1

Theatrical Movies As Capital Assets

By Rachel Soloveichik

Abstract

In 2007, I estimate that studios spent $20.0 billion producing original theatrical movies.

These movies were shown in theaters in 2008 and will be sold on DVD and broadcast on

television for decades to come. Because of their long working life, the international guidelines

for national accounts recommends that countries classify production of movies and other

entertainment, literary and artistic originals as an investment activity and then depreciate those

movies over time. However, BEA did not capitalize this category of intangible assets until the

July 2013 benchmark revision. In order to change the national accounts, I collected data on

movie production from 1915 to 2010. I then calculated how GDP statistics change when

theatrical movies are classified as capital assets.

To preview, my empirical results are: 1) Theatrical movies have a useful lifespan of at

least 80 years; 2) Over the past decade, nominal movie production has grown slower than the

overall economy. As a result, nominal GDP growth falls slightly when theatrical movie

production is classified as a capital investment; 3) Thanks to improvements in computer

technology; prices for shooting new movies have been constant over the past decade.

The views expressed here are those of the author and do not represent the Bureau of Economic

Analysis or Department of Commerce. Email: Rachel.Solov[email protected]

2

Introduction

The motion picture industry started in the late 1800s when Thomas Edison introduced the

Kinetescope. Over the next decades, movies improved in quality and became a very popular

source of entertainment. By 1929, Americans were spending $720 million per year on movie

tickets (Vogel 2004), 0.7% of nominal GDP. The GDP share of movies diminished in the 1950s

and 1960s when television became widespread. After 1980, the movie industry made a

comeback with the introduction of video cassettes and DVDs. In 2007, studios earned $39

billion from theatrical movies, 0.27% of nominal GDP.

In 2007, I estimate that studios spent $20.0 billion producing original theatrical movies.

This value includes box office licensing revenue, television licensing revenue, DVD sales,

merchandise licensing and any other revenue sources. Because of their long working life, the

international guidelines for national accounts recommends that countries classify movie

production as an investment activity and movie originals as capital assets. This recommendation

was first introduced by the 1993 System of National Accounts (SNA 1993 10.94) and was

reiterated in the 2008 System of National Accounts (SNA 2008 10.115).

In the national income and product accounts (NIPAs), this $20.0 billion of movie

production could either be treated as a current expense or it could be treated as an investment. If

theatrical movies have a useful life of less than one year, then the production costs for movies

should be treated as a current expense. In that case, the final revenue from the sale of movies is

all that matters for gross domestic product (GDP), and production costs for movies are an

expense in the same way that DVD stamping and movie advertising is an expense. Before the

July 2013 benchmark revision, BEA used this method to account for movie production.

In contrast, items with a useful lifespan of more than one year are generally classified as

capital assets. If theatrical movies have a long useful life, then the production costs for movies

should be treated as a capital investment. In that case, the capital investment in theatrical movies

is added to GDP as part of private investment and added to the pre-existing capital stock of

movies to get the total capital stock of movies. This capital stock of original movies then returns

a flow of value to its owner, and that flow is counted in GDP as part of capital services. GDP

counts both the flow of value and the initial investment. As a result, GDP is always higher when

a good is changed method 1) to method 2). Finally, the total capital stock of original movies is

3

depreciated, which is known as consumption of fixed capital. In addition to the well-known

GDP, BEA also estimates net domestic production. Net domestic production equals GDP minus

consumption of fixed capital. Because net domestic production does not include the cost of

maintaining the capital stock, it is generally viewed as a better long-term measure of the total

sustainable output of an economy.

In order to calculate the NIPAs with theatrical movies as a capital asset, I estimate real

production, prices and capital stock for theatrical movies back to 1929. The most important

results are given below.

1) Theatrical movies have a projected lifespan of at least 80 years. Furthermore, the

average depreciation rate is only 9.3% per year. The total capital stock of all theatrical

movies was worth more than $150 billion in 2007.

2) Over the past decade, nominal movie production has shrunk from 0.16% of GDP to

0.13% of GDP. This shrinkage occurred during a period that movie production prices

rose much slower than overall inflation. Over the same time period, real movie

investment grew at 5% per year.

3) The movie industry grew rapidly during the Great Depression. In 1929, theatrical

movie investment was $162 million, 0.15% of GDP. By 1934, movie investment was

$301 million, 0.46% of GDP. Accordingly, the Great Depression looks a little less grim

when movies production is counted as an investment activity. After World War 2, movie

investment hovered between 0.10% and 0.16% of the overall economy. Accordingly,

GDP growth from 1945 to 2010 does not change much when movie production is

counted as an investment activity.

My research on capitalizing theatrical movie production is part of a broader initiative by

the BEA to improve the treatment of intangible assets in the national income and product

accounts. In addition to the movie research, I have papers measuring investment in long-lived

television, original music, books and miscellaneous entertainment (Soloveichik 2013a, b, c and

d). Other researchers at the BEA have developed a satellite account measuring the annual

investment and capital value of R & D (Robbins and Moylan 2007), educational investments

(Fraumeni, Reinsdorf, Robinson and Williams 2008) and the role of intangible assets in foreign

direct investment (Bridgman 2008).

4

This paper consists of three sections. In section 1, I describe my data on nominal

production costs for theatrical movies and calculate the nominal value of movie production back

to 1929. In section 2, I describe my price index and calculate the real value of movies

production back to 1929. In section 3, I estimate the depreciation schedule for theatrical movies

and then use that depreciation schedule to calculate capital stocks of theatrical movies from 1929

to 2010.

1. Nominal Production

What Products are Included?

In this paper, I study the production of theatrical movies. The category “theatrical

movies” include any movie shown in theaters, even if it earns the majority of its revenue from

DVD sales or television licensing. However, this category does not include television movies or

direct-to-DVD movies.

1

Those movies are measured in a separate paper “Long-Lived Television

Programs as Capital Assets” (Soloveichik 2013a). I also exclude movies distributed on YouTube

or other internet broadcasters because those films are very different from theatrical movies. I

hope to study long-lived entertainment produced by internet broadcasters in a future paper.

Because this project is focused on the United States national accounts, I restrict my

sample to movies produced by US studios. Even if a movie is filmed abroad, it is still included

in my analysis if a US corporation or resident originally owned the movie. Some movies are

jointly produced by US and non-US studios.

2

In the absence of any data on the ownership

shares, I split those movies proportionally. For example, suppose that a $100 million movie is

jointly produced by a US studio, a French studio and a British studio. I assume that the US

studio spent $33 million producing its share of the movie.

My paper does not calculate imports or exports of movie licensing. In the trade data,

BEA treats revenue from US movies shown abroad as an export of services and overseas

production of US movies as an import of services. Previous researchers have found that studios

1

The treatment of direct-to-DVD movies is potentially controversial. They are too small to be in their own

category, but they could be placed in either television or theatrical movies. Based on viewership data from Nielsen

Media and advertising data from Kantar media, I believe that direct-to-DVD movies are more similar to television

programs than they are to theatrical movies. Accordingly, I placed them with long-lived television programs.

2

In a few cases, IMDB does not provide production studios. In those cases, I use listed country of production. I

drop movies with no information at all.

5

often misreport the revenue from US movies shown abroad (Hanson and Xiang 2006). It is also

possible that studios misreport the value of overseas production of US movies. However, these

potential problems have no impact on the estimates in my paper. My paper calculates the

change to GDP from capitalizing theatrical movies. If imports and exports are misreported, then

BEA’s estimates of GDP may be incorrect. However, the size of the error remains exactly the

same when movies are re-classified as capital goods. Therefore, my estimates are not sensitive

to any problems measuring international transactions properly.

Movie Investment in 2007

The primary dataset for this project is the 2007 Economic Census. According to the

Economic Census, theatrical movies earned $22 billion from domestic licensing, $6.5 billion

from foreign licensing, $7.1 billion from DVD sales and $3.0 billion from merchandise

licensing.

