revenue officer (RO) and taxpayer discuss the taxpayer’s financial statement (which includes the taxpayer’s name and SSN) on the

phone. The taxpayer is in compliance with all filing requirements. The balances due are specifically identified. The RO says thetaxpayer

needs to pay $1500 per month. The taxpayer says he will think about it. The revenue officer mails the taxpayer a 433D. TP changes the

amount on 433D and mails it back.

Note:

Though in pending status, the agreement (and payment amount) must be approved by the manager, unless it is a Streamlined,

Guaranteed or In-Business Trust Fund Express agreement. (See IRM 5.14.5.)

Example:

(3) A taxpayer wants to make payments. RO completes Collection Information Statement (CIS) including the taxpayer’s name and SSN

and tells the taxpayer $500 per month is appropriate. The taxpayer is in compliance with filing requirements. The taxpayer verbally

agrees to the payment amount.

(Ref) Examples From IRS IRM 5.14.1.3.10 (01-01-2016)

SITUATIONS THAT DO NOT RESULT IN IDENTIFICATION OF PENDING INSTALLMENT AGREEMENTS

Example:

(1) A revenue officer evaluates a taxpayer’s CIS. The taxpayer’s name, social security number and balances due are all known and/or identified. The revenue

officer informs the taxpayer that a $1500 per month installment agreement is appropriate. There is no response from the taxpayer.

Example:

(2) A revenue officer mails a 433D (with the taxpayer’s name, SSN and balances due listed) to a taxpayer. The 433D provides a payment amount based on an

analysis of the taxpayer’s CIS. No response is received by phone, FAX, e-mail or other means of communication from the taxpayer.

Example:

(3) A taxpayer who knows he owes taxes tells his employer to send $500 per month of his paycheck to the IRS. The taxpayer does not communicate with the

IRS. The taxpayer’s employer sends $500 per month referencing the taxpayer’s SSN. (Note: if $500 per month is being received, contact should be attempted

prior to taking collection action.)

Example:

(5) A taxpayer wants to make payments on an installment agreement. The RO completes a CIS including the taxpayers name and SSN. RO tells the taxpayer

$500 per month appears to be an appropriate amount for an installment agreement, but the taxpayer is not in compliance with filing his Forms 1040 for the

last two years. The taxpayer states that his accountant is away, and that the returns, which are complicated, will take some time to prepare. The revenue

officer requests that the taxpayer submit original, signed returns within 60 days, along with a $500 payment (based on the financial statement received). In

addition, the revenue officer requests that a payment of $500 be received within 30 days. These requests are made in accordance with the procedures

provided in IRM 5.14.3.1 and IRM 5.1.10.

(Ref) Examples From IRS IRM 5.14.1.3.10 (01-01-2016)

6/13/2019

29

(Ref)

A

ccepted & Rejected IAs

5.14.1.3 (07-16-2018)

Identifying Pending, Approved and Rejected Installment Agreement Proposals on IDRS

8. The following Transaction Codes (TC) and Action Codes (AC) will be input on ALL taxpayer

modules containing TC 971 AC 043 to indicate acceptance or rejection of proposed agreements:

a. For Approved Agreements: request that TC 971 AC 063 be input to IDRS on ALL

taxpayer modules.

Note: Agreements approved on ICS systemically input the TC 971 AC 063 to

IDRS, so no action is necessary for those agreements.

b. For Rejected Proposals: request reversal of TC 971 AC 043 forty-five (45) days after the

rejection is communicated to the taxpayer, unless a timely appeal is received. The date

of the reversing transaction (TC 972 AC 043) should be thirty (30) days from the date

the rejection was communicated to the taxpayer.

c. For Appeals: during appeals, TC 971 AC 043 remains on all modules. If Appeals

sustains a rejection, input TC 972 AC 043 thirty days (30) after a rejection is

communicated to the taxpayer. If Appeals grants an installment agreement, follow the

procedures above for approved agreements.

