May 15, 2012

To the Governor and Legislature:

I am pleased to submit to the New York State Legislature a copy of the first Annual Report of the New York State Department of Financial

Services, incorporating the annual reports formerly issued by the Departments of Banking and Insurance, as required by Article 2, Section 206 of

the Insurance Law and Section 43 of the Banking Law.

Although DFS has only been in existence since October 3, 2011, as detailed in this report, we have already begun to implement several initiatives

designed to achieve the Governor’s vision for the new Department.

I am proud of what DFS has been able to accomplish thus far, while both continuing our vital regulatory functions and dealing with the challenges

of the merger.

I can assure you that our initial success has increased our determination to achieve even more in the months ahead to contribute to the

Governor’s efforts to strengthen New York’s economy and create more jobs.

• We will continue to encourage financial services firms to locate more jobs in New York.

• We will further improve our responsiveness to consumers.

• We will expand our oversight into the financial products and services that had formally fallen into regulatory gaps.

• We will continue to focus on our operations and the law to find more ways to improve our efficiency and effectiveness.

• We will work to make our examinations better focused, more relevant and quicker so they are more effective in identifying and dealing

with issues in a timely way.

• We will clear up backlogs in both handling consumer complaints and reviewing industry filings.

In sum, we will strive to make the Department of Financial Services one of the premier regulatory agencies in the nation.

