PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, STATE OF KARNATAKA

(UNDER RULE NO: 16/17 of THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – VIPIN ANAND

In the matter of Mr. Hareesh N Shetty Vs ICICI Lombard General Insurance Co. Ltd.

Complaint No: BNG-G-020-2122-0079

Award No.: IO/BNG/A/GI/0011/2021-22

• The complaint is submitted by Mr. Hareesh N Shetty against ICICI Lombard General

Insurance CO. Ltd. for the reimbursement of conveyance and compensation for the

dereliction of duty, harassment, mental agony and hardship caused to the complainant on

rejection of renewal of motor policy no. - 3005/A/204633907/00/00 by RI.

• According to the complaint, the complainant had a motor policy bearing no.-

3005/A/204633907/00/00 issued by RI on 01.09.2020. It was due for renewal on

04.09.2021. The complainant went to RI’s office for the renewal of his policy but the RI

refused to renew it. Thereby the RI asked him to renew his policy with some other insurer.

The complainant claims that he hired tourist car and spent Rs. 2000/- as hire charges for

about 60 kms to and fro journey to RI’s office. He had to undergo mental agony, distress and

hardship due to negligence and dereliction of duty by RI’s staff. So his complaint is for

compensation of Rs. 50 Lacs for mental agony and harassment plus Rs. 2000/- for car hire

charges by RI. He got his policy renewed from National Insurance Co. Ltd. after rejection by

RI vide policy no.-60230031210001272 dt. 12.08.2021.

• The Forum has gone through the documents and notes that the complainant has filed his

complaint for the compensation of Rs. 2000/- taxi hire charges plus Rs. 50 Lacs for mental

agony and harassment suffered by him due to rejection of renewal of his motor policy by RI.

The complainant has not suffered any direct monetary loss under an insurance policy since

he has not paid any premium to the RI for renewal of his policy.

• As per Rule 13(1) (h) of the Insurance Ombudsman Rules 2017 – The Ombudsman shall

receive and consider complaints or disputes relating to non-issuance of insurance policy

after receipt of premium in life insurance and general insurance including health insurance.

Despite the non receipt of premium by the RI, the complainant has sought a monetary relief

of Rs. 50 lacs. This Forum has no jurisdiction to consider this monetary relief.

• In view of the above, the Forum concludes that the complaint is NON-ENTERTAINABLE

under Rule No. 13 of Insurance Ombudsman Rules 2017 as amended upto date.

Dated at Bangalore on the 11

th

day of November 2021.

(VIPIN ANAND)

INSURANCE OMBUDSMAN

FOR THE STATE OF KARNATAKA

PROCEEDINGS BEFORE

THE INSURANCE OMBUDSMAN, STATE OF ODISHA, BHUBANESWAR

(UNDER RULE NO: 16(1)/17 OF THE INSURANCE OMBUDSMAN RULES, 2017)

OMBUDSMAN – Shri Suresh Chandra Panda

CASE OF MR. ARNAB PRADHAN Vrs. THE NEW INDIA ASSURANCE COMPANY LIMITED

COMPLAINT REF: NO: BHU-G-049-2122-0118

AWARD NO: IO/BHU/A/GI/ /2021-22

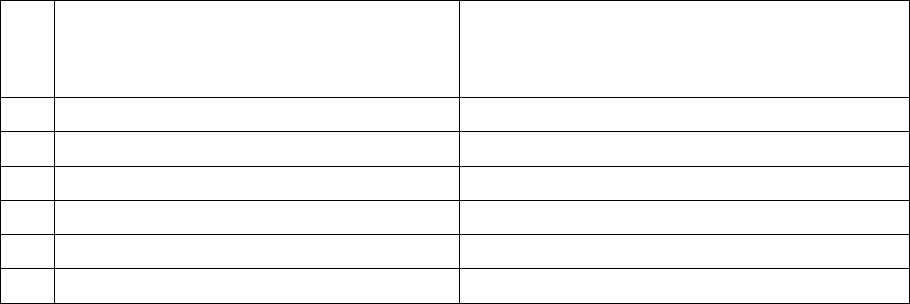

1.

Name & Address of the

Complainant

Mr Arnab Pradhan,

S/o Dr P.K.Pradhan, Mohanty Pada, Chandinichowk, Cuttack-

753002. Cell no.9776702510

2.

Policy No:

Type of Policy

Duration of policy/Policy

period

55040131190900017115 (Nil Depreciation Policy)

Bundled Motor Policy for Two-Wheeler, BMW/F 850 GS Two-

wheeler, IDV-Rs.14,63,000/-

12 months-23/03/2020 to 22/03/2021. DOA-08/07/2020

3.

Name of the insured

Name of the policyholder

Mr. Arnab Pradhan

Mr Arnab Pradhan

4.

Name of the insurer

The New India Assurance Company Limited

5.

Date of Repudiation

Settled for RS.163550/- on 23/10/2020

6.

Reason for repudiation

7.

Dt of receipt of the

Complaint

16/09/2021

8.

Nature of complaint

Partial settlement of claim

9.

Amount of Claim

Rs.1,05,237/- (balance amount)

10.

Date of Partial Settlement

11.

Amount of relief sought

Rs.1,05,237/- (balance amount)

12.

Complaint registered under

Rule no: of IO rules

13(1)b

13.

Date of hearing/place

08/11/2021, Bhubaneswar

14.

Representation at the

hearing

a) For the Complainant

Self through telephone (Mobile)

b) For the insurer

Mr. J R Mishra, Sr. BM through VC

15

Complaint how disposed

U/R 17 of the Insurance Ombudsman Rules, 2017

16

Date of Award/Order

08/11/2021

17. a. Brief Facts of the Case/ Cause of Complaint: -The complainant had insured his BMW/F

850 GS Two-wheeler with The New India Assurance Company Limited for the period 23/03/2020 to

22/03/2021 vide policy no. 55040131190900017115. The vehicle met with an accident on

08/07/2020. The Complainant submitted claim form and estimate for Rs.2,46,193/- obtained from

Prestige Motorrad on 16/07/20 after a delay of 9 days. On receipt of claim form on 16/07/2021,

surveyor was engaged who visited the garage on 17/07/2021. After repair Re-inspection was

conducted on 22/09/2021 and 23/09/2021. Surveyor submitted his report on 16/10/2021 where

he had assessed the loss for Rs.1,64,000/-. The insurer paid a sum of Rs.1,63,550/- after verifying

the bills. The Complainant had submitted bill for Rs.2,68.787/-. As he had received Rs.1,63,550/-

from Insurer, he has approached this forum for getting balance amount of 1,05,237/- (Rs.2,68,787/-

-Rs. 163,550/-)

b. The insurer, in its self-contained note, has admitted insurance and accident within policy

period. They stated that though estimate was for Rs.2,46,193/- he had submitted final bill for

Rs.2,68,787/-. They have submitted a detailed sheet mentioning reason for deduction for

Rs.1,05,237/-.

i)There was no estimate for clutch cover, control arm, heel guard, gasket ring, groved drive, wind

defeleet for Rs.37,275/-.

ii)No damage found for lateral trim for 41,474/-

iii) Tank cover for Rs.18,973/- not consistent to nature of accident and normal wear and tear

iv) Securing nut, body screw, gasket for Rs.1,289/- consumable items

v) Labour charges Rs.1345/-

v)Salvage Rs.4380/-

vi)Policy excess Rs.100/-

vii)PA premium Rs.450/- as PA cover not taken in policy

They had stated that the surveyor vide his letter 04/12/2020 had justified the assessment which

was also communicated to the complainant. Amount of Rs.1,63,550/- was paid to insured which

was just and proper.

18. a. Complainant’s Argument: - He had admitted for lodging claim for Rs.2,46,192/-. As he had

paid Rs,2,68,787/- to repairer and got reimbursement for Rs.1,63,550/- from insurer he is entitled

to get the balance amount

b. Insurer’s Argument: - They had rightly settled the claim as assessed by surveyor after

deducting Rs.450/- towards P.A. Premium as per audit guideline.

19. Reason for Registration of Complaint: Scope of the Insurance Ombudsman Rules, 2017.

20. The following documents are placed in the file.

a. Photocopies of Policy, & policy wordings, survey report, estimate, final bill, photos,

detail calculation sheet submitted by insurer, b. Photocopies of estimate, bills

21. Result of hearing with both parties (Observations & Conclusion): - This Forum has carefully

gone through all the documents relating the complaint and heard both the parties. When asked for

the details of the case, the complainant could not make his deposition correctly. He was also not

able to explain the Forum about the incident and about submission of documents properly. The

insurer informed that they have settled the claim as per surveyor’s assessment. The Forum

examined the documents and found that the insurer has settled the claim as per the surveyor’s

assessment after deduction of compulsory Personal Accident premium. The Forum found that the

surveyor is licensed by IRDAI.

AWARD

Taking into account the facts and circumstances of the case and submissions made by both

the parties during the course of hearing, it is observed that the complainant could not

substantiate his case for getting any additional amount. Since the insurer has settled the

claim as per surveyor’s assessment, the complainant is not entitled for any additional

amount on this claim.

Dated at Bhubaneswar on the 08

th

day of November, 2021

INSURANCE OMBUDSMAN

FOR THE STATE OF ODISHA

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 17 of the Insurance Ombudsman Rules, 2017)

Insurance Ombudsman- Shri Atul Jerath

Case of Sham Sunder v/s Universal Sompo General Insurance Co.