Validate A Pending IA

Complete a FOIA request for the Pending IA in question. Ask for all documentation in

regards to the Pending IA to include all notes in the IRS system as well as any written

documentation or forms submitted by the taxpayer.

If the pending IA was initiated by Examinations they are required to send a Form 3177

Notice of Action for Entry on Master File to Collections. Apparently, Exams is unable

able to input the Transaction Codes necessary. The Form 3177 should have enough

information to establish the Pending IA as valid.

Verify from the FOIA information that the IRS documented the requirements as

specified in IRM 5.14.1.3 specifically the proposed payment amount and that the

taxpayer was compliant at the time of the request for IA.

6/13/2019

30

Terminated Installment

Agreements

Terminated installment agreements are fairly straight forward. A terminated

installment agreement tolls the CSED for 30 days accounting for the time to file an

appeal and then if appealed the time of the appeal.

The TC 971 No longer in installment agreement status indicates this event.

Since this event only tolls 30 days there is not a lot of opportunity here to shorten

the CSED.

There is one example this author reviewed that appealing this type of tolling event

was warranted. Client was levied over $10,000 just one month before CSED. A case

review showed there were seven terminated installment agreements with a new

agreement established within days. The taxpayer advised he had been in an

installment agreement for several years and occasionally he had to call and

renegotiate the payment amounts. He never defaulted. 7 * 30 = 210 days of tolling.

Taxpayer Advocate was able to get his levied funds back since this should not have

tolled.

(Ref) Terminated Installment

Agreements

5.1.19.3.5 (04-26-2018) Installment Agreements

8. The Job Creation and Workers Assistance Act of 2002, effective March 9, 2002 amended IRC 6331(k)(3) and

reinstated the same CSED suspensions as described above during the time that a levy is prohibited for both

pending offers and installment agreements, and terminated installment agreements. This amendment suspends

the CSED for the number of days on or after March 9 that an installment agreement is pending, during the 30

days to appeal the rejection, during a timely-filed appeal of the rejection, during the 30 days to appeal the

termination, or during a timely-filed appeal of the termination.

Example:

An installment agreement is terminated on March 4, 2002. March 4, 5, 6, 7, and 8 would not be suspended. The

30-day period for appealing the termination starts on March 5 and ends on April 3. Of that 30-day period, the

collection statute would be suspended starting on March 9 through and including April 3. If the taxpayer

requests an appeal on or before April 3, then the collection statute will be suspended until Appeals sends the

taxpayer a letter giving its decision.

Note:

An installment agreement is deemed terminated on the 60th day after the date of the CP 523 or Letter 2975,

unless the taxpayer requests a CAP hearing challenging the proposed termination during the 30 days after the

date of the notice

6/13/2019

31

Pending Offer In Compromise

Pending OIC’s are pretty straight forward. The CSED is tolled from the time the

valid offer is received until the determination.

If rejected, an additional 30 days is added plus any time for the appeal.

If the OIC is not submitted correctly it will be reversed.

If the IRS has not made a determination within two years the OIC is approved.

5.8.8.12 (08-31-2018) 24-Month Mandatory Acceptance under IRC § 7122(f)

The CSED is not tolled for an accepted OIC but I saw a case recently where it was.

We are currently assisting with the validation and appeal.

Presentation Note: If a taxpayer gets an accepted OIC with less than 5 years on the

CSED do they need to stay compliant until 5 years after the OIC is accepted or just

until the CSED? (Not accounting for balances on other years with different CSEDs).

This author is unable to answer the question at this time.

Pending OIC Tolling Codes

Pending OIC – start of tolling

480 Offer in compromise received

Accepted OIC – end of tolling

780 Offer in compromise accepted

Denied OIC – end of tolling plus 30 days

481 Denied offer in compromise

Reversed OIC – event reversed no tolling

482 Offer in compromise withdrawn

6/13/2019

32

OIC Validation

FOIA request is the best way to validate the start and end of an OIC.

