Accountability

Statements.

2022 Annual Report

Vancity 2022 Annual Report 2 Accountability Statements

Contents

Introduction ......................................................................................................................................... 3

People ................................................................................................................................................... 3

Service experience ......................................................................................................................... 3

Member satisfaction and member feedback ....................................................................... 3

Member profile and membership growth ............................................................................ 4

Helping protect members ............................................................................................................. 5

Financial health and inclusion ...................................................................................................... 8

Financial literacy and advice ................................................................................................... 8

Affordable housing ................................................................................................................... 8

Initiatives to improve access ................................................................................................... 8

Accessibility and inclusion in our built environment ......................................................... 11

Workforce diversity and pay equity ..................................................................................... 12

Employees ..................................................................................................................................... 15

Employee engagement .......................................................................................................... 15

Employee profile and turnover ............................................................................................. 15

Parental leave .......................................................................................................................... 17

Paying a living wage ................................................................................................................ 18

Performance management ................................................................................................... 19

Labour-management relations and human rights ............................................................ 19

Health and safety .................................................................................................................... 20

Planet .................................................................................................................................................. 21

The climate crisis .......................................................................................................................... 21

Vancity’s net-zero commitments .......................................................................................... 21

Operational greenhouse gas (GHG) emissions .................................................................. 23

Financed greenhouse gas emissions: scope 3, category 15 ............................................. 24

Progress on Vancity’s interim climate targets .................................................................... 24

Financed emissions removals and avoided emissions ..................................................... 24

Products and services to reduce GHG emissions .............................................................. 25

Materials and waste ............................................................................................................... 26

Water ........................................................................................................................................ 27

Responsible investment .............................................................................................................. 28

Ethical Principles for Business Relationships ..................................................................... 28

Profit .................................................................................................................................................... 29

Financial and economic performance ...................................................................................... 29

Key financial data and ratios ................................................................................................. 29

Clean revenue ......................................................................................................................... 31

Supporting local communities ................................................................................................... 31

Shared Success allocation to members and communities ............................................... 31

Business relationships and value chain .............................................................................. 32

Community impact loans ....................................................................................................... 33

Community grants .................................................................................................................. 33

Taxes paid and payable ......................................................................................................... 34

Governance ........................................................................................................................................ 35

Board of Directors ........................................................................................................................ 35

Examples of how we engage with our stakeholders ......................................................... 36

Risk Management ................................................................................................................... 37

Public policy and advocacy .................................................................................................... 39

Board remuneration .............................................................................................................. 40

Senior management and CEO compensation .................................................................... 40

Reporting principles and other information ................................................................................. 41

Reporting principles..................................................................................................................... 41

Material topics and determining report content ............................................................... 43

Material topics ......................................................................................................................... 43

Global Reporting Initiative content index ...................................................................................... 44

Sustainability Accounting Standards Board content index ......................................................... 52

Vancity 2022 Annual Report 3 Accountability Statements

Introduction

The Accountability Statements supplement our 2022 Annual Report. They contain

our management approach to material topics, data tables, explanations, and

notes. We selected the data and information based on its relevance to our

business strategy, interest to stakeholders, and effectiveness at demonstrating

our impact. We used standard disclosures from the Global Reporting Initiative’s

Sustainability Reporting Standards (GRI 1: Foundation 2021) where applicable,

including Financial Services Sector Supplement disclosures, as well as reporting

applicable disclosures from the Sustainability Accounting Standards Board (SASB)

and the Public Accountability Statements (PAS) disclosures called for in Canada’s

Bank Act.

We collect and manage accountability data using a web-based data management

system (UL360), which includes data quality controls. We choose to have key

performance data and information externally verified.

Throughout these statements, we refer to additional data and information

contained in the following documents. These are all available on

vancity.com/AnnualReport

:

• 2022 Annual Report

• Climate Report

• Principles for Responsible Banking (PRB) Report

• Consolidated Financial Statements

• Glossary

We have listed definitions of key terms at the beginning of each section. Where a

term is specific to a data table, we have included the definition as a footnote to

the table.

◆ = 2022 data has been verified by KPMG LLP

BM = external benchmark data

n/a = data not available

(xxx-x) = GRI Standards

(FN-XX-xxxx.x) = SASB Standards

(FSx) = GRI Financial Services Sector disclosures

(PAS) = Public Accountability Statement reporting requirements

People

Service experience (3-3)

Member satisfaction and member feedback

Member satisfaction (2-29)

We survey our personal members to measure their satisfaction with our products

and services. Through a ‘member experience tracking survey’, we learn about the

in-branch experiences of members who borrowed, invested, or opened new

accounts in branch in the previous week. This information is used to understand

and improve our performance. Through annual, post-transactional in-branch and

ad hoc surveys, we ask members for opinions on a range of other issues. We

review results by diversity (gender, age, disability, ancestry, low-income, etc.) to

help ensure we are meeting the needs of all our members and communities.

Our members primarily reach us through digital channels, rather than in

branches or our contact centre. Key outages (including a nationwide

telecommunications outage which affected members’ ability to conduct online

banking), member frustration with our banking app, and wait times, all influenced

member satisfaction in 2022.

2022

2021

2020

2019

2018

Member satisfaction with overall

service delivery

1

◆

%

48

50 56 53

1

53

Data source: Member relationship health survey.

The score represents the percentage of members who responded 9 or 10 out of 10 to the

question: thinking about everything that you have experienced with Vancity in the past 6 months,

how would you rate Vancity overall using a 10-point scale where “1” means “Poor” and “10” means

“Superior”. The margin of error was +/- 3%. 1.7% of surveyed answered “Don’t know.”

1 Data prior to 2020 has been restated to align with current-year methodology.

The percentage of respondents answering “Don’t know” for personal members in 2022 was 1.7%.

Vancity 2022 Annual Report 4 Accountability Statements

Member feedback mechanisms (2-29)

We are committed to providing meaningful opportunities for members to provide

feedback on their experience with Vancity, and to have input in setting the

direction of the credit union.

Members can provide feedback through our branches, call centre, website, social

media (such as Facebook and Twitter), as well as by mail and e-mail. Members

can also attend and participate in our Annual General Meeting and run for or

vote for our Board of Directors, subject to eligibility. In addition, we use surveys,

online member panels, interviews, and focus groups with members (and

sometimes non-members) on various topics to inform our strategies, products,

and services.

As a credit union and a co-operative, our Board of Directors is accountable to our

membership. Our members have the option to communicate their concerns to

their Board. Members may also choose to communicate their concerns via an

external party, such as our regulator the BC Financial Services Authority (BCFSA),

Central 1, The Ombudsman for Banking Services and Investments (OBSI) or the

Better Business Bureau.

Member concerns and complaints (2-16, 2-26)

We take complaints very seriously at Vancity and view them as our best way to

identify and rectify problems. Our goal is to deal with member concerns in a

timely manner, preferably by the employee who receives the complaint. We have

a system which enables front-line employees to directly log complaints. Although

not all complaints require formal logging and reporting, themes are discussed at

various management meetings. We do formally track compliments and

complaints that are received by the Board of Directors, the Office of the CEO, the

Chief Complaints Officer and/or the Chief Member Services Officer. These

compliments and complaints are reported to Vancity’s Board of Directors on a

quarterly basis. We have systems that allow us to track, monitor, and report

member responses to significant issues as they arise, for example, branch

closures or a significant change to a product or service.

Member complaints and concerns are received by the office of the CEO and

addressed accordingly. In 2022, no special resolutions or critical concerns were

brought forward at AGM to the or Board of directors.

Vancity compliments and complaints

Vancity Community Investment Bank compliments and complaints

Member profile and membership growth

Members include people, businesses and organizations who choose to bank with

Vancouver City Savings Credit Union and/or Squamish Savings and hold Class B

Membership shares, regardless of the amount of shares. Members with a

balance of less than $5 in Class B Membership shares need to hold at least one

additional member activated financial account (excluding Shared Success

Patronage accounts).

Member numbers and breakdown by type

For definitions of terms, see the Glossary on vancity.com/AnnualReport.