Ltd. Co

mplaint Ref no: CHD-G-052-2021-0041

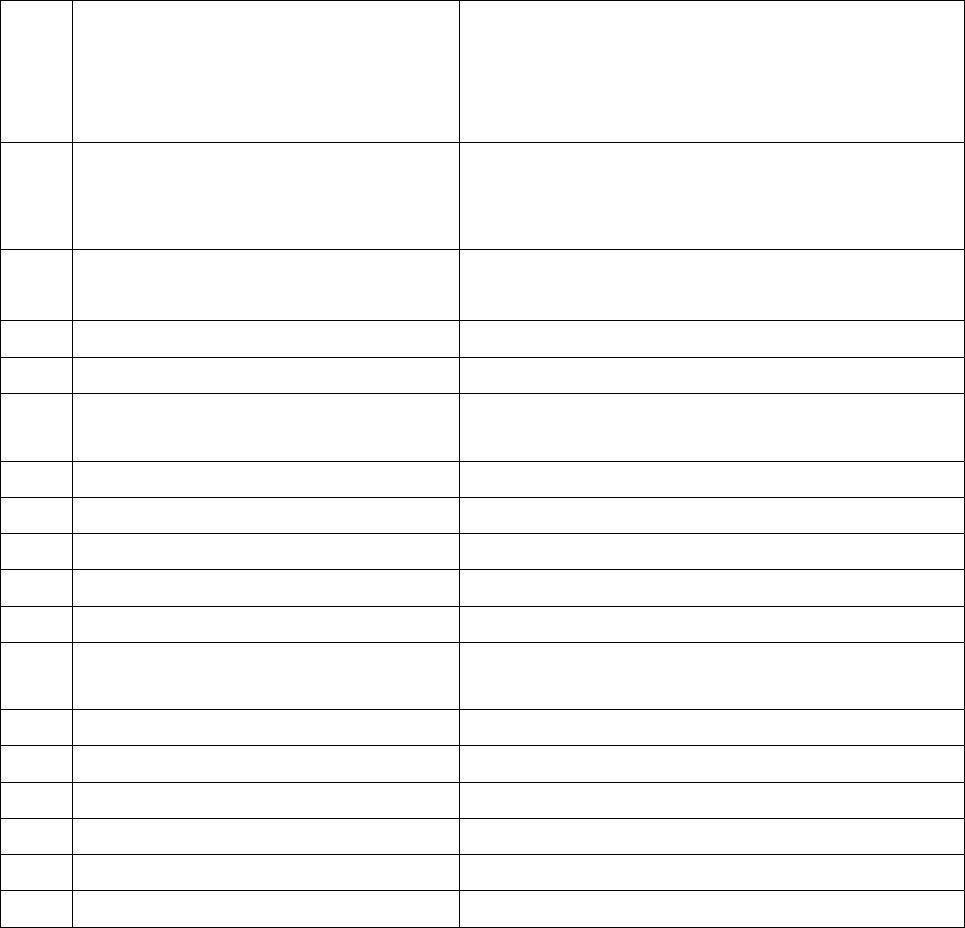

1.

Name & Address of the Complainant

Shri Sham Sunder

House No.1234, Sector 80,

S.A.S.Nagar (Mohali) -140308

Mobile No- 9417038734

2.

Policy No:

Type of Policy

Duration of policy/Policy period

2367/62239139/SO/0000

Private Car Package Policy

14/12/2020 to 13/12/2021

3.

Name of the insured

Name of the policyholder

Sham Sunder

Sham Sunder

4.

Name of the insurer

Universal Sompo General Insurance Co. Ltd

5.

Date of Repudiation

Not Applicable

6.

Reason for repudiation

Not Applicable

7.

Date of receipt of the Complaint

13-05-2021

8.

Nature of complaint

Deduction of claim

9.

Amount of Claim

Rs 39,800/-

10.

Date of Partial Settlement

26-03-2021 for Rs 51,763/-

11.

Amount of relief sought

Rs 39,800/-

12.

Complaint registered under Rule no:

Insurance Ombudsman Rules, 2017

Rule 13 (1)(b) – any partial or total repudiation of

claims by an insurer

13.

Date of hearing/place

29-10-2021, 16-11-2021/ Online hearing

14.

Representation at the hearing

For the Complainant

Shri Sham Sunder, Complainant

For the insurer

Shri Prashant Shukla

15

Complaint how disposed

Award under rule 17

16

Date of Award/Order

25-11-2021

17) Brief Facts of the Case:

Shri Sham Sunder (hereinafter, the Complainant) has filed this complaint against Universal Sompo

General Insurance Co. Ltd (hereinafter, the Insurers), for wrongly doing deduction in his motor

claim.

18) Cause of Complaint:

a) Complainant’s argument: On 13-05-2021, Shri Sham Sunder had filed a complaint that his

Maruti Swift Car bearing Registration No.PB65-AU-1451insured on 05/12/2020 for the period

14/12/2020 to 13/12/2021 from Universal Sompo General Insurance Company Limited. His car

got damaged in a road accident on 30/01/2021 and same was got repaired from M/s Tricity Autos,

Zirakpur at total cost of Rs..85,763. His total claim amounted to Rs.91,563/- but the Insurance

Company passed only Rs.51,763 and deducted Rs.39,800/- on very irrelevant and false grounds. The

details of such calculations were given by complainant as under:-

S.No

Description

Amount

1

Total billed amount against repairs as per Invoice

no.5/BI/20001290 dated 10/03/2021 issued by M/s. Tricity Autos,

Zirakpur

85,763

2

Claim against burst tyre

4,800

3

Claim against deduction in towing charges bill

1000

Total Claim Amount

91,563

4

Amount paid by the Insurance Co to M/s.Tricity Autos, Zirakpur

against above said bill dated 10/03/2021

51,763

Amount illegally deducted by Insurance Co.

39,800

Insurance Company Limited deducted claim amount on the grounds that some alterations i.e.

replacement of normal rims and tyres with alloy wheel and wider tyres; were made in the vehicle

by the complainant and as such these parts are not covered under the present policy. It was also

informed by dealer that due to this, no claim has been considered for damage caused to front left

side suspension also. Accordingly, the tyre was not replaced by dealer and an amount of Rs.34,000/-

and for not paying anything against the damaged tyre costing Rs.4800. They also didn’t pay towing

charges of Rs 1000/-. He requested this forum to direct the Insurance Company to pay Rs.39,800/-

at the earliest in the interest of justice.

b) Insurers’ argument: In the SCN insurance company stated that the Complainant had availed

a Stand Alone OD Policy (Private Vehicle) for his motor vehicle bearing Registration No. PB 65- AU-

1451 bearing policy no. 2367/62239139/SO/0000, having policy validity period from 14/12/2020 to

13/12/2021. It is the case of the complainant that during the insurance period, on 30/01/2021

Insured Vehicle met with an accident and got damaged. Subsequently OD claim was intimated to

respondent company for which claim form was submitted and Claim No. CL20173046 was

generated. After the intimation of claim, as per terms and conditions of the Policy, insurance

company appointed the Surveyor “Shri Jitendra Singh” who conducted Survey and submitted its

report. The complainant had itself admitted in the complaint that an amount of Rs 51,763/- has

been paid against his claim. The said amount has been paid to the Tricity Autos, Maruti Suzuki on

26.03.2021 through NEFT vide UTR No. AXISCN0073923554. It is pertinent to mentioned here that

the loss as assessed by the appointed surveyor was Rs 52,306/-. The claim has been paid as assessed

by the Surveyor. The deductions which has made is because of Oversized Tyres, demanded twice in

the bill, the parts which are not relevant, consumables, and parts found safe in initial survey.

Further insurance company vide letter dated May 3, 2021 had responded to the insured and made

our stand crystal clear “that we have taken up the matter with the surveyor to understand the issue.

However, the surveyor explained that during conversation with you, he discussed about cause of

loss which you had mentioned in the claim form. Accordingly, the surveyor assessed loss which was

relevant to the cause of accident. The surveyor disallowed the damages which were not concurrent

with cause of loss which is mentioned in the claim form and also not forming a single sequence of

event, the same was explained to you.” Based on the facts stated above Insurance Company is

rightly justified to repudiate the claim of Insured on the aforesaid grounds.

19) Reason for Registration of Complaint: - Deduction of claim amount.

20) The following documents were placed for perusal.

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21) Result of Personal hearing with both parties(Observations & Conclusion)

Case called, both parties are present and recall their arguments as noted in Para 18 above.

Complainant stated that his total claim amounted to Rs.91,563/- but the Insurance Company passed

only Rs.51,763 and deducted Rs.39,800/- on very irrelevant and false grounds. Insurance Company

has deducted his claim amount on the ground of that some alterations i.e. replacement of normal

rims and tyres with alloy wheel and wider tyres; were made in the vehicle by the complainant and

as such these parts are not covered under the present policy. He requested for balance payment of

his claim.

During online hearing, the company was advised to explore the possibility of review of the claim so

as to arrive at an agreement. Insurance Company vide their email 29-10-2021 reiterated their stand

of SCN and stated that their deduction made is in order.