3

Of course, movie studio revenue is not equal to returns on theatrical movie originals.

Studios must pay physical sales costs like DVD stamping and marketing costs before they can

earn any money from their intangible asset. Based on “The Big Picture” (Epstein 2005a), I

estimate that physical sales account for 5% of licensing revenue and 15% of DVD revenue.

Based on data from Kantar Media, I estimate that marketing accounts approximately 30% of

total revenue. This marketing includes direct advertising costs like airtime and also indirect

costs like studio overhead devoted to marketing. After subtracting sales costs, studios earned

$24.5 billion in returns from their theatrical movie assets.

Because my paper is focused on the production of new movies, I would like to measure

revenue by the year of release rather than year of sales. In other words, a 2010 re-run of

“Cinderella” is attributed to 1950 – not 2010. Of course, I don’t know how much movies

released in 2007 will actually earn in 2017. Instead, I use data on current market shares for older

movies to predict future earnings. This data is described further in section 3. Given my

predicted earnings, I calculate the net present value (NPV) of revenues for newly release movies:

Investment = (Sales of New Movies)*[(NPV of all Sales)/(Sales in First Year)]

3

The Economic Census does not split DVDs and merchandise licensing between television and movies. I use sales

data from The-numbers.com to split DVDs. I split merchandise licensing proportionally to other licensing.

6

In section 3, I calculate that new movies account for 33% of total industry revenue. I also

calculate that NPV of future sales is 2.48 times sales in the first year.

4

Therefore, I calculate that

new movie investment is:

Investment = (Revenue after sales costs)*.33*2.48 = 82%*$24.5 billion = $20.0 billion

Movie Investment 1929-2010

I use the Service Annual Survey (SAS) to measure movie investment from 2005 to 2010.

I first benchmarked each revenue type reported in the SAS to the 2007 Economic Census. I then

applied the adjustments for sales costs, market share for new movies and NPV factor described

earlier. Going forward, BEA plans to use revenue data from the SAS to measure movie

investment in the national income and product accounts (NIPAs).

5

Before 2005, I use data on real movie inputs from the website IMDB.com, which is a

massive database containing theatrical movies, television programs and videos. Based on my

own research, I believe that IMDB contains every major theatrical movie and most minor

theatrical movies produced in the US.

6

For each item in their database, IMDB collects a list of

actors and production crew, technical information like run-time and business information like

production budgets, etc.

IMDB allows researchers to download the complete raw data files for all movies,

television programs, videos and video-games in their database. All of my estimates reported in

this paper are based on the complete raw data files. Accordingly, the standard errors for my

estimates of real production are relatively small.

7

I supplement the IMDB data with industry

literature giving background on the process of movie production and the non-production costs.

Table 1 contains a description of the data used in my analysis and the figures they are used in.

4

This calculation depends critically on the discount rate. In earlier versions of this research, I used discount rates

ranging from 7% real to 10% real. The current numbers in this paper support a discount rate of 8.2% real.

The 8.2% discount rate deflates future sales by the PCE deflator, not the movie price index. Over the past 20 years,

movie prices have grown slower than overall PCE prices. However, I believe investors holding movie originals are

concerned with revenues relative to GDP, not revenues relative to the movie industry.

5

This approach produces relatively smooth estimates of annual investment. Actual movie filming can be volatile,

especially on a quarterly basis. For example, a threatened strike increased filming the first half of 2001. Even

though the strike did not materialize, filming still dropped in the second half because studios had already planned

their filming to avoid it.

6

Alexander and Associates surveys people about home video purchases and rentals. I was able to match most

movies mentioned by survey respondents to the IMDB data. Adult movies, exercise movies and music videos were

often unmatched.

7

However, my estimates are very sensitive to the techniques for imputing budgets to movies with missing data.

7

I use four separate variables from IMDB to estimate real production budgets: a) the

number of actors; b) the number of non-actors (e.g. writers, camera people, make-up artists, etc.);

c) the number of locations listed and d) the number of special effects companies. To start out, I

restrict the sample to major movies released 2000 to 2009.

8

In section 2, I will show that

inflation was very low over that time period. Therefore, I do not need controls release year.

Live action and animated movies are produced very differently, so I estimate two separate

production budget equations. The following equations are the precise regression used in Stata.

9

Nominal budget for live action films = α

LA

*(number of actors) + β

LA

*(number of non-actors) +

γ

LA

*(number of locations) + δ

LA

*(number of special effects companies) +ε

LA

Nominal budget for animated films = α

AN

*(number of actors) + β

AN

*(number of non-actors)

+ε

AN

For live action films, the coefficients imply that one extra actor costs $46,000; one extra

non-actor costs $172,000; one extra location costs $1,118,000 and one extra special effects

company costs $4,488,000. For animated movies, the coefficients imply that one extra actor

costs $485,000 and one extra non-actor costs $502,000. The higher labor costs for animated

movies is consistent with the industry literature. Animated movies are generally produced over

several years, and so each computer programmer or animator puts in more time on the movie

than a set designer does on a live action movie.

10

In the analysis given earlier, I focus on ‘major’ movies, which I define as the top 100

movies each year. All other movies are considered minor movies, and treated separately. Many

of these minor movies have no production budgets listed. If I impute production budgets for

minor movies based on the cost of major movies, then minor movies account for approximately

8

In order to define major movies, I first ranked all US movies by the number of non-actors (which are the biggest

cost factor). I then focus on the top 100 US movies each year. If a film is produced jointly by a US and non-US

studio, I count it as half a movie. Results are similar if I use another cut-off.

9

I use the no option to suppress the constant term. If the constant term is not suppressed, it is positive and

significant for every regression. My time series would be very different if I allowed a constant term. However, I

believe that the constant is caused by measurement error and is misleading. The R

2

is 0.80 for both regressions

10

Star actors are generally paid much less for animated movies, where they only provide voices. However, there are

many fewer extras on animated movies. Furthermore, programmers need to do a lot of support work for each

character in animated movie. The net effect may be higher costs per actor in animated movies.

8

84% of total production in 2007. However, minor movies earn only about 25% of the US box

office, 25% of the US video revenue and 35% of US television revenue in my sample.

11

Furthermore, relatively few IMDB users rate minor movies. Based on all of these factors, I

believe that minor movies have significantly lower budgets than their reported inputs would

suggest. I impute real production budgets for minor movies according to the following formula:

Real budget = (Supposed budget from listed inputs)*.99

min(max(rank-100,0),400)

In other words, I assume that minor movies have smaller budgets than their inputs would

suggest, and the difference grows as you move further down the list. My equation was calibrated

to a graph of (number of IMDB votes)/ (Supposed budget). The same general equation works

reasonably well for all decades studied, from the 1930’s to the 2000’s.

12

Therefore, it seems to

be a general fact of the movie industry that A-list movies use higher cost inputs than B-list

movies. However, I don’t have enough data to test whether the true budget for minor movies

matches this particular equation.

13

I also reduced budgets by 50% for short movies and 50% for

silent movies (75% for silent shorts). This adjustment has a big impact on production and prices

before 1929.

Finally, I calculate nominal production for each year. First, I aggregate the real budget

for each movie to get real investment by the entire motion picture industry. Next, I multiply real

investment by the price index described in section 2. This approach is a little different than the

measurement techniques used for long-lived television, books, music and miscellaneous artwork

(Soloveichik 2013a, b, c and d). For all of those entertainment categories, I measured nominal

investment first and then use my price index to estimate real investment. These two approaches

will both produce similar results if the prices are measured correctly. As a robustness check, I

also estimate nominal movie revenue from 1929 to 2010 and calculate investment from that.

11

My samples cover 2000-2009 for box office, 1988-2002 for video and 2003-2008 for television. All of the

numbers are approximate. The exact percentages might be different if I only look at 2007.