Respectfully submitted,

Benjamin M. Lawsky

Superintendent

4

TABLE OF CONTENTS

OVERVIEW

MAJOR ACCOMPLISHMENTS 6

INSURANCE DIVISION OVERVIEW 19

BANKING DIVISION OVERVIEW 21

FINANCIAL FRAUDS AND CONSUMER PROTECTION DIVISION (FFCPD) OVERVIEW 23

MARKETS DIVISION OVERVIEW 26

REAL ESTATE DIVISION OVERVIEW 27

OFFICE OF GENERAL COUNSEL OVERVIEW 28

ADMINISTRATION OVERVIEW 31

INFORMATION TECHNOLOGY SERVICES OVERVIEW 32

LIQUIDATION BUREAU OVERVIEW 33

INSURANCE COMPANY STATISTICS 41

PROPERTY INSURANCE 41

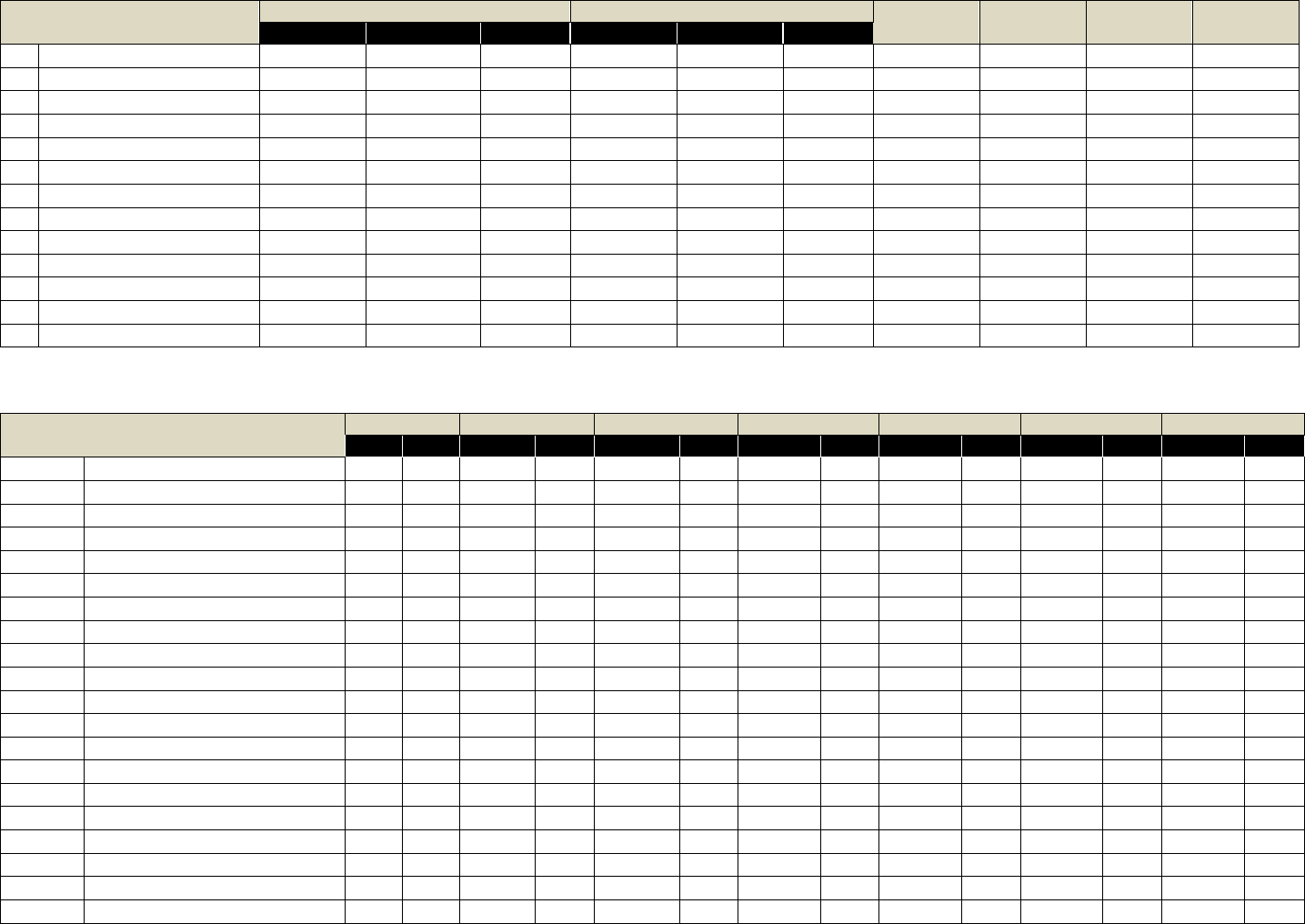

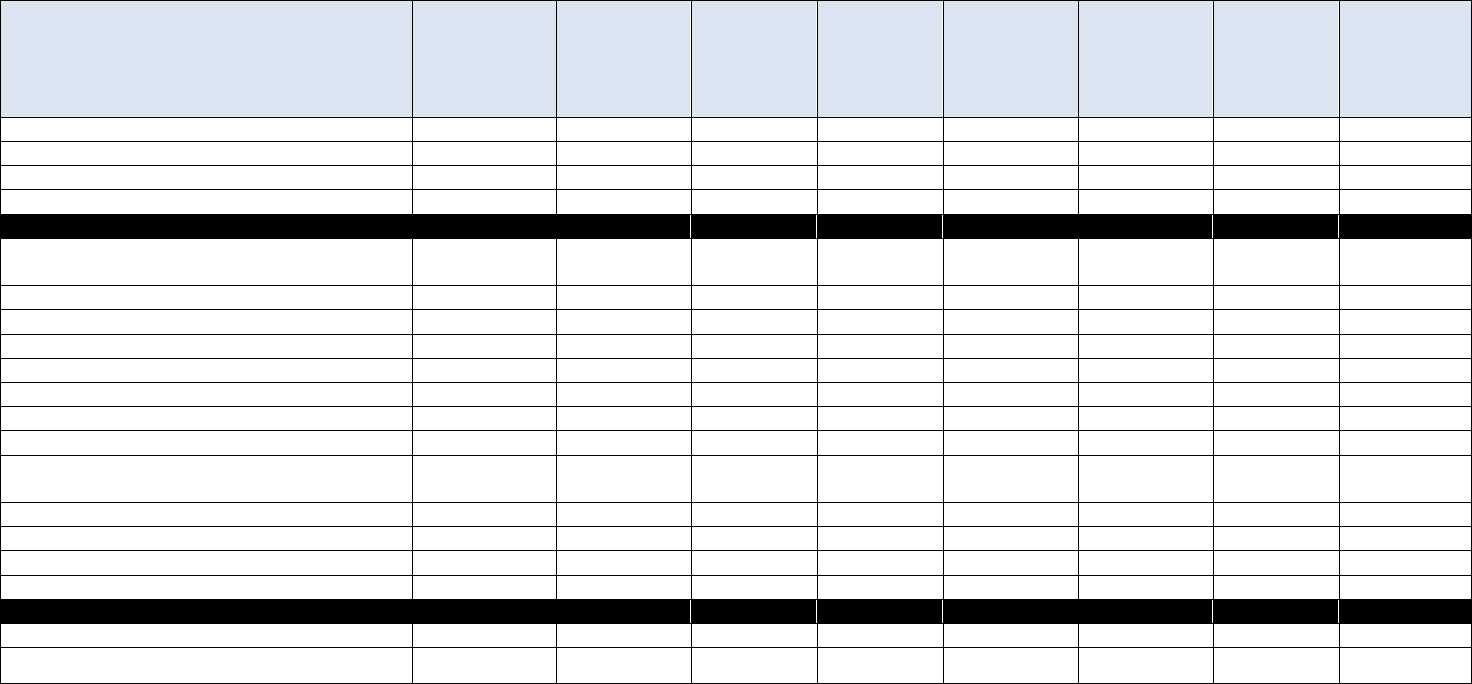

TABLE 1: NET PREMIUMS WRITTEN AND SURPLUS TO POLICYHOLDERS 41

TABLE 2: UNDERWRITING RESULTS 41

TABLE 3: INVESTMENT INCOME AND CAPITAL GAINS 42

TABLE 4: AGGREGATE UNDERWRITING AND INVESTMENT EXHIBIT 42

TABLE 5: SELECTED ANNUAL STATEMENT DATA PROPERTY/CASUALTY INSURERS 44

TABLE 6: DIRECT PREMIUMS WRITTEN BY PROPERTY/CASUALTY INSURERS 45

TABLE 7: NET PREMIUMS WRITTEN AND SURPLUS TO POLICYHOLDERS FINANCIAL GUARANTY INSURERS 46

TABLE 8: UNDERWRITING RESULTS FINANCIAL GUARANTY INSURERS 47

TABLE 9: INVESTMENT INCOME AND CAPITAL GAINS FINANCIAL GUARANTY INSURERS 47

TABLE 10: AGGREGATE UNDERWRITING AND INVESTMENT EXHIBIT FINANCIAL GUARANTY INSURERS 47

TABLE 11: SELECTED ANNUAL STATEMENT DATA FINANCIAL GUARANTY INSURERS 48

TABLE 12: NET PREMIUMS WRITTEN AND SURPLUS TO POLICYHOLDERS MORTGAGE GUARANTY INSURERS 49

TABLE 13: AGGREGATE UNDERWRITING AND INVESTMENT EXHIBIT MORTGAGE GUARANTY INSURERS 49

TABLE 14: SELECTED ANNUAL STATEMENT DATA MORTGAGE GUARANTY INSURERS 50

TABLE 15: SELECTED ANNUAL STATEMENT DATA TITLE INSURANCE COMPANIES 51

TABLE 16: SELECTED ANNUAL STATEMENT DATA ADVANCE PREMIUM AND ASSESSMENT CORPORATIONS 51

TABLE 17: NUMBER OF FILINGS RECEIVED BY TYPE 52

TABLE 18: MAJOR EFFECTS OF PRINCIPAL RATE & LOSS COST CHANGES BY PROPERTY/CASUALTY RATE SERVICE ORGANIZATIONS 53

TABLE 19: PRIVATE PASSENGER AUTOMOBILE RATE FILINGS 57

TABLE 20: NEW YORK AUTOMOBILE INSURANCE PLAN (NYAIP) EXPERIENCE IN 2009 AND 2010 62

TABLE 21: WORKERS COMPENSATION INSURANCE 67

TABLE 22: PCISF CONTRIBUTIONS 71

TABLE 23: MOTOR VEHICLE ACCIDENT INDEMNITY FUND 72

TABLE 24: INSURANCE ENTITIES SUPERVISED BY THE DEPARTMENT 72

HEALTH INSURANCE 74

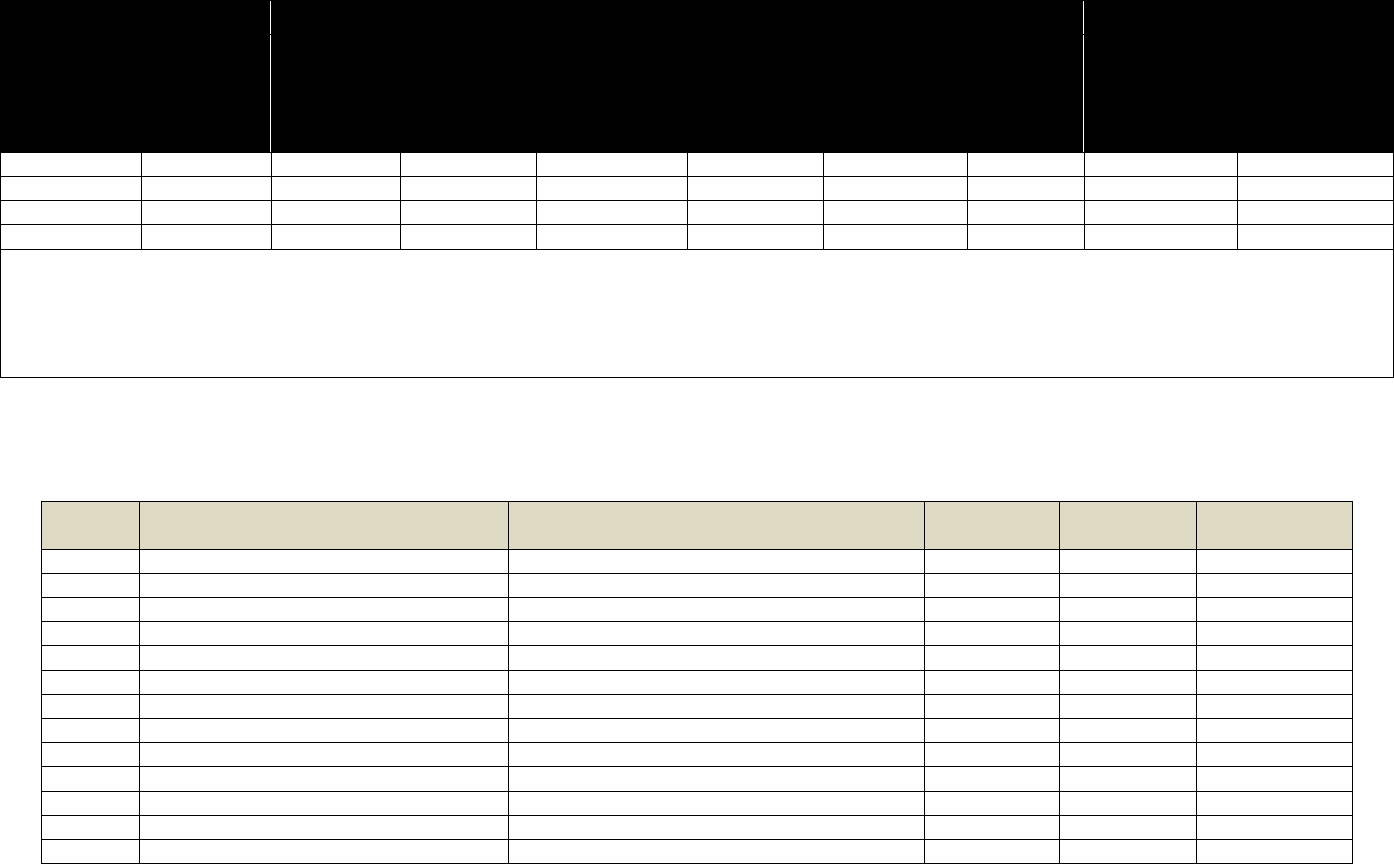

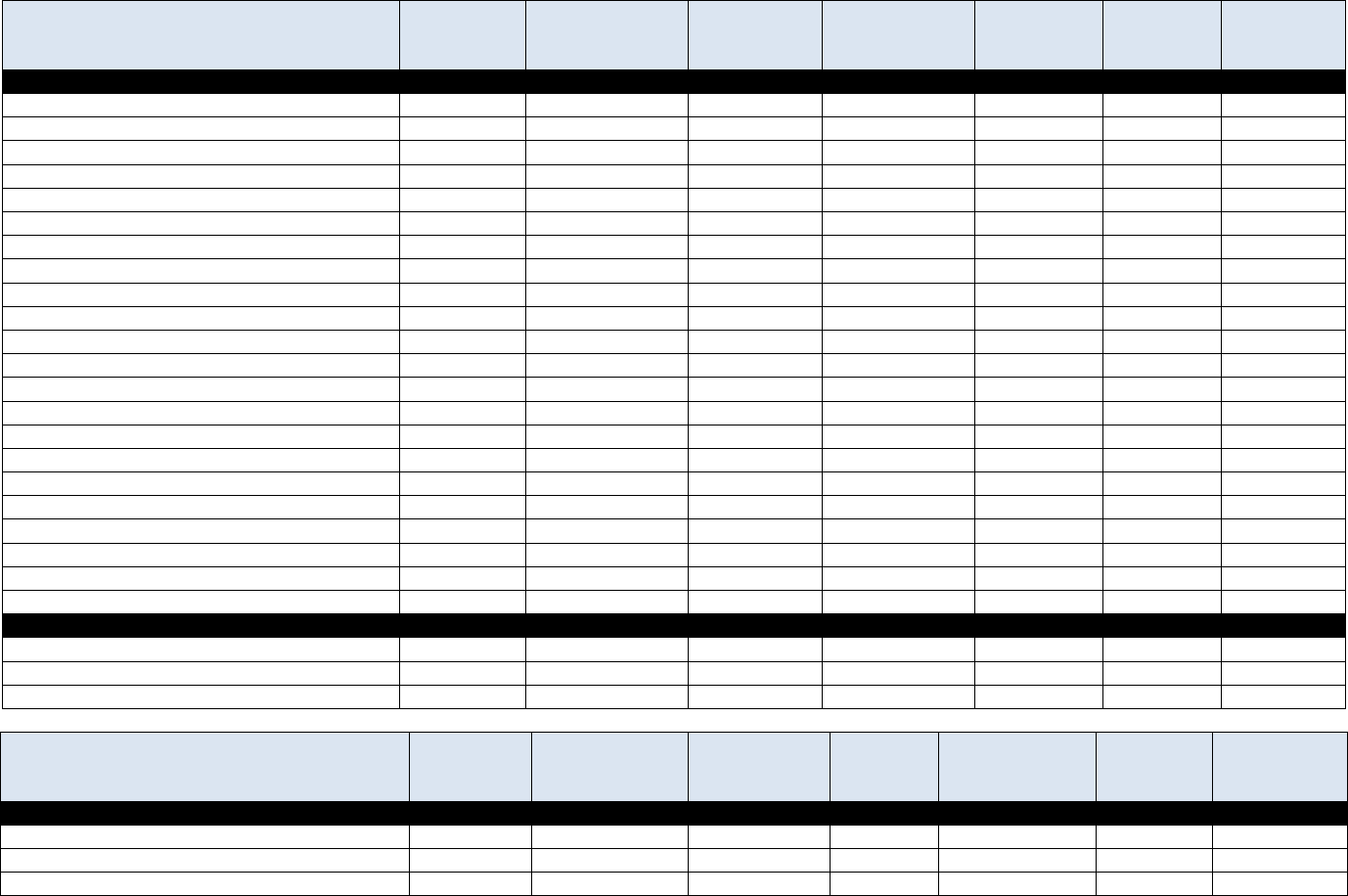

TABLE 25: HEALTH INSURANCE: CLASSES OF BUSINESS, ASSETS, LIABILITIES AND PREMIUMS WRITTEN 74

LIFE INSURANCE 75

TABLE 26: ADMITTED ASSETS 75

TABLE 27: BALANCE SHEET 75

TABLE 28: TOTAL LIFE INSURANCE IN FORCE 76

TABLE 29: SOURCES OF INCOME 76

TABLE 30: OPERATING RESULTS 77

TABLE 31: LIFE INSURANCE IN FORCE IN THE STATE OF NEW YORK 77

TABLE 32: ADMITTED ASSETS/INSURANCE IN FORCE 78

TABLE 33: FRATERNAL BENEFIT SOCIETIES 78

TABLE 34: PRIVATE PENSION FUNDS 78

TABLE 35: PUBLIC RETIREMENT SYSTEMS AND PENSION FUNDS 79

TABLE 36: SEGREGATED GIFT ANNUITY FUNDS 79

TABLE 37: COMPANIES REGULATED BY THE DEPARTMENT 79

BANKING STATISTICS 81

TABLE 38: PRINCIPAL BANKING AND LENDING FACILITIES OF NEW YORK STATE 81

TABLE 39: SUMMARY OF STATE SUPERVISED AND LICENSED INSTITUTIONS 82

TABLE 40: CONDITION OF COMMERCIAL BANKS 83

TABLE 41: CONDITION OF SAVINGS BANKS & THRIFTS 89

TABLE 42: CONDITION OF CREDIT UNIONS 91

TABLE 43: CONDITION OF SAFE DEPOSIT COMPANIES 93

TABLE 44: CONDITION OF INVESTMENT COMPANIES 94

TABLE 45: CONDITION OF LICENSED LENDERS 95

TABLE 46: ALL SUPERVISED BANKING INSTITUTIONS AND LICENSED LENDERS 97

TABLE 47: VOLUNTARY AND INVOLUNTARY LIQUIDATIONS 107

TABLE 48: UNCLAIMED DEPOSITS OR DIVIDENDS DEPOSITED WITH SUPERINTENDENT 107

TABLE 49: MERGERS AND ACQUISITIONS 107

TABLE 50: CHARTER CONVERSIONS 108

TABLE 51: STATE TRANSMITTER OF MONEY INSURANCE FUND (STMIF) 109

DEPARTMENT ORGANIZATION AND MAINTENANCE 110

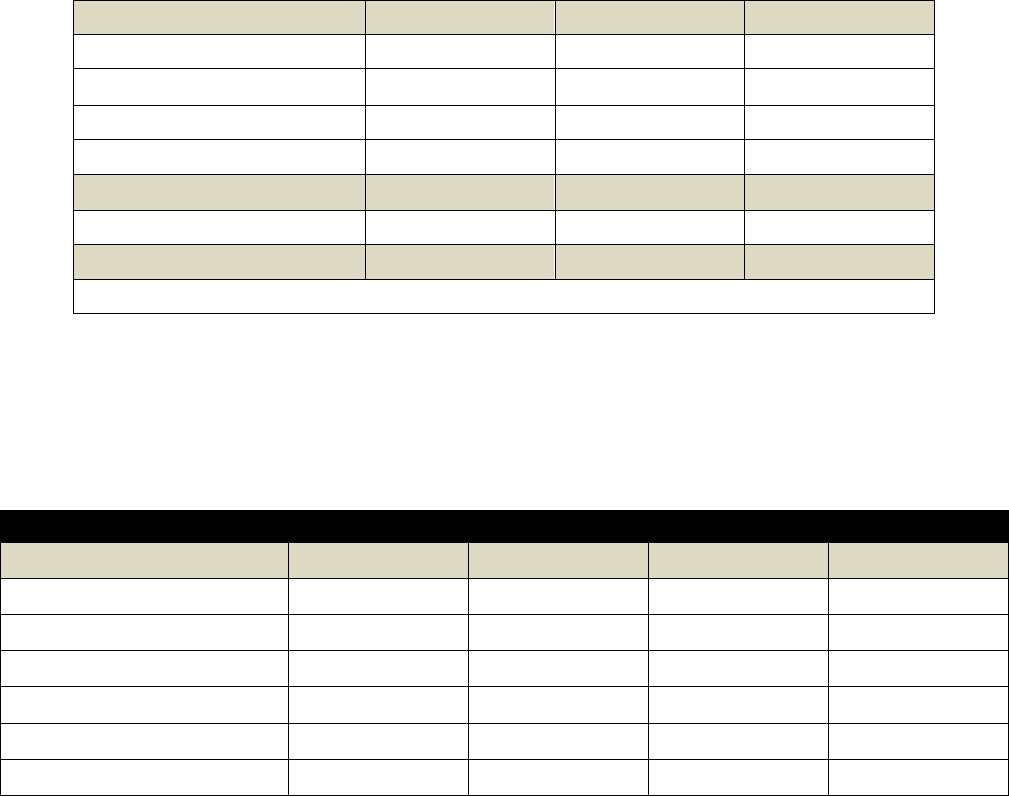

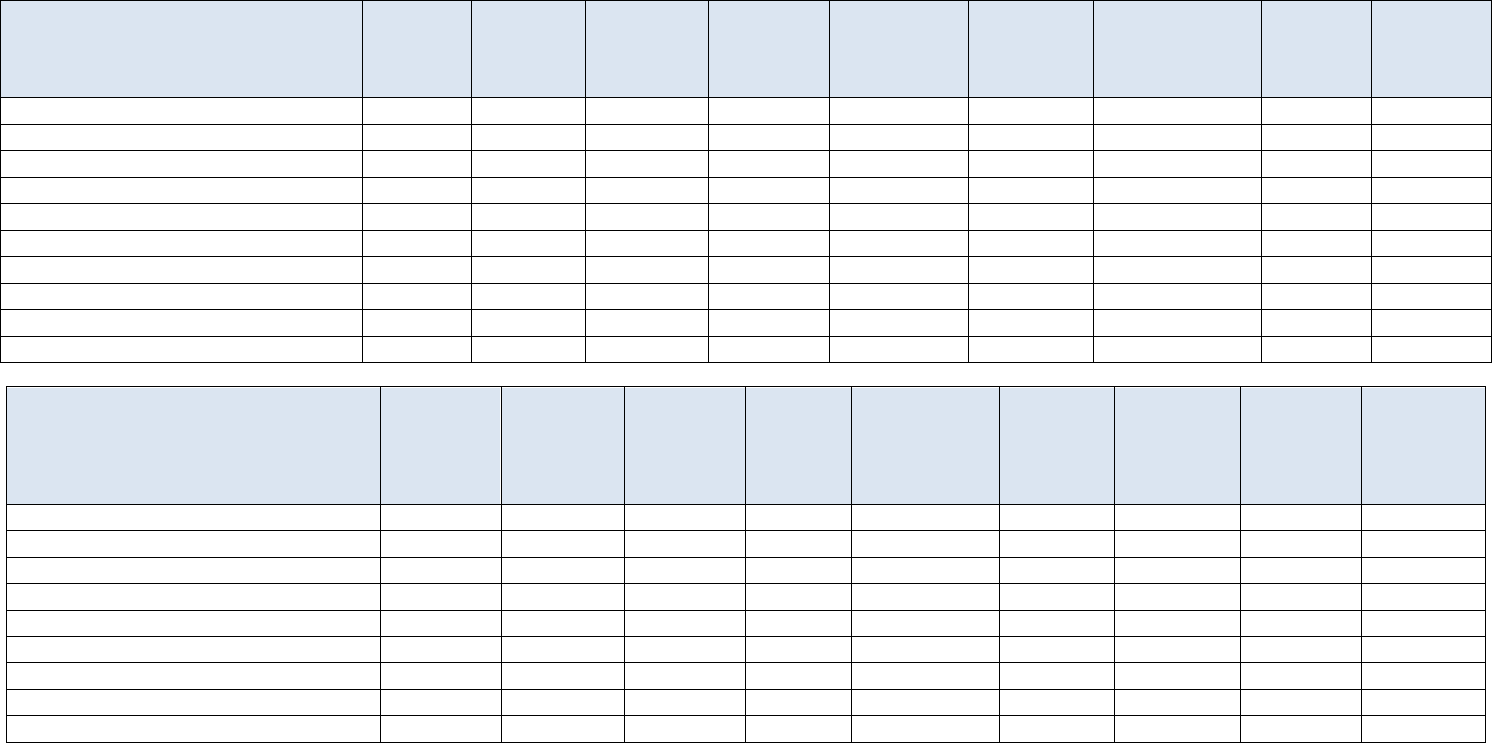

TABLE 52: FORMER INSURANCE DEPARTMENT 2010-11 STATE FISCAL YEAR EXPENDITURES 110

TABLE 53: FORMER BANKING DEPARTMENT 2010-11 STATE FISCAL YEAR EXPENDITURES 111

TABLE 54: ASSESSMENTS AND REIMBURSEMENT OF INSURANCE DEPARTMENT EXPENSES: 112

TABLE 55: ASSESSMENTS AND REIMBURSEMENT OF BANKING DEPARTMENT EXPENSES 113

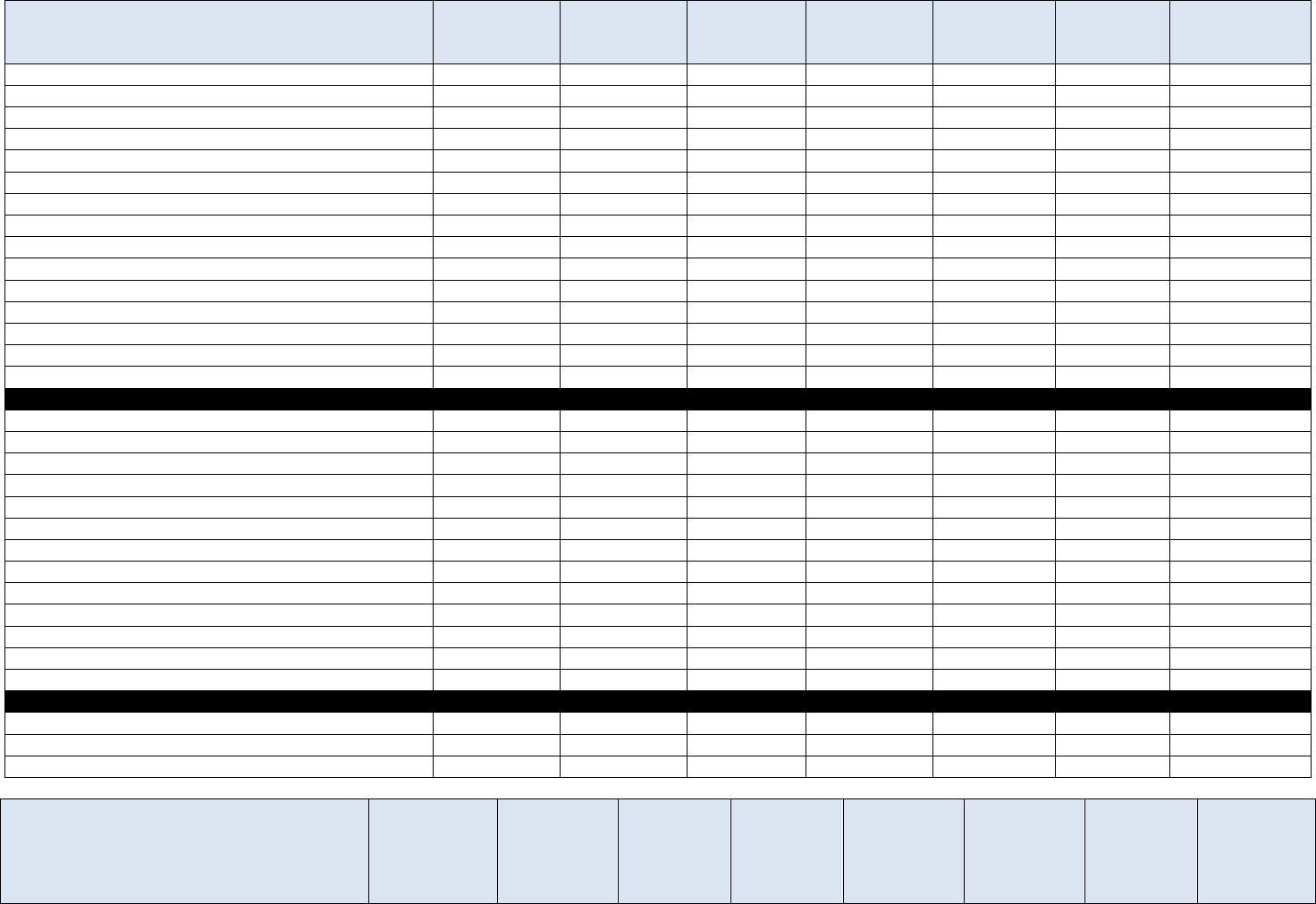

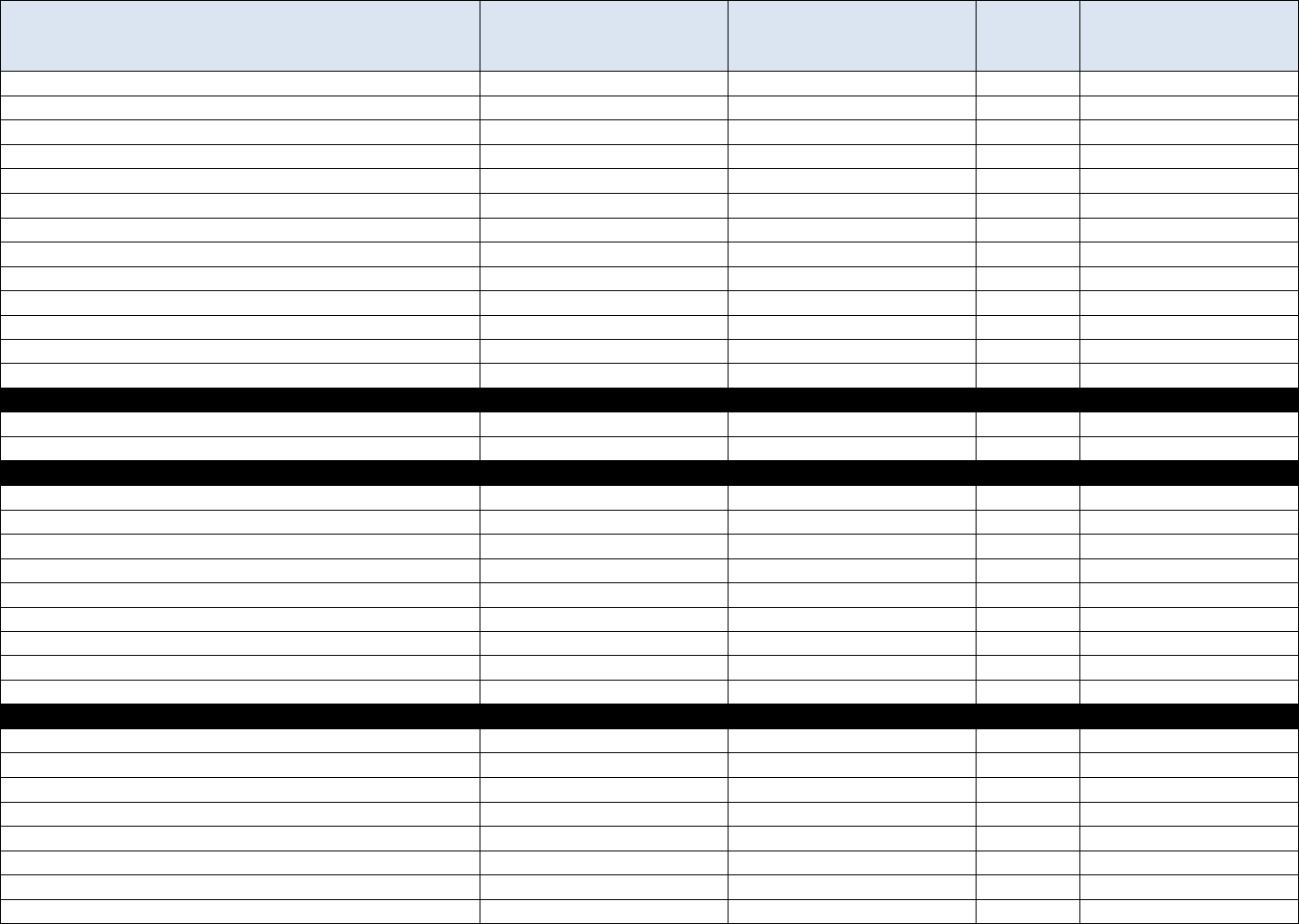

REGULATORY AND LEGISLATIVE ACTIVITIES 114

MAJOR LITIGATION 114

OVERVIEW

This is the first Annual Report of the New York State Department of Financial Services (DFS). It reviews the Department’s activities in 2011, as

well as developments in the financial services industries regulated by the Department.

In his 2011 State of the State address, Governor Andrew Cuomo announced his plan to merge the New York State Insurance Department and

the Banking Department into a single financial services regulator, DFS.

Governor Cuomo identified a need to modernize and close the gaps in regulation, which he proposed could be accomplished by creating DFS to

oversee the broad array of financial products and services in the market. This consolidation would leverage the combined financial expertise in

both Departments to guard against systemic risk while streamlining regulation and operations. An acknowledgment of an evolving financial

