For additional information and troubleshooting, please contact

your district’s assigned ESU Representative or EmpSup@trb.state.ma.us

© 2017 Massachusetts Teachers’ Retirement System

Guided Practice 9B

Deduction Reporting:

Common Errors and

Exceptions

April 24, 2017

In this guided practice you will learn how to:

• Interpret and fix the most common errors

• Interpret and fix the most common exceptions

This guided practice assumes you already know how to:

• Log in to MyTRS

• Navigate the Deduction Report Editor

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 2

The Exception Report

The exception report is a list of members that have errors and/or exceptions within the

deduction report. All errors must be corrected before submitting the deduction report to

MTRS. Exceptions do not prevent the file from being successfully submitted to MTRS,

but they still need to be investigated.

See Page 2 of Guided Practice 9A: Navigating the Deduction Report Editor if you are not familiar with

how to run the exception report.

Interpreting the Most Common Error Messages

A deduction report cannot be submitted with error messages. Each one needs to be

evaluated and addressed prior to submitting the report to the MTRS.

1. Error: Base earnings do not match salary, based on the FTE and Pay Frequency

reported. Please ensure those fields are correct. If they are, please use a SC

Correction Code.

Meaning: The earnings reported in the “Base” field are either higher or lower than

expected based on the following fields:

• annual salary

• pay frequency

• FTE%

Resolution:

a. Confirm the value in the “Base” field is correct and contains only base pay. If

the “Base” field contains any retro, coaching, longevity or ineligible earnings,

subtract these earnings from the “Base” field and enter the value into the

appropriately labelled field.

!

b. Confirm the annual salary being reported in the “Salary” field is the full-time,

non-adjusted annual salary from the step and scale schedule in the contract

(or from the individual contract if applicable). If it is incorrect, enter the

proper value in the “Salary” field. Please also update this information in

your payroll software.!

!

if an employee has their pay prorated due to starting after the start of the school year, or has

gone out on an extended leave, please make sure the full-time equivalent salary is reported,

and not the prorated salary.

a

b

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 3

c. Confirm the correct FT% is entered in the “FTE%” field. If it is incorrect,

enter the proper value in the “FTE%” field. Please also update this

information in your payroll software.!

!

d. Confirm the value in the “Pay Freq” field is the correct pay frequency. If it is

incorrect, enter the proper value in the “Pay Freq” field. Please also update

this information in your payroll software.

!

e. Click the Apply button.

!

i. If the Caution Sign icon ( ) next to the member in question goes

away, the error has been corrected and you can move on to the next

record/person on the deduction report. Please do not keep changing

the information just to get the caution sign to go away. The

information being reported must be correct.

ii. If the Caution Sign icon ( ) next to the member in question does

not go away, it’s possible there are other errors or exceptions

associated with the record or the base to salary error has not been

resolved. You may have to use a Service Correction code to resolve

the error.

!!

!

c

d

e

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 4

• If the “Base” is higher, it could be due to one of the following:

o Additional earnings included in the Base field (e.g.

Coaching, Stipend, Longevity or Retro pay).

Remove additional earnings from the base field and

move them to their respective field.

o Pay has been prorated/recalculated due to:

! Starting year late (use the Mid-Year Hire code)

! FT% change (use the Mid-Year Hire code)

! Salary increase (use the Salary Change Mid

Period code)

! Leaving district (use the Mid-Year Termination

code)

• If the “Base” is lower, it could be due to one of the following:

o One or two unpaid days due to not having enough

sick/personal time (Use the Unpaid Admin Leave

code).

o Pay has been prorated/recalculated pay due to:

! Extended unpaid leaves (use the Prorated Leave

code)

! Return from extended unpaid leaves (Use the

Return from Leave Code)

Employees with extended unpaid leave must have their events

updated in the View/Update Employee Information section of

MyTRS.

!

!

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 5

2. Error: Full-time percentage reported isn’t valid

Meaning: The value in the FTE% field is not between 0-100.

Resolution:

a. Check the value in the FTE% field in the deduction report. The FTE% should

be represented as a percentage, not the decimal equivalent.

!

b. Change the FTE% to the proper percentage. E.g. 60% should be reported as

60, not .60. 100% should be reported as 100.

!

c. Click the Apply button.

!

! !

a

b

c

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 6

3. Error: Full-time percentage does not match the current % on the member record in

out system. Note: Either correct the value or certify that this change is correct by

choosing the FTE% correction code.

Meaning: The value in the FTE% field on the deduction report does not match the

value in the FTE% field in the member’s employment record in the MTRS database.