12

The equation is also roughly consistent with data on box office, home video and television advertising revenue.

However, I do not have enough data to be certain of the precise form.

13

Movies that report budgets generally have higher (IMDB votes)/(Supposed budget from listed inputs). This

suggests movies with budgets might be higher quality. The bias is biggest for minor movies, which rarely report

budgets.

Because of the reporting bias, I ignore reported budget for minor movies. Instead, I only use imputed budget.

9

Figure 1 compares both estimates of nominal movie production from 1929 to 2010. The

most important result is that the estimate based on IMDB data tracks the estimate based on

revenue reasonably well over time. I believe that the IMDB data is higher quality than the

revenue data. For example, I do have any data on foreign box office revenue before 1965.

Before then, I assume that foreign box office revenue is a fixed percentage of US box office

revenue. This fixed percentage might not hold in unusual times like World War 2. Also, the

ratio of new investment to revenue may have changed over time. In the rest of the paper, I will

use the IMDB data to measure investment, prices and capital stock.

Calculating Quarterly Production

This paper counts movie investment when the movie is first released, not when the movie

is filmed. I make this choice for two related reasons: 1) It is extremely difficult to measure

quarterly filming costs in real times. Accordingly, my quarterly numbers would be too

speculative to include in the NIPAs; 2) Conceptually, unreleased movies could be counted in

inventories as “work in progress,” similar to the treatment of uncompleted manufactured goods.

This paper does not count unreleased movies in inventory. Instead, this paper is focused on how

GDP changes when entertainment originals are reclassified as capital assets.

For interested readers, Figure 2 shows estimates of the value of unreleased inventory

from 1990 to 2009. There is a clear seasonal pattern to movie inventory. Studios generally film

all around the year but release their best films during the summer and right before Christmas.

Most data users focus on seasonally adjusted numbers, so the consistent pattern is adjusted out.

However, there is also some non-seasonal variation in inventory. Some of this variation can be

explained by labor relations. For example, actors threated a strike that would have started in

May of 2001. Studios responded to the threatened strike by increasing production before the

strike and stockpiling enough films to last until the spring of 2002. In the end, no strike

occurred, but studios still cut back on production in the second half of 2001 so that they could

use up their huge stockpile (Graham 2001). Other inventory variation might be related to the

financial crisis or just a measurement error.

10

2. Price Indexes and Real Production

It is difficult to develop a price index for movie originals. Each movie is a unique artistic

creation, so I can never compare the cost of producing two identical movies at different times. In

this paper, I use labor and non-labor inputs to calculate the real budget for each film in the IMDB

dataset. I assume that each actor, each non-actor, each filming location and each special effects

company produces the same amount of entertainment capital over time. I then calculate my price

index as the ratio of nominal production budgets to real budgets. Therefore, my price index will

double if the nominal production budget doubles while inputs are held fixed. This price index

assumes zero multifactor productivity growth since 1915

14

and omitted inputs grow at the same

rate as inputs tracked. I believe that the technologies like DVD players should be considered

improvements in viewing technology – not movie technology. After all, studios often re-release

classic movies on DVD.

Price Indexes from IMDB Data

I used the same IMDB data described in section 1. First, I used the regression

coefficients described earlier to estimate what the nominal production budget for each movie

would be if it was filmed between 2000 and 2009. As a robustness check, I also calculated real

budgets using major movies filmed 1980-1989, 1960-1969 and 1940-1949. I then dropped the

movies which did not report production budgets and calculated a price index for each year:

Price in Year X = (Nominal Budget

Movie 1

+ … + Nominal Budget

Movie N

) /

(Real Budget

Movie 1

+ …. + Real Budget

Movie N

)

Figure 3 gives the price index from 1929 to 2009. The most important result is movie

prices have been almost flat from 2000 to 2009. At the same time, the general service sector

price rose 32%. I believe that the slow inflation for movies is caused by improvements in

computer technology. Digital video-cameras are cheaper and easier to use than film-based

14

Multi-factor productivity could rise if directors learned better production techniques over time. Alternatively, it

could fall if early movies used up all the good storylines. For simplicity, I assume that productivity has not changed

at all over time. This might overestimate productivity before 1935, when the movie industry was very new.

11

video-cameras. Once the movie is shot, studios use computers to edit the film, create special

effects, etc. The other noteworthy result from Figure 3 is that price trends are similar regardless

of which base period I use. For the rest of the paper, I will use movies filmed 2000 to 2009 to

calculate price indexes.

Potential Sample Selection Problems

Sample selection may potentially bias the price indexes shown in Figure 3. IMDB does

not report production budgets for all movies in the sample. Movies with missing data generally

have fewer actors, non-actors, special effects companies and filming locations. Even controlling

for the inputs listed, movies with missing data do worse. For every dollar of imputed production

spending, movies with missing budget data earn 73% lower box office revenues,

15

42% less from

home video

16

and 13% less from television licensing.

17

There are two ways to interpret this

correlation: a) movies with missing data are expensive flops; b) movies with missing data are

cheap successes. If a) is true, then my price imputations are correct and the missing data does

not bias my results. If b) is true, then my price imputations are flawed and the missing data

created biased estimates.

It is possible that missing data creates serious problems with my time series. For

example, suppose that movies with missing budgets cost 50% less than otherwise similar movies

which did report budgets. Between 1929 and 1989, only 22% of major movies report a budget.

Between 1990 and 1999, 54% of major movies report a budget. Between 2000 and 2008, 81% of

major movies report a budget. In that case, prices for major movies 1929-1989 are overstated by

(1-22%)*.5 = 39% before 1990, (1-53%)*.5 = 23.5% between 1990 and 1999 and (1-81%)*.5 =

10% between 2000 and 2009. In other words, I overestimate historical prices badly and

therefore underestimate inflation over time.

I can’t fix the sample selection problems. However, the results in Figure 1 suggest that it

is not too severe. In Figure 1, I used a price index based on Figure 3 to calculate nominal

investment for every year from 1929 to 2010. As a robustness check, I also used nominal

15

Based on US box office revenue reported by IMDB. Sample restricted to major movies released 2000 to 2009.

16

Based on survey data for 1987-2002. Sample restricted to major movies released 1990-1999.

17

Based on airing time (premium & regular cable counted equally) 2003-2008. Sample restricted to major movies

released 1990-1999.

12

revenue data to measure nominal investment. The two techniques give similar results,

suggesting that IMDB-based price index is reasonably accurate.

Input Prices for the National Accounts

The price index presented in Figure 3 is conceptually interesting, but it is too volatile to

use in the National Accounts. From one year to the next, prices may drop 25% and then go right

back. In addition, the IMDB price index requires days of data analysis to calculate. That work-

load is not feasible for BEA analysts to do each quarter.

In this section, I calibrate an input-based price index to match the IMDB price index

shown earlier. This input-based index is a weighted average of a BEA price index, and two BLS

price indexes. Because the data is already available, it can be calculated in a few minutes.

a) The main input for movies is live performances to film. These live performances

require inputs like scripts, scenery, costumes, actors, etc. Animated movies have different

inputs, but they still need writers to create a script, graphic designers to create characters and

actors for the voice-overs. For both types of movies, labor costs account for the majority of

input costs, but there are also non-labor costs like offices to plan the movie, materials for the

scenery and costumes, etc. I have not been able to locate a pre-existing price index that tracks

live performance costs in the movie industry. However, BEA does track consumer prices for

live entertainment such as theatrical plays, dance performances and music concerts. I assume

that performances in the live entertainment industry use similar inputs to live performances in the

movie industry – so the prices should move similarly.