They stated that as per Owner’s Manual & Service Booklet of Maruti Suzuki India Limited (herein

after referred to as (“Maruti Suzuki’) it has been explicitly mentioned under (4) Limitation. Even

warranty in this booklet at “(f)” states that “Any vehicle which has been modified or altered,

including without limitation, the installation of performance accessories.” Further as per point “(g)”

this stipulates that, “Any vehicle on which parts or accessories not approved by Maruti Suzuki have

been used.” Insurance company also relied on “The Owner’s Manual & Service Booklet” under the

head of “Warning” clause. These sections have been used by the insurer to support their partial

rejection/ deduction from the claim. They also made a reference to the limitation clause of the

policy for supporting their decision.

On examination of various documents available in file including the copy of complaint, SCN filed by

insurance company, and submissions made by both complainant and insurance company at the

time of online hearing, it is observed that the payment of Rs. 51763/- was made to Tricity Autos,

Maruti Suzuki, empanelled workshop of insurance company on 26.03.2021 through NEFT vide UTR

No. AXISCN0073923554 for complainant’s claim which was assessed by insurance company

appointed independent Surveyor “Shri Jitendra Singh”.

The deduction of claim in the instant case has been done mainly due to the reason that some

alterations i.e. replacement of normal rims and tyres with alloy wheel and wider tyres; were made

in the vehicle by the complainant and as such it is contended by the insurer that these parts are not

covered under the present policy relying on Owner’s Manual & Service Booklet of Maruti Suzuki

India Limited , Motor Vehicle Act, 1988 and limitation as to use but making no reference to the

policy documents which is the basic contracts of insurance and form the basis for indemnification

of insured under the policy.

Examining all the above documents and facts presenting during the course of hearing as well as the

disclosures of the complainant in his complaint the following critical facts has emerged.

• The subject vehicle was insured by the company’s representatives after physical inspection

of the vehicle on 05.12.2020 after fully explaining the coverage under the policy as well add-

ons available.

• The alloy wheels in vehicle and the alleged over size tires were already installed in vehicle

at the time of its inspection of insurance on 05.12.2020 which infact were originally installed

in 2018 as contended by the complainant.

• No reference of this was either made in the proposal or the policy documents issued with

respect to its coverage or exclusion under the policy contracts.

In view of forgoing the deductions made by Mr. Jatinder Singh in house surveyor in his assessment

as regards items SR no. 1-11 on account of oversize tyre is arbitrary and not strictly in line with the

policy contracts. The contention of insurer on service booklets etc may be of concerns and

actionable by the manufacturer to handle warranty claims and cannot be the basis for settlement

for insurance claims. Deductions made by the surveyor at sr. no. 12- 18 appear to be in order and

requires no intervention at our level.

In view of the above facts the insurance company is directed to get the claim reassessed for the

deductions made by Mr. Jatinder Singh in house surveyor in his assessment for items SR no. 1-11

on account of oversize tyre and pay the balance amount to the complainant as per terms and

conditions of policy subject to compliance of claim related formalities within 30 days after the

receipt of award copy.

AWARD

Taking into account the facts & circumstances of the case and the submissions made by

both the parties during the course of video conferencing, insurance company is directed to

pay the admissible claim amount subject to terms and condition of the policy after

completion of claim related formalities.

Hence, the complaint is treated as closed.

(Atul Jerath)

Insurance Ombudsman

November 25, 2021

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 16 of the Insurance Ombudsman Rules, 2017)

Insurance Ombudsman- Shri Atul Jerath

Case of Tarun v/s Go Digit General Insurance Co.

Ltd Co

mplaint Ref. No: CHD-G-059-2122-0009

1.

Name & Address of the Complainant

Shri Tarun

72, Gandhi Dham, Jagdhri-135001

Mobile No.- 8295760500

2.

Policy No:

Type of Policy

Duration of policy/Policy period

D009534049

Digit private car package policy

16-10-2019 to 15-10-2020

3.

Name of the insured

Name of the policyholder

Tarun

Tarun

4.

Name of the insurer

Go Digit General Insurance Co. Ltd.

5.

Date of Repudiation

03-04-2021

6.

Reason for repudiation

Non-fulfillment of requirement

7.

Date of receipt of the Complaint

07-04-2021

8.

Nature of complaint

Non-payment of claim

9.

Amount of Claim

Rs 70,300/-

10.

Date of Partial Settlement

Not Applicable

11.

Amount of relief sought

Rs 70,300/- + interest

12.

Complaint registered under Rule no:

Insurance Ombudsman Rules, 2017

Rule 13 (1)(b) – any partial or total

repudiation of claim by an insurer

13.

Date of hearing/place

27-10-2021, 29-10-2021, 16-11-2021 /

Online hearing

14.

Representation at the hearing

For the Complainant

Shri Tarun, Complainant

For the insurer

Shri Omkar Utture

15

Complaint how disposed

Recommendation under Rule 16

16

Date of Award/Order

16-11-2021

17. Brief Facts of the Case: Shri Tarun (hereinafter, the Complainant) has filed this complaint

against Go Digit General Insurance Co. Ltd (hereinafter, the Insurers), for non –payment of his

Motor accidental claim inspite of compliance of documents.

18. Cause of Complaint:

a) Complainants argument: On 07-04-2021, Shri Tarun filed a complaint to this office that his

vehicle no. HR-02T-4991 (Maruti Swift) met with an accident on 10/03/2020. He has done

compliance of every document but still his claim is not paid. He represented to customer cell but

no reply came to him till date. Complainant further vide his email dated 12-10-2021 pointed

that M/s Gupta Motor workshop has given cashless bill dated 11-07-2020 to insurance

company and later on insurance company in the month of August/ September 2021,

asked for re-inspection and final bill. He produced vehicle for re-inspection but it was

carried out by some other person who was not final surveyor. He attached photographs

of re-inspection which was carried out by person. He gave the bill which was generated

by workshop in his name to insurance company. He now came to know that insurance

company is taking plea that bills are different. He stated that bills were generated by

designated workshop of insurance company and he has no role in it. Nothing has been

muddled by him in the bill. He requested that forum to kindly instruct the insurance

company to pay his claim.

b) Insurers’ argument: Insurance Company stated that the vehicle of the complainant allegedly

met with an accident on 10th March 2020. However, the intimation regarding the same was

given to the Company on 12th March 2020 i.e after a delay of two days. In the meantime,

vehicle was shifted to “Gupta Motors”. As per the narration of loss, “on the way, a left side

passing truck dashed the IV, causing damages”. Accordingly, the surveyor visited the workshop

and physically examined the vehicle. On physical examination of the vehicle, it was observed

by him that, the damages noted do not tally with the cause of loss, he has made various

important observations and submitted his report along with his observations, the copy of

survey report and the color photographs of the accident vehicles were attached. Apart from

the above observations made by the surveyor, the Company also checked the previous claim

history of this vehicle and surprisingly it is revealed from the IIB that, the Complainant has taken

many claims on the vehicle. Based on the observations of surveyor and independent

verification of facts, the company officials suspected that, the alleged loss is not genuinely

described, there is suppression of material fact as to exact cause of loss, place of loss and the

driver who was driving the vehicle. Therefore, gave sufficient opportunity to the Complainant

to explain the correct details and sent clarification letter vide letter dated 27th March 2020.

This letter is also sent on the mail ID. It is submitted that, it is quite surprising that, the

Complainant instead of sending clarifications to our letter, he has approached this Hon’ble

court and failed to give his prompt response to the letter. They submitted that, Company has

given fair opportunity to the complainant, to explain correct cause of loss, place of loss and

driver at the time of loss, but there is willful misrepresentation of facts on the part of

complainant. The relevant facts which need to be taken into consideration in this claim. The

vehicle was removed from the spot and only after the vehicle reached at workshop intimation

was given to the company. The surveyor observed that, damages are not tallying with the cause

of loss. There is no explanation provided to the letter seeking explanation. The complainant has

failed to give the third-party vehicle details which caused this loss. Since, when a vehicle has

brushed the IV from left side, in a normal circumstance, one can note the vehicle number or

even description. No Police Complaint was lodged. The insured never met with the surveyor

nor participated anywhere during claim settlement. Further, insurance company vide email

dated 06-10-2021, stated after re-inspection and invoice that there are two different bills with

same date and invoice number, and they feel that complainant is trying to mislead this forum.

Thus, taking into consideration all these aspects, the Company has righty repudiated the claim.

Insurance Company requested that this complaint is liable to be dismissed since the

Complainant has made a willful breach of the policy terms and conditions and is not entitled

for any relief.

19. Reason for Registration of Complaint: Non-payment of motor claim.

20. The following documents were placed for perusal:

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21. Result of Personal hearing with both parties (Observations & Conclusion):

Case called for hearing. Both parties are present and recall their arguments as noted in Para 18

above.

During the online hearing, it was enquired from the insurance company whether in the view of the

facts emerging they would like to re-look at the claim and arrive at an agreement. The insurer vide

their email dated 15-11-2021 stated that they are ready to pay the claim for Rs 22,500/- (Twenty

Two thousand Five Hundred) without any interest subject to terms and conditions of policy and

completion of claim related formalities. The same was agreed upon by the complainant at online

hearing.

Accordingly, an agreement by way of conciliation was arrived at between the insurer and

complainant, which I consider as fair and reasonable for both the parties.

In the light of the amicable settlement of complaint between the Parties, the complaint is disposed

off with a direction that the company shall comply with the agreement and shall send a compliance

report to this office within 30 days after the receipt of award copy for information and record.