The FTE% in the deduction report:

The FTE% in the member’s employment record:

Resolution:

a. If the FTE% in the deduction report is correct, choose “Ok- Verified” from

the FTE% Code drop down list.

b. If the FTE% in the deduction report is not correct, enter the proper value in

the FTE% field (as a whole number). Please also update this information in

your payroll software.

c. Click the Apply button.

3

3

a

b

c

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 7

4. Error: The pay frequency reported does not exist on your Payroll Calendar. Please

either correct the pay frequency or update your payroll calendar.

Meaning: You have not yet created a payroll calendar for the pay frequency being

reported.

Resolution: Check the pay frequency value being reported in the deduction report.

Ensure it is the proper pay frequency for the member. If the member started the

school year late, this value should be the pay schedule the member is actually being

paid on and not the number of checks the member will receive.

a. If the pay frequency is incorrect, update it to the correct one.

i. Incorrect Correct

ii. Click the Apply button.

b. If the pay frequency is correct, close the deduction report after clicking the

Apply button.

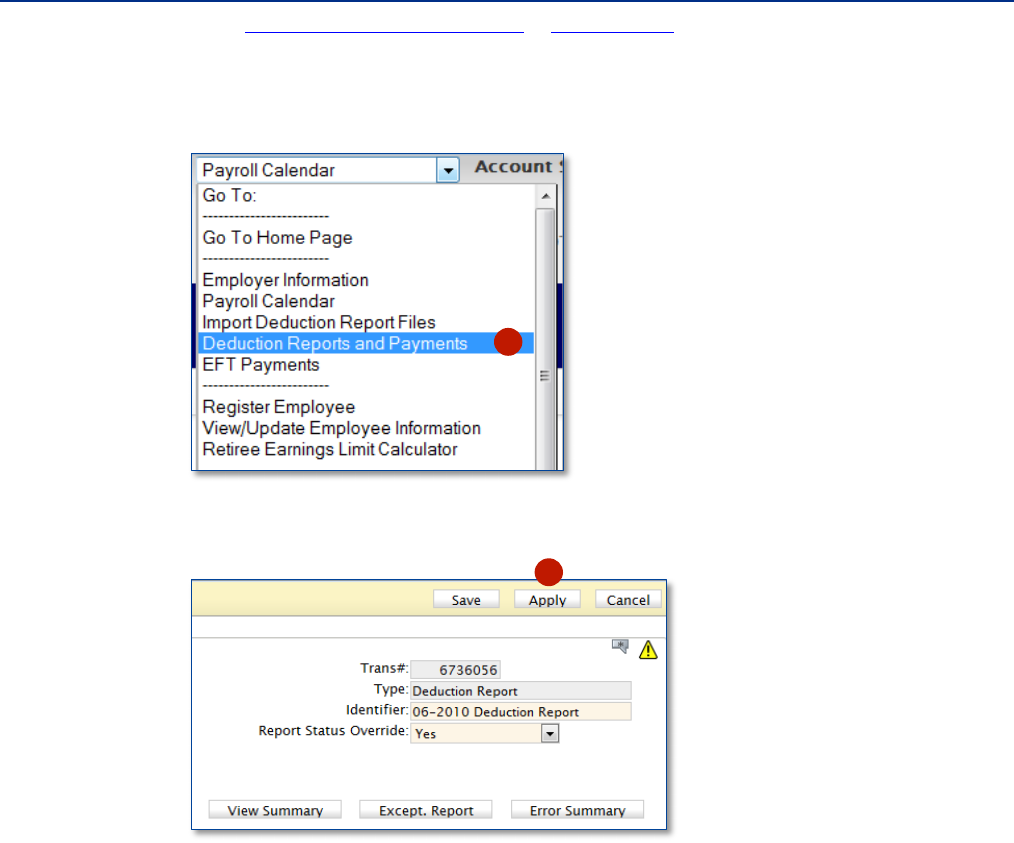

i. Choose “Payroll Calendar” from the drop down list at the top of the

screen.

ii. Create and save the Payroll Calendar that is needed

i

i

ii

i

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 8

See the Payroll Calendar Guided Practice or Training Video for directions if needed.

iii. Choose “Deduction Reports and Payments” from the drop down list

at the top of the screen.

iv. Open the deduction report and click the Apply button.

!

iii

iv

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 9

5. Error: Pay date cannot be found on your district payroll calendar for this pay

frequency. Please update your calendar.