marketplace, Governor Cuomo’s initiative took direct aim at the regulatory gaps that had contributed to the financial crisis.

The Financial Services Law was introduced and passed as part of Governor Cuomo’s 2011 budget. In May 2011, work began to integrate the

Banking and Insurance Departments. On May 16, 2011, Governor Cuomo nominated Benjamin M. Lawsky to serve as New York’s first

Superintendent of Financial Services. Superintendent Lawsky was unanimously confirmed by the Senate on May 24, 2011. The merger became

effective on October 3, 2011.

Superintendent Lawsky has defined three goals for the Department in order to fulfill Governor Cuomo’s mandate,:

• To maintain New York’s position as the world financial capital by modernizing the regulation of financial services and encouraging these

industries to grow and create jobs.

• To guard against systemic risk that leads to financial crises and to

provide to consumers and markets the most effective protection

against fraud.

• To make the Department an example of an efficient, well-run government agency.

The Department is responsible for supervising and regulating the activities of nearly 1,700 insurance companies with assets exceeding $4 trillion

and nearly 1,900 banking and other financial institutions with assets of more than $2.1 trillion. The Department is organized into five divisions:

The Banking and Insurance Divisions each continue to perform the core functions that had been assigned the previous Banking and

Insurance Departments, working to ensure the safety, soundness and solvency of regulated entities and the fair treatment of consumers.

4

The Financial Frauds and Consumer Protection Division (FFCPD) is responsible for protecting and educating consumers and fighting

consumer fraud.

The Real Estate Finance Division is involved with real estate and homeowner issues, as well as such financial services as title insurance and

mortgage insurance.

The Markets Division actively monitors the latest developments and products in the financial services marketplace, so that the Department

can better understand and regulate complex and rapidly changing financial products and services.

Several non-regulatory units in the two former departments have been integrated including administration, information technology and legal

counsel. Due to these and other efforts, DFS has reduced spending by more than 10 percent in just its first year, state fiscal year 2011—2012.

NOTE: This annual report is organized differently than prior reports by the Insurance and Banking Departments. It begins with text describing

the major accomplishments and responsibilities of the Department. The data tables included in prior reports have all been combined in a single

appendix, which follows the text section. In addition, to reduce reproduction costs, data that is posted on the Department website in the

normal course of business, and that has been included in prior reports, is referenced

with a link to its location on the Department website,

www.dfs.ny.gov.

Data in this report are for the most current available year, which in some cases is 2010 and in others 2011. Financial data for the Department is

for fiscal year 2010-2011, during which the Insurance and Banking Departments were still separate entities.

5

MAJOR ACCOMPLISHMENTS

Since its inception, the Department has worked aggressively to protect consumers, prevent systemic risk and encourage financial services to

thrive and create jobs, all while successfully implementing the merger of two large state agencies. The highlights of some of that work are

enumerated below.

Protecting consumers

Mortgage Servicing Reform

The Department sought to protect consumers by correcting abuses in the mortgage servicing industry that contributed to the collapse of the

housing market and the nation’s economic downturn. The Department focused on reforms in the industry by working proactively with

consumer groups and the mortgage industry to find ways to improve various aspects of the mortgage foreclosure process.

The Department took the lead in achieving reforms with eight mortgage servicers, which agreed to a thorough reform program that imposes

new standards and requirements on the servicers, such as discontinuing robo-signing, as well as protecting borrowers who have been subject to

wrongful foreclosure.

The reforms protect consumers by requiring the servicers to employ sufficient staff to properly handle foreclosure volume. For example, there

must be one person—a single point of contact—familiar with each case, so that homeowners do not get the run-around, are treated fairly

without conflicting responses, and have the opportunity to seek loan modifications before they go through a foreclosure.

The eight mortgage servicers that agreed to abide by the new mortgage servicing practices hold more than 1.2 million

loans nationally, with a

total unpaid principal balance of more than $186.1 billion. More than 67,000 of those loans are in New York, with a total unpaid principal

balance of more than $16.8 billion. The Department is working to make these reforms the industry standard going forward.

Protecting Consumers from Costs of Court Delay