AWARD

The complaint is resolved in terms of agreement of conciliation arrived at between the

complainant and insurers as stated above. Accordingly, both the parties should implement this

agreement within 30 days.

(Atul Jerath)

Insurance Ombudsman

November 16, 2021

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 16 of the Insurance Ombudsman Rules, 2017)

Insurance Ombudsman: Shri Atul Jerath

Case of Rajesh Kumar V/S HDFC ERGO General Insurance Co. Ltd.

Complaint Ref. NO: CHD-G-018-2122-0087

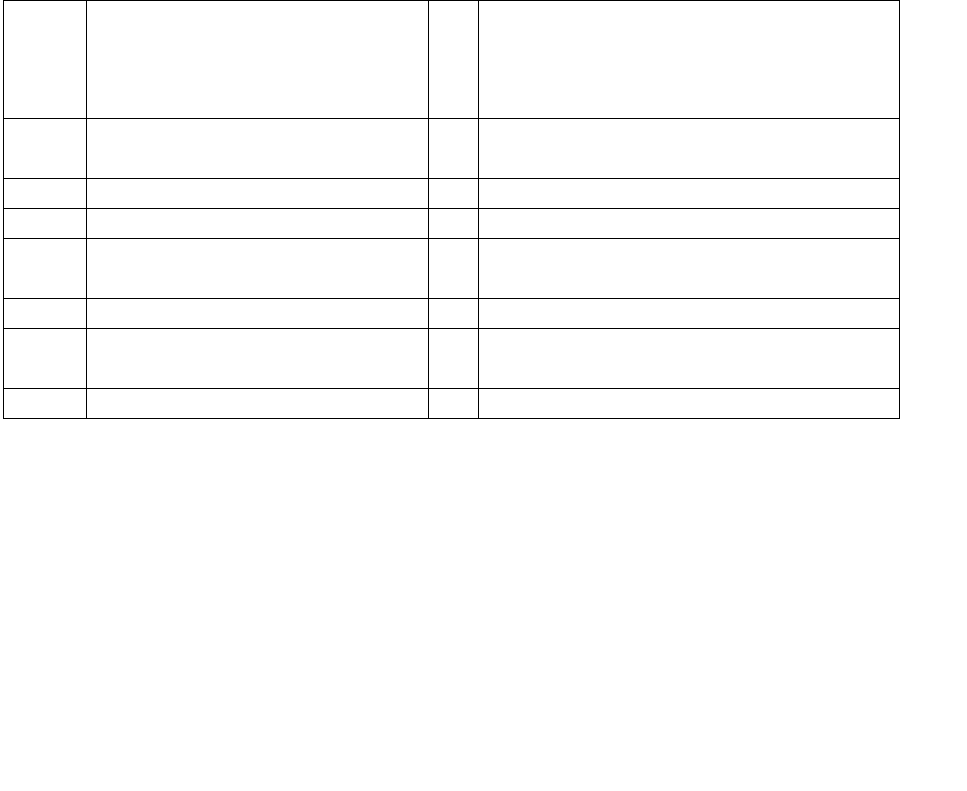

1.

Name & Address of the Complainant

Shri Rajesh Kumar

S/o Sh. Om Parkash, VPO- Mathana, Tehsil-

Thanesar, Distt.- Kurukshetra, Haryana-0

Mobile No.- 8199889003

2.

Policy No:

Type of Policy

Duration of policy/Policy period

2312201574902700000

Motor Policy

01-12-2016 To 30-11-2017

3.

Name of the insured

Name of the policyholder

Rajesh Kumar

Rajesh Kumar

4.

Name of the insurer

HDFC ERGO General Insurance Co. Ltd.

5.

Date of Repudiation

25.02.2019

6.

Reason for repudiation

Non submission of documents

7.

Date of receipt of the Complaint

17-06-2021

8.

Nature of complaint

Non-settlement of theft claim.

9.

Amount of Claim

Rs.30000/-

10.

Date of Partial Settlement

N.A

11.

Amount of relief sought

Rs.30000/-

12.

Complaint registered under

Rule no: Insurance Ombudsman Rules,

2017

Rule 13 (1)(b) – any partial or total

repudiation of claims by an insurer

13.

Date of hearing/place

17.11.2021

14.

Representation at the hearing

For the Complainant

Shri Rajesh Kumar, the complainant

For the insurer

Smt. Shweta Pokhriyal, Manager Legal

15

Complaint how disposed

Recommendations under Rule 16

16

Date of Award/Order

17.11.2021

17. Brief Facts of the Case: Shri Rajesh Kumar (hereinafter, the complainant) has filed this complaint

against HDFC ERGO General Insurance Co. Ltd. (hereinafter, the insurers) alleging non-

settlement of theft claim of motorcycle.

18. Cause of Complaint:

a) Complainant’s argument: His motor cycle was stolen from kurukshetra on 17.11.2017 for

which FIR No 1030 dated 24.11.2017 was registered. All the required documents sought by the

insurer were submitted by him. Police has already submitted the final report (Untraced) under

section 173 Cr.P.C along with in the court vide order dated 11.07.2019. Despite various visits

to office of insurer, claim has not been paid.

b) Insurer’s Argument: That the complaint of the complainant is liable to be dismissed on the

ground of claim being Pre-mature. The claim of the complainant has been closed by the respondent

on the ground of non-submissions of the requisite documents .The complainant even after various

repeated requests and reminders letters failed to submit the requisite documents. In absence of

the requisite documents the respondent was not able to decide the claim on merits and therefore

the same was closed and not repudiated. Therefore it is submitted that the complainant himself is

liable for the non -compliance of the present claim. On 18/11/2017 a claim was lodged by the

complainant alleging that his vehicle has been stolen. Soon after the claim intimation, the

respondent appointed an independent Investigator in order to verify the genuineness of the facts

and circumstances of the claim as reported. Thereafter, the respondent during claim process found

that certain relevant documents which were necessary for the settlement of claim have not been

provided by the applicant. Thus, the respondent issued a letter dated 13.08.2018 requesting the

complainant for the submission of documents like100 No. Call record, RTO forms 26, 28 , 29 & 30

duly signed by Insured, Previous Policy, Bank Account Statement, Un-traced Report U/S 173 CrPC

certified and accepted by Court, Letter of Indemnity cum subrogation duly notarized with copy of

witness ID proof. However, the complainant failed to provide the documents. The complainant even

after repeated requests dated 03.09.2018 and 08.11.2018 failed to submit the documents, and thus

the respondent was constrained to close the claim in want of documents. The respondent closed

the claim vide letter dated 25/02/2019, which was duly served upon the applicant. It is reiterated

that the claim of the applicant has never been rejected but has been closed due to Non-receipt of

documents from the complainant. That applicant has violated the terms and conditions of the

policy, therefore, he is not entitled for any claim as mentioned in the application.

19. Reason for Registration of Complaint: Incorrect denial of claims and cancellation of policy.

20. The following documents were placed for perusal:

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21. Result of Personal hearing with both parties (Observations & Conclusion):

Case called for hearing. Both parties are present and recall their arguments as noted in Para 18

above.

During the hearing, it was enquired from the insurance company whether in the view of the facts

emerging they would like to re-look at the claim and arrive at an agreement. The representative of

the insurer offered to settle the claim as per terms and conditions of the policy after receipt of

pending documents, details of which will be provided to insured through mail. The same was agreed

upon by the complainant during online hearing.

Accordingly, an agreement by way of conciliation was arrived at between the insurer and

complainant, which I consider as fair and reasonable for both the parties.

In the light of the amicable settlement of complaint between the Parties, the complaint is disposed-

off with a direction that the company shall comply with the agreement and shall send a compliance

report to this office within 30 days after the receipt of award copy for information and record.

Award

The complaint is resolved in terms of agreement of conciliation arrived at between the

complainant and insurers as stated above. Accordingly, both the parties should implement

this agreement within 30 days.

(Atul Jerath )

Insurance Ombudsman

17

th

November, 2021

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 17 of the Insurance Ombudsman Rules, 2017)

Insurance Ombudsman: Shri Atul Jerath

Case of Sadhoo Singh V/S Tata AIG General Insurance Co. Ltd.

Complaint Ref. NO: CHD-G-047-2122-0080

1.

Name & Address of the Complainant

Shri Sadhoo Singh

VPO- Bassi Gulam Hussain,

Hoshiarpur, Punjab-0

Mobile No.- 9417546746

2.

Policy No:

Type of Policy

Duration of policy/Policy period

0177771644

Motor Policy

20-02-2020 To 19-02-2021

3.

Name of the insured

Name of the policyholder

Sadhoo Singh

Sadhoo Singh

4.

Name of the insurer

Tata AIG General Insurance Co. Ltd.

5.

Date of Repudiation

N.A

6.

Reason for repudiation

N.A

7.

Date of receipt of the Complaint

17-06-2021

8.

Nature of complaint

Denial of full claim

9.

Amount of Claim

10.

Date of Partial Settlement

N.A

11.

Amount of relief sought

Full claim with cashless facility

12.

Complaint registered under

Rule no: Insurance Ombudsman Rules,

2017

Rule 13 (1)(b) – any partial or total

repudiation of claims by an insurer

13.

Date of hearing/place

17.11.2021/ Online hearing

14.