2022

2021

2020

2019

2018

Total number

of members

#

562,259

560,261 550,599 543,621 533,936

Personal

(individual)

members

%

92

92

93

93 92

Business

(organizational)

members

%

8

8 7 7 8

Vancity 2022 Annual Report 5 Accountability Statements

Net growth in membership

In 2022, Vancity’s membership grew by 1,998, or 0.36 per cent. This result was

negatively impacted by the reintroduction of a process to close dormant

memberships, which had been put on pause since 2017 as a result of technical

challenges. This process resulted in the one-time closure of 5,824 memberships

during the year. Excluding this one-time adjustment, Vancity’s membership grew

by 7,822 members, or 1.40 per cent in 2022.

2022

2021

2020

2019

2018

Net membership

growth

#

1,998

9,662 6,978 9,685 9,380

Net membership

growth ◆

%

0.36

1.75 1.28 1.81 1.78

Helping protect members (3-3)

For our approach see, 2022 Annual Report, ‘Helping protect members,’ p. 13

Privacy (FN-CB-230a.2, FN-CF-230a.3)

Privacy issues are handled by our Corporate Privacy Office, which is overseen by

our Chief Privacy Officer.

Protecting members’ information

Breaches of privacy and losses of member or client data (2-4, 418-1, FN-CB-

230a.1, FN-CF-230a.1)

In 2022, the Privacy Office recorded a total of 80 substantiated privacy breaches.

Most of these breaches were due to human error on the part of employees such

as sending email attachments to incorrect recipients or including the incorrect

documentation (member account statements, for instance) within mailouts. We

also observed the occasional system generated error, such as printing double

sided documents containing the incorrect members’ personal information.

2022

2021

2020

2019

2018

Total substantiated reports

and privacy breaches

# 80 89 121 102 71

Substantiated privacy breaches

identified and reported externally

by members or other outside

parties

# 60

68 108 96 68

Substantiated complaints

received from regulatory bodies

# 0 0 0 0 0

Internally identified and reported

substantiated privacy breaches

(leaks, thefts or losses of

customer data)

# 20 21 13 6 3

Vancity 2022 Annual Report 6 Accountability Statements

Percentage of employees who complete privacy training (205-2)

The yearly privacy training is a requirement for all employees and serves as a

yearly reminder of key privacy concepts and policies. As we have mandated since

2020, if an employee does not complete their compliance training within a

specific timeframe, employee access is restricted.

2022

2021

2020

2019

2018

Employees who completed training

%

99

100 98 91

1

93

1 Data prior to 2020 is not comparable due to a change in methodology.

Compliance

Vancity is regulated by the BC Financial Services Authority (BCFSA), an agency of

the BC government. Vancity Community Investment Bank is federally regulated

by the federal Office of the Superintendent of Financial Institutions (OSFI).

Citizens Trust is regulated both provincially by BCFSA and federally by OSFI.

We have procedures in place to be aware of various changes to and validate

compliance with applicable laws, regulations, legislation, and codes of conduct.

As part of the normal course of business, Vancity occasionally faces legal

proceedings. Updates on significant litigation are reported to the Board’s Audit

Committee quarterly. Provisions are recorded in the Financial Statements where

appropriate.

For our policies on money laundering and terrorist financing, see

vancity.com/MoneyLaunderingTerroristFinancing

Percentage of employees who reviewed and signed Vancity’s Code of

Conduct (2-24, 2-26, 205-2)

It is the responsibility of each employee to act in accordance with the respective

Code of Conduct standards in addition to any other professional code of ethics

and standards of practice to which an employee is bound. The Code sets out the

reporting responsibilities of employees, should they observe anything that

appears to violate its terms. All employees must review and complete an e-

learning module, and consent to the Code of Conduct annually. These activities

are routinely monitored through an established process. Where an employee

becomes aware of a potential breach or has committed a breach of this Policy,

they have a responsibility to report it immediately to a manager, or where

appropriate, use the Anonymous Reporting tool that Vancity has selected from

ClearView Strategic Partners Inc. (“Clearview”). The Clearview tool provides a

secure third party reporting system that allows employees to anonymously

report on unethical conduct and conflict of interest scenarios.

2022

2021 2020 2019 2018

Employees who signed Vancity’s

Code of Conduct

%

100

100 97 96 92

Signed by non-management

%

100

1

100 97 96 92

Signed by management

%

100

1

100 99 95 95

Signed by senior management

%

100

100 96 88 77

1 A very small number of employees did not complete and sign the Code of Conduct leading to

99.9% of non-management employees and 99.9% of management employees respectively, which

were rounded up to 100%.

Number of internal fraud incidents investigated (205-3)

Employee dishonesty is covered in the security training given to new employees.

Representatives from our Fraud and Security department periodically meet with

groups of managers to raise awareness of employee dishonesty and provide

guidance in managing incidents. Our Employee Dishonesty policy requires that all

incidents of employee dishonesty are reported for investigation. If substantiated,

the employee could be dismissed. All incidents of employee dishonesty and/or

breach of conduct are reported to HR and are included in the Operational Risk

Report.

2022

2021

2020

2019

2018

Substantiated incidents

#

0

1

4

3

4

Vancity 2022 Annual Report 7 Accountability Statements

Legal actions and incidents of non-compliance (2-27, 417-1, 417-2, FN-CB-

510a.1, FN-AC-510a.1)

In 2022, Vancity did not identify any significant instances of non-compliance with

laws and/or regulations where fines or sanctions were incurred concerning

product and service misinformation and/or mislabelling, fraud, insider trading,

anti-trust, anti-competitive behavior, market manipulation, malpractice, or other

related financial industry laws or regulations infractions.

Responsible marketing and selling (417-3)

Vancity is responsible for preserving our members’ collective assets. Our goal is

to provide members advice that is in their best long-term interests, including

managing debt and using credit responsibly.

Mortgages and personal loans

We do not want to provide credit or advice to members that puts them in a

position of taking on debt they cannot afford if interest rates rise, but we also

want to understand how credit can make a difference and we want to be

inclusive of our membership. We may say ‘no’ to a credit application because the

level of credit risk is too high, but we are more likely to say, ‘not right now’ and

provide alternative solutions to help applicants achieve their goals. We also look

at creative ways to view members differently who might traditionally not have

had access to credit.

For the retail loan portfolio (residential mortgages and personal loans), Vancity’s

underwriting methodologies and risk modeling are member-based rather than

product-based. We review the member’s capacity to repay the loan rather than

relying exclusively on collateral. Decisions on consumer loans are based on an

overall assessment of credit risk that considers factors such as debt levels relative

to income.

Our policies encourage member-serving employees to work directly with

members. Our residential mortgage process includes an advisory session as the

first step in the application process to determine if debt is the best option for the

member. We offer a variety of tools to help members understand the true costs

and obligations of borrowing and build their wealth and wellbeing in ways that

reflect their values. And when members have a hard time servicing their debt, we

provide them options to choose the best alternative that meets their needs.

First-time home buyers’ hub

Financial planning

Rates and fees

We're committed to delivering services at a fair, reasonable price to all our

members. We monitor and adjust interest rates to ensure our competitiveness.

In accordance with relevant legislation, we disclose interest rates and fees

associated with our products and services.

Personal banking account service fees

Business service charges

enviro

TM

Visa*

Vancity 2022 Annual Report 8 Accountability Statements

Financial health and inclusion (3-3)

One of Vancity’s guiding principles is to help enhance social justice and economic

inclusion for our members and communities. In the face of the climate

emergency and the recognition that climate impacts will be disproportionally felt

by those with less financial means to adapt in moments of crisis, our work in

financial inclusion and resilience has never been more important. This means

people can access financial services, build their savings and grow their assets

leading to increased confidence.

For more on financial health and inclusion see 2022 Annual Report, ‘Financial

health and inclusion,’ p. 14.

Financial literacy and advice

Financial literacy programs (PAS)

We believe a community-based model for learning creates meaningful and safe

programs that speak to the unique needs of diverse groups. Equipped with

courses and tools developed by our financial experts, our community partners

deliver culturally relevant workshops in their communities. Financial literacy

workshops - Vancity. Therefore, we partner with local community organizations

to help deliver financial literacy workshops in the community.