18

BEA’s live entertainment price index is

published in NIPA Table 2.4.4U, line 211. Before 1959, I use the overall PCE deflator as a

proxy for live entertainment costs. That price index is published in Table 2.4.4, line 1.

b) The second input for movies is video cameras to record and process the live

performances. BLS has produced a producer price index (PPI) for photographic and

photocopying equipment. The series ID for that PPI is PCU333316333316.

19

Going forward, I

recommend that analysts use that PPI. For historical prices, I use a variety of price indexes.

18

Ticket prices for popular music concerts have risen much faster than other components of the live entertainment

sector. This increase appears to be a response to music piracy (Krueger 2005) and is not caused by an increase in

input costs. However, popular music concerts are a relatively small share of the overall live entertainment industry.

Therefore, the price index does not change much when I adjust for music concert prices.

19

BLS briefly produced a specific PPI for video cameras used in the movie industry (PCU33315333157), but that

PPI only started in 2007 and was discontinued shortly afterwards.

13

From 1977 to 2006, I use the BEA deflator for ‘other video equipment’. That price index is

given in Table 2.4.4U, line 40. From 1947 to 1976, I use the BLS PPI for ‘audio and video

equipment manufacturing’. The series ID for that PPI is PCU334310334310. For 1929 to 1946,

I use the BEA deflator for ‘audio, video & information processing equipment and media”. That

price index is given in Table 2.4.4, line 14. I then splice all of those time series together to get a

price index for movie cameras from 1929 to 2010.

c) The last input for movies is computers to edit the raw footage, add special effects and

other digital enhancements. Over the past two decades, studios have benefited from enormous

improvements in computer quality. I recommend that analysts use the general PPI for

‘electronic computer manufacturing’. The series ID for that PPI is PCU334111334111. IF BLS

ever produces a more specific PPI, then analysts can switch to that.

Of course, computers have not always been used in movie studios. For historical price

indexes, I assume that computer usage was negligible before 1990. At that time, animated

movies used hand drawn illustrations instead of computers to create their scenes. Computer

usage then grew rapidly over 1990s. By 2000, computer costs plateaued at 15% of the nominal

budget for live action movies and 30% of the nominal budget for animated movies. Of course,

real computer prices have been plummeting since 2000. Therefore, real computer usage has

increased from 2000 to 2010. This includes supercomputers used to create special effects,

computers used to edit raw footage and other digital enhancements.

None of these price indexes are a perfect proxy for movie input costs. In particular, I am

concerned that the price index for live entertainment is too smooth. For a variety of reasons,

ticket prices for live theater may be sticky despite economic problems. In contrast, movie actors

and other talent may have flexible wages. Most studios hire their workers for an individual

movie, so they can quickly adjust wages for new projects. If unemployment is high, studios may

be able to assemble a top quality team for less than normal rates. I welcome suggestions to

measure historical prices better.

Figure 4 compares the input-based price index with IMDB price index. In the long-run,

both input-based price indexes track the IMDB-based price index reasonably well. The input-

based price index does a better job of matching IMDB prices when I adjust for unemployment.

However, this is mostly important during the Great Depression. In the past few years, the IMDB

price index has not dropped despite a large increase in unemployment. Accordingly, the

14

relationship between unemployment rates and movie costs may no longer hold. In order to be

cautious, BEA will use the unadjusted input price index in the national accounts. That price

index is used to calculate nominal investment in Figure 1 and nominal inventory in Figure 2.

Hedonic Price Indexes

I experimented with a hedonic price index to measure the cost of producing a movie of

constant quality over time. Unfortunately, the only measures of quality available on IMDB are

length of the movie, width of film, animated versus live action and color film versus black and

white. Most of these quality measures achieve their maximum by 1980. None of them capture

expensive items like dramatic special effects and high quality computer animation. In contrast,

the input-based quantity index performs reasonably well at measuring those expensive items. I

do quality adjust slightly by reducing the budgets for silent films by 50% and the budgets for

short films by 50% (75% for silent shorts). This adjustment has a significant impact on initial

capital stock in 1929, but little impact on prices after 1935.

Consumption-Based Price Indexes for Movies

Prices paid by consumers for theatrical movies might offer another potential price index

for theatrical movies. The BEA produces four separate price indexes that are relevant to movies:

a) a price index for movie tickets; b) a price index for purchased DVDs; c) a price index for

rented DVDs and d) a price index for cable television. These price indexes are all reported in

Table 2.4.4U. The line numbers are 44, 210, 215 and 219.

Figure 5 compares the input price index with BEA’s four price indexes. I find that the

consumption-based price indexes do not track each other or the input-based price index. Movie

ticket prices and cable prices rose significantly faster than input costs. At the same time, DVD

rental prices have remained almost constant and DVD purchase prices have fallen dramatically.

Given the huge differences between the four indexes, it is important to pick the right

consumption-based price index to deflate nominal expenditures. However, there is no easy way

to determine which index is the right one to use.

Even if the consumption-based price indexes were consistent, they still might not be

useful. All of those price indexes track prices for goods or services disseminating copies of

theatrical movies, not the underlying theatrical movie originals. For example, the price of movie

15

tickets might rise because rents go up for the building or wages rise for theater ushers. Based on

the industry literature, I estimate that theatrical movie costs account for approximately 25% of a

movie theater ticket prices, 50% of DVD prices (purchases & rented) and 15% of cable prices.

20

In theory, it is possible to adjust consumer prices to strip out non-artwork costs. However, that

process is much more difficult than using input costs.

Furthermore, the consumption-based price indexes are not adjusted for the quality of a

theatrical movie. Based on the IMDB data, I believe that real movie quality has risen

significantly from 1929 to 2010. In the 1930s, the typical major movie had 15 non-actors to

write scripts, design sets, etc. In the 2000s, the typical major movie had 106 non-actors. Modern

studios are also much more likely hire special effects companies and shoot scenes outside of the

studio lot. Therefore, the average movie ticket in 2010 buys a better experience than the average

movie ticket did in 1929.

Real Production 1929-2010

Figure 6 calculates an implicit quantity index by dividing the nominal production

spending estimated in Figure 1 with the unadjusted input-price index shown in Figure 4. I find

that real movie production grew rapidly from 1929 to 1935. Movie production then stayed flat

for the next forty years. After 1975, movie production started growing again. Between 1975 to

2008, movie production grew by 8% per year.

It is interesting to note that the quantity index in Figure 6 does not track with Census

data on total employment in the theatrical industry.

21

The Census data is based on worker’s self-

reported industry in the 1920, 1930, 1940, 1950, 1960, 1970, 1990 and 2000 population Census

and the 2001-2008 American Community Survey. My quantity index shows that real production

increased by more than 400% between 1980 and 2008. In the Census data, employment

increased by only 10%. The main difference between the two series is how they handle

outsourcing. The Census only counts workers in the United States. In contrast, my analysis

includes workers around the world as long as a US studio owns the movie. Over the last 30

years, domestic studios have moved much of their production out of the US (McDonald 2006).

Therefore, an index based on US employment only will underestimate the total value of movies

20

The 15% share is only for movie originals. Television program originals also contribute to cable costs.

21

This includes theatrical plays, movies and some television.

16

owned by US studios. In addition, the Census’s count of workers may miss employees who are

not employed directly by the movie studios. For example, Pixar might hire a computer

consulting firm to help with animation. In the 1970’s, the average movie paid $6.4 million to

actors and non-actors, but only $0.37 million to special effects companies (2005 dollars).

22

In

the 2000’s, the average movie spent $24.3 million to actors and non-actors and $17.5 million to

special effects companies. This rapid growth in special effects spending will not show up in

movie studio employment.

3. Depreciation Schedules and Capital Stock for Movies

The standard order for a movie release is first movie theaters, then DVD sales and finally

television. In this paper, I will use five separate datasets to estimate the rate at which studios

receive revenue from their movie originals: 1) US box office data from IMDB.com; 2) a

consumer survey of home video purchases and rentals within the United States from Alexander

and Associates; 3) A historical dataset from Tribune Media Services listing the dates and stations

selected theatrical movies are shown on US broadcast and cable television; 4) A historical

dataset from Red Bee Media Services listing the dates and stations selected theatrical movies

were shown on European television; 5) Nielsen ratings for a sample of US television airings of

theatrical movies.