In an industry-wide letter to mortgage servicers operating in New York, the Department said servicers should proceed expeditiously to

substitute new counsel in foreclosure cases previously handled by the Steven J. Baum P.C. (Baum) law firm, which closed in November, 2011.

The Department directed that homeowners should not be charged penalties, fees, costs, or interest accrued as the direct result of delays caused

by the Baum firm’s closing and the substitution of counsel.

6

A leading mortgage servicer, Ocwen Financial Corporation, has already signed an agreement with the Department promising to refrain from

charging homeowners for such costs. In an amendment to an agreement reached in September with DFS, Ocwen also agreed not to penalize

homeowners affected by the Baum closing and to adhere to groundbreaking mortgage servicing reforms designed to address troublesome

practices in the servicing industry generally.

Based in Amherst in Erie County, Baum closed after being fined $2 million by the federal government for its foreclosure practices, including

allegations of robo-signing, and after Freddie Mac and Fannie Mae removed the firm from their lists of approved law firms.

The Baum firm represented plaintiffs in an estimated 40% of the foreclosure proceedings in New York in 2010. Servicers across the state now

must hire new counsel, who will have to gather and review case files, and seek court approval of new legal representation. As a result, significant

delays in pending foreclosure cases are expected.

Force-Placed Insurance Investigation

The Department launched a major investigation into force-placed insurance, which is insurance placed by a mortgage lender or servicer, often at

a very high price, when a borrower’s insurance

lapses or does not satisfy the terms of the mortgage loan contract. Consumer advocates,

mortgage bond investors, and federal investigators have alleged that banks and insurers unlawfully place, sell, and reinsure force-placed policies.

Using the Department’s new authority to protect consumers under the insurance, banking, and financial services laws, the Department issued

document requests and subpoenas to mortgage servicers, insurers, and insurance producers as part of an ongoing investigation into force-placed

insurance.

As part of its investigation, the Department will hold public hearings beginning May 17, 2012, in New York City to review whether rates for

force-placed insurance are appropriate or excessive. The hearings will also examine the relationships and payments among insurers, banks,

mortgage servicers and insurance agents and brokers. Fifteen financial services companies have been directed to provide written and oral

testimony at the hearings and answer the Department's questions. The companies include banks, mortgage servicers, insurance agents and

brokers, insurers and reinsurers.

Investigation of Life Insurers’ Claims Practices

As the result of a DFS investigation, insurers are now regularly matching life insurance policies against a reliable death list, rather than simply

waiting for beneficiaries to file claims. The investigation, which is on-going,

has led to tens of millions of dollars being paid to thousands of

beneficiaries.

7

The DFS investigation focused on claims practices by life insurers regarding the use of the U.S. Social Security Administration’s Death Master File

for investigating claims and locating beneficiaries with respect to death benefits under life insurance policies, annuity contracts, and retained asset

accounts. DFS found that many insurers had used the death file to stop annuity payments once a contract holder died, but had not used it to

determine if death benefit payments were owed to beneficiaries under life insurance policies, annuity contracts, or retained asset accounts.

The Department administratively required insurers to perform cross-checks of all life insurance policies, annuity contracts and retained asset

accounts using the latest updated version of the death file, or another database or service at least as comprehensive as the SSA-DMF, to identify

any death benefit payments.

Insurers also were instructed to issue monthly reports to the Department through March 31, 2012, detailing their progress in making payments

based on identifying beneficiaries, though this deadline has been extended. As of April 2012, the investigation has resulted in 32,715 payments to

consumers nationwide totaling $262.2 million, including 7,525 payments totaling $95.9 million to New Yorkers.

Retained Asset Accounts

For many

years, the life insurance industry earned money by holding life insurance payouts of America’s soldiers, veterans, and others in so-

called “retained asset accounts”, instead of paying them out to the beneficiary in a lump sum. By doing so, the insurance companies invested and

earned interest on these funds, until they were withdrawn by survivors.

In many instances, the accounts are not as beneficial to consumers as bank accounts because they are not protected by FDIC insurance, the

interest rates are very low, and the accounts often have limitations on use that do not apply to checks from a bank account.