We offer the Small Business Startup Foundations free online resource for new

entrepreneurs. We continue to partner with Power Play to provide the Money

Manager program for secondary school teachers to access free, custom lesson

plans on finances to help students explore financial topics that are relevant to

their stage in life such as obtaining a car loan, understanding credit, and planning

for education. And in 2022, we formally launched the Wealth Mindset-I

ndigenous

Financial Resilience program in collaboration with Indigenous Elders to meet the

unique needs and strengths of Indigenous learners and communities. The

purpose of the program is to create a safe learning experience that is compelling

and integrates content and methodologies relevant to Indigenous peoples.

Financial literacy

Financial literacy backgrounder

Affordable housing

At Vancity, we hear from our members every day that access to affordable

housing is among their most pressing concerns. Lack of access to affordable

housing is severely affecting people’s financial resilience and quality of life.

With ongoing low vacancy rates and rising rents, there continues to be

insufficient supply of affordable and adequate rental housing for low- and

moderate-income populations. In our own trade region, almost half of renter

households are paying more than 30% of their income on rent and utilities. And

significantly, one in five renter households in Metro Vancouver are spending

more than half their income on rent and utilities, leaving them with little

disposable income. Our members include these renter households. Our

members also include community housing operators who are working to support

people living along the housing continuum from emergency and homeless

shelters, through to transitional housing, subsidized housing, co-operative

housing, below market rental housing, life leases, and property ownership.

For more on Vancity’s work in Affordable Housing, see

rethink.vancity.com/community/affordable-housing and 2022 Annual Report

,

‘Affordable housing,’ p 14.

2022

2021

2020

2019

2018

Units of affordable housing

financed

#

3,666

3,150 3,008 2,743 3,131

Counts acquisitions and renovations of homes that already existed, as well as net new homes.

For definitions of terms, see the Glossary at vancity.com/AnnualReport.

Initiatives to improve access (FS13, FS14, PAS)

We offer products and services to help people living on low incomes or who are

unable to access basic banking services, obtain credit within their means, build

savings, or buy a home.

We continue to look for innovative ways to recognize unique circumstances and

develop programs that support access to banking and credit that have a positive

Vancity 2022 Annual Report 9 Accountability Statements

community impact. We place an emphasis on supporting access to affordable

housing and home ownership, and economic self-reliance.

We are committed to working with First Nations governments and Indigenous

not-for-profit organizations in their efforts to improve the standard of living of

their members and help them achieve economic strength and independence.

Through a partnership with PHS Community Services, at Pigeon Park Savings we

serve nearly 5,000 individuals living on low incomes in Vancouver’s Downtown

Eastside – one of Canada’s poorest neighbourhoods. We have a branch in the

rural community of Cormorant Island near Port McNeil with our two partners, the

‘Namgis First Nation and the Village of Alert Bay. We are the only financial

institution with a presence in that community.

Since 2016, we’ve had an on-site banking kiosk at the ISSofBC Welcome Centre in

Vancouver. This is a one-stop support centre offering essential newcomer

services including opening bank accounts on arrival for newcomers and refugees

coming to Canada. In early 2022, we reopened the ISSofBC Welcome Centre in

Surrey to support the Resettlement Assistance Program (RAP).

Vancity’s microloan program supports new entrepreneurs by filling the gap

between traditional bank lending and the availability of venture capital. The

microloans are based on the character of the owner, the owner’s vision for the

future, and the strength of the business plan. In addition, we also look at what

the entrepreneur can achieve through financial literacy.

Vancity is part of the Black Entrepreneurship Program (BEP), which is a

partnership between the Government of Canada, Black-led business

organizations, and financial institutions. Vancity contributes to the National

Ecosystem Fund. The fund supports Black-led not-for-profits such as the Vancity

member organization the Black Business Association of BC

to provide support,

mentorship, financial planning, and business training for Black entrepreneurs.

Another BEP initiative is the Black Entrepreneurship Loan Fund, which provides

barrier-free access to business financing, tailored advice, mentorship, education,

and networking opportunities.

In response to the Ukraine invasion in February 2022, we provided financial

services to displaced Ukrainians arriving in BC by leveraging the existing RAP. We

worked with partners to translate financial literacy information into five different

languages and mobilized Ukrainian/Russian speaking employees to be available

at branches.

For more initiatives to improve access see Investing in communities

Indigenous communities

Products and services designed to provide access to basic financial services,

affordable housing, credit, and credit repair to individuals (FS7)

Product or service description/purpose

Target beneficiary

On-reserve housing loans: Mortgage-like loans

that provide financing to First Nations

community members who would like to

purchase or renovate a home located on First

Nations lands.

Indigenous communities

Pigeon Park Savings accounts: Personal bank

account package for a flat fee of $5 per

month, including cheque-cashing, unlimited

withdrawals, bill payments, money orders,

and ATM card access. For non-members, a

cheque-cashing service is available with no

charge for government cheques or a flat fee

of $5 for any non-government cheques.

Low-income and disadvantaged

individuals living in Vancouver’s

Downtown Eastside—one of

Canada’s poorest

neighbourhoods, where people

lack easy and affordable access

to basic banking services

Pigeon Park Savings cashable term deposits: A

12-month cashable term deposit with a

significantly reduced initial minimum deposit

of $100 that ensures affordability and a

preferred interest rate after 30 days.

Low-income and disadvantaged

individuals living in Vancouver’s

Downtown Eastside (see above)

Resettlement Assistance Program (RAP)

Accounts: A special account developed to

enable government-assisted refugees the

opportunity to open accounts in which to

deposit initial grants and subsequent

Individuals (low-income, new

immigrants and refugees) with

challenges accessing financial

services

Vancity 2022 Annual Report 10 Accountability Statements

assistance payments from the Federal

Government when they arrive in Canada.

Micro-loans: Small business loans to launch a

new business or get back to work in a chosen

field. Includes products such as: peer loans,

Be My Own Boss, Back to Work, With These

Hands, By Design, Small growers, and Next

step loans.

Micro-entrepreneurs, new

immigrants, or working poor

who face barriers to traditional

banking. Back to Work helps

foreign-trained professionals get

back into a facsimile of their

previous occupation; With These

Hands helps skilled trades

people.

Accessibility program Visa accounts: Credit is

offered to individuals who take part in a Visa

literacy discussion and agree to certain

conditions

Low-income and disadvantaged

members and communities

Secured Visa deposit account: One-year term

deposit account that provides individuals

with up to $500 of credit.

Individuals who are ineligible for

a standard credit card

Resettlement Assistance Program (RAP) Visa

account: A Visa offered to individuals with a

RAP deposit product, in order to establish

credit history in Canada.

Individuals (low-income, new

immigrants and refugees) with

challenges accessing financial

services

Fair & Fast loan

TM

: Small credit loans designed

to allow members fast, simple and

convenient access to financing at an

affordable cost.

Individuals with challenges

accessing financial services

Mixer Mortgage

TM

: Enables a “mix of friends”

to get together to purchase a home. All

parties are jointly and severally responsible

for the mortgage.

Singles or people in partner

relationships who want to own

their own home, and wanting or

needing to do so with friends,

partners, acquaintances, or

family

Laneway Housing bundle: This bundle is only

available to properties that will be creating

new livable laneway spaces. It has two

components: $750 towards closing costs and

free appraisal and cash back (1%), if a

member is transferring their mortgage from

another financial institution to Vancity.

Members who are creating

urban density in their

communities by developing

either existing garages or

building new laneway home

structures in the City of

Vancouver

Community Partner Refugee Loan program: to

provide loans to refugees to help pay the

fees associated with applying for permanent

residence (PR) status in Canada.

Convention Refugees and

Protected Persons (refugees) per

the Immigration and Refugee

Protection Act (IRPA) sections 96

and 97

Cormorant Island branch: The only financial

institution branch that delivers financial

services to the remote community of Alert

Bay.

Community of Cormorant Island

Unity Women Entrepreneur Loan: To give

women, and anyone who identifies as

women or non-binary, more access to the

funds they need, more networking

opportunities with like-minded people, and

more advice from experienced mentors.

Entrepreneurs who identify as

women or non-binary

Black Entrepreneurship Loan Fund: Seeks to

address the specific systemic barriers Black

business owners have too often faced when

seeking financing.