23

Appendix 1 contains more information on the source of the datasets used,

the data cleaning rules and the procedures for estimating quarterly revenue.

In this paper, I define the value of a movie original as the expected present value of future

revenues minus future costs. I define the depreciation schedule as the rate at which a movie

original declines in value over time.

24

There are many possible reasons why a movie original

might decrease in value over time. In this paper, I will not attempt to distinguish between

exhaustion of the target market, obsolescence of the special effects technology, physical

depreciation of the film reel, or any other reason why consumers stop buying an old movie. I

22

Sample covers live action movies in the top 100 each year. Payments are estimated from the regressions used in

Section 1 and IMDB’s data. I do not know actual payments.

23

Figures 7-20 are taken from an earlier version of this paper. Since that version, I have slightly changed my price

indexes and other factors which could influence the depreciation schedule. The graphs would be very similar if I

used the latest price indexes.

24

I discount future revenues at 7% real. The depreciation schedule changes slightly if I use a different discount rate.

17

will simply estimate the schedule at which studios earn revenue from their movie originals and

the costs associated with those revenues.

Revenues from Movie Theaters Worldwide

The first stage of a typical movie’s lifecycle is theatrical release. In 2002, studios earned

21% of their revenue from theatrical release. The 2007 Economic Census does not split box

office licensing and television licensing, but movie studios probably earned a slightly smaller

share from box office in 2007. Since the 1948 Paramount antitrust ruling, studios have not been

allowed to own movie theaters and display their films directly. Instead, studios rent copies of

their films to movie theaters in return for a share of the ticket sales (Gil 2007). The industry

norm is that theaters pay 70% of their box office revenue to studios in the first week after

theatrical release and smaller shares for later weeks (Vogel 2004). On average, box office

licensing equals 40% of movie theater ticket sales.

I found that the typical movie has a very short lifespan in US theaters, as shown in Figure

7. Between 2000 and 2009, the typical movie earned 69% of its box office revenue in the first

quarter after theatrical release and 26% in the second quarter. US box office revenue trails off

dramatically after that. As a robustness check, I also used data from The-number.com to track

worldwide box office revenue. I found very similar results: movie theaters around the world

only show new movies.

Home Video Revenue

The next stage in a typical movie’s lifecycle is DVD release. According to the 2007

Economic Census, studios earned 22% of their revenues from DVD sales. In the past, studios

released their movies to VHS approximately six months after theatrical release. This gap has

been falling steadily over time, and by 2006 studios waited only 4 months between theatrical

release and DVD release (Hettrick 2007). Movies are almost never withdrawn from the home

video market, and consumers continue to buy or rent old movies years after initial release.

Figure 8 shows (estimated real home video revenue)/(real production budget) for new

movies by quarters since release. The typical movie is not released to DVD until about six

months after theatrical release. Once it is released, it sells DVDs worth more than 100% of its

production budget over six months. After the first year, revenue trails off quickly. Total DVD

18

revenue is 125% of the production budget in the first year, 74% of the production budget in the

second year, 24% of the production budget in the third year and 14% of the production budget in

the fourth year.

Figure 9 shows (estimated real home video revenue)/(real production budget) for older

movies by quarters since release. I find that the revenue decrease slows dramatically once a

movie passes the first few years. Between years 4 to 9, revenue drops by about 14% per year.

Between years 10 to 14, revenue drops by about 5% per year. After year 15, revenue remains

almost constant. All of these numbers are an average. My sample covers the entire universe of

movies produced in the US, so there are many movies which do not appear in the dataset at all.

Those movies are counted as zeroes when I calculate (real licensing revenue)/(original

production budget). Because of random variation, I cannot determine the precise depreciation

rate for very old movies, but it is clearly small.

25

I also find a very small depreciation rate when I track a fixed sample of pre-1980 movies,

as shown in Figure 10. These movies accounted for a little more than 10% of total studio

revenue between 1988 and 2002. Because the depreciation rate is so small, I cannot determine

the precise number. The point estimate for my depreciation rate changes when I use a different

functional form or different price indexes to deflate nominal revenues.

In order to get the best possible estimate of the long-term depreciation rate, I use the

complete sample of classic movies. First, I calculated real home video revenue 1988-2002 by

year of release. For example, movies released in 1950 earned $760 million in home video

revenue between 1988 and 2002 (2005 dollars). Earlier in this paper, I calculated that studios

spent $1.5 billion (2005 dollars) producing those same movies.

Figure 11 shows the ratio (real home video revenue 1988-2002)/(original production

budget) by year of release. Even when I aggregate by year, the data is still very noisy. However,

there is a general pattern for older movies to earn less than newer movies. On average, movies

released 1929 to 1953 earned home video revenues equal to 25% of their original production

budget. Movies released 1954 to 1979 earned home video revenues equal to 39% of their

original production budget. Therefore, I calculate that long-term depreciation is 36% over 25

25

Some movies are remade every few years. For example, there are dozens of “Sherlock Holmes” movies or

television programs. Alexander and Associates tried to identify the precise movie people watched, but many

consumers might have gotten confused and misreported the movie. As a robustness check, I restricted the sample to

movies with unique titles. I found that depreciation rates were very similar.

19

years, or about 2% per year.

26

This depreciation rate is sensitive to my estimates of historical

production budgets, the price index used to deflate classic movie production budgets and the

price index used to deflate contemporary home video revenue.

Television Licensing Revenue based on Airtime

The final stage of typical movie’s lifecycle is television licensing. In 2002, studios

earned 34% of their revenue from television. Movies are first shown on premium cable about

nine months after theatrical release (Vogel 2004). Premium cable channels generally show

newer movies, but they occasionally show older movies if the audience is still interested.

Movies are first shown on regular cable and foreign television about 24 months after theatrical

release (Vogel 2004). Regular cable and foreign television show movies for decades, until the

audience loses interest.

Figure 12 shows (estimated real television revenue)/ (real production budget) for new

movies by age and television market. I find that US premium cable has two separate windows.

Premium cable starts showing movies about six months after theatrical release. It then shows

movies frequently for the 18 months. Movies then are withdrawn over the next few years. By

the time a movie is four years old, it is almost gone from premium cable. Finally, movies return

to premium cable when they are about seven years old. In contrast, regular cable and foreign

television are much steadier. Networks first show movies when they are about two years old.

After that, they continue showing movies at about the same rate for the next eight years. Just

like home video, I track the entire universe of movies produced in the US. Movies which do not

appear at all are counted as zeroes.

Figure 12 shows the depreciation rate for older movies is relatively small. However, the

time span is too short to estimate a precise depreciation rate. In Figure 13, I track a fixed sample

of pre-1995 movies from 2003 to 2008. Once again, I find that the depreciation rate for older

movies is relatively small, but I cannot get a precise depreciation rate. In order to get a better

depreciation rate, I use the complete sample of classic movies. I use the exact same techniques

described earlier for Figure 11.

26

According to current copyright law, movies lose protection after 95 years. In theory, I could adjust the

depreciation schedule accordingly. In practice, movies that are old are already heavily depreciated. Furthermore,

the industry has lobbied several times to extend their copyrights and may do so again.

20

Figure 14 shows the ratio (Estimated Television Revenue)/(Real Investment) by year of

release for US television. Very few movies released before 1980 are shown on premium cable.

Based on that data, I calculate that premium cable revenues decrease by 10% per year after the

first few years. In contrast, regular cable often shows older movies. I calculate that regular cable

revenues decrease by about 5% per year. I do not have good annual data for foreign TV, but the

market share for classics is fairly large.