Representation at the hearing

For the Complainant

Shri Sadhoo Singh, the complainant

For the insurer

Shri Vikas Thakur

15

Complaint how disposed

Award under Rule 17

16

Date of Award/Order

17.11.2021

17. Brief Facts of the Case: Shri Sadhoo Singh (hereinafter, the complainant) has filed this complaint

against Tata AIG General Insurance Co. Ltd. (hereinafter, the insurers) alleging incorrect denial

of claim and termination of policy.

18. Cause of Complaint:

a) Complainant’s argument: His vehicle met with an accident at 10.30 A.M on 18

th

Feb 2021 in

which side mirror of driver side, Front bumper and rear bumper was damaged for which claim

was lodged with the insurers. The surveyor of the company has not approved the back bumper

being old damage. In an earlier accident back window and back bumper were damaged but as

the loss to bumper was minor so it was not claimed. The surveyor at that time advised

complainant to get it repair next time.

b) Insurer’s Argument: Complainant registered claim with the company on 19.02.2021 for loss

dated 19.02.2021. The company appointed an independent surveyor, Mr. Vishal Saini to inspect

the vehicle and assess the loss. The surveyor assessed the loss in respect of damages resulting

from present accident. However, few other damages were disallowed as the same did not

correlate to the cause of loss. A letter dated 05.03.2021 to the effect was sent by surveyor to

insured. After receipt of survey report, it was noted that the insured had taken the vehicle

without getting it repaired. Hence, a letter dated 22.03.2021 was sent to insured. But no

response received from him till date for reasons best known to him. It is specifically submitted

that damages to rear bumper were denied as the same were a result of aggravation of earlier

damages to the rear bumper.

19. Reason for Registration of Complaint: Incorrect denial of claims and cancellation of policy.

20. The following documents were placed for perusal:

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21. Result of Personal hearing with both parties (Observations & Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

The surveyor vide his letter dated 05.03.2021 to complainant explained therein as to why damage

to the rear portion was not approved. Moreover, the Complainant himself admitted in the

complaint that back bumper the car was damaged in an earlier accident and same was not claimed

at that time being minor loss. In these circumstances, the decision of non-consideration of claim for

damage to rear bumper by the insurer is justified and cannot be faulted. Therefore, the complainant

is dismissed being devoid of merits.

Award

Taking into account the facts, circumstances of the case, the submissions made by both

the parties during the course of hearing, the said complaint is rejected being devoid of

merits.

The complaint is rejected.

(Atul Jerath)

Insurance Ombudsman

17

th

November, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 16 of The Insurance Ombudsman Rules, 2017)

Insurance Ombudsman: Shri Atul Jerath

Case of Surinder Kumar V/S ICICI Lombard Gen. Insurance Co. Ltd.

Complaint Ref. No. : CHD-G-020-2122-0076

1.

Name & Address of the

Complainant

Shri Surinder Kumar

S/o Sh.Mohal Lal, # 3622, Shaastri Street

Amrik Singh Road, Bathinda, Punjab - 151001

Mobile No.- 8360107717

2.

Policy No:

Type of Policy

Duration of policy/Policy period

3005/2011895443/00/0000003735

Bundled – Two wheeler policy

05.02.2020 to 04.02.2021 (OD)

3.

Name of the insured

Name of the policyholder

Sh. Pavnish Kumar

Sh. Pavnish Kumar S/o Sh.Surinder Kumar

4.

Name of the insurer

ICICI Lombard Gen. Insurance Co. Ltd

5.

Date of Repudiation

01.02.2021

6.

Reason for repudiation

FIR delayed by 33 days, Intimation after 49 days

7.

Date of receipt of the Complaint

09.06.2021

8.

Nature of complaint

Repudiation of theft claim

9.

Amount of Claim

S.I. – Rs. 53032/-

10.

Date of Partial Settlement

NA

11.

Amount of relief sought

Not mentioned

12.

Complaint registered under Rule

no: Insurance Ombudsman Rules,

2017

Rule 13 (1)(b) – any partial or total repudiation

of claim by an insurer

13.

Date of hearing/place

17.11.2021 / Online hearing

14.

Representation at the hearing

For the Complainant

Sh.Surinder Kumar

For the insurer

Sh.Karan Bagdai

15.

Complaint how disposed

Recommendation under Rule 16

16.

Date of Award/Order

17.11.2021

17) Brief Facts of the Case: Shri Surinder Kumar (hereinafter, the Complainant), has filed this

complaint against the ICICI Lombard Gen. Insurance Co. Ltd (hereinafter, the Insurers) for non

settlement of motor (theft) claim.

18) Cause of Complaint:

a) Complainants argument: Theft claim of veh. no. PB03BD/3364 has been rejected by company,

without any consent. Reason given is delay of intimation but they have pull report of 100 number

police call details.

b) Insurers’ argument: The complainant had taken a Two Wheeler Package Policy under policy

number 3005/193129844/00/000 for the period from February 05, 2020 to February 04, 2021. The

complainant alleged that on September 02, 2020 at around 11:00am, the insured vehicle (IV) was

parked near binani printing press patta market, Bathinda. Thereafter he came back at around

11:15am & noticed that the IV was missing from the parked place. On perusal of the claim

documents and further enquiry of facts, it was established that the complainant had lodged FIR on

October 05, 2020. Hence, there is an unreasonable delay of 33 days for filing an FIR. Company had

asked the complainant to provide the GD entry/100 no. call/ PCR copy if the complainant had

intimated the police about loss of the subject vehicle on the date of theft. However, the

complainant has not submitted any reply about delay in intimation or any confirmation about

intimation of theft to Police on the day of theft. Complainant is trying to mislead/misguide with the

baseless allegations that he had approached the police and had informed the Police Authority about

the theft of IV. Company even filed an RTI with the concerned authority to confirm whether the

complainant’s allegations about the intimation to the police on the very same day has any merits

however unfortunately the Company did not get any revert on the same from the concerned

authority. Though the Company took the reasonable steps to get the facts/information however

the complainant was unable to prove his allegation with any concrete evidence. Further, as per

policy terms and conditions of the policy, a claim should be intimated to the Insurance Company

immediately. Due to delay in intimation of claim to the Company, they unable to verify the actual

cause of loss and were unable to take immediate steps to get the insured vehicle traced. Further,

the IV could have travelled a long distance or may have been dismantled by that time and sold to

scrap dealer. Hence, this did not allow them to carry out proper investigation at the time of theft

and the scope to get the vehicle traced becomes negligible. Complainant had failed to comply as

per policy terms and conditions and as it is seen, there is a violation of policy condition. The

intimation/claim should have been immediately intimated to the Insurance Company and the

intimation should have been given to Police immediately & FIR should have been filed. As the

Company did not receive any justification from the complainant and/or any confirmation about

intimation of theft to Police & to the Company on the day of theft. Hence, the said claim was

rejected and the same was informed to the complainant vide our letter dated February 01, 2021.

Further, in their support, Company also refers a case of Insurance Ombudsman, Ahmedabad centre

in the matter of Mr. Hiten Shah Vs. ICICI Lombard GIC Ltd. vide Award dated October 13, 2021.

19) Reason for Registration of Complaint: - Non settlement of claim.

20) The following documents were placed for perusal.

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21) Result of Personal hearing with both parties (Observations & Conclusion):

Case called for hearing. Both parties are present and recall their arguments as noted in Para 18

above.

At this stage, in view of the facts narrated by the insured during this personal hearing the insurer

representative offer to pay the said claim as per terms and conditions of the policy. The same was

agreed upon by the complainant. Accordingly, an agreement by way of conciliation was arrived at

between the insurer and complainant which I consider as fair and reasonable for both the parties

AWARD

The complaint is resolved in terms of agreement of conciliation arrived at between the

complainant and insurers as stated above. Accordingly, both the parties should implement this

agreement within 30 days of receipt of these orders.

(Atul Jerath)

Insurance Ombudsman

November 17, 2021

PROCEEDINGS BEFORE THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 16/17 of the Insurance Ombudsman Rules, 2017)

Insurance Ombudsman: Shri Atul Jerath

Case of Narender Mann V/S The United India Insurance Co. Ltd.

Complaint Ref. NO: CHD-G-051-2122-0094

1.

Name & Address of the Complainant

Shri Narender Mann

House No.- 405, Sector-8, Part-II, Urban

Estate, Karnal, Haryana- 132001

Mobile No.- 9466341000

2.

Policy No:

Type of Policy

Duration of policy/Policy period

1120003119P102474880

Motor Policy

25-05-2019 To 24-05-2020

3.

Name of the insured

Name of the policyholder

Narender Mann

Narender Mann

4.

Name of the insurer

The United India Insurance Co. Ltd.

5.

Date of Repudiation

N.A

6.

Reason for repudiation

N.A

7.

Date of receipt of the Complaint

25-06-2021

8.

Nature of complaint

Payment of balance claim.

9.

Amount of Claim

Rs.4,05,000/-

10.

Date of Partial Settlement

N.A

11.

Amount of relief sought

Rs. 4,05,000/- plus interest

12.

Complaint registered under

Rule no: Insurance Ombudsman Rules,

2017

Rule 13 (1)(b) – any partial or total

repudiation of claims by an insurer

13.

Date of hearing/place

17.11.2021 and 24.11.2021

14.

Representation at the hearing

For the Complainant

Shri Narender Mann

For the insurer

Shri S.K Bhatia

15

Complaint how disposed

Award under rule 17

16

Date of Award/Order

29.11.2021

17. Brief Facts of the Case: Shri Narender Mann (hereinafter, the complainant) has filed this

complaint against The United India Insurance Co. Ltd. (hereinafter, the insurers) alleging

incorrect denial of claim.