Black entrepreneurs

In addition, we offer:

• The Jumpstart

TM

High Interest Savings account

• Business Jumpstart

TM

High interest Savings account

• Registered Disability Savings Plans and support to register through a

partnership with Ability Tax and Trust Advisors

• Registered Educational Savings Plans, and support to register for same, plus

various learning grants, in partnership with Smart Saver and the Omega

Foundation

Vancity 2022 Annual Report 11 Accountability Statements

New financed business and commercial loans and lines of credit to

members (PAS, FN-CB-240a.1)

As well as providing basic banking services to individuals, it’s also important that

we provide businesses access to finance, including microloan amounts.

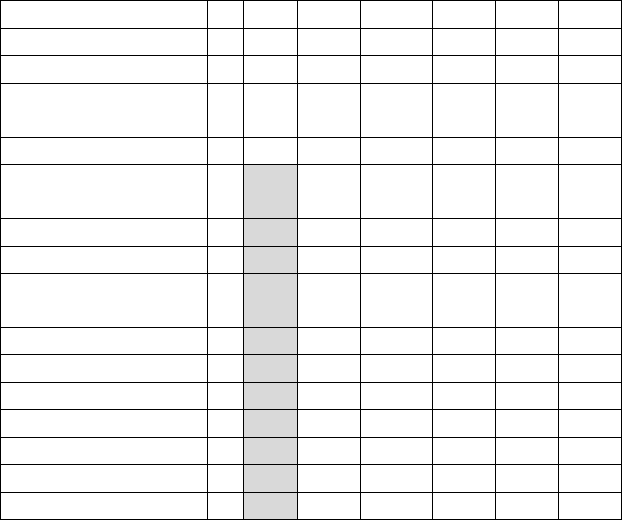

Value of loans financed by size:

(millions of dollars)

2022

2021

2020

2019

2018

$0 - $24,999

$

2

2

2

4

3

$25,000 - $99,999

$

9

10

9

18

16

$100,000 - $249,999

$

27

23

24

31

29

$250,000 - $499,999

$

36

71

48

56

71

$500,000 - $999,999

$

143

205

138

113

168

$1,000,000 - $4,999,999

$

685

949

483

480

718

$5,000,000 and greater $

616

1,243 804 679 577

Total value of loans financed

$

1,518

2,503

1,510

1,381

1,582

Average financed loan by size:

$

1.2

1.5

1.2

0.9

0.9

Number of loans financed by

size:

$0 - $24,999

#

146

183

236

352

305

$25,000 - $99,999

#

184

208

210

368

346

$100,000 - $249,999

#

189

159

164

215

194

$250,000 - $499,999

#

96

198

134

158

208

$500,000 - $999,999 #

197

289 197 160 240

$1,000,000 - $4,999,999

#

358

485

236

223

356

$5,000,000 and greater

#

55

105

74

60

60

Total number of new loans

financed

#

1,225

1,627 1,251 1,536 1,709

Data includes all new loans and lines of credit to businesses financed by our Community

Business, Community Capital, Community Real Estate, VCIB teams, and branch network. Financing

for construction loans is staggered, and all dollars may not get disbursed in the year the loan is

approved. The breakdown for total value of loans is rounded to the nearest one million dollars.

Accessibility and inclusion in our built environment

(FS14, PAS)

Our office and public locations are accessible and inclusive for both members

and employees. In addition to standard ramps, parking stalls, door operators and

open knee spaces, features include automated teller machines (ATMs) with tactile

keypads and walk-up ATMs have guided voice functionality. Corporate websites

are designed to be accessible with use of screen-reading devices such as JAWS

(Job Access with Speech). We train senior call-centre agents to provide TTY (text

telephone) banking services to members with hearing disabilities. There are

audio infrared and induction loops in our meeting rooms, training rooms and

community stages, as well as at the sit-down wickets. Portable induction loop

devices are available at every branch if needed while conducting business in

offices. Care has been taken to also ensure contrasting colours/tones and include

emergency response equipment such as distress alarms in universal washrooms,

as well as emergency evacuation chairs at all the office towers.

Tactile tape in emergency exit stairwells at Vancity Centre have been integrated

per our Emergency Evacuation program to ensure employees with visual

impairments can exit the building independently should the need arise, or if they

simply wish to take the stairs between floors. To ensure inclusive facilities for

people of all gender identities and members using our community stages, over

200 washrooms, showers, and change facilities have been identified as “Inclusive”

facilities throughout our branches and offices.

For more on accessing banking services, including for members with disabilities,

see Ways to bank

.

Vancity 2022 Annual Report 12 Accountability Statements

Diversity and anti-racism (3-3)

For our approach, see p. 15 of the Annual Report.

Workforce diversity and pay equity

We’re committed to being an anti-racist organization and we hold Reconciliation

as a core value. That means doing our part in removing barriers that stem from

systemic exclusion and inequities that affect women, Indigenous, Black and

people of colour, 2SLGBTQIA+, and people living with visible and invisible

disabilities. We took the Black North Pledge to achieve 3.5 per cent

representation at the senior management level and Indigenous representation to

three per cent organization wide.

We welcome people of all backgrounds to apply for positions within Vancity. We

aim to achieve diverse representation of employees that reflects the

communities we serve. This cannot be achieved without actively identifying and

addressing structural barriers to advancement.

We collect confidential and voluntary candidate diversity data to understand the

diversity of people we attract and outcomes for diverse candidates in the

recruitment process. This enables us to address barriers in the recruitment

process and set priorities for diverse recruitment. The executive leadership team

regularly reviews employee diversity trends.

Participation in our employee diversity survey increased to 83 per cent in 2022,

up from 69 per cent in 2021. We calculate percentages in each group by the total

number of all employees, but not all employees participated in the survey. While

the results provide a more complete picture of diversity at Vancity, not all the

changes since 2021 can be attributed to our efforts in recruitment, retention, or

promotion.

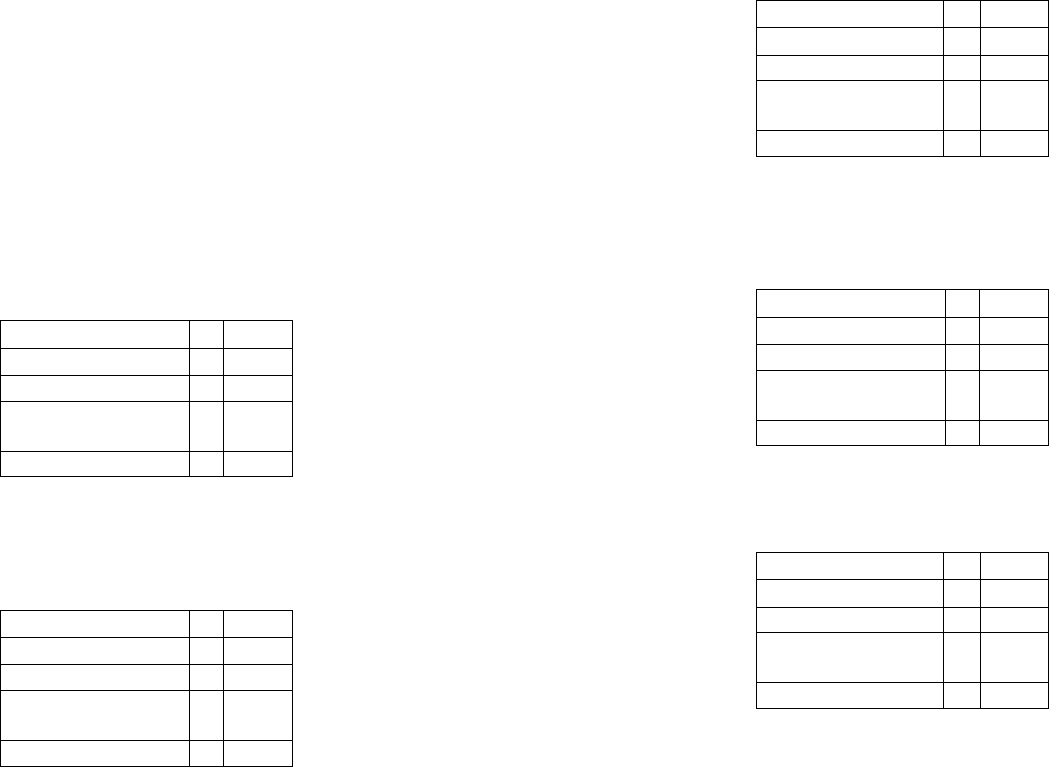

Employee profile (405-1)

BM

2022

2021

1

2020

2019

2018

Men

%

35

30

23

37

37

36

Women

%

65

52

43

63

63

64

Transgender or non-

binary

%

0.8

0.7 n/a n/a n/a

Did not participate %

17

33 n/a n/a n/a

Person with a

disability ◆

% 3

16

13 10 10 10

Indigenous person

◆

%

2

1.8

1.5

1.4

1.4

1.6

Black person

%

2.2

1.7

n/a

n/a

n/a

Black, person of

colour

% 37

47

37 37 37 38

2SLGBTQIA+ %

8.1

7.0 4.0 4.3 4.6

Aged under 30 years

%

29

16

15

15

17

19

Aged 30-50 years

%

41

57

60

59

58

56

Aged over 50 years

%

30

27

25

26

25

25

Non-management %

83

84 83 84 84

Management

%

14

13

14

13

13

Senior Management

%

3

3

3

3

3

Data for “Indigenous person”, “Black, person of colour”, “Person with a disability” and

“2SLGBTQIA+” is based on employees’ self-disclosure in our Human Resources Information

System.

Benchmark (BM) sources: women: HR Metrics report for Canadian credit unions, 2021 median

scores. Age categories: Statistics Canada. Vancouver, CMA, British Columbia: 2016 Census Profile

(aged 15-64 years). “Person with a disability,” “Indigenous person” and “Black, person of colour”:

Employment Equity Act: Annual Report 2019, Metropolitan Vancouver availability.

1 2021 not comparable to previous years. Only Q4 data diversity data available for analysis due to

revised survey tool becoming available in Q4.

Vancity 2022 Annual Report 13 Accountability Statements

Percentage of employees in non-management by indicators of diversity

(405-1, FN-AC-330a.1)

BM

2022

2021

1

2020

2019

2018

Men % 27

28

22 37 36 35

Women

%

73

52

41

63

64

65

Transgender or

non-binary

%

1

1 n/a n/a n/a

Did not

participate

%

19

35 n/a n/a n/a

Person with a

disability

%

16

13 10 10 10

Indigenous

person

%

1.8

1.6 1.5 1.5 1.7

Black

%

2.2

1.8

n/a

n/a

n/a

Black, person

of colour

%

38

48

37 38 38 40

2SLGBTQIA+ %

8.4

7.0 4.0 4.3 4.9

Aged under 30

years

%

18

19 18 20 22

Aged 30-50

years

%

55

56 56 55 54

Aged over 50

years

%

27

25 26 25 24

Data for “Indigenous person”, “Black, person of colour”, “Person with a disability” and

“2SLGBTQIA+” is based on employees’ self-disclosure in our Human Resources Information

System.

Benchmark (BM) sources: women: HR Metrics report for Canadian credit unions, 2021 median

scores. “Black, people of colour”: Canadian Bankers Association, Banks as employers report 2019.

1 2021 not comparable to previous years. Only Q4 data diversity data available for analysis due to

revised survey tool becoming available in Q4.

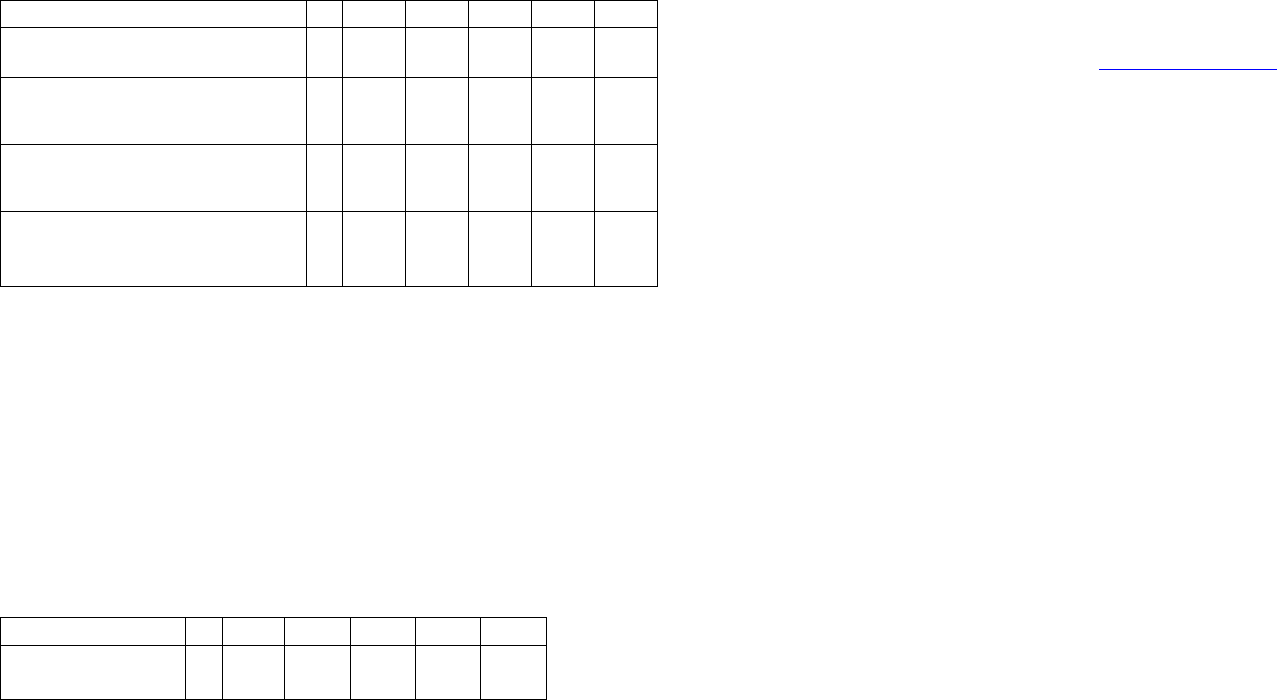

Percentage of employees in management by indicators of diversity (405-1,

FN-AC-330a.1)

BM

2022

2021

1

2020

2019

2018

Men

% 34

56

32 39 37 37

Women

%

66

37

50

61

63

63

Transgender or non-

binary

%

*

* n/a n/a n/a

Did not participate

%

7

18

n/a

n/a

n/a

Person with a

disability

%

18

15 10 10 10

Indigenous person %

*

* 0.6 0.8 0.4

Black

%

*

*

n/a

n/a

n/a

Black, person of

colour

% 33

43

36 36 33 27

2SLGBTQIA+

%

7

8

4.5

4.4

3.2

Aged under 30 years

%

3

2

1

4

4

Aged 30-50 years %

70

73 73 74 72

Aged over 50 years

%

27

25

26

22

24

* Below reportable threshold.

Data for “Indigenous person”, “Black, person of colour”, “Person with a disability” and

“2SLGBTQIA+” is based on employees’ self-disclosure in our Human Resources Information

System.

Benchmark (BM) sources: women: HR Metrics report for Canadian credit unions, 2021 median

scores. ’Black, people of colour: Canadian Bankers Association, Banks as Employers report 2019.

1 2021 not comparable to previous years. Only Q4 data diversity data available for analysis due to

revised survey tool becoming available in Q4.

Vancity 2022 Annual Report 14 Accountability Statements

Percentage of employees in senior management by indicators of diversity

(405-1, FN-AC-330a.1)

BM

2022

2021

1

2020

2019

2018

Men

% 53

40

30 46 49 47

Women

%

47

55

44

54

51

53

Transgender or non-binary

%

*

*

n/a

n/a

n/a

Did not participate

%

5

23

n/a

n/a

n/a

Person with a disability

%

13

10 10 11 12

Indigenous person

%

*

*

1.4

1.3

1.2

Black

%

*

*

n/a

n/a

n/a

Black, person of colour

%

18

35

27

26

19

21

2SLGBTQIA+

%

7

9

1.4

1.3

2.5

Aged under 30 years

%

0

0

0

0

0

Aged 30-50 years

%

60

65

67

68

58

Aged over 50 years %

40

35 33 32 42

*Below reportable threshold.

Due to the small number of employees in the senior management category, a change by one

employee can cause a significant shift in the percentage, as it has for “Black, person of colour”.

Data for “Indigenous person”, “Black, person of colour”, “Person with a disability” and

“2SLGBTQIA+” is based on employees’ self-disclosure in our Human Resources Information

System.