Meaning: The pay date on the record(s) in the deduction report is not on the

calendar for the pay frequency reported on the deduction report.

Resolution: Check the pay frequency reported on the deduction report and ensure it

is the correct pay frequency for the member. If the member started the year late, this

value should be the pay schedule the member is actually being paid on and not the

number of checks the member will receive.

a. If the pay frequency is incorrect, update it to the correct value:

Incorrect Correct

i. Click the Apply button.

b. If the pay frequency is correct, verify the pay date for the record(s) in

question.

i. If the pay date is incorrect, please correct it.

!

a

a

i

b

i

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 10

• Click the Apply button.

ii. If the pay date is correct and is on the pay schedule as a regularly

scheduled pay date (meaning it’s not a one-off manual check run),

close the deduction report after clicking the Apply button.

• Choose “Payroll Calendar” from the drop down list at the top

of the screen.

• Choose the proper Pay Frequency from the drop down list.

i

ii

ii

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 11

Scroll down to where the date in question should be located.

In this example, we are looking for the pay date of

11/23/2016. This date is not on the calendar, which is causing

the error.

The regularly scheduled pay date of 11/24/2016 happens to

be Thanksgiving and checks were therefore issued the day

before on 11/23/2016.

• Manually change the date to “11/23/2016” from

“11/24/2016”.

• Click the Save button.

See the Payroll Calendar Guided Practice or Training Video for directions if

needed.

ii

ii

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 12

• Choose “Deduction Reports and Payments” from the drop

down list in the top of the screen.

• Open the deduction report and click the Apply button.

!

ii

ii

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 13

6. Error: Pay duration and pay frequency are not a valid combination.

Meaning: Either the pay duration or the pay frequency value is not correct in the

deduction report.

Resolution: Check the values in the pay duration and the pay frequency fields.

a. Correct the value(s) that is incorrect and also update this information in your

payroll software.

If the member is on the 26 or 52 pay frequency, the pay duration can only be 12 or LS.

Choose LS if the member is going to receive a lump sum payment at the end of the school year.

If the member is going to be paid throughout the summer, choose 12.

If the member is on the 21, 22, 41 or 42 pay frequency, the only valid pay duration option

is 10 since they will not be paid throughout the summer and will not receive a lump sum at the

of the school year.

b. Click the Apply button.

!

a

a

b

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 14

Interpreting the Most Common Exception Messages

A deduction report can be submitted with exceptions; however, each exception message

needs to be read and addressed. Please do not skip over the exception messages.

1. Exception: Member not Enrolled

Meaning: The member has not completed the online enrollment process as of the

time the exception report was run.

Resolution: Contact the member and ask them to complete the online enrollment

process. You will need to provide them with their Enrollment Assignment sheet or

their member number in addition to the “Enrollment Directions and Tips”

document.

2. Exception: Potential rate error: MTRS rate X%, School rate Y%.

Meaning: The MTRS believes the member should be deducted at X% while the

school has the member set up at a different rate, represented by Y%.

Resolution:

a. If the school rate is a valid deduction rate, you will do nothing at this time.

MTRS will research the member’s rate and will notify you and the member if

the rate needs to be changed.

Valid deduction rates are 5%, 7%, 8%, 9% and 11%

b. If the school rate is not a valid deduction rate (e.g. 13.62%, 7.74%, etc):

i. Confirm all eligible earnings are listed in the appropriate fields on the

deduction report. If any earnings are missing, add them to the

deduction report in the appropriate field and click Apply to see if the

exception message goes away.

ii. If the earnings are reported correctly:

• If deductions were taken on ineligible earnings, calculate the

over-deduction and add a comment stating what happened

and when the member will have the ineligible deductions

reversed through payroll.

E.g. Sally Smith was paid $453.92 for hourly tutoring

which is not eligible. Payroll accidentally took deductions

on these ineligible earnings causing this exception

message. The deductions taken in error will need to be

reversed to the member through payroll in a future pay

date.

• If you failed to take deductions on eligible earnings,

calculate the deductions owed; add a comment stating what

happened and when you will be collecting the owed

deduction amount through payroll.

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 15

E.g. John Smith was paid $4500 for coaching but payroll

failed to take deductions on these eligible earnings,

causing this exception message. Deductions will need to be

collected for these eligible coaching earnings through

payroll.

• If additional deductions were taken or refunded to the

member to correct an error in a prior month, enter a separate

adjustment record. Add a comment to the report explaining

why the adjustment was made.