18. Cause of Complaint:

a) Complainant’s argument: His vehicle got damaged on 06.02.2020 and is total loss because

the loss assessed by the surveyor is Rs.28,20,000/-. The IDV of the vehicle is Rs.21,15,000/-

and as per terms and conditions Rs.21,13,500/- should be payable whereas insurance

company paid Rs. 17,08,500/-. The insurance company issued a single policy with IDV of

Rs.21,15,000/- In case of total loss IDV less Policy clause is payable. The insurance company

has not paid the amount of Trailer which is insured for Rs. 4,05,000/- and hence this amount

is payable to him.

b) Insurer’s Argument: As per policy schedule of the insured vehicle, the vehicle was insured

with IDV of vehicle was Rs.17,10,000/- and IDV for the trailer was Rs.4,05,000/- for trailer

separately. As already informed to the insured that the claim has already been settled as per

final surveyor J K Sharma report. The Sum Insured as per policy schedule was Rs.17,10,000/-

+ Rs.4,05,000/-for trailer. As per cause of accident, the vehicle caught fire and it got

completely burnt. The trolley was almost safe and de attachable part of the vehicle, so the

sum insured for the vehicle (Horse) was taken and assessed the loss. Being here was only the

loss of vehicle (horse) which is valued at Rs.17,10,000/- as per insurance policy and trailer for

Rs.4,05,000/-is safe as per survey report. So in order to indemnify the loss item, loss has been

settled accordingly.

19. Reason for Registration of Complaint: Incorrect denial of claims and cancellation of policy.

20. The following documents were placed for perusal:

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21. Result of Personal hearing with both parties (Observations & Conclusion): Case called. Parties

are present and recall their arguments as noted in Para 18 above. The case was scheduled for

hearing on 17.11.2021 but could not be heard due to internet connectivity issue faced by the

complainant. Therefore, the complainant was rescheduled for hearing on 24.11.2021. The

grievance of the insured against the insurer is that they have not settled the total loss claim

of his vehicle as per policy terms and conditions. The complainant stated that Insurers issued

a single policy covering his vehicle with IDV of Rs.21,15,000/-. His vehicle is total loss and in

case of total loss IDV less policy clause is payable. The insurance company has not paid the

amount of trailer insured with Rs. 4,05,000/-. Hence this amount is payable to him. The

representative of insurance company stated that Sum Insured as per policy schedule was

Rs.17,10,000/- + Rs.4,05,000/-for trailer. As per cause of accident, the vehicle caught fire and

it got completely burnt. The trolley was safe and de attachable part of the vehicle, so the sum

insured for the vehicle (Horse) was taken for assessed the loss. The loss has been paid as per

the assessment of the surveyor and policy terms and conditions on net of salvage basis

without R.C for Rs.15,33,500/- considering the wreck value of Rs.1,75,000 with policy excess

clause Rs. 1500/- and released the payment as per satisfaction and discharge voucher duly

signed by the insured on 18.01.2021. The insurance company further released balance

amount of salvage amounting to Rs.25,000/- to complainant as wreck was sold for

Rs.1,50,000/-. As confirmed by the assessing surveyor to insurers, the estimate was issued by

the authorized dealer. No trailer loss was demanded for the trailer and no loss for the trailer

was discussed as the trailer was safe. Due non submission of estimates and demand for the

loss to the trolley, the assessment made by the surveyor cannot be faulted. Therefore,

assessment of loss for the horse is as per policy terms and conditions. The insurance company

paid the loss as per the assessment of IRDA accredited surveyor after proper discharge from

the complainant. The complainant did not raise any issue with the insurers for non -payment

of loss to trolley and gave clean discharge to them. As such, the claim settlement by the

insurers is in order as per policy terms & conditions and does not warrant any interference.

The complaint is rejected being devoid of merits.

Award

The claim settlement by the insurance company is as per policy terms and conditions and

does not warrant any interference. The complaint is rejected being devoid of merits

(Atul Jerath)

Insurance Ombudsman

29

th

November, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 16 of The Insurance Ombudsman Rules, 2017)

Insurance Ombudsman: Shri Atul Jerath

Case of Neelam Rani V/S ICICI Lombard General Insurance Co.

Ltd. CO

MPLAINT REF. NO: CHD-G-020-2122-0046

1.

Name & Address of the Complainant

Smt. Neelam Rani

Village- Chhajpur Khurd, Teh.- Bapoli,

Distt.- Panipat, Haryana- 132104

2.

Policy No:

Type of Policy

Duration of policy/Policy period

3001/180129132/00/B00

Motor Policy

13-09-2019 To 12-09-2020

3.

Name of the insured

Name of the policyholder

Neelam Rani

Neelam Rani

4.

Name of the insurer

ICICI Lombard General Insurance Co. Ltd.

5.

Date of Repudiation

Not provided

6.

Reason for repudiation

Non receipt of documents

7.

Date of receipt of the Complaint

14-05-2021

8.

Nature of complaint

Non settlement of motor OD claim

9.

Amount of Claim

Not provided (IDV is Rs. 1,40,000)

10.

Date of Partial Settlement

NA

11.

Amount of relief sought

Not provided

12.

Complaint registered under Rule no:

Insurance Ombudsman Rules, 2017

Rule 13 (1)(b) – any partial or total

repudiation of claim by an insurer

13.

Date of hearing/place

09.11.2021 / 24.11.2021/Online hearing

14.

Representation at the hearing

For the Complainant

Smt.Neelam Rani/Sh. Raja Ram

For the insurer

Sh.Karan Bagdai

15

Complaint how disposed

Recommendation under rule 16

16

Date of Award/Order

29.11.2021

17) Brief Facts of the Case:

Smt. Neelam Rani (hereinafter, the Complainant), has filed this complaint against the ICICI Lombard

General Insurance Co. Ltd. (hereinafter, the insurers) for non settlement of her motor claim.

18) Cause of Complaint:

a. Complainants argument: Her tata indigo no. HR06T/3859 got accident on 06.02.2020. After

bringing vehicle to Panipat, survey and investigation is done. After 27 e-mails, company vide letter

dt. 25.09.2020 asked for some documents. She arranged all documents but could not contact

surveyor over phone. When company issued letter to surveyor Mr.Suresh Kumar, he resigned from

company. Neither company nor surveyor is listening to her.

b. Insurers’ argument: The complainant had taken a Private Car Package Policy under policy bearing

number 3001/180129132/00/B00 which was valid for the period from September 14, 2019 to

September 12, 2020. The insured (Neelam Rani) had filed an own damage claim with the Company

and as per the claim form, on February 06, 2020 at around 3am the insured vehicle (IV) met with

an accident due to heavy fog, due to fog the driver did not notice a sugarcane trolley & dashed the

front side of IV. The insured had reported the incident at Gagalheri police station and intimated to

the Company. Accordingly the Company duly allotted claim number MOT09724310 to the said claim

and appointed a surveyor to verify/assess the loss. In order to process the claim as per the terms &

conditions of the policy, the Company had asked the insured/complainant to submit the following

requisite documents;

Pan Card Purchase Invoice Indemnity Bond Vehicle Keys Form 28, 29 & 30 NOC /

Form 35 RC Cancellation / Letter to RTO Aadhar Card AML Documents

Despite repeated reminders the complainant did not submit the abovementioned requisite

documents to process the claim further. Therefore, the claim was closed by the Company on the

grounds of non-submission of the mandatory documents.

19) Reason for Registration of Complaint:- Non settlement of claim of travel insurance.

20) The following documents were placed for perusal.

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21) Result of Personal hearing with both parties (Observations & Conclusion):

Initially, case was called for hearing on 09.11.21. Both parties were present and recall their

arguments as noted in para 18 above. Insurance company stated that inspite of repeated requests

complainant has not submitted requisite documents to settle his total loss claim. Complainant

informed that insurance company is not providing duly signed certificate to be submitted in RTO.

In second hearing on 24.11.2021, insurance company informed that they have given relevant letter

for RTO to complainant who had to still comply with RC surrender, cancelled cheque/bank details,

indemnity bond. At this stage, insurance company offer to settle the said claim of complainant as

per terms and conditions of policy, subject to submission of above said documents and usual

formalities of claim. Complainant accepts this offer of insurance company during hearing and

assures to submit the requisite documents at the earliest. Thus an agreement of conciliation could

be arrived at between the Complainant and the Insurers, which I consider as fair and reasonable for

both the parties.

AWARD

The complaint is resolved in terms of the agreement of conciliation arrived at between the

Complainant and the Insurers. Accordingly, as mentioned above, the Complainant shall

submit the required documents to the Insurers at the earliest, and then Insurers will pay the

claim as per terms and conditions of the policy within 30 days of receipt of requisite

documents from insured.

(Atul Jerath)

Insurance Ombudsman

November 29, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, CHANDIGARH

(Under Rule 13 r/w 17 of The Insurance Ombudsman Rules, 2017)

Insurance Ombudsman: Shri Atul Jerath

Case of Suman Rani v/s Iffco-Tokio General Insurance Co.

Ltd. Co

mplaint Ref. No: CHD-G-023-2122-0089

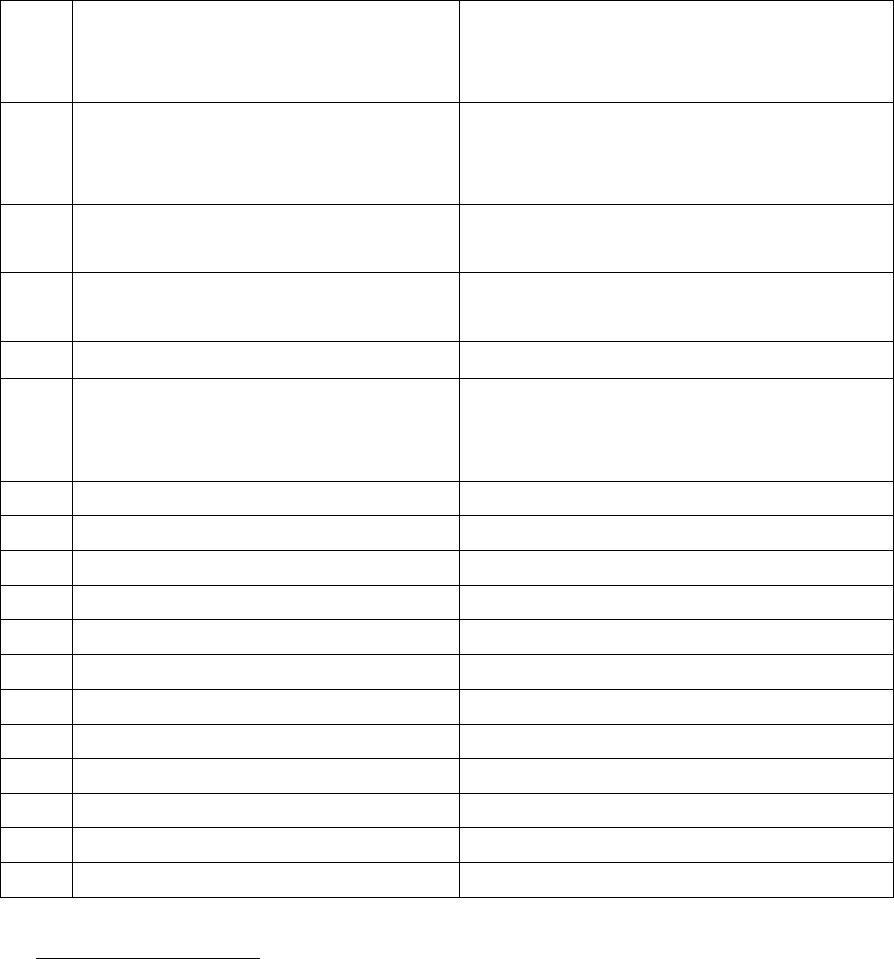

1.

Name & Address of the Complainant

Smt Suman Rani w/o late Shri Rohit Sharma

House No-99, Sector-13-17, Arya Nagar

Panipat- 132103

Mobile No.- 9812594661

2.

Policy No:

Type of Policy

Duration of policy/Policy period

ITG/82741531

Private car Package Policy

21-03-2020 to 20-03-2021

3.

Name of the insured

Name of the policyholder

Rohit Sharma

Rohit Sharma

4.

Name of the insurer

Iffco-Tokio General Insurance Co. Ltd

5.

Date of Repudiation

26-02-2021

6.

Reason for repudiation

Breach of utmost good faith and violation of

policy conditions No- 1 and 8.

7.

Date of receipt of the Complaint

25-06-2021

8.

Nature of complaint

Repudiation of claim

9.

Amount of Claim

Rs 3,03,135/-

10.

Date of Partial Settlement

Not applicable

11.

Amount of relief sought

Rs 3,03,351/- with interest.

12.

Complaint registered under Rule no:

Insurance Ombudsman Rules, 2017

Rule 13 (1)(b) – any partial or total repudiation

of claim by an insurer

13.

Date of hearing/place

24-11-2021/ Online hearing

14.

Representation at the hearing

For the Complainant

Smt Suman Rani, Complainant

For the insurer

Shri Hitender Kumar, Senior Manager

15.

Complaint how disposed

Award under rule 17

16.

Date of Award/Order

30-11-2021

17. Brief Facts of the Case:

Smt Suman Rani (hereinafter, the Complainant), has filed this complaint against Iffco-Tokio General

Insurance Co. Ltd (hereinafter, the Insurers) for undue repudiation of her husband’s vehicle claim.

18. Cause of Complaint:

a) Complainant’s argument:

On 25-06-2021, Smt Suman Rani had filed a complaint that that her car no HR-06W-5654 was

insured with Iffco Tokio general insurance company Ltd. Policy no was ITG/82741531. Car was

registered in the name of her husband Shri Rohit Sharma. Car met with an accident on dated

26-07-2020 and she completed all claim papers but insurance company did not settle the

claim. Her husband expired on dated 26.10.2020. Insurance company rejected the claim vide

letter dated 26.02.2021. She requested this forum to reconsider her claim and instruct

company to pay her claim.

b) Insurers’ argument:

On scrutiny of the submitted claim/medical records it was observed that complainant

intimated a claim on 04/08/2020 regarding accidental damages to the aforesaid vehicle which

reportedly met with an accident on 26/07/2020. On receipt of the intimation of loss, an IRDAI

licensed & independent Surveyor Sh. Sanjeev Chhabra was deputed for survey of the loss and

M/s Expert Investigators for investigation. On perusal of the investigation report and

documents on record, the insurance Company made the following observation:

i) As mentioned in claim form, insured’s friend Mr. Vinod Kumar was driving the said vehicle

and met with an accident on 26/07/2020 near Harsingh Pura village when it collided with rear

of a tractor-trolly which applied sudden brake, as a result vehicle got damaged.

ii) The insured stated that Mr. Vinod Kumar borrowed his vehicle and he was alone in the said

vehicle at the time of accident and there was no third party loss and injury to anyone in the

said accident.

iii) However, during the investigation when the insured and Mr. Vinod Kumar were present with

the investigator at the alleged spot to verify loss particulars, Mr. Vinod Kumar was not able

to identify the spot but also could not corroborate the loss particulars provided by the

insured. This raises serious apprehension about veracity of the loss particulars provided by

the insured and also suggest that Mr. Vinod Kumar was seemingly not driving the vehicle at

the time of accident as submitted by the insured.

iv) The location of accident as identified by insured is not established as the local residents have

denied occurrence of any such accident at that location in the past. This raises further

apprehensions about veracity of loss particulars provided by the insured.

v) Towing / Crane receipt No. 965 dated 27/07/2020 was also provided by insured on record,

but after verification of said towing receipt from crane operator it is confirmed that no such

accident vehicle was towed by them. Thus it is concluded that the insured have

misrepresented the details of towing and produced fake towing receipt in support of his

claim.

vi) From technical examination it is found that seat belt in the damaged vehicle was unlocked

indicating it was not fastened at the time of accident. In such situation the collision would

have resulted in grievous injury to drive which is denied by insured. This further corroborate

that the reported driver was not driving the vehicle at the time of accident particularly in light

of the fact that the insured have not produced any MLC or medical report of driver in support

of driver details provided.

vii) Further, the registration number of the opposite vehicle not provided by the insured which

simply could not have fled away after the accident.

viii) The reported claim was intimated to insurance Company after 8 days from the date of alleged

accident which is violation of policy terms and conditions no.01. The said delay on the part

of insured has seriously prejudiced rights of insurer Company to verify compliance of terms

and conditions of the insurance policy at the time of accident particularly in the light of grave

misrepresentation observed as mentioned in above paras.

The claim reported under the policy is admissible only when the loss particulars provided by the

insured are established beyond reasonable doubts and policy terms and conditions are compiled

by the insured. From the above observations, it is concluded that the insured have not established

the loss particulars beyond doubts rather misrepresented facts in support of his reported claim.

The vehicle is damaged but not as per the loss particulars provided by the insured, the insured not

only misrepresented loss particulars, driver particulars and produced fake towing receipt in breach

of utmost good faith. Further by delayed intimation of claim to insurer, the insured seriously

prejudiced rights of insurer Company to verify compliance of policy terms & condition at the time

of accident. In the light of above observation, the claim lodged by the insured was rejected and

intimation of this effect duly given to the insured vide letter dated 26/02/2021. Thus, the

declaration given in the claim form and condition no.1 & 8 of the insurance policy are violated by

complainant. In the light of above submission, it is clear that there was no deficiency on the part

of insurer, as the claim was repudiated as per terms and condition of the insurance policy and

accordingly the claim is not tenable.

19. Reason for Registration of Complaint: - Repudiation of claim.

20. The following documents were placed for perusal.

a) Complaint to the Company b) Copy of Policy Document

c) Annexure VI-A d) Reply of the Insurance Company

21. Result of Personal hearing with both parties (Observations & Conclusion):

Case called for hearing, both the parties are present and recall their arguments as noted in Para 18

above.

Complainant stated that her vehicle claim is still pending. Inspite of giving all clarification to

insurance company, her claim is not paid till date. He requested for payment of her claim.

During online hearing, the insurance company was advised to explore the possibility of review of

the claim to arrive at an agreement. Insurance company agreed to review the case. Insurance

Company vide their email dated 25-11021 reiterated their stand of SCN and stated that their

repudiation decision is in order.