When this practice was exposed in the summer of 2010, then-Attorney General Cuomo launched an investigation. Now, the Department has in

effect completed the investigation by outlining insurers’ obligations to consumers going forward.

In February 2012, the Department issued Circular Letter No. 4, which governs the use of retained asset accounts. The Letter describes new

procedures concerning the establishment of such accounts, and encourages insurers to implement best practices for existing accounts. Among

other new procedures, insurers should make payment by a single check if a life insurance policy provides for payment of the death benefit in a

lump sum and ensure specific disclosures to beneficiaries where the option of a retained asset account is provided. The new standard applies

unless the purchaser of the policy or the beneficiary specifically asks to receive the money in another form.

New York is the first state in the country to institute this tough pro-consumer policy, which makes a full payment to survivors the new standard

unless individuals expressly choose the option of having a retained asset account.

8

Fairly Reducing Health Insurance Costs

Finding ways to slow the pernicious rise in health care costs and ensuring that New Yorkers have access to affordable, quality health care are

top priorities of the Cuomo Administration. The Department is taking steps to address these issues on multiple fronts.

Implementation of Prior Approval. The Department is working hard to ensure the successful implementation of the new prior approval

law, which was enacted in 2010. Before that law was passed, health insurers could simply file a rate increase with the Insurance Department and

implement it. Now, insurers must seek approval in advance, and the Department has the ability to adjust rates, while carefully considering the

impact of premium increases on consumers against the solvency needs of the insurers. The process also includes the opportunity for public

comment.

In implementing this law, the Department is conscious of the balance that must be struck between keeping health insurance affordable and

making certain that insurers have both the resources to pay claims and incentive to continue to serve the market.

In the two years since prior approval has been in effect, the Department has already saved consumers more than half a billion dollars. Before

prior approval, health insurance premiums were going up an average of 14% a year. In 2011, although

medical costs went up 11%, the

Department held the increase in premiums to 10%. And, for 2012, the Department held the increase to 8% even though medical costs went up

9%.

Greater Transparency on Rate Increases. In October 2011, the Department ordered that all rate applications submitted by health insurers

as part of the prior approval process would be made public to consumers. Initially, some health insurers claimed that their requests for health

insurance premium increases should be confidential. This made it impossible for the public comment aspect of the prior approval process to be

meaningful.

After discussions with the Department, the health insurance industry withdrew its objections to the Department’s order and agreed to make

details of rate increase requests public. This is a huge step toward building transparency, allowing the public to rigorously comment on proposed

rates, and promoting competition. This measure will encourage insurers to hold down their own costs and work with medical providers to hold

down their costs.

Premium Refunds. Under the prior approval law, health insurers must spend at least 82% of premiums on medical claims. Several insurers

missed this minimum, and the Bureau ordered eleven insurance companies to refund $114.5 million to holders

of policies that cover 573,748

people.

9

Affordable Care Act Implementation

DFS worked in conjunction with the Governor’s office, the Department of Health (DOH), other agencies and stakeholders to implement the

federal Affordable Care Act (ACA), which was enacted in March 2010. Specific projects are outlined below.

Health Insurance Exchange. In 2011, the Department worked with DOH and the Governor’s office to introduce a bill to establish a Health

Benefit Exchange as a public authority that would allow consumers to shop for and purchase health insurance coverage. The bill did not pass the

Senate, and in April 2012, Governor Cuomo issued Executive Order No. 42, which established the New York Health Benefit Exchange to be

housed in the Department of Health and operated in conjunction with DFS. New York has received three rounds of Federal grants to help fund

establishment of the Exchange. The Department is working extensively on policy issues, healthcare market reforms, administrative and technical

operations, planning and stakeholder involvement necessary to set up and run the Exchange.

“6 Month Reforms” Legislation. The Department drafted and successfully negotiated a bill to conform New York law to the ACA

insurance reforms that went into effect six months after the enactment of the

ACA. These reforms included restrictions on annual and lifetime

benefits caps, no pre-existing condition exclusions for children, and coverage for dependents to age 26.

New York Bridge Plan (Pre-Existing Condition Insurance Plan). With federal funding under the ACA, the Department established the New

York Bridge Plan, which provides coverage for uninsured people with pre-existing conditions. The Department is working with GHI to

administer the plan. By the end of 2011, the Bridge Plan had enrolled more than 2,500 people. The Department continues to enroll consumers

in this insurance of last resort, helping seriously ill individuals obtain more affordable coverage.

Tropical Storm Disaster Response

Under Governor Cuomo’s direction, disaster response was a first level priority for DFS in its initial months. Flooding of historic proportions

occurred in many areas of New York State in August 2011 and again in September when two tropical storms hit the state and caused severe

damage. The Department assisted thousands of homeowners, renters and business owners, pressed insurers to respond to claims promptly and

fairly, and later worked with the federal government to set national disaster response policy. In responding to losses caused by Tropical Storms

Irene and Lee:

DFS personnel staffed Disaster

Recovery Centers at 24 locations in flood-affected areas and overall nearly 90 members of the agency were

directly involved in recovery efforts.

10

The Department’s Mobile Command Center, a 35-foot vehicle staffed with consumer services professionals and equipped with communications

equipment, was dispatched to help insurance policyholders in both Upstate and Downstate locations.

The Department activated the Insurance Emergency Operations Center (IEOC), a joint Department and industry operation staffed by insurance

company representatives and Department professionals. The IEOC was used to coordinate the efforts of insurance companies and help insurers

process claims more quickly to support policyholders faster and more efficiently.

The Department staffed a special disaster hotline that operated seven days a week and helped nearly 1,100 consumers who called with questions

about homeowners’, renters’ and business insurance.

The Department issued more than 9,200 temporary insurance adjuster licenses. This allowed insurers to bring in adjusters from all over the

United States so that properties could be inspected quickly and policyholder claims processed faster.

Post-disaster data filed with the Department by property/casualty insurance companies indicated that more than 85,000 personal and

commercial claims were filed with insurers, for an estimated value of more than $300 million.

As a consequence of its disaster recovery efforts, DFS helped establish national policy on flood disaster response after discussions with the

Federal Emergency Management

Agency (FEMA), which administers the National Flood Insurance Program (NFIP). For most homeowners and

businesses, NFIP insurance policies are their only protection against flood damage. The policies are sold through property casualty insurers.

The new national policy came in the form of a bulletin issued by FEMA to insurance companies. The bulletin instructed insurers to work with

state regulators in ensuring fairness and promptness in servicing customers with federal flood insurance. FEMA had originally asserted that state

regulators had no role in overseeing claims processing for flood insurance.

Consumer Recoveries

Department investigations into consumer complaints against insurance companies led to the recovery of $28 million for 3,496 consumers in

2011. The Department also instructed insurers to offer to reinstate 70,440 policies which had been improperly cancelled. These offers to

reinstate policies benefitted 14,590 homeowners whose policies were cancelled because an insurer improperly billed consumers for premium

amounts not yet in arrears. Also, insurers were directed to offer to reinstate 751 improperly cancelled personal lines policies and another 900

homeowners’ policies improperly allowed to expire because the insurer failed to send cancellation notices to its policyholders. In addition,

Department investigations into complaints from doctors, hospitals and other medical providers about unpaid claims led to the payment of $33.3

million from insurers to these providers.

11

First Personal Auto Usage Based Insurance Discount Program

The Department approved the first Personal Auto Usage Based Insurance (UBI) Discount program. The UBI program was approved for

Progressive Advanced Insurance Company, effective December 3, 2010 for new policies and February 1, 2011 for renewals. Policyholders who

choose to participate in this new optional rating program can earn a discount based on their individual driving patterns. Under the program, the

insurance company provides a device that is connected to the computer of the insured’s vehicle. The device records and uploads data on the

insured’s driving patterns for a specified period, and if the data collected indicates a discount is warranted, the discount percentage will be

calculated and applied to the policy. The final calculated discount will remain on the vehicle for the life of the policy. No policyholder will see an

increase in premium due to the data collected from this program. The device is returned to the company at the end of the data collection

period.

Additionally, the Department has approved optional miles-driven discount programs that do not use a data collection device. The discount for

such programs is based solely on the annual miles driven for

each policy period, as reported by the policyholder. Both types of programs allow

policyholders to potentially reduce their premiums, especially those who drive infrequently.

Maintaining a Competitive Market for Auto Insurance

Motorists are required to have insurance on their motor vehicles. When they are unable to receive coverage from insurance companies,

motorists are placed in the assigned risk pool, which requires them to pay substantially higher premiums. One sign of the competitiveness of the

auto insurance market is the percentage of drivers in the assigned risk pool, which is known as the New York Automobile Insurance Plan.

The number of vehicles insured in the Plan has remained at historically low levels and has even decreased by 15% at year end 2011, compared to

year end 2010. Less than 1% of New York private passenger registered vehicles are insured in the Plan. It had been as high as 17% less than two

decades ago. The stability in the Plan’s population can be attributed, at least in part, to various Department initiatives, including incentives to

voluntary market insurers that provide coverage to drivers who otherwise would have been placed in the Plan.

Protecting Seniors from Insurance Agents Claiming False Expertise

Seniors in New York are protected by two new regulations to combat misleading practices in the sales of annuities and life insurance to senior

citizens and other consumers. The Department acted in response to cases where seniors have been convinced to buy or replace existing

annuities with new annuities that are not in their best interests. The two emergency regulations:

12

Require that only a suitable annuity, based on a consumer’s financial situation and needs, be recommended to a consumer by an insurer, agent or

broker.

Prohibit insurance agents and brokers from using titles, such as “certified senior advisor”, that suggest they have special expertise on issues

regarding seniors when, in fact, they have no such qualifications.

The first regulation requires agents and brokers to consider the insurance needs and financial objectives of the consumer, based on the facts

disclosed by the consumer, when recommending an annuity contract for purchase or replacement

The second regulation addresses the fact that some agents and brokers use misleading titles, such as “certified elder planning specialist” or a

“certified senior advisor” to gain seniors’ confidence in order to sell them insurance products. Many of these titles are obtained by agents and

brokers by simply paying a fee. In recent years, the media have reported cases of sales to elderly clients, resulting in the loss of seniors’ savings,

by agents or brokers utilizing these misleading titles.

This regulation prohibits the use of these misleading titles and fraudulent marketing practices linked to the use of such titles in the solicitation,

sale, or purchase of,

or advice made in connection with a life insurance policy or annuity contract.

Encouraging the Growth of Industry

Enhancing the New York State Bank Charter

Banks that do business in New York State have the option of choosing a New York State or a federal charter. Although the advent of interstate

banking, with its need for regulatory uniformity, led many large banks to operate nationally, an opportunity now exists to reverse this trend. In

fact, the banking industry has encouraged DFS to aggressively promote the State option. State charter fees are significantly lower than the federal

charter fees and DFS looks to attract more banks by highlighting the advantages of a State charter.

Banks recognize that having the State charter provides greater potential for dialogue with regulators on issues important to the banks. Banks

also recognize the wealth of knowledge DFS has on local consumer issues. The New York State charter allows banks to be supervised by

regulators who are more accessible, flexible and responsive than their federal counterparts due to a greater understanding of their home

markets. By being more closely attuned to local institutions’ needs and markets, state regulators are better able to provide supervisory guidance

and support

during challenging economic periods. State regulators have a strong history of consumer protection, taking an early lead on anti-

predatory lending laws and foreclosure prevention, and reaching landmark settlements with large mortgage bankers.