Taxpayer’s paperwork and recollection would be the secondary

validation.

(Ref) Pending Offer In Compromise

5.1.19.3.4 (04-26-2018) Offer In Compromise

4. The Service is prohibited from levying and the CSED is suspended under the

following provisions:

a. While an offer is pending with the Service,

b. For 30 days immediately following rejection of the offer for the

taxpayer to appeal the rejection, and

c. If an appeal is requested within the 30 days, during the period while

the rejection is being considered in Appeals.

CSED extensions for the period of time "while any installment remains unpaid"

and "for one additional year thereafter" are eliminated. No days are suspended

before December 31, 1999, or after December 20, 2000.

6/13/2019

33

Innocent Spouse

Innocent spouse can be a tricky tolling event.

Innocent spouse can be part of a CDP.

An innocent spouse claim can also go to tax court (which would be a separate Tax

Court tolling but it does add 60 days at the end of that Tax Court proceeding).

Innocent spouse is also listed under the TC 550 IRS can collect until (date) manual

tolling events.

Innocent Spouse

Innocent Spouse– start of tolling

971 Innocent spouse claim received

End of tolling is the earlier of the following:

The waiver is filed possibly TC 971 Innocent spouse balance cleared

90 days after the TC 971 Innocent spouse claim received

If a Tax Court petition is filed, when the Tax Court decision becomes

final, plus, in each instance, 60 days.

6/13/2019

34

Innocent Spouse Validation

FOIA request is the best option to establish when and what happened.

If the case goes to tax court then PACER becomes an option.

Taxpayer’s records should also be used if available.

There is some opportunity here because the IRM states the lesser of three

dates.

(Ref)

Innocent Spouse

5.1.19.3.6 (04-26-2018) Relief From Joint And Several Liability On Joint Returns/Innocent Spouse

1. Unless collection will be jeopardized by delay, collection by levy or proceeding in court against a requesting

spouse is suspended if he or she makes a qualifying request under IRC 6015(b)or IRC 6015(c). Collection

against a requesting spouse is suspended if he or she makes a qualifying request under IRC 6015(f) and the

liability arose on or after December 20, 2006, or arose prior to December 20, 2006 and remained unpaid as

of that date. For more information see IRM 25.15.1.8, Statute of Limitations on Collection.

2. The collection period is suspended from the filing of the claim until the earlier of the date a waiver is filed,

or until the expiration of the 90-day period for petitioning the Tax Court, or if a Tax Court petition is filed,

when the Tax Court decision becomes final, plus, in each instance, 60 days.

3. If a request for relief is made in response to collection due process procedures, collection activity is

suspended and the collection period provided for by IRC 6330(e) for the period during which any

administrative hearings, and appeals therein, regarding the levy are pending. The rules for suspension

under IRC 6330 differ from IRC 6015. In general, the latest suspension of collection and the collection

period should control, which may require analyzing the suspension under both IRC 6015 and IRC 6330

where relief from joint and several liability is requested as part of an IRC 6330 hearing.

4. If the requesting spouse signs a waiver of the restrictions on collection, the suspension of the period of

limitations on collection against the requesting spouse will terminate 60 days after the waiver is filed with

the Service, limiting the CSED extension to the period from when the claim was filed to the time the waiver

was signed, plus 60 days.

6/13/2019

35

Military Deferment

Military deferment tolling events are a hybrid. They are active when a TC 500

Suspension of tax collection - military deferment is on the account transcript.

The TC 500 is changed to a TC 503 Suspension of tax collection - military

deferment when the deferment is over.

The military deferment TC 500 does not show the start and end date on the

transcript. Instead it is manually calculated using a TC 550 when the TC 500 is

changed to a TC 503.

The CSED is suspended during the taxpayer's military service and for an

additional 270 days afterward.

Military Deferment Validation

Most military personnel keep copies of their orders and deployment paperwork.

The taxpayer’s records are the best source of tolling validation.

FOIA request can be used to determine how the IRS established the starting and

ending dates of the tolling event.

6/13/2019

36

(Ref)

Military Deferment

5.1.19.3.8 (04-26-2018) Combat Zone or Contingency Operation

1. Under IRC 7508 the deadlines for certain acts performed by either taxpayers

and the Service are postponed when the taxpayer serves in:

a. An area designated as a combat zone;

b. A contingency operation designated by the Department of Defense;

c. A qualified hazardous duty area as defined by Congress; or

d. Direct support of military operations, as certified by the Department of

Defense, in a combat zone, contingency operation, or qualified hazardous

duty area.

2. The acts specified in IRC 7508 include :

• Paying Income tax, Estate, Gift, Employment or Excise Tax, and

• Collecting any tax.

Rev. Proc. 2007–56, or its successor, expands the list provided in the statute.

(Ref)

Military Deferment

5.1.19.3.9 (04-26-2018) Military Deferment

1. Under the Service Members Civil Relief Act of 2003 (cited as 50 USC. §4000)

the collection of any income tax due from any person in the military service,

whether falling due before or during military service, may be deferred up to

180 days if ability to pay the tax is materially affected because of that

person's military service. The CSED is suspended during the taxpayer's

military service and for an additional 270 days afterward.

2. A military deferment suspends the CSED. The Transaction Code 500 with

Closing Code 51 identifies a military deferment. For more information see

IRM 5.1.7.12.1, Military Deferment Procedures.

6/13/2019

37

Manually Adjusted CSED

The manually adjusted CSED (TC 550) are difficult to determine from the

account transcript since they are manually calculated.

The FOIA request is usually needed to determine how the IRS calculated

the CSED manually.

The IRS also uses the TC 550 to correct computation errors. If a taxpayer

successfully appeals a tolling event the IRS can either remove it from the

system or adjust it with a TC 550.

Form 900 Tax Collection Waiver

The Form 900 Tax Collection Waiver is a voluntary extension of the CSED by the

taxpayer.

The Form 900 is only currently used when the taxpayer enters into a Partial Pay

Installment Agreement. These are not used on all PPIAs, but they can be.

Use of the Form 900 was abused by the IRS prior to 2000 (more on the next slide).

6/13/2019

38

Form 900 Tax Collection Waiver

From the 2013 Taxpayer Advocate’s Annual Report:

As of December 31, 2013, 2,371 taxpayers remain subject to IRS collection action

because of waivers of the applicable statutory period for collection, which violate the

IRS policy limit of five years. Before 2000, IRS collection personnel solicited

waivers to extend the collection period when it did not appear the taxpayer

could pay the tax owed prior to the collection statute expiration date (CSED).

Congress limited this practice as part of the IRS Restructuring and Reform Act of 1998

(RRA 98), which generally ended CSED waivers, other than for extensions entered in

connection with installment agreements (IAs).

These cases still pop up occasionally. The IRS used to ask the taxpayer to sign the

Form 900 extending the CSED 25 years!!!!!! If you stumble on one of these cases with

a 25 year CSED extension just file form 900 and get it resolved.

Form 911-

T

axpayer Assistance

Order (TAO)

IRS IRM 5.1.19.3.13.2 states “Taxpayer Advocate Service (TAS) does not have to

input the appropriate IDRS codes to reflect the suspension of the statute of

limitations under IRC 7811(d).”

This means the IRS does not have to enter the Form 911 tolling event, but they still

can. If the IRS enters the tolling event for the 911 and you would like to appeal the

best avenue is with the Taxpayer Advocate. It is rare that this tolling event is applied

so your position should be claimed under the Taxpayer Bill of Rights #10 The Right To

A Fair And Just Tax System. Why was my client singled out?

6/13/2019

39

Taxpayer Out Of The Country

CSED tolls if taxpayer outside of the United States for 6 month continuously.

If the taxpayer returns to the US for even an hour it does not toll (think a layover in the US).

The IRS establishes out of country through the following methods:

From a signed 433-A stating taxpayer out of country.

Any other written or oral statements by the taxpayer or POA stating the dates the

taxpayer was outside the United States and Commonwealth Territories.

Tax returns consistently filed since the year of tax assessment with a foreign address.

Other data sources such as Accurint, credit report, IRP, third party testimony, etc., to

determine whether a taxpayer has been outside the United States for a long period of

time. Per the IRM do not rely solely on these sources to justify updating the CSED.

Government-based travel or residency source of information such as TECS Historical

Travel Records (State Department Computers).

The IRS tolls the CSED for an additional six months after the taxpayer returns to the US.

Validate Taxpayer

Out Of The Country

FOIA request will be the best source of information on how the IRS determined the taxpayer

was out of the country.

Taxpayers records including their passport, travel documents and possibly social media

accounts could be used to show the taxpayer returned to US Territory.

6/13/2019

40

(Ref) Taxpayer Out Of The Country

5.1.19.3.7 (04-26-2018) Taxpayer Living Outside the U.S.

1. The period of limitations on collection after assessment is suspended while

the taxpayer is outside the United States if the absence is for a continuous

period of at least six months per IRC 6503(c) .

2. To make certain that the Government has an opportunity to collect the tax

after the taxpayer's return, the period does not expire (where the taxpayer

has been out of the country for six months or more) before a minimum of six

months after the taxpayer's return to the country. As the application of this

provision can result in the CSED being suspended for a very long time,

policies for the administration of this code section are now established.

Tax Assessment Reduced To

Judgement

The IRS can go to court and have the assessment converted to a judgement.

The Tax Court Case would show up as a normal Tax Court case on the transcript

TC 520 and TC 521. After the case is concluded there would be a TC 550 extending

the CSED for 20 years (different than the Form 900 pre 2000 voluntary

extension).

The only chance for appeal with a judgement is to prove the CSED expired prior to

the start of litigation (before the TC 520).

6/13/2019

41

(Ref) Tax Assessment Reduced To

Judgement

5.1.19.3.2.2 (05-19-2016) Suit to Reduce Assessments to Judgment

1. A suit to reduce the assessments to judgment must be filed prior to the

expiration of the CSED to suspend the collection period. The filing of a suit

will suspend the collection statute during litigation. For more information see

IRM 5.17.4.7, Suit to Reduce Assessments to Judgment.

2. When a judgment is entered in a case where assessments were reduced to

judgment, request input of TC 550, definer code 04, using 20 years from the

date the judgment was entered as the new CSED.

Reminder:

The TC 550 definer code 04 must be input before the TC 520 is reversed. This

will prevent the CSED from expiring if it falls during the pendency of the

litigation.

Common Avenues To

Appeal A CSED

1. Call ACS or assigned RO and bring it to their attention.

2. Contact Advisory Control (Phone)

3. File a 911 for the Taxpayer Advocate’s assistance.

4. Form 843 Claim For Refund

5. File an OIC Doubt To Liability, but only after your CSED has passed (and even

then wait at least 90 days if possible just to make sure).

1. Appeal Rejection.

6. U.S. Court of Federal Claims or the Federal District Courts once tax is paid.

6/13/2019

42

Prepare Your Appeal

The more organized your supporting documents and materials are the higher

chance of success.

At a minimum show your work in a spreadsheet.

Remember most IRS personnel are managing their case load. Give them the

supporting documents to support your position when they go to their manager

for approval.

Call ACS or Assigned RO

I usually recommend this since it is the quickest method to resolve this issue, but

fewer and fewer cases have been resolved through this method recently.

ThebestpracticeistoasktheIRSPersonneliftheyhaveaccesstotheCCALC

Program. If they do they should be able to manually check the CSED.

Newer IRS employees seem to have not been trained on this program.

All manual recalculations need to be reviewed and approved by a

supervisor. If your IRS contact is not aware or unwilling to use the CCALC

then ask for a supervisor.

CCALC is the IRS Excel program used to calculate the CSED manually. It has

been available since 2012.

6/13/2019

43

Call Collection Advisory Group

IRS Collection Advisory Group under IRS Technical Services deals with liens

primarily.

They can also be used to contest inaccurate CSED calculations.

A list of addresses and contact numbers has been provided in the presentation

handouts.

File A 911-Taxpayer Advocate

This is my personal favorite.

There is not much payroll involved in this option other than prepping the case.

This is where most of the CSED cases I have had experience with are resolved.

6/13/2019

44

File Form 843 Claim For Refund

This would be an option especially for a case with not a lot of liability.

Example taxpayer owes $5,000 that is passed calculated CSED.

An OIC could cost at least that making this not the best option.

This would have a lot of the same documentation needed for the OIC if the 843 is

denied.

File An OIC Doubt To Liability

This is a great option but can be time consuming.

The taxpayer needs to weigh the risk versus reward based on what the OIC fees

are compared to the amount and probability of success.

Some professionals may opt to skip the earlier steps and do this first.

If the OIC is denied the taxpayer can go to appeals.

6/13/2019

45

U.S. Court of Federal Claims or

the Federal District Courts

This is obviously a last resort since the tax must be paid already to file in Federal

Court.

It is a statutory question so if the case is strong a reasonable option.

This option can be expensive and Pro Se can be a challenge.

SPECIAL OFFER

Good Until Midnight Tonight 6/13/2019

Try the fully loaded Tax Help Software Executive Product for six

months for only $250. Get the only product on the market that

calculates accurate CSED’s (More accurate than the IRS

calculations).

This product can also detect IRS Audits and CP2000s six months in

advance of the IRS Notice.

Purchase at: taxhelpsoftware.com/ASTPS.html (case sensitive)

or taxhelpsoftware.com and click “ASTPS” in footer at bottom of page

6/13/2019

46

Bankruptcy Webinar

Later this year Morgan King and I will be hosting a webinar on Bankruptcy and IRS

Tax Discharge.

If you are interested in learning how to add Bankruptcy Consulting to attorneys or if

you are an attorney wanting to learn more about tax discharge in bankruptcy this will

be the class for you.

The webinar will cover the calculations of the three rules, case law review, and actual

scenario examples so you can apply what you learn.

Special Offer From Morgan King to webinar attendees. 15% off any materials

www.morganking.com click on books

My recommendation is the Discharging Taxes in Consumer Bankruptcy Cases

QUESTIONS?

Additional Free Information Can be found at:

TaxHelpSoftware.com

and

AuditDetective.com

6/13/2019

47

Unmasked IRS W&I Transcripts

Now Available In e-Services

Last month the IRS stopped masking the Wage & Income Transcripts available

through e-Services. The IRS officially announced this June 4

th

in IRS IR-2019-101

(Press Release).

There Is A Tremendous Upside

To The IRS No Faxing &

Masked Transcripts

As a result of the no faxing and the transcript masking the IRS figured out they could

deliver transcripts electronically to the Secure Object Repository (SOR) also known as

the E-Service Mailbox.

This feature has been available since e-Services launched, but the IRS refused to

utilize it and continued to fax transcripts for fifteen years.

6/13/2019

48

Best Practice Getting

Transcripts The Same Day As

2848/8821

On February 4

th

, 2019 the IRS updated IRM 21.2.3.5.3 &

21.2.3.5.4 to include BMF and masked IMF transcripts to be

requested through PPS (with a valid 2848/8821) and placed in the

SOR Mailbox.

1

This now allows tax practitioners to call PPS, fax a freshly signed

2848/8821, and request transcripts be sent to the SOR Mailbox

immediately.

1 IRM Procedural Update Number: wi-21-0219-0109 Subject: e-Services Secure Mailbox for Authorized Representatives and

Customer File Number Programming Fix 2/4/2019