E.g. Steve Smith had deductions taken on ineligible

earnings in a prior month and payroll reversed deductions

back to him in the current month, causing this exception

message. You would report the deduction adjustment in a

separate adjustment record.

3. Exception: 2% deduction taken in error.

Meaning: The MTRS believes the member is at a deduction rate that is not subject to

the additional 2% deduction.

Resolution:

a. Check to see if there is another exception message for the same member for

the same pay date. If the member also has an exception message saying

“Exception: Potential rate error: MTRS rate 11% School rate 9%”, you

would want to consider these two exception messages together. The school

believes the member’s deduction rate is 9% + 2% which is why the school is

taking the 2% deduction. This exception message displays because MTRS

believes that the member’s rate is 11% and is therefore not expecting a 2%

deduction. As long as you see these two exception messages together, you

will do nothing at this time. MTRS will research the member’s rate.

b. If you see ONLY this exception message without the additional exception

message regarding the regular deduction rate, you will want to check your

payroll system to see why the additional 2% deduction is being taken when it

appears it is not required. If payroll is taking a deduction rate of 11%, no

additional 2% is required. Please turn off this deduction in your payroll

software and calculate the ineligible 2% owed to the member. Add a

comment to the deduction report explaining how much of a refund the

member is owed and when the deduction reversal will be processed through

payroll

4. Exception: Member’s rate and R+ status are on hold.

Meaning: This message typically means that the member has transferred service

from another retirement board and MTRS is awaiting the transfer and R+ election to

be made. Once the member’s R+ election form has been submitted, or the submission

deadline has passed without an election, the member’s rate and R+ status will be

taken off hold.

Resolution: No action needs to be taken on this exception message.

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 16

5. Exception: Combination of Member name and SSN does not match the data in our

system.

Meaning: The values in the “Reported Last Name”, “Reported First Name” and

“Reported Middle Name” fields do not match the value in the “Name” field.

In this example, the value in the “Reported Last Name” field (Jones) doesn’t match

the value of the last name in the “Name” field (Apple).!

The values in the “Reported Last Name”, “Reported First Name”, “Reported Middle Name”, “Reported

Suffix” fields are coming from your payroll software. The value in the “Name” field is coming from the

MTRS database based on the SSN provided in the deduction report.

Resolution:

a. If the information in all of the “Reported” name fields is correct, you do

not need to do anything. Once the deduction report is released, the

member’s name will be updated in the MTRS database.

b. If the information in all of the “Reported” name fields is not correct,

update it in the deduction report and also in your payroll software.

c. If the information in the “Reported” name fields is for a different person,

please call the MTRS to help rectify the situation.

!

! !

5

5

5

5

5

5

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 17

Missing Members

At the end of the Exception Report is a section entitled “Missing Members”. If there are

any members listed in this section, you need to address the issue before submitting the

deduction report to the MTRS. If someone is listed in this section, it means the member

is listed as an active employee of your school, but does not have any records in the

deduction report with a “RecType” of “Normal”.

1. Check the name and date for which the member is missing.

In this example, Beth Biology is missing a record on 12/08/16 and 12/22/16.

2. Check your payroll software to see if the member was actually paid on each of those

dates.

a. If the member was paid on the dates listed, please check to see if MTRS

deductions were taken.

i. If MTRS deductions were taken, please ascertain why the member

was not included in the deduction report; make any necessary

changes in your payroll software, and then manually add the records

to the report.

ii. If MTRS deductions were not taken and the member was MTRS

eligible for the pay dates listed:

• Update your payroll software to turn on the MTRS deductions

so the required deductions are collected on the member’s

remaining checks.

• Manually add a record(s) to the report and enter a regular

deduction of $.01.

• Add a comment to the report detailing the error and the

deduction amount owed. Notify the member of the error and

contact MTRS to discuss collection of the makeup deductions.

iii. If MTRS deductions were not supposed to be taken because it has

been determined the member was not MTRS eligible for the pay dates

listed, update the “Effective Pay Date” field to the proper pay date on

their Contributing event in the View/Update Employee information

section of MyTRS.

1

1

Guided Practice 9B: Deduction Reporting: Common Errors and Exceptions (04/24/2017) 18

b. If the member was not paid on the dates listed, check to see why they were

missed.

i. If the member no longer works for your school, or declined the

position after you registered them, terminate the member.

ii. If the member is on an unpaid leave of absence, create the LOA

event in the member’s account.

iii. If the member was accidentally left off of payroll, add a comment to

the report stating this and note when the makeup check and

deductions will be processed.

!