27

In my analysis, I will assume that foreign TV

depreciates at the same rate as regular cable. Just like home video sales, these depreciation

estimates are sensitive to my estimates of historical production budgets, the price index used to

deflate classic movie production budgets and the price index used to deflate contemporary

television revenue.

Television Licensing Revenue based on Viewership

I do not know how much television networks paid for television licensing. Based on the

2007 Economic Census and Nielsen data, I estimate that premium cable channels earn

approximately $0.28 per viewer-hour and regular cable channels earned $0.15 per viewer hour.

Therefore, it is likely that premium cable channels pay a higher licensing fee per viewer.

However, I do not have any data on actual prices charged for individual movies or genres. In

most cases, television licensing payments are negotiated privately and the prices are kept secret.

As a substitute for data on license fees, BEA has purchased a special dataset of cable

ratings from Nielsen. Cable networks receive a monthly fee per household, so they should prefer

movies that draw more households. Therefore, it seems reasonable to use viewership per hour as

a proxy for licensing fees per hour.

28

The Nielsen dataset reports the domestic rating for every

television program shown on ten randomly selected days between 2003 and 2008. I do not have

any ratings data for foreign television. I used the Nielsen dataset to impute television revenue

for Figures 12-14.

Figure 15 shows the average rating by age for premium cable and regular cable. The

ratings data is very noisy, so I cannot draw a smooth curve. But there does not appear to be any

trend for older movies to get lower ratings. Even if total viewership was fixed, it is possible that

27

BEA purchased a dataset that gave all airing for a sample of 1,000 movies. In order to get the most data, I picked

a sample of popular movies. It would be extremely difficult to translate that sample into a representative sample.

28

This assumes that the non-licensing costs are identical for old and new movies. The main non-licensing cost is

likely to be advertising by the network. I analyzed a dataset from Kantar Media that gives advertising by networks

for theatrical movies. I found that advertising is approximately proportional to viewership.

21

classic movie viewers could be less profitable for other reasons. In order to test that hypothesis,

BEA purchased ratings data by demographics. I found little relationship between movie age and

viewer demographics. If anything, classic movies attracted slightly more prime-aged men than

recent movies.

29

Therefore, it seems unlikely that classic movies earn less per viewer minute

than recent movies. Because all movies earn about the same amount per viewer minute, studios

probably charge similar licensing fees per viewer. If not, then a cable network could switch to

cheaper movies and reduce its costs without reducing the number of subscribers.

30

Lifecycle for Sequel Rights

In this paper, I only value individual movies. This is consistent with the SNA’s final

handbook (SNA 2008 5.2.2 “Criteria for inclusion”). In theory, one might also capitalize sequel

rights for theatrical movies as well. For example, the ‘Star Wars’ franchise is legally protected.

Nobody can make a new ‘Star Wars’ movie without permission from its current owner. Holding

the production budget fixed, sequels receive 25% higher box office revenue than original

movies.

31

Furthermore, box office revenue accounts for 21% of total movie revenue. Therefore,

one might calculate that sequel rights account for 25%*21% = 5% of a movie’s value.

As a robustness check, I measured the lifespan for sequel rights. I found that sequels are

the most common within five years of the original movie. After that, the sequel rate trails off

slowly. This lifecycle is very similar to the lifecycle for other revenue sources such as home

video and television. If I capitalized sequel rights, then I would split the value of each original

movie into two separate assets: the movie itself and potential sequel rights. However, these two

assets are both produced using the same inputs and have similar lifespans. Therefore, the

aggregate capital stock would not change if sequel rights were capitalized separately from

individual movies. By the same token, aggregate production and real production would remain

almost unchanged.

29

Advertisers pay much higher rates for men 18-49, so ad-supported networks often target their shows to that group.

On the other hand, cable distributors charge identical monthly subscription fees for all demographic groups.

30

It is possible that cable stations receive other benefits from showing new movies. For example, viewers might

value an hour spent watching new releases higher than an hour spent watching classic movies. In that case,

licensing fees per viewer-hour might be higher for new movies.

31

Sequels also earn slightly lower home video and television revenues and spend less on advertising. None of those

differences are statistically significantly. All figures for major movies only. Box office data is for 2000-2008.

22

Advertising Costs for Theatrical Movies

Movie studios spend enormous amounts of money advertising their films right around the

theatrical release. In fact, these advertising costs are often larger than the studio’s share of

theatrical revenue (Epstein 2005b). This advertising has an immediate impact on sales (Wilbur

and Renhoff 2008). Studios also spend money printing the film reels to be shown in movie

theaters and then shipping them nationwide. In order to track advertising spending, BEA

purchased a subscription to ‘Adspender’ by Kantar Media Services. This dataset tracks

advertising by product across the US. I then adjusted the Kantar data for non-US advertising. In

total, I estimate that studios spend about 45 cents on advertising airtime for every dollar they

spend on filming.

Figure 16 shows advertising spending by quarters since release. In the first quarter after

theatrical release, studios spend 30% of their filming investment on advertising. In the next three

quarters, studios spend another 14%. After the first year, studios spend almost nothing on

advertising. On average, studios spend more money advertising their new films than they earn

from theatrical release. At first glance, it would seem that studios could raise profits by skipping

the theatrical release entirely. In fact, advertising new movies almost certainly raises demand for

DVDs in six months when the movie is released to the home video market. It is also possible

that advertising new movies raises demand for television showings in ten years. BEA’s general

practice is to treat advertising as a current expense. Therefore, I will deduct advertising revenue

from revenue in that quarter. Because of this choice, the value of movie originals peaks in the

third quarter, after advertising is completed.

Manufacturing Costs

Before a movie can be shown in theaters, movie studios must print thousands of reels and

distribute them across the world. I estimate that printing and distribution costs are approximately

10% of box licensing office revenue.

32

All of these costs occur right before theatrical release.

Movie studios also need to stamp, pack and ship DVDs around the world. In “The Big

Picture”, Epstein reports that studios spend about $4-$5 for each individual DVD on

32

This estimate is significantly lower than the $1.3 billion for the six major studios reported in a recent article

Alimurung 2012). If that article is correct, then movie depreciation rates are slightly lower and movie investment in

2007 was slightly lower. In the future, studios may switch to digital distribution and save printing costs. However,

digital distribution requires other costs like new projectors.

23

manufacturing and sales. These manufacturing costs and sales expenses represent around 33%

of the wholesale price for DVDs. For simplicity, I will assume that studios stamp DVDs and

ship them in the same quarter they’re sold. Epstein also reports that it only costs $30,000-

$50,000 for a studio to prepare the master DVD file from a pre-existing film reel,

33

less than

0.1% of filming costs. This upfront cost is small enough to ignore.

Movie studios spend almost nothing on manufacturing for television licensing. In “The

Big Picture”, Epstein estimates that it costs only around $150,000 for a studio to prepare a pre-

existing film for television release. And the television network pays all of the advertising and

customer service costs itself. I will assume that 99% of the revenue from television licensing

represents a return on the investment filming a movie.

Overhead Costs and Profit-Sharing

The final cost to studios is residual payments to fulfill profit-sharing contracts between

the studio and workers. From the studio’s point of view, profit-sharing arrangements represents

a significant cost. Depending on the contract, actors and directors may be legally entitled to a

portion of the revenues earned from box office, home video sales and television licensing.

However, from the standpoint of national accounts, these payments are simply a delayed wage

payment.

34

This is similar to the tech industry, where workers are often paid with stock options.

The investment activity is the same regardless of when the workers are paid or how the payment

is structured. I will not subtract these payments from studio revenue.

Final Depreciation Schedule

Earlier in this paper, I calculated separate depreciation schedules for box office revenue,

home video revenue, television licensing revenue and advertising. In order to combine these

rates into a single depreciation schedule, I need to weight each revenue source properly. I will

benchmark all my revenue data to the 2007 Economic Census.

33

This only measure the cost of transferring a pre-existing file. It is common for studios to include additional

material on DVDs such as interviews with actors, extra scenes, etc. The cost of this material might be considerably

larger than $50,000.

34

An alternative method to account for profit-sharing agreements would be to assume that studios only own a

portion of the movie and actors own the rest. In that case, I would calculate the actor’s share by estimating the net

present value of future royalty payments. However, that procedure would complicate my calculations without

changing the aggregate value of theatrical movies.

24

According to the 2007 Economic Census, theatrical movies earned $22 billion from

domestic licensing, $6.5 billion from foreign licensing, $7.1 billion from DVD sales and $3.0

billion from merchandise licensing and other revenue. In order to calculate depreciation, I need

to split the licensing revenue by category. Based on the industry literature and other datasets, I

estimate that studios earned $6.4 billion from box office licensing, $8.7 billion for DVD sales

and DVD rental licensing

35

, $1.2 billion from pay-per-view licensing, $0.03 billion from

broadcast television licensing, $9.1 billion from US premium cable licensing, $5.3 billion from

US regular cable licensing and $4.6 billion from foreign television licensing. Figures 7 through

16 give the quarterly revenue schedule for each individual movie product. I weighted those

quarterly revenue schedules by the share for each individual product and then subtracted the

costs described above. I have no data on merchandising revenue or “all other operating

revenue”. However, most merchandising occurs early in a film’s lifecycle. For example,

McDonalds might run a Happy Meals tie-in for an upcoming kids’ movie. I will assume that

merchandising revenue tracks box office licensing.

The revenue in Figures 7-15 are not consistent with the filming budgets reported by

IMDB. For every $1 in filming costs, I calculate that studios earn $4.15 in future revenues and

pay $1.53 in non-filming costs. Based on that result alone, it might seem that film making is an

extraordinarily profitable investment. However, movie studios spend a lot of money on

administration and other overhead costs. For example, producers often read hundreds of scripts

before they pick a few to film. In a competitive market, total investment will be equal to total

revenue minus total sales costs on average. I assume that studio management spent $1.61 on

overhead for every $1 they spent filming. Those studio overhead costs are part of the original

investment just like film and costumes.

36

Figure 17 shows the present value of this net revenue stream for every year after

theatrical release. I cannot match the depreciation schedule perfectly with any simple curve.

35

Larger video rental companies generally do not buy their DVDs outright. Instead, they pay a small upfront fee for

the DVD and then share their rental revenue going forward (Mortimer 2006)

36

Depreciation rates are very sensitive to how studio overhead is allocated. When calculating depreciation, I allocate

all overhead to filming and count it in the original investment. If I allocate overhead equally between filming and

advertising, then theatrical movies appreciate early in life and peak in value at 140% of initial investment. On the

other hand, theatrical movie depreciate much faster if I allocate overhead to long-term television licensing.

In section 1, I allocated some overhead to advertising. This allocation determines the precise nominal investment in

movie originals – but it does not influence depreciation rates directly.

The depreciation schedule shown in Figure 17 uses earlier revenue numbers, so the weights are not precisely the

same as reported in the paper. This has minimal impact on depreciation rates.

25

However, I can match the aggregate depreciation rate with a simple geometric curve that drops

by 9.3% per year. In the national accounts, BEA will use that simple depreciation rate to

calculate capital stock and consumption of fixed capital.

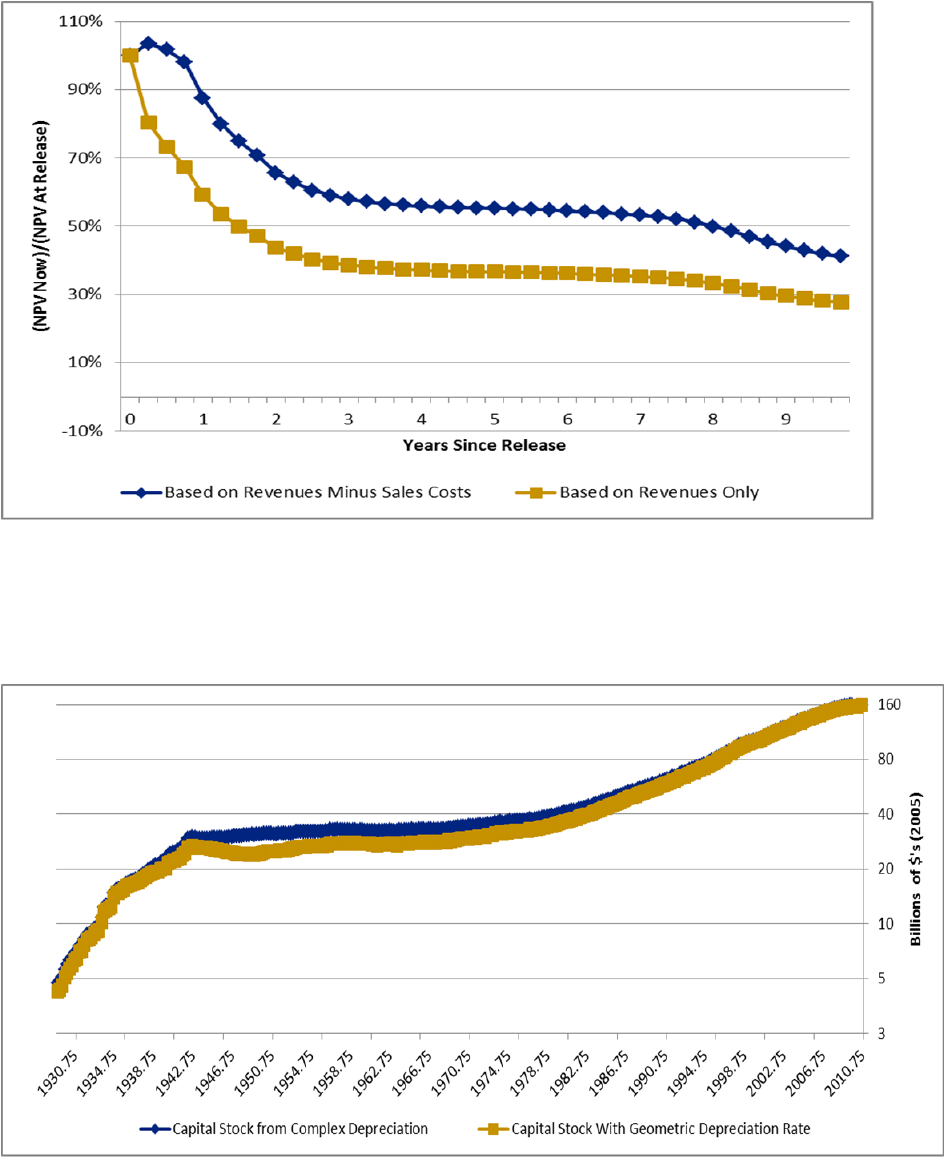

Figure 18 shows my estimate of the aggregate real value of movie originals for every

quarter from 1929 to 2010. These capital stock estimates are derived from the real investment

statistics shown in Figure 6 and the depreciation schedule shown in Figure 17 (after costs).

37

The most important result from Figure 18 is that geometric depreciation rates produce an

aggregate capital stock number very similar to aggregate capital stock number calculated with

complex depreciation schedules. Furthermore, the simple geometric depreciation rate is much

easier to incorporate into the national accounts.

It might seem that the public has a limited amount of time available for leisure, and so

there must be some upper bound to the amount of movies they can watch in a year. At that point,

the demand for movies is saturated and new movies will drive old movies from the market.