Benchmark (BM) sources: women: HR Metrics report for Canadian credit unions, 2021 median

scores. “Black, people of colour”: Canadian Bankers Association, Banks as Employers report 2019.

1 2021 not comparable to previous years. Only Q4 data diversity data available for analysis due to

revised survey tool becoming available in Q4.

Average compensation for women as a percentage of average

compensation for men (405-2)

In 2022, we are reporting two sets of gender-based pay ratios as we transition to

a new source for gender data. The old methodology used calculations based on

sex-based binary gender data, with two options: male or female, and without an

option to decline to respond. Recognizing gender is fluid and disclosure is a

choice, we’re now using our diversity survey. It allows employees to choose from

binary, cisgender, transgender, and non-binary options, update their gender

identity when they want, or decline to answer.

The table includes 2022 pay ratios based on the old data to support clarity in the

change and its impacts to historical year over year comparison. The calculations

using the new choice-based gender will provide our baseline for future year over

year analysis.

2022 new

method-

ology

2022 old

method-

ology

2021 2020 2019 2018

Non-

management

%

95 93

92 91 92 92

Management

%

97

97

96

94

99

98

Senior

management

% 104 103 97 89 111 111

Data set includes permanent full-time employees (and those who may be on short-term leaves)

and excludes part-time, contract employees, and employees on long-term leaves.

Compensation includes actual salaries from baseline earnings, profit share and benefits.

Average compensation for transgender or nonbinary employees as a

percentage of average compensation for men (405-2)

2022

Non-management

%

79

Management

%

*

Senior management %

*

* Below reportable threshold.

There are some cases of individuals being included in both the transgender or non-binary and

men or women population because of intersectionality of gender identity, which is consistent with

how diversity data is presented elsewhere in our reporting. In the new diversity gender data,

there are 272 fewer employees counted due to those choosing not to disclose their gender.

Data set includes permanent full-time employees (and those who may be on short-term leaves)

and excludes part-time, contract employees, and employees on long-term leaves. Compensation

includes actual salaries from baseline earnings, profit share and benefits.

Vancity 2022 Annual Report 15 Accountability Statements

Employees (3-3)

For our approach, see 2022 Annual Report

, ‘Employees,’ p. 16.

Commitment to diversity

Employee benefits, learning and development, compensation, time off

Employee engagement

In 2022, we adopted a new employee experience survey that is quicker to get

results and provides a deeper analysis. There are four questions that go into the

overall employee experience score.

Employee engagement score (2-29)

BM

2022

2021

2020

2019

2018

Employee

experience

1

% n/a 83 n/a n/a n/a n/a

Employee

engagement

2

◆

%

77

70

72 69 62 69

1 Data source 1: Qualtrix Employee Engagement Survey. The response rate was 86%.

2 Data source 2: Employee Engagement Survey. The participation rate was 82%.

BM: 2021 Kincentric Engagement Survey - Canada Average.

Employee profile and turnover

Employee profile (2-7, PAS)

BM

2022

2021

2020

2019

2018

Full-time equivalents

(FTE)

#

2,425

2,355 2,368 2,387 2,455

Headcount

#

2,738

2,679

2,601

2,675

2,853

Permanent full-time % 87

91

88 86 85 81

Permanent part-

time

%

11

8

10 13 14 15

Contract/temporary

%

2

1

2

2

2

4

Benchmark (BM) source: HR Metrics report for BC credit unions, 2021 median scores.

Full-time equivalents (FTE): calculated based on the number of regular scheduled hours worked

(excluding overtime) divided by 1,820 working hours in a year.

Headcount: total number of permanent and non-permanent (contract) employees.

For definitions of terms, see the Glossary at vancity.com/AnnualReport.

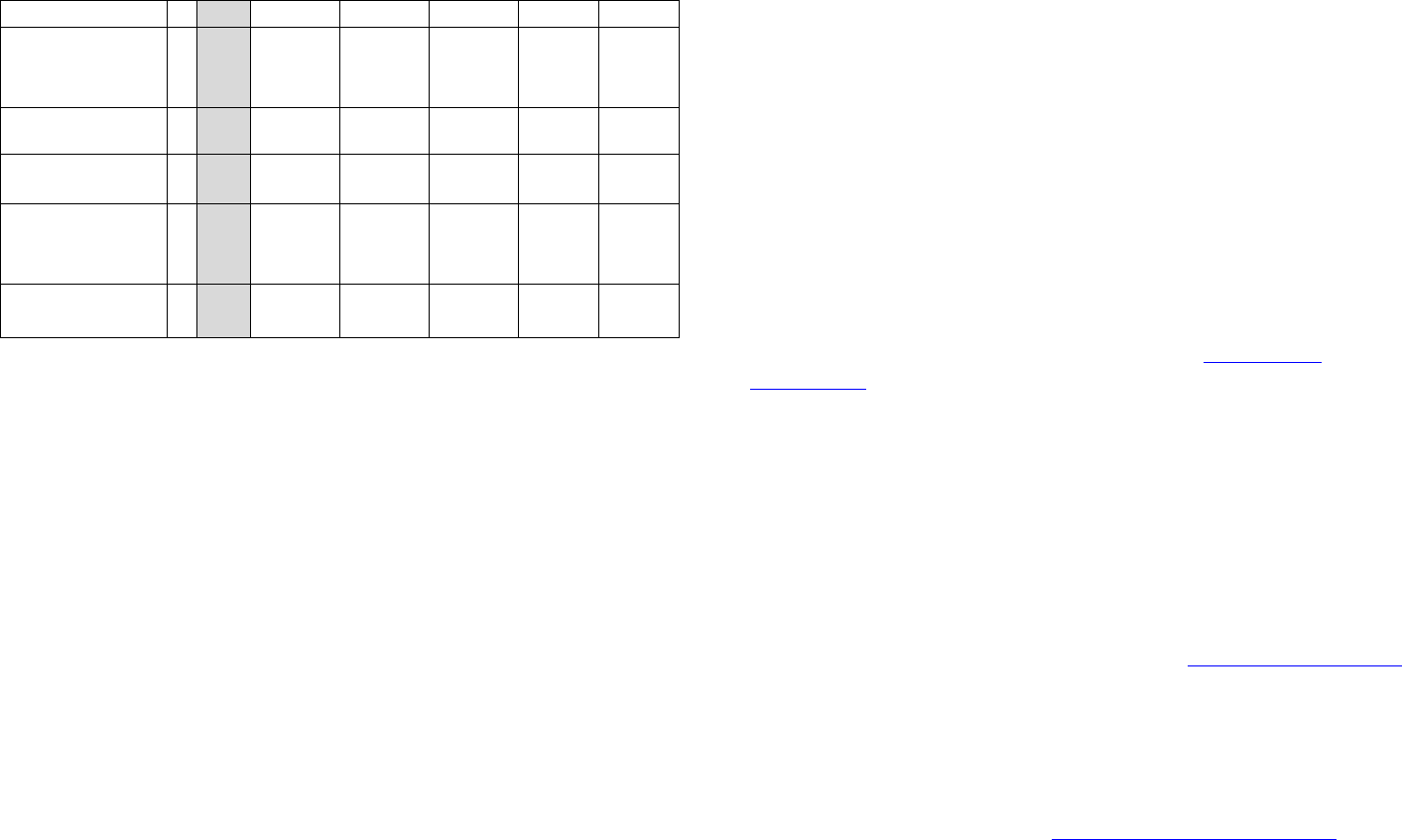

Position status for all employees (headcount), by gender (2-7, PAS)

2022

2021

1

2020

2019

2018

Total permanent full-time

#

2,486

2,369

2,233

2,261

2,306

Men

#

763

578

873

875

870

Women

#

1,260

1,006

1,360

1,386

1,436

Transgender or non-binary

#

20

16

n/a

n/a

n/a

Did not participate

#

383

738

n/a

n/a

n/a

Total permanent part-time

#

215

271

326

366

442

Men

#

31

37

75

88

109

Women #

125

118 251 278 333

Transgender or non-binary

#

*

<10

n/a

n/a

n/a

Did not participate

#

53

110

n/a

n/a

n/a

Total contract/temporary

#

37

39

42

48

105

Men

#

<10

<10

23

23

49

Women

#

17

12

19

25

56

Transgender or non-binary

#

*

<10

n/a

n/a

n/a

Did not participate #

14

15

n/a

n/a

n/a

*below the reporting threshold

1 2021 not comparable to previous years. Only Q4 data diversity data available for analysis due to

revised survey tool becoming available in Q4.

Number of permanent employee departures (401-1)

2022

2021

1

2020

2019

2018

Total departures

#

300

325

216

292

216

Men

#

61

17

82

119

87

Women #

93

23

134 173 129

Transgender or non-

binary

#

n/a

<10

n/a

n/a n/a

Did not participate

#

148

64

n/a

n/a

n/a

Aged under 30

#

77

101

55

95

73

Vancity 2022 Annual Report 16 Accountability Statements

Aged 30-50

#

144

143

86

128

100

Aged over 50

#

79

81

75

69

43

Voluntary departures #

250

273 156 231 169

1 2021 not comparable to previous years. Only Q4 data diversity data available for analysis due to

revised survey tool becoming available in Q4.

Permanent employee turnover rates (2-4, 401-1)

BM

2022

2021

1

2020

2019

2018

Overall turnover

%

18

11

13

8

11

8

Men

%

8

3

9

12

9

Women %

7

2

8 10 8

Transgender or

non-binary

%

0

*

n/a n/a n/a

Did not

participate

%

33

7

n/a n/a n/a

Aged under 30

%

18

25

13

20

14

Aged 30-50

%

9

9

6

8

7

Aged over 50 %

11

12 75 11 7

Voluntary

turnover

% 15

9

11 6 9 6

*Below reportable threshold.

Benchmark (BM) source: HR Metrics report for BC credit unions, 2021 median scores.

1 2021 not comparable to previous years. Only Q4 data diversity data available for analysis due to

revised survey tool becoming available in Q4.

Voluntary and Overall Turnover rates were restated for 2021 due to rounding errors.

Number of permanent new employee hires, overall and broken down by

gender and age (401-1)

2022

2021

1

2020

2019

2018

Total number of new hires

#

354

350

141

151

383

Men

#

97

10

59

84

158

Women

#

128

23

82

67

225

Transgender or non-binary #

*

<10

n/a

n/a

n/a

Did not participate

#

123

59

n/a

n/a

n/a

Aged under 30

#

146

167

62

66

218

Aged 30-50

#

186

168

71

76

152

Aged over 50

#

22

15

8

9

13

1 2021 not comparable to previous years. Only Q4 data diversity data available for analysis due to

revised survey tool becoming available in Q4.

Permanent employee new hire rate, overall and broken down by gender

and age (401-1)

BM

2022

2021

1

2020

2019

2018

Overall new hire rate

%

24

13

15

5

6

14

Men %

12

2

6 9 17

Women

%

9

2

5

4

13

Transgender or non-

binary

%

*

*

n/a n/a n/a

Did not participate

%

27

0.6

n/a

n/a

n/a

Aged under 30

%

35

42

15

14

42

Aged 30-50

%

12

11

5

5

20

Aged over 50

%

3

2

1

1

2

*Below reportable threshold. The new hire rate is the rate of new permanent employees joining

the organization for the first time.

Benchmark (BM) source: HR Metrics report for Canadian credit unions, 2021 median scores.

1 2021 not comparable to previous years. Only Q4 data diversity data available for analysis due to

revised survey tool becoming available in Q4.

Vancity 2022 Annual Report 17 Accountability Statements

Parental leave (401-3)

Parental leave should allow employees to take adequate leave and be able to

return to work in the same or a comparable position. In many workplaces, some

women are discouraged from taking leave and returning to work by employer

practices that affect their employment security, remuneration, and career path.

While many men are not encouraged to take the leave to which they are entitled.

Equitable gender treatment for parental leave can lead to the greater recruitment

and retention of qualified employees and boost employee morale and

productivity. For example, men taking advantage of leave entitlements positively

impacts women to take such leave without affecting their career path.

Number of employees who took parental leave (401-3)

2022

Men #

14

Women

#

35

Transgender or

non-binary

#

*

Did not participate

#

26

Number of employees who returned to work after parental leave ended

(401-3)

2022

Men

#

12

Women

#

28

Transgender or

non-binary

#

*

Did not participate # 19

Return rates of employees who took parental leave (401-3)

2022

Men

%

100

Women

%

100

Transgender or

non-binary

%

*

Did not participate

%

73

Number of employees who were still employed 12 months returning from

parental leave (401-3)

2022

Men

#

14

Women

#

23

Transgender or

non-binary

#

*

Did not participate

#

13

Retention rates of employees who took parental leave (401-3)

2022

Men

%

100

Women

%

100

Transgender or

non-binary

%

*

Did not participate

%

81

2022 was the first year reporting parental leave measures, hence previous years’ data has not

been reported.

Vancity 2022 Annual Report 18 Accountability Statements

Paying a living wage

Vancity is a certified living wage employer. Hourly rates are reviewed annually

and living wage rate adjustments are made accordingly. We are fully compliant in

paying eligible employees (full time, part time and casual employees) a living

wage. Employers are allowed to have a small number of trainees or co-op

students that are not eligible for the living wage rate. We also continue to work

closely with key suppliers and contractors to support them in paying their

employees a living wage.

Entry-level employee hourly wage compared with British Columbia’s living

wage (202-1)

Vancity is a certified living wage employer ◆. Hourly rates are reviewed annually

and living wage rate adjustments are made accordingly. The Metro Vancouver

living wage was $24.08 per hour in 2022, inclusive of benefits. This is the

minimum hourly rate that would be paid to meet basic living needs.

Vancity includes benefits in addition to base pay as part of a total compensation

package. This means the equivalent hourly living wage we need to pay employees

to be living wage compliant is reduced to reflect "credit" for these benefits.

We are fully compliant in paying eligible employees (full time, part time, and

casual employees) a living wage. Employers are allowed to have a small number

of trainees or student co-ops that are not eligible for the living wage. We’re also

working closely with key suppliers and contractors to support them in paying

their employees a living wage.

In 2022, Vancity recertified as a Living Wage Employer based on Metro

Vancouver’s living wage of $20.52/hour. We continue to make living wage

adjustments in what we pay our own employees as well as working closely with

key suppliers to have their employees who are providing direct services to

Vancity paid a living wage. The living wage increased to a minimum of $24.08 per

hour in Metro Vancouver in November 2022, effective May 2023.

For more on our approach, see 2022 Annual Report

, ‘Paying a living wage,’ p 17.

Living wage

Metro Vancouver Living Wage standard (2-4)

2022

2021

2020

2019

2018

Metro Vancouver hourly living

wage, including the value of

benefits

$

24.08

20.52 19.50 19.50 20.91

Equivalent hourly living wage

requirement for Vancity,

adjusted to reflect the value of

benefits which we provide to

permanent employees in

addition to base pay

$

19.75

17.08 17.08 17.08 17.08

1

1 2018 restated to correct a previous reporting error.

Vancity entry level employee hourly wage for permanent employees

2022

2021 2020 2019 2018

Permanent entry level

employee

$

19.75

17.82 17.82

17.82

17.82

Permanent entry level

employee hourly value of

benefits

$

4.33

3.83 3.83 3.83 3.83

Permanent entry level

employee hourly wage plus

value of benefits

$

24.08

21.65 21.65

21.65

21.65

Vancity entry level employee hourly wage for non-permanent/contract

employees

We don’t provide non-permanent employees with benefits, except for a vacation

allowance. In 2022, we paid non-permanent employees a minimum of $22.64

plus a vacation benefit. Living wage assumes a minimum amount of vacation

time off or equivalent vacation paid in lieu (equivalent to 70 hours). Vancity offers

vacation time or vacation time in lieu equivalent to 105 hours (35 hours more

Vancity 2022 Annual Report 19 Accountability Statements

than the living wage ceiling). The additional week that Vancity offers our

employees is considered a benefit that is equivalent to $24.08/hr.

2022

2021

2020

2019

2018

Non-permanent entry level

employee hourly wage

$ 22.64 20.50 20.50 20.50 20.50

Non-permanent entry level

employee hourly value of

benefits (vacation allowance)

$ 1.44 1.23 1.23 1.23 1.23

Non-permanent entry level

employee hourly wage plus

vacation allowance

$ 24.08 21.73 21.73 21.73 21.73

Vacation benefit is based on vacation leave available to employees beyond 70 hours

Performance management

At Vancity, we align our vision and values with the needs of our members, so that

our success helps to build healthy communities. A performance-planning cycle

connects individual performance to organizational goals and helps each

employee's contribution positively impact the community in which they live and

serve. Performance plans are aligned to Vancity’s business plan and include both

objectives and behaviours that reflect an employee’s accountabilities. Ongoing

coaching and feedback are critical to supporting the growth and development of

our employees.