13

Fostering a strong regulatory landscape

On December 31, 2011, DFS announced that Elmira Savings Bank was the first bank to convert to a New York State charter since the

Department’s inception. Several federal savings banks in New York are in the process of submitting applications for conversion to a State

charter as well.

It is the Department’s goal to cultivate a culture of superior service that will both satisfy the needs of existing State chartered banks while

encouraging others to seriously consider the State option.

The Financial Services Law created the State Bank Charter Advisory Board to assist the Department in encouraging the growth in state

chartered banks. In March 2012, Superintendent Lawsky announced the appointments of nine banking professionals to serve on the advisory

board. The banking professionals represent banks with a range of assets.

Workers’ Compensation Fraud

DFS demonstrated its ongoing commitment to fighting workers’ compensation fraud when 18 individuals in 13 counties were arrested in

December. The arrests were the culmination of a series of investigations led by DFS.

The investigations and subsequent arrests focused on identifying individuals who were collecting workers’ compensation benefits even though

they were ineligible. For example, some of the individuals

improperly obtained benefits while secretly working; others collected compensation

after faking injuries or filing false documentation.

Workers’ compensation fraud affects everyone because all honest New York businesses and taxpayers are forced to shoulder the burden of

higher premiums, unnecessarily driving up the cost of doing business in New York. The Department will continue to make fighting workers’

compensation fraud a priority.

Implementation of Commercial Modernization

14

On August 17, 2011, the Governor signed Chapter 490 of the Laws of 2011, modernizing the regulation of commercial lines insurance. The bill

amended Article 63 of the Insurance Law to add a new “Class Three” to the special risk provisions, commonly referred to as the Free Trade

Zone. Subject to specific conditions listed in the law, forms and rates for policies eligible to be written as Class 3 risks do not need to be filed

with the Department for prior approval. DFS then introduced the regulations required to implement the law.

Under the new measure, insurers are exempt from rate filing and form approval requirements when issuing qualified policies to businesses or

entities, like municipalities, that generate annual commercial risk insurance premiums totaling more than $25,000 for certain kinds of

property/casualty insurance. In addition, policyholders must retain special risk managers to assist in negotiating and purchasing the policies.

Insurers using the exemption must file with the Superintendent a certificate of insurance documenting the terms of the policy within one

business day of binding the insurance coverage. The new law and regulation promise to enhance the ability of insurers to underwrite large

commercial policyholders in New York, increase speed to market for certain insurance products not currently exempted, and eliminate barriers

to economic development in New York.

The Department will monitor the implementation of Chapter 490 and the

amendment to Regulation 86, and will address issues from industry as

they arise.

Modernizing Insurance Policy and Rate Review

In all three insurance bureaus, DFS is implementing numerous improvements to streamline its process for the review of rate, policy, license and

other industry filings. It is anticipated that a more efficient and focused Rate and Form Filing Process would better protect consumers, help

enhance competition in the insurance industry, and reduce unnecessary costs and burdens on regulated entities.

Improvements include:

• Elimination of non-essential, duplicative, time-wasting requirements.

• Standardizing checklists and exhibits to streamline rate filings.

• Accessing rate applications is now possible online.

• Improving requests for information for better, more complete market data.

• Better communication with industry on rate reviews—both the policy and process.

15

• Meeting with insurance companies to go over rate decisions.

• Providing understanding on the criteria used to make the rate decisions.

• Establishing the Fund

As part of an effort to reduce medical malpractice costs, the State has created a fund to pay the health care costs of plaintiffs. Chapter 59 of the

Laws of 2011 amended Article 29-D of the Public Health Law to create the Medical Indemnity Fund (“Fund”). The Fund is designed to pay all

future costs necessary to meet the health care needs of plaintiffs in medical malpractice actions who have received either court-approved

settlements or judgments deeming the plaintiffs’ neurological impairments to be birth-related. The purpose of the Fund is two-fold: 1) to pay or

reimburse costs necessary to meet the health care needs of a “qualified plaintiff” throughout his or her lifetime; and 2) to lower the expenses

associated with medical malpractice litigation throughout the health care system.

Pursuant to statute, the Department of Financial Services is charged with implementing the Fund which became operational on October 1, 2011.

The Department recently engaged a third party administrator to administer the Fund, and is working closely with the

administrator to ensure

that plaintiffs receive needed care. As of December 2011, nine plaintiffs had enrolled in the Fund.

Increasing Competition in the Reinsurance Market

The Department acted to strengthen reinsurance business activity in New York by relaxing the unnecessarily high 100 percent collateral

requirement that had previously been imposed on many large and financially strong alien reinsurers. Twenty property/casualty and life reinsurers

met the Department’s criteria under a new regulation that enables them to write new reinsurance contracts and renew existing contracts under

the new collateral requirement. Under the new regulation, the certified reinsurers post collateral based on a sliding scale, instead of the former

100 percent collateral requirement. This development helps cement New York’s reputation as an innovative and forward-thinking global financial

services center.

On-Going Efforts

A key priority of the Department is to make the examination process less complex and more modern and efficient. A DFS internal working

group has been formed to identify critical issues in the examination process, make recommendations, and outline an action plan. Among other

areas, the working group is looking at improvements that can be made in the following areas:

• Further strengthening the training of examiners.

• Enhancing IT components of exams.

16

• Improving timeliness of report issuance.

• Increasing financial analysts’ involvement in risk-focused surveillance.

• Improving the administrative aspects of the exam process, such as vendor management, contracts, billing hours and invoices.

• Setting new standards for timely response to industry filings.

DFS-regulated entities make numerous filings with the Department, including filings required to sell new products or adjust prices of existing

products. It is essential that the industry receive prompt responses to those filings to be able to conduct business. A timely rejection is often

preferable to long delays with no decision because it allows a business to make adjustments and go forward.

In order to improve response time, the Department is taking various actions, including the creation of a 45-day list documenting all pending

matters without a decision for more than 45 days. The list will be used internally to better monitor departmental responsiveness and to

encourage faster and more efficient decision making. Going forward, the Department is working on developing procedures that will allow it to

provide prompt final determinations or, when that is not possible, to identify problems so they can be discussed with the filing entity.

These efforts have already substantially reduced backlogs of filings waiting for review. As of October, 2011, the Property Bureau had 860 filings

that had been open, on average, for 91 days. By the end of April 2012, Property had 601 filings that had been open, on average, for 47 days.

Over the same time period, the Health Bureau went from 504 filings open on average 96 days to 221 open on average 65 days. And the Life

Bureau cut its backlog from 156 filings open on average 80 days to 114 filings open an average of 33 days.

Enhancing the Banking Development District Program

The Banking Development District (BDD) program is a program designed to encourage the establishment of bank branches in areas across

New York State where there is a demonstrated need for banking services. Banks can play an important role in promoting individual wealth,

homeownership, community development, and neighborhood revitalization. An aim of the program is to enhance access to financial services to

consumers, who may have little or no relationship with the banking industry, and to promote local economic development. Moreover, the

establishment of a bank branch can provide a foundation to stimulate the local

economy by enhancing access to capital for local businesses.

Currently, 70% of the BDDs are located within New York City and there is a demand for more BDDs to be available in Upstate New York. DFS

is aware of this discrepancy and is committed to increasing awareness of the BDD program in Upstate New York.

17

In the third quarter of 2011, DFS participated in a roundtable on BDDs, in which the Department presented its plans and recommendations for

improving the BDD program, including:

• Requiring that BDD branches provide financial education to residents and businesses within their districts and submit their plans to DFS;

• Amending application and renewal forms to require that applicants offer affordable banking products and services;

• Streamlining application and renewal forms for the BDD program.

The Department will continue to work with local government officials, community groups, and consumers to effectively expand the BDD

program further.

Improving Response to Consumer Complaints

DFS has instituted a new process for the resolution of consumer complaints that will result not only in improved efficiency but also enhanced

services for consumers. DFS receives approximately 160,000 calls and 50,000 complaints annually. Given the volume of traffic the consumer

complaint division receives, consumers and regulated entities often experience a delay in receiving needed information. DFS has therefore begun

to examine ways to enhance its use of technology and improve the public’s use of the Department’s website with an eye towards ultimately

reducing the number of calls received in the first place. DFS also recently executed

an agreement with the Department of Taxation and Finance

to provide Call Center Services for DFS. Implementation of this initiative, which will reduce costs, increase efficiency and improve customer

service, began on January 3, 2012.

Legal Modernization

The Department formed a working group to examine whether existing banking and insurance laws need to be updated to provide additional

tools to DFS to regulate more effectively or eliminate burdensome requirements for the industry that do not result in increased protections for

consumers. The Superintendent is reviewing the recommendations of the working group and is considering proposing legislative and/or

regulatory changes based on the recommendations.

18

INSURANCE DIVISION OVERVIEW

In 2011, the Insurance Division regulated nearly 1,700 insurance companies with assets exceeding $4 trillion. The Division includes the Property,

Life and Health Bureaus.

Property Bureau

The Property Bureau regulates more than 800 property/casualty insurance companies licensed in New York writing net premiums totaling more

than $312 billion.

The Property Bureau oversees the financial condition and market conduct of property and casualty insurance companies in order to monitor the

financial solvency of licensees and to maintain an equitable marketplace for policyholders.

The Bureau’s Market Section reviews policy forms and rate filings for all lines of business, including review of workers’ compensation, private

passenger and public automobile and medical malpractice insurance rates. In addition, the Market Section oversees the American Arbitration

Association’s (AAA) administration of conciliation and arbitration of no-fault auto insurance claims disputes and is responsible for overall

supervision of the excess and surplus lines insurance market, as well as purchasing groups organized pursuant to the federal Risk Retention Act.

The Bureau’s Financial Section conducts examinations and analyses, including reviewing and monitoring the financial condition of regulated

entities; reviewing mergers, acquisitions and transactions within holding company systems; reviewing applications for licensing of domestic

and

foreign insurers; reviewing applications for accreditation of foreign and alien reinsurers; reviewing applications to qualify as a certified reinsurer;

and reviewing applications for registration as a service contract provider.

Health Bureau

The Health Bureau regulates health insurers with total assets of $34.5 million and premiums totaling $58.5 million

The Health Bureau has responsibility for all aspects of health insurance regulation, including the premium rates and policy forms; legal aspects of

health insurance, including compliance, drafting regulations and legislation; and reviewing discontinuances of health insurance coverage.

The Bureau also regulates the fiscal solvency of accident and health insurance companies, Article 43 not-for-profit health plans, health

maintenance organizations (HMOs), municipal cooperative health benefits plans and continuing care retirement communities, including review of

financial statements and holding company transactions.

19

The Bureau conducts financial and market conduct examinations to ensure compliance with statutory and financial solvency requirements, as

well as proper treatment of policyholders. The financial examinations focus on high risk areas of an entity’s operations and include corporate

governance, internal controls, current and prospective risk assessment, and review of material transactions.

The Bureau also runs the Healthy NY program, the COBRA program and Brooklyn Healthworks, which provide insurance coverage to

vulnerable small businesses and individuals meeting certain eligibility criteria. In addition, the Bureau oversees the Market Stabilization Pools, the

Healthy NY Stop Loss Funds and the Direct Payment Stop Loss Funds which are risk adjustment mechanisms for individual, small group and

Medicare Supplement coverage.