However, the data suggest that customers for American movies are nowhere near any

hypothetical saturation point. Between 1988 and 2002, real production spending for new

movies increased from $4 billion to $9 billion per year (2005 dollars). Over that same time

period, Alexander and Associates report that home video rentals and sales of pre-1980 movies

remained steady at around $1 billion per year (2005 dollars). Based on that evidence alone, it

does not seem that new movies are strong substitutes for classic movies. In a separate paper, I

study books as capital assets (Soloveichik 2013c). In that paper, I find that real book production

has remained flat since 1965. Over the same time period, the adult population increased 50%.

Per-capita sales of newspapers and magazines have also fallen significantly. Perhaps Americans

are substituting from printed media to electronic media?

The pre-1950 capital stock estimates shown in Figure 18 are very speculative. In 2007,

virtually all movies shown in movie theaters are new. Before 1950, movie theaters were the only

way to watch movies. Accordingly, I might conclude that theatrical movies had a very short

lifespan in 1940. On the other hand, movies then were kept in theaters much longer then they are

now. Furthermore, the entire movie industry was extremely new. So, there was no stock of

older movies to watch even if theater audiences had been willing to watch classic movies. As a

37

I use IMDB data on real production to calculate initial capital stock in 1929. The first motion pictures were

produced before 1900, but those movies were mostly novelties. I start the theatrical movie industry in 1915.

26

robustness test, I also experimented with depreciation rates of 20% from 1915 to 1950. This

reduces the capital stock before 1950 significantly – but it has little effect on modern capital

stocks. The NIPAs will use a constant 9.3% depreciation rate from 1915 to 2010.

Comparing My Depreciation Schedule to Other Estimates

To the best of my knowledge, no previous researchers have estimated the depreciation

rate of movie originals from empirical data. Most European countries currently include movie

originals in their national accounts, but I have not been able to locate any scholarly economic

paper describing how they estimated their depreciation rates. And only two countries have

responded to my questions about how they account for movie originals. One country used a

service life of three years for movie originals because that is the lifespan they use for other assets

without known depreciation rates. Another country used a service life of fifteen years, but they

did not describe how they arrived at this lifespan. The closest existing empirical research used

renewal rates for patents to estimate their value (Schenkerman and Pakes 1986). However, that

research required very strong functional form assumptions. Therefore, I cannot compare my

estimate of the depreciation schedule with any previous literature.

I can double-check the depreciation schedule estimated above by comparing the actual

price paid for film libraries with my estimates of the fair market value. I used data from

IMDB.com to identify which films were in each transaction. I also used the number of IMDB

votes for each film to identify the popularity for each film by year of release. For example, ‘Star

Wars’ got 45% of all votes cast in 1977.

38

This procedure measures the realized market value of

each film library not the original investment cost. Unexpected hits are worth much more than

their original investment cost and flops are worth much less.

Results from my imputation are shown in Table 3. Using a complex depreciation

schedule for movies, I found that actual sale prices are 77% of predicted sale prices. However,

the sale prices are extremely variable. Most sale prices are well below the predicted price. On

the other hand, George Lucas sold the Star Wars series to Disney for $4 billion.

39

Even

38

Because Star Wars was so popular, 1977 received more total votes. I smooth votes over five years.

39

This deal was not a clean purchase of the Star Wars franchise. On the one hand, Disney did not purchase full Star

Wars rights. 20

th

Century Fox owns rights to “A New Hope” and has a home-video distribution contract for the

other films until 2020. On the other hand, Lucasfilms owned studio buildings and other non-film assets.

Furthermore, Lucasfilms had some rights to the Indiana Jones franchise, though most are held by Paramount. For

simplicity, I assume that the subtractions and additions cancel out.

27

accounting for the incredible popularity of the original Star Wars movies, I still only predict a

sale price of $1.4 billion.

At first glance, the low sale prices for film libraries indicate theatrical movies depreciate

quickly. In fact, new film libraries and older film libraries both sell below predicted prices. The

Warner film library is a striking example of that problem. It was first sold in 1957 for $30

million ($176 million in 2005 dollars). It was then resold in 1982 for $75 million ($134 million

in 2005 dollars). These two sales suggest a depreciation rate of 1.1% per year – even slower than

the decrease predicted by my complex depreciation schedule.

40

Distressed prices are one possible explanation for the low sale prices observed in Table 3.

When valuing future revenues, I used a discount rate based on long-term stock market returns.

However, studios selling film libraries are often near bankruptcy. Because of their financial

difficulties, they could discount the future more heavily than normal. The discount rate is likely

to be especially high when the overall movie industry is in financial distress. Predicted prices

would match actual film prices much better if I use a higher discount rate when valuing libraries.

The depreciation schedule estimated earlier in this paper does not match the depreciation

schedule used by studio accountants. The American Institute of Certified Public Accountants

requires that studios write down new films completely within ten years of theatrical release

(AICPA 2000). In contrast, I calculate that new films retain 41% of their original value ten years

after theatrical release. The accounting rules are different when studios purchase a library of

films at least three years old. In that case, studios are required to write down the entire library

within twenty years of purchase. In contrast, I calculate that film libraries retain about 24% of

their original purchase price twenty years later. However, it is common for accounting rules to

diverge from economic value. By itself, the discrepancy does not suggest any problems.

The depreciation schedule estimated above also does not match the IRS regulations

governing the write-down of films. At the present time, IRS treats small films, large films and

unfinished films very differently. Studios are allowed to write down their expenses on films with

a production budget under $15 million immediately (Triplett 2007). Large films are depreciated

over a period of ten years according to the income forecast method. The income forecast method

requires studios to estimate the total revenue they will receive from the film in the ten years after

40

However, the two prices may not be a fair comparison. The theatrical movie industry faced heavy competition

from broadcast television in the 1960’s, but then benefited in the 1980’s from home video and cable television.

Executives in 1957 and 1982 might have anticipated industry conditions in the near future when pricing libraries.

28

it is produced and the salvage value after ten years. Studios then depreciate the film by the

decrease in expected revenue each year (IRS Publication 946). If a film is never produced at all,

studios must amortize their expenses over a fifteen year period starting with the date the studio

writes off the film for accounting purposes (U. S. Master Depreciation Guide 2007). Like the

AICPA guidelines, I believe that IRS underestimates the value of old movies.

Conclusion

In this paper, I constructed estimates of investment, prices, depreciation and capital

stocks of theatric movies. This change helps bring the NIPAs in line with SNA 2008, which

recommended that entertainment originals be treated as capital assets.

My paper has three novel findings:

1) Theatrical movies have a projected lifespan of at least 80 years. Furthermore, the

average depreciation rate is only 9.3% per year. The total capital stock of all theatrical movies

was worth more than $150 billion in 2007.

2) Over the past decade, nominal movie production has shrunk from 0.16% of GDP to

0.13% of GDP. This shrinkage occurred because movie production prices rose much slower than

overall inflation. Over the same time period, real movie investment grew at 5% per year.

3) The movie industry grew rapidly during the Great Depression. In 1929, theatrical

movie investment was $162 million, 0.15% of GDP. By 1934, movie investment was $301

million, 0.46% of GDP. Accordingly, the Great Depression looks a little less grim when movies

production is counted as an investment activity. After World War 2, movie investment hovered

between 0.10% and 0.16% of the overall economy. Accordingly, GDP growth from 1945 to

2010 does not change much when movie production is counted as an investment activity.

29

Table 1: List of Datasets Used and How They Are Used

Dataset Description of Dataset Used to Create

2004-2008

Service Annual

Survey

The Service Annual Survey is

conducted every year by the Census

Department. It surveys businesses in

the service sector. However, it is less

detailed than the Economic Census.

Nominal Movie

Production, Real Movie

Production &

Depreciation Schedules

2007 Economic

Census

The Economic Census is conducted

every 5 years by the Census

Department. It surveys businesses in

the United States. Depreciation Schedules

IMDB.com

This website provides a list of all

movies produced back to 1929. It also

provides details about each movie

such as cast and crew, length of film,