On perusal of complaint, SCN (self -contained note), submission made by both the parties during

online hearing and review decision of the insurance company email, it is seen that in the instant

case, insurance company as repudiated the claim vide letter dated 26-02-2021 on the condition

No-8 of the policy terms and condition which states that “The due observance and fulfillment of the

terms, conditions and endorsement of this policy in so far as they relate to anything to be done or

complied with by the insured and the truth of the statements and answers in the said proposal shall

be conditions precedent to any liability of the company to make any payment under this policy.” It

is pre-requisite for complainant to do compliance of condition of policy. Complainant plea that

everything was known to her husband and she can’t tell anything about accident can’t absolve her

completely from doing the claim formalities compliance. There are glaring discrepancies in the

statement given to the insurance company and it is pertinent for insurance company to get

clarification in order to decide admissibility of the claim under policy.

Keeping in view the above discussions, the denial of claim of complainant by insurance company is

in order and no relief is granted. Hence, the case is dismissed.

AWARD

Considering the facts & circumstances of the case and the submissions made by both the

parties during online hearing, the case is dismissed.

Hence, the complaint is treated as closed.

(Atul Jerath)

Insurance Ombudsman

November 30, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 17 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Subhash ChanderVersus The Shriram GeneralInsurance Company Ltd.

Complaint Ref. No.: DEL-G-042-2122-0163

17. Brief Facts of the Case: Subhash Chander (hereinafter referred to as the Complainant) has filed

this complaint against the decision of The Shriram General InsuranceCompany Ltd. (hereinafter

referred to as the Insurers) alleging wrongrepudiation of claim.

18. Cause of Complaint:

a) Complainant's Argument: His son Mohit Kharabwas returning to his home bythe Insured

Vehicle (IV) Car DL2CBA1304after attending a relative’s marriage on 15.03.2021night at 1.30

a.m. Near Nazabgarh, a truck hit the car from left side and damaged right side despite his son‘s

effort tosave the accident. The accidental car took round turn on its axis and after taking same

position, it stuck with tree. Mohit could not note truck No. as hebecameunconscious. A

1.

Name & Address of the Complainant

Shri Subhash Chander

Village: Mundhela Khurd, Post Office: Ujwa

New Delhi – 110073

2.

Master Policy No:/Certificate No.

Type of Policy

Duration of policy/Certificate period

102015/31/21/006411

Private Car Policy

26.07.2020 to 25.07.2021

3.

Name of Policy Holder

Name of Insured

Subhash Chander

Subhash Chander

4.

Name of the Insurer

Shriram General Insurance Co. Ltd.

5.

Date of repudiation

30.04.2021

6.

Reason for repudiation

Misrepresentationof facts in the claim

7.

Date of receipt of the complaint

03.09.2021

8.

Nature of complaint

Repudiation of Claim

9.

Amount of Claim

Rs. 491085/-

10.

Date of partial settlement

N.A.

11.

Amount of partial settlement

N.A.

12.

Amount of relief sought

Rs. 491085/--

13.

Complaint registered under Rule No.

of the Insurance Ombudsman Rules,

2017

Rule 13(1)(b) – any partial or total repudiation of

claims by an insurer

14.

Date of hearing/place

02.11.2021, Delhi, Online, Via WebEx

15.

Representation at the hearing

For the Complainant

1. Shri Subhash Chander, the Complainant

2. Kum. Lalita, D/o the Complainant

For the insurer

1. Shri Jayabrata Chakraborty, Regional Manager

((MC)

2. Shri Peeyush Jain, Asst. Manager (Legal)

16.

Date of Award/Order

Award under Rule 17/ 02.11.2021

passerby saw the said car and helped Mohit Kharab and informed Mohit Kharab’s cousin. His

cousin came around 3.00 a.m. and moved the car to nearby Gaushala with the help of his

friend’s tractor. On the same day, accident intimation was given to Insurance Company. As

there was no injury, complainant did not inform police. On 17.03.2021 surveyor Mr. Pradeep

Kumar came to the spot of accident and tookphotos and visited Gaushala to check and took

photos of accidental car and advised Mohit Kharab to take the car to workshop for repair. The

damaged car was taken at A & A Enterprises at Gurgaon and intimated the estimate of

damages to surveyor.On 19.04.2021, Investigator

Case of Subhash Chander Versus The Shriram General Insurance Company Ltd.

Complaint Ref. No.: DEL-G-042-2122-0163

Lakshay Kumar visited complainant’s house and asked about accident and took statement of

Mohit Kharab and went to the spot of accident where he took some photographs. All

necessary information and documents were given to surveyor and investigator. But the

Insurers denied his claim stating that the damages of car did not match with the cause of

accident. Complainant wrote to GRO also but claim was denied for the same reason. Therefore

he has approached this forum for relief.

b) Insurer's Argument: The Insurers in their SCN dated nil have stated that they had issued a

policy no. 102015/31/21/006411 for the period 26.07.2020 to 25.07.2021 against vehicle no.

DL2CBA1304. After receiving the intimation of accident on 15.03.2021, Insurers deputed

Surveyor Mr. Sanjay Verma to survey and assess the loss and Mr. Lakshya Kumar to investigate

the matter.Surveyor submitted preliminary survey report of Rs. 284396/- in accordance with

policy terms, conditions and IMTs. Finally overall observation of investigation report and

documents submitted by the insured, Insurers found that cause of loss was not justified and

there was misrepresentation of the facts,for which complainant was intimated via letter dated

30.04.2021. The damages of the vehicle did not match with the cause of accident stated by

Mohit Kharab. Investigator visited the spot of accident where he did not find the sign of broken

tree and accident impact on the wall. The vehicle was so badly damagedin the accident, that

it could not be towed with tractor, therefore investigator also visited Mitro Gaushala for

confirmation but no one confirmed about it. Investigator asked about the contact no. of

passerby Mr. Jassu and details of tractor driver but Mohit Kharab stated that he did not have

their phone nos. In view of all, complainant tried to manipulate and hide the actual facts and

the narration of accident did not match with the spot and damages. Hence Insurers have

rightly repudiated the claim.

19. Reason for registration of Complaint:Repudiation of claim.

20. The following documents were placed for perusal:

a) Assessment Report& Investigation Report

b) Repudiation Letter

c) GRO

21. Result of hearing of the parties (Observations and Conclusion):

Case called. Parties are present and recall their arguments as noted in Para 18 above.

The Insurers had got an investigation conducted into the accident. After examining the

evidence and making inquiries, the Investigator reported that the location of the accident did

not match with the statement of the Complainant, no police report was made available, no

medical report was filed even though the driver had fainted, local people did not corroborate

the accident, and no evidence of accident could be identified at theplace of the accident

reported by the Complainant. In these circumstances, the Insurers were justified in

repudiating the claim on the grounds of misrepresentation of facts by the Complainant.

Pursuantly, the complaint shall deserve to be rejected.

Award

The complaint is rejected.

(Sudhir Krishna)

Insurance Ombudsman

November 02, 2021

PROCEEDINGS OF THE INSURANCE OMBUDSMAN, DELHI

(Under Rule 13 r/w 17 of the Insurance Ombudsman Rules, 2017)

Ombudsman: Shri Sudhir Krishna

Case of Anil Kumar Rathi versus ICICI Lombard General InsuranceCo.Ltd.

Complaint Ref. No.: DEL-G-020-2122-0184

1.

Name & Address of the Complainant

Shri Anil Kumar Rathi

Plot No.330, IInd Floor, D-Block,Sec-15,Omaxe

City, Bahadurgarh – 124507 (Distt. Jhajjhar)

2.

Policy No.

Type of Policy

Policy term/policy period

3001/216243704/00/000

Private Car Package Policy

23.02.2021 to 22.02.2022

3.

Name of the insured

Name of the policy holder

Anil Kumar Rathi

Anil Kumar Rathi

4.

Name of insurer

ICICI Lombard General Insurance Co.Ltd.

5.

Date of repudiation

18.09.2021

6.

Reason for grievance

Rejection of Motor Claim

7.

Date of receipt of the complaint

28.09.2021

8.

Nature of complaint

Rejection of Motor Claim

9.

Amount of claim

Rs.8,00,000/- on Return to Invoice Basis

10.

Date of partial settlement

N.A.

11.

Amount of partial settlement

N.A.

12.

Amount of relief sought

Rs.15,19,174/- and Comprehensive Insurance

Cost

13.

Complaint registered under Rule

No.of the Insurance Ombudsman

Rules 2017

Rule 13(1)(b)- Partial or Total Repudiation of

Claims by the Insurer

14.

Date of hearing

17.11.2021

Place of hearing

Delhi, Online Video Conferencing via Cisco WebEx

15.

Representation at the hearing

For the Complainant

Shri Anil Kumar Rathi, the Complainant

For the Insurer

Shri Karan Bagdai, Legal Manager

16.

Date of Award/Order

Award under Rule 17/ 17.11.2021

17. Brief Facts of the Case: ShriAnil Kumar Rathi(hereinafter referred to as the complainant) has

filed this complaint against the decision of ICICI Lombard General Insurance Co.

Ltd.(hereinafter referred to as the Insurers) allegingwrong rejection of Motor Claim.

18. Cause of Complaint:

a) Complainant's Argument:He had taken the Comprehensive policy with Return to Invoice

and Zero Dep.Add On Cover from ICICI Lombard GIC for the period 23.02.2021 to 22.02.2022

for his Creta car Regn.No.DL-7CM-8145 It was driven by his friend alone, met with an accident