In addition, the Bureau is responsible for implementing New York’s prior approval legislation and works closely with the Governor’s Office on

implementing federal health care reform.

The Department secured more than $4 million in federal funding to help improve its rate review process, including hiring actuaries, funding

improved data collection, and improving audit capacity to ensure rates are accurately and fairly reviewed.

Life Bureau

The Life Bureau supervises more than 595 regulated entities, including 132 licensed life insurance companies with assets of

more than $1 trillion

and premiums of more than $223 billion.

The 132 life insurers supervised by the bureau include 79 domiciled in New York and 53 foreign domiciled insurers. In addition, the bureau

supervises: 37 fraternal benefit societies; 12 retirement systems, including four private pension funds and eight governmental systems; nine

governmental variable supplements funds; 312 charitable annuity funds; 22 employee welfare funds; 31 life settlement providers (including 24

entities permitted to operate as life settlement providers pending approval or disapproval of their applications for licensure and contract forms);

35 accredited reinsurers and five certified reinsurers.

The Life Bureau regulates financial condition through: the establishment and application of financial standards (risk based capital (RBC), reserves,

accounting, etc.); the periodic examination of insurance companies’ financial activities; the evaluation of reserve adequacy and liquidity and other

risks; the review of life products for self-support and potentially excessive risk; and the analysis of financial statements and actuarial reports and

opinions submitted by regulated entities. Such Bureau processes are performed to verify that statutory and regulatory financial standards are

met and to ensure that insurers can meet their financial and contractual obligations.

The Life Bureau regulates market conduct through:

the establishment of market conduct standards (product provisions, replacements, claims

practices, etc.); the periodic examination of insurance companies’ sales and marketing practices and treatment of policyholders; the investigation

of specific or targeted market activities; and the analysis of market data. These processes are performed to: ensure compliance with statutory

20

and regulatory requirements; ensure that policyholders are treated fairly and equitably by insurers in accordance with prescribed standards of

conduct; and protect the marketplace by preventing and/or limiting practices that constitute unfair trade practices or unfair methods of

competition.

The Life Bureau reviews and approves life insurance policies, annuity contracts, funding agreements, and all other agreements and policy forms

relating thereto submitted by authorized life authorized life insurers and other regulated entities for sale in New York to individual or group

consumers for compliance with applicable laws, rules and regulations. Legal and actuarial reviews are performed to ensure that New York

consumers receive the protection afforded by New York law and regulations and to ensure that such consumers are treated in a fair and

equitable manner by authorized life insurers and other regulated entities.

The Life Bureau regulates the corporate conduct of authorized insurers through: the establishment of corporate standards (corporate

governance, holding company, licensing requirements, etc.); the enforcement of statutory and regulatory corporate governance standards; and

the review and approval of activities including licensing, corporate reorganizations, mergers, acquisitions, demutualizations and holding company

transactions. In so doing, the Bureau verifies that statutory and regulatory requirements are met; ensures

the prudent conduct of insurers; and

protects policyholder interests.

BANKING DIVISION OVERVIEW

Community and Regional Banks

Community and Regional Banks (CRB) is responsible for the prudential regulation of community and regional banks, credit unions and other

depository institutions through annual and periodic target examinations and continuous supervision. CRB staff review the compliance of the

supervised institutions with applicable New York State and Federal laws and regulations. CRB partners with the Federal Deposit Insurance

Corporation (FDIC), the Federal Reserve Bank of New York (FRB), and the National Credit Union Administration (NCUA) in joint supervision.

In 2011, CRB had supervisory oversight of a total of 83 banks and savings institutions, including 52 commercial banks, 20 savings banks, 10

limited-purpose commercial banks and one savings and loan association. CRB also provides regulatory supervision for 20 credit unions with total

assets ranging from $1 million to $1.7 billion, limited purpose trust companies, charitable foundations, bank holding companies, and three New

York State regulated corporations. The aggregate assets of institutions supervised by CRB are more than $231 billion.

During 2011, capital, asset quality and liquidity concerns lessened as the economic environment improved along with the outlook for institutions

supervised by CRB.

No CRB institutions were closed during the year compared with 3 closings in 2010.

21

The nation’s banking system allows banks to choose a state charter or national charter. Weighing the relative advantages of a state charter to a

federal thrift charter, many thrift institutions concluded in late 2011 that the state charter was preferred. The Elmira Savings Bank, FSB, the first

of many federal thrifts to apply to convert to a state charter, became a New York State-chartered stock-form savings bank under the name

Elmira Savings Bank, on December 31, 2011.

Foreign And Wholesale Banks

During 2011, banks from India, China, South America and Europe approached DFS regarding the possibility of opening a branch, agency or

representative office in New York. Furthermore, during 2011, DFS accepted new applications to open foreign branches and representative

offices and has issued licenses to such institutions as Banca Popolare di Vicenza and licensed a second branch of State Bank of India in Jackson

Heights, New York. DFS will issue more new licenses in the coming months.

From the interest our banking community has shown this year, it is clear that a New York presence continues to be an attractive prospect for

foreign banks regardless of global economic concerns.

Licensed Financial Services

The Licensed Financial

Services Division (LFS) supervises budget planners, check cashers, licensed lenders, money transmitters, premium

finance agencies, and sales finance companies. At year end 2011, the Department of Financial Services had regulatory oversight of 47 budget

planners, 177 check cashers, 19 licensed lenders, 73 money transmitters, 58 premium finance agencies, and 99 sales finance companies.

While there has been some improvement in economic conditions in 2011, we continued to witness consolidation in certain industries.

Consumer lending and check cashing were the areas primarily affected by mergers, acquisitions, additional cost cutting and business closures.

Although the number of licensees declined again, the overall levels of service available to New York consumers remained stable, with no adverse

effect noted by consumer groups.

Mortgage Banking

At year end 2011, Mortgage Banking supervised 910 registered mortgage brokers and 156 licensed mortgage bankers operating through 1,208

and 672 branch offices, respectively. Mortgage Banking also has supervisory authority for 21 registered mortgage loan servicers.

The number of regulated companies engaging in mortgage loan origination activities in New York State declined 21% between calendar year end

2010 and 2011. Since the onset of the mortgage meltdown, there has been a continuous decline in the number of

entities regulated by the

Department, dropping more than 50% from the figures reported at year-end 2007.

Although Mortgage Banking experienced a slight increase in mortgage banker applications during 2011, the uptick was fueled primarily by

provisions in Dodd-Frank eliminating the licensing preemption for national banking subsidiaries. In addition, the Department amended Part 39 of

22

the General Regulations to eliminate exemptions previously granted for certain products, including Home Equity Line of Credit and to banking

subsidiaries.

In 2011, Mortgage Banking responded aggressively to the robo-signing crisis by conducting examinations of mortgage loan servicers’ foreclosure

and loss mitigation practices. Mortgage Banking also assisted in drafting agreements with several servicers outlining best practice standards for

such servicers to use in managing its servicing operations and loss mitigation and foreclosure processes.

Mortgage Banking also assisted in returning monies improperly charged to consumers by directing institutions to make consumer restitution

totaling $597,328. Enforcement actions were also taken against several companies for deceptive advertisement, unlicensed activity and failing to

comply with laws and regulations, resulting in penalties of $435,100.

Accounting developments

The Securities and Exchange Commission (SEC) continues to study whether to require or permit U.S. public companies to comply with

International Financial Reporting Standards rather than U.S. Generally Accepted Accounting Principles. A decision is expected in 2012. In 2011

the former Banking Department submitted a comment letter in response to the latest SEC proposal, as also occurred in 2007 and 2009. DFS

and Banking Department comment letters are available on the DFS website.

FINANCIAL FRAUDS AND CONSUMER PROTECTION DIVISION (FFCPD) OVERVIEW

The Department’s Financial Frauds and Consumer Protection Division (FFCPD) is responsible for combating fraud against entities regulated

under the banking and insurance laws, as well as frauds against consumers. The Division also investigates consumer complaints and conducts

performance evaluation activities in the areas of consumer compliance, fair lending and the Community Reinvestment Act.

The FFCPD encompasses a Civil Investigation Unit, a Criminal Investigation Unit (comprising the bureaus handling banking criminal investigations

and insurance and financial frauds); the Consumer Assistance Unit (“CAU”), which includes the Holocaust Claims Processing Office; a Consumer

Examinations Unit and a Consumer Education and Outreach Unit.

As required by the Financial Services Law, the FFCPD submitted an Annual Report on its activities in 2011 on March 15, 2012. The complete

report can be found on the DFS website at http://www.dfs.ny.gov/reportpub/annualrep.htm

Following are highlights from that report:

23

Civil Investigations

The Civil Investigation Unit includes a staff of attorneys investigating civil financial fraud, consumer law, banking law and insurance law violations,

a unit conducting investigations of licensed insurance producers, and a staff of attorneys who bring disciplinary proceedings against insurance

producers for violations of the insurance law. Some of the Unit’s investigations, activities and initiatives since the FFCPD began its work on

October 3, 2011, are mentioned earlier in this Report. Those investigations and initiatives include securing agreements from eight mortgage

servicers to reform their servicing and foreclosure processes; the force-placed insurance investigation; the investigation, together with the Life

Bureau, of life insurers’ claims practices; and assisting in the Department’s issuance in February 2012 of a Circular Letter (No. 4) governing the

use of retained asset accounts.

The Civil Investigations Unit also consists of disciplinary attorneys and examiners who oversee the activities of licensed individuals and entities

who conduct insurance business in New York State. The goals of the Unit are to protect the public and ensure that licensees act in accordance

with applicable insurance laws and Department regulations. The Unit is conducting an ongoing investigation into the improper sale of annuities

and variable life contracts by companies not authorized to conduct business in New York that has already led to disciplinary action against more

than 50 agents and fines of more than $1.7 million

Criminal Investigations

The FFCPD combined the responsibilities of the Insurance Fraud Bureau from the Insurance Department and the Criminal Investigations Bureau

from the Banking Department. As currently constituted, the Criminal Investigations Unit (“CIU”) conducts specialized investigations into

criminal conduct involving the financial services industry and works cooperatively with law enforcement and regulatory agencies at the federal,

state, county and local levels.

Banking: The Department conducts criminal investigations into possible violations of the federal Bank Secrecy Act, federal and state anti-money

laundering laws and related regulations, and possible violations of the federal Office of Foreign Asset Control laws and related regulations. As a

result of multi-year, multi-agency investigations, three foreign banking institutions entered into Deferred Prosecution Agreements and paid

penalties in excess of $1.2 billion. Throughout New York State, the CIU participates in numerous federal, state, county and local mortgage fraud

investigations. Since its inception in April 2007, the CIU has participated in a numerous investigations which have culminated in charges against

over 160 persons and involved in excess of $ 369 million.

The Criminal Investigations Unit conducted 112 investigations which led to 33 convictions in 2011. A total of 83 new cases were opened for

investigation and Mortgage Fraud Unit investigations resulted in 23 arrests stemming from cases involving more than $33 million in losses to

victimized homeowners and financial institutions.

Insurance: The CIU recorded 703 arrests during 2011, with arrests for health care fraud (private health care, no-fault and disability) totaling

210. A focus on workers’ compensation fraud increased arrests by 24.4 % in 2011. The number of convictions obtained by prosecutors in CIU

24

cases totaled 401 for the year. In addition, the CIU received 23,422 reports of suspected fraud in 2011; no-fault fraud accounted for 11,974 or

51%. Court-ordered restitution totaled $34 million for the year. Currently the CIU has 1,919 cases open for investigation statewide.