Labour-management relations and human rights

Our Employee Code of Conduct and Respect in the Workplace Policy sets out

procedures for making and dealing with employee complaints, incidents of

discrimination, and any requisite corrective actions. Our collective agreements

govern union employees and include formal procedures for resolving workplace

issues. We track grievances and breaches of the Code of Conduct and report

these quarterly to the Human Resources Committee of the Board.

We have collective agreements with two unions: the BC Government and Service

Employees’ Union (BCGEU) and the Public and Private Workers of Canada (PPWC).

We have 25 branches and three departments that are unionized.

We believe that open and intentional communications with our union colleagues

can promote discussion, transparency, and proactive problem-solving around

both issues and opportunities that impact communities, members, employees,

and our workplace. Vancity does not endorse or discourage unionization and

recognizes that it’s each employee’s individual choice.

Employees covered by collective bargaining agreements (2-30)

We are mindful of creating an equitable experience for all employees across

Vancity regardless of if they are in a bargaining unit or exempt. For our all

employees, our terms of employment and total rewards packages are at or

ahead of market. We use an external vendor and several market surveys to audit

this on an annual basis. In all cases, we strive to create an employee experience

that is grounded in health and wellbeing of every employee.

BM

2022

2021

2020

2019

2018

Employees unionized

%

23

30

31

32

31

29

Benchmark (BM) source: HR metrics report for Canadian credit unions, 2021 median scores.

Employee grievances related to labour practices (2-4, 2-25)

2022

2021

2020

2019

2018

Total number of grievances

related to labour practices

that went to arbitration

#

76

68 7 42 69

Grievances refer to legal actions, complaints registered with the organization or competent

authorities through a formal process, or instances of non-compliance reported by union and non-

unionized employees.

Some grievances are filed on behalf of a collective group. The total number of grievances that

went to arbitration refers to grievances that were not able to be resolved by management or

human resources.

Restatements were made for 2020 and 2021 as not all of those years’ labour practice incidents

went to arbitration, but grievances continue to be discussed with the union in efforts to resolve

internally.

Vancity 2022 Annual Report 20 Accountability Statements

Employee grievances related to human rights and harassment (2-4, 406-1)

2022

2021

2020

2019

2018

Number of incidents of

discrimination

# 0 1 1 n/a n/a

Number of grievances reviewed

or addressed (file pending)

#

0

0 1 1 3

Number of grievances no longer

subject to action or resolved

# 0 1 5 4 4

Total number of formal

complaints filed related to

respect in the workplace

# 0 1 6 5 7

Actions taken for an incident of discrimination filed in 2021 included unconscious bias training

and a formal apology issued, and for an incident of discrimination filed in 2020, the complaint was

withdrawn.

Percentage of employees who completed biennial training on policies and

procedures concerning relevant aspects of human rights (2-24)

All employees are expected to complete annual training on policies and

procedures concerning aspects of human rights. The increase in participation is

largely due to new reporting tools that allowed us to remove employees on leave

from our reporting.

2022

2021

2020

2019

2018

Employees who

completed training

%

100

2

100 79

1

94 85

1 The change in completion is attributed to a change in delivery from one bi-annual training

course to four courses (one per quarter) per year. This may have impacted the number of

employees who were able to complete all four courses.

2 A very small number of employees did not complete mandatory compliance courses concerning

aspects of human rights in 2022 leading to 99.9%, which was rounded up to 100%.

Health and safety

We are committed to providing a healthy and safe workplace.

In 2022, Vancity signed the Thrive Global mental health pledge to continue

prioritizing the wellbeing and mental health of our employees and maintain our

investments and commitments in this critical area. Our management team

completed training on supporting their own and their teams’ mental health. We

plan on expanding this training to all employees beginning in 2023.

As a financial institution, one of our most significant health and safety issue is the

risk of robberies. We have extensive robbery training and security procedures as

well as a robbery support program for affected employees. Our rules and safe-

work procedures manual contains policies and procedures for workplace

violence, including prevention and dealing with irate members or customers.

Training for new hires in our branches includes a module on handling a robbery.

An employee assistance program is available to all employees and their

immediate families. It’s a voluntary, confidential, short-term counselling, advisory

and information service available 24 hours a day, seven days a week, and

includes a robbery recovery support program. We annually track and report

robbery related incidents, monitor the number of paid care days used per

permanent employee and maintain records of employee training on health and

safety.

Vancity 2022 Annual Report 21 Accountability Statements

Number of days lost due to employee illness (2-4)

BM

2022

2021

2020

2019

2018

Days for short-

term disability

leave

#

12,262

12,689 13,248 14,435 11,661

Care days

#

14,481

11,512

11,232

14,851 14,816

Pandemic pay

days

# 2,725 2,389 3,942 n/a n/a

Total days lost

due to

illness/care

#

29,468

26,590

1

28,422

1

29,287 26,477

Absenteeism

rate

%

5

12

10 11 12 11

1 Pandemic pay was created specifically for employees to take care days due to COVID-19

complications, however it was not clearly delineated from other sick time. Therefore, total days

lost due to illness/care for 2020 and 2021 were restated to include pandemic pay to reflect a

correct measure of total sick/care days.

Data includes unpaid care days taken.

Data includes permanent full-time and part-time employees.

Days lost due to illness includes time taken by employees to care for a sick family member.

Absenteeism rate is the number of workdays missed (lost) by employees due to illness or family

care per permanent full-time equivalent.

Benchmark (BM) source: HR Metrics report for Canadian credit unions, 2021 median scores.

Credit unions in the benchmark data have a short-term disability leave policy of four months

versus six months for Vancity (so the number of days included for Vancity will tend to be greater

in comparison).

Planet

The climate crisis (3-3, FN-MF-450a.3)

One of Vancity’s three guiding principles is to help ensure environmental

sustainability for our members and communities. We are focused on supporting

a just climate transition, a low-carbon future, and enhancing climate resilience in

our communities. This involves providing clear environmental sustainability

leadership in the financial sector. We are committed to action through our

ambitious interim climate targets, climate-related processes in our lending and

client investments, products and services aimed to address climate change, and

engagement work. For more details on our approach, see Climate Report p. 7.

Building on decades of leadership on environmental sustainability and issues of

social and economic inclusion, in 2021, we announced

five ambitious

commitments to address the global climate crisis. The five commitments focus on

building community resilience by strengthening local economies and addressing

systemic inequities to support a just climate transition.

Vancity’s net-zero commitments

One of Vancity’s five climate commitments is to target net-zero emissions by 2040

across all our mortgages and loans. That means the carbon emitted from our

lending will be eliminated or significantly reduced, with any remaining

greenhouse gas emissions being brought to net-zero. To help us in our journey,

in April 2021 we became a founding signatory of the Net-Zero Banking Alliance

(NZBA), and the first Canadian financial institution to join. A key reason for joining

was a desire to ensure our approach to net zero follows best practice and evolves

in line with evolving scientific knowledge. For more details on our NZBA

approach, see Climate Report p. 9

When it comes to the investments that we manage on behalf of clients, Vancity

Investment Management joined the Net Zero Asset Managers Initiative

in

October 2021. Similar to the NZBA, the NZAMI commits members to support the

goal of net-zero emissions by 2050 or sooner, in line with global efforts to limit

warming to 1.5 degrees.

Vancity 2022 Annual Report 22 Accountability Statements

For operational emissions, we’ve been carbon neutral ◆ since 2008

1

. We are

reviewing expanding the scope to include purchased goods and services, and we

plan to establish

long- and short-term net-zero targets.

In 2022, we continued to evolve and deepen our organization-wide climate

transition plan that will serve as a roadmap for achieving our net-zero targets. For

more about our approach to measuring emissions and establishing targets, our

climate transition plan, and progress to date, see our Climate Report p. 18.

Environmental Sustainability at Vancity

vancity.com/EnergyEnvironment

1