Physical Description

Location:

Thomas Brothers Guide:

Assessor Parcel Number:

Land Description

Site Area:

Shape:

Topography:

Utilities:

Zoning:

Sale Data

Interest Sold:

Date of Sale:

Deed Date:

Document No.:

Sale Price:

Sale Price/SF:

Grantor:

Grantee:

Financing:

Verification:

1136 Ingraham Street

Los Angeles, CA 90017

Los Angeles County: 634, D/4

5143-021-001 and 008 through 014

71,783± Square Feet, or 1.65± Acres (gross)

65,604± Square Feet, or 1.51± Acres (net)

Irregular

Level

All available to site

C4(CW)-U/6, City of Los Angeles

Fee Simple

September 1, 2010

August 16, 2010

1230729

$10,000,000

$139.31

Ingraham

&

Bixel, LLC

Career Lofts, LLC

$5,000,000 cash down payment (50%); $5,000,000 1" TD with

Shinhan Bank America at undisclosed market terms

Mark Hong, Listing Broker

30

Land Sale No.5 (Continued)

Comments: This site is located at the non-signalized southwest comer of lngraham and Bixel Streets and the

signalized northwest comer of Bixel and

7th

Streets and is bisected by a public alley. Access is currently

provided along lngraham and Bixel Streets and the public alley. The property is located within the Central

City West Specific Plan and allows C4 uses, with a height limit of 1,218 feet and a maximum FAR of 6:1.

Although it was entitled for 334 residential condominiums and 15,175 square feet of retail space at the time

of sale, the value of the entitlements was nominal as the buyer plans to re-entitle the property for 300

apartment units according to the listing broker. The site, which was improved with a parking lot at the time

of sale, is located within the Los Angeles State Enterprise Zone and the Central City Parking Area.

31

Physical Description

Location:

Southeast corner of Los Angeles Street and 2nd Street

Los Angeles, CA 90012

Los Angeles County: 634, G/4

5161-024-014,018

Thomas Brotbers Guide:

Assessor Parcel Number:

Land Description

Site Area:

Shape:

Topography:

Utilities:

Zoning:

44,027± Square Feet, or 1.01± Acres

Generally Rectangular

Level

All available to site

[QJC2-4D-O, City of Los Angeles

Sale Data

Interest Sold:

Date of Sale:

Deed Date:

Document No.:

Sale Price:

Sale Price/SF:

Grantor:

Grantee:

Financing:

Fee Simple

March 18, 2008

March 14,2008

0461811

$10,975,000

$249.28

CityView Kor I, LLC

Avalon Bay Communities, Inc.

All cash transaction

Verification:

Christopher Payne, Buyer

32

Land Sale No.6 (Continued)

Comments: This site is located at the signalized southeast comer of

2"d

aud Los Angeles Streets, with access

from both and reciprocal access through the properties to the south and east. This property is part of a larger

proposed development known as "The Block 8 Development," a mixed-use project consisting of 519

residential condominium units, 231 apartment units and 50,000 square feet of retail space. Although the

buyer had previously purchased the adjacent parcels to the south, there was reportedly no premium paid for

assemblage. According to the buyer, the property was fully entitled at the time of sale, with the entitlements

contributing approximately 30 percent to the purchase price; a downward Condition of Sale adjustment was

therefore made. The

[Q]

zoning condition limits the ground floor commercial uses that can be developed on

the site. The site, which was improved with two parking lots at the time of sale, is located within the Los

Angeles State Enterprise Zone, the Greater Downtown Housing Incentive Area, and the Central City and

Downtown Business District Parking Areas.

33

Physical Description

Location:

Thomas Brothers Guide:

Assessor Parcel Number:

Jefferson Boulevard at Centinela Avenue

Los Angeles (Playa Vista), CA 90045

Los Angeles County: 672,

FI7

4211-010-042 through 048, 051, 052, 057 through 059, 064 through

067,079 and 080; 4211-011-027 through 043

Land Description

Site Area:

Shape:

Topography:

Utilities:

Zoning:

2,787,840± Square Feet, or 64.00± Acres

Irregular

Level

All available to site

M(PV), City of Los Angeles

Sale Data

Interest Sold:

Date of Sale:

Deed Date:

Document Nos.:

Sale Price:

Sale Price/SF:

Grantor:

Grantee:

Financing:

Fee Simple

February 9, 2007

February 8, 2007

0284592 through 0284601

$265,000,000

$95.06

Playa Phase I Conunercial Land Company, LLC

PV Campus Parcell, L.P. through PV Campus Parcel 10, L.P. (each

deed individually identified)

All cash transaction

Verification:

Randy Johnson, Senior VP/CFO for Seller

34

Land Sale No.7 (Continued)

Comments: This sale is located along the south side of Jefferson Boulevard and Centinela Avenue, the north

side of Bluff Creek Drive between the intersection of Bluff Creek Drive and Centinela Avenue aud Westlawn

Avenue. All comers are signalized. The Site is zoned M(PV), Playa Vista Specific Plan, which allows C2

uses. At the time of sale, vesting tentative tract map 49104 and tentative tract map 52092 had been approved

after hearings before the Coastal Commission and Los Angeles Department of City Planning. According to

the seller, the purchase price consisted of $200,000,000 in cash and a Letter of Credit for $65,000,000. The

sale was all cash to the seller, and the buyer obtained financing through Bank of America after the close of

escrow. The seller was unable to estimate the contributory value of the entitlements. Although there are

II

buildings on the property which are classified as "historical," including the 300,000 square foot building

where the Spruce Goose was built, the seller does not believe that they had any contributory value.

35

Physical Description

Location:

Thomas Brothers

Gui

de:

Assessor Parcel Number:

1101 South Flower Street

Los Angeles, CA 90015

Los Angeles County: 634, D/5

5138-015-026 and 028 through 038 (now 5138-015-026)

Land Description

Site Area:

Shape:

Topography:

Utilities:

Zoning:

Sale Data

Interest Sold:

Date of Sale:

Deed Date:

Document No.:

Sale Price:

Sale Price/SF:

Grantor:

Grantee:

Financing:

Verification:

200,812± Square Feet, or 4.61± Acres

Generally Rectangular

Level

All available to site

LASED, City of Los Angeles

Fee Simple

August 15, 2006

Undated

1810546

$80,000,000

$393.38

L A Arena Land Company, LLC, and Flower Holdings, L L C

JM Fig LLC, as to a 45% interest, MG Fig LLC, as to a 5% interest,

HS Fig LLC, as to a 17% interest, and CLAD Resources Borrower,

LLC, as to a 33% interest

$15,000,000 casb down payment (18.8%); $65,000,000 1" TD with

Waebovia Bank at undisclosed market terms

Rich Mayo, Buyer's Broker

36

Land Sale No.8 (Continned)

Comments: This site is located across the street from Staples Center, and consists of the entire city hlock

bounded hy II th Street on the north,

Ith

Street on the south, Flower Street on the east and Figueroa Street on

the west.

It

is located at four signalized comers, with access from 11th, Flower, and Figueroa Streets, The

site is within the Los Angeles Sports and Entertainment District Specific Plan, which was in the process of

being amended to allow 207,376 square feet of hotellballroom space (222 rooms), 1,009,439 square feet of

residential space (860 dwelling units) and 271,286 square feet of retail/entertainment/restaurant space at the

time of sale. Tract Map No. 53384, an air rigbts subdivision, was recorded on June 11, 2003. Although the

property, formerly a Bank of America facility, is improved with a parking lot and 2 buildings tbat provide

access to a large underground vault, the improvements bad no contributory value according to the buyer's

broker. The value of the air lights subdivision was offset by increased demolition costs associated with the

underground vault. The site is located witbin the Los Angeles State Enterprise Zone, tbe Greater Downtown

Housing Incentive Area, and the Central City and Downtown Business District Parking Areas.

37

Physical Description

Location:

Thomas Brothers Guide:

Assessor Parcel Numbers:

2300 - 2400 South Flower Street

Los Angeles, CA 90007

Los Angeles County: 634, en

5126-005-005 through 007 (now 5126-005-008); 5126-017-014 and

015 (now 5127-017-017); and 5126-018-032 through 035

(now 5126-018-032, 033, 035 and 037 through 039)

Land Description

Site Area:

Shape:

Topography:

Utilities:

Zoning:

411,642± Square Feet, or 9A5± Acres

Irregular

Level

All available to site

[QJC2-2-0, City of Los Angeles

Sale Data

Interest Sold:

Date of Sale:

Deed Date:

Document No.:

Sale Price:

Sale Price/SF:

Grantor:

Grantee:

Financing:

Fee Simple

July 18,2006

July 18, 2006

1576695

$70,500,000

$171.27

Los Angeles Orthopaedic Hospital Foundation

PalmerlFlower Street Properties

$27,500,000 cash down payment (39.0%); $43,000,000 1" TD with

Bank of America at undisclosed market terms

Verification:

Emily Cohen, Entitlement Manager for Buyer

Dwight Hotchkiss, Listing Broker

38

Land Sale No.9 (Continued)

Comments: This sale consists of two non-contiguous parcels ofland, a 0.47± acre parcel located along the

northwest side of Flower Street,

120±

feet southwest of

23,d

Street, and an 8.98± acre parcel located at the

signalized southwest comer of Flower and

23,d

Streets, a portion of which extends to Adams Boulevard on

the southwest. The smaller parcel is accessible from Flower Street; the larger parcel includes a portion of

vacated Hope Street and is accessible from

23'"

Street and Adams Boulevard. The larger parcel is not

accessible from Flower Street due to an Expo Line light rail station scheduled to open in November

2011.

Although this station did not exist at the time of sale, the alignment was approved On December 15, 2005.

According to Emily Cohen, Entitlement Manager for the Buyer, a small portion of the property was improved

with a building at the time of sale, which did not have any contributory value and was subsequently

demolished. The [Q] zoning condition restricted permitted uses to educational, hospital, medical office,

parking and related uses at the time of sale. According to Ms. Cohen and Gregg Shoup, City Planner with the

City of Los Angeles, this property sold without entitlements, although the applicant reportedly had high

expectations that a zone change and GPA would be approved. The site is located within the Los Angeles

State Enterprise Zone, the Greater Downtown Housing Incentive Area, and the Central City Parking Area.

39

Physical Description

Location:

Thomas Brothers Guide:

Assessor Parcel Number:

The city block bounded by James M. Wood Boulevard, Francisco

Street, 8

th

Street and the Harbor/Pasadena (110) Freeway

Los Angeles, CA 90017

Los Angeles County: 634, D/4

5144-023-023 through 030, 032 through 057,059 through 063,065,

066, and 068 through 072

Land Description

Site Area:

Shape:

Topography:

Utilities:

Zoning:

Sale Data

Interest Sold:

Date of Sale:

Deed Date:

Document No.:

Sale Price:

Sale Price/SF:

Grantor:

Grantee:

Financing:

Verification:

274,428± Square Feet, or 6.30± Acres

Generally Rectangular

Level

All available to site

C2-4D, City of Los Angeles

Fee Simple

December 14, 2005

December 14, 2005

3069921

$70,000,000

$255.08

City Centre Development

LA Metropolis, LLC

$6,545,000 cash down payment (9.4%); $63,455,000 1" TD with

Fremont Investment

&

Loan at undisclosed market terms

John E. Vallance, Seller

40

Land Sale No. 10 (Continned)

Comments: Tbis sale consists of 46 contiguous parcels bounded by 8"' Street on tbc north, James M. Wood

Boulevard on tbe south, Francisco Street on the east and tbe HarborlPasadena (110) Freeway on the west.

The site is visible from the freeway, and access is provided along Francisco Street and 8"' Street (a one-way

street). Over the past 18 years, tbc seller bas assembled tbe site, vacated interior streets, entered into a

Development Agreement with the Los Angeles Planning Department and tbe Community Redevelopment

Agency, and entitled tbe property for

3,OOO,OOO±

square feet, wbich includes

3

office towers, 200,000 square

feet ofrctail, 100,000 square feet of entertainment (Arts, Museum, etc.), and a hotel. The seller estimated

that tbe entitlements contributed approximately 25 percent to the purcbase price; a downward Condition of

Sale adjustment was tberefore made. The site, which was improved with a parking lot at the time of sale, is

located within the Los Angeles State Enterprise Zone, the Greater Downtown Housing Incentive Area, and

the Central City and Downtown Business District Parking Areas.

41

Discussion of Adjustments

All of the land sales have been adjusted to the subject property for property rights, buyer expeuditures,

financing, condition of sale, market conditions, location, and physical factors when applicable. These

adjustments are defined below:

Property Rigbts at Sale

This category adjusts for property rights conveyed and takes into account differences in legal estate between

the subject and each comparable property. Generally, property rights are either fee simple interest or leased

fee interest.

Buyer Expenditures

This category adjusts for additional costs incurred by the buyer which arc required to make the property

ready for development andlor use. Tbis includes expenditures for demolitiou costs and other expenses paid

by the buyer in addition to the purchase price.

Financing

This category adjusts the sale price of each comparable into its cash equivalent or modifies the price to

current market financing. Favorable financing often leads to a higher selling price and unfavorable financing

may reflect a lower selling price.

Condition of Sale

This category adjusts for atypical conditions of sale and reflects any difference between the actual sale price

of a comparable and its probable sale if it were currently sold in an ann's length transaction. Please refer to

the individual datasbeets for discussion of applicable adjustments.

Market Conditions (Time)

Tbis category adjusts for market conditions and reflects changes in the prices paid due to changes in market

conditions over time. The comparable properties are adjusted from the date of sale to date of value. In

reviewing the market, we found ten commercial land sales that cover a marketing time from December 2005

through July 2011. These were the most recent and competitive sales in the subject market. Our analysis of

available market information, supported by discussions with market participants in the course of our

verifications, indicates land prices for commercial land increased by approximately 12 percent annually, or

1.00 percent per month, between December 2005 and December 2007, decreased by approximately 12

percent annually, or 1.00 percent per month, between January 2008 and December 2010, and were generally

stable between January 2011 and the present. Therefore, time adjustments were made for the appropriate

time periods to the date of value.

42

Location and Physical Conditions

These categories consider differences between the subject and each comparable property for location and

physical conditions. We considered differences in location, zoning, size, site utility, visibility and

accessibility. Each is defined below:

Location - This category adjusts the sales for differences in location for linkages, area, and other factors.

Zoning - This category adjusts for differences in zoning and allowable land uses.

Size - This category adjusts for differences in the size of each comparable to the subject site. Typically,

smaller properties require downward adjustment as they tend to reflect higher unit prices than larger sites.

Larger properties require upward adjustment as they tend to reflect lower unit prices than smaller sites.

Site Utility - This category adjusts for differences in topography, development, configuration, and usability of

the site.

Visibility - This category adjusts for differences in the visibility of each sale to the subject site.

Accessibility - This category adjusts for differences in the accessibility of each sale to the subject site.

The adjustment grid on the following page summarizes the adjustments for each of the sales as they apply to

the subject property. Adjustments for differences between the subject and each comparable property are

expressed in percentages for property rights, buyer expenditures, financing, condition of sale, and market

conditions based on our analysis of the market, as applicable, Qualitative adjustments have been applied for

the location and other physical characteristics of each sale compared with the subject. A superior rating

indicates the market data item is being adjusted downward to the subject. An inferior rating indicates the

market data item is being adjusted upward to the subject. Each physical characteristic may not be weighted

equally. Then, an overall rating is assigned to each sale as it compares with the subject.

43

+

"g

-I.

,~8 .~

~ ~

OJ

i

oi "

~l~

c> .~

'l

,

I ~,I

,~ 3! -,

~ <[ ~

Analysis and Conclusions

The adjusted sales range from $70.98 to $556.08 per square foot, before adjusting for physical characteristics.

Based on our analysis of the land sales, the overall ratings of the adjusted sales compared to the subject

property are as follows:

Inferior (Sale Nos. 5, 6, 7 and 9)

Similar

Superior (Sale Nos. 1,2,3,4,8 and 10)

$70.98 to $139.50 per square foot

N/A

$169.40 to $556.08 per square foot

Based on our analysis, an expected value indicator for the subject should fall between $139.50 and $169.40

per square foot. Sale Nos. 5, 6, 7 and 9 were considered inferior to the subject overall at $70.98 to $139.50

per square foot, due primarily to inferior location, site utility and visibility

as

compared to the subject. They

set the lower range of value for the subject. Sale Nos. 1, 2, 3, 4, 8 and 10 were considered superior to the

subject overall at $169.40 to $556.08 per square foot, due primarily to superior zoning or entitlement status,

accessibility, or smaller size as compared to the subject. They set the upper range of value for the subject.

After considering adjustments for differences in property rights, buyer expenditures, financing, conditions of

sale, market conditions, location and physical characteristics, it is our opinion that an appropriate value

indicator for the subject site, underlying land only, is $150.00 per square foot, which is within the range of

the market. Shown below is our calculation of the market value of subject site:

Land Area

Price/Sqnare Foot Indicated Valne

614,975± SF

x

Indicated Value of the Subject Site

by the Sales Comparison Approach

$150.00 $92,246,250

Rounded To:

$92,250,000

The final conclusion or opinion has resulted from the application of the Sales Comparison Approach. In

summary, this approach provides a value indicator for vacant land and is most commonly used by market

participants. The Sales Comparison Approach is considered to be the primary approach to value. Please

refer to Extraordinary Assumptiou Nos. 18, 19, 20, 21, 22, 23, 25 and 26. Based on the data presented,

analysis, and reconciliation, the Market Value of the Fee Simple Interest in the subject property, underlying

land only, as of September 21, 2011, is:

NlNETY-TWO MILLION TWO HUNDRED FIFTY THOUSAND DOLLARS .

.......................................................................................................................... $92,250,000.

45

At the request of the Client, we have calculated the annual market ground rent for the subject property as of

July 1 of 2011,2012,2013,2014,2015,2016 and 2017 based upon the $92,250,000 concluded market value

of the fee simple interest in the subject property as of September 21, 2011. The market ground rent

calculations will be utilized in negotiations with the proposed developer, AEG, to establish a ground lease for

the subject property. According to the terms of the draft MOU, the proposed ground lease would have a 55

year term, with 1.75 percent annual escalations. Based upon our review of the draft MOU and analysis of the

market, it is our opinion that a 1.75 percent rent escalation rate is reasonable. Please refer to Extraordinary

Assumption No. 24.

The market was surveyed for current ground leases, rates of return, and leasing practices of both private firms

and public agencies to derive the estimated net operating income attributable to the land. No recent vacant

land leases were discovered in the area. Therefore, the market value of the land was multiplied by an

appropriate rate of return to derive a market rental rate for the land. A survey of private firms and public

agencies was therefore conducted to determine their required rates of return on land. The following table

shows the results of that survey:

Private

9.0 to 10.0%.

Private 8.0 to 9.5%

Private

5.3%

Private

5.3%

Private

5.1%

Private 7.5 to 8.25%

Public 8.0 to 8.5%

Public

8.0%

MTA

Public

8.0 to 9.0%

Public

6.5%

Public 6.0 to 10.0%

Public 8.0 to 12.0%

Public

10.0%

Public

10.0%

Public 10.0%

Land leases are typically written for a 5 to 12 percent return on the estimated value of the land. Our records

indicate that municipal agencies, such as The Metropolitan Water District of Southern California, Port

Authorities, and Southern California cities predominantly range from 6.5 to 10 percent. Private firms have

negotiated ground leases in the range of 5.1 to 10 percent. Based on our analysis, we conclude a 7.0 percent

rate of return is appropriate.

The market value of the subject property as of July 1,2011 was considered to be unchanged from September

21, 2011, consistent with our analysis of the market and the market condition adjustments utilized in the

valuation of the underlying land. A future value factor, based upon a 2.0 percent annual growth rate

commencing on September 21, 20 II, was applied to the concluded market value of the fee simple interest in

the subject property as of September 21, 20II in order to calculate the market value of the subject property as

of July 1 of 2012, 2013, 2014, 2015, 2016 and 2017, as agreed with the client. The following table

46

summarizes our calculations of the market value of the subject property as of-July I of 2011, 2012, 2013,

2014,2015,2016 and 2017:

The concluded 7.0 percent rate of'return was multiplied by the calculated market value of the land as of July

I of 2011, 2012, 2013, 2014, 2015, 2016 and 2017 in order to derive the annual market rental rate for the

land on each of those dates. The annual market ground rental rates are calcnJated as follows:

The final conclusions or opinions have resulted from applying an appropriate rate of return on land to the

market land value for each year, which was calcnJated by applying a future value factor to the concluded

market value of tbe subject property as of September 21, 201l. Based on tbe data presented, analysis, and

reconciliation, the annual Market Ground Rent conclusions are:

As of July 1, 2011 $6,457,500

As of July 1, 2012 $6,558,017

As of July 1, 2013 $6,689,178

As of July 1, 2014 $6,822,961

As of July 1, 2015 $6,959,420

As of July 1, 2016 $7,098,609

As of July 1, 2017 $7,240,581

47

Location

The subject site is identified as portions of APNs 5138-016-912 and 913, located at the southeast comer of

L.A. Live Way and Chick Hearn Court.

Size and Shape

The subject site is generally rectangular in shape and contains a gross area of 633, 150± square feet, or 14.54±

acres. The approximate boundaries and dimensions of the site are as follows:

North Boundary (Chick Hearn Court) 727.41± Linear Feet

South Boundary 789.50± Linear Feet

East Boundary Varies

West Boundary (L.A. Live Way) 829.17± Linear Feet

Please refer to the exhibit labeled Scenario Two on the accompanying page for reference. Please refer to

Extraordinary Assumption Nos. 19 and 25.

Accessibility aud Visibility

The subject site consists of the underlying land of portions of the Los Angeles Convention Center and Staples

Center located at the signalized southeast comer of LA. Live Way and Chick Hearn Court in downtown Los

Angeles. The site has 829.17± feet of frontage and 3 curb cuts along L.A. Live Way and 727.41± feet of

frontage and 2 curb cuts along Chick Hearn Court.

L.A. Live Way (formerly Cherry StreetiSentous Street) is a northeast-southwest, 102± foot wide, asphalt-

paved collector street with 2 to 3 northeast-bound lanes, 2 southwest-bound lanes, a mid-block northeast left

turn pocket, a mid-block southwest left tum pocket, and northeast left and right turn lanes at Chick Hearn

Court. Chick Hearn Court (formerly 11th Street) is a northwest-southeast, 107± foot wide, asphalt-paved

collector street with

2

lanes in each direction, northwest-bound left and right lanes at L.A. Live Way and

southeast-bound left tum lane at Georgia Street. Even though both streets are over 100 feet wide, the City of

Los Angeles identifies them as collector streets.

The field inspection was conducted during normal business hours, and traffic was noted to be moderate to

heavy along L.A. Live Way and Chick Heam Court. Regional access to the subject site is provided by the

Harbor (110) Freeway at L.A. Live Way approximately 1 block southwest of the subject (northbound) or

Olympic Boulevard approximately 1 block north of the subject (southbound), and the Santa Monica (10)

Freeway at Grand Avenue approximately 0.7 miles southeast of the subject (eastbound) or Hoover Street

approximately 0.9 miles southwest of the subject (westbound). Overall, visibility is considered good-to-

excellent and accessibility is considered good.

Site Utility

The subject consists of a 633,l50± square foot, or 14.54± acre, generally rectangular, generally level site

located at the signalized intersection of two collector streets. Access is provided by 3 curb cuts along L.A.

Live Way and

2

curb cuts along Chick Hearn Court. The property is adjacent to L.A. Live and is improved

with portions of the Los Angeles Convention Center and Staples Center, although only the underlying land

has been appraised at the request of the client. Please refer to Extraordinary Assumption Nos.

19,20, 22,

48

23, 25 and 26. The subject has an adequate frontage-to-depth ratio, with visibility that is considered good-to-

excellent and accessibility that is considered good overall. All utilities are available to the site, and there are

no. apparent on/off-site conditions that detrimentally impact the site's use. The site's configuration and

location pose no.major developmental problems. The site is similar to other parcels

in

the neighborhood and

is functionally adequate for a commercial, residential or mixed use as permitted under current zoning.

Overall, the utility of the subject is considered good.

Real Estate Assessment Data

The subject site, identified as portions of APNs 5138-016-912 and 913, is located in Tax Rate Area 00211.

The 2011-2012 tax rate is 1.245849 percent per $100 of assessed value. The subject is exempt from all taxes

as it is owned by the City of Los Angeles, and therefore is not assessed.

Improvement Summary

The subject site consists of the underlying land of portions of APNs 5138-016-912 and 913. Although the

property is currently improved with portions of Staples Center and the West Hall of the Los Angeles

Convention Center, no consideration has been given to any existing buildings or improvements on the site,

which will be demolished according to the terms of the proposed ground lease, at the client's request. No

deduction has been made for demolition costs, as demand is considered sufficient to offset them. Please

refer

to.

Extraordinary Assumption No, 19.

49

Highest and best use is defined on Page 278 of The Appraisal of Real Estate, Appraisal Institute (13th

Edition, 2008), as:

"The

reasonably

probable and legal nse of vacant land or an improved property that is legally

permissible, physically possible, appropriately supported, financially feasible, and that resnlts

in the highest value."

The concept of highest and best use represents the premise upon which value is based. In the context of the

market value definition used in this report, other appropriate terms can also reflect the highest and best use

concept. These are the most probable and most profitable use for the site, first "as if vacant" and then "as

improved or proposed."

The determination of highest and best use is based not only on an analysis of the property in question, but

also on an analysis of the overall community, its history and trends, zoning, market conditions, as well as the

basic principles ofland utilization.

As indicated in the definition above, there arc four elements in highest and best use analysis that must be

considered. The highest and best use of a property is that use, among alternate uses, that is legally

permissible, physically possible, financially feasible, and maximally productive.

The following factors must be considered as follows:

Legal Use: The use in question must be legally permissible.

Physical Use: The USein question must be physically possible.

Feasible Use: The use in question must be economically feasible, not speculative or conjecture.

Productive Use: Among the feasible uses, that use which will produce the highest net return to the

land.

Factors controlling highest and best usc include:

• Type of use;

• Duration of use;

• Location of use; and

• Degree of intensity of use-density.

The highest use of land is dictated by zoning and other government and/or private restrictions. The best use

is constituted by that single use from the possible alternative types of improvements which will produce the

greatest economic advantage.

The following arc our conclusions of Highest and Best Use As-Vacant:

50

The Highest and Best Use of the subject as vacant assumes that the property is vacant or could be rendered

vacant by demolishing the existing improvements. Based on that assumption, possible uses for the property

can be considered among those uses which are legally permissible, physically possible, financially feasible,

and maximally productive.

Legal - The subject's zoning is governed and enforced by the City of Los Angeles. Although the site is

currently owned by the City of Los Angeles and zoned PF-4D-O, Public Facilities, with a corresponding land

use designation of Public Facilities, Senior City Planner Jon Foreman has indicated that it would likely be re-

zoned C2-4D-O, Commercial, with a corresponding land use designation of Regional Commercial if sold to a

private party. Please refer to Extraordinary Assumptiou Nos. 22 and 2:? Uses permitted in the C2 zone

include, but are not limited to, art or antique shops, tire shops, restaurantsltea rooms/cafes, advertising

signs/structuresibillboards, auditoriums or stadiums with a seating capacity of not more than 3,000,

automotive fueling and service stations, new and used automobile sales, hospitals, parking buildings, second-

hand stores, schools, and motion picture or media production. CR, Cl, Cl.5 and R4 uses are also permitted,

with some limitations. The

0

supplemental use district allows oil drilling with a number of limitations.

There are no lot area or setback requirements for commercial uses in the C2 zone; residential uses must meet

the lot area and setback requirements for the R4 zone. Parking requirements vary depending upon use. The

subject property is in Height District 4D, which limits CR uses to a maximum height of 75 feet; there are no

specific height limits for other commercial uses. The D prefix generally limits the Floor Area Ratio (FAR)

for R4 and commercial uses to a maximum of 6:1, with some exceptions.

The subject is located within the Los Angeles State Enterprise Zone, wbicb allows reduced parking ratios and

provides economic incentives to stimulate local investment and employment through tax and regulation relief

and improvement of public services, and the Greater Downtown Housing Incentive Area, which allows a 35

percent floor area bonns for projects that voluntarily provide a prescribed percentage of units for affordable

housing.

It

is also located within the Central City and Downtown Business District Parking Areas, which

have reduced parking requirements for a variety of uses.

Although requested, Riggs

&

Riggs,

Inc., was not provided with a Preliminary Title Report specific to the

subject property or a map plotting the encumbrances that impact the subject property. Therefore, for the

purposes of analysis, it is assumed that any encumbrances impacting the subject property are typical for an

urban property and do not adversely impact the site. Please refer to Extraordinary Assumption No. 20.

These are the legal uses and requirements under the current zoning.

Physical - After identifying the legal uses of the site, the physical uses of a vacant site are considered.

Development constraints imposed on a site vary by its confignration, size, and topography, which are fixed in

location. The subject is generally rectangular in shape, with a gross area of 633,150± square feet, or 14.54±

acres. Please refer to Extraordinary Assumption No. 19. The site is not located within an Alquist-Priolo

fault zone, although it is located within an unidentified fault zone and a methane zone. Topography is

generally level, and the site is considered legally conforming to current zoning requirements. The site is

located at the signalized intersection of two collector streets, with good-to-excellent visibility, good

accessibility, and an adequate froutage-to-depth ratio. Taking these physical and legal factors into

consideration, the subject site has good utility and appears to be legally and physically suited for a

commercial, residential or mixed use consistent with zoning.

51

Economic - The best use is considered to be that single use from among all the physically possible uses

legally-permitted by zoning which will produce the greatest economic advantage to a vacant site. Tbis is due

to the fact that real estate is fixed in location and return on land arises from the residual income remaining

after all operational and financial expenses are deducted from the gross income.

The subject property is located in downtown Los Angeles and surrounded by L.A. Live to the north, a portion

of the Los Angeles Convention Center to the south, a portion of Staples Center to the east and parking to the

west. The downtown area is 99% built-out, and new construction is limited to the redevelopment of existing

properties. Economic conditions are stabilizing, and projects that had been suspended due to the recession

are starting to move forward.

Based on a cursory review of the legal restrictions and physical site, it is our opinion that

it

is economically-

feasible to develop a commercial, residential or mixed use on the subject site, assuming that financing could

be obtained. The maximally productive use is considered to be that single use from among all the physically

possible and legally permissible uses that will produce the greatest economic advantage toa vacant site.

After review of the legal, physical, and economic factors mentioned relative to the subject, it is our opinion

that the highest and best use of the site, as though vacant, is to develop a commercial, residential or mixed

use consistent with zoning, assuming that financing could be obtained.

52

The valuation of any parcel of real estate is derived principally through the three basic approaches to market

value: the Cost Approach; the Income Capitalization Approach; and the Sales Comparison Approach. The

methodology used in the following sections of the appraisal include:

Cost Approach - This approach to value is devoted to an analysis of the physical value of the property; that is,

the current market value of the vacant land, to which is added the cost to construct the improvements. Any

accrued depreciation is deducted for physical deterioration, functional obsolescence, and external

obsolescence. Physical deterioration measures the physical wearing out of the property as observed during

the field inspection. Functional obsolescence reflects a lack of desirability by reason of layout, style or

design of the structure. External obsolescence denotes a loss in value from causes outside the property itself.

Income Capitalization Approach - Investment properties are normally valued in proportion to their ability to

produce income. Hence, an analysis of the property in terms of its ability to provide a sufficient net annual

return On invested capital is an important means of valuing an asset. An opinion of value by the Income

Capitalization Approach is arrived at by capitalizing the net income at an interest rate or investment yield

commensurate with the risk inherent in the fee ownership of the property. Such a conversion of income

considers competitive returns offered by alternative investments. Commercial developments are considered

to be desirable real estate investments.

Sales Comparison Approach - This approach to value is based upon the principle of substitution; that is,

when a property is replaceable in the market, its value tends to be set at the cost of acquiring an equally

desirable property, assuming no costly delay in making the substitution. As no property is identical to

another, it is necessary to make adjustments for any differences.

The indications of value derived by the three approaches are not always possible or practical to use. The

nature of the property being appraised and the amount, quality, and type of market data available dictates the

use or non-use of one or more of the approaches to value. In this appraisal, only the Sales Comparison

Approach was utilized since only the underlying land of the subject property is being appraised. The Cost

and Income Capitalization Approaches are not applicable.

53

The application of the Sales Comparison Approach produces an opinion of value for the subject property hy

comparing it with similar or comparable properties which have recently sold. The comparison process is

used to determine the degree of comparahility hetween two properties. This process involves judgment.

Similarity in value factors, such as property rights, buyer expenditures, financing, condition of sale, market

conditions, location, and physical characteristics are considered meaningful for this analysis.

The sale price of the properties deemed to he most comparahle establish a range in which the value of the

subject property should fall. Further consideration of the comparative data will result in a figure representing

the value of the subject property - the highest price at which it could be sold by a willing seller to a willing

buyer as of the date of the value.

The technique is fairly simple in nature. Sales data of comparable properties are gathered, investigated, and

verified. Data sources have been discussed, and each sale is confirmed with buyer, seller, or representative

when possible. After verification, comparison is made between the comparable and the subject.

Adjustments, if required, are made for any differences between sale and subject. The result is some unit or

units of comparison which will be helpful in evaluating the subject property.

The Sales Comparison Approach is used to estimate the value of real estate, based on the theory that an

informed and prudent buyer would not pay more for a property than the cost of acquiring another property

with the same utility.

It

is, therefore, based upon the principle of substitntion. This approach requires an

active market and the availability of other properties from which a bnyer can make a choice.

Several transfers arc considered reasonably comparable to the subject and snitable for further analysis. Data

items are narrowed to those sales which exhibit the greatest Similarity to the subject.

In

order to determine an

indicated value, the subject was evaluated based on the Sale Price Per Square Foot.

Market Data Summary

Although the subject property is currently zoned PF-4D-O, Senior City Planner Jon Foreman has indicated

that it would likely be re-zoned C2-4D-O if sold to a private third patty. Therefore, consistent with the

conclusion of Highest and Best Use As Vacant, a search was made for sales of commercial land within the

City of Los Angeles and surrounding markets over the past 3 years. This resulted in 5 sales that were

considered reasonably similar to the subject, all of which were under 8 acres in size. The search was

therefore expanded to include sales over the past 6 years that were in proximity to the subject. The resulting

sales were gathered, compared and analyzed. The results of this process provide the basis for the opinion of

value for the site as if vacant and available for development to its highest and best nse. All of the sales are

adjusted for quantitative factors, when applicable. Our market data is found on the following page, along

with a location map depicting each sale.

54

(j)

W

...J

«

(j)

o

z

:)

W

...J

en

~

<

0..

2

o

o

I

11215South Flower Street

[Los Angeles

$260.87

7/14/11

I

••-. 1

6/10111 1

I

96,762 SF

(T)(Q)C2.2 J~ffier

--"'r;;~,~;2

SF

LASED

,

-L:;~~:O~~O__,.

1 ~ .. ~--

i

$31,000,000

,

P670 Wilshire Boulevard

1Los Angeles

1

2

Corner

I 105,415SF $59,500,000

11117/10 1 C2-2-0

r-~-~-+----~-I

.__ If--_.

+

Co_ffi_e_r

_--+-__

._$5_64_.44 ..

I

I 346,302SF $148,300,000

/Wilshire Specifiqc......-----f--·-----II

I I

Interior

3 110000Santa Monica Boulevard

ILos Angeles

.......l. ,

4 19900Wilshire Boulevard

IBeverly Hills

1

10/6/10

$428.24

1 '

5 11136lngrahamStreet I

I

I

71,783 SF $10,000,000

!LoSAngeles

I

9/1/10

I

C4(CW)·U/6 Co=~-'

-;r:::~:;,;:~:~~;;;;;~;

;;;;~r-:::=T;:=+-:;;:;;;;;;-t;;;;;;,;;,-

iLos Angeles

!

Comer $249.28

I

1

7

I

Jefferson Boulevard at Centinela Avenue

i

I

2,787,840

SF $265,000,000

-L

Angeles (playa VIsta)

!

219/07 ~

M(pv) ~er

i

$95.06

- 8 1110~erStreet

r I - I

200,81~'

$80,0;;~~-

I

Los Angeles ,8/15/06 LASED

1------+.-------

I i I I

Comer

i

$39838

9 1

2300

- 2400South Flower Street i

I

411,642 SF

$70,500,000

i

Los

Angeles . 7/18/06 1 [QjC2-2-0 ~

1f----1 ;

I

I Comer

IThe city block bounded by James M. W--;'-O""d+j--.

1-----1

---1--.

10 Boulevard, Francisco Street, 8th Street and

i

I I 274,428SF $70,000,000

. 12114/05 C2-4D

the Harbor/Pasadena (110)Freeway

j

8171.27

55

Discnssion of Adjnstments

All of the land sales have been adjusted to the subject property for property rights, buyer expenditures,

financing, condition of sale, market conditions, location, and physical factors when applicable. These

adjustments are defined below:

Property Rights at Sale

This category adjusts for property rights conveyed and takes into account differences in legal estate between

the subject and each comparable property. Generally, property rights are either fee simple interest or leased

fee interest.

Buyer Expenditures

This category adjusts for additional costs incurred by the buyer which are required to make the property

ready for development and/or use. This includes expenditures for demolition costs and other expenses paid

by the buyer in addition to the purchase price.

Financing

This category adjusts the sale price of each comparable into its cash equivalent or modifies the price to

current market financing. Favorable financing often leads to a higher selling price and unfavorable financing

may reflect a lower selling price.

Condition of Sale

This category adjusts for atypical conditions of sale and reflects any difference between the actual sale price

of a comparable and its probable sale if it were currently sold in an arm's length transaction.

Market Conditions (Time)

This category adjusts for market conditions and reflects changes in the prices paid due to changes in market

conditions over time. The comparable properties are adjusted from the date of sale to date of value.

In

reviewing the market, we found ten commercial land sales that cover a marketing time from December 2005

through July 2011. These were the most recent and competitive sales in the subject market. Our analysis of

available market information, supported by discussions with market participants in the course of our

verifications, indicates land prices for commercial land increased by approximately 12 percent annually, or

1.00 percent per month, between December 2005 and December 2007, decreased by approximately 12

percent annually, or 1.00 percent per month, between January 2008 and December 2010, and were generally

stable between January 2011 and the present. Therefore, time adjustments Were made for the appropriate

time periods to the date of value.

56

Location and Physical Conditions

These categories consider differences between the subject and each comparable property for location and

physical conditions. We considered differences in location, zoning, size, site utility, visibility and

accessibility. Each is defmed below:

Location- This category adjusts the sales for differences in location for linkages, area, and other factors.

Zoning· This category adjusts for differences in zoning and allowable land uses.

Size

>

This category adjusts for differences in the size of each comparable to the subject site. Typically,

smaller properties require downward adjustment as they tend to reflect higher unit prices than larger sites.

Larger properties require upward adjustment as they tend to reflect lower unit prices than smaller sites.

Site Utility . This category adjusts for differences in topography, development, configuration, and usability of

the site.

Visibility· This category adjusts for differences in the visibility of each sale to the suhject site.

Accessibility· This category adjusts for differences in the accessibility of each sale to the subject site.

The adjustment grid on the following page summarizes the adjustments for each of the sales as they apply to

the subject property. Adjustments for differences between the subject and each comparahle property are

expressed in percentages for property rights, buyer expenditures, financing, condition of sale, and market

conditions based on our analysis of the market, as applicable. Qualitative adjustments have been applied for

the location and other physical characteristics of each sale compared with the subj ect. A superior rating

indicates the market data item is being adjusted downward to the subject. An inferior rating indicates the

market data item is being adjusted npward to the subject. Each physical characteristic may not be weighted

equally. Then, an overall rating is assigned to each sale as it compares with the subject.

57

Analysis and Conclusions

The adjusted sales range from $70.98 to $556.08 per square foot, before adjusting for physical characteristics.

Based on our analysis of the land sales, the overall ratings of the adjusted sales compared to the subject

property are as follows:

Inferior (Sale Nos. 5, 6, 7 and 9)

Similar

Superior (Sale Nos. 1,2,3,4,8 and 10)

$70.98 to $139.50 per square foot

N/A

$169.40 to $556.08 per square foot

Based on our analysis, an expected value indicator for the subject should fall between $139.50 and $169.40

per square foot. Sale Nos. 5, 6, 7 and 9 were considered inferior to the subject overall at $70.98 to $139.50

per square foot, due primarily to inferior location, site utility and visibility as compared to the subject. They

set the lower range of value for the subject. Sale Nos. 1,2, 3,4, 8 and 10 were considered superior to the

subject overall at $169.40 to $556.08 per square foot, due primarily to superior zoning or entitlement status,

accessibility, or smaller size as compared to the subject. They set tbe upper range of value for the subject.

After considering adjustments for differences in property rights, buyer expenditures, financing, conditions of

sale, market conditions, location and physical cbaracteristics, it is our opinion that an appropriate value

indicator for the subject site, underlying land only, is $150.00 per square foot, which is within the range of

the market. Shown below is our calculation of the market value of subject site:

Land Area

Price/Square Foot Indicated Value

633,150±SF x

Indicated Value of the Subject Site

by the Sales Comparison Approach

$150.00 $94,972,500

Rounded To:

$94.970.000

The final conclusion or opinion has resulted from tbe application of the Sales Comparison Approach. In

summary, this approacb provides a value indicator for vacant land and is most commonly used by market

participants. The Sales Comparison Approach is considered to be the primary approacb to value. Please

refer to Extraordinary Assumption Nos. 18, 19, 20, 21, 22, 23, 25 and 26. Based on the data presented,

analysis, and reconciliation, tbe Market Value of the Fee Simple Interest in the subject property, underlying

land only, as of September 21, 2011, is:

NINETY-FOUR MILLION NINE HUNDRED SEVENTY THOUSAND DOLLARS '"~

"""""""""""""""""""""""."""""""""",,",,.,,"",,,,"""""""""""""""""""".$94,970,000.

59

At the request of the Client, we have calculated the annual market ground rent for the subject property as of

July 1 of 2011, 2012, 2013, 2014, 2015, 2016 and 2017 based upon the $94,970,000 concluded market value

of the fee simple interest in the subject property as of September 21, 2011. The market ground rent

calculations will be utilized in negotiations with the proposed developer, AEG, to establish a ground lease for

the subject property. According to the terms of the draft MOO, the proposed ground lease would have a 55

year term, with 1.75 percent annual escalations. Based upon our review of the draft MOO and analysis of the

market, it is our opinion that a 1.75 percent rent escalation rate is reasonable. Please refer to Extraordinary

Assumption No. 24.

The market was surveyed for current ground leases, rates of return, and leasing practices of both private firms

and public agencies to derive the estimated net operating income attributable to the land. No recent vacant

land leases were discovered in the area. Therefore, the market value of the land was multiplied hy an

appropriate rate of retnm to derive a market rental rate for the land. A survey of private firms and public

agencies was therefore conducted to determine their required rates of return on land. The following table

sbows the results of tbat survey:

CJ Se erstrom

&

Sons

Teacbers lnsurance

&

Annui Association

McDonald's, Cano a Park (Ground Lessee

Jack in the Box, Valencia (Ground Lessee)

Private

Private

Private

Private

9.0 to 10.0%

8.0 to 9.5%

5.3%

5.3%

Chili's, Pico Rivera (Ground Lessee

First lndustrial Ac uisitions, lnc. (Listin

Private

Private

5.1%

7.5 to 8.25%

City of Long Beacb

Coun of Los An eles

County of Oran e

Los An eles Coun MTA

MWDSC

Public

Public

Public

Public

Public

8.0 to 8.5%

8.0%

8.0 to 9.0%

6.5%

6.0 to 10.0%

Port of Lon Beacb Public 8.0 to 12.0%

San Bernardino County

Port of Los An eles

Southern California Edison

Public

Public

Public

10.0%

10.0%

10.0%

Land leases are typically written for a 5 to 12 percent return on tbe estimated value of the land. Our records

indicate tbat municipal agencies, sucb as The Metropolitan Water District of Southern California, Port

Authorities, and Southern California cities predominantly range from 6.5 to 10 percent. Private firms have

negotiated ground leases in the range of 5.1 to 10 percent. Based on our analysis, we conclude a 7.0 percent

rate of return is appropriate.

Tbe market value of the subject property as of July 1,2011 was considered to be unchanged from September

21, 20 11, consistent with our analysis of the market and the market condition adjustments utilized in the

valuation of the underlying land. A future value factor, based upon a 2.0 percent annual growth rate

commencing on September 21, 20 11, was applied to the concluded market value of the fee simple interest in

the subject property as of September 21, 20 II in order to calculate the market value of the subject property as

of July I of 2012, 2013, 2014, 2015, 2016 and 2017, as agreed with the client. The following table

60

summarizes our calculations of the market value of the subjectproperty as of July I of 2011, 2012, 2013,

2014,2015,2016 and 2017:

7/112011

7/112012

7/1/2013

7/112014

7/1/2015

7/1/2016

The concluded 7.0 percent rate ofrelum was multiplied by the calculated market value of the land as of July

I of 2011, 2012, 2013, 2014, 2015, 2016 and 2017 in order to derive the annual market rental rate for the

land on each of those dates. The annual market ground rental rates are calculated as follows:

The final conclusions or opinions have resulted from applying an appropriate rate of return on land to the

market land value for each year, which was calculated by applying a future value factor to the concluded

market value of the subject property as of September 21, 20II. Based on the data presented, analysis, and

reconciliation, the annual Market Ground Rent conclusions are:

As of July 1, 2011 $6,647,900

As of July 1, 2012 $6,751,381

As of July 1, 2013 $6,886,409

As of July I, 2014 $7,024,137

As of July 1, 2015 $7,164,619

As of July 1, 2016 $7,307,912

As of July 1, 2017 $7,454,070

61

·ADDENDA

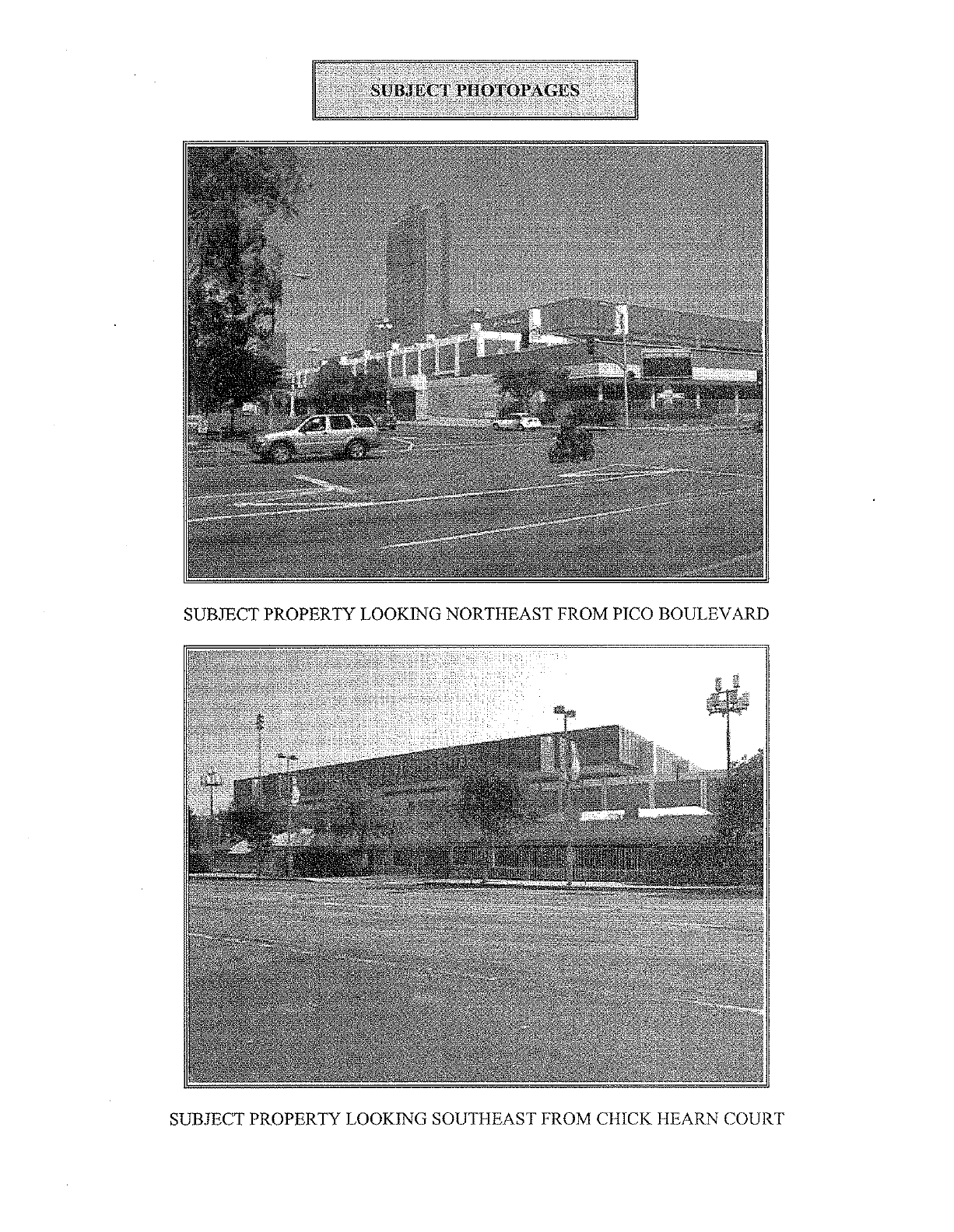

SUBJECT PROPERTY LOOKING NORTHEAST FROM PICO BOULEVARD

SUBJECT PROPERTY LOOKING SOUTHEAST FROM CHICK HEARN COURT

STREET SCENE LOOKlNG NORTH ALONG LA LIVE WAY

WITH SUBJECT AT RIGHT OF PHOTO

STREET SCENE LOOKING SOUTH ALONG LA LIVE WAY

WITH SUBJECT AT LEFT OF PHOTO

STREET SCENE LOOKING EAST ALONG CHICK HEARN COURT

WITH SUBJECT AT RlGHT OF PHOTO

STREET SCENE LOOKING WEST ALONG CHICK HEARN COURT

WITH SUBJECT AT LEFT OF PHOTO

Chicago Title Company

Commercial/Industrial Division,

700 South Flower, Suite 800 Los Angeles, CA 90017 (213) 488-4300

Title Department:

Chicago Title Company

Attn: Dave Balassi

Email: [email protected]

Phone: (213) 488-4394

Fax: (213) 488-4360

Order No.: 116743050F-X49

PRELIMINARY REPORT

Property Address: AEG Los Angeles Stadium and Event Center

Dated as of: August 1,2011 at 7:30 am

In response to the application for a policy of title insurance referenced herein, Chicago Title Company

hereby reports tbat it is prepared to issue, or cause to be issued, as of the date bereof, a policy or policies

of Title Insurance describing tbe land and tbe estate or interest therein bereinaftcr set fortb, insuring

against loss wbich may be sustained by reason of any defect, lien or encumbrance not sbown or referred

to as an Exception herein or not excluded from coverage pursuant to the printed Schedules, Conditions

and Stipulations or Conditions of said Policy forms.

The printed Exceptions and Exclusion from the coverage and Limitations on Covered Risks of said Policy

or Policies are set forth in Attachment One. The policy to be issued may contain an arbitration clause.

When the Amount of Insurance is less than that set forth in the arbitration clause, all arbitrable matters

shall be arbitrated at the option of either the Company or the Insured as the exclusive remedy of the

parties. Limitations on Covered Risks applicable to the CLTA and ALTA Homeowner's Policies of Title

Insurance which establisb a Deductible Amount and a Maximum Dollar Limit of Liability for certain

coverages are also set fortb in Attachment One. Copies of the policy forms should be read. They are

available from the office wbich issued this report.

This report (and any supplements or amendments hereto) is issued solely for the purpose of facilitating the

issuance of a policy of title insurance and no liability is assumed hereby. If it is desired that liability be

assumed prior to the issuance of a policy of title insurance, a Binder or Commitment should be requested.

The policy(s) of title insurance to be issued hereunder will be policy(s) of Chicago Title Insurance Company

Please read the exceptions shown or referred to herein and the exceptions and exclusions set forth in

Attachment One of this report carefully. The exceptions and exclusions are meant to provide you with

notice of matters which are not covered under the terms of the title insurance policy and should be

carefully considered.

It is important to note that this preliminary report is not a written representation as to the condition of

title and may not list all liens, defects, and encumbrances affecting title to the land.

CLTA Preliminary Report Form - Modified (ll-17-06)

Page 1

OrderNo.: 116743050F-X49

SCHEDULE A

1.

The estate or interest in the land hereinafter described or referred to covered by this report is:

A Fee

2.

Title to said estate or interest at the date hereof is vested in:

City of Los Angeles

3. The land referred to in this report is situated in the State of California, County of Los Angeles and

is described in the Legal Description, attached hereto:

END OF SCHEDULE A

CLTA Preliminary Report Form - Modified

(11-17~06)

Page 2

Order No.: 116743050F-X49

LEGAL DESCRIPTION

PARCEL A:

LOTS 1 TO 6 INCLUSIVE OF TRACT 28165, IN THE CITY OF LOS ANGELES, COUNTY OF LOS

ANGELES, STATE OF CALIFORNIA, AS PER MAP RECORDED IN BOOK 814 PAGES 66 TO 69

INCLUSIVE OF MAPS, IN THE OFFICE OF THE COUNTY RECORDER OF SAID COUNTY,

TOGETHER WITH THAT PORTION OF TRENTON STREET SOUTH BETWEEN FIGUEROA

STREET AND PICO BOULEVARD AS SHOWN AND DEDICATED ON THE MAP OF TRACT

28165, NOW VACATED BY (COUNCIL FILE NO. 82-1136 OF THE CITY OF LOS ANGELES)

RESOLUTION NO. 83-01558 OF THE CITY OF LOS ANGELES, ON FILE IN THE OFFICE OF THE

COUNTY RECORDER OF SAID COUNTY CLERK OF SAID CITY, AND RECORDED JUNE 5,

1990 AS INSTRUMENT NO. 90-1003283, AS SAID VACATION IS SHOWN IN VOLUME 23 PAGE

89 OF STREET VACATION MAPS ON FILE IN THE OFFICE OF CITY CLERKS OF SAID CITY

AND TOGETHER WITH ALL OF NAGOYA STREET AND TRENTON STREET SHOWN AS

TRENTON STREET NORTH ON THE MAP OF SAID TRACT 28165, BOUNDED AS FOLLOWS:

BOUNDED SOUTHEASTERLY BY A STRAIGHT LINE CONNECTING THE NORTHEASTERLY

TERMINUS OF THAT CERTAIN COURSE IN THE SOUTHEASTERLY LINE OF LOT 1 OF SAID

TRACT, SHOWN AS HAVING A BEARING AND LENGTH OF SOUTH 37° 41' 37" WEST, 187.38

FEET WITH THE SOUTHWESTERLY TERMINUS OF THAT CERTAIN COURSE IN THE

SOUTHEASTERLY LINE OF LOT 3 OF SAID TRACT, SHOWN AS HAVING A BEARING AND

LENGTH OF SOUTH 37° 41' 37" WEST, 363.89 FEET; AND BOUNDED NORTHERLY BY A LINE

DESCRIBED AS FOLLOWS:

BEGINNING AT THE NORTHEASTERLY TERMINUS OF THAT CERTAIN CURVE IN THE

NORTHERLY LINE OF SAID LOT 1, SHOWN AS HAVING A RADIUS OF 651 FEET, AND AN

ARC LENGTH OF 256.90 FEET; THENCE CONTINUING EASTERLY ALONG SAID CURVE

THROUGH A CENTRAL ANGLE OF 1° 59' 47", AN ARC DISTANCE OF 22.68 FEET; THENCE

SOUTH 86° 28' 08" EAST, 99.75 FEET TO THE NORTHERLY LINE OF LOT 2, SAID TRACT

28165, NOW VACATED BY (COUNCIL FILE NO. 82-1136 OF THE CITY OF LOS ANGELES)

RESOLUTION NO. 90-01558 OF THE CITY OF LOS ANGELES, ON FILE IN THE OFFICE OF THE

CITY CLERK OF SAID CITY, AND RECORDED AUGUST 16, 1990 AS INSTRUMENT NO. 90-

1426183, OFFICIAL RECORDS.

CLTA Preliminary Report

Form -

Modified

(J

1-17-06)

Page 3

Order No.: 116743050F-X49

LEGAL DESCRIPTION

(continued)

EXCEPTING THEREFROM:

THOSE PORTIONS OF LOTS 1, 2 AND 3 AND TRENTON STREET NORTH, 82 FEET AND 97

FEET WIDE, NOW VACATED BY (COUNCIL FILE NO, 82-1136 OF THE CITY OF LOS

ANGELES) RESOLUTION NO, 90-01558 OF THE CITY OF LOS ANGELES, ON FILE IN THE

OFFICE OF THE CITY CLERK OF SAID CITY, AND RECORDED AUGUST 16, 1990 AS

INSTRUMENT NO, 90-1426183, OFFICIAL RECORDS, AS SHOWN ON TRACT NO, 28165, IN

THE CITY OF LOS ANGELES, COUNTY OF LOS ANGELES, STATE OF CALIFORNIA, AS PER

MAP RECORDED IN BOOK 814 PAGES 66 PAGES 66 TO 69 INCLUSIVE OF MAPS, IN THE

OFFICE OF THE COUNTY RECORDER OF SAID COUNTY, DESCRIBED AS A WHOLE AS

FOLLOWS:

BEGINNING AT A POINT ON THE NORTHEASTERLY LINE OF LOT 1, DISTANT THEREON

SOUTH 61 DEGREES 51 MINUTES 21 SECONDS EAST 652.41 FEET FROM THE

NORTHWESTERLY TERMINUS OF SAID LINE SHOWN AS SOUTH 61 DEGREES 51 MINUTES

43 SECONDS EAST 666,02 FEET ON SAID TRACT NO, 28165 THEREOF; THENCE SOUTH 28

DEGREES 08 MINUTES 39 SECONDS WEST 44.47 FEET TO THE BEGINNING OF A CURVE

CONCAVE NORTHERLY AND HAVING A RADIUS OF 105,00 FEET; THENCE

SOUTHWESTERLY, WESTERLY AND NORTHWESTERLY 138,02 FEET ALONG SAID CURVE

THROUGH A CENTRAL ANGLE OF 75 DEGREES 18 MINUTES 41 SECONDS; THENCE NORTH

76 DEGREES 32 MINUTES 40 SECONDS WEST 33,23 FEET TO THE BEGINNING OF A CURVE

CONCAVE SOUTHERLY AND HAVING A RADIUS OF 43,00 FEET; THENCE WESTERLY 29,66

FEET ALONG SAID CURVE THROUGH A CENTRAL ANGLE OF 39 DEGREES 31 MINUTES 13

SECONDS; THENCE ON A NON-TANGENT LINE SOUTH 61 DEGREES 32 MINUTES 47

SECONDS EAST 162,17 FEET; THENCE NORTH 28 DEGREES 27 MINUTES 13 SECONDS EAST

31.50 FEET; THENCE SOUTH 61 DEGREES 32 MINUTES 47 SECONDS EAST 34,73 FEET;

THENCE SOUTH 28 DEGREES 27 MINUTES 13 SECONDS WEST 31.50 FEET; THENCE SOUTH

61 DEGREES 32 MINUTES 47 SECONDS EAST 32,62 FEET; THENCE 28 DEGREES 25 MINUTES

47 SECONDS WEST 269.35 FEET; THENCE SOUTH 61 DEGREES 48 MINUTES 26 SECONDS

EAST 63,37 FEET; THENCE NORTH 73 DEGREES 31 MINUTES 42 SECONDS EAST 60.45 FEET,

TO THE BEGINNING OF A NON-TANGENT CURVE CONCAVE WESTERLY, HAVING A

RADIUS OF 161.60 FEET AND TO WHICH BEGINNING A RADIAL LINE BEARS NORTH 72

DEGREES 37 MINUTES 32 SECONDS EAST; THENCE SOUTHWESTERLY 100.58 FEET ALONG

SAID CURVE THROUGH A CENTRAL ANGLE OF 35 DEGREES 39 MINUTES 46 SECONDS;

THENCE ON A NON-TANGENT LINE; SOUTH 61 DEGREES 37 MINUTES 19 SECONDS EAST

377.64 FEET TO THE NORTHWESTERLY RIGHT OF WAY LINE OF FIGUEROA STREET, 112

FEET WIDE, AS SHOWN ON SAID MAP, THENCE NORTH 37 DEGREES 41 MINUTES 47

SECONDS EAST 61.43 FEET ALONG SAID NORTHWESTERLY RIGHT-OF-WAY LINE OF

FIGUEROA STREET, 112 FEET WIDE, TO THE NORTHEASTERLY TERMINUS OF THAT

CERTAIN COURSE IN THE MOST SOUTHEASTERLY LINE OF SAID LOT 1 SHOWN AS SOUTH

37 DEGREES 41 MINUTES 37 SECONDS WEST 187,38 FEET; THENCE ON A DIRECT LINE

NORTH 42 DEGREES 20 MINUTES 09 SECONDS EAST 123,63 FEET TO THE EASTERLY

TERMINUS OF THAT CERTAIN COURSE IN THE MOST SOUTHEASTERLY LINE OF SAID LOT

CLT A Preliminary Report Fonn - Modified (11-17-06)

Page 4

OrderNo.: 116743050F-X49

LEGAL DESCRIPTION

(continued)

3; SHOWN AS SOUTH 78 DEGREES 04 MINUTES 11 SECONDS WEST 22.85 FEET; THENCE

NORTH 37 DEGREES 41 MINUTES 47 SECONDS EAST 545.94 FEET ALONG THE

NORTHWESTERLY RIGHT-OF-WAY LINE OF FIGUEROA STREET, 102 FEET WIDE, AS

SHOWN ON SAlD MAP TO THE MOST EASTERLY CORNER OF LOT 2; THENCE NORTH 15

DEGREES 32 MINUTES 53 SECONDS WEST 17.90 FEET ALONG THE EASTERLY LINE OF

SAID LOT 2 TO A POINT ON THE SOUTHERLY RIGHT-OF-WAY LINE OF SAID ELEVENTH

STREET, 102 FEET WIDE, AS SHOWN ON SAID MAP, SAID RIGHT-OF-WAY LINE BEING A

NON-TANGENT CURVE CONCAVE SOUTHERLY AND HAVING A RADIUS OF 549.00 FEET TO

WHICH BEGINNING A RADIAL LINE BEARS NORTH 20 DEGREES 09 MINUTES 57 SECONDS

EAST; THENCE WESTERLY 159.32 FEET ALONG SAID CURVED RIGHT-OF-WAY THROUGH

A CENTRAL ANGLE OF 16 DEGREES 37 MINUTES 40 SECONDS; THENCE NORTH 86

DEGREES 27 MINUTES 43 SECONDS WEST 235.98 FEET ALONG SAID SOUTHERLY RIGHT-

OF-WAY LINE OF ELEVENTH STREET, TO THE NORTHEASTERLY TERMINUS OF THAT

CERTAIN COURSE IN THE NORTHERLY LINE OF SAID LOT 2; SHOWN AS NORTH 50

DEGREES 01 MINUTES 32 SECONDS EAST 21.76 FEET ON SAlD MAP; THENCE NORTH 86

DEGREES 16 MINUTES 08 SECONDS WEST 122.45 FEET ALONG A DIRECT LINE TO THE

EASTERLY TERMINUS OF THAT CERTAlN CURVE IN THE SOUTHERLY LINE OF SAID

ELEVENTH STREET, 102 FEET WIDE, AS SHOWN ON SAlD MAP, HAVING A RADIUS OF 651

FEET, SAID POINT ALSO BEING THE BEGINNING OF A NON-TANGENT CURVE CONCAVE

NORTHEASTERLY AND HAVING A RADIUS OF 651.00FEET, AND TO WHICH BEGINNING A

RADIAL LINE BEARS SOUTH 5 DEGREES 31 MINUTES 37 SECONDS WEST; THENCE

WESTERLY AND NORTHWESTERLY 256.98 FEET ALONG SAID CURVE THROUGH A

CENTRAL ANGLE OF 22 DEGREES 37 MINUTES 03 SECONDS; THENCE NORTH 61 DEGREES

51 MINUTES 21 SECONDS WEST 13.62 FEET ALONG THE SOUTHEASTERLY RIGHT-OF-WAY

OF ELEVENTH STREET, 102 FEET WIDE TO THE POINT OF BEGINNING.

EXCEPT FROM THAT PORTION OF SAlD LAND INCLUDED WITHIN LOTS 13 AND 14, BLOCK

2 OF SAID SENTOUS TRACT, ALL GAS, OIL AND MINERAL BELOW A DEPTH OF 500 FEET,

WITHOUT RIGHT OF SURFACE ENTRY, AS GRANTED TO ROBERT W.P. MONTGOMERY, A

MARRIED MAN, BY DEED RECORDED JULY 18, 1967 IN BOOK D3706 PAGE 541, OFFICIAL

RECORDS, AS INSTRUMENT NO. 3015.

ALSO EXCEPT FROM THAT PORTION OF SAID LAND INCLUDED WITHIN LOT 70 OF SAlD

KINCAID'S TRACT AND THE SOUTHWESTERLY 6 FEET OF THE ALLEY ADJOINING SAlD

LOT 70; LOTS 42 AND 43 OF SAID FORMAN'S SUBDIVISION OF THE WEST 20 ACRES OF LOT

8, BLOCK 36 OF HANCOCK'S SURVEY, ALL GAS, OIL AND MINERALS BELOW A DEPTH OF

500 FEET WITHOUT RIGHT OF SURFACE ENTRY AS GRANTED LOT JAMES A. HENDERSON,

A MARRIED MAN BY DEED NOVEMBER 16, 1966 IN BOOK D3483 PAGE 677, OFFICIAL

RECORDS, AS INSTRUMENT NO. 2050.

ALSO EXCEPT FROM THAT PORTION OF SAlD LAND INCLUDED WITHIN LOT 16 OF SAID

KUGHEN AND CASTERLINE'S SUBDIVISION OF THE WARD TRACT, AN UNDIVIDED ONE-

HALF INTEREST AND TO ALL CARBONS, MINERALS HYDROCARBONS AND OIL AND GAS

APPURTENANT TO SAID LAND AS GRANTED TO CAROLE

L.

BENSON BY DEED RECORDED

MARCH 29, 1968 IN BOOK D3955 PAGE 794, OFFICIAL RECORDS.

BY AN INSTRUMENT DATED JUNE 6,1968 EXECUTED BY CAROLE

L.

BENSON, ALL RIGHTS

TO ENTER UPON THE SURFACE OF SAID LAND WERE QUITCLAlMED TO THE CITY OF LOS

ANGELES RECORDED JUNE 28,1968 AS INSTRUMENT NO. 2969.

CLTA Preliminary Report Form" Modified (11-17-06)

Page 5

Order No.: 116743050F·X49

LEGAL DESCRIPTION

(continued)

ALSO EXCEPT FROM THAT PORTION OF SAlD LAND INCLUDED WITHIN LOT 38 OF SAlD

KINCAID'S TRACT, ALL OF THE OIL, GAS, GOLD, SILVER AND OTHER PRECIOUS METALS,

MINERALS AND MINERAL SUBSTANCES AND OTHER HYDROCARBON SUBSTANCES, AS

GRANTED TO SAHARA APTS., INC., A CORPORATION, BY DEED RECORDED IN BOOK 56379

PAGE 119, OFFICIAL RECORDS, BUT WITHOUT THE RIGHT OF SURFACE ENTRY AND

QmTCLAlMED BY SAID SAl-IARA APTS., INC., IN DEED RECORDED IN BOOK D1492 PAGE

847, OFFICIAL RECORDS. A DEED TO THE CITY OF LOS ANGELES FURTHER RECITES, "IT IS

FURTHER UNDERSTOOD THAT ALL DIRECTIONAL DRILLING SHALL BE CONDUCTED IN

SUCH A MANNER THAT THE WELLS, HOLE, SHAFT OR OTHER MEANS OF REACHING OR

REMOVING SUCH OIL, GAS OR OTHER HYDROCARBON SUBSTANCES DOES NOT

PENETRATE ANY PART OR PORTION OF SAlD REAL PROPERTY WITHIN 500 FEET OF THE

SURFACE THEREOF".

ALSO EXCEPT FROM THAT PORTION OF SAID LAND INCLUDED WITHIN THAT LOT

PORTION OF LOT 3, BLOCK 4 OF SAID SENTOUS TRACT, ALL MINERALS, OILS, GASES AND

OTHER HYDROCARBONS BY WHATSOEVER NAME KNOWN THAT MAY BE WITHIN OR

UNDER SAlD PORTION OF LOT 3, WITHOUT, HOWEVER THE RIGHT TO DRILL, DIG OR

MINE THROUGH THE SURFACE OF SAlD LAND AS RESERVED BY STATE OF CALIFORNIA,

IN DEED RECORDED SEPTEMBER 24,1958 AS INSTRUMENT NO. 3651 IN BOOK D225 PAGE

376, OFFICIAL RECORDS.

ALSO EXCEPT FROM THAT PORTION OF SAlD LAND INCLUDED WITHIN LOTS 2, 3 AND 14,

BLOCK 4 OF SAID SENTOUS TRACT, ALL GAS, OIL AND MINERALS BELOW THE DEPTH OF

500 FEET, WITHOUT THE RIGHT OF SURFACE ENTRY AS GRANTED TO COMERA TYPE,

INC., A CORPORATION BY DEED RECORDED DECEMBER 19, 1967 AS INSTRUMENT NO.

2531 IN BOOK 03862 PAGE 920, OFFICIAL RECORDS.

ALSO EXCEPT FROM THAT PORTION OF SAlD LAND INCLUDED WITHIN LOTS 1 TO 19 OF

SAID KINCAID'S TRACT, ALL OIL, GAS AND HYDROCARBON SUBSTANCES LYING

BENEATH A DEPTH OF 500 FEET FROM THE PRESENT SURFACE OF SAlD LAND AND

WITHOUT ANY RIGHT OF ENTRY UPON THE SURFACE OF SAlD LAND ABOVE SAID 500

FOOT DEPTH, TOGETHER WITH ANY AND ALL LEASES AFFECTING SUCH OIL AND GAS,

ETC., WHETHER OF RECORD OR NOT, AS RESERVED TO THE GRANTOR THEREIN IN DEED

EXECUTED BY R. LESLIE KELLEY, A MARRIED MAN RECORDED APRIL 1, 1966 IN BOOK

D3257 PAGE 809, OFFICIAL RECORDS, AS INSTRUMENT NO. 1580.

ADEED TO THE CITY OF LOS ANGELES FURTHER RECITES; "IT IS FURTHER UNDERSTOOD

THAT ALL DIRECTIONAL DRILLING SHALL BE CONDUCTED IN SUCH A MANNER THAT

THE WELL, HOLE SHAFT OR OTHER MEANS OF REACHING OR REMOVING SUCH OIL, GAS

OR OTHER HYDROCARBON SUBSTANCES DOES NOT PENETRATE ANY PART OR PORTION

OF SAID REAL PROPERTY WITHIN 500 FEET OF THE SURFACE THEREOF".

CLTA Preliminary Report

Form -

Modified (11-17-06)

Page 6

OrderNo.: 1167430S0F-X49

LEGAL DESCRIPTION

(continued)

ALSO EXCEPT FROM THAT PORTION OF SAID LAND INCLUDED WITHIN PORTIONS OF LOT

8, BLOCK 36, HANCOCK'S SURVEY SPECIFICALLY DESCRIBED IN DECREES OF

DISTRIBUTION RECORDED IN BOOK D4172 PAGE 989, OFFICIAL RECORDS, IN BOOK D4330

PAGE 949, OFFICIAL RECORDS, IN BOOK D4275 PAGE 35, OFFICIAL RECORDS AND IN

BOOK D4038 PAGE 742, OFFICIAL RECORDS (CITY PARCELS 50, 51, II, 12 AND 13). THE

EASTERLY 25 FEET OF LOT 25 AND ALL OF LOTS 26, 30, 31, 41, 42, 59, 62, 63 AND 64. THE

SOUTHWESTERLY 25 FEET OF LOT 53 ALL IN FORMAN'S SUBDIVISION OF THE WEST 20

ACRES OF LOT 8 BLOCK 36 OF HANCOCK'S SURVEY, PORTIONS OF LOTS 12 AND 13 OF

KUGHEN AND CASTERLINE'S SUBDIVISION, OF THE WARD TRACT RECORDED IN BOOK

D4330 PAGE 975, OFFICIAL RECORDS (CITY PARCEL 52); LOTS 39, 45 (44 PORTIONS OF 46

AND 48, RECORDED IN BOOK D4337 PAGE 756, OFFICIAL RECORDS), (ALL OF LOT 47 AND

PORTION OF LOT 49 RECORDED OCTOBER 28, 1969 AS INSTRUMENT NO. 7262 IN BOOK

M3334 PAGE 145, OFFICIAL RECORDS). LOTS 51, 68, 69, 27 AND 29 ALL IN KINCAID'S TRACT

AND ALL OF THE FIRESTONE TRACT, ALL CRUDE OIL, PETROLEUM, GAS, ASPHALTUM

AND ALL KINDRED SUBSTANCES AND OTHER MINERALS OF WHATEVER NATURE IN,

UNDER, AND RECOVERABLE FROM THE REAL PROPERTIES, WITHOUT THE RIGHT TO

ENTER, DRILL OR PENETRATE IN OR UPON THE SURFACE OF SAID REAL PROPERTIES, OR

WITHIN 500 FEET THEREOF FOR THE PURPOSE OF RECOVERING CRUDE OIL, PETROLEUM,

GAS, ASPHALTUM AND ALL KINDRED SUBSTANCES AND OTHER MINERALS OF

WHATEVER NATURE AS EXCEPTED IN THE FINAL ORDERS OF CONDEMNATION, A

CERTIFIED COPY OF WHICH, WERE RECORDED IN VARlOUS INSTRUMENTS OF RECORD.

ALSO EXCEPT FROM THAT PORTION OF SAID LAND INCLUDED WITHIN THE REMAINING

LOTS ACQUIRED BY THE CITY OF LOS ANGELES, BY VARIOUS DEEDS OF RECORD (BUT

NOT INCLUDING THOSE PORTIONS OF SENTOUS STREET, ELEVENTH STREET, GEORGIA

STREET DESCRIBED IN DEEDS RECORDED APRIL 9, 1885, IN BOOK 137 PAGE 390 OF DEEDS,

IN BOOK 137 PAGE 391 OF DEEDS, IN BOOK 137 PAGE 392 OF DEEDS, IN BOOK 137 PAGE 393

OF DEEDS, RELINQUISHMENT RECORDED APRIL 22, 1964 IN BOOK R1896 PAGE 67,

OFFICIAL RECORDS AND LOT 17 OF KUGHEN AND CASTERLINE'S SUBDIVISION OF THE

WARD TRACT):

ALL OIL, GAS AND OTHER CARBON SUBSTANCES IN, UNDER AND RECOVERABLE FROM

SAID HEREINBEFORE DESCRIBED PROPERTY, TOGETHER WITH THE RIGHT TO DRILL FOR

AND PRODUCE SUCH OIL, GAS AND OTHER HYDROCARBON SUBSTANCES BY

DIRECTIONAL DRILLING CONDUCTED FROM SURFACE LOCATIONS ON LAND OTHER

THAN THE LANDS HEREINABOVE MENTIONED; IT BEING UNDERSTOOD THAT SUCH

EXCEPTION AND RESERVATION SHALL NOT OPERATE TO CREATE ANY RIGHT TO

CONDUCT DRILLING OPERATIONS FROM ANY PORTIONS OF THE SURFACE OF SAID

ABOVE DESCRIBED LAND. IT IS FURTHER UNDERSTOOD THAT ALL DIRECTIONAL

DRILLING, SHALL BE CONDUCTED IN SUCH A MANNER THAT THE WELL, HOLE SHAFT OR

OTHER MEANS OF REACHING OR REMOVING SUCH OIL, GAS OR OTHER HYDROCARBON

SUBSTANCES DOES NOT PENETRATE ANY PART OR PORTION OF SAID REAL PROPERTY

WITHIN 500 FEET OF THE SURFACE THEREOF, AS RESERVED BY VARIOUS DEEDS OF

RECORD.

CLTA Preliminary Report Form - Modified (11-1 7-06)

Page 7

Order No.: 1167430S0F-X49

LEGAL DESCRIPTION

(continued)

ALSO EXCEPT FROM THAT PORTION OF SAID LAND INCLUDED WITillN THE LAND

DESCRIBED IN THE FINAL ORDER OF CONDEMNATION, A CERTIFIED COPY OF WHICH

WAS RECORDED APRIL 25,1969 AS INSTRUMENT NO. 3171 ALL CRUDE OIL, PETROLEUM,

GAS, ASPHALTUM AND ALL KINDRED SUBSTANCES AND OTHER MINERALS OF

WHATEVER NATURE IN, UNDER AND RECOVERABLE FROM THE SAID REAL PROPERTIES

WITHOUT THE RIGHT TO ENTER, DRILL OR PENETRATE IN OR UPON THE SURFACE OF

SAID REAL PROPERTIES, OR WITHIN 500 FEET THEREOF, FOR THE PURPOSES OF

RECOVERING CRUDE OIL, PETROLEUM, GAS, ASPHALTUM AND ALL KINDRED

SUBSTANCES AND OTHER MINERALS OF WHATEVER NATURE. AS EXCEPTED IN THE

FINAL ORDER CONDEMNATION, A CERTIFIED COPYOF wmCH WAS RECORDED APRIL 25,

1969 IN BOOKD4350 PAGE 624, OFFICIAL RECORDS AS INSTRUMENT NO. 3171.

ALSO EXCEPT FROM THAT PORTION OF SAID LAND INCLUDED WITillN THE LAND