The top priority currently is the no-fault initiative, focusing on investigations involving staged/caused accidents and fraudulent billing by medical

mills. Referrals alleging no-fault fraud have accounted for more than 50 percent of all fraud referrals since 2007.

Every insurance company writing at least 3,000 private or commercial automobile, workers’ compensation and accident and health insurance

policies in New York State are required to file a Fraud Prevention Plan with the DFS and establish a Special Investigations Unit (SIU).

Department Examiners review these Plans for compliance with Department Regulation 95. Approval of the Plans is required.

Consumer Assistance Unit (CAU)

The Division’s Consumer Assistance Unit (CAU) is responsible for receiving, investigating and resolving consumer complaints. Individual units

focus on insurance and banking related matters.

The Insurance CAU received and opened 43,719 new cases in 2011; the Unit processed and closed 43,367 cases in 2011. The Unit responded to

35,177 e-mails and 102,887 telephone calls.

As a result of the Unit’s work, consumers received refunds from insurers, as well as reinstatement of lapsed coverage, payment for denied

medical claims, or coverage of disaster-related claims that had been previously denied. The Unit was successful in gaining $28 million in

recoveries for 3,496 consumers. The Department instructed insurers to offer to reinstate 70,440 policies.

The Banking CAU received a total of 3,370 written complaints of which 2,190 (65 percent) were mortgage related and 59,190 telephone

inquiries of which 13,446 (23 percent) were mortgage related. CAU recovered a total of $83,320 in restitution for consumers, of which $51,307

(62 percent) was mortgage related. Staff responding to consumer complaints and questions through the Department’s toll- free number can take

calls in English, Spanish, Russian and Cantonese.

Consumer Examinations Unit

The Consumer Examination Unit (CEU) is responsible for performing consumer compliance, fair lending and Community Reinvestment Act

(CRA) examinations. In 2011, CEU conducted 23 CRA, 28 consumer compliance, and 41 fair lending examinations. As a result of consumer

compliance examinations in 2011, CEU uncovered depository institutions overcharging consumers for service charges on dormant accounts and

check return items and objectionable practices in overdraft programs. This resulted in restitution totaling $16,000 to aggrieved consumers. As a

result of fair lending examinations in 2011 involving mortgage bankers and brokers, CEU uncovered comingled fees, and fees charged to

consumers that were not itemized on the final Good Faith Estimate. CEU is seeking refunds for aggrieved consumers.

25

Community Development

In 2011, the Community Development Unit (CDU) continued to address significant consumer issues. The Department partnered with the

Manhattan Borough President’s Office in initiating the Bank on Manhattan project, which seeks to promote banking services for the unbanked

through the development of a low-cost checking account. The Department hosted the first Annual Banking Development District (BDD)

meeting with all of the participating banks, to discuss and address some of the issues discussed in the Department’s report on the BDD Program.

The meeting resulted in greater understanding of the renewal recommendation process and understanding of the new financial education

requirement. The Department participated in two public hearings on BDD, the first hearing focused on clarifying the goals of the BDD program

and the criteria by which a BDD branch’s effectiveness is to be measured and the second hearing focused on discussing the steps involved in

establishing a new BDD branch.

Holocaust Claims

The Holocaust Claims Processing Office (HCPO) was created in 1997 to help Holocaust victims and their heirs recover assets deposited in

banks, unpaid proceeds of insurance policies issued by European insurers, and artworks that were lost, looted or sold under duress. The Office

accepts claims for Holocaust-era looted assets from anywhere in the world and charges no fees for its services. From its inception through

December 2011, HCPO has responded to more than 13,000 inquiries and received claims from 4,912 individuals from 45 states, the District of

Columbia and 39 countries. HCPO has successfully closed the cases of 2,125 individuals in which either an offer was accepted, the claims

process to which the claim was submitted issued a final determination, the assets claimed had been previously compensated via a postwar

restitution or compensation proceeding, or otherwise handled appropriately (i.e. in accordance with the original account holders’ wishes). The

claims of 2,787 individuals remain open.

The combined total of offers extended to HCPO claimants for bank, insurance, and other asset losses amounts to $158,292,370 and a total of

56 cultural objects have been restituted.

The HCPO annual report is available at http://www.dfs.ny.gov/reportpub/annualrep.htm

MARKETS DIVISION OVERVIEW

The Markets Division is a combination of the former Research and Technical Assistance Division of the Banking Department and the Capital

Markets Bureau of the Insurance Department. The combined group functions as a service provider for the entirety of DFS, offering specialists in

all aspects of capital markets including fixed income, equities, derivatives, swaps, modeling, futures, and commodities. The Markets Division also

offers expertise in conducting other technical examinations through its specialist teams in the arenas of: Information Technology, Fiduciary and

security operations, and Internal Control and Audit.

26

The Division likewise provides research, surveillance, accounting, enterprise risk and BSA/AML expertise in support of the Department’s

mission.

While Markets is a service arm to the other operating divisions within DFS, it also owns several relationships where it has primary supervisory

responsibility. These include the financial guarantors and several state-wide retirement systems.

Department training function also resides within this division. The training unit arranges, schedules and conducts training programs throughout

the year. Training is responsible for the Examiner training program and for continuing education of examiners ensuring that DFS maintains an

effective work force.

Since the formation of DFS, the Markets Division has jointly worked with the Banking and Insurance Divisions on examinations and training, and

the group continues to work on synthesizing examination processes and identifying commonalities and synergies where they exist.

REAL ESTATE DIVISION OVERVIEW

In October of 2011, Governor Cuomo announced the formation of a Real Estate Finance Division within the New York State Department of

Financial Services. The announcement was in direct response to the disastrous real estate market collapse that negatively affected almost every

New York State resident. It was observed that as a result of lax regulation, illegal and unethical marketplace manipulations took place where

mortgage fraud, consumer abuse, and excessive capital market risks were allowed to proliferate without transparency, proper disclosure or

meaningful oversight.

As a result, the Real Estate Finance Division is responsible for regulating all real estate and homeowner issues, ranging from mortgage origination

and servicing to title and mortgage insurance to the foreclosure crisis.

Foreclosure Relief Unit

In the 2012 State of the State address, Governor Cuomo announced the formation of the foreclosure Relief Unit. DFS was directed to use

resources available to assist homeowners already in foreclosure and those at risk of foreclosure. The Foreclosure Relief Unit (FRU) within DFS

deals exclusively with providing assistance.

In order to reach homeowners hardest hit by foreclosure DFS has sent its mobile command center, 36-foot long vehicle, to visit communities

statewide that have been disproportionately hit with foreclosures. DFS specialists assess where homeowners are in the pre-foreclosure or

foreclosure process and provide homeowners information about specific loan modifications available under federal law. The FRU also take

27

complaints from homeowners who believe they were subjected to lender or mortgage servicer abuses so these cases can be investigated by the

Department.

To date, the FRU has visited sites in the counties of Suffolk, Nassau, Rockland and Sullivan as well as Middletown, Schenectady, Brooklyn and the

Bronx.

In addition to the citizen outreach component under the Foreclosure Relief Unit, the Real Estate Finance Division is working with lenders as well

as the courts to improve upon the current foreclosure process. It was decided that DFS can most directly contribute to the relief effort by

affecting a regulatory scheme that would require greater lender involvement and accountability in the loss mitigation process envisioned by

applicable federal relief programs.

OFFICE OF GENERAL COUNSEL OVERVIEW

The Office of General Counsel (OGC) provides legal advice to the Superintendent of Financial Services and other Department officials regarding

the construction, application and enforcement of the Banking, Insurance, and Financial Services Laws and associated regulations, including

providing informal advice, written opinions and interpretive letters to Department staff, as well as members of the public. OGC supports the

Department’s administrative operations, such as drafting contracts, Requests For Proposals and other Department procurement documents and

ensuring the legal sufficiency

of all contract documents; reviewing applications made by regulated entities for incorporation and licensing, charter

and by-law amendments, mergers, and name approvals; managing the receipt of subpoenas served on the Department and substituted service of

legal process on insurers and licensed branches and agencies of foreign banking corporations; providing advice regarding the State ethics laws;

and managing and responding to Freedom of Information Law requests made to the Department.

OGC also plays a prominent role in carrying out the Department’s legislative responsibilities, including the drafting of proposed legislation and

commenting to the Governor’s Counsel’s office on bills affecting the Department. In 2011, for example, OGC helped to draft a variety of

banking and insurance-related laws, requiring insurers to cover orally administered anticancer treatment no less favorably than intravenous or

injected chemotherapy treatments, expanding coverage for the screening, diagnosis, and treatment of autism spectrum disorder and promoting

early autism intervention services, prohibiting health insurers and HMOs from requiring that policyholders purchase prescription drugs from

mail order pharmacies, and conforming provisions of the Insurance Law to recently enacted federal laws, such as the Dodd-Frank Wall Street

Reform and Consumer Protection Act and the Affordable Care Act.

In 2011, OGC also was involved in legislation providing for the expedited treatment of wildcard applications (applications by state chartered

banks to engage in activities permissible for federally-chartered banking institutions), clarifying the authority of the superintendent with respect

to credit exposures derived from derivative transactions and deleting references to credit ratings agencies.

28

OGC also drafts or reviews drafts of all Departmental regulations, and oversees the Department’s rulemaking process. This past year, OGC

has played a primary role in promulgating a variety of regulations to protect consumers, seniors and retirees, including rules that establish

minimum standards for internal appeal procedures for long-term care insurance and nursing home and home care insurance; ban placement

agents from the New York State Common Retirement Fund; require insurers and producers who make recommendations to consumers about

the purchase or replacement of annuity contracts to ensure that the recommendations are suitable based on the consumer’s personal and

financial information; and prohibit insurance producers from using certifications or professional designations to mislead senior citizens in

purchasing life insurance and annuities. OGC also drafted regulations governing bank compliance with the ATM Safety Act and administering the

newly created State Charter Advisory Board, for which the Superintendent serves as Chairman.

As part of its ongoing industry oversight role, OGC also published various bulletins providing guidance on a wide range of topics, including the

applicability of New York’s unfair claim settlement practices regulation to policies issued through the National Flood Insurance Program;

enterprise risk management; medical loss ratio

standards applicable to health insurance policies; and premium rate adjustment notices. When

industry participants violate the Department’s rules, OGC has played an important role in administrative enforcement proceedings, including

representing the Department in all such matters, providing hearing officers, and advising the Superintendent in his determinations whether to

adopt the reports and recommendations that follow from such administrative adjudications.

Finally, on the litigation front, the Department, with assistance from OGC, won significant victories in its efforts to require insurance brokers

and agents to disclose their role in insurance transactions as it relates to their compensation, to limit the ability of insurers to obtain a credit

against their retaliatory tax obligations, and to bar convicted felons from employment in the mortgage banking industry.

Circular Letters

For a list of all Insurance Circular Letters issued in 2011 visit http://www.dfs.ny.gov/insurance/circltr/2012.htm

Legislative Summaries

For a description of changes to the Insurance and Banking Laws in 2011 visit http://www.dfs.ny.gov/legal/leg_summ/2011_summary.htm

Legislative Recommendations

The Department has recommended that the following legislation be passed: